GUIDE

Welcome

Whether you’re buying, selling, or refinancing, we want to be the first to welcome you and thank you for trusting WFG National Title to guide you through one of life’s most important milestones We know this can feel exciting, life-changing, and at times overwhelming - but you are not alone.

At WFG, our mission is to make the process as smooth, simple, and stress-free as possible so that you can focus on what matters most - your next chapter. Backed by a team of experts who are passionate about what they do, we are here to serve you with care, confidence, and clarity every step of the way.

This guide is packed with helpful tips, key steps, and insights to help you navigate your transaction with ease. You can rest assured knowing you are working with a team that is committed to excellence and takes pride in delivering personalized service and exceptional results.

If you have any questions throughout the process, please don’t hesitate to reach out. It is truly our pleasure to serve you.

With gratitude, Your WFG Team

Who IsWFG?

WFG is one of only six truly national title underwriters and achieved that faster than any other title underwriter in history. Why? Because we’re doing something different. We take a people-centered approach to a transaction-centered business. We’re here to make that process as simple, cost-effective, and secure as possible.

WFG has earned a financial stability rating of A’ (a prime), unsurpassed, from demotech, inc

No Institutional Debt

WFG reserves 100 months in reserves (YTD 123123)

Customer Experience

WFG carries zero institutional debt

Contract To Close

Contract

1 3 7 5 2 4 8 6

WFG receives and Reviews the Purchase & Sale Agreement and pertinent information.

WFG opens the title report and distributes it to all parties..

Contacts

WFG obtains new lender information

WFG receives and reviews the title report and distribute

Finances Payoffs

WFG requests the payoff information and request clarification of other title exceptions (if any)

WFG requests financing information from the buyer.

WFG orders the payoffs and HOA (if applicable) and any other title exemptions

Loan Documents Recording

WFG receives the loan documents

WFG finalizes statements, escrow instructions, and pertinent documents.

WFG obtains signatures and closing funds from buyer/seller

WFG forwards documents for recording and recheck. Loan documents are returned and the loan funds are requested.

Funds Close

WFG receives loan funds on new loan(s) The documents are recorded with the county. WFG disburses the funds WFG forwards the final documents to all interested parties (seller, buyer, lender, realtors, etc.).

What is Title Insurance?

The policy guarantees that if the title differs from what is represented and the insured either the owner or lender suffers a loss due to a defect, the insurer will cover the loss and related legal expenses, up to the policy amount, subject to its exceptions and exclusions.

Generally there are 2 policies issued:

the Lender’s Policy which insures the lender or the amount of the loan and the Owner’s Policy which insures the purchasers for the purchase price.

What’sInvolvedInATitleSearch?

A title search is made up of 3 separate searches:

Chain of Title - History of the ownership of the subject property

Lien and Encumbrance Search - The search identifies any existing mortgages or deeds of trust that could affect the property. The search also identifies any easements (rights to use the property for a specific purpose) or restrictive covenants that may affect how the property can be used.

Judgment + Name Search - Searches for judgment and liens against the owners’ and purchasers’ name

Tax Search- The tax search reveals the status of the taxes & assessment status

After the 3 searches have been completed, the file is reviewed by an examiner who determines:

If the Chain of Title confirms the seller's legal right to transfer the property

How Is Title Insurance Different Than Other Types Of Insurance?

Unlike other types of insurance that cover future risks, title insurance protects against past issues affecting property ownership Before issuing a policy, title insurers conduct a thorough search of public records to identify and resolve any title defects or claims Your policy is issued after closing, requires a one-time fee, and remains in effect for as long as you own the property.

The status of property taxes and any special assessments, including whether they are current or past due

If there are unsatisfied judgments, liens, or claims such as court judgments, unpaid taxes, or mechanics liens that may affect the property.

The title search reveals only issues that are part of the public record, enabling the title company to work with the seller to resolve them before issuing a title insurance policy Once any defects are addressed, the title company issues a title commitment outlining the terms of coverage After this, the buyer, seller, and lender can move forward with closing

WhydoIneed Title Insurance?

The purchase of a home is likely going to be one of the most expensive and important purchases you will ever make You and your mortgage lender want to make sure the property is indeed yours and that no individual or government entity has any right, lien, claim, or encumbrance to your property.

Get Clarity, Control, and Protection Fast

The title insurance company’s job is simple: ensure the property you're buying has a clean title, the transfer is done right, and your interests are protected without delays Title companies work with all key players buyers, sellers, lenders, developers to eliminate risk and close transactions efficiently. There are two policies: an Owner’s Policy (protects you) and a Lender’s Policy (protects the lender). Both are issued at closing for a one-time fee. Once done, you’re covered as long as you or your heirs own the property. Before issuing a policy, the title company conducts a deep dive into public records to ensure no one else has a claim on the property. They use internal databases and title “plants” to uncover and resolve issues early before they become your problem.

If a covered claim does come up later, the title company pays legal fees and covered losses. But thanks to this up-front due diligence, claims are rare. That’s how your costs stay low and your investment stays protected

Unlike other types of insurance that react to future risks, title insurance eliminates risk before you close. This proactive approach protects both you and the insurer. It’s smart, strategic, and gives you the confidence to move forward, knowing your property rights are secure

TheTitle

Commitment

The Preliminary Title Commitment contains vital information which may affect the willingness and ability of the parties to close escrow.

