6 Super lawyer: Joseph E. Boucher, CPA, MBA, JD

He’s a co-founding shareholder of a law firm that bears his name. He has co-authored significant legislation that affects many Wisconsin businesses. He teaches accounting and law students at UW–Madison. What charges his batteries? Read and find out.

By Marcia Tillett-Zinzow

By Marcia Tillett-Zinzow

The Inflation Reduction Act of 2022 — passed in the House with a party-line vote on Aug. 12 — is vastly different from the original Build Back Better Act.

By Jim Brandenburg, CPA, MST

16 Time is up!

Key amendments to the Gramm-LeachBliley Act Safeguard Rule become effective in December. Make sure your organization is prepared.

By Jeffrey T. Lemmermann, CPA ,CISA, CITP, CEH

20 Employees weigh in on why they stay

A July survey found that nearly half of workers are planning to stay at their companies in the next 12 months — although younger workers may need convincing.

By Jeanne MeisterAdapt and prosper: The future for CPA firms

The days of ledger paper and in-person meetings are scarcer than ever, and tech stacks and remote work policies are now the focus for many firms.

By Christopher R. Cicalese, CPA, MSTFP

Be cautious following online financial advice

If you find yourself in need of some financial assistance, should you turn to social media for help? The answer: It depends.

By Brian Ellenbecker, CFP, EA, CPWA, CIMA, CLTC

Financial stress in America

Progressive organizations are expanding their wellness programs to include a financial component as a primary pillar.

By Joseph Topp, CPA

Avoiding the “retired” partner problem

Here’s how to get CPA firm partners who are destined to hold on until the bitter end to loosen their grip and successfully hand off their firms to the next generation.

By Jeff StimsonH NEW Affinity Partner

EPSA USA is focused on helping companies of all sizes take advantage of the R&D tax credit at the federal/ state level. Our experts help you identify qualified research expenses that yield a large tax benefit for our clients. Complimentary assessment is available at www.us.epsa.com.

These

WICPA

Chair Steven A. Pullara, CPA, CGMA

Chair-elect Matthew J. Schaefer, CPA, CGMA

Past Chair

Angela C. Thomas, CPA

Secretary/Treasurer Lucien A. Beaudry, CPA, JD Directors

Christopher M. Cholka, CPA, CGMA John R. Heindel, CPA Donna R. Scaffidi, CPA Kyle R. Stephens, CPA Stacy A. Stinson, CPA

AICPA Council

Ruth A. Kallio-Mielke, CPA Neil R. Keller, CPA/ABV, CVA

President & CEO

Tammy J. Hofstede

Design & Layout

Brett Stallman

Advertising Sue Daniels

Editor Marcia Tillett-Zinzow

Printing Delzer

Spectrum Investment Advisors co-sponsors the annual Retirement Plan Investment Seminar, which offers WICPA members CPE credits at a nominal cost. WICPA members can work directly with Spectrum to receive plan consulting services for their retirement plan program as well as individual wealth/asset management services.

can

UWorld Roger CPA Review delivers exceptional course materials that make difficult concepts easy to understand. Proven with a 91% CPA Exam pass rate, we proudly serve the accounting profession’s top educators, employers and professional organizations to ensure success for future CPAs across the nation.

at wicpa.org/discounts

By Steven A. Pullara, CPA, CGMA

By Steven A. Pullara, CPA, CGMA

One of the things I’ve missed in recent years is playing golf and reconnecting with our members at the annual WICPA golf outing. For many years, I invited other members and led foursomes at the golf outing. We always had a great time, and then for some reason I can’t remember — other than simply not making time due to a busy schedule —I stopped attending.

I am so glad to have participated again this year after missing out on the fun. This year’s outing was a historically fabulous success. Here are just a few of the reasons we had so much fun:

• We had 200-plus attendees, including members from public accounting, private industry, government and nonprofits.

• Ironwood Golf Course hosted the outing, and its 27 holes were in excellent condition.

• The format was a scramble, so no matter how bad a golfer you are (some might have been even worse than I am) there was usually a good shot to play for any foursome.

• The food and drink were outstanding.

• There were plenty of door prizes (provided by the WICPA and the outing sponsors) as well as skill event prizes, so nobody left empty-handed.

• The entire WICPA staff team did a fantastic job helping out with registration, food, drinks, staffing the prize holes and keeping the event fun and entertaining for everyone.

• There was plenty of time for networking before and after golf.

I was fortunate enough to be in a foursome with one of our state representatives who is a WICPA member. It was

very informative to find out what is on the state assembly agenda and the latest and greatest of what is going on in state government.

My favorite part of the golf outing was enhancing relationships with members and reconnecting with members whom I hadn’t seen in a while. As WICPA members, we have many opportunities to connect with each other, build relationships and enhance our networks. The golf outing gave those of us who attended the opportunity to not only connect, but also to make time to have a little fun and keep the balance in life and work. Watch for this event again next September!

Steve Pullara, CPA, CGMA, is a tax partner with BDO USA LLP in their Madison office. He leads the Wisconsin real estate and construction practice groups. Pullara also teaches financial management through UW–Madison’s School of Business, Small Business Development Center. Contact him at 608-828-3156 or spullara@bdo.com.

“My favorite part of the golf outing was enhancing relationships with members and reconnecting with members whom I hadn’t seen in a while.”

By Tammy J. Hofstede

By Tammy J. Hofstede

As we know, there is a shortage of students in the CPA pipeline, and we need to reach students much earlier to influence their career decisions.

As part of our efforts to promote accounting awareness to high school students, the WICPA Educational Foundation is offering $250 stipends to new attendees at the High School Educator Accounting Symposium held in November and has increased the number of grants to be awarded to high school educators who attend the symposium. Grants are awarded up to $2,500 each. Grant application requirements for the educators include a planned activity that supports accounting as a career (and must include a CPA).

Too often, the educators do not know where to start or whom to contact. To make this as easy as possible for the educators, we would like to provide them with a listing of firms they can select from that have accounting recruitment and informational activities in place (or are willing to develop them). The time commitment for the activity can be anywhere from two to four hours, depending on the agenda. Typical attendance is around 25, but it can be as many as 50.

A few suggestions for activities include the following:

• a presentation of what the organization does

• a roundtable discussion with accountants who work with a variety of large and small businesses

• young professional staff to talk with the students and answer questions

• an accounting-related activity (with all students or students divided into teams)

• a discussion of important classes to take in college and the different accounting paths to choose from

• a tour of the firm and/or an interesting client’s company

• lunch with firm staff

• playing a game that helps staff relieve stress

• swag items from the organization

“I am asking you to volunteer your organization to be part of this program in order to provide students exposure to the profession and the ability to influence the CPA pipeline for future employment opportunities.”

CEO’s

I am asking you to volunteer your organization to be part of this program in order to provide students exposure to the profession and the ability to influence the CPA pipeline for future employment opportunities. This also gives you the opportunity to promote your firm, high school or college internships, or job shadow opportunities. I encourage all areas of the state to participate!

In addition, all high school educators who attend the symposium will be offered a complimentary WICPA membership and the opportunity to join the new High School Educator Committee.

This is only one of the many initiatives the WICPA Educational Foundation supports to create accounting awareness through contributions and volunteer time. If your organization would like to participate in providing a planned activity for high school educators’ accounting and business classes, please contact me for more information. Or if you would like to support these (and many other) efforts to influence and create awareness of the accounting profession through a donation, please go to wicpa.org/edfund.

If you’ve ever had a conversation with Joe Boucher, you probably noticed that he talks so fast you can hardly get a word in edgewise, and he skips from one topic to the next with lightning speed. He’s like the Energizer Bunny. His brain seems to be working overtime, and so is he. That’s evident when you look at his career.

Boucher is a founding shareholder of the Madison law firm Neider & Boucher S.C. and currently serves as the firm’s chairman of the board. He is an active WICPA member who (among other things) co-drafted the original Wisconsin Uniform Limited Liability Company (LLC) law (Wisconsin § Chapter 183), amendments to Chapter 183, the Wisconsin Uniform Partnership (LLP) law (Wisconsin § Chapter 178) and the 2021 Wisconsin Act 258, which modifies the most recent versions of both laws.

Boucher has written extensively for On Balance and The Wisconsin Lawyer about LLC developments since the initial law was passed in 1994. Since the early 2000s, Boucher has been named a Wisconsin Super Lawyer, and Madison Magazine has consistently named him one of Madison’s leading business attorneys. In 2020, he received the WICPA’s Career Achievement Award.

He graduated from St. Norbert College with a bachelor’s degree in 1973 and went on to earn an MBA from the University of Wisconsin–Madison in 1978 after receiving a Juris Doctorate from the UW in December 1977.

