2023 Edition A CPE publication by the Wisconsin Institute of CPAs for accounting and business professionals Develop your skills. Update your knowledge base. Advance your career. 10 Taxation 6 Practice Management 14 Cybersecurity 28 Corporate Finance 34 Accounting & Auditing 36 Artificial Intelligence 24 Industry 18 Human Resources 32 Business Operations

Visit wicpa.org/CPErequirements for more information about CPE requirements. ATTENTION! THE CURRENT CPE REPORTING PERIOD ENDS DEC. 31, 2023 Reporting Period: Jan. 1, 2022 – Dec. 31, 2023 CPE Requirement: 80 total CPE credits Ethics Requirement: 3 Ethics CPE credits

By Christopher Martin, CPA, CGMA

By Tammy J. Hofstede, WICPA President & CEO

By Geoff Trotier, JD, and Caitlyn Doyle, JD

By Shifra Kolsky, CPA

By Jim Brandenburg, CPA, MST

By Chad Schaefer, CPA, CISA, CISSP and Monica Weggemann, CISSP, CISA, CIA, HITRUST CCSFP

By Tammy J. Hofstede, WICPA President & CEO

By Geoff Trotier, JD, and Caitlyn Doyle, JD

By Shifra Kolsky, CPA

By Jim Brandenburg, CPA, MST

By Chad Schaefer, CPA, CISA, CISSP and Monica Weggemann, CISSP, CISA, CIA, HITRUST CCSFP

By Scott Hirschfeld, President & CEO, CTaccess

By Scott Hirschfeld, President & CEO, CTaccess

By Tommy Kleinhans, CPA

By Anna J. Johnson-Snyder, CPA, CFE

By John Rasche, WICPA Public Relations Manager

By Tommy Kleinhans, CPA

By Anna J. Johnson-Snyder, CPA, CFE

By John Rasche, WICPA Public Relations Manager

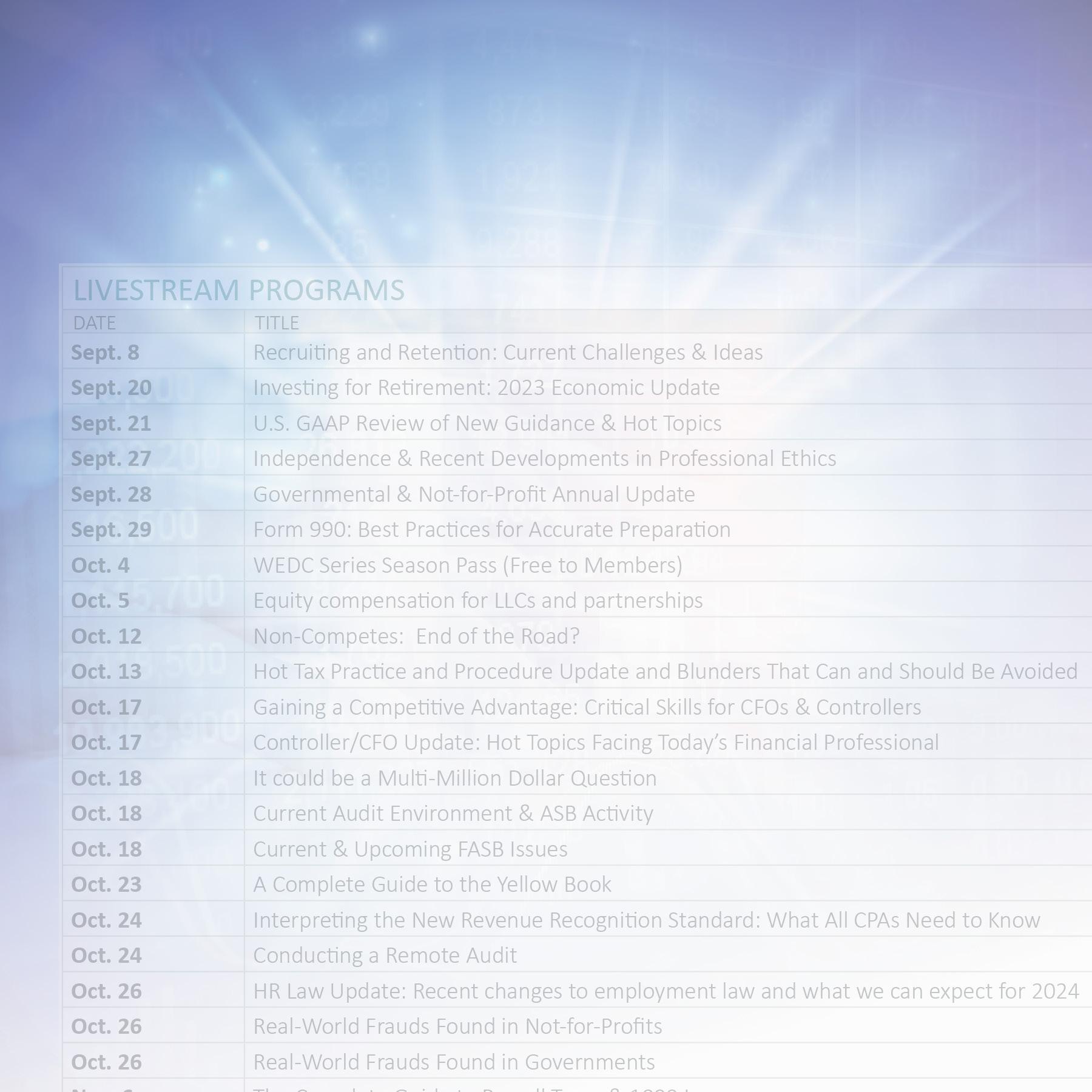

46 REGISTRATION 39 ONLINE CPE 40 CONFERENCES 44 BREAKFAST PROGRAMS 46 SEMINARS 52 CPE REQUIREMENTS 68 REGISTRATION FAQs 71 CPE CALENDAR Back Cover Foldout CEO Message Readjusting

Practice Management ESG as a retention strategy

Taxation Caught between a rock and a hard place

Cybersecurity Don’t let the hackers win

Inc. Human Resources Solutions for solving Quiet Quitting

Industry Business and tax opportunities for the food and beverage industry

Corporate Finance 4 ways to make finance a strategic business partner

Business Operations Maintaining effective internal controls in a compliance-driven world

Accounting & Auditing Best practices for closing the books

Artificial Intelligence ChatGPT passes CPA Exam — on second try

Features CPE & Special Events CONTENTS 2023 EDITION | wicpa.org A publication of the Wisconsin Institute of CPAs 4 6 10 14 18 24 28 32 34 36 14 28 Back Cover Foldout 6

Tammy Hofstede President & CEO Ext. 4518 tammy@wicpa.org

Brett Stallman Graphic Design Manager Ext. 4512 brett@wicpa.org

The CPE publication for accounting and business professionals Join

The Bottom Line is published annually by the Wisconsin Institute of Certified Public Accountants (WICPA). Change of address should be sent to: WICPA Membership, W233N2080 Ridgeview Parkway, Suite 201, Waukesha, WI 53188; Phone: 262-785-0445 or 800-772-6939; Fax: 262-785-0838; email: comments@wicpa.org. Statements and opinions expressed are those of the authors and not necessarily those of the WICPA. Publication of an advertisement does not constitute an endorsement of the product or service by The Bottom Line or the WICPA. Articles may be reproduced with permission.

© Copyright 2023 The Bottom Line

Rachella Fortier CPE Program & Event Manager Ext. 4505 rachella@wicpa.org

Emily Weber CPE Program & Event Coordinator Ext. 4506 emily@wicpa.org

Marcia Tillett-Zinzow Editor mtzinzow@icloud.com

2 The Bottom Line | 2023 Edition wicpa.org

INSIDE STAFF

us online!

A GREAT WAY FOR WICPA MEMBERS TO COLLABORATE

WICPA Connect is your exclusive members-only networking and knowledge base designed to connect you with WICPA members and resources.

• Network with peers and grow your contact list using the member directory of more than 7,000 members.

• Post questions to find out from fellow members who have the expertise or may have been in the same situation.

• Personalize your profile by adding your interests, education, experience, honors and even your photo.

• Contribute and download resources such as documents, whitepapers, articles, reports, guides and more.

• Share your knowledge and expertise by answering questions and offering your insights and ideas to fellow members.

• Customize your experience with controls for profile visibility, discussion signatures, notifications and more.

As a WICPA member, you already have a profile on WICPA Connect. Simply go to wicpa.org/connect and sign in using your existing website login information.

The Bottom Line | 2023 Edition 3 wicpa.org Connect with thousands of fellow members now at wicpa.org/connect

Let’s make the connection.

