Building Bridges: Strategies for Reaching and

Supporting Hispanic Customers

By Katie Reiser

The Hispanic community is one of the fastest-growing demographics in the United States, projected to reach 30% of the population by 2060, according to the U.S. Census Bureau. In Wisconsin, Hispanics already make up a significant and growing portion of the population, creating both an opportunity and a responsibility for banks to better serve this vital community. By adopting culturally responsive outreach strategies, banks can foster trust, improve financial literacy, and grow their customer base.

In September, the Federal Deposit Insurance Corporation’s (FDIC) Alliance for Economic Inclusion (AEI) and BankOn Greater Milwaukee hosted a conference, Promoting Economic Inclusion in Milwaukee’s Hispanic and Latino Community, which helped shine a light on what financial institutions, non-profit organizations, and the FDIC are doing to build these bridges. Many of the bankers interviewed for this article participated in panel discussions during the conference or shared important data.

Note: The terms Hispanic and Latino are often used interchangeably but have distinct meanings. Hispanic refers to people connected to Spanish-speaking countries, while Latino emphasizes connections to Latin America, regardless of language. In this article, we have chosen to use the term Hispanic for consistency, unless an interviewee specifically used the term Latino.

Here are some proven strategies and actionable tips to consider, combined with insights from bankers and professionals who are making an impact in Wisconsin.

Develop Bilingual Resources and Services

Language barriers are a significant hurdle for many Hispanic customers, especially those who are recent immigrants or first-

generation Americans. Offering bilingual services, both in person and online, is a foundational step to improving accessibility.

• Hire bilingual staff: Having employees who can communicate fluently in Spanish demonstrates respect and commitment to serving the community.

• Translate materials: Ensure that brochures, websites, mobile apps, and marketing materials are available in both English and Spanish.

• Leverage technology: Provide live translation services or chatbots that can assist Spanish-speaking customers in real time.

Across the board, the language barrier remains the highest hurdle. Jennifer Lamb, loan officer with Great Midwest Bank said, “Providing bilingual materials, having actual staff members or customer service representatives that speak the language, and online resources can definitely alleviate some of the language barriers that we see.”

It goes beyond simply having a few brochures and forms translated into Spanish. Lamb said, “Many Hispanic families nowadays, they're tech savvy. A lot of them are starting to use digital platforms and digital services like mobile banking.” She recommends a robust online platform, along with the option for the families to do their banking in person.

Sara Fameree, retail sales office manager with Bank of Luxemburg, said, “In my branch, there are three of us who speak Spanish, and we are very much in that community. So that has been essential for us to be able to assist those customers.” She added, “Beyond that, even in the call center you need to have adequate staff to be able to assist those customers because they're not just opening up checking accounts, they're getting mortgages, getting business loans.” She shared, “To have that language available to them, customers are just going to feel so much more comfortable and more welcomed to work with you.” Fameree revealed that often customers are initially shy due to the language barrier, but “You see their face light up and they react like ‘oh my goodness you speak my language.’”

Build Trust Through Financial Literacy Programs

Many Hispanic individuals come from cultures with different financial systems or may have had limited access to banking services. Providing financial education can help demystify banking and encourage long-term relationships.

Mid-Term Reflections: A Year of Engagement and Progress for Wisconsin’s Bankers

By Al Araque

As I reach the halfway point of my term as Chair of the Board of the Wisconsin Bankers Association (WBA), I reflect on the incredible progress we’ve made together in amplifying the impact of our Association. It has been a truly rewarding experience, and I have had the privilege of attending events and engaging with many of you, witnessing firsthand the power of our collective efforts.

Presiding over Board meetings, I have been struck by the dedication of WBA Board members, who along with volunteer committee, advisory board, and section leaders exemplify the vital role members play in advocating for the industry and driving meaningful change.

Speaking of advocacy, it has been energizing to witness the impact of member advocacy in action. From meeting with legislators to pushing for policies that benefit our communities, your voices are truly making a difference. A good example of the effectiveness of WBA members was the annual fall trip to Washington, D.C., where members met with senior officials from the Federal Reserve, FDIC, OCC, CFPB, and SBA. Topics covered included interchange/ Reg II, brokered deposits, preemption, Basel III, FDIC signage rules, banking as a service, and Section 1071. I had the chance to connect with many of you during our annual WBA Chair’s Member

Appreciation Golf Outing in August. It was a fantastic opportunity to meet, or re-connect with fellow members, share ideas, and discuss the important work we’re doing in the banking industry.

Another highlight was attending the Wisconsin Bankers Foundation Gala in September, where I was joined by fellow bankers to raise funds for financial literacy initiatives. These efforts are critical in ensuring that we continue to serve our communities with the knowledge and resources they need to succeed. It was inspiring to see the generosity of WBA members, all committed to building a stronger financial future for the people of Wisconsin.

WBA President and CEO Rose Oswald Poels recently shared some numbers that reflect the scope of member involvement.

Education:

• 500+ bankers are members of our free WBA Connect online peer groups

• 600 members belong to the Building Our Leaders of Tomorrow (BOLT) section

• Over 6,000 people have attended WBA-hosted events in 2024

Advocacy:

• In December, over 85% of our advocacy goal of $300,000 had been raised

• There were 49 BIGG Award recipients; 48 Gold Triangle members; 14 Leadership Circle members; and 91 Silver Triangle members

• 183 banks designated Advocacy Officers

Wisconsin Bankers Foundation:

• 400+ volunteers made a total of approximately 900 financial education presentations –reaching more than 30,000 community members

• 79 individuals and 21 banks recently received Excellence in Financial Education Awards Volunteerism:

• Approximately 170 members serve on the WBA, FIPCO, and EBC boards of directors, WBA committees, and WBA section boards.

I hope your holiday season was festive and fulfilling and wish you all the best as the new year begins. In 2025, I encourage all of you to consider making a resolution to get more involved with the WBA. Check out one of the numerous educational and professional development opportunities from WBA’s Education team, volunteer for Teach Children to Save Day, register for WBA’s Capitol Day in Madison, or make donations to Wisbankpac or the Alliance for Bankers Conduit. There are countless ways to contribute (financially and through volunteerism) to make an impact. Together, we can continue to strengthen our association and build a brighter future for Wisconsin’s banking community. Let’s make 2025 a year of even greater engagement and impact!

Araque is SVP, director of consumer, private, and business banking with Johnson Financial Group, Racine, and the 2024–2025 WBA Chair.

Engage, Advocate, Lead: A Call to Action for Wisconsin’s Banking Industry

By Lorenzo Cruz

The fall elections are finally done and so is the onslaught of non-stop political TV ads. Enjoying the momentary reprieve from ads, we can expect to see another heavy barrage of political advertisements during the spring election for ideological control of the state supreme court.

There was a red wave that hit Wisconsin, but the state remains purple with a divided government. As predicted, the Legislature remains in the hands of the GOP under the new maps but with smaller majorities. The Assembly now has a 5445 majority, and the Senate stands at an 18-15 majority with the East wing held by Democratic Governor Tony Evers.

At the federal level, President-elect Donald Trump and incumbent U.S. Senator Tammy Baldwin (D-WI) defeated their respective opponents, Vice President Kamala Harris for the presidency, and businessperson Eric Hovde for Senate by less than one percent. There were no surprises in the competitive U.S. Representatives races. Steil, Van Orden, and newcomer Wied replacing Gallagher won by sizable margins. 2025 marks the beginning of a new legislative session. We have 37 fresh faces to work with at the state capitol, six from the Senate and 31 in the Assembly. The caucuses in both chambers reelected their leaders: Assembly Speaker Vos, Assembly Minority Leader Neubauer, Senate Majority Leader LeMahieu, and Senate Minority Leader Hesselbein. Committee chairs and members will begin their legislative work after inauguration day in early January. The Governor’s State of the State address is set to occur later in the month.

Legislators will primarily focus on passing a version of the Governor’s state budget before July 4. With a reported $4 billion surplus, the debate will center on tax cuts, spending,

education, health care, transportation, environment, and corrections. Meanwhile, there will be bills that legislators introduce and move through the legislative process which the WBA Government Relations team will be monitoring.

WBA’s team has been communicating with new and key legislators on WBA’s legislative priorities: interchange fees, taxes, ESG, Trust Code, credit unions, and artificial intelligence. Other policy issues revolve around banking modernization, privacy, merchant category codes, elder fraud, and SWIB investment risk.

