1895

1965

1946

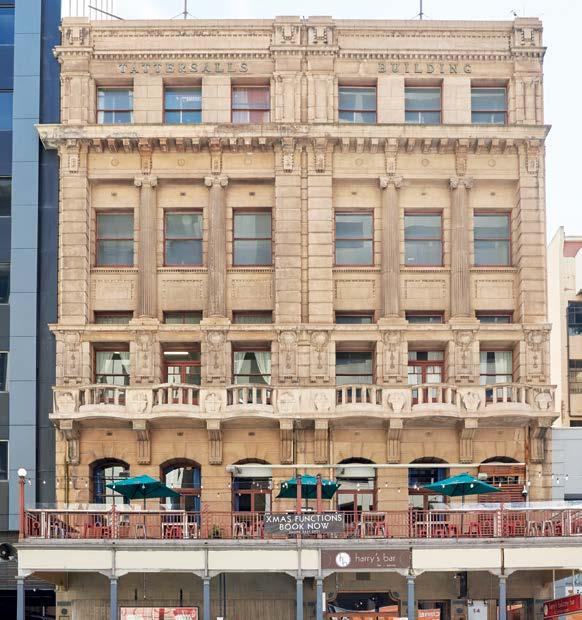

1966

Relocation

1978

1927

1947

1976

Mr William Buck establishes accounting firm in Melbourne.

Brothers Ken and Mawson Giles establish accounting firm Giles & Giles in Adelaide.

from Grenfell Street, Adelaide to Northview House, Greenhill Road, Wayville.

Mawson Giles appointed Senior Partner.

Dean Trowse appointed Senior Partner.

RJC Evans and Ken Giles establish accounting firm Evans & Giles in Adelaide.

Merger with Victor Trenerry.

1951 Merger with FG Malpas, Kadina.

Giles & Giles enters the world of technology, purchasing first computer.

1982

1985

1989

1993

William Buck expands nationally. First annual Outstanding Achievement Award presented. Merger with Higgins Botha.

1996

Giles & Giles joins the William Buck Group.

2000

GST introduced.

1987

Dennis Laundy appointed Managing Director. Stock Market crash.

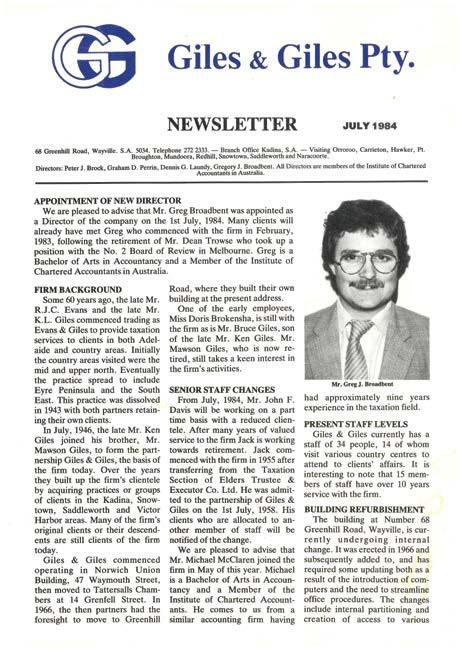

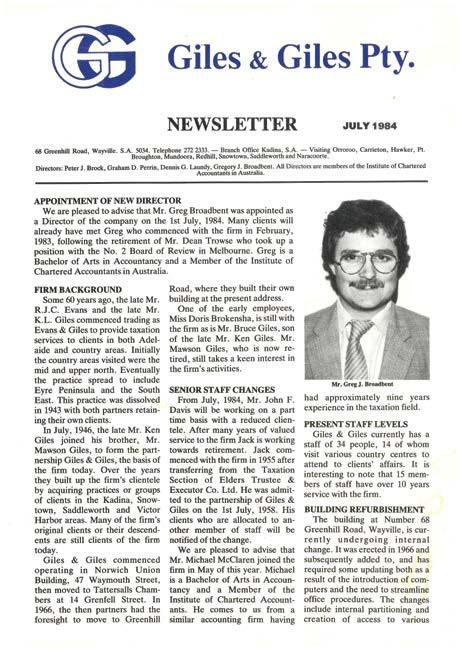

Peter Brock appointed Senior Partner.

CGT introduced.

1994 Joined GMN International.

1998 Giles & Giles changes name to William Buck. Moved to 48 Greenhill Road, Wayville.

Giles & Giles forms specialist divisions –Business Advisory & Wealth Advisory. Kadina office established.

Published June 2022

William Buck (SA) Pty Ltd Level 6, 211 Victoria Square Adelaide SA 5000 williambuck.com | 08 8409 4333

Printed in South Australia by: Open Book Howden Print + Design

Written by: Sally Collings

Designed by: Welbourn O'Brien

Feature Photography: ASB Creative Professional Photography

All reasonable attempts at factual accuracy have been made.

The WilliamBuck Adelaide Story

A history of William Buck Adelaide 1895 – 2020

1. Who is William Buck? 9 Introducing William Buck Adelaide 10 Our vision 16 Our strategy 20 Our professional services 24 2. Growth and resilience 39 Becoming William Buck 40 Relocating to the CBD 48 Joining Praxity 54 Mergers 60 Future proofing the firm 70 3. Our values and culture 85 Our values and culture 86 Our employee care plan 92 Community 96 Changing lives 106 Contents

4. Our people 115 Our team 116 Awards 122 Learning and development 128 Leadership 134 5. Our clients 147 Client service 148 Genuine care 150 Client value 156 Multi-generational clients 166 Growing together 170 Conclusion 180 The William Buck team 182 Testimonials 184

Foreword

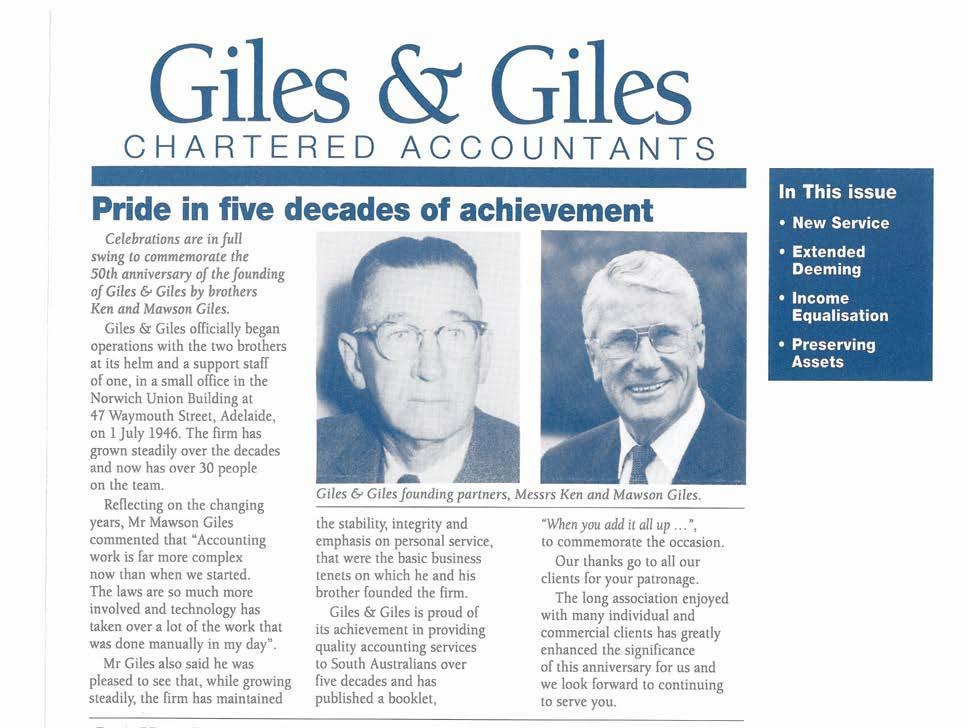

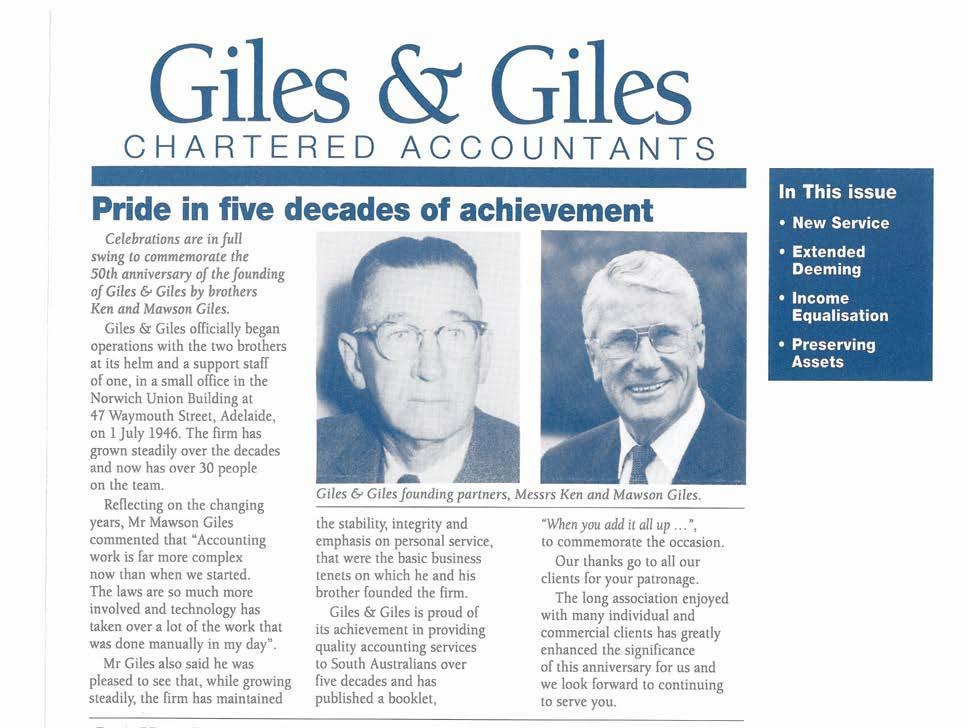

I wonder whether Mr William Buck ever considered that the accounting practice he started in Melbourne in 1895 would be changing lives 125 years later. His is an incredible story of determination, generosity, and above all, total commitment to his clients. On a parallel path, brothers Ken and Mawson Giles started their own accounting firm in Adelaide in 1946. According to Mawson, Giles & Giles did not have a motto but simply gave its clients the best service it could and treated them like family.

These heartfelt, yet inauspicious origins, laid the foundations for something much greater than Mr William Buck or the Giles brothers most likely intended. Their respective firms followed a bumpy road of ups and downs as they negotiated wars, depressions and droughts. They wrestled with new technology and transitions in leadership and came through the other side. No matter what was thrown at them, Mr William Buck and Ken and Mawson Giles put their clients first.

Today, it is our privilege and our responsibility to ensure this tradition continues. Here at William Buck, we believe that what is best for our clients is best for us. We stop at nothing to get to know our clients and their businesses; to understand

the complexities of family relationships, the intricacies of corporate structures and uphold our high-quality standards to deliver innovative and superior outcomes for clients. We help our clients overcome challenges to be the best they can be. We are in the business of changing lives!

To do this successfully, we rely on a dedicated team of professionals and support staff. Each one of them is a William Buck person; genuine, grounded, caring, ambitious and above all committed to our clients. We pride ourselves on our ability to recruit and retain the best people in the business. We create opportunities for our staff and promote from within. We are focused on wellbeing and we like to have a good time! We employ staff for the long-term which helps us build long-term relationships with clients. That is what it’s all about!

William Buck has come a long way in 125 years. We have grown, merged, specialised and benefited from being part of national and international networks. Today, we are one of Adelaide’s largest accounting and advisory firms. We are the clear leader in the mid-market and we are committed to providing this sector with the breadth and depth of

specialist services it needs. We are very proud of what we have achieved, but we have much to look forward to, and believe our best is ahead of us. As we look forward to the next 125 years of change, one thing that won’t be changing is our passion to continue to change the lives of our clients and staff.

On behalf of our staff, past and present, I’d like to present you with the William Buck story. You all play an incredibly important part in this. Understanding where we have come from will play an integral part in how we navigate the future.

I hope you enjoy reading it!

Jamie McKeough Managing Director

William Buck Adelaide team, 2021

William Buck Adelaide team, 2021

1

Who is William Buck?

Introducing William Buck Adelaide

Today’s William Buck is confident and contemporary. The firm has built on the foundation of professional excellence and genuine care for clients which was established by Mr William Buck in the late 19th century. The celebration of the 125th anniversary of the William Buck Group, coincides with 75 years since William Buck Adelaide was established. This was back in 1946, when brothers Ken and Mawson Giles founded a small accounting practice called Giles & Giles. Since then, the firm has undergone a significant transformation from an unassuming, “old school” firm to one which offers multidisciplinary services delivered by a team of experts. Today’s William Buck is mixing it with the Big 4 accounting firms in Adelaide in terms of its size, specialist services and its exceptional client base.

Despite its growth, one thing that has remained steadfast over the last 125 years, is the firm’s genuine interest in and care for clients and staff. Mr William Buck laid the foundation for this as early as 1906 when he started up a school for accountants. Ken Giles, and his younger brother Mawson, also contributed to this cornerstone philosophy through their unwavering commitment to client service. Today, the combined legacy of Mr William Buck and Ken and Mawson

Giles is a firm with a strong appreciation of its history, but more importantly an understanding of its capabilities and an uncompromising focus on delivering professional services to a broad range of clients and providing outstanding career opportunities and other benefits for its staff.