In addition to his busy career, Boucher also teaches college classes. He has been teaching business law at UW–Madison for more than 30 years: since 1988 to accounting majors and since 2000 to graduate students. One wonders where he gets the energy to juggle it all. The answer is motivation — perhaps seasoned by just a pinch of attention deficit hyperactivity. Thus, the Energizer Bunny analogy.

The CPA-lawyer-educator grew up in Marinette, where the family lived in a four-unit apartment building, built in the 1880s and overlooking the Menominee River. His father established a sole proprietorship there after World War II: Bouche’s Bungalow Bakery. The name was misspelled intentionally because Mr. Boucher thought people would mispronounce the family name — which is accurately pronounced “boo-shay” and still is often mispronounced. The bakery gave Boucher his first job.

“It was a great place to work as a kid and to learn how to work and how a business operates,” he said.

Boucher’s father died suddenly in 1970 — right before Boucher’s graduation from Marinette Catholic Central High

School (now St. Thomas Aquinas Academy). His mother kept the bakery going until the 1980s, when his younger brother, Patrick, took over and operated the business until about 2000.

“Mom did a great job keeping it going, and Patrick did the best he could,” Boucher said. “It was a tough business, both physically and financially.”

Before his father died, Boucher had been accepted at “half a dozen” colleges; he had made up his mind to attend UW–La Crosse, but his father’s death created a dilemma.

“We had this family business in Marinette,” he said. “So I felt obligated to stay close to home. St. Norbert College in De Pere is only an hour away, and that’s how I ended up there,” he explained.

After a couple of years at St. Norbert, Boucher started having second thoughts about his major, which at that time was math. He wanted to change it, but he didn’t want it to delay his graduation plans. He was determined to finish before he turned 22. His education had been partially financed by Social Security benefits he received after his father’s death, and

his advisor at St. Norbert, and they came up with a plan. As a result, Boucher graduated with a liberal arts degree in December 1973 — and then headed for grad school.

“My mom wanted me to go to law school. Her best friend was a court reporter, and her dad was a judge and her brother a lawyer. They’re both Irish Catholic women, and Mom thought being a lawyer was a big deal,” he said. “But when your mom pushes you toward something, you push back, right?” He headed for business school (and added law school later).

Boucher chose the MBA program at UW–Madison and financed his first year of graduate school with money he had earned working for the Chicago & North Western Railroad.

“The long story is that my dad employed the railroad boss’s kids because the railroad had a policy prohibiting nepotism. In return, the railroad hired me during one summer in high school and again between St. Norbert and grad school. Back then, you could earn enough money to pay for school because UW tuition was so low,” Boucher remembered.

His dream was to ultimately work in sports management, but the only graduate program in that field was in Ohio. “I couldn’t afford out-of-state tuition,” said Boucher. “So I thought maybe if I got an MBA, I could weave in sports management somehow.”

That decision led him to a decades-long relationship with Edgewood High School of the Sacred Heart, a Catholic college-preparatory school in Madison, where he and his

“I’ve always been involved in sports,” Boucher said. “So when I started grad school at UW, I wrote to all the high schools in the area and told them I really wanted to coach, and the only one that responded was Edgewood. So I developed a relationship there early on, in 1974, and I fell in love with the place. I coached there for a year and then I also served on their board of trustees, chairing it for two years.”

Boucher also coached at Blessed Sacrament Grade School for many years. And while he was coaching, his wife, Susan DeGroot — who holds bachelor’s and master’s degrees in piano performance in addition to her law degree — served as Edgewood’s piano accompanist for choirs, plays and music classes.

Edgewood showed its appreciation to the Bouchers with several honors over the years: Boucher received the Annual Alumni Appreciation Award in 2009 and induction to the school’s Sports Hall of Fame in 2016, and De Groot was honored with induction into the school’s Fine Arts Hall of Fame. Boucher also was named a Hall of Fame member “as a friend of high school basketball” by the Wisconsin Basketball Coaches Association in 2020.

Boucher and his wife have three children, all high achievers like their parents. In fact, one is a CPA-lawyer like his father. Their youngest child, J. William “Willie” Boucher, CPA, JD, is an attorney for the law firm of Quarles & Brady LLP in Madison and a member of the WICPA. Boucher’s oldest child, Elizabeth Boucher Dawson, JD, is an environmental lawyer in

Washington, D.C.; and Bridget Boucher Harland, the middle child, has a Master of Science degree in social work and currently works part time at Froedtert Hospital. All three of Boucher’s children are bilingual, speaking Spanish in addition to English.

Boucher has been teaching business law and other courses to aspiring CPAs and attorneys at UW–Madison for more than 30 years now. It’s obvious he loves to teach. When asked what motivates him to keep doing it year after year, he replied: “It’s real simple: Young people are so cool. I’m so motivated by 21-year-olds. I’m motivated by my own kids. I’m kind of a glass-half-full kind of guy, a real optimist, and what makes me optimistic is young people,” he said.

But his primary motivation is his wife, Susan. The two have been together since meeting in law school in 1975. They married in 1977.

“The only reason I can do all this stuff is because of Susan. She and I are a team, and we share the same passions. She is equally as motivated and driven as I am,” he said, adding that Susan played the piano for Blessed Sacrament Christmas programs and at Edgewood High School as a volunteer for nearly 20 years — in addition to her career as an estate planning attorney at Neider & Boucher.

But Boucher had another motivating force all his life until just a few years ago: his brother Paul, who was disabled and sadly passed away suddenly, early in the pandemic.

“He was my north star. He motivated me,” said Boucher. “Everybody in Marinette knew Paul. For 44 years, he worked at Goodwill Industries of Northern Wisconsin and Upper Michigan, which was just a block from our home — and right next to Goodwill was the Marinette Fire Department. The firefighters there just embraced my brother. Paul spent all his free time there. So, four or five years ago they had the 150th anniversary of the fire department, and — of all the people over

plus. He had a great memory, he was musical, he was just a terrific person.

“I took him all over the country. I’d take him to fire departments and places like that because he loved firefighters,” said Boucher. “So Paul had disabilities, but we nurtured him, and my mom did a spectacular job with him. But what I’m saying is that I’m motivated by people like that.”

Marcia Tillett-Zinzow is a Wisconsin freelance writer and editor. Contact her at mtzinzow@icloud.com.

H Distinguished alumnus, St. Norbert College

August 2004

H Wisconsin Small Business Advocate, Wisconsin Small Business Administration

1993 and 2005

H Wisconsin Lawyer’s Charles Dunn Author Award, recognizing writing excellence, for the article “E-Legacy: Who Inherits Your Digital

H Named a Leader in the Law by the Wisconsin Law Journal

2015

HH Named Best Lawyer in the Madison Area for Closely Held Companies and Family Businesses — August 2016, 2018, 2019 and 2020

H Inducted to the Entrepreneur’s Hall of Fame, Weinert Center for Entrepreneurship of the University of Wisconsin–Madison School of Business — May 2017

H State Bar of Wisconsin’s Charles L. Goldberg Distinguished Service Award, given for lifetime service to the legal profession and to the public — September 2020

Eric Babler, CPA, MPA, has been promoted to managing director at the Madison office of FORVIS, an international CPA and advisory firm.

Jim Brandenburg, CPA, MST, tax partner with Sikich in Brookfield, was consulted for his expertise in an Aug. 31 Spectrum News 1 segment on the tax implications of student loan forgiveness in Wisconsin.

Todd Clemens, CPA, CFE, CGMA, has been promoted to principal at SVA Certified Public Accountants, Madison and Brookfield.

Vanessa Conlin, CPA, has been promoted to principal at SVA Certified Public Accountants in Madison.

Julie Duckett, CPA, CFE, controller of BayCare Clinic in Green Bay, has been appointed director and secretary/treasurer of the BayCare Clinic Foundation’s board of directors.

Holly Eisenhauer, CPA, has been promoted to principal at SVA Certified Public Accountants in Madison.

Chris Fearn, CPA, has been promoted to principal at SVA Certified Public Accountants in Madison.

Jason Grosh, CPA, JD, has been promoted to managing director at the Madison office of FORVIS.

Gloria Klomberg, CPA, has joined Huberty CPAs, Fond du Lac, as an assurance consultant.

Brad Kussow, CPA, has joined Vrakas CPAs + Advisors in Brookfield as a shareholder. He will manage audit engagements and provide specialized audit, review and consulting services for a variety of industries.

Robert Mathers, CPA, JD, ABV, PFS, has joined Quarles & Brady LLP as a partner. He specializes in business and tax law in the Milwaukee office.

Paul Matson, CPA, MBA, has joined the Milwaukee School of Engineering as vice president of finance and CFO.

Rachel McAlexander, EA, has been promoted to principal at SVA Certified Public Accountants in Madison.

Cindy Meicher, CPA, CVA, managing partner of Meicher CPAs, was consulted for her expertise in an article for the Madison-based In Business magazine about how businesses are preparing for a potential economic slowdown.

Allan Michalski, CPA, CFO of Felker Bros. Corp. in Marshfield, has been elected chairman of the board of directors for Wisconsinbased Forward Bank. He has served on the board since 2008.

Chad Naidl, CPA, MBA, has been promoted to assurance director with CliftonLarsonAllen (CLA) in Manitowoc.

Kyle Overby, CPA, was named the best financial planner of 2022 in the Amery area by the Amery Free Press

Benjamin Rydecki, JD, associate attorney at Thiensville-based O’Leary-Guth Law Office SC, was named a Rising Star in Law by Biz Times Milwaukee.

Michael Sattell, CPA, CFE, president and CEO of Ovation Communities, was featured in an article by the Wisconsin Jewish Chronicle about his commitment to exposing elder financial abuse.

Matthew Schaefer, CPA, CGMA, has been promoted to chief credit officer for the Bank of Wisconsin Dells.

Sheri Springer, CPA, has been promoted to principal at SVA Certified Public Accountants in Madison.

Tim Steffen, CPA, PFS, CFP, CPWA, director of tax planning for Robert W. Baird & Co. Inc. in Milwaukee, was interviewed on “The Long View,” a Morningstar podcast, about tax-loss selling, Roth conversions and the new rules for inherited IRAs.

Eric Tischer, CPA, MBA, the CFO of Oak Creek-based Keder Solutions and Frontline Commercial Real Estate, was named to BizTimes Milwaukee’s list of 2022 Notable CFOs.

Mike Webber, CPA, has been promoted to partner in Wipfli’s nonprofit and government practice. He is in the firm’s Madison office.

Grant Wheat, CPA, has joined Members Cooperative Credit Union, a Minnesota-based company, as director of risk management.

he Inflation Reduction Act of 2022 (which is now Public Law No. 117–169 and was previously titled the Build Back Better [BBB] Act), obtained final congressional approval when it passed the House in a party-line vote on Aug. 12. This followed a similar partisan vote of 51-50 in the Senate on Aug. 7, with Vice President Kamala Harris casting the tie-breaking vote. There was a flurry of debate on the Senate floor before final passage and a “Vote-a-Rama,” with various amendments submitted to modify the bill. Several amendments were adopted, but nothing significant enough to block the bill from final passage.

By James D. Brandenburg, CPA, MST

The final bill was vastly different from the BBB that was introduced in September 2021. Here are some of the late changes made in the bill:

After the stunning agreement between Senators Joe Manchin and Chuck Schumer was unveiled on July 27, Sen. Krysten Sinema had not yet announced her position on the bill. Sinema indicated support for the bill in early August but said she would not allow it to move forward with a “carried interest provision.” As a result, this item was removed and replaced with a “1% excise tax on stock buybacks.” This particular provision was part of the BBB last fall.

Sen. Sinema was also in favor of an amendment to reduce the new corporate book minimum tax (BMT), as it might impact private equity ventures (due to the aggregation rules that are part of the new tax). While a proposal to extend the $10,000 state and local tax (SALT) cap did not make it into the final bill, an extension of the large loss limit (under

Section 461(l)) of $250,000 ($500,000 for married filing jointly; both amounts indexed for inflation) was included for two years through 2028. Therefore, the SALT cap will remain in place, but only through 2025.

Next, we explore several key items of the bill in greater detail:

This corporate tax hike would first become effective in 2023. The book minimum tax is a complicated new measure, but it is not likely to impact many corporations. It applies primarily to large corporations, and congressional leaders indicated it might impact only 150 or so companies. BMT applies if a corporation has over $1 billion in book profits. Book profits are measured as the three-year average of alternative financial statement income (AFSI). BMT does not apply to S corporations, regulated investment companies (RIC) or real estate investment trusts (REIT). There were several late changes made to the BMT:

1. Depreciation differences are not part of the BMT. This was an attempt to appease manufacturers.

2. Aggregation provisions for the BMT under Section 52 were scaled back. As noted, this was an attempt by Sen. Sinema to avoid subjecting private equity firms to BMT; however, they still might fall prey to this tax.

TThere was a flurry of debate on the Senate floor before final passage and a “Vote-a-Rama,” with various amendments submitted to modify the bill.

Budget projections show that the BMT will generate roughly $200–$250 billion in new tax receipts over the budget period.

This tax would take effect beginning in 2023 and is limited to publicly traded corporations. This excise tax provision on stock buybacks is similar to the provision the House passed in the BBB last fall and is projected to raise roughly $70 billion. The proposed provision excludes certain repurchases from excise tax to the extent that:

• repurchase is part of a tax-free reorganization;

• repurchased stock or its value is contributed to an employee pension plan, ESOP or similar plan;

• total amount of stock repurchases within a year is less than $1 million;

• repurchase is by a dealer in securities in its ordinary course of business;

• repurchase is treated as a dividend (§301); or

• repurchase is made by a RIC or a REIT.

The bill would extend the ACA subsidy of the premium tax credits through 2025 for qualifying individuals. The subsidies were scheduled to expire at the end of 2022, causing many taxpayers to have increased premiums in 2023 and beyond.

This controversial measure includes additional IRS funding of $80 billion allocated as follows:

• $4 billion for taxpayer service

• $46 billion for enhanced enforcement activities (not just for audits but also for many other investigation activities)

• $25 billion for support of IRS operations (for a variety of operational needs)

• $5 billion for technology modernization and improvements

The bill does not intend for these IRS enforcement efforts to apply to those making less than $400,000 per year; however, there are no clear assurances of that. It will have a wide-ranging impact on most businesses and individuals for many years.

Numerous credits, deductions and other incentives for various energy measures are included in the legislation. For some of these that apply to construction or manufacturing, the credits can be increased when prevailing wages and apprenticeship requirements are satisfied. Here are several selected energy provisions:

Energy investment credit — This credit is extended through 2024. It includes enhancements for renewable electricity and solar facilities in low-income communities.

Energy from renewable resources — The credit for energy produced from certain renewable energy resources is extended through 2024. The credit could be enhanced if it satisfies certain wage requirements in operations or in the construction of the facility.

Residential energy incentives — The nonbusiness energy credit for residential property, which lapsed in 2021, is extended through 2032. A new annual cap of $1,200 for this credit is adopted. There is a credit of $150 for an annual energy audit in addition to the cap.

Elective direct payments — Instead of obtaining a tax credit, a business can elect to claim a direct payment for certain qualifying energy projects. Qualifying energy projects include carbon oxide sequestration credits, renewable energy production credits and alternative fuel refueling credits.

Credits for clean-energy vehicles — The tax credit for certain vehicles is extended through 2032. This covers fuel cell and plug-in vehicles. The maximum tax credit is $7,500. Taxpayers looking to claim this credit will have an income limitation that had not previously existed. Further, there will be a cap on the price of a vehicle. While this credit had been allowed only on new vehicles in the past, it is now also available on used vehicles. The used vehicle credit is limited to $4,000.

Credit for commercial clean-energy vehicles — For commercial vehicles used in a trade or business and designed for public roads, the clean-energy credit can range between $7,500–$40,000 depending on the weight of the vehicle.

Advanced manufacturing production credit — Tax credits are available based on a formula for manufacturers of components for battery and green energy technology. Different formulas are calculated for different components.

Credits and incentives for special fuels — The incentives for alternative fuels, alternative fuel mixtures and biodiesels are renewed through 2024.

“

Numerous credits, deductions and other incentives for various energy measures are included in the legislation.

Energy-efficient commercial building deduction (Sect. 179D) — Two key changes were made to Section 179D:

1. It increased the Section 179D deduction up to $5 per square foot (previously $1.80/sf).

2. It allows the §179D deduction for work with a tax-exempt organization (not just a governmentowned building).

Extension and increase in new energy-efficient home credit — This credit is increased up to $2,500 per home, or up to $5,000 per home when the builder pays a “prevailing wage.”

Research tax credit for startups — The bill increases the research credit against payroll tax for small startup businesses to $500,000 (previously $250,000).

Special provision to sell energy credits and incentives

— The law would permit taxpayers obtaining several energy tax credits to be able to sell credits and incentives to other parties. We await IRS guidance on the details of this new approach, but it is something for those generating credits and those seeking to acquire such credits to be aware of.

The original BBB bill was projected to raise revenues of over $3 trillion, whereas the final bill ended up at around

$700 billion (less than 25% of the initial proposal). The original bill started with major across-the-board corporate, individual and estate tax hikes. The final bill passed by both chambers included higher taxes only on major corporations and corporate stock buybacks, some sizable energy tax incentives, and funding for the IRS (projected to generate $124 billion), but no major tax increases.