As the WBA GR Team continues its advocacy efforts, I encourage bankers to remain engaged in political advocacy. WBA’s Advocacy Toolkits will go out in February, and I urge bank presidents/CEOs to work with their advocacy officer to launch their political fundraising campaign for the PAC and conduit early in the year to achieve Gold Triangle recognition for banks and Leadership Circle and Silver Triangle recognition for individual bankers. Other political fundraising events I ask bank leaders to get involved with are the issue advocacy event June 16–17 at Kohler and the PAC sporting clays event at Milford Hills on October 23.

On the grassroots side of advocacy, I urge all banks to send their Advocacy Officers and other employees to WBA’s Capitol Day on May 6 in Madison. It is a fantastic way for bankers to function as one unified voice and effectively lobby legislators and staff on banking issues impacting their communities back in their districts. Thank you all for supporting WBA’s advocacy efforts.

Contents Coverage for Purposes of Flood Insurance

By Scott Birrenkott

While there are no new requirements regarding flood insurance, examiners have been looking closely at portfolios for flood compliance lately. Specifically, WBA has become aware of some questions arising regarding contents coverage. This article will discuss what the flood rules require for purposes of insuring contents, as well as some important concepts to be aware of.

The requirement of “contents coverage” starts with the general requirement to purchase flood insurance for designated loans. That requirement being that a bank shall not make, increase, extend, or renew any designated loan unless the building or mobile home and any personal property securing the loan are covered by flood insurance for the term of the loan. “Personal property” in this context will be referred to as “contents” for the rest of this article. Meaning, a bank making a designated loan in a special flood hazard area (SFHA) must also ensure that any contents securing that loan are covered by flood insurance. The rule, in this context, leaves some unanswered questions. Fortunately, the agencies have provided clarification in the form of questions and answers.

In 2022, the agencies issued the revised Interagency Questions and Answers Regarding Flood Insurance (Q&As). The Q&As clarify that when a building and its contents both secure a loan, and the building is located in a SFHA in which flood insurance is available, flood insurance is required

Comment Letters

for the building and any contents securing the loan. They also clarify that if contents securing the loan are stored in a building which does not secure the loan, then flood insurance is not required on those contents, regardless of whether the building is in a SFHA. The agencies also clarify that both contents and the building will be considered to have a sufficient amount of flood insurance coverage for regulatory purposes so long as some reasonable amount of insurance is allocated to each category. The Q&As provide an example which is helpful in this regard:

Lender A makes a loan for $200,000 that is secured by a warehouse with an insurable value of $150,000 and inventory in the warehouse worth $100,000. The Act and Regulation require that flood insurance coverage be obtained for the lesser of the outstanding principal balance of the loan or the maximum amount of flood insurance that is available. The maximum amount of insurance that is available for both building and contents is $500,000 for each category. In this situation, Federal flood insurance requirements could be satisfied by placing $150,000 worth of flood insurance coverage on the warehouse, thus insuring it to its insurable value, and $50,000 worth of contents flood insurance coverage on the inventory, thus providing total coverage in the amount of the outstanding principal balance of the loan. Note that this holds true even though the inventory is worth $100,000.

It is important to note that when contents coverage is required, a bank

must always assign a “reasonable amount” to the contents. This is true even if the building’s value meets or exceeds the minimum flood insurance required. For example, if the facts of the above example were changed so that the insurable value of the warehouse was $200,000, the bank couldn’t assign $200,000 to the warehouse alone and leave the contents uninsured. It would need to be divided in a reasonable amount among both the warehouse and the contents.

In the commercial and agricultural setting, it is common within the industry for banks to take a security interest in property which includes contents. Because of this, it’s important to be aware of the language within a bank’s security agreements, and what it covers, so that the bank is able to meet flood insurance requirements. If a bank does not wish to take contents as collateral to avoid flood insurance implications, it could consider disclaiming the collateral. In this case, the bank should also consider the implications of disclaiming collateral from a loan policy standpoint, understanding that such decisions have broader implications on the security of the loan beyond just flood insurance rules. The Q&As can be found here: https://www.fdic.gov/sites/default/ files/2024-03/fil22020a.pdf

Birrenkott is WBA director – legal.

The Wisconsin Society of Association Executives (WSAE) recognized Scott Birrenkott with a 2024 WSAE Visionary Award, which was presented in November at the WSAE Annual Summit in Madison. Congratulations!

WBA has recently filed two new comment letters. Additionally, WBA created a template letter for both topics which banks used to submit their own comments.

The first letter, filed in October, addressed the interagency regulatory review required by the Economic Growth and Regulatory Paperwork Reduction Act. In its letter, WBA urged the agencies to work together to ensure consistency in their approach to consumer protection regulation, restructure and simplify Regulation O, and adjust outdated Bank Secrecy Act reporting requirement thresholds.

The second letter, filed in November, requests that the Federal Deposit Insurance Corporation (FDIC) withdraw its proposed revisions to its regulations relating to brokered deposit restrictions. WBA also commented on how the proposal would upend the framework FDIC already established in 2020 for analyzing whether certain deposit arrangements qualify as brokered. For copies of these letters, and others, visit the WBA comment letter page here: https://www.wisbank.com/advocacy/comment-letter-library/.

Invest in the Success of Your Bank’s Future Leaders

Registration open for WBA’s highest-level school

Beginning on April 7, 2025, the Wisconsin Bankers Association’s (WBA) School of Bank Management will assist your team in becoming more well-rounded bankers. The week-long school provides bankers with an enhanced understanding of the bank as a business which, in today’s ever-changing banking environment, is critical for those who have the potential to rise within the institution.

This year’s school will cover a number of topics including economics, money, and market; understanding the bank’s UBPR; lending functions in a bank; bank human resources; compliance management and bank operations; bank marketing; digital banking; asset/liability management; and more.

As the highest-level school offered by the Association, the School of Bank Management is the ideal opportunity for management trainees, managers new to the banking industry, and bankers pursuing a career in bank management and leadership to prepare for future enrollment at the Graduate School of Banking at UW–Madison. Additionally, GSB instructors and alumni make up a portion of the school’s faculty, providing attendees with the chance to establish and build connections early.

Upon completion of the WBA School of Bank Management, graduates will be eligible for future Prochnow Educational Foundation/Wisconsin Bankers Association scholarships to be used for the Graduate School of Banking 25-month program.

To learn more about additional educational opportunities available through WBA this spring, please see pg. 16 of this issue or visit wisbank.com/Education.

Register now for the WBA School of Bank Management, April 7–11, 2025, at wisbank.com/BankManagement.

BankWork$: Building Meaningful Careers in Banking

Congratulations, Graduates

BankWork$ is a free, eight-week training program to prepare participants — primarily individuals from under-resourced communities — for retail banking careers. The nationwide program was brought to Wisconsin in 2019 through a partnership between the Wisconsin Bankers Association (WBA) and Employ Milwaukee. So far, BankWork$ has provided over 140 individuals in the Milwaukee area with the opportunity to begin a career in banking. The program recently expanded to the Waukesha area.

In November, a class — including Stephanie Brimmer, Julisa Jones, Angelina Thor, and Habibah Ramat Ullah — graduated from the program. WBA’s Heather MacKinnon attended the ceremony and congratulated the graduates on their achievement.

Over the course of the eight-week program, students learned the hard and soft skills necessary for entry-level retail and operations positions. Upon graduation, graduates have the opportunity to take part in on-the-spot interviews with BankWork$ employer partners.

BankWork$® is a public-private partnership that primarily trains adults from underserved neighborhoods for careers in retail banking. To learn more about the program, or how your bank can get involved, please visit employmilwaukee.org/BankWorks.htm.

Wis. Banker Meredith Strieff Serves on ABA Community Bankers Council Strieff appointed to newly created emerging leader seat on national council

If Horicon Bank's Meredith Strieff has one message to aspiring or emerging leaders, it is "Just. Say. Yes." Her role doesn't stop at vice president, customer experience at the bank; she has stepped up as chair of the Wisconsin Bankers Association (WBA) Building Our Leaders of Tomorrow (BOLT) Section Board, a member of the American Bankers Association (ABA) Emerging Leaders Council (ELC), and now as the first emerging leader appointed to the ABA Community Bankers Council (CBC).