William Buck Adelaide owes its existence primarily to the Giles brothers, who between them led the firm steadily for more than 32 years. Ken Giles handed the baton to Mawson in 1965, and after Mawson’s retirement in 1978, the firm took the opportunity to consider a more contemporary direction. Senior Partner Peter Brock, proposed that Giles & Giles needed to become more strategic in order to survive and succeed in an increasingly competitive profession. Dennis Laundy invigorated this transformation when he took the reins as Managing Director in 1987. Dennis describes himself as a “man in a hurry”. His perception that Giles & Giles was an “old firm” was shared by the Adelaide market which viewed Giles & Giles as a trustworthy and reliable firm who diligently turned out farmers’ tax returns. “I wanted people to think that we were a bit broader, a bit more contemporary and a firm that was actually doing things,” Dennis said.

10

Chapter 1 | Who is William Buck?

Today’s William Buck Adelaide is confident and contemporary.

11

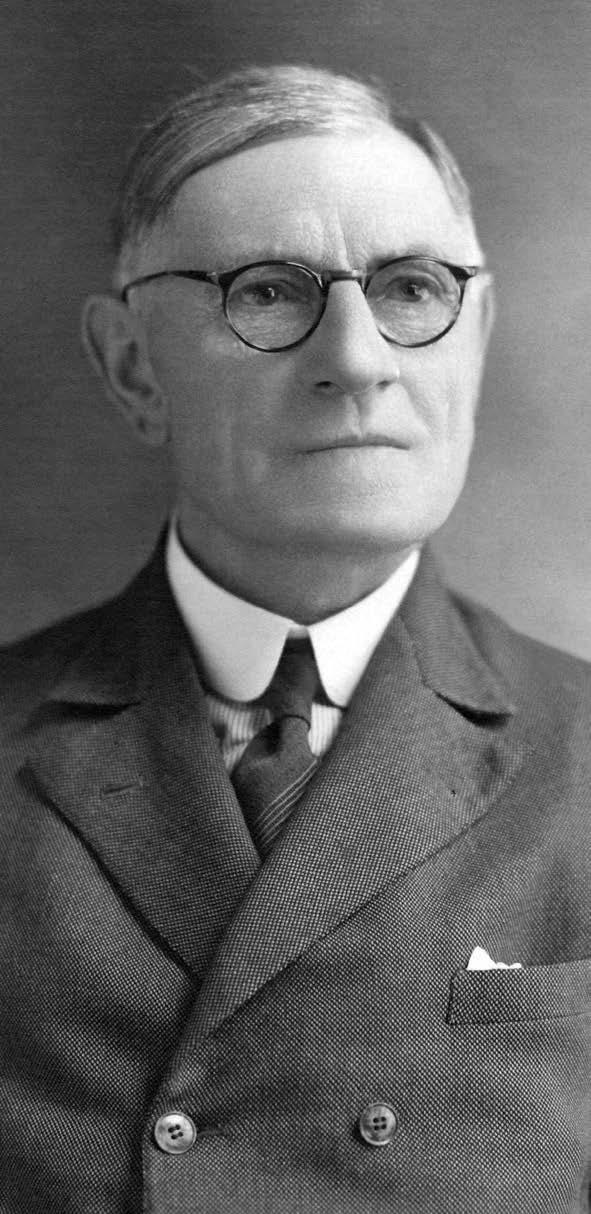

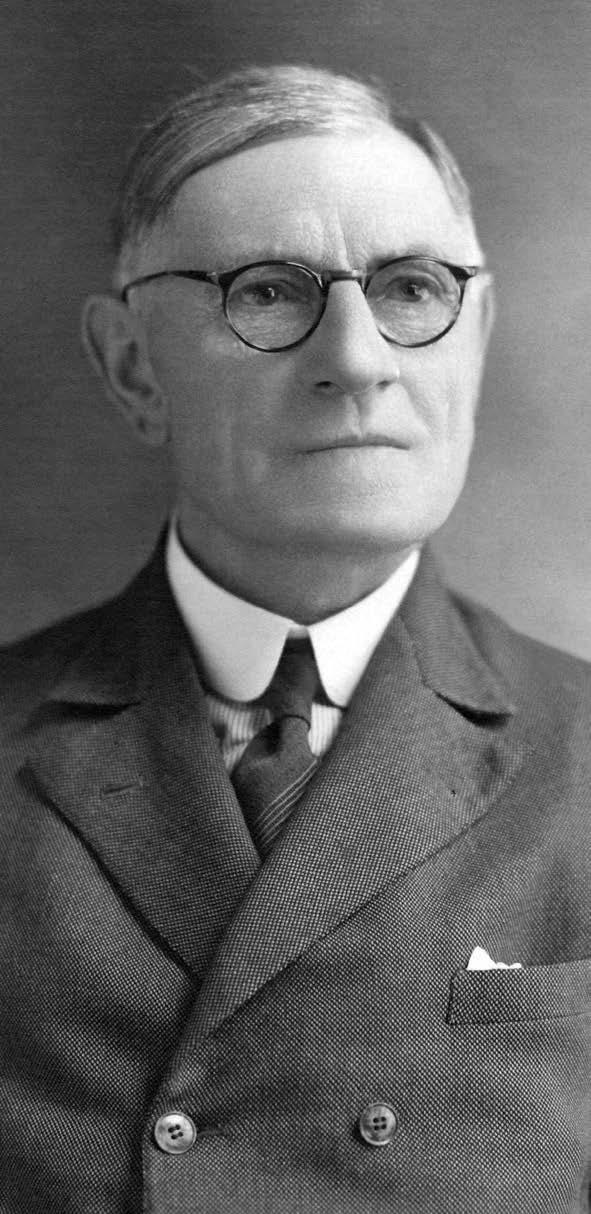

Mr William Buck

Top Right: Mawson Giles

Bottom Right: Ken Giles

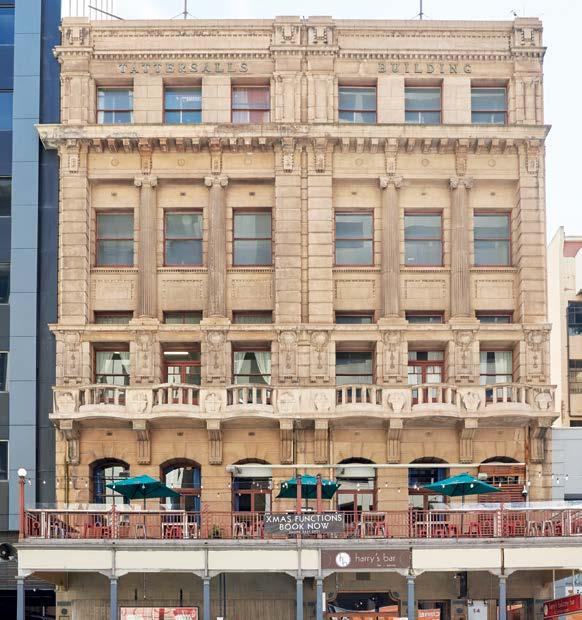

And so, he set the ship on a new course, recruiting staff for the journey, among them Jamie McKeough who joined Giles & Giles in 1988. Dennis described Jamie as “the sort of person I wanted to get on the bus”. In 1993, Jamie was promoted to Director and it soon became evident that one day he would succeed Dennis as Managing Director. Giles & Giles began executing its vision for a bold, new direction. It was a pivotal moment when the firm joined the William Buck Group in 1996 and within two years changed its name to William Buck. The Giles & Giles name was synonymous with the firm’s solid foundation, but not with its future. The name change coincided with the firm’s relocation from 68 to 48 Greenhill Road in 1997, to a bigger and more modern office that could accommodate its 40-strong staff.

Over the next few years, William Buck Adelaide focused on its vision to become more contemporary and expand its range of services, as well as its number of staff. The firm began investing in the William Buck brand and its financial performance and reputation were dramatically

boosted by the rapid growth of the Wealth Advisory division. Funds under management (FUM) reached $500 million in 2002.

Specialist Audit and Superannuation divisions were also added to the firm’s professional service offering. Another pivotal moment was Jamie’s appointment as Managing Director in 2006. With a head for facts and figures and the charisma to win people over, Jamie was the ideal candidate to lead the firm into the future. As many long-term staff acknowledge (and there are plenty of them), Dennis kicked off the firm’s growth, but Jamie accelerated it. A combination of strong organic growth and a series of mergers saw the firm quickly expand in size, expertise and confidence. In addition, continued investment in the William Buck brand began paying dividends.

During the 1990s, there were several iterations of the William Buck Group, but essentially it was a federation of like-minded accounting firms, each wanting to grow and pass on the benefits of the William Buck association to their clients. In 2009, a rejuvenated William Buck Group joined Praxity, the world’s sixth largest accounting alliance, which represents more than 60,000 professionals in more than 110 countries. The association with the William Buck Group and Praxity confirmed to William Buck Adelaide what it already knew. That it had everything it took to be successful; the right people, the right strategy and all importantly, strong alignment within the organisation. This gave the firm the confidence it needed to continue to develop its specialist services and to pursue bigger and more complex clients. Associating with the William Buck Group and Praxity also provided the firm with access to new knowledge and experiences. It was like selling candy to a kid! William Buck Adelaide was a sponge when it came to soaking up new ideas. Today, the firm continues to demonstrate this almost obsessive pursuit of knowledge and better ways to do business. “We don’t pretend to know it all,” Jamie says. “Learning from others is part of our DNA”.

12

Chapter 1 | Who is William Buck?

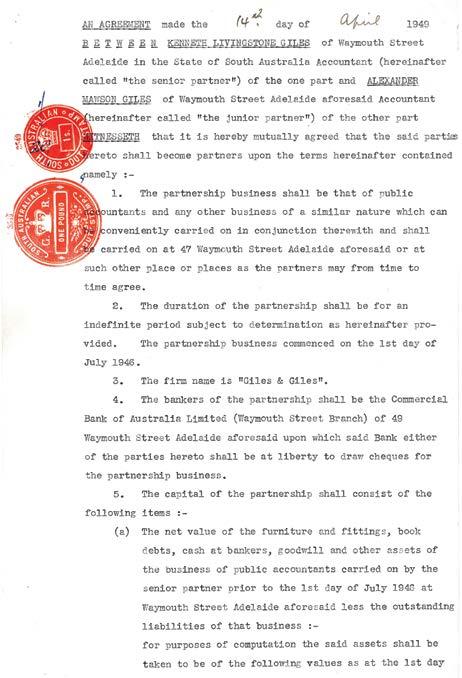

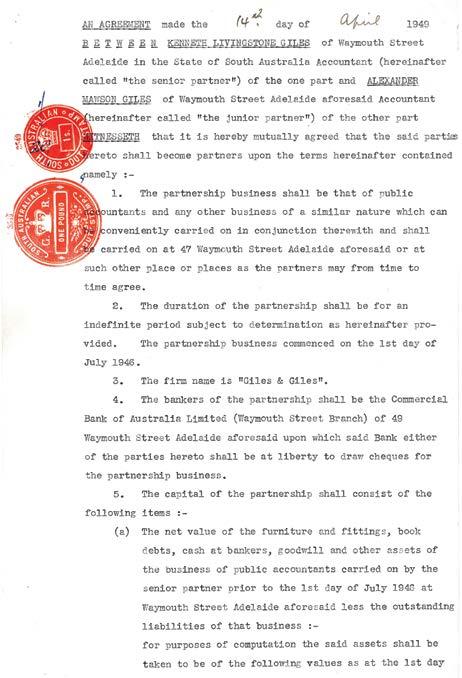

Partnership agreement between Ken and Mawson Giles, 1949

So, who is William Buck Adelaide today? It’s a firm which remains grounded, cognisant of the values of friendly service and genuine care for others which were laid out by Mr William Buck and Ken and Mawson Giles. Today’s firm is defined not only by the admirable values of its founders, but also by a dedicated team of professionals who work collaboratively to deliver a broad range of specialist accounting and advisory services. Today’s William Buck Adelaide is confident and even has a little swagger. Retired Director Wendy Drake says that today’s William Buck “dares to go there”. No client is out of reach. The firm has grown to a staff of almost 200. It is larger than one of Adelaide’s Big 4 accounting firms and is

a similar size to the other three. But even for accountants, it’s not all about the numbers, and at William Buck Adelaide, success is not measured in size. Instead, the firm measures success in terms of its ability to have a positive impact on the lives of its clients and its staff. To change lives! Jamie says the firm’s motivation to grow and develop is to create greater career opportunities for staff, so they remain with the firm, which in turn, facilitates long-term and more valuable relationships with clients. You will learn, as you read through this story, that’s what William Buck is all about. Long-term relationships with clients. Long-term relationships with staff. It’s the William Buck way.

13

"The firm measures success in terms of its ability to have a positive impact on the lives of its clients and its staff. To change lives!"