While many tax changes were proposed, few of them made it into the final law. The major change that will impact taxpayers — both businesses and individuals — is the expanded and enhanced IRS enforcement.

Some of the initial tax measures that were not in the final bill could be reintroduced at some later point by Congress. So, many taxpayers might breathe a sigh of relief on what ended up in this bill — but they should keep a wary eye on future tax legislation in Congress. Lastly, the IRS (with its expanded budget) will be busy drafting guidance on this legislation over the coming weeks, so watch for this.

Jim Brandenburg, CPA, MST, is a tax partner with Sikich LLP in Brookfield. Contact him at 262-754-9400 or jim.brandenbug@sikich.com.

The Gramm-Leach-Bliley Act, passed in 1999, requires the protection of non-public personal information by financial institutions, specifically outlining “an affirmative and continuing obligation to respect the privacy of its customers and to protect the security and confidentiality” of that information.

The Federal Trade Commission’s Safeguards Rule — formally, the Standards for Safeguarding Customer Information — details the requirements outlined in the GLBA. Originally published in 2001, the rule outlines “the administrative, technical, or physical safeguards you use to

access, collect, distribute, process, protect, store, use, transmit, dispose of, or otherwise handle customer information.” Due to significant changes in technology over the last 20 years, amendments to the rule have been made. The clock started ticking Jan. 10, 2022, when these amendments became effective. Knowing that the implementation of some of those provisions would take time, portions of the amendment have an effective date of Dec. 9, 2022.

There are two main qualifiers: You must comply if you 1) are a “financial institution” under the GLBA’s definitions or 2) receive information about customers of financial institutions.

The definition of “financial institution” under the rule is wider than most definitions. There are 13 specific examples in Section 314.2(h) of the rule, including the following:

• Mortgage lenders

• Payday lenders

• Finance companies

• Mortgage brokers

• Account servicers

• Check cashers

• Wire transferors

• Collection agencies

• Credit counselors and other financial advisors

• Tax preparation firms

• Non-federally insured credit unions

• Investment advisors that aren’t required to register with the SEC

Size also matters. The FTC has exempted from certain provisions of the rule entities that maintain customer information concerning fewer than 5,000 consumers.

At the heart of the Safeguards Rule are several key elements involving the development, maintenance and enforcement of a written information security plan (ISP). Following are the keys aspects and notable amendments:

A single qualified individual must be designated to oversee, implement and enforce the ISP. This is a change from the original language, which allowed for one or more employees to coordinate the program. (Note: If your organization doesn’t have a qualified individual on staff, a third-party company can be utilized for this function. This does require the designation of a senior member of the organization to direct and oversee the third party, and all compliance obligations remain with the hiring organization.)

A risk assessment process must be in place. This process must identify and assess risks to customer information in each relevant company area and evaluate the effectiveness of current controls implemented to mitigate those risks. This is not a new requirement; however, for companies maintaining information on 5,000 or more customers, the amendments now require the following elements:

• The criteria used to evaluate and categorize risks and threats to information systems

• The criteria used to assess the confidentiality, integrity and availability of information and systems used to process customer information and adequacy of the existing controls

• A description of how identified risks will be mitigated or accepted and how the ISP will address those risks

Design and implement a safeguards program, and regularly monitor and test it. This is not a new requirement; however, the amendments added eight specific types of safeguards that must be part of this program:

1. Physical and technical access controls, including a review of authorized users

2. Identification and evaluation of the data, personnel, devices and systems used that interact with customer data

3. Encryption of all customer information, both in transit and at rest

4. Secure development practices and security testing for applications used for transmitting, accessing or storing customer information

5. Implementation of multifactor authentication for any information system that contains customer information accessed by any individual. (This requirement can also be met if the qualified individual noted in item 1 has approved an equivalent or stronger control.)

“ Design and implement a safeguards program, and regularly monitor and test it.

6. Procedures for the secure disposal of customer information no later than two years after the last date the information is used unless retention is otherwise required or necessary for legitimate business purposes

7. Implementation of change management policies

8. Implementation of policies, procedures and controls to monitor and log authorized user activity and detect unauthorized use

Routine testing and monitoring of controls enforcing the safeguards program must be conducted to evaluate their effectiveness. This is not a new addition; however, two specific control tests are now required for companies above the 5,000 records threshold: They must conduct vulnerability scanning at least every six months and undergo penetration testing at least annually.

There must be specific policy requirements for training information systems personnel and general security awareness training. The amendments add specificity to the existing training requirements that were already in place and require formal documentation of the policies. These include:

• Security updates and training procedures to address new risks specific to systems that are running in the enterprise’s environment,

• Verification that key personnel are maintaining their knowledge of threats and available defenses against those threats, and

• General security awareness training requirements and procedures for all employees and engaged third parties utilizing the enterprise’s information systems.

The requirement to oversee service providers that assist in the preparation, maintenance and use of the environment

handling consumer data was part of the original rule. This requires the selection of service providers capable of maintaining appropriate safeguards and that contract language mandates these safeguards. The amendments add an additional requirement that the service providers must be periodically assessed on the risks associated with their use and the adequacy of the safeguards they have implemented.

For entities above the 5,000 records threshold, a new requirement involves a written incident response plan. There are seven requirements for this plan in the new amendments:

1. Stated goals of the response plan

2. A description of internal procedures for responding to a security event

3. The definition of roles, responsibilities and levels of decision-making authority for individuals involved in the incident response process

4. Plans for handling internal and external communications and details on the use of information-sharing resources

Routine testing and monitoring of controls enforcing the safeguards program must be conducted to evaluate their effectiveness.

5. Procedures for

6. Requirements for documenting

security events,

be assessed by the FTC on the enterprise and/or individuals responsible for compliance. They are as follows:

classifying

the activation of the incident

7. A defined process for post-incident performance, evaluation and revision of the incident response plan following an event

Another new requirement for entities above the 5,000 records threshold is a written report, presented to the enterprise’s governing body or senior/executive, done at least annually. This report should be created by the qualified

• The institution will be subject to a civil penalty of not more than $100,000 for each violation.

• Officers and directors of the institution will be subject to and personally liable for a civil penalty of not more than $10,000 for each violation.

• The institution and its officers and directors will also be subject to fines in accordance with Title 18 of the U.S. Code or imprisonment for not more than five years or both. Covered financial institutions should be in compliance with the nonamended components of the Safeguards Rule already,

he Great Resignation may be waning, as a recent survey found nearly half of workers are planning to stay at their companies in the next 12 months,1 although younger workers may still need to be convinced of the benefits of staying.

Paychex, in partnership with Executive Networks, conducted a 10-minute online survey with 604 fulltime and part-time employees who were all living in the U.S., working at small to mid-sized businesses (20-500 employees) and aged between 18-75 years old. The research sample included 65% active workers and 35% sedentary workers. Active workers work on the front line of their business, while sedentary workers work at a desk for a majority of their workday. The survey was also segmented by employees who work fully remote (19%), fully on-site (63%) and hybrid (18%).

Overall, job stability and performing meaningful work were cited as the two most important reasons employees continue to stay at their companies.

However, there were variations depending on working arrangements (remote/hybrid/on-site and active/sedentary), industry sector and generation.

Here were some of the top findings:

More baby boomers (46%) reported that flexibility in work hours or schedule would make them stay long term at their organization than Gen X (38%), millennials (31%) and Gen Z (24%).

Sedentary workers (20%) were more likely to say flexibility in work environment would make them more likely to stay at their company long term than active workers (11%).

Active workers (66%) were less likely to feel valued for the work they do than sedentary workers (75%).

