Economics

May 2024

THE WorLD IN BrIEF

The body shop closures

March 2024: Hunt's spring budget

The general election

under 24's rise in Car Insurance & More...

To buy or not to buy?

By archita & vaibhavi

In 2008, we saw the decline in house prices, the mortgage market was irrevocably changed, making it even more difficult for first time buyers to enter the property ladder. Since then, banks have become more cautious when providing mortgages to people, requiring higher credit scores and larger down payments as a method to minimise the risk of another financial crisis caused by irresponsible lending. These stricter regulation options have now led to increasing difficulties for people to find financial support to afford housing.

On paper, most first-time buyers could afford to buy the home they rent but banks’ stress-testing puts home ownership out of reach for many. In the aftermath of the crisis, decades later, the mortgage market prioritised financial stability over leeway for first time buyers, resulting in the average age of first-time buyers climbing to the thirties from the previous twenties. This is due to economic shocks such as the cost-ofliving crisis combined with COVID-19 leading to many redundancies and lower disposable income. For first time buyers, mortgages take 2/5s of their disposable income, which has

resulted in a tighter budget for what many people can afford to spend monthly on mortgages, which has coincided with a lack of affordability in the mortgage market. The struggles of first-time buyers have had a significant impact on their confidence in the property market. This low confidence then undermines the willingness of these buyers to take risks associated with purchasing property, which could then prompt the rise of longer-term high fixed rate mortgages. This means future buyers could now be looking at paying back their mortgage over a much longer time frame. All these events have led to decreased demand from first time buyers, which has caused a slowdown in the housing market as there is less competition for properties. This has also led to consequences for homeowners such as a negative wealth effect (when value of property falls there is a fall in consumption and spending) due to greater struggles to sell their properties and depreciation of assets.

Many measures are already in place to assist first-time homebuyers. For example, the 2021 Budget announced a mortgage guarantee scheme that allows first-time buyers to pay only 5% of the deposit. There is also a ‘Help to Buy’ scheme available in

Wales, with conditions such as a shared-equity loan when you deposit 5% and receive a shared equity loan of up to 20% of the purchase price.

Furthermore, if you live in England or Northern Ireland and are a council or housing association tenant, you may buy the property at a discount.

Furthermore, the government has been considering a radical plan in which first-time buyers would only have to provide 1% of the loan, while lenders would create a 99% loan. As a result, buyers would only need a few thousand pounds to purchase an average UK home; however, experts have warned that this would significantly inflate house prices while failing to account for extreme housing shortages. On the other hand, there has been a recent rise in new-build housing projects throughout the UK – properties that are more desirable to buyers due to developed functionality and sustainability.

In essence, a first-time buyer’s path to finding a property will continue to have its barriers for a while. The banks’ prioritisation of financial stability has ultimately led to barriers for first time buyers in securing a mortgage. However, support is in place to help entrants into the market; in May 2024, experts predict that interest rates are likely to fall, potentially helping consumers who are looking to enter the housing market.

rolls royce profits surge amidst strategic cost-cutting measures

By tiana & alysha

Rolls-Royce Holdings is a British multinational aerospace and defence company incorporated in February 2011. Civil aerospace, defence and power systems are their main businesses in which they have four pillars that they follow, for the benefit of the company-portfolio choices and partnerships: Advantaged businesses, Strategic initiatives, Efficiency and Simplification. Rolls-Royce’s strategic focus on becoming a higher-margin business through cost management and pricing strategies suggests a forward-looking approach aimed at sustainable growth such as lower carbon emissions. By prioritising these areas, the company demonstrates its commitment to maintaining competitiveness and financial health.

Rolls Royce has seen a significant increase in revenues from £13.52 billion to £16.49 billion, with profits from £652 million in 2022 to £1.6 billion currently. So why has Rolls Royce done so well? Due to Rolls Royce extremely effective cost cutting methods of firing 2500 of its work force by the end of 2024. These cost-saving measures alongside a pricing strategy designed to enhance margins, played a pivotal role in their financial turnaround. The strategy has been put into place by the company’s recently reassigned CEO Tufan Erginbilgiç. This has been put into place in all their divisions, despite the risk due to current geopolitical events such as the Ukraine-Russia war, where the company used to rely heavily on Russia, as it was a major source of their titanium with total figures amounting to 20% of their total input of the metal. However, after conflicts the previous CEO Warren East decided there was a need to

source from different countries. Effects from the Covid pandemic and the reduction in the need for their industry meant that the company had a complete loss of £2 billion.

Although, they did have a very strong 2023 where there was increased demand for their jet engines and rising military spend. This bumped up margins in its Civil Aerospace and Defence units, where it’s meant that the effects of the pandemics due to reduced flights and the need for the company, have almost disappeared. The profit is predicted to continue rising by 6% from £1.6 to £2 billion, as more defence orders arise due to the company’s influential name. The investor response was overwhelmingly positive, as reflected in the nearly 8% rise in Rolls-Royce’s share price in London. In 2023 Rolls Royce shares have gained over 200% making it one of the biggest risers in the FTSE 100.