Readjusting

By Tammy J. Hofstede

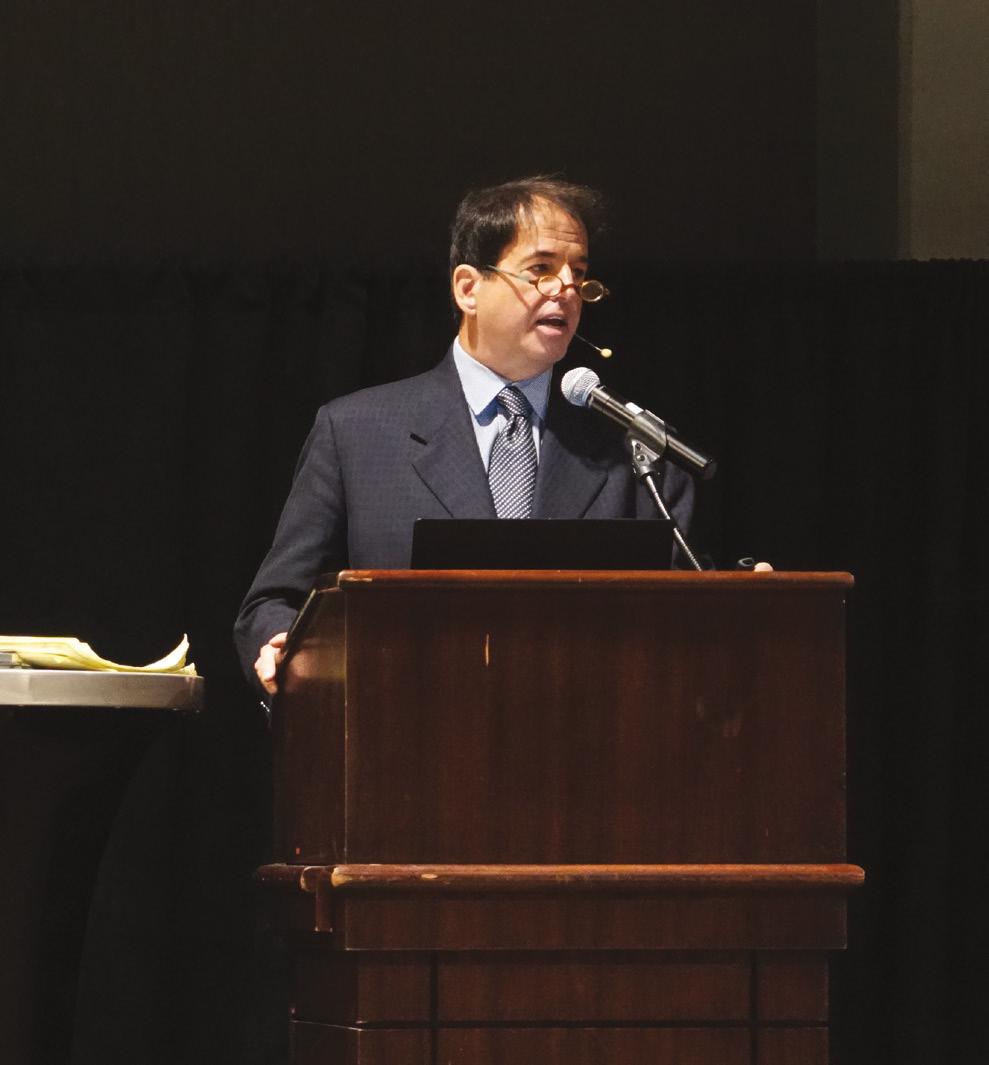

It was quite a busy year as we readjusted to finally coming back to some normalcy while adapting to changes the pandemic brought. One of the most significant adjustments was coming back to in-person activities and shifting and planning for the new norm of hybrid meetings and events.

We were delighted to be able to hold all our conferences and events in person this year! Our conferences were offered in person as well as via livestreams. Although we saw a decline in in-person attendance, the livestream and on-demand options have continued to be increasingly popular.

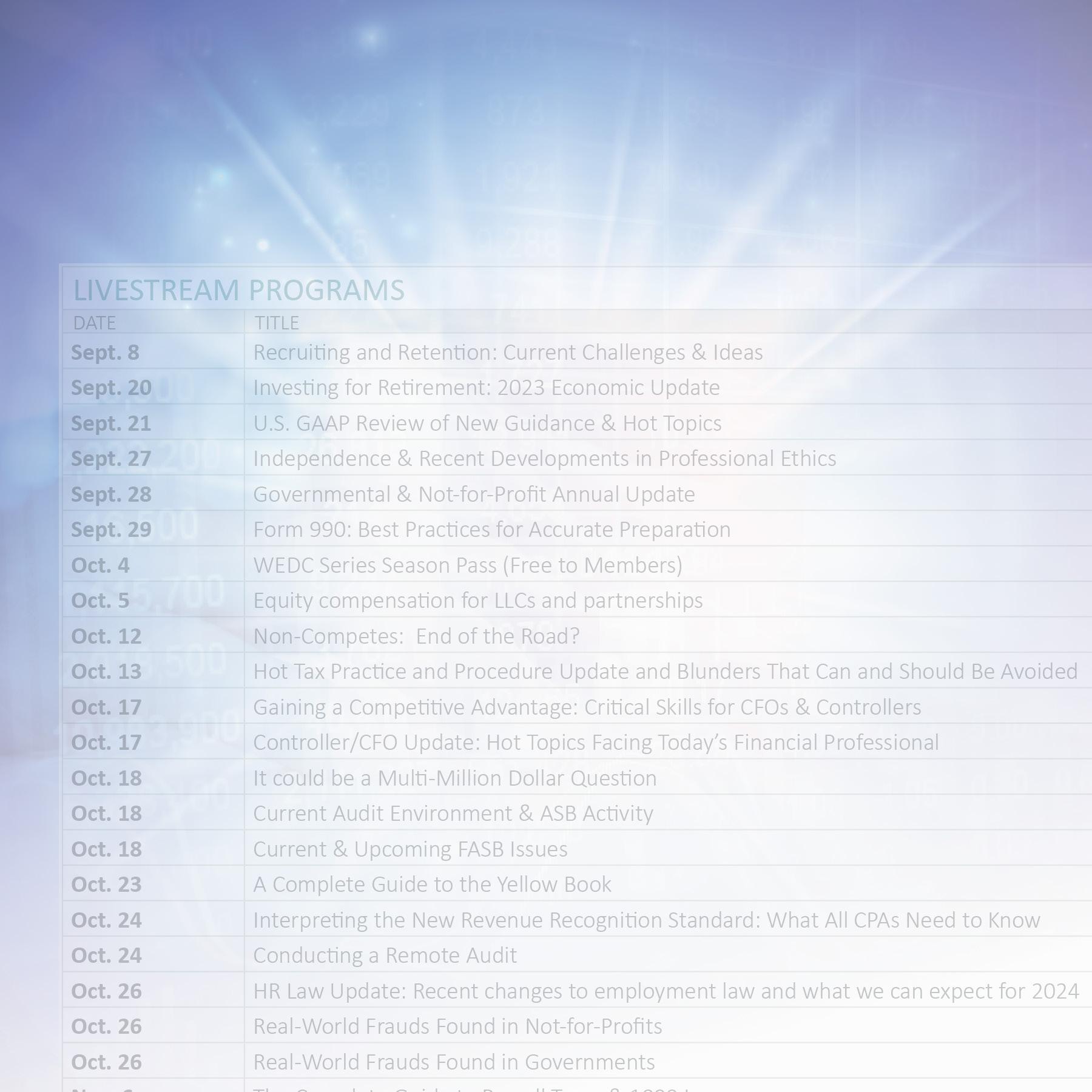

CPE

This year (2023) marks the second year of the two-year CPE reporting period for WICPA membership and CPA license renewal. To assist you with your CPE requirements, your WICPA membership includes discounts on continuing education to keep you up to date on tax laws, technology, human resource issues and new standards. We will again offer free CPE programs, including three law and employment update programs, the annual retirement program, and one selected program from each of our conferences that will include ethics. That’s more than 16 new, complimentary formal CPE credits in addition to the free programs already in our course catalog.

Our conferences are all back in person, and we continue to offer livestream options for each of them. Our primary venue for most of our conferences will continue to be the Brookfield Conference Center, which is easily accessible from the interstate and has free parking and an attached

hotel with negotiated reduced room rates for out-oftown attendees.

You will see in this new fiscal year that several of our smaller conferences will be moving to WICPA headquarters and utilizing our space now that the majority of participants are attending via livestream.

For quick and convenient CPE, we have planned more one- to four-hour livestream programs, including the Wednesday and Friday breakfast program season passes. The popular Individual Income Tax Update program with June Norman, a favorite that includes the Master Tax Guide, will continue to be held in person in several locations across the state. A livestream option will also be available.

Go-to resource

The WICPA is committed to being your go-to resource. We are your connection to up-to-date, accurate and trustworthy information through our Featured News, social media, Connect, high-quality publications and e-news. Committee meetings and membership events are also valuable opportunities to build relationships with other professionals from different areas of the state to share ideas and common challenges.

4 The Bottom Line | 2023 Edition wicpa.org

“

We will again offer over 16 credits of free formal CPE!

We continue to offer our virtual quarterly member orientation meetings for those who wish to learn more about the WICPA.

Events

We’re pleased to announce that all our signature events are back! Our annual golf outing at Ironwood Golf Course will be held in Sussex on Sept. 22. We sold out last year, so register early! Also watch for networking nights to be back this fall as well as our Bowling Night next April.

We thank you for your continued support of the WICPA and our programs as we continue to shape programs, services and activities designed to enhance your opportunities and member experience.

