THE VINEYARD ISSUE

Growers Report Prices, Changing Consumer Preferences as Top Concerns

Plus:

Latest in Automation, New Products from Unified Checklist: Start Preparing for Bottling Now Bankers Discuss Lending Landscape

STELLA COLLECTION

THE

STARS OF AN INVENTIVE AND SUSTAINABLE DESIGN

Agile and in tune with the times, Stella brings a light rotation into the Saverglass collections ! This range bears witness to new uses and innovative processes that enable us to explore disruptive designs while boasting optimized weights from 499 to 528 grams. The bottles in the Stella collection thus experiment with new creative territories, revealing revisited silhouettes that are incredibly durable and still formidably distinctive.

Saverglass, Inc. | www.saverglass.com 22950 Cordelia Road, Fairfield (CA) 94534

West Coast: (707) 259-2930 | East Coast: (859) 308-7130 Pacific Northwest: (707) 259-2930 | Mid West (KY): (859) 308-7130

Innovation and Resilience

At the risk of stating the obvious, it is a challenging time for grape growers. We know that California crushed the fewest number of grapes in 20 years, that wineries are not renewing contracts.

Our annual vineyard survey, detailed in this issue, indicated grape growers across the U.S. had to sell nearly half of their 2024 crop for prices that were lower than the average prices paid the prior year. While the impact varied regionally, the message was clear: the industry is going through a period of transition. We also delve into the complexities of obtaining and maintaining vineyard financing in this environment, echoing the sentiment of one grower who wisely notes that "cooperation, understanding and flexibility are going to win the day."

Amidst these challenges, we also found inspiring examples of proactive adaptation. A winery group from the Paso Robles area, The CAB Collective, is challenging its members to take one block from their vineyards and grow it regeneratively. By encouraging members to implement regenerative practices on a single vineyard block, they are fostering a culture of experimentation and learning, allowing growers to assess the environmental and financial impacts of sustainable methods before broader adoption.

Finally, our experience at the Unified Wine and Grape Symposium in January offered a valuable pulse check on the industry's overall health. In addition to state-of-the-industry-focused sessions, checking in with the suppliers at the show is always informative. This year the feedback from suppliers was mixed yet, we’re still seeing impressive innovations in vineyard supplies.

These include robotic drone sprayers that fly over the vineyard autonomously; a yeast cell counting system that gives you the status of your fermentation; and battery-operated pruning shears for the vineyard that last all day with new safety features. This issue includes first looks at these and several other innovations from Unified.

We also look at innovation on the bottling line. Bottling day anxiety is real, but a bit of preparation will go a long way. Little details make a difference and there are new products for measuring dissolved oxygen and CO2 to consider.

This May issue is a testament to the dynamic nature of the wine industry. It highlights both the challenges we face, and the ingenuity being applied to navigate them.

- Cyril Penn, editor

Editor Cyril Penn

Managing Editor Erin Kirschenmann

Assistant Editor Katherine Martine

PWV Editor Don Neel

Eastern Editor Linda Jones McKee

Copy Editor Paula Whiteside

Contributors Bryan Avila, Marc Fuchs, Victoria J. Hoyle, Kerana Todorov

Design & Production Sharon Harvey

Editor, Wine Analytics Report Andrew Adams

Staff Writer Sarah Brown

Events Director Danielle Robb

Web Developers Burke Pedersen, Peter Scarborough

Marketing Specialist Katie Hannan

President & Publisher Eric Jorgensen

Associate Publisher & Vice President of Sales Tamara Leon

Chief Commercial Officer Dave Bellon

ADVERTISING

Account Executives Laura Lemos, Ashley Powell, Bonnie Magid

Account Support Representative Aidan O’Mara

ADMINISTRATION

Vice President – Data Management Lynne Skinner

Project Manager, Circulation Liesl Stevenson

Financial Controller Katie Kohfeld

Data Group Program Manager Rachel Cunningham

Data Group Account Manager Wesley Elliott

Research Assistant Sara Jennings

Public Relations Mary Jorgensen

Office Manager/Customer Support Maggie Cline

Chairman Hugh Tietjen

Publishing Consultant Ken Koppel

For editorial or advertising inquiries, call 707-940-3920 or email info@winebusiness.com

Copyright 2025 Wine Communications Group, Inc. Short passages can be quoted without permission but only if the information is attributed to WineBusiness Monthly

WineBusiness Monthly is distributed through an audited circulation. Those interested in subscribing for $39/year, or $58 for 2 years, call 800-895-9463 or subscribe online at subs.winebusiness.com. You may also fill out the card in this magazine and send it in.

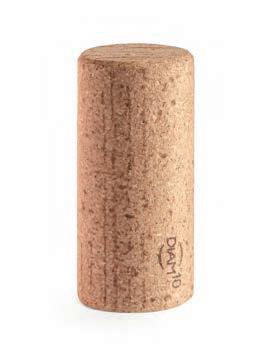

Diam, the new tradition.

For 20 years, our unique and unparalleled technology has revolutionized the consistent bottle aging of both still and sparkling wine. We are the first and remain the only authentic guardian of aromas, and we are proud to work together with winemakers to build this new standard every day.

Find out how at: www.diam-cork.com

® Things are changing, and fast. The old ways of doing things aren’t always the best ways anymore. Everyone knows barrel alternatives can save a winemaker big money with considerably less impact on the environment. StaVin barrel alternatives can actually help one to build a better wine, too. Our Barrel Fingerprinting Program utilizes nuanced combinations of oak concentrations, toast levels, micro-oxygenation and blending procedures. Finally offering unheard of mastery over wine.

Mario Mazza

vice president, general manager, Mazza Wines . “Bottling Best Practices: Better To Be Prepared than Idling on the Line,” page 14 “A quality system isn’t perfect; that’s your aspiration. But catching defects that do occur and finding and reducing causes, that is a quality system working.”

Victoria J. Hoyle and Marc Fuchs

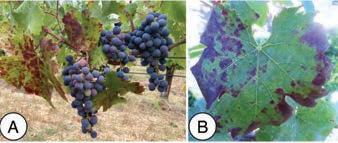

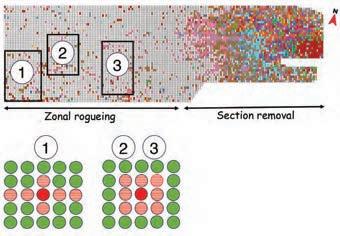

researchers, Cornell University “Red Blotch: A Disease that Defies Comparison,” page 44 “At this time, block removal and zonal rogueing are the most appropriate red blotch management responses to limit GRBV spread and maintain fruit quality when disease incidence is low to moderate.”

Caine Thompson

managing director, Robert Hall Winery, head of sustainability, O’Neill Vintners & Distillers “The One Block Challenge for the Regenerative Farming Movement,” page 38 “Growers fear that the transition could be a disaster. We were able to show in both data and wine quality that making the transition to regenerative was a break-even proposition. Most importantly, these vines are more resilient and, given more time, will likely outperform their conventionally farmed counterparts.”

Karissa Kruse

president, Sonoma Winegrowers “Vineyard Survey Details Pain of 2024 Crush,” page 32 “Despite the headlines, in Sonoma County, we remain optimistic as 95% of our vineyards are still family-owned with many multi-generational, that possess decades of experience in successfully managing the ups and downs in farming.”

Tom Hedges

founder/owner, Hedges Family Estate “Could L ightweighting by Channel be More Effective than Making a Blanket Change?,” page 52 “I believe the soon-to-be required nutrition info and ingredients labeling for U.S. wines will produce much more demand for organic wines and a move to lighter bottles; we do it now.”

Ben Maddox

western food agriculture and wine executive, Bank of America “Vineyard Owners Face High Interest Rates, Lack of Grape Contracts,” page 66 “When industries go through a downturn, like wine is currently experiencing, it’s not uncommon for lenders to tighten covenants and terms until improving trends can readily be identified.”

Top Stories from WineBusiness .com – In Case You Missed It

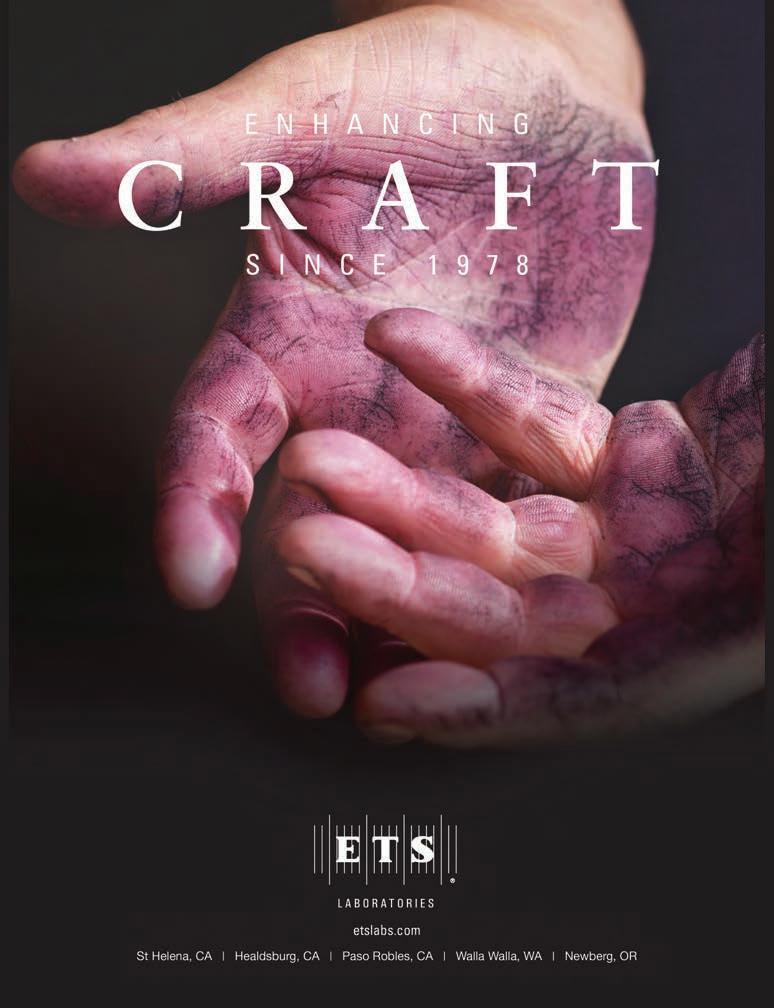

ETS Laboratories and Laboratoires Dubernet Form Strategic Partnership Agreement

France-based Laboratoires Dubernet and ETS Laboratories have announced a strategic partnership agreement in an effort to strengthen both their operational and scientific capabilities. In this new partnership, both laboratories will combine their expertise to accelerate innovation in technological and analytical processes while also focusing on the needs of global and local clients. Their shared goals also include increased support for agro-environmental practices and climate change adaptation.