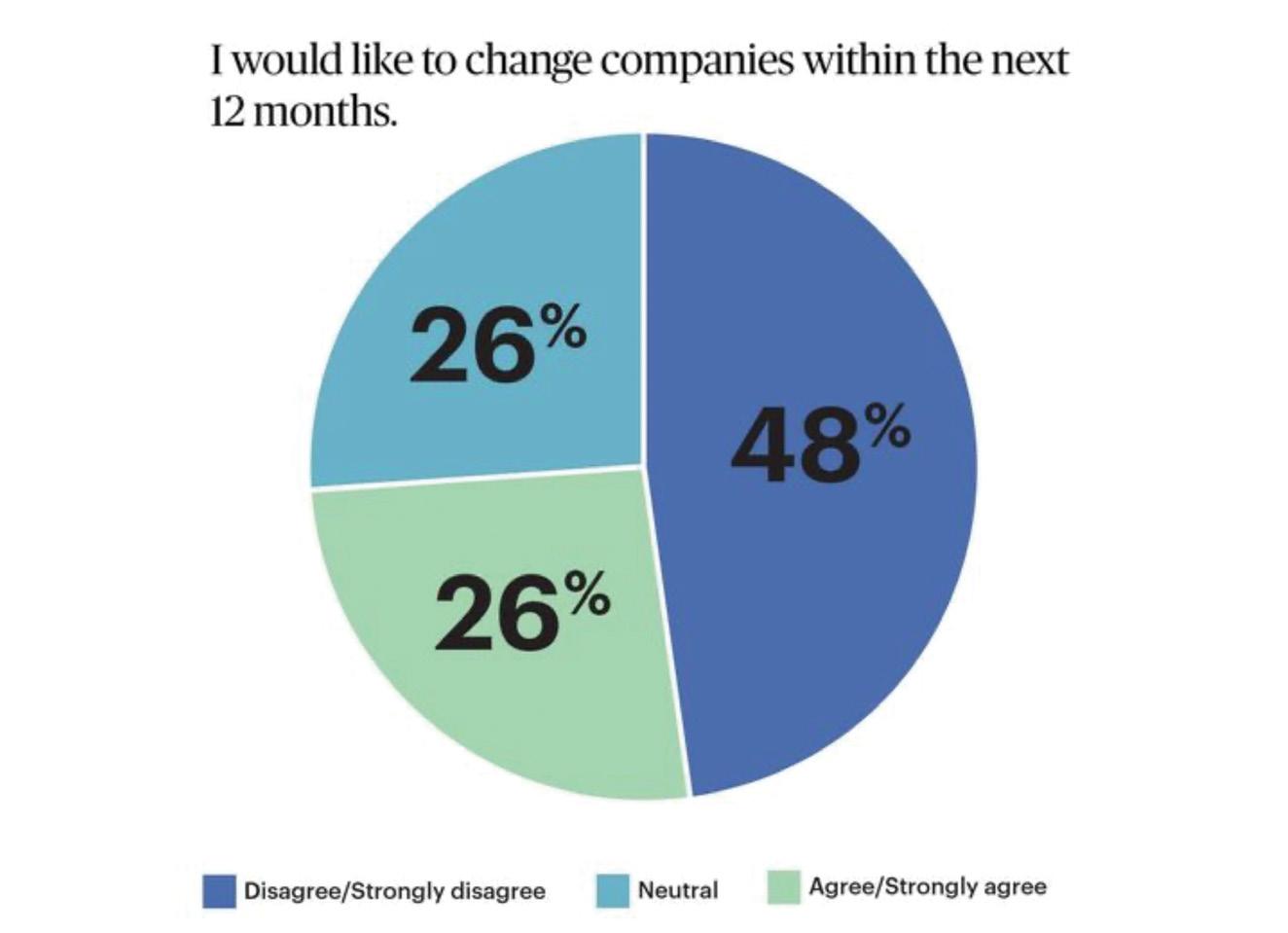

#1 Almost half of employees surveyed plan to stay with their current companies.

The data could lead us to believe that workers are starting to see the value of staying with their current employer. Most agreed that they currently perform reasonable amounts of work (71%), are provided the tools they need to be successful (71%) and that they feel valued for the work they do (69%). Additionally, 48% of

employees said they do not plan to change companies within the next 12 months [Note: survey results published in July 2022].

Of those who reported they would like to change companies in the next 12 months, millennials (34%) and Gen Z (30%) were significantly more likely to say they would want to switch employers than baby boomers (15%) and Gen X (22%).

Employers may already recognize this, as Gen Z (49%) and millennials (36%) are more likely to report having a “stay interview” at their company compared to Gen X (21%) and baby boomers (12%). For the purposes of this study, a stay interview was defined as when an employer meets with an employee to gather information about what the employee values about their job and to discover what the employee believes can be improved.

When it comes to leaving their current company, those in professional and business services (41%); retail, trade, transportation and utilities (35%); and construction (36%) were the most likely to say they’re interested in leaving in the next 12 months. Those in education and health services (16%), as well as those in financial services (18%), were the least likely to report wanting to change companies.

Key findings: What’s important to workers, and what makes them stay with a company?

#2

value companies that align with their personal interests and values.

When asked to consider factors outside of compensation and benefits, the top-ranked reasons employees work at their companies were:

#3 While baby boomers, Gen X and millennials value job stability and financial wellness most when it comes to staying with their organizations, Gen Z places value on mental health benefits.

Baby boomers (32%), Gen X (35%), and millennials (31%) were significantly more likely to say that job stability is the most important reason they work at their company than Gen Z (14%).

When asked to rank benefits (aside from higher pay), more Gen Z (23%) participants cited mental health benefits as the top benefit that would make them stay at a company long term compared to millennials (14%), Gen X (5%) and baby boomers (3%).

Baby boomers (14%), Gen X (16%) and millennials (14%) were also more likely to rank financial wellness benefits as their top reason for staying at a company compared to Gen Z (7%).

When asked to rank perks (aside from higher pay), more baby boomers (46%) reported that flexibility in work hours and scheduling would make them more likely to stay long-term at their organization than Gen X (38%), millennials (31%) and Gen Z (24%).

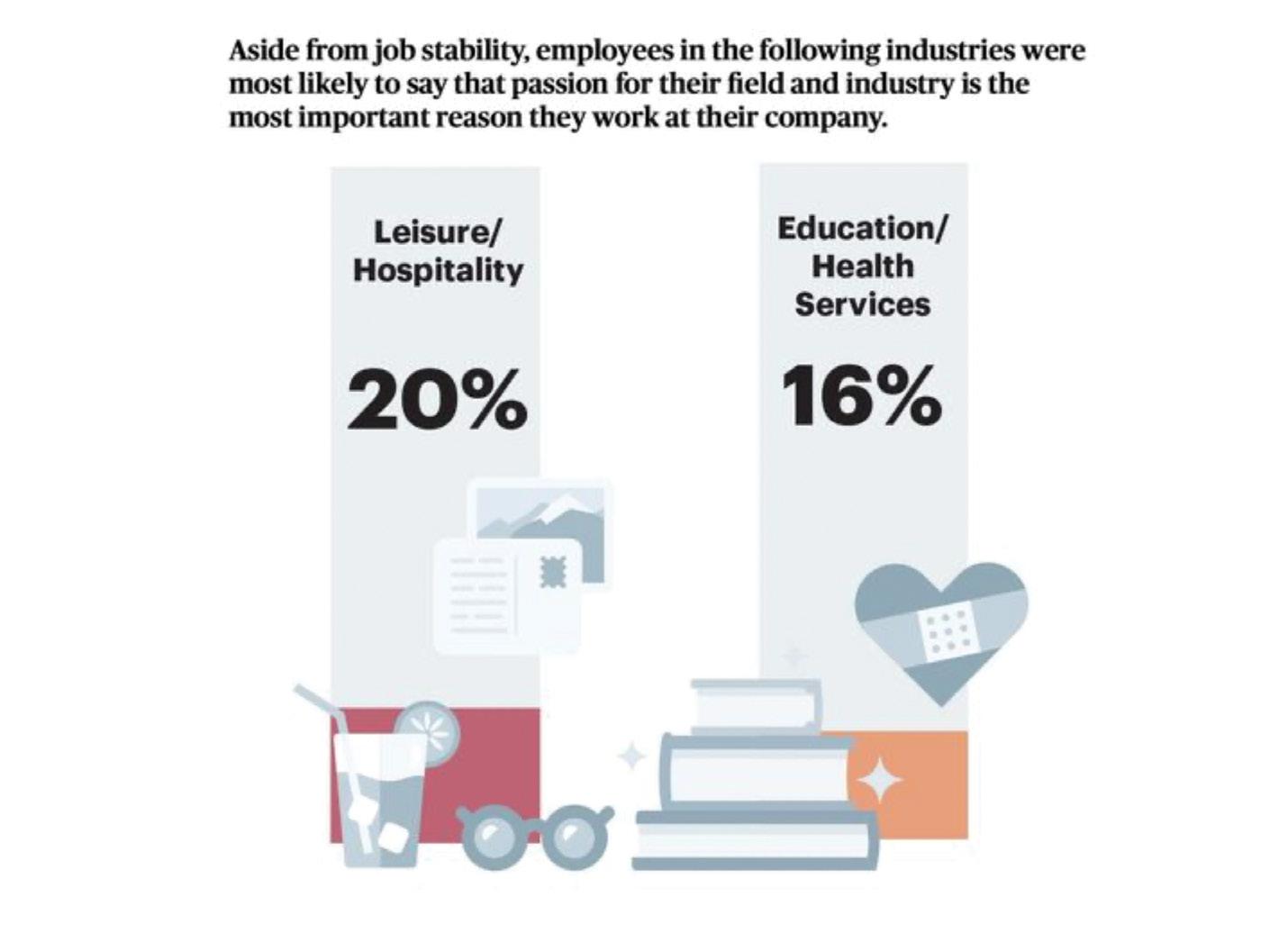

#4 Failing to consider industry preferences when evaluating employee values may lead to poor retention.

