page 12 WISCONSIN

JUNE | JULY 2023 • VOL. 29 NO. 2 | WFBF.COM

FARM BUREAU FEDERATION®'S

RuralRoute

FARM BILL

Understand this major piece of legislation.

EXTENSION CONNECTION

Learn more about what Extension has to offer.

RIPPLEY FAMILY

This farm family is woven into the agricultural community in many ways.

SUSTAINABILITY AT HOME

Simple swaps around your house can have a big impact.

RECIPES

Gather around the table with friends or family to enjoy these recipes.

MEMBER BENEFITS

You membership doesn’t cost, it pays.

VOICES

Columns from Krentz and Duvall.

HEROES OF HOPE

Meet local leaders who make a difference in their communities.

AG IN THE CLASSROOM

Winners named in this annual contest for fourth- and fifth-grade students.

PICTURE THIS

Beautiful imagery from around the state provided by our members.

RURAL

Teach children about smart money management.

3 wfbf.com JUNE | JULY 2023 contents vol. 29 no. 3

MUTUAL

6 10 23 32 26 19 17 12 36 39 43 COVER PHOTO BY CASSIE SONNENTAG stay connected WIFarmBureau ONLINE LIBRARY Read our previous issues at wfbf.com/read. BRITTANY ZENNER 12 39 19 32

Iwas recently on an airplane. If you’ve been on one, you know what I mean when the ride up and down reminds you just how small you are. While it’s a great reminder of just how small our piece of the world is, it also forces us to rethink what we do with our limited voice.

The great thing about Farm Bureau is the ability to combine your voice with others to make a larger impact. Farm Bureau is a network of people from all over the country. We all have different stories and backgrounds but what connects us, is that we all eat and we all want to know more about the food we grow and consume. Whether it’s community events, promotion of healthy eating or policy to address farm and food issues, together we are truly stronger.

This issue of Rural Route showcases Farm Bureau members who are using their voices and Farm Bureau membership to make a big impact. It’s heartwarming to see our county Farm Bureau members checking in on their

friends and fellow farmers as part of the #FarmNeighborsCare campaign. Planting season can be stressful for farmers. A snack, water or a quick chat is a simple gesture that can make a difference in someone’s day.

Our featured Farm Bureau family in this issue is a great example of what farm families are made of: hard work and a lot of helping hands. Their mindset of giving back to their community and finding their own niches to help agriculture shine is encouraging.

Just like I had to trust the pilot and other team members to get me safely to my destination, we have to trust that farmers are doing all they can to make sure our food supply is safe, bountiful, nutritious and delicious. I don’t know about you, but I appreciate that greatly.

You’ll get to know a little bit about the farmers who feed us through the pages of Rural Route and as you carry on with your summer, enjoying many of the things they provide, I hope we can all take a moment to genuinely thank them for their labors.

No matter our role, whether we grow the food or eat it, appreciating the process and being a small part of the larger community is important.

Next time you are riding in a plane and are reminded of how small you are, know that you are just a small part of something much bigger.

Thanks for reading,

Amy Eckelberg Rural Route Editor Wisconsin Farm Bureau Federation

Editor

Amy Eckelberg - 608.828.5706

Designer

Lynn Siekmann - 608.828.5707

Contributors

Cassie Sonnentag - 608.828.5711

Rachel Gerbitz - 608.828.5709

Address of Publication

Wisconsin Farm Bureau Federation PO Box 5550

1241 John Q. Hammons Dr. Madison, WI 53705-0550

Postmaster: Send address changes to Wisconsin Farm Bureau Federation PO Box 5550 Madison, WI 53705-0550

Contact Information

608.836.5575

800.261.FARM (3276) wfbf.com info@wfbf.com

WFBF Board of Directors

Kevin Krentz, Berlin (President)

Joe Bragger, Independence (Vice President)

Dave Daniels, Union Grove

Arch Morton Jr., Janesville

Robert Nigh, Viroqua

Rosie Lisowe, Chilton

Brian Preder, Weyauwega

Ryan Klussendorf, Medford

Brad Olson, Frederic

Brenda Dowiasch, Augusta (Promotion and Education Committee Chair) Savannah Brown, Black River Falls (YFA Committee Chair)

Wisconsin Farm Bureau Federation’s Rural Route (ISSN 1082-1368) (USPS 39940), the official publication of the Wisconsin Farm Bureau Federation, is published six times per year in February|March, April|May, June|July, August|September, October|November and December|January. Subscription of $5 is included in Farm Bureau dues. Periodical postage is paid at Madison, Wisconsin. All rights reserved. No portion of this magazine may be reproduced in whole or part without written consent.

For advertising rates and information:

Wisconsin accounts contact Slack Attack at 608.222.7630 or barbara@slackattack.com.

National accounts contact Casey McNeal at 800.798.2691 ext. 334 or casey@iafalls.com.

For general inquiries, contact Amy Eckelberg at 608.828.5706 or aeckelberg@wfbf.com.

4 WISCONSIN FARM BUREAU FEDERATION Rural Route

WISCONSIN FARM BUREAU FEDERATION’S

EDITOR’S

Rural

Route

NOTE

FARM BUREAU MEMBERSHIP Q AND A

Valued Member

What is Farm Bureau?

Wisconsin Farm Bureau Federation is a voice for farmers. At more than 47,000 members strong, WFBF is the state’s largest general agriculture organization that represents farms of all types and sizes. WFBF consists of 61 county Farm Bureaus, each with a local board of directors. Farm Bureau’s grassroots policy development process ensures that the organization’s legislative policy is created from the bottom up, based on resolutions that are proposed at the local level by voting members.

Why pay dues to be a Farm Bureau member?

Farm Bureau is a membership organization that relies on dues as a primary source of revenue. By joining Farm Bureau, you become part of an organization that provides numerous member benefits (for more details, see page 22) while helping to support Wisconsin’s #1 industry. Members are classified at the county level as voting or associate, with voting members having the right to hold office and vote on the organization’s policy.

I’m not a farmer, so why should I be a member of Farm Bureau?

Agriculture is a major driver of Wisconsin’s economy. We all have a vested interest in helping maintain a safe, affordable and abundant food supply. As a member of Farm Bureau, you support programs and policies that ensure that farmers can continue to feed and clothe us, while keeping Wisconsin’s economy strong.

Can my spouse and I share a membership?

Yes! A Farm Bureau membership is a family membership. It applies to the member, member’s spouse and any children younger than 21. A family member 21 or older requires his or her own membership.

I have an insurance policy with Rural Mutual. Why is Farm Bureau membership required?

In 1934, Wisconsin Farm Bureau members created the Rural Mutual Insurance Company to service the insurance needs of its members. Rural Mutual is an affiliate of Farm Bureau and access to insurance products sold through Rural Mutual is a benefit of membership. Therefore, a paid Farm Bureau membership is a prerequisite to purchase auto, homeowners, country estate, farm and crop/ hail policies through Rural Mutual Insurance Company.

How much are my annual membership dues?

Membership dues are established at the local level by your county Farm Bureau board of directors and vary from county to county. Annual dues range from $50 to $65, depending on which county you live in.

How are my dues used?

When you join Farm Bureau, you not only become a member of your county Farm Bureau, but also Wisconsin Farm Bureau and American Farm Bureau. Your membership dues are allocated as follows:

Wisconsin Farm Bureau Federation

$40

Used to support state activities, conduct programs and provide staffing for those efforts throughout the state. Consumer and youth education, issue advocacy, leadership development and member publications are services that also are funded with state dues.

American Farm Bureau Federation

Forwarded to support Farm Bureau activities at a national level. These funds support agriculture’s voice in our nation’s capital as well as the many programs that AFBF has in place to educate consumers, share the message of agriculture and provide online resources to its members.

Member Protector Policy

Members receive $2,000 in accidental death insurance for themselves and their spouse and $1,000 for unmarried children under 24 years of age residing in the same household; policy does not increase in value.

County Farm Bureau

The remaining portion of your dues depending on the county is used to fund local events and activities. This may include county meetings, scholarships and other programs for youth, consumer education activities and member service programs in that county.

$5 <$1 $

VM VM VM VM VM VM

The Farm Bill Impacts Everyone

Articles include information from AFBF Economist Shelby Myers and WFBF National Affairs Coordinator Tyler

Do you eat? Then the farm bill impacts you.

What is the farm bill? The farm bill refers to an authorization of mandatory and discretionary spending bills appropriated to provide assistance related to food and farms. It is a multi-year law that is primarily executed by the United States Department of Agriculture (USDA) and it governs a wide variety of agricultural and food programs. First created to help struggling farmers in the 1930s, the farm bill has expanded to be a resource to help the industry grow and thrive in an ever-evolving world. The current farm bill, the Agriculture Improvement Act of 2018, is set to expire on Sept. 30, 2023. To prepare for the 2023 farm bill, discussions about how best to address the issues of agriculture have already begun. These will be especially important given what the agriculture sector has been up against over the past few years and the various unknowns farmers and ranchers face.

The farm bill provides an important consistent opportunity for policymakers to address agricultural and food issues comprehensively. It has grown over the decades to serve food and agriculture, but its roots are in farm commodity program support. Because of the diversity of its coverage, the farm bill brings together some of the most unlikely partners to advocate for a legislative package composed of provisions that would likely not survive the legislative bureaucracy as standalone measures.

What are the areas covered within this large piece of legislation?