TheInformationInTheTitleCommitmentIncludes

The ownership of the subject property

The manner in which the current owners hold title

Matter of record which specifically affect the subject property or its owners

A legal description of the property

An informational plat map

The type of title insurance offered by the title company

Exclusion and exceptions in the Title Insurance coverage

Recorded deeds of trust Easements

Agreements

Covenants, Conditions, and Restrictions (C.C. & R.’s) Taxes

Your real estate agent should review the Title Commitment as soon as it arrives, with particular attention to certain areas:

Verify the Ownership Vesting

The name(s) on the Title Commitment should match the name(s) on the purchase contract.Sometimes the name of an unexpected owner will appear and corrective documents may be required.

Verify the Property Address

The plat map and legal description should match the address. An owner could own two properties adjacent to or across the street from each other, causing confusion in identifying the correct property

Q +ATitle

Am I required to have Title Insurance?

While it is not legally mandated, the Purchase and Sale Agreement (PSA) includes verbiage that the Seller will provide Title Insurance to the Buyer to ensure the clear transfer of title and defaults to ALTA Home Owners Policy.

What is title insurance for?

Title insurance is a protection for Home Buyers and unlike any other type of insurance, it protects against things that may come up from the past rather than from the future for things like an heir who pops up claiming interest in the property after their purchase and so much more Please see page 4 for a breakdown of coverage.

Do I pay title insurance monthly?

No. Typically, the Seller purchases a one- time premium payment of Title Insurance for the Buyer which is based off of the purchase price. The Buyer purchases a title insurance policy on their loan, which is a one-time premium (as required by their lender) payment, which is paid at closing and based off of the loan amount.

How long am I covered?

The title policy on your home will be in effect for the entirety of your ownership

The Lender’s title policy, should the loan be paid off in full, will go away but the policy on your home will remain in affect

Commonly asked questions from Buyers and Sellers on Title Insurance

What is a ‘Red Flag’ on title?

A ‘red flag’ on title is any type of cloud that has been recorded on a specific property and includes Easements, Judgements, Liens etc. and that could affect one’s future use of a property or potentially delay or halt a closing. Certain items of record can be attached to the property for the rest of time. Please consult with one of our Title Officers to go over any specific questions on red flags seen on one of our reports.

Will title ever ask me for personal information?

Possibly In some instances, the title department will require personal information in addition to your Purchase and Sale, in order to confirm or remove items off of title, as seen from the commonly requested, Statement of Identity. People who have common names like Adam Smith for example, may be required to fill out and return a Statement of Identity which includes providing a SSN#

When and where do I get my final sale proceeds?

The proceeds of your sale are disbursed upon close of escrow once the escrow holder has recieved confirmation from the county recorders pffice that the Warranty Deed and other required documents have been recorded and legal transfers has occured. The proceeds will be delivered as per your instructions to the escrow holder and /or officer at WFG

Whatis Escrow?

Escrow is a neutral third party that takes in all monies and documents in a real estate transaction, creates specific legal documents (but never gives legal advice), clears all necessary items off of title in order to transfer clear title from the Seller to the Buyer, is the ‘agent’ who actually closes the transaction, then distributes all final documents and monies as instructed by the Purchase and Sale (PSA) Escrow’s main function is to execute the instructions given within the PSA contract.

Clears Title

Obtains payoffs and release documents for underlying loans on the property

Receives funds from the buyer and/or lender

Prepares certain legal documents vesting document affidavit on seller’s behalf

Prorates insurance, taxes, rents, etc

Prepares a final statement

”Settlement Statement” for each party, indicating amounts paid in conjunction with the closing of your transaction

Forwards deed to the county for recording

Schedules signings

Once the proper documents have been recorded, the escrow agent will distribute funds to the proper parties

Title Officer, Examiner, Title Team

Conducts in-depth property research

Locates and documents all pertinent recorded documents that are attached to a specific property

Reviews recorded documents such as mortgages, liens and easements

Confirms ownership and verifies a Seller’s legal authority to covey real property

Title Underwriter

Asses risk

Define ‘exceptions’ to coverage

Prepares preliminary title reports

Creates Final Policies

Q +A Escrow

How do I open an escrow?

Generally, the real estate agent will open the escrow As soon as you execute the real estate purchase & sale agreement, the agent will place the buyer’s intial deposit, if any, in the escrow account with WFG.

What information will I have to provide?

You may be asked to complete Seller Information Form(s) and a Statement of Identity as part of the necessary paperwork Because many people have the same name, the statement of Identity is used to identify the specific person in the transaction. This information is kept confidential by WFG

What do I need to do before my appointment to sign escrow documents?

All parties signing the documents must bring proper identification to the signing appointment, such as a current driver’s license, identification card, or current passport. These items are needed to verify your identity by a Notary Public; this is a routine but necessary step for your protection.

What do I sign escrow instructions, and where do I do this?

