Wisconsin Banker

The Stablecoin Shift: What the GENIUS Act

Means for Wisconsin Banks By

Elizabeth Fenton

The conversation around digital assets has long been dominated by speculation and hype, and, until recently, stablecoins have existed largely on the periphery of traditional finance. President Donald Trump signed the GENIUS Act into law on July 18th, 2025, which brought this asset into a formal framework. The policy establishes clear rules for issuance, reserves, and reporting — and, for the first time, creates a regulated bridge between decentralized finance (DeFi) and the banking sector.

FIS — a global leader in financial technology — has partnered with Circle, the issuer of U.S. dollar-backed USDC stablecoin, to integrate stablecoin usage into FIS’s Money Movement Hub. The collaboration gives banks the option to participate in this new payment system while also maintaining their existing infrastructure.

For this article, WBA spoke with John Omahen, vice president of product management at FIS, to unpack what this shift means for Wisconsin bankers. Omahen, a veteran in capital markets technology and a key player in the FIS/Circle partnership, has been at the forefront of integrating crypto technology into traditional financial systems.

As Fraud Evolves, Wisconsin Banks Respond By

Katie Reiser

In the last Wisconsin Banker issue, we shared information from presenters at the WBA’s first Fraud Summit held in June. We now turn to Scott Birrenkott, WBA director – legal, and three members of WBA’s Financial Crimes Committee for their fraud fighting insights.

As much as the fraud landscape evolves, some things never change. While criminals now employ artificial intelligence and deepfakes to trick their victims, long-standing schemes like check fraud remain stubbornly persistent. Particularly concerning is the rise of bank impersonation/spoofing which WBA President and CEO Rose Oswald Poels recently addressed in an Executive Letter and a press release which was picked up by many media outlets.

“Check fraud is one the biggest challenges right now,” said attorney Birrenkott, who also serves as staff liaison for the association’s Financial Crimes Committee. “Additionally, banks are not only battling check fraud, but also electronic payments fraud and new accounts fraud.”

“Whether you love it or hate it, it’s happening,”

Omahen says.

“It’s better to stay informed, educated, and prepared for what that change will ultimately bring to your business.”

Stablecoin as a Mainstream Payment Rail

Stablecoins are a digital token pegged to an asset, like the U.S. dollar, and backed by audited reserves. Omahen first began working with digital assets in 2020 when stablecoins were a niche tool mostly used to facilitate crypto trades. Just five years later, payment stablecoins offer something more powerful: the ability to settle both an asset and its payment simultaneously on a blockchain.

“That’s revolutionary,” Omahen explains. “It means settlement finality on both sides, automated and insured. The velocity of money has a new speed limit — and it's much faster.”

Continued on pg. 13

For banks, the challenge is twofold: fighting fraud while continuing to serve customers and build trust. “Fraud targets both consumers and businesses,” Birrenkott added. “Criminals spoof individuals, create fictitious people or companies, or compromise existing accounts. Prevention is ideal, but it’s difficult — banks have to think about both prevention and how they’ll respond once fraud occurs.”

New Faces of Fraud and Classic Scams

Emerging schemes increasingly leverage technology to appear more legitimate. AI-driven voice spoofing, deep-fake impersonations, and business email compromise are giving fraudsters powerful new tools.

Mike Christensen, deposit compliance and operations officer at Farmers Savings Bank in Mineral Point, said a common trend is what he calls “shock and awe” tactics. “Fraudsters will text or call reporting fake transaction alerts, bank embezzlement, or even criminal investigations to get the victim’s attention.

Continued on pg. 20

Why Advocacy Matters — Now More Than Ever

By Paul Northway

It was a pleasure to either meet or reconnect with so many members at the Annual WBA Chair’s Member Appreciation Golf Outing on August 14 at Trapper’s Turn Golf Club. In addition to it being a fun event, it underscores how much the WBA Board values the active participation of our bank and associate members. Thank you for your membership.

As community bankers, we wear a lot of hats. We serve customers, support our teams, lead our organizations, and stay on top of everything from regulations to technology. But one responsibility that sometimes flies under the radar, but shouldn’t, is our role as advocates for the industry we love.

Advocacy may not always be top of mind, but it’s one of the most important things we can do to protect and advance community banking in Wisconsin. Why? Because if we don’t tell our story, someone else will — and chances are, they won’t get it right.

When we engage in advocacy — whether that’s attending Capitol Day, traveling to Washington, D.C., hosting a legislator for a Take Your Legislator to Work Day, (TYLTWD), or even just picking up the phone to share how a proposed regulation might affect your bank — we strengthen the relevance and resilience of our industry. We remind lawmakers that community banks are essential to the health of our local economies. We fund small businesses, support local farmers, and provide financial guidance to our neighbors. That is not a story that should be left untold.

Advocacy also plays a vital role in shaping a regulatory environment that works for us, not against us. Without our voices in the room, there is a real risk that laws and regulations will be written with only the largest institutions in mind which can create burdens that don’t fit the scale or mission of community banks. When we speak up, we help make sure the community bank model is protected and allowed to thrive.

One of the simplest and most effective ways your bank can stay engaged is by designating an Advocacy Officer. Advocacy Officers help coordinate outreach and keep their bank informed about key legislative and regulatory issues. It doesn’t require a political science degree, only a willingness to help tell our story.

Events like Capitol Day and trips to Washington, D.C. with the American Bankers Association or the Independent Community Bankers of America are great opportunities to build relationships with elected officials and make sure they know who we are and what matters to us. These connections don’t just help our industry, they help our communities by ensuring our policymakers understand the real-world impact of their decisions.

Don’t forget — advocacy isn’t just for CEOs. In fact, it’s even more powerful when a broad range of voices are involved. Every banker has a story to tell, and every story helps paint a clearer picture of the industry’s relevance in our state.

The bottom line is this: advocacy amplifies our voices, protects what makes community banking special, and helps ensure a strong future for our industry. I encourage you to take the next step: name an advocacy officer; attend Capitol Day; host a TYLTWD event; register for the upcoming Milford Hills Outing; or simply reach out to learn more about how you can support WBA.

Our fundraising goal for 2025 is to raise $300,000 for WBA’s Wisbankpac (PAC) and Alliance for Bankers Conduit (ABW). The dollars raised for advocacy will help ensure our message is loud and clear in Madison and Washington as we continue to keep community banking relevant by shaping legislation that lessens regulatory burden and aims to level the playing field with competitors such as the credit unions and other non-traditional banks entering our space. I am asking for your support in achieving this important goal of raising $300,000.

I should note that WBA staff recently held a “WBA Mini-Golf Challenge” themed staff advocacy campaign organized by the WBA government relations team (Lorenzo Cruz and Tyler Foti) to support PAC and ABW. WBA staff collectively raised over $14,197 which exceeded the Association’s goal of $12,500. As WBA President and CEO Rose Oswald Poels says, supporting pro-banking political candidates is not about “D” or “R” for political affiliation, but instead it is “B” for the “Banking” Party.

When we speak up together, we’re impossible to ignore.

Northway is president and CEO of American National Bank Fox Cities and the 2025–2026 WBA Chair.

Thursday, October 23, 2025 | Milford Hills, Johnson Creek | wisbank.com/events/milford-hills-outing/

Smart strategy. Strong service. Real results.

As a community banker, we believe you deserve more than off-the-shelf solutions. At BOK Financial Capital Markets, we strive to offer solutions backed by insight, experience and commitment — from investment and liquidity planning to risk management and funding strategies. Structured to deliver a banker’s insights and built to work side by side, we aim to combine the strength of a national platform with the precision of personalized support — helping you stay focused on what is most important to your institution.

CFPB Issues Interim Final Rule for Section 1071

Small Business Lending Data Collection

By Scott Birrenkott

On June 18, 2025, the Consumer Financial Protection Bureau (CFPB) issued an interim final rule (IFR) amending the compliance deadlines for its Section 1071 small business lending data collection rule (1071). This latest development marks yet another chapter in the long and complex implementation process of Section 1071, which was first introduced under the Dodd-Frank Act more than a decade ago.

Because Section 1071 was enacted by Congress as part of the Dodd-Frank Act, CFPB is statutorily required to implement the provision through rulemaking. The 1071 rule is designed to increase transparency in small business lending by requiring financial institutions to collect and report data on credit applications from small businesses, including demographic information about the principal owners. The goal is to facilitate enforcement of fair lending laws and enable better policymaking. However, it also presents significant operational changes given the impact collection and reporting has on the business of lending.

