INTRODUCTION

Here at Wiltshire Pension Fund (WPF) our primary goal is to earn sufficient returns to pay pensions as they fall due and support employers by keeping their contribution rates as stable and affordable as possible. We strongly believe that responsible investment is instrumental in achieving this, by protecting the fund’s assets, earning strong risk-adjusted returns, and ensuring a sustainable future for our stakeholders – which is why responsible investment is embedded in our values and strategic goals.

LONG TERM THINKING

We always act with the long term in mind, whether we are setting our investment strategy, planning improvements, or working towards our net zero by 2050 goal.

Positive impact

Responsible ownership and stewardship

Strong, risk-adjusted returns

Safeguard the assets

This report is one of three reports which focus separately on environmental (Climate and Nature Report), social, and governance (Stewardship Report) factors. This report incorporates the impact reporting for the Fund’s affordable housing portfolio, a portfolio with a social theme.

The social factors we’ll focus on in this report are outlined below, alongside an explanation as to why we feel that these issues are so important.

The UK suffers from an imbalance of the supply and demand of affordable housing. This provides us with an opportunity to address the issue while achieving inflation-linked returns.

Diverse workforces have been linked to a number of positive outcomes and matters to us in terms of how we run our operations.

Promoting education results in a more skilled workforce and a more resilient economy. This includes professional training and re-skilling, which are essential for adapting to modern industry and the transition to a low-carbon economy.

Health is a wide-ranging theme encompassing worker health, consumer health and community health. The importance of good health in a productive economy is clearly linked to our investment portfolios.

Technological advancements, including Artificial Intelligence (AI), create opportunities but also risks, such as workforce disruption and cybersecurity threats. Understanding these changes is key to managing long-term social and economic impacts.

Poorly managed labour practices can introduce risks of industrial action, human rights abuses, and reputational damage – all of which are risks to our investments.

AFFORDABLE HOUSING IMPACT REPORT

WHAT IS IMPACT INVESTMENT?

These are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.

As defined by the Global Impact Investment Network (GIIN)

WHAT IS AFFORDABLE HOUSING?

There is no one universal definition for affordable housing, but in broad terms it refers to housing where the rent or cost is at least 20% lower than market rat e.

The imbalance between the demand for and supply of housing in the UK has resulted in house prices and rents climbing, with 30% of adults who pay rent or mortgage payments saying that they find it difficult to afford those payments and a similar proportion of adults struggling to afford their energy bills. To further drive the point, in 2000 the average house price in England was 4.19 times the average salary; by 2024 that figure had increased by 84%, with the average house price being 7.7 times the average salary in England. The need for genuinely affordable housing, defined as homes sold or let at a 20% discount versus local market prices, is clear and provides WPF with an opportunity to make investments which generate positive, measurable social and environmental impact while also earning strong risk-adjusted returns for our members.

HOW IS WILTSHIRE PENSION FUND INVESTING WITH IMPACT?

WPF has committed to investing 5% (£172m) of the fund into affordable housing. In late 2024, we announced the selection of the fourth manager, Octopus Investments, to make up our affordable housing portfolio. Alongside our existing managers (Man Group, Gresham House, and CBRE), Octopus provides further diversification – reducing our reliance on any one manager or investment style.

Our portfolio is well diversified across type of affordable housing, geographical locations, and situations; there is no concentration in areas of highest relative unaffordability (i.e. South East England) nor to urban areas (projects include a mix of developments in rural villages, town and fringe as well as those in cities).

An arrangement which allows residents to buy a 10–75% share in a property and pay discounted rent on the remainder.

A development with multiple types of housing, including market rate, which is intended to promote social cohesion. £30m

For those in receipt of housing benefit and those on low- to medianincomes, who've been priced out of market rents in areas where they work and live.

Provides safe and stable accommodation with tailored support to help vulnerable individuals maintain independence and improve their quality of life.

HOW’RE WE MEASURING UP?

As an impact portfolio, it is important that we ensure that we’re using objective metrics to assess the positive environmental and social impact that our Affordable Housing portfolio is having. We’ve worked with our investment managers to collate the following metrics across our affordable housing portfolio1:

5,129 HOMES

Of the 5,129 homes in this portfolio, 85% are new builds

This shows that this portfolio is helping to address the supply and demand imbalance in the UK for affordable homes by increasing the supply of affordable homes. Wiltshire’s share of these homes is c.11%.

