3 minute read

Gig Workers Offer Big Benefits Opportunity

By Eastbridge Consulting Group, Inc.

According to McKinsey’s 2022 American Opportunity Survey, a full 36% of employed respondents—roughly 58 million Americans—identify as independent workers. [1]

Carriers looking to expand their markets to serve underpenetrated populations may be overlooking a key demographic: gig workers.

Contract workers, temps and free-lancers are a large and growing part of the US workforce. A recent McKinsey study shows 36% of employed respondents equivalent to 58 million Americans identify as independent workers. [1] That’s a huge leap from a University of Chicago study just a few years earlier that pegged the number at 5 million, after tripling between 2017 and 2021. [2]

Despite their impact on the US economy, a recent Eastbridge survey of independent contractors and 1099 employees shows gig workers are tremendously underserved when it comes to health and other benefits. That means there’s a significant opportunity for carriers interested in meeting this need.

Limited Access to Benefits

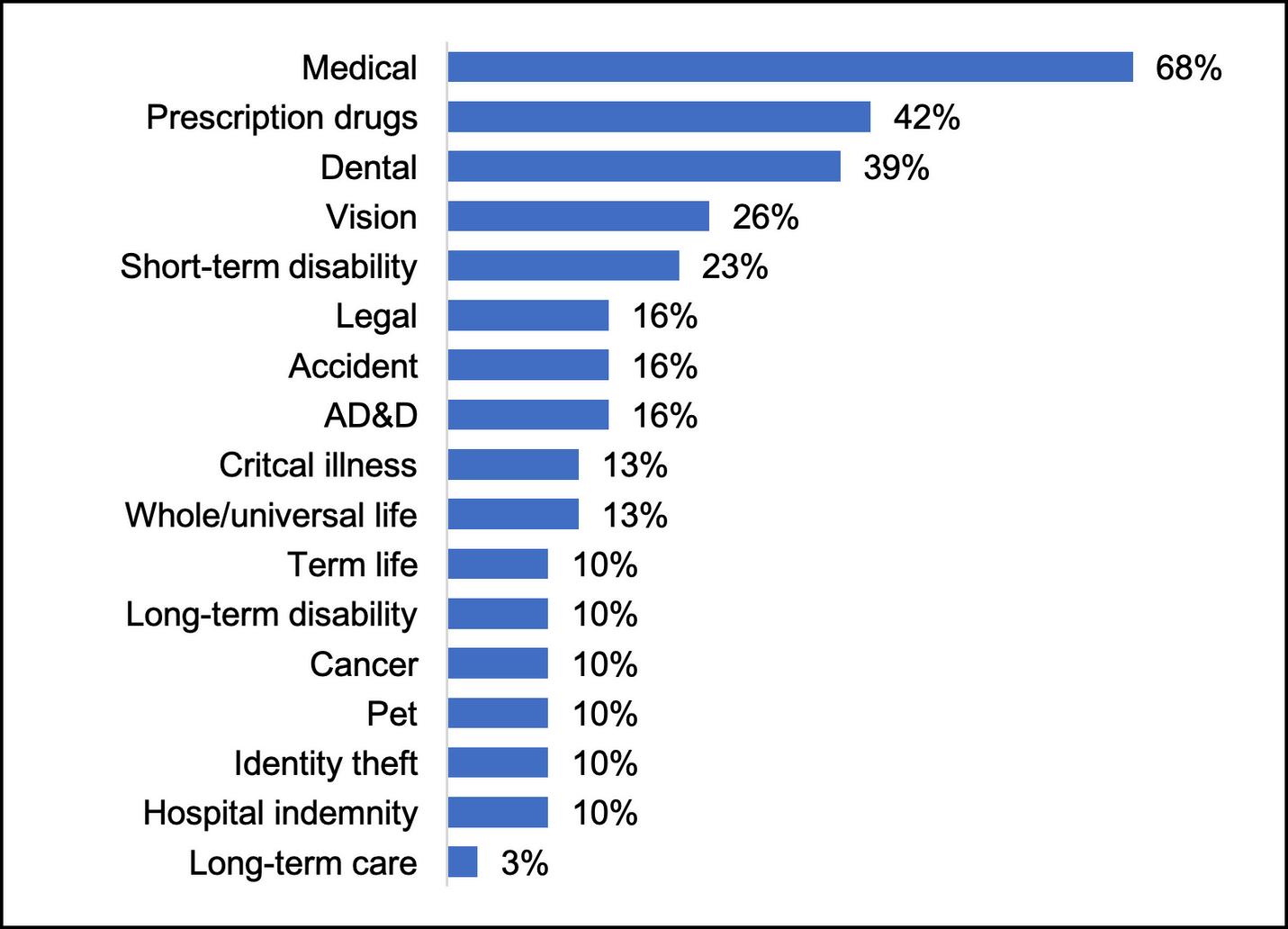

Only 20% of gig workers have access to any benefits through the employers they work for, according to Eastbridge’s 2023 “Benefit Access and Preferences for Gig Workers” Frontline™ report. The most common benefits employers offer these workers are medical insurance (68%), prescription drug coverage (42%), dental insurance (39%) and vision coverage (26%). Short-term disability (23%), accident (16%), AD&D (16%) and legal plans (16%) also are sometimes available from employers.

But gig workers express strong interest in obtaining benefits coverage. Most of those surveyed say access to core benefits such as medical, dental and vision is important or very important. Many say they’re also interested in additional coverage: More than a third (34%) place high importance on access to voluntary benefits, and a fourth say it’s important to have access to non-traditional benefits such as identity theft protection, mental health or legal plans.

Benefit Sources for Gig Workers

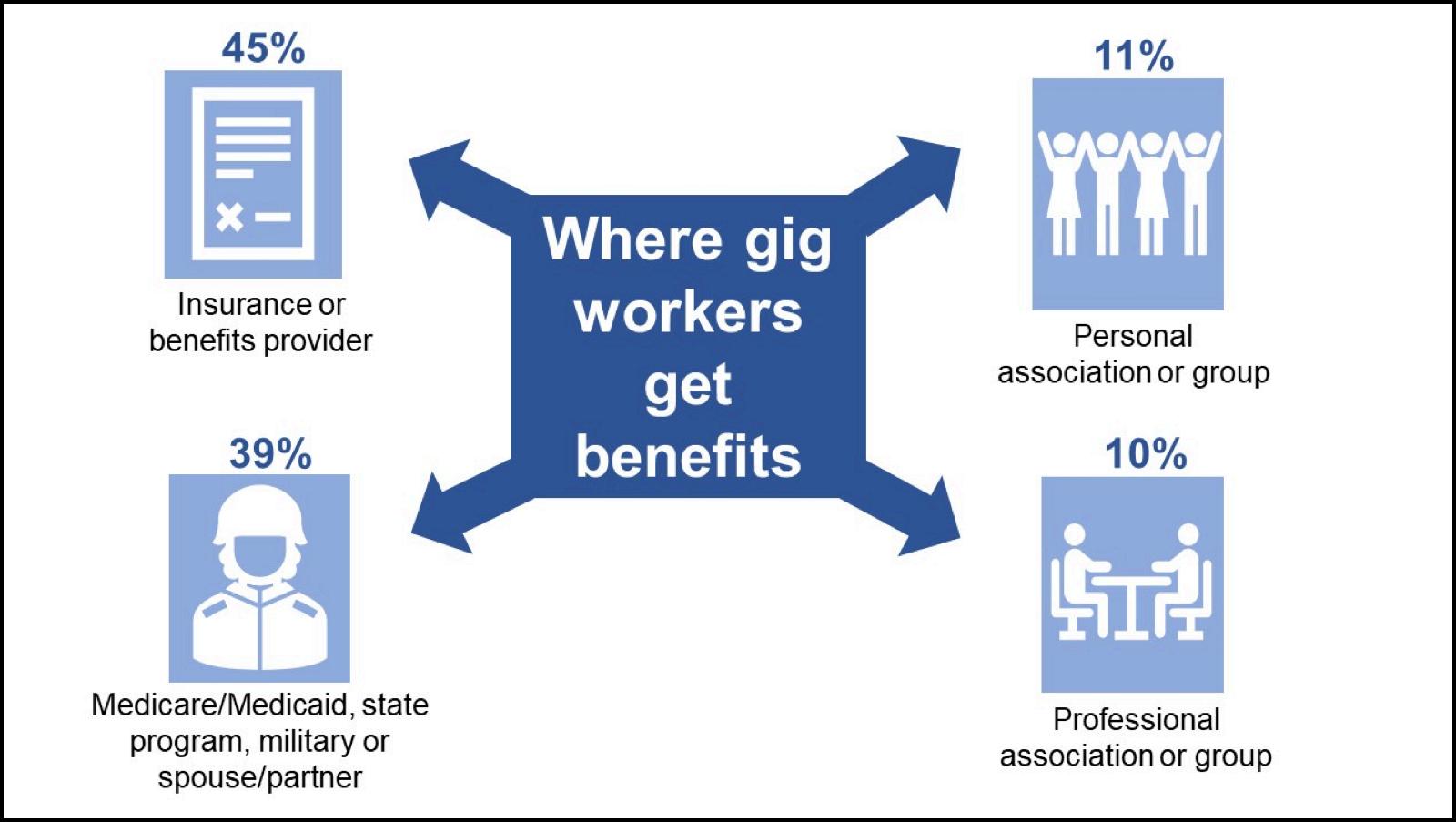

Independent workers who can’t get benefits through an employer are forced to find coverage on their own. Nearly half (45%) say the most common source is directly from an insurance or benefits provider. About one in four (39%) rely on government-funded coverage such as Medicare or Medicaid, state or military health and retirement benefits, or coverage through a spouse or partner. Only 10% report that they have access to benefits through a professional association or group, and a similar number (11%) say they obtain benefits through a personal association or group.

Reaching gig workers to educate them about benefits and enroll them in the right coverage may require carriers to be creative and use a variety of methods in fact, some of the same strategies they need for any effective benefits program. Carriers also may need to rethink their approach to underwriting this disparate group. But the effort could pay off for carriers that want to take advantage of a significant business opportunity to expand their markets.

Danielle Lehman Senior Consultant

Eastbridge is the source for research, experience, and advice for companies competing in the voluntary space and for those wishing to enter. For over 25 years, they have built the industry’s leading data warehouse and industry-specific consulting practice. Today, 20 of the 25 largest voluntary/worksite carriers are both consulting and research clients of Eastbridge.