Initially finalized in March 2023, the rule’s implementation was quickly met with legal challenges. In particular, the

American Bankers Association and Texas Bankers Association filed suit in federal court, resulting in a preliminary injunction issued in July 2023. That injunction paused enforcement of the rule for the plaintiffs in the case and was later extended nationwide while the U.S. Supreme Court considered the constitutionality of the CFPB’s funding structure in a separate case. That constitutional question was resolved in CFPB’s favor in May 2025, clearing the way for 1071 to move forward.

The newly issued IFR responds to the delay caused by the litigation. It provides a revised set of tiered compliance dates, offering additional time for lenders depending on their volume of covered originations. While the Bureau largely maintained the original structure of its implementation timeline, each compliance tier has been pushed back to account for the injunction period.

Notably, the IFR does not address other stakeholder concerns raised during the comment process or litigation. CFPB has indicated that it expects lenders to begin preparing for compliance based on the revised dates and existing rule framework. Still, the legal battle may not be over. On July 25, 2025, a coalition of community

advocacy groups filed a new lawsuit seeking to force the CFPB to implement the rule more quickly, citing harm to small businesses from the continued delay. The outcome of this latest suit remains to be seen.

Most recently, on August 1, 2025, the CFPB filed a status report with the Fifth Circuit Court of Appeals in the pending litigation (Texas Bankers Association v. CFPB) outlining further steps the agency is taking. CFPB confirmed that its new leadership has formally directed staff to initiate a new Section 1071 rulemaking, signaling that changes to the 2023 rule may be on the horizon. Thus, the IFR extension creates somewhat of a limbo, where the industry is still waiting to see what action CFPB will take with respect to 1071. Given the change in the Administration, the litigation status, news and expectations of a new proposed Section 1071 rule, WBA’s recommendation at time of publication of this article is that banks should take a temporary pause pending forthcoming rulemaking.

For more specific details on the new timelines see the June 2025 WBA Compliance Journal.

Birrenkott is WBA director – legal.

Current Fiscal Year Comment Letter Summary

As part of the rulemaking process within the Administrative Procedure Act (APA), all agencies are required to allow the public an opportunity to comment on proposed rules for a prescribed period (minimally 30 days). All WBA members are encouraged to share their comments with federal and state agencies as requested. Information regarding comment letters, or WBA-created letter templates, when available, are typically shared with the membership in the Wisconsin Banker Daily. Additional rulemaking developments at the federal level are compiled in the monthly WBA Compliance Journal.

WBA has submitted six comment letters to advocate for regulatory clarity, modernization, and community bank flexibility so far this fiscal year.

• June 16 – CFPB COVID-Era Rule Rescission: WBA supported rescinding temporary mortgage servicing flexibilities under Regulation X, recognizing the end of pandemic-related hardships and the need for updated servicing rules.

• June 19 – OCC Preemption Standards: WBA endorsed the OCC’s reaffirmation of national bank preemption, emphasizing its importance for regulatory consistency and efficient interstate banking.

• June 30 – Treasury RFI on Modernizing Payments: WBA backed Treasury’s efforts to expand electronic federal payments, urging practical implementation, improved account-matching, and tailored outreach to underserved populations.

• July 14 – Regulatory Thresholds Modernization: WBA recommended updates to Regulation O and other supervisory thresholds to reflect inflation and current banking realities, including increased credit limits and extended exam cycles.

• July 18 – Section 1071 Interim Final Rule: WBA urged the CFPB to simplify compliance timelines and data requirements for small business lending, advocating for narrower data collection, higher coverage thresholds, and stronger privacy protections.

• August 18 – CRA Rescission Proposal: WBA supported rescinding the 2023 CRA final rule, calling for interagency consistency, reduced data burdens, and supervisory improvements without further rulemaking.

WBA will continue to advocate for the industry through our ongoing active regulatory comment letters.

Budget Signed, Governor’s Seat Open: Now’s the Time for Banker Advocacy

By Lorenzo Cruz

The 2026 Wisconsin gubernatorial race is expected to break spending records, with key battles for both the governor’s office and control of the state legislature. On July 24, 2025, Democratic Governor Tony Evers announced he would not seek re-election, opening up the race for the first time in 16 years. Here’s a breakdown of the candidates and potential contenders:

Democratic Candidates:

• Lt. Governor Sara Rodriguez: Has officially launched her campaign.

• Milwaukee County Executive David Crowley: Taking steps toward running.

• Attorney General Josh Kaul: Has shown interest, either publicly or privately.

• Former Lt. Governor Mandela Barnes: Considering a run.

• State Senator Kelda Roys: Also mulling a bid.

Republican Candidates:

• Washington County Executive Josh Schoemann: In the race.

• Businessperson Bill Berrien: Has launched his campaign.

• U.S. Rep. Tom Tiffany: Considering a run.

• State Senator Mary Felzkowski: Seen as a potential candidate.

• Former U.S. Senate candidate Eric Hovde: Considering running.

• Businessperson Tim Michels: Also

weighing a run.

• Former Governor Tommy Thompson: Has not ruled out a bid.

Independent:

• David King: Running as an Independent.

With the race still evolving, Attorney General Kaul would likely be the early favorite for the Democratic primary, assuming he enters. On the Republican side, the candidate who secures Donald Trump’s endorsement is likely to have the edge, but the primary could still be unpredictable with a crowded field. The last open gubernatorial seat in Wisconsin occurred in 2010, when Scott Walker defeated Tom Barrett. National analysts have shifted the race from lean Democrat to a toss-up.

In other news, on July 3, 2025, Governor Evers signed the state’s $111 billion 2025-2027 budget into law. The budget was passed quickly due to tight deadlines for federal funding and a more divided legislature following recent elections and redistricting. The budget represents a compromise between Evers and the Republican-controlled legislature, with key provisions including:

• Tax Cuts: $1.3 billion in tax cuts, restructuring the second tax bracket, eliminating the sales tax on household utilities (effective October 2025), and exempting some retirement income for seniors.

• Education Funding: Increases to the state’s special education

WBA Staff Advocacy Event

reimbursement rate and support for the University of Wisconsin system.

• Child Care: $330 million allocated for childcare, including direct payments to providers.

Despite this compromise, some Democrats felt the budget did not go far enough in addressing their priorities, such as funding for schools, childcare, and Medicaid expansion. Governor Evers called it the best deal achievable through compromise.

The state’s non-partisan fiscal bureau projects a $770 million surplus for the 2025-2027 budget, but a looming structural deficit of $2.2 billion for the 2027-2029 period. With a challenging budget outlook and a contentious gubernatorial and legislative race ahead, the likelihood of significant new legislative action in the coming months appears limited.

Amid this uncertainty, it remains crucial for bankers to stay engaged in the political process. As of mid-August, the Wisconsin Bankers Association (WBA) had reached 61% of its $300,000 annual fundraising goal. WBA’s advocacy efforts continue to focus on issues like interchange fees, crypto regulation, credit unions, taxes, AI, and privacy. Contributions to WBA’s PAC or conduit are encouraged to support pro-business, pro-banking candidates, ensuring the industry’s voice remains influential.

Cruz is WBA vice president – government relations.

WBA's annual fundraiser in support of Wisbankpac and the Alliance of Bankers for Wisconsin (ABW) welcomed voluntary staff donations through specified personal contribution from payroll, a check made out to one of the funds, or the purchase of one or more ‘Jeans Day’ stickers for a casual dress day at the office. All money raised directly supports WBA’s pro-banking and pro-business advocacy efforts.

The popular “WBA Mini-Golf Challenge” fundraiser culminated in a summer cookout themed staff lunch on July 22. WBA President and CEO Rose Oswald Poels shared, “I’m proud to see our staff committed to supporting advocacy efforts that benefit the entire banking industry. Their dedication reflects just how strongly they believe in the mission we share with our members.” “In fact,” she added, “the collective contributions from WBA staff have made WBA the top-contributing organization so far in 2025.” WBA staff collectively raised over $14,100 — exceeding the Association’s goal of $12,500!