In November 2024, Strieff traveled to the ABA Annual Convention in New York City, where — among many exciting experiences — she had the opportunity together with her fellow ELC members to be a part of the iconic Nasdaq bell ringing ceremony at MarketSite. From NYC, she headed straight to Washington, D.C. for her first meeting with the CBC. The emerging leader seat on the CBC was established to facilitate two-way communication between the CBC and ELC, and Strieff was selected as the first banker in the nation to serve in the role.

Strieff touts the important role of emerging leaders and emphasizes that they are passionate about helping their communities and making lives better, whether that is through traditional financial services, partnerships with Fintechs to deliver forward-thinking solutions, or educating their communities to enhance the fight against fraud.

This is our future! And it’s bright! We, as an industry, need to be deliberate in our nurturing and give this group [of emerging leaders] a voice. Listen to them, learn from them, and do not be afraid of change. – Meredith Strieff

A Q&A with Strieff — including her views on emerging leaders' role in shaping the future of banking, her engagement with WBA and ABA, and her advice to bankers who are interested in becoming industry advocates — is available at wisbank.com/strieff-qa.

Over 30,000 Wisconsinites Reached by Banks’ Financial Education Efforts

Wisconsin Bankers Foundation Recognizes Volunteer Service of Bank Employees

The Wisconsin Bankers Foundation (WBF) has recognized 79 Wisconsin bankers and 21 banks for their efforts in promoting financial literacy to Wisconsin's community members. WBF is the non-profit arm of the Wisconsin Bankers Association (WBA) whose mission is to promote financial literacy and financial capability to the public and to broaden consumer empowerment in the financial services industry through research, education, grants, and scholarships.

The outstanding efforts of all honorees were celebrated at the recent WBA FLEX Retail and Marketing Summit held in Wisconsin Dells on November 21, 2024. During the 2023–2024 fiscal year, the individual and bank-level WBF Excellence in Financial Education award winners helped WBF expand its financial education to reach over 30,000 people throughout the state. These efforts included giving presentations in local classrooms to teach children about saving and managing money, leading homeownership workshops, and hosting fraud prevention seminars, among many other initiatives.

This year, Sue Krause of Fox Valley Savings Bank in Fond du Lac was awarded the prestigious Financial Literacy Banker of the Year Award. Krause completed 138 financial education presentations over the year. Paige Vieth, of Royal Bank in Elroy, was recognized with the Financial Literacy Banker Award for completing 70 financial education presentations.

In addition, Krause and Vieth were honored with the Certificate of Excellence alongside Rachael Ehrenberg, Farmers State Bank of Waupaca; Tammy J. Tongusi, Forte Bank, Hartford; Katlein Detloff, Ladysmith Federal Savings & Loan Association; and Jenean Friedl, Ashley Lombard,

New 2025 Reading Raises Interest Kits Available to WBA-Member Banks

Are you planning financial literacy presentations for Teach Children to Save Day on April 24, 2025, or other elementary school visits? WBF will provide one free Reading Raises Interest Kit per WBA-member bank, which features:

• 10 copies of the book "Rock, Brock, and the Savings Shock" by Sheila Bair,

• sample lesson plans, and

• additional resources for your classroom visits.

Visit wisbankfoundation.org/ reading-raises-interest-kits to learn more and to place your order. Questions? Contact Katie Reiser, WBF coordinator, at kreiser@wisbank.com.

and Jen Yager of Royal Bank, Elroy, for exceeding 20 financial education presentations in their local communities during WBF’s 2023–2024 fiscal year.

The WBF Excellence in Financial Education Award was presented to the following WBA-member banks for their bank-wide dedication to financial education: Bank of Lake Mills; Bank of Luxemburg; Bank of Sun Prairie; Farmers & Merchants State Bank, Waterloo; First Federal Bank of Wisconsin, Milwaukee; First National Bank of River Falls; FNC Bank, New Richmond; Forte Bank, Hartford; Horicon Bank; Ladysmith Federal Savings and Loan Association; National Exchange Bank & Trust, Fond du Lac; One Community Bank, Oregon; Pillar Bank, Baldwin; Premier Community Bank, Marion; PremierBank, Fort Atkinson; River Bank, Stoddard; Royal Bank, Elroy; The Stephenson National Bank & Trust, Marinette; Waukesha State Bank; Waumandee State Bank; and Wolf River Community Bank, Hortonville.

WBF Spring Scholarship Opportunity

The application period for WBF's Spring Scholarship will open in late January and close on March 14, 2025 Four scholarships of $2,000 each will be offered to selected students. To qualify, students must:

• be a Wisconsin high school senior, an employee of a WBA-member bank, or a dependent of a WBAmember bank employee;

• be currently enrolled or enrolling in fall at an accredited Wisconsin public or private, non-profit college, university, or technical college; and

• demonstrate academic, community, and preprofessional (job or internship) achievement and be able to articulate the importance of financial literacy.

Visit wisbankfoundation.org/scholarships to learn more and to apply.

• Offer free workshops: Host community events on topics like budgeting, credit building, home buying, and small business loans.

• Partner with local organizations: Collaborate with Hispanic chambers of commerce, community centers, non-profits, or churches to co-host educational events.

• Create youth programs: Partner with schools to teach financial literacy to young students, helping families build intergenerational wealth.

Sanjuana Maqueda, loan officer with North Shore Bank, stressed the importance of good listening skills and respect when it comes to cultural differences. “You can be Hispanic but come from many different countries. We do have the Spanish language in common, but so much depends on the person’s background and past financial experiences in their country.”

Another issue to be aware of that Maqueda has noted while working extensively with Hispanic customers is that often customers will feel more secure when they have a lot of cash on hand. This sometimes stems from distrust in the U.S. financial system. Her bank works to educate customers and increase their faith in the security of U.S. banks. Maqueda has also found that some customers’ beliefs about banking and what is possible for their own financial futures are heavily influenced by others. Customers will say to her, “Oh my friend said this, or my mom, my grandma, my uncle, or my coworker.” Maqueda shared she asks questions to reveal the origins of their concerns, uncover misinformation, and then will explain, “You know you can do this [alternative bank product] and it might be more beneficial for you based on your own case.” She stresses that each individual is unique and that despite what customers may have heard from their inner circle, what has worked for a relative may not be the best financial fit for them.

Maqueda described the bank’s successful partnerships with local community organizations like: United Community Center, Housing Resources Inc., Acts Housing, La Casa de Esperanza, and Hispanic Round Table.

Gina M. Sanchez Juarez is the director of the Center for Financial Stability at La Casa de Esperanza, Inc. The Center’s Financial Stability Initiative is a collaborative of forprofit and non-profit organizations, with the goal of assisting families in attaining financial stability and building wealth. Sanchez Juarez shared a personal story related to cultural

awareness that recently impacted her own banking experience. After detecting fraud on her account, she needed to open a different account and pointed out to the banker that she has two last names (common with Hispanics). The banker unfortunately brushed her warning off. She encountered difficulties cashing checks with the new account because her name had been entered incorrectly despite her request.

Sanchez Juarez said, “There's a lot of differences in the socioeconomic and cultural factors with many of our clients. They have a lack of trust, especially if they are either going through a legalization process in the U.S. or possibly if they have an ITIN or even if they don't.” Based on their prior experiences in another country, they may not feel confident about the safety of their money or the ease of accessing their money in a financial institution.

Engage Through Culturally Relevant Marketing

Effective outreach to Hispanic customers requires understanding cultural nuances and crafting marketing messages that resonate.

• Highlight shared values: Focus on themes like family, community, and hard work, which are highly valued in Hispanic culture.

• Celebrate cultural events: Host or sponsor events such as Hispanic Heritage Month, Día de los Muertos, or local festivals.

• Advertise in Spanish: Place ads in Spanish-language media, including newspapers, radio stations, and social media channels.

Lamb shared, “Engagement initiatives like sponsorships of local events within the Hispanic community can foster trust and a sense of belonging.” She added, “A sponsorship is a good thing, but you actually have to show up to community events,” further explaining, “you can't just send a check and think that that's going to work.” Lamb emphasized that typically the Hispanic community wants to know who they are working with and recommends that bank professionals “actually hit the pavement and get out in the community and be seen along with the sponsorships and workshops.” She believes this goes a long way because the Hispanic community tends to prefer engaging with people who they know and feel comfortable with.