Ongoing Litigation Between Napa Winery and Neighbors Brings Up Regulatory Questions

The issue of whether wine trade tours and tastings should be regulated has been raised as part of an ongoing lawsuit between a group of neighbors in litigation against Oakville-based Dalla Valle Vineyards. The topic was brought up by Kevin Block, the attorney representing the neighbors’ group, at a Napa County Board of Supervisors meeting in March during the meeting’s public comment period. A lawsuit was initially filed by Dalla Valle in 2022that was focused on a dispute over an easement for a bridge on a private road leading to the winery. A trial was set to begin on April 7 in Napa County Superior Court.

Provi Settles Southern Glazer’s Wine & Spirits Lawsuit

Online alcohol marketplace Provi and Southern Glazer’s Wine & Spirits have settled an antitrust lawsuit. Provi filed a lawsuit against Southern Glazer’s in 2022 in the U.S. District Court for the Northern District of Illinois Eastern Division, alleging that Southern, and Republic National Distributing Co. (RNDC) had unlawfully boycotted its platform. Meanwhile, Provi’s case against RNDC is moving to the discovery phrase and is proceeding. The financial settlement in the Southern Glazer’s case to Provi has not yet been determined.

West Pike Acquires Bin to Bottle

In early April, West Pike, an operator-led company that’s investing in building infrastructure for the wine business, acquired Napa Valley-based Bin to Bottle. With this acquisition, West Pike assumes all existing Bin to Bottle customer contracts. Existing Bin to Bottle staff have also been retained. Bin to Bottle provides custom winemaking, bottling and alternative beverage production for products like distilled spirits, hard seltzers, spritzers, canned wine cocktails, cider and beer. Following the acquisition, West Pike plans to expand its footprint with additional acquisitions and partnerships

Constellation Divests Several Wine Brands to The Wine Group, Retains Higher-Growth, Higher Margin Wine Brands

Constellation Brands, Inc. announced on April 9 that it signed an agreement with The Wine Group to divest its primarily mainstream wine brands, and related vineyards and facilities, from its wine portfolio to The Wine Group. This includes Cook’s, J. Rogét, Meiomi, Robert Mondavi Private Selection, SIMI, and Woodbridge. Constellation’s retained wine portfolio will consist of wines from top regions predominantly priced at $15 and above. WBM

Arthur C. Clarke wrote: “Any sufficiently advanced technology is indistinguishable from magic.” Introducing StaVin Pure, Nature and Express Oak, untoasted and toasted liquid tannins made from three-year seasoned oak. An incredibly simple way to impart refined structure, mid-palate mouthfeel, and an elegantly extended finish to any wine. Achieve the benefits of fermenting on oak without the labor, wine loss, and difficulties. And prepare to reap an astonishing result. Magic? No. Alchemy? Yes.

PRECISION CLEANING

THE FOUNDATION OF FINE WINE

FERMETATION TANKS & VATS

Cloud-Sellers ® 360

Fluid-driven Tank Cleaner

For tanks up to 100 ft. (30 m) in diameter. This fluid-driven high-impact cleaning machine removes even the most stubborn residues efficiently and effectively so tanks can be returned to service quickly.

SURFACE CLEANING

CU150A High-impact, Low-pressure GunJet ® Spray Guns

This spray gun offers versatile high-impact, low-pressure performance. The GunJet CU150A features an adjustable spray pattern – from wide angle to solid stream.

BOTTLE DRYING

WindJet ® Solutions

Produce clean, heated air using energy-efficient, low-maintenance, low-noise regenerative blowers instead of compressed air.

TOTE, BARREL & PORTABLE STORAGE TANKS

In an industry as dynamic as winemaking, purity and time are vital.

The Cloud-Sellers 360 tank cleaner is specially engineered for winemaking to ensure fast, thorough cleaning and quick maintenance turnaround. Our dedicated in-house experts specialize in diagnostics and repairs so you can focus on crafting exceptional wines.

• Service Center Maintenance: Ship your tank cleaner to our U.S. service centers for fast, cost-effective repair

• On-Site Support: Locally based technicians provide timely, on-site diagnostics and repairs

• Training: Equip your team with skills to maintain equipment in-house

TankJet ® 50 Fluid-driven Tank Cleaner

This powerful cleaner can be used with high-impact solid stream or narrow angle diffused solid stream nozzle tips. Since this nozzle is fluid driven it doesn’t require an external power source and can be used with a variety of pumps, including pressure washers.

• Wear Components/Parts: Quick delivery on domestically produced components keep your equipment running smoothly

• Preventative maintenance: Basic repair parts & service

LEARN MORE

Winemakers Review Bottling Best Practices

Better to Be Prepared than Idling on the Line

Sarah Brown

Meet the Author: Sarah Brown, staff writer, earned her B.S. in viticulture and enology from the University of California, Davis before working in winemaking at various wineries throughout Napa and Sonoma counties. Brown is a regular contributor to the Wine Analytics Report, WineBusiness Monthly and winebusiness.com, and has been writing creatively and professionally her entire life. A resident of Sonoma, Brown is also a partner in a local coffee shop and enjoys gardening, cooking and hosting dinner parties for friends when she is not writing about wine.

then what is bottling?

“It’s much more technical and disciplined—it has to be consistent and repeatable,” said vice president and general manager of Mazza Wines, Mario Mazza. His family’s winery, located in North East, Penn., produces 65,000 cases of wine each year under multiple brands, as well as beer and spirits under New York-based Five & 20 Spirits and Brewing— the first hybrid wine, beer and spirits producer in the state of New York.

While crafting the product is certainly an art, Mazza, who has a background in chemical engineering, believes that bottling, and doing it properly, demands a much more scientific approach.

Drawn to the manufacturing perspective, Mazza and his team developed a “robust” system of checks and balances to reduce mishaps, catch problems and create systems to prevent future issues. Mazza said creating bottling best practices is important, not only for reducing downtime but also for capturing the wine as it’s meant to be.

“That’s what lets the wine shine,” he explained. Of course, capturing the quality of the wine was deemed of the utmost importance in preparation for and running a bottling day, but winemakers are now also chasing efficiency. Bottling days are long enough, oftentimes 10 or 12 hours from start to finish—so any technology or strategy to reduce downtime and increase throughput is essential.

A successful bottling run, according to founder and owner of Peregrine Mobile Bottling Thomas Jordan, begins with an in-depth conversation with his clients. Jordan hired a project manager whose main responsibility is working with winery staff in the lead-up to bottling to understand every detail of the project. The project manager asks the right questions and collects the information that the customer wants, and the information needed for when

they show up for bottling. As such, rather than call it a bottling company, Jordan refers to Peregrine as a project management company that provides bottling services.

While conversations about fill heights, shade structures, hot water supply and everything in between may seem tedious in the moment, Jordan said they are important for starting the bottling day off right.

“Little details make an impact, and you’d be surprised how important it is to have these conversations up front,” he warned. “It takes the anxiety and the unknown out of the process.”

Mara Fitzgerald, associate winemaker at O’Shaughnessy Estate Winery in Angwin, Calif., shared that in her opinion, bottling runs are “second in squirelliness” only to harvest season, but are a bit more manageable because there is time to plan and strategize.

Bottling day anxiety can also stem from outdated machinery, which is why Groth Vineyards in Oakville, Calif. decided to invest in a new Bertolaso bottling line. The previous line, which assistant winemaker Collin Dillingham described as being “frankensteined” together, led to oxygen intake in the wines and other complications that warranted stopping the line for adjustments.

When running Bordeaux bottles, which Groth uses for their Sauvignon Blanc, as well as their red wines, the new machine can bottle approximately 80 bottles a minute, outpacing the old machine by nearly 50%. That, paired with less down time for adjustments, means the time spent bottling can be whittled down, saving time and money spent on labor. “Those extra two weeks make all the difference,” Dillingham said.

However, for many wineries, financial barriers are holding them back from improving on quality and efficiency.

“That’s really the Achilles heel of the wine industry,” Dillingham noted. “There’s some really incredible technology, and some stuff is right out of the ‘70s.” This came up in a discussion of CO2 measurement and the notoriously tricky means of measuring it: the Carbodoseur. The glass cylinder and its associated accessories can measure CO2 consistently if the same individual is shaking it each time with the same exertion and with almost robotic replication. It works but often requires repetitive testing—not exactly something that anyone wants in the middle of prepping a tank for bottling.

The next step for measuring CO 2 is an electronic meter, like the Anton Parr Cbox QC, which provides accurate, real-time measurements for the price of $10,000.

