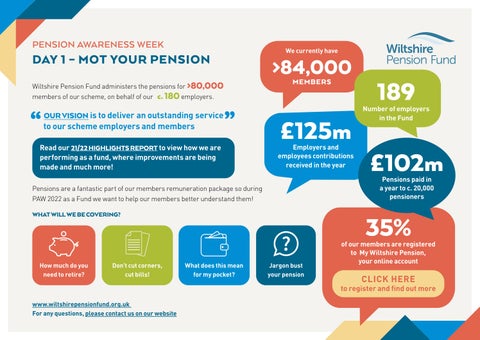

PENSION AWARENESS WEEK DAY 1 – MOT YOUR PENSION

Wiltshire Pension Fund administers the pensions for >80,000 members of our scheme, on behalf of our c. 180 employers.

OURVISION is to deliver an outstanding service to our scheme employers and members

Read our 21/22 HIGHLIGHTS REPORT to view how we are performing as a fund, where improvements are being made and much more!

Pensions are a fantastic part of our members remuneration package so during PAW 2022 as a Fund we want to help our members better understand them!

WHAT WILL WE BE COVERING?

We currently have >84,000 MEMBERS

189

Number of employers in the Fund

£125m

Employers and employees contributions received in the year

£102m

Pensions paid in a year to c. 20,000 pensioners

35% of our members are registered to My Wiltshire Pension, your online account

How much do you need to retire?

Don’t cut corners, cut bills!

www.wiltshirepensionfund.org.uk

For any questions, please contact us on our website

What does this mean for my pocket?

Jargon bust your pension

PENSION

AWARENESS WEEK DAY 2 – HOW MUCH DO YOU NEED TO RETIRE?

Four in five workers (16 million people), are not saving at levels which are likely to deliver an acceptable standard of living in retirement

Source Living Wage Foundation

£5,021 average annual pension paid in 21/22 from the LGPS

Log in to MY WILTSHIRE PENSION

to view your retirement projection

Do you know how much you have built up in your pension account?

Full State Pension 2021/22 is only £9,339 PER YEAR

Take action now to provide financial security for yourself in retirement

WHAT STANDARD OF LIVING COULD YOU HAVE?

www.wiltshirepensionfund.org.uk

For any questions, please contact us on our website

MINIMUM £10,900 A YEAR

Covers all your needs, with some left over for fun

COMFORTABLE £33,600 A YEAR MODERATE £20,800 A YEAR

More financial security and flexibility

Source: Home – PLSA – Retirement Living Standards based on a single person living outside of London

More financial freedom and some luxuries

PENSION AWARENESS WEEK DAY 3 – DON’T CUT CORNERS, CUT BILLS!

In this cost of living crisis your pension is a valuable part of your remuneration package, helping to secure your financial future.

• Your annual pension is increased each year in line with Cost of Living (CPI) inflation which as of July 2022 is at 10.1%

Feeling the financial squeeze and thinking of opting out?

HOW MUCH COULD YOU SAVE?

I have worked for the council for 22 years opting out when I joined, never giving it a second thought. I now realise how much that I have lost having only my state pension (21/22 £9,339 per year) as an income during retirement. In this cost of living crisis this is something I wish I could tell my younger self.

Consider the 50/50 OPTION where you could pay half your normal contributions in return for half your standard pension

Your pension contributions are calculated based on your taxable income , visit HOW IS MY PENSION CALCULATED for more information

www.wiltshirepensionfund.org.uk

For any questions, please contact us on our website

Total annual savings £383 Reduce to a 4 minute shower £70

Turn down the thermostat by 1 degree Celsius £105

Source: Quick tips to save energy at home –Energy Saving Trust Switch off to standby £55 Turn off the lights £20 Draught proof gaps £45 Avoid the tumble drier £60 Reduce to one wash a week at 30 degrees £28

PENSION AWARENESS WEEK DAY 4 – WHAT DOES THIS MEAN FOR MY POCKET ?

WILTSHIRE PENSION FUND’S INVESTMENT PERFORMANCE SHOWING

that in the last three years, actual investment performance has exceeded expectations, putting the Fund in a healthy funding position!

you can pay half your normal contributions in return for half you normal pension helping members stay in the LGPS if things become financially tough

www.wiltshirepensionfund.org.uk

For any questions, please contact us on our website

Billions £3.35 £3.25 £3.15 £3.05 £2.95 £2.85 £2.75 £2.65 £2.55 £2.45 Dec 21Mar 22 Dec 20Mar 21Jun 21Sep 21 Dec 19Mar 20Jun 20Sep 20 Mar 19Jun 19Sep 19 Covid-19 Back: Bounce Government Stimulus Strong m Perforance k from of “wor tocks home” s Vaccine Rally Inflation concerns Covid-19 reopening Omicron variant War in Ukraine and inflation concernts ret Expected t urn a .2019valuation(3 er a 8%p nnum) £315m excess returns al Fund Actu Valuation HOW YOUR PENSION IS FUNDED* 20% BY YOU 40% BY YOUR EMPLOYER 40% BY INVESTMENT RETURNS FLEXIBLE RETIREMENT

Provides a SECURE INCOME FOR LIFE increased in line with inflation

year Full State Pension 2021/22 is only £9,339 PER YEAR TAX RELIEF on the contributions that you pay

Option of taking some of your pension if you reduce your working hours or move to a less senior position* * subject to employer consent

each

50/50 OPTION

So for every £1 you put in, on average your employer puts in £2 and the investments contribute £2 *Based on averages Flexibility to pay more or less contributions THE

means

...

PENSION AWARENESS WEEK DAY 5 – JARGON-BUST YOUR PENSION

WHAT DOES CARE PAY ACTUALLY MEAN?

Career Average Revalued Earnings scheme, which means your pension is calculated on your salary for each year you are in the scheme.

WHAT IS A DEFERRED MEMBER?

An employee/former employee who previously paid into the scheme.

WHAT IS AN ACTIVE MEMBER?

An employee who is currently paying into the scheme.

WHAT IS AN EXPRESSION OF WISH?

Who would you like any Death Grant to be paid to should you die in service or shortly after you retire, update this on

WHEN CAN I RETIRE?

You can claim your LGPS pension from age 55, for your state pension age visit

CAN I TAKE A LUMP SUM WHEN I RETIRE?

Yes , you can convert some of your annual pension into a tax free lump sum.

KEEPING UP TO DATE MEMBER WEBINARS MEMBER VIDEOS AND GUIDES

GET A PENSION ESTIMATE INSTANTLY ON

www.wiltshirepensionfund.org.uk

For any questions, please contact us on our website