Whether you’re looking for a new career or a new employee, the WICPA’s new and enhanced Career Center can help you make the most of your search.

4 membership message

Free student memberships? Yes, you read that right.

The WICPA offers a wealth of resources to our CPA members around the state. Now high school and college students can take advantage of these resources without having to pay a membership fee.

By Devin Yates6 member profile

Ambition meets altruism

Luis Castellanos Solano enjoys many outdoor activities when he’s home with his family in Lake Mills. But when he’s in school, he’s serious about his major and enjoys being active on his college’s campus.

By Marcia Tillett-Zinzow

By Marcia Tillett-Zinzow

12 focus on the CPA Exam

The CPA Exam in 2023 and 2024: CPA Evolution explained

Every five or so years, the American Institute of Certified Public Accountants performs an analysis of the profession to make sure the CPA Exam is relevant, valid and current. Upcoming changes to the exam are pretty vast. This article breaks them down for you.

By Amy Napolski18 focus on technology

AI is changing the world, but can it help you get a job?

Everybody’s talking about generative artificial intelligence (GAI) and how it’s used to assist students with homework. But can it help get you a job?

By Dr. Scott Dell, CPA, CPC, DBA22 focus on learning

How to create good study habits

There’s more to studying than flash cards, PowerPoint presentations and multicolored highlighters.

By Helen Harris26 professional perspectives

Destination CPA

Three young professionals share their career paths and provide insight into what it’s like to be a CPA, whether in public accounting or industry.

By Kassandra Gillis, CPA; Colin Kammerzelt, CPA; and Bryce Pass, CPA30 looking back

Note to self

A seasoned professional writes a letter to her college-student self to reassure her that she’s choosing the right career.

By Tori Morrow, CPA, CGMA, MBA32 career preparation: video interviews

Video interview tips: A job candidate’s checklist

Many of the changes the pandemic brought to the way we work seem likely to stick around, and interviewing virtually is one of them.

By Robert Half Talent Solutions36 career preparation: internships

It’s never too early

Talent recruiters agree that students looking for an internship shouldn’t procrastinate. Find out what CPA firms are looking for in interns.

By Donna Pinsoneault17 Welcome new members

40 Career planning

2023-2024 WICPA Educational Foundation

Board of Directors: President

Paul J. Frantz, CPA

Secretary/Treasurer

Jeff Dewane, CPA, CGMA, CMA, MBA Directors

Mark Bichler

Janet J. Egan, CPA

Jon C. Gaines, CPA, CGMA, MBA

Kale Post, CPA, MPA

Bret J. Priaulx, CPA, MBA

Gina C. Skibo, CPA

Jidong Zhang

WICPA Board Liaison

Lucien A. Beaudry, CPA, JD

WICPA President & CEO

Tammy J. Hofstede

Publication Team: Editor

Marcia Tillett-Zinzow

Design & Layout

Brett Stallman

Advertising

Sue Daniels

Printing

Special Editions

Receive $2,500 in scholarship money!

Apply online at wicpa.org/scholarships through March 1, 2024.

Scholarships are awarded from the WICPA Educational Foundation to qualified accounting students that have completed at least 90 credits of a degree program that qualifies to sit for the CPA Exam.

CPA2bisabiannualpublicationoftheWisconsinInstituteofCertifiedPublicAccountants.Changeofaddressshouldbesentto:Membership,W233N2080RidgeviewParkway,Suite201, Waukesha,WI53188;Phone:262-785-0445;Fax:262-785-0838;email:comments@wicpa.org.Statementsoropinionsexpressedarethoseoftheauthorsandnotnecessarilythoseof theWICPA.PublicationofanadvertisementdoesnotconstituteanendorsementofaproductorservicebyCPA2bortheWICPA.

Articlesmaybereproducedwithpermission.©Copyright2023CPA2b.

The pathway to becoming a CPA can be a complex one, and the WICPA is here to simplify it for students in Wisconsin. We are proud to announce that we are now offering complimentary membership to both high school and college students. The wealth of resources that we offer to our CPA members around the state can now be accessed by students at no cost.

With changes to the CPA Exam and the accounting profession as a whole on the horizon, there has never been a more valuable time for you to be connected with our organization. We have been working hard to fill our new Student Resources tab on WICPA.org with content, and it is ready to be explored! The page is structured to make it easy for you to find the information you need to succeed in your educational journey.

Take a look at the CPA profiles on our website to gain insights into the various professional paths you can pursue with an accounting degree and CPA certification. When you watch the videos, you will see that every CPA has a unique journey, and once you hold your license, the opportunities are limitless. If you’re unsure of what pathway you may be interested in, these videos are a great place to start. Along with the profiles, there is other great content available on our YouTube page, including videos like “Become a CPA” or “Accounting as a Career.”

The Accounting FAQ page provides essential information for students pursuing careers in accounting. It addresses common questions regarding what skills are needed to be an accountant, all the way down to the basics of why accounting is important in our modern world.

Through our Connect platform, we have created a community dedicated to our student members.

We envision this community as a place where future CPAs can come together to share their journeys to the CPA license. This is also a place where we can share important updates that may affect students, such as updates on the exam and changes in the landscape of the CPA profession.

With the simple step of joining the WICPA and getting involved, you can level up your potential. You can apply for scholarships that can support your college journey, access discounts on CPA review courses and conferences that can help you prepare for your future, and put yourself on employers’ radar by posting your résumé.

Highlight your WICPA membership on your résumé and LinkedIn profile to demonstrate your commitment to the accounting profession, set yourself apart from others, and possibly catch potential employers’ attention. As a WICPA member, potential employers can find you easily, increasing your chances of landing the right opportunity. Other benefits of WICPA membership include the following:

• Stay updated with accounting career insights, technical trends and the latest industry news through our award-winning publications, e-newsletters and online resources.

• Engage with fellow professionals in our membersonly online community, where you can connect, discuss and learn.

• Join our exclusive student community to interact with other students who share your aspirations.

When you join the WICPA, the opportunities are endless, and you’re not just becoming a member — you’re entering a world of opportunities, connections and growth. Your journey to success starts here. Head over to wicpa.org and join for free today!

Join the premier association for Wisconsin accounting and business professionals.

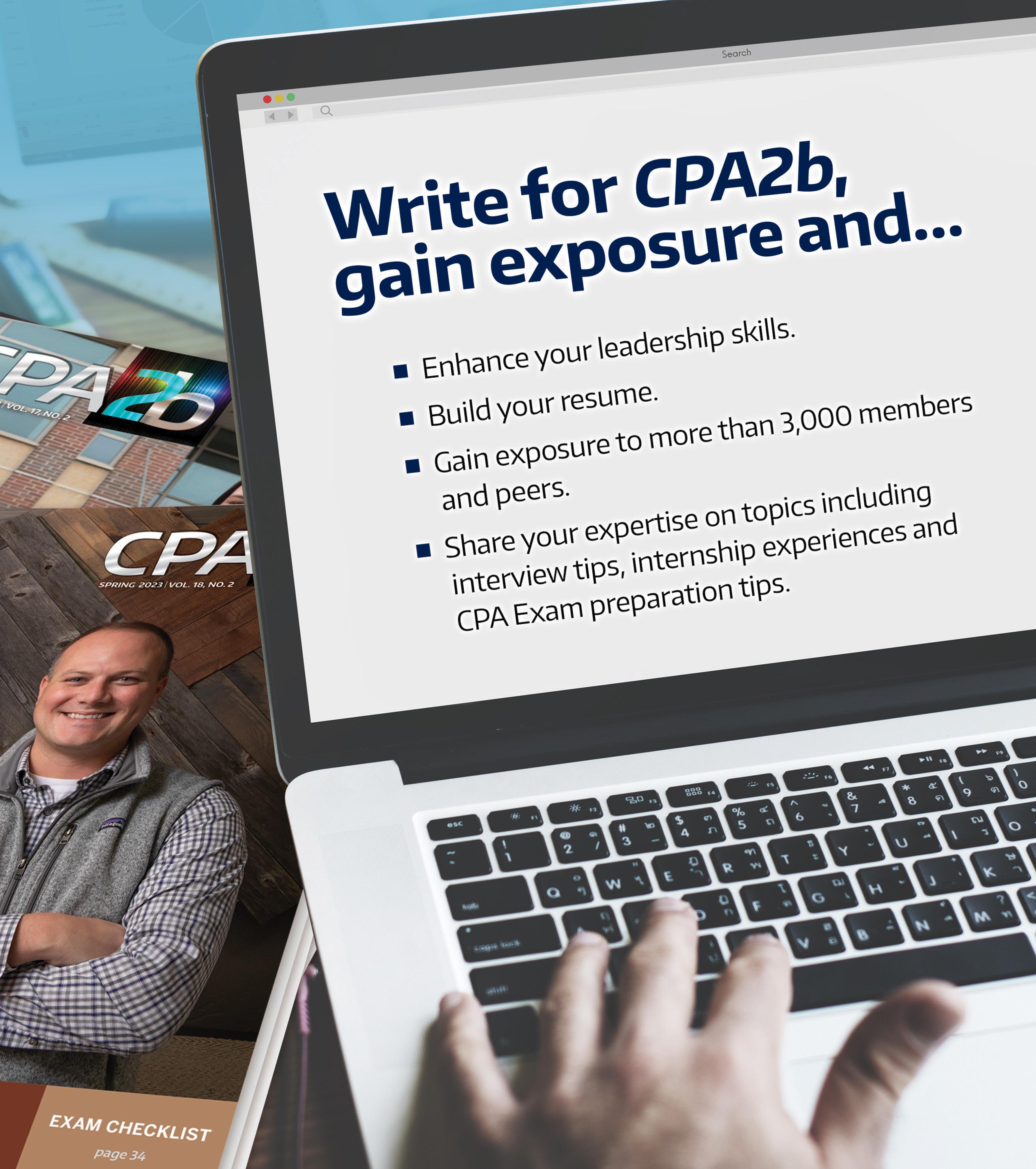

WICPA Connect: Leadership Development:

Join the YP Committee, write for WICPA publications, enhance public speaking skills and more.