Wisconsin Bankers Foundation Announces 2025 Spring Scholarship Recipients

The Wisconsin Bankers Foundation (WBF), the philanthropic arm of the Wisconsin Bankers Association, has awarded four Wisconsin students — Ava Kok, Celine C. Kronstedt, Logan Schultz, and Bryana Williams — with the 2025 WBF Spring Scholarship.

The WBF Spring Scholarships of $2,000 each are open to graduating Wisconsin high school seniors and current college students pursuing higher education at an accredited Wisconsin college, university, or technical college. Recipients are chosen based on their academic achievements, community involvement, career goals, and financial literacy.

• Ava Kok is a junior at Marquette University, thriving in the university's Commercial Banking program. She worked as a summer commercial banking intern at Johnson Financial Group.

• Celine C. Kronstedt, a graduate of Cedarburg High School, worked as a customer service representative at Port Washington State Bank and is attending the University of Wisconsin – Madison.

• Logan Schultz graduated from New Glarus High School and is pursuing a degree in finance, investment, and banking at the University of Wisconsin – Madison. Schultz was an apprentice at Woodford State Bank in New Glarus.

• Bryana Williams is currently working to earn her Bachelor’s degree in Finance at UW – Green Bay. She started as a Universal Banker and now serves as a Commercial Loan Coordinator with Fortifi Bank.

“The Wisconsin Bankers Foundation is honored to recognize Ava, Celine, Logan, and Bryana with our annual Spring Scholarship,” said Foundation Chair Rose Oswald Poels. “We are pleased to support their continued education and wish them success and fulfilment in their future financial services careers.”

For more information on the Wisconsin Bankers Foundation and its annual scholarships, please visit wisbankfoundation.org.

The Wisconsin Bankers Foundation (WBF) is accepting applications for the 2025 Agricultural Banking Scholarship. Two selected students will receive a scholarship of $1,500 each.

Applicants must be currently enrolled at a Wisconsin public or private, non-profit college, university, or technical college and be pursuing a career in agricultural banking.

The selection criteria include academic achievement, having a career goal related to ag banking/finance, relevant experience in agriculture, extracurricular activities, and community involvement.

Bankers are encouraged to share the opportunity with interns, local students, and educators.

Visit wisbankfoundation.org/scholarships to learn more and apply. Applications are due November 17, 2025.

Pictured (left to right) are: Ava Kok, WBF Spring Scholarship recipient, and Heather MacKinnon, WBA vice president – legal and communications.

Pictured (left to right) are: WBA President and CEO Rose Oswald Poels and Celine Kronstedt, WBF Spring Scholarship recipient.

Pictured (left to right) are: FIPCO President Pam Kelly and Logan Schultz, WBF Spring Scholarship recipient.

Pictured (left to right) are: Greg Lundberg, president and CEO, Fortifi Bank, Bryana Williams, WBF Spring Scholarship recipient, and WBA's Rose Oswald Poels

BankWork$ Builds Meaningful Careers in Banking

Congratulations to the recent graduates!

BankWork$ is a free, eight-week training program to prepare participants — primarily individuals from under-resourced communities — for retail banking careers. The nationwide program was brought to Wisconsin in 2019 through a partnership between the Wisconsin Bankers Association (WBA) and Employ Milwaukee.

In August, a class of 10 students including Manasha Bridges, Yer Chang, Karrington Davis, Letitia Fowler, Nashay Frizell, Sierra Hampton, Tomadir Mahmoud, Spi Paw, Courtney Whitelaw, and Mikai Wolff graduated from the program. WBA President and CEO Rose Oswald Poels attended the ceremony and congratulated the graduates on their achievement.

Over the course of the eight-week program, students learned the hard and soft skills necessary for entry-level retail and operations positions. Upon graduation, each graduate has the opportunity to take part in on-the-spot interviews with BankWork$ employer partners.

BankWork$® is a public-private partnership that primarily trains adults from underserved neighborhoods for careers in retail banking. To learn more about the program, or how your bank can get involved, please visit employmilwaukee.org/BankWorks.htm.

Pictured (left to right) Front row: Manasha Bridges, Spi Paw, Yer Chang, Karrington Davis. Back row: Courtney Whitelaw, Tomadir Mahmoud, Mikai Wolff, Sierra Hampton, Nashay Frizell, Letitia Fowler, and WBA’s Rose Oswald Poels

WBA’s Rose Oswald Poels and BankWork$ instructor Adriene Wright. Oswald Poels presented a $15,000 donation to Wright in support of the program.

WBA CHAIR’S MEMBER APPRECIATION GOLF OUTING

More than 220 bankers and event sponsors joined WBA for the annual outing at Trappers Turn Golf Club in Wisconsin Dells. Thank you to all the bankers and event sponsors who participated to make this year’s event another successful outing! WBA would like to extend our appreciation to the 37 event sponsors (listed on the next page) who made this outing possible.

In his brief remarks to the group, WBA 2025-26 Chair Paul Northway welcomed attendees and talked about relevance as a mindset for all bankers, focusing on the importance of staying in tune with what is important to your team, your customers and community, and our industry through impactful advocacy opportunities. A special thank you to State Senator Howard Marklein (R-17), for joining the group and sharing an update from the state capitol.

Platinum Associate Member Sponsor

• Federal Home Loan Bank of Chicago

Gold Associate Member Sponsors

• Bankers’ Bank

• BMO

• BOK Financial Capital Markets

• FIPCO

• Godfrey Kahn

• ICBA

• MBIS

• WBA EBC

Silver Associate Member

Sponsors

• Bell Bank

• Cinnaire

• Hovde Group

• Integris

• Midwestern Securities

• Performance Trust

• UFS

• Wipfli

Bronze Associate Member Sponsors

• Advantage, powered by JMFA

• BHG Financial

• Boardman & Clark LLP

• Delta Dental

• Eide Bailly LLP

• Executive Benefits Network

• Forvis Mazars

• Jefferson Wells

• Locknet Managed IT

• Northland Securities

• Plante Moran

• Quad City Bank & Trust

• SHAZAM

• The Baker Group

• Vantage Point Solutions

Associate Members

• AmTrust Financial Services

• First Business Bank

• Ironcore

• PCBB

• UnitedHealthcare

Head Back to School With WBA! Upcoming education opportunities for Wisconsin bankers

Fall has arrived and schools are back in session, and that means your WBA banking schools are back in session as well! Each school focuses on a particular area of banking, allowing for the deep dive into that focused area over the course of two to five days. Visit wisbank.com/education for more information about these schools and to register your team online.

Principles of Banking – Two-day Accelerated Course

September 3–4 in Medford

September 30–October 1 in Horicon

October 8–9 in Mineral Point

Whether you are brand new to banking or looking to gain a broader understanding of the industry, WBA Principles of Banking School is the perfect starting point. Recognized for over 40 years as the most thorough introduction to banking, this course covers essential banking concepts, how banks operate as both service providers and businesses, risk management responsibilities, and the critical role of employees in a customer-focused environment.

Branch Manager Boot Camp

Fall Series Starts September 17; Four Virtual Half-Day Sessions

This exciting, four-part series will focus on the next generation manager who will be leading the transition to client relationship management, and to managing an active advisory environment for the client to achieve financial goals. The next generation manager will be leading this vital transformation.

Personal Banker School

September 30–October 1 in Wausau

November 12–13 in Madison

This program is designed to equip personal bankers with the essential tools, techniques, and industry knowledge needed to confidently sell, cross-sell, refer, and service a wide range of financial products. Participants will return to their institutions with sharper product expertise and enhanced customer service skills.

Advanced Commercial Lending School

October 14–15 in Madison

Take your bank's commercial lending expertise to the next level with this highly interactive two-day school. Designed for experienced bankers (pre-requisite courses and/or three-five years of working experience highly suggested), this program dives deep into advanced credit analysis tools, real-world case studies, and strategic problem-solving techniques. Attendees will work collaboratively in teams to analyze real businesses, tackle challenging loan scenarios, and sharpen their underwriting skills using Excel-based templates and hands-on exercises.

Deposit Compliance School & Regulation E Workshop

October 21–23 in Madison (or Virtual)

This three-day school was designed to provide you with a strong foundation of the various deposit regulations affecting your bank, the current trends in compliance, and the resources you need following the school. Bank retail and branch staff will benefit from this school, in addition to compliance and audit staff. A registration option is also available for those interested in just attending the full day of Regulation E on October 23.