This demonstrates that the homes being offered are genuinely affordable and so residents are able to keep up with payments. 0%

0% DEFAULT RATE

Default rates sit at 0% across the portfolio

27% MORE AFFORDABLE

The homes in our portfolio are offered at a 27% discount versus the going market rate in those areas2

This means the that houses we’re funding are being offered at a greater discount than the minimum threshold (20%) – delivering genuinely affordable housing.

88% ENERGY PERFORMANCE B-RATED OR ABOVE

88% of homes in our Affordable Housing portfolio have energy performance certificates (EPCs) rated at B or above and 98% are rated C or above

This means that the homes being offered are efficient and cheap to run.

94% OF HOMES ARE MORE AFFORDABLE

94% of the homes being offered through this portfolio are affordable

This shows that the money we’ve committed to this portfolio is creating social impact, helping to address housing affordability and improve access to quality homes for those in need.

9.7 AVERAGE AFFORDABILITY RATIO

The weighted average affordability ratio of the local authority districts that that the developments held in this portfolio sit within is 9.7, higher than the national average (7.7).

This means that we’re creating homes in areas where affordability is most challenging for local residents.

Most of the developments managed by the three funds which we’ve held in the portfolio for the longest (i.e. CBRE, Gresham House, and Man GPM CoHo I) are well into the building phase, with several homes being completed and residents already moving in. As these developments progress, we expect to see returns stabilise and, in some cases, we expect to start to see income being distributed to investors. This means that our holdings in these funds will gradually get smaller as income and capital is distributed to us as the funds mature. To ensure that our Affordable Housing portfolio remains within our strategic asset allocation, we have committed £30 the Octopus Affordable Housing fund and we expect to make further commitments in the near future.

1 These metrics include data from CBRE, Gresham House, and Man GPM RI Community Housing I. Octopus and Man GPM RI Community Housing III haven’t been included, since these are new additions to the portfolio.

2 Weighted average based on data provided by CBRE, Gresham House and Man GPM.

SUPPORTING LOCAL COMMUNITIES

LOCAL AFFORDABLE HOUSING: CHIPPENHAM

On a sunny day in March, we spent the day looking around a busy building site in Chippenham, where we met up with representatives from Vistry (the developer), Thriving Investments, and Gresham House – the latter two of which run the Residential Secure Income (ReSI), which aims to deliver affordable housing throughout the UK.

The site is being developed on a brownfield site near Chippenham’s train station, providing residents with fantastic transport links to Bristol, Bath, Swindon and London. The local authority and Vistry have worked to set a new standard with this development, offering high quality, energy efficient homes which will be delivered to EPC A energy efficiency standards. The developer is also holding itself to a higher standard, with occupied homes on the perimeter of the site, Vistry are taking steps to reduce the impact of the development on their neighbours. Neighbours that include a nearby badger sett, which the team are working to carefully relocate. Although this did delay the start of the development, investment return is still materially in line with the target and plenty of headroom was built into the programme, preventing delays from impacting the final practical completion date too heavily.

UK COMMUNITY HOUSING: WANTAGE

In November 2024 some of the Wiltshire Pension Fund (WPF) Team went to Wantage to visit a development which we’re invested in via Man Group’s Community Housing Fund, which is part of WPF’s affordable housing portfolio. Man Group have funded 108 homes that sit on this site, which was formerly a WWII airfield.

All the homes funded by Man Group in this development are being offered on affordable or shared ownership tenures, in an area where new affordable housing supply has not been delivered since c.2020. These homes increase the supply of local affordable homes above the threshold required by planning authorisationhelping to address local demand in an area where population growth is expected to increase. The wider development is also delivering two primary schools, one secondary school, green spaces, play parks, allotments, a sports centre and more, building and supporting the local community.

2,975 (53%) AFFORDABLE OR REGULATED RENTAL HOUSES

2,588 (46%)

SHARED OWNERSHIP HOMES

IN LINE WITH OUR POSITIVE IMPACT GOAL

EDUCATION

Education is one of our stewardship priorities and is an area where our Committee believe there is a strong investment case, as education contributes towards a skilled workforce and better economic outcomes. Education as a theme applies to all companies, in the form of training and development, as well as investments directly in companies that provide education services. In the following case studies, we highlight some exceptional organisations which are inspiring people to cross-skill, up-skill, and learn.