Get tips on accounting careers, technical trends and the latest in accounting news with our awarding winning publications, e-news and online resources.

Connect with professionals in our members only online community and chat with other students in our exclusive student community. Join over 7,000 professionals who represent business contacts, employers and mentors.

Networking Opportunities:

News & Resources: Educational Savings:

Apply for college scholarships and save on CPA review courses and conferences.

Career Center : Put yourself in front of employers by posting your resume.

Credibility: List WICPA membership on your resume and LinkedIn, to demonstrate your commitment to the profession and set yourself apart from other talent.

WICPA CAN HELP YOU LEVEL UP IN ACCOUNTING!

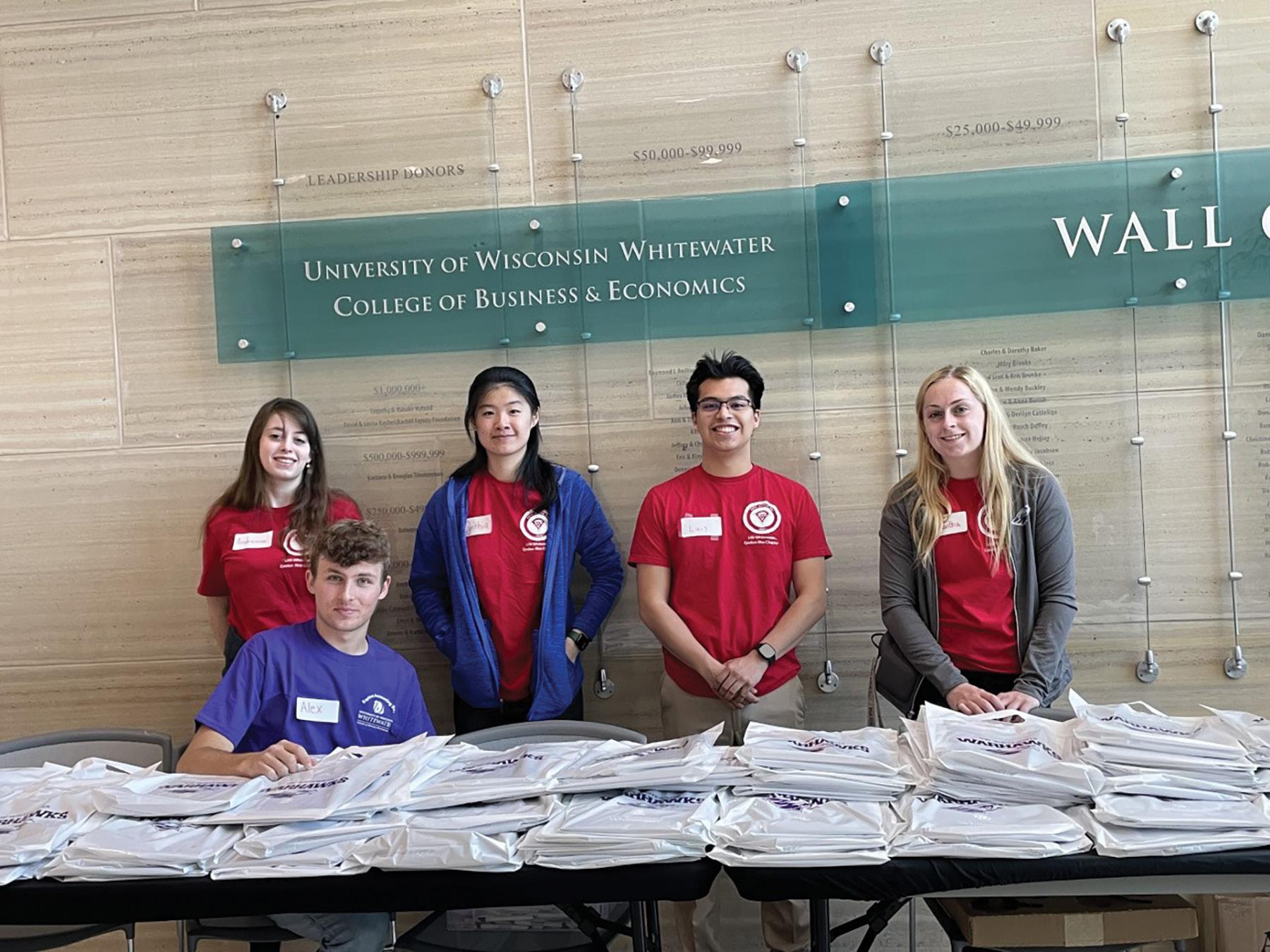

Well-rounded might be a good description of Luis Castellanos Solano, 21, a senior at the University of Wisconsin–Whitewater (UWW) with a double major in accounting and business analytics. He is a high achiever who is active on campus and enjoys many outdoor activities when he’s home with his family in Lake Mills. This year, he is president of the campus accounting honor society, Beta Alpha Psi, and vice president of the Catholic campus ministry, Warhawk Catholic. He has been active in both organizations and is also a student member of the Wisconsin Institute of CPAs (WICPA). At the time of this writing, he was carrying a 4.0 GPA.

Last spring, Luis was awarded an Accounting Faculty Scholarship, and he has been awarded the UWW Chancellor’s Scholarship every year he’s been at the school. “It’s one of the main reasons I decided to study at Whitewater. The scholarship covers about half my tuition,” he said.

Luis started out as a math major. “I don’t actually know why I did that because originally I wanted to be a doctor,” he said. But when he thought about the many years of schooling and the erratic hours doctors often keep, he dropped that idea.

As a new adult who was now managing his own money, Luis became interested in personal finance and decided to major in finance. “But I didn’t really enjoy that either,” he said. Then one of his friends, who was getting ready to graduate with an accounting degree, told Luis about the various job opportunities that are available in accounting. “And he just thought I would like it because I like to be organized, and I like working with numbers, and that’s what accounting is: organizing numbers,” said Luis.

Accounting clicked with him, and he decided to also carry a second major in business analytics. The outcome will be graduating with more than the 150 credit hours required to take the CPA Exam — which he intends to do.

“I’ll have at least 160 credits and possibly close to 170 when I graduate,” he said. “It took me a while to find out accounting was where I wanted to go. But I’ve taken 18 credits the past four semesters, including two or three accounting courses every semester. I would take more, but you can only take three.”

Luis graduated from high school in 2020, so he will have amassed all those credits in just four years — which have also included two internships that gave him hands-on experience in tax and audit.

“In spring 2021, I did a tax internship at a place called Compeer Financial in Sun Prairie. It’s a smaller company; most people haven’t heard of them,” Luis said. “They work mainly with people in rural communities, such as farmers. I did tax returns for their clients. This past summer I also did an internship with another small firm that works in a niche area, with only insurance companies — Strohm Ballweg in Middleton — where I did a little tax and audit work.”

One of the campus activities Luis has enjoyed is volunteering for a free federal and state income tax preparation program called VITA, which is sponsored by the Internal Revenue Service (IRS) to

assist low- and moderate-income taxpayers during tax season. Certified student tax preparers like Luis are supervised by faculty. VITA gives the students an opportunity to apply their training in a real-world setting. For Luis, it also shined a light on his passion: helping others in a selfless manner — which is the definition of altruism

“People would come to the VITA clinic with no idea how to do their taxes. Many of them were confused or just plain scared of the IRS,” he noted during a recent

Accounting Faculty Scholarship award presentation. “However, it was such a privilege to work with them and see them leave with smiles on their faces. For many of the families we worked with, [their tax refund] was much-needed income. Realizing the good we can do in the world has deepened my passion for the accounting profession and has made me more excited to begin my career as an accountant.”

Two summers ago, Luis served as a missionary for Life Teen, a nonprofit organization in Georgia that

sponsors summer camps for teens and provides materials for churches to use in their youth groups. He found the experience uplifting. “So, maybe I will move into more of an accountant-type role with them or another organization like them,” he said.

Luis’s family emigrated to the United States from Mexico: specifically, the state of Veracruz, a major commercial fishing port located along the country’s southeastern coast on the Gulf of Mexico. He was 3 years old when they came here in 2005. Since then, his two sisters were born: Lili (short for Liliana), now 8; and Kimberly, now 15. Kimberly is setting her sights on a career in medicine and is currently thinking of going to college at UW–Madison, UCLA or a college in Germany. “She’s going there her junior year of high school, so she might want to go back there,” Luis said.

The future CPA enjoys living in Lake Mills, which some have described as “a pretty little town.” His father, Luis Castellanos, works as a CNC machinist for Aztalan Engineering in Lake Mills, and his mother, Maria Solano, is a stay-at-home mom who takes care of little sister Lili. Luis said he likes the small-town feel of Lake Mills and the proximity to I-94, which can easily take them to Milwaukee or

Realizing the good we can do in the world has deepened my passion for the accounting profession and has made me more excited to begin my career as an accountant.”Hiking and kayaking at Tyranena Park in Lake Mills are two of Luis’s favorite activities.. The family: Luis; sisters Kimberly and Lili; his mom, Maria; and his father, also Luis. Photo provided by Luis Castellanos Solano

Madison if they’re looking for a day in the city. But it’s the variety of outdoor activities that he really enjoys.