Prep Work Makes the Dream Work

To fine or not to fine is ultimately a winemaking question, but for those choosing to fine, there are a few new products in rotation that take the guesswork out of it.

After complaints of what looked like glass shards at the bottom of one of their red wines, the enologist at Columbia Valley’s Mercer Estates, Samuel Elliot, sought a fining product which could eliminate tartrate instability in both their red and white wines. Mercer, which produces 60,000 cases annually, bottles their wine in-house on a Eurostar 16-filler head bottling line; they also bottle wine for a variety of custom clients.

For reds, however, it’s a bit trickier to ensure cold stability.

“We chill in barrel, before it goes into tank, to help drop out [tartrates], and then the tank is going to be very cold to help drop out anymore tartrates,” Elliot explained.

Elliot found his solution in Zenith Uno, a solution of potassium polyaspartate and sulfur dioxide, which can be used as a substitute for cream of tartar when preemptively reducing potassium tartrates before cold stabilization. It’s an effective, quick alternative, Elliot said, which is preferred when they are on a tight bottling schedule and want consistent results. Zenith Uno can be added before or after filtration, according to Elliot.

“In the past couple years, we’ve retested and resampled wines that we’ve bottled (with Zenith), and they remained cold-stable,” Elliot observed. In addition to longevity, he also loves how the product takes out any guesswork.

“The rate doesn’t change—it’s very consistent.”

Cold stabilization isn’t very common for red wines; the number of consumers actively chilling their wines, before opening the bottle, isn’t nearly

as high as for white wines. However, there is still some concern over unsightly deposits and sludge, said O’Shaughnessy’s Fitzgerald.

“It’s more like sediment,” she described. “It’s not going to hurt anybody, but it’s definitely a visual defect.” A combination of polysaccharides, pectins and other elements in the wine matrix can “crash out of solution” when they are oxidated.

To prevent this sediment formation, Fitzgerald closely monitors the dissolved oxygen and turbidity of the red wines, both while in barrel and after transferring to tank. In conversation with a representative from ETS Labs, Fitzgerald learned that by keeping dissolved oxygen (DO) under 1ppm and NTU under 30 in bottle, the likelihood of “red wine sludge” is significantly reduced. O’Shaughnessy filters their white wines but not their reds.

“Thanks to time in barrel and polyphenolic content, we don’t usually see high turbidity in our red wines,” Fitzgerald said.

As for haze, bentonite is still the top solution for binding to proteins. The team at Mercer adds 2 pounds of Bentonite per 1,000 gallons of white juice, which helps clarify the juice before the yeast get to work. However, when that isn’t enough, Elliot turns to Blancobent, a purified powdered bentonite that provides protein-absorbing power without stripping aromas. “It’s a very similar product but not as heavy,” Elliot qualified. “It settles a lot faster, and you can filter right off it if you’re in a pinch.”

What’s Cooler than Cool? Cold Stable

At Groth Vineyards, the winemaking team bottles in four separate runs each year; thanks to their recently purchased Bertolaso bottling line, they have a bit more flexibility in scheduling their bottling runs. Whites are bottled in the

late spring, and then later in the summer, just before harvest, they bottle their previous vintage reds.

Assistant winemaker Dillingham works backward from the anticipated bottling date and will typically aim to have blended wine in tank about a month before bottling.

Several producers admitted they prefer to wait until the last possible opportunity for this final transfer; especially in the case of reds housed previously in oak vessels, any time spent in stainless steel prior to bottling can leave the wine smelling and tasting lackluster, or as one assistant winemaker put it, “Tanky.”

After transferring wine to tank and confirming the correct blend with analysis and a winemaker’s approval, some wineries choose to send their samples to ETS for a second set of analysis; others included a Scorpion in the analysis to “cross the t’s and dot the I’s” prior to bottling.

For Groth’s larger SKUs, such as their Sauvignon Blanc, which takes three weeks to bottle completely, the tank-to-tank homogeneity is confirmed by comparing individual tank analysis, specifically alcohol. Wine is then sent through cross flow filtration and cold-stabilized, using a new technology that saves time and energy.

“We’ve been using electrodialysis (for cold stability) for six or seven years with success,” Dillingham said. Traditionally, wines are cold stabilized by dropping the tank temperature to below freezing for multiple days to force potassium bitartrate crystals to fall out of solution, reducing the chance that these crystals will appear in a consumer’s glass. By comparison to traditional cold stabilization, electrodialysis can achieve the same level of cold stability in less time, which is better for the wine. “We save a significant amount of energy on electricity and cooler, and we have less time in tank so there is less opportunity for oxygen uptake in the wine.”

Not only has electrodialysis proved beneficial in reducing energy costs, but with the volumes Groth produces, Dillingham feels it provides a “guarantee of stability,” which wasn’t always true for traditional methods. “Spending weeks

in tank freezing down the wine is not always reliable and not always on the timeline you want to work with.”

Groth rents a mobile unit for electrodialysis, which can be used in tandem with the cross flow-filtering, eliminating that time sink. The only challenge with electrodialysis, Dillingham cautions, is the careful coordination between filtration and bottling. “Ideally, once it’s filtered, it’s in the bottle within 48 hours.”

Jordan, of Peregrine Mobile Bottling, is always looking for expansion projects and new services he can offer his winery clients; quite a few wineries have inquired about electrodialysis for cold stabilization. He shared that while they don’t have it, they’d like to learn more about it.

Welfare of the Gases

Dissolved Oxygen, also commonly referred to as DO, was a key component of every conversation for this article: From the freshness and ageability of the wine, to stability and reduction of sediment fallout, DO is a huge player in bottling.

“DO is the biggest measure on quality control and the biggest enemy,” said Dillingham. “We want to keep it as fresh and lively as possible.”

Prior to starting a bottling run, Dillingham measures DO on every transfer and again when they are ready to start. The new bottling line has been great at keeping DO down; with their previous line, there was plenty of opportunity for DO pickup, which meant lots of downtime while trying to fix the problem.

Most wineries aim to keep DO at or under 0.5ppm prior to sending wine through the line; this assumes that a maximum of 0.5ppm will be picked up through the bottling line.

Once DO is greater than 1ppm, there will be a higher likelihood of the aforementioned “red wine sludge” and other unwanted oxidative side effects.

However, some wineries prefer to follow the mantra of “less is more” when it comes to DO, aiming to get the DO as low as possible. At Groth, when bottling their white wines, Dillingham will stop the line if the in-bottle DO is higher than 0.6ppm. This was difficult to achieve on their previous line but not with the Bertolaso—they can consistently come in under threshold.

In addition to testing DO with a meter, Fitzgerald also remarked on the importance of tasting the wine once it’s gone through the bottling line, to make sure it doesn’t taste off, another indicator of unwanted oxidation.

O’Shaughnessy purchased a DO meter a few years ago, and Fitzgerald said it has given her more confidence when the team assembles blends and bottles. “We were not looking at DO prior to a couple years ago,” she recalled. “The

Introducing the brand-new Scharfenberger vertical press line, Europress EV. Integrating current technologies with ancient philosophical principles, the new EV is designed to satisfy the highest standards for juice extraction. Intelligent programs conduct the pressing operations and are able to produce exceptional wines.

EAST 741 Old Brandy Road, Culpeper, VA 22701, Phone: (540) 825-5700

WEST 497 Edison Court, Suite G, Fairfield, CA 94534, Phone: (707) 864-5800

NORTHWEST 10670 Main Street NE, Donald, OR 97020, Phone: (503) 776-9118

www.euromachinesusa.com

good news is in using the DO meter, our in-tank DOs have been about right.” Even so, Fitzgerald prefers the surety that a DO meter provides.

Among his winery clients, Peregrine’s Jordan has seen both ends of the spectrum; some wineries don’t even own a DO meter while others almost obsessively check it. For the former, he said, lacking such a basic piece of equipment could be a hindrance in making the best wine possible.

When bottling wine for clients, Jordan’s system uses dual preevacuation of the line to further reduce DO pickup in the bottle. The system actively sucks air out of the bottle before it is filled with nitrogen gas. This is then repeated on each bottle.

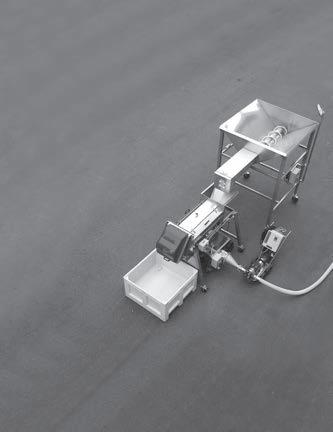

For clients more concerned with DO, as well as carbon dioxide, Jordan is now utilizing a gas management system from the German-founded KH Tech, of which Jordan is a U.S.-based sales representative. He hopes more wineries and bottling services adopt the technology, which allows oxygen, carbon dioxide and nitrogen gases to be easily and precisely controlled during the bottling process.

The gas management system uses a hydrophobic membrane to separate wine from the gases in solution, allowing the operator to fine-tune the concentration of each individual gas before the wine is put into bottle.

“You get a gas side and a products side,” Jordan explained. “You can exchange the CO2 and the O2 to dial your wine into the exact flavor profile you want.”

CO2 gas is typically added prior to bottling to give a “pop” of freshness to the wine and can have a significant impact on the organoleptic character of the wine when it’s young, as well as when it’s aged. The adjustment of CO2, unfortunately, is not an exact science and can often cost time, gas and precious aromatics, Jordan said. With the new technology, there is less agitation of the wine, and the aromatics are preserved.

“Everybody who has had a demonstration on this technology said they will not run their wines without it,” Jordan claimed. Many of his clients were “blown away” by how much better their wines tasted after going through the gas management system—all without the time and frustration of manually sparging wines with different gases. “It’s the ultimate adjustment before wine goes into the bottle,” Jordan said.