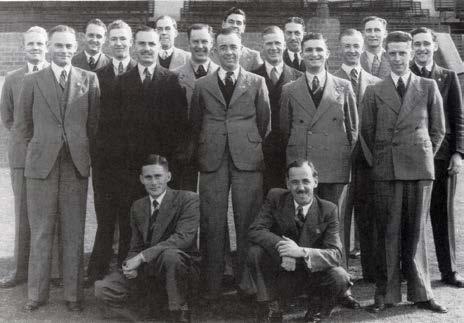

Giles & Giles Partners and Senior Staff, circa 1980. Back L-R: Jack Davis, Graham Perrin, Peter Brock, Dennis Laundy, Bruce Giles. Front L-R: Doris Brokensha, Dean Trowse, Mac Dunstone, Mawson Giles

Step back in time: From the beginning

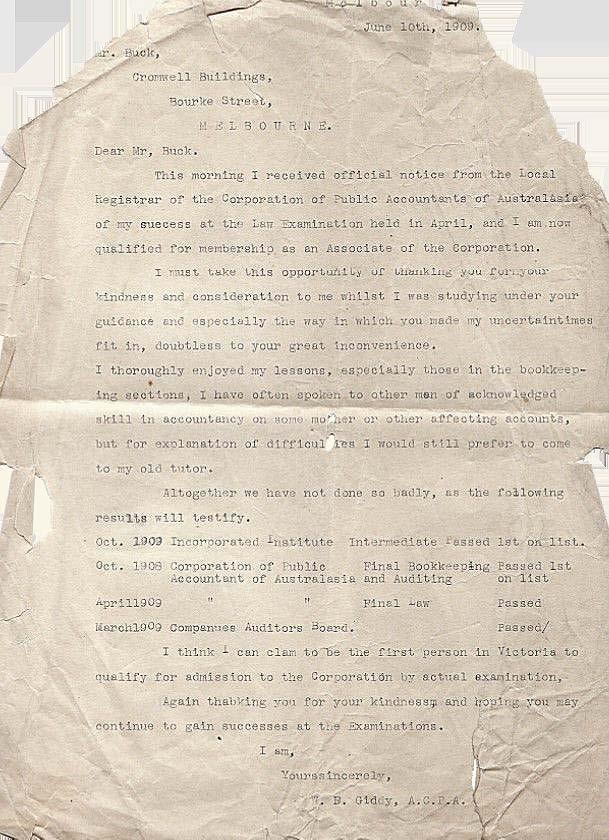

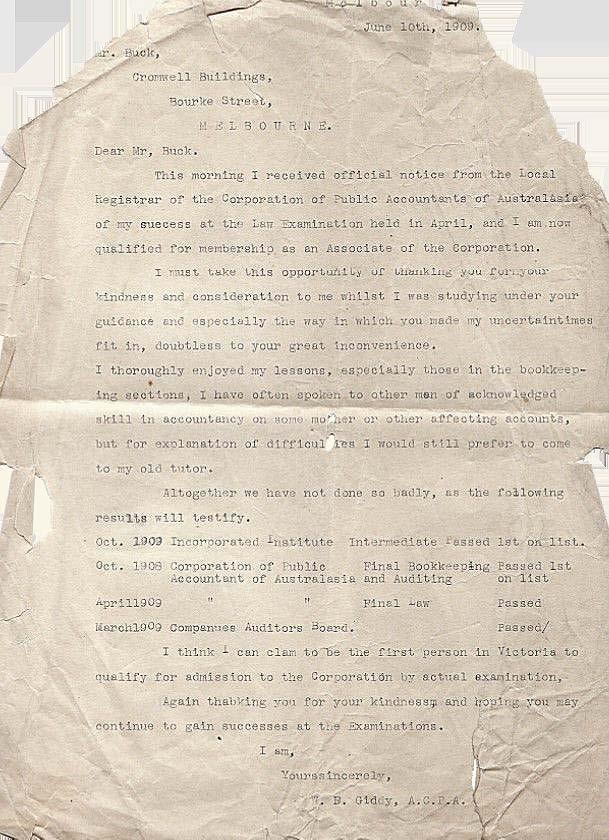

Mr William Buck was born in Launceston in 1870 and started his own accounting practice in Melbourne in 1895, aged 25. It took resourcefulness and determination to establish a new business in the midst of one of Australia’s worst economic depressions. William’s passion for helping people ensured his firm gained a solid reputation in the Melbourne business community. As well as assisting clients and their businesses, William had a desire to raise the bar within the accounting profession and in 1906 he founded an accounting school. Over the next 20 years, he mentored hundreds of students as they prepared for their final examinations to gain admission into the Incorporated Institute of Accountants in Victoria, today known as Chartered Accountants Australia and New Zealand. William took a personal interest in each of his students, just as he did with his clients. He was described as courteous, generous and a ‘true friend’.

In 1925, William’s son, William Walter Buck, affectionately known as Bill Buck Junior, joined the firm. Bill was charismatic, witty and popular. He was an accomplished sportsman and after being spotted by a talent scout, he was recruited to the Collingwood Football Club. He played 32 games between 1920 and 1924 and held the highly unusual distinction of being club secretary while still playing football. However, in 1925, both his playing and administrative careers ended prematurely, following a bus accident in which Bill broke his arm in three places. As you read on, you will discover that William Buck’s long association with Australian Rules Football is very much alive today!

In 1927, Bill took over from his father as Managing Partner of William Buck. William remained at the firm as a Principal for the next 20 years until he returned to his hometown of Launceston. Under Bill’s leadership, the firm continued to have a positive impact on the lives of clients and the success of their businesses. The firm had seven business units, eight Partners and nearly 100 staff and it was one of the leading accounting firms in Victoria. Bill inherited his father’s passion for helping people and continued to be involved with the company until shortly before his death in 1980.

Chapter 1 | Who is William Buck? 14

Accounting school founded by Mr William Buck, 1906

The late 1970s proved a challenging time for Australian businesses, and the difficult transition from Bill Buck’s leadership to his successors, saw William Buck contract in size and move from the city to Hawthorn. Around this time, two ex-Arthur Andersen managers, Fausto Pastro and Peter Harrison, ventured out on their own and set up a successful practice. They were looking for another firm to merge with and William Buck had all the right characteristics. In 1983, Peter and Fausto joined William Buck. Together with a young William Buck Partner, Ian Lee, they commenced their journey and charted a new course for the firm. Using Fausto’s background in tax and Peter’s experience in audit, the firm’s new strategy was to build up speciality services for the benefit of their clients. In addition, the three Partners devised a plan to take the company national, with Fausto moving to Sydney in 1989 to set up William Buck’s first interstate office.

Peter was appointed as William Buck’s first national Chairman and he began recruiting firms from across Australia to join the network. The number one thing he was looking for was firms who were making a positive impact on those around them. Perth-based Bradshaw Judd and Collins was the first recruit, joining the William Buck Group in 1994. From there, the Group went on to recruit firms in each capital city, as well as an associate in New Zealand. The William Buck Board was created in 1997, with a vision to become the leader in the mid-market. Over time, the Board adopted a national approach to branding, quality and training to ensure William Buck developed an outstanding reputation for changing lives through quality advice and excellent service.

15

Left: Student letter of appreciation to Mr William Buck, 1909 Bill Buck Jr, Collingwood Football Club Career, 1920-1924

Our vision

Today, William Buck Adelaide has a clear vision; to be the leading advisory firm to mid-market clients. William Buck is currently one of the largest firms in Adelaide, enjoying an enviable position in the mid-market. According to Managing Director Jamie McKeough, this is absolutely deliberate. The firm recognises that there are greater opportunities for developing and maintaining long-term relationships with privately owned and family businesses, small corporates, notfor-profits and high net worth individuals. These businesses typically provide greater stability across generations than larger corporations where people come and go.

William Buck Adelaide’s vision is to continue to grow, but not just grow for growth’s sake. First and foremost, growth must deliver a tangible benefit to clients, by increasing the depth and breadth of its services and recruiting and developing more specialists to deliver these services. William Buck’s Directors believe “what is best for our clients will be best for us.” That’s the acid test they use when it comes to making decisions around the Board table. “We want to grow in the future and we’ll grow as big as we need to be,” Jamie says. “Our vision is very clear. We want to be the leading accounting firm in Adelaide, but rather than being big for the sake of being big, we’d rather be

regarded as a quality firm in terms of our culture, our values and service, and every aspect upon which a business is looked at.”

Directors and staff alike are well versed with the firm’s vision, which is underpinned by four key values: CARE - Collaborative. Aspiring. Relationship-driven. Enterprising. These are the cornerstones on which William Buck continues to build its enviable reputation for friendly and professional service. Some of these values stem from the early Giles & Giles days, when the Giles brothers went out of their way to visit clients on their farms. Others are the result of many years of pursuing excellence; Directors and staff honing their specialist skills in order to provide clients with a breadth and depth of service more typically associated with larger accounting firms. However, clients are not the only beneficiaries of William Buck’s commitment to its vision and values. Staff thrive in this environment of trust and collaboration, where they are simultaneously nurtured and challenged. They have embraced the firm’s mantra ‘Changing Lives’, which was adopted across the William Buck Group in 2014, but more about this later! Jamie admits it is a bold statement, but says above all else, the firm aspires to have a positive impact on the lives of its clients, its staff and the broader community.

Chapter 1 | Who is William Buck? 16

Today, William Buck Adelaide has a clear vision; to be the leading advisory firm to mid-market clients.

In summary, William Buck’s vision is to be the leading advisory firm to mid-market clients. The firm’s leaders understand that in order to achieve this they must have a good value proposition for clients; they need to have passionate staff and recognise and promote talent to create an engaged and motivated workforce; and they need to continue to grow strategically and sensibly. Time will tell, but William Buck is well on the way to achieving its vision.

In for the long haul

William Buck Adelaide’s long history is enriched by many stories of multi-generational relationships between the firm and its clients. A stand-out example is the Wilkinson family. Lloyd Wilkinson came from a small farm at Orroroo in the Mid North. He entered into a partnership in a farming business with his father-in-law, George May, who was the Managing Director of City Motors, one of Giles & Giles’ early audit clients. Lloyd borrowed some money and bought a couple of properties, one of which was in Western Australia, near Geraldton. After mineral sands were discovered on the property in the late 1960s, Lloyd began receiving royalties and amassed a large amount of wealth which he invested wisely. At the time, Lloyd rented an office in the Giles & Giles building on Greenhill Road. In 1971, Graham Perrin joined Giles & Giles and started doing Lloyd’s accounting work, assisting him with investments in commercial property and further growing his wealth. When Graham retired as a partner 18 years ago, he continued to work for Lloyd and what later became the CL Wilkinson Group. Graham continued to work for Lloyd’s children for many years following Lloyd’s death in 2008, and even after his retirement from William Buck. Through its broad range of services, William Buck continues to provide tax and accounting, portfolio management and wealth advisory services to members of the Wilkinson family, maintaining a valued relationship that spans more than 70 years.

While Lloyd’s businesses have been wound up, his daughter, Anna, and her husband Damien Brown continue to benefit from their family’s long association with William Buck. “Always in these relationships, there’s that deep personal understanding of what the firm’s goals are and what our goals are,” Damien says. “We feel enormously comfortable with William Buck and they are an integral part of Leyton Funds and Anna’s and my businesses.” Lloyd’s son, John Wilkinson, and his wife, Susan, also appreciate the advice they have received from William Buck over two generations, particularly in regard to succession planning. They say business is always conducted in a friendly, amicable way.

17

"What is best for our clients will be best for us."

Front: Meredith Treloar, Shirley and Lloyd Wilkinson. Back: Haydn Wilkinson, Roger McLaughlin.

Step back in time: brothers in arms

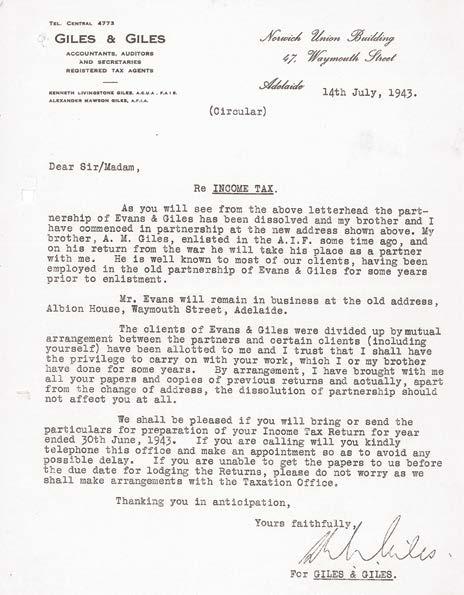

Cast your mind back to Christmas Eve 1945. Australia, and the rest of the world, is emerging from the devastation of World War II. Kenneth Livingstone Giles, aged 42, warmly welcomes his brother Alexander Mawson, home from the war. Mawson, who hated every minute of his time training in the Armoured Corps, then serving with Field Security in Papua New Guinea, is delighted to be home. The two brothers celebrate a special Christmas with their family. The following year, they embark on a new adventure together, a partnership called Giles & Giles. While it wasn’t the first time the two brothers had worked together, Giles & Giles was a fresh start, and an opportunity to lay the foundation of what would eventually become one of South Australia’s most successful accounting firms. Mawson’s personal war diary reveals he felt terrible that Ken had to make a start in the business without him. When Mawson was transferred to Papua New Guinea in 1944, he wrote “It is surprising how far away office life seems.”