“The lake is right across the street, and I like to kayak a lot, or sometimes we’ll take our pontoon boat out on the lake and spend the day there. I like to swim with my sister Lili, too. She likes to be a mermaid, so we swim together and pretend we’re mermaids,” he said with a smile. “And there are lots of hiking trails around town. I like to hike or bike there with my family a lot.”

Luis will graduate in May 2024 with a double major in accounting and business analytics and plans to work as a tax consultant in Madison or Milwaukee after graduation. He’s already had some offers.

He hopes to one day work with nonprofit organizations. While he’s not quite sure where that will be, he said that’s the type of organization he’s passionate about and the kind of people he’d like to work with.

“After I changed my major to accounting, I still had some reservations about it. I wondered, How would I help people with this? But through my internships and working with VITA and Life Teen, I came to see the impact accountants have on the world. We aren’t just boring introverts whose only goal is to advance a company’s bottom line,” Luis noted. “Our financial knowledge can truly be a force for change.”

We aren’t just boring introverts whose only goal is to advance a company’s bottom line. Our financial knowledge can truly be a force for change.”

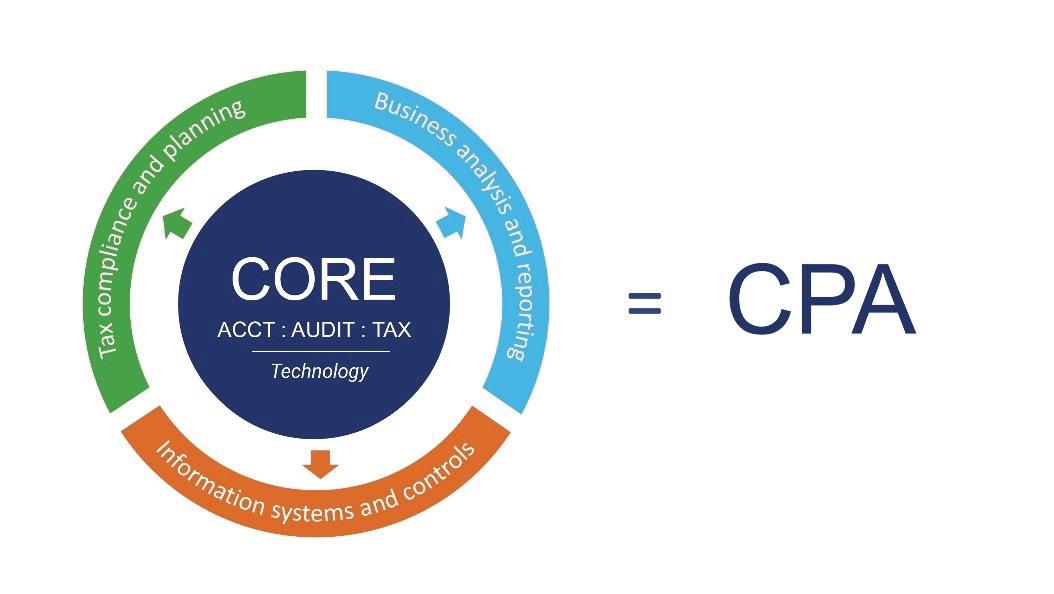

By now you’ve probably heard the CPA Exam will be changing Some may even say it’s evolving. In fact, the change is called CPA Evolution.

This isn’t anything new; it’s just bigger than previous changes. (The last big exam change was in 2017.) Every five or so years, the American Institute of Certified Public Accountants (AICPA) performs an analysis of the profession to make sure the exam is relevant, valid and current. CPA Evolution is a joint venture with the National Association of State Boards of Accountancy (NASBA). Let’s examine how the exam is changing and how to plan for the changes.

By Amy Napolski

By Amy Napolski

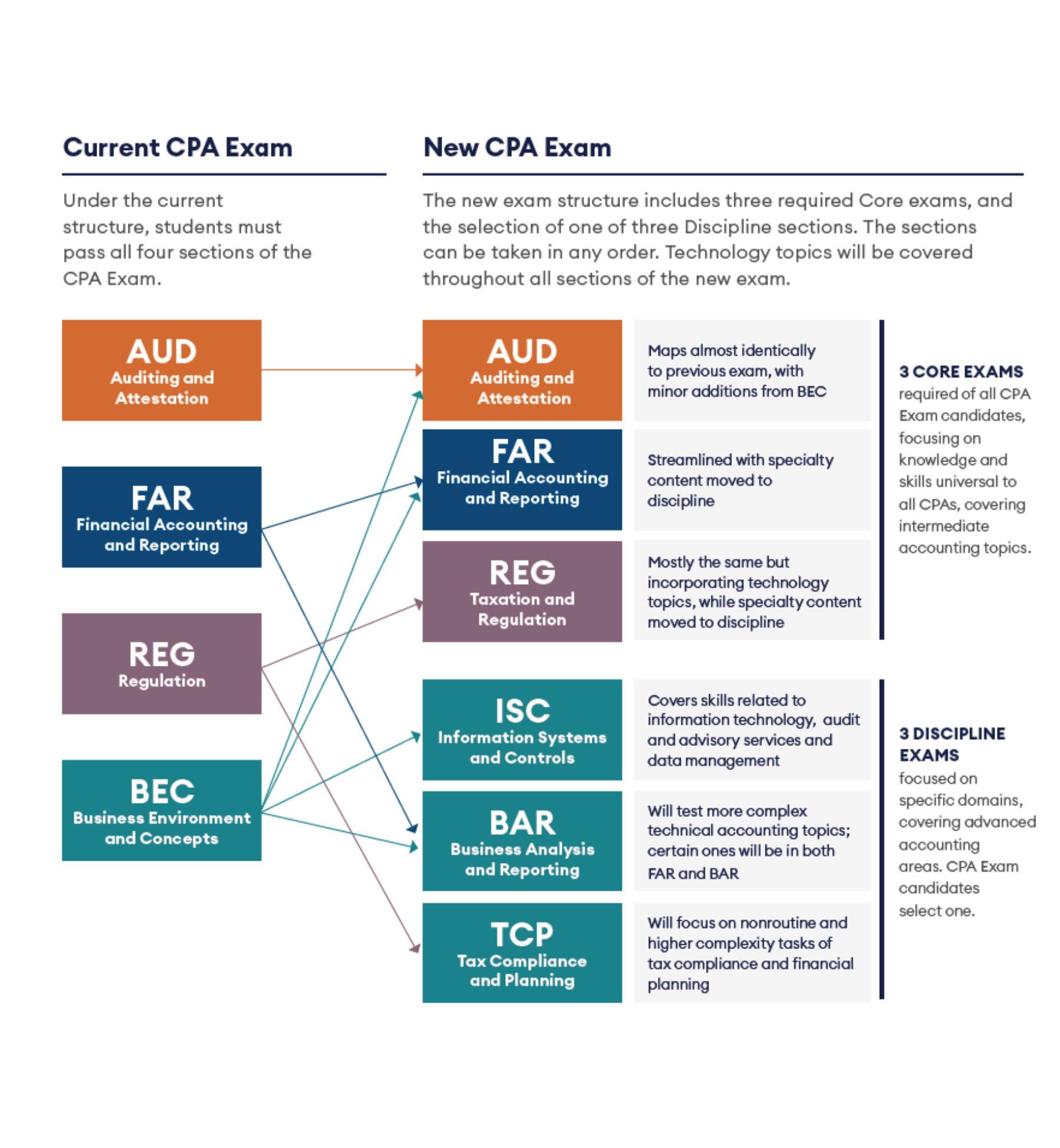

For the current exam, everyone takes the same four parts: Auditing and Attestation (AUD), Business

