• Your WBA Advocacy Team . . . 3

• BIGG Award . . . 4

• Gold Triangle Club . . . 6

• Ways to Give . . . 7

• Issue Advocacy Fund . . . 8

• Issue Summaries . . . 9

• Advocacy Officers . . . 10

• 2025 Election Summary . . . 12

• 2025 Voting Information . . . 13

• Find Your Legislators . . . 14

• Wisconsin Congressional Delegation . . . 15

• Wisconsin State Assembly . . . 17

• Wisconsin State Senate . . . 19

• Sample Fundraising Memo . . . 21

• Best Practices . . . 22

The Wisconsin Bankers Association is grateful to the banks that go above and beyond to help achieve our advocacy goals. For these efforts, we are pleased to present these members with our Bankers Involved in Grassroots and Government (BIGG) award. The BIGG award is our highest level of recognition for overall advocacy by our member banks.

Examples of the awards given out in the past include flags flown over the United States or Wisconsin Capitol building, a piece of stone from the Wisconsin Capitol from the 1990s renovation, a pennant signed by the Governor, or a framed print.

BIGG award winners are published in the Wisconsin Banker (WBA’s bi-monthly newsletter), on wisbank.com, and in WBA’s electronic publications such as the Wisconsin Banker Daily — reaching thousands of bankers and opinion leaders throughout Wisconsin. In addition, BIGG award winners are recognized at the annual Bank Executives Conference.

Complete at least five of the seven goals to earn BIGG status and return your checklist to Tyler Foti (tfoti@wisbank.com) by December 1, 2025.

Achieve at least five goals from the list

GOAL 1

Name an Advocacy Officer

GOAL 2

Obtain Gold Triangle Award

GOAL 3

Contribute to WBA’s issue advocacy fund

GOAL 4

Send at least one employee to WBA Capitol Day

GOAL 5

Participate in a Federal delegation meeting or go on a Washington, D.C. regulatory trip

GOAL 6

Hold a Take Your Legislator to Work Day

GOAL 7

Other (e.g., testify on a bill, host a fundraiser, analyze legislation, etc.)

Date Completed Notes

Congratulations to the 2024 WBA BIGG Award Winners!

• American National Bank –Fox Cities

• Associated Bank, Green Bay

• Bank Five Nine, Oconomowoc

• Bank of America

• Bank of Brodhead

• Bank of Sun Prairie

• Bank of Wisconsin Dells

• Bankers’ Bank, Madison

• BMO Bank

• Bristol Morgan Bank, Oakfield

• Capitol Bank, Madison

• CBI Bank and Trust, Beloit

• Citizens First Bank, Viroqua

• Community First Bank, Boscobel

• First Business Bank, Madison

• First Citizens State Bank, Whitewater

• First National Community Bank, New Richmond

• Fortifi Bank, Berlin

• Forward Bank, Marshfield

• Horicon Bank

• Huntington National Bank

• IncredibleBank, Wausau

• Johnson Financial Group, Racine

• JP Morgan Chase Bank

• Ladysmith Federal Savings and Loan Association

• Lake Ridge Bank, Middleton

• Mound City Bank, Platteville

• National Exchange Bank and Trust, Fond du Lac

• North Shore Bank, Brookfield

• One Community Bank, Oregon

• Oostburg State Bank

• Peoples State Bank, Prairie du Chien

• PNC Bank

• Premier Community Bank, Marion

• Royal Bank, Elroy

• Security Financial Bank, Durand

• Security State Bank, Iron River

• The Equitable Bank S.S.B., Wauwatosa

• The Park Bank, Madison

• The Peoples Community Bank, Mazomanie

• The Peshtigo National Bank

• The Stephenson National Bank and Trust, Marinette

• Town Bank, N.A., Hartland

• U.S. Bank

• Waldo State Bank

• Waukesha State Bank

• Wells Fargo

• Wolf River Community Bank, Hortonville

To get involved, contact a member of the WBA Government Relations Team:

Lorenzo Cruz, Vice President – Government Relations (lcruz@wisbank.com | 608-441-1206)

Tyler Foti, Director – Government Relations (tfoti@wisbank.com | 608-441-1215)

Thank you, 2024 Gold Triangle Members!