• Manage your profile and contact information.

• Update your areas of interest and volunteer opportunities.

• Find member benefits.

• Renew your membership.

Designate an organization administrator to manage membership and registrations for everyone at your organization.

• Pay membership dues and make Educational Foundation contributions for your organization in one transaction.

• Register multiple individuals for programs.

• Update your organization’s roster, and manage employees at multiple office locations.

• Add your organization’s information to Find a CPA. Reach out to membership@wicpa.org or call 800-772-6939 to become an administrator.

• See your upcoming WICPA programs, events and meetings.

• Access and download your CPE materials and certificates.

• Use the CPE Tracker to monitor your formal and informal CPE credits for the reporting period.

• Add other formal and informal CPE to the tracker to keep all your records in one place.

Ask questions, give advice and share information in the WICPA Connect online community.

• Read and participate in current discussions — or start a new one.

• Personalize your profile by controlling notifications and adding interests, education, experience, signatures and your photo.

• Use the Member Directory to find and connect to members across the state.

• Connect with specialized groups by joining a committee such as Wisconsin or Federal Taxation, Business and Industry, Not-for-Profit and many others.

The Bottom Line | 2023 Edition 5 wicpa.org

Tammy J. Hofstede is president & CEO of the WICPA. Contact her at 262-785-0445, ext. 4518, or tammy@wicpa.org.

Use the MY WICPA personal dashboard to put membership at your fingertips.

Easily track registrations, upcoming courses, events and meetings in MY CPE.

Make the Most of Your WICPA Website!

ESG as a Retention Strategy

Setting ESG goals to hang onto your fleeing workforce

6 The Bottom Line | 2023 Edition wicpa.org Practice Management l Retention strategies

By Geoff Trotier, JD, and

The environmental, social and governance (ESG) framework has come into the spotlight in recent years. From ESGfocused investment strategies to the Securities and Exchange Commission’s goals of increasing required disclosures related to ESG, most companies have been inundated with requests for ESG information. Even if ESG is implemented for purely financial reasons, ESG done correctly can also be leveraged as a retention strategy for a younger workforce that has shown they are not afraid to flee.

There are various understandings of what ESG looks like in practice. At a high level, ESG asks three questions:

1. E – How does your company work to protect the natural environment?

2. S — How does your company treat people, including stockholders, employees and community members?

3. G – How does your company govern itself?

The answers to these questions impact a company’s reputation internally and externally, especially among younger generations.

Over the past few years, companies have noticed an increase in resignations in the millennial and Generation Z age groups.1 The phenomenon has been colloquially named “The Great Resignation.”2 However, this trend was not surprising to many, as millennial and Gen Z individuals have always been more willing to switch jobs — and switch jobs frequently.3 With

1 Michael Dimock, “Defining Generations: Where Millennials End and Generation Z Begins,” Pew Research Center (January 17, 2019), https://www.pewresearch.org/ short-reads/2019/01/17/where-millennials-end-and-generation-z-begins/.

2 Tim Smart, “Study: Gen Z, Millennials Driving ‘The Great Resignation,’” U.S. News (August 26, 2021), https://www.usnews.com/news/economy/articles/2021-08-26/ study-gen-z-millennials-driving-the-great-resignation.

3 Amy Adkins, “Millennials: The Job-Hopping Generation,” Gallup, https://www.gallup.com/ workplace/231587/millennials-job-hopping-generation.aspx; George Anders, “Is Gen Z the Boldest Generation? Its Job-Hunt Priorities Are Off the Charts,” LinkedIn News, https://www.linkedin.com/pulse/gen-z-boldest-generation-its-job-hunt-priorities-offcharts-anders/.

millennials and Gen Z workers making up approximately 72% of the global workforce by 2029,4 companies must make an intentional effort to attract and retain these age groups. Those that are unable to do so will feel economic hardship through hiring and training costs and the loss of industry knowledge as baby boomers retire.

Fortunately, both millennials and Gen Z workers generally gravitate to similar companies: those that prioritize ESG initiatives in their business practices, such as environmental sustainability, community awareness and ethical management.5 In fact, companies that effectively prioritize ESG initiatives with measurable results are found to be more attractive to talent and have higher employee satisfaction and retention rates than companies that do not have such initiatives.6

The best way to measure the effectiveness of a company’s ESG initiatives is to begin now with a baseline ESG score. There are numerous third-party organizations that allow companies to self-report relevant data, which the third-party organizations will weigh in accordance with their publicly available metrics to give participating companies an ESG score.

5 Alex

Stand Out for Climate Change Activism, Social Media Engagement With Issue,” Pew Research Center (May 26, 2021), https://www.pewresearch.org/science/2021/05/26/gen-z-millennials-stand-out-for-climate-changeactivism-social-media-engagement-with-issue/; Matt Kunkel, “How ESG Alignment Can Spur Employee Retention and Attract Future Talent,” Corporate Compliance Insights (February 16, 2022), https://www.corporatecomplianceinsights.com/esg-alignment-employee-retention-great-resignation/. 6 Bailey, Yeo, Jiang and Ferguson, “ESG as a Workforce Strategy,” Marsh McLennan, https://www.marshmclennan.com/insights/publications/2020/may/esg-as-a-workforce-strategy. html; Matt Kunkel, “How ESG Alignment Can Spur Employee Retention and Attract Future Talent,” Corporate Compliance Insights (February 16, 2022), https://www.corporatecomplianceinsights. com/esg-alignment-employee-retention-great-resignation/; Sarah Carpenter, “How Effective ESG Programs Recruit & Retain Top Talent,” Assent (July 5, 2022), https://www.assent.com/blog/esgprograms-recruit-retain-top-talent/.

The Bottom Line | 2023 Edition 7 wicpa.org

4 Robert Bailey, Jaclyn Yeo, Lingjun Jiang and Angela Ferguson, “ESG as a Workforce Strategy,” Marsh McLennan, https://www.marshmclennan.com/insights/publications/2020/may/esg-as-aworkforce-strategy.html.

Tyson, Brian Kennedy, and Cary Funk, “Gen Z, Millennials

Caitlyn Doyle, JD

“

ESG done correctly can also be leveraged as a retention strategy for a younger workforce that has shown they are not afraid to flee.

7

By engaging in this process early, companies are able to understand the categories their current practices are falling short in and can use the third party’s metrics to work backwards to create effective ESG initiatives.

The good news is that ESG initiatives can be simple and still have measurable success across multiple categories. For example, a diversity, equity and inclusion (DEI) initiative is an ESG initiative under the social and governance categories. DEI initiatives could be as simple as providing clear paths to leadership roles within the company and increasing mentorship to diverse employees. Initiatives that encompass the environmental and social portions of ESG include creating a company practice of highlighting a healthy workplace — such as improving office air quality or implementing a wellness subsidy — which can be costfree with buy-in from health insurance providers. Lastly, investment opportunities in environmentally conscious portfolios can both diversify your company’s portfolio and increase environmental and governance scores.

Once your company has an ESG score or otherwise understands where there is room for improvement, it should engage legal counsel to determine what initiatives would provide measurable impact and riskmitigation benefits. For example, a well-implemented DEI initiative can decrease discrimination complaints, increase inclusivity in the workforce, increase risk identification at management levels and even increase revenues.7 Engaging legal counsel early in this process provides your company with attorney-client privilege when discussing sensitive DEI shortcomings and increases the effectiveness of your DEI initiatives to ensure your company is taking full advantage of the risk-mitigation benefits.

The last step to leverage these initiatives as an employee retention strategy is to publicize the ESG initiatives and successes both internally and externally. Talent knows talent, and making current employees your company’s biggest fans will not only increase retention but may also increase the willingness of millennial and Gen Z job hunters to choose your organization over others.

she advises clients on ESG to attract and retain talent. Contact her at Caitlyn.Doyle@HuschBlackwell.com.

8 The Bottom Line | 2023 Edition wicpa.org

Geoff Trotier, JD, is a partner in the law firm of Husch Blackwell LLP in Milwaukee, where he handles labor and employment law challenges. Contact him at Geoff.Trotier@HuschBlackwell.com. Caitlyn Doyle, JD, is an attorney with Husch Blackwell, where

“

Talent knows talent, and making current employees your company’s biggest fans will not only increase retention but may also increase the willingness of millennial and Gen Z job hunters to choose your organization over others.

Bailey Reiners, updated by Brennan Whitfield, “50 Diversity in the Workplace Statistics to Know,” BuiltIn (March 28, 2023), https://builtin.com/diversity-inclusion/diversity-inthe-workplace-statistics; Megan Krause, “5 Reasons Diversity & Inclusion is Important for Business,” Investis Digital (January 6, 2022), https://www.investisdigital.com/blog/corporatecommunications/why-is-diversity-inclusion-important.