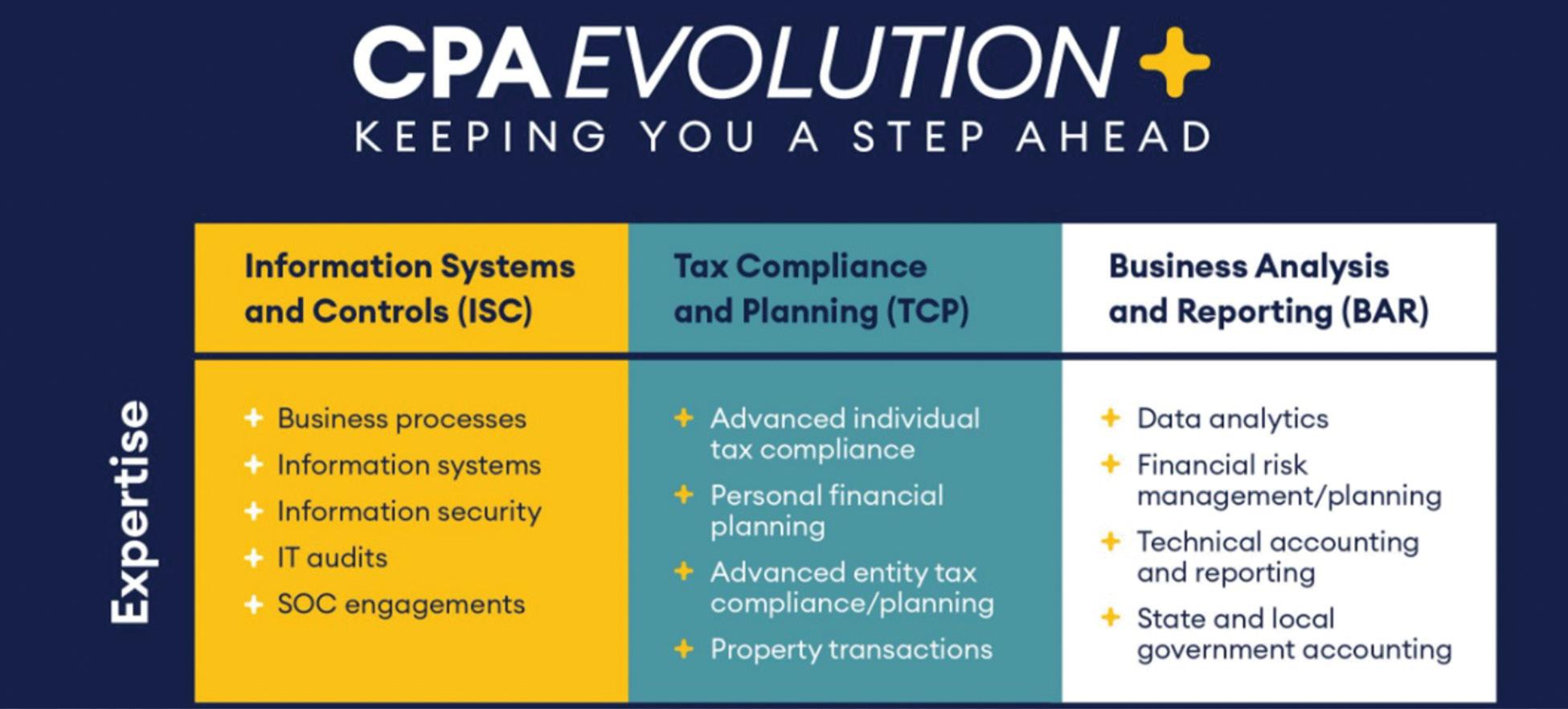

Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Starting January 2024, candidates will have a choice. All candidates will take three “Core” exams: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG). For the fourth exam, candidates will choose one of three “Discipline” exams: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), or Tax Compliance and Planning (TCP). (The exams may be taken in any order.)

The goal of the new model isn’t to award a specialized license but to allow candidates to choose their paths based on the area of accounting they plan to pursue or are pursuing. The Core exams cover the essentials all CPAs need to know. The Discipline exams cover the more in-depth content of the specific areas in accounting. The graphic below shows the six exams.

Source: https://www.evolutionofcpa.org/

Candidates may or may not know the area they will be working in, which is fine since they will have a CPA license — not a specialized license — once they pass the exams and complete the other requirements for licensure. Following is an overview of the content on the three Discipline exams. (Note that if a candidate fails a Discipline exam, they may choose a different Discipline for their next attempt.)

Source: https://www.becker.com/cpa-evolution

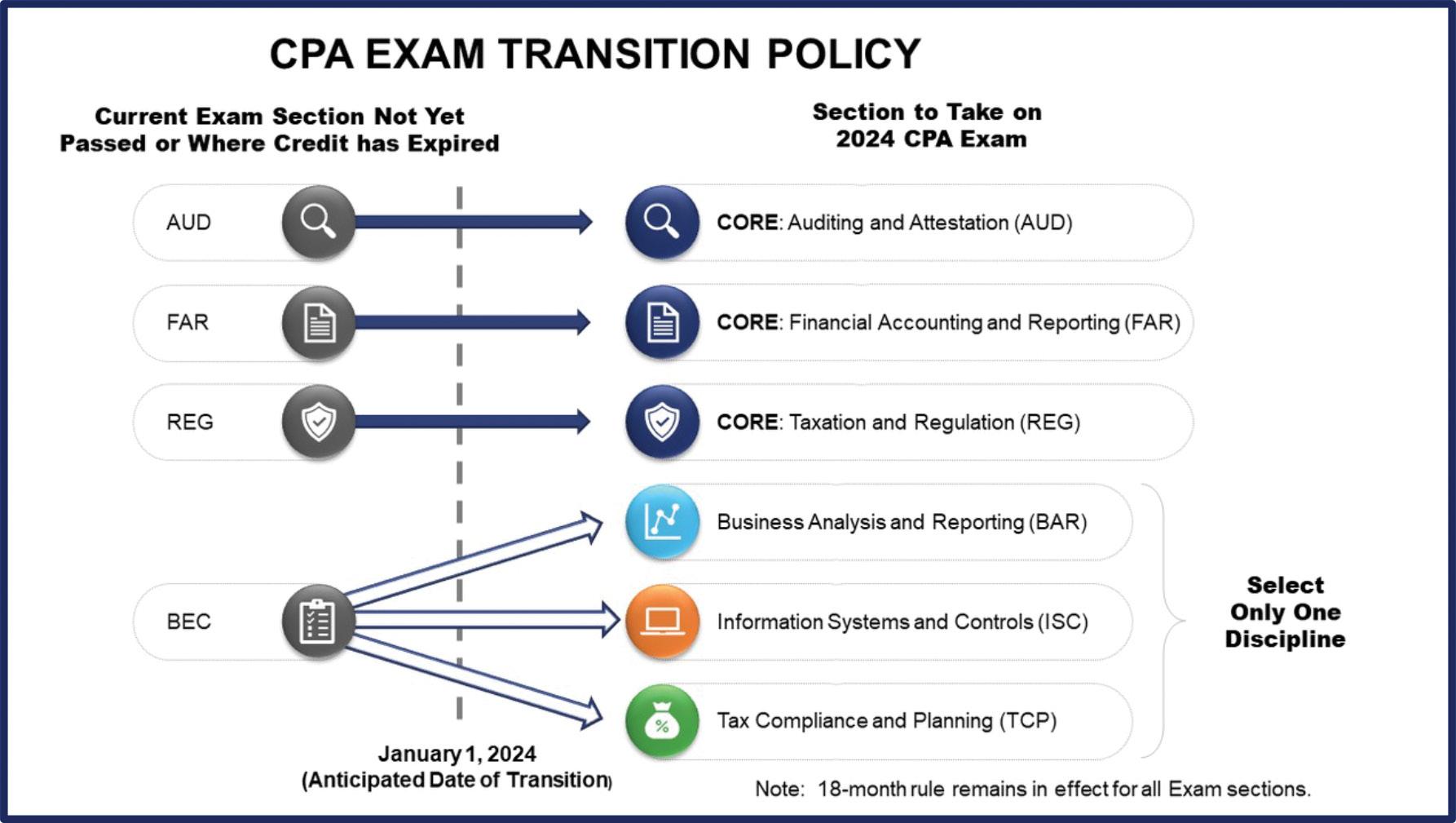

NASBA has provided a transition policy for candidates who may be taking exams in both 2023 and 2024. If you pass AUD, FAR or REG in 2023, those will count as the corresponding Core exams. If you pass BEC in 2023, it will count as a Discipline exam. The following chart shows the policy.

Source: https://nasba.org/blog/2022/02/25/transition-policy/

Another reason behind CPA Evolution is to address the issue of the amount of content being tested. The accounting profession changes at a rapid pace, with new rules and regulations happening on an ongoing basis. It’s a lot of content for the exam, so with the Core + Discipline model the candidate has the choice of the specific area (Discipline) on which to be tested. Content for the current four exams is being moved around for the six new

Source: https://www.becker.com/cpa-evolution#students

• There will be no Written Communications piece on the new exam.

• Authoritative Literature will not be available as a searchable database. Excerpts will be provided for candidates to answer research questions.

• Microsoft Excel will be replaced with a generic equivalent, SpreadJS, with similar functionality.

NASBA and the AICPA released the following tentative application information and testing schedules for late 2023:

• Nov. 22, 2023: NASBA starts processing applications for the new Discipline exam sections (BAR, ISC, TCP)

• Dec. 15, 2023: last day of testing for all sections of the current exam (AUD, BEC, FAR and REG)

• Dec. 16, 2023 – Jan. 9, 2024: no testing, to allow for IT systems to convert to the new exam