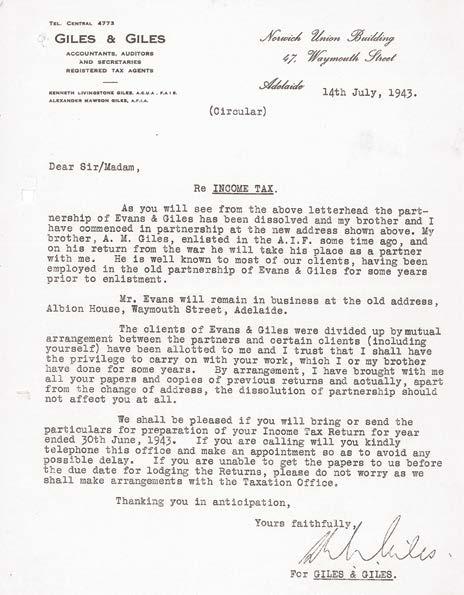

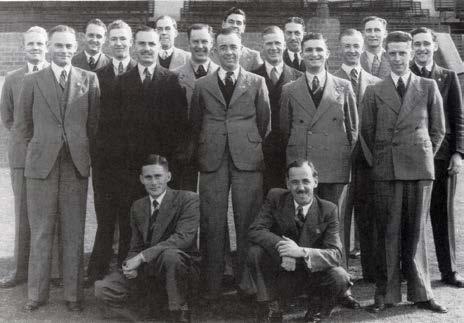

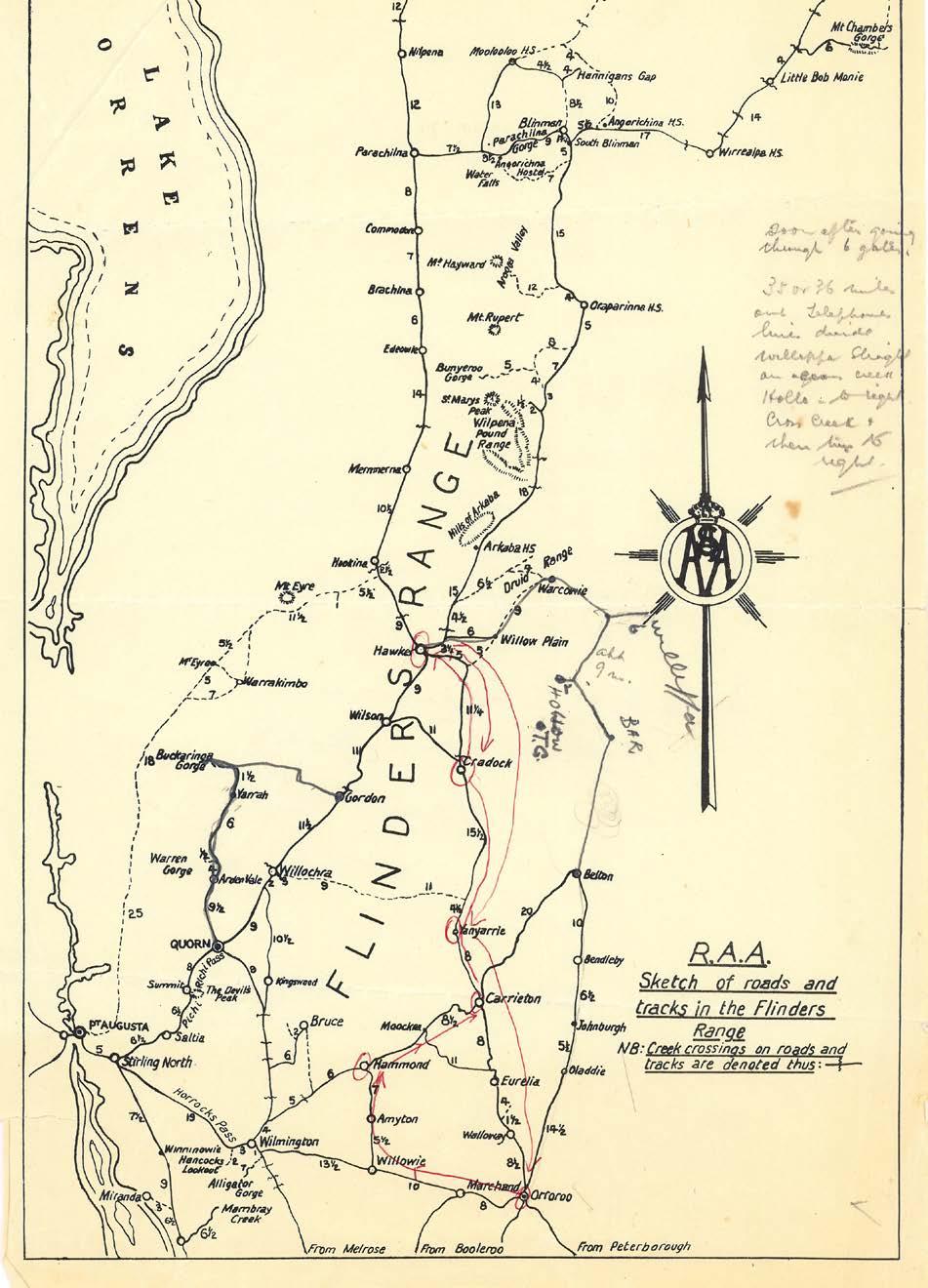

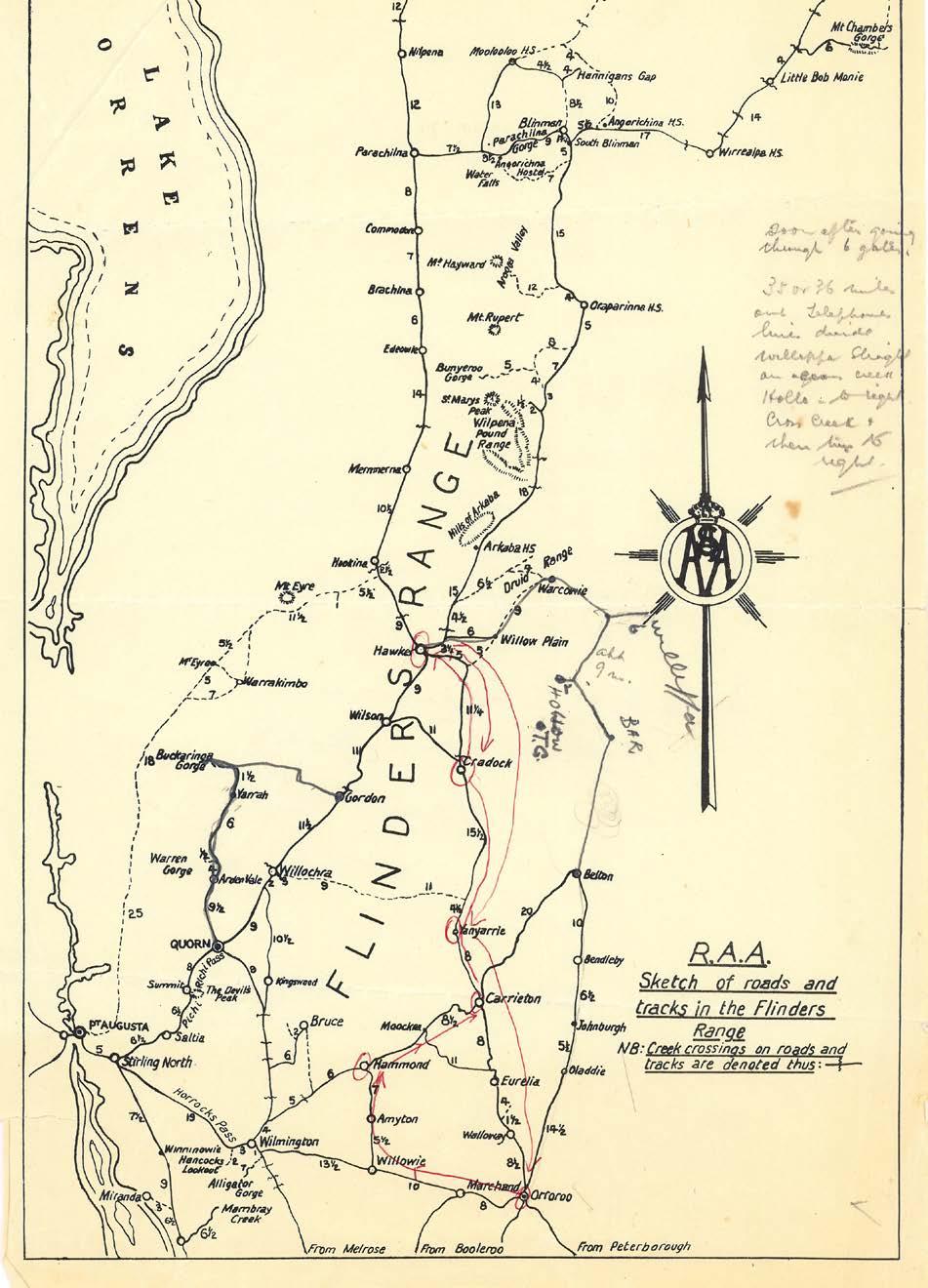

Ken received his Diploma of Commerce from the University of Adelaide in 1924. After a short stint as a tax assessor with the Taxation Department he entered into a partnership with Roy John Coleman Evans (Jack) who had established a tax agent’s practice in Adelaide following his discharge from the army after World War I. Evans & Giles was registered in 1927, with offices in the Norwich Union Building at 14 Waymouth Street. Jack and Ken quickly built up a significant list of rural clients. Their modus operandi was to visit country clients in their homes, offering them a highly personalised and friendly service. A document recording the early history of Evans & Giles states that, “Service to clients and consideration for their needs and conveniences were truly paramount, if unspoken, tenets of the firm’s creed.” Many miles were travelled in horse-drawn carriages and on horseback, as Jack and Ken tended to their concentration of clients in the Mid North of the state, and as far away as the Eyre Peninsula and the South East. Mawson joined his brother and Jack at Evans & Giles in 1938. He said Jack had a reputation as “a first-class mixer with a habit of shouting a drink to almost every client.” Mawson recalled that one visit to Jamestown concluded with a “rip roaring cocktail party” at a local hotel.

Prior to joining Evans & Giles, Mawson worked for the State Bank of South Australia, including a country posting to Karoonda. He transferred to Yacka where he met his wife, Sylvia, the daughter of a local farmer. Mawson recalls that the experience of working at these country branches in his late teens and early 20s, was one of the happiest times of his life. “I liked the country. I liked farmers and I liked living and working with them.” However, in 1943, Mawson was conscripted into the army and the Evans & Giles partnership was dissolved. Mawson believed that a disagreement between Jack and Ken over whether the firm should give him army pay was “the match that set the thing alight”. “You can imagine whose side my brother was on,” Mawson said of the incident. This fall-out led to Ken moving up the street to number 47, where the business Giles & Giles was registered in 1943. In his diary, Mawson records that he visited the new office prior to joining the army and was thrilled to see “Giles & Giles” on the door. “It is good

Chapter 1 | Who is William Buck? 18

Giles Brothers, Ken (40), Max (38), and Mawson (26), 1941

of old Ken to put me in right from the start and I must think of some way to let him know I appreciate it.” It wasn’t until Mawson returned from the war, that he officially joined his brother in the partnership on 1 July 1946. From the outset, their shared vision for Giles & Giles was to service their clients. This centered around the brothers’ genuine interest in and concern for people, and their natural inclination to friendliness. In Mawson’s words, “The firm of Giles & Giles did not have a motto but simply tried to give its clients the best service it could for a reasonable charge, treating them like ‘part of the family’ with the Partners and staff.”

Right: Evans & Giles dissolved, 1943

Below: Evans & Giles letterhead, 1928

Named for a knight

Mawson Giles confessed his name was a minor embarrassment to him throughout his life. It was somewhat of a pattern, as his father’s name was Alexander Livingstone Giles. In an interview in 1991, Mawson explained that the intrepid Douglas Mawson lived nearby and had just returned from his second expedition to the Antarctic when he was born in 1914. Douglas Mawson was the only survivor of a three-man exploratory party that formed part of the expedition and was knighted later that year. For the Giles family, with a tendency towards explorers, there was no escaping this coincidence and the latest addition to the family was duly named Mawson!

19

Mawson Giles

Our strategy

William Buck Adelaide’s strategy is to bring the range of services to the midmarket that the mid-market needs.

Based on its vision and values, William Buck Adelaide’s strategy is to bring the range of services to the mid-market that the mid-market needs. Business has become more complex as life has become more complex, and today, William Buck’s clients require a much broader range of services to support their businesses and financial needs. This has been the key driver for the firm’s growth and the reason it has invested heavily in developing a range of specialist services, which have materialised through an equal proportion of mergers and organic growth.

William Buck’s strategy revolves around its staff being the number one trusted advisor to each and every client. The firm banks on its staff being the first people clients turn to when something happens, whether this is good or bad. The position is an enormous responsibility, as well as a privilege, and it’s what drives the team at William Buck. It underpins the firm’s success in building multi-generational relationships, cradle to grave. First, the firm must gain the confidence of the client. Once this relationship is formed, the firm and its professionals become embedded in the client’s business; their most trusted advisor. This is when the magic happens! Through total investment in what clients

do and how they do it, William Buck is able to help clients and their businesses be the best they can be. It’s how the firm change lives!