American National Bank – Fox Cities

Associated Bank, Green Bay

Bank Five Nine, Oconomowoc

Bank of Brodhead

Bank of Sun Prairie

Bank of Wisconsin Dells

Banker’s Bank, Madison

Bluff View Bank, Galesville

Bristol Morgan Bank, Oakfield

Capitol Bank, Madison

Gold Triangle is the highest level of fundraising recognition for banks, achieved through:

Citizens Bank, Mukwonago

Citizens First Bank, Viroqua

Community First Bank, Boscobel

Farmers & Merchants Bank, Berlin

First Business Bank, Madison

First Citizens State Bank, Whitewater

First National Community Bank, New Richmond

Fortifi Bank, Berlin

• bank employee or director personal contributions to Alliance of Bankers for Wisconsin (ABW) political conduit,

Forward Bank, Marshfield

Greenwoods State Bank, Lake Mills

Horicon Bank

IncredibleBank, Wausau

Johnson Financial Group, Racine

JP Morgan Chase Bank

Mound City Bank, Platteville

• bank employee or director personal contributions to Wisbankpac, or

• corporate contributions to WBA’s issue advocacy fund.

National Exchange Bank and Trust, Fond du Lac

North Shore Bank, Brookfield

Northwestern Bank, Chippewa Falls

Oak Bank, Fitchburg

Oostburg State Bank

Peoples State Bank, Prairie du Chien

BANK ASSETS

$0–100 Million

$100–250 Million

TOTAL PERSONAL BANKER CONTRIBUTIONS

$1,500

$2,000

$250–500 Million $3,000

$500–750 Million $4,000

$750 Million–$1 Billion $5,000

$1 Billion+ $7,000

Premier Community Bank, Marion

Royal Bank, Elroy

Security Financial Bank, Durand

Security State Bank, Iron River

State Bank Financial, La Crosse

State Bank of Chilton

The Equitable Bank S.S.B., Wauwatosa

The Park Bank, Madison

The Peoples Community Bank, Mazomanie

The Peshtigo National Bank

The Stephenson National Bank & Trust, Marinette Town Bank, N.A., Hartland

U.S. Bank

Waldo State Bank

Wells Fargo Bank

Wisconsin Bankers Association, Madison

Wolf River Community Bank, Hortonville

ABW and Wisbankpac funds are utilized as part of our overall effort to support pro-banking candidates, regardless of whether they have an R or a D next to their name. Issue advocacy dollars are used in various capacities to shape public opinion on pro-banking, pro-business issues.

To donate, visit wisbank.com/advocacy or contact a member of the WBA Government Relations Team.

Lorenzo Cruz, Vice President – Government Relations lcruz@wisbank.com | 608.441.1206

Tyler Foti, Director – Government Relations tfoti@wisbank.com | 608.441.1215

Authorized by Wisbankpac. Angie Swanson, Treasurer

WBA has two political action funds through which individual bankers and the industry as a whole support pro-business, pro-banking candidates at the state and federal level. Our giving strategy isn’t Democrat or Republican, but rather “B” for banker. Political giving drives home our message with legislators and shows we are actively engaged in influencing policy affecting the banking industry.

Wisbankpac is the registered political action committee of WBA. Wisbankpac is the “set it and forget it” option for bankers who want to help the industry support pro-banking candidates and committees of both parties. When pro-banking candidates receive a check from Wisbankpac, it is from the PAC, and the individuals who contributed to Wisbankpac are NOT listed. Wisbankpac provides a higher level of anonymity. THANK YOU to the bankers from 94 WBA-member institutions who contributed to Wisbankpac in 2024! Contribute securely online via credit card at wisbank.com/advocacy, or mail a check payable to “ Wisbankpac” to WBA.

The Alliance of Bankers for Wisconsin (ABW) conduit is for bankers who want to direct their personal dollars to the pro-banking candidates of their choosing. With permission from the banker, WBA forwards dollars from banker’s money in their conduit account to pro-banking candidates. The ABW Conduit TRIPLES the impact of your individual dollar by sharing the credit with you, your bank, and the state’s banking industry as a whole. Think of the ABW Conduit as your personal bank account for political giving. THANK YOU to the bankers from 82 banks who made 517 individual contributions to their conduit accounts in 2024! Contribute securely online via credit card at wisbank.com/advocacy, or mail a check payable to “Alliance of Bankers for Wisconsin” to WBA.

Dollars from the WBA issue advocacy fund are used to help define bank/ business issues with the public. Contributions to this fund count toward Silver Triangle, Gold Triangle, and satisfy a criterion for the BIGG Award. Corporate contributions are permitted. For more information on the issue advocacy fund, please refer to the next page.

Political Giving Recognition

Leadership Circle – earned by individual bankers who contribute at least $3,000 to any combination of Wisbankpac and ABW. In 2024, 17 bankers earned Leadership Circle recognition.

Hall of Fame Recognition – earned by individual bankers who contribute at least $25,000 aggregate lifetime investment through any combination of Wisbankpac or ABW.

