CLIMATE AND NATURE REPORT

One of the most important ESG factors to consider is climate risk. When it comes to climate risk, the Fund’s goal is as follows:

To protect the investments from climate change risk, identify opportunities to both invest in and benefit from the transition to net zero, and secure a sustainable financial future for the Fund

One of the Fund’s investment beliefs is as follows:

In order to protect the Fund’s investments into the future, the Fund supports a global warming scenario of well below 2°C, and states an ambition to achieve net-zero carbon emissions across all investment portfolios by 2050

Our Climate and Nature Report 2025 evidences how we are dealing with the material financial factors of climate risk and biodiversity as a Fund. We want our report to be interesting and understandable for our stakeholders, so we bring the stats to life with examples of our investments in action. Each year our approach evolves, and this year we have two new sections of the report which we hope will provide additional transparency and context.

This year is the first time the Fund will report on the impact its innovative and award-winning Climate Opportunities (Clops) portfolio is having. This portfolio targets superior risk-adjusted returns (8-10%) by investing in a diversified mix of assets which have the intention to deliver real world change by actively supporting the transition to a low carbon economy. Read case studies of the investments being made to take advantage of the opportunities arising from the global transition.

As part of our commitment to transparency, for the first time we have included detailed company level assessments and analysis of the Fund’s fixed income holdings, moving beyond just equity portfolios.

15 Transparency and information sharing

We always act with the long term in mind, whether we are setting our investment strategy, planning improvements, or working towards our net zero by 2050 goal

Progress is being made on addressing the risk of climate change, and globally we are seeing a shift towards lowcarbon technologies. In 2024 worldwide, one in seven of all new car sales were fully electric, a record 117 GW of wind generation capacity was installed, and total investment in clean energy technologies and infrastructure reached $2 trillion.

The UK Climate Change Committee reported on progress. UK emissions are now 50.4% below those in 1990. The reduction in emissions from 2023 to 2024 marked the 10th consecutive year of sustained emissions reductions.

However, the world is not on track to meet net zero by 2050, with global pledges to date falling short of what is required. Global carbon emissions continue to rise, with 2024 seeing a record high in emissions. In 2024, global warming exceeded 1.5°c compared to pre-industrial levels for the first time, and 2024 was confirmed globally as the hottest year on record. The challenge for us is in understanding how to evolve our strategy when the data shows we would be better off in a scenario where the world goes through an orderly transition to net zero, but that doesn’t seem to be the world we are living in.

The rapid warming trend being experienced across the world indicates a significant and accelerating danger. To help us understand the risk this poses to the Fund, we have conducted updated climate scenario modelling, to assess potential financial impacts across a range of outcomes.

Our climate scenario modelling tells us that the Fund faces greater financial risks and poorer investment returns in a rapidly warming world. The Fund faces risks under all scenarios modelled, with the outcomes being worse as the transition to net zero becomes more disorderly and as real temperature rises exceed 2°c.

This scenario modelling is based on numerous assumptions and the model has inherent uncertainty, it is recognised that the modelling methodology often underestimates climate risk, particularly from severe impacts and climate tipping points. However, as a Fund we must make decisions based on imperfect data, with our pension obligations stretching out over a century from today, we must consider the long term. The data tells us that unmitigated climate change will be detrimental to our ability to meet these payments, and therefore we must continue to act.

The modelling supports the Fund’s climate goals, endorsing the view that the Fund’s financial interests are best served in a world where global warming is limited to 2°c It is essential that the Fund continues to monitor its exposure to climate related risks and invests in the opportunities, doing so to ensure it can meet its fiduciary duty to members and employers.

Climate change has the potential to cause economic disruption so profound that no pension scheme, whatever its specific investments, could hope to escape the adverse impact upon its ability to fund its commitments to pay benefits.

Nigel Giffin KC – Updated opinion on the fiduciary duty in the context of the LGPS

Getting to net zero is not simply about decarbonising our portfolios. In order to give ourselves the best chance of success, we tackle this issue from many different angles:

We focus on our top emitters, to deliver maximum impact

We work with our investment managers to evolve their approach

We allocate money to renewable infrastructure and climate solutions

We have a plan to divest from all fossil fuels by 2030, and ensure all remaining holdings can transition

We investigate significant sectors, to ensure we are investing in forward-looking companies

We have developed a framework to understand our exposure to biodiversity risks

We transparently report on the work we have been doing

The information in this report is intended to help illustrate the wide range of work that we do, alongside monitoring our decarbonisation progress. Through this work, we aim to achieve real world change and create a sustainable future for our Fund.

In order to get to net zero by 2050, we have made the following commitments:

1

We commit to a whole Fund carbon reduction target of 50% by 2030

2 We commit to a listed equities carbon reduction target of 43% by 2025 and 69% by 2030

3

We commit to allocating 30% of the Fund to sustainable/low carbon green assets by 2025, and 35% by 2030 (as measured by the long-term strategic asset allocation (SAA).

4

We commit to all of our property investments being aligned with a net zero by 2050 target by 2030.

5

We commit to engaging with our top 10 emitters and reporting transparently on our findings.

Our goal is to decarbonise from our baseline position, set at 31 December 2019, and achieve net zero by 2050. The Fund’s baseline position for decarbonisation is calculated as follows:

Calculation date: 31 DECEMBER 2019

What has been included?

SCOPE 1 AND 2 EMISSIONS OF ALL EQUITY INVESTMENTS

Carbon footprint (tCO2e/$m investment – measures the emissions impact of a portfolio per $1m invested):

39.9 TCO2E/ $M INVESTED

We use the carbon footprint metric to measure progress against our targets. This is the preferred metric due to the link to real-world absolute emissions, and because it is widely used by other investors, it enables easier comparison. We also hold ourselves accountable against our climate commitments – see more in the next section!

We have set a target pathway to decarbonise our portfolio and reach our net zero target by 2050. We recognise that progress might not always be a smooth journey, especially as our allocations evolve and investment markets experience volatility

We are pleased to share we have decarbonised our portfolio by 58% since our 2019 baseline, this included a 24% reduction in 2024. A key driver of the reduction in the year has been divestment from some high emitting companies in our active equities portfolios. The following graph shows our decarbonisation pathway against our actual progress to date1:

The carbon footprint measure is affected by fluctuations in the valuations of the Fund’s investments. Over the year our investments performed well. As they increase in value, the carbon footprint will reduce, even if emissions remain static, because this is a measure of carbon per £m invested. This highlights the importance of not relying solely on one measure of performance. The Fund addresses climate risk in a wide range of ways, as shown earlier in this report.

In order to maintain momentum with our progress, we look at individual holdings which have a high carbon footprint to understand their position in our portfolio, and to be assured that they can be a valid part of our journey to net zero. This is covered in more detail later in this report.

We also look at things from a top-down perspective – we look at portfolios as a whole and ensure that the managers for those portfolios are doing enough to challenge the companies they hold and to meet the decarbonisation targets which they have set. This has been supported by our Climate Opportunities portfolio which is explored from page 28.

1 In our 2024 Climate and Nature report, we calculated our carbon footprint data using USD. However, this year we have changed this to GBP for consistency against how we report on other values. Reporting this data in GBP slightly changes how our graph looked compared to last years by around 3%.

The following chart shows how each of the Fund’s equity portfolios contribute towards the total carbon footprint:

Our emerging market equities portfolio is a large part of our carbon footprint. In the western world, we have outsourced a lot of our manufacturing to emerging markets, and with that we have effectively outsourced a large amount of our emissions. This is therefore a global issue, and supporting emerging markets to transition is a vital part of the journey to net zero.

We have collaborated with the manager of this portfolio, Ninety One, to set ambitious decarbonisation targets. Read more on page 25!