Another of William Buck’s cornerstone principles is that it operates as a ‘one firm firm’. This philosophy dictates that clients are clients of the firm, rather than any individual Director. In practice, this means the client receives the best service from the best person to resolve their particular issue. Traditionally, Partners in accounting firms have been highly protective of their patch, unwilling to involve their colleagues. This is generally driven by the financial rewards generated through that particular client. William Buck moved away from this model in the early 2000s, believing that a ‘one firm firm’ mentality was better for clients. “It was quite a pivotal moment in the history of the firm,” Jamie says. Such is William Buck’s commitment to this philosophy, that on rare occasions, it has parted company with staff who are not 100% aligned with this collaborative approach. Another consequence of the ‘one firm firm’ philosophy, is that the ownership of William Buck Adelaide is shared by all Directors, who each own a proportion of the whole pie, not different pies. “That is huge in terms of our DNA, the alignment

Chapter 1 | Who is William Buck? 20

and in terms of us moving in one direction,” Jamie says. Deputy Managing Director Martin Hill agrees that the firm’s ownership structure has a lot to do with the success of the ‘one firm firm’ approach. He says this philosophy has been adopted by other accounting firms at a client level, but it doesn’t always extend to the ownership. “We’re doing better at it than most and our ownership structure is a big part of that,” Martin says. “We’re all in it together. We help each other.”

There is no doubt that William Buck Adelaide’s strategy has been shaped by the acknowledgement that they don’t know everything. They describe themselves as leading edge, not bleeding edge. They are wide open to new ideas. Their sponge-like ability to absorb best practice is matched only by the willingness of the William Buck Group, Praxity, and individual mentors to share their experiences. Among them, Bill Hermann (former Managing Director of Michigan-based Plante Moran), Kingsley Purdie (Port Pirie born and bred, globally accomplished) and several visiting professors from Harvard Business School. Bill has visited Australia on several occasions to run strategy days for the William Buck Group. He’s described as a “been there, done that type of person” who can take things to another level. Bill was instrumental in encouraging William Buck Adelaide to have a bit more swagger. As a former Board member of William Buck Adelaide, Kingsley helped develop the Wealth Advisory division and build the William Buck brand in the Adelaide market. One visiting Harvard professor shared this pearl of wisdom, which the leadership team at William Buck has taken on board. “Alignment trumps strategy”. It doesn’t matter how great your strategy is, unless you are aligned as an organisation you won’t be able to execute it. In particular, the firm takes great pride in the alignment of its Directors. There are no factions and no politics. “We are bereft of that here, and that absolutely helps with our alignment,” Jamie says. High-level advice from valued mentors has not only boosted the firm’s confidence, but it has helped the firm to develop a healthy business model and to run an aligned business with minimal headwind.

William Buck’s strategy to bring the range of services to the mid-market that the mid-market needs, gives the firm a clear direction. Alignment is key. Developing multigenerational relationships and trusted advisor status with clients is fundamental. As is the ‘one firm firm’ mentality and being wide open to learning and new ideas. These principles ensure that William Buck remains ahead of the curve. They enable and empower the firm to go about its business of ‘Changing Lives’.

21

"Alignment trumps strategy. It doesn’t matter how great your strategy is, unless you are aligned as an organisation you won’t be able to execute it."

Deputy Managing Director, Martin Hill

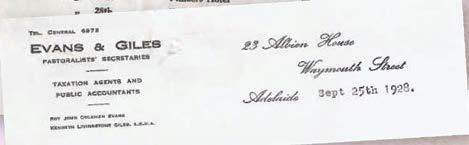

Step back in time: planning for the future

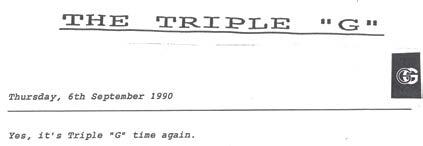

Today, strategic plans are commonplace in successful businesses. However, this was not the case in the early days of Giles & Giles when the focus was on “keeping the ship upright and steady”. “It wasn’t business like it is today,” former Senior Partner Peter Brock says. “The whole thrust for our firm back then was to do the right thing by clients. The client was king and we had to look after these clients.” Prior to 1980, Giles & Giles did not have a formal strategy.

As explained by Peter, the firm was in the business of servicing its clients and did not afford itself the luxury of thinking too far ahead. The first indication of a more forward-looking organisation was the “Giles & Giles Plan for the Future” (1982), which stated “For some time now, there has been a

growing feeling amongst the Partners that we need to look to the future – not only to maintain our current position, but to be prepared for the changes that must come.”

In 1987, the firm’s Partners agreed to engage Peter Edwards of Edwards Marshall & Co to advise on planning decisions for 1988 and beyond. This was the first time the firm had sought external input into a range of strategic issues and it proved to be a turning point in the firm’s learning journey. In 1989, Dr Adrian Geering, a prominent Adelaide business consultant, was engaged to assist with the firm’s strategic planning. Dennis Laundy, who was Managing Partner at the time, said Dr Geering’s role was to facilitate changes and act as a catalyst for development. The input of both Peter Edwards and Dr Geering received a mixed response from the firm’s Partners, although there was never any doubt that Giles & Giles benefited from these external perspectives.

Despite Dr Geering’s input, it wasn’t all smooth sailing ahead for Giles & Giles. On the back of a disappointing financial result in 1995, the firm’s Partners committed to a new strategic plan. This identified that there had been “cracks in the foundation as early as 1988 when the people and the methods of the previous 30-40 years were struggling to keep pace with new technology, new legislation and an ever-increasing workload.” The strategic plan reported that the firm’s financial performance had been steady, yet unspectacular. Going forward, the firm was to embrace a new vision: “To be a contemporary, medium-sized firm which aims to excel in the provision of a range of accounting, business and advisory services, as required by clients and meets the financial and personal needs of stakeholders”. The Partners set themselves a goal to raise the number of large clients, provide more comprehensive services and increase the number of staff to more than 40 in the next few years. They were committed to seeing the firm survive and thrive past 2000.

Giles & Giles Plan for the Future, 1982

Chapter 1 | Who is William Buck? 22

In 1996, Giles & Giles as it was still known, engaged the services of consultant Barry McGuinness, a former partner of Arthur Andersen in Melbourne. As an aside, Barry was Chairman of William Buck Melbourne at the time and was responsible for introducing Giles & Giles to William Buck. Barry didn’t hold back with his advice to the firm. He said the Partners and staff had become a little comfortable and needed to get off their backsides and become more proactive. This fired things up. The firm embarked on a mission: “To consciously change emphasis from an introspective, safe, compliance-based firm with predominantly smaller clients to a firm focused on the provision of advisory and specialist services and higher level compliance work to the corporate businesses of Adelaide.” It’s quite a mouthful, but this bolder strategic approach more closely resembled the firm’s strategic plan today.

From these early experiences when it relied on external consultants, William Buck Adelaide has learned the value of planning for the future. Today, the firm is a leader in strategy, not just for its own business, but also assisting clients with their own strategic planning, and through its significant contribution to the direction of the William Buck Group.

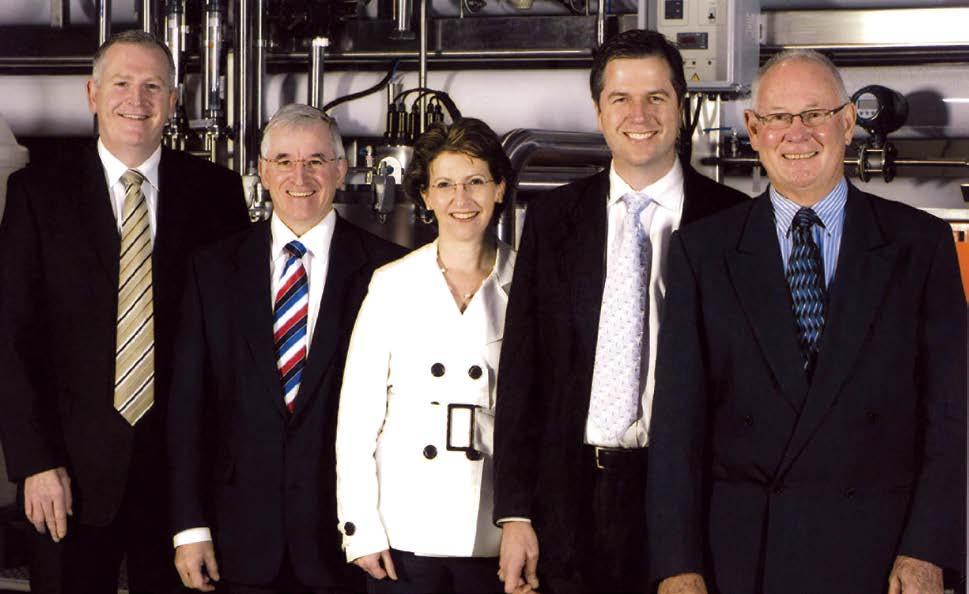

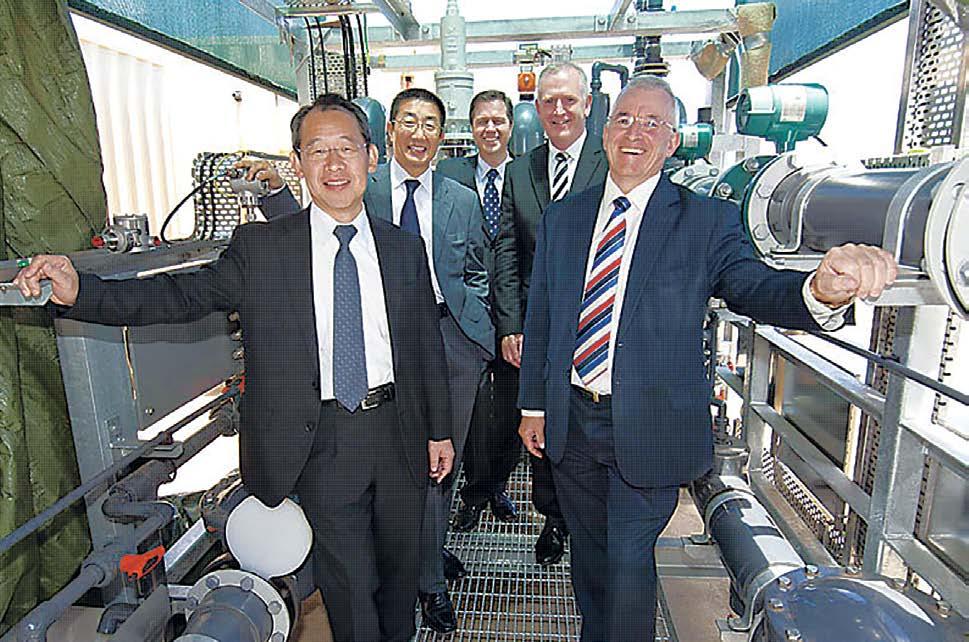

Top Right: Dennis Laundy, Former Managing Director, 1987-2006 and Dr Adrian Geering, 1989

Right: Former Senior Partner Peter Brock, 1973-1995

Top Right: Dennis Laundy, Former Managing Director, 1987-2006 and Dr Adrian Geering, 1989

Right: Former Senior Partner Peter Brock, 1973-1995

23

Our professional services

The days of being a firm which focused on doing tax returns for predominantly country clients, with a spattering of hotel and audit clients, are long gone. Today, William Buck Adelaide prides itself on a broad range of services. An increasingly complex business environment has created the need for specialist advisory services and William Buck has grown alongside its clients to provide a fully integrated, one-stop shop solution. Branching out from the firm’s traditional compliance-based Business Advisory services, new divisions have continued to emerge, including Wealth Advisory (and Family Office), Audit and Assurance, Superannuation, Specialist Tax, Corporate Advisory, and more recently Finance Advisory and Managed Funds Administration. A combination of strategic mergers, investment and recruitment have enabled William Buck to develop this extensive suite of services to meet the needs of the mid-market.

The firm’s era of specialisation started with the creation of a Wealth Advisory division in 1989. The emerging Wealth Advisory services were separated from the firm’s traditional tax and accounting services, which later became known as the Business Advisory division. Today, Business Advisory is William Buck’s largest division. It has grown considerably

in the last decade to support eight Directors, including Ben Trengove who heads up the division. Ben joined William Buck as part of the MSI Tilley merger in 2011, bringing with him a strong understanding of rural industries and an affinity with agricultural clients. Tom Laundy was appointed Director in 2008, having become one of the firm’s key influencers since joining as a graduate. One of Tom’s stand-out qualities is his people skills and his enviable ability to gain the confidence of his clients. Prior to these recent appointments, Matthew Illman and Babis Mavrakis were appointed Directors in 2015, followed by Paula Liddle and Lee Fuller in 2018. Matthew Illman is another great people person, with real presence and excellent leadership qualities. He looks after many of William Buck’s longest standing clients. Babis is charismatic and has built an impressive portfolio of property clients with whom he has a fantastic relationship based on his ability to really understand their business. Paula first experienced life at Giles & Giles during a work experience placement while she was still at school. She later joined the firm on a parttime basis while she was studying at university and quickly progressed due to her background and interest in agriculture. Paula is described as technically very smart and someone

24

William Buck Adelaide now boasts more specialist services than any other mid-market accounting firm in Adelaide.