Jordan sold several of these gas management systems to some of the largest wineries in California, including Gallo, which bought the first system. While these larger facilities are not yet using the machines for bottling, they are used when tanker trucks offload wine at the winery to lower DO as the wine is transferred from tanker to tank.

“Every Little Detail Matters”

One shouldn’t judge a book by its cover, but in the case of wines, consumers often judge a wine by its label. Producers, on record for this article, seemed to be shifting toward a focus on packaging quality and consistency, which can save time on the botting line and make a very important first impression with a customer.

“Every minute detail counts,” Groth’s Dillingham observed. “It might seem, in the grand scheme of things, what does a capsule matter? But that’s going to be someone’s first impression of your product.”

Producers varied on their intake protocol for dry goods, like glass, labels, corks and capsule. Some simply verified that it matched the original order and previous bottling—vintage-to-vintage consistency was key—while others weighed individual elements in triplicate for an average weight.

While bottling a client project at Mercer Estate Winery, Elliot and bottling lead Jerry Lopez discovered at the start of a run that their client’s glass was highly inconsistent. “We had to figure it out on the fly,” Elliot said. As bottles went through the labeler, labels were wrinkling or not sticking properly, leading to further issues. Once they discovered that glass was the culprit, they were able to tweak the labeler to reduce further issues.

Wine Testing Systems

Reagents, Autoanalyzers, Fast Service, Great Quality

A Full Line of Enzymatic Reagent Kits: Glucose/Fructose, Malic Acid, Ammonia, NOPA, Acetic Acid, Free & Total SO2, and more! Wine Analyzers: Enolyzer: Semi-Automated, Portable Chemwell-T For Wine: 100 tests/hour Chemwell For Wine: 200 tests/hour, Auto Washing Spectrophotometer: Unitech V-120

ORDER ONLINE: www.unitechscientific.com

CONTACT US: Info@unitechscientific.com

PHONE: 562-924-5150

Bottling Season

WE TAKE CARE OF YOU!

Pumps, hoses, foil rollers, change parts, filler tube repairs, corker jaw resurfacing, barrel care and more

Winemakers Review Bottling Best Practices

Winemaking Treatments and Steps Before Bottling Day

4 months to 8 weeks Assemble final blend and homogenize in one tank

4 months to 8 weeks Full chemical analysis (Alcohol, pH, FSO2 , etc.)

8 weeks Alcohol adjustment, if needed/desired

8 weeks VA adjustment, if needed/desired

6-8 weeks Add any finishing tannins

6-8 weeks Final concentrate trials (R.S. adjustment) if using

6 weeks Protein stability assessment/trials

4-6 weeks Add bentonite for protein stability, let settle

4-6 weeks If doing traditional cold stability, run trials for KHTA addition Often N/AX X

4-6 weeks If planning on using CMC for cold stability, send out finished wine w/ additives for DITS test (do not use CMC on reds or rose wines)

4-6 weeks Read DITS results- if you can’t use CMC for white stability, do traditional chilling and seeding for tartrate stability. Plan enough time for your particular winery to achieve this.

2-4 weeks Double check cold stability

2-4 weeks Double check protein stability, especially after traditional cold stability treatment which can affect the isoelectric point of wine proteins Often N/AX X

2 weeks Rough and polish (or cross flow) filtration if no concentrate being used/added.

1-2 weeks Add concentrate, if using, filter w/in 48 hours

1 week Rough and polish (or cross flow) filtration

1 week Add CMC if using for tartrate stability, homogenize tank and immediately send out for ISTC50 test to confirm cold stability.

1 week Adjust wine temperature. <60 F can increase likelihood of clogged filter

1 week If CMC used for tartrate stability, read ISTC50 results to determine if CMC worked properly

48 hours out Add mannoprotein, gum arabic products, if using, at least 48 hours before bottling/going through 0.45 micron filter in bottling line

Bottling Day Adjust gasses (Dissolved Oxygen, CO2) if needed

Bottling Day Adjust wine temperature if needed <60 F can increase likelihood of clogged filter

Bottling Day Wine to filler bowl in bottling line

Bottling Day Check alcohol or TA of first bottles against mother tank to make sure no water remains in the filler bowl and bottling line.

Bottling Day

Once no more water is confirmed in line, do an early (within 30 minutes of full running) check of Dissolved Oxygen in the bottle against mother tank to ensure low oxygen pickup. Continue to do periodic Dissolved Oxygen and FSO2 tests during the run, and pull QC samples as required by your protocols.

Note: steps in darker purple cells are optional or are more style-driven and won’t be appropriate for every bottling project When in doubt, plan more time than you think you’ll need “Often N/A” = step may not be appropriate or common for this type of wine

Winemakers Review Bottling Best Practices

In the Napa Valley, Dillingham recalled how immediately following the COVID-19 pandemic and subsequent supply chain breakdown, there was greater inconsistency in a lot of packaging, and more was out of spec. Now, the supply chain issues seem to be resolved.

Production staff often conduct a visual inspection of labels upon receipt, ideally several weeks before bottling, to confirm that alcohol levels are correct, necessary legal verbiage is included and that all text, images and colors match proofs provided to the printer.

Dillingham also likes to double-check the adhesive for Groth’s labels; with so much of their production devoted to Sauvignon Blanc, he wants to make sure the labels have the right adhesive which will stick when the bottle is chilled.

Quality Checks, Traceability and Playing Detective

Even with all the preparation and careful planning, ultimately, there is still a chance that something can go wrong, which is why quality control and recall protocols must be put in place.

“A quality system isn’t perfect; that’s your aspiration,” Mazza said. “But catching defects that do occur and finding and reducing causes, that is a quality system working.”

Mazza, again drawing from his engineering background, utilizes the Pareto Lean approach, which helps identify and prioritize the most important causes of problems, and works to resolve issues with the team. In case any bottles need to be recalled, Mazza built out a flow diagram, with funnels from customer preference to critical incidents, with steps to work toward a resolution. Having a protocol and decision tree helps team members “avoid flying off the cuff” when trouble arises.

On the back end, Elliot and the production team have been using Vintrace as their winemaking software since 2018. The program, which can be used for generating work orders and creating mock blends, also catalogues each work order for each wine, providing an in-depth history of all wines produced since 2018.

The goal is to catch problems before they exit the winery, which is why, according to Dillingham, the team members at the end of the bottling line are the “last line of defense.”

“It may seem simple, but the staff working that station needs to be trained as well as, if not more so, (than other staff),” Dillingham explained, adding that these individuals must be able to catch inconsistencies with label spacing, nicks on the capsules and any other physical defects. “It’s a tough skill to learn.”

For wineries with in-house bottling lines, many also had a time stamp laser, which engraves the date, time and lot code onto the side of each bottle near the bottom. If there is ever a larger issue, such as faulty packaging or chemical instability, the time stamp can be the first clue in the case. Winemakers can then look at records to search for the likely culprit and hopefully rectify the problem or at least prevent the same issue from happening again.

While Groth has not had an instance where it was necessary to play detective, Dillingham said having a time stamp and means of tracing back the entire production lifecycle of a wine is a necessity for any bottling production. “Every winery should have traceability in case the worst comes to pass.” WBM

Innovation Hits the Tradeshow Floor

We found the coolest products at the 2025 Unified Wine & Grape Symposium

Richard

Carey

, which took place in Sacramento from Jan. 28-30, 2025, featured more than 650 national and international exhibitors with approximately 10,000 winemakers, grape growers and others in attendance from across the United States and Canada. Some of the most interesting and innovative equipment and products, including corks, labels and other items, featured at the symposium are reviewed in this article.

Signite Labels

ACTEGA

Collection by DIAM

DIAM

Diam has released a new stopper that is designed for the ultra-premium market (FIGURE 2 ). The new stopper features the Diam 30 for long-term aging of wines at its core, with an ultrathin slice of natural cork wrapped around it. Diam also attaches a small piece of cork onto the ends of the stopper with such precision that the cork looks as if it were a natural cork stopper. At the show, the booth had only a small handful of stoppers, and photos will not be available until the actual production rollout begins. Diam says that very limited numbers of these corks, at about $1 per stopper, will be available during this first year of production.

Battery Clippers

FELCO

The current method of most wine label production is continuous roll label application. In many respects, this method is not as sustainable as it could be, given that it generates more waste than just the label applied to the bottle: there is backing paper, as well as the front paper that has ink and label graphics for the wine.

A Rhode Island-based company has developed a process that reduces the waste of materials by 50%. The new process prints the label on the backing paper. No paper label is applied to the bottle as the ink and graphics are applied directly to the bottle from the backing paper. The specialized ink, when pressed onto the bottle, releases the ink from the plastic backing paper, transferring the ink onto the bottle.

The user has the option of making the wine bottle look as if the label is etched onto the bottle, shown in FIGURE 1 . The label also can be printed with a color stock to provide a more traditional wine label look.

FELCO 834V battery-operated pruning shears have now been released (FIGURE 3 ). The shears have several interesting features that will impress vineyard staff. It is a small lightweight device (980g) that has the battery attached directly to the shears. The battery is 3.0Ah and can work for half a day then charge completely during lunch; with two batteries that should last for a day’s work in the vineyard. The cutting diameter is 30mm. Like other FELCO products, the clippers come with a pair of conductive gloves to protect against cutting injuries to fingers. There is one caution: FELCO stipulates that anyone with a pacemaker should have their physician’s permission before using these shears due to the electrical conductivity system for injury prevention. There are several software adjustments that can be implemented with these shears, such as turning off the safety shield function that would otherwise eliminate protection against potential cutting injuries. One can also adjust the amount of blade opening to a smaller diameter than the fully open position which is the default open position. The shears have an LED light that can help locate a cutting surface in dimly lit areas. There is also an LCD screen that provides several updates about the shears throughout the day, including the number of cuts and the percentage charge remaining on the battery. The shears come with an assortment of tools for maintenance, including sharpening.