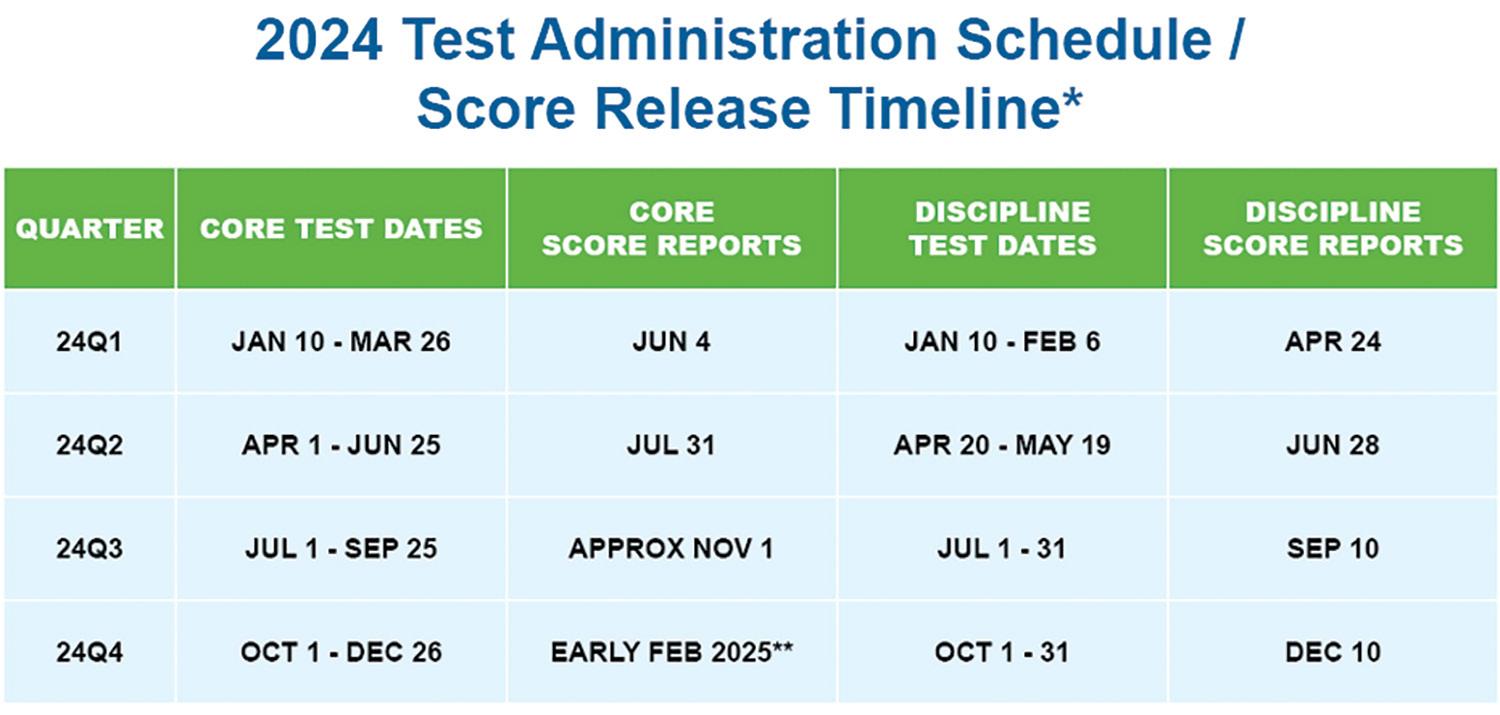

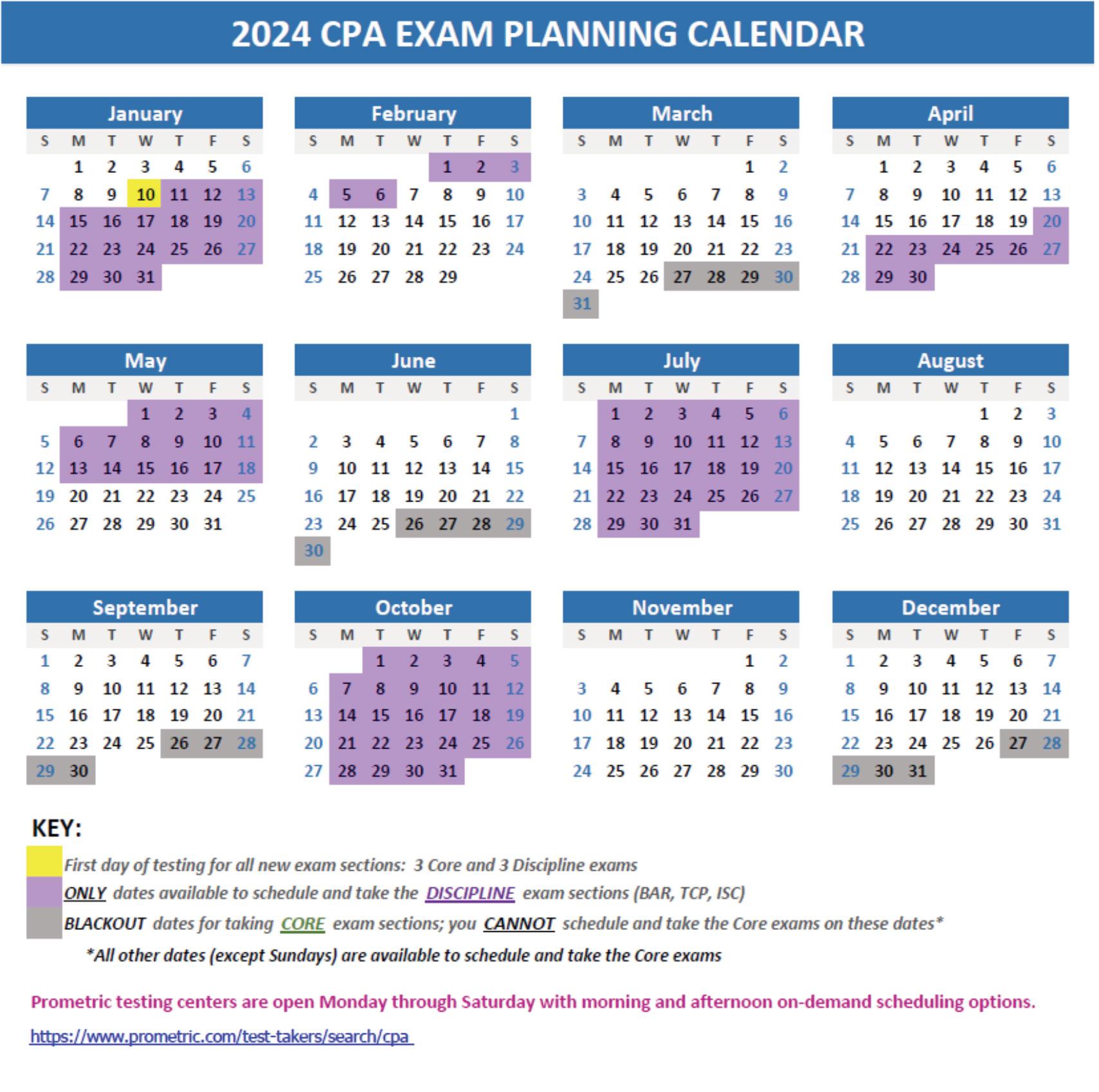

Below is the tentative administration schedule and score release timeline for 2024.

Key takeaways:

• Jan. 10, 2024: Testing begins for the new exam.

• There will be five “black-out dates” each quarter for the Core exams.

• Testing for the Discipline sections of the exam (BAR, ISC and TCP) will only be available for approximately one month each quarter.

With all the changes, it may be overwhelming for candidates to decide where to start. Here are some considerations:

• If you can, pass BEC in 2023 since this passed exam will count for a Discipline exam in 2024.

• Exams that could be easier to pass in 2024 are FAR and REG since they are moving content from these sections. Now, if you have time to pass all four in 2023, you should by all means do so!

• The exam that will be pretty much the same in 2024 is AUD.

• Use a calendar to map out your plan, taking into consideration the dates you can and cannot take the Core and Discipline exams. The graphic at right provides an example.

As shown in the previous chart, there will be a limited number of score release dates because the AICPA will need more time to evaluate and score the new exams. This means you may take multiple exams before you receive any scores, which may be nerve wracking and make planning difficult. The AICPA and NASBA are aware of this, so NASBA has proposed a credit extension policy that will impact the current 18-month window to complete the four parts of the CPA Exam. This policy allows candidates who have passed any parts by Jan. 1, 2024, to have credit for those exams extended to June 30, 2025. All state boards of accountancy have adopted this policy, as reflected in the map below.

Change can be difficult. Let’s address that head-on. Keep in mind that change can be advantageous, too, and use that as your mantra as you navigate the CPA Exam: I will have a choice; change is good; I will be successful. Taking time to stay on top of the changes coming in 2024 will give you the confidence to pass the exams and navigate the process to becoming a CPA. At the end of this article are links to resources for CPA Evolution.

I wish you all the best during this exciting juncture in the profession. Just think, you’re part of making history!

• CPA Evolution. https://www.evolutionofcpa.org/

• CPA Evolution Transition FAQs. https://nasba.org/ examtransitionfaqs/

• Becker CPA Evolution website, including 10-minute video on the 2024 exam.

https://www.becker.com/cpa-evolution

Source: https://nasba.org/exams/credit-extension-map/

Molly E. Baker

Nicholas Benkert

UW–Milwaukee

Devin Black

Kailan B. Brown

UW–Milwaukee

Luis Castellanos

UW–Milwaukee

Joannah Chang Kerber, Eck & Braeckel LLP

Nisha Desai

UW–Madison

Gabriella Elliott

Janesville School District

Emily R. Ewert

Andrew Fischer

UW–Milwaukee

Sarah E. Fleming

UW–Milwaukee Lubar

School of Business

Meghan E. Hayes

Marquette University

Nathan Jacob

Janesville School District

Sara N. Jochims

UW–Milwaukee

Kallista Johanson

UW–Stevens Point

Marcus D. Katka

UW–La Crosse

Emelia Keller

Kayleigh R. Knauss

Treena Knowles

Johnson Block & Co. Inc.

Kylie Krajenka Port Washington High School

Autumn Kuehn

Marquette University

Isabel A. Kumar

Luke Lessila St. Norbert College

April Madsen

Dane Metzger Port Washington High School

Ardi Muqaj Associated Bank

Melanie Perez

Rocco V. Pintozzi

UW–Milwaukee

Emma Radtke

UW–Whitewater

Malick Sarr

SSM Health Wisconsin –Dean Medical Group

Sarah Sarsour

UW–Milwaukee

Sarah Sebastian

Johnson Block & Co. Inc.

Luke D. Sweere

UW–Oshkosh

Emily Van De Hey

UW–La Crosse

Cory Verhaalen

U.S. Bank Wealth Management

Carter Wolf Carroll University

cure diseases.

So how can you use it to find a job? Is this a lifechanging event that will change the world as we know it? This author thinks so. Will this technology eliminate jobs? You bet! Will it create jobs? Most definitely. Let’s take a look first at the impact this technology might have. We’ll then go into some background on how the technology works and dive into applying this technology in your internship or job search.

Let’s start with the big picture. In 2020, the World Economic Forum projected that artificial intelligence (AI) would lead to a loss of 85 million jobs by 2025. They also projected that 97 million jobs would be created. You don’t need to be a CPA to calculate the net impact to be an increase of 12 million jobs. Sounds promising. This past May, the same folks projected that in the next five years, 83 million jobs would be lost and 69 million created, a net loss of 14 million. The reality is that nobody really knows, but as you can see, lots of job will be lost, but many will be gained. This author’s concern is more one of timing. Some, including this author, expect that many of the losses will be in the short term, while the gains will take longer to recover as new skill sets are developed.

There is a quote circulating about jobs and AI that is also the title of a May 3 Business Insider article, “It’s not AI that’s going to take your job, but someone who knows how to use AI might.” Bottom line: This game-changing technology can and will do many things. Let’s see how it can help you on

your way to succeeding in pursuing and living your dreams through getting that job. If you want to get a perspective on the impact of AI on the job market over the next two decades or so, take a look at the LinkedIn newsletter found at https://www.linkedin. com/pulse/future-jobs-ai-increasing-decreasing-jobdr-scott/, which includes ChatGPT-3.5, GPT-4 and Bard conversations.

In brief, technology like ChatGPT, known as a large language model (LLM), is a “word projector.” When you give it a prompt (ask it a question), it taps into its database and then starts projecting words based on probabilities of what the next word is likely to be. This is sometimes why these tools “hallucinate,”

which is a technical term for lying or making stuff up. When the word projection veers off, it can go in a wildly crazy path and yield bad or wrong information. Fortunately, in the career space, the questions we ask can be direct and will usually result in cogent and useful answers. It can also produce in seconds what might take a user hours to generate on their own. Its best use is as a supplement to your activities, not a replacement. But because of hallucinations, you still have to validate and proofread ALL outputs.

I used to call ChatGPT and similar tools “Google on steroids.” I have since changed my tune. A Google search is a one-way query. You ask a question, and it gives you resources that you can use to dive deeper into a topic. GAI is a conversation with a memory. You can ask it questions (prompting), and not only will it give you answers, but it also remembers previous questions and can elaborate on the answers it gives based on additional follow-up questions. The process of asking effective questions is known as “prompt engineering,” and it’s worth checking out some YouTube videos to see it in action.

In a career search, what kinds of things can GAI do? Lots! Some of the things this technology can assist you with include industry and company research, answering questions about how and what companies do so you can better understand the players and processes in an industry. You can summarize articles, news stories, books and more to save time and get clear and concise commentary. You can edit and enhance résumés, cover letters and LinkedIn profiles. (Notice I said to enhance and edit. You really don’t want to create from scratch.)

It’s not AI that’s going to take your job, but someone who knows how to use AI might.”

Be warned, GAI is NOT intelligent. It often yields pretty vanilla outputs that lack heart, soul, ethics, morality and authenticity. That being said, it can be an amazing idea generator and springboard for enhancing your efforts. It can also give you not only typical job-specific interview questions that you might experience on a job interview, but it will also suggest answers to those very same questions. You can have it role-play and act as an interviewer, draft emails, and extract keywords from a job description that you would want to include on a résumé or LinkedIn profile. You can even have it draft a cover letter if you feed it both your résumé and the job description as part of your prompt. If you are looking for tips on networking or salary negotiation, you can pursue those lines of questioning as well.

As you can see, this tool has the power to assist you on the road to success. In the not-too-distant future, this author feels that we will all have our own private virtual assistants/tutors that will assist us with daily activities, including acting as a sounding board, setting appointments, and giving ideas as to how to improve our lives — in addition to being able to help us develop new skills and understanding.

I am excited about the potential these tools bring to enhancing our effectiveness in almost anything we do — and it will only improve with time.

Note: This article was not created by GAI, though GAI was used as a grammar and spelling checker.

I am excited about the potential these tools bring to enhancing our effectiveness in almost anything we do — and it will only improve with time.”

“

When you think of studying, flashcards, PowerPoint presentations and multicolored highlighters might come to mind. But there is more to creating a healthy routine for learning. Developing good study habits at any age is important for educational, career and personal development. It starts with knowing your “why” and is then made possible with the implementation of good habits and tactics.

It’s the night before your big test. There are flashcards and highlighters before you, your textbooks are sprawled across the floor, and the glow of the PowerPoint on your laptop lights the room. It’s 2 a.m. Your test is at 8 a.m.

You can probably recall a night (or many) like this during high school or college. While you had many days to prepare for that big test or exam, you still waited until the last moment to cram the material in just a few hours — forcing yourself to wake up groggy, grumpy, and probably not performing your best the next day.

So, what exactly are good study habits, and where do they start?

To begin, Yana Weinstein, assistant professor of psychology at the University of Massachusetts–Lowell, points to The Learning Scientists’ concept: “The 6 Habits of Highly Successful Students.”

“The most important strategies are the first two: spacing out your studying and retrieval practice, or when and how to study,” said Weinstein. “The others help keep your mind engaged by offering different ways to tackle the material.”

And as far as developing good study habits, John Lincoln, CEO of Ignite Visibility, digital marketing expert and investor, stresses the importance of setting aside your most productive time each day for learning and studying.

“Trying to jam [content] in the middle of the day or in between things — all it does is disrupt your mind and overwhelm you,” said Lincoln. “So it’s important to have specific time set aside to do your learning and have it already scheduled.”

Dr. Scott Dell, an award-winning academic, career educator and LinkedIn advocate and author (as well as a former WICPA member and accounting educator at Marian University), emphasizes that, above all, students have to be motivated and understand their “why” and their purpose for wanting to learn any content.

He also adds the following points when it comes to forming good study habits:

• Practice self-care. “Cramming doesn’t work,” said Dell. “Getting small bits and pieces consistently is more powerful.”

• Take advantage of the people around you. Utilize on-campus resources and your teachers and tutors — anything that can help you better understand the material.

• Eliminate distractions. “Are you turning off the beeps and buzzes on your phone and dedicating a study time?” asked Dell. “Because there’s no such thing as multitasking. You’ve got to focus, understand the time of day you learn best, and take advantage of that time.”

• Don’t try to learn everything in one sitting. Take short breaks to take a walk or grab a snack. Studying for long periods of time can lead to burnout.

Above all, a student has to be motivated and understand their “why” and their purpose for wanting to learn any content.”

— Dr. Scott Dell

“

You may be in the habit of opening up your laptop every time you study. However, Dell offers advice on the benefits of handwritten note-taking. He says that you actually internalize more by writing materials down.

Additionally, he offers a tactic to best learn material when reading: First, read the objectives or introduction, then read the conclusion, next go through the PowerPoint if there is one, and lastly, read the material in between the introduction and conclusion. Practice implementing the concepts.

“The 6 Habits of Highly Successful Students” elaborates on this concept with two of its points, stating that students should practice retrieving information from memory and elaborate by asking “how” and “why.”

For practice retrieving information from memory, The Learning Scientists suggest putting away your books, notes and handouts and writing down everything you know about a topic from memory. Next, check to see what you got right and what you’re missing. Then make flashcards, take practice tests, and try studying with a partner and trading questions and quizzes.

For the next point, elaborate, The Learning Scientists suggest asking how and why questions applicable to what you’re studying and trying to find answers in your class materials. Next, discuss your questions and answers with classmates. Make connections between different ideas and think about how they’re similar and different. Try pulling from personal experiences to help make the content more relatable.

As we all know, learning goes beyond high school and college. Learning is forever. We have to take steps to stay on top of our study habits and make sure we are constantly growing and developing in our lives and careers.

“I recommend that people attend a class or take a course at least once a quarter,” said Lincoln. “That can be an immersive three-day intensive course or a simple educational course through LinkedIn Learning. But it’s critical that people continue to learn and then practice those daily study habits around the

things that are bubbling to the top as most important in their lives.”

Lincoln also states that finding a local mastermind group pertinent to your industry can be a great place to learn, grow, build your network, and advance in your career.

It’s critical that people continue to learn and then practice those daily study habits around the things that are bubbling to the top as most important in their lives.”

— John Lincoln

He notes that consistent, good study habits start with writing down your daily challenges and topics you want to learn more about at the end of each day. From there, you set goals either a month out, three months out, six months out or whatever makes the most sense. Then find the educational resources you need; set aside a time each day for yourself to learn; and keep tabs on your progress in an Excel spreadsheet, an app on your phone or a Trello board.

And remember, you can’t always learn it all on your own.

To this fact, Lincoln notes that there’s more to learn beyond the textbook and states that there is a point when you should seek help if you need it.

“You can only learn so much studying on your own,” said Lincoln. “There’s going to be a point in time when it will really make a ton of sense to connect with a real person, and it can be much more powerful.”

For example, perhaps you want to learn about a new career field. You are doing things such as reading the relevant newsletters in your email, listening to audiobooks and podcasts, and taking online learning courses. If you are still seeking more information — it might now be time to get help from a mentor.

“People who really have the most success know when it’s the right time to find an expert in the space who’s accessible and set up an hour with them, buy them lunch if possible, and ask them all the questions that they have on the topic,” said Lincoln. “And sometimes, that can turn into a mentorship or a lifelong relationship.”

