Jennifer Daniel Aflac

Steve Clabaugh CLU, ChFC

Editors

Heather Garbers | Trevor Garbers

Marketing Director

Marin Daniel

For Media and Marketing Requests Contact: Heather@voluntary-advantage.com and Trevor@voluntaryadvantage.com

Jack Holder EBIS

Rachel McCarter Mercer

Mark Rosenthal PwC

Seif Saghri BenefitHub

Tim Schnoor

Birch Benefits

Sydney Consulting Group A d v i s o r y B o a r d

Hunter Sexton, JD, MHA

Michael Stachowiak

Colonial Life

Spring is in the air, and we all know what that means – spring showers, graduations, yard work and baseball if you are part of Team Garbers! In fact, the other day we set a goal to master all these in one day However, mother nature here in the great State of Colorado said not so fast, as I started to mow in the bright sunshine and within a few minutes, I found myself having to quit as it was outright snowing. Yes, you heard that right, snow in May.

So, what was I do to but pivot for a few minutes and complete a few quick tasks until the snow ceased and I could get back to my lawn mowing duties. Like anything, we should always be ready to pivot at moment’s notice, much like we do every week here at Voluntary Advantage when it comes to finding the next big topic, addressing a trending issue, or pushing the envelope to move our industry forward as a whole

I recently posted a LinkedIn article where I spoke about “who’s winning business and how?” from a brokers perspective regarding which carriers are winning today and how are they winning?

Trevor GarbersNow, you didn’t see the replies on LinkedIn, but my phone blew up from strong Regional Sales Leaders, Regional Sales Vice Presidents and Heads of Distributions asking if I’d share the who and how. With zero doubt, the one common theme are the carriers that are winning today are pivoting nonstop to secure the business Now, I sincerely apologize in advance for another sports metaphor, for those that know me personally, know I was very blessed to play both football and baseball in college However, I did not fulfill the dream of my father who played DI basketball and had high hopes that his 5’8” son would be the next great Pete Maravich So, the best I can give my father today who’s my mentor, hero, and the human I love so dearly, is a solid basketball reference to hopefully fill that unfilled void

In basketball, when a player pivots, he or she can gain leverage on the defender and better position themselves into a triple-threat position where they can either pass, shoot or dribble the ball Much like a carrier when they have an opportunity to grow their market share, they can take the shot and win it or, reposition themselves by dribbling to take a better shot or angle at market share or finally, pass the ball and wait for the next opportunity In today’s competitive voluntary benefits landscape, you have to pick one of the three or you’ll be non-existent in a heartbeat Take a quick peak around – M&A is everywhere And sadly, this month, more carrier layoffs So yes, at a minimum, we all need to be ready to pivot when listening to our policyholders, clients, and valued stakeholders as the days of status-quo and doing things because that’s how it’s always been, are far-far behind us as we enter a new galaxy of voluntary benefits and the value, they bring to our overall employee benefit solution.

In closing I ask you this simple question: What is your next pivot to win market share?

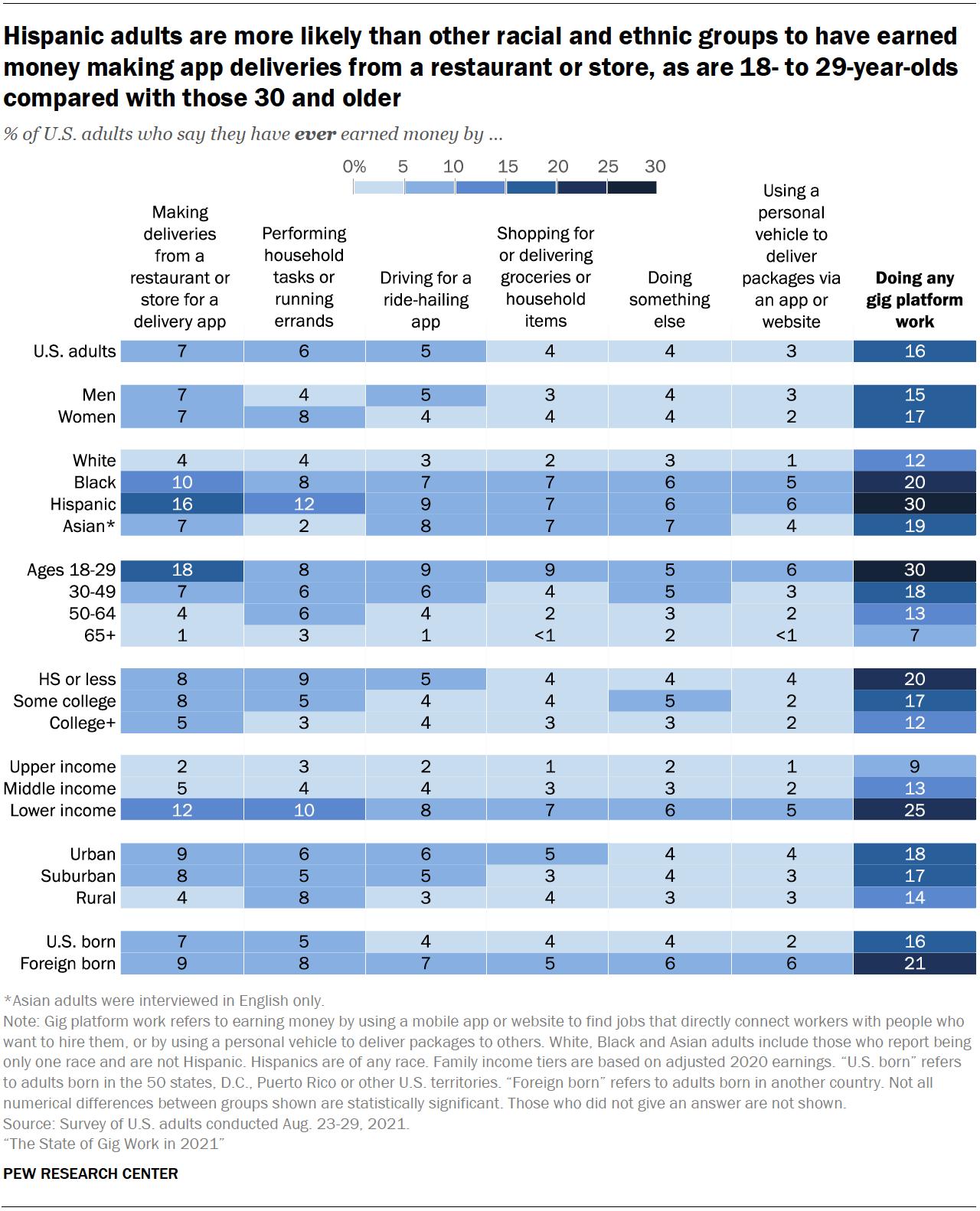

According to McKinsey’s 2022 American Opportunity Survey, a full 36% of employed respondents—roughly 58 million Americans—identify as independent workers [1]

Carriers looking to expand their markets to serve underpenetrated populations may be overlooking a key demographic: gig workers.

Contract workers, temps and free-lancers are a large and growing part of the US workforce A recent McKinsey study shows 36% of employed respondents equivalent to 58 million Americans identify as independent workers [1] That’s a huge leap from a University of Chicago study just a few years earlier that pegged the number at 5 million, after tripling between 2017 and 2021 [2]

Despite their impact on the US economy, a recent Eastbridge survey of independent contractors and 1099 employees shows gig workers are tremendously underserved when it comes to health and other benefits That means there’s a significant opportunity for carriers interested in meeting this need.

Only 20% of gig workers have access to any benefits through the employers they work for, according to Eastbridge’s 2023 “Benefit Access and Preferences for Gig Workers” Frontline™ report. The most common benefits employers offer these workers are medical insurance (68%), prescription drug coverage (42%), dental insurance (39%) and vision coverage (26%). Short-term disability (23%), accident (16%), AD&D (16%) and legal plans (16%) also are sometimes available from employers

But gig workers express strong interest in obtaining benefits coverage Most of those surveyed say access to core benefits such as medical, dental and vision is important or very important Many say they’re also interested in additional coverage: More than a third (34%) place high importance on access to voluntary benefits, and a fourth say it’s important to have access to non-traditional benefits such as identity theft protection, mental health or legal plans

Independent workers who can’t get benefits through an employer are forced to find coverage on their own Nearly half (45%) say the most common source is directly from an insurance or benefits provider About one in four (39%) rely on government-funded coverage such as Medicare or Medicaid, state or military health and retirement benefits, or coverage through a spouse or partner Only 10% report that they have access to benefits through a professional association or group, and a similar number (11%) say they obtain benefits through a personal association or group

Reaching gig workers to educate them about benefits and enroll them in the right coverage may require carriers to be creative and use a variety of methods in fact, some of the same strategies they need for any effective benefits program. Carriers also may need to rethink their approach to underwriting this disparate group. But the effort could pay off for carriers that want to take advantage of a significant business opportunity to expand their markets

[1] https://wwwmckinseycom/featured-insights/sustainable-inclusivegrowth/future-of-america/freelance-side-hustles-and-gigs-many-moreamericans-have-become-independent-workers

[2] https://www.irs.gov/pub/irs-soi/23rpevolutionofplatformgigwork.pdf

Nick Rockwell President

Nick Rockwell President

Danielle Lehman Senior Consultant

Danielle Lehman Senior Consultant

Eastbridge is the source for research, experience, and advice for companies competing in the voluntary space and for those wishing to enter. For over 25 years, they have built the industry’s leading data warehouse and industryspecific consulting practice. Today, 20 of the 25 largest voluntary/worksite carriers are both consulting and research clients of Eastbridge.

Legal rules governing discretionary groups have paradoxically been among the most disorienting and most unchanged over the years Despite having changed little, there is widespread confusion about how to comply with these ancient legal paradigms. So much so, that industry perception of discretionary groups is often that they are something to avoid. We at Sydney argue the opposite: discretionary groups (and the laws governing them) are worth another look because they can provide an alternative option for delivering worksite benefits to diverse and often overlooked groups in our evolving economy

States use group eligibility laws to control the types of entities to which an insurer may issue a policy The most widely used group insurance vehicle is the employer group Typically, as a baseline, states also include laws permitting issuance of group insurance contracts to unions and associations Examples of other entities that may be contemplated, albeit with less predictable results, include debtor/creditor arrangements, multiple employer trusts, nonprofits, credit unions, religious institutions, and institutions of higher education

Certainly, there are many ways to provide group insurance benefits. But what happens if the group offering benefits is not contemplated in the state eligibility laws?

Consider for example, a group that consists of drivers who deliver fresh takeout food to local customers all over the United States The drivers are closely associated with, but not employed by, a business that connects them with hungry patrons. Rather, these drivers operate as independent contractors (of course, more commonly referred to as “gig workers”). The closest strictly defined eligibility option is addressed to employer groups. Consider a representative example in Nebraska Revised Statute 44-760, which says that group accident and sickness insurance benefits can be provided under policy “issued to an employer, who shall be deemed the policyholder, insuring at least two employees of such employer, for the benefit of persons other than the employer” “Employees” explicitly incorporates “officers, managers, and employees of the employer, the partners if the employer is a partnership, the members if the employer is a limited liability company, the officers, managers, and employees of subsidiary or affiliated corporations of a corporate employer, and the individual proprietors, partners, and employees of individuals and firms, the business of which is controlled by the insured employer through stock ownership, contract, or otherwise.” The term “employees” may also include retired employees.

Of course, this type of statute is designed to be expansive because it must encompass a very broad set of employment arrangements However, because the hypothetical gig-worker members are independent contractors rather than employees who are employed by the policyholder, the ubiquitous employer group eligibility option is inapplicable Unfortunately, no other strictly defined eligibility mechanism provides a better way to address this type of arrangement Yet there is clearly a strong and reliable nexus running from the business to its members suggesting insurability What then? Enter the discretionary group

The discretionary group, so called because it is approvable at the discretion of Commissioners of Insurance, is often surrounded with apprehension. Uncertainty is even built into the name. But it can also provide an option for a legitimate group to become benefit eligible where there may be no other way forward. At its core, a discretionary group is one which is otherwise not strictly defined by relevant state law. There are generally two paths to establishing the legitimacy of a discretionary group The first is via what is often referred to as the threeprong test method, and the second is by showing similarity to other permitted groups

Under the three-prong test method, a policy may be issued to cover any undefined group when the Commissioner of Insurance finds that:

(1) the issuance of such group policy is not contrary to the best interest of the public, (2) the issuance of the group policy would result in economies of acquisition or administration, and (3) the benefits are reasonable in relation to the premiums charged.

In this type of arrangement, the premium for the policy must be paid either from the policyholder's funds, from funds contributed by the covered person, or from both.

Under the substantially similar method, a policy may be issued to cover any undefined group that is substantially similar to another defined group-type and which, in the discretion of the Insurance Commissioner, may be subject to the issuance of a group policy or contract Recalling the prior gig worker example, arguments can be made that both discretionary group tests are relevant

Under the three-prong test, the issuance of a group policy serves the best interests of the public because it provides access to valuable supplemental benefits that can be used to defray the costs associated with unexpected illnesses and accidents The issuance of the group policy results in economies of acquisition and administration by making benefits available to large populations of associated members who would otherwise have to pursue such benefits on a more costly and potentially less administrable individual basis. And, while ensuring the reasonableness of benefits in relation to the premiums charged is a business endeavor, it is not difficult to imagine that a well-designed and appropriately priced product would satisfy this requirement

Alternatively, under a substantially similar test, the parallels between a group of employees and a group of independent contractors are undeniable Of course, such a determination is certainly not uncontroversial because of the implications for “employers” that are associated with classification of its workers as employees rather than independent contractors Still, for purposes of saying “one of these things is like the other,” the equivalences are hard to dispute

So, it is possible But is discretionary group approval for this type of entity probable? That remains to be seen. There can be little doubt that efforts to insure gig workers under a discretionary arrangement will be met with resistance in some jurisdictions. However, this is a nascent conversation between interested groups, the industry, and state regulators. Finding a way forward will take strong advocacy, but there is assuredly a path.

Benjamin Davis, JD, AIRC, Compliance Counsel, Sydney Consulting Group - Ben joined Sydney in 2021 after 13 years with the group benefits division of a Fortune 200 company, where he specialized in providing a wide variety of compliance services for Hospital Indemnity, Term Life, and Accident Indemnity He also has extensive experience supporting Short and Long Term Disability, Statutory Disability, Critical Illness, and Dental Ben holds a Juris Doctor from the Creighton University School of Law

According to the IRS, it is “an activity where people earn income providing on-demand work, services or goods Often, through a digital platform like an app or website” This includes part-time and temporary or contract work

Technology has transformed the gig economy, making it easier to connect customers with private contractors. These gig workers work in anything from food and package delivery, taxi service, dog walking, IT, marketing or bookkeeping services, to lawyers and actors. This may be their “side-hustle” or a growing portion of this population views gig work as their primary source of income.

Individuals may be drawn to it due to the flexibility and independence, lack of other options, or even as a side gig to have an additional income stream or pay down debt At the same time, they may sacrifice job and income security provided by a 9 to 5, and often do not have access to benefits including both insurance and paid-time off options due to their job classification

In our industry, many of us have shied away from offering this population benefits for a multitude of reasons maybe they represent a small portion of employees, or that it can be difficult to engage them, or they were just overlooked

With the rate at which the state of “work” is changing, this often-overlooked population may deserve a second look. Is there a need for benefits in the gig economy? Would employers chip in to help engage employees in exchange for a competitive edge in recruitment and retention? Are there even benefits available in the market that would appeal to this demographic?

We have interviewed several solution providers to get their insights on offering benefits to this evolving demographic Quinn Pearl is SVP of Sales at Recuro Health, Devyn Kettner is Director of Sales at Spot Pet, and Bruce Brotine is Enterprise Sales Leader at Avibra

Studies show that a growing segment of employees prefer gig/part-time work and have a need for benefits. How is your firm addressing this need in the marketplace today?

Quinn: At Recuro Health, we are dedicated to delivering affordable healthcare solutions to the gig and part-time workforce Our services include access to primary care physicians, urgent care facilities, behavioral health support, and prescriptions at no additional cost all at a price that fits your budget. Unlike traditional insurance, our programs aren't bound by underwriting processes, minimum work-hour stipulations, or employeremployee relationship prerequisites.

Bruce: This is the exact need Avibra is filling, both for gig platforms and employers, as well as hourly and part-time workers The platforms and employers want to be able to offer benefits–often positioned as ‘perks’–that their workers consider valuable What do gig and part-time workers want from their benefits?

Bruce: The whole point of gig work is that these people are coming to the platform for all sorts of reasons Some consider this their full time job, while others are using it to shore up their finances or get through a rough patch. The same goes for part-time workers. Gone are the days of people taking part-time work because they can’t find anything else. Avibra can cover both ends of the spectrum with our a la carte Dollar Benefit Store that has over 40 benefits. A buck a week can get you Family Dental Benefits, or it can get you Global Travel or Alternative Medicine Savings. And that’s on top of the free core benefits the gig and parttime workers already get, like credit counseling, prescription drug savings and $10,000 AD&D insurance

Devyn: Spot's Pet Insurance can be offered to all employees regardless of benefit eligibility status, including gig and part-time classifications Flexibility can attract a wider range of talent who value autonomy and work-life balance Spot plans can help pet parents prepare for expensive, unexpected vet bills We have found that this demographic has a high rate of pet owners and so for employees who cannot afford to self-insure, pet insurance is a great way to provide financial stability.

How receptive have employers been to the concept of offering benefits to this population?

Devyn: Employers are constantly looking for the best ways to attract and retain top talent. Since part-time or gig employees do not typically qualify for benefits, it can be hard to provide added value to them outside of pay. Employers are overall excited to be able to offer a popular benefit like pet insurance to this segment of the workforce since there is less opportunity for value-added benefits with this population of workers Pet Insurance specifically caters to all ages and demographics, so it is a great offering to appeal to the entire workforce

Bruce: I’ve heard over and over again in calls, how much employers want to offer benefits to their part-time and gig workforce, but it’s just too expensive And I get it, traditional benefits really are a huge expense for an employer It can be a real drought-or-flood situation with benefits

Bruce: Fully voluntary benefits cost the employer nothing but may be of reach for part-time and gig employees, while employer-sponsored medical plans cost the employer way too much We try to hit that happy middle For gig platforms particularly, the issue is a bit more interesting as we are constantly navigating rulings from state governments and the Department of Labor on whether gig workers should exist at all and what protections should be put in place for them.

Quinn: The adoption of our benefits by employers has surged, particularly as the COVID-19 pandemic has heightened the relevance of virtual care. With our advanced plan features, employers are able to offer high-value benefits at an affordable cost Many employers are contributing to or fully covering the costs of our programs, which not only boosts enrollment, but also strengthens their strategies for recruiting and retaining employees and enhances their overall wellbeing

What typical type of benefits are most popular in this segment and what level of participation should we expect to see?

Quinn: Our Complete Virtual Primary Care program is the most popular among our offerings It provides a comprehensive $0 copay plan that includes access to a dedicated primary care physician, at-home laboratory services, genomic testing, virtual urgent care, behavioral health services, and prescription plans We typically see about 20% enrollment in passive settings, but this figure can climb to over 50% when enrollment is mandatory. When employers contribute financially, enrollment rates often soar to between 75% and 100%.

Bruce: We do see that each group’s employee population really is different, although Family Dental and $20,000 of additional AD&D Insurance are always at the top of the list. We’re regularly seeing greater than 45% enrollment in free benefits for part-timers Gig workers love the Dollar Benefit Store, with 10% even adding on a few extra benefits

What ways have you found most effective in engaging populations of Part-Time & Gig employees in benefits?

Bruce: Gig and part-time workers know what’s best for them and our messaging focuses on building a safety net that fits their needs We’ve found that our gig platform and employer partners are often surprised at what their workers end up selecting when given the choice

Devyn: It’s important to note that one size doesn't fit all when it comes to benefits Offering customizable benefits packages allows employees to choose the options that best suit their needs Employee lifestyles can vary depending on their work schedule, so it is important to communicate benefits through several channels including but not limited to, emails, newsletters, and even social media advertisements.

Quinn: Engaging gig and part-time employees effectively is key to the success of our program We've achieved significant results through tailored text messaging campaigns, emails, and, in certain instances, support from outbound call centers Traditionally, telemedicine has been utilized primarily when a family member falls ill However, our Virtual Primary Care program offers employees the opportunity to connect with a dedicated primary care physician for annual wellness visits. It's crucial that partners whether employers, staffing firms, or associations actively support these initiatives by spearheading the outreach with email communications.

This population highly engages with technology. How can technology be leveraged to provide these solutions?

Devyn: Employers are leveraging technology to streamline benefits administration for gig and part-time workers. This includes using digital platforms for enrollment, managing benefits, and providing support resources online

Devyn: We offer a 100% digital end-to-end solution from sign-up to claims reimbursement. Direct-bill model products can also provide flexibility to employees as they can enroll or cancel anytime throughout the year as their budget or needs change.

Quinn: Our Virtual Primary Care and Virtual Behavioral Health services are crafted with cuttingedge technology at their core Our offerings are delivered entirely online, with members accessing services through our mobile app, web portal, or by phone This scalable approach combines advanced technology with stringent security measures We are proud to have achieved HITECH certification, underscoring our commitment to securely integrating technology in healthcare delivery

Bruce: The insurance industry has been a bit slow in adopting technology that best serves the needs of consumers Often they’ve been trying to make a one-to-one swap from brokers to an app with the same products–which tends to fall flat over time. We put way more control into the workers’ hands via our app, which is is something they are very familiar with. They get to toggle benefits on and off as needed, make and have tele-appointments right in the app, and keep track of their benefits over time right on the home page.

As many companies classify employees as gig to reduce certain obligations (ie workers compensation and taxes), this subset of employees may also be key to that same organization’s growth and mission. Although offering part-time and gig employees benefits and perks is not the market standard today, it can help organizations to enhance their appeal to recruit and retain this demographic of employees.

For the employees, they get access to services that might not be available, or that they might not be able to afford, on the individual marketplace These types of offerings can enhance their perception of their employer, as it shows that they care about them

Brokers and carriers alike should take a fresh look at offering solutions to these individuals to open doors in an industry filled with noise and make benefits available to a growing population in our workforce who may not have any other options.

The end product might look different than what we are used to, but change is necessary for growth.

Bruce Brotine, Enterprise Sales Leader, Avibra - Since 2021, Bruce has led the sales and partnership team at Avibra. Bruce is known for his strong leadership skills, humanistic approach, and dedication to fostering a culture of excellence within their teams. Before Avibra, Bruce scaled SoFi, CareerBuilder and TradeStation.

Devyn Kettner, Director of Sales, Spot Pet Insurance - helps companies offer affordable and comprehensive pet insurance to their employees and clients. She manages relationships with Benefit Brokers and HR Professionals across the country and is a proud Spot policyholder and dog mom to Juno, my adorable pup. My goal is to help as many people as possible access quality vet care for their pets, without having to worry about the cost of treatment.

Quinn Pearl, Senior Vice President of Sales Recuro Health, Inc. - Quinn’s expertise lies in forging national partnerships with Insurance Carriers, Third Party Administrators, and Consultants, focusing on developing tailored virtual health benefit packages and risk management solutions. Quinn is instrumental in collaborating with Employee Benefit providers to design and implement bespoke programs encompassing Virtual Primary Care, Family Behavioral Health, and Pharmacy services, aimed at delivering advanced, affordable healthcare.

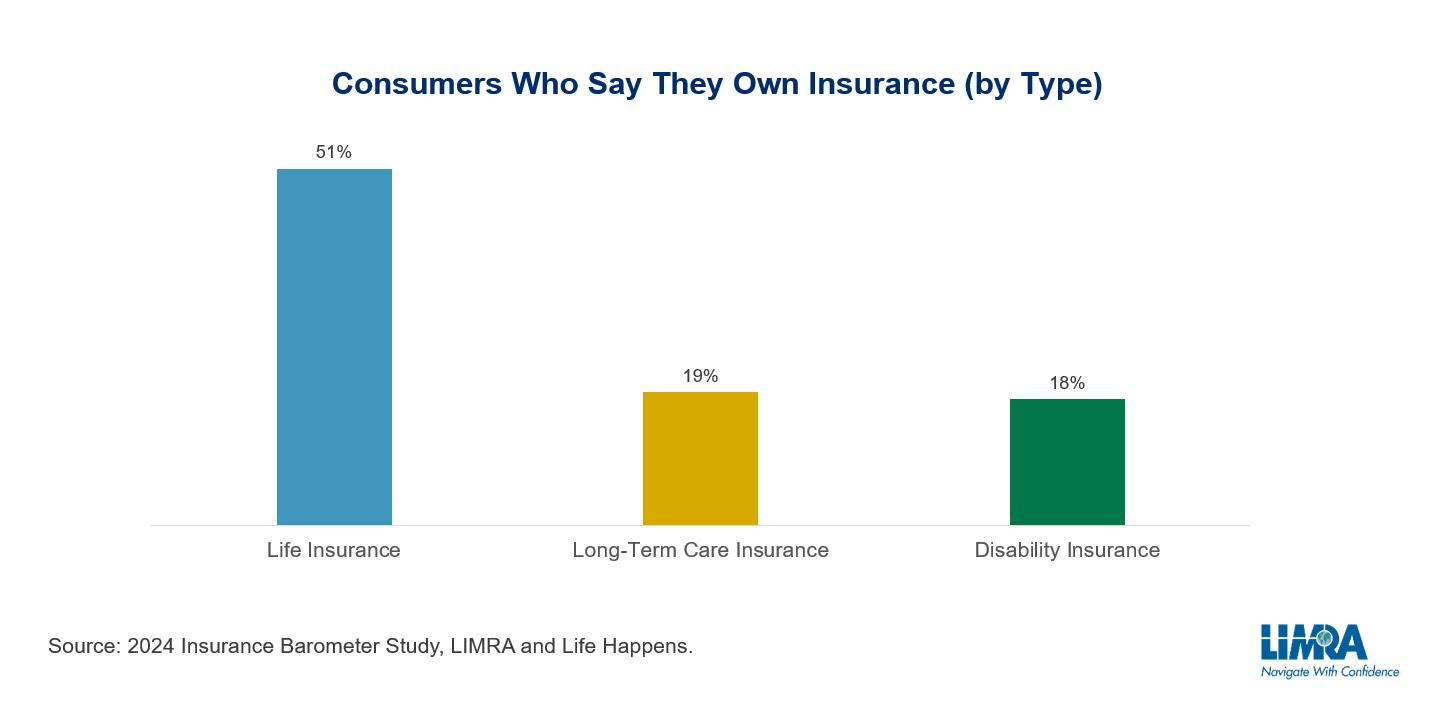

Although no one likes to think about it, the likelihood of a disability is more common than people realize The Social Security Administration reports that about 1 in 4 of today’s 20-year-olds will become disabled before reaching retirement age[1] In addition, the Centers for Disease Control and Prevention notes that 27% of American adults currently live with a disability [2] These statistics underscore a major truth: We must protect our incomes from the impact of an unexpected disability.

Despite this evident need for disability insurance, LIMRA data suggests a significant gap between those who recognize they need coverage and those who actually have coverage The 2024 Insurance Barometer Study, conducted by LIMRA and Life Happens, shows that 46% of US adults say they need some sort of disability insurance Yet, currently, less than 1 in 5 consumers (18%) say they have it and LIMRA estimates that true individual ownership may be far less. This does not include coverage they may have obtained through work.

Lack of knowledge about disability insurance could play a big role in the lack of protection Just 16% of adults say they are very/extremely knowledgeable about disability insurance This signals a significant need for education about disability coverage not only on the individual level but within the workplace as well According to the LIMRA’s 2024 BEAT Study, employees opt out of employersponsored disability plans for the following reasons:

They don’t believe they need the benefit; They don’t think the benefit is worth the cost; and

They don’t think they can afford the benefit.

Less than half of employees believe they understand disability insurance somewhat or extremely well What this ultimately shows is that our industry can do more to better educate and communicate the need for disability coverage, the value it provides, and the risks of not having coverage

One way to build awareness and understanding around disability insurance is by educating consumers and employees about the cost a disability can inflict upon a household The National Disability Institute found households with one adult who has a disability require 28% more income to retain a similar standard of living than households without an adult with a disability[3]

That’s a staggering number According to 2024 Insurance Barometer Study data, consumers without disability insurance coverage say their families would resort to tapping into personal savings (48%) or retirement funds (26%) to meet their day-to-day expenses. Consumers need to understand that there’s a lot at risk should the primary wage earner become disabled. Disability insurance can help safeguard against undermining one’s future financial security

“The workplace continues to be an important way for consumers to obtain the insurance coverages they need,” notes Patrick Leary, corporate vice president, LIMRA Workplace Benefits Research “This is especially true of middle-market consumers who may not have a personal financial advisor to help them address these needs”

In fact, according to LIMRA’s Consumer Sentiment survey, more than 7 in 10 workers rely on at least to some degree their employee benefits plan to meet their disability insurance needs. It’s important to keep reemphasizing the value of participating in an employer-sponsored disability insurance plan to protect their financial future.

Sixty-seven percent of employees who choose not to enroll in disability benefits either believe the coverage is too costly or say they don’t need it. The truth is that many employers provide disability coverage on an employer-paid or contributory basis, where the employer and their workers share the cost of coverage However, just 56% of workers can definitively say whether their employer offers disability insurance This again highlights the need for effective communication and education around disability insurance benefits

The 2024 Insurance Barometer Study shows that 20% of adults say they intend to purchase disability insurance coverage within the next 12 months Of course, intent does not always translate into action During Disability Insurance Awareness Month, the industry has an opportunity to keep educating consumers and hopefully spur them to purchase the coverage they need to protect their income.

Originally published on LIMRA.com.

[1]Social Security disability insurance is coverage that workers earn, Social Security Administration, 2022.

[2]Disability Impacts All of Us, Centers for Disease Control and Prevention, 2023.

[3]The Extra Costs of Disability: Resetting the Policy Table, National Disability Institute, 2021.

VoluntaryAdvantagehaspartneredwithNABIPtoupdatetheirVoluntary/WorksiteCertificationand itisliveandavailabletoyou24/7virtually.

ThecostoftheVoluntary/WorksiteCertificationcourseis$304.70forNABIPmembersand$401.50fornonmembers,whichincludesonlineinstructioninthreeone-hourwebinarmodules,afinalexamand continuingeducationcredits.Uponcompletion,youwillreceiveacertificateofcompletionas voluntary/worksitecertified.

CourseHighlights:

Mastertheproductwithinnovativesolutions

Understandcontractdifferences

Reviewimplementationandadministration

Obtaincrucialcomplianceinsights

Ultimately, we are all in this business for the benefit of our end customer, the employee. Our goal is to provide solutions that they view as valuable in protecting themself and their family.

While we busy ourselves with fancy spreadsheets, pivot tables, graphs, predictions, projections and research, the judge of how effective the programs we provide is the man or women who will use the program

How do I know this? The first time a claim is denied in a group that the employee and corporate leadership thinks should have been paid, someone calling into customer service and sitting on an extended wait or being passed around on the phone tree before they can find someone that can assist them - is often the last time that group will renew with that carrier.

Why then, with the ultimate judge and jury being the consumer, do we forget to ask them what they think?

What do they think about the benefits being offered? Do they fit their needs and price point?

Do they feel like they understand what is being offered to them and how to utilize the benefits?

What is most important to them from a benefits standpoint today

In search of answers, we went to entities that know employees very well in our industry, the individuals meeting with employees in person or over the phone to educate and enroll them in benefits, and are able to hear employee perspectives first-hand They aren’t the employee’s “boss” and so often they will be a little more candid in their feedback

Here is what they had to say

“When an employee enrolls in benefits what they want more than anything is to feel confident they are making the right choices to protect themselves and their families.

The questions that we often get at the point in time when an employee is sitting down with or speaking to a Benefit Counselor are - There are a lot of choices, which benefits are right for me or my family? Once I select these benefits how do I actually use them if needed? Who can I call when I have more questions? The employee ultimately wants to feel seen, valued, and heard!”

Benefits - Benefit Counselor Team

“In today’s ever complex world of benefits, employees today contact their HR service center with an array of questions both general and personal. At the time they are preparing for or are ready to make their benefit selections, we have been seeing the following themes in those calls:

For Existing Employees

When employees call us who are already participating in the benefit programs, the most common questions we get as they prepare to enroll are:

1 ACCESS TO CARE - What is changing about our benefit offerings that may impact me, positively or negatively, from a Doctor/Provider perspective? Will my doctor(s) still be in network?

3

COSTS - How are the premiums changing and how will my current or planned enrollments affect my paycheck?

- I am currently receiving care and or planning to in the upcoming plan year, can you help me pick the best plan?

For New Employees or those New to Benefits

When new employees call us, their questions may depend on whether they are coming from another employer where they had benefits already or not. The general themes we see are similar but in a different order:

PLANNING – Me and my family have the following benefit needs, can you help us better understand the offerings and pick the best plan? 1. COSTS – What will be the costs for selecting the benefits that I need

ACCESS TO CARE – Me and my family used to see X doctor/provide will be in-network for the benefit programs I am selecting? 3.

Given the variety of questions that may see depending on the Employees Personal Situation, we spend a lot of time developing robust training programs and multiple talk tracks for our Benefit Counselors to walk an Employee thru to best address their questions. We combine and deliver that together with our contact center software which uses machine learning tools to surface relevant information from our digital knowledgebase to the agent while speaking with the employee in real time. All of these tools and processes are intended to deliver a 1st call resolution for more than 90% of all calls.”

Colin Bradley, President & CEO, Winston Benefits

“Two of the top questions we hear on most groups are: Am I getting what I need for myself and my family? Why is the cost of coverage going up? How much more is it this year versus last year?

If voluntary benefits are offered, employees often have questions and what they really need and how much they cost. Resources to support employee decision making are very important today.

It’s also important that employees clearly understand what changes are taking place, and that the offerings are clearly communicated in terminology that they understand.”

Todd Hondru, Co-Founder and Managing Partner at Benefit Educators, LLC“Education, knowledge of the benefits and an easy way to elect benefits always seem to be what is most important to employees at the point of enrollment. During hundreds of benefit fairs and thousands of coordinated enrollment appointments, the top questions that employees ask are:

The Basics - they are interested in normal day to day benefit usage; what is covered, where can I go, how much is covered and what are the costs?

1 Overall Risks - what if something big happens to me, what is the potential cost to me, what is covered, what am I responsible for? 2 Cost - what will my benefits cost me? Per paycheck premiums, deductibles, OOP Max, etc.

To answer these three main questions, it is important to provide education and resources to answer the more detailed questions:

What are the new offerings, what is covered or not, why should an employee elect this benefit? What do the plan changes mean and how do they impact an employee? What is covered, what do the networks look like, do these products include ‘their’ providers, are these services covered, is a referral needed, etc.?

What does the costs of these plans look like? Between the annual premium, out-of-pocket expenses, deductibles, OOP max, what could my total expenses look like, including worst case scenarios? What combination of elections offer the best protection but are still affordable? (For example - leveraging HSA’s, FSA’s, supplemental benefits, etc.) What is my per paycheck for that combination of benefits?

These questions can easily expand and become more specific depending on the benefit, but if education and examples can cover these topics, it will address most employees concerns.”

Tim Schnoor, Voluntary Benefits Practice Leader, Birch Benefits

Selecting the right people for the right positions is critical to the process of building a highperformance team. But it is equally important to help those individuals grow in their skills, experience, and ability to work together as they develop and become that high-performance team. Mentoring is perhaps the most effective means of preparing people for individual and team leadership In today’s challenging work environment, it is not surprising to learn that mentoring (formal and informal, as well as, reverse mentoring), is a hot button topic of conversation among employers and employees In this month’s article, we will introduce a standard definition of mentoring and begin the consideration of why, who, what and how of formal mentoring

The Merriam-Webster Dictionary defines mentor as “a trusted counselor or guide ” In this case, it seems to me that Wikipedia actually does a better job defining mentor as: “Mentorship is the patronage, influence, guidance, or direction given by a mentor. A mentor is someone who teaches or gives help and advice to a less experienced and often younger person. In an organizational setting, a mentor influences the personal and professional growth of a mentee.”

Mentoring is going on all around us all the time. It is important because it is how we learn to interact with our leaders, peers, subordinates, customers and the world around us. Whether we recognize it or not, we are constantly being seen as a mentor to others, many times completely without our knowledge. What is more important is to understand who is mentoring us and how their mentoring is impacting our lives and careers This month we’ll focus on mentoring as it relates to an employment environment In this context, there are 5 critical questions to answer in determining the type of mentoring program that will be effective for a particular type of organization

Determining the purpose of mentoring in an organization leads directly to choosing whether a formal or informal program is best suited to achieve the desired outcomes of the program It also has a direct impact on whether the program is designed on a one-to-one or group basis. Although there may well be others, here are three primary purposes for implementing a mentoring program.

More than 9 in 10 workers (91%) who have a mentor are satisfied with their jobs, including more than half (57%) who are “very satisfied.”

Workers with a mentor are more likely than those without to say they’re well paid (79% vs. 69%) and to believe that their contributions are valued by their colleagues (89% vs. 75%) two key components of overall happiness at work.

71% of employees with a mentor say their company provides them with excellent or good opportunities to advance their career, while just 47% of those without a mentor say the same.

More than 4 in 10 workers who don’t have a mentor say they’ve considered quitting their job in the past three months, compared with just 25% of those who do have a mentor.

Creating or Expanding Impact On The Organizational Culture.

Over the past 20+ years, companies have become aware that work culture can have a dramatic impact on an organization’s ongoing success and growth Think about retail businesses you have done business with Can you think of businesses where employees seem to be positive in their jobs and happy to assist you as a customer? It can be enjoyable to spend your hard-earned dollars at such a business No doubt you can think of others where the experience can be tiring and unpleasant Usually, you only do business with those companies if you have little or no other choice

A formal mentoring program for new employees can help to create a desirable work environment for employees, customers and vendors. It can also help to weed out associates who can’t or won’t adapt to the desired culture. This formal program can be done on a group basis, but care needs to be taken that it consists of more than the traditionally brief “employee orientation” process done while onboarding new employees.

Rather than covering the basics of work hours, dress codes, benefits, location of the break room, etc. it needs to focus on such subjects as: company history, purpose, goals, customer needs, work philosophy, etc.

Preparing Individuals For Current Or Future Promotion

Whether hiring a new associate or promoting an existing employee to a higher-level position, it is vital to provide them with the knowledge they will need to achieve their highest “capacity for a near perfect performance” in the new role It is also important to expose them to the new contacts they will be making, and the desired relationships needed for success

This type of mentoring can be done using either a formal or informal approach but should always include some measure of informal coaching even as part of a formal program.

CNBC Workplace Happiness SurveyCompanies sometimes change priorities and reorganize departments to improve results or enter a new line of business This often necessitates reorienting the workflow processes and priorities of employees who have been successful and have the skills for the new operations.

Depending upon the scale of the changes, this mentoring focus can be done on a formal or informal basis. Identifying the new skills and capabilities required for the changes should be carefully considered and planned for as part of the planning process prior to announcing or implementing those changes

One of Dr Steven Covey’s “The Seven Habits of Highly Effective People,” is to “begin with the end in mind” Nowhere is this more important than in determining the desired outcomes for any type of mentoring program It is tempting to think that determining the purpose of a mentoring is sufficient For a program to be successful, however, there need to be specific targeted outcomes that are easily understood and observed. A successful mentoring program will benefit both the organization and the individual. This is a core principle of relational leadership.

In the process of planning a formal or informal mentoring program, take the time to think through and write down how the organization or team will be different as a result of implementing a successful mentoring program. Benefits for the organization might include: the appearance of new common terminology; improvement in employee satisfaction results; increased success in recruiting; lower employee turnover; successful results from promotions and new hires, increased production or sales results, reduction in reported conflicts and complaints, etc

Relational Leadership places equal focus on how a program benefits the individual as well as the organization Observable benefits to individuals can be seen in improved time and attendance records; reduced number of sick days taken; increased participation in voluntary benefits and retirement plans; increased involvement in company sponsored education, community and athletic programs, etc Many of these can be seen as benefitting the company but, while that is true, they also indicate the presence of positive feelings by the employee about their company and their work. The primary result of the Relational Leadership Experience is a win-win for employer and employee. It can be argued that it is also a win for customers, vendors and the community at large.

Next month we’ll consider who should participate in a mentoring program (mentors and mentees), how long a program should last and if it should be a group or individual program

In the meantime, please feel free to contact me if you have questions or particular relational leadership challenges you would like to discuss Several readers participated in our recent Relational Leadership Experience on-line program and have reported some very positive results I will be happy to discuss with you how a program may be of benefit your organization or that of your clients

Steve Clabaugh, CLU, ChFC - started his career in insurance as a Field Agent, moving on to Sales Manager, General Manager, Regional Manager, Vice President, Senior Vice President, and President/CEO A long time student of professional leadership, Steve created the Relational Leadership program that has been used to train home office, field sales associates, mid-level managers, and senior vice presidents

Your employer clients are facing new and different challenges in today’s business environment including: Remote Work - Returning to Office Diversity - Equity - Inclusion Geopolitical Uncertainty - Cultural Conflicts

The timeless principles of Relational Leadership can help your employer clients navigate these issues as they grow and prosper their business

Relational Leadership Experience helps your clients:

Create and build high-performance teams

Select and train the right employees

Implement effective mentoring

Develop positive conflict management

Determine and implement the best outcomes

Achieve ongoing growth and success

In-person, online and combination programs available to meet the needs of your employer clients

To learn more about Relational Leadership Experience Contact: Steve Clabaugh, CLU, ChFC at sjcsr@hotmail.com or 910-977-5934