Aside from job stability, employees in leisure/hospitality (20%) and education/health services (16%) were most likely to say that passion for their field and industry is the most important reason they work at their company. They were also the two industries most likely to site meaningful work as their number one reason they work at their company (20% and 25% respectively). Manufacturing (6%); retail, trade, transportation and utilities (5%); and other services (4%) were least likely to rank passion for their field and industry as number one.

The lowest-ranked reasons that employees choose to stay with their company include: company culture and values, company brand and reputation, and company products/services. From this we could infer that employees are making career decisions based on their own goals and values and not those of their employer.

When asked about what perks would make employees more likely to stay long term with their employer, respondents were most likely to rank flexibility in hours/schedules (35%), opportunities for skills development, career advancement and internal job mobility (15%) as their top picks.

However, there were some key differences when we examined these factors based on generation, industry and working arrangements.

Those in financial services (29%) were most likely to cite greater company commitment to work-life balance as their top reason to stay at an organization, followed by flexible work schedules (20%), while more opportunities for skills development, career advancement and internal job mobility came in last for this group (3%).

And those who work in leisure/hospitality (27%), construction (24%) and professional/business services (20%) were significantly more likely to cite financial wellness benefits as the top way to encourage them to stay at their employer long term. Those who work in manufacturing (9%); education/health services (6%); and retail, trade, transportation and utilities (13%) were least likely to rank financial wellness benefits at the top.

1. Look for ways to build flexibility into work schedules. Our research shows workers highly value flexibility in when they work (working hours) rather than just where they work (remote/hybrid/on-site). Employers could start by taking regular polls to uncover employee suggestions for building schedule flexibility into all types of roles, as “flexibility” can mean different things to those in different industries. However, they should first consider what the business can accommodate and tailor the questions to what is feasible before asking an open-ended question, in case they do not have the ability to meet most requests. What flexibility looks like for a healthcare worker, for example, may be different from that of an office worker. Employers can also explore a range of technology solutions that allow workers to easily indicate their scheduling preferences, see upcoming shifts and initiate shift swaps (if applicable), or request time off.

2. Survey employees to understand what benefits are of value to various segments of workers. As we saw in our research results, different generations place higher value on different benefits, so employers need to take an employeecentric approach to total rewards and benefits. And if you have a mix of employees on-site, hybrid or fully remote, it may be worth segmenting your survey results based on location so that you can offer a benefits package that addresses the needs across your workforce. Fully remote workers, for example, might prefer monthly remote work stipends to help them pay for home internet bills, while fully on-site workers might prefer access to financial wellness classes offered in person at the worksite.

3. Invest in a range of opportunities for skill development and provide greater access to mentoring and coaching opportunities. Workers are looking to their employers for opportunities to broaden their skills and grow their careers. Employers could start by questioning how they are approaching their investment in training and

development: What is their total investment in training and development? How are they delivering this to employees? Is it aligned to their current and future strategic business priorities? Is it easily accessible and relevant?

4. Have regular check-ins or “stay interviews” with employees. Stay interviews are opportunities to learn how to better engage your employees so they want to stay with your company. Rather than just interviewing employees on their way out in an exit interview, more employers need to have “stay” conversations with employees to receive their feedback on the workplace and what would motivate them to stay. This is especially important for younger workers who, as our research shows, are more likely than older workers to have had a stay interview, yet still want to switch companies. Employers can build regular check-ins as part of the company culture and train managers to have these on a regular basis with their teams. Stay interviews help employers learn about an employee’s career aspirations, receive feedback on what makes them want to stay with the company and understand exactly what support and resources they need to succeed in their job.

This content is for educational purposes only, is not intended to provide specific legal advice, and should not be used as a substitute for the legal advice of a qualified attorney or other professional. The information may not reflect the most current legal developments, may be changed without notice and is not guaranteed to be complete, correct, or up-to-date.

Kristine K. Aeschlimann State Collection Service Inc.

Michael Ahrndt Exact Sciences Corp.

Kristen E. Andersen MGIC Investment Corp.

Taylor L. Bekkum RSM US LLP

Rajana Britton

Sylvester Brown O’Neil, Cannon, Hollman, DeJong & Laing

Tyler M. Burn

Connor P. Cappaert

Dave Copeland Bryant Products LLC

Brock A. Cornwell RSM US LLP

Sarah E. Curtis Vrakas CPAs + Advisors

Jill M. Dearing Quarles & Brady LLP

Paul M. Doering

SVA Certified Public Accountants S.C.

Janet J. Egan Egan Financial Services

David A. Eppers

Abigail Epping Wipfli LLP

Stefani J. Fallabeck Uline Inc.

Julie L. Fender

ALLETE

Jamie N. Garner Johnson Outdoors Inc.

Andrea J. Gierach Schensema CPA Inc.

Rachel J. Gorski BDO USA LLP

Raymond J. Guns

Cyprian Hasselbrook

Alex R. Horner RSM US LLP

Charles M. Houser National Guardian Life Insurance Co.

Nicole C. Hultman

Barbara C. Jewell Carthage College

Thomas P. Jostad Harry & Rose Samson Family Jewish Community Center Kelsey R. Kawula Ernst & Young LLP

Tina M. Kellicut

Ryan M. Kirkpatrick Ataco Steel Products Corp. Jerry D. Leikness

Benjamin D. Matthews Exact Sciences Corp.

Scott J. Merten Brookdale Senior Living

Marc A. Monreal Neocoil

Sara Mueller

Tyler Nehring

Nathan L. Oukrop KerberRose S.C.

Michelle Reisbig Inland Label & Marketing

Madison A. Ryan Spectrum Brands Inc.

Michael J. Schaller ABC Supply Co. Inc.

Danielle H. Scheunemann

Michael R. Schoos Northwestern Mutual Andrew J. Schuessler Donahue & Associates LLC

Lyaisan Sharapova U.S. Bank

Henry O. Stayduhar Wis-Pak Inc.

Connor J. Teske PwC

Jennifer Vander Loo Northwestern Mutual

Breana Vander Wielen

Kimberly A. Verheyde MBA

Matthew J. Weltzien Baker Tilly

Hannah K. Wensing

Brad Wiegman Cohen & Company

James P. Yorgan James P. Yorgan CPA

Ben M. Zielinski

Jidong Zhang UW–Eau Claire

If the pandemic has taught the accounting profession anything, it is that traditional accounting firms full of paper, office hours and in-person meetings are officially on the outs, and firms must start to adapt to the new era.

The days of ledger paper and in-person meetings are scarcer than ever, and tech stacks and remote work policies are now the focus for many firms. To compound the issue, the profession has started to see a talent shortage that is requiring firms to figure out how to increase capacity to maintain sanity during busy times and leverage their teams appropriately.

At the beginning of the pandemic, virtually every professional was forced home. For tax professionals, it came at the worst possible time, with the April 15 deadline looming. Despite the various extensions, firms had to pivot, if they had not already, to adopt an electronic delivery system. Client portal systems and safe file-sharing services that focus specifically on the electronic delivery of tax returns became vitally important.

But firms shouldn’t stop there. Consumers are using apps to conduct many facets of business and commerce, and humanto-human interaction is less prevalent. Even with businesses returning to more “normal” operations, customers will still want a choice in how they interact. And this includes clients’ interactions with their accounting firms.

In addition to improving the customer experience with apps, overall accounting has changed for the better. Clients who were stuck on outdated software that made seamless collaboration next to impossible were forced to make a change, or at least be more open-minded about change, so they could run their businesses remotely. The increasing prevalence of cloud-based software has opened the possibility for any accounting firm to adopt more of an advisory approach to their services and provide more value by automating lowerend services.

Any accountant who has had the opportunity to follow the #TaxTwitter community on social media will tell you that traditional firms are under fire. Various “members” have been promoting their firms’ low-hour busy season work week,

“ Traditional accounting firms full of paper, office hours and in-person meetings are officially on the outs, and firms must start to adapt to the new era.

unlimited supply of talent and absence of time tracking. To some, this all seems too good to be true. But potentially, to some extent, this is the way of the future.

Many firms perform a large majority of their services in the first 25% of the year, and this often requires a significant overtime commitment to make sure that the workload gets completed timely in such a compacted period. Successful firms will strive for creative ways to increase capacity and decrease burnout. Hiring per-diem help during crunch time is a solution many firms have used for years. This concept has expanded recently, with more professional service firms offering outsourced business-to-business services.

For accounting firms, outsourcing can take various forms. One is sending tax returns to an outsourcing provider, such as CCH, and another could be having a “team member” from anywhere helping the team as a temporary, remote employee. If there was a bottomless talent pool, there would not be an

issue; however, it is a struggle for teams to find talent. By adopting remote desktops, firms can add employees from other states. This opens the talent pool but also requires a firm to be able to work, communicate and train remotely.