Food Security: America’s public investment in agriculture through farm bill programs helps secure our domestic food supply and keep our country strong while consumers get the benefits of high-quality, affordable food.

Jobs: The food and agriculture industry supports nearly 21.5

million U.S. jobs (that’s more than 14% of U.S. employment) and contributes more than $1 trillion to U.S. gross domestic product.

Conservation: The farm bill’s investment in ag research and conservation programs is critical to ensuring the productivity and sustainability of our farms and domestic food supply.

Wenzlaff

Risk Management: We all depend on the success of American agriculture so it’s important for America’s farmers and ranchers to be supported by strong farm programs as they face weather disasters, high supply costs and inflationary pressures. Managing risk is critical to keep food on our tables.

Addressing Hunger: The farm bill includes nutrition programs intended to ensure the most vulnerable among us have access to healthy, affordable food. Going back almost 100 years, the history of the farm bill largely tracks the history of food production in the United States as the legislation evolves to meet the needs of its modern-day constituents – farmers and consumers. Agriculture’s role in providing food security, and in turn national security, to the United States is more important than ever. And now, work on the next farm bill has started during a period of volatility on every front – political, economic and beyond.

Wisconsin’s Farm Bill Priorities

As a group that advocates for farmers, what are the main priorities that Wisconsin Farm Bureau is advocating for?

Here is a breakdown of the different areas of the farm bill and what asks are being made on farmers’ behalves. We support the following principles to guide the development of programs in the next farm bill:

• Protecting agricultural program funding in the Farm Bill –including adjusting for inflation.

• Ensuring competitive local FSA wages for adequate staffing.

• The 2023 Farm Bill prioritizing family farms and slow the pace of agriculture sector consolidation.

• The 2023 Farm Bill prioritizing family farms.

• The 2023 Farm Bill being fair to all farmers and effectively administering all programs.

TITLE I: COMMODITIES AND DISASTER

The commodity title has provided certainty and predictability to eligible producers by reauthorizing and improving commodity, marketing loan, sugar, dairy and disaster programs. Within Title I, we support:

• Updating base acres with every new farm bill;

• Increasing the effective reference price formula and reference price;

• Increasing commodity loan rates; and

• The opportunity for farmers to re-elect and/or re-enroll annually if current programs continue. Specifically for dairy, we support:

• Reform the dairy pricing formula, back to “Higher of” as opposed to “Average of”;

6 WISCONSIN FARM BUREAU FEDERATION Rural Route

ISSUES

• Retain the current Dairy Margin Coverage Program (DMC) with supplemental and feed cost updates;

• Increase DMC Tier 1 limit from 5 million pounds to between 6-10 million pounds;

• Update production averages to a three-year rolling average or current production for payment calculations; and all federal insurance programs related to the dairy industry taking into consideration negative Producer Price Differentials (PPDs) to ensure that farmers actually receive the margin that they insured.

Specifically for specialty crops, we support:

• Incorporating all types of domestic fruits and vegetables (fresh, frozen, canned and dried) into the Fresh Fruit and Vegetable Program providing an affordable option for increasing the variety available year-round for all and more market opportunities for producers. Priority must be given to fresh and locally grown products when available notwithstanding price;

• Ensuring adequate funding for the specialty crop industry with emphasis on fundamental research, marketing and promotions, and pest management programs;

• The USDA giving more consideration to specialty crop growers when considering planting history for various programs;

• Defining "specialty crops" as any fruit, vegetable, nut or non-program crop grown for consumption and sales; and

• USDA commodity purchases.

TITLE II: CONSERVATION

The conservation title provides voluntary conservation programs that farmers and ranchers use to improve their productivity and address natural resources and, increasingly, environmental concerns.

Within Title II, we support:

• CRP land payment rates should incentivize enrollment of sensitive land while discouraging enrollment of highly productive land;

• Funding for the Conservation Stewardship Program (CSP) with greater accessibility to farmers.

• New and continued conservation practices remain voluntary;

• Practices known to improve soil and water quality while avoiding wildlife management incentives; and

• Maintaining the current prioritization of the Environmental Quality Incentives Program (EQIP) funding being targeted to livestock producers.

TITLE III: TRADE

Post-World War II and post-Korean War conditions in agriculture created a need to focus on trade and trade development programs.

• Within Title III we support: Increased funding for the Foreign Market Development (FMD) program and Market Assistance Program (MAP).

TITLE IV: NUTRITION

First created with the Food Stamp Act of 1964, the nutrition title is a pillar in farm bill discussions, of particular interest to urban voters and their representatives.

Within Title IV, we support:

• Reform in the SNAP program that includes but is not limited to employment, wages, identification and legal status of the recipient; and

• The use of SNAP for U.S.-produced agricultural products when available.

TITLE V: CREDIT

The credit title of the farm bill provides lending opportunities that private commercial entities cannot offer.

Within Title V, we support:

• Streamlining loan programs and ensuring loan amounts keep pace with farm-level expenses; and

• Minimizing application requirements for young and beginning farmer guarantee programs so they are more aligned with agricultural lenders.

TITLE VI: RURAL DEVELOPMENT

The rural development title has held a spot in the farm bill since 1973 with the purpose to create and support new competitive advantages in rural areas.

TITLE VII: RESEARCH

When the United States Department of Agriculture was created in 1862 it was primarily charged to support agricultural research. Serving, technically, as the oldest title of the farm bill, stemming from the Morrill Land Grant Act of 1862, the purpose was to establish and fund research in land grant institutions in each state. Within Title VII, we support:

• Funding for agricultural research and education;

• Funding a producer-directed, research-oriented specialty crop block grant program and the IR4 bio-pesticide research program for minor crops; and

• Funding for research into the health risks and strategies for mitigating risks associated with chemical contaminants in water and food such as PFAS.

• Maintaining funding, with the possibility for additional funding, for the Animal Disease and Management Fund.

TITLE VIII: FORESTRY

First created in the 2002 farm bill, the forestry title provides authority for the United States Forest Service, which is the principal federal forest management agency.

TITLE IX: ENERGY

Renewable energy, primarily ethanol and biodiesel production, was spurred through the Renewable Fuel Standard, which is not included in the farm bill. However, it created interest in the development of farm bill programs regarding energy.

Continued on page 8

7 wfbf.com JUNE | JULY 2023

Within Title IX, we support:

• A comprehensive energy plan that focuses on domestic energy sources.

TITLE X: HORTICULTURE

The horticulture title is designated to specifically support specialty crops and certified organic and local foods.

TITLE XI: CROP INSURANCE

The crop insurance title provides new and continued insurance products for producers to purchase in a public-private partnership. The insurance helps protect producers against losses resulting from price and yield risks on over 445 million acres, in addition to a growing assortment of policies for animal agriculture. Within XI, we support:

• A robust crop insurance program, with no reductions in premium cost share; and

• Develop and maintain adequate risk management tools for livestock producers including contract growers. We oppose:

• Means testing, income limits, or add in’s, such as required production practices, that might limit the availability or adversely impact risk pools.

TITLE XII: MISCELLANEOUS

The miscellaneous title holds a variety of programs. In most cases, these programs either do not have a “home title” or are individual programs to address specific problems. In the 2018 farm bill, the miscellaneous title primarily focused on livestock programs, agriculture and food defense, historically underserved producers, limited-resource producers and other miscellaneous provisions. We also support:

• Greater emphasis by USDA and DOJ of enforcement of antitrust laws and anti-competitive practices;

• Strengthening restrictions on foreign investment in agriculture; and

• Not tying conservation programming to a farm's ESG score.

8 WISCONSIN FARM BUREAU FEDERATION Rural Route

Continued from page 7

By

By

Among the rolling hills and steep slopes of Buffalo County, Ed Rippley’s grandparents settled on the farm he calls home in 1934. Ultimately, the Rippleys became members of the county Farm Bureau and the rest, as they say, is history.

Ed is the third generation to be a member of the Buffalo County Farm Bureau and the second of his family to serve as the Buffalo County Farm Bureau president. He and his wife,

Laura, farm near Waumandee alongside his three daughters: Ella, Anna and Andrea.

While each member of the Rippley family has their own niche, they are woven together through agricultural passions and a drive to better their community.

A Diverse Variety

Ed and Laura began raising goats in the summer of 1993.

“I mean – just look at them. What’s not to love about goats?” Laura said.

The Rippleys have 13 registered milking goats as well as buck kids raised for meat. Four years into

WISCONSIN FARM BUREAU FEDERATION

Cassie Sonnentag & Heidi Strey

The Rippley family raise milking goats, buck kids, beef steers and chickens on their farm near Waumandee.

began making soap from goat’s milk which has since become a sought-after item by locals at craft sales and businesses. These days, she makes soap seasonally alongside her daughter, Anna.

“One year, we peaked at making 7,000 bars,” Laura said. “It is something we really enjoy; it just adds to the diversity of our farm.”

In addition to the goats, the Rippley family began raising broiler chickens for what is now called Pilgrim’s Pride in 2005. A portion of the chicken raised on Ed’s farm is sold in Kwik Trip stores in various cuts.

“We’ve been raising chickens for 18 years, which amounts to 139 flocks of 52,000 chicks at a time,” Ed said.

From Project to Passion

What started as an equine project grew into a passion for Anna Rippley.

“You could say I never grew out of the horse phase,” Anna said.

Anna’s love of horses began when she was 12 years old. She later purchased two horses and began showing them across the state. Anna was a member of the Arcadia High School rodeo team before receiving a bachelor’s degree in animal science with an equine emphasis from UW-River Falls in 2019.