Silver Triangle – earned by individual bankers who contribute at least $1,000 to any combination of Wisbankpac, ABW, or the issue advocacy fund. In 2024, 94 bankers earned Silver Triangle, and recipients are honored at WBA’s annual Bank Executives Conference.

Gold Triangle – earned by banks whose officers, directors, and employees aggregately contribute a minimum amount to Wisbankpac, ABW, or the issue advocacy fund. The threshold is based on the bank’s asset size. In 2024, 48 banks earned Gold Triangle, and recipients are honored at WBA’s annual Bank Executives Conference.

The WBA issue advocacy fund is an opportunity for your bank to contribute corporate dollars that are pooled with those from other Wisconsin business coalition partners to craft pro-business public policy messages to the general public, opinion leaders, and elected officials.

This year marked a high level of activity on issues impacting the banking community which created a lot of uncertainty. We’ve seen many changes in recent months — some we expected and some we did not. At WBA, our goal is to not only help the banking industry be ready for 2025, but for the years ahead.

The question for us is, “will we be ready?” Help us help you by contributing to WBA’s Issue Advocacy Fund.

What does the fund do?

The fund is established to help educate the public, local leaders, and elected officials and to define banking and business issues primarily through advertising. WBA works with coalition partners to determine the best course of action. The message is sent at appropriate times during the legislative session and throughout the year.

Why should my bank give?

To help get out a clear and direct message about banking and business issues in a way that the public will understand. Issue advocacy communications always aim to explain (albeit briefly) why banking issues pertain to people and why they should buy-in. This includes a connection to a particular fact or statistic to the policy you’re advocating, explaining why it is important, and connecting it to the public’s everyday life. WBA is the only issue advocacy voice for the banking industry in Wisconsin.

Are contributions tax deductible?

Contributions are not deductible as a charitable contribution. 100% is attributable to lobbying as defined by the Internal Revenue Code and is therefore not deductible as an ordinary business expense. Please consult your tax advisor for guidance.

What’s at stake?

The banking industry in general continues to face challenging issues detrimental to all Wisconsin banks. Some candidates for office in Wisconsin are running on an issue platform harmful to banks. We need to continue to highlight banking’s positive impact and dispel anti-banking rhetoric with the public.

What can be done?

Wisconsin banks need to unite and deliver a strong message to the public using TV, radio, and direct mail to educate the public about policy differences and the importance of strong pro-banking leadership in the Legislature.

How can my bank help?

Make a generous contribution to the Wisconsin Bankers Association (WBA). Corporate contributions are allowed by law. Join your peers in making a donation of $1,000, $5,000, $10,000 or whatever you deem appropriate to the WBA issue advocacy fund. Your bank’s corporate donation will be kept confidential. For contributions of $5,000 or more you will be invited to the WBA Advocacy: Kohler Outing, June 16–17, 2025.

Contact: Lorenzo Cruz, Vice President – Government Relations, lcruz@wisbank.com | 608.441.1206 Tyler Foti, Director – Government Relations, tfoti@wisbank.com | 608.441.1215

Interchange – WBA continues to monitor for credit card interchange fees, a/k/a “swipe fee” legislation. The legislation, which was introduced two sessions ago, would have created operational and compliance problems for card issuers and merchant acquirers, and jeopardized valuable interchange income that banks use for card issuance, fraud prevention, data-privacy, cybersecurity infrastructure, and more. Concerns have grown since the passing of interchange language in Illinois.

Privacy – Positive progress was made on data privacy legislation last session where financial institutions and their affiliates were exempted. WBA will continue to work with elected officials and other stakeholders on privacy issues.

Tax Parity – As more competitors leverage their tax-exempt status to gain a competitive advantage over banks, WBA will keep pursuing legislative solutions to level the playing field for the banking industry and its customers. While there is still a long way to go to bring banks closer to tax parity with credit unions, the industry got one step closer in the last state budget, which included a tax exemption from loan income earned from certain commercial and agricultural loans of up to $5 million.

Elder Fraud Prevention – While positive progress was made last session, concessions were made to pass a streamlined bill that only provides for the creation and use of a trusted list. This remains a priority for WBA during the 2025–26 session.

Merchant Category Codes – While WBA was able to amend last session’s MCC bill that would have required the use of merchant category codes on the sale of firearms and was vetoed by the Governor, we expect this issue will not go away. WBA will continue to neutralize any harmful legislation.