Kathleen Rolfs, VP/chief marketing and communications officer with PremierBank, wrote an informative article which is still accessible on the WBA website, “Serving Increasingly Diverse Communities” for Wisconsin Banker a few years ago outlining the innovative work being done by their Bilingual Initiatives Committee, a group comprised of several bilingual bankers along with marketing and retail banking officers. The goals for the committee include “identifying opportunities that exist within our communities for strategic community partnerships, and collaborative education within our organization to ensure all our bankers are equipped to understand and anticipate the needs of the rapidly growing, ethnically diverse Hispanic community.”

Provide

Tailored Banking Products

Hispanic customers may have unique financial needs that require customized banking solutions.

• Simplify account opening: Make it easier to open accounts by accepting alternative forms of identification, such as Individual Taxpayer Identification Numbers (ITINs).

• Offer remittance services: Many Hispanic customers send money to family members abroad. Providing affordable, reliable remittance options can meet this critical need.

• Design targeted products: Consider savings accounts for immigrationrelated expenses or low-interest loans for small businesses in Hispanic communities.

Sanchez Juarez described a successful co-branded product, La Casa de Esperanza Loan Program Powered by Peoples State Bank. La Casa has been serving the community since 1996, so “we’re trusted by many folks.” This low-interest emergency loan program is for people with credit challenges or no credit to borrow $1,000 to $3,000. Criteria considered: Has the applicant been working a year or more at their job? Are they able to afford a loan payment? The rate is 3.99% with a 36-month payback term, and financial counseling is paired with the loan. Sanchez Juarez suggests that there are many positive programs that can be done in partnership with local organizations, “if you just have more conversations about the needs of the people in your community.”

Build Long-Term Community Relationships

Trust is built through consistent and meaningful engagement. Showing up for the Hispanic community beyond transactional interactions demonstrates a genuine commitment.

• Hire from the community: Employing local staff members who reflect the community fosters familiarity and trust.

• Sponsor community events: Support local parades, festivals, or sports teams that are popular within the Hispanic community.

• Create advisory councils: Establish Hispanic advisory boards to guide the bank in making culturally sensitive decisions.

Sanchez Juarez recommends patience when offering workshops and educational sessions in the community in collaboration with local organizations, “You’re not going to see big turnouts in the first three or four sessions.” It may be just a few people attending initially, but she believes consistency pays off.

Fameree also stressed the importance of banks showing a long-term commitment, “With the Hispanic community it really boils down to word of mouth. If you are doing something right, that positive word of mouth is going to reflect that.”

FDIC’s Insights and Resources

At the Milwaukee AEI conference these top responses were shared from Hispanic participants in the FDIC’s National Survey of Unbanked and Underbanked Households 2021 who were asked what their main reasons are for not having a bank account:

• Don't have enough money to meet minimum balance requirements

• Avoiding a bank gives more privacy

• Don't trust banks

• Don't have personal identification required to open an account

The FDIC’s Money Smart program is a good entry point for banks considering engaging with the Hispanic community in their area but may be unsure of how to tap into resources, especially when it comes to Spanish materials. Not only is the Money Smart collateral translated into Spanish, that entire portion of fdic.gov is available in Spanish (Programa Money Smart). Sanchez Juarez spoke highly of it, “They have curriculum, they have instructional workbooks, and they have online options banks can use.”

Beyond Personal Accounts, Banks Perfectly Poised to Foster Business Growth

Oakleigh Ryan, founding principal of

Whiton House, a management consultancy and engagement institute based in Janesville, has partnered with PremierBank through her board work with Forward Janesville and its Foundation. Ryan believes banks are in a perfect position to build bridges in the Hispanic business community. Ryan said banks partnering with their local chamber is a “great way to make sure Hispanic businesses feel like they are part of the bigger economic community in their town.” Ryan explained, “The largest growing sector of consumers in the United States are of Latino descent, so if you’re in business it makes sense to figure out how to work with this important population in our community.”

Ryan described feeling like she had hit a goldmine when she initially met with Silvia Donday-Selenske, residential loan officer with PremierBank, because DondaySelenske was incredibly well-connected in the community and it was obvious that PremierBank had intentionally increased their Spanish language capacity and concentrated on engaging with the Hispanic community in a very visible way. Part of DondaySelenske’s job is getting to know new business owners, with priority placed on in-person communications, which resonate more with the Hispanic community. Ryan described successful classes that have been hosted at PremierBank, including classes on how business owners can use credit and be smarter about energy efficiency and a class on obtaining business loans.

Looking Ahead

Reaching the Hispanic community is not just about inclusivity — it is a smart business decision.

According to a report from Nielsen, Hispanic consumers wield $1.9 trillion in purchasing power annually. By addressing barriers, investing in financial education for customers, professional development for staff, and celebrating culture, banks can play a pivotal role in the financial empowerment of this growing

demographic while expanding their own market share.

As Wisconsin bankers look to the future, building bridges with Hispanic communities can ensure everyone has access to the financial tools they need to succeed. By learning from each other and sharing best practices, Wisconsin banks can create a landscape that is as inclusive as it is prosperous.

Lamb suggest focusing on prioritizing diversity and inclusion to stand out. Increased business and stronger customer loyalty will follow for banks after “creating that space and building a reputation for fairness and transparency.”

When asked what is most gratifying about her job, Lamb shared, “Success for me is knowing that the families that I work with now have the tools to create generational wealth. I've had the opportunity to help entire families.” She added, “It’s gratifying because they accomplished something they looked forward to — becoming homeowners, and now they are hyped up and are starting their business, paying down debt, or finally building their forever home after their small first home. They were able to take advantage of the tools and resources that we offered.”

Reiser is WBA writer/editor.

By Grace Bruins

Somewhere between deciphering what is “sus” in Gen Z slang and making sure we manage the AI robots (instead of the other way around), marketers continue to rank data strategy as a top priority for their team. So why does it feel so … cringe?

The topic of data strategy is not new to the Wisconsin Bankers Association Marketing Committee or Marketing Connect Groups. If you’re right there with the rest of us, here are a few ideas to take your data plans from “basic” to “bussin”:

Locate Your Data

Start by discovering exactly where your data lives and what metrics are available.

• Website analytics: traffic, audience behavior, conversions on your site

• Social media: engagement metrics and audience demographics

• Market data: local community demographics and competitor data

• Customer data/CRM: customer insights, interactions, communication history, contact information, current products, and transactions

Define Success

Have proactive conversations with your leadership team about what you are hoping to accomplish with your data strategy.

• What are we trying to measure? What are those measurements telling us?

• What does a successful campaign look like? Higher click throughs? Increased accounts? Additional deposits?

• Are there assumptions about our customers and our markets that we make that can be validated (or challenged) by additional data?

In My Data Era

• How do you hope our data can inform business decisions?

Get Compliant

Make sure Compliance knows you understood the assignment.

• Know your privacy policy (and stick to it).

• Collaborate with your Compliance team to ensure transparency and security.

Dig In

You’ve got your hands on your data; you know what metrics your leadership team values, and Compliance is on board. Now what?

• Keep your data current. If email is a primary channel of communication, work closely with your front-line teams to verify customer contact information when a customer is at the teller line or on the phone. This doesn’t need to feel like an aggressive demand for email addresses. It can be a simple conversation about the way the bank likes to communicate important information and updates with customers.

• Personalize the customer experience. Look at data points that tell you something about your customer’s stage in life.

o Did they just open a checking account for their teenager? Consider talking to the parent about student credit cards.

o Does your customer have regular transfers into their savings? Consider educational information about saving for the future or better yet, offer a higher interestbearing account option to help grow their savings.

o Did your customer’s transactions suddenly increase at furniture stores or home improvement

stores? Consider reaching out about home loan or home equity line of credit options.

• Create customer segments and profiles. Use your data to inform demographic and behavioral information about your customers. Creating customer segments and concise profiles offers valuable decision-making power to future projects. Have a product idea you think is perfect for your customers? Test it against your customer profiles. Ask yourself “Is this right for Customer A – a bluecollar worker with three kids and low personal debt?” If the answer is “yes” – move forward! If the answer is “no” – move on.

• Watch for trends in activity. Watch for signs of customer disengagement. Has transaction activity started to drop off? Have recurring transfers or automatic payments been cancelled? Maybe it’s time to re-engage with that customer before they move on completely.

• Don’t be afraid to communicate. Regularly. Nobody wants to feel like a “big bank” – hammering customers with offers that aren’t relevant to their life. But remember, your customers have put a lot of trust in you. You hold all their personal information and should know them better than any big bank could. So, reach out. Remind customers they are more than an account or loan. Find ways to show what a valuable partner your bank can be in their financial journey.