Chief executive Tufan Erginbilgiç said: ‘Our transformation has delivered a record performance in 2023, driven by commercial optimisation, cost efficiencies and progress on our strategic initiatives.’

While cost-cutting measures are essential, Rolls-Royce recognises the importance of continued investment in research and development to drive innovation and maintain its competitive edge.

Looking ahead, Rolls

Royce provided a forecast suggesting further growth in its underlying operating profit.

Overall, Rolls Royce’s rising profits and cost-cutting measures reflect its proactive approach to managing its business in a dynamic and challenging environment. By focusing on both revenue growth and operational efficiency, the company is well-positioned to sustain its success and drive long-term value for its stakeholders. With ongoing investments in technology and sustainability, with a sharp focus on high-margin areas, Rolls-Royce is likely to remain a key player in the industry, setting a benchmark for operational excellence and financial performance.

Nigeria's economy

By jasleen & leeya

Nigeria, as Africa’s largest economy, plays a crucial role in the continent’s economic landscape. However, recent years have presented significant challenges to Nigeria’s economy, with issues such as inflation, currency depreciation, and the rise in the cost of living affecting millions of Nigerians.

What is causing this crisis?

Due to the increase in the price of fuel and other expenditures brought on by the conflict in Ukraine, inflation has skyrocketed in several countries. However, President Tinubu’s initiatives to restructure the economy have also made things worse. The new president declared the end of the long-standing fuel subsidy on the day he took office nine months ago. For residents of this oil-producing country, this had kept petrol costs low, but it was also a major financial burden on the government. It used 15% of the budget in the first half of 2023, which was more than the government spent on healthcare and education combined. But other prices have increased because of the subsequent sharp increase in the price of petrol.

Nigeria’s Cost of Living Crisis.

The cost of living in Nigeria has been on the rise, posing a considerable burden on the average citizen. Essential goods and services, including food, housing, healthcare, and education, have become increasingly expensive, outpacing the growth of household incomes. High unemployment rates, coupled with stagnant wages, have exacerbated the affordability crisis, leaving many Nigerians struggling to make

ends meet. The cost of living is particularly burdensome for lowincome households, who are forced to allocate a significant portion of their earnings towards basic necessities. Some individuals in the north are currently consuming the rice that is typically thrown out after the milling process.

Inflation:

Inflation remains a persistent challenge in Nigeria’s economy, with double-digit inflation rates recorded in recent years (31.7% as of February 2024 from 21.91%, February 2023). Factors contributing to inflation include supply chain disruptions, currency depreciation, and government policies such as fuel subsidy removals and increases in value-added tax (VAT). Inflation erodes the purchasing power of consumers, making it more difficult for households to afford goods and services. Moreover, high inflation rates can discourage investment and savings, further exacerbating economic instability. Due to the rapid increase in inflation (more than 10% in just a year), the cost of food has subsequently risen by an estimated 35%. Many are going hungry rationing food, or actively looking for cheaper alternatives.

Currency Depreciation:

The depreciation of the Nigerian currency, the Naira, has been a significant concern for policymakers and economists alike. External factors such as fluctuating global oil prices, Nigeria’s heavy dependence on oil revenue (6.33% of GDP in 2022), their primary agricultural sector (23.7% of GDP in 2022), and capital outflows have contributed to the depreciation of the Naira against major currencies like the US Dollar and Euro. A weaker currency makes imports more expensive, contributing to inflationary pressures and the increasing cost of living for Nigerians.

Additionally, currency depreciation undermines investor confidence and hampers efforts to attract foreign investment, further constraining economic growth. In addition, Mr Tinubu abandoned the practice of determining the Naira’s value in relation to the US dollar, instead of letting supply and demand dictate market prices. The level was being maintained at great financial expense to the central bank. However, the Naira’s value has dropped by more than two-thirds since the peg was abandoned, momentarily reaching an all-time low last week. Ten thousand Naira were used to purchase $22 last May, but more recently it is only worth approximately $6.40 (USD).

Economy hit hard by internet outages:

Major network disruption which has had a major impact of Nigeria’s economy. Reliable network services are crucial for online transactions, and the disruption has led to a decline in sales for online retailers, with customers facing difficulties in accessing e-commerce platforms. According to statistics by Mordor Intelligence, Nigeria’s e-commerce market size is estimated at $8.53 billion in 2024, and is expected to reach $14.92 billion by 2029, growing at a compound annual growth rate of 11.82% during the forecast period. Temidayo Adefioye has stated this disruption will result in substantial financial losses, hinder market growth, and lower investor confidence.