FIGURE 1

FIGURE 3

FIGURE 2

Sensory Consistency

A result of the combination of 3 proprietary innovations used in concert.

Consistency

Consistency

Earthquake Protection for Tanks

ONGUARD SEISMIC SYSTEMS

OnGuard Seismic Systems is a New Zealand-based company that has created a method to protect above-ground wine tanks during an earthquake up to a 7.8-magnitude. The engineers found an antisymmetric, ductile-elastic and ductile-plastic anchor force distribution that best matches the forces a wine tank may encounter during an earthquake. The company can retrofit existing tanks and work with current new designs to assure wineries that the tanks they put in place will withstand the risk potential for the winery’s physical region location.

The company has earthquake monitoring services that track all quakes that happen in regions where their retrofitted tanks are located. When an earthquake occurs at a threshold OnGuard determines to be cause for concern, they will dispatch an engineer to the location to assess the structural integrity of their systems to assure they are still in compliance with the original design threshold.

The system is composed of anchors around the base (FIGURE 4 ). The anchors are secured by a stainless-steel rim at the base of the tank. Then the space is filled with concrete between the base of the tank and the safety ring.

Yeast Cell Counter

OCULYZE

The Oculyze yeast cell counting system defines the fermentation cycle for wines and other beverages. The system is composed of two parts, the camera (FIGURE 5 ) and the software used to count the yeast cells (FIGURE 6 ). Depending on the analysis, the user either loads a sample chamber with a diluted yeast solution or one that is stained with alkaline methylene violet. Then the chamber is placed into the microscope slot for viewing. The microscope is connected to a computer or a mobile device through the web app.

The user then takes five pictures of the sample at random locations on the specialized slide chamber. The app will calculate yeast activity, and their algorithm determines the fermentation status, i.e., cells budding, percentage of cells alive, percentage of cells dead, cell size distribution and more. The microscope is capable of 400X magnification and can distinguish objects less than 10µm in diameter. The cell counts for accuracy range from 105 up to 107 cells/ml. Above that number, the user must dilute the solution to achieve the desired accuracy.

The system cannot directly count bacteria, such as lactobacillus; however, the manual mode can count those organisms. The reason for the staining procedure is to provide more accurate stages of cell growth, such as the exponential phase as opposed to a stationary phase of growth. Staining also provides data when cell viability falls below 90%. There is an option to allow the Oculyze

GRAPE PROCESSING SYSTEMS

device to be connected to a camera attached to a non-digital microscope. is especially valuable to those fermenting low nutrition fermentations or difficult fermentations, such as high sugar, low sugar and more. Winemakers can record their best and worst fermentations and store them for recall to strategize a better outcome for those fermentations in the future.

Upon purchasing the Oculyze microscope, the user can subscribe to 100, 200 or 500 tests annually. The company provides the ability to store fermentation data online for review of similar fermentations in the past with current fermentations.

Used Equipment Deals

WINETANKBROKER

With the obstacles of the current business climate, there has been an increased interest in used winemaking equipment. The Winetankbroker booth was quite busy with inquiries about used equipment for sale. If you are looking for just about anything a winery uses, you just might save a lot by purchasing a used piece of equipment rather than new. Some of the equipment for sale included: open-, closed-top and pressure tanks; crush pad equipment, such as destemmers, presses, sorting and elevators; cellar pumps and filtration; sanitation equipment; chillers; bottling equipment; lab equipment and many more items.

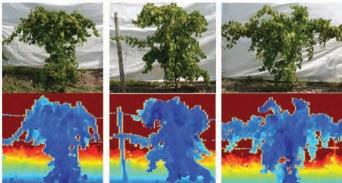

Integrated Spray Using LiDAR

SMART APPLY

As Smart Apply says in their literature, nothing sensed, nothing sprayed (FIGURE 7 ). Their claim is to reduce spray load by 70% in terms of chemical and water reduction. They also can reduce up to 87% of airborne drift and up to 93% less run-off. This is accomplished by using a LiDAR sensor on the front of a tractor. This device feeds its gathered data to the sprayer and times the application of the spray to the corresponding image of the foliage map it has just scanned. The system can retrofit many tractor types, which can lower the overall cost of upgrading vineyard equipment.

Winetasting Table

IDEUM

Ideum is a large-format computer monitor camouflaged as a tasting table for winetasting experiences (FIGURE 8 ). The table has been around for more than a decade but recently has gone through an uptick in popularity, especially at this year’s Unified. The tables come in sizes for up to four people to sit down and share their wine experiences with each other. High-resolution graphics are displayed on the tabletop for viewers to move their glasses around, which brings up different facts about the wines being presented. A

FIGURE 5

winery staff member can direct the discussion about the wines and bring greater depth to the conversation.

Drones and Robots

There have been many automation offerings for vineyard operations over the years. Automation has now been adopted by many growers, and at Unified this year there were three robotic device companies that stood out. Yamaha featured aerial drones, which was a very cool and frequently visited booth at the show, as well as Robotics Plus with their hybrid-powered tractor sprayers and, finally, Amos with their all-electric tractor sprayers.

YAMAHA AERIAL DRONE

When it comes to robotic sprayers, drone helicopters have been tasked with the job of everything, from vineyard mapping and disease detection to, of course, spraying. The Yamaha robotic sprayer (FIGURE 9 ) has a stand-out drone that measures 3.6m from tip to tail and just over a meter tall. The drone can carry both granular sprays (two tanks, 15kg each), as well as liquid sprays (two tanks, 15.9L each). They fly autonomously once the vineyard area is mapped and automatically look for objects, such as trees and power lines, that they avoid. Historically, the company has only run these helicopters on a fee-for-service basis but is now introducing the copters for lease or purchase. They fly low over the vineyard, minimizing drift. The copter flies at 25km/hr. with a spray width of 10m. When the battery is low the drone returns to base to be filled. It’s ready to return to service in about five minutes time to fill and change batteries.

ROBOTICS PLUS

A New Zealand company, Robotics Plus, produces a hybrid robotic sprayer (FIGURE 10 ), which uses a diesel-powered generator to produce the electricity needed to propel the tractor and run all the equipment for the spraying function. Like hybrid cars, the hybrid function recaptures the energy by using regenerative braking. The tractor is standard wheel-driven and can operate in a minimum row space of 72” or 1.85m.

The vehicle has software that allows programmed management of future jobs and is available with multilanguage capability. The software provides

FIGURE 6

FIGURE 7

Napa • El Dorado Hills Modesto

FIGURE

FIGURE

remote real time viewing of daily operations. The viewer can “see” what the tractor sees and can manage more than one vehicle at a time. The vehicle weighs 3,950 pounds and can be adjusted with two to three fans per side. Each fan is individually adjustable to control zones.

AMOS POWER

Amos Power is an American company that has redesigned a fully autonomous electric tractor from the ground up to be a working partner in the vineyard for

multiple tasks (FIGURE 11 ). It is designed for 72” row spacing for grapes. The forward portion of the tractor is the removable battery compartment, with each side tread and the motors for driving them attached to the main frame. This orientation keeps the tractor’s center of gravity firmly on its tracks and can allow the vehicle to work on grades up to 40%.

As of this writing, there are three patents that have been issued to Amos Power, one for the modular track drive units, one for the removable battery and a third for the electrically driven hitch assembly. There are three models, from 47” center track to track and 59” tall, to 80” and 54” tall. The vehicle has 85hp and 50hp PTO, eight to 10 hours of battery life, weighs about 6,800 pounds and can lift 2,500 pounds. WBM

FIGURE 10

FIGURE 11

Vineyard Survey Details Pain of 2024 Crush

Many Growers Left 30% of Crop on Vine Amid Weak Market

Andrew Adams

been widely expected to be light, but the crush report took many by surprise—if not by shock—when the preliminary 2024 California crush report came in at 2.84 million tons.

It was the smallest crop in 20 years, and the 2024 WineBusiness Monthly Vineyard Survey, conducted in November, provides additional, objective data on how small the crop was and the pains felt by growers. In Napa County, more than half, or 51%, of those surveyed said they had to sell grapes at prices that were less than the previous year’s average. Among all survey participants, the share of those who had to accept less than what they received last year was 41%.

While all growers are contending with rising costs, only a minority has seen revenue keep pace. In 2021, 17% of those surveyed reported lower revenue from the most recent growing season than the previous year. That share grew to 41% in 2024, and the share of growers making the same, or less, than a year earlier came to 66%.

Sixty-four percent of all growers claim the prices in their existing contracts for the 2025 harvest and beyond do not cover the costs of farming to provide a sustainable return. That share was the lowest in Napa County at 53% and highest at 74% among growers in the “Rest of California” category that includes the Sierra Foothills, Mendocino and Lake counties, and Southern California.

On average, growers across the United States had to sell nearly half their crop for prices less than the average paid last year. The survey found the highest share of grapes sold for less than last year’s average was in Sonoma County with 54% while the lowest was in the Central Coast at 30%.

A significant number of growers reported being unable to sell a large portion of their crop at all. Among all survey participants, the average amount growers were unable to sell was 29%, ranging from the low of 14% for the Rest of the U.S. to 41% for the Rest of California.

Small Crop Arrives in Very Different Market

The last time California produced such a small crop was in 2004 when growers produced 2.76 million tons in what was a hot vintage with a compressed picking window across much of the state. That small harvest came at a very different time for the U.S. wine industry.