If your data is giving main character energy in 2025, it’s time to create a strategy that slays.

Grace Bruins, marketing officer, AVP at Horicon Bank, is a member of the WBA Marketing Committee.

Is Your Team Ready for Power of Community Week?

In 2024, 373 individual bank branches (representing 57 member banks) reported their participation in the Wisconsin Bankers Association’s (WBA) Power of Community Week. The annual campaign — which brings together member banks, Associate Member companies, and the WBA staff — encourages all participants to engage in one or more service activities to demonstrate to the public the ongoing commitment of Wisconsin’s banking industry to local communities.

This year, WBA’s Power of Community Week will be held April 21–26. (National Teach Children to Save Day is Thursday, April 24.) However, throughout April — Community Banking Month — and May, activities including volunteering at nursing homes, hosting shredding events at the bank, running a food drive, or giving financial literacy presentations in K–12 classrooms all count toward a bank’s participation in the WBA Power of Community Week. We invite all members to participate in this effort to show how much Wisconsin’s banking industry supports the communities in our state.

To get started, make sure your team has their Power of Community shirts ready. These t-shirts feature the campaign logo and hashtag (#BanksPowerWI) and can be ordered at wisbank.com/BanksPowerWI. A company logo may also be added to the back.

Next, organize your bank’s volunteer activities and share your plans with WBA. All bank initiatives will be added to the interactive map to highlight the impact and serve as inspiration for other banks for their community-focused activities. A media kit, including a press release template, sample social media posts, and best practices, is also available.

Finally, share your photos on social media using the hashtag #BanksPowerWI. Throughout Power of Community Week, WBA will be sharing the ways in which the Wisconsin banking industry is committed to serving Wisconsin communities.

Bulletin Board

News from Wisconsin Bankers Association Members

Promotions and New Hires

Brookfield

First Business Bank welcomes Christen Meyer (pictured) as vice president – treasury management.

Fond du Lac

Steve Tramp (pictured) recently joined National Exchange Bank & Trust, as a senior vice president of commercial lending at the downtown Fond du Lac office.

Hartford

Forte Bank is pleased to announce two promotions. Doug Persich (pictured) has been promoted to senior vice president and chief financial officer and Gary Heckendorf (pictured) to senior vice president and chief lending officer.

Lake Geneva

Bryan Iwicki (pictured) has been named Community State Bank’s VP/ market president in Lake Geneva, replacing Michael Ploch, who retired in December.

Madison

First Business Bank welcomes Lori McGowan (pictured) to its subsidiary, First Business Specialty Finance, LLC, as vice president – equipment finance.

Manitowoc

John Todryk (pictured) joined Community State Bank as successor to SVP/Market President Steve Donovan. Donovan will continue supporting Todryk until his official retirement date in February 2025.

Marion

Premier Community Bank is excited to announce the promotion of four key employees to senior leadership positions: Jeff Brady, SVP of lending;

Morgan Mielke, SVP of finance; Kay Tellock, VP of human resources; and Tiffany Krueger, VP of credit services.

New London

First State Bank is pleased to announce the appointment of Matthew J. Fries (pictured) as its new executive vice president and chief financial officer.

Oak Creek WaterStone Bank is proud to announce the appointment of Katrina Rivera as the new community president for its Oak Creek-27th Street branch.

Oregon

One Community Bank welcomes James Nelesen (pictured) as VP –retail banking manager.

Sun Prairie

Starion Bank is pleased to announce the promotion of Grant Stenerson (pictured) to business banking officer VP.

Union Grove

Community State Bank Executive Vice President/Chief Financial Officer

Bob Findysz (pictured) is set to become Community State Bank’s 10th president in the organization’s 126-year history. Findysz takes over in his new role — along with a position on the Community State Bank Board of Directors — on January 1, 2025. Community State Bank President/Chief Executive Officer Scott Huedepohl (pictured) will retain his role as CEO. In other promotions effective January 1, Community State Bank Senior Vice President/Chief Lending Officer Robert Pieroni (pictured) and Chief Operations Officer

Katie Stolp (pictured) take on new responsibilities. Pieroni will become executive vice president/chief lending officer and Stolp will move into a senior vice president/chief operations officer role.

Waukesha Waukesha State Bank announced the appointment of Dawn Griesbach (pictured) as vice presidentcommercial banking officer in October and the appointment of Darci Miller (pictured) as vice president – commercial banking officer in November. Waukesha State Bank also announced the retirement of Patricia Witkowiak (pictured), senior vice president – operations manager, effective January 10, 2025. In her place, the bank is excited to introduce Kristine Baxter (pictured) as the new senior vice president –operations manager and pleased to announce the promotion of Jacob Pyle (pictured) to vice president – risk officer.

Waumandee

Herb Lallemont (pictured), president/ CEO of Waumandee State Bank, recently announced his retirement effective February 25, 2025. With Lallemont’s forthcoming retirement, the bank also recently announced the promotion of two veteran employees: Todd Pronschinske has been promoted to the role of president and Kathryn Michaels has been promoted to SVP chief operations officer.

Retirements

Brenda Hansen (pictured), VP, marketing manager with First State Bank retired, after 28 years with the bank.

National Exchange Bank & Trust's Anna Fichtner (pictured) retired on November 13, 2024, after working for NEBAT since 1980.

William (Bill) Campbell (pictured) worked at Farmers & Merchants Bank since 2001 and served as president and CEO from 2006 to 2024. Over his 23 years with F&M and a career in banking that began in 1983, Bill’s leadership, dedication, and commitment to enriching financial lives left an indelible mark on the bank and community.

Milestones in Industry Service

Lisa Benike (pictured) celebrated 30 years at National Exchange Bank & Trust. Benike joined NEBAT as a customer service representative. Benike currently serves as a vice president.

Community Involvement

Community State Bank launched its seventh annual #Gift2Giving employee-driven donation drive. Since its inception, the campaign has distributed over $90,000 to nearly 70 nonprofit organizations throughout Kenosha, Racine, and Walworth counties. The bank also shared that their Harvest Club (pictured above), a group of local seniors 55-and over who receive banking discounts and can participate in trips organized by the bank, has reached membership of nearly 1,000.

Bulletin Board

News from Wisconsin Bankers Association Members

Congratulations

Joseph Fazio III, Chairman of the Board of Directors for Bristol Morgan Bank, Oakfield, Wis. and Oakfield Bancorp, Inc., was re-elected as FHLBank Chicago Director. Fazio is the Wisconsin Member Director.

Jessica Brown, chief financial officer and senior vice president with Peoples State Bank, Wausau, was named a 2025 Wisconsin Titan 100. The Titan 100 program recognizes Wisconsin’s Top 100 CEOs & C-level executives.

During the American Bankers Association National Agricultural Bankers Conference held in Milwaukee November 12–15, retired Wisconsin banker Dave Coggins was named the 2024 recipient of the prestigious Bruning Award. This annual award recognizes bankers who demonstrate outstanding leadership and dedicated service to providing credit and guidance to farmers, ranchers, and their fellow agricultural bankers.

Ted Gunderson, senior vice president-business relationship manager at Lake Ridge Bank, was recently named to WBD’s group of Elite Lenders. Formerly known as Wisconsin Business Development, WBD recognizes lenders from across the state for their commitment to and success in helping small businesses get the financing they need to grow, create jobs, and build communities.

Community Involvement Cont.

Wisconsin State Fair officials announced a new naming rights agreement for the State Fair Main Stage that will now be known as the Bank Five Nine Main Stage. This multi-year agreement with Bank Five Nine ensures this vibrant stage will shine as the premier entertainment destination throughout the 11-day State Fair.

Prevail Bank gifted $93,650 through its semiannual charitable contributions program this fall. Non-profits that assist low-tomoderate income households, those that stimulate communities financially, provide financial literacy, and/or enhance the standard of living of those less fortunate, in the communities Prevail Bank serves, were encouraged to apply.

Badger Bank partnered with their community school districts to offer the exclusive School Spirit Debit Card. When the Debit Card is used for purchases, Badger Bank donates money to the customer’s chosen school district. Pictured (from left to right): Leigh Ann Scheuerell, Fort Atkinson principal, Tom Dehnert, Badger Bank VP, Tammi Windl, Badger Bank marketing coordinator, and Tom’s family.