FRIDAY, SEPT. 22 – Ironwood Golf Course, Sussex

REGISTRATION INCLUDES

Breakfast & Lunch

Beverage Vouchers

Hole & Event Prizes

Entry in Prize Drawings

Reception & Appetizers

2023 WICPA

8:30 a.m. Check-in & Breakfast 9:00 a.m. Practice Greens & Driving Range 10:00 a.m. Shotgun Start

PERSON LIMIT 4-Person Scramble $95 per Golfer $380 for Foursome HOLE & EVENT PRIZES

in Individual Prizes

in Team Prizes $500 Inside the Circle Contest

GOLF OUTING SCHEDULE

216

$1,700+

$500+

18 Holes of Golf With Cart

Practice Greens & Driving Range

DON’T MISS OUT! Register now at wicpa.org/GolfOuting REGISTER NOW

Taxation l ERC eligibility and brokers

Caught Between a Rock and a Hard Place

Employers can be confused when tax professionals and opportunistic brokers offer conflicting advice on the Employee Retention Credit (ERC).

The Employee Retention Credit, since its introduction under the CARES Act in March 2020, has significantly impacted many for-profit and not-for-profit employers, both large and small. While the ERC got off to a slow start (most employers opted instead for a Paycheck Protection Program (PPP) loan), the enhancements of the ERC under “CARES 2” in December 2020 made the credit available to employers even if they obtained a PPP loan (although the same wages could not be used for both the ERC and the PPP). The floodgates opened as employers wanted to learn how the ERC worked and whether they would be eligible for this incentive.

By Jim Brandenburg,

Opportunistic ERC brokers sprang up, as employers searched for direction on the specifics of the ERC, seeking to aid employers in obtaining a refund. Some of these brokers were professional and diligent in following IRS guidance to assist employers; others, however, were not. Many brokers were aggressive in their search for business owners and pushed the envelope in their interpretations of the IRS’s ERC guidance. ERC brokers also received a percentage — often 15% to 35% — of an employer’s ERC refund.

As ERC brokers increased their outreach to businesses last year, the IRS began cautioning employers about aggressive brokers contacting unsuspecting taxpayers

— many of whom did not qualify for the ERC. The IRS warnings regarding the ERC expanded this year as the agency added abuse of the ERC to its “Dirty Dozen” list of tax scams and recently issued the following alerts:

• IRS warning on ERC mills: This IRS warning, issued on March 7, urged taxpayers “to carefully review the [ERC] guidelines before trying to claim the credit as promoters continue pushing ineligible people to file.” This IRS alert also noted that the “IRS and tax professionals continue to see third parties aggressively promoting these ERC schemes on radio and online. These promoters charge large upfront fees or a fee that is contingent on the amount of the refund.”

10 The Bottom Line | 2023 Edition wicpa.org

“

As ERC brokers increased their outreach to businesses last year, the IRS began cautioning employers about aggressive brokers contacting unsuspecting taxpayers.

CPA, MST

• IRS alert to tax practitioners regarding professionals not following IRS standards: In this separate alert, the IRS cautioned tax practitioners about their responsibility in ERC situations. The IRS noted that “to fulfill their professional obligations to clients and to tax administration, practitioners (attorneys, CPAs and enrolled agents) must meet the applicable provisions in Circular 230.” A key aspect of Circular 230 involves a practitioner exercising “diligence as to accuracy” (Section 10.22(a)). The IRS notes the following in its alert:

o If the practitioner cannot reasonably conclude (consistent with the standards discussed in the guidance) that the client is or was eligible to claim the ERC, the practitioner should not prepare an original or amended return that claims or perpetuates a potentially improper credit.

o Additionally, if a practitioner learns that a current client did not comply with the ERC requirements in a prior tax year, the practitioner must — under Section 10.21 — promptly inform the client of

the noncompliance, error or omission and any penalty or penalties that may apply.

Therefore, not only must employers be cautious in pursuing ERC claims, but tax practitioners must also exercise diligence in working with the ERC. They are often caught in the middle as they advise employers about the ERC. For instance, a CPA could perform a thorough assessment that an employer is NOT eligible for the ERC only to have an aggressive broker tell the employer they ARE entitled to a refund. An employer would be confused as to how to proceed, and the CPA would likely be put on the defensive.

Tax practitioners know that sometimes gray areas can occur in dealing with tax issues, but some brokers are aggressively pushing large ERC claims in cases where there is not even a hint of gray. This puts the employers, and in some cases the CPA, in a quandary.

IRS audits of ERC

IRS audits of the ERC have started, sometimes involving an on-site visit by an auditor and/or a correspondence

The Bottom Line | 2023 Edition 11 wicpa.org

audit. During an examination, the IRS will request documentation from the employer concerning its ERC claim and question whether it complies with IRS guidance. Some disputed cases might eventually find their way into the courts, as legal arguments supporting ERC eligibility due to a full or partial shutdown from a government order will be tested.

If employers have their ERC claims disallowed, they will be forced to pay back the ERC amounts, possibly with interest and penalties. If an ERC claim is disallowed and repayment is required, one challenge for employers that worked with an ERC broker will be to seek a refund of the fees paid. The ability to recover these fees may largely depend on the terms of the contract that was signed.

While unclear now, many practitioners are hopeful that by the end of 2023 they will have a better understanding of the types of ERC claims the IRS disallows.

What advice would a practitioner offer to an employer now regarding ERC?

Be diligent. Encourage employers to compare their situations to the IRS rules on the ERC. Remind employers that a company officer must sign the ERC refund claim on behalf of the employer and, thus, bears the responsibility to be diligent in determining the employer’s ERC eligibility, reviewing the ERC calculations and documenting the ERC support.

If an employer engages a consultant or ERC broker for assistance, they should consider the terms of the contract for payment — for example:

• Will the employer be required to pay the fees before the ERC refunds are received?

• In the event the ERC claim is disallowed in an audit, will the broker or consultant refund fees paid?

Lastly, stress to employers that they understand the net amount they will receive after all fees and additional income taxes on amended tax returns are paid.

Don’t rush. Urge employers not to be in a hurry to file an ERC claim. As noted, they should take their time to be diligent and not feel pressured to file an ERC claim until they are comfortable with it. The statute of limitations does not start until 2024 for ERC claims from 2020 (and 2025 for claims from 2021).

Retain documentation supporting the claim. Inform employers that they should assume the IRS will examine

their ERC claims. They should gather and retain all the applicable documentation as they file. If they have already filed a claim, they should go back through the ERC filings and make sure to gather documentation, even if the IRS has not contacted them for an exam. Employers who had a consultant or ERC broker prepare their claims should request all documentation from the broker to retain in their files.

Pay now; refund later. Remind employers that ERC refunds must be included in taxable income for the period the wages generated by the ERC were earned. For example, if an ERC claim was filed in 2022 for the second quarter of 2021, but the employer did not receive their ERC refund until 2023, the business still needs to include the ERC amount in their taxable income for 2021, the year of the claim. Amended income tax returns will likely be needed to include this ERC in taxable income. Thus, employers will need to pay the income tax cost now for the amount of the ERC to be received later — or they will be subject to additional interest.

Carefully weigh eligibility methods. There are two main methods a business or not-for-profit organization can follow to be eligible for the ERC. The first method involves a significant decline in the employer’s gross receipts in a calendar quarter compared to the same quarter in 2019. This is an objective and generally straightforward calculation for ERC eligibility.

12 The Bottom Line | 2023 Edition wicpa.org

The other method involves a full or partial shutdown of the organization due to a government order. The IRS further states the impact to the employer must be “more than nominal” (which the IRS indicates is at least 10%). This is a much more subjective determination, and many ERC brokers present the opportunity to generate refund claims under this method. In some cases, they use aggressive and seemingly unsupportable legal positions to help employers qualify for the ERC. These aggressive positions will likely cause employers to be subject to IRS audits that will consume time and resources, and the ERC may ultimately be disallowed.

Practitioners should directly alert employers who are filing an ERC claim in which they are relying on a government order to proceed with caution. If contemplating this path, some practitioners recommend obtaining a legal opinion from an independent legal counsel that addresses (1) the applicable government orders in 2020 and/or 2021, (2) how these government orders applied to their business and (3) assurance that the order satisfies the IRS guidance issued on government orders. Further, employers should be instructed to

quantify how they satisfy the nominal standard of at least 10% and not just provide a narrative.

Consult with advisors. Practitioners should cover the above items with employers and remind them to be diligent in their work, but they should then consider reviewing their ERC claims with outside advisors (who should be independent from an ERC broker) and rely on IRS guidance to justify any ERC. The advisor may also need to obtain a legal opinion on the ERC, as noted above.

Conclusion

The ERC continues to present a significant opportunity for employers. It also poses a critical exposure area for others. Employers should exercise caution, whether they are considering an ERC now or have previously filed an ERC claim. They should always take a close look at their documentation and assume the IRS will likely review it.

The Bottom Line | 2023 Edition 13 wicpa.org

Insurance coverage is really just a promise. Protect what’s important to you with the promise of “we’ll take care of you” from an agency and insurance company you trust. Find out more about the Silver Lining and a special discount on home and auto insurance just for members of the Wisconsin Institute of CPAs. To find an agency near you, visit thesilverlining.com. Promise. The worst brings out our best.®

Jim Brandenburg, CPA, MST, is a tax partner with Sikich LLP in Brookfield. Contact him at 262-754-9400 or jim.brandenbug@sikich.com.