Environmental, Social, and Government (ESG) – Financial institutions should be free to lend to, invest in, and generally do business with any entity or activity that is legal, without government interference. Likewise, financial institutions should not be compelled to do business with an entity, except in the case of fair lending or anti-discrimination requirements. Allowing financial institutions to make their own risk-based business decisions has helped foster the deepest and most resilient banking system in the world, and the government should not undermine it. The state procurement process should not be politicized, but rather should focus on the best outcome for taxpayers. State legislation that prevents financial institutions from exercising their own riskbased evaluation of customer relationships impedes competition and could create significant safety and soundness concerns.

Trust Code – WBA will work on a legislative proposal with the State Bar advisory group on Domestic Asset Preservation Trust and other trust related changes.

Artificial Intelligence – Artificial Intelligence is a hot topic among legislatures nationwide. WBA will work with legislators to minimize the impact of any AI legislation that would affect the industry.

What is an Advocacy Officer?

The Advocacy Officer is a volunteer position coordinating regulatory, legislative, and community advocacy efforts for the bank by working with the Wisconsin Bankers Association (WBA). Simply put, Advocacy Officers are government relations point people at our member banks.

What’s in it for you?

Leadership, development, opportunity, visibility, and impact. Advocacy Officers receive timely and regular government relations information, so they can then be seen as a resource at their bank.

What’s the ROI?

An Advocacy Officer helps your bank and the industry by providing action and input on legislative and regulatory policy items as well as strategic direction and assistance to the WBA Government Relations Committee.

Who would make a good Advocacy Officer?

The typical background for this position usually includes someone who has an interest in public policy, a strong understanding of the banking industry (compliance, credit, external relations, etc.), the ability to speak for the bank on matters of regulatory or public policy, and has a fairly flexible schedule that is at their own discretion.

WBA pro tip: if you have someone signed up for the BOLT program, name them as your Advocacy Officer. A CEO can definitely be the Advocacy Officer, but many choose to give someone else this leadership opportunity.

Duties

• Keep informed of legislative and governmental issues that impact both the bank and the banking industry.

• Participate in the annual Capitol Day hosted by the Wisconsin Bankers Association.

• Contact both state and federal legislators on emerging issues and encourage other bankers to do the same.

• Be the liaison within the bank for WBA advocacy actions and initiatives to bank officers and board.

• Support building advocacy infrastructure and attend local political fundraisers.

“Becoming the Advocacy Officer for my bank has allowed me to become a thought leader in establishing a positive future for the banking industry, while also being the liaison between my bank and WBA. It allows me to connect with like-minded banking professionals and gives me access to exclusive information that can’t be found online or in the news. I’m proud to join a network of people making advances in our industry.”

– Gary Kuter Senior Vice President, Chief Compliance Officer/Risk Officer, Capitol Bank

Join the Growing List of Banks That Have Named an Advocacy Officer

Don’t see your bank on the list? Email Tyler Foti at tfoti@wisbank.com to designate someone or express interest. Bank presidents/CEOs can also designate an Advocacy Officer using the form at wisbank.com/advocacy/advocacy-officers.

American Bank of Beaver Dam

American National Bank – Fox Cities

Associated Bank, Green Bay

Badger Bank, Fort Atkinson

Bank First, Manitowoc

Bank Five Nine, Oconomowoc

Bank of Alma

Bank of America

Bank of Cashton

Bank of Lake Mills

Bank of Luxemburg

Bank of Milton

Bank of Prairie du Sac

Bank of Sun Prairie

Bank of Wisconsin Dells

Baraboo State Bank

Bluff View Bank, Galesville

BMO Harris Bank

Bristol Morgan Bank, Oakfield

Byline Bank

Capitol Bank, Madison

CBI Bank & Trust, Beloit

Citizens Bank, Mukwonago CCFBank, Altoona

Citizens First Bank, Viroqua

Citizens State Bank, Cadott

Citizens State Bank of Loyal Columbia Savings and Loan Association, Milwaukee Community Bank of Cameron Community First Bank, Boscobel