Celebrating a Lifetime of Service

WBA is proud to recognize the individual bankers who dedicate their service to our industry and their community. The 50- and 60-Year Clubs recognize bankers who have served in the banking industry for 50 and 60 years, respectively. Additionally, WBA’s Lifetime Service Awards recognize bankers who have served in the industry for between 30 and 49 years. To recognize a banker for the esteemed honor, please visit wisbank.com/ServiceAwards.

First National Bank of Bangor

Bill Bosshard, president, was presented with a 50-year club plaque at a surprise celebration for him in October at First National Bank of Bangor. Pictured (left to right) Front Row: Jeff Schmidt and Andrew Bosshard, First National Bank of Bangor, WBA President and CEO Rose Oswald Poels, Bill Bosshard, Joanie Wilcox, First National Bank of Bangor. Back Row: J.K. Walsh, Bank of Mauston; Dennis Vogel, Citizens State Bank of La Crosse; David Swiergosz, Bank of Mauston; Randy Balk, Intercity State Bank; Jerry Luebke and Carol Jefferies, One Community Bank; Lynn Reinhardt, Bank of Alma.

State Bank

Steve Malone, former Benton State Bank president and CEO, who served as executive vice president until his retirement at the end of 2024, was honored for his 37 years of industry service.

Pictured (from left to right): Scott Freiburger, Benton State Bank president and CEO; Steve Malone, Benton State Bank executive vice president; WBA President and CEO Rose Oswald Poels; and Kay Orth, Benton State Bank SVP.

Bank of Milton

Wisconsin Bankers Association

President and CEO Rose Oswald Poels recently presented a 45-year WBA Lifetime Service Award posthumously to the family of Jeffrey Roethe for his years of board service to the Bank of Milton/Bank of Edgerton. Pictured (from left to right): WBA's Rose Oswald Poels, Matt Roethe, Bank of Milton President Dan Honold, Kay Roethe, Jenny Schmeling, and Janis Frank

Bonduel State Bank

WBA President and CEO Rose Oswald Poels recently presented a WBA Lifetime Service Award to Laurie Peterson, vice president operations, at Bonduel State Bank in recognition of her 40 years of service in the banking industry. Pictured (left to right): Laurie Peterson and Rose Oswald Poels

Paper City Savings Bank

Debra Edwards was recognized in October for her 38 years of service at Paper City Savings Bank, Wisconsin Rapids. Pictured (from left to right): Larry Turba, Daryll Lund, WBA EVP – chief of staff; Tammi Jepson; Debra Edwards; Jeff Whitrock; and Fred Siemers

New Associate Members

Darling Consulting Group (DCG)

https://www.darlingconsulting.com

For over 40 years, DCG’s only business has been to help banks manage balance sheets effectively. DCG provides independent risk management consulting and strategic advisory services including asset/liability management, model risk management/validation, capital planning and data-driven solutions (deposit and loan analytics, liquidity, credit stress testing), bringing clarity to the complex.

Contact: Kelly Coletti

Email: kcoletti@darlingconsulting.com

Phone: 978-463-0400

Eris Innovations

https://www.erisfutures.com

Due to credit access and operational challenges, many banks have difficulty accessing swaps from dealers. Eris SOFR swap futures were created to make it easier for entities of all shapes and sizes to access these critical tools for interest rate risk management.

Contact: Craig Haymaker

Email: questions@erisfutures.com

Phone: 646-961-4489

Essent Guaranty

https://www.essent.us

Founded in 2008, Essent is a private mortgage insurer, approved by Fannie Mae and Freddie Mac and licensed nationwide. We offer private mortgage insurance, also known as MI, for singlefamily mortgage loans, providing private capital to mitigate mortgage credit risk for lenders and investors.

Contact: Todd Snodgrass

Email: todd.snodgrass@essent.us

Phone: 414-406-1694

Wysh

https://www.wysh.com/business

Wysh's innovative deposit solution, Life Benefit, helps Financial Institutions grow, retain, and differentiate their deposit offering by seamlessly embedding life insurance onto a consumer's accounts.

Contact: Kseniya Zaslavskaya

Email: kseniya.zaslavskaya@wysh.com

Phone: 917-478-7330

A Full-Service Partner You Can Bank On.

Quad City Bank & Trust is committed to building long-term relationships by providing the right tools and personalized service.

CorrAccess

A

Correspondent Lending

WISCONSIN ECONOMIC REPORT

Rose Oswald Poels, President and CEO of the Wisconsin Bankers Association

Banking Industry Approaches 2025 with Cautious Optimism Amid Economic and Regulatory Uncertainty

As Wisconsin’s banking sector looks ahead to 2025, there is a sense of both optimism and caution among industry professionals. Bankers will be closely watching how national policies under President Trump’s administration may bring much-needed regulatory relief, while remaining mindful of the challenges the economy may continue to pose in the near future.

Overall, Wisconsin’s banking sector remains very strong. Data released by the FDIC shows that Wisconsin banks remained in a healthy position through the third quarter of 2024 (the most recent numbers available as of this writing). Lending held fairly steady or increased in the third quarter of 2024 over the prior year in all categories (commercial, residential, and farm loans), as banks responded to the borrowing needs of their customers. Deposits also increased 3.53 percent year over year, due in part to the high interest rates offered on CDs and money market accounts. Finally, the net interest margin, a key indicator of a bank’s profitability and growth, for Wisconsin banks remained steady at 3.18% in the third quarter which was an increase from the prior quarter (3.14%), but a slight decrease over the prior year (3.19%).

Wisconsin banks are also leveraging investments in technology and innovation to drive growth. Digital banking platforms, mobile payment systems, and AI-powered tools for staff and customers are becoming essential for operational efficiencies as well as for attracting and retaining customers.

Regulatory burden at the federal level remains an ongoing concern for the banking sector. In the new

administration, bankers are optimistic that there will be a pause on the introduction of new regulations, allowing the industry to focus on its core business rather than new compliance burdens. In addition, the industry is hopeful that overly burdensome regulations will be rolled back to a more reasonable level. One area of significant concern is the new Section 1071 requirements issued by the Consumer Financial Protection Bureau (CFPB). These rules, designed to collect more data on small business loans, have been criticized by many in the industry for imposing an excessive administrative burden on both the banks and their small business customers. The requirements go far beyond the original intent of the DoddFrank Act and could negatively impact small businesses by making access to credit more complicated and costly.

Despite these regulatory hopes, bankers remain cautious about the broader economic landscape. The path to economic recovery is still uncertain and a significant rebound may take longer than expected. The third-quarter data released by the FDIC shows that past-due loans for Wisconsin’s banking sector were elevated year over year (19.30%) as inflation and the high cost of living impacts borrowers. Past due loans were also higher quarter over quarter (6.55%), and the current level of past-due loans remains above recessionary levels.

One area of concern is the current state of the housing market. Mortgage rates are unlikely to drop significantly in the immediate future, and the high cost of housing, coupled with a limited supply, continues to challenge both buyers and sellers. This ongoing imbalance between supply and demand could lead to a slower recovery for the

housing market and, by extension, for the broader economy.

Similarly, interest rates for commercial and ag borrowers are unlikely to be dramatically lower in 2025. As a result, loans that will re-price in 2025 could put greater financial strain on some commercial and ag borrowers. A typical duration for commercial and ag loans is a five-year fixed term with a balloon payment due at maturity. As a result, many customers renewed loans in 2024 and will renew in 2025 at interest rates higher than what the borrower had been paying.

For certain agricultural producers, adding to the strain of elevated interest rates is the fact that commodity prices are dropping to multiyear lows. With these decreases, the overall ag economy and farm income outlook continue to weaken. Ag producers always expect and experience variable farm income; however, large declines in farm income can quickly pressure cash flow and impair debt repayment capacity. As commodity prices retreat from their highs, ag producers are working with their lenders to adjust expenses and update cash-flow projections.

In conclusion, the banking industry is entering 2025 with a mixture of hope and hesitation. While the year may bring incremental changes rather than sweeping transformations, Wisconsin banks remain well capitalized to support the local needs of their customers and communities.

Oswald Poels is president and CEO of the Wisconsin Bankers Association.

Founded in 1892, the WBA is the state’s largest financial industry trade association, representing 180 commercial banks and savings institutions, their branches, and nearly 30,000 employees.

WISCONSIN ECONOMIC REPORT

Robb Kahl, Executive Director of Construction Business Group

Construction Industry Approaches 2025 with Cautious Optimism

The U.S. construction economy has experienced record growth in recent years but as expected, did show signs of slowing in 2024 due to economic uncertainty marked by the battle against inflation, rising interest rates, and a decrease in both consumer and business confidence. Nationally, nonresidential construction spending increased by 5% over 2023 (lower than the previous years) led by growth in data centers, manufacturing, transportation, and power/utility projects.

The industry is cautiously optimistic about the 2025 economic forecasts that predict moderate economic growth, supported by federal infrastructure investments, the demand for sustainable and digital infrastructure, and a reduction in regulations that could streamline permitting and allow projects to start quickly. Nonresidential building activity is projected to rise by 8%, due to significant investments in manufacturing, data centers and infrastructure.

Provided federal investments and incentives (such as the Inflation Reduction Act (IRA), Infrastructure Investment and Jobs Act (IIJA) and CHIPS Act) remain intact after the new administration takes office in January 2025, Wisconsin’s construction industry is expected to see ongoing opportunities in transportation infrastructure, water line replacement, fiber optic construction, renewable energy, energy storage, conversion of coal power plants to natural gas, and technologydriven projects like data centers.

Wisconsin will also benefit from nearly $17 million in federal funds aimed at expanding the EV charging network – again assuming these laws and appropriations remain in place.

Throughout the COVID pandemic, the construction industry faced tight margins due to elevated material costs and supply chain disruptions, which increased project costs and delayed projects. Excluding copper, brass and steel mill products, and diesel fuel, construction material prices were not as volatile in 2024, resulting in stabilization of bid prices. There is some concern that the incoming administration’s change in approach to tariffs could have a negative impact on the cost of construction materials.

Workforce remains one of the most significant challenges for the construction industry with more than 90% of contractors reporting the need to hire both skilled trade and office positions. U.S. nonresidential construction employment increased by 3.7%, a modest increase compared to prior YoY of 11%. Wisconsin’s construction employment numbers were almost exactly the same as the national average, coming in at 3.6%. Contractors remain eager to hire employees but find it difficult to hire because of lack of qualified applicants and new hires that fail to show up or quit soon after starting.

The construction industry is a crucial contributor to Wisconsin’s economy. We need state and federal policymakers to continue to advocate for existing legislation and maintain appropriations to provide more funding through federal programs, such as the IIJA, to improve roads and bridges. Construction Business

Group’s wish list for 2025 includes:

• Ongoing statewide support for registered apprenticeship programs, which provide family-sustaining wages for Wisconsin residents and align with federal incentives tied to labor standards.

• Streamlining environmental review processes without compromising sustainability standards, ensuring timely completion of projects.

• Enacting policies favoring local hiring for public projects, which keeps economic benefits within Wisconsin and maximizes job creation.

• Incentivizing labor and prevailing wage agreements to enhance job quality and worker retention in construction.

Construction Business Group is prepared to work with our industry partners and elected officials in 2025 to enhance the impact that the construction industry has on the state, private industry, and individuals. Let Us Build Wisconsin Together.

Kahl is the executive director of Construction Business Group.

The Construction Business Group works to promote and protect the construction industry by ensuring fair contracting laws are followed on public construction projects. CBG works cooperatively with contractors, employees, and public entities by educating them on fair contracting laws; monitors projects for fair contracting compliance; and aids to resolve compliance issues.

WISCONSIN ECONOMIC REPORT

Bradley Uken, Wisconsin Farm Bureau’s Chief Administrative Officer

2024 Stays Challenging for Farmers

While the agricultural economy continues to evolve under the weight of significant global pressures, inflation, and a variety of domestic policies that are out of date and exacerbating existing issues, there are few bright spots for Wisconsin Farmers.

Significant improvement in milk prices over the past year has been welcome news, but revisions to the Federal Milk Marketing Orders now pending at the U.S. Department of Agriculture (USDA) will substantially reduce returns for farmers selling Class 3 milk (milk for cheese). For dairy farmers in the upper Midwest, the net impact of the various changes in the order, had they been in place from 2020 to 2023, would have reduced payments to farmers by $75 million a year.

Meanwhile, other commodities face a combination of increasing input costs, reduction in market prices and high volumes of existing holdover stocks putting downward pressure on prices. Grain prices were projected to fall ten percent in the most recent USDA forecast, and with holdover stocks just shy of thirty percent higher than last year and a bumper crop expected, agricultural economists are making bearish projections for pricing.

These developments come at the end of a year when the country has been operating on an extension of the outdated 2018 Farm Bill. While provisions in the bill have allowed some modest adjustments to account for market changes, bill authors at the time had no way to anticipate the impacts of a global pandemic,

the highest inflation in forty years, or major geopolitical developments hitting prices for the products farmers buy and sell. Farm safety net programs like the Price Loss Coverage Program and Dairy Margin Coverage Program are tied to statutory reference prices and other standards set in law that must be updated for the programs to function as intended. Clearly, we need a new Farm Bill.

Unemployment rates remain historically low, and on-farm labor costs have continued to rise. According to USDA National Agricultural Statistics Services, farm labor rates were up 2-3% in October from the year prior, a lower increase than the 4-10% in the prior year, but still a substantial increase. (The range is dependent on the area of farm work.)

As much as farming is impacted by policy, the weather can have a more determinative impact. This year a very wet spring caused significant delays in planting, with some farmers not finishing until early July. The wet start gave way to a dry late summer and fall, creating unusual issues with shallow rooted corn. Even after the late start, the dry and warm extended fall had many farmers finishing harvests earlier than they have in years.

Wisconsin Farm Bureau continues to work to support farmers across the state. Having successfully lobbied for a very agriculture-friendly Wisconsin state budget, Wisconsin Farm Bureau has been directly involved in implementing the newly created Agricultural Roads Improvement Program (ARIP). Additionally, our members have seen the benefit of increased funding for the Ag in the Classroom program, and several programs within the Department of Agriculture, Trade, and Consumer

Protection to improve the function and efficiency of Wisconsin farms.

Wisconsin agriculture is now a $116 billion industry that provides more than 350,000 jobs with nearly one in ten Wisconsinites employed directly in the industry. The farms and processing facilities that blanket much of our state come in all shapes and sizes and are anchor employers in our rural communities. The dollars that come from these facilities are spent over and over in local communities around the state. What’s good for Wisconsin farmers is truly good for Wisconsin.

As we come to the end of 2024, Wisconsin farmers face continued challenges. Wisconsin Farm Bureau will continue to work with policymakers and our agricultural partners to make sure Wisconsin is a place where farms not only survive but thrive, so we can continue to pass down our heritage and our ability to feed our state, nation and world, to future generations.

Uken is chief administrative officer (CAO) of the Wisconsin Farm Bureau Federation.

The Wisconsin Farm Bureau Federation is the largest general farm organization in the state and serves as a voice for farmers. WFBF’s mission is to lead the farm and rural community through legislative representation, education, public relations, and leadership.

WISCONSIN ECONOMIC REPORT

Mike Semmann, President and CEO of the Wisconsin Grocers Association

Price Check on Every Product in All Aisles

Consumer Sentiment, Competition, and Consolidation Drive Wisconsin’s Grocery Industry

In 2025, Wisconsin’s grocery industry will continue to be highly competitive and complex with razor-thin margins, maintaining a focus on the consumer. Wisconsin’s grocers continue to stand at the ready to provide value through evolving consumer behaviors, a strong competitive environment, and increased consolidation.