Government Response and Challenges:

The Nigerian government has implemented various measures to address economic challenges, including fiscal and monetary policies aimed at stabilising prices, stimulating growth, and promoting diversification. However, challenges such as corruption, inadequate infrastructure and policy inconsistency continue to hinder economic progress. Additionally, the COVID-19 pandemic has exacerbated existing vulnerabilities, further straining the economy and socioeconomic inequalities.

To Conclude:

Nigeria’s current economic landscape is characterised by rising costs of living, high inflation rates, and currency depreciation, posing significant challenges to the population and policymakers alike. Addressing these challenges requires concerted efforts to implement sustainable economic policies, tackle corruption, and invest in critical infrastructure and human capital development. By addressing these issues, Nigeria can unlock its full economic potential and improve the livelihoods of its citizens.

Apple fined $1.8 billion over breaching app store rules for music being broken

By Nimisha & rania

The European Commission (EC) has fined Apple over $1.8 billion (£1.5 billion) for abusing its power and suppressing competition from other rival music streaming services for a decade through its App Store. This is the first time the multinational corporation and technology company has been punished for the breach of EU antitrust laws. The fine is nearly four times higher than the expected fine at around $40 million, however, it only accounts for 0.5% of Apple’s worldwide turnover. For years, Spotify and other apps have criticised Apple’s App Store, contending that the 30% fee on apps and in-app purchases (on non-Apple made applications) stifled competition.

The European Commission stated that, “Apple’s conduct, which lasted for almost 10 years, may have led many iOS users to pay significantly higher prices for music streaming subscriptions.”

During their investigation, the Commission found that Apple

applied restrictions on all app developers which prevented them from informing IOS users about alternative, cheaper music subscriptions outside of the Apple ‘ecosystem’. Margarethe Vestager - the European competition commissioner – said that the fine was to act as a deterrent against repetition and sent a powerful message that “no company, not even a monopoly like apple can wield power abusively to control how other companies interact with their customers.” She added that as a result of these anti-competitive practices, consumers paid a much higher price as they could not use effectively use or make informed decisions with the withheld critical information.

Apple claims that there is no evidence customers had been harmed even after they themselves were the ones who had stopped streaming app developers from letting customers know how to subscribe to offers. They had also stopped them providing

any information because of the high commission fee imposed by Apple on developers and passed on to consumers in the form of higher subscription prices for the same service on the Apple App Store. Moreover, Apple’s anti-steering provisions led to non-monetary harm in the form of a degraded user experience. Alternatively, iOS users either had to conduct extensive searches before discovering relevant offers outside the app, or they refrained from subscribing to any service due to their inability to find suitable options within it.Top of Form Regarding this matter, Apple had stated that the EU had failed to find any substantial evidence that proved their involvement in this issue.

Because of this, Apple has announced that they would appeal the $1.8 billion fine. It said that the decision “was reached from failure to uncover any credible evidence of consumer harm and ignores the realities of a market that is thriving, competitive,

and growing fast.” This highlights the company’s apparent blindness to the alleged customer harm despite ongoing high profits.

Apple had revealed in a statement that, “Spotify has the largest musicstreaming app in the world and has met with the EC more than 65 times during this investigation.” Apple had also claimed that a large proportion of Spotify’s successes were thanks to the Apple App Store. The EU Digital Markets Act (DMA) was designed recently to identify and regulate the gatekeeper power of the largest digital companies, complementing the EU competition rules to help break the stronghold that firms such as Apple and Google have on the global market. Multiple tech companies were given six months starting from August of last year to comply with a full list of requirements under this new legislation, or they would face an extortionate fine of up to 10% of their annual turnover. The firms had until the 6th of March to adhere to these changes, with those such as Meta and TikTok pursuing challenges to

certain aspects of the regulation.

Law professor at EDHEC, Anne Witt, told the BBC that the DMA will have a “significant impact” on the way designated platforms operate within the EU. There has been a letter written from 34 companies and associates across a variety of sectors pleading the EC to take action on Apple. “Apple’s new terms not only disregard both the spirit and letter of the law, but if left unchanged, make a mockery of the DMA and the considerable efforts by the European Commission and EU institutions to make digital markets competitive.”

Although, since the start of the year, Apple has already proposed a multitude of changes to its iOS software, for example, allowing users to download apps from other apps and accessing alternative payment systems.

Although this scandal has experienced an extensive backlash from many companies - due to the sheer magnitude of the corporation and the hundreds of millions of people that habitually consumer Apple products - Apple will most likely continue to receive major profits and remain unchanged. As consumers are increasingly turning to streaming services (like apple music), it is essential to ensure that these platforms operate with integrity and uphold the value of artistic content and the law. The revelations surrounding the Apple Music scandal should serve as a wake-up call for the industry to address issues within the company and learn to promote transparency.