Community State Bank, Union Grove

Crossbridge Community Bank, Tomahawk

Cumberland Federal Bank, FSB

Dairy State Bank, Rice Lake

East Wisconsin Savings Bank, Kaukauna Ergo Bank, Markesan

Federal Home Loan Bank of Chicago

First Business Bank, Madison

First Citizens State Bank, Whitewater

First Community Bank Milton First Federal Bank of Wisconsin, Waukesha

First National Community Bank, New Richmond

First State Bank, New London

Fortifi Bank, Berlin

Forward Bank, Marshfield

Fox Valley Savings Bank

Frandsen Bank & Trust, Eau Claire

Greenleaf Bank

Highland State Bank

Horicon Bank

Hustisford State Bank

IncredibleBank, Wausau

Independence State Bank

Intercity State Bank, Schofield

Ixonia Bank

Johnson Financial Group, Racine

JPMorgan Chase Bank, National

Association

KeySavings Bank, Wisconsin Rapids

Ladysmith Federal Savings and Loan Association

Lake Ridge Bank, Middleton

Laona State Bank

Marathon Bank, Wausau

Mayville Savings Bank

MidWestOne Bank, Osceola

Mound City Bank, Platteville

National Exchange Bank and Trust, Fond du Lac

Nekoosa Port Edwards State Bank

Nicolet National Bank, Green Bay

North Shore Bank, Brookfield

Northwestern Bank, Chippewa Falls

Oak Bank, Fitchburg

Oakwood Bank, Pigeon Falls

Old National Bank

One Community Bank, Oregon

Oostburg State Bank

Paper City Savings Association, Wisconsin Rapids

Park Bank, Holmen

Partners Bank of Wisconsin, Marshfield

Peoples State Bank, Wausau

Peoples State Bank of Plainview

Pillar Bank, Baldwin

PNC Bank, National Association

Premier Community Bank, Marion

PremierBank, Fort Atkinson

Prevail Bank, Medford

PyraMax Bank, FSB

Quad City Bank & Trust

Range Bank, National Association

River Bank, Stoddard

River Falls State Bank

Royal Bank, Elroy

Sauk Valley Bank & Trust Company

Security Financial Bank, Durand

Security State Bank, Iron River

Shell Lake State Bank

Spring Bank, Brookfield

State Bank Financial, La Crosse

State Bank of Chilton

State Bank of Newburg

State Bank of Reeseville

Superior Savings Bank

The Bank of Brodhead

The Bank of Kaukauna

The Bank of New Glarus

The Benton State Bank

The Equitable Bank S.S.B., Wauwatosa

The Farmers & Merchants Bank, Berlin

The Farmers State Bank of Waupaca

The First National Bank and Trust Company, Beloit

The First National Bank of Bangor

The First National Bank of River Falls

The Huntington National Bank

The International Bank of Amherst

The Park Bank, Madison

The Peoples Community Bank, Mazomanie

The Peshtigo National Bank

The Pineries Bank, Stevens Point

The Stephenson National Bank & Trust, Marinette

Town Bank, N.A., Hartland

Tri City National Bank, Oak Creek

U.S. Bank National Association

Union State Bank of West Salem

Unity Bank, Augusta

Waldo State Bank

WaterStone Bank, SSB, Wauwatosa

Waukesha State Bank

Wells Fargo Bank, National Association

West Pointe Bank, Oshkosh

Westbury Bank, West Bend

Wolf River Community Bank

Wisconsin voters get a bit of a break in 2025, as there are only two statewide races on the ballot this year – Wisconsin Supreme Court and Superintendent of Public Instruction. Both races are considered non-partisan offices. Following the February 18 primary, the general election will be held on the regular Spring Election Day, April 1.

Wisconsin State Supreme Court

Retiring Supreme Court Justice Ann Walsh Bradley has created for another hotly contested Supreme Court race. Brad Schimel and Susan Crawford will face off in the April general election, with the winner earning a ten-year term on the bench. This election will decide the ideological makeup of the Wisconsin Supreme Court.

Individual Contribution Limit: $20,000

Superintendent of Public Instruction

Incumbent Superintendent of Public Instruction Jill Underly seeks another term for the office. Campaign registrants also include education consultant Brittany Kinser, and Sauk Prairie superintendent Jeff Wright. The state superintendent is elected to a four-year term, overseeing public schools throughout the state and leading the Department of Public Instruction. The three will face off in the primary on February 18, with the top two vote getters advancing to the general election in April.

Local Elections

There are several locally elected offices also on the ballot throughout the state. School boards and municipal governments can be powerful bodies whose decisions have wide-ranging impacts on communities. Be sure to make it to the bottom of your ballot and vote in these local races, where applicable.

Find Your Polling Place

www.myvotewi.gov/find-my-polling-place

Check Your Registration Status

www.myvotewi.gov/register-to-vote

Register at Your Polling Place

Wisconsin has same-day voter registration at the polls.

Need to vote absentee?

Anyone who wants to vote absentee in Wisconsin may do so — we are a “no-excuse” absentee voting state. You may cast your absentee ballot by mail, or cast an in-person absentee ballot, also known as early voting.