Nine crucial cybersecurity strategies for business security

Cybersecurity l Risk prevention

By Scott Hirschfeld

Irecently met with the CFO of a distribution company about improving and updating their information technology (IT). As we were talking, he made a statement that expressed a deeper understanding of cybersecurity than I have seen from many leaders. He said that their management team has concluded that of all the risks and factors in business, “Our greatest risk is cybersecurity. If we are hacked or get crypto-locked, this would devastate our business. It represents our greatest risk.”

While this is true for many companies, I rarely hear such strong acknowledgment of the risk we all face. This risk is real and backed up by the cyber events we hear about daily in the news.

According to the respected security vendor Check Point in their 2023 Cybersecurity Report, there has been a significant increase in the number of attacks on cloud-based networks per organization, shooting up by 48% in 2022. Additionally, their report shows that global cyberattacks increased by 38% in 2022 compared to 2021.

Overall, hacking is up. Hackers have grown even bolder. The risk to organizations is higher due to their increased activity. Organizations’ finances, operational interruptions, the turmoil created by extortion demands and reputation damage all are at stake.

Many companies have invested in cybersecurity insurance as these risks have increased. However, the insurance companies have been hit hard by the number of claims they have received, and most now require cybersecurity prevention measures before they will provide coverage. Other insurance companies are simply exiting the cybersecurity market altogether because it has proven to be unprofitable and too risky. As a result, some companies no longer see the value in insurance. The are so many rules and restrictions on coverage that money may be better spent on improving one’s cybersecurity posture.

How can we protect ourselves in such a tumultuous environment? Interestingly, there are fundamental ways to reduce risk and raise your level of protection. Here are nine crucial cybersecurity strategies designed to improve your security stance.

1. Good IT hygiene

Yes, IT hygiene is a thing. A strong password policy is at the top of the list, and surprisingly, this is still an area where some companies cut corners. Another must is a patching system to update your Windows, Apple and other systems automatically. Patching is essential to stay secure. Hackers exploit

The Bottom Line | 2023 Edition 15 wicpa.org

“

Our greatest risk is cybersecurity. If we are hacked or get crypto-locked, this would devastate our business. It represents our greatest risk.

the unpatched, and their automated tools find the holes. Many other things fall under good IT hygiene, including a backup and recovery solution that meets your recovery time objectives. If you have not recently reviewed these basics with your IT advisor, it may be time to open a conversation.

2. Multifactor authentication (MFA) for critical entry points

MFA is that safety feature we know well from banking, as most banks send a PIN or onetime security code as a secondary method of authenticating. Enabling MFA for email is a standard security practice that prevents phishing by using web-based email portals. It is also necessary to implement MFA for any remote access. Whether you log in with a VPN or a remote access tool, MFA should be configured — and turned on! In addition to these two entry points, enabling MFA for any administratorprivileged access is also essential and often required by cybersecurity insurance policies.

3. Advanced endpoint protection with a security operations center (SOC)

New protection software has exploded beyond the traditional antivirus software. Solutions include endpoint response (EDR), managed detection and response (MDR) and extended detection and response (XDR). The important thing to look for with these advanced strategies is a solution that does proactive threat-hunting over and above the standard reactive prevention. In addition, it is vital to have a 24/7 SOC in which human eyes are always on critical events.

4. Cloud protection

Ensuring you have the right cloud protection in place is also essential. Many organizations have moved files and folders to the cloud. It is important to not only survey the cloud vendor to see what their protection looks like but also implement strategies of your own that check, scan and watch your cloud data.

5. Log collection and review with security information and event management (SIEM)

Almost every system on your network creates log files: firewall, PC, server, wireless and more. SIEM is a technology that pulls all these logs into one

6. Encryption of data in transit

The most common form of data in transit is email. We all need to occasionally email confidential information, and some of us do it daily. There are a variety of email encryption tools available. The key is to implement the right one for yourself and your organization. Suppose someone intercepts an email with a bank account, Social Security number, passport or health information. This can be incredibly damaging to both the intended recipient and the company sending it. I am amazed at how often I am asked to “just email” business and personal items. Always send it encrypted.

7. Data loss prevention (DLP)and data asset inventory

The issue with protected data is that we don’t often know what we have. Using an advanced tool to do a data asset inventory can be very revealing. These tools often reveal data where it should not be

16 The Bottom Line | 2023 Edition wicpa.org

that data is located, with the click of a button it can be automatically encrypted (transparent to the user) and then restricted from upload to various sites like OneDrive, Box or other public file-sharing sites.

8. Zero trust

This relatively new network security strategy installs on a computer or server, learns what is normal and then locks the computer down and does not allow anything other than that baseline. The idea here is: Rather than operating from a perspective of “What should we stop?” the perspective is to disallow everything and instead determine what to allow. This advanced software provides the highest level of security and does it efficiently. It prevents malware and spyware by prohibiting anything that’s not part of the baseline.

9. Penetration testing

Penetration testing is a method of testing that simulates a hacking attack on your network resources.

penetration test is now within reach of many companies that may have chosen not to do it previously.

Sometimes knowing what is next and how to stay protected is overwhelming. And often we don’t think we are really at risk. The reality is that everyone has resources that a hacker will use. It doesn’t matter whether you are a company of five or 50,000. They use automated tools to find your weaknesses and do everything they can to extort and exploit them once they get in.

Your cybersecurity protection need is almost certainly more than you have now, especially if you haven’t reviewed it in the last year. Take time to review your information security strategy and ensure you are keeping up with the current threat landscape.

The Bottom Line | 2023 Edition 17 wicpa.org

“

Your cybersecurity protection need is almost certainly more than you have now, especially if you haven’t reviewed it in the last year.

Scott Hirschfeld is president and CEO of CTaccess Inc., which provides outsourced managed information technology and business automation and support services. Contact him at 262-789-8210 or scotth@ctaccess.com.

Solutions for Solving Quiet Quitting

By Anna J. Johnson-Snyder, CPA, CFE

When COVID-19 hit in early 2020, the world was unprepared for the mass shutdowns required to curb the spread of the deadly virus. At an unprecedented rate, employees were forced to work remotely without much mental preparation, leading to anxiety, depression and burnout.

The World Health Organization reports a 25% rise in anxiety and depression.1 The American Psychological Association reports that 60% of surveyed employees have an increase in work-related stress, and 44% claim to be exhausted.2

Initially, the pandemic led to the “Great Resignation,” where employees either chose to retire or find another position with better employment conditions. Frank Luntz, a political strategist, argues that the pandemic also led to the “Great Rethink” in which people began to

1 “COVID-19 Pandemic Triggers 25% Increase in Prevalence of Anxiety and Depression Worldwide: Wake-up Call to All Countries to Step Up Mental Health Services and Support,” World Health Organization (2022). www.who.int/news/item/02-03-2022-covid-19-pandemic-triggers-25increase-in-prevalence-of-anxiety-and-depression-worldwide

2 Ashley Abramson, 2022 Trends Report, American Psychological Association (Vol. 53, No. 1, 2022).

reconsider their quality of life.3 Many who didn’t resign but still question their employment position are part of what has been termed the “quiet quitting” movement, a state in which employees are unwilling to exert effort beyond the minimum required for employment. The generations that followed the baby boomers are less inclined to compromise for minimal gains.4 Generation X (born between 1965 and 1980) was the first to apply quiet quitting years ago, although the term wasn’t used at the time. Now in managerial positions, Gen X is picking up the slack when the younger generations quietly quit when feeling unappreciated, without purpose or over-stressed. Many baby boomers and Gen Xers do not understand the younger generations’ motivations and need for a healthier work-life balance.

In November 2022, I surveyed business students with work experience to collect employment-experience

3 Jim Harris, “The Great Resignation,” Consumer Technology Association (May 24, 2022). www.cta.tech/Resources/i3-Magazine/i3-Issues/2022/May-June/The-Great-Resignation

4 Human Resource Training, Generational Differences Chart, The University of South Florida (2022). www.usf.edu/hr-training/documents/lunch-bytes/generationaldifferenceschart.pdf

18 The Bottom Line | 2023 Edition wicpa.org

Human Resources l Employee retention

Career Advancement Training

Goals and Rewards

Wellness Benefits

Office Comforts Management Behavior

Mentoring

data on Generation Y (millennials born between 1981 and 1996) and Generation Z (born between 1997 and 2012). Participants were upper-level undergraduate or graduate students. Seven themes emerged in the areas of career advancement, training, goals and rewards, wellness benefits, office comforts, management behavior and mentoring. These themes should interest every leader and manager striving to nurture engagement and improve retention.

Career advancement

Younger generations want to advance, yet they are flexible concerning the method. In situations where promotion is unavailable, they will consider other careerenhancing opportunities. Moreover, they are more cognizant of the “big picture” and interested in learning how they and their work fit into the overall environment and accounting process.

Constructive feedback and clarity on how they can positively contribute are appreciated. For example, one

participant wanted to regularly meet with their boss to discuss performance and how to “grow in the company,” suggesting that some junior professionals are committed to long-term employment. Items of interest among younger staff that may also attract new graduates who are open to diverse career paths include the following:

• A corporate lattice instead of a corporate ladder: A lattice is multidirectional, widening career opportunities to include lateral and diagonal movement, enabling professionals to continue learning internal functions that can help build skills and lead to later promotion opportunities. Planned descents are also possible, such as a move from an audit senior to consulting staff. This strategy allows companies to adapt to the business environment and clients’ needs while encouraging professionals to adjust to their career needs and life stages.