Navigating global trade tides: ningbo's economic outlook in a changing world

By vida

In the landscape of global trade, few cities stand as prominently as Ningbo, an eastern Chinese port city with a high population of 9.6 million residents. Nestled along the coast of Zhejiang province, Ningbo has emerged as a beacon of China’s export prowess, serving as a crucial tool for the nation’s industrial might. However, recent shifts in the global economic currents have cast a spotlight on Ningbo’s resilience and adaptability in the face of uncertainty.

At the heart of Ningbo’s economic narrative lies its sprawling industrial district, a hive of activity where thousands of predominantly family-owned firms churn out an eclectic array of goods, ranging from textiles and car parts to electronics and machine components. This manufacturing skill and expertise has been pivotal in driving China’s overwhelmingly strong export force over the past four decades, positioning Ningbo as a vital enterprise in the global supply chain. Yet, the city’s fortunes are inextricably linked to the movement and flow of global economic tides, particularly the health of the American economy. As the world’s largest consumer market, any tremors in the United States reverberate swiftly across the Pacific,

with Ningbo often among the first to feel the ripples. The recent resilience of American demand for Chinese exports, despite broader economic headwinds, has provided a ray of optimism in Ningbo’s economic landscape.

However, this optimism is tempered by a sobering reality. Ningbo’s heavy reliance on foreign demand renders it quite vulnerable to external shocks, such as fluctuations in global trade dynamics or geopolitical tensions.

The presence of a downturn in foreign demand looms large, potentially spelling disaster for the region’s export-oriented economy. Some past episodes have highlighted the fragility of Ningbo’s prosperity, as evidenced by the brief downturn experienced in early 2023. Moreover, local manufacturers grapple with a myriad of challenges, ranging from limited access to financing to the daunting task of keeping pace with technological advancements. While larger manufacturers in cities like Shenzhen enjoy government support for innovation and technology upgrades, Ningbo’s smaller firms often find themselves at a disadvantage, struggling to compete in an increasingly digitized global economy.

Amidst these challenges,

questions linger about Ningbo’s ability to adapt and diversify its markets. While the city has made strides in selling directly to customers in the West through online platforms like Amazon, there are uncertainties about its capacity to penetrate emerging markets, where demand is burgeoning. The recent surge in demand from regions such as Africa and South America underscores the shifting dynamics of global trade, necessitating a recalibration of Ningbo’s export strategy.

In essence, Ningbo stands at a crossroads, navigating the treacherous waters of global trade with a mix of optimism and trepidation. Its fate hinges not only on the resilience of the global economy but also on its ability to innovate, diversify, and adapt to evolving market dynamics. As China’s economic landscape continues to evolve, the fortunes of Ningbo serve as a barometer of the nation’s economic resilience and adaptability in an ever-changing world.

Young drivers face sky rocketing car insurance

By luiza & kitty

What is car insurance?

Car insurance is an agreement with an insurance company that protects you financially from the costs of fixing a damaged car, paying medical bills after an accident, or replacing a stolen car. For example, if you got into a car accident that was not your fault, the individual at fault would pay for the damage done through their car insurance. Car insurance premium is the amount you pay for your car insurance policy, which generally tends to reduce when insurers think you are lower risk on the road, since with age more driving experience is gained.

Why are young people facing higher car insurance?

It is no secret that many houses throughout the UK have faced the strain of rising costs in the recent years. The cost-of-living crisis has been a prominent topic of discussion for many individuals. Car insurance premiums are no exception to this.

Currently, soaring car insurance is most greatly disadvantaging new young drivers. Following the COVID-19 pandemic, which has hindered many driving lessons and tests, numerous individuals have had to start their driving journey at a later stage in life alongside the current new drivers.

Automatic cars have become more popular in the UK. Particularly with young drivers who are eager to pass their test and look after the environment simultaneously. Most automatic cars have been made past the ULEZ date, and therefore are more efficient to drive in long term, avoiding ULEZ charges. Automatic cars are also relatively easier to drive, which is an attractive quality to

copious numbers of young drivers keen to get on the road.

Automatic cars are more expensive to insure than manual cars. This is due to several reasons including automatic cars being of higher specification, more expensive to buy and a harder to repair gearbox. These prices are continuing to soar due to increasing cost of production - oil prices have sky-rocketed as a result of the Ukraine-Russia war, additionally complicating shipping of materials. This further raises the prices of automatic car insurance premiums. Furthermore, an increase in claims and the resulting pay-outs to these have contributed to the rising car insurance premiums. There has been rising weather related claims, rising pothole damage and rising rates of theft particularly for expensive vehicles.

Car insurance now makes up 66% of the total running costs for young drivers. At the end of 2023, the average UK premium for an 18–24-year-old was £1260.49, while for a 35–44-year-old it was £711.65 – this represents how young drivers are having to pay almost double the amount than the middle-aged population of drivers.

How young drivers can save money on car insurance?

Explore all options – car insurance premiums often tend to increase, so comparing prices for the best deal possible is recommended.