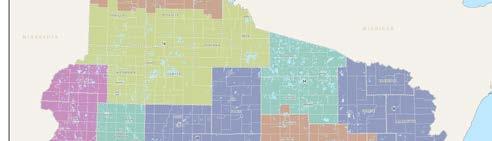

Step 1: Go to https://legis.wisconsin.gov

Step 2: Enter your home address in the search field

Step 3: Send an email or call the office

How to Address a U.S. Senator

The Honorable [First Name Last Name] United States Senate

____ Hart Senate Office Building Washington, D.C. 20510

Dear Senator [Last Name]:

How to Address a Member of the U.S. House of Representatives

The Honorable [First Name Last Name] U.S. House of Representatives

____ [Building Name] House Office Building Washington, D.C. 20515

Dear Congressman(woman) [Last Name]:

Rep. Bryan Steil (R-District 1)

20 South Main Street, Ste 10 Janesville, WI 53545

Phone: 608-752-4050

Rep. Scott Fitzgerald (R-District 5)

175 E Wisconsin Ave, Ste H Oconomowoc, WI 53066

Phone: 262-784-1111

Mark Pocan (D-District 2)

10 East Doty Street, Ste 405 Madison, WI 53703 Phone: 608-258-9800

Rep. Glenn Grothman (R-District 6)

24 West Pioneer Road Fond du Lac, WI 54935

Phone: 920-907-0624

Senator Ron Johnson (R-WI) 328 Hart Senate Office Building Washington, D.C. 20510 Phone: 202-224-5323

219 Washington Avenue, Ste 100 Oshkosh, WI 54901 Phone: 920-230-7250

Senator Tammy Baldwin (D-WI) 141 Hart Senate Office Building Washington, D.C. 20510 Phone: 202-224-5653

30 West Mifflin Street, Ste 700 Madison, WI 53703 Phone: 608-264-5338

Derrick Van Orden (R-District 3)

210 7th Street S., Ste 204 La Crosse, WI 54601

Phone: 202-225-5506

Rep. Tom Tiffany (R-District 7)

2620 Stewart Avenue, Ste 312 Wausau, WI 54401

Phone: 715-298-9344

Gwen Moore (D-District 4)

250 E. Wisconsin Avenue, Ste 950 Milwaukee, WI 53202 Phone: 414-297-1140

Rep. Tony Wied (R-District 8)

1702 Scheuring Road, Ste B De Pere, WI 54115

Phone: 920-301-4500

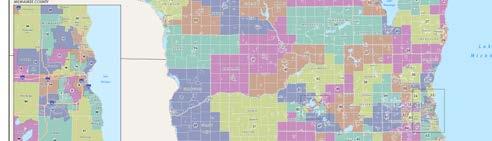

Democrats: 45 | Republicans: 54 | Ratio: 65 men/34 women

* Denotes freshman legislator

Allen, Scott (R-82)

Anderson, Clinton (D-45)

Andraca, Deb (D-23)

Armstrong, David (R-67)

*Arney, Margaret (D-18)

August, Tyler (R-31)

Bare, Mike (D-80)

Behnke, Elijah (R-6)

Billings, Jill (D-95)

Born, Mark (R-37)

*Brill, Lindee (R-27)

Brooks, Rob (R-59)

*Brown, Brienne (D-43)

Callahan, Calvin (R-35)

Clancy, Ryan (D-19)

*Cruz, Angelina (D-62)

Dallman, Alex (R-39)

*DeSanto, Karen (D-40)

*DeSmidt, Ben (D-65)

Dittrich, Barbara (R-99)

Donovan, Bob (R-61)

Doyle, Steve (D-94)

Duchow, Cindi (R-97)

Emerson, Jodi (D-91)

*Fitzgerald, Joan (D-46)

*Franklin, Benjamin (R-88)

Goeben, Joy (R-5)

*Goodwin, Russell Antonio (D-12)

Green, Chanz (R-74)

Gundrum, Rick (R-58)

Gustafson, Nate (R-55)

Haywood, Kalan (D-16)

Hong, Francesca (D-76)

Hurd, Karen (R-69)

*Hysell, Andrew (D-48)

*Jacobson, Brent (R-87)

Jacobson, Jenna (D-50)

Joers, Alex (D-81)

*Johnson, Tara (D-96)

**Kaufert, Dean (R-53)

*Kirsch, Karen (D-7)

Kitchens, Joel (R-1)

**Knodl, Dan (R-24)

**Kreibich, Rob (R-28)

Krug, Scott (R-72)

Kurtz, Tony (R-41)

Madison, Darrin (D-10)

Maxey, Dave (R-83)

*Mayadev, Renuka (D-77)

