6 The velvet hammer

Michael Goller, JD, is a nationally recognized attorney who regularly counsels accountants on tax practice and procedure.

By Sharon Zalewski

12 ChatGPT and CPAs: The perfect partnership

In today’s world, CPAs need every resource at their disposal to effectively report on and communicate financial information.

By John Higgins,

CPA.CITP

16 Artificial intelligence in CPA firms

Artificial intelligence adoption by the accounting world has grown dramatically since our last article on the topic in the May/June 2023 issue.

By Neil Fauerbach, MBA

20 Conducting the business resilience symphony

Fine-tuning and organizing the efforts of the incident response, disaster recovery and business continuity teams is much like conducting a symphony.

By Jeffrey Lemmermann, CPA, CISA, CITP, CEH

26 LEADERSHIP

Why don’t young professionals want to be CPA firm partners?

Too few accountants aspire to become CPA firm partners — an issue that should sound off alarms for the accounting profession.

By Art Kuesel

30 FEDERAL TAXATION

From deal to ledger: Financial reporting of income taxes in M&A transactions

Rising M&A activity has drawn attention to the preparation or audit of the associated purchase accounting.

By Michael E. Noreman, CPA, MS, MAcc and Nick Stufano, CPA

34 STATE TAXATION

Simplifying sales and use tax systems for states

The Streamlined Sales Tax Governing Board and the Streamlined Sales and Use Tax Agreement aim to create efficiencies.

By Holly Hoffman, MSA

38 WEALTH MANAGEMENT

The impact of the Social Security Fairness Act

The Social Security Fairness Act has important implications for certain workers who earned government pensions.

By Brian Ellenbecker, CFP, EA, CPWA, CIMA, CLTC

Outlook | chair’s letter

In Touch | president & CEO’s

Memorials | departed members

On Balance is published five times a year by the Wisconsin Institute of Certified Public Accountants (WICPA). Change of address should be sent to: Membership, W233N2080 Ridgeview Pkwy, Suite 201, Waukesha, WI 53188; Phone: 262-785-0445 or 800-772-6939; Fax: 262-785-0838; email: comments@wicpa.org. Statements and opinions expressed are those of the authors and not necessarily those of the WICPA. Publication of an advertisement does not constitute an endorsement of the product or service by On Balance or the WICPA. Articles may be reproduced with permission. © Copyright 2025 On Balance

Join us online!

Chair Ryan J. Hanson, CPA, CGMA

Chair-elect

Stacy A. Stinson, CPA, MBA

Past Chair

Matthew J. Schaefer, CPA, CGMA

Secretary/Treasurer

Lucien A. Beaudry, CPA, JD

Directors

Christopher M. Cholka, CPA, CGMA

Michael Donahue, CPA

Jessica B. Gatzke, CPA, MST

Tori M. Morrow, CPA, CGMA, MBA

Donna R. Scaffidi, CPA

AICPA Council

Ruth A. Kallio-Mielke, CPA

Neil R. Keller, CPA/ABV

Pearl Insurance

Printing Special Editions 2024-2025

President & CEO

Tammy J. Hofstede

Design & Layout

Brett Stallman

Advertising

Sue Daniels

Editor

Marcia Tillett-Zinzow

Contributor

Sharon Zalewski

Spectrum Investment Advisors

Pearl Insurance has provided professional liability insurance to accountants for 60 years with comprehensive and competitively priced coverage. By continuously evolving insurance plans, we stay ahead of the curve as an industry leader with coverage that is responsive to the needs of accounting professionals. These affinity partners and

Spectrum Investment Advisors co-sponsors the annual Retirement Plan Investment Seminar, which offers WICPA members CPE credits at a nominal cost. WICPA members can work directly with Spectrum to receive plan consulting services for their retirement plan program as well as individual wealth/asset management services.

von Briesen & Roper, s.c. von Briesen’s tax team handles any type of matter that may present a significant tax issue. We partner with CPAs to successfully address any state, local, federal or international issue.

.

“While my term is concluding, I am confident that the WICPA is well positioned for continued growth and success.”

By Ryan J. Hanson, CPA, CGMA

As my term as chair of the WICPA board of directors comes to an end, I am honored to reflect on the journey we have taken together. I have had the privilege of working alongside dedicated professionals who are committed to advancing the accounting profession and supporting our members.

Over the past year, we have continued our legislative advocacy by monitoring and encouraging legislation that is supportive of the profession and Wisconsin businesses and citizens. The past year witnessed additional developments in CPA credentialing, such as the introduction of alternative educational requirements by some states. Through expanded course offerings, virtual learning options and high-impact conferences, we empowered our members to stay ahead in an evolving industry. Our education initiatives continue supporting CPAs with the skills necessary for the future. We also updated the WICPA’s strategic plan that will provide guidance to the organization for several years to come. Many of these strategic initiatives have been initiated and will be observed in the coming months and years.

When I accepted the chair position, I encouraged all of us to support changing the perception of the CPA profession. Through advancements at the WICPA, I know we have made incremental advancements on this journey. I trust each of you has done the same, in part by communicating how dynamic and diverse our profession truly is along with all that it has afforded you.

As your career partner, the WICPA continues to need your support. No matter what chapter you find yourself in your career, you can support the WICPA’s initiatives by becoming involved in committees, participating in WICPA-sponsored events and contributing to the WICPA Educational Foundation and CPAC/LIF. As each of us

contributes to the career partnership, the stronger and more rewarding the partnership will become.

While my term is concluding, I am confident that the WICPA is well positioned for continued growth and success. The organization’s commitment to advocacy, education and professional excellence remains unwavering. I look forward to seeing the next generation of leaders build upon the foundation we — and our predecessors — have laid.

I extend my deepest gratitude to my fellow board members, WICPA staff and every member of this incredible organization. Your dedication and passion have made this journey truly memorable. Thank you for allowing me the honor of serving as your chair.

Ryan J. Hanson, CPA, CGMA, is senior vice president and chief financial officer for Pekin Insurance and the WICPA 2024–2025 board of directors chair. Contact him at 309-478-2746 or rjhanson@pekininsurance.com.

“The accounting profession has a future that offers continuous value and sets you up for a fulfilling and meaningful journey at every stage of your career.”

As the accounting profession undergoes an incredible transformation with the rapid advancement of technology and new services, CPAs are being called to redefine their roles. This shift is not just about adopting new tools to get the job done — it’s about embracing a broader perspective on the value CPAs bring to businesses and communities.

Accounting is the language of business, and CPAs hold a unique responsibility within the profession. Regardless of specialization — audit, finance, tax, consulting or technology — CPAs are trusted advisors. Their value lies in their expertise, advice and ability to reduce client and company risk — and with that comes significant career benefits and opportunities.

Whether it’s your first year or you are a seasoned professional, there are things you can do to make your career more rewarding and fulfilling.

• Find work that gives you meaning: Explore and find work that is meaningful to you. Do what you love. Doors open for CPAs at all kinds of businesses, and CPAs can easily adapt their expertise when transitioning careers.

• Shape your own path: There are many ways to advance. Don’t assume your career path must mirror those of others in your company. Create a path that demonstrates your strengths and goals.

• Take risks: Don’t be afraid to try something new.

• Practice giving back: Use your success and expertise to give back to the community; and there are many ways you can do that.

• Seek mentors: Look for mentors both inside and outside your organization, and learn from them.

• Be a mentor: Use your knowledge and experience to help others improve and succeed.

The accounting profession has a future that offers continuous value and sets you up for a fulfilling and meaningful career at every stage of your journey.

Tammy J. Hofstede is president & CEO of the WICPA. Contact her at (262) 785-0445, ext. 4518 or tammy@wicpa.org.

—

by

Michael Goller is a staunch advocate for tax clients — and the accounting profession.

