Steven Leafgreen PRESIDENT & CEO

Lorrell Bellotti CHIEF MARKETING OFFICER

Mike Mason CHIEF FINANCIAL OFFICER

Dan Moss C HIEF INFORMATION OFFICER

PJ Brennan SENIOR VICE PRESIDENT SALES & EXPERIENCE

Scott Sutherland SENIOR VICE PRESIDENT CREDIT & LENDING

As I reflect on 2024, I recognize that while it presented its share of challenges, it also brought numerous achievements. We concluded the year with improved net income, a $13 million reduction in corporate borrowing, and an expanded membership base. Notably, we maintained a robust net worth ratio of 9.49%, well above the regulatory requirement to be considered “well capitalized.”

The persistent inflationary pressures of 2024 created economic hurdles reminiscent of the 2008-2010 financial crisis. These challenges, combined with increased delinquencies, unstable used auto values, and elevated borrowing rates, resulted in record charge-offs. To maintain compliance with the Current Expected Credit Losses (CECL) regulation and ensure our continued safety and soundness, we allocated a record $1.8 million to our allowance for credit losses. Despite these headwinds, it was a year of significant accomplishments:

1. Membership Growth:

We’ve increased our member count to nearly 17,000, a testament to our commitment to financial inclusion and community support.

2. Technological Advancements: We upgraded our credit card program, enhancing security and convenience for our members. We anticipate exciting changes to our debit and digital card offerings in mid-2025.

3. Culture: We were named a “Best Credit Union to Work For” for the second time in three years.

4. Geographic Expansion: We are expanding our presence in the Casper market with the purchase of a new branch, set to open in mid-2025.

5. Financial Strength Recognition: Western Vista received a 5-star rating from Bauer Financial, underscoring our financial stability and sound management practices.

As we move forward, we remain committed to maintaining the highest standards of security and service. Our daily operations are driven by a singular focus: safeguarding and enhancing your financial well-being.

I extend my sincere gratitude to our dedicated employees, board of directors, supervisory committee, and member advisory panel. Your tireless efforts enable us to serve our members with excellence.

To our members, we truly appreciate your trust and loyalty. We look forward to continuing to meet all your financial needs for personal, non-profit, and business for years to come.

Sincerely,

Steven Leafgreen

Steven Leafgreen President/CEO

Aimee Lewis CHAIRMAN

Vickie Nelson VICE CHAIRMAN

Christine Kronz SECRETARY

Cindy Garvin TREASURER

Tim Bolin ASSISTANT SECRETARY

Mark Mercer ASSISTANT TREASURER

Theresa Talmadge BOARD MEMBER

Western Vista Credit Union’s mission statement is “Your Finances. Our Focus.” The mission statement is a powerful reminder of the credit union’s purpose and couldn’t be a better description of 2024.

As complexity in the financial world is starting to look like the new normal, Western Vista is more focused on providing value to our members than ever. Both behind the scenes and publicly, at the individual level and from an organizational view, the staff of Western Vista worked diligently over the past year to improve the financial lives of our members.

Many people in our country experienced financial hardships in 2024, including some of our own members. Western Vista staff worked with individual members who may have hit hard times to help them navigate difficult situations while maintaining their financial integrity. Members were able to work out more affordable payment plans that allowed

them to keep their assets, providing much-needed stability.

On an organizational level, the executive staff looked beyond the current financial complexities to make decisions that will put the credit union in the best financial position for the long run, continuing to build the solid foundation that we have come to expect.

Taking center stage on the individual level was the credit card conversion with a focus on providing more advanced technology and ease of use to our credit card holders. This was a massive undertaking by the staff over several months, resulting in bold designs, new features like “tap to pay” and an improved rewards program. If you’ve never considered a Western Vista credit card, there’s no time like the present!

There has never been a more exciting time to be a member of the board of directors at Western Vista Credit Union. Representing the members

is a true honor, and we look forward to continued growth and opportunities.