*McCarville, Maureen (D-42)

McGuire, Tip (D-64)

Melotik, Paul (R-22)

*Miresse, Vinnie (D-71)

Moore Omokunde, Supreme (D-17)

Moses, Clint (R-92)

Murphy, Dave (R-56)

Mursau, Jeffrey (R-36)

Nedweski, Amanda (R-32)

Neubauer, Greta (D-66)

Neylon, Adam (R-15)

Novak, Todd (R-51)

O’Connor, Jerry (R-60)

Ortiz-Velez, Sylvia (D-8)

Palmeri, Lori (D-54)

Penterman, William (R-38)

Petersen, Kevin (R-57)

*Phelps, Christian (D-93)

*Piwowarczyk, Jim (R-98)

*Prado, Priscilla (D-9)

Pronschinske, Treig (R-29)

*Rivera Wagner, Amaad (D-90)

Rodriguez, Jessie (R-21)

*Roe, Ann (D-44)

*Sheehan, Joe (D-26

Sinicki, Christine (D-20)

Snodgrass, Lee (D-52)

Snyder, Patrick (R-85)

Sortwell, Shae (R-2)

*Spaude, Ryan (D-89)

Spiros, John (R-86

Steffen, David (R-4)

*Stroud, Angela (D-73)

Stubbs, Shelia (D-78)

Subeck, Lisa (D-79)

Summerfield, Rob (R-68)

Swearingen, Rob (R-34)

*Taylor, Sequanna (D-11)

*Tenorio, Angelito (D-14)

Tittl, Paul (R-25)

Tranel, Travis (R-49)

*Tucker, Duke (R-75)

Tusler, Ron (R-3)

*Udell, Randy (D-47)

VanderMeer, Nancy (R-70)

Vining, Robyn (D-13)

Vos, Robin (R-33)

Wichgers, Chuck (R-84)

Wittke, Robert (R-63)

Zimmerman, Shannon (R-30)

Democrats: 15 | Republicans: 18 | Ratio: 23 men/10 women

* Denotes freshman legislator

** Denotes Senator who served in the Assembly last session

*(D-18) Alfheim, Kristin

(R-28) Bradley, Julian

(R-19) Cabral-Guevara, Rachel

(D-3) Carpenter, Tim

**(D-4) Drake, Dora

(R-12) Felzkowski, Mary

(R-20) Feyen, Dan

*(D-8) Habush Sinykin, Jodi

(D-27) Hesselbein, Dianne

(R-5) Hutton, Rob

(R-1) Jacque, Andre

(R-13) Jagler, John

(R-23) James, Jesse

(D-6) Johnson, LaTonya

(R-33) Kapenga, Chris

*(D-14) Keyeski, Sarah

(D-7) Larson, Chris

(R-9) LeMahieu, Devin

(R-17) Marklein, Howard

(R-11) Nass, Stephen

(D-32) Pfaff, Brad

(R-25) Quinn, Romaine

**(D-16) Ratcliff, Melissa

(D-26) Roys, Kelda

(D-31) Smith, Jeff

(D-15) Spreitzer, Mark

(R-10) Stafsholt, Rob

(R-24) Testin, Patrick

(R-29) Tomczyk, Cory

*(D-30) Wall, Jamie

(R-21) Wanggaard, Van

(R-2) Wimberger, Eric

(D-22) Wirch, Robert

[Date]

[Name] [Address]

[City, State, Zip Code]

Dear [Personalized Name]:

Wisconsin banks and bankers are the lifeblood of our communities. Today I am asking you to make an investment in both the success of our bank and Wisconsin’s banking industry by contributing to the Wisconsin Bankers Association’s political action funds.

In 2023 and 2024, several public policy threats and WBA priorities were on the table. WBA government relations successfully advocated with your support on tax parity, banking modernization, credit card swipe fees, and trust code. The industry’s arguments are compelling and well-articulated, but government relations wins don’t happen by accident. More work will continue into next session on interchange, elder fraud, ESG, merchant category code, trust code, artificial intelligence, and privacy.

Political contributions significantly lift the collective voice of the banking industry. They send a clear message to lawmakers that we are active, involved, promote sound legislation, and educate the public about the good work we do.

WBA uses the generous contributions of its member bankers to help elect pro-banking candidates and defeat anti-banking candidates. I think we’ve seen what it means when antibanking legislators are in charge: uncertainty, more regulation, constraints on the work you can do to help our customers. Proposals on the federal and state levels would change the way we offer products, process electronic payments, raise capital, make new loans, and even how we talk with our customers.