• Additional career-advancing opportunities: Consider creating new roles with more responsibility and engagement with colleagues and clients.

The Bottom Line | 2023 Edition 19 wicpa.org

• A “big picture” view: Provide younger employees with an overview of how various roles and associated functions work together to achieve the organization’s mission and goals. Distill strategy into specific attributes incorporated into career development frameworks and reinforced by performance evaluations. The inclusion of this information helps connect people to the organization’s purpose, vision and values. It also helps staff see that they can make a difference, even as entry-level employees.

• Job shadowing and rotation: Use these tools to help match employees to their preferred areas.

Professionals in the younger generations want additional guidance. However, the timing of the feedback will depend on the recommendations in the Training and Goals and Rewards sections below.

Training

Employees want to develop new skills through job shadowing/rotation, additional training and experience on tasks with more importance. Survey participants expressed frustration with a lack of guidance from upper management. The following recommendations were developed based on participants’ comments and the author’s professional and educator experience:

• Regardless of employment rank or title, do not assume employees have the same abilities and skills for every task. Some professionals may not have prerequisite skills for completing assigned tasks. Employees needing more experience should be given old cases (or assignments) to review and reperform to help provide clarity on expectations.

• Employees interested in expanding their knowledge should be encouraged and given opportunities for application. Regular assessment and comparison of individuals’ learning opportunities will promote equitable distribution of opportunities and minimize perceptions of favoritism.

• Provide professionals with training beyond the minimum continuing professional education (CPE) requirement. Materials should include nonaccounting topics, such as personal development, that may not qualify for CPE credit.

It’s easier to attract and retain new staff when current employees are happy and content with their professional development.

Goals and rewards

Part of creating a healthy, productive employment environment is to ignore personal biases, create realistic goals, inform all parties of the criteria to achieve goals and earn rewards, and show immediate recognition and appreciation for quality work. Almost all participants said they were less likely to quiet quit when a superior genuinely appreciated their hard work.

Despite common misconceptions, Generations Y and Z are self-competitive (working to beat their previous score). Moreover, they dislike a workplace with an overly competitive mindset that promotes negativity. Companies can remain profitable without upper management forgoing all else to make a profit. The following points may help encourage a positive, more productive environment:

• If a bonus/reward system is not in place, upper management should strongly consider transitioning to such a system.

• Bonuses and rewards should depend on actual performance and goal-based incentives. Excellent employees are intolerant of unfair work practices where their award is no different from underperforming staff. Rewarding underperforming employees makes the productive more likely to quiet quit because they feel unappreciated for their additional effort.

• Quarterly (instead of annual) bonuses and rewards can help with retention.

20 The Bottom Line | 2023 Edition wicpa.org

• Tie bonuses to goals. Assess progress against goals regularly throughout the quarter or year to avoid surprise disappointments at the end of the period.

• When goals are not met, provide guidance for improvement while being positive and supportive. Some employees may be more sensitive and feel vulnerable in such situations. The primary goal is to provide a supportive environment to help the employees learn while retaining them.

Employees appreciate periodic recognition when their work is noteworthy or exceptional. Nonmonetary rewards are relatively inexpensive, yet they have a disproportionate benefit in the recognition and appreciation expressed to employees. For instance, a former employer of mine had an annual employee appreciation day in which every employee (and their family) brought a covered dish, played games and won prizes. During lunch, certain employees were recognized and rewarded. One colleague received concert tickets. The thoughtfulness represented by the two tickets meant more to my colleague, her spouse and fellow employees than if she had gotten a cash equivalent. Although I left this employer many years ago, I still think fondly of upper management. Other rewards that may improve the attraction, retention and engagement of employees include these items:

• A letter of recognition or social media acknowledgment

• Paid lunch during the week

• Retailer gift cards or certificates for two at local spas, gyms or restaurants

• Customized gifts, such as an engraved pen/pencil set or specific event tickets

• Biweekly cleaning service for one to two months

• Preloaded gas card for one to three months

• iPad/tech awards

• Additional vacation days to use, transfer or cash out

• Money toward selected incentive recognition, such as a cruise

• Donation-matching or donation to the employee’s favorite charity

(Note: Appropriate tax treatment for the employer and employee must be considered.)

Those surveyed experienced poorly functioning bonus/ reward systems. During an in-class discussion, many agreed they were more likely to quietly quit and find other employment when an employer doesn’t keep promises.

Meeting outside the workplace and periodically celebrating is essential for employee morale. Beyond the goal and reward system, management should incorporate celebrations after a significant achievement, milestone or busy period via luncheons, social events, dinners or happy hours. At one ex-employer, each time someone successfully passed the CPA Exam or earned a promotion, a celebration was organized for that Friday evening at a local restaurant. This act of kindness created a family-like bond, resulting in employees staying when offered higher pay by other companies.

Wellness benefits

Workers in Generations Y and Z strive for better physical and mental health than their elders, commenting as such in the survey. One participant summed up the spirit of these generations: “[Our] generation has been through a lot from the pandemic. We are now more inclined to get burned out, which affects our mental health heavily. This is one of the biggest reasons … our generation is quietly quitting; we [won’t] put our mental health over our jobs.” The following items are suggested based on feedback and the author’s experience as a younger Gen X member:

• Provide mental and physical wellness plan benefits. For instance, the company could offer a gym membership or access to exercise equipment during the workday.

The Bottom Line | 2023 Edition 21 wicpa.org

“ Employees appreciate periodic recognition when their work is noteworthy or exceptional.

• Arrange wellness activities during the workday or workweek to boost health and morale.

• Offer additional paid time off for mental health days beyond the typical personal days and twoweek vacation.

• Much accounting work is seasonal. During off-peak times, allow employees to take the paid time off that’s earned during the busy season.

• Give professionals more flexibility through hybrid remote/in-office schedules. Where work is completed is irrelevant if the employee provides quality work on time. Additionally, a hybrid schedule may improve employees’ mental and physical strain caused by long commutes.

There has been a massive movement toward workforce wellness. However, companies should understand that work-life balance goes beyond the standard allowance of personal days and a two-week vacation. Additional wellness days and other benefits provide an opportunity for mental refreshment, show employee appreciation and give a sense of belonging.

Office comforts

Interestingly, participants did not mention preferring an office to a cubical, yet most appreciated and enjoyed the small offerings within the office setting. Employers may want to improve their offices by incorporating some of the suggestions below:

• Present a welcoming, well-lit break- or lunchroom. The sterile, dimly lit breakroom in my office building is rarely used and only visited for the soda and snack machines.

• Provide a coffee/tea bar with a popular selection of coffee, tea, creamers and syrups.

• Furnish a snack bar with an assortment of soda, bottled water and snacks, including healthy options.

• Arrange company lunches in a nonwork setting.

• Offer ergonomic office equipment, such as standing desks, anti-fatigue mats and lumbarsupport cushions.

The little details that make the office environment more comfortable, however, will not make up for issues with management behavior.

Management behavior

Many survey participants encountered situations similar to those I experienced as a young professional concerning management and differing expectations. The recommendations below can improve the working relationships between superiors and subordinates, decreasing the likelihood of frustration and quiet quitting:

• Consider setting boundaries for superiors’ delegation and employee time commitments. Studies show that working long days, such as 10plus hours consecutively for a prolonged period, has devastating effects. Professionals are more likely to exhibit burnout and quietly quit, have worse long-term physical health,5 and make more costly mistakes. For instance, nurses admittedly make more errors during the 13th hour after working a 12-hour shift.6

• Teach managers to adapt their expectations to match employees’ knowledge accumulation and to avoid micromanaging. This can improve the autonomy and professional growth of higherskilled employees. A problem can arise as an employee’s experience rises and their manager’s people-management skills do not grow at a comparable rate. This results in misaligned expectations. For example, faster learners tend to feel they are underutilized, micromanaged or spoken down to.

• Management should periodically complete updated education on sensitivity, empathy and constructive criticism.

CPAs and accountants are renowned for their adaptability to different business environments. Hence, employers and managers should be open to feedback and increase one-on-one communication with those following in their footsteps.

Mentoring

Younger professionals have much to learn to succeed in our industry. Considering the mass retirement of baby boomers, younger professionals need to learn from specialists and experts while they still can. Some

22 The Bottom Line | 2023 Edition wicpa.org

5

6

“Health Risks of an Inactive Lifestyle,” MedlinePlus (2022). https://medlineplus.gov/ healthrisksofaninactivelifestyle.html

A. E. Rogers, W. T. Hwang, L. D. Scott, L. H. Aiken, and D. F. Dinges, “The Working Hours of Hospital Staff Nurses and Patient Safety,” Health Affairs, 23(4), 202–212 (2004).

established professionals see this eagerness for what it is, a sincere desire to learn. Some, though, view young professionals not as over-eager learners but as replacements or competitors. In these situations, the advanced professional may resent the younger employee and exhibit territorial behavior. The following may assist in enhancing camaraderie among multigenerational professionals:

• Provide established professionals with emotional support and reassurance that their position within the company is secure. We can all fall prey to insecurity. Seasoned practitioners can unintentionally view younger staff as threats and develop unhealthy dispositions. Regular observance and review of mentor-mentee relationships are preventative measures to encourage healthy connections. When problems arise, the primary goal should be to minimize relationship damage between the mentor and mentee and among the employees and the employing firm.

• Offer lattice-style mentoring, reverse mentoring, or a knowledge-sharing program rather than a traditional top-down program. The mentormentee relationship is about sharing knowledge; it doesn’t matter the direction in which it flows. For example, junior staff can mentor mature members on technology and social media while the latter counsels on career growth and practice options.

• Temporarily match a new staff member with several mentors of varying ages to create, encourage and maintain open communication lines. A familial and welcoming environment develops loyalty. Depending on new employees’ needs, they will indirectly identify preferred mentors within a few weeks.

• Allow adequate time for the mentoring process.

• Have mentors periodically gauge employees’ interest in learning, acquiring a new responsibility and the continuing need for a mentor in some areas.

Managers and employers need to be proactive in monitoring and supporting employees. Prevention, detection and corrective measures can be implemented to decrease the threat of quiet quitting among established professionals while attracting and retaining younger professionals.

Conclusion

Quiet quitting isn’t about wanting more money. Employees are weighing the cost of additional effort for incremental benefit and finding it not worth the trouble. Everyone wants to feel appreciated, have a purpose and work in a comfortable, stable environment. Professionals can afford to be selective when choosing an employer because of the shrinking workforce. Generations Y and Z want a better work-life balance and can have it today. Entities should use a combination of options because one universal blend won’t work. Improvement and advancement often require change. Organizations can attract, retain, minimize quiet quitting and keep employees engaged by treating them well, recognizing and rewarding notable work, expressing appreciation when earned, paying them fairly and equitably, offering perks, following through with promises and improving the employment environment.

The Bottom Line | 2023 Edition 23 wicpa.org

Reprinted with permission from the Pennsylvania CPA Journal, a publication of the Pennsylvania Institute of Certified Public Accountants.

Anna J. Johnson-Snyder, CPA, CFE, is assistant professor of accounting at East Carolina University in Greenville, North Carolina. Contact her at johnsonan18@ecu.edu.

“

Quiet quitting isn’t about wanting more money.

Business and Tax Opportunities for the Food and Beverage Industry

By Christopher Martin, CPA, CGMA

Business owners operating in the food and beverage space have lived through a tumultuous few years. Thinking about what restaurants, supermarkets, and manufacturers and distributors of food products faced between 2020 and today, it is mind boggling that so many of these businesses survived. Those that did shared a common trait: an ability to adapt quickly and decisively. As advisors in this space, CPAs are expected to ensure that clients keep up with, and are ahead of, changes occurring in this industry. Key issues to consider include:

Income taxes, of course

Income taxes are a main driver of many of the conversations CPAs engage in with their clients. Key issues to consider:

• Research and development tax credits. There are various avenues for businesses in the food and beverage sector to take advantage of these credits. Opportunities include innovations and changes in food product formulation; new or improved sanitization methods, ingredients and formulations; ERP software implementation for purchasing and shipping; packaging redesign and methods to increase shelf life; production process changes and efficiencies; and testing to reduce costs and meet regulations.

• Charitable contributions of food inventory. The pandemic resulted in the unpredictability of consumer demand and uncovered supply

issues that this sector is still feeling. As a result, companies in the food and beverage space may be left with obsolete or expiring inventory that they can donate to local food pantries or other charitable organizations. By doing so, they can take advantage of an underutilized tax deduction where a business can not only deduct the cost of the food donated but can also receive an additional deduction for a portion of the retail markup they would have received if the inventory was sold at fair market value.

• Last in, first out (LIFO) conversion. In times of rising food costs, it is often beneficial to consider

24 The Bottom Line | 2023 Edition wicpa.org

Industry l Food & beverage

“

Business owners operating in the food and beverage space have lived through a tumultuous few years.

converting inventory valuation from first in, first out (FIFO) to LIFO. LIFO provides a valuation allowance (and tax deduction) in inflationary periods, which helps to better match current sales with the related costs. While this is a temporary solution, timing it can be an extremely valuable tool in reducing income taxes in the short term and increasing cash flow for other uses.

Other business strategies

There are several other strategies that businesses in the food and beverage space are considering to support increased efficiency, broaden the customer base and cut costs, such as:

• Reassessing pricing strategies. It is often difficult to raise prices on food and beverage products without customer backlash. The last two years have been a period of extremely high inflation, which has a direct impact on the inputs and products that companies are purchasing and utilizing. As such, it is imperative that pricing is changed in a timely manner to match or get ahead of those rising costs.

• Diversifying product lines. Not only should pricing models be adjusted, but it is also important to diversify the current line-up with new and innovative products that meet customer

The Bottom Line | 2023 Edition 25 wicpa.org

taste. In this way, demand can create new revenue streams that will keep the company competitive and even put them ahead of the competition. There also may be some research and development credits to take advantage of.

• Leveraging technology. There cannot be a meaningful conversation about gaining efficiency and cutting labor costs (often the top expense line after product costs) without talking about technological innovation. Technology can be utilized to automate manual packaging processes, create more efficient shipping and receiving practices, provide real-time inventory information and aid in formulation of new products. And coming full circle to the income tax conversation, it’s also a great way to invest in the business. Making sure plans are in place to put equipment in service prior to year-end is critical from a timing perspective.

The issues that food and beverage companies face are not always unique to that industry; however, it is vital that advisors in this space continue to be aware of trends

26 The Bottom Line | 2023 Edition wicpa.org RETIREMENT PLAN SERVICES FROM LOCAL SPECIALISTS. Associated Bank is a marketing name AB-C uses for products and services offered by its affiliates. Investment management, fiduciary, administrative and planning services are provided by Associated Trust Company, N.A. (“ATC”). Investment management services are also provided to ATC by Kellogg Asset Management, LLC® (“KAM”). ATC is a wholly owned subsidiary and affiliate of Associated Bank, N.A. (“AB”). AB is a wholly-owned subsidiary of Associated Banc-Corp (“AB-C”). KAM is a wholly owned subsidiary and affiliate of ATC. AB-C and its affiliates do not provide tax, legal or accounting advice. Please consult with your tax, legal or accounting advisors regarding your individual situation. (5/22) P06513 NOT FDIC INSURED NOT BANK GUARANTEED MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY Investment, Securities and Insurance Products:

the right retirement benefits, your employees can plan for future financial freedom. For over 50 years, we’ve helped Midwest businesses choose comprehensive retirement plan solutions while building long-term relationships. Let us put our knowledge and experience to work for you. Learn more: 608-259-3740 | Michael.StJohn@AssociatedBank.com

With

Reprinted from New Jersey CPA magazine with permission from the New Jersey Society of CPAs.

UPCOMING WICPA

WICPA members save up to $150 on registration! Registration opens approximately eight weeks prior to a conference. View conferences currently open for registration at wicpa.org/conferences.

Corporate Finance l Changing perceptions

4 Ways to Make Finance a Strategic Business Partner

Corporate finance professionals must become strategic business partners who drive successful business outcomes. Here’s how to take that step.

By Shifra Kolsky, CPA

As corporate finance professionals, we play a key role in the operations of our organizations and help enable good decision-making based on sound analysis. We help assess the impact of each option that’s weighed and help hold our colleagues accountable for meeting goals and targets. While we’ve historically been seen as scorekeepers across industries, we’ve also fought to secure our seats at the table as strategic

business partners who can share important insights and help guide meaningful conversations in the interest of driving greater outcomes for our companies.

I spent some time with my colleague Vishal Shah, business unit CFO of Discover Global Network (the payments brand of Discover), to understand his approach to being an effective strategic business partner. Shah sits in a unique and sometimes challenging position where

28 The Bottom Line | 2023 Edition wicpa.org

he serves two bosses — his business unit head and our enterprise CFO.

“To be successful, you have to remain unbiased and be willing to advocate for your business unit while still remaining true to your responsibilities as CFO,” he says. “It may require some alignment conversations and some finesse, but if you ensure that everyone is talking with each other about a shared goal, you can play a key role in helping folks meet in the middle.”

According to Shah, there are four elements every corporate finance professional needs to be mindful of to be an effective strategic business partner.

1. Understand the business

While deep knowledge of the numbers is always important, exercise your curiosity to learn more about what’s behind the numbers, and spend time gaining a deep understanding of the business you support and how it functions. Talk with your stakeholders to learn both what they do and why they do it. Be clear on how the business makes money and what it takes to be successful. A business model canvas, which is a template for documenting a business plan on a single page, can be a useful tool to guide your research and summarize what you learn. With this understanding, you can better assist in blending business and financial goals.

2. Build relationships

If you want your business partners to listen to your views and consider your thoughts, it’s important to build trust and credibility. Start by getting to know your partners. Learn what’s important to them, their passion projects and how they view their business unit’s role within the context of achieving the enterprise’s overall goals. Then, demonstrate your competence to them by bringing ideas that are meaningful to helping drive the success of the business.