CATAPULTING INNOVATION

On a crisp autumn morning in 2024, we visited Stevenage to meet representatives from UBS’ UK Life Sciences Fund, part of Brunel’s UK Property portfolio which we’re invested in. The fund finances specialised workspaces, such as labs and manufacturing facilities. One such facility is the cell and gene therapy Catapult, an incubator established by Innovate UK committed to advancing cell and gene therapies.

The Catapult incubator not only provides workspace to fledgling businesses, but has also established apprenticeships, training programmes, and learning materials “ to guide, upskill and cross-skill people throughout the UK .” In order to ensure that the training and development opportunities that they offer are relevant, Catapult send out a biannual ‘Skills Demand Survey’ to the industry – supporting organisations in planning for expanding manufacturing. Catapult also coordinated the Advanced Therapy Community (ATAC) and the Advanced Therapy Skills Training Network (ATSTN), providing in-person and online training as well as connecting employers with individuals who’re interested in upskilling and training via apprenticeships.

REACHING NEW HEIGHTS

In December 2024, we visited Space Forge (which is held by World Fund in our award-winning Climate Opportunities portfolio), an innovative UK-based aerospace and satellite company specialising in low-impact landings and space manufacturing. Space Forge is the only company in the UK with the ability to produce gallium nitride and silicon carbide and is therefore of strategic importance. As a result, it is vital that the company helps forge the next generation of engineers and scientists to ensure that the UK is able to continue pushing towards the bleeding edge.

For this reason, Space Forge work with Swansea University to offer apprenticeship schemes and PhD programmes. They’ve also attended talks at the university, hoping to foster conversation and inspire would-be engineers and scientists. Additionally, having been awarded almost £8m from the Space Clusters Infrastructure Fund, they’re also taking the lead in establishing a “ first-of-its-kind National Microgravity Research Centre – driving advanced material research and production”.

LEARNING AND DEVELOPMENT AT WPF

As well as education being a stewardship priority within our investments, we believe that it’s equally important that we invest in learning and development internally – both in order to upskill local talent and to support existing colleagues in further developing their skills.

Jack and Joe, two accounting apprentices from the local area, say that the apprenticeship scheme at Wiltshire Pension Fund “has been a fantastic opportunity for both professional and personal growth.” Both Jack and Joe are progressing through their Association of Accounting Technicians (AAT) exams, supported by those in the team who’re AAT qualified. Joe explains that the support he’s had both in terms of his exams and from the WPF team as a whole has kickstarted his career and helped him score a distinction in his “AAT Level 2 Bookkeeping exams”, with Jack adding that “the hands-on experience has significantly enhanced my understanding of accounting in a real-world setting.”

At Wiltshire Pension Fund we aim to support colleagues in their professional development, this can take the form of professional qualifications or can be as simple as shadowing a colleague for a few hours, helping to bridge the gap between teams. Becky and Mollie, who’re both Employer Support Officers, took the opportunity to study for the Award in Pensions Essentials (APE) qualification. Becky explained that the fund supported her by “offering one full study day as well as the exam day”, as well as by paying for both the study materials and the exam. Mollie went on to explain the impact that the qualification has had on her work and personal development: “It has equipped me with essential skills and insights that have not only improved my performance but also contributed to my growth and confidence in both my role and career within the fund.”

We’re pleased to hear of the positive impact that both the apprenticeship scheme and the professional qualifications that are on offer are having. Investing in learning and development is key to strengthening the fund and ensuring its long-term success, just as it is in the wider economy – that is why “Grow-Your-Own” is one of our core resourcing principles and we were glad to hear that 90% of colleagues felt that WPF provides the learning and development opportunities that they need.

LONG TERM THINKING

We always act with the long term in mind, whether we are setting our investment strategy, planning improvements, or working towards our net zero by 2050 goal.

Responsible ownership and stewardship

Strong, riskadjusted returns

Positive impact

HIGH PERFORMING TEAMS

We aspire to be role models and leaders, through our commitment to develop knowledge and training.

Employers are advocates for the scheme

HEALTH

It almost goes without saying that health is intrinsically linked to productivity, unemployment levels, and economic prosperity. As responsible investors with a long-term view, we believe that investing in health and focusing on health outcomes is of the utmost importance and so in this section we’ll take a look at some of the companies that WPF holds and what they’re doing to improve health (or what more we feel they could be doing).