There are two options available to you: the Alliance of Bankers for Wisconsin (ABW) political conduit, or Wisbankpac, WBA’s registered political action committee. ABW is a personal political giving checking account. You deposit funds into it, and then decide which candidates you would like to authorize a portion of those funds for. Wisbankpac is your set-it-and-forget-it option; you contribute to it and the GR team decides which candidates to direct contributions to.

There is no contribution too little or too large – the key is to participate in some way.

If you have any questions about political giving or how your contribution would be used, please do not hesitate to contact WBA’s Tyler Foti at tfoti@wisbank.com or 608-441-1215 or Lorenzo Cruz at lcruz@wisbank.com or 608-441-1206. Thank you for your consideration of my request.

Sincerely,

[Bank CEO]

WBA Government Relations staff frequently rely on bank executives and Advocacy Officers for help in four key advocacy areas — fundraising, grassroots, communications, and Take Your Legislator to Work days. Here are the topline things you need to know about each.

Political Fundraising

• Decide what fund.

• Wisbankpac: funds are pooled. Incoming funds are public, and distributions to candidates do NOT identify contributors.

• ABW Conduit: a personal political account is set up that is controlled by the individual donor. You deposit money into your conduit account and then determine where it goes. Distributions do identify contributors.

• WBA Issue Advocacy: funds used to help define banking/business issues with the public

• How should you choose what fund?

• Wisbankpac: When you want to count the funds toward the WBA Gold Triangle, but don’t want anyone contacting you after you’ve made the contribution. Set it. Forget it.

• ABW Conduit: When you want to count the funds toward the WBA Gold Triangle, and individuals (and the bank) want to be acknowledged for the donation to a specific candidate or candidates.

• WBA Issue Advocacy: When you want to help, but don’t want anyone’s name showing up anywhere or being placed on any list, ever. OR When you want to contribute corporate funds.

• Follow the rules. (Call Tyler Foti at 608-441-1215 with questions.) The rules are pretty simple. WBA does not support any particular political party. We’re not “D” nor “R”, we’re “B” for “Banker!” For Wisbankpac & ABW conduit, only personal funds are allowed. The Issue Advocacy Fund may accept corporate contributions.

It’s important to contact your elected officials via phone or email. Really. Before you ask anyone (bank employee or director) to call or send an email (or letter), make sure that bank management is ok contacting elected officials – it’s not a big deal to contact a civic leader.

• Send an email. WBA GR staff periodically asks bankers to contact members of the Legislature or Congress.

• Write a letter and send it snail mail. This works well! Hand write something to really get attention. Addresses are listed earlier in the toolkit.

• Call. They won’t bite. They won’t argue. The person on the phone will ask your name and home address (to make sure you’re a constituent). State your position on a bill (get the bill number in advance), be polite and brief.

Communicating with CEO, Board, and Bank Staff

• Periodically provide brief updates on government and regulatory activities impacting the industry.

• Encourage financial and grassroots participation and remind them that our peers and competitors are highly engaged in the legislative, regulatory, and political processes.

• Utilize WBA’s dashboards, talking points, or other materials.

• Direct questions or concerns to WBA’s Government Relations Team.

The secret to a “TYLTW” day is that it’s just a meeting to talk with an elected official about three things:

• To get to know your legislator

• Share what’s going on in your marketplace from your perspective

• Explain the state/federal issues that we’d like the elected official to support or oppose

WBA Government Relations staff will do all the work in setting up TYLTW days. Someone from the WBA GR team can also be present. They are a great way to get legislators out in their districts and help us showcase all the great work our industry does.

Contact Tyler Foti (tfoti@wisbank.com) or Lorenzo Cruz (lcruz@wisbank.com) to get one set up.

Mound City Bank hosted State Representative Travis Tranel and State Senator Howard Marklein in November of 2024.

Picured seated (left to right) are: WBA’s Lorenzo Cruz, Michael Phillips, Rep. Tranel, Sen. Marklein, Donna Hoppenjan, and WBA’s Daryll Lund.

In October of 2024, Lake Ridge Bank hosted State Senator Joan Ballweg for a Take Your Legislator to Work Day at the bank’s Sauk location.

Picured (left to right) are: Lisa Runnels, Stephanie Johnson, WBA’s Lorenzo Cruz, Ryan Ackerman, Sen. Ballweg, Kassy Ripp, Pam Wipperfurth, and Jeremy Sauer.

Advocacy is at the heart of WBA. Our staff of lobbyists and lawyers work tirelessly every day representing banks in Wisconsin.

We unify the voice of the members to promote a healthy environment that allows you and your communities to prosper.

With you, we can do even more.