3. Maintain accountability and transparency

Strong partnerships are fostered through clear lines of accountability and transparent reporting, which are key to successfully driving desired business outcomes. Remember, as a strategic business partner, you’ll be engaged in both annual planning and project-level planning. Better business decisions will be made when everyone involved has a clear understanding of the project’s plan, how it’ll be managed and how it’ll be measured.

• Project planning: During the planning process, the finance team often takes the lead to connect business initiatives to desired financial outcomes. Understanding how value is created and how different levers drive impact is important to building the business case for a particular initiative, and you’ll want to ensure early on that project leads can clearly articulate how their initiatives will drive value for the company. It’s important to have a clear understanding of the risks and opportunities, as well as any assumptions used to build the business case for the initiative. Using this information, you can translate the desired financial outcomes into a system for managing financial decisions and can pressure-test the assumptions to ensure the plan is appropriately

The Bottom Line | 2023 Edition 29 wicpa.org

“

To be successful, you have to remain unbiased and be willing to advocate for your business unit while still remaining true to your responsibilities as CFO.

— Vishal Shah

balanced between being aggressive and achievable. A documented decision tree or criteria to consider in a decision framework can clarify expectations and decision thresholds upfront.

• Project management: For any initiative, implementing general project management principles will help with accountability. It’s important to put a scoping document together to clearly establish a common understanding of what you’re trying to accomplish or the value you’re trying to create, the timeline and key milestones, the workstreams, tasks, ownership, help needed from others and key dependencies. By documenting everything clearly, you can gain alignment upfront and clarify anything that needs to be further refined. Once that’s all documented and agreed upon, it’s critical to put systems in place to ensure information flow, processes and structure are there to help drive the right decisions.

• Project measurement: With these systems in place, you should have the data available to transparently influence outcomes, ensuring that the right thing is rewarded and receives visibility. Often, you’ll need to help the team determine the best metrics or measurements to track key decisions and actions, and using a scorecard that reflects the appropriate metrics can help. During this time, consider whether your value drivers are at the right level of detail or whether

you need to break them down further for tracking. Additionally, identify your hypothesis on achievable outcomes and ensure that the items you expect to move or change or that are most sensitive are being tracked. Lastly, ensure that scorecards are shared broadly across the team and that there’s time set aside to review and understand progress on a routine basis.

4. Navigate challenges

At times, you may find yourself at odds with the team you’re trying to support. In order to get these relationships back on track, you may have to sit down and directly discuss the root cause of your disagreements. While you may not come to a full agreement in these discussions, you can at least understand where each party is coming from and find a better way to resolve the issue(s) going forward.

Becoming a strategic business partner requires corporate finance professionals to look well beyond the numbers. A strong understanding of your business, a dedication to your partners and effectively driving outcomes for the company must all become top priorities. However, with clear communication and by consistently demonstrating that you’re always seeking the best outcomes for the company, you should have no problem earning a seat at the table and bringing your business partners together to support each

Reprinted from Insight magazine with permission from the Illinois CPA Society.

30 The Bottom Line | 2023 Edition wicpa.org

Shifra Kolsky, CPA, is senior vice president and chief accounting officer for Discover Financial Services in Riverwoods, Illinois.

WICPA Career Center

Post Job Openings l Upload Your Resume l Apply For Jobs

Whether you’re looking for a new career or a new employee, the WICPA’s new and enhanced Career Center can help you make the most of your search.

The Bottom Line | 2023 Edition 31 wicpa.org

Find or post a job today at wicpa.org/CareerCenter.

Business Operations l Internal controls

Maintaining Effective Internal Controls in a Compliance-Driven World

By Chad Schaefer,

By Chad Schaefer,

Implementing and maintaining effective internal controls can pose several challenges. It is important to note that internal controls are not a one-time implementation but an ongoing process. They require regular review, assessment and adjustment to accommodate regulations, organizational needs and changes in the business environment.

Weggeman,

Weggeman,

Internal controls are a combination of processes, policies and procedures established within an organization to achieve its objectives, mitigate risks and maintain compliance with applicable laws and regulations. These controls help safeguard assets, promote accurate and reliable financial reporting and encourage adherence to organizational standards.

Here are some common issues faced by organizations and leading practices to support a healthy control environment:

1. Complexity/Scalability

Internal controls can become complex for a variety of reasons, including but not limited to the size of an organization, whether the organization is publicly traded, the number of business lines the organization has, recent acquisitions and the gamut of compliance requirements the organization may be subject to. As organizations have more compliance requirements, scaling controls to meet requirements while being efficient is a challenge. Organizations can begin by establishing a baseline of all

compliance requirements that apply. Some requirements may impact all lines of business, while others may be business-line specific. To effectively manage these requirements, further analysis of the requirements is needed to identify where the same requirement can be covered for multiple business lines or compliance frameworks. Root cause analysis is the first step in the planning process, whereas failing to plan is simply planning to fail.

2. Compliance efforts

Internal controls can be used for internal compliance and to help external auditors fulfill their examination obligations. Internal controls apply not only to financial reporting but also to information technology systems. Working with an organization’s external auditor(s) can be beneficial to identify where internal control testing can be used directly or modified to include the scope being examined by the auditors. Historically, controls have been developed to cover risks for independent business lines or systems, which often leads to duplicate efforts and inconsistent treatment of controls across an organization. Understanding the scope of controls is critical to identifying duplication and finding ways to become more efficient and standardized as an

32 The Bottom Line | 2023 Edition wicpa.org

CPA, CISA, CISSP and

Monica

CISSP, CISA, CIA, HITRUST CCSFP

“

It is important to note that internal controls are not a one-time implementation but an ongoing process.

organization. To do this, actively work with process owners to determine if processes are the same across different business lines and systems. An example of this can be seen with the shift to cloud-based infrastructure. Multiple service lines may be loaded to the cloud infrastructure, where a single process is now used instead of numerous legacy processes. Actively managing controls and understanding organizational changes can help identify ways to potentially consolidate duplicate efforts where it makes sense for the business.

3. Changing regulations

As mentioned before, internal controls can apply to different areas outside of financial reporting. With new compliance frameworks and updated guidelines continually evolving, understanding whether an organization complies with new requirements is challenging. Manually reviewing each framework and set of requirements is time consuming and can lead to manual error. To avoid this, an organization should effectively maintain a current list of controls and identify a systematic way of analyzing whether adjustments are needed. Leveraging a governance, risk and compliance tool may help maintain this going forward.

4. Cost

Developing and implementing robust internal controls can involve significant costs. In addition, purchasing a tool to manage them effectively can also require a considerable investment. Conducting an initial risk assessment, designing and implementing controls, training employees, documenting and retaining audit evidence and addressing control deficiencies are just some of the requirements of an internal control environment. Organizations should take a “crawl–walk–run” approach, in which a realistic plan that considers limited human resources and budget constraints is coordinated. A healthy control environment takes time to build.

5. Organizational standpoint

There may be resistance when new controls are implemented. Controls may be time consuming and hinder work efficiency. Suppose an organization has a compliance-first mentality. This would lessen the burden of implementing controls after the fact and convey that having controls in place to meet requirements is essential to the organization. In addition, if controls are proactively factored in during process implementation,

it reduces risk and allows for easier maintenance of controls. For example, automated controls are more accessible to add in during a process buildout rather than adding a manual check afterward. This also reduces the burden and human error of manually supporting a control. Giving time back to focus on tasks at hand rather than pulling compliance documentation will be well received by employees, as well.

A healthy internal control environment takes time to build and has many challenges. Overcoming these challenges in an evolving compliance landscape can be overwhelming. When organizations face requirements from different frameworks and address various risks, having a culture in which compliance is at the forefront is critical. Risk is everywhere. How will your organization work to control it?

Chad Schaefer, CPA, CISA, CISSP, is a risk advisory manager for Baker Tilly in Appleton, where he specializes in system and organization controls (SOC) reporting. Contact him at chad.schaefer@bakertilly.com. Monica Weggeman, CISSP, CISA, CIA, HITRUST CCSFP, is a risk advisory manager for Baker Tilly in Milwaukee, where she specializes in attestation engagements. Contact her at monica.weggeman@bakertilly.com.

The Bottom Line | 2023 Edition 33 wicpa.org

Best Practices for Closing the Books

By Tommy Kleinhans, CPA

By Tommy Kleinhans, CPA

The month-, quarter- and year-end close processes often create a bottleneck for companies of all sizes and all industries. Most financial executives do not have their numbers in time to meet their reporting requirements and steer their companies in the right direction. Instead, many rely on their pulse to make decisions, which could, in turn, become disastrous. Here are best practices controllers and accounting firms can implement in their

companies and with their clients in order to focus more on key performance indicators (KPIs) and analysis:

STRATEGIES Month-end checklists

When a company has a manual that shows all procedures and tracks against the close deadline, it keeps all teams on the same page and avoids a lag in communication. This also can help decision makers

34 The Bottom Line | 2023 Edition wicpa.org

Accounting

Auditing l Close

&

processes

determine where there are bottlenecks in the close process and whether they can be avoided.

Integrated technologies