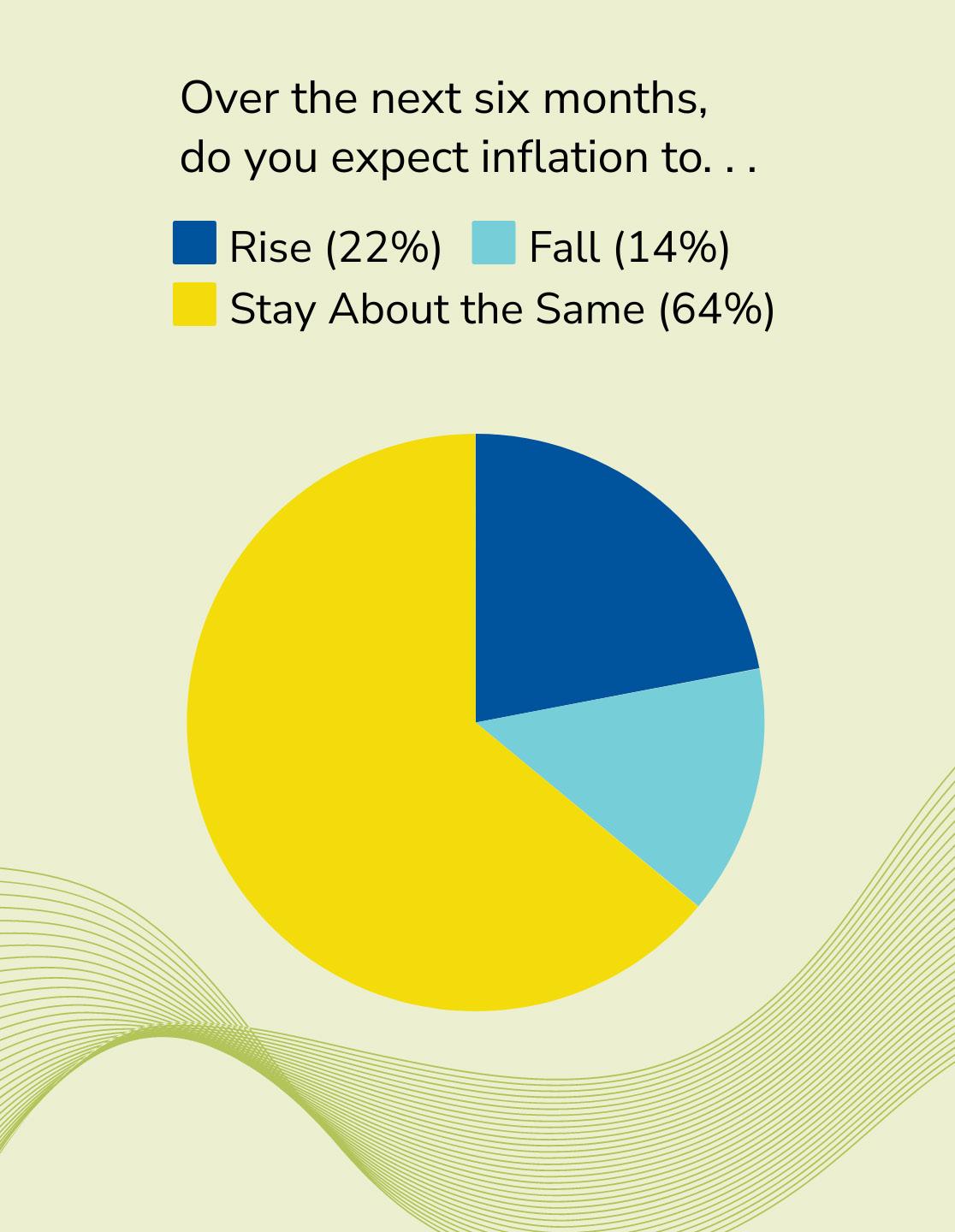

The Consumer Price Index and food price inflation captured the public's attention and became a high-profile component of the economic and political narrative over the last 18 months. Since the inflationary peak, food price inflation remains on a solid path and prices on staple items this past holiday season experienced areas of disinflation. Overall, inflationary pressures and the resulting increase in the cost of goods and services will likely persist, placing continued financial burdens on American households. This will have a lasting impact on consumer sentiment which has seen a temporary upswing following the 2024 elections, spurred by optimism about future business conditions. Clouds may be on the horizon as speculation about tariffs have economists’ expectations focused on the potential to raise consumer prices, which may temper

enthusiasm. Middle- and lowincome consumers, already strained by elevated costs, are likely to maintain their line of sight on value-oriented shopping.

Although pricing, promotion, and convenience strategies are important competitive tools, grocers who want to win the consumer sentiment battle in 2025 must also attend to market differentiation through good products and quality service. The ultimate measure is only when a grocer’s product and service offerings result in increased sales and additional customer loyalty. Arriving at the correct formula is the difference between success and failure in the low-margin grocery business. Differentiation is not a linear process; it is the result of trial and error, which may not favor some risk-averse owners, who are still weary after the pandemic.

Competition between grocery retailers is a clear advantage for consumers.

According to reports, Wisconsin households enjoy the lowest weekly grocery expenses in the nation ($221), thanks to a combination of unique advantages that work together to keep costs down. These include the state’s relatively low cost of living, smaller average household size (2.31 persons), proximity to subsidized Midwestern agricultural producers, culture, and competition for the consumer’s dollar.

While the pandemic years slowed growth on new brick & mortar construction, the industry has seen some new store activity in 2024 with companies in the upper-Midwest and Wisconsin having planned openings of grocery stores with sizeable footprints.

As a result, the highly competitive U.S. grocery industry will continue to see corporate consolidation. The likely industry M&A activity will result as real (or even perceived) regulatory scrutiny eases and grocers will seek to reap the benefits of more optimal economies of scale. Changes in the regulatory environment will take time; however, at a minimum, regional players will continue to acquire distressed grocers, especially smaller operations with one or two stores.

The grocery industry has become much more complex, and for grocers who are able to implement changes that help differentiate themselves in the marketplace, 2025 will be a productive and profitable year. Semmann is president and CEO of the Wisconsin Grocers Association.

The Wisconsin Grocers Association represents over 500 independent grocers, retail chain stores, warehouses and distributors, convenience stores, food brokers, and suppliers in Wisconsin.

WISCONSIN ECONOMIC REPORT

Eric Borgerding, President and CEO of the Wisconsin Hospital Association

Addressing Financial Strain, Workforce Shortages and Administrative Complexity in Health Care

As we look ahead to 2025, hospitals across Wisconsin are under unprecedented financial pressure. Rising inflation, labor costs and flat reimbursement are severely impacting hospital margins and access to care.

In the last two years, supply costs have grown by 17% and labor costs 11%. Despite these mounting expenses, hospitals are reimbursed at rates that do not reflect the true cost of care, particularly in light of rising patient volumes and increasingly complex cases. As a result, in 2023 one-third of Wisconsin’s hospitals, nearly all of which are non-profit and treat all patients who come through their doors, operated in the red.

In early 2024, two hospitals in Chippewa Valley closed. The vast majority of patients served by those hospitals were covered by Medicare and Medicaid, government programs that reimburse hospitals well below the cost of providing care and patients from which many for-profit hospitals and surgery centers refuse to care for. In fact, the two hospitals that closed in 2024 lost $56 million in the two years leading up to their closure. Service lines, such as labor and delivery care, are also shrinking in parts of the state. At least 14 hospitals have had to stop delivering babies since 2014.

Hospitals are also burdened with growing bureaucracy and the cost of health care “middlemen”—insurance companies, third-party administrators and many others that occupy the space between patients and health care providers. They introduce unnecessary layers of bureaucracy that drive up administrative expenses without improving, and sometimes harming, patient care. Insurance denials, delayed authorizations and complex claims processes create inefficiencies that hospitals must absorb, further adding to the cost of care and exacerbating workforce challenges.

Looking ahead, the demand for health care services is expected to intensify, driven by Wisconsin’s aging population. By 2030, one in four Wisconsinites will be over the age of 65, further heightening the demand for health care. Meanwhile, hospitals will continue grappling with workforce shortages, making it even harder to meet the growing demand for care. Administrative burden will only exacerbate this situation, as hospitals are required to spend valuable staff and resources navigating increasingly complex, caredenying insurance systems and regulatory requirements.

We can begin addressing— and even reversing—some of these challenges by enacting public policies that enhance reimbursement from Medicare and Medicaid services, investing in the health care workforce, and increasing transparency around the role of “middlemen” in health care and the resources they drain from the system. By tackling these issues head-on, we can help ensure that Wisconsin’s hospitals remain financially viable and able to continue delivering essential care to our communities. The health care landscape is evolving, but with the right policies in place, we can navigate these changes and ensure a healthier future for all Wisconsinites.

Borgerding is president and CEO of the Wisconsin Hospital Association.

Advocate. Advance. Lead. It’s what the Wisconsin Hospital Association (WHA) does for its member hospitals and health systems so they can provide highquality, affordable, accessible health care for Wisconsin families and communities.

WISCONSIN ECONOMIC REPORT

Kurt R. Bauer, President and CEO of Wisconsin Manufacturers & Commerce

What Will Trump II Mean for Business?