This portfolio passively tracks a Paris-aligned benchmark, which is calculated in a forwardlooking way, incorporating higher weightings to companies with a more compelling transition plan, helping us to achieve our net zero goal.

Paris-aligned passive

Global high-alpha equities

Global sustainable equities

Emerging markets equities

Global transition equities

Our global high alpha portfolio has a footprint which one third of its benchmark index, the MSCI All County World Index. This is due to the portfolio having higher weightings to sectors like technology, and lower weightings to sectors like energy.

The managers in our global sustainable equities portfolio and global transition fund have selected companies which are helping to finance the transition. Some of these companies may have higher emissions now, but are investing in technologies which will help the economy decarbonise in the future.

We are on track to meet our target of having 30% of the investments (measured by SAA) invested in “green” assets. The SAA review, as part of the 2025 valuation process, will allow us to increase suitable allocations to meet this target. Sustainable equities, climate opportunities and renewable infrastructure investments enable us to meet the target.

91% of our Property Fund investments by value have set a target of Net Zero by 2050 or earlier.

Following divestment by managers of some high emitting companies, the concentration of the Fund’s emissions in the top 10 has reduced from last year, reducing from 48% of the footprint to 34.3%.

There has also been a reduction in the number of fossil fuel companies held by the Fund, reflected in the footprint of these reducing from 20% to 5.1% over the last year.

TOP 10 EMITTERS 34.3% of footprint, and 5.7% of value

FOSSIL FUEL HOLDINGS 5.1% of footprint, and 0.3% of value

This is most often spoken about with regard to fossil fuel investments, and there is significant pressure on LGPS funds to divest from all fossil fuel companies. This pressure comes both from scheme members and wider campaigns.

Divestment = the intentional act of moving money and investments out of a company.

As a long-term investor, WPF’s goal is to protect the investments from climate change risk, and safeguard the financial future of the Fund. We support a global warming scenario of well below 2°C, and have an ambition to achieve net-zero carbon emissions across all investment portfolios by 2050. We do not see a long-term place for fossil fuel investments in our portfolios, and will work towards being fully divested from these companies by 2030. In the short term we will continue to monitor our holdings in these companies, to ensure that any such investments are helping to finance real-World change. Alongside this, we will continue to invest in renewable infrastructure and climate solutions, to help create sustainable replacements for traditional fuel sources, and contribute positively towards ensuring energy security. This approach aims to ensure that the Fund’s risk of exposure to stranded assets is well managed, and that the Fund can benefit from the investment opportunities presented by the transition to a low carbon economy.

Through the Fund’s allocation to the Paris-aligned passive portfolio, some companies are removed from the investable universe if they meet certain criteria. These are as follows:

Companies with:

• 1% or more of revenues from exploration, mining, extraction, distribution or refining of hard coal & lignite.

• 10 % or more of revenues from the exploration, extraction, distribution or the refining of fossil fuels.

• 50 % or more of revenues from the exploration, extraction, manufacturing or distribution of hydrocarbons, hydrogen and carbon monoxide mixtures present in a gaseous state.

Electricity producers with carbon intensity of lifecycle GHG emissions greater than 100 gCO2e/kWh (50%+revenues).

Any companies found or estimated by them or by external data providers to significantly harm one or more of the environmental objectives under the “Do No Significant Harm” definition.

• Currently, this includes pure-play coal and pure-play tar sands companies.

The Fund uses these exclusion criteria from the Paris-aligned benchmark as its definition of “fossil fuel companies”, and monitors holdings on this basis.

Due to the nature of investment pooling, there can be barriers to aligning climate change policy at the pool with that of our own, due to the fact that pooled portfolios have to contain the same holdings for all client funds, and a consensus position needs to be sought. We communicate our position to our pool and other investment managers and continue to work with our pool and other client funds in order to advance the approach in this area.

The Fund will continue to monitor our pool’s progress on implementing its policy objectives and will work with them to achieve our collective climate change ambitions. If the Fund does not feel action is progressing at an appropriate pace, the Fund will seek to address this with the other partner funds and with the pool directly.

Through pooling, we are not able to make unilateral decisions, and there is a need to collaborate and compromise in order to achieve the best collective decision. There is a risk that we are not always able to achieve the exact outcomes that have been set, however we will still work towards driving up standards collectively. By engaging with our pooling partners we have the opportunity to influence the direction of travel for a very large pool of capital. Through scale, we can deliver more significant real-world impact and exert greater influence over the companies we invest in.

In late 2024, the Government launched its “Fit for the Future” consultation, setting out major reforms to how the Local Government Pension Scheme (LGPS) manages its investments. The Government stated that the proposed approach of our current pooling partner, Brunel, did not align with its long-term vision for the LGPS. The Fund will need to work with its chosen new investment pool on how this divestment policy can be implemented. The transition to this new arrangement may also influence the wider holdings and emissions of the Fund. This will become more clear in the year ahead and will be reported on in the next Climate and Nature Report.

Shareholdings of companies in our equities portfolio meeting any one or more of the aforementioned criteria on page 11 amounted to 0.3% of equities total value.

We are actively engaging with and challenging our investment managers on these holdings. A full analysis of our equity holdings in fossil fuel companies as at 31 December 2024 is as follows:

See case study on page 20.

Since this data was compiled, Phillips 66 has been sold.

We are unsatisfied with ConocoPhillips’ approach to Scope 3 emissions, which they view as counterproductive. Additionally, the company’s plans to pivot to liquefied natural gas production feels more like a fossil-to-fossil shift than a true transition towards a low-carbon business model.

We maintain a cautious view of Glencore’s ability to transition to a low carbon economy despite the slight progress Glencore has made.

As at 31st December 2024

The number of fossil fuel companies held in equities portfolios was larger last year, holdings in PRIO, NESTE, PetroChina and MEG have all been sold by managers, helping the Fund move towards achieving its divestment objective. China Longyuan Power Group which was included last year no longer fulfils the fossil fuel definition, due to increases in revenues from other renewable energy sources.

For the first time, the Fund is reporting on its fossil fuel holdings in fixed income investments, supporting our goal of transparency and information sharing. Fixed income investments are when the Fund provides debt financing to smaller businesses. This year we have carried out a further line-by-line investigation into our holdings in fixed income. Below are the three largest Fossil Fuel holdings, by % of emissions, in our fixed income investments.

At least 10%

At least 10%

1.6%

1.7%

At least 10% revenue from oil fuels

Transparency and information sharing

Oxy was the first U.S. oil and gas company to announce netzero goals, aiming to achieve them through CO2 capture and operational efficiencies. While its climate disclosures align with global standards, concerns remain over the efficacy of CO2 capture technologies and the lack of plans to phase out fossil fuels.

Genesis is transparent about its Scope 1 and 2 emissions. However, it lacks a net-zero target, decarbonisation roadmap, any clear climate commitments, and doesn’t disclose Scope 3 emissions. While the company appears to be working to reduce its environmental footprint, it has made no commitment to phasing out fossil fuels.

PEMEX aims to achieve net-zero Scope 1 and 2 emissions by 2050, and has committed to aligning climate reporting with international standards. However, PEMEX lack Scope 3 targets, have struggled to meet past commitments, and has made no public commitment to phase out fossil fuel production.

As part of our journey to net zero, it’s important that we demonstrate the engagement that we are doing to understand the highest emitters in our portfolios.

We use a variety of tools to assess which holdings to prioritise for engagement:

Reviewing assessments by Climate Action 100+ and the Transition Pathway Initiative (TPI) to identify which companies have the poorest scores across the full range of metrics, including considerations such as: target setting, strategy, climate policies etc as well as the company’s actual transition alignment.

Emissions data, to identify which companies are the heaviest emitters.

We prioritise the highest value holdings in order to achieve the highest impact.

Identify holdings which meet our definition of being a fossil fuel company.