In Santa Barbara County in California’s Central Coast, growers had been particularly rushed to complete picking during a heat wave that threatened their average-sized crop of thin-skinned Pinot Noir grapes. At the time, the signature grape of Burgundy would account for just 70,000 tons, or 2.5%, of the total harvest. But the variety had found a home in Santa Barbara County;

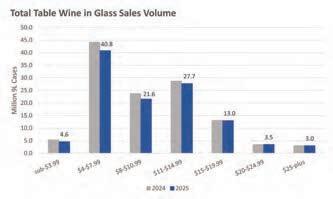

How much of your 2024 crop sold for less than average?

How

How much of your 2024 crop sold for less than average?

Source: WineBusiness Monthly Vineyard Survey

and as that year’s early harvest came to an end in October, the film Sideways made its U.S. debut. Grossing more than $70 million in the U.S. market, the film sent demand for two key varieties, Pinot Noir and Merlot, in very different directions.

Given the 2024 harvest is the smallest since 2004 and while the weather did affect yields—particularly on the Central Coast—that small pick also reflects entrenched market challenges. Last year’s Pinot harvest totaled more than 218,000 tons (more than 7% of the state total), but that is 24% less than in

Elevate your Vineyard’s Appeal to Grape Buyers with In-Season Berry Phenolic Testing

Did you sell grapes at prices less than average? share answering “yes”

2023. The loss in Pinot tonnage between 2023 and 2024 is roughly the same that was grown in the entire state in 2004.

The “Sideways effect” has been well documented, but the similarities in crop size between 2004 and 2024 illustrate the need for a new social effect to galvanize the next generation of wine drinkers. Grape growers are typically the first to feel the effects of changing consumer sentiment, such as when Merlot became uncool, Moscato blew up, and today when Sauvignon Blanc is expected to save the bottom line.

In 2024, growers acutely felt the pain of a market undergoing a major correction because of weak consumer demand for wine, as well as an oversupply of winegrapes. As the industry seeks its next Sideways moment, growers are taking the time to redevelop and replant vineyards for when demand swings back in their favor.

When the Bordeaux variety picking started in Napa Valley last year, Rombauer’s director of winemaking, Richie Allen, was aware of significantly more grapes unsold than normal, and the number of phone calls he received from growers looking for buyers was also abnormally high. By the end of picking, Allen said he, thankfully, didn’t see that many grapes go unharvested in Napa Valley.

“Even in a long market, the fruit is still highly sought after,” Allen commented in a post-harvest webinar hosted by the Napa Valley Grapegrowers.

• Conserve water

• Manage heat events to protect fruit quality

You Can’t Manage What You Don’t Measure

• Weekly berry phenolic tracking including polyphenols ( avors), catechins (tannins), and anthocyanins (color) can help your vineyard stand out

Combining berry phenolic tracking with CVC’s real-time leaf and berry temperature monitoring allows you to:

• Manage grape phenolics with site-speci c data

The Only Water Stress Monitoring using Soil Moisture, VPD, Fruit and Canopy Temperatures ALL in Real Time.

• Know when water stress begins in real time and know how much water to apply to maintain the desired plant water status

Matt Stornetta, president of the vineyard management firm Stornetta Made, works with wineries and growers in Napa and Sonoma counties and said, during the same webinar, that he has been collaborating with winery partners on pricing, contract terms and even marketing support to address the weak market. “We’ve had to really address the situation with our partners,” he noted. “Wine sales aren’t what they used to be so how can we work together to find something to allow us to weather the storm mutually.”

Caleb Mosely, executive director of the Napa Valley Grapegrowers, said in an email that based on the group’s own estimates, “only a small percentage of contracted grapes was left on the vine with a vast majority of uncontracted fruit sold at negotiated prices.”

Adjust your Farming to Maximize Phenolics in your Vineyard

• Evaluate irrigation effectiveness and grape quality during heat spikes

• Demonstrate the cost-effectiveness of alternative cooling methods (e.g. shade cloth, sunscreen, misters)

Crop Water Stress and Grape Berry Temperature IN REAL TIME Bryan Rahn, Sadie Dutcher, Hannah Rahn www.coastalvit.com of ce: 707.965.3700 info@coastalvit.com

Grapes Left Hanging with No Buyer

Across California, however, it’s estimated that 400,000 to 500,000 tons went unharvested in 2024, and that appears likely, given that 73% of the growers who were unable to sell grapes left them on the vine or harvested them to the ground. A similar number of grapes is thought to also have been left on the vine in 2023.

Growers Making Less Revenue

Growers are Making Less Revenue

Eleven percent of those surveyed made wine to sell on the bulk market while 13% produced wine for their own label, and the remaining 3% sold the grapes for distillation, concentrate or some other use.

Nearly all those surveyed on the Central Coast, or 95%, reported leaving their unsold grapes on the vine while Napa had the highest share of growers that made wine for the bulk market with 25%. The share of producing more wine under their own label was highest in the Rest of the U.S. with 32%.

Despite the challenges, only 12% of growers surveyed will be permanently removing vineyard acreage this year. That share was highest in Sonoma County at 18% and the lowest in the Pacific Northwest at 2%. Of those who will be taking out vines, 59% say it’s because they can’t find a buyer for the grapes, with an additional 14% blaming weak demand in the U.S. wine market.

A Forced, but Needed, Cull of Red Grape Vineyards

Several of those who selected “other” for why they are removing acres, however, are doing so because the vines are old, never should have been planted on the site in the first place or are diseased.

Nearly a quarter of survey participants will be replanting or redeveloping a vineyard this year, with that share being the highest in Napa County at 36% and the lowest in Rest of California at 13%. In Napa County, the top reason for redevelopment was disease and pest pressure followed by the age of vines. Among Sonoma County growers, 40% of those who are redeveloping vineyards are doing so to change varieties, and the share was even higher among those in the Rest of the U.S. at 54%.

The weak wine market has only compounded the business challenges that growers have been dealing with for years. In 2022, labor was the top concern among 62% of the growers surveyed. While grape pricing has since replaced it as growers’ top worry, labor remains the top concern for 32% of those surveyed.

Considering the future and where they will need to allocate, or find, additional capital over the next three years, 74% of all growers identified increased labor costs as the biggest need followed by replanting at 49%. New tractors and equipment fell to just 42% of those surveyed.

In terms of securing that labor, 52% of growers across all regions use a labor contractor. The use of contractors was highest in the Central Coast where 82% of those surveyed work with the companies and the lowest in the Rest of the U.S. at 26%. This region also accounted for the highest share of using “guest/ foreign” workers at 26%. Growers in Sonoma County had the highest rate of full-time, year-round staff at 26%.

“Sonoma County is well positioned, having focused for years on building relationships with restaurant groups, the wine trade, media partners, sports

Areas of Vineyard Business Needing Capital

Source:WineBusinessMonthlyVineyardSurvey

Areas of Vineyard Business Needing Capital

Do

teams and more,” said Sonoma Winegrowers President Karissa Kruse in an email. “Despite the headlines, in Sonoma County, we remain optimistic as 95% of our vineyards are still family-owned with many multi-generational, that possess decades of experience in successfully managing the ups and downs in farming.”

According to Kruse, Sonoma County did not see as significant a drop in tonnage or average price as some other major regions, and she attributed that to the strength of the county’s climate and brand. “As with any year, some growers fared better than others,” she noted.

Considering the year ahead, Kruse said the county’s growers are taking the time to replant or pursue a lease with a vineyard management firm while others are looking to secure new contracts with wineries.

Come see us at Unified - booth #518

On Sept. 5, 2024, the Napa Valley Grapegrowers issued an alert, advising their members that an unstable market may well mean spot prices for grapes which their members could find unsustainable. The group organized a market task force to help their members understand what was driving the market and find opportunities for their crop.

Executive director of the Napa Valley Grapegrowers, Caleb Mosley, said the group is still evaluating alternative markets and distribution channels for surplus grapes, as well as mitigating price fluctuations and working to reduce overhead costs. In addition to hosting regular webinars on the market, the task force has also developed grape purchase agreement templates as a tool to calculate and manage farming costs, along with connecting members with potential buyers in bulk wine and custom crush.

“Growers are using this as an opportunity to re-evaluate their vineyards, including removing older blocks that were previously considered for redevelopment,” Mosley explained.

In Mendocino County, the local market reflected the wider grape market in that demand was much stronger for white grapes. Zac Robinson, co-vice president of Husch Vineyards, which his family founded in 1971, said one of the nation’s largest wine companies was an eager and active buyer of Chardonnay at “bargain” prices in 2024. “Something like 25% of chard in Mendocino was this scenario,” he commented.

The county’s principal reds, Cabernet Sauvignon and Zinfandel, either sold at normal prices or went unsold while Pinot Noir and Sauvignon Blanc appeared unaffected by the weak market.

“I see lots of blocks that were ripped out, so there was definitely a culling of the herd,” he said when asked if growers were pulling vines in response to the market. Many of the vines that have been removed were “flawed” due to virus, poor rootstock, water inefficiencies or other reasons. “I think the

overall quality of Mendocino reds will improve in future years because the mediocre stuff is gone now.”

Even if the reset and rebalancing of the supply side of the business needed to occur, Robinson believes the overall market is still facing considerable challenges. “The aging of the Baby Boomer bubble presents an intractable problem for wine sales. Even if the next generation enjoys wine at the same per capita rate, there aren’t enough bodies in this cohort to replace the consumption of the Boomers,” he said, adding outside of market worries, there’s the challenge of national media “misrepresenting” the risk of alcohol consumption. “Plus, there’s a growing diversity of beverage options. The wine world is going to change tons in the years ahead. Buckle up!” WBM

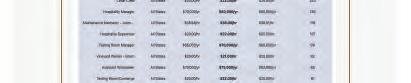

2024 WineBusiness Monthly Vineyard Survey

The WBM study was conducted between November 5 and 29, 2024. The data are compiled by WineBusiness Analytics.