After graduating from college, Anna moved to New York state where she worked in a reigning performance barn before returning to the Waumandee area. Today Anna currently works at Waumandee State Bank and owns four horses that she continues to show around the state.

“I would love to create a business related to horses here at home,” Anna said.

Called to Create

Ella Rippley-Twidt recalled a middle school art class that has since shaped her career.

“It was in 7th grade that I first touched clay and have been addicted ever since,” Ella said.

Ella was in her first year of college when she realized she needed a change. She returned home to help on the farm but felt a natural draw to pottery. She took an intensive summer internship in Cornucopia in

JUNE | JULY 2023

Top Right: Anna Rippley owns four horses on the Rippley farm. Her passion for horses spurred from a middle school 4-H project.

Bottom Right: Andrea Rippley-Schlais serves as the 4-H Program Educator in Jackson and Trempealeau counties. Andrea and her husband, Nick, have one daughter, Grace.

Bayfield County in 2016 that was spent camping, hiking and in-depth learning about her chosen art form.

“I learned so much more in those few months than I ever learned in a classroom,” Ella said.

Today, Ella creates household items including mugs, plates, cups and more in her studio on the farm. She loves the personal

Giving Back to the Next Generation

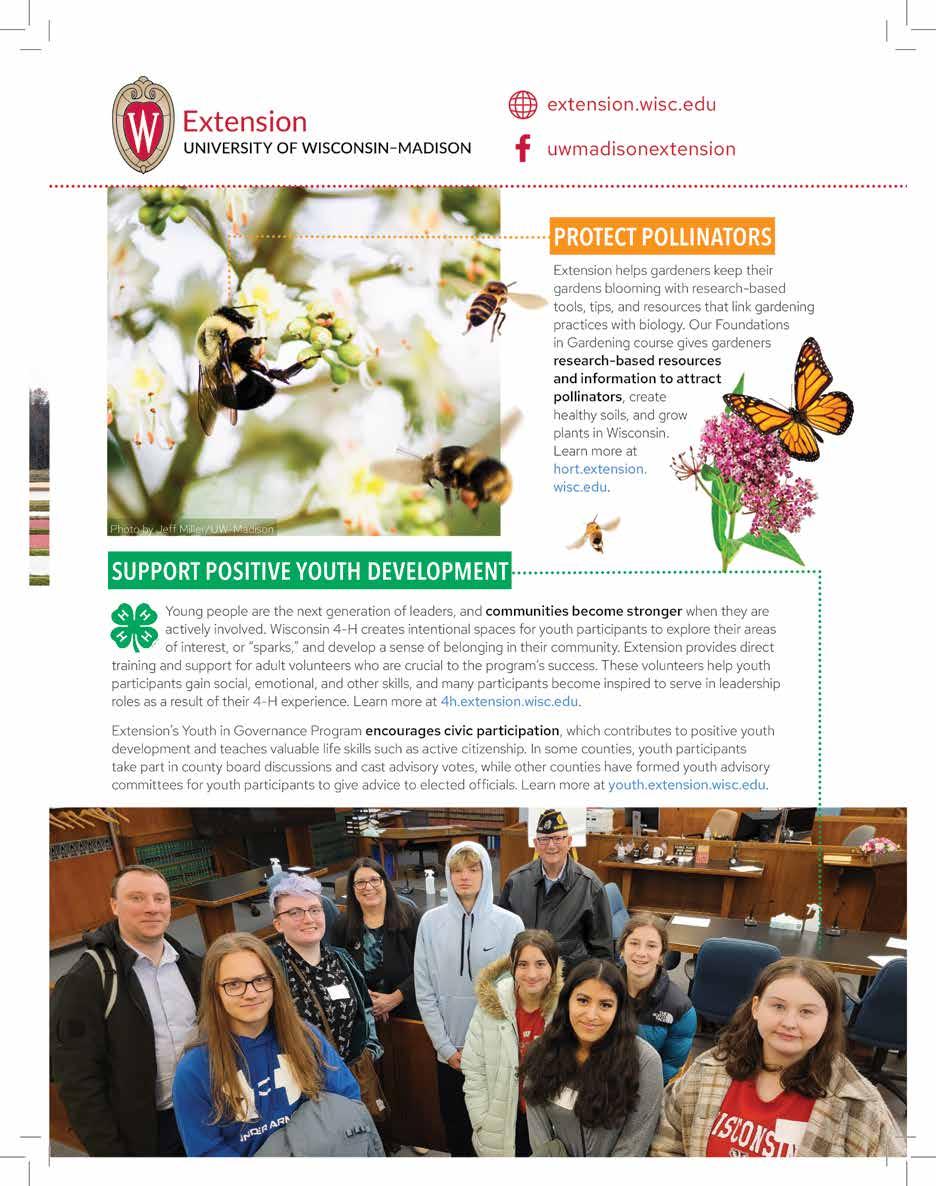

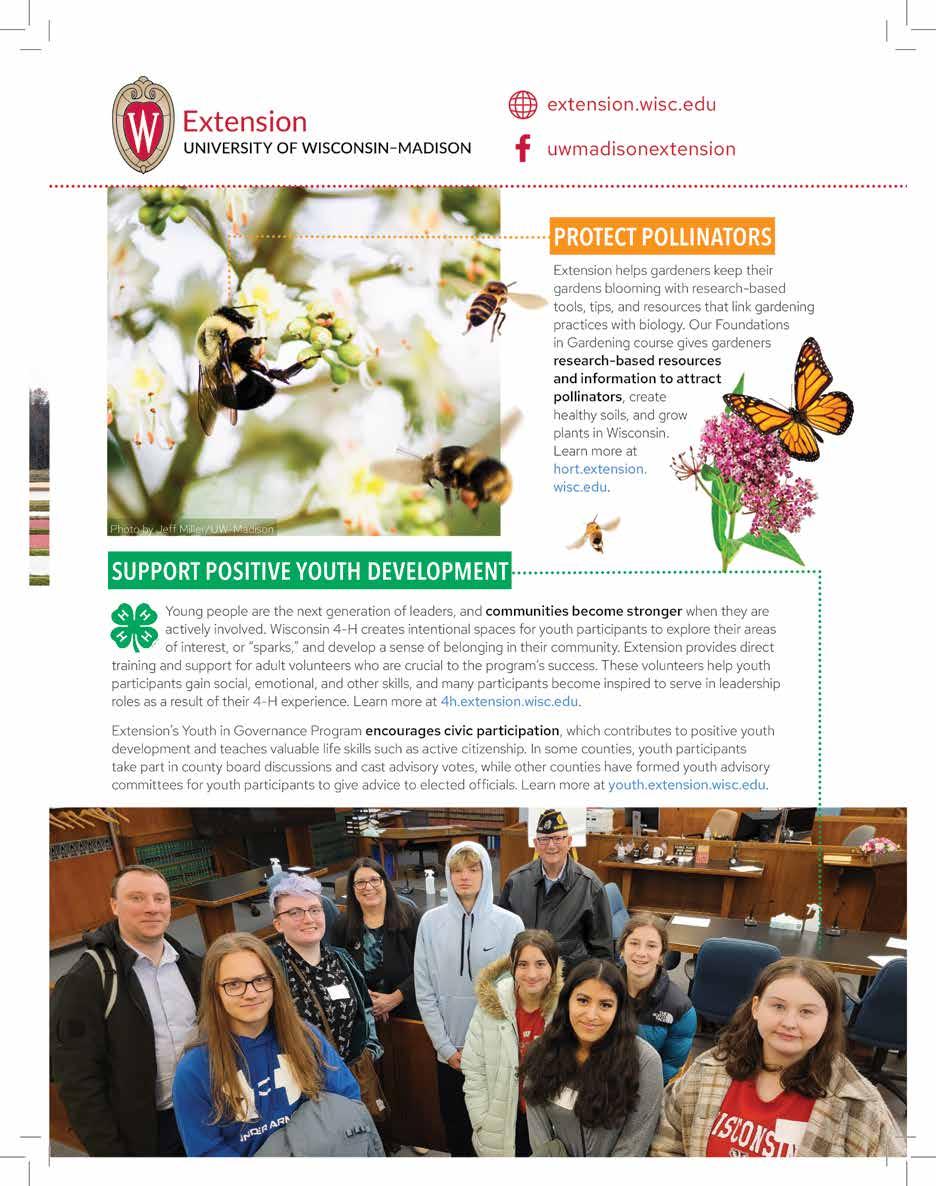

Andrea Rippley-Schlais was drawn to a career with Extension after graduating from UW-Platteville in 2017 with a degree in agricultural education. She has been serving as the 4-H Program Educator in Jackson and Trempealeau counties for the past five years where she trains volunteers, facilitates 4-H programming and raises general awareness of the organization in the community.

“I like to call myself the ‘Head Clover’,” Andrea said. “I love the variety in what I do that I am able to work on new and different things throughout the year.”

Her career in extension allows her to give back to the organization that has left an impact on her and her sisters.

“I love county fairs, albeit exhausting, because they give me the opportunity to meet with members and volunteers to learn about the things they are working on,”

Andrea said. “It’s exciting to see kids find something they are interested in and build a project around it.”

Andrea and her husband, Nick, have one daughter, Grace.

touch and relationship she can build with customers through pottery.