Tip – there are multiple price comparison websites online which you can use to ensure you are recovering the best possible deals.

Secure your car – installing various safety measures such as an alarm system, tracking device or immobiliser will reduce potential damage do your car, resulting in a discount on your car insurance premiums of 5%.

Pay annually – paying upfront each year is likely to reduce the interest charge on your premiums. This is because the insurance company is likely to charge higher interest on monthly instalments.

Do fewer miles – a lower mileage can help keep insurance costs down as spending less time on the roads decreases the likeliness of accidents occurring. Insurers will look favourably upon this.

Change the model of your car- If possible, changing the model of your car can influence how much a car can cost to insure. The bigger the engine your car has, the higher the insurance premium.

March 2024: hunt's spring budget

By anjalee & jahnvi

The Chancellor of the Exchequer presented his Spring Budget 2024 to Parliament on 6 March.

What is the Spring Budget?

The Spring Budget is when the Chancellor, Jeremy Hunt, announces the main tax changes for the year ahead and puts legislative tax changes through to the Financial Act for the year. In the last four years, the UK has struggled due to many external shocks such as the global Covid-19 Pandemic, soaring energy prices, and an overall high rate of inflation. These shocks have made life tough for people in the UK, but the economy is beginning to turn a corner.

In January 2023, Prime Minister Rishi Sunak set out five priorities, three of them were economic: to half the level of inflation in 2023, to grow the economy, and to reduce debt. And since then, there has been good progress - inflation has more than halved, falling from its peak of 11.1% to 5.1% in January 2024 (with it

estimated to fall to its target of 2% by Q2 of 2024), GDP has been stronger than expected, and debt is forecasted to fall as a proportion of GDP in the medium term.

Finally, as expected, Hunt decided against any cut to any personal taxes, such as the basic rate of income tax or inheritance tax, which may have been postponed until the 2024 Autumn Statement before the general election.

Summary of what happened in spring Budget:

National Insurance rates were cut for employed and self-employed. Increase in high-income child benefit charge threshold from £50,000 to £60,000.

Tobacco duty will increase and a duty on vaping products will be introduced.

The top rate of Capital Gains Tax paid when selling a property will be cut from 28% to 24%

Fuel duty frozen for another year. UK’s inflation rate forecasted to fall below 2% by the end of June.

National Insurance:

The reduction in January’s National Insurance, announced during the Autumn Statement in 2023, did not produce the desired surge in polls for Tory MPs. Ahead of the Budget, there was significant speculation that the chancellor would choose to lower income taxes, as this is seen to have a greater political effect on voters.

However, he went down a different route and announced a 2p cut in National Insurance (NI), reducing the rate paid by employees from 10% to 8%, and from 8% to 6% for the selfemployed.

What are the Impacts on Benefits and Income support?

The Chancellor announced in the 2024 Autumn Statement that a range of benefits received by millions of people, such as universal credit, would rise by 6.7% in April, in line with the rate of rising prices. The state pension will go up by 8.5% in April, which means it will be worth: £221.20 a week for the full new flatstate pension (for those who reached a state pension age after April 2016), and £169.50 a week for the full old basic state pension (for those who reached the state pension age before April 2016).

We also learned that the National Living Wage for over 23’s - paid by employers - will rise from £10.42 an hour to £11.44 in April, which increases for younger workers too. The point at which child benefits are withdrawn will now be set at a higher level of earnings. Instead of starting to lose child benefit once at

least one parent earns over £50,000 a year, it will be £60,000. It will be taken away entirely from £80,000 a year, rather than £60,000. The benefit is worth £24 a week for one child and £15.90 for each additional child. Those amounts are due to rise to £25.60 and £16.95 a week in April. Overall, the government estimates 485,000 families will gain an average of £1,260 in child benefit in 2024-25 as a result, and 170,000 will avoid having to pay any back. By April 2026, the plan is to move it to a system of household income, not that of individuals.

What are the Impacts on the Cost-of-Living?

Direct payments to people receiving benefits, pensioners and some with disabilities have been a lifeline for many in dealing with high prices and bills. With the cost of domestic gas and electricity falling in April, no further plans were announced for any cost-of-living payments. However, there was new funding for the Household Support Fund, which councils used to help those in need pay for essentials or have a warm place to go. This will be extended for another six months, having been due to end in March 2024. Councils have called for two more years.

Effects on Public debt, Inflation & the Economy (A)

The Office for Budget Responsibility (OBR) has forecasted that the economy will expand by 0.8% this year, 1.9% by the next year and by a further 2% in 2026. This is higher than the forecasts of 0.7%, 1.4% and 2% growth, in November. The OBR also forecasted that inflation would fall below 2% this year, from a level of 5.1% (as of January 2024).

The public debt, excluding Bank of England debt, forecasted to be 91.7% of GDP this year, rising to 92.8% next year.

What does this Mean for Savers?