Your escrow officer will contact you to make the appointment for you to sign your escrow instructions, Warranty Deed, and final closing papers At this time, the escrow officer will also tell you the approximate amount of sales proceeds you will recieve at closing

Commonly asked questions from Buyers and Sellers on the escrow process

How long is an escrow?

The length of an escrow is determined by the terms set forth in the real estate purchase agreement and can range from a few days to several months. The average time frame, however, is about 30-60 days.

What is the next step after I/we have signed the closing escrow papers?

After the buyer and seller have signed all the necessary documents, the escrow officer will return the buyer’s loan documents to the lender for final review. This usually occurs anywhere from 24 hours to a couple of days after the execution of said documents. After the review is completed the lender is ready to fund the buyer’s loan, they will notify the escrow officer, who in turn, will notify all parties

What is an “escrow closing”?

An escrow closing marks the official transfer of title from seller to buyer Once all escrow conditions are met and funds are received, key documents like the Warranty Deed and Deed of Trust are recorded usually within one business day signifying the “close of escrow” The escrow officer then finalizes the transaction by disbursing all funds and notifying the parties of the closing date

When and where do I get my final sale proceeds?

The proceeds of your sale are disbursed upon close of escrow once the escrow holder has recieved confirmation from the county recorders pffice that the Warranty Deed and other required documents have been recorded and legal transfers has occured. The proceeds will be delivered as per your instructions to the escrow holder and /or officer at WFG

EarnestMo

Deposit Options

WFG will be the neutral third party assisting you, your lender, and your real estate agent through closing. Please review your earnest money deposit options below.

Check

Your check can be dro Title locations. FedEx: If you need a shipping label, please contact your escrow closing team.

*Please Note: Personal checks are only accepted up to 11 business days prior to the closing date Checks should be made payable to “WFG National Title” and please note escrow order number when available

Wire Transfer

Should you choose to wire your earnest money, your escrow closing team will email you a secure link and call you to provide you with the PIN code to access the wire instructions.

ZOCCAM

Download the ZOCCAM app, which allows you to deposit earnest money from your mobile device. Available on Apple iOS & Android

WARNING! FRAUD ALERT:

BORROWERS, BUYERS AND SELLERS ARE TARGETS FOR WIRE FRAUD. TO AVOID BECOMING A VICTIM, NEVER TRUST WIRING INSTRUCTIONS OR CHANGES TO WIRING

INSTRUCTIONS SENT VIA EMAIL. ALWAYS CALL YOUR WFG ESCROW OFFICER AT A KNOWN PHONE NUMBER TO CONFIRM WIRING INSTRUCTIONS PRIOR TO WIRING ANY FUNDS.

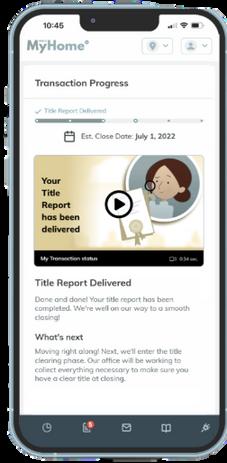

MyHome

Simplifying your journey to a

Successful Closing

WFG’s MyHome® provides full transparency, real-time updates, and postclosing home information in a secure web environment. It is fully responsive, mobile-first and built with YOU in mind.

Sign up for an account at https://myhome.wfgtitle.com today!

Click Register for MyHome® account on a MyHome email notification or go directly to: https://myhome. wfgtitle.com

Complete a brief registration form

Use your email address on file with WFG, and have your escrow number handy.

Confirm email for immediate access.

Instant access to essential file details

Contact information for all parties involved

In-depth Knowledge Center

Timeline view of the entire escrow process

Real-time updates via text, email, or personalized dashboard

Complete forms needed for your transaction

Upload documents to your escrow team

Explainer videos for each milestone

Access on desktop, tablet or mobile

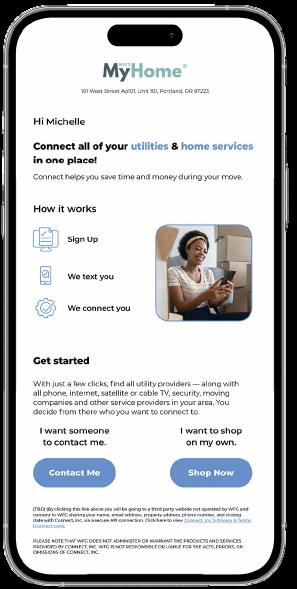

MyHome Move

Take the stress out of moving with a single point of information for utility and home service needs

WFG’s MyHome has partnered with Connect to provide buyers with a personal concierge that will get them connected with the top-rated utilities and services.

A personalized invitation will come from WFG’s MtHome after the title report is completed This complimentary service is totally optional.

Get help connecting:

Your Personal Home Services

Concierge

How it works

Sign up for the MyHome Move concierge service.

Receive text message from personal concierge with top-rated utilities and services for specific location.

Review and confirm chosen providers and get connected.

Understand

Settlement Statement

At WFG National Title, we’re committed to making your closing process as seamless and transparent as possible Your settlement statement provides a detailed breakdown of all debits and credits for both the buyer and seller, based on the terms outlined in the Purchase and Sale Agreement and your lender’s instructions (if applicable) Your WFG escrow officer ensures these figures are accurate and in balance for a successful closing.

