DAYTONA BEACH SHORES, FL

2 FINANCIAL ANALYSIS RED LOBSTER - DAYTONA BEACH SHORES, FL PRICING & FINANCIAL ANALYSIS

OPERATING DATA Year(s) Commencement Annual Increase 1-5 01/01/2016 $215,2956 10/01/2021 $219,601 2.00% 7 10/01/2022 $223,993 2.00% 8 10/01/2023 $228,473 2.00% 9 10/01/2024 $233,043 2.00% 10 10/01/2025 $237,704 2.00% 11 10/01/2026 $242,458 2.00% 12 10/01/2027 $247,308 2.00% 13 10/01/2028 $252,255 2.00% 14 10/01/2029 $257,301 2.00% 15 10/01/2030 $262,447 2.00% 16 10/01/2031 $267,696 2.00% 17 10/01/2032 $273,050 2.00% 18 10/01/2033 $278,511 2.00% 19 10/01/2034 $284,082 2.00% 20 10/01/2035 $289,764 2.00% NET OPERATING INCOME $228,473

ANNUALIZED

3162 S Atlantic Ave Daytona Beach Shores , FL 32118 OFFERING SUMMARY Price $3,480,000 Cap Rate 6.57% Net Operating Income $228,473 Year Built 1986 Gross Leasable Area 4,400 SF Lot Size 0.63 Acres LEASE SUMMARY Lease Term 20 Years Lease Commencement 01/01/2016 Lease Expiration 09/30/2035 Remaining Term 12.5 Years Lease Type NNN Roof & Structure Landlord Increases 2% Annually Options 4 x 5 Years For Financing Options, Please Contact: Greg Holley | Managing Partner High St Capital (O) 469-998-7200 | (C) 714.514.2990 gholley@highstcapital.com

Red Lobster

Red Lobster is the world’s largest and most-loved seafood restaurant company, headquartered in Orlando, Florida. It has grown to become an iconic casual dining brand since its first location opened in Lakeland, Florida in 1968. Red Lobster has nearly 750 locations in the United States, Canada and has 43 franchised restaurants in international markets. Red Lobster generates $2.5 billion in revenue and is the sixth largest casual dining concept in North America.

COMPANY SUMMARY

Company

Red Lobster

Ownership Private

Number of Locations 750+ Worldwide

Years in Business 54 Years

Headquarters Orlando, FL

Website www.RedLobster.com

Thai Union Group is the world’s seafood leader bringing high quality, healthy, tasty and innovative seafood products to customers across the world for more than 40 years. Today, Thai Union is regarded as one of the world’s leading seafood producers and is one of the largest producers of shelf-stable tuna products with annual sales exceeding THB 126.3 billion (US$ 4.1 Billion). The company is publicly traded, has 50,000 employees and operations throughout the world. Thai Union is based out of Thailand with offices in North America, Europe, the Middle-East and Asia. Besides Red Lobster, the company’s global brand portfolio includes marketleading international brands such as Chicken of the Sea, John West, Petit Navire, Parmentier, Mareblu, King Oscar, and Rügen Fisch and Thaileading brands SEALECT, Fisho, Qfresh, Monori, Bellotta and Marvo.

COMPANY SUMMARY

Company

Thai Union Group

Ownership Public

Area Served Worldwide

Years in Business 42 Years

Headquarters Samut Sakhon, Thailand

Website www.ThaiUnion.com

3 PROPERTY DESCRIPTION RED LOBSTER - DAYTONA BEACH SHORES, FL TENANT OVERVIEW

Orlando-based Red Lobster acquired by Thai Union and other investors

Aug 31, 2020

Red Lobster stakeholder Thai Union and a group of investors have acquired the rest of the Orlando-based restaurant chain from the private equity firm that bought it in 2014.

San Francisco’s Golden Gate Capital, which bought the seafood chain from Orlando’s Darden Restaurants for $2.1 billion in 2014, announced Monday it had agreed to sell the remainder of its stake to the Thailand-based seafood supplier Thai Union, along with an investor group of restaurateurs and hospitality industry executives and Red Lobster management, a news release said.

In 2016, Thai Union paid a combined $575 million for a 25% stake in Red Lobster along with another 24% stake it would be able to convert after 10 years.

San Diego-based restaurant analyst John Gordon said it was a positive development that Red Lobster will be backed by a publicly traded company, Thai Union, that can raise capital.