The survey participants include vineyard managers and owners throughout the U.S., from a total universe of 8,800 vineyards and wineries with vineyards.

The responses were structured to enable reporting by vineyard region, allowing us to accurately report activity for the total market. Accepted statistical techniques are employed to allow segmentation as indicated in the data presented.

TRIALS & TROUBLESHOOTS

The One Block Challenge for the Regenerative Farming Movement

Robert Hall Winery Pilots Transition to Regenerative Viticulture, Shares Data and Invites Others to Join One Block Challenge

Bryan Avila

Meet the Author: This applied research forum discusses how growers, vintners and their technical leaders overcome challenges by using science and a systemic approach to provide insights on how to grow better grapes and make better wines with minimal environmental impact. Bryan Avila is the co-founder of the Vintners Institute, Guild & Academy.

A special thanks to my friend Pam Strayer for inspiring a conversation with Caine Thompson and this story.

TRIAL LEAD: Caine Thompson, managing director, Robert Hall Winery and head of sustainability, O’Neill Vintners

Caine Thompson grew up on his family’s orchard in Tauranga, New Zealand, which inspired his interest and studies in horticulture and business. Named New Zealand’s “Young Viticulturist of The Year” in 2009, Caine had worked for several high-profile producers prior to signing on as managing director of O’Neill Vintners & Distillers’ Robert Hall Winery. Since assuming his role in October 2020, Caine has spearheaded a regenerative viticulture case study which has evolved into 140 acres of certified regenerative organic with a further 600 acres in conversion to regenerative. He has also helped O’Neill Vintners become one of the largest B-Corp Certified and the largest Zero-Waste Certified beverage company in the world. Caine serves

SPINS.

on several wine industry boards, including the Regenerative Viticulture Foundation, Sustainable Wine Roundtable, Wine Institute, Calpoly University Vit & Wine, Organic Trade Association and the Paso Robles CAB Collective. He was selected as one of Wine Enthusiast’s “Future 40” in 2023.

ONE BLOCK CHALLENGE PROGRAM

(1BC): Stephen Cronk, co-founder and chairman, Regenerative Viticulture Foundation

Stephen Cronk is the co-founder and chairman of the Regenerative Viticulture Foundation, a global non-profit dedicated to inspiring the transition to regenerative farming in vineyards. Stephen joined the London wine trade in his early-twenties, and 20 years and three children later he moved his family to Provence where he and his wife, Jeany, founded Maison Mirabeau, an internationally-recognized Rosé wine brand. In 2019, they acquired a 20-hectare estate near La Garde Freinet in the Côtes de Provence appellation. The soil, having been intensively farmed for the previous 25 years, resembled a moonscape, so the couple set out to bring the estate back to life. With the guidance and support of regenerative viticulture pioneers, they did just that. They are currently measuring the impact of this holistic system of farming over time.

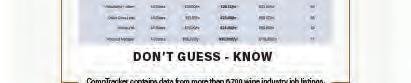

BACKGROUND:

The future is regenerative. The Expo-West 2024: Trends and Treasures webinar was the collaborative effort of consumer-packaged goods (CPG) industry agencies Mattson, SPINS and Moxie Sozo, offering insights into the latest market developments, consumer preferences and products. The webinar also announced the results of a report on CPG market data, which revealed a strong alignment between some of the more popular emerging trends and the core values of Gen Z and Millennials: “carbon footprint” and “regenerative agriculture” were in their top five observed trends. The Regenerative Organic Certified eco-label has become a top sales performer, up 24% to $41.6 million from 2022 to 2023.

In addition, the effects and costs of farming inputs, from fuel to fungicides and fertilizers, have all increased drastically, causing farmers to reconsider conventional wisdom. As data from biodynamic trials begin to shed new light on how to harness nature’s biological services on the commercial scale, larger and larger growers are taking notice. The biodiversity present in healthy soil provides it with a myriad of nutrient cycling abilities that farmers are just

FIGURE 1 Regenerative Organic Certified Product have performed well from 2021-2023, according to

The One Block Challenge for the Regenerative Farming Movement

beginning to grasp as more data-driven approaches and technologies become available to safely guide growers in assessing their risk during the transition between systems.

All of this led one of the country’s largest producers, O’Neill Vintners & Distillers, to transition all estate properties into regenerative farming, with the hope of inspiring other growers to do the same.

Jeff O’Neill, founder, said, “When Caine [Thompson] shared the concept of trialing regenerative viticulture on our vineyards, I was fully supportive. I knew that this had the potential to build resilience and to fight climate change, and this four-year study has confirmed that. We are making better wines, rebuilding the soil, delivering what the customer wants and helping our fellow growers do the same. A rising tide lifts all boats, and the wine industry can use that right now.”

O’Neill isn’t alone in that effort. The Regenerative Viticulture Foundation’s One Block Challenge (1BC) is an initiative designed to encourage winegrowers to adopt and experiment with regenerative farming practices on a small, manageable scale. The challenge invites vineyards to dedicate at least one block of vines to regenerative viticulture methods, allowing them to observe the benefits of improved soil health and biodiversity. The goal is to demonstrate how regenerative techniques, such as cover cropping, composting, no/ low tillage, removal of herbicide and integrated livestock grazing, can enhance vineyard resilience, reduce inputs, avoid soil compaction and improve grape quality while also contributing to climate change mitigation. By implementing these practices in a single block, growers can assess the impact for themselves before expanding to a larger area. A short interview with RVF’s co-founder, Stephen Cronk, is provided following the Q&A with Caine Thompson.

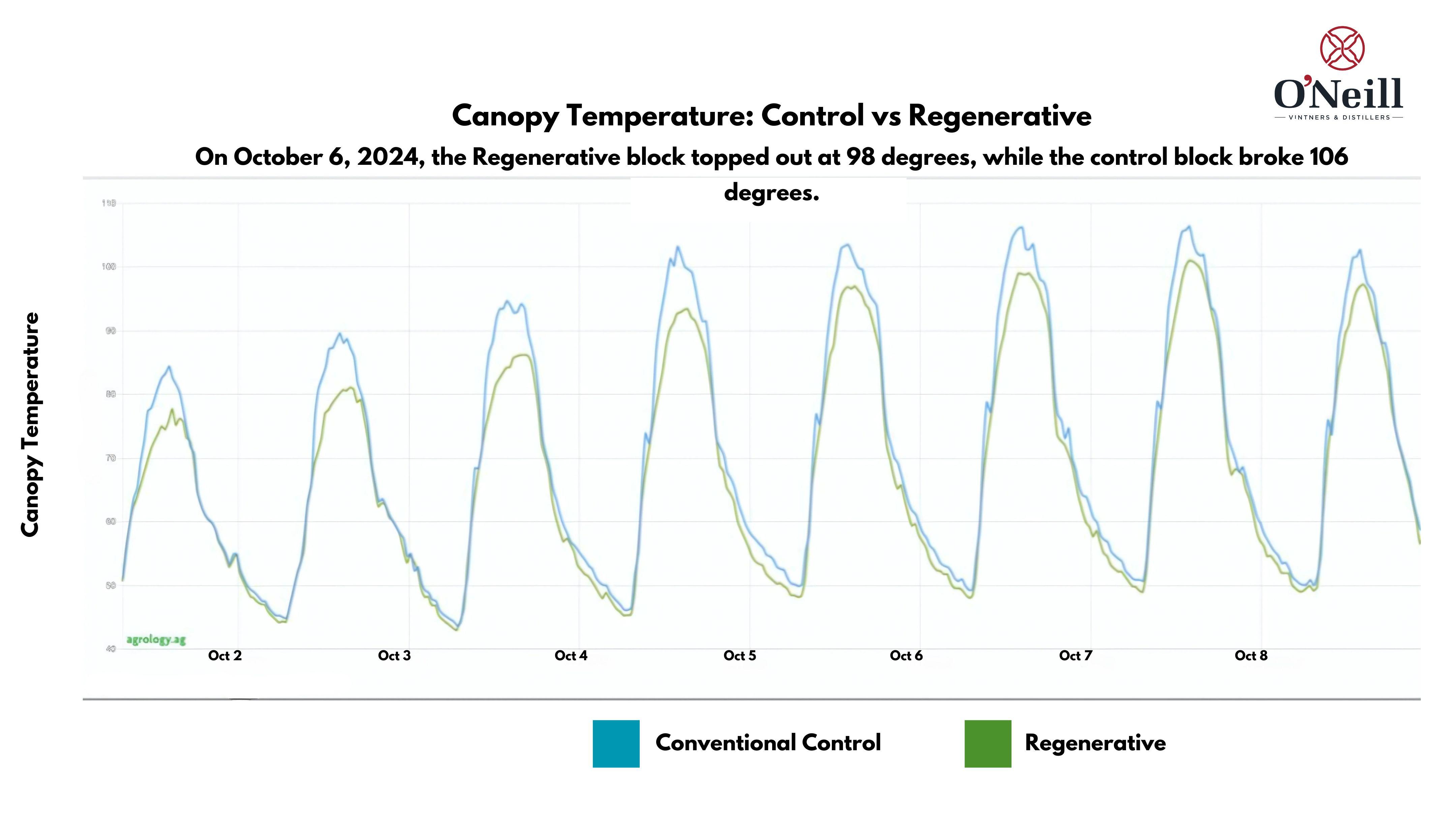

Previously reported by wine journalist Pam Strayer, this pilot study was kicked off by O’Neill Vintners and now serves as a commercial example of a successful transition from conventional to regenerative organic farming methods for California growers. Caine Thompson, now a Regenerative Viticulture Foundation board member, is hoping to challenge other growers in Paso Robles by sharing his transition data, alongside sensor readings produced by Agrology, to better tell the story.