A regular feature profiling young professionals who provide their insights about what it’s like to work as a CPA in public accounting or industry

Job title: International Tax Experienced Associate l Employer: BDO USA P.C.

What influenced your decision to become a CPA?

In high school, I had the opportunity to meet some very successful women who started their careers as CPAs in public accounting. I looked up to these women as role models and knew that I could pursue an equally successful career by following a similar path.

How did you complete the 150 hours necessary to take the CPA Exam?

I took advantage of the Master of Science in Professional Accounting (MSPA) program at UW–Milwaukee. My master’s degree enabled me to gain valuable insight into the tax profession, helped me to prepare for the CPA Exam, and allowed me to reach the 150 credit hour requirement.

What are some dead-wrong assumptions people make about public accounting?

Many people assume that it is nearly impossible to have a family while working in public accounting due to the long hours, travel and so forth. My experience taught me that it truly depends on the firm and the flexibility that you create with your team.

What’s the best part about your current job?

The best part about my job at BDO is definitely the knowledgeable team members I work with every day. BDO affords me the opportunity to work with teams and clients across the country, which has given me a broad range of experiences.

How did you find your first job out of college?

I found my first job out of college through networking opportunities that were available at UWM. The Lubar School of Business does an incredible job of connecting its accounting students with employers of all kinds through career fairs, on-campus internship interviews and other networking events.

What was your first year like?

My first year out of college was split between working at a Big Four accounting firm and in private industry. These experiences were influential, as they helped me to find what I value in a company, which ultimately led to my current position at BDO.

What surprised you the most when you started your job?

What surprised me the most when I started my job was the rapid pace at which the tax environment can change, especially in international tax. Continuous learning is so important because of the many changes taking place on a global scale.

What’s the best thing about being a CPA?

The best thing about being a CPA is that it distinguishes you and your technical skills. In the current economic climate, holding a CPA license ensures that you will not only be employed, but that you will also have a wide variety of successful career paths to choose from.

What do you like most about the organization you work for?

BDO offers an exceptional amount of flexibility and resources for working parents, which I value immensely. This allows me to have a fulfilling career while also giving me the ability to spend quality time with my husband and son.

What do you do outside of work? Do you have any hobbies or special interests?

Most of my time outside of work is spent with my family. We like to go hiking around the Kettle Moraine and take our son on as many adventures as possible.

What are your goals for the future?

For a very long time, it has been my goal to become a partner at a public accounting firm. However, my interim goal is to achieve a senior associate promotion at BDO. Only time will tell what opportunities the future holds thereafter.

Job title: Senior Assurance Associate l Employer: RSM US LLP in La Crosse

What influenced your decision to become a CPA?

The value attributed to those three letters and potential career advancement opportunities that a CPA license provides.

How did you complete the 150 hours necessary to take the CPA Exam?

I added a minor in information systems along with additional accounting electives.

What are some dead-wrong assumptions people make about public accounting?

One thing that’s dead wrong is the idea that CPAs always have to work on SEC jobs as well as the perception that you must work for the IRS when you tell someone that you are an auditor.

What’s the best part about your current job?

The flexibility of when and where you work, along with the clear line of career advancement (for example, moving from associate to senior, then to supervisor, then to manager and so forth).

How did you find your first job out of college?

I received a full-time offer after doing an internship with RSM.

What was your first year like?

The honest truth that most people won’t tell you is that it’s not great. You struggle with being new to everything along with working stressful hours on top of it. That being said, it is manageable. Once you start gaining experience, you eliminate a lot of the stressors that the first year brings.

What surprised you the most when you started your job?

Two things: 1) How smart a lot of the individuals I work with are. 2) What feels like unlimited access to the variety of client information that I need to perform my job.

What’s the best thing about being a CPA?

The best thing about being a CPA is knowing that there is a need for individuals with CPA licenses — which means you’ll likely always have a job.

What do you like most about the organization you work for?

RSM has always been great with flexibility. I have never had anyone question why I wasn’t online at any point. As long as you get your work done when it needs to get done, nobody questions your work habits. I also appreciate RSM being conscious about market conditions and making sure their employees are compensated accordingly.

What do you do outside of work? Do you have any hobbies or special interests?

I enjoy watching a variety of sports as well as playing golf, hunting and playing video games. I also have a very energetic miniature Australian Shepherd dog that also keeps me busy.

What are your goals for the future?

Future goals would include running a company’s accounting department someday. I would even like to own my own business if that is in the cards.

Job title: Senior Accountant l Employer: Wipfli LLP

What influenced your decision to become a CPA?

I decided I wanted to become a CPA when I attended the Explore Accounting Day at UW–Whitewater while I was in high school. I liked the idea of knowing what I wanted to major in prior to entering college as well as all of the opportunities being a CPA has to offer.

How did you complete the 150 hours necessary to take the CPA Exam?

I did a double major in accounting and finance at UW–Whitewater.

What are some dead-wrong assumptions people make about public accounting?

I think the most wrong assumption is that you have your head down and work all the time. While there are busier times, public accounting is very flexible and allows you to create your own work schedule. Wipfli also does a great job of promoting time off and setting up events outside of work so you can get to know other associates.

What’s the best part about your current job?

The best part of my current job is the people I work with. Everyone I work with is very knowledgeable and more than willing to help me grow my career.

How did you find your first job out of college?

I interned with Wipfli during the spring semester of my senior year at UW–Whitewater and received a fulltime offer after the internship.

What was your first year like?

My first year was a lot of learning and asking questions. Doing an internship made the first year

easier than it might have been because I already had experience using the software, and I had met a lot of people in the office. I was able to build on the knowledge that I had already gained during the internship.

What surprised you the most when you started your job?

What surprised me most was how quickly I picked up on the work I was doing and how quickly I gained confidence. By the end of the first year, I was confident in the work that I was completing and was able to effectively communicate with both clients and the team I was working with.

What’s the best thing about being a CPA?

The best part about being a CPA is all the opportunities that are available as I progress through my career.

What do you like most about the organization you work for?

As I mentioned before, what I like most about Wipfli is the people I work with as well as all the events that we do throughout the year (Milwaukee Brewers games, golf outings, boat cruises and more).

What do you do outside of work? Do you have any hobbies or special interests?

Outside of work, I like to do anything that involves sports, especially attending the Milwaukee Brewers, Milwaukee Bucks or Green Bay Packers games.

What are your goals for the future?

My goal for the future is to continue to develop my technical, communication and networking skills so I can one day become a leader within the firm.

Note to Self is a regular column in which CPA professionals write notes to their college-student selves to give them a glimpse of what lies ahead for them. In this issue, Tori Morrow, CPA, CGMA, MBA, who is the president of Vulcan GMS, a major manufacturing company based in Milwaukee, shares her path with us. Mrs. Morrow is also a member of the WICPA board of directors.

Dear Young Tori,

I have exciting news to share about the professional opportunities you will have because you are pursuing an accounting career. You are passionate about accounting as a way to help others and save them money on their taxes, but that is just the beginning. You aspire to one day become a CFO or a partner at an accounting firm — but I want you to know that your degree and work experience will lead you to become president one day. Yes, I said president. I know you can’t believe it’s true, so let me explain further.

The path you take, starting with earning your accounting degree and CPA license, followed by the work experience you gain in public and private accounting, will teach you invaluable skills. First, you will learn how to make business decisions. There are countless decisions to be made every day in business, and you will know how to use data to optimize financial performance. Of course, not all decisions can be made solely on data, but it is usually an important element. You will learn how to assess business risks and then

develop and implement action plans to reduce or eliminate them. This is very important to the long-term success of any business. Also, you will learn how to drive business goals with analytics and metrics — something you can teach others in your company.

Second, you will learn effective communication skills. Your experience interacting with a variety of people and companies will offer opportunities to continuously improve ways to receive and share information. People have different personalities and communication styles, and adjusting your approach will be a key to your success. This will lead to building trust and meaningful relationships with others.

Third, you will learn how each function of a business works. In order to gather data, perform analysis and offer recommendations on business decisions as well as verify that the accounting records are accurate, you will need to understand how the business makes money. This means you will learn each step, from creating a quote for customers to collecting payment after the product or service is delivered to the customers. This information will allow you to understand the entire business and have the skills necessary to be a successful leader or entrepreneur.

Finally, the first three skills will earn you the role of key business advisor to company owners and senior executives. You will also be a trusted colleague to other leaders. They will learn how you make business decisions, communicate and understand how each function works. Then they will find that the recommendations you provide and knowledge you share achieve results. They will feel that

your role is so important that they won’t make an important business decision without your input. Over time, you will advance into various leadership roles and become president of a business that impacts lives (what did I tell you?). You will find this very meaningful and rewarding.

I’m really excited for the path and opportunities ahead of you — all because you decided to pursue an accounting career. You got this!

Sincerely,

Tori of Today

Tori of Today

Test your technology. Charge it up.

Dress for success.

Set the stage for a distraction-free video interview.

Be a well-prepared early bird.

Maintain good eye contact and body language.

Project and pause.

End the video interview with appreciation.

Many of the changes the pandemic brought to the way we work seem likely to stick around, some perhaps permanently. Remote work and virtual recruiting are among them, which means your next job interview may happen via video.

Whether you’re an old hand with years of traditional interviewing experience or this is your first time in the job market, a video interview doesn’t have to be a stressor. Yes, there are distinct nuances you need to understand. But along with some practice and the right mindset, following these tips on how to prepare for a video interview can help you shine as easily as you would in a faceto-face interview.