Supervisor Boot Camp

October 28–29 in Madison

This two-day dynamic, interactive workshop is just what all supervisors need – both new and experienced supervisors will benefit! The program includes exploring coaching and leadership skills that lay out a plan for your success as a highly effective supervisor. You will find this experiential training opportunity invigorating, motivating, and applicable to managing and supervising others.

Consumer Lending Boot Camp

November 17–18 in Madison

Designed for those new to consumer lending or loan processing, this two-day boot camp provides practical training and insights to help participants become effective, confident consumer lenders. In addition to the classroom instruction, discussions, and case study application, attendees will receive a copy of ABA’s 7th edition Consumer Lending Textbook to use as a resource for additional learning back at the bank!

Questions regarding WBA’s schools and boot camps can be submitted via email to wbaeducation@wisbank.com.

GENIUS Act: Establishing a Regulatory Framework

The implications of the GENIUS Act are far-reaching for Wisconsin banks. The law allows eligible institutions to issue their own stablecoins, act as custodians for stablecoin issuers, and facilitate transactions. The legislation also reinforces safeguards, such as one-to-one reserve requirements and prohibition on paying interest to avoid the risks of unregulated digital assets. These guidelines serve as a critical first step for banks, Omahen says.

“In the short term, it makes it easier for banks to access markets and networks that were largely developed by the crypto trading world,” he says. “It’s now simpler for banks to engage with DeFi, and for DeFi to engage with banks.”

Omahen stresses that GENIUS Act’s audit requirements and reserve rules create an ecosystem of trust that was previously lacking. “We like predictability and auditability,” he explains. “Now we can trust that the issuer of a stablecoin actually has the funds to back it up.” Stablecoin as a Tool for Wisconsin Banks Community bankers have expressed

concerns that stablecoins could drain deposits. Omahen acknowledges that stablecoin held off-balance-sheet can’t be used to lend — but he sees more promising possibility in the long run.

“I would challenge the idea that stablecoin is just an exit for deposits,” he emphasizes. “It could just as easily bring you new deposits as it could remove them.”

Stablecoins offer benefits in the nearterm, like faster, lower-cost transactions, particularly across borders. He explains that economic growth is fueled by international business-to-business and business-toconsumer transactions.

“In some ways, this is bringing what was possible at the top end of the market down to a wider audience,” he says. “Faster payments mean more deals can be made. More business, more hiring — it’s a macroeconomic positive.” Looking Ahead: Bringing Stablecoin into Bank Territory

The GENIUS Act opens the door for banks to offer custody services for stablecoins, a corner of the market that Omahen believes will become strategically important. Community banks could offer safe storage, extend lending against digital currency, issue their own stablecoins and even tokenize bank deposits to open the

door to new customer bases.

“This generally involves a younger demographic,” he notes, “one that may not have a mortgage today but will be the recipient of the largest intergenerational transfer of wealth in history.”

Omahen’s work with the FIS/Circle partnership aims to make stablecoin adoption seamless for banks. By integrating Circle’s USDC stablecoin into FIS’s Money Movement Hub, banks can offer their customers a different payment rail option without overhauling their existing operations.

“It’s a premium add-on,” Omahen explains. “The design fits within a process that bankers already understand. Whether a payment goes through USDC, Tether, or something else, you’re still doing your fraud checks, compliance checks, and ledger adjustments.”

In simpler terms: Stablecoin becomes “just another payment option” within a bank’s already established workflow. For community banks, the question is less about whether stablecoin will become relevant, and more about how to be prepared when customers start asking about it.

Fenton is WBA Communications Coordinator

set up cost

Access a turnkey digital solution that delivers stable retail deposits with the efficiency of wholesale funding . Raise insured retail deposits from US consumers nationwide - all on one platform. Book a demo at raisin.com/partnerships No minimums

IT integration

Lights, Camera, Community: Easy DIY Video Tips for Bank Marketers

By Lauren Moran

As community bank marketers, we wear lots of hats — often juggling design, social media, events, and strategy as a team of one, two, or maybe a few if we're lucky. The idea of adding video to the mix can feel overwhelming. But video doesn’t have to mean big budgets, professional crews, or complicated editing. With a smartphone, a few simple tools, and a strategy focused on authenticity, you can create meaningful video content that boosts your brand and connects with your community.

Why Video Works for Banks

Video builds trust, communicates quickly, and adds personality to your brand. Social media platforms prioritize it because users like, share and watch more. An Invesp report showed that video posts get 48% more views and are shared 1,200% more than text-and-image content. Website visitors also spend 2.6 times longer on pages with video. In a scrollheavy world, video helps your message stand out and stick.

Start Simple: Equipment You Likely Already Have

You don’t need a fancy setup to get started. A smartphone with a good camera (most iPhones or Androids from the last three to five years will do) is enough to shoot high-quality video. To improve audio quality — a crucial part of video — invest in a clip-on lavalier microphone that pairs with your phone ($20 to $30 on Amazon). Good lighting is another quick win: filming near a window during daylight hours or using an inexpensive ring light can dramatically enhance your footage.

A small tripod or phone stabilizer keeps your shots steady, especially for sit-down interviews or event coverage. Many tripods now come with Bluetooth remotes, making it easy to start recording without touching the phone.

Easy Editing with Free or Low-Cost Tools

Once you have your footage, editing is where the magic happens — and it’s easy with beginner-friendly apps like CapCut, InShot, or iMovie (on iPhones). Canva also offers video editing tools to add branding, text overlays, transitions, and music, plus pre-sized templates for social posts, Reels, and Stories. Don't forget to add captions, as many viewers watch videos muted. Before you publish, always preview your video on desktop and mobile to ensure it fits and reads well on all screens.

Content Ideas That Work

You don’t always need a script — just a plan. Think bitesized, engaging, and relevant to your audience. Need help mapping it out? Use tools like ChatGPT or CoPilot to turn your ideas into a step-by-step storyboard or outline.

Here are a few DIY video ideas that are perfect for a small marketing team:

• Event recap or bank sponsorship highlights

• Fraud or financial tips from your in-house experts

• Customer testimonials

• Employee spotlights (these can help with your recruiting efforts!)

Congrats, You Made a Video! … Now What?

You don’t need to go viral — just stay visible. You can get a lot of mileage out of every video — post them on your bank’s social media pages and ask your staff to help spread the word, add them to your website, email campaigns and in-branch digital signage.

Aim for consistency over perfection — one video a month can make a difference.

And … ACTION!

DIY video production isn’t just possible — it’s powerful. In a relationship-driven industry like banking, authentic video builds trust, showcases your community impact, and keeps your brand top of mind. With a smartphone, a mic, and a little creativity, even small teams can produce big results.

Moran is assistant vice president – marketing with Wolf River Community Bank and serves on the WBA Marketing Committee.

Bulletin Board

News from Wisconsin Bankers Association Members

Promotions and New Hires

Brookfield

North Shore Bank announced Craig Plazak (pictured) as the bank's new vice president and commercial banking manager.

Madison

Kyle George (pictured) joined the Lake Ridge Bank Wealth Management team as a vice president and relationship manager.

First Business Bank welcomed Laura Osterling (pictured) to its subsidiary, First Business Specialty Finance, LLC, as vice president - equipment finance.

Milwaukee

Associated Banc-Corp announced that Chris Sager (pictured) has joined the bank as senior vice president, Private Banking Group manager of Professional Services.

New London

First State Bank announced the appointment of James Dietzler (pictured) as senior vice president, business banking.

Oostburg

Oostburg State Bank announced that Tom Brickley (pictured) has joined the bank as vice president – business banking.

Oregon

One Community Bank announced that Dan Carey (pictured) has been promoted to executive vice president.

Platteville

Mound City Bank announced the promotions of Mollie Clapham (pictured) to vice president – chief risk officer and Justin Olthafer (pictured) as vice president – chief information officer.

Superior

National Bank of Commerce announced the addition of Paul Wilcox (pictured) as SVP – chief mortgage banking officer.

Sun Prairie

Bank of Sun Prairie welcomed Gary Kuter (pictured) as their new senior vice president, chief financial officer.

Waterloo

F&M State Bank announced Joshua S. Patterson (pictured) as their new senior vice president and senior lender.

Waukesha

First Federal Bank of Wisconsin announced the promotion of Andrew (Andy) Narr (pictured) to executive vice president of commercial banking.