TRIAL OBJECTIVE:

The Regenerative Viticulture Foundation and Robert Hall Winery pilot KPIs on Paso Robles Cabernet Sauvignon to spearhead movement for other growers.

TRIAL DESCRIPTION:

This three-year regenerative conversion trial was carried out at Robert Hall Vineyards and Winery on Cabernet Sauvignon in the Geneseo AVA of Paso

Robles, Calif. during the 2021, 2022 and 2023 vintages. The experimental design involved the 48-acre vineyard block (FIGURE 2 ) in which 43 acres were transitioned to regenerative organic in 2021 while reserving five of those acres to be farmed conventionally to allow for data collection during the transition. Those five acres represent the control. The following table displays the change in farming practices from the conventional methods and regenerative methods applied.

Seasonal Management Methods for both blocks:

•Winter: Sheep Grazing + 6 tons/acre compost application

•Spring: Mowing

•Summer

•Pre-Harvest

•Post Harvest

Winemaking: Native Fermentation

•Add 30ppm KMBS at crush (keep at 20ppm)

•No enzymes added

•No oak added

•No tannin added

•Pump-over once per day

•No inoculation for MLF

•100% French oak

Agrology data:

O’Neill Vintners used Agrology sensors to better tell the story from the vine’s point of view. The data shows the results of regenerative farming practices,

5

Regenerative Organic Clemens undervine weeder

Bio-control mealybug destroyer, UAC-IQ, Mating disruption (Pheromone traps)

Sulphur, Pure crop oil Compost teas/preps botanicals: BD prep (CPP. 500, 501), Teas (Comfrey, Chamomile, Nettle) and Organic products (Zinc, Oroboost) 43

specifically in terms of soil moisture, CO2 in the canopy, carbon concentrations in the soil and ground temperature, and how they affect Brix levels and yield.

CONCLUSIONS:

Conventional control and regenerative blocks were farmed over a three-year period as described above. Each of these studies recorded a standard set of data that most growers use to measure winegrowing outcomes: tonnage and sugar concentration, as Brix, are common metrics used to specify grape purchase criteria between growers and vintners. Additionally, yeast assimilable nitrogen (YAN) and color provide insights into wine quality, along with actual wines to taste. Six wines were produced. However, no formal sensory data were reported on the wines, though they have been reserved for growers to taste the results for themselves at One Block Challenge presentations. The results of this study were as follows.

FIGURE 2 An overhead image of the 48-acre trial site at Robert Hall Vineyard and Winery in Paso Robles, California. Five of these acres make up the conventional “control” block.

Conventional Control Round up, Rely, Shark Wrangler (leaf hopper), Movento (Mealybug), Intrepid (tortrix moth)

Sulfur, Champ, Rally, Quintec, Telbustar Zinc, Calcium, Phosphate

FIGURE 3

The data show a minimal risk of major pitfalls during this transition case study. Given that no two vineyards are the same, the yields were slightly lower on the conventional side with slightly higher sugars at harvest as compared to the regenerative side, which showed higher yields with slightly lower sugar. Color intensity is slightly lower in the regenerative lot, but the YAN numbers were 20ppm higher, not to mention the regenerative sample wines at the Robert Hall tasting had slightly more complexity to them.

If one were to estimate the price of premium Paso Robles Cabernet Sauvignon at $2,500 per ton, the difference between farming an acre of each treatment, during the three-year transition, would be approximately $300 in favor of the conventional without adding on a regenerative organic premium for the grapes. But, if a picture is worth a thousand words, FIGURE 6 shows just how much the regenerative canopy has developed since it parted ways from the conventional method in 2021.

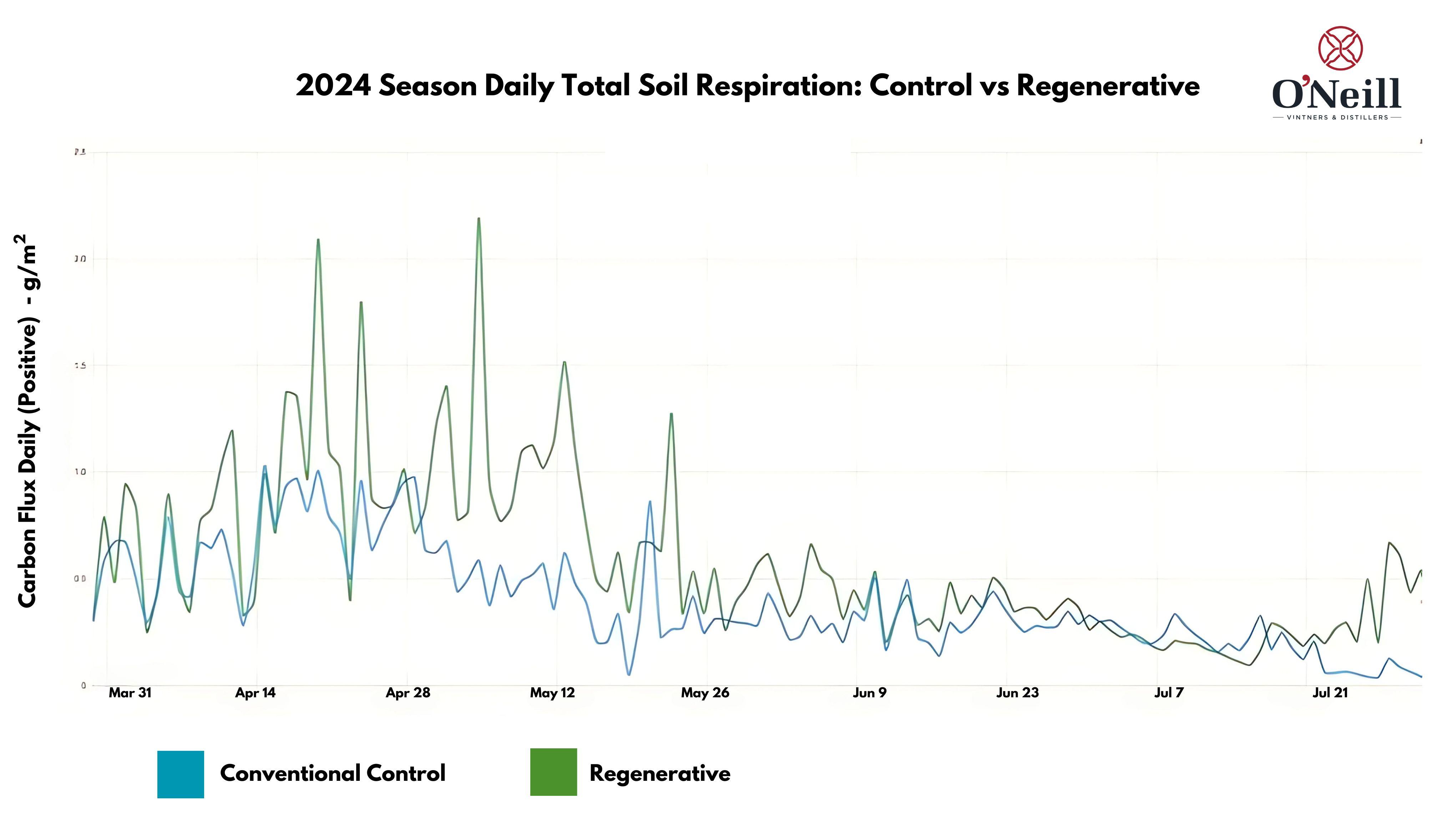

FIGURE 7 “Green represents the regenerative block, and blue represents the conventional block. This graph shows improved microbial activity throughout the season in the regenerative block, with particularly large differences in spring and early summer,” said Dana Revallo of Agrology. “The lines indicate daily totals of CO₂ respiration, closely mirroring the Haney test’s 24-hour incubation results. However, these measurements are taken directly in the field rather than in a lab. CO₂ released from the soil pores— known as soil respiration—is a direct indicator of microbial activity. While it doesn’t identify the types of microbial communities present, it does show the total amount of metabolic activity within the soil microbiome.”

FIGURE 8 “This trial suggests that the risk of transitioning a vineyard to regenerative practices is relatively low,” noted Dana Revallo of Agrology. “Data from the three-year study period show that plants and soil have been especially active under regenerative management. Even though both the conventional and regenerative plots received the same compost applications, regenerative practices reduced soil evaporation, allowing more moisture to be released through evapotranspiration in the canopy. This created a cooler, more hospitable environment for the vines and soil, enhancing nutrient cycling services.”

Post-Mort Q&A with Caine Thompson, Robert Hall Vineyards

What was the motivation for transitioning Robert Hall/O’Neill Family Vintners to a regenerative farming system? What is the One Block Challenge?

ompson: When we started out on this project five years ago, we noticed that all our growers were certified sustainable. This was very encouraging for me since I came from an organic certified background in New Zealand, and the Regenerative Organic Alliance (ROA) had just been formed, and the whole notion of regenerative organic was growing. The ROA took the best parts of the current organic, Biodynamic and sustainable certification models, and it really resonated with farmers.

Tablas Creek was the original pilot, and I said to Jeff O’Neill, “This is the perfect opportunity to be involved in this new program,” and he was intrigued. I said, “How about we set up a side-by-side trial and make it an open-case study for industry to learn?” After all, we are all on this big blue and green planet together. Jeff was in. He loved the idea that we could learn

FIGURE 6 In the run up to harvest 2024, you can visibly see the difference in canopy growth between conventional and regenerative treatments.

winery tanks

this stuff together collectively as an industry, so I set up the grower data in a way that we thought growers would want to see when making the transition. We wanted to capture what a conversion would look like in numbers so that outcomes, in terms of carbon sequestration, organic matter, biodiversity, etc., were clear. Basically, we are forming the farming metrics of the future.