Sincerely,

Aimee Lewis

Aimee Lewis Chairman of the Board

Doug Thiede VICE CHAIRMAN

Nancy Sargent SECRETARY

Frank Magazine COMMITTEE MEMBER

Steve Cooke COMMITTEE MEMBER

Western Vista Federal Credit Union’s supervisory committee is made up of five volunteers, appointed by the board of directors to independently evaluate the financial condition of the credit union. The committee retained the services of Credit Union Audit Group, an external audit firm, to review internal auditing activities to ensure the credit union’s financial statements provide a fair and accurate representation of its financial condition. While the supervisory committee acts independently to perform its duties, the committee regularly interacts with the board of directors, National Credit Union Administration (NCUA) examiners, as well as the independent audit firm.

The supervisory committee’s efforts ensure that the credit union is safeguarding member assets and protecting members’ interests by verifying that there have been internal controls implemented. To that end, the committee oversees the auditors who function within

the mandated guidelines set forth by the governing bodies, NCUA regulations, and generally accepted accounting principles.

Despite challenges presented by an ever-changing economy, it is the supervisory committee’s opinion that these audits have proven Western Vista to be in excellent financial condition. We are pleased to report that Western Vista continues to be well-managed and operates effectively in accordance with federal regulations. Together, the volunteer officials, along with credit union staff, form a dedicated group working together to continue a tradition of excellent financial management.

We look forward to continuing our work with the management team and the board of directors and would like to thank our board liaison, Tim Bolin, for his support. Serving on the supervisory committee with me are Nancy

Sargent, Doug Thiede, and our two newest members, Frank Magazine and Steve Cooke. I thank them for their time, dedication, and commitment.

Sincerely,

Ann-Marie Trujillo

Ann-Marie Trujillo Chairperson

Western Vista’s executive leadership team is responsible for setting strategic direction, managing operations and making key decisions. After seven years of service, Dan Buchan retired from his role and was replaced by Scott Sutherland.

Steven Leafgreen PRESIDENT & CEO

Dan Moss CHIEF INFORMATION OFFICER

Lorrell Bellotti CHIEF MARKETING OFFICER

PJ Brennan SENIOR VICE PRESIDENT SALES & EXPERIENCE

Mike Mason CHIEF FINANCIAL OFFICER

Scott Sutherland SENIOR VICE PRESIDENT CREDIT & LENDING

As a member-owned financial cooperative, Western Vista Credit is a democratic organization owned and controlled by its members. Each member gets one vote, no matter their financial status, to elect the board of directors who help make the organization’s policies and decisions. Cindy Garvin, Christine Kronz and Aimee Lewis were re-elected to the credit union’s board of directors in 2024, while Theresa Talmadge joined as a first-time board member.