These tools provide the foundations for our engagement. We analyse and challenge the data to build a well-rounded understanding of the highest emitters and assess how future-proofed these holdings are. We may be happy to invest in a highly emitting company if our investment can help finance its transition to a low carbon economy. We may be less satisfied with the inclusion of a company which is unable or unwilling to transition, as this presents a financial risk to the Fund. Any concerns will be raised with the investment manager that manages the appropriate mandate. Through our engagement, we can understand what work is being achieved to reduce emissions. The position is then monitored on an ongoing basis.

The top 10 listed below accounts for around 34.2% of the Fund’s entire listed equity emissions.

The Fund’s listed equity holdings include Brunel’s Global High Alpha, Global Sustainable, and Paris Aligned portfolios (the latter of which is passively managed). Outside of Brunel, listed equities are also held in Lombard Odier’s Planetary Transition Fund (part of our Clops portfolio) and in Ninety One’s Emerging Markets Multi-Asset portfolio. All companies are held in an active equities mandate in addition to any passive exposure.

Waste Management is now our highest emitter (up from third last year), largely because last year’s highest emitters have been sold. Around 90% of its emissions come from landfills – a result of the company delivering waste disposal. While there is progress to be made, Waste Management is recognised as a sector leader in sustainability, with a well-developed strategy for addressing climate change and meeting its emissions targets.

We continue to believe that our investment in NextEra is supporting the transition to a low-carbon future. The company remains committed to being carbon-emissions free by 2045, it continues to invest in the expansion and development of renewables, and has integrated climate change into its decision making. 3

Air Liquide, the French multinational supplier of industrial gasses, has committed to reaching net-zero emissions by 2050 and has set interim targets to reduce GHG emissions. It is also investing in solutions like carbon capture and storage, renewable hydrogen production plants, and more. Air Liquide is ranked second-best in ESG risk within its industry by Sustainalytics and is recognised by the TPI for demonstrating the highest standards of climate transition planning and implementation.

CRH has received recognition from S&P Global, FTSE Russell (LSEG), Sustainalytics, and others for their sustainability performance and climate action. As a major building materials provider in a high-emitting sector, its decarbonisation efforts stand out. While TPI suggests there is progress to be made on transition planning and implementation, we’re pleased with CRH’s leadership in sustainability and comfortable with the rationale for holding the company. 5

Linde is the world’s largest industrial gas supplier and ranks best in its industry for ESG risk by Sustainalytics. The company has a detailed climate transition plan, is investing $3bn in internal decarbonisation, supports customers in avoiding emissions, and backs low-carbon technologies and fuels. Linde is recognised by the TPI for leading climate transition planning and implementation, though TPI notes there’s still room for improvement.

Republic Services is the second-largest waste disposal company in the U.S. after Waste Management. While TPI suggests it could do more to support domestic and international climate change mitigation efforts, we’re broadly pleased with its progress. The company has strong climate commitments and has been recognised among the most sustainable companies by Forbes and Barron’s.

Steel Dynamics is an American steel producer that exclusively uses electric arc furnaces, positioning it as a leader in lower-carbon steel. It targets a 50% reduction in Scope 1 and 2 emissions by 2030 and net-zero by 2050. However, Sustainalytics flags high ESG risk and TPI notes limited integration of climate risks into the company’s strategy. While we support the holding rationale, we’d like to see stronger progress on climate-related strategic assessments and transition planning.

TSMC is the world’s largest contract chipmaker, supplying companies like Apple, Nvidia, and Amazon. Despite being a high emitter due to energy use, water use, and potent fluorinated gas emissions, it has pledged to achieve netzero by 2050, 100% renewable energy by 2040, and aims to be water positive. It reports a 96% reduction in fluorinated gas emissions and holds a level 5 TPI rating (the highest available). While TPI notes areas for improvement, TSMC is at the coal face of global tech and is making credible progress on sustainability.

WH Group is one of the world’s largest meat and food processing companies. S&P ranked it in the top 10% for sustainability in the food industry. However, MSCI ESG and TPI have rated the company as average. We met with WH Group following the release of our 2024 Climate and Nature Report. While we welcomed their climate commitments and progress in reporting, stronger integration of sustainability and climate risk is needed. We remain cautious but encouraged by their direction.

For the first time, the Fund is also able to report on the top contributors to the Funds carbon footprint in fixed income. The following companies represent 42% of the fixed income carbon footprint. Insight into each company is included below.

The manufacturing and construction sector is a major emitter of greenhouse gases, with cement manufacturing alone responsible for c.8% of global CO 2 emissions

Cemex, one of the world’s largest cement producers, is held in both Ninety One’s Emerging Markets Multi-Asset portfolio and Brunel’s Multi-Asset Credit portfolio (our share of which is £1.1m). As of 2024, Cemex ranked first in the World Benchmarking Alliance’s Heavy Industries Benchmark , reflecting strong alignment with the lowcarbon transition. The company has 2030 goals, which include a 47% reduction in CO 2 per ton of cementitious material and 65% clean energy use, alongside a net-zero by 2050 goal. These goals are validated by the Science-Based Targets initiative under the ‘Well Below 2°C Scenario’

Cemex are already making progress, with low-carbon cement making up 63% of the company’s cement volumes and low-carbon concrete accounting for 55% of total concrete sales in 2024, ahead of their >50% target for 2025. The company has also started producing clinker, cement’s primary component (responsible for 90% of cement production emissions), using solar heat. Cemex are incorporating industrial by-products and recycled construction waste into their processes and, in Mexico City, the company processes c.25% of non-recyclable waste into fuel for its operations.

While we’re pleased with Cemex’s progress and leadership, the World Benchmarking Alliance highlights gaps in its decarbonisation strategy – particularly around emissions from purchased clinker and cement; supplier targets and reporting; and ‘just transition’ planning. While we acknowledge these concerns and will monitor Cemex’s progress, we’re by and large happy that Cemex are meaningfully working to transition to a low-carbon future.

Cleveland Cliffs is a fully integrated, end-to-end steelmaker, controlling every stage from ore mining through to steel production and downstream processing. With the steel industry being another of the highest emitting industries, contributing 7% to global CO 2 e emissions, it is important that the sector moves to reduce emissions in order for the world to transition to a low-carbon economy.

Cleveland Cliffs have already reduced Scope 1 and 2 GHG emissions by 25% (ahead of their 2030 goal) and the company aims to “reduce Scope 1, 2 and material upstream 3 emissions intensity per metric ton of crude steel to near net zero by 2050.” While Cleveland Cliffs have been conducting trials to use hydrogen to power their blast furnaces in an effort to reduce emissions, the company’s blast furnaces are currently predominantly powered by coal. Additionally, while the Transition Pathway Initiative (TPI) recognises that Cleveland Cliffs acknowledges climate change as a business risk and have largely integrated climate change concerns into operational decision making, some concerns remain. These include a lack of clarity regarding the actions necessary for the company to meet its emissions-reduction targets, insufficient evidence of support for climate policy, and a lack of detailed transition planning.

While we’re mindful of TPI’s assessment, we also acknowledge the progress that Cleveland Cliffs have made, the commitments they’ve made to becoming near net-zero by 2050, and their efforts with regards to upgrading legacy assets and exploring lower-carbon technologies. We share the view of the underlying manager, Oaktree, that the company is on the path to aligning with a low-carbon future.

As a power producer, Talen Energy is part of the sector responsible for the largest proportion of global GHG emissions. The company aims to eliminate the use of coal in their wholly owned generation facilities by the end of 2028 and aims to reduce CO 2 emissions by 75% by 2030 (against the 2010 baseline year). The company also suggests that they have invested heavily in environmental controls over the last few years.

Transparency and information sharing

Beyond Talen Energy’s commitment to reduce the use of coal and cut emissions by 75%, it is hard to see that the company has made any meaningful commitments or progress towards transitioning to a low-carbon future. c.60% of the electricity generated by the company is generated using fossil fuels, roughly a third is generated using nuclear, and less than 10% is renewable – a mix that is more heavily dependent on fossil fuels than comparable peers. Talen Energy do not appear to have a net-zero ambition, nor a meaningful decarbonisation roadmap, and are ranked 554th of 618 among utility providers by Sustainalytics in terms of sustainability – leaving them with a ‘severe’ ESG risk rating.

The underlying manager, Neuberger, believes the company is pragmatically navigating the transitional realities of the power sector, which is being incentivised by data centre customers to prioritise reliable, long-term power supply - regardless of generation source – resulting in Talen Energy purchasing two additional natural gas plants. While we acknowledge the market dynamics at play in the US, we don’t believe that Talen Energy are doing enough to align with a low-carbon future and will push for the sale of the position if no meaningful progress has been made by the time we start drafting our 2026 Climate and Nature Report.

In our 2024 Climate and Nature Report, we highlighted companies we did not believe were making reasonable progress towards net zero in line with the Fund’s investment policies, either as a fossil fuel company or in our top 10 emitters.

We understand our portfolio emissions might be higher in the short term whilst companies develop and adapt suitable transition plans, and we want to support companies in this process. However, in some instances we are not happy with the investment rationale. This may be due to insufficient transitions ratings, strategies or targets, including misalignment to our Responsible Investment Policy. In our 2024 report, we are held a cautious view with several companies. We assessed these companies against our own responsible investment policy, and we found a misalignment. Four out of the seven companies have since exited the portfolio.

Under Brunel’s Activity Based Exclusions Policy, MEG exited the portfolio due to Oil Sands Extraction, revenues were equal or greater than 25%.

our last report.

As part of our plan to divest from fossil fuels by 2030, we engage regularly with our top emitters, particularly oil and gas companies on their transition plans. We have reported Shell in our Top 10 Emitters list since 2023. While we cautiously accepted the investment rationale at the time, we committed to continue to monitor their progress. Throughout 2024, asset managers and environmental groups have expressed their concerns with Shell’s targets being insufficiently ambitious to meet the Paris Agreement goals. Shell's continued investment in oil and gas projects indicates they are not aligned to sufficient climate commitments.

We took a cautious position but were satisfied with the investment rationale, while committing to continued monitoring

Shell was found to be misaligned with Wiltshire Pension Fund's responsible investment policy

Brunel joined 26 other investors to co-file a shareholder resolution, which called for more rigourous climate targets and to cover Scope 3 emissions

Pension Fund asks Brunel to sell

Resolution supported by 20% of shareholders and did not pass

Brunel have undertaken activities on our behalf, including holding Shell to account. In 2023, Brunel joined 26 other investors to co-file a shareholder resolution, which called for more rigorous climate targets. The resolution was supported by 20% of shareholders and whilst this is still positive, it was not adopted. In our 2024 Top 10 Emitters list, Shell ranked 8th – contributing 3% to our active equity carbon footprint. We assessed Shell, alongside other top emitters, against our own Responsible Investment (RI) Policy, and found Shell to be misaligned. On this basis, taking into account the previous year of engagements and negative development with their transition pathway, we asked Brunel to sell our position in Shell. We are among 10 funds pooling with Brunel so our views and assessment against our own RI Policy may not be shared with other clients and thus, our request to sell may not be achieved.

We want to support companies that are showing a willingness to transition to a fossil free world with appropriate targets and actions. We continued to monitor Shell throughout 2024 and were disappointed to see that Shell won a legal case in a Dutch court which overturned a 2021 ruling requiring the business to cut its carbon emissions by 45% by 2030 from a 2019 base line. Yet, Shell maintains a net-zero emissions target by 2050. This case reaffirmed our concerns about Shell’s ability and commitment to transition to a low carbon economy. This strengthened our decision to reiterate the request for Brunel to sell our position in Shell.

We want to support companies that are showing a willingness to transition to a world free from fossil fuels with appropriate targets and actions.

Following the ruling, Brunel co-filed another shareholder resolution with Shell, focusing on the company’s liquefied natural gas (LNG) strategy in early 2025. The resolution called on the company to disclose how this strategy was consistent with its climate targets. We are pleased to see Brunel’s persistent engagement with Shell to enhance its transition efforts.

We believe through a strong risk-adjusted returns strategy, we can help finance the transition to a net-zero future, without compromising on returns. However, if the data and actions do not suggest a credible or genuine intent to transition, we will make a request to sell our position to align with our RI strategy and net-zero targets.

The engagement work undertaken with Shell demonstrates the Fund’s commitment to achieving its climate and responsible investment objectives and reporting transparency. Brunel’s work on behalf of the Fund supports the outcome of holding companies to account on their climate targets. This case study also highlights the challenges of working as part of an LGPS pool, which can limit the Fund’s ability to achieve its RI objectives.

The decarbonisation progress in the section above is for equities and property. We will eventually expand target setting across other asset classes, but for now data availability is a big challenge. We engage across all asset classes and make an assessment of how each of our portfolios is doing.

The following table shows our assessment of our entire strategic asset allocation against various climate criteria. This table shows that, as expected, we are making strong progress in our equity portfolios, and that there are still challenges with data availability in private markets. We are working with all our managers to drive forward improvements.

Paris Aligned Passive Equity

Global High Alpha Equity (Active)

Global Sustainable Equity (Active)

Private Equity

Emerging Markets Equity

Multi Asset Credit

Private Lending/Debt

Emerging Markets Debt

Private Infrastructure

Secured Income – Long Lease Property

Impact Affordable Housing

Property

Secured Income - Operational Renewables

Gilts

Bank loans

Climate Opportunities

Fully delivering against the Fund's climate objectives

Very good progress made towards target setting/ reporting and metrics/high-level of coverage

Strong foundations, working towards formal targets/metrics in development/ coverage improving

Signficant progress needed by way of target setting, metrics and/or coverage, but no causes for concern

Actively causing problems for the Fund's climate objectives

Not available

We made a strategic allocation to affordable housing with social impact being an integral part of the business case for investment. There are also measurable benefits from a climate perspective. Examples of these are solar panels, heat pumps, electric vehicle (EV) charging points, access to green space, and the overall ecological impact on the area, during and after construction. These features make properties more attractive to potential tenants and can result in faster lets/sales.

A key metric we use is Energy Performance Certificates (EPCs), which assess a building’s energy efficiency. These certificates assign a rating from A (very efficient) to G (inefficient). They give an estimate of the potential costs for heating and lighting the building, as well as the expected carbon dioxide emissions.

For more information about our Affordable Housing portfolio, please see our 2025 Spotlight on Social Report

To learn more about how Brunel integrate ESG into Private Debt, check out our interview with Wiltshire Pension Fund’s Daniel Smith and Brunel’s Nick Gray. Lending Insights: ESG in Private Debt interview with Nick Gray – Wiltshire Pension Fund

of the homes we are invested in are rated C or above

While our Top 10 Emitters List focuses on equities, we also assess the Fund’s fossil fuel exposure across asset classes. PineBridge, our bank loans manager, has reduced energy sector credit exposure over the past year in line with our RI policy, supporting our target to fully divest from fossil fuels by 2030. While shareholder engagement in equity markets is well understood, less is known about lender-debtor interactions in credit markets. To explore this, we spoke with PineBridge, who manages leveraged loans for Wiltshire Pension Fund, about their approach to ESG engagement with debtors.

We were keen to understand PineBridge’s engagement process and how this looks in practice. It was explained that, from a legal perspective, there are limitations to the powers that lenders have in order to bring about change to an issuer’s business practices. However, the issuer will be subject to their escalation process where they feel that the issuer isn’t meaningfully engaging with them. This means PineBridge’s Credit Committee will review and decide whether to continue engaging or reassess the investment. PineBridge also explained that they coordinate their engagement efforts across the firm for greater leverage when holding loans in multiple portfolios and will reach out to other lenders if an issue is material and the issuer isn’t responding.

Coordinate with other creditors

Issuer unresponsive

Engagement (coordinated across PineBridge)

Issuer responsive

Escalate to credit Committee

Collaborative engagement

Extend timeframe

Review whether holding is still appropriate

PineBridge focuses on engaging issuers constructively around three ESG themes: limiting global warming to 1.5°C; promoting diversity, equity, and inclusion; and addressing human rights issues. These engagements aim to manage ESG risks and enhance long-term investment value. PineBridge aims to prompt issuers with inadequate ESG disclosures to adopt and publish a formal ESG policy, improve disclosure of key ESG metrics, and complete the Loan Syndications and Trading Association’s ESG Diligence Questionnaire annually or an equivalent.

One example in the portfolio is a well-known cruise line, which was receptive to their engagement efforts. Cruise lines in general are well known for being heavily reliant on fossil fuels and producing considerable waste from their operations. PineBridge engaged with the company on some of these concerns and found management to be receptive to their engagement, with the cruise line outlining their aspiration to be “net carbon neutral by 2050, with interim goals by 2030”. The company explained that their roadmap includes fleetwide upgrades to improve fuel efficiency, investing in port/destination projects and taking delivery of Liquified Natural Gas (LNG) powered ships.

We are pleased with PineBridge’s proactive approach with regards to addressing some of the challenges with engagement and ESG data in credit markets, their alignment with the values of our members, and we look forward to hearing more about how their engagement efforts are progressing.

In 2022, we outlined our ambitious approach to achieving net-zero emissions by 2050, and in 2023 we collaborated with Ninety One to set clear targets for emissions reduction across the Emerging Market Multi-Asset (EMMA) portfolio. This strategy is comprised of equities and debt, maintaining a roughly 50:50 split and the targets included:

Net-zero emissions by 2050.

75% of equity holdings (by emissions) with science-based targets commitment (SBTi) by 2030

Engage the portfolios highest emitters, which account for 65% of total emissions.

80% of sovereign bonds to be classified as “very high alignment” or “high alignment” on the Net Zero Sovereign Index by 2030

10% exposure to sustainable investments by the end of 2023, with plans to increase to 15% and beyond.

Since then, significant progress has been made in advancing these goals, highlighting our ongoing commitment to both environmental stewardship and collaborative efforts within the investment community.

Emission-weighted SBTi Commitment rose from 14.6% to 23.0%

The portfolio now holds more companies with SBTi approved net zero commitments, aligned to a net zero target. Some of the improvement came from new holdings being introduced, and some from companies improving their targets, demonstrating real world change.

Ninety One progress engagement on the top emitters, this includes companies listed in our top 10.

Ninety One have progressed engagements with companies accounting for 65% of emissions, this includes WH Group on the theme of target setting and TSMC on aligning its emissions reductions targets with SBTi.

24.6 % of Bond investments are financing very high or high aligned projects and countries.

This includes bond investments in Kenya and Ethiopia, who along with Costa Rica are classified as the highest net zero alignment.

We are pleased with the progress being made against these targets and can see progress made on real world decarbonisation through equities and fixed income investments in the emerging markets.

Interest in Artificial Intelligence (AI) surged with the announcement of OpenAI’s ChatGPT in November 2022. While large language models had been in development for years, ChatGPT’s ease of use, conversational style, and OpenAI’s ability to position itself as a leader in the space captured the public’s imagination.

While WPF doesn’t directly hold Open AI, we do hold positions in the below:

Our exposure to AI:

Microsoft (£48.2m)

Amazon (£43.4m)

Apple (£29.6m)

Alphabet (£34.9m)

Meta (£5.7m) and Nvidia (£26.9m) all of which are either working directly with OpenAI or have made significant investments into AI

AI models and the hardware that supports them are power hungry, with an average ChatGPT query requiring ~10 times as much electricity to process as a Google search. To contextualise this, the power required to resolve a single ChatGPT query is enough to power an average LED bulb for roughly 2030 minutes Both Google and Microsoft have announced significant increases in their emissions, a notable portion of which are the result of these companies integrating AI more heavily into their products. Some researchers are concerned that the hardware that AI models are most reliant on (Graphics Processing Units) aren’t likely to be able to offer the efficiency improvements required to address AI’s increasing hunger for electricity.

It isn’t all doom and gloom though. Start-ups, researchers and industry leaders are actively working to address the issue. Some, including Intel and Analog Devices (two companies which Wiltshire Pension Fund holds positions in, valued at £631k and £1.7m respectively), are looking towards analogue computing. Unlike digital devices, analogue devices don’t just work in binaries - they work with the inbetween. Therefore, they can store more data in a given area. In another example, Google are exploring the possibility of using small nuclear reactors to generate the clean energy required to power its AI data centres. Additionally, AI may even help us to mitigate up to 10% of greenhouse gas emissions by 2030!

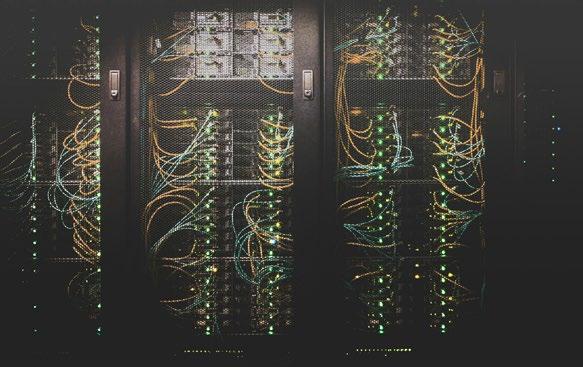

While the opportunities are huge, and it’s likely that we’ll see AI models become more energy-efficient over time as their use cases and designs become more refined. As part of our award-winning Climate Opportunities portfolio, Wiltshire Pension Fund is backing a project which is focusing on improving cooling, reducing energy use and CO2 output by up to 50% versus traditional air-cooled data centres.

Wiltshire Pension Fund holds positions in Microsoft, Amazon, Apple, Alphabet, and Meta, and so any increase in their emissions will impact the fund’s carbon footprint. We will therefore be closely monitoring their progress and, if necessary, we’ll engage with each company to ensure they’re working to reduce emissions - in line with our goal for our investment portfolios to be net zero by 2050.

As a proud signatory of the UK Stewardship Code, we believe that it is important that we engage with the companies that we own in order to maintain or enhance the value of our assets. Additionally, engaging with the companies that we invest in means that we can seek to influence their behaviour in order to bring about better environmental and social outcomes, something that our members told us was important to them and is aligned with our goal to be net zero by 2050.

These case studies show how we can have an impact on how companies are run. Companies that are well run are more likely to perform well and deliver better investment returns.

Glencore plc (£525k holding as at June 2024)

Glencore is one of the world’s largest producers and marketers of commodities, including mining of minerals and coal. It is therefore unsurprising that it features in our fossil fuel list on page 12.

2024 has continued to be testing for Glencore on the ESG front. Legal & General have announced that they will be selling Glencore from all workplace pension funds and ESG funds, due to concerns around ongoing coal production. At Glencore’s 2024 AGM, there was a vote on the company’s “2024-2026 Climate Action Transition Plan”, which was an improvement on the company’s previous plan but still did not go far enough. We therefore voted against the resolution for Glencore’s 24/26 transition plan, however the majority (90.7%) voted for the resolution.

Shell plc (£2.7m as at 30 June 2024)

In Shell’s 2024 AGM, the company’s “Energy Transition Strategy 2024” took centre stage. In the document, the company announced that by the end of 2023 they were 60% of the way toward halving Scope 1 and 2 emissions by 2030. Shell also announced that they’re expecting to invest $10-15bn into low carbon energy solutions between 2023-2025. However, there was still lack of clarity around how the company will achieve net zero by 2050, and the company’s actions in this space remain unconvincing.

Given the concerns outlined above, most of which we touched on page 20, we supported a vote against Shell’s 2024 energy transition strategy, however, the resolution was approved by 78.03% of shareholders.

Sometimes our voting and engagement doesn’t lead to the result that we would like. However, as seen in the example of Glencore, the pressure created by the process of voting can result in incremental change and improvement, leading to better outcomes for both shareholders and stakeholders.

We have allocated 7% of our Fund to climate solutions, which we are implementing through our Clops portfolio. This portfolio targets superior risk-adjusted returns (8-10%) by investing in a diversified mix of assets which have the intention to deliver real world change by actively supporting the transition to a low carbon economy. We do this by investing directly in renewable energy assets, as well as broader technologies and investments which support the adoption of renewable energy sources and/or support the delivery of decarbonisation on a meaningful scale.

In the following section of our Climate and Nature report, we explore how our Clops portfolio is helping us delivery against our Strategic Vision Goals. Through case studies and key climate metrics, we explore the real impact our investments are having.

*as at December 2024

In late 2023, we were absolutely delighted to announce that we had committed £100m to the Wessex Gardens fund, managed by Schroders Greencoat. We collaborated with 5 other LGPS funds to make this a reality, working together with Schroders Greencoat, to create a fund of £330m in total which is dedicated to accelerating the development of renewable assets across 17 sites in the South West of England. This investment enables us to earn strong returns for our members, while also supporting net zero by 2050 goal.

65,000 tcO 2 avoided

90 FTE Jobs created

171,000 MWh renewable electricity generated

63,000 homes powered

Over 747,000 PV modules

The largest single site in our portfolio - and one of the UK’s biggest - is right in our backyard, in Wroughton, Wiltshire. Naturally, we jumped at the chance to visit, gaining valuable insight into how it will generate sustainable returns for the fund.

The 88-acre site, once an airfield, now hosts 200,000 solar panels generating 60MW of power which is enough power 21,000 homes. During our visit, the sun was shining, making it perfect weather for harvesting photons. We explored the essential workings of the site, from solar panels to inverters converting DC to AC power for the national grid, we could hear the hum of the inverter fluctuate –an audible reminder of real-time energy generation.

This site operates under a 15-year fixed agreement with a global bank, supported by a 20-year UK government subsidy. These agreements provide a secure, inflation-linked source of sterling income, which is a great match for our liabilities, with the return anticipated to be around 8%. The site is 8 years old and has the potential to run for up to 40 years, as long as suitable spare parts are available and the equipment is well maintained.

During our visit we encountered deer, swifts, birds of prey and a beautiful hare. Biodiversity protection is an important consideration for these sites to protect both wildlife and infrastructure. Careful design is also needed to protect the panels and cables from damage by wildlife, mitigations such as making sure all cables are protected and buried underground are important.

The EMTD strategy is managed by Ninety-One, and we were proud to be a foundational investor in this vehicle with a commitment of £50m. Investing in and supporting emerging markets to transition is a vital part of the journey to net zero. This portfolio will also allow us to invest in private debt, i.e. lending to smaller companies, and will provide financing to companies which are currently highly emitting on their transition journey, while also diversifying our portfolio. The strategy will measure carbon avoided and reduced by the companies we have invested in, increasing the impact towards a genuine transition.

tones of carbon reduced to 2030

As of December 2024 437m tones of carbon avoided to 2030

As of December 2024

Istanbul is one of 12 non-EU cities involved in Horizon Europe, an EU mission to achieve 100 climate-neutral and smart cities by 2030. Istanbul has pledged net-zero carbon emissions by 2050 and aims to cut emissions by around 50% by 2030, and given transport is the city’s second-largest emitter (28%), it is a key focus area.

To support sustainable mobility, Istanbul secured a bullet loan at 9.25% interest, maturing in June 2029, and rated B+ by Fitch. The funds will see the purchase of 100 metro and 34 tram vehicles, reducing the transportation emissions by 1.2 million tons per year from 2025, with a total projected reduction of 25.2 million tons by 2030.

This is a great example demonstrating how the EMTD portfolio delivers real-world decarbonisation. We are excited to see how this strategy develops.

This portfolio may be small but has the potential to deliver a vast impact on global emissions through innovative new technology. The investments are higher risk, the technology is new, and we expect that a small number of the companies invested in will ultimately be successful.

Invest in companies with scalable technologies which can reduce global carbon emissions in line with the Carbon Performance Potential.

World Fund is the first venture capital and climate tech fund that Wiltshire Pension Fund have invested in. World Fund strongly resonates with Clops’ dual mandate of linking competitive financial returns with environmental impact. Their commitment to backing startups focused on developing technologies capable of decarbonising entire industries is in perfect alignment with our objectives. World Fund’s impact and investment teams ensure a startup’s technology has the potential to fit into its vision of a regenerative world - which centres around full material circularity, regenerative systems, as well as climate and social equity.

Carbon Performance Potential

>100Mt CO 2 e emissions per annum This is equivalent to the emissions of a large City

5 Key themes: Industry & Manufacturing Energy Buildings Transportation Food & Agriculture

In January 2025, Wiltshire Pension Fund visited Anaphite, a UK-based company backed by World Fund. Founded by University of Bristol students, Anaphite is pioneering a dry-coating process to decarbonise automotive EV batteries—an innovation with the potential to transform the industry.

Anaphite took part in the Faraday Battery Challenge, their aim was to drive innovation in the development of low-cost, reliable and long-range electric vehicles in the UK. Having won funding, Anaphite focused their attention on EV Batteries with the support of Science Creates, a Bristolbased incubator which provided Anaphite with the space and resources needed to start its journey.

The standard method of making electrodes is by wet-coating, which uses giant industrial ovens. Anaphite are developing a process to make a different method, dry-coating, viable for industrial scale battery makers. The dry-coating technique could cut energy cost by 30% , reduce production floor space by 15%, and lower the cost of electric vehicles. To make a well performing electrode, the dry coating needs to be a homogeneous mixture of active material, conductive additives and binders. Dry mixing these materials is very difficult at industrial scale due to numerous material-handling and processing challenges.

Anaphite’s main differentiation is the process they have developed to form a homogeneous composite material that enables their customers to produce better quality and higher performance electrodes. Their dry coating is applied to foil 12 microns thick (slightly thinner than the tin foil that you might find in your kitchen) to create the cathode.

Anaphite licenses its process to automotive companies – some of which produce 40% of the world’s cars – adapting the technology to their specific needs.

This investment demonstrates how real-world impact and competitive returns can go hand in hand – by advancing low-carbon technology, supporting UK innovation, and accelerating the global transition to sustainable transport.

There is potential for Anaphite to save 4.9MT of CO2 by 2040

Lombard Odier’s (LO) Planetary Transition mandate fulfils the listed equities allocation of our Clops portfolio. The strategy invests in companies that are driving the transition to a net zero economy through themes such as: Energy (electrification, renewable/ greener power, enabling solutions); Nature (new food systems, bio-based solutions, biodiversity, water cycle, protection of oceans); and Materials (transition to a circular economy, reduction of primary material extraction and use, more efficient processes).

To measure the effectiveness of this portfolio LO focus on the implied temperature rise of the portfolio holdings, assessing the future trajectory of emissions and assessing how well aligned they are to global warming goals. LO assess the portfolio to be aligned with a 1.8°C temperature outcome, below the Funds 2°C objective. This metric is used by the investment managers to find transition leaders, which are companies in high carbon sectors that are vital to the transition to net zero.

WPF Market Value: £345,739 as at December 2024

This Portfolio is aligned to a 1.8°C temperature outcome – in line with Wiltshire Pension Fund’s targets.

In 2023, around 60% of consumers were actively incorporating protein into their diets – a c.10% rise since 2021. This growing demand for protein presents significant environmental challenges. Agriculture already accounts for roughly 30% of global emissions, and therefore, meeting the rising protein needs with traditional animal sources could further burden the climate and environment.

Bellring Brands is a consumer product company comprised of Premier Protein, Dymatize and Powerbar – providing high-protein nutrition products including ready-to-drink shakes, protein powders, and bars.

The brands use whey protein, a by-product of cheese manufacturing which many cheese producers often discard due to a lack the resources to utilise whey. This makes Bellring’s use of it a more sustainable option that supports higher protein intake without adding agricultural strain.

Additionally, Bellring offers plant-based protein products, allowing the brand to align with the growing shift toward plant-based diets while continuing to promote the health benefits of protein.

In the health and wellness market, Bellring Brands holds a leading c.20% share of the ready-to-drink protein shake segment, positioning it strongly to meet both evolving consumer preferences and broader sustainability challenges.

£23m commitment and long-term risk-adjusted returns

In the first quarter of 2025, we committed £23m to the Forest & Climate Solutions Fund II, with Campbell Global, a J.P. Morgan Asset Management company.

The fund aims to achieve a carbon-negative outcome over its lifetime while generating commensurate long-term, risk-adjusted returns aligned with Clops’ target of 8-10%. The fund invests in and develops highquality, responsibly managed forestlands that promote biodiversity, sequester carbon, and contribute to global efforts to mitigate climate change. By ensuring sustainable forestry management, the fund also helps prevent forest fires, combat disease, and maintain healthy ecosystems.

With Campbell Global, the fund has been strategically designed to minimise supply chain emissions, while contributing to sustainable economic growth. These working forests produce renewable products such as lumber and pulp, creating living wage jobs for rural communities and supporting the transition to a more sustainable global economy.

In 2024 alone (before we were investors in the fund), the fund planted 1,131,067 trees across 3,186 acres

– the sequestered carbon potential is enormous!

Properties in the fund are managed in accordance with sustainable forestry certification standards, reflecting its commitment to best-in-class environmental stewardship. This investment further strengthens Wiltshire Pension Fund’s focus on sustainable growth while actively working towards keeping global temperature rises below 2°C, in line with the Paris Climate Agreement.

In our 2026 climate and nature report, we will be able to report how much carbon has been reduced through our investment, as well as provide case studies highlighting how and where we are invested.

Biodiversity is rapidly gaining attention as an area that investors should be considering. The World Economic Forum’s Risk Report 2025 puts “Biodiversity loss and ecosystem collapse” as the 2nd biggest economic risk facing the world over the next 10 years. The UN has published a report into this area, entitled “Stepping up on Biodiversity, what the Kunming-Montreal Global Biodiversity Framework means for responsible investors”. Our net zero by 2050 target and wider investment beliefs mean that this is an area where we need to take action. In order to identify key areas, we focus on investments in sectors which are particularly impacted, as well as looking at the key drivers of biodiversity loss, as defined by IPBES (the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services). These are as follows:

To illustrate how these drivers manifest in the companies that we’re invested in, we’ve identified specific examples across each category.

Invasive species

Land and sea use change

BASF, which we’re invested in via Brunel’s passive Paris Aligned portfolio is one of the world’s largest chemical producers. It is well known for its crop protection and pest control products. The company has made a number of commitments to biodiversity and conservation, including implementing measures at their own sites to protect biodiversity. For example, at BASF’s former Rensselaer production site in New York, a herd of goats were hired to graze and clear the site of invasive species. This not only prevented the regrowth of invasives but also fertilised the land through the goats’ natural waste – offering a sustainable alternative to traditional chemical treatments.

We have £625.5k invested in Enel, an Italian producer and distributor of electricity and gas, through our passive Paris Aligned portfolio with Brunel. The company came under fire in early 2025 following accusations of “‘land-grabbing’ for wind projects in Brazil”. While Enel wasn’t directly involved, it is understood that the company relied on developers who used aggressive tactics to secure contracts with local landowners to acquire occupied public land. These developers then leased the land to companies like Enel for renewable energy projects. While Enel explained that it complied with all relevant legal and environmental requirements and doesn’t purchase land in Brazil, the company has faced criticism for outsourcing contentious land acquisition practices. This example illustrates the importance of robust governance, especially as we accelerate the transition to clean energy.

Pollution Tesla, despite its central role in the transition to a low-carbon future, illustrates how poor environmental management can undermine sustainability goals. We have £40.2m invested in Tesla across two portfolios with Brunel, as well as Lombard Odier’s Planetary Transition portfolio. In 2024, it was reported that Tesla had racked up over 100 violations for releasing toxic emissions from its paint shop operations in California. This followed earlier violations by Tesla in 2022 in Texas, where Tesla was accused of not treating wastewater properly before discharging it into sewers and not closing the door of the furnace used to make car parts – resulting in higher fuel consumption and emissions.

Natural resource exploitation Glencore, the Anglo-Swiss commodity trading and mining company (which we have £459k invested in via Brunel’s Global High Alpha portfolio), has been accused of natural resource exploitation as it extracted vast mineral wealth from the Democratic Republic of Congo (DRC) under conditions that involved corruption , human rights abuses, and economic injustice. The minerals in question are copper and cobalt, both of which are used in the production of rechargeable batteries. A global supply glut, driven by over extraction of cobalt, drove prices down to nine-year lows, prompting the DRC to ban exports as tax revenues came under pressure

These examples highlight the real risks and controversies that can arise when biodiversity loss drivers are overlooked. We’ll continue to monitor the companies mentioned and raise any ongoing concerns with the relevant managers. At the same time, we’re also allocating capital to initiatives working to address these challenges – such as the Campbell Global Forest and Climate Solutions Fund and World Fund, both of which are part of our Climate Opportunities portfolio.

The Fund’s approach to nature aligns with emerging frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD) and seeks to progressively improve transparency and data quality over time. We use data and analysis provided by our consultant, Redington, as well as tools including FAIRR, Nature Action 100 and ForestIQ.

We approach Biodiversity risk in the following ways:

• Making use of new reporting tools and company assessments to understand the risks we are exposed to.

• Working with our managers to understand these risks and their impact on the investments.

• Our strategic allocation to climate opportunities contains a specific allocation to nature related investments. Providing the opportunity to earn competitive financial returns whilst also delivering positive impacts to nature.

Nature Action 100 (NA100) is a global investorled engagement initiative that aims to support greater corporate ambition and action on reversing nature and biodiversity loss to mitigate financial risk and to protect the longterm economic interests of investors’ clients and beneficiaries.

Investors participating in the initiative engage companies in key sectors deemed systemically important in reversing nature and biodiversity loss by 2030.

• We are focusing on the high impact sectors of agriculture, food and drink and construction.

• Our stewardship efforts will focus on the 5 main drivers of biodiversity loss

We analysed our holdings as at 31 December 2024 to identify our exposure to equity holdings in high-impact sectors (agriculture, food & drink, and construction). Our total exposure to high-impact sectors amounted to £55m (just over 4% of our total equity holdings), across 95 companies! Most of this was in the food & drink sectors (c.68% of £37m)

As the name suggests they have identified 100 large companies across key sectors which have significant impacts on nature and are heavily dependent on ecosystem services to function. It does not necessarily mean these companies are having the greatest negative impact on Nature.

Biotechnology and pharmaceuticals; chemicals; household and personal goods; consumer goods retail; food; food and beverage retail; forestry and paper; and metals and mining.

The Nature Action 100 Company Benchmark measures the 100 companies’ progress towards the protection and restoration of ecosystems. The initial work shows that most companies are still in the early stages of addressing their nature-related impacts and dependencies.

Of the 100 Nature Action companies, WPF has investments in 49. This exposure is 10% of the Funds equities holdings.

The scale of Amazon’s operations has impacts on ocean and waterways pollution, recyclability issues for packaging, global demand for products drives deforestation and resource extraction.

Zoetis – Pharmaceuticals for Animal Agriculture

Risks that pharmaceuticals provided for agricultural purposes could have on the natural environment.

TJX Cos Inc – Consumer retail (includes TK Max brand)

The company has an impact on nature through its global supply chains. The fashion industry is the second-largest consumer industry of water, and dyeing processes can lead to pollution of water sources.

Synthetic fibres used in clothing are a significant source of micro-plastics pollution in the environment.

Nature Action 100 is a new tool we can use to scrutinise our investments. Many companies are at the start of their journey in understanding and disclosing their nature related risks, dependencies and impacts. We will use this tool to monitor progress our top holdings make against the NA100 benchmark and to inform engagement with managers on nature related issues.

WPF participates in the Local Authority Pension Fund Forum (LAPFF) who undertake collective engagement work with companies on behalf of the LGPS.

NA100 published a benchmark assessment of large companies in sectors which have a material impact on Nature. LAPFF are part of the investor group in NA100 who engage with Procter and Gamble (P&G). This company designs, manufactures and sells a wide range of consumer goods in beauty, grooming, and healthcare.

The company has an impact on nature through, the use of palm oil in products, wood pulp for packaging, and through the use of water during production.

At the engagement meeting, P&G provided an update on progress being made in improving disclosures on nature and biodiversity. They have made commitments to align with international standards on nature impact reporting and ongoing work on water stress assessments. On deforestation, P&G outlined its approach, which includes third-party certification, satellite monitoring covering 98% of its palm oil supply, and a grievance mechanism for non-compliance.

WPF will continue to track the engagement being undertaken on our behalf, and will follow how these progress beyond the initial stage of understanding how companies approach nature risk.

Constellation Brands: (£1.7m holding as at September 2024

Constellation Brands is an American producer and marketer of alcoholic beverages. Some of their brands include, Corona, Casa Nobel Tequila, and Modelo.

As one of the largest companies in the sector, Constellation Brands is exposed to water scarcity related risks, with the CDP outlining that the company sources all of its hops and 68% of its grapes from areas of high water stress. In order to manage this risk and protect shareholder value, the Greater Manchester Pension Fund filed a shareholder resolution calling for Constellation Brands to “set quantitative, timebound targets to reduce water use across its supply chain, especially in water-stressed areas” –in line with peers such as PepsiCo and Diageo.

We voted in favour of this resolution, however the majority (~65%) of shareholders voted against the resolution. This was in line with the recommendation of the board of directors of Constellation Brands, who feel that issuing such a report on managing these risks would be an “unnecessary use of the company’s funds [...] particularly considering the actions the company is already taking”

Given that, according to UNICEF, some predictions suggest that half of the world’s population could be living in areas facing water scarcity by 2025, and given how reliant Constellation Brands’ success is on clean water, we are disappointed that the majority of shareholders voted against the resolution calling for improved water management targets and reporting. However, we will continue to monitor their progress in this area to ensure they’re protecting the environment and shareholder value.

At Pensions for Purpose’s 2024 Annual Symposium & Awards, Wiltshire Pension Fund won BEST BIODIVERSITY STATEMENT!

Our submission for the winning award was our Biodiversity Statement, contained within our 2024 Climate and Nature Report!

The judges said:

“The report effectively explains their climate change management, with clear, concise insights and good presentation of their net-zero journey and future goals. It highlights their carbon footprint analysis, justifying the majority comes from their EM portfolio and detailing their engagement with top emitters. They advocate for divestment from companies with weak commitments and emphasize that carbon credits should not replace internal efforts.”

We were also thrilled to receive Highly Commended Certificates for:

• BEST CLIMATE CHANGE POLICY

• BEST PLACE-BASED IMPACT for our 2024 Affordable Housing Impact Report

At the 2024 Local Government Chronicle Investment Awards, we were recognised with the Investment Innovation Award for our Clops portfolio.

As this report has shown, our Clops portfolio has the objective to earn superior risk-adjusted returns by investing in a diversified mix of assets which have the intention to deliver real world change by actively supporting the transition to a low carbon economy.

To meet the full reporting requirements of the Task Force on Climate-related Financial Disclosures (TCFD)2 , this section includes some further details on how Wiltshire Pension Fund carries out the identification, analysis and management of climate related risks. It is reported under the four themes of: governance, strategy, risk management, metrics and targets, highlighting items not covered earlier in the report. We have also included some information on our management of biodiversity and nature risks, in preparation for more detailed reporting on these areas in due course.

Responsibility for the Fund’s investment and responsible investment strategies sit with the Wiltshire Pension Fund Committee, our decision-making body, who are supported by the Local Pension Board in terms of ensuring compliance, and by professional advisors. The investment strategy and responsible investment policy are the two key documents which

Short to medium term

Longer term

Short to medium term

Cost of investing in new technology and policy risks during the transition from high to lower carbon.

Availability of natural resources and the impact of natural catastrophes.

set out how the Fund responds to the risks of climate change and biodiversity loss and to identify investment opportunities presented by the transition. Committee members receive suitable training on climate related risks and scenario modelling to inform the approval of the strategies. All decisions are made in line with the Committee’s fiduciary duty.

Day-to-day responsibility for management and implementation of the Fund’s strategies in relation to climate and nature risk is delegated to officers, who work with advisors and industry initiatives. WPF has a fully integrated approach to responsible investment, which includes how the Fund manages climate and nature risk and opportunities.

Overall, we wish to avoid the risk of the assets in which we invest not being prepared to adapt to the challenging landscape of the future.

Allocating to sustainable active equities and Parisaligned passive equities.

Building an innovative portfolio with a goal to earn superior risk-adjusted returns by investing in a diversified mix of assets which have the intention to deliver real world change by actively supporting the transition to a low carbon economy

Longer term

Regulatory change, supply chain disruption, reputational damage and increased operational costs.

Ecosystem collapse, resource scarcity and climate change acceleration

Investment in companies that are able to adopt the principals of circularity to achieve resource efficiency and make operational savings

Dedicated allocation to nature-positive investment solutions, backed by a solid business case, such as regenerative agriculture and sustainable forestry

2 The Task Force on Climate-related Financial Disclosures (TCFD) provides a framework for reporting climate-related risks and opportunities. This report follows the TCFD’s recommended disclosures across governance, strategy, risk management, and metrics & targets.

Acknowledging and quantifying the materiality of climate risk to WPF has had a huge impact on how we work. We have developed clear decarbonisation pathways, expanded our work across as many asset classes as possible, and made changes to our strategy to ensure that climate risk is managed and our returns are protected, whilst identifying compelling new investment opportunities. We have refined our approach to engagement and how we hold our managers to account, focussed on high-impact sectors and holdings, and worked to embed a comprehensive and fully integrated approach to managing the risks and taking advantage of the opportunities of transition to a low carbon economy. We plan to work to quantify the materiality of nature risk in the near future. In the shortterm, we have been able to identify high-impact sectors and tailor our engagement accordingly.

In order to properly assess the potential financial implications of the risk, and to help identify ways to mitigate the risks and take advantage of opportunities, we commissioned scenario modelling from the Fund’s investment consultants and the Fund’s actuary. The modelling which we conducted in 2020 indicated that a more sustainable strategy would be more resilient under all warming scenarios (2, 3 and 4 degrees C).