When a loan is involved, both parties will receive a settlement statement and a federally required Closing Disclosure, as outlined by the Consumer Financial Protection Bureau (CFPB)

At WFG, we’re here to guide you every step of the way. From start to finish, our team is committed to providing clarity, communication, and confidence in your transaction

Closing Disclosure

The Closing Disclosure outlines all final fees and costs related to your home purchase or sale Buyers receive it from their lender at least three business days before signing

Sellers receive a version from their escrow officer that outlines the final proceeds and expenses. This is one of the most important documents in your transaction. Take time to carefully review the details and reach out to your WFG Escrow Officer with any questions

Net Proceeds

This is the amount the seller receives after all closing costs, mortgage payoffs, commissions, and other fees are deducted. It’s different from the total equity in the home and reflects the final amount disbursed at closing.

Right of Rescission

In refinance transactions (on a primary residence only), federal law allows the borrower to cancel the transaction within three business days after signing This is known as the Right of Rescission

Closing Costs

These are fees paid by both the buyer & seller in a real estate transaction. Common closing costs include:

Loan-related fees

Escrow and title services

Government taxes & recording fees

Homeowner’s insurance & HOA dues

Real estate agent commissions

e's a breakdown of common settlement s and who typically pays them:

ncial Consideration

ws the final purchase price and any agreed its. Also includes the earnest money osit and new loan amount, if applicable

ations/Adjustments

ers shared costs like property taxes or HOA s that are split between buyer and seller ed on the closing date

A Charges

ers fees due to the Homeowners ciation, like move-in/move-out fees, sfer fees, or prepaid dues

mmissions

ments made to real estate agents as ned in the listing or purchase agreements.

e

& Escrow Charges

seller usually pays for the owner's title rance If there’s a loan, the buyer pays for ender’s title policy. Escrow fees are split ed on the sale price

ernment Charges

udes taxes and fees like real estate excise typically paid by the seller) and document rding fees (often paid by the buyer)

w Loan Charges

tied to the buyer's loan, such as appraisal, it check, origination fee, insurance, and rves These vary by loan type

offs

e seller has existing loans or liens, they will aid off through closing.

cellaneous

ers any extra costs not listed above like y estimates, mobile notary fees, or other ue charges.

WhoTypicallyPays For

What?

Escrow fee, one half

Work orders, such as termite inspection or home repairs

Home warranty

Real estate excise tax

Loan costs required under the FHA/VA provisions of contract

Listing Agent’s Commissions

Selling Agent’s Commissions

If agreed upon within the listing agreement or within a buyer’s agency agreement

Owner’s title insurance premium

Payoff of all loans in Seller’s name (or existing loan balance if being assumed by buyer)

Statement fees, reconveyance fees (including associated recording charges), and any loan prepayment penalties

Encumbrances (such as judgments and tax liens) against the seller

Tax pro-ration (for any unpaid taxes up to time of transfer of title)

Delinquent taxes

Unpaid homeowner’s dues

Assessments or bonds

Notary & Courier fees (if applicable)

Lender’s title insurance premium (if applicable)

Escrow fee, one half

Inspection fees

Home warranty

Notary fees (if applicable)

Courier fees (if applicable)

Selling Agent’s Commissions if agreed upon within the listing agreement or within a buyer’s agency agreement

Recording charges for all documents in buyer’s name.

Tax pro-ration (for any taxes from time of transfer of title to end of the tax payment period)

All new loan charges (except for those required by lender for seller to pay)

Hazard insurance premium for first year

Interest on new loan from date of funding to 30 days prior to first payment

Document preparation (if applicable)

Preparingfor

Avoid Delays In Closing Checklist:

Return forms as requested by Title & Escrow quickly

Common form types requested:

Statement of Identity Formation Documents Trust

Property Settlement Agreement (if applicable)

Community property agreement (if applicable)

Will

Complete opening disclosure forms through our secure, MyHome portal, quickly

Notify your Escrow team of any travel plans during your transaction

Prepare to keep your availability flexible approximately 10 days before closing for your upcoming signing

Notify your Escrow team if you will be out of the country during your transaction. Depending on the circumstances, its possible that a client may need to schedule their signing in an Embassy which can lead to delays

Check to see if you qualify to use our inhouse Remote Online Notary (RON) signing option while overseas!

Open title for listings at least two weeks before going on market to ensure:

You’re in contact with all of the correct sellers that will need to sign

There is nothing on title that will keep you from closing the transaction

Closing Day!

Required At Closing:

Valid drivers license or other state or government photo identification.

For Funds to Close, please contact your escrow team for the amount & how you can submit the funds

Does Escrow...

Close utility Accounts or transfer services like, water, sewer/garbage, cable or electricity?

No! Escrow will pay off lienable, prorated utilities, as instructed by the utility company on behalf of the Sellers through closing (generally with funds from Net Proceeds however, it is the Seller’s responsibility to make sure that the account itself is closed and the Buyer’s responsibility to open their own account with the Utility Companies.