The unicorn for many accountants is the day that they no longer need to keep time sheets. In an age when firms utilize realization statistics and key performance indicators to help evaluate staff members, it may be hard to eliminate the time sheet. But firms with no time sheets still have time as a component of the conversation. The time sheet is more of an internal measurement strictly to ensure that jobs are not a bottomless pit of time. Firms that do not keep time sheets can focus on making sure their staff have short-term, hard deadlines that they are required to meet to promote quick turnaround. This concept is still evolving, and traditional firms will likely not eliminate timekeeping altogether, but it is a step in the direction of the future. When the larger firms figure out how to do this and successfully evaluate team members, other firms will likely follow.

The pandemic has proved that working remotely can be successful. While less-experienced staff may need to be in the office to develop their skills and learn from management, it is possible to work remotely for extended periods of time and still get the work done. This gives employees the flexibility to not only choose their own hours, but also to choose where they work. Logging in from a vacation home or Airbnb could be just as productive as logging in from home.

While not every firm may be ready to make the leap to future-proof themselves all at once, changes can be made one step at a time. This could be as simple as testing software by putting a small batch of work through it or having a few remote-only days during the slower months to help with work-life balance. At the end of the day, the profession is changing, and those who do not adapt will slowly fade away.

Gary L. Hoff, CPA (1937 – 2022)

Gary L. Hoff, CPA, of Fitchburg, passed away on Tuesday, Sept. 20, at age 85. Hoff graduated from Lincoln High School in Wisconsin Rapids and continued his education at the University of Wisconsin–Madison. He subsequently became a CPA and worked for RSM McGladrey, retiring in 1997. Hoff was a lifetime member of the WICPA and also a member of the American Institute of Certified Public Accountants. He was an avid Wisconsin sports fan and enjoyed playing softball and bowling, as well as participating in card clubs with his neighbors and friends, traveling, reading and indulging a love of cars. Hoff is survived by his daughter, Kristine Kepke; special friend Toni Andress and her family; two sisters-in-law; and nieces and nephews.

Edwin A. Keller, CPA (1936 – 2022)

Edwin A. Keller, CPA, a lifetime member of the WICPA, passed away Thursday, Sept. 8, at age 86. He served on the WICPA board of directors from 1998 to 2000 and served on the Federal Taxation, Wisconsin Taxation and Public Policy committees in years past. Born in Pennsylvania, Keller served his country in the United States Army during the Korean War. He became a CPA and owned and operated Keller and Yoder CPA in Wisconsin Rapids for many years. He also co-owned Aniwa Creek Cranberry for a number of years. Keller was an active member of the Wisconsin Rapids Rotary Club and Christian Life Fellowship Church in Port Edwards. He is survived by his daughter, a grandson, two great-grandchildren, two brothers and a sister.

Karyn Ann Morell (1955 – 2022)

Karyn Ann Morell (nee Scheid) passed away at her home in Oregon, Wisconsin, on Tuesday, June 2. She was 67. Morell was born and raised in Fort Atkinson and graduated from Fort Atkinson High School. She attended the University of Wisconsin–Madison and obtained a Bachelor of Science degree in home economics in 1977. Morell began her career as a kindergarten teacher and later owned and operated three kindergarten and day care centers in the Madison area. She operated the centers for over 25 years. After selling the business, Morell became an accountant, working most recently for CliftonLarsonAllen (CLA) in Middleton. She is survived by her husband, David; one son; three granddaughters; and a sister-in-law.

Margaret Noon Pavelic, CPA, MST (1963 – 2022)

Margaret (Maggie) Noon Pavelic, CPA, MST, passed away Wednesday, May 25, at age 59. Pavelic graduated from the University of Wisconsin–Whitewater in 1985 with a BBA in accounting and ultimately became a CPA. She returned to school and earned a Master of Science in management and taxation from the University of Wisconsin–Milwaukee in 1992. Pavelic was employed by Fidelity Information Services (FIS) for more than 27 years, including the first 20 with Metavante Technology Services Inc., which was acquired by FIS in 2009. She was most recently senior director of IT strategy with FIS. Pavelic is survived by her husband, Peter; their two sons; both of her parents; one brother and three sisters; nieces, nephews, other relatives and many friends.

Dennis Winkler, CPA (1942 – 2022)

Dennis Winkler, CPA, passed away Friday, Sept. 9. Winkler earned his Bachelor of Business Administration degree from UW–Whitewater and became a CPA. He began his professional career with the IRS and progressed to leading the Tax Accounting Department as a partner for Schenck & Associates, formerly Shinners and Huckovski (and now CLA). After retirement, Winkler served as senior executive at a national cabinetry company. Throughout the years, he volunteered with vigor to causes he held close. He was a member of the Optimist Club for 35 years and championed youth sports — including bringing a national basketball tournament to the region. He served on stewardship committees, including church endowment, buildings and grounds, dairy breakfast and church men’s group. He volunteered for many community organization building projects, aiding in a new start for reformed prisoners. In his younger years, Dennis was a successful athlete. He enjoyed competitive and recreational basketball, football and baseball throughout his life. Winkler is survived by his wife of 52 years, Jeanne; two sons; three siblings; and many nieces, nephews, other relatives and friends.

Significant financial events often happen to us early in life: You just landed your first job at the firm you always wanted to work for; you were just awarded your first big promotion at work; or a close relative just passed away, and you are in line to inherit a portion of their estate. This all can happen while you’re trying to balance student loan payments and living expenses and also trying to save for your future by contributing to your company’s 401(k) plan. Learning what to do isn’t always obvious, and there can be a lot of pitfalls. Where do you go for help?

By Brian Ellenbecker, CFP, EA, CPWA, CIMA, CLTC

Many people, especially those on the younger side of the age spectrum, turn to social media for financial advice. TikTok and YouTube seem to have become the most prominent apps to turn to. TikTok has exploded in popularity with over 1 billion monthly active users, while

YouTube has well over 2 billion. Personal finance TikTok, more commonly referred to as #FinTok or #StockTok, seems to be the first place many younger people look. Twitter, Reddit (Wall Street Bets lives here), Facebook, Instagram and others all have their fair share of this type of advice, too.

If you find yourself in need of some financial assistance, should you turn to social media for help? The answer: It depends.

There are many knowledgeable financial experts on social media who provide good, sound advice to their followers. Unfortunately, there are also many who give incorrect advice, some of which can get you into significant trouble — financially or even with the law. Some of the most popular advice-givers on any given platform are those who lure viewers in by manipulating the platform’s algorithm with click bait or “too good to be true” headlines. The more clicks they get, the more popular they appear. Their popularity could be confused with expertise on a given topic. The notyet financially savvy could unknowingly become a victim of following bad advice.

While you can easily find bad advice on any number of financial planning topics, I tend to see some of the most egregious on the topics of cryptocurrency, taxes, real estate

investing and “can’t miss” stocks. Whether it’s the next “to the moon” stock or cryptocurrency, incorrect tax advice, the questionable application of certain real estate-related tax breaks or how an S-corp or LLC is the be-all-end-all in tax savings, there is no shortage of advice that can lead you astray. The consequences of following this advice could be severe. Most often, you might learn a lesson and suffer only a small financial loss, if at all. In extreme cases, you could experience significant financial harm. I’ve even seen advice that could result in significant legal action, with the worstcase scenario being the potential for owing significant back taxes — and/or prison time.

Not all advice is intentionally harmful. Most of these videos need to be short and to the point, so the YouTuber or TikToker doesn’t always have time to cover the nuances of a situation. While the blanket advice might be appropriate for some, it may not be for others. There can be a lot of “it depends” scenarios in financial planning. Take the lease vs. buy decision when purchasing a car. For many people, purchasing a car outright will make more financial sense. However, if someone drives only a modest number of miles, doesn’t want to worry about significant repairs popping up or wants a new vehicle every few years without worrying about trading in, the convenience of a lease may outweigh some of the financial benefits that purchasing might offer. It’s unlikely a 30-second TikTok video is going to be able to

You might also find online advice that is good in theory but in practice could be much more nuanced. A recent example I saw on TikTok teased “How to make $10,000/month at 18 years old.” Naturally, this is an appealing proposition for nearly any young adult just getting started. The idea is

I’ve even seen advice that could result in significant legal action, with the worst-case scenario being the potential for owing significant back taxes — and/or prison time.

to wholesale rental property by finding a run-down house, tracking down the owner, making an offer and putting it under contract, then finding an investor to select the contract for $10,000. Sounds great — right? Any seasoned real estate

will tell you that it could be very difficult to find a

as it’s usually a very competitive market. You typically have to put money down to sign a contract to purchase a property, so if you’re unable to sell it because you can’t find an investor, you could end up losing the deposit.