Waukesha State Bank welcomed Kevin Flood (pictured) as vice president – commercial banking officer. The bank also announced the promotion of Thomas (Thom) Kieffer (pictured) to vice president – senior wealth advisor.

Whitewater

First Citizens State Bank announced that Lea Sperle (pictured) has joined the bank as vice president – business banker at the East Troy Office,

Anniversary

Miranda Gustafson (pictured), manager – education and business development, celebrated 10 years of service with the Wisconsin Bankers Association in August.

Retirement

Congratulations to Ken Thompson (pictured), former President/CEO of Capitol Bank, who will be retiring on October 9, 2025, after 29 years of distinguished service. Thompson will remain on the Capitol Bank Board of Directors as Chairman. Thompson served a term as WBA Board Chair and was named the Association's 2024 Banker of the Year.

Good News

Four WBA members were named 2025 Women of Influence by the Milwaukee Business Journal

Two WBA bank members were honored:

• Tina DeGustino, Retail Regional President, Wisconsin, BMO Bank and WBA Board Member

• Heather Nelson, President and CEO, Spring Bank

Two WBA associate members were also honored:

• Sarah Alt, Chief Process and AI Officer, Michael Best

• Rebecca Mitich, Office Managing Partner, Husch Blackwell LLP

Unity Bank announced their 2025 Bankers of the Year (pictured below).

• Collaboration: Madison Rickbeil

• Customer Service: Dexeray Huth

• Innovation: Missy Gunderson

• Leadership: Malissa Grant

PremierBank announced that Silvia Donday-Selenske (pictured), bilingual loan officer at its Janesville location, was recognized as a recipient of the YWCA Rock County’s 50th Annual Women of Distinction Award.

Three WBA members were named Notable Latino Leaders by BizTimes Milwaukee

Two WBA bank members were honored:

• Ivan Gamboa, SVP, Tri-City National Bank

• Alfredo Martin, AVP and Community Engagement Manager, North Shore Bank

One WBA associate member was also honored:

• Alexandra Appenzeller, Shareholder, von Briesen & Roper s.c.

BOSP Bancshares, Inc., the holding company of Bank of Sun Prairie, Sun Prairie, Wis. and Banner Bancorp, Ltd. the holding company and sole shareholder of Banner Banks, Birnamwood, Wis., announced they have entered into a definitive agreement where BOSP Bancshares, Inc. will acquire all of Banner Bancorp, Ltd.’s ownership interest in Banner Banks. The transaction is expected to close in the fourth quarter of 2025.

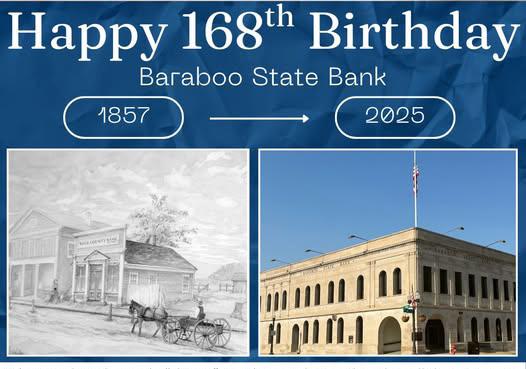

Congratulations to Baraboo State Bank for celebrating their 168th anniversary on July 20, 2025. Baraboo State Bank is the oldest bank in Wisconsin.

One Community Bank welcomed Intercity State Bank to their growing organization. The successful completion of this planned merger was official as of August 1, 2025. Intercity State Bank will operate as Intercity State Bank –Branch of One Community Bank.

Bill Borchers (pictured), SVP – loan servicing with One Community Bank, was elected as the President of the Wisconsin Mortgage Bankers Association Madison Chapter Oak Bank in Fitchburg proudly celebrated 25 years of growing Dane County on August 14, 2025.

Carey Clapham

Olthafer Wilcox Kuter Narr Kieffer Sperle Patterson

Sager Plazak Osterling Brickley Dietzler Flood George

Gustafson Donday-Selenske Borchers Thompson

Bulletin Board

News from Wisconsin Bankers Association Members

Celebrating a Lifetime of Service

Bank of Sun Prairie

Alan Sebranek, senior vice president, director of corporate governance and investor relations with Bank of Sun Prairie, was recently honored with a WBA Lifetime Service Award in recognition of his 42 years of service in the banking industry. WBA President and CEO Rose Oswald Poels was on hand to present a plaque to Sebranek. Pictured (left to right): WBA’s Rose Oswald Poels, Alan Sebranek, and Bank of Sun Prairie President and CEO Jimmy Kauffman

Headwaters State Bank, Land O’ Lakes

Community Involvement

Bay Bank celebrated its 30th anniversary on August 13, 2025, by awarding a total of $30,000 to local nonprofit organizations in the Green Bay and Keshena areas. Ten nonprofits each received $3,000.

First National Bank and Trust announced the return of its annual School Supply Drive, a community-wide initiative designed to ensure local students have the essential tools they need for a successful academic year.

Bank Five Nine donated $1,000 to the Silver Streak Transportation Program, a local transportation program dedicated to helping seniors and adults with disabilities maintain independence and access essential services. The bank also supported the Boys & Girls Clubs of Greater Milwaukee with a $2,500 donation toward their “S’more Fun at Camp” program.

WBA President and CEO Rose Oswald Poels presented Headwaters State Bank’s VP of Loan-Compliance, MaryEllen Otterpohl, a Lifetime Service Award plaque honoring her 35 years of service on August 22, 2025. Otterpohl, who has retirement on the horizon, is the bank’s longest-tenured employee. Pictured are MaryEllen Otterpohl (third from left) and Rose Oswald Poels (fifth from left) with Headwaters State Bank Board Members (from left to right): Greg Bybee, Tom Reed, Jeanene Meisser, James Meisser, Cori Zavada, and John Sarama

Accolades

Associated Bank was named a Financial Services Top Workplaces 2025 award winner — an honor based entirely on the voices of its employees.

Bank of Luxemburg named a 2025 Top Workplace in Northeast Wisconsin and also ranked #1 in the New Ideas category, underscoring the impact of their culture of innovation and fresh thinking.

Ixonia Bank was recognized as a 2025 Future 50 company by BizTimes Media, in partnership with the Metropolitan Milwaukee Association of Commerce (MMAC).

North Shore Bank was named to Forbes Best-In-State Banks list for 2025. The community bank has received Best-In-State Banks distinction for Wisconsin by Forbes six times.

Wolf River Community Bank was voted Best Bank and Best Mortgage Lending Company in the 2025 Wisconsin Community Choice Awards – Best of the Valley, presented by Post-Crescent Media.

Associated Bank made a donation of $40,000 to Junior Achievement of Wisconsin to support K-12 financial educational learning experiences in the Sheboygan area and throughout Wisconsin.

Prevail Bank completed its 2022 pledge to the Children’s Museum of Eau Claire recently with a final $1,000 payment toward its $10,000 commitment. The bank also contributed $5,000 to CREATE Portage County, bringing the bank’s total investment in the community development organization to $22,250.

Citizens State Bank announced its commitment to enriching the local Cadott community with a $100,000 donation to support the new Cadott Community Library.

Lake Ridge Bank became the first agency ambassador for Own It: Building Black Wealth which is a local initiative focused on increasing Black and Brown homeownership in Dane County.

SESSIONS INCLUDE:

• What’s New in Compliance Concierge™

• Popular Support Questions

• Support Reveals Some Tips and Tricks

• Lessons Learned From the Field (ShareFI)

• Share and Compare Networking

• Breakout Sessions

• Answers to Your HELOC Entry Questions

• A Closer Look at Business and Ag Loans

• To Escrow or Not to Escrow

• Navigating Interfaces Register online at: www.fipco.com/training/fipco-training-events

LEADERS IN BANKING EXCELLENCE

Class of 2025 Installed on Honor Wall in WBA Headquarters

Five individuals will be recognized by the Wisconsin Bankers Association (WBA) for their excellence in banking, community service, and civic involvement. A celebration will be held on Friday, September 5, unveiling five new plaques on the Leaders in Banking Excellence honor wall at the WBA headquarters in Madison. Established in 2020, the wall now profiles 32 outstanding current and former banking leaders who have helped to shape the industry into what it is today.