“This acquisition today improves Red Lobster’s position,’’ he said. “It doesn’t solve their basic on-the-ground restaurant condition in terms of its needs to continue to make itself as relevant as possible in the basic casual dining place in the United States, but it makes the foundation a little stronger.”

Financial terms of the deal were not revealed, but the chain of more than 700 restaurants is expected to keep its headquarters in Orlando and be led by CEO Kim Lopdrup and the rest of the current management team.

The new investor group will be named Seafood Alliance and will include restaurant industry veterans and key shareholders Paul Kenny, the former CEO of Asia’s Minor Food, and Rit Thirakomen, CEO and controlling shareholder of Thai chain MK Restaurant Group, the release said. .... Click

4 PROPERTY DESCRIPTION RED LOBSTER - DAYTONA BEACH SHORES, FL TENANT OVERVIEW

HERE for Full Article

• Long Term Lease with Minimal Landlord Responsibilities

• 2% Annual Increases in the Primary Term and in Option Periods

• Subject Property Fronts 10 Hotels and Numerous High Rise Condominiums in the Heart of Daytona Beach Shores. A Great Synergistic Restaurant for Such High Density Living.

• Corporate Guaranteed Lease by Red Lobster. Now Owned by Thai Union. Thai Union Acquired Red Lobster in 2020 and is Regarded as One of the World’s Leading Seafood Producers with Annual Sales Exceeding $4.1 Billion and a Global Workforce of Over 44,000 People.

• Red Lobster is the World’s Largest Seafood Restaurant Company (Originally Started in Orlando, FL) with Over 700+ Locations, Reported $2.6 Billion in Revenues in 2020 and is Listed as One of Forbes’ Largest Private Companies.

• Strong Traffic Counts with Over 16,000 VPD

• High Density Travel Destination in Florida

SNAPSHOT

16,000

Estimated Vehicle Per Day

$60,333

Average Household Income

101,648

Population: 5 Mile Radius

5 PROPERTY DESCRIPTION RED LOBSTER - DAYTONA BEACH SHORES, FL INVESTMENT HIGHLIGHTS

6 PROPERTY DESCRIPTION RED LOBSTER - DAYTONA BEACH SHORES, FL SITE PLAN Oceans Luxury Realty (Not a Part) Mike’s Galley Restaurant (Not a Part) S ATLANTIC AVE 16,000 VPD