“I love being able to create personal items people get to use every single day,” Ella said. “Owning a pottery business allows me to connect with people in a different way than a normal 9 to 5 job.”

Ella and her husband, Erick Twidt, have one son, Eli. Her pottery creations are available for purchase at craft and art shows across the state as well as at Together Farms and Suncrest Gardens in Buffalo County.

14 WISCONSIN FARM BUREAU FEDERATION Rural Route

Above: Ella Rippley-Twidt fell in love with pottery in a middle school art class.

Right: Today, Ella creates a variety of household items in a studio on the Rippley family farm.

A Farm Bureau Family

The Rippleys have a unified interest when it comes to Farm Bureau. Being a part of the organization is something Ed remembers from a very young age.

“I remember my dad, Charlie, always said, ‘There’s more to farming than being on the farm’,” Ed said. “And once I joined, I realized Farm Bureau is a really powerful organization.”

“Farm Bureau is about having a voice,” Laura added. “Being a part of the policy development process, seeing what members are passionate about and what they vote on gives us as farmers hope that we can make an impactful change.”

From serving on the county

board to participating in the Leadership Institute, the Rippleys continue to take advantage of the opportunities Farm Bureau has to offer. While the commodities raised and interests within the Rippley family are diverse, Farm Bureau continues to be a common theme that has woven through their family now raising the fifth generation of members.

“We truly are a Farm Bureau family,” Andrea said.

Top Right: The Rippleys began raising chickens for what is now called Pilgrim’s Pride in 2005. Since then, the family has raised 139 flocks of 52,000 chickens per flock - or more than 7.2 million birds in 18 years! Chicken from the farm is sold in grocery stores across the country and in Kwik Trip locations across the Midwest. Located outside of the chicken coop, Ed installed solar panels five years ago. The panels continue to provide a renewable energy source to generate enough electricity to power the Rippley’s home and the farm’s outbuildings.

Bottom Left: Ed Rippley milks the family’s 13 milking does twice per day. The milk from their farm is made into soaps which are sold within the region.

15 wfbf.com JUNE | JULY 2023

Bottom Right: A Farm Bureau member sign greets visitors at the driveway. (Supplied Photo)

Leaders of the Land Lineup

Wisconsin Farm Bureau members put conservation in action on their farms. Meet these Leaders of the Land.

Rick Roden

Statistics

• 2nd-generation

• 850 dairy cows

• 40 stall rotary parlor

• 1 teat spray robot

• 2003 UW-Madison Farm & Industry Short Course graduate

• 10+ years of using cover crops

• Founding member of Clean Farm Families watershed group

“Sustainability means being successful managing our herd, raising our crops and taking care of our people. We’ve been farming for generations and work hard to set up the future generation for success here.”

Doug Rebout

Statistics

• 2nd-generation

• 4,200 acres of corn, soybeans and winter wheat

• 500 heifers and 200 steers

• Member of Farmers on the Rock watershed group

• 2 runoff research projects hosted with Discovery Farms®

• 20+ years of strip tilling

“Sustainability means doing the right thing for our farm, land and community. We want future generations to be able to keep the family farm going and if we are not sustainable that might not happen.”

16 WISCONSIN FARM BUREAU FEDERATION Rural Route

Ozaukee County Farm Bureau

Rock County Farm Bureau

Roden Echo Valley West Bend Rebout Farms Janesville

Sustainability at Home

We all have a responsibility to use our resources wisely. On or off the farm, being mindful of our resources is the right thing to do.

Farmers do their part through innovation and implementation of new technologies. Farmers are creative thinkers and innovators, using every last bit of their resources to maintain their bottom line and help the environment. You can do your part by reducing your impact and maximizing your resources in your home. Check out these sustainable swaps from Gather Wisconsin™.

Food storage

Minimize food waste while making your grocery budget stretch further by making a list and storing food properly.

Water

We are fortunate to have a safe, plentiful water supply in Wisconsin, but we should still be responsible with our water use.

Trash, recycling and compost

3

In the world of waste, everything has its place. Learn your local garbage disposal guidelines to properly dispose of your trash and recycling.

Pollinators

4

Simple changes can have a huge impact on the pollinator population – try incorporating some native species to provide food and habitat for pollinators.

Even small steps to reduce your impact can have a big influence on future generations. Find these tips and more at gatherwisconsin.com/sustainabilityathome.

17 wfbf.com JUNE | JULY 2023

1 2 3 4 1 2

Let’s Talk About Buying Local

From making connections in your community, to gaining knowledge of where food comes from, to boosting local commerce, the benefits of buying locally are endless.

As a farmer, providing safe and affordable food to my community is a priority. Since my family farm was founded in 1874, we’ve acquired a magnitude of experience in food production. Over time the markets we sold our products to moved us away from direct contact with our customers. Basically, there have become more people involved in the process between the farm and plate. How did this happen? It wasn’t overnight, of course, and many times these things are out of our control as farmers. To continue to provide for our family and keep our business running, we’ve had to adjust and adapt.

The market trends for food purchasing have changed once again. Our customers want to know where their food comes from and place value on the relationship with their farmers. As a farmer, this has been a great opportunity to rebuild the connections we lost with the families who purchase our products.

How has my family farm done this? A year ago, we wanted to find a way to directly link our farm to our community. My family opened a meat market on our farm, and it has been an endlessly rewarding experience. We converted an existing, unused space on our farm into a store. By having minimal startup costs, we can keep our prices affordable

With Brittney Muenster

With Brittney Muenster

and by selling our product direct to our customers, we also maintain consistent prices allowing families to buy in bulk and budget more efficiently.

Many farmers are focusing on direct-to-consumer sales. Whether at a farmer’s market, online or on-farm store, there are an increasing number of opportunities to buy local and support farmers. How can you find these farmers? Many of them advertise on social media and in groups specific for marketing their goods.

I should note that you don’t have to visit a farm to support your local farmer (although always encouraged). Many grocery stores carry local produce and products. A good example is milk which takes less than 48 hours to travel from the farm to the grocery store. If you are wanting to support local businesses look for certified seals on the labels that signify that item is being sourced locally. Farmers look forward to answering questions and providing information to consumers to make well-informed decisions when grocery shopping for their families. Because we don’t always get the opportunity to connect with our customers directly, being a part of organizations like Farm Bureau allows us a platform to share what we do and develop valuable tools to help explain what is truly going on at the farm level.

Wisconsin Farm Bureau created a resource called Gather Wisconsin™. This is a website geared specifically for providing information about our state’s agriculture to consumers and opportunities to support farmers locally. I highly recommend you check it out! Visit gatherwisconsin.com.

Brittney Muenster is the District 7 Representative on the WFBF Promotion and Education Committee. Brittney is a fifth-generation farmer on her family’s 200-acre farm in Seymour where they raise cattle for beef and milk production. In addition to farming, she’s an independent insurance agent specializing in farm and agribusiness insurance with Family Insurance Center.

The Promotion and Education Committee is a dynamic group of Farm Bureau leaders who develop, implement and promote programs that build agricultural awareness and provide leadership development to the agricultural community.

Promotion and Education Program

18 WISCONSIN FARM BUREAU FEDERATION Rural Route

AROUND THE TABLE

Visit gatherwisconsin.com for more recipes.

Beef Tenderloin, Cranberry and Pear Salad

INGREDIENTS

• 4 beef tenderloin steaks cut 3/4 inch thick (4 oz. each)

• 1/2 tsp. freshly ground black pepper

• 1 5-oz. pkg. mixed baby salad greens

• 1 medium red or green ripe pear cored, cut into 16 wedges

• 1/4 c. dried cranberries

• 1/4 c. pecans, coarsely chopped and toasted

• 1/4 c. crumbled goat cheese, optional

Honey Mustard Dressing:

• 1/2 c. prepared honey mustard

• 2 to 3 Tbsp. water

• 11/2 tsp. olive oil

• 1 tsp. white wine vinegar

• 1/4 tsp. freshly ground black pepper

• 1/8 tsp. salt

INSTRUCTIONS

1. Season beef tenderloin steaks with 1/2 tsp. pepper. Heat large nonstick skillet over medium heat until hot. Place steaks in skillet; cook 7 to 10 minutes for medium rare (145°F) to medium (160°F) doneness, turning occasionally.

Cook’s Tip: To grill, place steaks on grid over medium, ash-covered coals. Grill steaks, covered, 7 to 10 minutes (timings remain the same for gas grill) for medium rare (145°F) to medium (160°F) doneness, turning occasionally. Do not overcook.

2. Meanwhile whisk honey mustard dressing ingredients in small bowl until well blended. Set aside. Divide greens evenly among 4 plates. Top evenly with pear wedges and dried cranberries.

3. Carve steaks into thin slices; season with salt, as desired. Divide steak slices evenly over salads. Top each salad evenly with dressing, pecans and goat cheese, if desired.

Cook’s Tip: To toast pecans, spread in single layer on metal baking sheet. Bake in 350°F oven 3 to 5 minutes or until lightly browned, stirring occasionally. (Watch carefully to prevent burning.) Set aside to cool.

Agua Fresca

EQUIPMENT

• blender

INGREDIENTS

• 4 c. watermelon, cubed

• 1 lime, juiced

• 2 Tbsp. sugar

• 3 c. water, divided

INSTRUCTIONS

• strainer

Optional Garnishes

• coarse sugar

• mint sprigs

• lime slices

• watermelon wedges

1. Blend all ingredients in a blender until smooth.

2. Strain the mixture into a pitcher and discard the solids.

3. Add the remaining water to the pitcher and stir completely.

4. Chill until ready to serve.

5. Add optional garnishes and enjoy!

Cook’s Tip: Feel free to change up this recipe by substituting your favorite fruits or even substituting in vegetables like cucumbers! You can even make this beverage carbonated by adding sparkling water.

19 wfbf.com JUNE | JULY 2023

BEEF COUNCIL

WISCONSIN

20 WISCONSIN FARM BUREAU FEDERATION Rural Route

MEMBER BENEFITS

Farm Bureau Bank Has You Covered

As a member of the Wisconsin Farm Bureau, you have access to many member benefits, including Farm Bureau Bank. Since 1999, Farm Bureau Bank has been focused on providing an exceptional banking experience to members across the country. As part of the Farm Bureau Family, they are committed to offering the banking products you need, delivered with the personalized service you deserve. Plus, Farm Bureau Bank offers special pricing, promotions, and perks exclusive to Farm Bureau members.

“I always use my Farm Bureau credit card. I charge everything I can since I get rewards for spending money! We always pay the card off in full each month so we acquire no other fees. Every February we travel for an extended period of time. I cash in those rewards and it usually takes between $300-$400 off our trip costs! An added benefit is that I also get my annual WFBF dues paid for by using the card so often.”

- Jill Bennwitz, Dane County Farm Bureau member

Business Services – conduct business more efficiently, optimize returns, and improve cash flow.

• Premier Business Visa® credit card with rewards

• Free account management online – anytime

Farm Bureau Bank is committed to serving you with customized financial products and services including:

Deposit Services – a full range of personal accounts to handle your day-to-day expenses and steadily grow your savings.

• Interest-bearing Performance Checking

• Money Market Accounts

• Certificates of Deposit (CDs)

• Individual Retirement Accounts (IRAs)

• Health Savings Accounts (HSAs)

• Free Visa® Debit Card(s) available for select Deposit products

• Free 24/7 Online Banking

• Free FBBmobile app with mobile deposit1

The Farm Bureau Member Rewards Mastercard® - turn everyday purchases into everyday savings.

• 3x reward points on gas, grocery, and dining purchases2

• 2x reward points on select Farm Bureau benefit partners, such as Farm Bureau Financial Services, Rural Mutual Insurance, and Grainger®2

• 1x reward point on all other purchases2

• Spend $12,000 or more in the 12 months prior to your membership billing date and Farm Bureau Bank will pay your annual Wisconsin Farm Bureau membership dues3

• No annual fees4

Vehicle Loans – make life’s large purchases more affordable with flexible financing options.

• Member-special rates for new and used vehicles, RVs, motorcycles, ATVs, personal watercraft, and boats5

• Up to 100% financing and refinancing6

• Competitively priced protection plans

• Business Checking

• Treasury Management Services

Equipment Loans – to help you get the job done.

• Finance or refinance new or used farm equipment

• Flexible payment plans

For more information or to apply today, visit Farm Bureau Bank online at farmbureau.bank, or call 800.492.3276.

1 Must be enrolled in Online/Mobile Banking.

2 Purchases mean any signature or pin-based, online, phone or mail-order purchase made with the Farm Bureau Member Rewards Mastercard. Offer excludes Cash Advances, Balance Transfers, credits and returns. Points expire after four full years. Program may change or be canceled at any time. 3X reward points on qualifying transactions, up to $1,500 quarterly. 2X points may vary by state. Visit farmbureau.bank/creditcards to see what double point benefits your state receives. See complete Terms and Conditions for the Farm Bureau Member Rewards Mastercard and Member Rewards Program.

3 Based on purchases made in the 12 months prior to your membership billing date. Balance Transfers and Cash Advances are not included. Visit farmbureau.bank/ creditcards for details.

4 Other fees may apply. For full terms and conditions, visit farmbureau.bank/ creditcards.

5 Non-member rates may be 1.50% higher than posted rates.

6 Some restrictions apply. Member FDIC. Equal Housing Lender.

22 WISCONSIN FARM BUREAU FEDERATION Rural Route

Insurance Company Rural Mutual *WFBF member benefits may be changed or discontinued at any time without notice.* Learn more about your Farm Bureau member benefit savings by scanning the QR code or visiting wfbf.com/membership/member-benefits. Get the MEMBER BENEFITS MOST out of EVERY DOLLAR with your FARM BUREAU By being a Wisconsin Farm Bureau member, you qualify for benefits and services that provide a range of options that respond to the needs of farmers, families and businesses in Wisconsin. Member Protector Policy

WITH POLK BURNETT’S ISAAC CHRISTENSON 5MINUTES

Tell us a little about yourself.

Born and raised in Amery and still live in my hometown. I attended UW-River Falls for agricultural business and agricultural marketing communications. I work as an agriculture and commercial loan officer for Pillar Bank covering northwest Wisconsin. I enjoy being outdoors, whether that is walking my dog Arya at Interstate Park, fishing, kayaking or camping.

What do you enjoy most about your career in agriculture?

I enjoy having customers with a wide variety of farms. From dairy goat farmers to newly installed robotic dairies to monarch habitat growers to large cash grain operators, I get to work with it all.

What is a success in your agriculture career that you are most proud of?

Helping a family achieve their dream of owning and operating a farm.

What are some of the challenges you face in your career and how do you handle them?

Agriculture is cyclical and price fluctuations are difficult for everyone. You handle them through smart business practices and understanding financial positions.

What is one agriculture experience that has defined you and why?

Serving as a Wisconsin State FFA Officer was a great experience. It taught me a lot about education, public speaking, public relations and agriculture.

What is a Farm Bureau experience that you are most proud of and why?

Making it to the Final Four for the Discussion Meet my first year competing. It taught me that I know more about agriculture than I perceived!

What is something that most Farm Bureau members would not know about you?

One of my hobbies with my family is making maple syrup.

Why are you proud to be a Farm Bureau member?

Farm Bureau continuously shows its investment in members through opportunities to not only grow personally and professionally but also push agriculture into a bright future.

What advice do you have for new Farm Bureau members or those looking to get more involved?

Say “yes” even if the opportunity is new or intimidates you. The growth you’ll see is worth it. Saying “yes” is often the hardest part.

24 WISCONSIN FARM BUREAU FEDERATION Rural Route

25 wfbf.com JUNE | JULY 2023

We Are Proud Of Our Strong Agricultural Community

A Message from WFBF President Kevin Krentz

much of which is spent within local communities. I am a dairy farmer and recently analyzed every expense on my farm. I found 62% of my expenses were spent within 15 miles of where we are located in central Wisconsin. With 64,000 farms in Wisconsin, it is easy to see the tremendous impact agriculture has locally.

Imagine a circle 15 miles around your home and how many farms are in that area. We are all impacted by the dollars farmers invest in our communities. Expenses to land, labor, feed, seed, fertilizer, parts, supplies and so much more are dollars spent over and over within our communities.

stand up for our state’s farmers. That need continues today which is why Farm Bureau is the trusted voice leading Wisconsin agriculture forward.

Our organization advocates for tools that give farmers the ability to protect themselves. From the farm bill to local road infrastructure, WFBF carries the collective voice of our members directed by our policy to our state and nation’s capital. I am extremely proud of the work of Farm Bureau protecting our farmers, which in turn protects the food supply chain and addresses the major concern of food security.

Wisconsin has the climate and abundance of water that allows farmers across the state to grow a diverse variety of food, fuel and fiber. In turn, that diversity is exhibited in the selection of products we as consumers rely on in our daily lives. It is easy to take for granted that those products will be readily available as we go to the store, shop online or stop at the fuel station.

The vast array of products raised in Wisconsin ranges from easily recognized commodities like cranberries, corn, dairy, potatoes and beef, to more niche markets that you may not know as much about such as ginseng, mink, sweet corn and maple syrup. There are simply too many local agricultural products to list but we all should feel fortunate about the agricultural diversity we have here in our state – much of which is not possible in other parts of the world.

Agriculture contributes $104.8 billion to Wisconsin’s economy annually,

If those farms were gone, the impacts on the surrounding community would be huge. There is plenty of risk for agriculture in Wisconsin and the U.S.: weather extremes cause narrow windows of planting, caring for and harvesting crops; price swings also can move from profitable to a loss in a given season; and the amount of assets a farm must maintain and upkeep is usually in the millions of dollars.

At the end of the day farmers just want to farm, raise their crops and care for their livestock. Farming is high asset, variable profit and farmers have learned to wear the many hats needed to manage their businesses.

Diversity is important, especially in agriculture. It puts Wisconsin in a unique position to be a leading producer of many crops and food products. But diversity also creates challenges. Many voices are hard to hear.

Farm Bureau was started generations ago to help create a collective voice and

WFBF is dedicated to connecting consumers with farmers across the state. Through an initiative set by our members through a strategic planning process, WFBF recently introduced Gather Wisconsin, a website sharing connections between food, farming and family. This new website will serve as a valuable advocacy tool for the work of our members within their local communities. I encourage you to visit this new website at gatherwisconsin.com and follow Gather Wisconsin on Facebook and Instagram.

Whether at the dinner table or in your local community, agriculture has a tremendous impact on us all. Your Farm Bureau membership helps strengthen the voice of our organization and provides the tools necessary to keep farmers farming in your local community.

Thank you for being a member and for supporting Wisconsin agriculture.

26 WISCONSIN FARM BUREAU FEDERATION Rural Route VOICES

Krentz was elected president of Wisconsin Farm Bureau in 2020. He is a dairy farmer from Berlin.

Time to Move on Milk Marketing System Reform A Message from AFBF President Zippy Duvall

My earliest memories of farming were in my family’s dairy barn. Those were some of my happiest memories—rising before the sun to milk the cows, helping care for our animals and doing my part to provide a nutritious product for our community. Dairying also brought some of my earliest heartache in farming. It’s a hard business on the best days, but the most frustrating part of the job came from the mysterious ups and downs of milk prices under the Federal Milk Marketing Order (FMMO) system. Dairy farmers deserve a fair and transparent paycheck for the work they do, 365 days a year, and it’s long past time we set about modernizing this system.

My frustration with the unfairness and uncertainty of the market as a young farmer was one of the issues that led me to get involved in Farm Bureau. After yet another day of my complaining at the breakfast table, my dad told me that if I really wanted to see change, I needed to get outside my fencerows. Back then the FMMO’s needed improvements, and that was more than 40 years ago. Change has been slow in coming to say the least, but it might never have come if we hadn’t finally brought everyone—farmers, commodity groups and processors—to the table to find common ground.

That’s just what Secretary Vilsack asked the dairy business to do a couple years back. So, last year, Farm Bureau held a forum to discuss what changes are needed in the FMMO system. Nothing was off the table in those discussions, which covered everything from updating Class pricing formulas to reducing de-pooling incentives to milk check transparency and strengthening the farmer’s voice in the referendums that are required to approve or reject changes to FMMO’s. Overall, everyone was able to agree on the need to modernize the FMMO system in a way that reflects the current market and is fair to everyone involved.

Now Farm Bureau, along with the National Milk Producers Federation, is calling on USDA to take the next step and hold a public hearing on FMMO reform. In NMPF’s petition to USDA they called for reforms to the FMMO that, in principle, are right in line with Farm Bureau policy:

• Discontinue the use of barrel cheese in the protein component price formula;

• Return to the “higher-of” Class I mover; Update the milk component factors for protein, other solids, and nonfat solids in the Class III and Class IV skim milk price formulas; and Update the Class I differential pricing surface throughout the U.S.

All these changes would reflect where the dairy industry is today and how the market has changed over the decades. What’s more, these changes would help ensure farmers receive a fair price for their farm products.

NMPF is also asking for increases in the allowance that processors receive in the milk price formulas for their cost of turning milk into cheese and whey and butter and powder. Farm Bureau, however, believes these allowances for processors will only be fair if they are based on accurate data. USDA can only ensure fairness in dairy pricing by accurately capturing those costs through mandatory surveys of processor costs and yields.

In May, I sent a letter to USDA outlining these solutions on behalf of our members. We believe USDA has the legal authority to conduct mandatory, audited cost and yield surveys of dairy processors, which can be used for determining make allowances as they are factored into dairy pricing. Voluntary surveys simply won’t work, and the numbers prove it.

Two-thirds of the dairy processors that participate in USDA’s weekly mandatory price survey did not provide cost data in the voluntary survey that USDA released in 2021. And since there’s no audit of the voluntary data that is provided, there’s no way to ensure the little data available is accurate. The only way to restore trust between farmers and dairy processors is to get full participation— just once every two years—of all the plants that are already working with USDA on the weekly price survey.

When USDA announces a hearing of this sort, they normally ask for additional proposals. We look forward to the opportunity to propose additional AFBF policies that NMPF hasn’t addressed in their petition. These include milk check transparency standards and additional price formula changes that could further reduce or eliminate de-pooling incentives and make milk pricing more predictable.

Just as everyone can agree that the FMMO system is long overdue for reform, we also can agree it’s a complex issue that needs to be addressed thoughtfully. We are hopeful the Secretary’s leadership will bring about a fair solution on these issues, and we are eager for USDA to take the next steps toward holding the hearings that can put these solutions in place.

America’s dairy farmers have made tremendous strides in improving sustainability and increasing the nutritional value of the dairy products we all enjoy. FMMOs should reflect the modern dairy industry and restore fairness for our hardworking dairy farm families.

27 wfbf.com APRIL | MAY 2023

President of the American Farm Bureau Federation, Duvall raises beef cattle, hay and poultry in Greshamville, Georgia.

“Just as everyone can agree that the FMMO system is long overdue for reform, we also can agree it’s a complex issue that needs to be addressed thoughtfully.”

28 WISCONSIN FARM BUREAU FEDERATION Rural Route

29 wfbf.com JUNE | JULY 2023

Farm Neighbors Care is a campaign to support our farmers who are facing stress due to low market prices, poor weather and crop conditions, etc. Farming can be an isolating career, especially if other family members work off the farm. It is important to check in on your friends, neighbors and family members to gauge how they are doing and offer support and a listening ear. The campaign asks rural residents to have face-to-face conversations with farmers and agribusiness owners. For some, this conversation and check-in may be the dose of positivity needed to make it through a tough day.

During May Mental Health month, many county Farm Bureaus worked to distribute goodies to their friends and neighbors through the campaign.

The county Farm Bureaus in District 4 took nominations for Farm Neighbors Care packages to recognize farmers during Mental Health month.

WFBF YFA Chair, Savannah Brown and WFBF Promotion and Education Chair, Brenda Dowiasch along with past YFA committee member Sally Turpin helped to deliver care packages to farmers during the month of May. Some of those lucky recipients were Todd Stanek and Brandon Boettcher from Eau Claire County.

30 WISCONSIN FARM BUREAU FEDERATION Rural Route

Stanek

Boettcher Turpin, Dowiasch and Brown

Dodge County Farm Bureau hosted a member picnic on May 21 at Monien Farms. Members learned about mental health resources for farmers and their families from the Wisconsin Farmer Wellness Coordinator at the Wisconsin Farm Center.

Young Farmer and Agriculturist members in Racine County showed farmers appreciation during spring planting by delivering meals on wheels. In total they delivered about 30 meals by sharing a sign up on social media and word of mouth. It was well-received and most likely will occur again next year.

31 wfbf.com JUNE | JULY 2023

Heroes of Hope Named

Bob Nash of Ozaukee County has been named Wisconsin Farm Bureau’s Hero of Hope in the organization’s third annual Heroes of Hope campaign.

Heroes of Hope, a subset of the #FarmNeighborsCare campaign, is focused on shedding light on rural heroes who have helped others through a tough time. Heroes of Hope aims to identify people who have helped bring hope to farmers or businesses, either in large or small ways. Members of the agriculture community were encouraged to nominate individuals who have made an impact on the way they conduct business, both ordinary and extraordinary.

Also being recognized as finalists this year are Brenda Statz of Sauk County, Randy Roecker of Sauk County, the Baraboo FFA Chapter of Sauk County and Dan Wiese of Brown County.

As this year’s Hero of Hope, Bob will receive $500 cash, $50 to Kwik Trip and a Culver’s meal package valued at $50. The four remaining finalists will each receive $125 cash, $25 to Kwik Trip and a Culver’s meal package valued at $25.

The

Bob Nash, Ozaukee County

Bob works full-time for Ozaukee County as a heavy equipment operator while working nights and weekends for Chris and Tracey Elbe at Golden E Dairy Farm in West Bend. Nash recently completed his term as the District 1 Young Farmer and Agriculturist Representative on the WFBF YFA Committee, where he also served as the chair in 2022. He currently serves as the Ozaukee County Farm Bureau president, a role he took seriously when disaster struck a local dairy farm earlier this year.

The two people who nominated him said, “Bob went above and beyond when disaster struck at a farm in his community. A barn fire occurred, and Bob was quickly there to help. He coordinated getting heavy equipment in to clean up the debris and found a barn to relocate the cattle that survived the fire. Bob was a true hero that night when his neighbors were dealing with disaster.”

“Bob is everyone’s hero. He is always a phone call away. He will always lift you up and be your biggest cheerleader. He genuinely cares about his people and it shows through his kindness, attentiveness and work ethic. Bob will drop everything to help get the job done, even after putting in his own 40-hour work week."

When told he was selected as a Hero of Hope, Bob stated, “I am proud to be a part of the agricultural community. I learned from a young age that farmers need to keep farming no matter what. Stepping up when others need help is the right thing to do and I am humbled to answer the call.”

32

WISCONSIN FARM BUREAU FEDERATION Rural Route

2023 Heroes of Hope campaign was sponsored by Rural Mutual Insurance Company, Kwik Trip, Culver’s, Josh and Ashleigh Calaway, Lynn Siekmann, and Dave Meihak, Lake and Woods Regional Manager at Rural Mutual Insurance Company.

Heroes of

NEIGHBORS HELPING NEIGHBORS

Hope

Baraboo FFA, Sauk County

The Baraboo FFA has hosted a fundraiser for four years, Flapjacks for Farmers and Friends. Each year the chapter has donated the profits from the fundraiser to an agriculture based group. Most years have been a mental health organization such as Sauk County Farmer Angel Network and AgrAbility of Wisconsin.

Dan Wiese, Brown County

Dan is on the ownership team for a successful progressive dairy farm. His role at the farm is demanding and he is always on call for his employees and suppliers. On top of his leadership at the farm, Dan volunteers for his local fire department and serves on the Brown County Fair Board. He is a hero of hope because he always puts others before himself. He works until the job is done and fully gives himself to his family and his community.

Brenda Statz, Sauk County

Brenda’s willingness to be vulnerable and speak to the pain she, her husband and her family went through from her husband’s mental illness and death by suicide has been not only a reason Farmer Angel Network exists, but also one of the keys to success for the group in bringing awareness to mental health struggles for farmers and preventing suicide in our community. Brenda is impacting not only our local community, but the state and nation due to her willingness to speak through the painful situation so we can learn to prevent it.

See this article in the New York Times. farmerangelnetwork.com/post/farmer-angelnetwork-featured-in-the-new-york-times-mental-health-crisis-in-rural-areas

Randy Roecker, Sauk County

Randy’s willingness to share his experience living with mental illness and advocating for resources in rural and farming communities has been a huge success factor for the work of Farmer Angel Network in bringing awareness and preventing suicide. He is willing to be vulnerable and speak to painful experiences in his life so others can learn. He shares this not only in our local community but throughout Wisconsin and the nation. In the last year he has spoken with Rural Realities podcast, PBS documentary, Dairy Radio Now, Dairy Star, advocated in Washington, D.C. and more.

Farmer Angel Network

The Farmer Angel Network (F.A.N.), builds strong rural communities that support agriculture by providing education, resources, and fellowship with a focus on mental health. Learn more at facebook.com/FarmerAngelNetwork.

33 wfbf.com JUNE | JULY 2023

N C A M P U S with Collegiate Farm Bureau

Collegiate Chapters Host Ag Day on Campus Events

The Collegiate Farm Bureau chapters at UW-Madison, UW-Platteville and UW-River Falls each hosted an Ag Day on Campus event for students, faculty and community members. The events focused on highlighting the importance of agriculture within Wisconsin. From hands on activities and animals to Wisconsin commodity handouts, more than 150 Collegiate Farm Bureau members helped to share agriculture’s story.

UW-River Falls | April 18

UW-Platteville | April 25

UW-River Falls | April 18

UW-Platteville | April 25

34 WISCONSIN

FEDERATION Rural Route

UW-Madison | April 13

FARM BUREAU

Spotlight on

YFA

Get to know the members who are leading Wisconsin Farm Bureau’s Young Farmer and Agriculturist Program.

Casey and Morgan Lobdell, District 3 WFBF YFA Committee Representatives Farm Bureau members since 2017

able to participate in leadership development opportunities to better ourselves. We also find a lot of value in the relationship with Rural Mutual Insurance and all the wonderful membership discounts.

What has been your favorite Farm Bureau program/event/ etc and why?

We, of course, love the state Young Farmer and Agriculturist conference and all that it offers in terms of competitions and learning experiences. On the county level, we really enjoy some of the summer outings. One of our favorites was last year’s Brewer’s trip. It does not get more exciting than a bus trip with members that share similar interests.

What would you tell YFA members about getting involved in the YFA program?

Stay after the meeting and go get ice cream. Meetings and events are great, but often the stories that remain come from the time spent gathering after the meeting.

Why do you value your Farm Bureau membership?

We value the people that we have met through Farm Bureau. From Colorado honeybee farmers to strengthening relationships within your county, the network of people is really what makes Farm Bureau the most valuable. As a couple, we enjoy being

Best words of advice/words of wisdom.

Get involved in your community. There are many programs that need the next generation to continue the traditions. Young farmers make up a small percentage of the population. We are stronger and better when we can get together. Along the way, you are likely to make relationships that will last a lifetime.

35 wfbf.com JUNE | JULY 2023

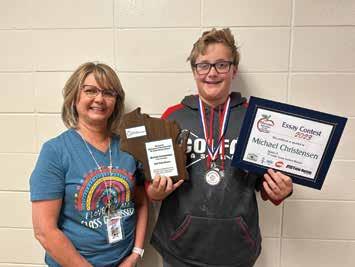

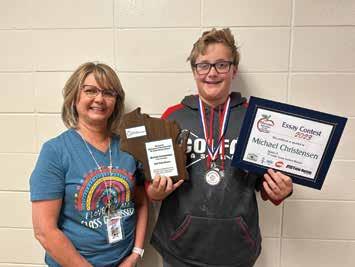

Classroom Connections: Essay Winners Named

Wisconsin Agriculture in the Classroom offers fourth-and fifth-grade students a fun, competitive opportunity to put their writing skills to work while exploring how agriculture impacts their daily lives through the annual essay contest.

This year’s essay prompt was, “You’re Gonna Need Milk for That – Wisconsin dairy fuels our bodies, communities and economy.” More than 1,800 students from 95 schools met the challenge and submitted essays sharing knowledge, trivia and personal connections to Wisconsin dairy.

Ag in the Classroom is excited to announce the winners of the fourth- and fifth-grade contests:

Fourth-Grade State Winner: Bree Stalsberg, Fennimore Elementary

Fifth-Grade State Winner: Michael Christensen, Colfax Elementary

The 2023 Ag in the Classroom essay contest is sponsored by Culvers, Dairy Farmers of Wisconsin, WE Energies and the Wisconsin Farm Bureau Foundation. Special thanks to all teachers, county Ag in the Classroom essay coordinators and the Wisconsin Farm Bureau Promotion and Education Committee for submitting and judging essays.

More Than Just Milk

By Bree Stalsberg

Every day dairy helps fuel my body, my parents' bank account, and my community. My family relies on dairy more than anything else in the world. Wisconsin is known as Wisconsin's Dairyland. That's why for every meal, I drink milk!

Wisconsin's dairy industry has fueled the lives of my family for generations and still does today! Every night when my family sits down for supper there is an ice cold milk on the table. Drinking milk is very important, it makes your teeth and bones strong. Milk is an excellent source of calcium and twelve essential nutrients. The average dairy cow in Wisconsin produces seven gallons of milk a day. Other dairy products like chocolate milk, cottage cheese, yogurt and cheese are always in our fridge for an easy, healthy snack to fuel my body.

Dairy farmers do business with so many people, even some in my family. My brother milks cows on a local dairy farm. My mom works as a dairy nutritionist, and my dad is an Ag Business instructor. My grandparents have been dairy farmers for nearly 50 years. Every community in Wisconsin benefits from dairy cows. One in nine jobs in Wisconsin relies on dairy farmers. If you think of all the people a dairy farmer can see in a day from the milk truck driver, seed dealer, feed delivery person, cow breeder, nutritionist, veterinarian, to milk equipment company. All those businesses rely on dairy farmers for their jobs and livelihoods. For every dollar generated by dairy farming, it turns three to seven times in the economy. When a farmer is making money, everyone is making money.

Wisconsin's 1.27 million cows help generate over 154,000 jobs and create over a billion dollars in state and local taxes. When a farmer pays all of their employees the employees get money to put into their wallets to buy clothing, food and local products. Spending by others helps fuel the economy. Wisconsin's dairy industry contributes $45.6 billion to the economy each year. That's a lot of milk!

I can't imagine our world without milk and the very important dairy farmers. My life and others have been sculpted by the hard working dairy farmers who help take care of the cows and produce milk. That's why with every meal, I'm going to drink milk!

36 WISCONSIN FARM BUREAU FEDERATION Rural Route AG IN THE CLASSROOM

You’re Gonna Need Milk for ThatWisconsin Dairy Fuels Our Bodies, Communities, and Economy

By Michael Christensen

By Michael Christensen

Did you know that Wisconsin is America's Dairyland? Wisconsin is a wonderful place to live. There are many reasons I love to live in Wisconsin, one of the main reasons is that I like dairy and Wisconsin is America's Dairyland. Dairy is very important because it helps fuel us with good food and it helps our community and economy grow, which helps Wisconsin's agriculture grow and makes a circle constantly growing.

Milk is very helpful for our bodies. Milk can come from many different animals such as cows, goats or even sheep. There are numerous types of dairy products. A few products are cheese, milk, yogurt, and ice cream. Wisconsin makes a whole 2.8 billion pounds of cheese per year and in every pound there is calcium which helps our teeth. Milk contains 8 grams of protein per cup-that's 512 grams of protein per gallon. Cows in Wisconsin produce 2.44 billion pounds of milk a month. Yogurt also includes calcium too. In 5 years the U.S.A. will make 84.5 billion pounds of ice cream. All these dairy products contain nutrients that help me grow strong and healthy.

Wisconsin agriculture helps the community. Wisconsin’s dairy and agriculture help fund money to farmers. The farmers get paid money from the people who buy their products. Then those people sell the product and earn money. Both the farmers and the buyers earn money to purchase items from the community. Those places also get paid and the cycle continues. That money also will help the neighboring communities and that will help Wisconsin as a state.

Dairy farmers are constantly finding ways to make sure they have a positive, lasting effect on local communities and the planet as a whole. Dairy farms contribute to communities by creating job opportunities. The dairy industry is one of the most regulated industries in agriculture. Farmers take many steps to protect the land, water and air around them. They do this for the well being of their communities, their cows and their families. They do this because they want to sustain their farm for generations to come.

The overall economic impact of Wisconsin’s dairy industry is bigger than ever. This was reported in 2017 by research professor Steven Deller from the University of Madison, Wisconsin.

In conclusion, Wisconsin’s dairy industry has a huge impact on me. Wisconsin is a great place to live. It is the one and only America's Dairyland. Wisconsin fuels our bodies, community and even our wonderful economy. Go Wonderful Wisconsin Farmers!