Wire Fraud

PROTECT YOUR MONEY WHEN BUYING A HOME Checklist

Every day, hackers try to steal money by emailing fake wire instructions Criminals will use a similar email address and steal a logo and other information to make it look like the email came from your real estate agent or title company. You can protect yourself and your money by following the steps below

WFG will never change escrow instructions through a transaction or email wiring instructions to you nor change WFG account information after it’s been provided to you by our staff

Call, don’t email. Confirm your wiring instructions by phone using a known number before transferring funds

Don’t send sensitive financial information via email.

Keep your email account clean, remove any stale messages. Hackers can watch your business patterns and use this information against you

Call your title company or real estate agent within four to eight hours to confirm they have received your money

Ask your bank to confirm the name on the account before sending a wire

Escrow

Funds

A payoff is the receipt of funds from the buyer and the payment of the seller’s obligations in conjunction with a real estate transaction The payoff function is performed by the title company.

WFG must be in receipt of “Good Funds” prior to the disbursement on a payoff. Types of “Good Funds” include:

Funds wired to a WFG escrow/sub-escrow account

A cashier’s, teller’s or certified check (next-day availability after deposit)

Local check (fund availability 2 days after deposit) Out-of-area (check availability 5 days after the deposit)

Payoff Fees

Fees for handling a payoff vary slightly from county to county The fee is strictly a processing charge and does not cover a special handling charges or potential shortages

Demands

Demands must include specific payoff information concerning the particular property and must be signed It is the responsibility of the escrow company to order and provide all necessary demands, including any updates or changes, in a timely manner

Shortages

WFG will require from the escrow account the necessary funds to cover the outstanding obligations Any shortages must be received prior to payoff

Prefigures

Estimated payoff figures are calculated and given prior to closing upon request. These figures are only valid through the date given and are based on the information provided at the time.

Refunds

Any overpayments of demands will be refunded to the escrow account upon receipt from the lender. Refunds typically take two to six weeks to process

Wire Transfers

Funds can be wired into or out of Escrow or Title trust account(s)

Disbursement Checks

Checks are delivered locally to lending institutions by a contracted messenger service. Checks to individuals and out-of-area lenders are typically sent via an overnight delivery company

Signing+ More

Traveling

If you’re an out-of-state buyer or seller, or traveling out of the area, please notify your escrow officer as soon as possible to ensure there is adequate time to prepare and deliver the necessary documents.

Identification

The buyer needs to bring 2 forms of current photo ID to sign notarized closing documents.

Disclosures & Contingencies

As part of the home selling process, sellers are legally required to complete a Property Disclosure Statement This informs the buyer of any known conditions or material facts about the property

Your real estate agent or escrow officer can help guide you through this process

Keep in mind: Most real estate contracts include several contingency dates that must be met in a timely manner, such as:

Buyer’s loan approval

Preliminary Title Report approval

Structural inspections

Pest control clearances

Staying closely connected with your real estate agent helps ensure these important deadlines are met.

After the Buyer’s Loan Is Approved

Once the buyer’s loan is officially approved and loan documents are sent to escrow, the process moves quickly Your escrow officer will:

Contact the buyer to schedule a signing appointment

Collect final closing funds

Coordinate with the seller to gather all required documentation, including the executed Grant Deed

If the Grant Deed hasn’t been submitted yet, the escrow officer will ensure it is included before moving forward

What Does “Close of Escrow” Mean?

Close of Escrow is the legal transfer of ownership from the seller to the buyer, officially completing the transaction.

Here’s what happens next:

The Warranty Deed and Deed of Trust are typically recorded within one business day of receiving loan funds

A Final Settlement Statement is provided

The seller’s net proceeds become available the same day the sale is finalized

Sellers can choose to receive their proceeds via company check or wire transfer.

Confidence Through Every Step

At WFG, we’re committed to transparency, clarity, and exceptional service at every stage of your transaction Whether you’re buying or selling, you can rely on us for a smooth closing experience.

Remote Online

Notarization

(R.O.N.)

CONVENIENCE | COMPLIANCE | CONFIDENCE

What is R.O.N.?

Remote Online Notarization allows signers to complete the notarization process using secure audio-visual technology over the internet without needing to be physically present in the same room as the notary

To perform RON, the notary must hold both a standard electronic notary endorsement and a specific R.O.N. endorsement

Is R.O.N. the same as electronic notarization?

Not quite. While electronic notarization involves digital documents, it still requires inperson interaction with the notary. R.O.N., however, allows signers to appear remotely using a secure virtual platform. It’s important to note: All elements of a traditional notarization still apply during R.O.N.

Note: Not all lenders accept RON Please confirm with your lender before proceeding

Requirements for a R.O.N. Certified Notary

The notary must:

Be in a state where R.O.N. is legally permitted

Hold an active notarial commission

Carry both an electronic notary endorsement and a R.O.N. endorsement (In Washington State, both are required.)

How Signers Can

Prepare for a R.O.N. Appointment

To participate, signers will need:

A desktop, laptop, tablet, or computer

The latest version of Google Chrome

A webcam

A headset (recommended)

A valid government-issued ID (driver’s license or passport)

A smartphone with camera and email or text access

What Happens Next?