A new tax-free Individual Savings Account (Isa) will be available to savers. The money invested will be directed to British businesses. Savers will be allowed to save £5,000 a year into the British Isa, on top of the existing Isa allowance of £20,000. No start date has been announced.

National Savings and Investments (NS&I) will offer British Savings Bonds for savers willing to lock their money away for three years in April. The interest rate is yet to be set.

Transport, Energy and Housing

Fuel duty has been frozen again on both petrol and diesel; the freeze was meant to have ended in the next month however this has been kept till 2025. Additionally, air passenger duty for business class tickets will increase in line with RPI (Retail Price Index), beginning April 1, 2024. Tax on the significant profits of energy firms has been extended to 2029, instead of ending in 2028. Furthermore, the government has also decided to invest a further £120 million in green energy products to help meet environmental objectives. A significant amount of the budget was also allocated towards housing. Jeremy Hunt announced he would, ‘allocate £242 million of investments in Barking Riverside and Canary Wharf’ which can build over 8000 houses. Additionally, a higher tax rate of 28% on profits from selling properties has been cut to 24%.

How strong is India's economy under Narendra Modi?

By Maryam & Minnah

Narendra Modi is an Indian politician and is the current Prime Minister of India, serving since 2014. He was the Chief Minister of the state of Gujarat from 2001 to 2014 and was elected as the Prime Minister of India in May 2014. Throughout the years, India’s economy has gone through highs and lows, with a current standpoint of 5th of the highest GDP in the world. There are many aspects to consider when viewing how strong or effective an economy is. This includes: economic growth, trade, income and unemployment.

India recently posted the growth rate of 8.4% in the final three months of last year, even though speculations aroused from the sourcing of this data. This took over Japan and Germany as the world’s third largest economy and was led by strong performance by the country’s manufacturers, with the sector expanding by 11.6%. Also, Modi took advice and raised government spending on infrastructure.

According to the National Statistics Office of India, inflation dropped to 5.09% in February 2024 (the

February this year, after hitting a nine-month low in the month before. India’s trade deficit in January 2024 stood at $17.5 billion while in February 2023, it was $16.6 billion. A narrowing trade deficit does tend to help limit India’s current account deficit and strengthen the Rupee, which has been leading among Asian currencies in terms of performance this year. In February, services exports were $32.35 billion, while imports were $15.39 billion. In January, services exports were $32.80 billion, and imports were $16.05 billion. Overall, many have argued that it is unlikely that overall exports during this year would be any higher than last year. Modi has tried to combat this with trade deals, his most recent with the UK. Britain has been demanding better access for UK professional services’ companies to the Indian market, as well as big tariffs on exports. Boris Johnson, former UK prime minister, claimed that a trade deal with India could be secured by October 2022, arguing that it would be a flagship accord following Britain’s exit from the EU. However, this came to a pause as the Indian government requested that the trade deal only continue after the next general election (May 2024). With some negotiating, plans are set to resume with this bilateral deal which holds tremendous benefits for both countries.

For major developing economies such as India, distribution of wealth and quality of life within the country are major indicators of development.

Shamika Ravi, Member to Prime Minister Economic Advisory Council stated, “The World Poverty Clock updates: shows India’s extreme poverty at less than 3 per cent. This is one of the most significant global developments of our lifetime,” on a blog post. Though poverty rates have seen a decline in the recent years, the large levels of informal activity within India play a key role in the economics of the country. On the 8th of January 2016, PM Modi announced that all 500 Rs and 1000 Rs notes would cease to be legal tender. This demonetisation was quite a large success due to the takling of untaxed cash transactions, corruption and circulation on counterfeit notes. This encouraged citizens to switch to online banking and payments using apps such as “Google Pay” and “PhonePe”. Though this movement decreased levels of corruption and cash usage within the country, India’s growth rate could be much higher than calculated. The large informal economy within the country is predicted to account for 38.9% of the country’s GDP which is roughly $4183 Billion (USD).

Unemployment is a vital issue that continues to challenge India’s economy. Unemployment rate has been increasing in India [8% in

February 2024 from 6.8% In January 2024, according to CMIE’s Consumer permits, Household survey]. Rural unemployment rate has increased to 7.8% in February from 5.8% in January, while urban unemployment rate fell from 8.9% to 8.5%. The COVID-19 pandemic had a significant impact on employment in India, leading to an enormous amount of job losses, particularly in sectors such as hospitality, tourism, retail and manufacturing. Although the economy has been recovering, the pace of job creation may vary across sectors as certain industries may continue to face challenges. While urban centres have experienced rapid development and economic growth, many areas will continue to struggle with poverty, lack of infrastructure, and limited access to basic services such as education and healthcare. 86% of India’s poor live in rural areas. To conclude, India’s economy has seen numerous ups and downs. With many negatives, Modi has successfully been able to tackle problems and weave India out on top. Their economy is increasing by the day, employment has begun to rise, and their trade is one of their main revenue points. In the next few years, it is likely we will see them prosper even more.

lowest in the previous four months). However, food inflation increased from 8.3% in January 2024, to 8.66% in the following month. Additionally, Government officials have said the economy will likely increase to 7% in the fiscal year, after an expected expansion of 7.6%. Morgan Stanley remains upbeat about India’s prospects, comparing their current financial status to one of a boom in previous years.