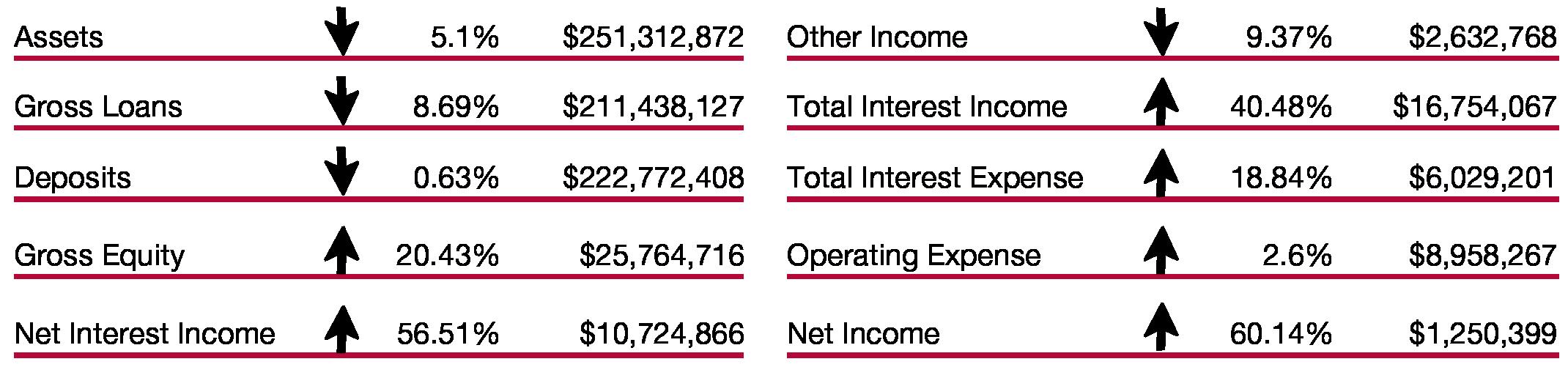

Deposit accounts are crucial for conducting credit union business. They serve as a primary source of funds for the credit union, providing liquidity that allows for loans to other members. Total deposits decreased by .63%.

Our state-of-the-art online banking portal and mobile app allow our members to have round-the-clock access to funds, anywhere in the world. In addition, members can check their credit score and receive offers tailored to their individual needs.

465

NET NEW MEMBERS

925

DEPOSIT ACCOUNTS

16,917 TOTAL MEMBERS

Commercial loans enable member businesses to purchase new equipment, lower loan payments through refinancing opportunities and supply working capital lines of credit.

For nearly 85 years, Western Vista has delivered essential financial solutions to its members. We are proud to continue supporting the financial needs of our community and look forward to continuing a long tradition of helping our members.

$28.1M

COMMERCIAL LOAN PRODUCTION

29 COMMERCIAL LOANS FUNDED

3.3%

YEAR-OVER-YEAR GROWTH IN COMMERCIAL LOAN PRODUCTION

$43M CONSUMER LOAN PRODUCTION

1,306 CONSUMER LOANS FUNDED

2125

TOTAL CREDIT CARD HOLDERS

$45.2M NEW RESIDENTIAL REAL ESTATE FINANCING

192 TOTAL LOANS 14.49% INCREASE IN PRODUCTION

31.78% INCREASE IN PORTFOLIO SIZE HOME EQUITY LOANS REAL ESTATE LENDING

$5.7M NEW HOME EQUITY LINES OF CREDIT

56 NEW HELOCS FUNDED

$9.3M IN FIXED SECOND MORTGAGES

49

13.9% NEW LOANS FUNDED INCREASE IN PORTFOLIO SIZE FIXED SECOND MORTGAGE

As of December 31, 2024 & 2023

As of December 31, 2024 & 2023

Western Vista Credit Union remains financially strong, with net worth to assets reaching 9.49% and return on assets at .48%, both numbers reflecting significant strength. In addition, our membership base grew by 465 members, a 2.75% increase.

The year began with interest rates at a 23-year high of 5.5%, instituted to fight a historic inflation surge. However, the final quarter realized a full percentage point lowering of the benchmark rate, signaling that inflation was coming under control.

Western Vista borrowers struggled to pay off their loans, requiring an increase of $1.8 million in provision expense for the year, asserting downward pressure on earnings. As with many other financial institutions, member balances declined throughout the year as members continued to draw down excess savings. Despite the economic challenges, the credit union’s loans to assets ratio remains above 84%, reinforcing the fact

that Western Vista continues to be the lender of choice for its members.

Additionally, many members moved their funds from on-demand deposits to more attractive yielding share certificates, causing interest expense to increase 18.8% over the previous year. As a result, total assets decreased by 5.1%.

Western Vista experienced a successful year in commercial lending, contributing $5.1 million in production, while the mortgage area saw a slight decline. Net income improved by 60% year-overyear, despite the provision for loan losses. Delinquent loans remain a challenge at .85% of total loans.

According to the guidelines set forth by the National Credit Union Administration (NCUA), Western Vista is wellcapitalized. The credit union produced a net income of $1.25 million in 2024, a direct result of the dedication of the CEO, management team and staff. Western Vista’s

2024 financials are strong, particularly when compared to its peer group. Western Vista is geared to successfully mitigate external challenges, while continually focusing on improving our services with timely share certificates, effective credit card services and loan availability.

Operating expenses increased $226,808 or 2.6% in 2024 in support of the credit union’s critically important infrastructure. As your treasurer, I assure you that the credit union remains safe, secure, and well-capitalized, consistent with the standards set by NCUA, and that we are well-positioned to continue to support the financial health and well-being of our members.

Sincerely,

Cindy Garvin

Cindy Garvin Treasurer

Established in 1940, Western Vista Federal Credit Union has always placed its members' financial well-being at the heart of its mission:

Guided by the vision to "Enhance the lives of our members. Enrich the communities we serve. Encourage financial success," the credit union actively fosters community development through corporate giving.

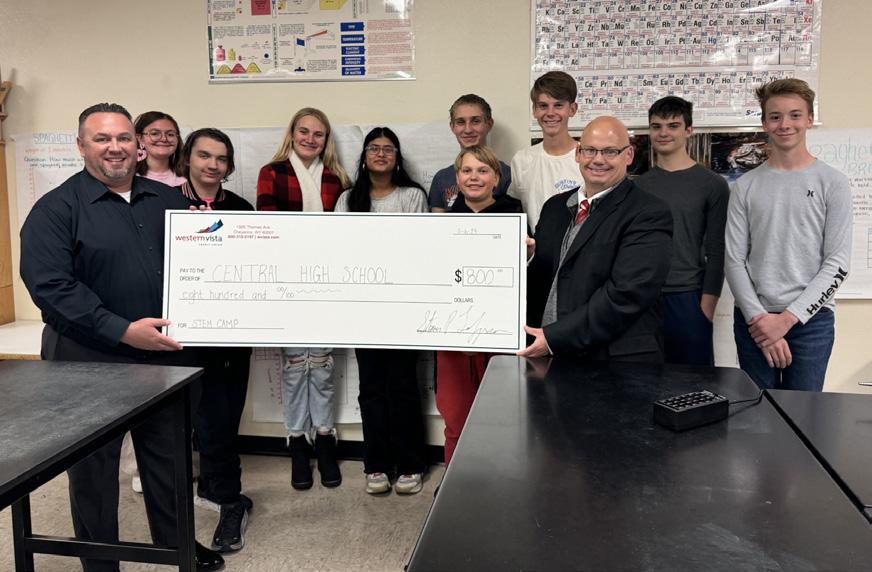

Credit unions are built on the philosophy of “people helping people.” In 2024, Western Vista Credit Union gave back to the communities it serves with nearly $41,000 in donations to approximately 50 non-profit organizations.

Western Vista demonstrates its commitment to enriching lives and building stronger communities by investing in initiatives that uplift and empower others, especially in the areas of housing, education and financial literacy.

Highlights for the year:

$8000+ to:

area chambers of commerce

$3000 to:

Laramie County School District #1 in support of Student of the Week and other programs

$2000+ to:

Boys & Girls Club of Cheyenne

Cheyenne Regional Medical Center

Cheyenne Symphony Orchestra

Shared among four non-profits in honor of International Credit Union Day

$1500+ to:

Connect2Women

Laramie County Library Foundation

Rotary Club of Cheyenne

In support of military activities and veterans’ services

$1000+ to:

Cheyenne Animal Shelter

Kiwanis Club of Cheyenne

Magic City Enterprises

Safehouse Services

Thankful Thursday

YMCA Capital Campaign

Split among several non-profits as part of the credit union’s Leap Day celebration

$40,953 TOTAL DONATIONS

TOTAL DIVIDENDS PAID TO MEMBERS $5.4M $248,464

CHECKING DIVIDENDS

$4.4M SHARE CERTIFICATE DIVIDENDS

Western Vista Credit Union employees passionately embody our vision to enrich the communities we serve. We strive to improve lives one member at a time and build a legacy of lasting prosperity in the regions we call home.

2024 VOLUNTEER HOURS

Mike Mason

Michelle Blatt

Chance McLean

Tanner Abbott

Martha Avery

Matt Cannon

Melody Fenton

Jeremy Ngirbedul

Dan Moss

Lilly Winegeart

Laurel Long

Elise Macy

Heidi Moore

Financial Narrative 50

Lorrell Bellotti was named to the Financial Narrative 50, an exclusive list celebrating the very best marketing communications professionals in the financial services industry. She was the only credit union professional to make the list!