Signers will complete Knowledge-Based Authentication (KBA) before their session begins They’ll be asked 5 personalized questions and must answer at least 4 correctly within 2 minutes (with two attempts allowed) If authentication fails, R.O.N. cannot proceed.

We’re committed to providing safe, convenient, and compliant options for all your closing needs, no matter where life takes you

Moving Checklist

8

8 Weeks Before You Move

Inventory Sheets: Create an inventory sheet of all your belongings which need to be moved

Research Moving Options: You’ll need to decide if yours is a do-it-yourself move or if you’ll be using a moving company

Request Moving Quote: Solicit moving quotes from as many moving companies and movers as possible There can be a large difference between rates and services within moving companies.

Discard Unnecessary Items: Moving is a great time for ridding yourself of unnecessary items Have a yard sale or donate unnecessary items to charity

Packing Material: Gather moving boxes and packing material for your move. Contact Insurance Companies: You’ll need to contact your insurance agent to cancel/transfer your insurance policy.

4

4 Weeks Before You Move

Start Packing: Begin packing all things destined for your new location.

Obtain Your Medical Records: Contact your doctor, physician, dentist and other medical specialists who may currently be retaining any of your family’s medical records. Obtain these records or make plans for them to be delivered to your new. Medical facilities if changing: Security is critical of personal records

Note Food Inventory Levels: Check your cupboards, refrigerator and freezer. Use up as much of your perishable food as possible

Small Engines: Service small engines for your move by extracting gas and oil from the machines. This will reduce that chance to catch fire during your move.

Protect Jewelry and Valuables: Transfer your jewelry and valuables to a safety deposit box; you don’t want them to be lost or stolen during your move.

Borrowed and Rented Items: Return items that you may have borrowed or rented. Collect items borrowed to others.

1 Weeks Before You Move

Your Change of Address: Change your address with the USPS, DMV, Financial Institutions, Utilities, Government Offices, Health Care Service

Providers, Memberships, Subscriptions and Insurance Provisions

Bank Accounts: Transfer or close bank accounts if changing banks. Make sure to have a money order for paying the moving company.

Service Automobiles: If automobiles are to be driven long distance, you’ll want to have them serviced so you have a trouble-free drive.

Cancel Services: Notify any remaining service providers (newspapers, lawn services, etc.) of your move.

Travel Items: Set aside all items you’ll need while traveling. Make sure these are not packed on the moving truck

Contact Utility Companies: Set utility turnoff date, seek refunds and deposits and notify them of your new address

Moving Day

Plan Your Itinerary: Make plans to spend the entire day at the house or at least until the movers are on their way Someone will need to be around to make decisions. Make plans for kids and pets to be at a sitters for the day.

Review the House: Once the house is empty, check the entire house (closets, attic, basement, etc) to ensure no items are left or no home issues exist

Double Check With Your Mover: Ensure the mover has the new property address and all of your most recent contact information, should they have any questions during your move.

Vacate Your Home: Make sure utilities are off, doors and windows are locked and notify your real estate agent you’ve vacated the property

Questions To Ask: Where is the garage door opener? Where are the keys to the house, mailbox and other lockable area? Did you retrieve all keys from neighbors and friends?

ChangeOf Address Checklist

Government

US Post Office

Department of Motor Vehicles

IRS

Passport Office

Veteran Affairs

Unemployment Office

(If you are currently receiving unemployment benefits)

Financials

Banks and Credit Unions

Credit Card Companies

Store Credit Cards

Lenders

Insurance Companies

Retirement

Investments

Online Bill Payer

Paypal

Health

Physician

Pharmacies

Other

Friends and Family

Employers

Service Provider

Childcare

Housecleaning Services

Delivery Services

Lawn Care Services

Veterinarian

Pool Service

Subscriptions

Newspapers

Magazine

Movie Subscriptions

Book or Music Clubs

Memberships

Health Clubs

Membership Clubs (AAA or similar)

Community Groups (PTA, Neighborhood Associations, Civic Clubs)

Children’s Extracurricular Activities

(Dance Classes, Music Lesson, Sports Clubs)

Utilities

Electric

NW Natural Gas

Water District

Sewer District

Garbage Provider

Cable/Satellite

Fuel (Propane)

Phone Services

Internet

Helpful Online Resources ForYour Move

Mail Forwarding

USPS Online – wwwuspscom

Quickly and securely update your address through the United States Postal Service. Secure – ID verification required; $1 fee

Convenient – Avoid a trip to the post office

Instant Confirmation emailed

A credit or debit card is required to complete the form online Prefer paper? Visit any post office and request a Mover’s Guide packet to complete and return manually

Driver’s License + Vehicle Registration

WA Department of Licensing www.dol.wa.gov

You have 10 days to update your driver’s license after moving No fee to update your address (fee applies for a reissued license) Updating your license does not update your vehicle registration

Voter Registration + Election Information

Snohomish County

3000 Rockefeller Ave, 1st Floor, Admin Bldg W Everett, WA 98201

Phone: 425 388 3444

Fax: 425.259.2777

Email: elections@snoco.org wwwsnohomishcountywagov

King County 919 SW Grady Way Suite 100

Renton, WA 98057

Phone: 206.296.8683

Fax: 206 2960108

Email: elections@kingcounty.gov www.kingcounty.gov

Pierce County 2501 S 35th St , Suite C Tacoma, WA 98409

Phone: 253798 8683

Email: pcelections@copiercewaus www.piercecountywa.gov

RealEstate Terminology

Addendum: A list or other material added to a document, letter, contractual agreement, escrow instructions, etc.