Following are eight video job interview tips that can help you advance to the next round.

A few days before your interview, do a technology test run to make sure your equipment is working correctly. Download any apps or plugins you’ll need. Whether you’re using Zoom, Microsoft Teams or another video platform, make sure you have a username that’s professional, just as you would with your email address or social media handle. This is a detail that has famously gotten a few people into trouble, but it’s an easy mistake to avoid.

Check to make sure your computer’s camera, microphone and internet connection are working. Do a trial run with a friend or family member, if possible, so you have ample time to adjust if your equipment or software isn’t working properly.

3 3

If you’re using a laptop or tablet, make sure it’s fully charged on the day of the interview. And pick a spot that has strong Wi-Fi. If you’re using a tablet, find a way to keep it stationary. Otherwise, the screen may appear shaky if you’re holding the device. Avoid using a smartphone for video interviews if at all possible.

Whether you’re an old hand with years of traditional interviewing experience or this is your first time in the job market, a video interview doesn’t have to be a stressor.”

Dress as you would for an in-person interview — from head to toe. Doing so will make you feel more confident. Don’t try the old newscaster trick of wearing a blazer with sweatpants assuming you’ll only be seen from the waist up (you never know). Also, avoid wearing bright, flashy colors, and choose something that looks neatly pressed while you’re sitting down. Wear your video interview outfit during your trial run so you can get feedback from your friend or family member about how it looks onscreen.

3

3 3

Choose a location that’s free from the distractions of children, roommates or pets. Hang a sign on the door asking mail carriers and package deliverers not to ring the doorbell.

Make sure the background is free from clutter and embarrassing items like laundry piles. Set up lighting that’s bright but not glaring, illuminating your face from the front. Natural light is best.

Turn off email, text and social media alerts, software updates and other notifications that may

pop up on the screen during the interview. Turn off programs that might interfere with the webcam, and close browser tabs.

Before you join the interview, make sure you don’t have any filters on that might make you look like a cat or anything other than yourself, and that you don’t have an unprofessional-looking virtual background on.

When the time for your interview approaches, log in five or 10 minutes early so you can be calm and centered when the video interview begins. Have your résumé handy, along with the job description and any speaking points you want to hit or notes you’ve taken

Choose a location that’s free from the distractions of children, roommates or pets.”

about the company or position. You won’t want to read directly from them, but having everything right there can take away some stress.

Expect to field some common interview questions, including these:

• Tell me about yourself.

• Why do you want to work here?

• Why are you leaving your current job?

• What are your weaknesses?

• What’s your expected salary?

It’s easier for your eyes to wander when the person you’re talking to isn’t in the room. Maintain virtual eye contact by looking directly into the camera instead of at the screen or at your own

photo. Make sure your face is centered, and try not to move around too much. Keep good posture, sitting with your back straight, feet on the ground and arms resting in your lap or on the desk.

Project your voice. Check your volume controls and speak clearly so the microphone picks up your voice and the interviewer doesn’t have to strain to hear you. And remember that digital connections can sometimes be delayed. To avoid talking over the interviewer or having your first few words cut out, let the interviewer finish the question and then pause for a couple seconds before delivering your answer.

Just as you would with any interview, thank the interviewer for the opportunity, and follow up with a post-interview thank-you note within 24 hours. In your note, briefly reinforce why you’re interested in the job and why you’d be a great match for the role and company. Include something that you and the employer discussed while getting to know each other that’ll make the thank-you message more personal. Establishing that kind of rapport with the hiring manager, especially after the video interview, can make all the difference in advancing to the next round.

To avoid talking over the interviewer or having your first few words cut out, let the interviewer finish the question and then pause for a couple seconds before delivering your answer.

If you’re looking for an internship, don’t put it off, say talent recruiters from several Wisconsin-based CPA firms.

“The latest to apply for spring tax internships is early December, but Hawkins Ash CPAs recruits throughout the year,” said Heather Notbohm, talent acquisition specialist with the firm. “Today’s students are exploring opportunities earlier. Currently we are talking to students about internship opportunities for 2025.”

Alison Walsh-Hirsh, national talent attraction leader for Baker Tilly, agrees. She suggests starting your search 12 to 18 months prior to the internship window. “It’s never too late though,” she said. “If you’re

searching for an internship this fall, reach out. Be proactive.”

Recruiters encourage students to engage with potential employers as early as freshman year. Baker Tilly, for example, offers opportunities for freshmen and sophomores to go on-site, meet professionals and learn about their services. “You can get a foot in the door and see what the firm can offer you,” Walsh-Hirst said.

Since 2019, Walsh-Hirsh has focused on college recruiting nationwide. “Student interest is sparking earlier in their college careers,” she said. “Many seek a double major and earn up to 150 credits that way.

They want to interact earlier with employers — to gain experience through working or shadowing.”

“The timeline change means that firms may offer extended internships,” said Angela Wurtz, recruiting manager with Wegner CPAs. “We anticipate that we’ll be hiring into 2025 this fall.”

When you are ready to reach out, recruiters advise prospective interns to prepare by researching the firm.

“You want to understand the company and be prepared to talk about your experiences in work and school and how they can relate to internship opportunities at that company,” Notbohm said.

Recruiters are likely to ask for examples of how your work and school skills and experiences relate to what they are looking for in an intern.

“At Hawkins Ash, we look for that desire to take on new challenges, to really get in and learn,” Notbohm said. “We look for responsibility, efficiency and accuracy. We look at how the candidate manages time and stays organized. We look at how much they want to learn about the organization. We also evaluate the candidate’s communication skills.”

“Relative to the GPA, there is always more to the story,” said Baker Tilly’s Walsh-Hirsh. “A student’s major GPA can vary from their accounting GPA. Students also have personal stories. Maybe they had to step away for a while or make a degree program change. We don’t encourage interviewers to pry, but often students will offer information. If they are comfortable sharing the information, they should offer the story.”

“We look at the GPA, but it’s not at the top of the list,” said Hawkins Ash’s Notbohm. “It’s important but not the main priority.”

Wurtz agrees. “GPAs reflect a student’s dedication to school, but ambition, drive and culture fit are the most important things to us at Wegner,” she said. “We are willing to invest our time and training for people who are likely to be good culture fits long term.”

“It’s a red flag when the candidate is not prepared or shows a lack of interest,” said Notbohm. “Research the firm — look at our website and our services. Learn as much as you can about what the job entails. Ask questions that show you are interested in us.”

Another red flag is raised when a candidate talks poorly about a former manager or employer. “Experiences are not always ideal, but you don’t need to divulge all that information,” Walsh-Hirsh said. “You need to look forward.”

Recruiters tend to focus on interpersonal communication over social media.

“I like to talk with the candidate on the phone and with the partner in charge to see if the candidate would be a good fit,” Notbohm said.

Wurtz agreed. “We focus on the interview and correspondence at Wegner,” she said. “Speak about your coursework, clubs you belong to, activities you participate in.”

Maintaining social media can be a benefit. “Many use LinkedIn as if it’s a résumé and update it over semesters,” said Walsh-Hirsch. “Use it as an opportunity to highlight

accomplishments, leadership roles, competitions, and professional and volunteer experience. It’s a spot where you can brag about all you are accomplishing.”

Recruiters want to see that a candidate is passionate about pursuing an accounting career. They are looking beyond technical skills toward examples you can share about such topics as work-life balance; ongoing learning; being part of a team; working independently; and your ability to adapt, prioritize, take initiative and manage your time.

Many area schools offer opportunities for mock interviews and résumé review — valuable opportunities to practice interviewing and get feedback.

“Seek that out,” Notbohm said. “They do a great job giving feedback. If their school doesn’t offer that opportunity, students can call me if they want to practice.”

“Don’t be shy,” Wurtz said. “Any type of internship will benefit you. It will help you build your résumé, make you more well-rounded, give you experience and help you understand the whole picture.”

Any type of internship will benefit you. It will help you build your résumé, make you more wellrounded, give you experience and help you understand the whole picture.”

Embrace the 2024 CPA Evolution with UWorld!

#UWorldCPA2024

Proven learning methods for exam mastery and career readiness

FACULTY

Program resources to demystify the exam and build student confidence

FIRMS

Dedicated partner to ensure employees stay on track and pass faster

www.sikich.com

l Neil Keller, Partner l Neil.keller@sikich.com

Realize your full potential at Sikich. Become part of a highly motivated team that values individual effort and growth. Specializing in accounting, advisory, technology and managed services, Sikich ranks within the nation’s top 30 largest CPA firms and the world’s top 1% of enterprise resource planning solution partners.

www.vrakascpas.com

l Tara Tomter, Director of Talent l ttomter@vrakascpas.com

As a Top Workplace award winner with nearly 100 professionals, our experience, size and resources enable us to provide high-quality assurance, tax and small business accounting services for privately held companies. At Vrakas, we provide you with the tools needed to map out your path to success. Experience the Vrakas difference today!

www.wipfli.com

l Tori

Spencer,Talent Acquisition Specialist l vspencer@wipfli.com

We’re Wipfli, a national consulting firm serving clients across today’s most complex industries. Our professionals guide clients through the process of identifying growth, profitability and efficiency challenges – accounting, taxes, operational issues, enterprise collaboration, effective decision making and more. At Wipfli, curious is more than a personality trait. It’s a way of thinking. Of learning. Of working. At Wipfli, curious is our approach to the world. We challenge ourselves to push beyond obvious answers to find smarter solutions for our 100,000+ clients. Curious? Come join us.