Several employees earned the Certified Credit Union Financial Counselor designation through America’s Credit Unions in 2024.

Lorrell Bellotti

Matt Cannon

Heidi Moore

Dan Moss

Peggy Ritts

Lilly Winegeart

For the second time in three years,

Awarded in the "E-mail - Single or Series" category for a member onboarding campaign targeted at new members joining through the indirect channel.

Each year, Western Vista awards two $1000 scholarships to help deserving students continue their education. Pictured with Steven Leafgreen, president/CEO, and Aimee Lewis, chairman of the board, are Kamryn Tempel (left) and Brynlee Gwynn (right).

The VISTA Award was created in 2021 to honor Russ West, a longtime employee of Western Vista who passed away unexpectedly. The VISTA Award recognizes an employee who epitomizes the mission, vision and values of Western Vista and is awarded bi-annually. The 2024 recipients were Leslie Fox (left) and Lisa Apodaca (right).

Steven Leafgreen, President/ CEO of Western Vista Federal Credit Union welcomed members and gave his opening remarks.

The 84th Annual Meeting of the Western Vista Federal Credit Union was held March 20, 2024, at the Thomes Branch Boardroom of the City Center Building of Western Vista Credit Union and via ZOOM and was called to order at 5:34 p.m. by Chairman of the Board of Directors, Mark Mercer. Christine Kronz, secretary of the board of directors, ascertained a quorum was present.

Chairman Mercer introduced the members of the credit union’s board of directors and the supervisory committee chair and gave the board report. He shared that in 2023 that Western Vista not only weathered the challenges presented by the economic landscape but emerged with remarkable success.

The economic conditions of 2023 were marked by

uncertainties and volatility. Despite this, Western Vista’s prudent financial management and strategic decision-making allowed the credit union to navigate the landscape effectively. Mercer shared that Western Vista is dedicated to offering members the financial tools that align with their diverse needs and goals. He concluded his report by sharing that Western Vista achieved remarkable milestones in 2023 and will continue to thrive in years to come. After a motion and second, the board report was approved.

Chairman Mercer requested a vote of approval for the March 15, 2023 meeting minutes, which were included in the annual report. After a motion and second, the minutes were approved.

Vickie Nelson gave the treasurer’s report, explaining Western Vista continues to be in a very strong and safe financial condition. After a motion and second, the treasurer’s report was approved.

Ann-Marie Trujillo, chairman of the supervisory committee, was called to give the supervisory committee report. She shared that the supervisory committee has over 75 years of combined volunteer service. Trujillo reviewed the role of the supervisory committee, noting that they act as a link between the membership and the board of directors.

The committee retained the services of Ferrin & Company to conduct a financial audit of the credit union. Based on the audit report, it is the opinion of the supervisory committee that Western Vista continues to be well-managed and operated in accordance with federal regulations. Trujillo thanked the committee for their service to the credit union as well as Tim Bolin, who served at the board liaison to the supervisory committee.

After a motion and second, the supervisory committee report was approved.

The nominating committee report was given. There were

four open positions and five qualified candidates. And election was held, and Cindy Garvin, Aimee Lewis and Christine Kronz were elected to serve another term. In addition, Theresa Talmadge was elected to the fourth position on the board of directors.

Steven Leafgreen announced the milestone anniversaries that were celebrated in 2023 and recognized those employees for their service and dedication to the credit union and its members.

The winners of the prize drawings were announced, and the meeting was adjourned at 6 p.m.

Sincerely,

Crystal Mancera Meisner

Crystal Mancera Meisner Recording Secretary

Accepted by:

Christine Kronz, Secretary Aimee Lewis, Chairman

$251,312,872

IN TOTAL ASSETS as of December 31, 2024

553 NEW ENROLLMENTS IN SAVVYMONEY our free credit score monitoring service

16,917

TOTAL MEMBERS

192 MORTGAGES

3,956 COMMUNITY SERVICE HOURS performed by credit union staff

100% INCREASE IN INSTAGRAM CONTENT INTERACTIONS

1,027 FACEBOOK FOLLOWERS

$25,764,716 NET WORTH