Another aspect of India’s economy is their trade. Currently, India’s trade deficit widened to $18.71 billion in

zack

polanski -

deputy leader of the green party of england and wales

1. What inspired you to become a politician?

I was working in community theatre. Hearing and seeing people’s stories – particularly from working class and ethnic minority communities – was a real stark indication that the system fundamentally wasn’t working. I got into politics to fix the system – there’s no environmental justice without racial, social and economic justice and we’ve got to join those dots.

2. What would the Green Party to do improve the economy? We talk about a cost-of-living crisis but really, it’s an inequality crisis. Multi-millionaires and billionaires have done better than they ever have before including profiting from the pandemic. The Green Party would tax the wealth of the super-rich (1% on assets above £10m.)

3. What are you currently watching on Netflix? One Day!

4. How does the Green Party plan to address income inequality?

A Universal Basic Income is the idea of giving everyone in the country a set amount of money each money that they would have without condition. Martin Luther King said this could literally eradicate poverty. This would be money everyone gets whether they’re working or not to make sure everyone could pay rent, food and transport. Making sure that everyone has what they need for basic essentials – is one of the ways of levelling the playing field. Along with making sure education is free and available to everyone.

5. What would be the most important thing you would do if you were Prime Minister? Proportional Representation. Unless we have a voting system where every vote counts – it’s very difficult to ever change anything sustainably because the two old parties often rely on financial donors from major corporations and immensely wealthy individuals. Once we’ve got a fair voting system – tackling the climate and ecological emergency is obviously the biggest challenge facing our times.

6. How will the Green Party tackle the issue of rising housing costs and homelessness?

We need to make sure that we’re building homes – the right homes (decent standard that are energy efficient), in the right place (on brownfield sites rather than destroying wildlife and biodiversity) and the right place (linked to average income in local areas.) The Government should also be bringing in rent controls as it’s becoming increasingly difficult even in a house share to find an affordable rent. We also need to bring empty homes back into use – there’s hundreds of thousands of homes not doing anything which could really help plug the gap.

7. If you weren’t a politician, what career would you choose?

I think I’d go back to being an actor – and making political theatre!

8. Many members of the Watford Girls community have a keen interest in theatre. How has your experience in theatre studies helped influence your work in politics today?

I think ultimately storytelling is about authentic communication. It’s about empathising about how it is to walk in someone else’s shoes and realise the joy and trauma that lots of communities have – outside of your own lived experience. It’s also a really vital skill in just working cooperatively with a team of people in a shared adventure!

9. Rishi Sunak introduced the ‘furlough scheme’ during the Pandemic. What was the Green Party’s opinions on the effectiveness of this scheme? It was important to support people who were losing income – but Rishi Sunak’s scheme really deepened existing inequalities. For instance, somebody in Britain earning the median wage of £2,500 a month will have been receiving £2,000 a month, whereas somebody who

was earning £800 a month, will have received £640. Not only is that increasing inequality, but it is also imperilling lowincome earners, for the loss of £160 is likely to make them unable to service their debts and pay their rent. This is why we need a Universal Basic Income –rather than a scheme which had disproportionately awful impacts for poorer communities.

10. What is your favourite food? Spag Bol (Vegan!)

11. What global trends do you think will shape the economy in the next ten years?

I think technology is going to make huge differences. It could easily be for worse which is the direction we’re heading in where we have tech/social media firms with more power than world governments. But we could also see it move in the direction of more democratisation and citizen engagement where people are more involved with decision making processes. I also fear that the climate crisis will deepen

forced migration as areas of the world become uninhabitable. We shouldn’t just tolerate migration – we should celebrate it. But migration in our world should be because people choose to move –rather than they’re forced to by circumstance.

I also think that time is up on the super-rich. It’ s become increasingly clear that trickledown economics has failed – and the fallacy of needing economic growth. Our GDP has grown consistently – but ultimately peoples living standards are much worse and mental health is not improving either. We need to transform our economy away from private profit and steer it towards people and planet.

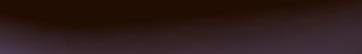

The Body Shop Closures

preesha & keisha

The Body shop has signed files for bankruptcy as they plan to close 75 branches in the US over the next four weeks. This leaves only 116 shops left open across the USA. On top of this, the UK branches have entered administration. This happens when a company is under persistent pressures from creditors due to difficulty being faced with money liquidity problems. This has resulted in nearly half of the stores being closed in the UK, alongside 40% cuts in employees at the London headquarters.