7 MARKET OVERVIEW

-

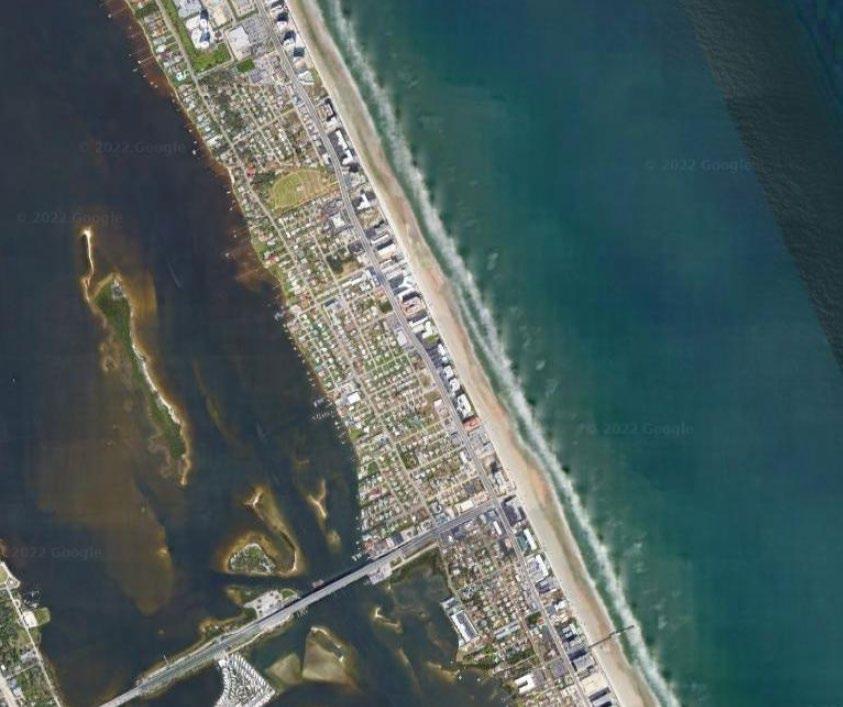

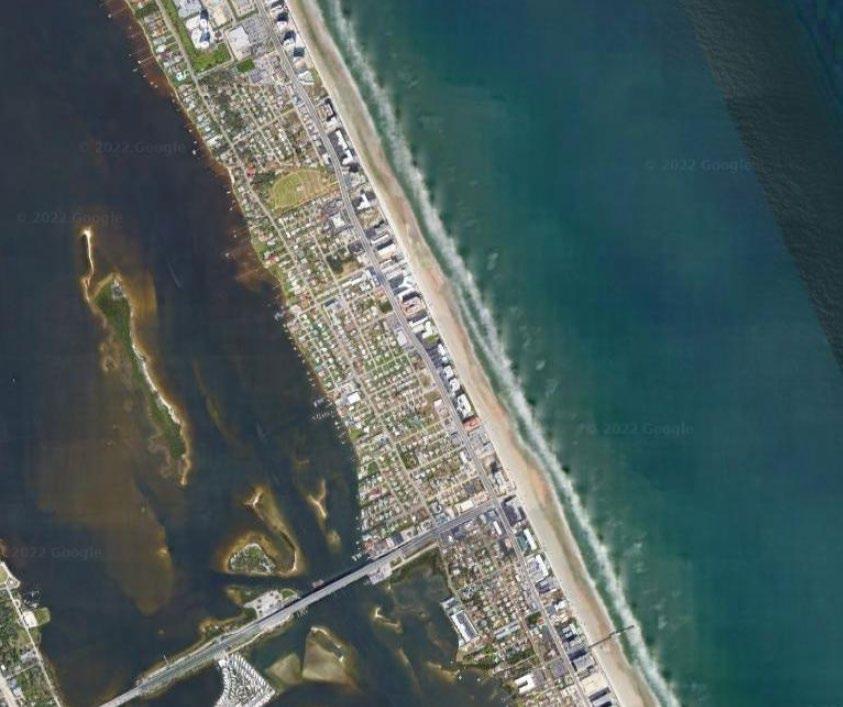

FL AERIAL MAP S ATLANTIC AVE

VPD

RED LOBSTER

DAYTONA BEACH SHORES,

16,000

DAYTONA BEACH

8 MARKET OVERVIEW

SHORES, FL AERIAL MAP

16,000VPD

RED LOBSTER - DAYTONA BEACH

S ATLANTIC AVE

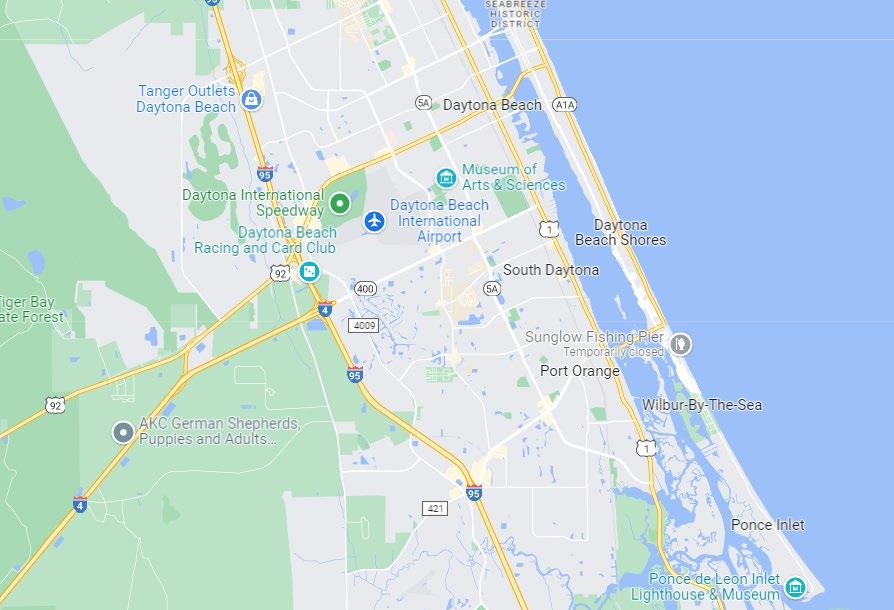

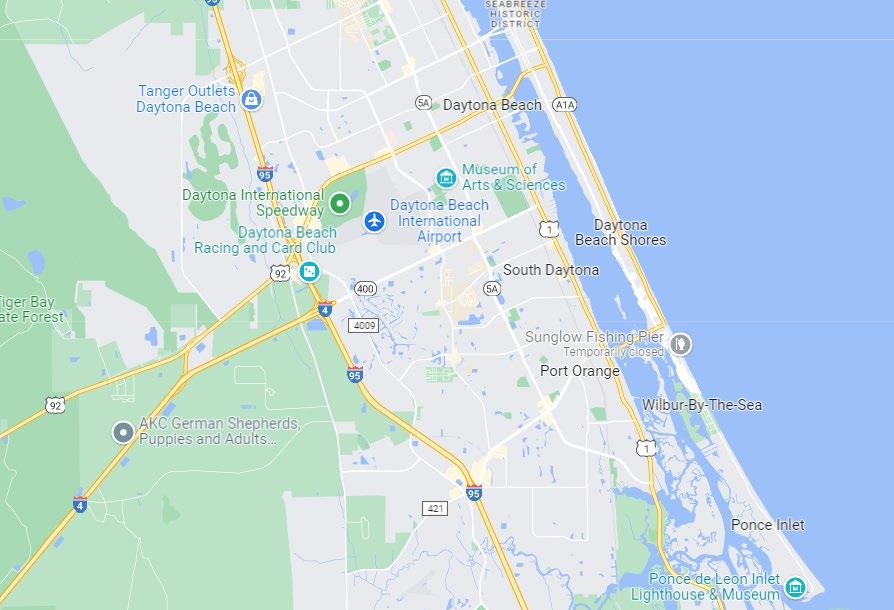

9 MARKET OVERVIEW

FL LOCAL MAP

RED LOBSTER - DAYTONA BEACH SHORES,

10 MARKET OVERVIEW

- DAYTONA BEACH SHORES, FL REGIONAL MAP

RED LOBSTER

11 MARKET OVERVIEW

LOBSTER - DAYTONA BEACH SHORES, FL

STATISTICS Demographic data © CoStar 2021 1 Mile 3 Mile 5 Mile Population 2010 Population 3,379 32,416 92,318 2020 Population 3,519 36,669 101,648 2025 Population Projection 3,781 39,883 109,974 Median Age 64.3 50.4 46.9 Bachelor's Degree or Higher 38% 22% 21% U.S. Armed Forces 0 10 25 Population by Race White 3,311 31,953 81,733 Black 32 3,032 14,653 American Indian/Alaskan Native 7 135 419 Asian 91 656 2,446 Hawaiian & Pacific Islander 3 47 99 Two or More Races 75 847 2,299 Hispanic Origin 190 2,708 7,804 Housing Median Home Value $318,580 $190,640 $182,940 Median Year Built 1984 1978 1980 1 Mile 3 Mile 5 Mile Households: 2010 Households 1,863 15,605 42,638 2020 Households 1,886 17,387 46,214 2025 Household Projection 2,015 18,842 49,888 Annual Growth 2020-2025 1.40% 1.70% 1.60% Owner Occupied 1,536 12,318 31,468 Renter Occupied 479 6,524 18,420 Avg Household Size 1.8 2.1 2.1 Avg Household Vehicles 1 2 2 Total Consumer Spending $54M $428.4M $1.1B Income Avg Household Income $83,015 $60,755 $60,333 Median Household Income $62,836 $44,264 $45,274 < $25,000 378 4,552 12,350 $25,000 - 50,000 377 5,142 12,771 $50,000 - 75,000 418 3,254 8,817 $75,000 - 100,000 220 1,954 5,593 $100,000 - 125,000 170 1,113 3,055 $125,000 - 150,000 64 265 967 $150,000 - 200,000 127 563 1,423 $200,000+ 133 545 1,238

RED

DEMOGRAPHIC

Net Lease Disclaimer

STRIVE hereby advises all prospective purchasers of Net Leased property as follows:

The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable. However, STRIVE has not and will not verify any of this information, nor has STRIVE conducted any investigation regarding these matters. STRIVE makes no guarantee, warranty or representation whatsoever about the accuracy or completeness of any information provided.

As the Buyer of a net leased property, it is the Buyer’s responsibility to independently confirm the accuracy and completeness of all material information before completing any purchase. This Marketing Brochure is not a substitute for your thorough due diligence investigation of this investment opportunity. STRIVE expressly denies any obligation to conduct a due diligence examination of this Property for Buyer.

Any projections, opinions, assumptions or estimates used in this Marketing Brochure are for example only and do not represent the current or future performance of this property. The value of a net leased property to you depends on factors that should be evaluated by you and your tax, financial and legal advisors. Buyer and Buyer’s tax, financial, legal, and construction advisors should conduct a careful, independent investigation of any net leased property to determine to your satisfaction with the suitability of the property for your needs.

Like all real estate investments, this investment carries significant risks. Buyer and Buyer’s legal and financial advisors must request and carefully review all legal and financial documents related to the property and tenant. While the tenant’s past performance at this or other locations is an important consideration, it is not a guarantee of future success. Similarly, the lease rate for some properties, including newly-constructed facilities or newly-acquired locations, may be set based on a tenant’s projected sales with little or no record of actual performance, or comparable rents for the area. Returns are not guaranteed; the tenant and any guarantors may fail to pay the lease rent or property taxes, or may fail to comply with other material terms of the lease; cash flow may be interrupted in part or in whole due to market, economic, environmental or other conditions. Regardless of tenant history and lease guarantees, Buyer is responsible for conducting his/her own investigation of all matters affecting the intrinsic value of the property and the value of any long-term lease, including the likelihood of locating a replacement tenant if the current tenant should default or abandon the property, and the lease terms that Buyer may be able to negotiate with a potential replacement tenant considering the location of the property, and Buyer’s legal ability to make alternate use of the property.

By accepting this Marketing Brochure you agree to release STRIVE and hold it harmless from any kind of claim, cost, expense, or liability arising out of your investigation and/or purchase of this net leased property.

Information About Brokerage Services

Texas law requires all real estate license holders to give the following information about brokerage services to prospective buyers, tenants, sellers and landlords.

TYPES OF REAL ESTATE LICENSE HOLDERS:

• A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

• A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

• Put the interests of the client above all others, including the broker ’s own interests;

• Inform the client of any material information about the property or transaction received by the broker;

• Answer the client’s questions and present any offer to or counter-offer from the client; and

• Treat all parties to a real estate transaction honestly and fairly.

A LICENSE HOLDER CAN REPRESENT A PARTY IN A REAL ESTATE TRANSACTION:

AS AGENT FOR OWNER (SELLER/LANDLORD): The broker becomes the property owner’s agent through an agreement with the owner, usually in a written listing to sell or property management agreement. An owner’s agent must perform the broker’s minimum duties above and must inform the owner of any material information about the property or transaction known by the agent, including information disclosed to the agent or subagent by the buyer or buyer ’s agent.

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any material information about the property or transaction known by the agent, including information disclosed to the agent by th e seller or seller ’s agent.

AS AGENT FOR BOTH - INTERMEDIARY: To act as an intermediary between the parties the broker must first obtain the written agreement of each party to the transaction. The written agreement must state who will pay the broker and, in conspicuous bold or underlined print, set forth the broker’s obligations as an intermediary. A broker who acts as an intermediary:

• Must treat all parties to the transaction impartially and fairly;

• May, with the parties’ written consent, appoint a different license holder associated with the broker to each party (owner and

• buyer) to communicate with, provide opinions and advice to, and carry out the instructions of each party to the transaction.

• Must not, unless specifically authorized in writing to do so by the party, disclose:

ӽ that the owner will accept a price less than the written asking price;

ӽ that the buyer/tenant will pay a price greater than the price submitted in a written offer; and

ӽ any confidential information or any other information that a party specifically instructs the broker in writing not to disclose, unless required to do so by law.

AS SUBAGENT: A license holder acts as a subagent when aiding a buyer in a transaction without an agreement to represent the buyer. A subagent can assist the buyer but does not represent the buyer and must place the interests of the owner first.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY

• The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

ESTABLISH:

• Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

LICENSE HOLDER CONTACT INFORMATION: This notice is being provided for information purposes. It does not create an obligation for you to use the broker’s services. Please acknowledge receipt of this notice below and retain a copy for your records.

Information

Regulated by the Texas Real Estate Commission

available at www.trec.texas.gov

IABS 1-0

exclusively

469.844.8880 STRIVERE.COM

listed