For those who have more experience dealing with these types of situations, you may roll your eyes at some of the previous examples and know it’s time to quickly move on. However, if this is your first time having to make a serious financial decision, it’s not as easy to sort through good and bad advice. Even the most experienced or savvy experts today most likely learned a lesson or two the hard way.

Like any source of advice you seek, advice on social media has its positives and negatives. It can be a great place to start, but be sure to seek out advice tailored to your personal situation from a trusted advisor before making a big decision.

Depending on your situation, sometimes parents, other family members or friends may be able to help. When making a more significant or complex financial decision, you may want to consult a trained professional, such as a financial planner, accountant, financial advisor or attorney. Spending a little time and/or money upfront to ensure you make the right decision can save you a lot of money and potential trouble down the road.

Brian Ellenbecker, CFP, EA, CPWA, CIMA, CLTC, is a financial planner with Shakespeare Wealth Management in Pewaukee. Contact him at 262-814-1600 or brian@shakespearewm.com.

Bank-A-Count Corp. offers a variety of computer, manual, and blank stock checks and accessories. Our business

are guaranteed to be compatible with your accounting software. We also offer a full range of Pre-Inked Stamps,

WICPA Connect is your exclusive members-only networking and knowledge base designed to connect you with WICPA members and resources.

• Network with peers and grow your contact list using the member directory of more than 7,000 members.

• Post questions to find out from fellow members who have the expertise or may have been in the same situation.

• Personalize your profile by adding your interests, education, experience, honors and even your photo.

• Contribute and download resources such as documents, whitepapers, articles, reports, guides and more.

• Share your knowledge and expertise by answering questions and offering your insights and ideas to fellow members.

• Customize your experience with controls for profile visibility, discussion signatures, notifications and more.

As a WICPA member, you already have a profile on WICPA Connect. Simply go to wicpa.org/connect and sign in using your existing website login information.

Connect with thousands of fellow members now at wicpa.org/connect

As employers, we tout our employee benefits package as a key component to attracting talent. In a tight labor market, many have enriched their offerings, seeking an edge in the war for talent. The overall cost to an organization is significant in dollars and time to administer. Often overlooked in the process of designing and delivering the benefit package is the employee’s ability to understand and properly utilize these powerful resources. Even if the benefit comes with a user’s manual, it is left up to the individual employee to figure out how each benefit offering fits into their household financial situation. Unfortunately, evidence suggests the typical American worker is not equipped to effectively use these generous tools.

Search online for “financial stress in America,” and you will find overwhelming support for the assertion that the overall financial well-being of the American population is downright scary. How can it be that the most affluent country on this planet is burdened with this malady? As financial professionals, you’ve endured countless hours of formal classroom training, hands-on experience and continuing professional development activities. The typical American — your workforce, to be specific — has been asked to manage your employee benefit offering, their personal retirement planning and the everyday task of balancing the household budget with little to no training. One of the biggest failures in the American educational system is not requiring personal financial management in the school curriculum. It should come as no surprise that 65% of Americans surveyed by the American Psychological Association1 say money is a significant source of stress; in fact, it is the highest stress level reported since 2015. Employers, it is your time to step up!

Why would the employer want to take on this responsibility when our educational system can’t figure it out? Simply said, because it’s good business. With reported return on investment (ROI) up to $3 for every $1 spent on wellness

and the creation of community within your organization, training employees in personal financial management makes sense. Practically speaking, your organization invests a great deal of money and resources to provide your employees with a generous suite of employment benefits. These benefit programs are complicated, prone to misuse and mismanagement in the hands of those who lack the appropriate financial acumen. While you wouldn’t put a new machine into production without properly setting up and training your workforce, why would you deliver the employee benefit package without proper setup instructions, ongoing training and user supervision? Historically, employers have relied on the respective benefit vendor to

One of the biggest failures in the American educational system is not requiring personal financial management in the school curriculum.

As an example, the optimal use of a Health Savings Account (HSA) would be to accumulate the annual contributions and invest the account for use in retirement. While this strategy provides meaningful tax benefits, it creates another pool of assets requiring ongoing investment management. An investment strategy for these assets should be made only after considering the household’s retirement savings position and investment strategy. Typically, neither your HSA provider nor your insurance benefits broker are willing to provide an employee advice that encompasses both investment accounts. A better solution would be an advisor with knowledge and expertise across the multiple disciplines impacted, such as tax planning, retiree medical expenses and investment management.

The other important consideration when evaluating your financial wellness provider is to understand if there are potential conflicts of interest. The reality is that financial wellness offerings are often developed by providers as a chance to prospect the employee population for opportunities to develop retail relationships or promote additional product sales. The consequence of this is that the employees who need the most help are often the ones who are not attractive prospects for wealth management or other financial products. Therefore, they receive little if any attention when they need

it most. Your best bet is to align with a financial wellness provider that does not sell financial products or services. To help you identify the true educators from the prospectors, ask them to agree in writing to serve as an ERISA fiduciary for the participant services they are providing.

Progressive organizations are expanding their wellness programs to include a financial component as a primary pillar. They understand the complexity of the suite of employment benefits they offer and genuinely seek to assist their employees in making prudent financial decisions. Additionally, when identifying a provider with the expertise to advise across the breadth of financial issues, they consider the potential conflicts of interest that may impair the quality of advice rendered. While quantifying the ROI is difficult, a quality financial coaching benefit can have a dramatic impact on the employee population and contribute to the sense of community employers are trying to build.

Joseph Topp is a principal and vice president – investment consulting services at Francis Investment Counsel LLC in Brookfield. Contact him at 262-781-8950 or joseph.topp@francisinvco.com.

CAMICO knows CPAs, because we are CPAs.

Created by CPAs, for CPAs, CAMICO’s guiding principle since 1986 has been to protect our policyholders through thick and thin. We are the program of choice for more than 8,700 accounting firms nationwide. Why?

CAMICO’s Professional Liability Insurance policy addresses the scope of services that CPAs provide.

Includes unlimited, no-cost access to specialists and risk management resources to help address the concerns and issues you face as a CPA.

Provides potential claim counseling and expert claim assistance from internal specialists who will help you navigate the situation with tact, knowledge and expertise.

Does your insurance program go the extra mile? Visit www.camico.com to learn more.

Harris Hauptman

Senior Account Executive

T: 800.652.1772 Ext. 6727

E: hhauptman@camico.com W: www.camico.com

Accountants Professional Liability Insurance may be underwritten by CAMICO Mutual Insurance Company or through CAMICO Insurance Services by one or more insurance company subsidiaries of W. R. Berkley Corporation. Not all products and services are available in every jurisdiction, and the precise coverage afforded by any insurer is subject to the actual terms and conditions of the policies as issued. ©CAMICO Services, Inc., dba CAMICO Insurance Services. All Rights Reserved.

The American Association for Retired People (AARP) will tell you that more than half of American workers plan to continue working in retirement. Their reasons vary, from the desire for added income to simply staying active. And then there’s the “sense of purpose” work provides. We commit much of our lives to our careers, so it’s no wonder they’re not only meaningful but also the basis for strong connections to people and purpose that we don’t want to give up. However, there’s a time when the inability to truly walk away becomes problematic — particularly for CPA firms and their partners.

That time is when a partner “retires” and then hangs on at the firm in a sometimes-reduced capacity for as long as possible. When some 60% to 80% of CPA firms are firstgeneration firms, it’s no surprise this happens with high frequency. It’s also no surprise that many firms never survive beyond the first generation for this same reason.

“In my 20-plus years of consulting with CPA firms, I estimate that 99% of all partners who actually retire from their firms continue working part time,” says Marc Rosenberg, CPA, founder and managing partner of Rosenberg Associates.

“The problem here is that retired-but-still-active partners can create situations that range from simply uncomfortable to outright risky, and the conditions can quickly become emotionally prickly on a number of fronts,” notes Bill Reeb, CPA, CITP, CGMA, CEO of Succession Institute LLC. “No matter when asked, partners always say they’ll really retire in five years.”

“But it often becomes a rolling five years,” warns Tommye E. Barie, CPA, Reeb’s colleague and executive vice president of leadership development at Succession Institute. A recently retired partner from a top 100 full-service accounting and consulting firm herself, Barie can empathize — but she also recognizes the risks: “Partners work all their lives to build successful firms. What are they going to do now? There’s often some passive-aggressive behavior that must be addressed, and every weakness a partner allowed to perpetuate is also spotlighted in succession.”

For instance, it’s common to see aging partners not being able to keep up with the demands of partner-level work, there’s less urgency for them to maintain their technical skills, and their often equally aging clients tend to offer diminishing business development opportunities.

Here’s how to get CPA firm partners who are destined to hold on until the bitter end to loosen their grip and successfully hand off their firms to the next generation.

“