Congratulations to the Class of 2025 Leaders in Banking Excellence: Robert B. Atwell, Nicolet National Bank, Green Bay; Michael E. Daniels, Nicolet National Bank, Green Bay; Mark W. Forsythe, Peoples State Bank, Prairie du Chien; Douglas S. Gordon, WaterStone Bank, Wauwatosa; and the late Samuel C. Johnson, Johnson Financial Group, Racine.

A short bio of each honoree is included below. Read more about the honorees and view event photos at wisbank.com/excellence or visit the WBA office to view the Wall of Excellence in person.

Nominations for the Class of 2026 are welcome now through May 15, 2026, at wisbank.com/excellence.

Bob Atwell co-founded Nicolet National Bank with Mike Daniels in 2000. Bob held the roles of Chairman, Chief Executive Officer, President, and Executive Chairman at Nicolet. He successfully led Nicolet through the early stages of organic growth, laying groundwork for Nicolet’s purpose and values. Bob often spoke about Nicolet’s role as local people who deal in local solutions.

While Bob’s career has many great moments, perhaps none were greater than his leadership during the financial crisis of 2008-2010. Bob insisted that Nicolet be in front of customers, listening, and explaining that even though problems were created at the federal level, they could be solved together locally. Bob’s gift of strategic vision and unwavering belief in the bank’s purpose and values helped set Nicolet up for success for years to come. Bob is a graduate of Beloit College and the Yale School of Management. He serves as a director of Ariens Company, Great Northern Corporation, and Relevant Radio. He also served on the University of Wisconsin Board of Regents. Bob’s career is defined by big ideas, collaboration, and a lifetime of service to the community.

Nicolet started with one of the largest capital raises in Wisconsin banking history and grew to become the second-largest bank headquartered in Wisconsin. Nicolet’s focus on creating shared success by effectively serving customers, employees, and shareholders created a simple, enduring platform for community bank success.

Mike Daniels co-founded Nicolet National Bank with Bob Atwell in 2000. Throughout his career at Nicolet, Mike held various roles, including Chairman, Chief Executive Officer, President, Chief Operating Officer, Chief Lending Officer, and Executive Vice President. He successfully spearheaded Nicolet’s growth, both organically and through acquisition, and led teams that successfully integrated ten acquisitions over eight years.

While leading these bank integrations, Mike created what is known at Nicolet as the “Friday Email,” where he explained in detail Nicolet’s purpose, core values, and the concept of shared success in a series of emails to all employees. The messages helped new employees understand what success looks like at Nicolet and to help them succeed. Nicolet published a booklet called Friday Emails with Mike for all employees. He is currently working on two additional booklets. Mike’s greatest gift to Nicolet, beyond his strategic vision, was his ability to convey complex ideas in simple terms. He rallied every level of employee around a central purpose, which was the precursor to great execution.

Mike is a graduate of St. Norbert College in De Pere, Wisconsin. He serves on several community and non-profit boards and is the founding President of the Nicolet National Foundation. He serves on the Board of Directors of the Green Bay Packers and the Board of Trustees at St. Norbert College. Mike is well-known in Wisconsin as a sounding board for entrepreneurs, business executives, and young professionals.

Nicolet started with one of the largest capital raises in Wisconsin banking history and grew to become the second-largest bank headquartered in Wisconsin. Nicolet’s focus on creating shared success by effectively serving customers, employees, and shareholders created a simple, enduring platform for community bank success.

LEADERS IN BANKING EXCELLENCE

Mark Forsythe embarked on an impactful 40-year banking career after earning his master’s degrees in Agriculture and Applied Economics from the University of Wisconsin-River Falls. He taught at both the high school and college levels, then transitioned to Peoples State Bank as an Agricultural Loan Officer in 1982—a career move that marked the beginning of his lifelong commitment to serving rural communities.

His leadership trajectory was swift, advancing to Senior Lender and Head of the Loan Department in 1989, then joining the Board of Directors in 1990. Mark rose to President and CEO in 2008 and held the role until his retirement in 2020. Peoples State Bank experienced historic market expansion that achieved record levels of growth and profitability under his smart and strategic leadership. He stays connected to the banking community in retirement by serving as the director of both Peoples State Bank and Peoples Bancorp Inc.

Mark believes in strengthening his community far beyond the walls of the bank. He remained active in professional organizations during his career, serving as Chairman of the Wisconsin Bankers Association (WBA) Agricultural Bankers Section Board, contributing his leadership on the WBA Board of Directors, and acting as a strong voice for political advocacy on behalf of the banking industry.

His philanthropy extended to leadership roles on the Prairie du Chien School Board, Crawford County Dairy Promotion Committee, Driftless Development Board, UW-River Falls Foundation Board, Couleecap Board of Directors, and his church. Mark and his wife, Kati, continue to support citizen-led initiatives focused on education, agriculture, and rural development. Mark’s legacy is defined by a lifelong mission to support community banking and rural families.

Douglas Gordon launched his extensive 40-year banking career in 1977 while completing his undergraduate education at the University of Wisconsin-Parkside. He worked as a Credit Analyst at Cudahy Marine Bank while earning two degrees in Business and Mathematics. He quickly rose to President of Cudahy Marine Bank after graduation and secured the esteemed “Preferred Lender” designation from the U.S. Small Business Administration—one of only four banks in Wisconsin to win that status.

Doug brought his powerful leadership to his role as Executive Vice President at Security Bank and led the organization through a successful sale to Marshall & Illsley Bank, where he then served as a Senior Vice President. He retired in 1999—but his passion for community banking proved too strong to leave behind. He returned for an 18-year tenure as President and CEO at WaterStone Bank. In his final career chapter, he restored profitability, strengthened financial performance, and expanded the bank’s community impact before retiring for the final time in 2023. He remains deeply connected to WaterStone Bank and continues to serve on the Board of Directors.

Doug uplifted the banking industry in Wisconsin and beyond. His industry involvement extended to the Wisconsin Bankers Association, where he added his powerful voice on legislative advocacy, regulatory discussions, and leadership development programs that helped strengthen Wisconsin’s banking landscape. He also served on the Federal Reserve advisory councils in Chicago and Washington, D.C.— including a national leadership role—where he provided high-level insight on banking policy.

Doug supports civic initiatives, financial literacy efforts, and philanthropic nonprofits. He has served as a key advisor to Marquette University’s Commercial Banking Program since the initiative’s inception. Doug remains deeply committed to empowering the next generation of Wisconsin bankers and building a strong pipeline of industry-ready graduates.

Samuel C. Johnson, a lifelong resident of Racine, was the fourth generation of his family to lead S.C. Johnson & Son, where he transformed a wax business into a multibillion-dollar global empire for consumer goods. He earned a master’s degree in Economics from Harvard Business School in 1952, then returned to Wisconsin to guide his family business through decades of exponential growth.

After recognizing the need for a different kind of bank focused on unmatched personal service and a commitment to local communities, Sam founded Heritage Bank & Trust in 1970, laying the groundwork for what would become Johnson Financial Group. His smart leadership burgeoned the establishment from a trailer with three employees into one of Wisconsin’s largest privately-owned community banks. As of 2025, Johnson Financial Group has 950 employees and has grown to over $6 billion in assets.

Sam’s commitment to banking in his home state reflected his broader philosophy of reinvesting in local people and businesses to build self-sustaining economic resilience. He was a pioneering environmentalist and dedicated philanthropist. Sam personally financed a grassroots campaign against building coal plants in Oak Creek and served as a founding member of the World Business Council for Sustainable Development. He supported local arts, education, and health initiatives, and together with his wife Imogene P. Johnson, founded The Prairie School in Wind Point. He also revitalized downtown Racine with sustainable architecture projects.

Through Johnson Financial Group, Sam left a legacy of service, security and sustainability that you will not find anywhere else. As a trustworthy financial partner, Johnson Financial Group is invested in the success of its individual and business customers.

The criminals work together as a team — one poses as law enforcement, another as a bank representative, another as a government agency. The victim, eager to help resolve the issue, often ends up handing over money or gift cards.”

At Fortifi Bank, Chief Risk Officer Theresa Weckwerth has seen a rise in imposter scams. “Criminals are calling and texting clients while pretending to be from trusted organizations, including their bank’s fraud department or law enforcement, in an effort to obtain credentials to the client’s online banking.”

But, despite all the new technology, some scams endure.

“The most common type of fraud we continue to encounter is check fraud — specifically altered checks intercepted from the mail,” said Jennifer Haydon, CAMS, vice president and compliance officer at American National Bank Fox Cities. “These checks are legitimate, but they’ve been washed or changed after being issued. We also see business email compromise involving ACH rerouting or demographic changes intended to facilitate fraud, and a recent increase in check kiting, driven in part by increasing costs and financial pressures on individuals.”

Christensen said fraudsters are refining old tactics. “Whereas they used to work alone, they now work in groups. After hours of talking to multiple ‘experts’ from supposed government agencies, victims feel overwhelmed and confused — which makes them more likely to hand over sensitive information or money.”

Building a Fraud-Savvy Workforce

Bank employees remain the first line of defense. Ongoing training and empowerment are essential.

“Education is paramount,” said Haydon. “Fraud can occur across many platforms, so it’s essential that staff are trained to recognize the warning signs. Teaching employees to ask questions, dig deeper, and investigate unusual requests is often all it takes to uncover a fraudulent attempt.”

Christensen noted that training must be both formal and ongoing. “Each year, we hold in-person fraud training using real examples of recent attempts. Throughout the year, we supplement that with online meetings focused on different fraud scenarios. I’m very proud of our staff for following procedures and knowing how to handle red flag situations to protect our customers and the bank.”

Birrenkott agreed that frontline empowerment is key: “If a teller notices a customer acting strangely, withdrawing unusually large sums, or presenting

a suspicious check, they should have the confidence, tools, and authority to respond — whether that means asking questions, involving a manager, or refusing the transaction. Once the bank accepts a fraudulent check, it becomes much harder to address the situation.”

Birrenkott suggests sharing real-world examples of fraud attempts and ensuring that employees know the bank’s policies for refusing a suspicious check or escalating concerns, stating “Quick huddles, regular updates, and strong communication channels help keep everyone alert.”

Tools, Tech, and Teamwork

Alongside training, banks rely on a mix of technology and collaboration. Fraud monitoring software, transaction alerts, and law enforcement partnerships are crucial. Just as important is industry-wide cooperation to share intelligence and trends before they spread.

Four WBA member banks, AbbyBank, Forward Bank, Northwestern Bank, and Prevail Bank have come together to educate their communities on avoiding common forms of fraud. Since last summer they have been educating their customers and community members through fraud alerts shared with local media.

Many member banks work with local law enforcement to spread the word about fraud by hosting educational sessions that are open to the public on a variety of fraud-related topics. Those partnerships help underscore the gravity of today’s fraud landscape.

It’s now increasingly common to see warning messages on the homepages of banks’ websites. For example, the First Business Bank website shares this message in a prominent spot: Your Security Is Our Top Priority — First Business Bank will never request sensitive information like account numbers, online banking IDs, tax ID or Social Security numbers, passwords, or Personal Identification Numbers (PINs) via unsolicited calls, emails, or texts. Please regard such requests as highly suspicious. For tips on preventing fraud, visit our Security Center.

Protecting Customers While Ensuring a Smooth Banking Experience

Banks are also investing heavily in customer education. “The best approach is to get ahead of it,” said Haydon. “The more we talk about fraud, the less effective it becomes. Awareness helps customers recognize red flags before they’re deceived — sparing them the financial loss or shame that often follows.”

Christensen emphasized the importance of customizable tools: “We offer free, real-time alerts, one-time passcodes, the option to add Trusted Contacts, and comprehensive debit card controls. That way customers can choose

the level of security that works best for them.” Weckwerth said Fortifi Bank integrates fraud education into daily client conversations. “When we ask questions, we remind clients that we want to protect them from fraud. We also provide custom-created materials, fraud brochures distributed at the teller line and drive-up lanes, and free community presentations to raise awareness about common fraud trends.”

Tap Into Reliable Resources

• WBA has many consumer resources available at www.wisbank.com including content created by WBA in addition to resources from federal agencies.

• ABA’s BanksNeverAskThat Campaign includes tips on how to avoid phishing in emails, calls, and text messages, how to videos, a game, a quiz, and downloadable resources. ABA also has social media posts for banks to use. Registration is free for banks regardless of ABA membership status. Registered banks will receive a link to access the social media campaign materials. The ABA Fraud Contact Directory is another valuable tool.

• ICBA’s Check Fraud resources include guides for banks responding to instances of check fraud claims and an information piece for customers to help them protect against check fraud. ICBA’s Solutions Directory lists service providers in payments, compliance, and security.

• Visit WBA’s online Best Practices Library to access tools and sample affidavits shared by the Financial Crimes Committee. WBA’s Negotiable Instruments Manual is another helpful resource.

• WBA partners with Community Bankers Webinar Network and OnCourse Learning who offer fraud webinars.

A Shared Responsibility

Fraud prevention is a joint effort between banks, customers, regulators, and communities.

“Vigilance and awareness are key,” Birrenkott said. “Everyone in the bank — not just risk or security officers — should know the signs of fraud and how to act.”

“Fraudsters are constantly adapting, and with AI making schemes more sophisticated, banks can’t treat fraud prevention as an occasional task,” Birrenkott added. “It requires constant vigilance and engagement — every day.”

Reiser is WBA writer/editor

Is your community bank bond portfolio performing?

Our experienced team of attorneys has been helping financial institutions tackle mission-critical issues like these for more than 30 years, so if any of the following are on the minds of your management team and board, they’re on ours as well:

• Mergers & acquisitions

• Fraud mitigation and recourse

• Succession planning

• Capital strategies

• Shareholder liquidity Technology

• Compliance

• Changing regulatory environment and relationships

• Attracting and retaining talent

• Entering new business lines or markets

• Risk and credit mitigation, restructuring or collection

• Branding and intellectual property

At Reinhart, we’re dedicated to ensuring you can anticipate changes, mitigate risk and be poised to seize opportunities whenever they arise.

It’s what we call partnering in possibilities.

Effective Creativity: Marketing Lessons from Clark Hook

Many banks tout the same core values: personable service, reliability, and quick delivery. According to Clark Hook, Executive Creative Director at FMS, that’s exactly the parity problem: “You’re trying to build a personal, memorable brand for a bank that does exactly the same thing as its competitors,” he says. “Finding a way to stand out in that sea of sameness is hard — but it’s also wildly rewarding.”

Hook will take the podium at the WBA FLEX Retail and Marketing Summit hosted in Wisconsin Dells on November 19-20. He will lead two sessions: “From Mundane to Memorable,” a deep dive into crafting authentic brand messaging for your bank, and “The Case for Creativity,” a breakout session about mixing bold ideas with strategy.

In his 14 years working exclusively with banks, Hook has seen how powerful branding can transform an institution. His philosophy is straightforward: Creativity only works when it is paired with strategy. “Everything we do has a reason, and everything is rooted in a strategy to solve a business problem,” he emphasizes.

Attendees can expect actionable advice for dodging cliches, building a narrative that is authentic to your organization, and creating marketing that resonates with your community. Find more information on the Summit website at wisbank.com/FLEX.

A

Quad City Bank & Trust is committed to building long-term relationships by providing the right tools and personalized service.

CorrAccess

A web-based cash management tool that allows us to serve as the bridge between your financial institution and the Federal Reserve.

CorrExchange

Lowers costs of clearing transit items through our OnWe® Image Exchange Network

Correspondent Lending

Available for Bank Stock Loans, Personal Loans, Officer/Director Loans, Participation Loans, Secured and Unsecured Lines of Credit and Letters of Credit.

By Rob Foxx

Have you ever wondered why there’s been such a strong push toward next-generation antivirus (NGAV) programs over the past five years? Many individuals, businesses, and even banks often fail to see the value in upgrading their traditional antivirus solutions. The reason isn’t always a lack of need — it’s often a lack of clear communication. As someone in IT, I admit that we’re not always the best at explaining complex concepts to those outside the tech world.

For years, traditional antivirus products rarely found any real issues — and if they did, the problems were usually resolved quickly. But does that really mean you're safe?

Traditional antivirus is primarily designed to detect file-based threats. If an attacker is using only known malicious files, there’s a good chance your antivirus will catch it. However, attack tactics have evolved. A small change to a file can alter its signature and bypass detection. Worse, many modern attacks don’t rely on malicious files at all.

Today’s threats often reside in active memory or use legitimate system tools already present on the machine—a method known as “living off the land.” These attacks can operate under the same

AI Driven Threat Detection

permissions as the user, making them harder to spot. In some cases, the attack originates from another compromised device on the network, meaning the affected machine may not have done anything wrong. While not all of these attacks use AI, the most advanced and damaging ones often do.

So, how do we defend against them?

That’s where AI-powered antivirus tools with EDR (Endpoint Detection and Response) capabilities come in.

Unlike traditional antivirus, AI-based systems use deep learning to monitor behaviors — not just file signatures. These tools analyze endpoint behavior, user behavior, network traffic, and file activity to identify suspicious actions. They go beyond detecting “known threats” by recognizing behavior that resembles malicious activity. Depending on configuration, these systems can automatically remediate issues or flag them for investigation.

Of course, behavior-based detection isn’t perfect. False positives are a reality. Fortunately, most systems allow tuning through rules, whitelists, and baselines to distinguish between real threats and benign activity.

EDR platforms also offer other advantages. For example, is one of your salespeople logging

in at 3:00 AM on a Saturday? That could be a legitimate case — or it could be a compromised account. Did someone plug in a USB device? That might be a new keyboard — or it might be an external drive loaded with malware. Is your backup system suddenly seeing a spike in traffic? That could signal a ransomware attack preparing to encrypt your backup data.

With the right tools, you can detect and respond to threats like these before they cause damage. Which tools are best? That depends on your environment, but some leading names in that space include Cynet 360, CrowdStrike, SentinelOne, and others. Most rely on similar data sets, but their features, interfaces, and response strategies can vary.

In today’s cyber landscape, traditional antivirus simply isn’t enough. AI-powered, behavior-focused tools are no longer optional — they’re essential. Foxx is director – infosec and IT audit services for FIPCO. He can be reached at rfoxx@fipco. com or 608-441-1249.

For more information about FIPCO forms, software, or other products, visit fipco.com, call 800-723-3498, or email fipcosales@fipco.com. FIPCO is a WBA subsidiary and WBA Gold Associate Member.

Jeff

Otteson Vice President of Sales

jeffo@mbisllc.com 608.217.5219

Melissa Noonan Account Manager melissan@mbisllc.com 608.441.1275

Professional Lines

Financial Institution Bond

Directors & Officers Liability

Cyber-Privacy Liability

Property & Casualty Lines

Property-Liability-Business Auto

Umbrella Liability

Workers Compensation

Foreclosed Property

Lending Lines

Mortgage Impairment

Force Placed Hazard and Flood

Lenders Single Interest

Commercial Asset Lenders Single Interest

• Work Directly with the Owners

• Receive Loan Approvals Within 2-3 Days

• Avoid Annoying Covenants

• Limited or No Origination Costs

• Low Interest Rates

• Mergers & Acquisitions

• Strategic Planning

• Ownership Succession

• Securities Offerings

• Vendor Contracts

• Compensation Plans

• Commercial Lending

• Consumer Finance

• Workouts & Bankruptcy

• Privacy & Information Security

• Fintech

As a WBA Gold Associate Member, we prioritize our commitment to the Wisconsin banking industry. More depth, more expertise, better results.

“We trusted Godfrey & Kahn with the sale of our family’s most valuable asset...our bank. And we would do it again.”

— $50 Million Community Bank

“Godfrey & Kahn’s responsiveness, follow-up, teamwork and expertise exceed expectations.”

— $1 Billion+ Community Bank

Thank you, Package Holders

Thank you to the WBA Platinum, Gold, Silver, and Bronze Associate Member companies for their continued support of the banking industry and the Association. These companies provide services, information, and products that help Wisconsin banks serve their customers and communities. Thank you. Please visit wisbank.com/associates for more information about these companies.

Correspondent Banking

WBA

WBA Gold Associate Members

WBA Silver Associate Members

WBA Bronze Associate Members

Cracking the Collaboration Code

“Edutainer” Nan Gesche Teaches Teamwork at BOLT Winter Leadership Summit Corporate values statements often include “collaboration” as a fundamental aspect of their culture, yet many organizations struggle to put it into meaningful practice. As the adage goes: People don’t leave companies; they leave bad managers. At the WBA BOLT Winter Leadership Summit on November 5, 2025, leadership coach, educator, and former bank regulator Nan Gesche will help participants close that gap with her interactive session, “Cracking the Collaboration Code.”

Gesche learned the power of collaboration early on in her career. “I wasn’t promoted just because of my technical skills. I was promoted because of my ability to interact effectively with senior management.” She emphasizes that the ability to collaborate with your peers is a decisive factor in professional success. “You can be the most competent person in the world, but if you don’t fit the culture and you don’t know how to collaborate, you won’t be successful long term.”

Gesche’s conviction springs from 16 years of experience working at regulatory agencies and banks. She now teaches courses in communication, conflict resolution, and leadership, and touts the power of interpersonal skills in the workplace.

Attendees can expect an active, hands-on session — including structured networking and respect-building discussions — designed to show how easy it is to make a meaningful connection in just a 40-second conversation. Participants will leave with strategies to strengthen team communication and navigate workplace differences with empathy. Find the full BOLT Winter Leadership Summit agenda online at www.wisbank.com/Summit.

Immediately following this workshop session at the summit will be the popular peer group discussions. Ten different topics will be identified for discussion, and attendees can then choose which topic table they would like to join. The energy will continue into the afternoon, where attendees will enjoy a keynote on “Building a Culture that Fosters Curiosity” with Anne Schutt from Midwestern Securities, and take a look at “The New Rules of Leadership” with April Lewis, a nationally recognized leadership strategist, keynote speaker, and decorated U.S. Army veteran.

Find the full BOLT Winter Leadership Summit agenda online at wisbank.com/Summit.

Taking Care of Your People: Affordable, High-Quality Benefits Through WBA EBC

By Daryll J. Lund

As banks around Wisconsin start digging into their 2025 budgets, now’s a good time to talk about something that matters to every team member: benefits. Offering a strong benefits package isn’t just good business — it shows your staff you’re invested in their health, well-being, and financial security. That’s where WBA’s subsidiary, the Wisconsin Bankers Association Employee Benefits Corporation (WBA EBC), comes in.

WBA EBC has been helping member banks offer comprehensive, high-quality benefits ranging from medical, dental, vision, and prescription coverage to life and disability insurance at pricing that’s typically only available to much larger employers. Thanks to the combined purchasing power of Wisconsin’s banking community, your bank can offer top-tier benefits that help attract and retain the people who help make your bank great.

And here’s the best part: WBA EBC understands banks. The team knows the challenges you’re facing when it comes to hiring and keeping great talent. They’re problem-solvers, focused on finding the right fit for your bank and backing it up with attentive and reliable service. Got a question? Need a hand with enrollment or billing? The easy-to-use online portal makes managing it all an easier lift.

A standout offering is WBA EBC’s Association Health Plan, serviced by UnitedHealthcare, which gives employees and their covered spouses the chance to earn up to $1,000 each through UHC Rewards simply for doing things that support a healthy lifestyle. Whether it’s tracking daily steps, completing a wellness survey, or getting that annual checkup, these rewards come at no extra cost with the UHC plan.

It’s a win-win: your employees work toward their wellness goals, and they’re rewarded for doing it — all while your bank demonstrates a real commitment to their futures.

WBA EBC also partners with Lincoln Financial Group to offer life and disability insurance with great value adds like Travel Connect and Life Keys (included with life insurance), and employee assistance programs (included with long-term disability). These offerings help give your team more peace of mind while setting your bank apart as an employer that cares.

If you’re looking to strengthen your benefits package and show your employees that their well-being is a top priority, WBA EBC has you covered.

To learn more about the options available, reach out to Jeff Wagner, vice president WBA EBC, at jwagner@wisbank.com or 608-279-8148.

Lund is WBA executive vice president and chief of staff.

See the Future Clearly with DeltaVision

Now Offered Through WBA-EBC!

After 15+ years of a trusted partnership with Delta Dental, WBA-EBC is proud to bring you DeltaVision — a new vision coverage plan backed by the same exceptional service and reliability you know and trust.

Why Choose DeltaVision?

• Long-term savings with a rate guarantee through 2027

• 20% off items not covered by the plan at in-network providers

• 40% off an extra pair of glasses after your benefit is used