Chapter 1 | Who is William Buck?

who doesn’t like fuss but prefers to get on with the job at hand. Lee is another stand-out for service delivery and he is well regarded for his determination to always do the best for his clients. This commitment to service was rewarded when one of Lee’s farming clients from Kimba named a paddock, “Fullers”, after him! The Business Advisory division includes two of the firm’s newest Directors, James Northcote and Shane Taylor who were appointed in 2021. James joined MSI Tilley as a graduate, prior to the firm merging with William Buck. As a result of the MSI Tilley’s strong Riverland

client base, he developed an interest in the horticultural and viticultural industries. James lives with cystic fibrosis, manages it admirably and is an inspiration to everyone he works with. Shane joined William Buck as an undergraduate, before leaving to pursue other opportunities. A few years later, he called William Buck for a reference and they said, “why don’t you come back,” which he promptly did! Having settled back in at William Buck and worked his way up to Director, Shane excels in servicing some of the firm’s larger and more complex clients, particularly in agribusiness.

25

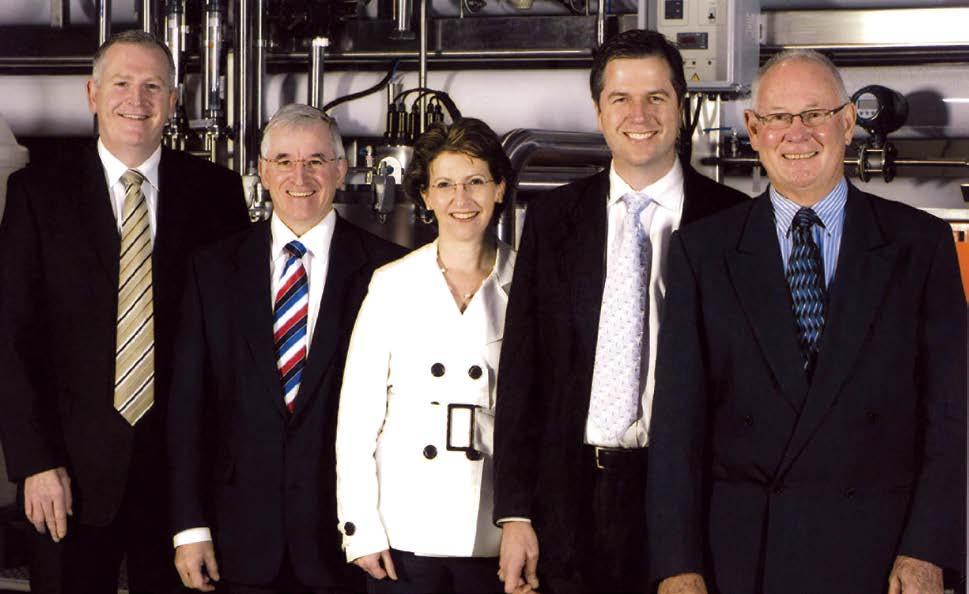

William Buck Adelaide Director Group, 2021

"An increasingly complex business environment has created the need for specialist advisory services and William Buck has grown alongside its clients to provide a fully integrated, one-stop shop solution."

In 1987, Giles & Giles aligned itself with licenced dealer Count Financial Group, to enable it to offer an investment service to clients. According to Peter Brock who managed the division until the mid 1990’s, Giles & Giles learned a lot from this association and for a period was the leading Count firm in Australia. However, in 1996 the firm switched to Lonsdale Limited and renamed its fledgling investment division Link Financial Services, which operated as a wholly owned subsidiary of Giles & Giles. The Giles & Giles newsletter at the time, reported that this development was a result of the strong growth of the investment division over the last eight years, which it described as “an exhilarating stage in our business development”.

Indeed, the creation of the Wealth Advisory division proved to be a pivotal moment in the history of William Buck Adelaide. The firm obtained its own Australian Financial Service Licence in 2003. This was a distinction from competitors and a clear benefit, with the division gaining significant traction. Its early success was due largely to the dedication and expertise of

Wendy Drake, a qualified chartered accountant who joined the firm in 1988 and was appointed Director in 2001. From the mid 1990s, with the guidance of Graham Perrin and Dennis Laundy, Wendy drove the Wealth Advisory division, with strong support from Chris Kennedy, Janine Williamson and long-term team members Nicole Holton and Michelle Hurcombe. Wendy and the team put their heart and soul into building the Wealth Advisory division and serving clients well beyond their expectations. Wendy said while William Buck’s client base provided a critical mass for the Wealth Advisory division to demonstrate its capability, but “it was all about reputation,” Wendy says. “Rather than product, we delivered a really good strategy, and it was actually our competitive advantage in Adelaide. The secret to the whole thing was that as a team we could deliver some superb results on behalf of a client that other financial planning firms in Adelaide couldn’t. They sold product and they invested money, but they didn’t bring the two together and we were integrated and that was the critical difference.”

Today, the Weath Advisory division has grown to 35 staff. Wendy has retired and Janine is a Director of the Wealth Advisory division, along with Adrian Frinsdorf, who heads up the division, Andrew Barlow and Aaron Trombetta. Adrian was appointed as a Director of Wealth Advisory in 2012 and brought a lot of sophistication to the firm’s investment offerings, primarily as a result of his background

26

Left: Standing: Chris Kennedy, Wendy Drake, Graham Perrin. Seated: Lonsec employee, Janine Williamson

Chapter 1 | Who is William Buck?

Right: Michael Miles and Michael McClaren – Link Financial Services

in stockbroking and investment banking and his unique skill set. “Adrian’s investment knowledge is superior, and he has brought a lot of ideas to the table which have broadened investment opportunities for our clients,” Jamie McKeough says. Andrew was recruited to William Buck from another firm and his passion and ambition contributed to him becoming one of the firm’s youngest Directors in 2020. Andrew is well known for his deep connection with his clients and his ability to get things done. Aaron was appointed Director in 2021 and along with Andrew, will drive the Wealth Advisory division forward into the future. Aaron’s clients have enormous confidence in him and his excellent knowledge of investments.

The Wealth Advisory division continues to be a significant contributor to William Buck, with more than 750 clients. In 2021, funds under management (FUM) exceeded $1.6 billion. In 2020, Wealth Advisory introduced a new Family Office service headed up by Principal Andrew Bradley. Advising families across multiple generations is something the firm has been doing successfully for a long time. With specialist skills in this area, the recruitment of Andrew has taken this offering to the next level. “Over the years, we’ve been very good at educating the next generation to manage wealth,” Andrew says. “We’re also very focused on defining the family’s purpose and what that means beyond just their wealth. This ensures ownership is structured appropriately so when the older generation pass away the family doesn’t fall apart over money or have to sell up all their assets because they have to be split three or four ways when they should be kept together.” Getting this right can be life changing.

Wealth Advisory Directors – Standing: Andrew Barlow and Aaron Trombetta. Seated: Janine Williamson and Adrian Frinsdorf

Below: Wendy Drake, Former Wealth Advisory Director

27

"Wendy was fearless, tenacious, she was well ahead of her time. She was a lady dealing in what was pretty much still a man’s world and in terms of Wealth Advisory, she knew more than most people in that space. She gave her heart and soul to that division and the firm."

– Mark Collins, Managing Director

Former Giles & Giles Partner Graham Byrne, whom Peter Brock described as energetic and entrepreneurial, died prematurely aged 36 in 1975. Graham had focused on Audit services and his clients were dispersed to other Directors at the time. It was not until many years later, when Audit Manager Priit Taylor was promoted to Director in 2003, that the firm created a dedicated Audit division, however, this did not reach a critical mass until the merger with MSI Tilley in 2011. Managing Director of MSI Tilley Grant Wilson, who is a Director with William Buck Adelaide today, says that William Buck’s Audit division more than doubled overnight, thanks to MSI Tilley’s very strong audit list.“We knew with our client base and skill level that we had a lot to put on the table,” Grant says. Following the merger, fellow MSI Tilley Partner Dean Spencer stayed on to hand over his audit clients. Dean was looking to retire, so when Priit had to retire due to ill health, Dean stayed on until the firm recruited Matthew King. Matthew had Big 4 audit experience, having previously worked for Ernst & Young and MSI Tilley, as well as completing a stint in commerce with Elders. During the recruitment process, the firm was introduced to Grant Martinella (also ex-Ernst & Young), who was working for an accounting firm in Mildura. The firm was so impressed with Grant that it recruited him a couple of

months later, even though there was only enough audit work for one Director. “It was a perfect example of us investing in the firm’s future and investing in our specialist services,” Jamie says. “Over the last nine years, Matthew and Grant have built our Audit and Assurance division into a highly regarded division in the Adelaide market which is capable of handling any audit.”

In 2001, Tricia Kleinig transferred from William Buck’s Business Advisory division to start up a dedicated Superannuation division. In 2021, Tricia chalked up 35 years with the firm, including 20 years managing Superannuation, now as a Principal. Her specialist knowledge of self-managed super funds (SMSFs) ranks among the best in Adelaide. Along with Sarah Parson, Superannuation Manager, and the support of a team of 16, including Sarah Withall and Sarah Gibson, Tricia oversees approximately 600 self-managed super funds.

From the mid 1990s until 2011, William Buck Adelaide did not have a Tax Services division, but relied on the stand-out tax knowledge of Ian Snook. Ian is widely recognised as an exceptional tax practitioner with an extraordinarily deep understanding of tax legislation. Jamie says Ian is peerless in his knowledge of tax legislation as it relates to SMEs and can come up with solutions that others cannot.” Even the legal

28

Matthew King and Grant Martinella, Audit and Assurance Directors 2021

Chapter 1 | Who is William Buck?

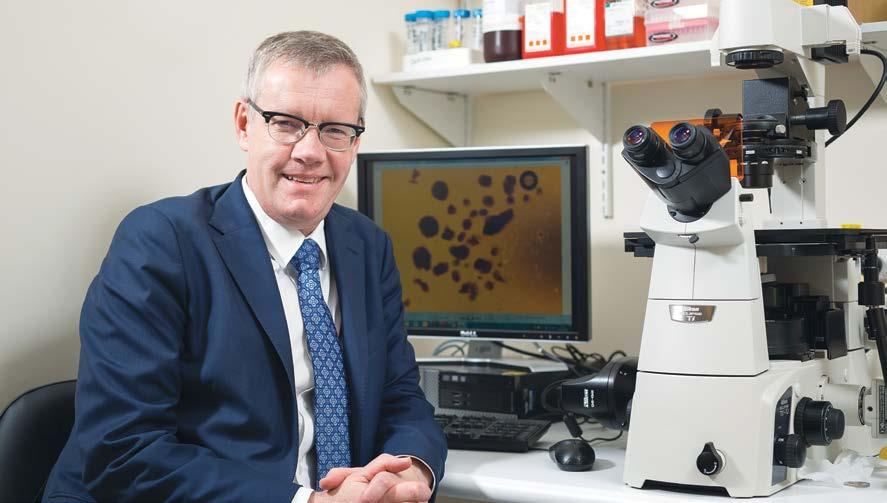

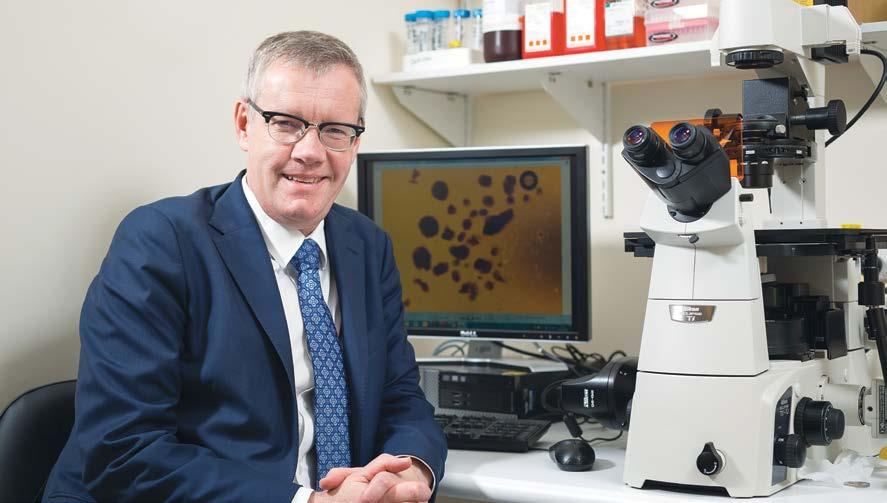

Andrew Nicola, Malcolm Wight and Ian Snook, Specialist Tax Directors 2021

fraternity come to Ian for tax advice,” Jamie says. “He delivers huge value to clients that is often understated. His ability to structure and restructure complex situations legitimately saves clients hundreds of thousands of dollars.” The search for someone to support Ian and build a Tax Services division ended when the firm successfully recruited Malcolm Wight back to the firm in 2011 after a 17-year hiatus working with Grant Thornton. Malcolm relished the role of creating an entire division, including the appointment of young gun Andrew Nicola, from KPMG, to Director at the age of 31 and James King who was recruited as Principal from Deloitte in 2021. Andrew now heads up the Tax division which is an accurate reflection of his intellect, ambition and ability to form strong relationships with clients. Andrew’s interest in corporate and international tax complements Ian’s focus on SMEs. While it took time to build this specialist team, William Buck now lays claim to a highly functional, highly capable Tax Services division that can handle any tax situation, no matter how complex, including international tax, working with our Praxity colleagues when required.