37 wfbf.com JUNE | JULY 2023

A Snapshot: The Past Year with Wisconsin’s Ag in the Classroom Program

Agriculture in the Classroom is a program coordinated nationally by the U.S. Department of Agriculture to help students K-12 to explain the importance of agriculture. In Wisconsin, the program is coordinated by the Wisconsin Farm Bureau Foundation with funding from other agricultural groups and a grant from the Wisconsin Department of Agriculture, Trade and Consumer Protection.

The Wisconsin Ag in the Classroom program objectives have been honed to direct the program work to best meet the curricular and career readiness needs of Wisconsin K-12 students by working to unite all Wisconsin Ag Literacy efforts by:

A variety of agriculture literacy programs and projects allowed educators and Wisconsin Ag in the Classroom staff to reach a variety of students with diverse agriculture content. Programs including grants, essay contest and book program afforded educators a variety of resources to help engage students with agriculture context in core curriculum.

• Mini Grants and Matching grants totaling $5,800 were awarded to 26 agriculture literacy projects impacting over 10,000 students.

• More than 1,500 fourth- and fifth-grade essay contest entries were submitted for the 2022 Ag in the Classroom Essay Contest - an increase in participation from the previous two years.

• 132 online educational materials requests reached 40 counties and more than 9,200 students.

Wisconsin Farm Bureau county programs have been integral in serving as ‘boots on the ground’ for the Ag in the Classroom program. Volunteers build local connections with schools, educators and community partners.

• 63 county Ag in the Classroom programs had approximately 200 individuals volunteer more than 11,000 hours to engage in student agricultural literacy lessons and programs.

• Statewide in-person Ag in the Classroom Volunteer Trainings reached 42 volunteers, or 60% of all county Agriculture in the Classroom program leaders to provide lessons and training on the essay and Book of the Year programs.

• Volunteers helped to support county-level agriculture literacy programs and lessons reaching more than 30,000 students.

• Creating/curating great curriculum that supports core academic standards.

• Engaging educators and volunteers where they are at figuratively, digitally, and geographically.

• Collaborating with like-minded organizations to unify Agricultural Literacy education outreach.

• Applying data-driven decision-making to new programs, resources, and outreach to continually increase program relevance with teachers, volunteers and students. These directives have helped to drive focus to programming areas that are gaps for both educators and industry in current agricultural literacy programming.

Ag in the Classroom programing is transitioning to more educator-facing, with support from county volunteers. Educator outreach began with workshop proposals and tradeshow participation at major education forums including Wisconsin Association of Environmental Educators, Wisconsin Association of Agriculture Educators.

• 4 Agriculture Literacy Educator workshops were led by Ag in the Classroom staff, reaching 80 K-12 educators.

• 4 Wisconsin Educators attended the National Ag in the Classroom Conference

Other highlights worth mentioning:

• Audit of current programs and target audiences was conducted to develop a strategic plan of work.

• New logo launched to align with National Agriculture in the Classroom.

• Developed an interactive presentation in collaboration with the Alice in Dairyland program to develop urban and suburban elementary agriculture literacy outreach.

• The Bulk Order Accurate Agriculture Book program engaged 52 county Agriculture in the Classroom programs and an estimated 21,500 students.

• Began work with Milwaukee Public School District to support the transition of River Trail, a K-8 school, to an agriculture magnet school. This is the first time our program has had administrator level conversations on curricula and ag literacy.

38 WISCONSIN FARM BUREAU FEDERATION Rural Route AG IN THE CLASSROOM

This data is from the 2022-2023 school year reports as of June 2022.

Send us YOUR Photos

Wisconsin Farm Bureau members live and work with beautiful landscapes and livestock. On this page we highlight those sights and special moments. Please email your best photos (high resolution jpgs at 300 dpi) to Lsiekmann@wfbf.com Due to the high volume of photos we receive, we are unable to publish every photo. Photos sent in may be used in other WFBF publications.

39 wfbf.com JUNE | JULY 2023

Jeff & Suzie Fude, Mt. Morris

Bev Brey, Greenwood

Amanda Volp, Omro

Alena Calaway, Vesper

Melissa Hafenstein, Lake Mills

Colleen Johnson, Cumberland

Kris Nowak, Dousman

ONLINE GIVING DAY

Wednesday, Aug. 2 | 10 a.m. - 3 p.m.

Want to support agriculture education and leadership development programs in Wisconsin? The Wisconsin Farm Bureau Foundation will host its second annual Giving Day on Aug. 2 from 10 a.m. - 3 p.m. via the Wisconsin Farm Bureau Facebook and Instagram accounts. Proceeds from this event benefit:

Collegiate Farm Bureau

Ag in the Classroom

EVENT SCHEDULE

10 - 11 a.m.

11 - 11:30 a.m. 11:30 - Noon Noon - 1 p.m.

1 - 1:30 p.m.

1:30 - 2 p.m.

2 - 3 p.m.

Kick-off and Power Hour

Ag in the Classroom Challenge

YFA Challenge

Power Hour

County Farm Bureau Board Challenge

Promotion and Education Challenge

Leadership Institute Challenge

Power Hour

Promotion and Education

Leadership Institute

Young Farmer and Agriculturist

EVENT HIGHLIGHTS

Donors during the power hours will be entered into a drawing for one of five prizes valued at $200 each.

Program participants will issue challenges throughout the day to increase awareness of the event and the Foundation programs listed above.

Individual donors who give $100 or more will receive a “Friend of the Farm” t-shirt.

You don’t need to wait until Aug. 2 to give! Scan the code to be a part of Giving Day today!

Thank You Foundation

to the Following WFB Foundation Donors:

(Donations were made between April 1 and June 2, 2023)

• Compeer Financial

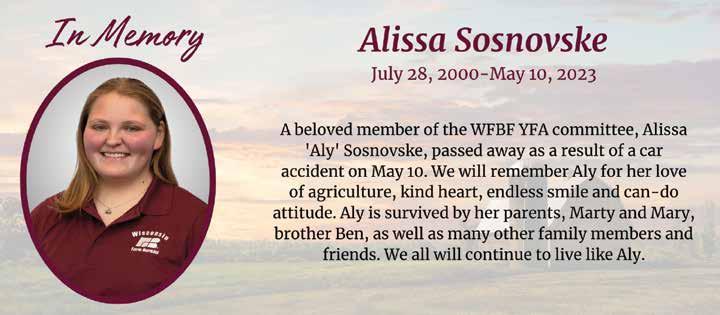

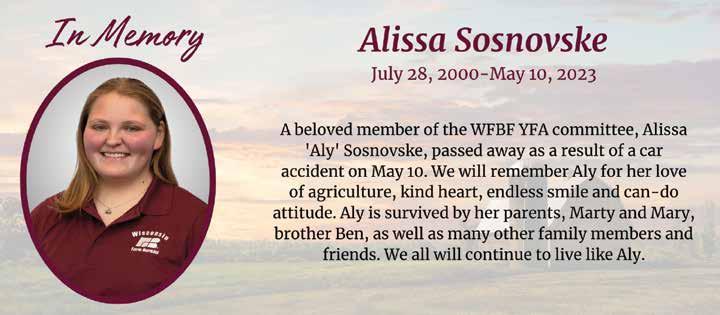

• Ryan & Cheri Klussendorf in memory of Aly Sosnovske

• Wendy and Austin Volkert in memory of Aly Sosnovske

• WFBF YFA Committee in memory of Aly Sosnovske

About the

The Wisconsin Farm Bureau Foundation was established in 1988 to provide support for agricultural education and leadership programs. Through donations and other contributions, the foundation invests time and resources to support the next generation of agriculturists.

42 WISCONSIN

Rural

FARM BUREAU FEDERATION

Route

Wisconsin Farm Bureau Foundation

How to Teach Kids of All Ages About Money

The key to teaching kids about money is making it a part of your life. People don’t just pick up good financial practices; they need to be taught, and it all starts at home. According to financial literacy surveys by the National Foundation for Credit Counseling, the number one source of knowledge for the majority of people is their parents. You can make a significant impact in your child’s life by helping them establish good money habits early and reinforcing them often.

Here are a few key strategies for major age groups. These principles build upon each other to help develop strong personal finance skills for kids that will pay off throughout their lifetime.

Personal Finance for Kids in Preschool and Kindergarten

Play pretend with money. What 4-year-old doesn’t love a good game of pretend store or restaurant? This is an easy way to remind your child that nothing’s free — including that yummy fake ice cream cone.

Take the kids to the store. Once they have some practice at the pretend store, they can help hand over cash at the real one. Instead of only explaining that a new toy costs $10, gather the bills at home and have them physically pay for it. That exchange with actual money, not just a card, is important.

Let them participate. Kids this age are all about doing. Let them add money to their piggy bank regularly. It may seem small, but being an active participant makes it even more exciting when they start to see their pile grow.

Money Management for Kids in Elementary School

Make them earn their allowance. Having an allowance teaches children about managing money and helps them experience a bit of financial independence. Having their own money is an important learning opportunity and opens the door to other financial literacy lessons.

Teach the spend-save-share method. By now, your kiddo is probably over the moon when they get $20 from grandma or a birthday gift card. The spend-save-share method models basic budgeting.

Take them to open a bank account. A piggy bank is fine for younger children, but when your children reach elementary school consider opening an account at a bank to teach them about building up their balance.

Include the whole family in money conversations. One of the best ways to build money management skills for kids is to simply talk about money. Include your children in discussions about budgets, saving for vacation, where to make charitable gifts and more.