What is the Body Shop?

The Body Shop was founded by Anita Roddick in 1976, where she opened a small green shop in Brighton hoping the business would expand and grow with the incentive of producing beauty products organically. This was very different to its competitors, which is what lead to great fascination for this addition to the beauty market. In 2006, the Body Shop was taken under the wing of L’Oréal, and then by Natura &Co in 2017, and lastly the AURELIUS group in 2023, keeping the business trending and open for over 40 years.

Its main aim has been to increase the confidence of women to feel confident within their own skin, and not promoting the idea of wanting to look like someone else. One of the main attractions of the Body Shop was their ethical and cruelty-free sources of production which have never exploited the lives or rights of animals. Anita made a revolutionary diversion in the common beauty products produced, hoping to lead other companies following in her footsteps of a more rightful world. Her path has helped to pave the idea for other companies like L’Occitane and Lush to sell ecologically sustainable products.

What happens for the Body

Shop now?

With inflation beginning to eat away at firms and companies, costs of production therefore increase whilst compromising profits. With a decline in the profit incentive for production, this can place a slowdown in the productive potential of the business, leading to supply and quality of the products to decrease, and therefore leading to an inward shift in demand. The company had reached its biggest

shatter in the business after landing in $51 million growing debt by the end of 2022.

Recently, the US has been loaning subsidies to the Body Shop to help stabilise their business. However, as of March 1st, the subsidy has no longer been in operation. This also means that some stores in Canada are predicted to close soon and be replaced with e-commerce stores. This shift in the market can lead to increased unemployment in Canada of unskilled workers who are qualified to the extent of working in retail.

This means that economic growth of the country could potentially drop as consumption would decline from the unemployed, and increased government subsidies on claimed benefit. In addition to this shift, there will be escalation in deliveries, which leads to an increase in carbon emissions, and government failure as this catalyst in negative externalities. This can cause an opportunity cost as healthcare and education could be possible compromised as pollution would be subsidised over public services.

Mrs Carr's Chocolate Brownies

Trialled & Tested by 12D Economists

Ingredients

190g unsalted butter

100g milk chocolate

90g dark chocolate

100g plain flour

40g cocoa powder

50g milk chocolate chips

50g white chocolate chips

Around 30g white chocolate shavings

3 eggs

275g caster sugar

Instructions

1. Cut the 190g unsalted butter in cubes and tip into a medium bowl with the 190g of milk and dark chocolate.

2. Fill a small saucepan about half full with hot water, then sit the bowl on top so it rests on the rim of the pan. Put over a low heat until the butter and chocolate have melted, stirring occasionally with a spatula to mix them.

3. Once the chocolate and butter has completely melted, remove the bowl from the pan and leave to the side to cool.

4. Turn the oven on to 180 degrees – prepare a shallow 20cm square tin with baking parchment paper

5. Break the eggs into a large and tip the sugar in. With an electric mixer on maximum speed, whisk the eggs and sugar. They will look thick and creamy, like a milk shake. This can take about 5-10 minutes, depending on how powerful your mixer is. The mixture will be ready when it becomes and pale and has doubled in it’s original volume.

6. Pour the cooled chocolate mixture over the eggy mousse, then gently fold together with a spatula. Continue going under and over in a figure of eight, moving the bowl round after each folding so you can get at it from all sides, until the two mixtures are one and the colour is a dark brown.

7. Hold the sieve over the bowl of eggy chocolate mixture and sift the cocoa and flour mixture, shaking the sieve from side to side, to cover the top evenly.

8. Gently fold in the powder mixture using the same figure of eight action as before. The mixture will look dry and dusty at first, but will end up looking gungy and fudgy at the end.

9. Stir in the white and milk chocolate chips

10. Pour the mixture into the prepared tin, scraping every bit out of the bowl with the spatula. Gently ease the mixture into the corners of the tin and paddle the spatula from side to side across the top to level it.

11. Put the brownies in the oven for 30 minutes, you will know when they are done.

12. Leave the brownies it tin until they have completely cooled down and then lift out the tin and cut into squares.

The WGGS Economics department would like to offer ad space for YOU to advertise your business in our magazine, read by over a thousand within the WGGS community each half-term. Whilst promoting your business to our many readers, you will support our objective to make the magazine self-funding. As part of your sponsorship, Invo Design will assist with the design of your advert at no extra cost. If you are interested please get in touch with Meera Carr - m.carr@watfordgirls.herts.sch.uk ADVERTISE WITH US. Please contact oldgrammarians@watfordgirls.herts.sch.uk If you are interested in coming to speak to our students or completing an interview. CALLING ALL WGGS ALUMNAE

created by the wGGS Economics department Part of Involvement. Designed by Invo Design sales@invo-design.co.uk

uma and Nimisha

www.watfordgrammarschoolforgirls.org.uk

Editors: