Wisconsin Banker

Bringing Out the Best at Your Bank Through Professional Development

By Katie Reiser

When talking to experts in the area of professional development and leadership coaching (Vicki Kraai, chief engagement officer, Interaction Training and Mika Moser, founder and CEO, At C Level Consulting Group) as well as those leading the charge in this area at Wisconsin Bankers Association-member banks (Kari Geyer, human resources officer, Mound City Bank; Sue Neuzil, PHR, vice president of human resources, Bank of Luxemburg; and Nona Zahn, organizational development manager, Forward Bank) it became clear that investing in professional development sends a strong cultural signal to your team that you are willing to invest in them, that you believe in them as part of the growth story at your bank, and that you want to set them up for success.

Banking on Baby Boomers

By Malcolm McDowell Woods

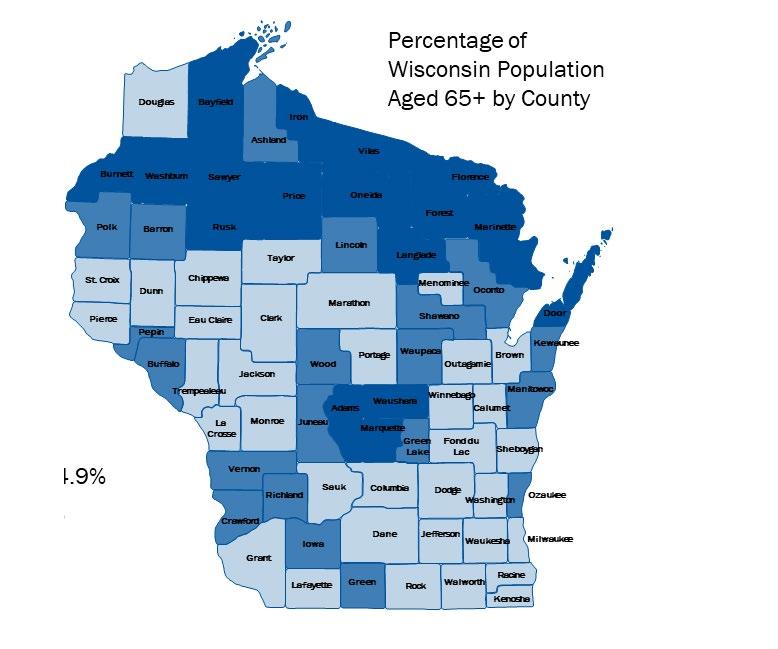

The rust belt is graying, as the swell of baby boomers reach retirement age, and Wisconsin is ahead of the trend. The state is among several states experiencing a larger than average increase in the percentage of its population hitting 65 and older.

That aging workforce has serious implications across all industries, but Wisconsin-based banks and other businesses in the financial services industry face an additional — and perilous — challenge: an aging and dwindling customer base fueling an unprecedented transfer of wealth.

Jim Perry is a senior strategist at Market Insights, a Seattle-based consulting firm. He has been traveling the country the past year and a half delivering a presentation entitled Demographic Disruption. “I think it’s necessary to keep raising this issue, especially to financial institutions,” he says. In his presentation, Perry shows a map of the United States that is broken down to the county level and illustrates the expected change in each county of the population aged 65 and older between now and 2028.

Kraai put it blunty, “I'm often asked, ‘What if we develop them and they leave?’ Well, what if you don't develop them and they stay?”

A Better Buys survey found that employees who have professional development opportunities are 15% more engaged and have 34% higher retention than those who don’t. Not providing development opportunities can lead to costly turnover. The ExecuSearch Group reported that 86% of professionals would leave their job for one offering more opportunities for professional development.

Contributing to a Culture of Engagement

Moser consults banks across the country and sees that great talent craves growth opportunities. She believes there is real value to providing learning opportunities and professional development because it improves employee engagement. This is key because, as Moser pointed out,

Shaping Brighter Financial Futures in Wisconsin

By Al Araque

On September 12, I had the pleasure of gathering with colleagues, WBA members, and special guests at the Wisconsin Bankers Foundation’s second annual gala. The gala, held at the Wisconsin Historical Society, celebrated the WBF’s mission of empowering financial decisions through education, scholarships, and research. WBF is the non-profit arm of the Wisconsin Bankers Association and was granted public charity status in 2015.

A sincere thank you to the generous sponsors, donors, and attendees who helped WBF raise a net profit of $23,000! I departed with some excellent auction items and a good feeling having learned about the meaningful work being done by the four WBF grant recipients: 6:8, Inc, Asset Builders, Eastbrook Academy, and Economics Wisconsin. I also got to hear an inspiring speech from Cole Hicken, a 2021 WBF Spring Scholarship recipient, who has already achieved success in the industry.

Each year WBF awards grants to support non-profit organizations whose work aligns with the foundation’s missions. If you work with a non-profit in your community that assists in providing the public with the resources and knowledge to make sound financial decisions, encourage them to apply.

Applications for the 2025–2026 fiscal year are accepted February 2025–May 2025.

The foundation has two scholarship programs. The Agricultural Banking Scholarship (applications are open through November 15!) of $1,500 is given to two winners annually. The Spring Scholarship application opens in early 2025. Four winners of $2,000 scholarships are selected. Details about both scholarship programs can be found on the WBF website.

Here are just a few of the many positive impacts of financial literacy:

• Financially literate individuals are more likely to engage in responsible financial behaviors, such as creating budgets, managing expenses, and prioritizing savings.

• Studies show that people with higher financial literacy tend to have lower levels of highinterest debt, such as credit card debt.

• Financial literacy education has been linked to higher participation in retirement savings plans.

I hear from leaders at financial institutions around the state that financial literacy is top of mind. But not all banks have the resources to create collateral or design presentations for their communities about financial literacy. That is where WBF can help so much. I urge banks to consider WBF a clearinghouse for financial education resources and encourage you to leverage those resources. Lots of helpful information can be found on the WBF website, including links to resources from agencies like FDIC and CFPB and programs like BankOn. The resources provided by WBF include a range of free financial literacy lessons targeted at K–12 children, college students, business owners, older adults, and everyone in between.

If bankers are looking for ways to get involved, you’ll find information about volunteer opportunities with organizations like ABA, Junior Achievement, and local Finance & Investment Challenge Bowls.

WBF also partners with WBA to generate new consumer content on the current financial issues impacting your customers. These resources are meant to be distributed to clients and help start the conversation about check fraud, budgeting, and more. Check out the Consumer Content on the WBA website.

Because financial literacy is so crucial, WBF recognizes the banks and volunteers who generously donated their time and

expertise each year to do presentations in their communities. Whether it is through the popular Read Raises Interest Kits distributed statewide for National Teach Children to Save Day, workshops for first-time homebuyers, or fraud prevention seminars. Staff is preparing for the Excellence in Financial Education awards which will be presented at the FLEX: Retail and Marketing Summit in November. These impressive stats were recently shared with me: over 400 volunteers did 900+ financial education presentations which reached more than 30,000 individuals in communities across Wisconsin (ranging from elementary school students to senior citizens).

WBA staff will be working with the Financial Literacy Advisory Board to select the 2025 Reading Raises Interest (RRI) book. Previous RRI books and related resources including lesson plans are available on the WBF website.

The Innovation Award winner will be announced at the annual WBA Bank Executives Conference in February. The award recognizes one bank that has taken a unique approach to empowering the financial decisions of its community members. It’s always inspiring to hear about the winning bank’s programs.

Let WBF support your bank’s commitment to helping customers and community members build a strong financial foundation.

Araque is SVP, director of consumer, private, and business banking with Johnson Financial Group, Racine, and the 2024–2025 WBA Chair.

Each Bank Is Unique … Your Counsel Should Be Too

There are 4,568 banks in the country.1 The breadth of issues facing those banks vary greatly, as do the resources each bank has at its disposal. Community bankers deserve legal counsel that takes into account the specific needs, goals and ambitions of each individual bank – counsel that consistently delivers sophisticated, yet practical legal advice tailored to your particular situation.

While we work with dozens of community banks throughout the country, and can leverage that

experience and perspective for you, we understand that the challenges and opportunities facing your bank are frequently unique to you.

At Reinhart, our dedicated attorneys function as a seamless extension of your management team, working alongside you to help solve even the most complex situations facing your financial institution. In many instances, it’s not just providing legal advice, but leveraging our network of contacts to serve your needs. It’s what we call Partnering in Possibilities™.

1

How to Take and Perfect a Security Interest in a Mobile Home

By Scott Birrenkott

While there are no new requirements regarding the taking and perfecting of a security interest in a mobile home, WBA has received several questions recently regarding the steps for doing so. While taking and perfecting a security interest depends upon the facts of a particular loan, as well as a bank’s available documentation, there are some important general aspects to consider specific to mobile homes, which are presented in this article.

When it comes to perfecting a security interest on a mobile home (note that there is an important distinction when a mobile home becomes a “manufactured home” which is discussed more below), we have a few recommendations for what to consider. Typically, we recommend starting with whether the home is on land and whether it is affixed to that land. This is important because if the home is

affixed to the land, the bank will need to file a fixture filing with the register of deeds office where the land is located. Additionally, if the home is located on land not owned by the homeowner, for example a trailer park, the bank should consider obtaining a fixtures disclaimer signed by landowner. On the other hand, if the home is on land owned by the mobile home owner, the bank should consider filing a mortgage on that land as well.

For purposes of perfection, under Wisconsin law, a security interest in a “manufactured home” is perfected by notation on the certificate of title with the Department of Commerce (DOC) unless it is a fixture or intended to be affixed to land. Note that a “manufactured home” includes in its definition a mobile home that is greater than 45 feet in length. A mobile home that is 45 feet or less is considered a “recreational vehicle” and the Department of Transportation (DOT) retains responsibility for these vehicles.

the owner of the manufactured home owns is not necessarily perfected by a notation on the certificate of title, as there may be no such title. Instead, the creditor should file a fixtures filing on the manufactured home.

With respect to such a fixtures filing the Wisconsin Manufactured Home Certificate of Title must be completed for titled manufactured homes greater than 45 feet in length. To obtain a perfected security interest in the home, a lender must have its lien noted on the title of the home that is delivered to DOC.

The DOC may remove information pertaining to a security interest perfected in a manufactured home from its records when 20 years has elapsed after the original perfection. This is also true with regard to the DOT and information pertaining to a security interest in “recreational vehicles.” However, a secured interest in a manufactured home that is a fixture or which the owner intends to permanently affix to land that

Keeping in mind the distinction between a “manufactured home” versus mobile homes that might not meet that definition, the MV1- Wisconsin Title and License Plate Application must be completed for those mobile homes 45 feet in length or less which are titled. The perfection of a security interest in a mobile home is accomplished by a notation of the lien on the Certificate of Title that is delivered to DOT. For titled manufactured homes, the bank's security interest is perfected as of the time of its creation if the delivery described (to either DOT or DOC) is completed within 10 days thereafter, otherwise, as of the time of such delivery.

Taking all of this together, and given the various complexities in the area of mobile homes, it has been our longstanding recommendation that lenders do all as applicable to perfect their security interest in manufactured homes. For example, have the bank’s lien noted on title either with DOC or DOT, and File UCC 1 and UCC 1A fixtures filing with Register of Deeds office where a mortgage would be filed on related real property noting that the fixtures filing is being filed in connection with a manufactured home transaction, and if applicable, a fixtures disclaimer.

Birrenkott is WBA director – legal.

Note: The above information is not intended to provide legal advice; rather, it is intended to provide general information about banking issues. Consult your institution’s attorney for specific legal advice or assistance.

Strengthening Our Industry Through Grassroots Advocacy and Financial Giving

By Lorenzo Cruz

Wisconsin remains a key battleground state at both the state and federal level of government. With newly redistricted legislative maps, Wisconsin will see smaller GOP majorities in both the Senate and Assembly. Currently the Senate has a supermajority of 22-11 and the Assembly is two seats short of a supermajority at 64-35.

Wisconsin could see a more purple Legislature after the fall election in November. A dozen races in the Assembly and four in the Senate are in play. Both sides of the aisle are spending tens of millions of dollars on media buys and field staff to win the majority. Republicans and Democrats will break even more spending records during this election cycle.

Once the dust settles and the elections are over, there could be new legislative leadership and committee chairs, and the size and membership of the committees could change as well. The Legislature will also begin to focus its full attention on the Governor’s budget. The state’s budget is expected to have a $3–4 billion surplus. Both sides of the aisle have different ideas on what to use the excess revenue on. Republicans will push for more tax cuts, a rainy-day fund, and spending reductions in the budget, while Democrats will want more money for higher education, K-12 education, childcare, and Medicaid expansion.

Meanwhile, WBA will continue to build on the successes from the last legislative session below as well as pursue the Association’s priorities in the 2025–26 session. Thanks to the entire membership for their grassroots and financial support of WBA’s advocacy efforts.

Victories

• Successfully received a tax exemption on income earned from certain commercial and agricultural loans of up to $5 million, creating a tax savings of $25M annually to industry (Governor Evers’ budget 2023–25)

• Proactively negotiated and passed legislation on Financial Institutions Modernization in both Houses (signed into law by Governor)

• Proactively led and passed legislation adopting changes to the Wisconsin Trust Code (signed into law by Governor)

• Supported a requirement for one-half credit of financial literacy for high school graduation (enacted last session)

• Defeated two bills related to ESG (no hearings were held)

• Blocked introduction of any interchange legislation (credit card swipe fees)

• Amended legislation that would have required the use of merchant category codes on the sale of firearms (bill vetoed by Governor)

• Supported changes to allow for 529A ABLE Accounts (signed by Governor)

• Worked with broad business coalition to repeal personal property tax (signed into law)

Ongoing Priorities

• Elder fraud prevention – provide more protections

• Privacy – preserve exemption

• Interchange Fees – neutralize legislative efforts

• Tax Parity – pursue solutions to level the playing field with tax exempt competitors

• MCC – neutralize any harmful legislation

• ESG – minimize impact of legislation that limits a bank’s ability to make their own risk-based business decisions over loans and investments

• Trust Code – work with groups on DAPT and other trust related changes

• Credit Unions – level playing field

• Banking Modernization – streamline regulation

• Artificial Intelligence – minimize regulation

Cruz is WBA vice president – government relations.

Invest in the Future Prosperity of the Banking Industry

As part of the Wisconsin Bankers Association’s (WBA) mission to support bankers in Wisconsin, advocacy — at both the state and federal level — plays an important role in the work the team does each day. In order to continue advocating for the strength and well-being of our industry, the WBA membership is encouraged to help make political contributions to WBA’s political accounts: Wisbankpac, the Alliance of Bankers Conduit (ABW), and the WBA issue advocacy fund. These donations play a vital role in supporting our elected officials who support banking and business initiatives. Through the Association’s political action funds, individuals have the ability to pool their personal contributions with that from other bankers for even greater impact and visibility for the industry. Here’s how your bank can make a difference:

Individual Recognition

Silver Triangle Club

Silver Triangle is earned by individual bankers who make a minimum personal contribution of $1,000 to any combination of the Alliance of Bankers for Wisconsin (ABW) political conduit, Wisbankpac, or the WBA issue advocacy fund.

Leadership Circle

WBA’s Leadership Circle recognition requires individual bankers to make a minimum personal contribution of $3,000 to any combination of the Alliance of Bankers for Wisconsin (ABW) political conduit or Wisbankpac.

Hall of Fame

WBA’s Hall of Fame recognition requires individual bankers to contribute a minimum aggregate lifetime personal investment of $25,000 to any combination of the Alliance of Bankers for Wisconsin (ABW) political conduit or Wisbankpac.

Bank-Wide Recognition

Gold Triangle Club

Gold Triangle recognition is achieved by banks whose officers, directors, and employees aggregately contribute a minimum amount (based on bank asset size) to the Alliance of Bankers for Wisconsin (ABW) political conduit or Wisbankpac.

Not sure where to start?

More information regarding the Association’s yearly priorities and ways to get involved is available at wisbank.com/advocacy. WBA staff are also available to give virtual or in-person presentations to WBA-member bankers and/or a bank’s board of directors. These informative updates help illustrate the legislative environment we work in and detail the Association’s priority issues.

To receive the 2024 Gold Triangle Club recognition, WBA-member bankers must contribute, at minimum, the above amount based on bank asset size.

Milford Hills Outing

On October 23, 2024, WBA’s Government Relations team hosted the inaugural Milford Hills Outing, at one of Wisconsin’s premier shooting ranges, in support of Wisbankpac. Participants enjoyed a day of perfect fall weather, challenging stations on the sporting clays course, a silent auction, and after-shoot social in the clubhouse — all in support of Wisbankpac.

Professional Development

Continued from pg. 1

“Employees that are engaged tend to be happier, more productive, more collaborative, and more innovative.”

Not Your Parents’ Career Trajectory

Neuzil suggested that older generations may have been “content staying in the exact same role for the next 40 years.” But now, potential employees from younger generations are “looking for an organization who is going to help them grow.” That is why Bank of Luxemburg highlights the possible career development paths in their recruitment ads and draws individuals in by sharing examples of employees who have gotten the bank’s help in developing their careers. She thinks that banks need to be more outspoken in pointing out that they offer career development.

Professional

Maturity

Kraai consults on many banking topics with a strong focus on frontline training. She describes tellers as the

CEOs of the customer experience.

She cautions banks to avoid a practice they may inadvertently engage in, simply checking off a list of training requirements on policies and procedures without first training on how to talk to customers.

A big piece of her work developing bank employees at all levels involves professional maturity training — essentially how one acts and reacts on the job. Kraai considers all employees to be on a professional development journey. “We all need coaching … professional maturity training needs to be done at every level.”

For Kraai, it boils down to emotional intelligence,“We need to train on emotional intelligence, which is your ability to recognize

and understand emotions in yourself and others and your ability to use that awareness to manage your behavior and your relationships.”

She added, “That's what we need to be focusing on, how to act and react not just to customers but also with our coworkers. It’s a learned skill, but sometimes we all need to practice it.”

Hire for Character, Chemistry, and Lastly Competence

LinkedIn VP of Talent Development Linda Jingfang Cai said in their 2023 Global Talent Trends Report, “We have to evangelize the shift from valuing our people’s experience to valuing their skills.”

Kraai shared that when she asks trainees to name an organization that does a great job training their frontline, everybody says Chick-fil-A. She encourages banks to use their model,

Continued

Geyer Moser Zahn Neuzil Kraai

Putting your institution’s best foot forward for a lower-rate environment

By BOK Financial Capital Markets

After four years of hiking rates and then keeping them high, the Federal Reserve has now started lowering rates, hitting the ground running with a large cut of 50 basis points (0.50%) in September. As rates continue to fall, it’s important for management teams to understand how lower rates will impact their institutions’ income statements and to take steps to better position themselves for the even lower-rate environment likely to come.

Past, present and future conditions

First, let’s consider where we are now and how we’ve gotten here. Over the past few years, federal and consumer spending have been driving economic growth, despite higher interest rates. However, with many consumers now having used up all their excess savings from COVID— and then some—and also having record credit card debt, it’s questionable whether consumer spending can last at these levels. Meanwhile, unemployment has risen, which has raised concerns about weakening in the job market, even though unemployment is still relatively low on a historical basis. Given all these factors, the market is now forecasting a large number of Fed rate cuts, and some investors are wondering if the Fed can still pull off a soft landing or if a recession is in the making.

Preparing for 2025

Against this backdrop, each decision your management team makes in the last quarter of 2024 will be impactful for 2025. For instance, one important question to consider is when to begin cutting deposit rates. As financial institutions assess their ability and willingness to do so, margin and liquidity position will be important considerations. The news cycle also may aid decision-making this time around, as the Fed cuts likely will be well covered by the media. Consider reviewing rates against wholesale funding rates regularly and be prepared to adjust deposit rates frequently. Conversely, intermediate Treasury and wholesale funding rates have already fallen. To the fullest extent possible, attempt to hold loan rates higher for longer until the cost of funds begins to recede. Frequently, we see a race to the bottom on loan rates, so be prepared to fight for every basis point! This strategy may allow your institution to manage net interest margin from both sides of the balance sheet.

Understanding your interest rate risk position

With a significant inversion in the yield curve between Fed Funds and intermediate Treasuries, a non-parallel yield curve shift may be a more likely outcome. This may be led by the front end coming down more significantly than any changes in term Treasury rates that have already accounted for expected future rate cuts. If your institution has substantial risk around falling rates, you may be wondering if it is too late to manage your position given the inversion in the curve. What if you will benefit at some point from a steeper lower yield curve? Can you wait it out? With these questions in mind, you may want to take some proactive steps to hedge the risk of the market being wrong.

Investment portfolio conundrum

The current yield curve challenges investors to diversify risks. Although keeping large amounts of cash or short securities can generate the highest yield today, doing so could result in significant yield erosion if or when the short end comes down. Equally, the decision to lock into investments further out on the curve may give up immediate earnings for possible future benefit.

Instead, a balanced investment strategy could allow your institution to add a mix of securities that average a yield close to the Fed Funds rate with an allocation to call-protected assets. We urge management teams to consider the trade-off of investing in only the highest yield options compared to the potential benefits of adding assets with call protection that could result in an unrealized gain when the Fed lowers rates further. Finally, it’s important to keep in mind that repeating the past is unlikely, but it’s still essential to learn from it. Understanding the choices that your institution made and then making informed decisions for the future is how your institution can and will put its best foot forward.

Kent Musbach is a senior vice president and Marc Gall is a senior vice president and asset/liability strategist for BOK Financial Capital Markets.

Contact BOK Financial Capital Markets at 866-440-6514 to discuss the latest economic outlook and timely considerations. We can help guide a unique, well-conceived strategy that considers many variables and potential outcomes.

September 23–24

MANAGEMENT CONFERENCE

Oneida Hotel I Green Bay

Over 215 bankers and Associate Members gathered in Green Bay at the Oneida Conference Center this September for the annual WBA Management Conference. During the morning on the first day of the conference, attendees could also participate in a pre-conference golf outing at Thornberry Creek at Oneida. The event then kicked off with a reception to honor several Lifetime Service Award recipients and continued to day two with a full day of education, time in the exhibit hall, and networking.

The WBA Management Conference occurs annually to bring timely, critical discussions to bank leadership teams which provide valuable insights that will elicit well informed decision-making and strategic planning for the year ahead. This year, bankers were advised by presentations on building a workforce with diversity; innovation; deposit growth; commercial loans; and an economic, political, and financial outlook for 2025.

The reception program in the evening on September 23 honored nine bankers with a prestigious WBA Lifetime Service Award for their dedication to the banking industry and the communities they serve. The recipients were presented with the award plaque by Rose Oswald Poels,

WBA president and CEO, and Daryll Lund, WBA executive vice president – chief of staff, after recently achieving between 30 and 49 years of banking.

The first general session in the morning of September 24 delved into recruiting and retaining talent in the current competitive workforce. Presenter Mika Moser, founder and CEO of At C Level Consulting Group, walked through the data and advantages to building a team from diverse backgrounds. Moser also provided the steps to adopting inclusive hiring practices, building community trust, and creating a bank culture that boosts recruitment.

After choosing from a variety of breakout topics and connecting with peers and exhibitors, attendees gathered for another vital session with Frank Kelly, founding and managing partner at Fulcrum Macro Advisors, as he provided the membership with an outlook on the economic, financial, and political landscape of 2025. Kelly’s tenure in the industry and beyond brought an international view to the discussion and predicted regulatory agendas and challenges post-election for banks to monitor.

The WBA would like to thank all the event sponsors and attendees for contributing to the success of this year’s event!

BANKERS RECOGNIZED FOR THEIR TENURE IN THE INDUSTRY

At the evening reception during the WBA Management Conference, the Wisconsin Bankers Association honored nine bankers with a 2024 Lifetime Service Award, recognizing their exceptional commitment and contributions to the banking industry. The WBA also celebrates bankers throughout the year at various ceremonies across Wisconsin. To learn more or recognize a banker with one of WBA’s Lifetime Service Awards, please visit wisbank.com/serviceawards.

Pictured (left to right, back row) are: Nancy Wirtz (47), National Exchange Bank & Trust; Cindy Nierode (40), Port Washington State Bank; Shannon Parrett (40), Farmers & Merchants Bank & Trust; Laura Edwards (31), Bank Five Nine; Kathy Ganswindt (30), Bank Five Nine; WBA President and CEO Rose Oswald Poels; and WBA Executive Vice President – Chief of Staff Daryll Lund. Pictured (left to right, front row) are: Angela Salewsky (35), Farmers & Merchants Bank & Trust; Amy Pamenter (43), National Exchange Bank & Trust; Jane Massart (30), Bank of Luxemburg; and Melissa Rogers (30), Bank of Luxemburg.

CONGRATULATIONS

2024 GRADUATES FROM WISCONSIN MEMBER BANKS

We congratulate you on completing the rigorous 25-month program and joining the more than 23,000 alumni who have gone on to leadership positions in their organizations, associations and the financial services industry. Best wishes for continued success!

Chelsea Ballou The First National Bank and Trust Company Roscoe

Stefanie Bonesteel Citizens Bank Mukwonago

Scott Bruce Johnson Financial Group Waukesha

Jordan Casto Lake Ridge Bank Middleton

Trent Cox CBI Bank & Trust Galesburg

Elizabeth Deihs One Community Bank McFarland

Jake Dittmann Bank of Luxemburg Green Bay

Shelly Draeger Bank of Lake Mills Lake Mills

Susan Fibert Frandsen Bank & Trust Hayward

Daniel Glass Peoples State Bank Lancaster

Dena Hineline Bank of Sun Prairie Sun Prairie

James Hinks First Mid Bank & Trust, National Association Mattoon

Aaron Holt First Mid Bank & Trust, National Association Mattoon

Ryan Jaecks National Exchange Bank and Trust DePere

Natalyn Jannene AbbyBank Abbotsford

Desirae Jimenez National Exchange Bank and Trust Fond du Lac

Kyle Johansen Frandsen Bank & Trust Luck

David Johns, II Prevail Bank Eau Claire

Brett Johnsen The Equitable Bank, S.S.B. Wauwatosa

Suzanne Johnson The Park Bank Fitchburg

Adam Keuler IncredibleBank Wausau

Nathan King Bay Bank Green Bay

Brooke Klug Forward Bank Marshfield

Andrew Lau Federal Deposit Insurance Corporation Eau Claire

Joseph Lautenschlager Wolf River Community Bank Hortonville

Steven Leaman Horicon Bank Fond du Lac

Sponsored by:

Michelle Matthys CBI Bank & Trust Roscoe

Rebecca McClelland Johnson Financial Group Kenosha

Brian Milliken National Bank of Commerce Superior

Peter Moskal Starion Bank Middleton

Michael Papendorf Bonduel State Bank Clintonville

Daniel Pohnl Security Financial Bank Eau Claire

Courtney Searles Johnson Financial Group Madison

Adam Sommer The Bank of Brodhead Madison

Meredith Strieff Horicon Bank Horicon

Joshua Wagner Johnson Financial Group Racine

Eric Waite Johnson Bank Mequon

Not pictured: John Lisowski, Security Financial Bank, River Falls

Maximize the Impact of Your Community Sponsorships

By Lauren Moran

We all know that the heart of community banking goes well beyond checking accounts and business loans. Sponsorships and donations are powerful tools for community banks to strengthen ties with local residents and businesses. These efforts not only demonstrate your bank's commitment to the community but also offer marketing opportunities that can increase visibility, drive engagement, and build lasting relationships. While many of us are working with one- or two-person marketing teams and a limited advertising budget, it’s imperative we make the most of our community sponsorships and treat them as incredibly valuable extensions of our bank’s marketing efforts.

Here are some tried and true ways to make a splash with your community involvement.

Likes and Clicks and Shares, Oh My!

There is no shame in shouting from the rooftops about all the good your bank is doing. Announce your partnerships and local support by sending media and press releases. You never know when news outlets are going to be in the market for a “feel good” story. As they say, a picture is worth 1,000 words. Positive community interactions featuring photos of your staff members in action are social media gold. Share pictures and news of your community partnerships on your social platforms, tagging other participating organizations, including references or photos of any influential or well-known community members like business

owners, social media influencers, or local government officials. Encourage featured staff and community members to share your posts with their own social networks. Get even more mileage out of your event photos by adding them to a blog post or featuring them in your annual report.

Become the Go-To Resource for What’s Happening in the Community

Host a community calendar on your bank’s website to highlight events you are sponsoring. Use a consistent format and share as much detail about the event or cause as possible. You can even feature which of your core values the event or cause aligns with. Not only will your calendar serve as a helpful tool for community members, but it will quickly ramp up website visits and engagement from non-customers and customers alike who are seeking information on local happenings. Your website will quickly become a trusted community resource and will gain visibility for your bank in the process. It’s a win-win!

Think Outside the Box and “Beyond the

Banner”

We’re all used to seeing the typical “bronze,” “silver,” and “gold” level sponsorship categories that allow logo placement, program mentions, a logoed banner, etc., but if there’s anything bank marketers excel at, it’s getting creative. Think of ways to expound on the typical sponsorships your bank takes part in, finding ways you can have an in-person presence or leave a lasting impression. Bank volunteers are always encouraged and appreciated, but what about setting up a fun, bank-branded photo op, doing a surprise giveaway, hosting a unique contest or serving

as an educational resource at an event? Even if these ideas are not offered in writing on a sponsorship request, fun additions to fundraising efforts are almost always welcome and can create memorable ties to your brand.

It Never Hurts to Ask … (For More)

Many organizations are surprisingly open-minded in allowing some creative freedoms when it comes to “enhancing” a sponsorship. For instance, did you agree to sponsor the high school football team with a digital ad on their live streaming platform? Ask if the school would also allow you to hang a custom banner at the football stadium as part of this sponsorship so you can capture in-person impressions, too. Are you sponsoring the local library with an annual donation? Ask if you could come up with a fun theme and name for an area of the library to highlight your successful partnership. Not every organization will be comfortable allowing this type of “enhancement,” but you won’t know until you ask.

There are endless opportunities to maximize the impact of your organization’s sponsorships, donations and community involvement. Leverage local and social media, involve your staff, become a go-to resource and get creative!

Moran is marketing director at Wolf River Community Bank and chair of the 2024–25 Marketing Committee.

Professional Development

Continued from pg. 8

“At Chick-fil-A, they don't put you behind the cash register, they don't teach you how to make food, bag food, or run the drive thru until you have graduated from customer experience training.”

When Chick-fil-A hires for their frontline, the first thing they look at is character and the last piece of their hiring hierarchy is competency. Kraai thinks this approach makes sense, “What we do in our banks, though, is backwards. I did it too, all those years running a bank. I went with competency first.” Kraai cautions, if you're hiring people because they have great cash handling experience, but they have zero ability to work well with others, you're likely missing the boat.

Neuzil explained the Bank of Luxemburg’s approach to certain hardto-fill positions like credit analysts, “For probably the last five years, we can't find experienced credit analysts out there in the world, so we have started working with recent college graduates with no experience.”

The bank developed a program for new employees right out of college to go through a two-year program starting out as entry level credit analysts working on smaller loans with their more experienced credit analysts. The bank trains them and if they meet milestones during their two years, they are promoted to a full-fledged credit analyst role.

An Investment, Not Just Budget Line-Item

All three member bank interviewees described the positive benefits of professional development like improved retention, attraction of better talent, the boost to morale, and an element that is so important in the heavily regulated, compliance-centric banking industry — staying up to date on regulations.

Geyer described Mound City Bank’s approach, “Our bank’s professional development and education budget is set high enough to be able to give all our employees who are interested in receiving external training the opportunity to do so. We want to encourage the employees

to seek out education both externally and internally.”

Those dollars are well spent. Data from Deloitte shows that organizations with a strong learning culture are 92% more likely to develop novel products and processes, 52% more productive, 56% more likely to be the first to market with their products and services, and 17% more profitable than their peers.

Identifying

Potential and Interest

Banks have different strategies for identifying employees for professional development opportunities.

Neuzil said, “We started doing stay interviews, and out of those stay interviews came input from employees regarding their desire to know what was available from a career development standpoint.” She added, “From the stay interviews, we created a career development committee.” The bank also conducts monthly one-on-one meetings with a portion of those meetings focusing on career development with questions like, “What would you like to learn more about in regard to career progression? What is some training that we can do?”

Zahn stated, “At Forward we create a list of individuals who have shown an interest or those who are up and coming in managerial or leadership roles and keep track of possible professional development opportunities that would be a good fit.”

Matching employees with appropriate professional development opportunities is a two-way street at Mound City Bank. Geyer said, “An employee might identify an opportunity they're interested in or I could see something in a WBA email which I might send to a manager and say ‘Hey, this could be beneficial.’”

Ensuring Equitable Access to

All

Moser recommends having a codified program to identify potential employees for leadership development. She cautions that relying solely on suggestions from managers might cause banks to “miss out on the next great leader from an underrepresented group,” because managers may tend to fall back on developing people they know and like the best. A formal program may be more inclusive because clear criteria can be

established with transparent processes and parameters to avoid unconscious bias. For example, banks can stipulate that employees can nominate themselves, or require nomination from managers, establish a minimum number of years on the job, and set deadlines for applications and completion.

Stagnating Takes a Toll on Succession Planning

Moser warns, “If you're not developing your managers or other leaders, it impacts your succession planning and you're not going to be able to bring up the next executive level.”

When that happens, you end up with a gap in your leadership pipeline, and “now you have to go outside and recruit that person and we all know that is much more expensive,” explained Moser.

Moser added, “The other cost of not developing leaders is that you end up keeping people on the team that are just poor performers. So now you're retaining not the best, you're retaining the mediocre and that has a real impact on productivity and your ability to innovate.”

Tap into Local Resources

Bank of Luxemburg had an innovative program partnering with students from a UW–Green Bay organizational development class to create career road maps for employees. Neuzil said, “We looked at all our positions to identify the different paths you can take in your career and the courses to help on that path.” Interestingly, one of the students ended up working part-time for the bank during the pandemic re-finance rush.

Zahn has found success linking Forward Bank employees up with Dale Carnegie courses offered locally. Additionally, Leadership Marshfield is offered through the Marshfield Chamber of Commerce and provides networking and educational opportunities, as well as a community service component.

Getting Creative

Zahn and the team at Forward Bank were busy gearing up for the bank’s annual training and leadership symposium, Epic Day. “We bring in guest speakers and really hone in on leadership styles.”

For over ten years, the bank has been highlighting different departments to showcase their expertise, conduct team building games, and bring in fun guest speakers (some from pop culture hits like Survivor and American Ninja Warrior) who are uplighting and motivational. It’s an ideal day to focus on continuing employee education and the interconnectedness of the departments and teams.

Woven into the Employee Experience

A LinkedIn report found that employees believe professional development is the number one way to improve company culture.

Additionally, 35% of employees rated learning and development among the top three elements of the employee experience according to MetLife’s annual U.S. Employee Benefit Trends Study.

Bank of Luxemburg’s commitment is underscored by having a full-time training coordinator on staff, bringing in subject matter experts, and tapping into the experience and insights of long-term employees like a commercial lender who is retiring, but serves as a consultant to mentor newer employees in sales training and business development.

Job Shadowing and Mentorship Make a Difference

Bank of Luxemburg enhanced their job shadowing program. Neuzil elaborated, “We’ve created a job shadow application, set up time for shadowing, and follow up with questions like, ‘What did you learn from the job shadow? Is this something that you would be interested in as a career path?’ This has made job shadowing more interactive and led to more impactful conversations about career paths.”

Their mentorship program doesn’t necessarily match up employees who work in the same role. “That's not what it's for. It's more for developing your soft skills, how to network, how to be a good leader, how to be more organized, how to prep for meetings, how to run a meeting.”

Measuring the Impact

Zahn revealed, “While we don’t have an actual rubric, employees who have participated in professional development often use performance reviews with their

managers to measure outcomes and benefits as well as set new goals.”

Geyer shared that Mound City measures the effectiveness of their program by tracking all education completed for all employees including seminars, webinars, workshops, and schools adding, “If there is a certification of completion, we make sure to obtain that for that particular employee and also honor them for completing the course.”

Neuzil looks at the number of employees who go through different programs, whether it's their youth apprentice or in-house training and development and track how many people can continue to move into higher positions within the bank.

Let WBA Help

WBA has a robust lineup of training and professional development opportunities that are available yearround; ranging from webinars, seminars, conferences, schools, and customized training from WBA’s Legal Team.

Offering options for everyone is key, because as Zahn pointed out, “Everybody learns in so many different ways. You really have to keep an open mind about the best way to present training when it comes to promoting and developing people.”

Like Geyer does, keep an out for WBA emails to help identify upcoming opportunities that are a good fit for your staff or visit the WBA website regularly to see what’s new in both in-person and virtual training.

Geyer shared that the BOLT Leadership Summits have been instrumental in developing their employees’ leadership potential. Geyer also finds webinars from WBA partners a helpful approach to disseminate knowledge that often generates conversation between employees after viewing, “employees might say, ‘I have a follow-up question on that topic,’ and they can bounce ideas off one another.”

Geyer praises the many Mound City Bank employees who have completed the Graduate School of Banking at UW-Madison (GSB). It’s a rigorous and rewarding course with a commitment of 25 months. Right now, their Cuba City manager is enrolled. “She took the initiative and wanted to take on

that challenge despite her very busy schedule,” Geyer stated.

Neuzil said, “We do a lot with WBA classes, whether it’s Principles of Banking, Supervisor Boot Camp, or Commercial Lending School.” The bank also looks to GSB for professional development. In addition to the Graduate School of Banking course, they send employees to a variety of GSB’s weeklong schools.

Neuzil explained the benefits of those shorter courses, “Our marketing manager started as a youth apprentice and has been with the bank for about 20 years working her way up. Attending the GSB Strategic Marketing School for a week allowed her to see how other banks are marketing using different methods. It also connected her to a network of other community bankers and marketing people from across the country.”

Zahn has sent employees to WBA’s Supervisor Boot Camp, Personal Banker School, as well as Consumer, Commercial, and Ag Lending. “We utilize WBA for leadership training or skill training that focuses more on an employee’s specific role at the bank.”

Zahn is a fan of in-person professional development because it can increase camaraderie in the banking community, explaining, “You make those connections and then if you're stuck on something back at your bank, you can always connect back to them.” She shared that Forward developed a good rapport with Horicon Bank. These valuable connections can be forged through professional development.

Summing it Up

Many banks may be asking the question that Neuzil posed, “How can we be creative and innovative when it comes to retaining our employees because we don't want to lose them since they're so hard to find.” Adding, “If we can keep having those good conversations, we can help employees continue to develop and grow without leaving for other opportunities.”

Reiser is WBA writer/editor.

Bulletin Board

News from Wisconsin Bankers Association Members

Promotions

Fitchburg

and New Hires

Pam Lokken (pictured) joined Oak Bank as vice president human resources.

Florence Great North Bank is pleased to announce that Sara Ferguson (pictured) was promoted to SVP –chief accounting officer and Michelle Chartier (pictured) was promoted to vice president – deposit operations.

Madison First Business Bank is pleased to announce that Jamie Vogt (pictured) was promoted to vice president –commercial banking.

Manitowoc

Bank First is pleased to announce the following promotions: Debbie Weyker (pictured) has been promoted to senior vice president – marketing; Matt Longmeyer (pictured) has been promoted to senior vice president – technology director; and Greg Berken (pictured) has been promoted to senior vice president – finance. Jeff Gagnon (pictured) has been promoted to information technology officer.

David Rucker (pictured) has joined Bank First as vice president – retail banking.

New London

First State Bank is pleased to announce the appointment of Jason Wood (pictured) as senior vice president, business banking.

Oregon

One Community Bank is thrilled to announce the promotion of Liz Deihs (pictured) to executive vice president & chief experience officer.

Peshtigo

Peshtigo National Bank is excited to announce the promotion of

to senior vice president, senior ag lending officer.

Prairie du Sac Bank of Prairie du Sac is thrilled to announce two promotions within their lending department. Bradley Prohaska (pictured) moves from vice president, commercial lending to senior vice president, chief credit officer, and Casey Koenig (pictured) shifts from vice president, commercial lending to senior vice president, chief lending officer.

Stevens Point

Prevail Bank is pleased to announce that Randy Zietlow (pictured) is the bank’s new chief financial officer.

Wisconsin Rapids

Prevail Bank is pleased to announce that Michelle Kearns (pictured) is the bank’s new vice president of compliance. She succeeds long-time professional, Lenore Breit, who will be retiring soon.

Wausau

Senior Vice President Erik Rajek (pictured) has been promoted to commercial group leader of Peoples State Bank.

Anniversary

Brian Siegenthaler (pictured), VP of Wisconsin Bankers Association’s Employee Benefits Corporation, Inc. (EBC), celebrated his 10th anniversary.

Milestones in Industry Service

Vicki Yenter (pictured) celebrated 35 years of service at Community First Bank.

Forte Bank’s Deposit Operations Manager, Joyce Hall, (pictured) celebrated a half-century of service in banking. Forte Bank held a party to celebrate this milestone on October 1 at their Hartford branch.

Congratulations

In Business Greater Madison recently revealed its inaugural Power 100 list. The list recognizes a group of 100 business and community role models serving companies, nonprofits, and the government, who were selected for their impact on their industries, Greater Madison, and beyond. Along with WBA President and CEO Rose Oswald Poels, several WBA members and Associate Members were honored:

• Wendy Baumann, President and CEO, Wisconsin Women’s Business Initiative Corp.

• Megan Jerabek, Attorney and Shareholder, von Briesen and Roper

• Mark Meloy, Executive Vice President, First Business Financial Services, Inc.

• Elmer Moore Jr., CEO and Executive Director, WHEDA

• Wendy Perkins, President and CEO, WPS Health Solutions

• Jeff Ticknor, SVP – Group Managing Director, Wisconsin; BMO Harris Bank

• Jim Tubbs, CEO, Lake Ridge Bank

Bank Five Nine was one of six banks to receive the American Bankers Association's 2024 Brand Slam Awards. The winners were recognized during the recent ABA Bank Marketing Conference in Chicago. Bank Five Nine won in the Public Relations/Community Engagement Activity category for its “Tim’s Treat” initiative. Bank CEO Tim Schneider participates in “Tim’s Treat” where he surprises a local business or nonprofit organization in the community with a visit and treat.The campaign was also recognized by the Wisconsin Bankers Association with a 2023 Marketing Excellence Award.

Chambas, CEO of First Business Financial Services, Inc. the parent company of First Business Bank, was featured in a Nasdaq Spotlight on Community Banks article and on the Nasdaq billboard in Times Square. In the article Chambas discussed the bank's evolution and the importance of building long-term relationships.

Peoples State Bank, Wausau received recognition as a 2024 Best Human Resources Team from Employee Benefit News, in partnership with Best Companies Group. The team earning this award includes Tina Seidl, vice president and human resources director; Jen Cassell, senior human resources generalist; Dawn Darling, learning and development officer; and Scott Staszak, talent acquisition manager.

FNC Bank was recently named the Best of the Valley for 2024, an honor determined by local readers of The Sun publications. FNC Bank won in both categories for which they were nominated: Best Bank/Financial Institution and Best Place to Work (Large Company).

Brian Rieth (pictured)

Corey

Vogt Weyker Longmeyer Berken Gagnon

Rucker Wood

Rieth Prohaska Koenig Zietlow Kearns

Rajek

Lokken Ferguson Chartier

Siegenthaler Yenter Hall

Deihs

Bulletin Board

News from Wisconsin Bankers Association Members

Celebrating a Lifetime of Service

WBA is proud to recognize the individual bankers who dedicate their service to our industry and their community. The 50- and 60Year Clubs recognize bankers who have served in the banking industry for 50 and 60 years, respectively. Additionally, WBA’s Lifetime Service Awards recognize bankers who have served in the industry for between 30 and 49 years. To recognize a banker for the esteemed honor, please visit wisbank.com/ServiceAwards.

Peoples State Bank in Marathon City

Jackie Hamann of Peoples State Bank in Marathon City celebrated her 40 years in the banking industry. Staff and family members were at the Marathon branch award ceremony. Pictured (left to right): WBA President and CEO Rose Oswald Poels, Peoples State Bank Personal Banker Jackie Hamann, and Peoples State Bank President/CEO Scott Cattanach

Black River Country Bank

Three Black River Country Bank employees were recently honored for their longtime commitment to the banking industry. Combined, their service totals 142 years. The employees, Cindy Adams (51 years of service), Roxie Hostraswer (41 years of service), and Dawn Tracey (50 years of service), were celebrated at a Customer Appreciation Tailgate Party in Melrose. Pictured (from left to right): Black River Country Bank President and CEO Bob Becker, Dawn Tracey, Cindy Adams, Roxie Hostraswer, and WBA President and CEO Rose Oswald Poels.

Bonduel State Bank

President and CEO David Schultz celebrated 43 years of service to the banking industry. Schultz retired at the end of September.

Pictured (left to right): Bonduel State Bank Senior VP Mike Papendorf, WBA President and CEO Rose Oswald Poels, Bonduel State Bank President and CEO David Schultz, and Bonduel State Bank board members Richard Kucksdorf and James Bleick

Port Washington State Bank

Lifetime Service Award honorees from Port Washington State Bank were: Mary Karnitz (32 years of service), Ron C. Knaus (45 years of service), Lynne Melchert (40 years of service), Cindy Nierode (40 years of service, all at PWSB), Catherine Pujanauski (30 years of service), Lois Roeske (30 years of service), and Donna Wendtlandt (42 years of service). Pictured (left to right): front row: Catherine Pujanauski and Lois Roeske. Back row: Cindy Nierode, Mary Karnitz, Ron Knaus, and WBA President and CEO Rose Oswald Poels.

In Memoriam

The

Stephenson National Bank & Trust

Jerry Schmidt recently retired from the Board of Directors at The Stephenson National Bank & Trust after a long and successful career of helping generations of families in the Wausaukee and Crivitz area. He was presented the award at his retirement ceremony. Pictured (left to right): WBA President and CEO Rose Oswald Poels and Jerry Schmidt

First Business Financial Services, Inc.

CEO of First Business Financial Services, Inc. and First Business Bank board member Corey Chambas, who has worked in banking for 40 years, and Executive Vice President of First Business Financial Services, Inc. Mark Meloy, who has been in banking for 41 years, were both celebrated for their contributions to the banking industry and their communities. Pictured (left to right): Mark Meloy, WBA President and CEO Rose Oswald Poels, and Corey Chambas.

Ronald J. Schowalter, a third-generation owner of Port Washington State Bank, passed away on October 17, 2024. Ron was 98 years old. Starting his career with PWSB in 1949, Ron held key leadership roles, including Vice President, President and CEO, Chairman of the Board, and most recently, Chairman of Port Bancshares. As a 75-year recipient of the WBA Lifetime Service Award, his dedication to the bank and the community is profound. His legacy of service and leadership will continue in his sons Steve and Mark Schowalter and grandson James Schowalter who lead the bank today. He is survived by his wife Bette of 75 years, three children, six grandchildren, and nine great grandchildren.

Johnson Financial Group

Bob Reinders with Johnson Financial Group celebrated 40 years of industry service.

Pictured (left to right): Johnson Financial Group Chief Risk Officer Todd Shaffer, Johnson Financial Group VP Compliance Officer Bob Reinders, and WBA President and CEO Rose Oswald Poels

Port Washington State Bank (PWSB) committed $32,000 to PWSB Soccer Park, the official home of North Shore United Soccer Club. The club helps more than 1,500 local players acquire new skills, learn about teamwork, and maintain physical well-being by offering leagues, recreational programs, and more. PWSB’s support funds the club's efforts to engage local youth in the sport of soccer.

Bank Five Nine proudly donated $15,000 as the naming sponsor of the Operation Finally Home Summer Concert Series in Menomonee Falls. Operation Finally Home provides mortgagefree homes, home modifications and transitional housing to wounded, ill and injured military veterans, first responders and their families in honor of their service and sacrifice to country and community.

Banking on Baby Boomers

Continued from pg. 1

“About 15 percent of the counties in Wisconsin are going to have greater than 30 percent of their population in that age group, and about 40 percent of the counties that will have more than a quarter of their population in that age group.”

Perry’s predictions continue a trend. The country is aging. The percentage of the American population aged 65 and older went from 12.4% in 2000, to 13% in 2010, and to 16.8% in 2020. But Wisconsin is aging faster. In 2020, 17.7% of the state’s population was 65 or older. In fact, from 2010 to 2020, according to U.S. Census Bureau figures, Wisconsin saw an increase of 41.7% in the share of its population aged from 6584 and a 7% jump in the Wisconsin population 85 and older between 2010 and 2020.

“You’re seeing a pretty dramatic shift (in Wisconsin), especially given that Wisconsin’s population hasn’t been growing as rapidly as the rest of the country.” The demographic shift is even greater among some of the state’s most rural counties. In some counties in the far northern part of the state, close to 30% of the population is between the ages of 65 and 84, with a growing proportion aged 85 and older. Aging baby boomers are just one part of the story. Younger residents departing for greater opportunities in urban areas and the continuing migration of people away from the rust belt and northeastern states to states in the south and west compound the issue. The trends present several challenges particular to financial institutions. “As those counties shrink and age, it makes it especially difficult for the financial institutions that are trying to serve those communities,” notes Perry. “Most bankers can tell you the average age of their customer base, because that's long been a standard way to measure their ability to meet the needs of their customer base, but they can't always tell you the number of actual customer households that fall into the 65 or older bucket.” When his firm examined account holders for some Wisconsin banks, it found cases in which anywhere from 30 to 50 percent of the account holders were in the 75 and older age group.

“And we all know what that means,” he adds. “We know how that story ends: this great

transfer of wealth that is going to be happening in the United States in the next 20 years.” And, due in large part to those demographic shifts, it often means that wealth is going to be leaving the state. That’s because the children of those aging account holders have either left the state or moved to larger, urban areas. For affected banks, the loss of customers is one thing, but the loss of that income stream will bring a second impact. As homes are sold and retirement savings spent, older customers transition from asset accumulation to asset spend down, causing a further erosion in the deposit base for financial institutions.

The bad news, from the perspective of Dennis Winters, chief economist and director of the Bureau of Workforce Information for the Wisconsin Department of Workforce Development, is that this demographic shift is neither new nor easily remedied. “We’ve known about this trend for quite a while,” he notes. “We knew when, why, and how it was going to happen.” The swollen Baby Boomer generation affected the country’s economic structure when it arrived, spurring housing starts and new school buildings and engorging the workforce, and it’s causing an equally disruptive effect as it ages out of the workforce.

The impact of a diminishing workforce was highlighted by the COVID pandemic. “That was a crystalizing event,” says Winters.

“Suddenly, we couldn’t find enough help. There just weren’t enough people (to take jobs) and there still aren’t. You see it in health care, you see it in education, restaurants, everywhere.” And it’s not just Wisconsin. The overall workforce across the nation is shrinking.

“You know, the main focus on labor, whether it’s in education, business, or

government, is trying to attract and retain workers,” notes Winters. But neither the situation nor the usual solutions are unique to Wisconsin. He points to neighboring states Michigan and Minnesota. “They're not going to let us attract all their people, right? So, they're going to try the same things.” The shrinking labor force is an example of a macroeconomic problem, he explains, while the typical solutions are microeconomic. “You can do all the things that you want to try to attract someone to your firm. You can raise wages, you can give more benefits, offer flexibility, child care and so on, all those kinds of things. And that'll get the person to your firm. Well, now I have to go out and find somebody, right? So, I do the same thing and attract them from somebody else's firm, and around and around it goes.”

Unfortunately, beyond hoping for a population explosion — and even that wouldn’t have much of an impact for a couple of decades — leaders of the state’s financial institutions are going to have to brainstorm microeconomic solutions. Perry says there are numerous ways banks can work to survive the changing demographics.

Foremost is relationship building, with the children and grandchildren of those account holders, and even with their spouses. Citing the fact that wives often outlive their husband, he notes that at many older, traditional banks, the people in charge are older men, who have mostly dealt with their male clients. Relationship building is critical now to help ensure that some of those assets remain in your communities.

Providing education and services to the generation about to inherit that wealth transfer is critical as well. “It really kind of pushes some financial institutions to be more aggressive in terms of financial education and wellness. A lot of folks have come to that rather passively, perhaps offering some advice or some articles or something like that on their website, but it’s really going to involve them making more of a human connection.” He cited an example of a client bank in Michigan that had a long volunteer

relationship with the local Habitat for Humanity, organization, helping construct housing. Bank leadership realized they could perform another vital role — providing financial education and coaching to the housing recipients. “It takes finding new ways to leverage your community connections, to make yourself that trusted resource for information,” says Perry. “It's requiring banks to get out from behind the desk and to do more to engage the folks that they hope to reach most directly.”

Community banks, says Perry, need to do a better job recruiting young customers, who are currently opting for national banks and financial technology firms (fintechs) such as Chime. The fintechs, he explains, examined pain points customers had with traditional banking and developed innovative ways to answer customer needs. “I think right now, community banks only have about a six percent share of those new accounts … we have to do better on that front.”

Education is critical here as well, and Perry adds that banks may need to be more imaginative in how they deliver that material. In-person seminars and lunch and learns may not cut it. “If you're not out on social media, or if you're not delivering it in bite-sized segments,” he notes, “you're not going to be giving these younger adults the information they need in the way that they need it.”

In addition to developing strategies to attract and retain younger customers, banks may need to look to other markets to replace those assets. How are banks going to replace those customers, Perry asks? “That really requires a long-game strategy of making sure first of all that they have the digital tools they need and the functionality to attract younger customers over time, but it also invites them to expand their business models.” That may mean working to expand their commercial base or even stretching beyond their geographic boundaries by developing digital tools that can be accessed and utilized from anywhere.

Remote banking leads to another strategy that may help banks manage the more direct challenge of an aging workforce, that of replacing retiring workers. Banks are going to have to wrestle with the concept of remote work, Perry states, especially given some of the specialized skill sets that are needed to deal with the digital transformation underway within the industry. He cited a Pacific Northwest bank that employs a third of its staff remotely. They did what they had to do to recruit the talent needed to remain competitive, he says.

Of course, bank leadership may elect for a more drastic solution, Perry adds. “Because this all can seem a little daunting, especially with everything else that banks are having to deal with — cybersecurity issues, the rate environment, all of that — the industry overall is anticipating that some institutions are going to say, ‘All right, maybe it's time to look for a merger opportunity, maybe it's time to sell.’ You've got some bank boards that have been doing this for a very long time and have gone through the Great Recession and they went through COVID and all the rest and they're thinking, ‘Do I have the strength to continue growing our institution and doing everything that it's going to take to actually do that?’ There is a lot of anticipation in the industry that we're going to begin seeing a significant wave of consolidation over the next decade.”

A drastic solution, perhaps, but, as Winters with the Department of Workforce Development maintains, this really isn’t a problem that will be solved with microeconomic solutions.

“That's the thrust of my argument: micro solutions won't work on the macro problem,” he concludes. But be first or be best with those micro solutions, and you may buy yourself valuable time. “You’ll have some advantages, right?” He notes, “And the clever ones will stay out in front as long as they can.”

McDowell Woods is a freelance writer and an instructor of journalism and media studies at the University of Wisconsin–Milwaukee.

In Review YEAR 2023–2024

Our mission is to empower financial decisions through education, scholarships, grants, and research.

6 Scholarships

4 Grants

Supporting the work of non-profit orgs providing financial education

• 6:8, Inc – The Circles Sauk Prairie program was awarded $2,500.

• Asset Builders – The statewide high school Finance and Investment Challenge Bowl competition was awarded $5,000.

• Eastbrook Academy – The Empowering Educators for Financial Education Excellence project at Eastbrook Academy in Milwaukee was awarded $2,500.

• EconomicsWisconsin – The statewide middle and high school Stock Market Game was awarded $5,000.

2,200+ Books

Building knowledge and skills

Encouraging financial planning for higher ed and future careers

Agricultural Banking Scholarship

Two scholarships of $1,500 each were awarded to Wisconsin students pursuing careers in agriultural banking.

Spring Scholarship

Four scholarships of $2,000 each were awarded to Wisconsin students who demonstrate excellent academic achievement, career preparation, and financial literacy.

92 Reports

Providing free access to data

Banonomics

Quarterly banking reports on seven Midwest states, compiled by UFS Tech, were published on banconomics.com.

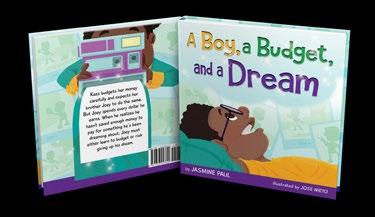

Reading Raises Interest Kits

In conjunction with Teach Children to Save Day in April, 78 banks utilized the kits for lessons in classrooms around the state. This year's kits featured the book "A Boy, a Budget, and a Dream" by Jasmine Paul, and over 2,200 books were donated to students, classrooms, and libraries.

Excellence in Financial Education Awards

Our dedicated volunteers engage with audiences of all ages in locations spanning the state. This year's awards celebrated the efforts of 400+ bankers, who made a total of approx. 900 financial education presentations reaching more than 30,000 community members.

400+ Volunteers

Empowering community members

Apply Now for the WBF Agricultural Banking Scholarship

The Wisconsin Bankers Foundation (WBF) — the non-profit arm of the Wisconsin Bankers Association — is accepting applications for the 2024 Agricultural Banking Scholarship. Two selected students will receive a scholarship of $1,500 each. Applicants must be currently enrolled at a Wisconsin public or private, non-profit college, university, or technical college and be pursuing a career in agricultural banking.

The selection criteria include academic achievement, having a career goal related to ag banking/finance, relevant experience in agriculture, extracurricular activities, and community involvement.

The scholarship is part of WBF's mission to promote financial literacy and aims to support the talent pipeline into the banking industry, particularly in rural Wisconsin communities. Bankers are encouraged to share the opportunity with interns, local students, and educators.

Visit wisbankfoundation.org/scholarships to learn more and apply.

ScholarshipAgricultural Banking

$1,500 . .

wisbankfoundation.org/scholarships

Deadline: November 15, 2024

Fueling Turnaround, Acquisition, and Expansion Solutions

We help companies overcome financial obstacles through innovative Asset-Based Lending solutions, focusing on small- and mid-market companies in transition with credit requirements from $2,000,000 to $18,000,000.

BankWork$ Builds Meaningful Careers in Banking

Congratulations, Graduates

BankWork$ is a free, eight-week training program to prepare participants — primarily individuals from under-resourced communities — for retail banking careers. The nationwide program was brought to Wisconsin in 2019 through a partnership between the Wisconsin Bankers Association (WBA) and Employ Milwaukee. So far, BankWork$ has provided nearly 140 individuals in the Milwaukee area with the opportunity to begin a career in banking.

In August, a class of nine students including Cortney Corprue , Cynthia Cohn , Augustin Khey , Mariah Lee-Salisott , Glenn Morgan , Diarelis Rodriguez , Valerie Santiago , Victoria Smith , and Erika Winters graduated from the program. WBA’s Rose Oswald Poels attended the ceremony and congratulated the graduates on their achievement. Oswald Poels also presented a sponsorship check from WBA.

Client-driven solutions for community banks.

We are seasoned community bankers, helping banks more efficiently manage risk and internal work processes for successful long-term strategic growth. We tailor our solutions to your unique business needs with a hands-on approach so you can focus more internal resources on revenue generation and enhancing shareholder value in an increasingly complex and competitive industry.

Credit Administration + Operational Support

• Credit analyst + Underwriting

• Commercial loan typing + Processing

• Loan Reviews

• CECL guidance

• Commercial loan annual reviews

• Risk rating + Policy guidance Compliance

• Compliance officer support

• Risk assessments + Audits

• BSA/AML reviews

• CRA guidance

• Staff + Board training

• Program policy + Procedures implementation/reviews

Kelly W. George

CEO

(906) 286-1445

kgeorge@maccreditcomp.com

Tammy McDowell President + COO

(906) 286-0808

tmcdowell@maccreditcomp.com

Scott Alexander

SVP + Director of Compliance

(920) 750-4020

salexander@maccreditcomp.com Experience,

Over the course of the eight-week program, students learned the hard and soft skills necessary for entry-level retail and operations positions. Upon graduation, each graduate has the opportunity to take part in on-the-spot interviews with BankWork$ employer partners.

With the success of Bankwork$ in Milwaukee, the program recently expanded to the Waukesha area. Their inaugural class began in August and the cohort of three graduated in early October.

BankWork$® is a publicprivate partnership that primarily trains adults from underserved neighborhoods for careers in retail banking. To learn more about the program, or how your bank can get involved, please visit employmilwaukee.org/ BankWorks.htm.

Pictured (left to right) in front row: WBA President and CEO Rose Oswald Poels, Augustin Khey, Erika Winters, Valerie Santiago, Victoria Smith, and Adriene Wright (instructor). Back row: Diarelis Rodriguez, Mariah Lee Salisott, Glenn Morgan, Cortney Corprue, and Cynthia Cohn

Diversify

Expand your loan portfolio profitability

BHG Financial loans provide banks with rates up to 8.5%, premier credit quality, diversification benefits, lower expenses, and more. With average borrower incomes of $275K and 748 FICOs, these loans will look great on your books. Plus, no origination cost to your bank!

Talk to us today about adding strong-performing assets to your portfolio.

Making a Case for Third-Party Loan Origination

By Jeff Schmid, CRCM – Director ShareFI Services/FIPCO

Not long after FIPCO created a business model for shared compliance and risk management in 2019, the demand for shared loan processing and origination spiked. It only made sense as in the years that followed, we saw the lowest mortgage loan rates in nearly a decade. Unfortunately, our ShareFI services were not equipped to offer this assistance back then, even though our ShareFI team had more than twenty years of experience managing loan processing and origination departments in both large and small institutions. Fast forward to 2025, and I think we will see the next cycle of low rates with high refinances, especially as a recession is possibly on the horizon. Think back to 2020 when loan processing departments across the country were swamped with loan applications. It was very dynamic too because loan processors were mostly working remotely and the concept of PPP loans created quite a stir within our commercial departments. For the first time, we had to prioritize customers in both loan products. I am not sure if we have all recovered, but more importantly, I am not sure banks are ready for the next low-rate cycle. In this article, we explore the case of outsourcing third-party origination (TPO) to help you prepare. The case for compliance: while most Loan Origination Software (LOS) vendors tout their systems as the most compliant with federal regulations,

we all know it really comes down to knowledgeable staff making the right decisions. When you have an inexperienced staff who process less than five mortgages a month, will they be able to keep up loan demand next year while at the same time, keep your bank from regulatory scrutiny? TPO services can keep you compliant and so can ShareFI.

The case for staffing: look around and ask yourself, “do we have the same level of staffing as we did in 2020, even though loan demand has declined sharply?” If this is true in your bank, I offer you the concept of TPO services and saving your capital. Afterall, the next cycle will not last long and then you are back to overstaffed departments again. Or conversely, did you find a void in loan processing and now wondering where you are going to find talent to help you through the next cycle?