By Sharon Zalewski

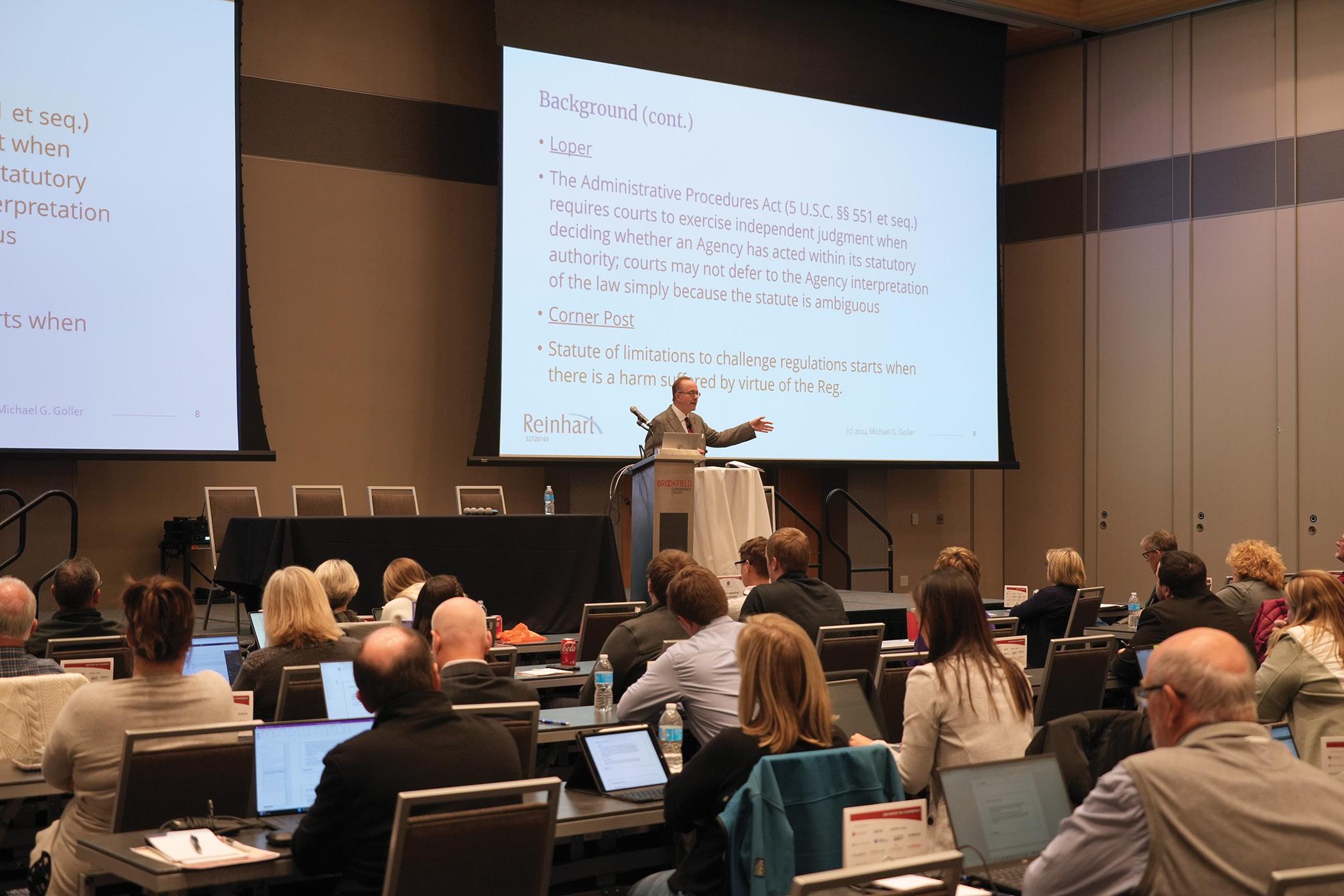

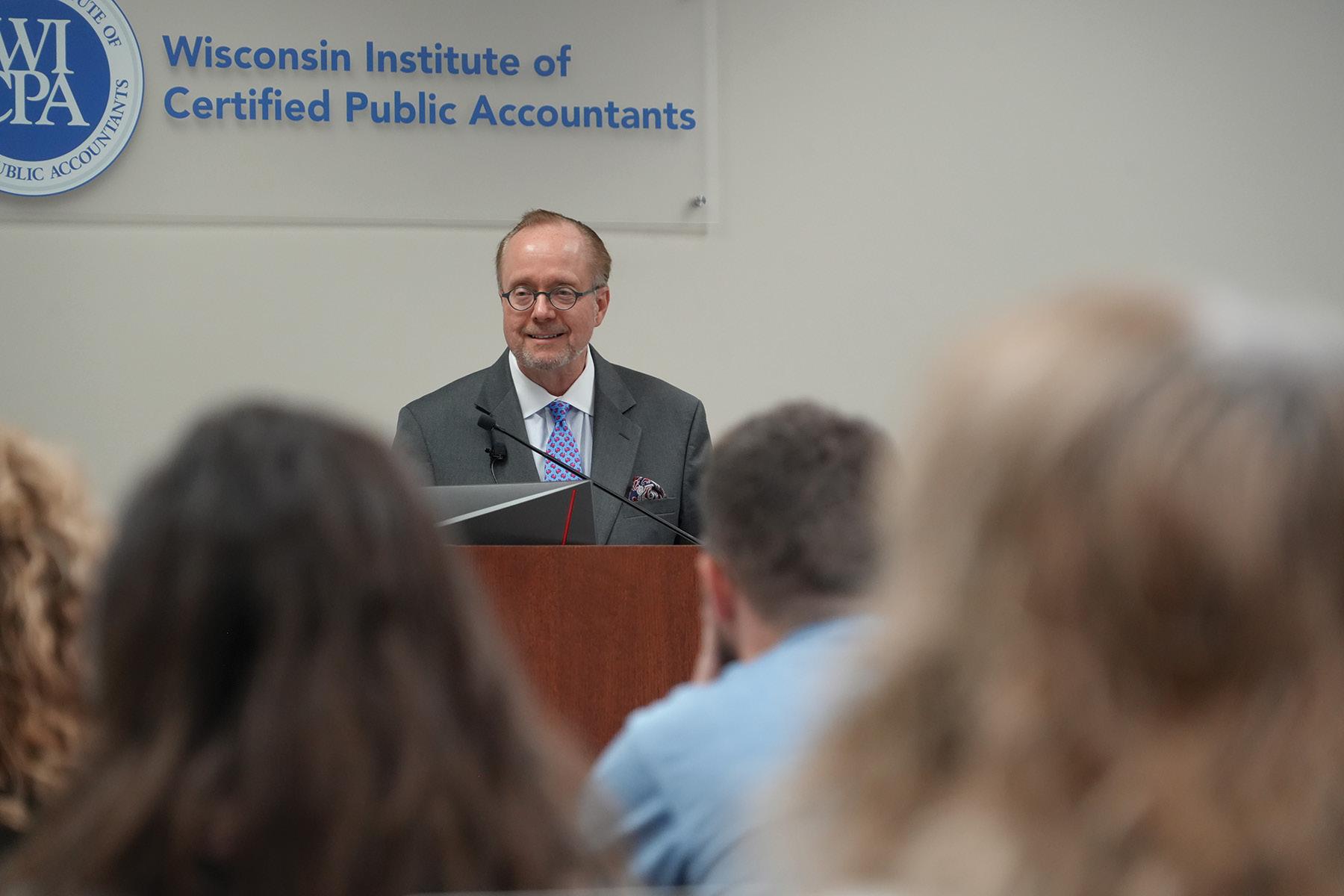

Attorney Michael Goller, after 30 years in practice, is a familiar name and face to government taxing authorities — and to the WICPA membership. Through the spoken and written word, the nationally recognized Reinhart Boerner Van Deuren S.C. shareholder regularly counsels accountants on tax practice and procedure. His presentations and On Balance articles often include an ethics component — because when handling matters that are controversial, ethics are usually involved. “It’s not just ‘my conscience tells me what’s right,’” Goller said. “High-quality work is usually ethical work. If you fall short on the ethical rules that govern the accounting and legal practices, you likely fall short on quality.”

He is keenly aware that it’s not an easy subject to digest because the IRS and AICPA ethics rules are complicated. “But if I talk about interesting issues that I am seeing and then bring in the ethical rules to illustrate the right and wrong things to do, that sticks.”

Dinner conversations

Sharing business insights comes naturally to Goller. His father, a CPA and chief financial officer for Grede Foundries, engaged Goller and his identical twin brother, Chris, in discussions at the dinner table. As the brothers learned about accounting, financial statements and financial planning during the Carter and Reagan years, their interest in these subjects grew. The two went on to study at Marquette University: Michael earned accounting and law degrees, while Chris earned a finance degree and an MBA in finance and banking and now serves as an executive vice president at PNC Bank.

Hammer time

While studying accounting, Goller was drawn to tax controversies and disputes. Today, he assists large public corporations and midsize private businesses with tax planning, federal and state tax controversy, and tax litigation. As a litigator, Goller is personable and enjoys negotiating but also likes to “mix it up a little bit. … There are a lot of tax practitioners and general litigators,” he said, “but there aren’t many who litigate before the IRS and the Department of Revenue, think about tax on the weekends and evenings, and like tax law. I think I’m somewhat unique in that respect.”

Clients wish to resolve their cases fairly, quickly and as cost effectively as possible. When negotiating, Goller is often described as “the velvet hammer.” “I’m pleasant. I’m a straight

“

High-quality work is usually ethical work. If you fall short on the ethical rules that govern the accounting and legal practices, you likely fall short on quality.

shooter. I meet deadlines. I deliver what I promise,” he said. “I don’t make unreasonable arguments” — but he’s tough as nails when defending his clients’ positions to the government. “My mentors here at Reinhart used to point to the library and say, ‘That’s your sword. If you research more than the opposing party does, you’re going to come up with a creative solution.’”

And creative solutions frequently lead to wins, which, in turn, require a detailed understanding of tax law — and the client’s business.

Enter the accountant.

Goller forms valuable relationships with his clients’ accountants, and often it is a client’s accountant who calls him when a situation may be headed toward litigation. “When planning a transaction, the client may want to make it as bulletproof as possible to hopefully prevent an audit — or at least be better prepared for one.”

To provide excellent service, Goller must remain current with tax law. “Certain tax issues are hot for a while; then they’re not,” he said, citing research credit, private airplane cases and high-net-worth audits as examples of front-burner IRS issues at the time of this writing. When IRS or state Department of Revenue professionals train on issues, it often signals that these will be the next issues to watch.

Training is also something Goller knows a lot about. He is a regular on the speaker circuit, whether for the WICPA, accounting firms or the State Bar of Wisconsin, and enjoys presenting for two primary reasons — keeping himself sharp and meeting and chatting with other tax professionals.

Relationships beyond those Goller develops with accountants and lawyers also play a role in client success. For service businesses, it is important to build and maintain personal relationships with clients and adversaries. “You must remember that you are dealing with people, not just the taxing entities,” he said. “Cultivating relationships within the IRS and state departments of revenue is no different than developing other personal relationships: Be honest, be timely, keep your promises and act with integrity. I’ve never seen an opponent object when you’ve vigorously defended your client, as long as you’ve done it in a well-thought-out and intelligent manner.”

Technology, while helpful in many respects, has made the actual practice of tax — whether in accounting or law — less personal, he said. In years past, if Goller was going to settle a case, he would walk to these government agencies in Milwaukee — both of which he can see from his office window — and work things out. Now, much of this is done electronically. “When you negotiate anything, a personal relationship just helps,” he said. “The end result may not change, but oftentimes you can work toward a resolution in a less confrontational manner.”

Goller shares these lessons with future accountants as well as working professionals. He has been teaching tax practice and procedure in the Graduate Tax Program at the University of Wisconsin–Milwaukee Lubar School of Business for more than two decades. When he first started, his class was offered in fall and spring, and each usually reached the maximum capacity of 40 students. Now it’s offered only in fall, and the fall 2024 semester class had 14 students. While online education is a factor, the smaller class size is tangible evidence that fewer people are entering the profession. Goller, however, is convinced there will be an uptick eventually because the demand for accountants — and the rewards the career offers —

“

Be honest, be timely, keep your promises and act with integrity. I’ve never seen an opponent object when you’ve vigorously defended your client, as long as you’ve done it in a well-thought-out and intelligent manner.

are just too great. He’s doing his part to ensure accounting students are prepared for this challenging but fulfilling career.

“When I was in business school and law school, the best classes were always those taught by real-world practitioners who could say, ‘This is how it is,’” he said. As such, to illustrate points, Goller shares actual cases that he has handled — “and 100% of the assignments involve something that I had on my desk once upon a time or have right now,” he said. “Practical applications are much more exciting than theories.” Goller’s stellar reviews from students suggest they feel the same.

For the past four years, an IRS attorney has co-taught with Goller. Students receive the practitioner’s and the IRS’s perspectives on tax controversy. “We’re adversaries,” Goller

said, “but we respect each other, and I think that’s enhanced the class.”

Because accounting is a profession that demands creativity, Goller’s class assignments and exams demand it as well.

“What’s interesting — and this makes it difficult to grade — is usually there’s no ‘right’ answer,” he said. Instead, students must share how they would handle issues strategically, which reinforces creative thinking.

Goller also reinforces the need for balance: “If all you do is work hard, you will lose creativity, so you need to have outside interests that inspire you,” he said. He and his wife, Mimi, whom he met in law school and who is a patent attorney at Abbott Laboratories, are pickleball fanatics. They also spend time in the kitchen — Goller has studied cooking all over the U.S. and with chefs in France and Italy — and regularly attend Milwaukee Repertory Theater and Milwaukee Symphony Orchestra performances. Their travels — which, whenever possible, include their daughter, Vivian, a student at the University of South Carolina — always involve stops at art museums.

“You’ve got to be well rounded and expose yourself to different things and ideas,” Goller said. “If everyone thinks and does everything the same, there is no creativity. But if you work hard at this business and are open to creative ideas, you’re going to come up with better arguments.”

And better arguments help win cases.

provided by Michael

William Ahlstrom

Karl Ahonen

Michael Akers

John Andres

Laura Arnow

William Bantz

Richard Barry

David Benner

Leif Bergquist

Michael Berns

Lawrence Bittner

Jennifer Bogli

Joseph Boucher

Richard Boulay

James Brandenburg

Erin Breber

Dana Brunstrom

Suanne Cain

Charles Cedergren

John Chidester

Chris Cholka

Timothy Christen

Michela Cobb

William Coleman

Cheryl Connor

Robert Cook

Joann Noe Cross

Jonathan Crowell

Gerald Denor

Patti Desrosier

Jeff Dewane

Linda Dicks

Richard Dieffenbach

Andy Diehl

Sean Donahue

Dale Ebert

Janet Egan

Gary Ertel

Deidre Erwin

Kate Exner

Jennifer Fahey

Fred Farris

Lisa Fernandez

Delores Fischer

David Fohr

Robert Foulks

Spencer Francis

Ann Freund

Michael Friedman

Anthony Fuerst

Michael Gabron

Jessica Gatzke

David Geertsen

Sharon Geertsen

W. Richard Gerhard

John Gerold

Charles Gierl

Alan Giuffre

Chad Gloudeman

Daniel Goelzer

Robert Goldie

Kathryn Golsteyn

William Goodman

Michael Grams

Kurt Gresens

Craig Gretzinger

William Grimmer

Randall Grobe

Douglas Haag

Michael Hablewitz

Theodore Hart

Scott Haumersen

Katherine Hauser

Daniel Heerey

Keith Helm

Glen Helmbrecht

John Hicks

Kathleen Hoffman

Steven Hollmann

Katy Hook

Wayne Huberty

Patricia Huettl

Joseph Imhoff

Nana Adjoa Iyahen

George Jaloviar

Mark Janke

David Johnson

Elizabeth Johnson

Josh Kaiser

Ruth Kallio-Mielke

David Kamke

Carl Kantner

John Kellerman

Paul Kersten

David Kimpel

Kenneth Klemm

Fr. Kurtis Klismet

Michael Konecny

Thomas Koops

Rosanna Kopling

Amar Kothapalli

Dennis Krautkramer

Jason Krentz

Glenn Krieg

Bernard Kristal

David Kuesel

John Kuhn

Keith Kwaterski

Gregory LaFreniere

David Lauer

Jack Lee

Xiaoling Liao

Ronald Ligman

Richard Lindgren

Thomas Luken

Patrick Lyons

Muriel Marx Hoffmann

Lucretia Mattson

Robert McGrane

Michael McNamara

William Merrick

Linda Meyers

Howard Miller

William Miller

Mark Mirsberger

Jean Mosher

Chad Neumann

Terence Niewolny

Emily Olson

Gerald Ontko

Dana Outhouse

Arnold Parise

Jeffrey Peterson

Sandra Peterson

Ray Petkovsek

Jason Pickart

James Possin

Daren Powers

Gerald Powers

Michelle Puls

Keith Radke

Joseph Rock

Betty Roethle

Michael Ronk

James Rose

Kenneth Rose

John Sawtell

Matthew Schaefer

Thomas Scheidegger

David Schlichting

Eli Schmukler

Robert Schneider

Harold Schroeder

David Schulz

Steven Seymour

Dan Smith

Jane Somers

Richard Spencer

Josephine Stahl

Stacy Stinson

Thomas Stolper

Louise Stone

Terry Strittmater

William Tatman

Dennis Tomorsky

Scott Tracy

Kim Tredinnick

Debra Trost

Brian Valiquette

Dale Van De Loo

Lynn Visser-Young

Roberta Ward

Paula Wegner

Thomas Weingarten

Joseph Wenzler

Lori Wermuth

Sarah Whyte

Thomas Wieland

George Wiesner

Susan Wilcox

Raymond Wilson

Robert Wittke

Richard Woelfel

James Woloszyk

Jerad Yapp

Michael Zongolowicz

April is National Financial Literacy Month and a great opportunity for you to help students get smart about money by reading to an elementary school class (K - 4th grade) about the basics of money.

The WICPA Educational Foundation will provide everything you need. For more information and to volunteer, visit wicpa.org/ReadingMakesCents.

By John Higgins, CPA.CITP

If this article had been written 40 years ago, the title would be “VisiCalc and CPAs: A Perfect Partnership.” For those of you who don’t study history, VisiCalc was the original electronic spreadsheet that preceded Lotus 123 and was followed by Excel. Forty years later, this electronic spreadsheet software is likely the most widely used software application across our profession, forming a perfect partnership.

Generative AI tools, such as ChatGPT, will likely provide the basis for an even more perfect partnership for CPAs. Why? Because CPAs primarily process and report on financial information based on numbers. Spreadsheet software has unquestionably enhanced our ability to process this numerical data. On the other hand, it has had limited impact on our ability to report on the data and communicate what it means to our respective audiences. This is where ChatGPT and generative AI come into play.

In today’s world, in which an abundance of information comes from every format and platform imaginable, we as CPAs need every resource available at our disposal to effectively report on and communicate financial information.

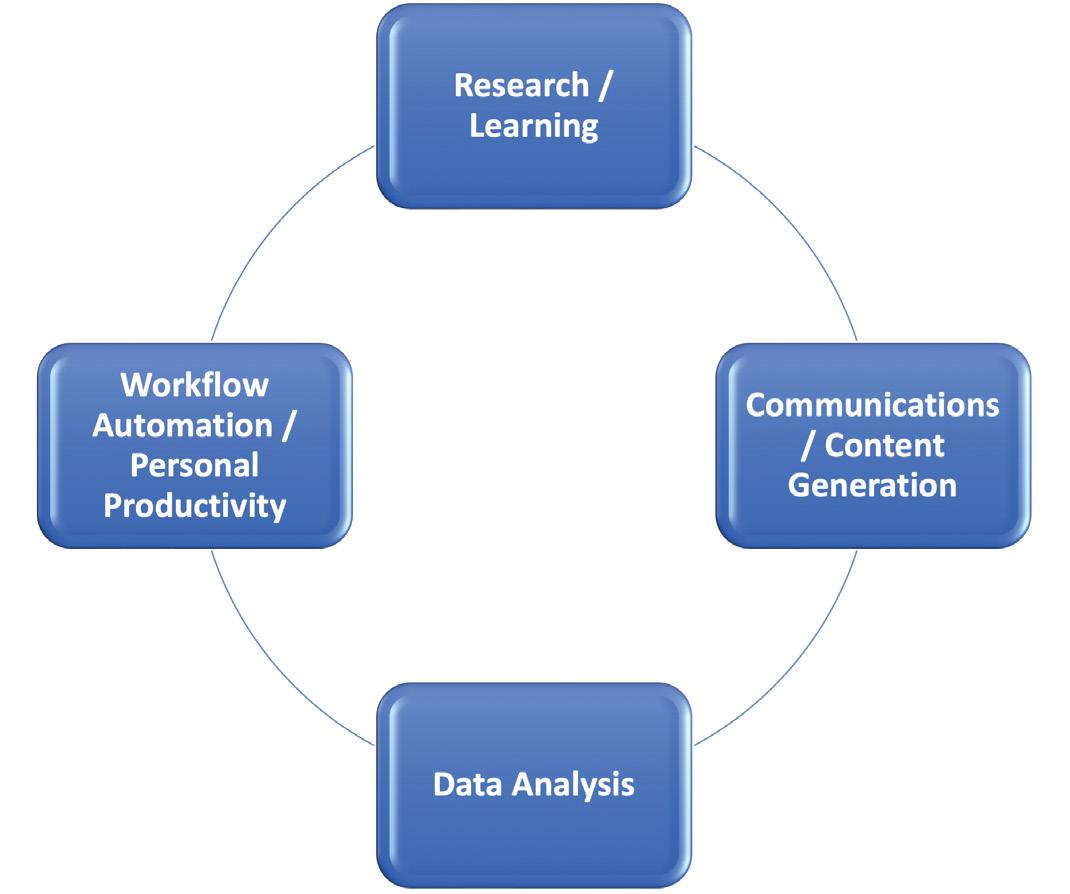

To understand the value that ChatGPT offers CPAs, it is helpful to review a variety of practical, everyday applications to improve the quality and efficiency of our information processing and reporting responsibilities. The illustration below depicts four distinct categories of ChatGPT applications that CPAs can take advantage of today.

A good starting point for leveraging the capabilities of ChatGPT is to use it as your research assistant and tutor. Whatever topic you want to learn more about, simply ask (prompt) ChatGPT at www.chatgpt.com. Try the following basic example yourself and assess the results:

Explain what a passive loss carry-forward means, relative to federal income taxes; include citations. Also provide detailed instructions for creating a schedule to track them in Excel.

This example illustrates how ChatGPT can be used to research virtually any topic; and by requesting citations as part of your prompt, you can substantiate the information provided. On the Excel side of the equation, the results show how you can use ChatGPT to provide detailed instructions on how to do virtually anything within the power of Excel. This is a perfect example of “just-in-time learning.”

There is a substantial amount of momentum within our profession to focus more on client advisory services (CAS) to complement our technical compliance services and enhance our value to clients. ChatGPT can serve as an invaluable coach in helping CPAs to communicate complex financial and tax information to an audience that often has

“ ChatGPT can serve as an invaluable coach in helping CPAs to communicate complex financial and tax information to an audience that often has a limited understanding of the topic.

a limited understanding of the topic. Try the following prompt example:

Identify the key balance sheet and income statement financial ratios that are relevant to the owner of a group of pizza franchises. Provide a narrative of the importance of each ratio and how to evaluate them. Write the output in a format that I, as a CPA, can explain to my client, who has limited understanding of financial information.

You may find the results surprisingly on point, and it will open your eyes to many different ways you can use ChatGPT to help you communicate financial information more effectively.

Analyzing financial data on behalf of our clients is one of the most important services we provide. This often involves extracting data from transaction files or lengthy documents,

such as contracts, financial reports, data files and so forth.

ChatGPT can substantially expedite the data/document analysis process. Examples include the following:

• Upload a large contract document as part of your prompt, and ask ChatGPT to look for the existence of specific terms or terminology.

• Upload a sales transaction file in Excel format, and ask ChatGPT to analyze the transactions to produce specific calculations such as gross margin percentage by product line, average sales by salesperson and more.

• Upload financial statement documents, and ask ChatGPT to calculate the key financial ratios identified in the communications example above.

Try this prompt example, which includes uploading the Nvidia Annual Report1 as part of your prompt:

Calculate the quick ratio, current ratio and debt-to-equity ratio for each of the years presented in the Nvidia 2024 Annual Report.

This final category is focused on using ChatGPT to help you get your work done faster. While all the examples provided previously help you to work more efficiently, in this case you will focus on automating some of your routine tasks by getting more out of the software tools you use every day. Nothing exemplifies this better than using ChatGPT to generate Excel macros to automate routine tasks you perform within your spreadsheets. For those not familiar

1 https://investor.nvidia.com/financial-info/annual-reports-and-proxies/default.aspx

with macros, they are simply coded instructions to complete a routine task in an Excel spreadsheet. Examples include printing reports, organizing data, consolidating worksheets and more. The following is one of my favorite examples to illustrate this capability. Give it a try with your own amortization schedule worksheet.

Create an Excel macro to print the amortization schedule through to a specified payment date entered via prompt to the user, including the mortgage input variables.

Inclusion of the “prompt to user” will, amazingly, create a very user-friendly prompt for the user to enter the payment date through which they want the amortization schedule printed.

Workflow automation applications for ChatGPT are not limited to Excel macros. A practical approach to identify other opportunities is to generate a list of all the software applications that you use in a particular workflow, such as client accounting. Then generate a narrative flowchart of the tasks that you perform in the workflow — the more detailed the better. Create a ChatGPT prompt that includes both, and ask for specific ways to automate the tasks with the software tools available. This will need to be an iterative process in which you drill down specifically on how to automate the suggestions provided.

This article would be remiss if it didn’t cover some of the risks associated with using generative AI tools. The two most significant are hallucinations and data privacy protection — both of which can be mitigated with a little effort.

Hallucinations refers to the fact that the output generated can be factually wrong. When generating facts or figures with your prompts, it is imperative that you validate the results by alternative means relative to the reliance you or your clients are going to place on the information. This is no different than with any other information we provide as CPAs. It is imperative that the information we share is accurate. Be careful not to get lazy and simply accept the output as correct.

Regarding data privacy protection, it is important to understand the nature of how generative AI “may” use your data to help train their models. You can protect against this risk with a few basic procedures. First, take the time to understand the policy of ChatGPT (or whatever generative tool you may be using) and whether they use your prompt data to train their models. ChatGPT allows you to opt out of your data being used for training purposes. Visit their data privacy policy to understand how to activate this. The other step is to anonymize any data that you include in your prompts. This includes company data, personal data and so forth. If you don’t offer your private data to ChatGPT, you don’t have to worry about its privacy.

This article has focused on ChatGPT, but there many generative AI solutions to choose from, including Google Gemini, Anthropic Claude, Perplexity, Microsoft Copilot and others. The concepts and examples in this article can be applied to any of them. However, the results will vary from one tool to another. If your company uses Microsoft 365,

Don’t

wait to start exploring the use of generative AI. The opportunity to leverage it to increase productivity and establish new revenue streams is too important to pass up.

Microsoft Copilot provides unique capabilities in the way that it is directly integrated into the individual applications.

Final note

Don’t wait to start exploring the use of generative AI. The opportunity to leverage it to increase productivity and establish new revenue streams is too important to pass up. It takes time and commitment to create a perfect partnership!

John Higgins, CPA.CITP, is the founder and CEO of Higgins Advisory LLC in Rochester, Michigan. His firm’s mission is to help CPAs, CFOs and other financial professionals successfully guide their organizations through a successful digital transformation.

Brian Barrett

Lynn Fischer

Sheila Fisher

Jason Haen

Heather Hafeman

Chad Helminger

Neil Keller

Amanda Linehan

Christopher Olson

Brett Rimkus

Sali Sheafor

Angela Thomas

Natalie Van Den Bosch

Denise Vandenbush

By Neil Fauerbach, MBA

Artificial intelligence (AI) adoption by the accounting world has grown dramatically since we last wrote about it in the May/June 2023 issue of On Balance. For this article, we revisited firms large and small who were embracing it, controlling it or ignoring it. Anxiety and caution are still there, but most firms are using it in some form. We wanted to see what had changed.

Allen Smith, chief information officer for Baker Tilly in Milwaukee, said, “Over the past year, our firm has launched a comprehensive AI initiative aimed at developing a unified, strategic approach to leveraging AI for the benefit of our clients and our firm.” According to Smith, they are currently working on over 30 AI-related projects that aim to integrate AI into various aspects of the practice.

Tim Seidel, CPA, a partner with Wegner CPAs in Madison, said his firm’s involvement with AI is steadily increasing. “While we may not be on the cutting edge of the technology, we aren’t ignoring its potential either,” he said. “I use ChatGPT most days or at least several times a week, and I discuss how I use it with my team so they can see its capabilities, and I encourage them to think about how it can enhance their day-to-day work. We are currently testing Microsoft’s Copilot with plans to roll it out to a small group in early 2025 and expand usage across the firm later in the year if all goes well.”

Northland CPAs’ managing partner, Ben Hauser, CPA, said his firm uses AI with caution. “AI has always been somewhat built in to some of the software we use, but we have not made any significant changes during 2024 because of the recent AI boom. One of our administrative assistants has been using it to develop client spotlight articles, which may be a time-saver. However, another staff member has compared letters written by ChatGPT to human-written letters and observed the bot lacked the personal touch,” Hauser said. “I truly believe it can be a blessing and a curse at the same time.”

“

In March 2024, The Washington Post reported that the AI assistants in two popular online tax preparation software products gave false or misleading answers to tax filers’ questions more than half the time. The bots did not calculate answers but provided information the user could interpret improperly while filling out forms.

In June 2024, the IRS Taxpayer Advocate Service warned, “Taxpayers should not rely on AI-generated responses to complex tax questions.” CPA firms that provide tax services may experience this when clients approach them with their own “research,” as doctors experienced when WebMD was introduced.

Having policies around AI use may help avoid critical or embarrassing situations. There have been documented instances of CPA and law firms that have felt the negative effects of unchecked use of chatbot answers.

One person who has been studying the AI frenzy is Daniel Hood, editor in chief of Accounting Today. Hood advises, “I recommend that every firm establish a written set of AI policies they can share with everyone on their teams. A quick Google [search] will turn up plenty of templates and boilerplate language, but the main things to cover are data security, client communication around how the firm is using AI, and clarity around work product that may include AI-generated material.”

That’s good advice because whether you know it or want it or you don’t, your people are using it in their work.

Baker Tilly has established comprehensive policies governing the use of AI across the business, according to Smith. “These

I recommend that every firm establish a written set of AI policies they can share with everyone on their teams.

— Daniel Hood, editor in chief of Accounting Today

policies are designed to ensure that we fully understand the benefits and risks associated with specific AI capabilities,” he said. “A critical aspect of our approach is to explore and address the legal and ethical risks linked to AI. We are committed to transparency to prevent unintended biases in AI usage. To this end, we have formed a cross-functional team of leaders who meet regularly to discuss and address these issues.”

Wegner’s Seidel responded similarly. “We rolled out a generative AI usage policy in the first half of 2024. The policy includes guidelines on how to appropriately use Large Language Models — or LLMs — with example do’s and don’ts.”

Hood suggested that every firm have someone on staff to regularly scan the horizon for new developments in AI that might affect accountants and the work they do — “… or their clients’ industries.”

“

There is a strong interest in AI among marketing professionals, driven by the potential to scale small marketing teams to compete with larger firms.

— Stacey Dreher, chief growth officer at James Moore CPAs

At Wegner CPAs, the IT team keeps a close eye on advancements in AI technology, according to Seidel. “We have a small committee representing our various service lines that meets every couple of months to discuss potential technologies. We anticipate testing at least one technology in our assurance practice in 2025, with the possibility of exploring additional tools in other service areas,” he said.

The Association for Accounting Marketing (AAM) has a keen interest in helping members understand and use the tools with AI capabilities. AAM created an “AI Circle” dedicated to helping its members utilize AI in their firms. Led by Stacey Dreher, chief growth officer at James Moore CPAs in Gainesville, Florida, the group meets every five to eight weeks to discuss challenges and tools.

“There is a strong interest in AI among marketing professionals, driven by the potential to scale small marketing teams to compete with larger firms,” said Dreher. “AI adoption in marketing initially faced hesitancy due to concerns about Google penalizing AI-generated content. However, Google has reversed that stand and now emphasizes quality over authorship.”

For marketing departments that may feel under-resourced, AI is widely used in social media management for content planning, SEO optimization and creating article outlines. Dreher said that firms are integrating AI across workflows,

such as automating the process from content creation to publishing with tools like WordPress and HubSpot.

Is AI coming for your job?

Let’s ask it — here’s the prompt: I am a CPA and partner in a medium-sized firm in Wisconsin. Do I need to worry about AI disrupting the accounting industry and laying off CPAs?

ChatGPT’s answer: AI tools like ChatGPT are designed to enhance productivity, but they’re not a replacement for the critical thinking, expertise and interpersonal skills that CPAs bring to the table. AI can automate repetitive tasks like data entry, reconciliation and some aspects of tax preparation. However, advisory services, strategic decision-making and understanding the nuances of client needs remain firmly in human hands.

Instead of worrying, think about how AI can complement your work. It can free up time for higher-value tasks, help identify trends and improve accuracy. Staying informed about emerging AI tools and integrating them into your workflows could make your firm even more competitive.

Neil Fauerbach, MBA, has 37 years’ experience in CPA firm marketing and business development and has been honored with CPA Marketing Report’s Accounting Marketer of the Year, Accounting Today’s 100 Most Influential People in Accounting, and induction into the Association of Accounting Marketing Hall of Fame.

Mark Ampaw, CPA, managing partner of Ampaw & Associates LLC in West Allis, was featured in an article titled “From Visa to Vision” for the online news outlet Madison365

Brad Baumann, CPA, a managing principal in the southeast Wisconsin office of CliftonLarsonAllen (CLA), was named to BizTimes Milwaukee’s 2024 list of the state’s most influential business leaders.

Kevin Behnke, CPA, has been promoted to partner at Hawkins Ash CPAs in Manitowoc.

Aaron Boettcher, CPA, MBA, has been promoted to partner at Hawkins Ash CPAs in Green Bay.

Cheryll Bossingham, CPA, has been promoted to partner at Strohm Ballweg LLP in Madison.

Rachel Burrow, CPA, has been promoted to partner at Hawkins Ash CPAs in La Crosse.

Shannon Campy, CPA, has been promoted to manager of tax services at Northland CPAs in Rhinelander.

Beth Colson, CPA, MSA, has been promoted to managing director at Truity Partners for the Milwaukee and Madison offices.

Christine Dahlhauser, CPA, a managing principal at Baker Tilly in Madison, was named to BizTimes Milwaukee’s 2024 list of the state’s most influential business leaders.

Emily Di Nardo, CPA, CITP, a principal in Baker Tilly’s risk advisory practice, was selected by the Milwaukee Business Journal as one of their 2025 40 Under 40 honorees.

Patrick J. DiStefano, CPA, MBA, a managing partner at Deloitte LLP in Milwaukee, was named to BizTimes Milwaukee’s 2024 list of the state’s most influential business leaders.

Kurt Gresens, CPA, CGMA, a managing partner and board chair at Wipfli LLP in Green Bay, was named to BizTimes Milwaukee’s 2024 list of the state’s most influential business leaders.

Tenisha Grimmer, CPA, chief financial officer at Access Community Health Centers, has been recognized by the news website Madison365 as one of Wisconsin’s 40 Most Influential Black Leaders for 2024.

Chris Handrick, CPA, a principal at CLA in Green Bay, has been named to the board of directors of New North Inc., the regional economic development corporation for the counties of northeast Wisconsin.

Ted Ibinger, CPA, has been promoted to principal in the tax service line and real estate industry group at SVA CPAs.

Tommy Jostad, CPA, has been promoted to chief financial & operating officer at the Harry and Rose Samson Family Jewish Community Center in Milwaukee.

Bryan Kronberger, CPA, has been promoted to manager of accounting and attest services at Northland CPAs in Rhinelander.

Ryan Meyers, CPA, has been promoted to vice president of finance at Kolbe Windows & Doors in Wausau.

Brad Netzel, CPA, has joined Wixon Inc., a St. Francis-based food flavoring company, as chief financial officer.

Matthew Neu, CPA, has been promoted to partner at Hawkins Ash CPAs in Manitowoc.

Doug Persich, CPA, has been promoted to senior vice president and chief financial officer at Forte Bank in Hartford.

Nathan Roth, CPA, has been promoted to partner at Andaloro, Smith & Krueger LLP in Waukesha.

Robert W. Scott, CPA, director of finance and administration for the city of Brookfield, has been appointed to a five-year term on the Governmental Accounting Standards Board, effective July 1. He is also the local government representative to the State of Wisconsin Investment Board.

Emily Sladky, CPA, has joined Vrakas CPAs + Advisors in Brookfield as a tax principal.

Peggy Stebbins, CPA, has been promoted to executive vice president, chief operating officer and interim chief financial officer at PremierBank in Fort Atkinson.

Victoria Thayer, CPA, founder and president of Novii CPA in Madison, has been selected by In Business Madison as a 2025 40 Under 40 honoree.

Brian Thiel, CPA, has been promoted to principal on the valuation team at SVA CPAs.

Bob Watson, CPA, has joined Hawkins Ash CPAs as a partner in the firm’s Mequon office.

Rob Wedel, CPA, has been promoted to senior director of finance at the Harry and Rose Samson Family Jewish Community Center in Milwaukee.

Fine-tuning and organizing the efforts of the incident response, disaster recovery and business continuity teams is the logical next step in the “business resilience symphony.”

By Jeffrey T. Lemmermann, CPA, CISA, CITP, CEH

Iremember my first time seeing a symphony orchestra performance as a child and wondering what the person with the wand in front of everyone was doing. Aerobics? Trying to fly?

Demonstrating how to hail a cab? Our music class teacher had already anticipated the goofy thoughts of her first graders and let us amuse ourselves before pointing out what they were doing and why, which was:

• Selecting music and interpreting the musical score.

• Setting and maintaining tempo.

• Directing each instrument family to deliver a unified performance.

This is a very simplified list, but without these key tasks, the result would be much different and certainly less consistent and pleasing to the ear.

An orchestra without a conductor is the situation many organizations face today when considering their own business resilience strategy. Just as orchestras have their instrument families (strings, woodwinds, brass and percussion), businesses also have their groups — disaster recovery, business continuity and incident response — mixed in with various risk assessment efforts.

How did we get here? For most organizations, it started with the development of a disaster recovery plan (DRP).

Once computer systems became a primary component of business operation, the need for a disaster recovery plan grew. The goal of disaster recovery is straightforward: to minimize the amount of time that business processes are disrupted due to some unplanned event. Whether the size of the disaster is large (loss of an entire facility) or something less than that (a water pipe failure taking out a rack of servers), the DRP should be designed to recover from different levels of disasters.

At its most basic, the DRP is expected to contain the following:

• Recovery team members and contact information (internal and third-party resources)

• Resources and instructions for obtaining/implementing recovery equipment

• Steps necessary to recover the affected systems and data

A strong risk assessment program is a key resource for the DRP. It provides a number of important inputs for disaster recovery efforts, including likelihood and impact measurements. These allow the DRP to focus on those events that are more likely and develop strategies that prioritize systems that have the greatest impact on services.

For most organizations, the DRP was and still is primarily in the domain of the information technology (IT) group. However, what is changing with the increased emphasis on business resilience is the group’s involvement in overall planning activities. This has occurred naturally as companies began developing business continuity plans (BCPs).

The order for the first business continuity plan was likely put into development moments after the board of directors of some company was informed that it would take a week (or more) to perform the steps in the newly created DRP.

What to do while systems and data are being restored is the problem the BCP is designed to address. Ideally, each business process or business unit should have its own BCP containing the following key information:

“

The goal of disaster recovery is straightforward: to minimize the amount of time that business processes are disrupted due to some unplanned event.

• Alternate procedures and resources to use when key systems are down

• Procedures covering various downtime lengths

• Steps to reintegrate information once systems have been restored

But when should the BCP be enacted? That is generally where the incident response plan (IRP) comes into play.

Credit for the development of the first organized incident response plan is generally given to a number of fire chiefs in California in the 1970s. In response to growing numbers of regularly occurring wildfires, they created an incident command system designed to provide better coordination among the various firefighting agencies responding to the blazes. The system defined the role of an incident commander at the top, established a consistent set of terms to improve communication, and defined several categories of incident response processes.

Today, those concepts are the basis of a good IRP for any organization. They ensure the efforts of different teams throughout the enterprise are organized, coordinated and maintained when dealing with incidents affecting the key services or mission of the organization.

There will be times when the IRP will need to call on procedures from the DRP or the BCP — or both — depending on the incident. This is where the emergence of a business resilience component is needed. To maintain a unified and cohesive effort across the different groups responding to an incident, someone must play the role of conductor.

All along, the goal of these various plans has been to keep the organization functioning in the face of potential disruptions. Structurally then, the BCP, DRP and IRP should all be components of an overall business resilience strategy. This would enable the following results:

• Oversight and consistency in developing individual BCPs at the department or business process level

• Application of business impact analysis-related calculations to plan test results (such as maximum tolerable downtime, calculated recovery times and more)

• Reduced duplication of efforts when plans are developed without coordination

• Ensurance that individual plans are tested and updated appropriately

• The ability to conduct enterprise-wide tests of plans

The Federal Financial Institutions Examination Council (FFIEC) publishes information related to IT examinations that can be useful in developing and analyzing your own business resilience strategies. In 2019, the Council updated its business continuity management booklet with a focus on the value of resilience to protecting organizations in the financial industry.

Objective six of this resource is: Determine whether the entity’s risk management strategies are designed to achieve resilience. This section relates specifically to resilience and provides a good basis for analyzing your own practices.

In total, this FFIEC resource provides 13 objectives, supported by 89 examination procedures that could be useful to organizations in any industry to self-examine their current business resilience capabilities. The booklet and related examination procedures are available for free at https://ithandbook.ffiec.gov/it-booklets/businesscontinuity-management.

The good news for most organizations is that bringing these plans under the direction of one group or individual isn’t the equivalent of starting over.

The National Institute of Standards and Technology’s Special Publication 800-53, Security and Privacy Controls for Information Systems and Organizations (revision 5), addresses the confluence of disaster recovery and business continuity in its contingency planning family. Incident response is also addressed in its own family. This resource is also available for free at https://csrc.nist.gov/projects/cprt/catalog#/cprt/ framework/version/SP_800_53_5_1_1/home.

The good news for most organizations is that bringing these plans under the direction of one group or individual isn’t the equivalent of starting over. It is simply ensuring that these components begin working in concert with each other to produce a better-tuned plan for a resilient enterprise.

Jeffrey T. Lemmermann, CPA, CISA, CITP, CEH, is an information assurance auditor and consultant at SynerComm Inc. in Brookfield. Contact him at 262-373-7100 or jeffrey.lemmermann@synercomm.com.

Chassidy G. Anderson

Menomonee Falls High School

Alexander P. Anewenter

Port Washington High School

Billina Augustian

UW–Green Bay

Andy L. Averill

Defense Contract Audit Agency

William Bailey

UW—Platteville

Amanda Beaudo

Dodgeland High School

Jennifer L. Belisle CLA

Justin Berg

Eau Claire Area School District

Danielle Boehm

Brookfield Academy

Nicholas C. Borchardt Chortek LLP

Farah N. Brown

Nicholas Burgher

UW—Platteville

Christopher Burish Muskego High School

Henry A. Butzlaff

Jocalyn J. Carpenter

Vong Chang

Jessica Chase

Madison Metropolitan School District

Charles L. Coons

Menomonee Falls High School

Tasha Dantoin

KerberRose S.C.

Richard Dauphinais

Taylor Debs

Austin DeMoss

Wipfli LLP

David Diedrick CLA

Megan Dimech-Krueger

Eric Doese

SVA Certified Public Accountants

Albert L. Douglas

Ampaw & Associates LLC

Oreoluwa O. Durojaiye

Menomonee Falls High School

Kevin R. Evanoff

Bank Five Nine

December 1, 2024 – January 31, 2025

Kathryn Fuxa

James Gabriel

Batley CPA LLC

Deedra Gloeckler CLA

Morgan Guenther

UW—Milwaukee

Nathan Gurgel

Reid Gust

Stevens Point Area Senior High School

Mike Haase

Tracy Hamilton

Fields Tax and Accounting LLC

Kirsten M. Hein

Nick Heiting

West Bend High School

Brian Hellenbrand

McFarland School District

Kyle A. Helminger

Kenneth J. Hoffman

Ken Hoffman CPA LLC

Patricia Holland

Dawid R. Jacobs

Dylan J. Jagodinski

Menomonee Falls High School

Mason J. Janowiak

Ellen Jegen

Deborah Jenkin

Linto Jerry

Barbara A. Kane

Franciscan Sisters of Christian

Charity Sponsored Ministries Inc.

Finnian J. Keila

Menomonee Falls High School

Eric J. Kennedy

Reilly, Penner & Benton LLP

Tyler W. Kuglitsch

UW—Milwaukee

Tyler J. Lauber

Zachary P. Lawrence

UW—Milwaukee

Philip LeClaire

Lucida Tax & Accounting Solutions

James D. Locatelli

Locatelli Financial Management

Co. S.C.

Pete D. Lotz

Port Washington High School

Jean A. Louis

Sheboygan Area School District

Isaac J. Lynch

Menomonee Falls High School

Melanie A. Marks

Craig High School

Santosha A. Martinez

Jacob Marx

Forvis

Phil McCabe

St. Lawrence Seminary

Jennifer L. McCauley

Robert W. Baird & Co. Inc.

Diamond Meek

Alanna J. Miller

Menomonee Falls High School

Andy Mills

UW—Platteville

Leslie M. Minkel

Menomonee Falls High School

Jada C. Moore

Fallon E. Morrissey

Wegner CPAs

Kate Mumma

UW—Milwaukee

Michelle N. Niemec

National Guardian Life

Insurance Co.

Eric R. Nygaard

Orthopedic & Sports Medicine

Specialists of Green Bay SC

Steven R. O’Connell CentroMotion

Pedro S. Orozco Katafias

Ampaw & Associates LLC

Therese M. Pearce

Lisa A. Perry

Blair Taylor High School

Gabrielle L. Peters

KerberRose S.C.

Noreen R. Riley

Noreen Riley CPA LLC.

Shaddai N. Santiago

Terrence J. Schaffner

ABC Supply Co. Inc.

Jordan T. Schnabel

UW—Milwaukee

Michael Schubring

Scribner, Cohen and Co. S.C.

Aaron Schwantes

Whitnie Schwartz

Kate E. Serpe

Sage Accounting Solutions

Jenna N. Shadoski

Sarbjeet Singh

Menomonee Falls High School

Carlie Smith

UW—Milwaukee

Kenneth A. Smith Sr.

Kohler and Franklin CPAs LLC

William M. Sohn

Baker Tilly

Naomi G. Sotomayor

Kimberly High School

Jexen Stietz

UW—Platteville

Hunter C. Stuber

Menomonee Falls High School

Elliot Thompson

Menomonee Falls High School

Kathleen M. Thorn

Eau Claire North High School

Mijal Tohi

Yvonne E. Trainor

Lindsay Van Der Wegen

UW—Milwaukee

Mason Vasquez

Ryan W. Vlies

Stephanie Waldschmidt

Campbellsport High School

Jeremy R. Wedell

Contentstack Inc.

Dorian A. Wegner

Menomonee Falls High School

Elise P. Wegner

UW—Milwaukee

Nolan D. Weiss

Menomonee Falls High School

Russell J. Wendorf

Michael R. Westbrook

Jillian Westplate

Jon Winter

Sherry Mattson S.C.

Brandon Wolf

KPMG LLP

Kellea J. Wright

Paralegal Services

Susan Ziegler

Lodi High School

The Property Tax Section of von Briesen & Roper, s.c. has extensive experience and is your comprehensive resource for property tax issues. From public to private entities, the Property Tax Section has assisted clients in contesting and defending property tax assessments, chargebacks, tax exemptions, and advising on PILOT agreements and TIF/TID districts. Our creative approach to the most complex matters has positioned us to be your trusted advisor on property tax. The bottom line? We get results.

To learn more about our Tax Section, please contact Dan Welytok at daniel.welytok@vonbriesen.com.

By Art Kuesel

I’ve noticed a trend brewing in the accounting profession: Too few young accountants aspire to become CPA firm partners. While this may seem far from a crisis to some, it’s an issue that should sound off many alarms for those of us in public accounting. A diminishing desire to pursue partnership means that a considerable number of CPA firms (both large and small) won’t be able to survive the next generation of retirements and will need to merge upstream, pursue another succession solution, or simply dissolve. The dearth of aspiring partners, plus the other talent challenges reshaping the profession’s landscape, could fundamentally change the experience of working in public accounting.

But is it really any surprise that young professionals aren’t interested in stepping onto the path to partner like they used to be? It’s been my observation that the negatives of being a partner are often on display in a bright spotlight, while the positives and privileges that come with such a prominent position are hidden backstage or seldom touted. It’s worth emphasizing that many parallel professions enjoy the spotlight in pop culture (think attorneys, doctors, software engineers and Wall Street types), while accountants rarely make an appearance on the big screen or, when they do, typically play the part of the stereotypes we wish to escape. We desperately need to change the perception of accountants and what it means to be a partner in a firm.

What if we told a different narrative? What if we said the path to partner offers opportunities to make a positive difference for the individuals, businesses, nonprofits and more that we serve; partners earn notable compensation; they’re entrepreneurial and work competitive hours compared to peers in other professions; they enjoy the flexibility of not being tied to a single, physical location; they work in a profession that values lifelong learning; and the profession affords a stable income in any economy?

“

It’s up to us — those who know the partner role well — to counter the stereotypical negatives and shine a brighter spotlight on the positives being a partner in a successful firm provides.

Unfortunately, these perks aren’t what most students and young professionals are being told or shown about the accounting profession.

It’s up to us — those who know the partner role well — to counter the stereotypical negatives and shine a brighter spotlight on the positives being a partner in a successful firm provides.

Here are three negatives and three positives we can craft better stories around.

1. Partners work too many hours, especially during busy season. Make no mistake, busy season is a considerable obstacle to us positively promoting the profession and the partner role. However, when you compare total work hours versus other parallel professions — such as legal and finance — CPA firm partners generally work fewer total hours than most and often have more flexibility.

2. Partners don’t enjoy a lavish lifestyle. Accountants are generally modest in their projection of wealth. But with equity partners earning an average of $650,000 per year (based upon recent survey data),

rest assured their bank accounts are full. For many CPA firm partners, college is funded for the kids, there’s a vacation home in their portfolio, and their international travel plans are confirmed. Interestingly, $650,000 is more than most physicians earn. With starting compensation such a contentious topic in the profession right now, it’s important to help prospective accountants and aspiring partners understand their real earning potential.

3. Partners are beholden to their clients. It can seem that when clients yell “Jump!” the partner asks, “How high?” In some cases, this is true. But in most cases, the partner-client relationship is balanced. Even more so, the immeasurable value brought to clients and their show of appreciation is the real star of the

show. And, of course, let’s not forget the personal satisfaction derived from solving complex financial and business challenges. We need to do a better job of spotlighting how meaningful client relationships make a career in public accounting so rewarding.

1. Partners enjoy the flexibility to work anytime, anywhere. Many of our peers in the professional world have several guardrails dictating when and where they work. In public accounting today, there’s more freedom than ever to build your schedule around your life — especially for partners. As long as you take care of your clients and train and mentor your staff, your geography and schedule can flex.

2. Partners can set their own schedules to accommodate personal commitments. A point of pride for so many partners today is their ability to make it to every one of their child’s ball games or other activities. Having the freedom to set your own schedule is a priceless benefit that isn’t available to many of our peers in parallel professions.

3. Partners are business owners in one of the most profitable yet low-risk sectors of our economy. A typical local CPA firm produces margins of 30% or more. How many of your clients can brag about that kind of margin? What’s more, public accounting is one of the most resilient professions when economic headwinds strike. That’s because whether the economy is good or bad, you need to have accurate financial statements, file your taxes and get an audit.

While I hope these few positives about being a CPA firm partner are compelling to the next generation of accounting professionals, this illustration is far from complete. It’s up to all current and up-and-coming partners to fill in the blanks and help the profession tell a better partner story. We all look at the partner role through different lenses, which means we all have unique stories to tell that can help attract the next generation of CPA firm partners to the table.

If you’re someone who has long discounted the partner position, I hope you begin to look beyond the negatives about being a partner that have become so visible — take some time to learn about and explore the positives that aren’t talked about enough. In fact, I’d encourage any young accounting professional to ask a CPA firm partner a series of questions:

“ Given the current talent landscape and the pipeline challenges the profession faces ahead, it’s imperative that we finally flip the script about becoming a partner and tell a better story to every aspiring accounting professional.

• What’s it like to be a partner?

• How did you make partner?

• What are the best and worst things about being a partner?

• What would it take for me to become a partner?

With a little research and curiosity, I suspect a brighter narrative about what it means to be a CPA firm partner would emerge.

Given the current talent landscape and the pipeline challenges the profession faces ahead, it’s imperative that we finally flip the script about becoming a partner and tell a better story to every aspiring accounting professional.

Art Kuesel is president of Kuesel Consulting. Contact him at 312-208-8774.

Reprinted from Insight magazine and used with permission of the Illinois CPA Society.

Friday, May 9, at 5 p.m. Brookfield Conference Center

• Recognize membership milestones.

• Elect the 2025–2026 Board of Directors.

• Enjoy dinner, drinks and networking. Join us for the WICPA’s signature event of the year to:

• Present the 2025 Excellence Awards.

Complimentary for WICPA members. Registration is required to attend.

For more information and details, visit wicpa.org/banquet.

By Michael Noreman, CPA, MST, MAcc and Nick Stufano, CPA

With merger and acquisition (M&A) activity on the rise in 2024, a trend that practitioners are encountering is the preparation or audit of the associated purchase accounting, which is required under Accounting Standards Codification (ASC) 805, Business Combinations

Many professionals who deal with ASC 805 are well versed in

the nontax aspects, but when tax comes into the picture, many can be outside their comfort zone. The following framework can help ensure that the appropriate considerations are made.

Determine the tax structure of the transaction

The initial consideration that should be made is to understand the tax structure of the acquirer and the acquiree as well as

the method being undertaken to effectuate the transaction. This can be done through a careful review of company organizational charts as well as the purchase agreement.

Transactions are effectuated in one of two ways: through a taxable transaction or through a nontaxable transaction.

A taxable transaction leads to a “step-up” in the target’s tax basis of assets acquired and liabilities assumed to fair market value. This type of treatment is typically seen in acquisitions of assets and stock acquisitions that are treated as asset acquisitions for tax purposes by election (e.g., §338 elections for qualified stock purchases).

Conversely, a nontaxable transaction results in a “carryover” of the historical tax basis in the assets acquired and liabilities assumed. Assuming a premium is paid, this will typically result in a lower tax basis than the fair market value utilized for financial statement purposes under ASC 805. This type of transaction generally occurs in an acquisition of the acquired entity’s stock (unless a §338 election is made).

Determine the financial statement and tax bases

Under ASC 805-20-30-1, the acquirer measures the identifiable assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree at their acquisition-date fair values. A valuation specialist is typically engaged to assist with the identification and measurement of such fair values. This will typically result in a step-up for financial reporting purposes to the acquired assets and liabilities of the target. The deferred tax consequences of such a step-up will depend on how the transaction is being accounted for from a tax perspective.

In a taxable transaction, the acquirer will receive steppedup basis in acquired assets and liabilities for both financial reporting and tax purposes. In many cases, the basis in each class of assets will be equal for both financial reporting and tax purposes. Accordingly, no deferred taxes are recorded as part of purchase accounting in these instances. However, in some cases, there can still be a difference between the financial reporting fair value and the tax allocation of acquired assets and liabilities under IRC §1060. When this occurs, deferred taxes are recorded in purchase accounting to reflect the differences between financial reporting and tax bases. It is important to review the purchase agreement in detail, as it may outline how the parties will allocate the fair value for tax purposes and can save considerable time during the financial statement preparation and audit.

“

Transactions are effectuated in one of two ways: through a taxable transaction or through a nontaxable transaction.

In a nontaxable transaction, the financial reporting basis of assets and liabilities both receive a step-up to fair market value; however, the tax basis in assets and liabilities maintain carryover basis. This will lead to basis differences between book and tax that will require the establishment of deferred tax assets (DTAs) and deferred tax liabilities (DTLs). The most common and significant difference relates to the step-up in nongoodwill intangibles, resulting in a DTL.

A complexity that is commonly faced is accounting for goodwill. In cases where goodwill established for financial reporting purposes exceeds tax-deductible goodwill, no DTL should be established. However, a DTA is established when tax goodwill basis is greater.

operating losses, tax credit and disallowed interest expense carry forward to the acquirer. These future tax benefits will be reflected as acquired DTAs, which may be significant. However, it is crucial to understand any potential limitations in the future utilization of these acquired tax attributes (e.g., IRC §382 on net operating losses). If an attribute will necessarily expire unutilized due to these limitations, then it is not appropriate to record a DTA as of the date of acquisition.

Perform realization assessment for deferred tax assets

Acquirers should assess the need for a valuation allowance against acquired DTAs as part of business combination accounting. An analysis of whether reversing taxable temporary differences (such as DTLs) are sufficient to utilize existing DTAs is an objective way to determine if a valuation allowance is needed, although there are other sources of evidence allowable to be used under the accounting standards (e.g., historical and projected profitability from operations). Also, acquirers should consider if the business combination warrants a change in the valuation allowance assertion for its own DTAs based on the combined entity’s tax position.

Consider treatment of tax uncertainties and indemnifications

Additional historical tax exposures may be uncovered during the due diligence process. It is imperative that, if

It is imperative that, if there are findings on historical positions, the risk be assessed and, if appropriate, recorded as a liability as part of purchase accounting.

there are findings on historical positions, the risk be assessed and, if appropriate, recorded as a liability as part of purchase accounting. The recognition and measurement criteria for these findings can vary depending on whether the liability falls within ASC 740, Income Taxes, or ASC 450, Contingencies

Although accounting for the income tax in a business combination is complex, the above framework can be a great starting point to navigate the reporting nuances and considerations.

Michael Noreman, CPA, MST, MAcc, is a senior director at Alvarez & Marsal Tax LLC. Contact him at noreman@alvarezandmarsal.com.

Nick Stufano, CPA, is a manager at Alvarez & Marsal Tax LLC. Contact him at nstufano@alvarezandmarsal.com.

Brian S. Miller, CPA (1962–2024)

Brian S. Miller, CPA, passed away on Sunday, Dec. 8, 2024. He was 62. He attended St. Joseph High School in Kenosha, graduating as the class valedictorian, before attending the University of Wisconsin–Whitewater, from which he graduated with a bachelor’s degree in accounting in 1984. In 1989, he became licensed as a CPA. Miller was dedicated to his career as a CPA and worked for the Bradley Corp. for nearly 20 years. He was a dedicated Green Bay Packers and Milwaukee Brewers fan; however, baseball was his passion. He spent countless hours coaching his son Matt’s baseball teams throughout Matt’s childhood, and the two would spend nearly the whole summer traveling to ballgames while his son was in high school. Miller was known to have a can-do attitude, a kind heart and a gentle spirit and was always ready to lend a helping hand. He is survived by his wife, Jan; two sons and a daughter; one sister and one brother; and many other family members and friends.

Richard J. Skora, CPA, CFE (1940–2024)

Richard J. Skora, CPA, CFE, passed away on Friday, Dec. 27, 2024. He was 84. Born in Chicago, Skora moved with his family to Bristol, Wisconsin, when he was four years old. He graduated from Salem Central High School in 1985 and from the University of Wisconsin–Madison in 1962. In 1980, he became licensed as a CPA, and he joined the WICPA in 1981. Skora worked in several industries during his career as a CPA, primarily in the energy and oil sectors. He excelled in sports in his younger years, playing both basketball and baseball, and he was a devout Catholic, achieving a 4th Degree in the Knights of Columbus. Skora is survived by his wife of more than 63 years, Jessie; three children; six grandchildren; six great-grandchildren; a brother; and many other relatives and friends.

If you are aware of a member obituary and believe it should be included in Memorials, please send a copy of the obituary or contact Marcia Tillett-Zinzow at mtzinzow@icloud.com.

We are a Wisconsin-based company, focused on one thing: our customers

take pride in boasting the lowest prices and the very best customer service, and have been doing so since 1956.

By Holly Hoffman, MSA

The Streamlined Sales Tax Governing Board (SSTGB) and the Streamlined Sales and Use Tax Agreement (SSUTA) represent a significant effort to simplify and modernize sales and use tax systems across the United States. These initiatives aim to create a more uniform and efficient tax environment for both states and businesses, particularly in the context of increasing e-commerce and remote sales. Some of the WICPA members who attended the 2024 Fall Tax Conference may have met Craig Johnson, the executive director of SSTGB.

Key facts a tax professional should know

1. Establishment and purpose: The SSTGB was established in March 2000 to address the complexities in state sales tax systems and to simplify tax compliance for businesses operating across state lines.

2. Voluntary agreement: The SSUTA is a voluntary agreement among states aimed at standardizing sales and use tax administration.

3. Supreme Court decisions: The SSUTA was developed in response to the U.S. Supreme Court rulings in Bellas Hess v. Illinois and Quill Corp. v. North Dakota, which limited states’ ability to require remote sellers to collect sales tax.

4. Membership: As of now, 24 states have adopted the simplification measures outlined in the SSUTA, representing over 31% of the U.S. population. Tennessee is an associate member state.

5. Centralized system: The SSUTA includes a central, electronic registration system that allows businesses to register for sales tax in multiple states through a single process.

“ These initiatives aim to create a more uniform and efficient tax environment for both states and businesses, particularly in the context of increasing e-commerce and remote sales.

6. Certified Service Provider program: The SSTGB created the CSP program, which authorizes thirdparty providers to handle various aspects of sales tax compliance on behalf of businesses. This program is particularly beneficial for clients of tax professionals, as it offers a streamlined and outsourced solution for managing sales tax obligations. This program is provided at no cost to the business, since the states have an agreement through the CSP program to pay the provider a portion of the tax remitted for the filing service.

• Reduced compliance costs: The SSUTA simplifies tax administration, reducing compliance costs for businesses, especially those operating in multiple states. This is crucial for tax professionals who manage multistate clients.

• Uniformity and simplification: The agreement promotes uniformity in tax bases, tax rates and sourcing rules, making it easier for tax professionals to manage and calculate taxes accurately.

• Efficient tax filing: Streamlined tax returns and remittances reduce the administrative burden, allowing tax professionals to focus on other critical tasks.

• Fair competition: By leveling the playing field between local brick-and-mortar stores and remote sellers, the SSUTA ensures that all businesses adhere to the same tax rules.

• Consumer privacy: The SSUTA includes provisions to protect consumer privacy, which is an important consideration for tax professionals handling sensitive client information.

• Increased revenue: Simplified tax systems can lead to increased tax compliance and, consequently, increased revenue for states, benefiting tax professionals working in government or advising governmental clients.

• Certified Service Provider program: The CSP program provides an outsourced solution for managing sales tax compliance, making it easier for tax professionals to ensure their clients remain compliant with state tax laws. CSPs handle tax calculations, returns and remittances, which can significantly reduce the workload for tax professionals. The CSP is liable for audit, except if the business provided misleading or incorrect product or service information.

To become a member of the SSUTA, states must submit a petition for membership and demonstrate compliance with the agreement’s requirements. Each member state appoints representatives to the SSTGB, which oversees the administration and operation of the agreement.

The SSUTA faces challenges, including the need for more states to adopt the agreement and the ongoing evolution of e-commerce and remote sales. The U.S. Supreme Court’s decision in South Dakota v. Wayfair Inc. has further complicated the landscape by allowing states to require remote sellers to collect sales tax even without a physical presence in the state.

Moving forward, the SSTGB and its member states will need to continue working together to address these challenges and adapt to changes in the retail environment. This may

“

The SSTGB and the SSUTA represent a significant step toward simplifying and modernizing sales and use tax systems in the United States.

include further simplifications, technological advancements and increased collaboration with businesses to ensure a fair and efficient tax system.

The SSTGB and the SSUTA represent a significant step toward simplifying and modernizing sales and use tax systems in the United States. By promoting uniformity and reducing compliance costs, these initiatives benefit both states and businesses, fostering a more efficient and fair tax environment. As e-commerce continues to grow, the SSTGB and SSUTA will play a crucial role in shaping the future of sales and use tax administration.

To learn more about Streamlined Sales Tax, visit https://www.streamlinedsalestax.org/.

Holly Hoffman, MSA, is the owner of Sales Tax Advisory Network, providing sales and use tax audits, assessments, training and seminars to Wisconsin businesses. Contact her at 715-883-1299 or holly@salestaxlady.com.

Our firm’s proven resources may help you and your clients We consistently emphasize a high standard of service and professionalism in our dedication to client relationships. Backed by the strength and breadth of the world’s best bank for wealth management,1 our team has access to the resources and technology necessary to help clients pursue their investment objectives.

Ask us about our trusted advisor referral program.

Burish Group UBS Financial Services Inc. burishgroup@ubs.com Madison 8020 Excelsior Drive, Suite 400 Madison, WI 53717 608-831-4282

advisors.ubs.com/burishgroup

17335 Golf Parkway, Suite 525 Brookfield, WI 53045 262-794-0872

By Brian Ellenbecker, CFP, EA, CPWA, CIMA, CLTC