Agency: Agency is the relationship that occurs when a Broker represents a Buyer or Seller in a real estate transaction An Agent has fiduciary duties to the Client, such as confidentiality, accounting, reasonable care, loyalty, obedience, advocacy, and disclosure.

Annual Percentage Rate: The yearly interest percentage of a loan, as expressed by the actual rate of interest paid The APR is disclosed as a requirement of federal truth-in-lending statutes

Appraisal: A valuation of property by the estimate of an appraiser. The appraiser can use any number of valuation methods to determine the appropriate value, including the current market value of similar properties, quality of property, and valuation models

As Is: In an “AS IS” contract, the Seller is saying the property will be sold in its existing physical condition and the Buyer is taking the property’s condition into account when making an offer The clause does not negate a Seller’s common law duty to disclose known latent material defects

Assumption: Agreement by a Buyer to assume the liability under an existing note secured by a mortgage or deed of trust The Lender usually must approve the new debtor in order to release the existing debtor (usually the Seller) from liability

Beneficiary: As used in a trust deed, the Lender is designated as the beneficiary, i.e., obtains the benefit of the security

Buyer-Broker Agreement: An employment agreement between a Buyer and a Broker that employs the Broker to locate property and negotiate terms and conditions acceptable to the Buyer for the purchase of a home. The Buyer usually agrees to work exclusively with the Broker and the compensation the Buyer is obligated to pay is often offset by any compensation the Broker receives from the Listing Agent

Close of Escrow: The date that title passes from Seller to Buyer and documents are recorded

Chain of Title: The chronological order of conveyance of a parcel of land from the original Owner (usually the government) to the present Owner

Closing Disclosure: Provided to the borrower at least three business days before he or she becomes contractually obligated for the loan (generally when final loan documents are signed) Like the Loan Estimate, the Closing Disclosure lists information about the loan terms, monthly payments and closing costs However, these are not estimates, but the actual and final terms of the loan. The two forms work together so borrowers can easily compare them and ensure they are getting the terms promised to them The Closing Disclosure is required to be used if the loan is subject to the requirements of the Final Rule of the CFPB, effective Oct 3, 2015

Closing Statement: An all-inclusive summary itemizing debits and credits to each party, Seller and Buyer, and presented in the form of a balance sheet

Cloud on Title: An invalid encumbrance on real property, which if valid, would affect the rights of the Owner. The cloud may be removed by quitclaim deed, or, if necessary, by court action.

Comparable Sales: Sales of properties used as comparisons to determine the value of a specific property

Conditions, Covenants & Restrictions (CC&Rs):

CC&Rs are recorded against the home and are an enforceable contract The CC&Rs empower the homeowner’s association, if there is one, to control certain aspects of the home A Homebuyer should always carefully read the CC&Rs (and any other association documents) because the Buyer will be obligated to comply with all the rules and restrictions.

Contract: A contract for the sale of a home must be signed and in writing to be enforceable

RealEstate Terminology

Contingency: A contingency is a clause in a contract that requires the completion of a certain act before the parties are obliged to perform their contractual obligations The most common contingencies are financing, acceptable property condition, and condition of title

Conveyance: Transfer of title to a property Includes most instruments by which an interest in real estate is created, mortgaged, or assigned

Counteroffer: An offer (instead of acceptance) in response to an offer For example: A offers to buy B’s house for X dollars; B, in response, offers to sell to A at a higher price B’s offer to A is a counteroffer

Deed: Written instrument by which the ownership of land is transferred from one person to another

Deed of Trust: An instrument used in many states in place of a mortgage. Property is transferred to a trustee by the Borrower (Trustor), in favor of the Lender (Beneficiary) and reconveyed upon payment in full.

Deposit: Money given by the Buyer with an offer to purchase Shows good faith

Disclosure: To make something known All disclosures should be in writing when dealing with real estate interests and real property

Due on Sale Clause: An acceleration clause that requires full payment of a mortgage or deed of trust balance when the secured property changes ownership

Easement: The right to use another person’s land for a specified purpose, such as for public utilities, ingress and egress, etc

Escrow: A procedure in which a third party acts as a stakeholder for both the Buyer and the Seller, carrying out both parties’ instructions and assuming responsibility for handling all the paperwork and distribution of funds

Escrow Account: Account held by Lender for payment of taxes, homeowner’s insurance, and other periodic debts against real property required to protect their security interest

Fair Market Value: Price that probably would be negotiated between a willing Seller and a willing Buyer in a reasonable time

Fixtures and Personal Property: A fixture is an item that was once personal property, but is affixed to the home in such a manner as to become part of the home itself A Buyer purchases the fixtures affixed to the home, but personal property is not part of the transaction unless it is listed in the contract The contract should specifically identify all items that are to be conveyed in the transaction

Homeowners’ Association (HOA): An association of people who own real property in a given area, formed for the purpose of improving or maintaining the quality of the area. Also an association formed by the builder of condominiums or planned developments, and required by statute in some states. The builder’s participation as well as the duties of the association is controlled by statute.

Homeowner’s Insurance: Property insurance protecting against loss caused by fire, some natural causes, vandalism, etc, depending upon the terms of the policy

Homestead Exemption: A homestead exemption protects equity in a home in case of bankruptcy The homestead exemption is usually automatic, meaning you do not have to file a homestead declaration to claim it in bankruptcy

Lien: An encumbrance against a property for the repayment of a debt Examples include judgments, taxes, mortgages, and deeds of trust

Listing Agreement: An employment contract between a Seller and a Listing Broker, that establishes the duties of the Broker and the terms under which the Broker will earn a commission

RealEstate Terminology

Loan Estimate: Usually provided to the borrower within three business days of applying for a mortgage loan It includes the terms of the loan, the projected payments, and an estimate of the closing costs. Since the Loan Estimate is uniform from Lender to Lender, it can be used to compare and shop for the best mortgage to fit a borrower’s situation. The form is required to be used if the loan is subject to the requirements of the Final Rule of the CFPB, effective Oct. 3, 2015.

Mortgage: The instrument by which real estate is pledged as security for the repayment of a loan Mortgage Insurance: Insurance written by an independent mortgage insurance company protecting the Lender against loss incurred by a mortgage default, thus enabling the Lender to lend a higher percentage of the sales price

Multiple Listing Service (MLS): The MLS is a repository of information on homes for sale The MLS is also a means by which Broker participants make offers of compensation to other Broker participants for bringing a ready, willing, and able Buyer for the property

PITI: Payment that combines the Principal, Interest, Taxes, and Insurance

Points: An amount equal to 1 percent of the mortgage loan Lenders can charge a point as an origination fee to cover the cost of making the loan. A discount point can be paid by the Borrower to lower the interest rate on the loan.

Power of Attorney: An authority by which one person (principal) enables another (attorney) to act for him or her.

Purchase Agreement: An agreement between a Buyer and Seller of real property, setting forth the price and terms of the sale

Quitclaim Deed: A Deed operating a release; intended to pass any title, interest, or claim that the Grantor may have in the property, but not containing any warranty of a valid interest or title by the Grantor

Recording: Filing documents affecting real property with the County Recorder as a matter of public record

Right of First Refusal: A first right of refusal is a provision in a contract that requires the Owner of a home to give another party (usually a tenant) the first opportunity to purchase or lease the property before it is offered for sale to another.

Subdivision: The division of one parcel of land into smaller parcels (lots) created by filing a subdivision plat with the governmental authority (city or county) and receiving approval from the governmental authority

Title: The evidence one has of right to possession of land

Title Commitment: The title commitment reflects the condition of the title to the property The commitment tells the Buyer whether the taxes and assessments are paid, whether there are deed restrictions, liens, and easements on the property, and what the requirements are to the issuance of title insurance on the property

Title Insurance: There are generally two title insurance policies issued at close of escrow, Owner’s Title Insurance and the Lender’s Title Insurance The Owner’s policy is an insurance policy that protects the homeowner from defects in the title to the home, such as a forged deed. The Lender’s policy protects the Lender against the same sort of title defects until the loan is paid.

Warranty Deed: A deed that conveys fee title to real property from the Grantor (usually the Seller) to the Grantee (usually the Buyer).

1031 Exchange: A tax-deferred or 1031 exchange is a transaction involving the transfer of investment or income property and the receipt of like-kind property that will be used as income or investment property When certain criteria are met, as set forth in section 1031 of the Internal Revenue Code, the income taxes on any gain realized from the sale of the relinquished property are deferred

Bellevue

10500 NE 8th St.

Suite 950

Bellevue, WA 98004

Phone: 425-453-8880

Fax: 425-453-8881

Gig Harbor

2727 Hollycroft St Suite 240

Gig Harbor, WA 98335

Phone: 253-851-3300

Fax: 253-851-3310

Olympia

724 Columbia Street NW Suite 120

Olympia, WA 98501

Phone: 360-314-0303

Fax: 253-799-8541

Seattle

617 Eastlake Ave E

Suite 300

Seattle, WA 98109

Phone: 206-729-7000

Fax: 206-729-7001

Everett

2707 Colby Ave. Suite 704

Everett, WA 98201

Phone: 425-467-8840

Fax: 425-317-8885

Kent

20829 72nd Ave S

Suite 110

Kent, WA 98032

Phone: 206-223-9130

Fax: 206-223-9131

Puyallup

424 29th St NE

Suite A

Puyallup, WA 98372

Phone: 253-445-2140

Fax: 253-445-5441

Tacoma 617 Eastlake Ave E

Suite 300

Seattle, WA 98109

Phone: 206-729-7000

Fax: 206-729-7001