Will October be repeated in April?

The ruling coalition, having won the parliamentary elections, expects another success Page 3

The ruling coalition, having won the parliamentary elections, expects another success Page 3

Polish

Heroines of Warsaw Uprising

Ukrainian Art on the Vistula

Universal Dilemmas at Collegium Nobilium

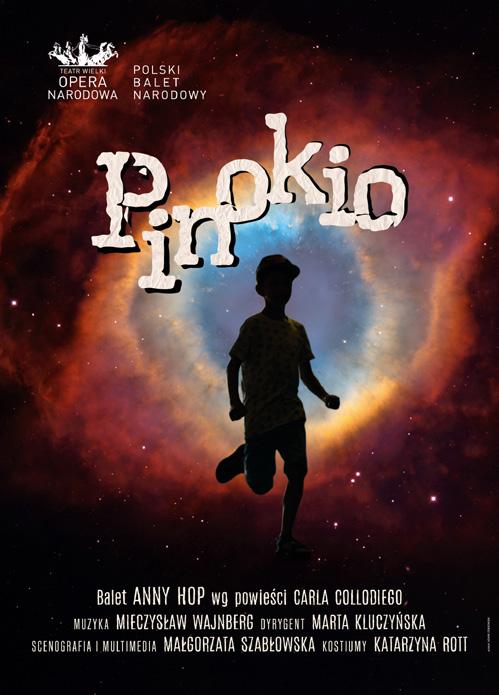

Pinocchio - Ballet Performance for the whole family

Tom

Published by WV Marketing Sp. z o.o.

Editor-in-Chief

Andrzej Jonas, tel. (+48) 22 299-55-60

Managing & Online Services Editor

Witold Żygulski, tel. (+48) 22 299-55-60

Moto Section Coordinator

Bartosz Grzybiński, tel. (+48) 22 299-55-60

The Wrocław Voice

Barbara Deręgowska, tel./fax. (+48) 71 783-61-29, mobile: 501 154 416

CEO

Juliusz Kłosowski, tel. (+48) 22 299-55-60

Accounting

Beata Robak, tel. (+48) 22 299-55-60

Magazine Layout

Michał Lis

Office Manager

Anna Krawczyk, tel. (+48) 22 299-55-60

Address:

Government

Enter Air’s

with

The New Chemical Giant Plant

Polish Food Fights for New Tables

New Award for Prologis

Poles are Increasingly Eager to Buy Gold

Government Promises to Speed Up Hydrogen Work

Advertising Department e-mail: advertising@warsawvoice.pl

Distribution & Subscription

Anna Krawczyk, tel. (+48) 22 299-55-60 e-mail: distribution@warsawvoice.pl

Address

29 Jana Olbrachta St. Apt. 22, 01-102 Warsaw, tel. (+48) 22 299-55-60

Cover photo: PAP/ITAR-TASS

29 Jana Olbrachta St. Apt. 22, 01-102 Warsaw

Internet site

http://www.warsawvoice.pl e-mail: voice@warsawvoice.pl

To contact a member of The Warsaw Voice team by e-mail, use the following format: firstname.surname@warsawvoice.pl

On April 7 and 21, Poles will vote in local elections, which will also be the second installment of a political battle scheduled for four rounds; parliamentary elections were held last October 15, European Parliament elections are set for June 9, and presidential elections are to be held next spring. So, what will be the role of local elections? In Poland, we have so far experienced an unusual phenomenon; although voter turnout in the largest cities was - as in many other countries - lower than in parliamentary elections, in smaller towns and villages more people usually went to the polls precisely for local elections. Many citizens therefore cared more about electing a mayor than they did about electing an MP, senator or even a national President. For the past two decades, it could be said that local elections, especially in central and eastern Poland, were considered more important than national elections, while metropolitan areas did not share this attitude at all. In 2018, during the last local elections, this changed a bit, as more people went to the polls in larger centers and cities. Then, in a single local government term, we had two parliamentary elections [due to the extension of the local government term by almost a year and a half], in which successive turnout records were set. In the elections to the

Sejm and Senate on October 15 last year, turnout - both in cities and rural regions - was the highest in Polish history since the political breakthrough of 1989. So, we don’t know what will happen now, whether this unprecedented voter activity will continue on April 7.

Since 2006, we have also had a situation where local elections were held a year before the parliamentary elections. They were therefore treated by many as a test of strength. As a Danish researcher once aptly put it, local elections have been the “incubator and respirator” of national politics, in which the country’s governing cadres are hatched and sometimes resuscitated in case they have failed before. Thus, until now, local elections have been a test for all parties before the parliamentary election. Now the situation is completely different. The parliamentary elections brought

A SCENARIO IS POSSIBLE IN WHICH LOCAL ELECTIONS WILL BE A “HARVEST FESTIVAL” OF THE ULTIMATE DEFEAT OF LAW AND JUSTICE

Szymon Hołownia with Władysław Kosiniak-Kamysz

Professor Jaros ł aw Flis , a sociologist at Jagiellonian University in Cracow, talks to Witold Żygulski

Szymon Hołownia with Władysław Kosiniak-Kamysz

Professor Jaros ł aw Flis , a sociologist at Jagiellonian University in Cracow, talks to Witold Żygulski

a spectacular loss of power to the United Right, which had been in power for eight years. Thus, a scenario is possible in which local elections will be a “harvest festival” of the ultimate defeat of Law and Justice (PiS). Such a concern can be clearly seen if one looks at the current tactics of candidates who succeeded in 2018 by running under the PiS banner. Today, on a massive scale, we see the phenomenon of them abandoning such party identification by choosing to run from their own electoral committees, already without the PiS logo on their posters. They are, yes, members of the former ruling party, or supported by it, but formally they are already campaigning as an independent election committee. Meanwhile, some 75 percent of those who won their offices in 2018 by running from the [today’s ruling] Civic Platform (PO) committee are still officially running from that party.

This year’s election campaign is exceptionally short; what strategy have the major parties chosen?

As far as Law and Justice is concerned, one can talk about the lack of a consistent message in the local government campaign. The former ruling party has fallen into its own trap, unable today to apply any of the strategies it used in years past. In 2014, when PiS was still in opposition, its message before the local elections was based on criticism of the then ruling team of the country [the PO and Polish People’s Party (PSL) coalition]. Law and Justice candidates portrayed themselves as outsiders criticizing the government’s actions and its lack of success, including at a given local level. Today, after eight years of United Right rule and fatally lost parliamentary elections, such an argument has

lost its raison d’etre. The narrative of criticizing and fighting against the arrangements of power that is inept and disrespectful to citizens is not possible when you yourself have governed for two terms and, in addition, everyday information about more scandals, scandals and incompetence of Law and Justice politicians during these 8 years comes to light.

In contrast, in 2018, the dominant strategy of PiS candidates was to convince voters that they were representatives of the central government. In my hometown of Kraków, we had such a nationally model situation, when the PiS candidate for mayor, Małgorzata Wassermann, had the slogan “New President - New Opportunities,” which was meant to suggest that if there was a change in the city’s host [which did not happen in the end], the government in Warsaw would pour money into Kraków. It turned out that voters were completely alienated by such political clientelism. If, by the way, PiS had checked the data from the 2010 elections, when such tactics were tried by PO, it would have found out in advance that such argumentation does not work. When PiS further reinforced such a message in 2018, it became even more apparent that it doesn’t work. Now, PiS cannot at all - even if it wanted to - try such a method of convincing the electorate, because it simply no longer governs in Warsaw, has lost power, and no longer has any real influence on the distribution of money from the state coffers. If even right-wing voters remember such argumentation from 5 years ago, it already works against PiS today.

The Polish right also has a problem with presenting itself as a defender of conservative values. The snag is that local Poland has largely been governed for years by politi-

cians who are largely conservative. Those who care about an alliance with the local parish priest are reluctant to have any revolution in moral issues, rather appeasing the mood in their municipalities, villages, or towns. To quote Yaroslav Hasek, they could be called “a party of moderate progress within the limits of the law.”

It will also be difficult for the Law and Justice to win by fielding candidates with well-known names, based on their recognition and popularity. In previous local elections, this was especially evident in large cities, where right-wing politicians known from the front pages of newspapers were only able to get into the second round of elections for mayor, where they usually lost to PO candidates or popular local candidates running from their own independent committees (albeit often supported by Platform). This is because the electoral law means that, even with the support of 40%, one still has no chance of final success.

As for Civic Platform, the question is whether the party, after its October 15 success, has already come to believe that it is undisputedly the best and everything lies at its feet. Meanwhile, the formation is undisputedly weaker than it once was, with support today at around 30% against the former 40%. It is therefore by no means in a position to win local elections on its own; rather, it is doomed to continue its previous tactics, i.e., forming local alliances with local election committees and exercising power in municipalities or counties in coalition arrangements in which it will not always be senior coalitionist. From observation, it seems that the PO has come to terms with such a scenario, but of course, the role of only one of the elements of local power arrangements is not something Donald Tusk’s

GOOD

OF THE GOVERNMENT DO NOT TRANSLATE INTO RATINGS OF LOCAL MAYORS AND GOOD RATINGS OF MAYORS DO NOT HELP THE PARTY AT THE NATIONAL LEVEL

people dream of after winning parliamentary elections. But dreams are one thing, and reality is another - so far in Poland it has not been possible to create a party that would have high enough support and enough to offer to govern independently at all levels of government. Nonetheless, in the statements of PO politicians there is hope that the very “Anti-PiS” strategy that made it possible to win elections to the Sejm and Senate may work once again at the local ballot box.

Canadian studies have shown that the mayor’s rating is by no means directly related to the rating of the party supporting him, nor vice versa. That is, good ratings of the government do not translate into ratings of local mayors and good ratings of mayors do not help the party at the national level. There is only one exception: if voters give a party’s government a bad rating, they mostly play up to

its local representative. The question is whether those who didn’t like the United Right’s government are still going to play off their criticism against the party’s mayor in their town. There is such a concern, so it should come as no surprise that local candidates are hiding their party colors, not wanting to find themselves in the position of whipping boys.

It should still be noted that local officials - city mayors, aldermen, district governors, etc. - know very well that the parties are weak and act towards them in the position of client rather than in the role of dominator. The parties, for example, have no serious expertise in local government issues. And local governments have created such a base for themselves with local forces and do not need nationwide parties to do so. To sum up, it is the people in power in Warsaw who need the support of local authorities, not the other way around. The latter expect the parties and the central government, first and foremost, to follow the medical principle of Hippocrates - “first, do no harm...”

However, nationwide political parties are trying to solicit votes in local elections; what methods are they using?

First of all, there are a few thousand separate campaigns. However, one can see issues where parliamentary groups are trying to break through to the electorate and take votes away from their rivals, especially those to whom they lost support in the October 15 vote.

The Left is leading a frontal attack on the issue of amending the law regulating the conditions for legal abortion, trying to attack the Third Way [the electoral coalition

A PARTY CALLED

“NEW LEFT” IS TODAY ONLY ONE OF THREE CHOICES FOR PEOPLE WITH A LEFTIST WORLDVIEW

of PSL and Poland 2050], whose politicians, with Speaker of the Sejm and Poland 2050 leader Szymon Hołownia and PSL leader, Deputy Prime Minister and Defense Minister Władysław Kosiniak-Kamysz, are reluctant to do so.

The Third Way, on the other hand, is trying to present itself as a conservative alternative to former PiS voters disillusioned with the last eight years of its rule. The argument for a change of party for which conservative-minded voters could vote is undeniably that the Third Way, as a member of the ruling coalition, today has a real influence on the changes planned nationwide, unlike the Law and Justice, which can only protest against these changes from the opposition’s parliamentary benches, unsuccessfully so far.

Civic Platform resigned in the local elections to run jointly with the Left, with which it forms a governing coalition. PO leader and incumbent Prime Minister Donald Tusk appealed to the party’s supporters, who

for “tactical” reasons [the idea was for Kosiniak-Kamysz and Hołownia’s party to exceed the 8% electoral sample to enable it to take over from PiS] voted for the Third Way in the parliamentary elections, to cast their vote for the Civic Coalition this time. How do you interpret such political movements?

After Donald Tusk returned to Poland from Brussels, KO’s ratings by no means jumped sharply upward. It neither succeeded in dominating the political scene nor in pushing the current coalition partners to the margins. People did not vote for the Third Way because Tusk allowed them to; they simply made such a political calculation themselves. The prime minister, agitating for the KO, does not say that his grouping has a better program, better candidates, or a better idea of what to do in local governments. In my opinion, appealing to supporters not to vote for the Third Way anymore is a very weak move. Especially since the polls show that both PO and the Prime Minister himself still have a large negative electorate. The votes for the Third Way were not simply due to the belief that without this grouping in parliament, it would be impossible to remove PiS from power; they were simply due to the fact that for a sizable group of voters in the opposition at the time, Platform, and its leader in particular, did not arouse special enthusiasm.

For the Left, which has returned to the ruling system after 20 years, could the current elections become another way to return to the political premier league? Poland is a rather unusual country compared to Europe, where leftist parties oscillate around 10% support while, as in the EU, almost half of the population declares leftist views? A party called “New Left” is today only one of three choices for people with a leftist worldview. They can vote for the Civic Platform, which has conspicuously lost its right wing in recent years; there remains, admittedly, some 15-20% of voters of politicians with right-wing views, but they do not decide the party line. The choice of the Third Way is equally justified and logical; after all, the PSL was a coalition partner of several strictly left-wing cabinets ruling Poland in the 1990s and early this century, while Poland 2050 attracted a number of well-known figures from the left side of the political scene.

Poland’s political divide has long been not about a leftright arrangement, but about an “up-and-down” arrangement, i.e. opposing those who are better off and those who are worse off, primarily in material terms, in finding their way in the new reality that took shape after the political transformation of the early 1990s.

The Left has been struggling for survival all along. In the previous local elections it recorded a very poor result. On the political scene it is a party in fourth place, all the time defending it against the radical-nationalist Confederation. If the votes between Law and Justice and the Confederation had been distributed slightly differently in the parliamentary elections, the Left could have fallen to the fifth and last place among parliamentary groups. The times when the Left’s presidential candidate Grzegorz Napieralski won almost 14% of the vote are irrevocably gone. Napieralski himself is now a senator for Civic Platform, and the results of Left presidential candidates are now in single digits. It remains to be seen how the Left will perform in the upcoming elections to the European Parliament, whether it will again field candidates in the persons of [current MEPs] former prime ministers of left-wing governments such as Leszek Miller, Marek Belka and Włodzimierz Cimoszewicz, who come from the Polish United Workers’ Party [former ruling communist party], or whether it will decide

to bet on young faces, the new generation. My political scientist colleague Prof. Rafał Chwedoruk puts forward an impressive thesis that the Left today has two hardcore groups of the electorate - the LGBT and the LWP [People’s Polish Army - the armed forces during the communist period]. But the former group is not as numerous as it portrays itself, and the latter is unlikely to grow any more, and on the contrary, will disappear for biological reasons. It may turn out that the Left will not gain new supporters and its role will decline even further.

For now, it looks like the Left’s basic argument is to play with the abortion issue and attack Hołownia. I am not convinced that this is a good idea, but perhaps there is simply no better one. The same goes for attacking the Church, which, especially at the local level, is also unlikely to have a positive effect.

The Left’s current participation in the system of power can be reduced to a position where the Civic Platform enjoys the principle of “we invite when we must, we throw out when we can.” For the Left, this is a dangerous scenario. The PO is keen on a permanent alliance with the PSL, its former coalition partner from 2007-2015, not least because of the fear that the PSL might, in the event of discontent, change front and make a deal with the Law and Justice. Admittedly, United Right has done everything to discourage the PSL, alternately insulting and ignoring it during its years in power, on top of trying to bribe its politicians, which was particularly evident during Mateusz Morawiecki’s inept attempts to form a government after losing the October 15 elections [contrary to parliamentary

arithmetic, President Andrzej Duda entrusted Morawiecki with the doomed mission of forming a cabinet, thereby extending the United Right’s rule by 2 months] but this may change when the leaders of the Law and Justice change, when its leader Jaroslaw Kaczynski leaves and the so-called “PC Order” [of the Porozumienie Centrum (PC), Kaczynski’s first party founded in the early 1990s] loses influence. Perhaps there will then be new party helmsmen who will more effectively court the PSL’s sympathies.

The Left, on the other hand, has nowhere to go. Its electorate could not stand an alliance with PiS, so it has to take what they give. If, for example, 20 members of the Sejm from the back benches of the Law and Justice were to move to the PSL - which is by no means an unrealistic scenario - the Left’s participation in the governing coalition would immediately cease to be necessary for the Civic Coalition to have a sufficient parliamentary majority. The opposite scenario, on the other hand, is impossible - the Left will not be able to take so many deputies from there that the PSL will become unnecessary.

One of the leaders of the Left, Adrian Zandberg, recently said that local elections are beautiful because a seat in the local government or the position of mayor or alderman can be “stomped”, going from house to house, from neighbor to neighbor, convincing your candidacy? You can, only “stomping out” is not enough during the campaign, you have to do it for several years. Voters appreciate a candidate’s direct contact and activity in the current issues of their locality, but this needs to be shown much

with Law and Justice] and boasting poll support of 15% or more, have any chance in local elections?

AS LONG AS PIS DOES NOT TRANSFORM ITSELF IN SUCH A WAY THAT IT REGAINS THE ABILITY TO FORM ANY COALITION, IN WHICH PSL COULD BE ONE OF THE POSSIBLE PARTNERS, THERE IS NO QUESTION OF CONSTRUCTING AN ALTERNATIVE GOVERNING ARRANGEMENT

earlier than only when you run for office. Local candidates are usually people who have been known in their community for years and hold important positions. Surveys show that about 15% of voters change their sympathies because of the appearance in their neighborhood of such a new [in politics] but well-known candidate from their professional activities or social work.

Does the Confederation, just two months before the October elections, typified as the tongue-in-cheek of the future governing arrangement [in a possible coalition

At the local level, the Confederation is weak, with neither local structures nor a program that can attract supporters. It has tried to join forces with the Nonpartisan Local Government Workers, but it seems that the only result will be that the latter will not survive such an alliance, that it will be a kiss of death, not a plank. The Confederation is growing almost exclusively because part of the PiS electorate has become alienated from their party due to the arrogance of politicians and the scandals that are now being revealed. A vote for the party of Sławomir Mentzen and Krzysztof Bosak is a kind of safety valve not to vote for PiS anymore and, of course, not to support Donald Tusk and the ruling coalition. Perhaps, then, if, for example, 5% of existing PiS supporters vote for the Confederation, it will cross the electoral threshold and place its candidate here or there in the regional assemblies.

How will the outcome of the local elections affect the shape of the Polish political scene, the unity of the ruling coalition, and the future of PiS, which some are prophesying a breakup?

The ruling coalition is unthreatened. As long as PiS does not transform itself in such a way that it regains the ability to form any coalition, in which PSL could be one of the possible partners, there is no question of constructing an alternative governing arrangement. As for the future of the former ruling party, I would be inclined to the thesis that it will not be profitable for PiS politicians - especially of the younger generation - to try to create some new entity on the right side of the political scene; they will prefer a situation in which they will wait a few years in opposition until perhaps there is an opportunity to return to power on their own or in some new coalition constellation.

According to “ Office Occupier – Office Market in Regions ” , a report published by real estate advisory firm Newmark Polska, total office take-up in 2023 in the largest Polish regional cities surpassed 741,300 sqm - an increase of almost 19 % year-on-year and 7 % from the pre-pandemic 2019 peak.

eanwhile, issues related to ESG, functionality improvements, efficient office space management and optimization of lease costs have filtered through into the vocabulary and strategies of tenants and developers alike.

MAt the end of 2023, Poland’s eight largest regional city markets (Kraków, Wrocław, Tricity, Katowice, Poznań, Łódź, Lublin, Szczecin) had a combined office stock of almost 6.7 million sqm, of which more than 279,600 sqm was delivered in the last 12 months through 21 office projects.

The strongest development activity was, however, recorded

during the third quarter, which saw office completions accounting for over 42% of last year’s total new supply. The largest office buildings completed in 2023 included Ocean Office Park B (Krakow, Q1), Craft (Katowice, Q3), Nowy Rynek E (Poznań, Q2) and Kreo (Krakow, Q3).

The last quarter of 2023 was another consecutive quarter of a shrinking office space being commenced. At the end of December there was approximately 300,000 sqm under construction, down by more than 22% from the third quarter of 2023, by nearly 47% year-on-year and by over 73% from the 2017 peak of almost 1.1 million sqm.

RENEGOTIATION ACTIVITY IS EXPECTED TO REMAIN RELATIVELY ELEVATED IN THE COMING QUARTERS, WITH TENANTS SEEKING TO AVOID OFFICE RELOCATION AND FIT-OUT COSTS

“Faced with significant levels of office space available in existing buildings and widespread office optimization, developers remain cautious regarding launching new projects, especially those without pre-lets,” says Joanna Bartoszewicz, Senior Advisor, Office Tenant Representation, Newmark Polska.

In the fourth quarter of 2023, leasing activity in the key regional city markets reached nearly 210,300 sqm - up by over 6% on the previous quarter and last year’s best quarterly result. Total take-up for 2023 as a whole surpassed 741,300 sqm - an increase of almost 19% year-on-year and 7% from the pre-pandemic 2019 peak. Despite the growing demand for office space, tenants remain firmly focused on optimizing office occupancy while targeting highly energy efficient buildings with green credentials.

Leasing activity in 2023 hit its highest in Krakow, which saw 201,300 sqm of office transactions. The runner-up was Wrocław with 165,550 sqm transacted while office take-up in Tricity amounted to more than 143,900 sqm. These three cities accounted for nearly 69% of the total leasing activity across the regions in 2023 as a whole.

“Prime office rents in the core regional city markets remain at EUR 16.00-17.00/sqm/month. This is especially the case with office buildings featuring modern technologies and meeting environmental and social (ESG) requirements as their landlords are generally less willing to negotiate rental rates. Office projects underway are experiencing upward pressure on rental rates,” adds Urszula Sobczyk, Head of Valuation, Newmark Polska.

In 2023, new leases accounted for 45% of the total office take-up, followed by renegotiations and renewals which contributed 41%. The remaining 14% came from owner-occupier deals (6%), expansions (5%) and pre-lets (3%). Leasing activity during the fourth quarter was dominated

by renegotiations which had an over 55% share in the total take-up. Renegotiation activity is expected to remain relatively elevated in the coming quarters, with tenants seeking to avoid office relocation and fit-out costs.

At the end of December 2023, the overall vacancy rate in the key regional city office markets stood at 17.5%, up by 0.2 pp over the quarter and by 2.2 pp year-on- year. Vacancy rates were above 10% in all the markets but Szczecin, including above 18% in four regional cities.

“Office availability in existing buildings remains on an upward trajectory and amounted to nearly 1.2 million sqm at the end of the fourth quarter. Additionally, regional markets offered also substantial amount of office space available for sublease,” comments Agnieszka Giermakowska, Research & Advisory Director, ESG Lead, Newmark Polska.

Newmark Polska, a Newmark Global Partner, is a member of the Newmark Global Network. As one of Poland’s premier integrated commercial real estate services companies, the group provides conflict-free tenant representation, in addition to capital markets, market research and advisory, valuation, design and project management and workplace strategy services. Newmark Polska is led by Piotr Kaszyński, based in Warsaw, with additional offices in Wrocław, Tricity and Kraków. The team leverages Newmark’s (Nasdaq: NMRK) global platform, which offers a comprehensive suite of services that seamlessly powers every phase of the property life cycle from offices around the world.

Poland ' s industrial sector slowed in 2023, but the market hopes to rebound in 2024. After the peak of take-up and supply in the so-called COVID-19 period falling in 2020-2022, the logistics and manufacturing market has returned in many values to those observed in 2018-2019.

Poland’s largest consulting firm, AXI IMMO, presents a summary of 2023 with estimates for the industrial market.

Estimated forecasts summarizing total tenant activity in 2023 indicate that gross take-up should stabilize at around 4.7-5 million sqm; the key in this aspect will, as usual, be the last quarter of this year, when historically the most transactions close. Nevertheless, the previous 18 months in the Polish industrial market have been a time of challenges related to the weaker economy, political uncertainty related to the war in Ukraine, energy price hikes, and high inflation. All of the factors above negatively affected tenant activity, with the logistics sector, retail chains, and manufacturing proving to be the industries with the greatest stability and resilience to the unfavorable macroeconomic situation, according to our predictions. A noticeable improvement was also noted for the e-commerce segment.

In the last 12 months on the Polish industrial market in terms of take-up, it is impossible not to mention the large number of renegotiations and the noticeable trend of prolonged decision-making processes for leasing new space. The last factor influenced the stabilization of rents observed at the end of Q2 2023. Due to relatively high rates and the risk of losing staff, clients were more likely than in previous years to opt for renegotiating contracts (about 35% and growing) rather than choosing new locations. In line with our predictions, the share of manufacturing companies, which ac-

counted for about 20% of completed transactions, increased take-up demand during the more challenging period.

Global analysts indicate that in the medium to long term, Poland will play a significant role in such trends as nearshoring and friendshoring. We are already one of the largest producers of large household appliances and play an essential role in the automotive sector. Our advantage invariably remains our location on the map of Europe and our professional and qualified staff, who have built their experience working in or for foreign corporations. Nevertheless, it is essential to remember that the processes involved in the greater regionalization of supply chains and the relocation of production to Europe take time.

Once again, more than 100,000 sqm of unit transactions were closed on the Polish industrial market. In the year-end period, these included a new deal with a retail company for 120,000 sqm at DL Psary/Czeladź and a lease of 110,000 sqm by Raben at CTPark Warsaw West (Wiskitki). Thus, we have maintained the trend of the last two years. On the other hand, the regions with the highest tenant activity are likely to become the Mazovian, Silesian, and Lower Silesian voivodships.

Financing is the word of 2023 in terms of activity for developers who have had to deal with banks’ increased requirements for collateral for pre-lease agreements. Equally important in the context of the year as a whole was again meeting ESG-related guidelines. Bank analysts note that Poland differs from other CEE countries regarding the number

of decisions denying loans due to failure to meet ESG criteria.

Despite the challenges during the economic downturn, investors and developers have focused on opening projects in significant markets characterized by high liquidity, a large consumer market, and an extensive network of connections to other areas of the country and Europe. It should be assumed with a high probability that the total stock of the Polish industrial market at the end of 2023 will reach 31.5 million sqm, which will maintain about a 15% growth rate. Developer activity at the end of 2023 should reach 3.6-3.7 million sqm, noting that 60% of this space will be projects delivered in Q1 of this year, i.e., investments started back in H1 2022 under different market conditions. Nevertheless, it is noteworthy that almost 2/3 (about 20 million sqm) of the total market stock has been built since the beginning of 2017.

The industrial market in Poland is entering another phase of maturity, in which the previous group of five major regions has been expanded to eight, including Warsaw and its surroundings, Łódź, Upper Silesia, Wielkopolska, Lower Silesia, and the areas of Szczecin, Tricity, and Kraków. Particularly noteworthy are the last two markets, whose relevance has increased in recent years and have exceeded the thresholds of one million square meters of total stock. Among the aspiring regions is the Lubuskie region, with the litmus test for this market being the intense competition from Szczecin, Wielkopolska, and Lower Silesia. As a result of the uncertain geopolitical situation, most developers have been and are expected to remain relatively passive in undertaking activity in the eastern part of Poland.

In 2023, weakened take-up resulted in fewer speculative projects, whose share of space under construction fell from 61% in Q2 to 53% in Q3 2023. Given the more significant requirements for obtaining financing, we expect this trend to continue in 2024 and the share of projects without signed leases in new supply to decrease by the end of the first half of

next year. This situation and lower take-up than in previous years may reduce vacancy rates in 2024.

Our predictions for the first months of 2024 are that developers will opt for a safe investment strategy, focusing mainly on projects with a significant share of pre-leases and the delivery of BTS projects. The potential economic improvement, announced for the second half of next year, may result in a change and a renewed increase in speculative investments, surpassing the current level.

After a one-year hiatus, the industrial sector will again lead Poland’s investment market in 2023. The year’s transaction was the acquisition of an 80% stake in 7R S.A. by Scandinavian investment fund NREP. The majority owner gained access to investments with a total area of about 4.2 million sqm consisting of existing warehouse parks and a land bank with projects to be built.

According to analysts’ predictions, the improvement in consumer sentiment announced for the second half of 2024 will affect the economic and macroeconomic situation, which will be a reason to increase Poland’s attractiveness and start building new investments. For this reason, we assume that the return of investors and an increase in market liquidity will occur by the last months of 2024. Until then, we will witness a two-speed market in the investment sector. The first group will be funds interested in so-called prime assets, with the lack of high-quality products heralding another phase of waiting for a better moment and, as a result, fewer transactions. The second group, on the other hand, will include distressed owners and value-add projects sought by opportunistic investors. In 2024, we expect a preponderance of investors from Europe, including smaller local players rather than large Asian platforms. The market should also see the formation of so-called investment vehicles composed of several smaller players to invest in sectors with good fundamentals, such as warehouses or retail parks.

HR Group hotel chain is not well-known in Poland as you entered the Polish market on 2021 with acquisition of first Vienna House hotels. Could you present it to our readers in a nutshell?

It’s pretty straightforward: I own the HR Group and want my company to become Central Europe’s largest hotel operator in the multi-brand sector in the medium term. This means that we will operate even more hotels with our franchise partners - such as in Poland with Wyndham and Vienna House - and with our own brands. At the same time, we attach the utmost importance to being a leader in the field of digitization, being highly attractive to employees by focusing on growth.

THE TOURISM SECTOR HAS SIGNIFICANTLY GROWN, REBOUNDING QUICKLY AFTER THE COVID-19-RELATED DOWNTURN. I BELIEVE IN POLAND’S ADVANTAGES FOR BUSINESS TRAVELLERS

What are the Group’s further intentions in Poland? Are there any new acquisitions involved, or are you focusing on improving the quality of your offering of existing facilities? Which brands would you like to introduce in Poland?

Our expansion strategy includes Poland for sure. We are privileged to collaborate with exceptional franchise partners and continuously seek discussions with those we deem an ideal fit for specific locales. Here I can think of collaborating with Accor or IHG or other partners. In Poland, Vienna House by Wyndham predominantly represents us at the moment, opening up possibilities for other concepts and further expanding our brands. Among these is Revo, a Ho-

Ruslan Husry , owner of HR Group hotel chain, talks to the Warsaw Voice

tel-Living concept with tremendous success in its Munich launch. And it goes without saying that quality and the fulfilment of brand standards are firmly anchored in our strategy. Ongoing investments are a matter of course.

What are the advantages of the Polish market in your opinion? From the investor and business traveller point of view?

Poland has a dynamic economy with a diversified industrial and service landscape that offers attractive investment opportunities. On the other side, factors such as the labour situation, price increases, and, unfortunately, the instability in world politics slow down the business. But we are quite optimistic and e.g. the demographic situation, the city structure is comparable to Germany, where we have achieved great success. The tourism sector has significantly grown, rebounding quickly after the COVID-19-related downturn. I believe in Poland’s advantages for business travellers. In addition to business opportunities, the country also offers great potential for combining business with leisure, thereby significantly increasing overnight stays.

And the strengths of your Vienna House by Wyndham hotels in Poland? Are you satisfied with the Polish properties’ performance?

There is always room for improvement, but the Polish hotels are doing very well. Vienna House, with its lifestyle ap-

proach, was the right brand at the right time, and the hotels are in perfect condition, which guests highly appreciate.

The HR Group evolves not only in Europe but also in the Asian market. The new board members responsible for development and finance have recently been introduced. What role does the CEE region (and Poland) play in your strategy? Is further expansion envisaged in this region?

We are looking for opportunities in the CEE Region and are very interested in Polish development. We plan to grow through lease or management agreements for existing properties and acquire entire platforms. We are also interested in participating in new project developments and making proprietary investments in hotel properties that align with our portfolio. We look for platform deals and portfolios in countries where we are entering the first time.

How do you select your cooperation partners - I mean whether investors, hotel owners or hotel brands? What is the most important for you as a businessman?

Fortunately, I have built many good partnerships over the years and stay in close contact. However, I am also open to new productive contacts and would love to meet with you for new business opportunities. What is important to me is a “handshake mentality,” a sense of friendship and reliability.

Millennium Docs Against Gravity, the largest documentary film festival in Poland and one of the largest in the world, will be held from May 10 to 19 in eight Polish cities, including Warsaw.

The festival audience will have an opportunity to see documentaries which earlier premiered at the iconic American Sundance festival. Among them are “A New Kind of Wilderness” by Silje Evensmo Jacobsen, a story about whether living isolated from society can bring happiness and “The Eternal Memory” by Maite Alberdi, the winner of the Grand Jury Prize last year.

Among Polish film worth noting is “The Last Expedition” by Eliza Kubarska. It tells the story of a Polish mountaineer Wanda Rutkiewicz, the first European to conquer Mount Everest and the first woman in the world to climb K2.

Every year, the MDAG program features documentaries about renowned film directors and their view of art and reality. This year the audience will go on a crazy journey - from the colorful microcosm of Michel Gondry, through the inspiring cinema of Frank Capra, to the revolutionary work of Agnes Varda.

Matthew Wells in his film “Frank Capra: Mr. America” uses previously unpublished archives to examine the legendary director’s history and unravel his complex relationship with the United States.

As part of the festival, on May 17, the audience will be treated to a live concert by “Efterklang: The Makedonium Band” from Denmark.

Apart from Warsaw, the festival will also be held in Wrocław, Gdynia, Poznań, Katowice, Łódź, Bydgoszcz and Lublin.

From May 21 to June 3, all the films will be available at mdag.pl.

Aunique display of Chinese reverse glass paintings from the late 19th and 20th centuries at the Asia and Pacific Museum in Warsaw demonstrates the diverse appeal of this unique and fragile art form.

The exhibit “Reflected Beauty” has brought together 75 of the Chinese glass paintings from one of the world’s most important collections, the Mei Lin.

The presented works depict romantic landscapes, traditional motifs, scenes from mythology and popular literature, objects of good luck, and portraits of children and women. They also show the changing image of the Chinese woman living at the end of the dynastic period, entering modernity, characterized by numerous political and socio-cultural changes.

Glass paintings have been known in China since the 17th century, when European merchants and diplomats arrived at the imperial court, presenting a new type of painting. This art, initially intended for a narrow audience, gained great popularity in the 18th century. Paintings from this period were often created for the export market and were very popular among collectors in Europe and North America. But the 19th and 20th centuries were a time when the manufacture of glass paintings was more local. Their themes were full of prosperity symbols and literary references, and they were sold mainly in China.

On view through April 21.

Anew exhibition at the Warsaw Uprising Museum - “The Heroines’ Journey.

Uprising of Women” is dedicated to the female participants of the 1944 Warsaw Uprising against the city’s Nazi German occupiers.

In total, nearly 12,000 women participated in the revolt, which constituted around 20% of all insurgents. Women were primarily liaisons and nurses, but they also performed other functions, like cooking meals and mending clothes for soldiers putting out fires, building barricades, digging people out from under the rubble and making grenades. But some of them fought with weapons. About 250 of these heroines are still alive with most living in Warsaw.

The exhibition has collected photographs and artifacts related to 60 female insurgents. It is divided into several sections, each under the patronage of a mythical goddess.

The section watched over by goddess Demeter displays some personal items of nurses and orderlies who took part in the Warsaw Uprising. Among them is a spoon used by nun Bronisława Węglińska, who looked after the wounded and the apron of Mirosława Osmólska aka “Seweryna”, who ran a canteen for soldiers.

Memorabilia of the female conspirators can be found at the goddess Hera’s section,

including personal items of Helena Jamontt “Hela”, who helped to organize deliveries of medicines and food to the sick and to prisoners of concentration camps in occupied Poland.

In the section under the patronage of Athena, one can see the brush/ cache of the legendary General Elżbieta Zawacka aka “Zo”, a courier of the underground Home Army, who carried messages and reports to the West in it. On display is also the bag of a 16-year-old liaison officer, Marzena Podgórska, aka “Tajfun”, used to carry conspiratorial mail. Women’s handbags, shopping baskets and even children’s school bags were used to carry secret documents, illegal forms, and sometimes weapons and ammunition.

Among the exhibits in the Artemis section there is a hat of Barbara Synoradzka aka “Little Basia” who, owing to her small body build, squeezed through narrow underground pipes to deliver grenades to the Warsaw Old Town. The aviator hat then protected her braids.

Femininity also flourished during the fighting. Allied pilots dropped aid in metal containers attached to small parachutes over occupied Warsaw. Women sewed dresses, shirts, blouses and even wedding gowns from silk parachute canopies. Examples of those can be seen at the Aphrodite section., along other objects and photos of female soldiers who, despite the fact that they often had no change of clothes and no water to wash, did everything to look their best. A fitted hairstyle, a scarf tied around the neck, a self-sewn shirt, or a blanket skirt - all this helped maintain dignity, reminded them of the “good times” and gave them comfort.

The exhibition will be open until the end of June.

orks of Maria Prymachenko, one of the key figures of 20th century Ukrainian art, will be shown in the Pavilion on the Vistula, from March 22 to June 30.

Amid the Russian invasion in Ukraine, Prymachenko’s joyful but openly anti-war work takes on a special meaning. Her artistic imagination drew heavily on folk art and folklore, and her distinctive style helped shape the visual identity of the Ukrainian nation.

The exhibition “A Tiger Came Into the Garden. The Art of Maria Prymachenko” is the first such extensive presentation of the artist’s ouvre in Poland. The exhibition has gathered 89 of Prymachenko’s gouaches painted in the years 19821994. They come from the private collection of Eduard Dymshyts, an art historian fascinated by her work. The Warsaw exhibition is a continuation of the project presented in 2022 at the Andrey Sheptytsky National Museum in Lviv.

Prymachenko depicted the connections between human beings and nature, drawing on folk traditions of the region of Polesia, rich in symbols and metaphors. She painted people, animals and plants in their everyday surroundings. Her images of the world built on observations of the everyday life of Bolotnya, her birthplace, undergo a magical transformation—rather than portray reality they cast a positive spell on it. Motifs in her painting include fantastic creatures and birds, both mythological and inspired by pagan

beliefs. Her characteristic bestiary of “humanized creatures” comprises numerous elaborate allegories, often expressing moral judgments, mocking human vices, or celebrating the delights of everyday life.

The garden in the exhibition title represents nature, which coexists harmoniously with humans, gifts them with all its bounty and in exchange for their work, while the tiger symbolizes the mysterious, fantastic and wild.

Prymachenko’s recognizable style involves a decorative line, and flat, intense patches of color. Her works bear poetic, descriptive titles, which sometimes help decipher the paintings, or serve as dedications or wishes, as well as modified quotations from folksongs.

Following Russia’s invasion of Ukraine, Prymachenko’s works have taken on particular relevance, in part due to their anti-war message. In 2022 the Local History Museum in Ivankiv, near Bolotnya, was burned down, with only some of her paintings rescued.

A Tiger Came Into the Garden is the last exhibition organized by the Museum of Modern Art in Warsaw in its temporary Pavilion on the Vistula before moving to a new, permanent seat at Defilad Square in Warsaw.

The Collegium Nobilium Theatre in Warsaw is showing in March, April and May two diploma performances by fourth-year students of the Acting Department of the Warsaw’s Theatre Academy.

The first, Casting (or alsoAudition in English) is based on the acting and life experiences of the students performing in the play. The directors of the show, Mateusz Atman and Agnieszka Jakimiak, invited them to spontaneously co-create the script. In this way, it became a record of a certain stage in the lives of the young people.

“I have the impression that today most of us take part in a casting - for a new job, to rent an apartment, to be someone on social media,” says Kamil Książek, one of the young actors taking part in the performance.

This is a casting about self-promotion, competitiveness, self-confidence, mutual assessment, mutual withholding of judgment, good and bad feedback strategies.

According to Atman and Jakimiak, the casting formula reveals a common mechanism that governs human life: the wheel of fortune turns and grinds us along the way. Casting is our chance to show our best or worst side.

“Likes, exams, applications, requests and job interviews - all these serious and frivolous situations decide whether ‘to be or not to be’, they affect our fate,” they say.

The script also uses fragments of William Shakespeare’s “Hamlet”, as most aspiring young actors dream of asking the ‘to be or not to be’ question. In the play, seven people interpret Hamlet’s soliloquy in a variety of ways facing a dilemma - How to present myself to you today?

The other proposal by the Collegium Nobilium Theater is “Coronation” (Koronacja) written

by Marek Modzelewski and directed by Izabela Kuna. It is a story of Maciek, a thirty-year-old immature and irresponsible man who confronts the demons of his own adolescence. The protagonist tries to meet the expectations of people around him - pretends to be a conflict-free son to his parents, a loving husband to his wife, and a professionally accomplished doctor to his friends. He is unable to free himself from parental authority, leave his wife, talk honestly to his sister, or change his job. He begins to look for his own way, with the help of the Kinghis inner voice.

The play carefully examines the diversity in the experience of masculinity and femininity, emancipating transgenderism, and the redefinition of submission and domination against the aesthetics and customs of Poland at the end of the 20th century.

Characters of the drama, Wife, Mother, Father, Sister, Woman, Patient, Childhood Friend, come to the fore fighting for their truth, dignity and independence. Even the King, the materialised voice of Maciek’s unfulfilled dream about himself, opposes and paradoxically fights for the right to self-determination.

Through the diversity of the characters’ perspectives, Coronation portrays the most universal story about people, their hidden desires and fears, about their dreams that do not come true and how they come into terms with this.

Pinocchio, a ballet in two acts to premiere at Wielki Theatre on April 21, is the perfect opportunity for children and grown-ups to enjoy together live ballet, music and theatre.

The growing interest in its composer, Mieczysław Weinberg, drawing from Polish, Jewish, and Russian culture, means that his music, which until recently was mainly confined to recordings and philharmonic concerts, is making its way into theatre programs.

The ballet was written between 1954 and 1955; the revised version was composed between 1961 and 1962. It is a vibrant, multicolored story full of humor, lyricism, and references to popular dances like waltz and tarantella.

Every child knows the tale of Pinocchio, a wooden puppet that becomes a real boy. While the character was originally conceived by Carlo Collodi, it is important to note that every era has its version of the story. Weinberg’s ballet is based on a reworking of the original tale, Alexei Tolstoy’s book Buratino Tolstoy, a distant cousin of the famous writer, drew heavily on Collodi yet took the liberty of making some far-reaching changes to the plot.

Drawing inspiration from Collodi, Anna Hop, the director, choreographer, and author of the libretto, weaves an original story fit for the modern age. One thing remains the same: the universal message about the hardships of growing up. The production is also a wonderful opportunity to showcase the magic of stagecraft as we follow the fairy tale adventures of a boy who roams different worlds to eventually return home and face his past.

Pinocchio is a ballet to be admired by the whole family. All thanks to Weinberg’s playful

music, the beauty of dance, the magic of theatrical imagery, and the deeply meaningful story about the triumph of vulnerability over violence, the pursuit of freedom, and the necessity to sometimes lose one’s way in to grow as a person.

Performed by the Polish National Ballet, with music conducted by Marta Kluczyńska.

An acclaimed British singer-songwriter Tom Odell will give a concert at the COS Torwar hall in Warsaw on March 27 as a part of his Black Friday Tour.

Odell has many platinum records and prestigious awards, including Brit and Ivor Novello, to his credit. His career spans over a decade, and his music attracts around 28 million monthly listeners on streaming platforms. The Black Friday Tour is the largest in his career and will promote his latest album Black Friday which contains a mesmerizing mix of songs. The delicate sounds of drums and bass, combined with beautiful string arrangements, create an intimate and emotional journey through his music.

The artist has stuck to his indie pop style, favouring simple, piano-based arrangements that let his voice and deeply personal

lyrics shine. In concert he performs seated at the piano.

Odell studied classical piano as a child and started writing songs at age 13. After high school he abandoned plans to attend university and instead focused on music, performing at open mic nights around the Liverpool area. He enrolled in the Brighton Institute of Modern Music shortly after and started the band Tom and the Tides, but ultimately decided to go solo. He released his 2012 debut EP Songs from Another Love and won the BRITs Critics’ Choice Award in early 2013. He followed up in 2013 with his first studio album Long Way Down the same year. Odell spent the next few years touring, and in 2016 he released his sophomore album Wrong Crowd. Soon after, on 9 December 2016, Odell released his Christmas EP Spending All My Christmas with You.

Over a hundred original ceramic objects by a renowned Polish artist Henryk Lula are presented at a new exhibition at Zachęta - National Gallery of Art in Warsaw.

“Ceramics. The Art of Matter” is the most comprehensive presentation to date of Lula’s works, an artist who has worked in the technique and medium of ceramics from the 1950s to the present day. On display are handcrafted unique objects governed by the laws of physics, thermal and chemical processes — including shells, bottles, platters, containers, flat, round, concave, and convex forms.

“They are colorful, shine and don’t get old owing to the glazing and firing processes to which the clay was subjected. Original glazes, created by the artist himself and precisely matched to the shape of

the forms, enhance the works in such a way that they become an inseparable unity of ceramics, understood as the art of matter,” says the exhibition’s curator Dr. Katarzyna Jóźwiak-Moskal.

The artist pays particular attention to presenting works in sets. “Beautiful objects enhance each other’s values. Color and structure - after all, it is the art of matter,” says Jóźwiak-Moskal. “Examples of works composed in sets based on harmony or contrast of forms serve to reveal the complexity and nuances of ceramic design, determined by refined technique and artistic sophistication and characterised by a wide range of potential possibilities,” she adds.

The exhibition also presents Lula’s work and participation in the reconstruction of a Renaissance ceramic masterpiece — the Great Stove from the Artus Court in Gdańsk, an object of great importance for European cultural heritage.

The theme of matter, highlighted in the title of the exhibition, corresponds to the conceptual message of the presentation, as well as the artist’s theoretical reflection on its role in art. The exhibition also explores the question of the development of the modern ceramic tradition in Poland, eluding the criteria of applied art or design, which has been vibrant on the Polish art scene since the 1960s.

On view through May 19.

Floraïku, the poetic perfume brand from the makers of artisanal perfumes Memo Paris, has finally come to Poland. On February 15, it was launched at Quality Missala Perfumery at Mokotowska 40 in Warsaw, which is now the only place in Poland you can find it. The Warsaw Voice spoke to Juraj Sotosek , Global Commercial Director and Alejandra Rozzi , Global Brand Manager Floraïku Paris about this unique brand.

You are a French perfume house but the name of the brand sounds exotic?

AR: The brand was founded in 2017 by Clara and John Molloy. They started with Memo, which is about scents that can remind you of somewhere you travelled. And after they visited Japan, they wanted to create a fragrance inspired by their Japanese experience for the Memo brand. But then, at some point, they felt Asia is so full of ceremonies, stories, and sophistication that it deserves a full collection rather than one single scent. And that’s how the Floraïku brand was created.

Floraïku perfumes have been highly sought-after by fragrance connoisseurs and enthusiasts who like to try something special. Why did it take you so long to come to Poland?

JS: It was important to start from the cradle of perfumery, so we started with Paris. We also have a beautiful boutique in Harrods, on the 6th floor, as London is a very strategic point of sale because of how many tourists from all over the world travel there. And we have developed a lot since we kicked off in 2017-2018, we and are now in around 40 markets already. But we have a more selective distribution for Floraïku so it’s not everywhere. It’s a matter of choosing the best points of sale like this one here and creating the right partnerships, like the one with the Missala family. We want to make sure we are in the best selective perfumeries and have the right clients that look for our perfumes. After 5 years working with the Missala family I am very proud and happy that we have launched our brand here, at their beautiful boutique at Mokotowska in Warsaw.

And Poland is the first country to have our noveltySpring River, inspired by the first micro-season in the Japanese calendar, when the snow starts to melt. It’s not available anywhere else yet as the worldwide launch is planned for March 1.

Going back to the name of the brand, what does Floraïku stand for?

JS: It’s a very nice combination of two words “flora” and “haiku”. The first one is a homage to natural beauty that Floraïku has because a lot of our formulas are very clean, transparent, and very beautiful. The second refers to a short, sublime Japanese poem which is highly connected to nature and life. They are composed of three verses like the three notes of a perfume. Each of our perfumes is named after a dedicated haiku written on the back of the bottle, a poem composed by Clara Molloy. So, the brand is actually a collection of perfume poems.

Could you then say that haiku is some kind of signature to all your fragrances?

AR: Yes, the haiku is the start of all the creative process, it gives the name to each perfume, inspires the master perfumer to compose the fragrance and the designer to create the packaging and all the visuals.

JS: Floraïku fragrances are composed in a similar artistic and distinctive way as haiku, a short formula showcasing rare and precious natural ingredients blended to create fragrances that stand out in terms of complexity and depth.

The creative process is different for each fragrance but the haiku specific to each perfume gives it its character. We have about 30 fragrances which belong to one of our three collections that pay homage to three different Asian ceremonies where teas, flowers and incense play a major role.

How are these ceremonies reflected in the fragrances?

JS: All the fragrances in the white bottles belong to the Secret Teas and Spices collection inspired by the tea ceremony called ô cha. They all have teas in their lightly spicy formula, white, green, black, jasmine tea, or a combination of teas. The second collection is dedicated to ikebana, the ceremony of flower arrangement. The perfumes in the indigo bottles

have more complex structures with “Enigmatic Flowers”, something hard to get but beautiful. The perfumes in black bottles, from the Forbidden Incense collection, pay homage to kōdō ceremony, the art of appreciating incense, which is always part of spiritual life in Asian culture.

And what about these two fragrances in crimson bottles?

AR: They are part of the Shadowing Collection, an innovative way to make your fragrance your own. In Asia, shadowing is the concept of contrasts, of having different souls. With the shadowing collection we suggest how to be yourself and have fun. As we all have two shadows, the light shadow, and the dark shadow, here we have two shadowing scents – one light and one dark, to either bring luminosity to your favorite perfume or bring depth to it. It is the concept of “me, myself and I” - who do I want to be today? If I choose to be “me” and want to empower my fragrance for a formal meeting, or if I choose to be “myself” with my family and friends and add my light shadow. But at night, when you are by yourself it’s the “I”, your essence and then you wear only your favorite fragrance.

These two perfumes, the light Sleeping on the Roof and the dark Between Two Trees, you can use with each fragrance from the three collections, but no layering, no mixing, just side by side. You can also wear them alone.

AR: One Umbrella for Two is our client’s favorite, it is iconic, like a signature. This is a fragrance about memories with the note of black currant bringing us back to the times of childhood. But you also have green matcha tea infused with rice, the same base they use for sake, there is a more adult side to the fragrance. Then you have cedar wood oil which roots it, bringing you back to earth. So, it’s a fragrance with many facets and layers.

I have to say the Floraïku fragrance packaging is really impressive. Each box, each flacon is a work of art.

JS: The packaging has been inspired by a bento box used in Japan for packed meals. Bento boxes have multiple compartments because in Asia everything has its own place and so does our bento. When you open it, you find a 50 ml perfume bottle, a purse spray, a 10 ml refill vial, and bottle caps with Japanese-style graphic motifs. Everything is separated and nothing is touching each other, just like in Asian cultures.

Each box is beautifully decorated with golden sakura flowers on the top and, inside, it features a picture of the yōkai cat, a supernatural creature typical of Japanese tradition.

As we are company that believes in suatainability and is committed to having a very green impact on social community, we are also very proud of the fact that all our packaging is made from recycled materials.

What else makes your brand unique on the niche market?

AR: We offer more than just beautiful perfumes; we offer an emotional experience. Each client who comes to us is offered a cup of tea and while enjoying the beverage and testing a fragrance they are treated to the recital of a complementary haiku - poem. When you hear the haiku it helps the mind to open to the world of imagination and to fragrance. Our clients are captivated by the whole concept, by the stories behind the perfumes and by the poems.

What is next for Floraïku?

JS: We try to focus on innovations, it’s our key driver. We want to become a lifestyle brand. We plan to launch all over body alcohol-free body mists, one invigorating and one to calm you down, for sleeping.

1/ Wake up looking younger

Natura Bissé Essential Shock Intense Retinol Night Renewal is a power-packed beauty treatment to renew your skin as you sleep. This concentrated anti-aging night serum delivers all the power of retinol but is enhanced with bakuchiol, a natural retinol-like active ingredient but without potential side effects.

The advanced formula, designed as the ideal balance between maximum efficacy and skin tolerance, also includes a potent mix of Glycolic Acid, Matrixyl, Proteoglycans, and Collagen for an unparalleled lifting effect.

Night after night, the nourishing treatment works to benefit your skin both internally and externally as it promotes collagen synthesis and boosts epidermal renewal process for a smoother and firmer complexion.

Each morning, you wake up to a rejuvenated, more luminous skin with fewer signs of sagging and wrinkles, and a more even tone.

2/ Tribute to passion

Two new perfume extracts, which are part of the Les Extraits Collection by Eight & Bob, a Spanish fragrance house, pay homage to creativity and elegance.

Le Geste d’Edmond encapsulates the legacy of a young visionary. Edmond Albius, a 12-years old apprentice who, in the 19th century, mastered vanilla cultivation. His groundbreaking technique transformed Madagascar into the world’s premier vanilla producer. With top notes of Madagascar Ginger oil, heart notes of Madagascar Cinnamon Bark oil and base notes of Bourbon Vanilla, the fragrance immortalizes Edmond ‘s journey in perfumery, capturing his brilliance and creativity that shaped the history of a coveted botanical treasure.

La Musique de Christie is a fragrant ode to the elegance of the prestigious opera festival Glyndebourne in the UK. Crafted with luxurious Greek Saffron, Leather, Moss, Nutmeg, Musk, and Patchouli, each note intertwines to create a harmonious

symphony of scent. The fragrance pays tribute to the creator of Glyndebourne, offering a contemporary celebration of luxury and passion in every drop.

3/ Celebration of life’s pleasures

Love Delight, a new scent in Amouage’s The Secret Garden collection is an invitation to savor every moment of indulgence.

This alluring floral-gourmand fragrance has been inspired by the sweet and spicy scents of the irresistible delicacies offered by Arab confectioneries.

The perfume, crafted by the esteemed perfumer Pascal Gaurin masterfully combines delicate floral accords of Heliotrope, Jasmine and Rose Blossom with the spicy notes of Cinnamon and Ginger and the sweetness of Vanilla, Cocoa, Rum Absolute and Cyproil.

4/ Aromatic story of fairly-tale land House Memo Paris has launched Cappadocia, a new fragrance in the Graines Vagabondes collection.

The new creation by Gaël Montoro captures the magic of its namesake, with its fantastic volcanic landscape, rock formations known as “fairy chimneys” and the underground and cave-dwelling cities.

The keystone of this oriental-woody composition is Greek saffron - an ingredient with an intense, spicy aroma that gives the fragrance depth and character. It is enhanced by the softness of flower petals and the creaminess of wood and resins.

The organic palette of this amber, enveloping fragrance, also includes Jasmine Absolute and Orris Butter in the opening. The Turkish Rose takes center stage in the heart, along with Mahonial and Sandalwood Oil. Finally, this exotic blend settles on a warm base of Gold Vanilla, Myrrh Resinoid and Nirvalonide with each ingredient adding to its uniqueness and complexity.

The perfume’s sandy brown flacon features a representation of the ‘fairy chim-

neys’ characteristic of the Cappadocia region.

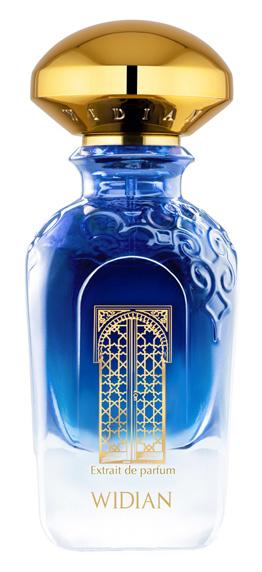

5/ Olfactory journey to Granada

Granada is the latest addition to the Sapphire Collection by Widian perfume house dedicated to cities from various corners of the globe, and the third fragrance after London and New York.

Created by Hamid Merati and inspired by the famous Alhambra palace-fortress, it is a unique aromatic portrait of this magnificent Spanish city.

In this captivating olfactive creation full of contrasts the softness of delicate Rose and the freshness of Juniper harmoniously blend with fiery Black Pepper and Cinnamon.

This seductive scent is enhanced by deep undertones of Amber, Musk, Vetiver and Patchouli, merging in a perfect balance.

6/ Scent of wild rock’n’roll

Xerjoff Tony Iommi Monkey Special, is a unique fragrance created by Xerjoff, an

Italian Luxury Perfume house, in collaboration with the legendary guitarist of Black Sabbath, Tony Iommi. The composition is a tribute to the rock’n’roll of the late 1960s and a pioneering multi-sensory interaction between sound and scent, combining Iommi’s characteristic monolithic riffs with Xerjoff’s perfume craftsmanship.

The fragrance opens with intriguing top notes of Bergamot from Reggio Calabria that reflect Tony’s Italian roots. The notes of Rum, Bulgarian Geranium and Passion Fruit complete the dynamic opening. The heart of the fragrance is a combination of Cinnamon, Bulgarian Rose, Patchouli and Leather for a truly rocking vibe. In the base Australian Sandalwood harmonizes with Caramel, Vanilla, Tonka Bean, and Musk for the unique and sophisticated sensory experience.

The perfume comes in a sleek bottle in an elegant, Gothic style that is fit for those who like to express themselves in a boisterous way. All

Nissan X-Trail is one of the many family models of the SUV segment. Some like it more, others less, and perhaps there would be nothing special about it if it weren ' t for the kind of innovative hybrid drive it uses, a drive in which the only source is an electric motor.

Nissan X-Trail is a hybrid, that is, a car with two engines working together –an internal combustion engine and an electric motor, but in which the wheels are driven not by an internal combustion engine, assisted by an electric motor – as in traditional hybrids, but by an electric motor, for which the source of energy is the internal combustion engine. It’s like a reversal of concepts and a combination of electric and internal combustion models, with the difference that electric models require battery charging, while in the case of the X-Trail e-POWER the “char-

ger” is a turbocharged, three-cylinder gasoline engine with a capacity of 1.5 liters and 158 horsepower.

The X-Trail e-POWER hybrid is available in two versions: 2WD front-wheel drive, with a single electric motor with a combined output of 204 horsepower, and a 4WD version of the e-4ORCE with two electric motors located on both axles of the vehicle.

In the presented version, the combined driving power of this unusual hybrid is 213HP. and the maximum torque is 330Nm. on the front axle and 195Nm, on the rear axle. According to the technical data provided by the manufacturer, the car accelerates to a hundred in 7.2 seconds and can go at a top speed of 180 km/h. The manufacturer puts the average fuel consumption of this model at 6.4-6.5 l/100km. During test drives, using the e-Pedal system and eco-driving techniques, we managed to achieve 7.5 l/100km. For

a hybrid model and preferred driving style, this is a bit too much. And what about subjective impressions? In my opinion, the entire power train is not only efficient, but also works very smoothly. While driving, you can hardly hear the engines working together, and the driver has a sense of full control over the vehicle - mainly thanks to the high torque and linearly, as in electric cars, increasing power. Such a little foretaste of a full e-car.

The drive is electronically distributed and transmitted to both axles and each wheel separately, which, combined with the nearly 20-centimeter ground clearance and short body overhangs (the distance between the wheel axle and the end of the body), makes it possible to treat Nissan as at least an off-roader car that can cope not only on level surfaces but also in the wilderness. Few family SUVs, much less hybrids, can boast such qualities.

THE DRIVE IS ELECTRONICALLY DISTRIBUTED AND TRANSMITTED TO BOTH AXLES AND EACH WHEEL SEPARATELY, WHICH, COMBINED WITH THE NEARLY 20-CENTIMETER GROUND CLEARANCE AND SHORT BODY OVERHANGS

In addition to its undoubted driving and off-road qualities, the X-Trail has more than enough utility. The body measures 4.68 meters in length and the wheelbase measures 2.70 meters. The e-POWER 4ORCE version is available in two versions - a five-seater and a seven-seater. However, it should be noted right away that the seven-passenger version is rather in name only, as the two seats, or rather seats retracted into the trunk floor, can only be used for children or people of small stature, and only for short-distance travel. The passenger cabin, however, is spacious enough to comfortably accommodate five adult passengers without the third-row seats folded down. Another convenience is the ability to move the second-row bench seat (by 22cm) and adjust the angle of the backrests. In the middle position of the bench seat, a spacious trunk with a capacity of 575 liters is available for passengers.

The equipment and quality of finishing materials deserve detailed attention. In the presented, richest version of the Tekna+, these include adaptive LED headlights, leather upholstery, wood and aluminum inlays, heated front and rear seats, tri-zone air conditioning, HUD display, 360-degree cameras, Bose audio system, glass roof, 20-inch alloy wheels and keyless tailgate closing. The quality of the trim materials and their fit is world-class. At the very least, this equipment version will feel premium.

The dashboard is clear and ergonomically laid out. As in every car produced today, its main elements are the displays: a 12.3-inch cockpit display, a 12.3-inch touchscreen on-board computer and a 10.8-inch HUD head-up display. The driver can operate the systems via buttons on the sleek three-spoke steering wheel. Fortunately, traditional dials and switches have not been abandoned. The center tunnel houses the e-Shifter lever, buttons for the electric ev and e-Pedal (electronic brake for energy recuperation) modes, or a large dial for selecting the driving mode, including a choice of two off-road modes. Between the main screen and the center tunnel there is an air conditioning panel,

also operated manually with buttons and dials, and underneath it a shelf for a phone with an inductive charger. The whole thing looks not only modern but also very elegant.

Nissan X-Trail with e-POWER drive is a very interesting model that could become a bridge between electrified cars and full electrics. “Electrifying power, without charging” is not only an advertising slogan for Nissan’s drive, but fully reflects its greatest advantage, namely the charger (in this case, the internal combustion engine), which is one of the fixed components of the drive. Owners of fully electric cars who often in Polish conditions plan trips “from charger - to charger” probably envy such a solution the most.

Despite the high purchase price (about PLN 250,000 for the Tekna+ version) and a few minor drawbacks such as

high (for a hybrid) fuel consumption, the irritating sound of an unheated engine or a small and quickly discharging battery - this is a model worthy of attention and already appreciated by European drivers. In a statement released in early February, the brand said that since the debut of the e-Power powertrain in September 2022, more than 100,000 Qashqai and X-Trail models equipped with this innovative system have found buyers in the European market. Of this number, almost 35,000 were X-Trail. All indications are that the innovative power train is gaining more and more interest among drivers, and the brand’s plans to confirm work on further development of this technology may be a good omen for the future.

Scenic E-Tech 100% electric has won the title of Car of the Year, awarded by the jury of the European competition The Car of the Year.

The jury’s verdict was announced at an awards ceremony at the Geneva Motor Show.

After the first round of voting in November 2023, the Scenic was among seven finalists - BMW 5-series, BYD Seal, Kia EV9, Peugeot E-3008/3008, Renault Scenic, Toyota C-HR and Volvo EX30. The winning model was chosen by a vote of 58 automotive journalists from 22 countries.

Scenic took first place with 329 points. It is the brand’s seventh car with the prestigious title after the Renault 16 (1966), Renault 9 (1982), Clio (1991), Scenic (1997), Megane (2003), and Clio (2006) models.

“All employees of the Group and the Renault brand are immensely proud to receive the prestigious “The Car of the Year” award. It’s a tribute that shows we made the right

choices - we set our sights on record range, a spacious and friendly interior and reducing our environmental footprint! Add to that the driving pleasure and features that have made Renault the car brand of choice for a full life, such as the new Solar Bay roof and the latest generation of the OpenR Link system with built-in Google search, and the Scenic has fantastic assets to conquer the European electric car market,” said Fabrice Cambolive, CEO of the Renault brand.

The Scenic E-Tech electric is a 100% electric car developed on the AmpR medium (former CMF-EV) platform. It is designed for active people who want a versatile car. With zero emissions, maneuverability, low weight (1,890 kg) and compact dimensions (4.47 m long), the Scenic performs well in the city. At the same time, for long journeys it offers a range of up to 625 km (WLTP), comfort, a spacious interior and driving pleasure, to which useful technologies contribute.

Warsaw has been named the best among Central and Eastern European cities in this year ' s edition of the acclaimed Financial Times " European Cities & Regions of the Future " ranking.

In the main ranking among 330 European cities, the Polish capital was outranked only by London, Amsterdam and Dublin. Warsaw was followed by Paris, Berlin and Barcelona, among others. In the “Business Friendliness” category, Warsaw ranked 2nd only behind London.

The latest ranking of cities and regions of the future was prepared by fDi Intelligence, a company owned by The Financial Times Group. This is one of the most prestigious

lists often cited by local governments and investors. It evaluates European cities and regions in terms of economic, financial, and business strengths.