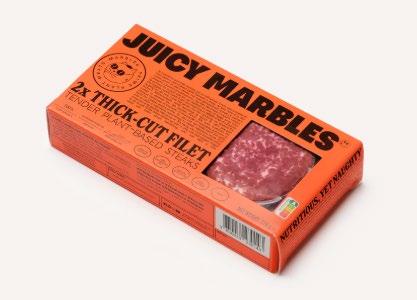

JUICY ALTERNATIVES

With over 2,000 companies fighting to be the industry leader, there’s no shortage of competition in the alternative protein market. However, Juicy Marbles’ – which is held by World Fund, forming part of our award winning Climate Opportunities portfolio – offering stands out from the crowd. Their thick-cut fillet steak, whole-cut loin, and baby ribs (all of which are plant-based), seek to emulate the mouthfeel, taste, and nutritional profile of traditional beef products. Juicy Marbles’ products have earned a Nutri-Score (a nutritional rating system endorsed by the European Commission) of A, and the ingredients lists for both their whole-cut loin and their thick-cut filet are reassuringly comprehensible – featuring only 7 ingredients (excluding water). As well as being a healthy alternative to meat, their product also helps to reduce greenhouse gas emissions by providing whole-cut alternatives to traditional beef products, which are resource intensive and drivers of deforestation.

SUPPORTING INNOVATION IN LIFE SCIENCES

As part of our visit to Stevenage in autumn of 2024, we met with representatives from UBS’ UK Life Sciences Fund, part of Brunel’s UK Property portfolio which we’re invested in. The fund finances specialised workspaces, such as labs and manufacturing facilities, providing life science businesses with the specialised workspaces required to flourish and develop treatments with the potential to improve length and quality of life.

One of the fascinating sites that we visited on the day was the offices of Autolus, a company whose focus is creating personalised treatments for cancer and autoimmune diseases. They do so by taking patients' blood and programming their T cells to recognise and kill cancer cells. So far, their treatments are indicated to be ~90% successful with little to no side effects. A stellar example of some of the groundbreaking UK innovation being supported by LGPS investments.

YOU ARE WHAT YOU EAT

We chose to start working with Lombard Odier in 2024 because of their scientific approach and the Planetary Transition Fund’s commitment to investing in a sustainable future, including a focus on the interplay between health and food.

One example of this approach is the fund’s holding in Yakult Honsha (WPF holding £1.5m), the world-renowned probiotic milk company. Yakult promotes gut health and wellbeing, benefitting from the public’s shift in focus to preventative care. The company has successfully expanded into global markets, offering plant-based, lower-calorie, and reduced sugar options. Another example is the fund’s holding in Abbott Laboratories (WPF holding £2.9m), a company who specialises in nutrition, medical devices, and pharmaceuticals. Abbott’s medical devices help individuals, such as those with diabetes, better understand their body’s response to different foods and create more refined meal plans. The company also produces nutrition products for adults and children with specialised needs, further supporting health and wellbeing.

SHAREACTION FOR HEATHIER PROFITS

At Nestlé’s (WPF holding £7.6m) 2024 AGM, ShareAction proposed a shareholder resolution urging the company to set targets for increasing sales of healthier products.

ShareAction highlighted that “more than 50% of Nestlé’s sales do not meet the Health Star Rating (HSR) healthier threshold”, citing growing public health policies and consumer demand as the inspiration for the resolution. Nestlé disputed these figures, claiming that ~60% of their (non-PetCare) sales come from more nutritious or specialised nutrition products and pointing toward their “Good for You strategy”, which they say encourages balanced consumption. However, ShareAction argue that Nestlé’s definition of nutritious includes products not considered healthy under HRS guidelines. Ultimately, 88% of shareholders voted against the resolution. We were disappointed by this outcome and would like to see Nestlé improve their reporting in this area while increasing the proportion of sales from heathier products. We will continue monitoring Nestlé’s progress in both areas.

These case studies highlight some of the important work that is being done, and needs to be done, to improve health outcomes. A healthier society results in a more resilient economy which can grow sustainably. With increasing government intervention on matters of health and rising engagement among the public, it’s important to back companies which help us improve life quality and longevity. As signatories to the UK Stewardship Code, WPF is also dedicated to protecting the long-term value of our assets by engaging with companies which fall short of our expectations.

LONG TERM THINKING

We always act with the long term in mind, whether we are setting our investment strategy, planning improvements, or working towards our net zero by 2050 goal. Responsible ownership and stewardship

Positive impact

EQUALITY, DIVERSITY AND INCLUSION (EDI)

In its purest form, EDI is focused on ensuring that everyone is given equal opportunity and helping us better understand each other and our differences. A more diverse and inclusive workforce and society, where everyone is given equal opportunity and individual experiences are valued, fosters innovation and results in better outcomes for everyone. In this section we’ll look at EDI at Wiltshire Pension Fund and we’ll look at two shareholder proposals that were raised regarding EDI in companies that we’re invested in.

AN UNSUSTAINABLE CULTURE

Over the last decade, Tesla (which WPF has a holding worth ~£27.5m in) has faced several complaints regarding workplace culture and worker mistreatment, leading to settlements for sexual harassment and racial discrimination. This led Thomas DiNapoli, trustee of the New York State Common Retirement Fund, to propose an annual report on Tesla’s anti-harassment and discrimination efforts at the company’s 2024 AGM. Despite Tesla’s “zero-tolerance policy”, it opposed the proposal

While the majority voted against DiNapoli’s proposal, we were pleased that ~32% of shareholders backed the proposal, putting pressure on Tesla to do more. We’ll be keeping an eye on developments to see if any further reports emerge and, if necessary, we’ll be working with our pool and investment managers to ensure that these concerns are being addressed.

TRUMP AND COSTCO

Within Donald Trump’s first day in office, he issued executive orders which sought to dismantle EDI programmes, reversing Joe Biden’s efforts and banning EDI initiatives in the federal government. He also directed the attorney general to investigate measures to encourage the private sector to end EDI initiatives too.

Shortly thereafter, Costco Wholesale (in which WPF holds a £950k stake in) held its AGM, where a conservative think tank proposed a report on the risks of Costco’s EDI initiatives. The proposal was overwhelmingly rejected (>98%), in line with Costco’s recommendation – a recommendation that we were pleased to see on the basis that it wouldn’t represent good value for shareholders. It’ll be interesting to see how thinking around EDI initiatives evolves during Trump’s administration and what change he’ll affect. We’ll be paying close attention to this matter, in the hope that a balanced approach prevails.

EDI AT WPF

We pride ourselves on creating an inclusive culture at Wiltshire Pension Fund, where diversity is championed, and everyone is afforded the same opportunities and treated as equal. Below are some examples of us putting our values into practice.

CONNECTING WITH OUR MEMBERS

Being inclusive means understanding our ~90,000 members and tailoring our communications and solutions to meet their needs and align with their values. This commitment is reflected in both the investments we hold and the ways we connect with our members.

For instance, in our Responsible Investment Survey, 74% of our members highlighted the importance of climate change, with members believing that it presents a financial risk to the pension fund’s investments and feeling that it is important that we invest in sustainable and low-carbon assets. This has given us the confidence to continue to pursue our net zero by 2050 goal and invest in things like the Campbell Global Forest & Climate Solutions fund.

Another example of our efforts to connect meaningfully with members was Pensions Awareness Week ’. Our Communications & Customer Service Engagement Team designed an inclusive campaign that considered a diverse range of needs and perspectives. For those who prefer face-to-face interactions, we arranged in-person drop-ins. Webinars catered to members at different stages in their financial lives, while busy individuals appreciated our concise and informative factsheets with infographics highlighting key points.

AN AWARD-WINNING APPROACH

At the 2024 LAPF Awards, we won the award for Diversity and Inclusion, which recognised how deeply embedded EDI is into our culture. Colleagues have all attended training on ‘Creating an inclusive workplace’; staff surveys show that colleagues feel part of a team and feel that teams collaborate well, with 90% of staff agreeing that WPF actively promotes an inclusive culture; and our Communications & Customer Service Engagement Team ensure that their campaigns are inclusive –celebrating EDI in our communications as well as ensuring that the campaigns themselves are accessible.

Award

Winning Teams

90% of staff agree WPF actively promotes an inclusive culture

Inclusive Communications

Training and Development

Despite EDI initiatives becoming a topic of political debate, Wiltshire Pension Fund remains dedicated to championing equity, diversity and inclusion. We believe that fostering a collaborative workplace culture, combating discrimination, and creating inclusive communication campaigns to better understand our members and help them engage with their pensions are essential to the fund’s success and our members’ financial wellbeing.

CREATIVE DESTRUCTION, EQUITABLE OUTCOMES, AND AI

Since the announcement of OpenAI's ChatGPT in late 2022, interest in artificial intelligence (AI) has surged. Goldman Sachs suggests that investment into AI could reach $200 billion this year, with the touted benefits ranging from helping us achieve a more precise understanding of dark energy to helping us mitigate up to 10% of greenhouse gas emissions. While it is exciting to see where AI might take us, its impact on our daily lives is already noticeable. Companies like Salesforce (which WPF has a £9.5m holding in) offer AI products which help cut costs and boost productivity. Salesforce reports that one company saves $230k annually by using their AI-powered agents to help customers resolve common issues on their own, allowing representatives to focus on more complex cases. Salesforce’s products, such as Data Cloud and Agentforce, also integrate with each other and third-party systems to predict customers’ needs, driving sales and delivering an improved experience for customers. UnitedHealth Group (which WPF has a £14.3m holding in) touts similar AI-driven efficiencies, using AI and machine learning (ML) to simplify administration, build new data science platforms, and provide insights to help medical professionals excel

However, these advancements bring with them their own issues. UnitedHealth have faced criticism following claims that they “knowingly used a faulty artificial intelligence algorithm to deny elderly patients coverage for extended care deemed necessary by their doctors.” While the lawsuit is still ongoing (as at the time of writing) and UnitedHealth have denied accusations that AI is being used to make coverage decisions, this still raises an important issue: how appropriate is it that AI is used to make such impactful decisions, and how much oversight is there of decisions made by, or made using information from, AI algorithms? In the case of Salesforce, and other companies offering similar AI-enabled products, some are concerned about the impact of AI on the labour market and the disproportionate impact that it might have on those in lower paying jobs

Following increasing public pressure, UnitedHealth Group agreed to produce a report outlining “the ethical guidelines, governance structures, guardrails, limits, complaints and review mechanisms that surround its use of AI.” While lacking finer detail, the report does provide some clarity and reassurance with regards to privacy, transparency, and oversight. It also reiterates that AI/ML solutions won’t replace clinical judgements and explains that they assess the performance of their solutions so that they can address any potential bias and “disparate impact on vulnerable groups”. In the case of products like those offered by Salesforce, the Tony Blair Institute for Global Change suggests that AI is expected to generate some job losses, however it is “also likely to create new demand for labour by boosting economic growth and speeding the development of new products and services that create entirely new jobs.” This follows similar patterns of ‘creative destruction’ seen throughout history, whereby new innovations dismantle existing processes in order to make way for improved methods which create new industries and opportunities.

TECH AND EDI

Why should we care about EDI in tech?

The topic of EDI in the tech sector is not new. Wired describe a video that went viral in 2009 showing an HP webcam, which was designed to track people’s faces as they moved, following the face of a white worker but struggling to follow the face of her black colleague. Similarly, when the iPhone X was released, there were reports that Face ID failed to distinguish between Chinese users The Washington Post also highlighted an example of bias in search engine advertising algorithms, which resulted in Google serving men with adverts for higher-paying positions more often than they were served to women. This issue, where flawed training data results in algorithms that produce unfair or discriminatory outcomes, is referred to as 'algorithmic bias' Algorithmic bias occurs for a variety of reasons, such as bias inherent in the design of the algorithm itself and biases in the training data, which could be because the data itself is flawed and non-representative. Not only can this limit access to technology, but it may also further perpetuate biases in humans

Is anything being done about this?

Microsoft, which WPF has a £48.2m holding in, believes that “diversity and investment in the workforce can help fix AI's bias problems.”

Speaking with the BBC, Microsoft’s Chief Diversity Officer, Lindsay-Rae McIntyre, suggests that “ensuring a wide range of backgrounds, skills and experiences are represented” is the key to building products that are inclusive of all users Apple, which WPF has a £29.6m holding in, created the “Technology for All of Us” course as well as the “Inclusive Products Initiative” – presumably partly in response to the Face ID controversy mentioned earlier, as well as claims of sexism that had been levied against Apple due to lower credit limits being offered to women who applied for Apple’s credit card (although these claims were later dismissed by investigators). Apple say that the aim of these efforts is to “help inspire a culture where being inclusive by design becomes an inherent part of everyone’s process.”

The measures taken by industry leaders, like Microsoft and Apple, are a crucial start in addressing algorithmic bias and ensuring that technology serves everyone equitably. In the end, the goal is to create a more just and accessible tech ecosystem, resulting in better outcomes for users and more users for the companies themselves.

LABOUR PRACTICES

Good labour practices are important to us not only from an ethical perspective but also because good practice reduces the risk of industrial action, human rights violations, and reputational damage. Also, research suggests that higher employee wellbeing results in increased profitability. This means that by investing in businesses that uphold strong labour standards, we can reduce risk to the fund while also screening for more profitable, high-quality companies.

KEEPING NIKE ON THEIR TOES

In our Q3 2024 voting report, we highlighted concerns regarding wage theft linked to Nike. The company have faced criticisms relating to labour practices for decades, and during Nike’s recent Annual General Meeting shareholders voted on resolutions that sought to bring light to weaknesses in Nike's existing practises and policies.

Unfortunately, the majority of shareholders voted in opposition to these resolutions, implicitly supporting Nike’s position that they’re already committed to respecting human and labour rights in their operations and arguing that they already provide comprehensive disclosures via various reports. WPF doesn’t find Nike’s retorts compelling and will continue to monitor the company whilst working with Brunel, who manage the portfolio which WPF’s holding pertains to, to encourage better practices and improved reporting.

SOMETHING DOESN’T SMELL RIGHT

In May 2024 the BBC released a report raising concerns regarding the use of child labour in the luxury perfume industry, with Estée Lauder and L'Oréal (two companies which WPF holds) being called out specifically. The article highlighted tough working conditions and low pay, resulting in some workers resorting to bringing their children to work so that they could make a living. Even so, the report suggested that one worker and her four children (aged from 5 to 15) only took home about $1.50 for one night of work.

The article went on to criticise luxury brands for squeezing budgets, resulting in low pay, with poor oversight of their supply chains.

However, L'Oréal issued a response explaining that they were aware of these issues and had begun work addressing these concerns before the BBC’s report was released. While we’re pleased to hear of L'Oréal’s proactive approach, we’re still mindful that much of the industry is reliant on materials sourced from regions known to have lax labour practices – we will therefore be keeping an eye out for any further developments on this story.

Animal testing had been practiced for centuries with little public objection up until the 19th century, as the increased adoption of domestic pets in England ignited interest in animal welfare. Since then, countries across the world have moved to regulate animal testing, with several countries, including the UK, Canda, Columbia, India, Tiawan, New Zealand, and the EU, banning animal testing on cosmetics entirely. Bans on animal testing for cosmetics have been supported by conglomerates such as Unilever and Estée Lauder (both of which WPF are invested in), with Unilever having spent decades developing alternatives to animal testing, an effort that Estée Lauder are also supportive of.

However, as acknowledged by Estée Lauder, animal testing on cosmetics and cosmetic ingredients is required in certain countries. Additionally, despite some international conglomerates vowing to not test on animals, it is estimated that >75% of top beauty brands still test on animals. This may not come as much of a surprise when we consider that many countries, including the US as well as most African and Asian countries, do not ban the testing of cosmetic products on animals.

While there is clearly much progress to be made on animal testing, we’re proud to be invested in some of the leading companies in the industry which are pushing to end the practice – with Unilever pushing regulators in the EU to go further and phase out animal testing for “assessing the safety of all chemical ingredients –not just those used in cosmetics”

The World Trade Organization [sic] suggests that there is consensus among member governments to a narrower set of internationally recognised “core” standards (i.e. freedom of association, no forced labour, no child labour, and no discrimination at work), however the International Labour Organization (ILO) [sic] say that many developing countries continue to struggle to lower informality and working povertywith poor working conditions and inadequate protection of low-skilled migrant workers and women remaining a concern. While we’re proud to be invested in companies which champion good labour practices and employee wellbeing, we recognise that there is still much progress to be made and we will continue to work with our investment managers to hold to account companies which fall short of our expectations. Responsible ownership and stewardship

Safeguard the assets

Positive impact

WHERE TO FIND OUT MORE!

We hope you enjoyed find out a bit more about what we’re doing to address social issues and how these issues impact the fund. Up-to-date information can be found on our News pages and you can find more information about what we invest in and why on our Investment pages

We would like to thank our investment managers for supporting our enquiries in writing this report and our members for engaging with us and telling us what matters to you!