In 2014, William Buck Adelaide identified a gap in its service offering and established a new Corporate Advisory division which has been very successful. This offers some similar services to Business Advisory, but with a focus on supporting entrepreneurs, business owners, SMEs and ASX companies in the mid-market. The Corporate Advisory division thinks outside the box to identify growth opportunities, raise capital, facilitate mergers and acquisitions, trouble shoot, conduct valuations and develop succession plans. Directors Grant Wilson and Adrian Chugg moved across from Business Advisory to head up this new division. Adrian has attracted some of the firm’s largest clients because of his unparalleled ability to build people’s confidence and support them in growing their business in terms of structure and strategy.

“Once Adrian gains a client’s confidence and becomes fully engaged in their business, he becomes a critical part of their business,” Jamie says. Like Adrian, Grant moved from Business Advisory to support the new Corporate Advisory division, demonstrating his preparedness to be a team player and take on a role that has benefited the firm greatly. “Grant really immerses himself with clients and gains their confidence

including a number of the firm’s largest and long standing clients,” Jamie says. He is a left-field thinker and he and Adrian have really worked well with each other. In 2021, the Corporate Advisory division welcomed Samantha Nicholls as a new Director. According to Jamie, Samantha’s nontraditional skill set complements what Adrian and Grant offer clients. “Samantha is superbly organised and has great commercial acumen and a real presence,” Jamie says. “Clients love her!”

Finance Advisory is a small division, formed in 2016 under the leadership of Manager Malcolm Anderson. William Buck Adelaide is looking to grow this service as an additional offering to clients who are looking for support with their finance broking and business banking needs.

The firm’s newest division is Managed Funds Administration, which was formed following a merger with MacKenzie Advisory in 2020. Director Scott MacKenzie’s substantial business consisted of equal parts Business Advisory and Managed Funds Administration which had great appeal to William Buck Adelaide as the firm was looking to bulk up that part of its business. Scott and his team had carved out a niche managing smaller funds, an area that was being overlooked by the big players in the funds management business. In 2021, William Buck had more than $1.5 billion in funds under administration domestically and internationally, including property, shares and mortgage funds. Recently appointed Director, Cain Meschiati is now working with Scott in Managed Funds Administration and taking on greater responsibility for the division.

29

Grant Wilson and Adrian Chugg, Corporate Advisory Division, established 2014

William Buck Adelaide’s efforts to expand its range of specialist services began in earnest in 2000. Over the last decade, this specialisation has accelerated considerably to the point where the firm now boasts more specialist services than any other mid-market accounting firm in Adelaide. Jamie says that back in the early 1990s, the firm’s clients were mainly farmers and investors, and one of his goals as Managing Director was to rebalance this by building up a client base of substantial and decent business clients. “What’s so good about businesses is they have much broader and more complex financial needs and that has helped spawn a lot of our specialist services,” he says. As well as a broader range of services, William Buck Adelaide is now of a size that it can offer specialisation by industry. While not the primary focus for the firm, its reputation as a leader in the provision of accounting and advisory services to the agribusiness, Health and Property segments in the Adelaide market is highly regarded. William Buck Adelaide also has a concentration of clients in the Manufacturing, Aged Care and Education space. Jamie cautions that the market in Adelaide is not deep enough to specialise in one area and you have to do a bit of everything. However, as the firm grows it will naturally accumulate a concentration of clients in particular industries, creating opportunities for consolidation in these market segments.

Over many years, William Buck has built up its specialist services to not only support clients, but to also support the journey of graduates all the way through to Director. Today, the firm’s specialist divisions are firmly entrenched in William Buck’s professional offering. Many of the firm’s Directors are considered to be leaders in their field. To name a few; Ian Snook, whose tax expertise is highly valued by the South Australian business community; Tom Laundy and Andrew Barlow who provide

business advice to many of the State’s medical and health professionals; Paula Liddle and Ben Trengove who head up the firm’s agri service offering; and Grant Martinella in Aged Care. These industry leaders, and many other talented professionals and support staff at William Buck Adelaide are the backbone of the firm’s specialist services, which according to retired Director Wendy Drake, has been a powerful driver for staff. “It has pushed us all up to another level so that we can help bigger and better clients,” she said. “As a practitioner it makes you so much more competent.”

Clients are the main beneficiaries of this increased pool of knowledge, and for this reason, William Buck Adelaide will continue to develop specialist divisions and services within divisions, such as risk insurance and trustee services, where they align with clients’ needs. As clients’ businesses continue to evolve and disruption becomes the norm, William Buck Adelaide is poised to further broaden its specialist services for the mid-market.

Chandlers Hill Surgery

One client who has benefited enormously from William Buck’s specialist services is Chandlers Hill Surgery. The surgery, as well as four of the Partners, use William Buck and have done so for the last 15 years. One partner, Dr Danny Byrne, says William Buck’s excellent understanding of general practice has revolutionised the practice and brought it into the 21st century. “You can’t just go to any old accountant, it’s not enough even to understand health, you have to understand general practice and these guys really do,” Danny says.”William Buck talk at GP conferences, they go through industry surveys and benchmarking. They’re not just paying it lip service, they’re staying at the top of their game. They keep us up to date and pass that knowledge on to us. They speak our language.”

30

Chapter 1 | Who is William Buck?

"Over many years, William Buck has built up its specialist services to not only support clients, but to also support the journey of graduates all the way through to Director."

Specialist services

Business Advisory (1989)

Accounting and Tax Compliance

Strategic Business

Advice and Planning

Estate Planning

Tax Planning

Business and Forecasting

Restructure and Asset Protection

Business Succession Planning

Outsourcing, Bookkeeping and Payroll Services

Tax Services (2011)

Tax Planning

Complex Tax Advice

Tax Audits, Disputes and Private Rulings

Tax Risk Management

Structuring and Restructuring

Indirect Tax

International Tax and Transfer Pricing

Remuneration Planning

Tax Consolidation

Executive Tax Services

R&D, Grants and Incentives

FBT and Employment Taxes

Superannuation (2001)

Superannuation Compliance

Specialist Self-Managed

Superannuation Strategies and Advice

Audit and Assurance (2003)

External Audit

Internal Audit

Financial Reporting Advice

Risk Management

Data Mining

Fraud Investigation and Prevention

IT Assurance

Preparation of Financial Reports for Disclosing Entities

Corporate Advisory (2014)

Business Sales, Acquisitions and Divestments

Financial Modelling

Business Valuations

Debt and Equity Capital Raisings

Due Diligence Assignments

Forensic Accounting

Investigating Accountant's Reports

Independent Expert Reports

Purchase Price Allocations and Impairment Testing

Pre-Lending Reviews

Wealth Advisory (1989)

Financial and Strategic Investment Advice

Personal Wealth Creation Strategies

Portfolio Management and Administration

Estate and Succession

Planning and Administration

Risk Management and Life Insurance Advice

Private Manager and Trustee Services

Personal Structuring and Finance Application

Family Office

Finance Advisory (2016)

Finance Broking

Residential and Commercial Lending

Debt Structuring and Financing Application

Managed Funds Administration (2020)

Services and Advice for Wholesale and Retail Managed Funds

Investment Portfolio

Administration and Reporting

Unit Registry

Daily Management Accounts

Daily, Weekly, Monthly Unit Pricing (Special Prices as Required)

Distributions Including Tax Statements

GST and Income Tax Reporting

Fund Accounting

Review of Constitutions and Commercial Advice on Fund Operations

Advice on Management and Performance Fee Formulas

Including Use of Benchmarks and High Water Marks

31

From small things big things grow

While many of Giles & Giles’ tax clients in the early days were small, some of them have gone on to become very significant clients of William Buck today. In an interview in 1991, Mawson singled out Reg Rugless as an excellent example of a client for whom he began doing a personal tax return, which led onto much bigger things. Reg was a friend of Mawson’s. His father was a butcher who opened Rugless Butcher Shop on Brighton Road, Brighton more than 100 years ago. This butcher’s shop grew into more than 20 shops, owned and operated by Reg and his brother Claude, and three of Claude’s four sons – Brian, Peter and Colin. Today Claude’s grandson, Tim, is the Managing Director of Rugless Family Foodland, a valued client of William Buck, whose business benefits from the firm’s full range of professional services. Claude’s granddaughter, Belinda, is also working within the business.

The Rugless family has now been associated with Giles & Giles and William Buck for more than 60 years and Tim says he’s certain the relationship will continue for another 60. “It’s been a fantastic relationship built on loyalty and respect,” Tim says. “Nothing’s ever too much trouble for William Buck. They really have been a steadying influence with us when times are tough as well as in good times. I always feel a great sense of relief after catching up with our advisors at William Buck.”

Tim says the fact that the firm has worked with the Rugless family for so long means it really understands the business and the supermarket industry and how this is intricately connected to the family’s personal wealth. “William Buck were instrumental in our Brighton project where we doubled the size of our supermarket, added a wine store and got involved in the property syndicate,” Tim says. “They were amazing with the advice they offered, we couldn’t have done it without them!”

Another of Claude’s grandsons Graham, owns and operates Happy Valley, Mt Barker, Yorketown and Penola Foodlands. Graham has the next generation of Rugless’ coming through with his children Michael and Georgina working within the business.

32

Chapter 1 | Who is William Buck?

Above: Original Rugless butcher shop, 1922 Right: Former Senior Partner, Graham Perrin and Colin Rugless

33

Kelly and Tim Rugless

Step back in time: early services

In 1946, Giles & Giles was heavily focused on providing tax and accounting services to its clients. The following year, however, the firm acquired a small hotel accounting practice from the estate of Victor Trenerry, and along with it, the services of bookkeeper Doris Brokensha. After Bruce Giles joined the firm in 1950, he worked with his father, Ken, and Doris to build up the hotel side of the business. Ken was an executor for a client called Alfred Francis who owned several city and country hotels and when Alfred died, Ken and the other executors decided that instead of leasing the hotels, they would manage them. This led to the formation of a sub-branch of Giles & Giles known as G&G Hotel Supervision. The Partners were Ken and Mawson, Bruce and Doris. According to Bruce, Ken was considered to be “the hotel expert” and Giles & Giles gained a great deal of work through hotel brokers. The firm also bought a liquor trade price list and Bruce spent many hours updating the prices and sending them to hotels, which attracted new business. In addition, Bruce did the stocktake for a dozen or so hotels, which became quite a business in itself. This work led to Bruce being

asked to be the secretary of the Vine Inn Hotel in Nuriootpa, which he described as a highlight of his career. For the next 23 years, Bruce travelled to the Vine Inn every three months to do the stocktake. “I saw that hotel grow from just being a tin pot country pub with a bit of residential with debts, into a multimillion dollar business and property,” he said. Greg Broadbent who became a Director of Giles & Giles in 1984 took over the firm’s hotel clients following Bruce’s retirement in 1988. As the firm’s Hotel Services Director, Greg was an expert in financial and taxation issues facing hoteliers, including in investments, capital gains tax and general accounting and audit.

While the hotel sideline was a significant part of Giles & Giles’ business for many years, the firm was first and foremost a tax practice. In 1951, it acquired a small accounting practice in Kadina from FG Malpas, which quickly expanded its client list in the Mid North. In 1958, Jack Davis joined the firm, with an already impressive track record in tax which he gained at Elders Trustee. Dean Trowse, also from Elders Trustee, joined Giles & Giles in 1965 and according to Bruce, he and Jack were “a terrific combination” and had a great deal of tax expertise between them. Dean also had a background in trustee work and the firm started to act as trustee for many of its farming clients. Bruce said these clients had so much trust in Giles &

Former employees, Doris Brokensha and Bruce Giles, 1985

Chapter 1 | Who is William Buck? 34

Giles, much more so than Elders Trustee where “they didn’t know who Johnny Bloggs was”. “The clients knew us, could trust us, could talk to us and we could sympathise with them,” Bruce said. “That built up a terrific relationship with some of our clients.”

As well as tax and estate administration, Giles & Giles had several audit clients in its formative years, including automotive companies City Motors Pty Ltd, State Motors Ltd and City Supplies and H Graves & Co which was one of the big carrying firms of the day. When Graham Byrne joined Giles & Giles in 1967, he looked after firm’s audit work until his premature departure from the firm in 1973 due to ill-health. Ralph Pomeroy was then recruited to head up the audit area, however, he left the firm in 1976, at which time Giles & Giles sold most of its audit clients.

Despite its interest in hotels, audit and estate administration, by the time Ken retired and the firm moved to new offices on Greenhill Road, Giles & Giles was still very much considered to be a tax firm. True specialisation of the firm’s services did not begin until the beginning of the 21st century.

Above: Greg Broadbent, Former Partner 1984-2001

Above: Greg Broadbent, Former Partner 1984-2001

35

Below: Giles & Giles Kadina Office, 1989

Chapter 1 summary

Reflecting on the early years at Giles & Giles, Mawson said from time to time they talked about growing the business and possible amalgamations. However, he said the type of people who were Partners at the time were content to grow slowly. “I don’t think there was any urgency amongst any of the Partners to suddenly grow bigger or to amalgamate and become a huge organisation,” he said. But Mawson acknowledged that by the time he retired there was an appetite for change. Perhaps borne out of necessity. Or perhaps driven by the likes of Dennis Laundy, who had ambitions to modernise the firm. So, in the early 1980s, Giles & Giles began the gradual transformation from a conservative, compliancebased firm to a more confident, progressive firm.

Over this journey, the firm’s vision materialised and several successive strategic plans helped the Partners define and execute this vision. “Making the firm contemporary is not the sort of thing you can change overnight,” Dennis says. “But I think if you walked in as a graduate today it would feel a lot different than it did in my day. If I came in as a graduate now, I would think ‘this firm is going somewhere. This firm is going to provide me with opportunities that I may not necessarily get elsewhere, and this firm genuinely cares.” This statement sums up William Buck today; a firm that is going somewhere; and a firm that cares about its clients and staff.

Chapter 1 | Who is William Buck?

Giles & Giles picnic, Port Elliot, 1950s

"Despite its growth, one thing that has remained steadfast over the last 125 years, is the firm’s genuine interest in and care for clients and staff."

2

Growth and resilience

Becoming William Buck

The transformation from Giles & Giles to where William Buck sits today as the leader of the mid-market in Adelaide is remarkable. The firm’s long-time marketing consultant Marc Makrid describes it as a 12-year overnight success story! This period encapsulates 10 mergers, the addition of well over 100 staff and the development of several specialist divisions. Not to mention its long and enviable list of loyal, multi-generational clients, along with several high-profile clients who have found a new home at William Buck. Amongst all these milestones, Deputy Managing Director Martin Hill singles out joining the William Buck Group as the most significant event in the firm’s history. “It opened up our thinking and gave us more confidence,” Martin says. This key event took place in 1996, by which time Giles & Giles was fully committed to its growth strategy. This is why it aligned so well with the direction of the William Buck Group which had offices in Melbourne and Sydney and had recently recruited Bradshaw, Judd and Collins in Perth, Hogg Lawson in Brisbane and RJC Evans in Adelaide. A small firm called O’Hallorans in Auckland, New Zealand later joined as an associate. The Perth and Brisbane offices changed their names to William Buck, but RJC Evans chose not to, which led to the William Buck Group approaching Giles

& Giles to become its Adelaide-based firm instead. Former Chairman of the William Buck Group and Managing Director of William Buck Sydney, Nick Hatzistergos, says the intent was to recruit firms to the national network who had a view of themselves. In addition, the Group was looking for firms that wanted to build a brand that would lend itself to getting bigger and more complex clients in the small to medium enterprise (SME) space. “Giles & Giles was a very successful firm,” Nick says. “They had a lot of history in Adelaide. They were well managed and they were seen as a really good firm.”

40

Chapter 2 | Growth and resilience

Joining the William Buck Group was the most significant event in the firm’s history.

"The greatest benefit of joining William Buck Group is being part of something bigger than ourselves. If we can help you and you can help us and we're all individually better, then we're collectively better."

Mark Collins, Managing Director of William Buck Perth, was involved in recruiting Giles & Giles to the William Buck network and says the firm shared many similarities with the Perth office. He says one of the challenges they faced was that the Melbourne office thought Victoria was the centre of the universe and wanted to control the Group. “It was very Viccentric,” Mark says. “They were good people but they didn’t know any better. Dennis Laundy and I often used the analogy of the VFL and gradually they started to understand that for the national approach to work there had to be equal participation.”

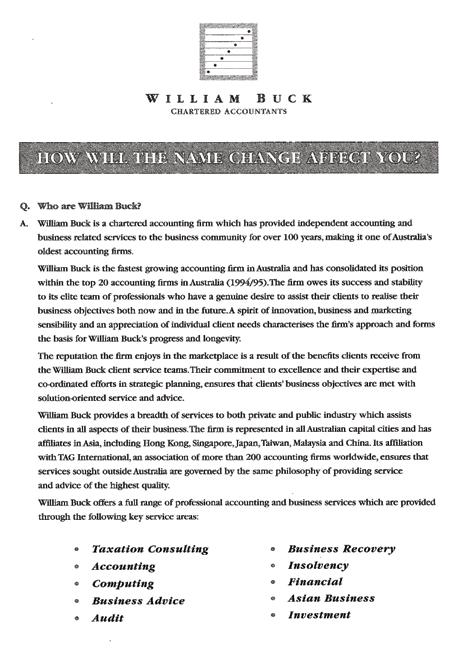

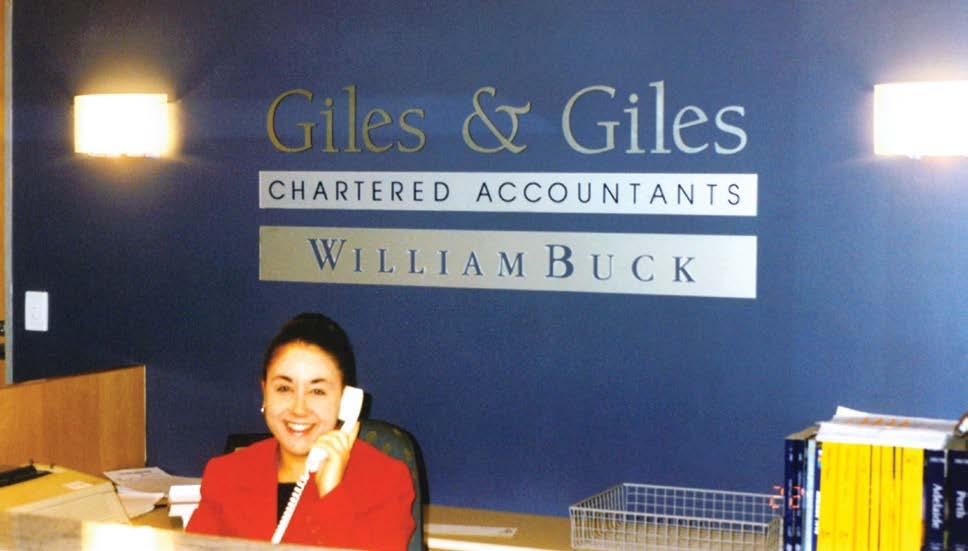

Within two years, the Adelaide Directors made the difficult decision to change the firm’s name from Giles & Giles to William Buck. “I wanted to get away from being known as a firm that only did tax returns for country clients,” Dennis says. “I thought unless we shake off that reputation, we’re never going to do that.” Nick says the willingness of Giles & Giles to change its name demonstrated its commitment to wanting to be more than just an Adelaide firm. “They had a bigger view of themselves and wanted to provide more opportunities for the younger people coming through,” he says.

41

Above: Name change from Giles & Giles to William Buck

Below: Receptionist Nicole Grima, 1998

42 Chapter 2 | Growth and resilience

Like William Buck Adelaide, the William Buck Group’s skill set is in the SME market, and proudly so, according to Nick. “We don’t want to pretend to be something we’re not,” he says. “We’re never going to chase a style of business that doesn’t suit our skill set.” Another point of difference is that the William Buck Group is locally owned and operated. “It’s not owned by a European or North American conglomerate that dictates terms,” Nick says. “It is Australian and New Zealand owned. It is uniquely ours. Each office is locally owned and operated.” The Board of the William Buck Group is made up of the six Managing Directors of the Australian and New Zealand offices. Jamie McKeough, who took over as Chairman of the William Buck Group from Nick in 2021, describes the William Buck Group as a federation which offers each individual office the best of both worlds. “We can work together with our colleagues in Australia and New Zealand where it makes sense to do so, but we can run our own shows,” Jamie says. “There are many people in the individual firms who contribute their time to the Group, but we operate independently.” At a Group level, William Buck shares resources in marketing, learning and development, people and culture, and audit and risk. This small, but growing team focuses on supporting Group-wide activities, including branding, website, professional development, compliance and the sharing of Intellectual Property.

Jamie says the greatest benefit of joining the William Buck Group is “being part of something bigger than ourselves”. “You have to be part of something bigger to continue to grow and develop and that’s what the William Buck Group (and Praxity) are for us,” he says. “We respect the other firms in the Group for the openness that’s always been there and their willingness to share. If we can help you and you can help us and we’re all individually better, then we’ll be collectively better.”

In 2007, the William Buck Group “got the wobbles”, which although not intended, shaped the future of the Group for the better, according to Jamie. The fallout for the William Buck Adelaide office was that the firm’s Directors were forced to do some serious soul-searching. There was the option of selling, but instead of being taken over by some other organisation they decided to create their own story. "We had good fundamentals, we had a good client base, we had good staff, and we had this desire to build so that’s what we decided to do,” Jamie says.”And we learned out of that moment of adversity for the Group about how to grow.” Ultimately, the decision not to sell the firm was motivated by what was in the best interests of clients and staff. The Directors felt their clients would get a better service if the firm stayed on its own and grew. They also realised that a lot of young staff coming through would most likely leave the firm if it was sold.

43

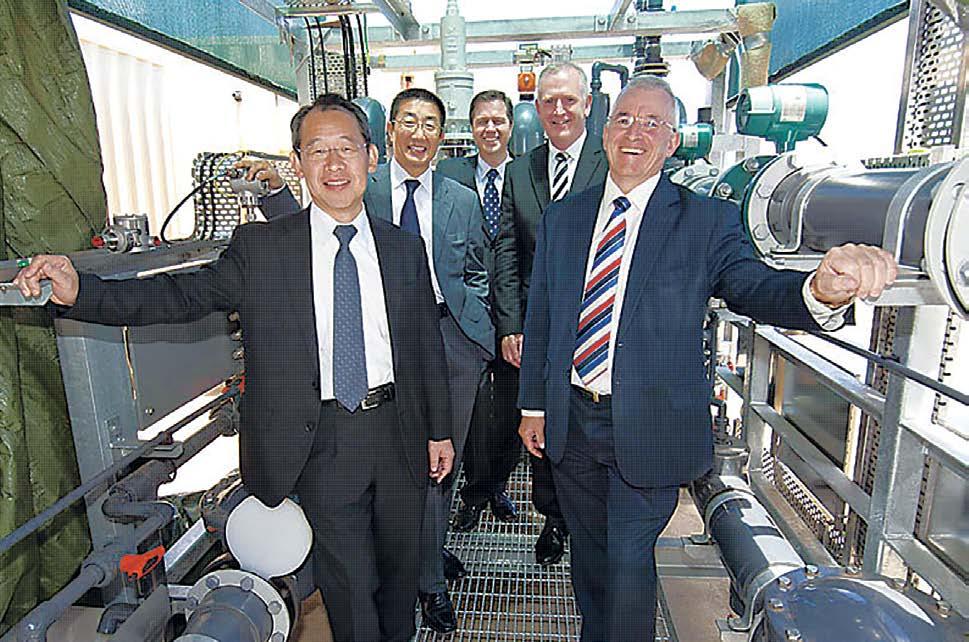

Top Left: William Buck Group Board, Jamie McKeough (SA), Clyde Young (NZ), Nick Hatzistergros (NSW), Junaide Latif (QLD), Lindsay Holloway (VIC), and Mark Collins (WA), 2021

Left: William Buck Sydney is established marking the beginning of the William Buck network, 1989

"The transformation from Giles & Giles to where William Buck sits today as the leader of the midmarket in Adelaide is remarkable."

44 Meeting your needs on both sides of the Tasman. A wealth of knowledge One of the most progressive firms in Australia and New Zealand, we offer a full range of integrated business and financial solutions. 9 Offices 950 Professional staff Leading mid-tier firm In Australia and New Zealand 125 Years of creating positive change in the lives of our clients and people WA 1 Office 9 Directors 50+ Professionals Chapter 2 | Growth and resilience

45 SA 1 Office 24 Directors 190+ Professionals VIC 1 Office 25 Directors 170+ Professionals NSW 2 Offices 34 Directors 235+ Professionals NZ 2 Offices 11 Directors 85+ Professionals QLD 2 Offices 10 Directors 105+ Professionals

Step back in time: The William Buck wobbles

In 2007, William Buck Melbourne, the founding and largest office of the William Buck Group, underwent a change of leadership and expressed its interest in joining Mazars to become part of an international partnership where all six William Buck offices would operate as one business. The other William Buck offices said ‘no’. Then out of the blue, William Buck Melbourne dropped a bombshell, and left the William Buck Group. Some time earlier, William Buck Brisbane had been sold to a consolidator firm called WHK, leaving just Sydney, Adelaide and Perth, as well as the smaller Auckland associate office, O’Hallorans, which was “hanging out on a limb,”. Mark Collins (Perth) and Nikolas Hatzistergos (Sydney) flew to Adelaide to make sure the three remaining firms

would stand together to rebuild the William Buck Group. “We were very clear that we were going to rebuild,” Mark says.

“The relationships were good and we all had a strong work ethic. We had a lot of similarities and were determined to make our mark on the world, so it just made sense.”

As adversity so often does, the ‘William Buck Group wobbles’ provided a valuable learning opportunity, particularly for the three firms who decided to stick it out. According to Mark, there were just two rules when they began rebuilding the national alliance.” The number one rule was we would never allow a big office to dominate ever again,” he says.

“The second rule was that it would truly be a national group, in other words it was going to be the AFL, not the VFL.”

With this agreed, away they went! Firstly, they recruited a new Melbourne outfit; Hawthorn-based Webb & Co in 2009, followed by Cranstoun & Hussein in Brisbane. Then

Nick visited the Auckland office, to apologise on behalf of the Group, for hanging them out to dry. These six offices

Mark Collins, Managing Director of William Buck Perth

"We learned a lot, contributed a lot and spent a massive amount of time building relationships."

Chapter 2 | Growth and resilience 46

– Mark Collins, Managing Director, William Buck Perth

Changing of the guard

Nick

Managing Director of William Buck Sydney