Each year, Visit Denver compiles this Marketing Plan, which contains a thorough study of industry information, customer feedback and consumer sentiment, as well as a situation analysis of local, national and international trends. Together, this information helps guide Visit Denver in developing its 2026 strategies and tactics.

The mid-point of 2025 brings an unprecedented degree of uncertainty across the country and around the world that has no real comparison in the lifetimes of most travelers. Domestic political divisions, economic uncertainty, climate change and international strife have always been present, but rarely, if ever, have they been so prevalent all at the same time, and so visibly.

While we explore this volatility in general, and these issues in greater detail throughout this report, one constant will emerge: the Resiliency of Travel.

Throughout recent history, travel has been a poster child for an industry that is at the whims of prevailing winds, whether they are related to a single incident, such as the September 11 terrorist attacks, to macroeconomic forces, such as the 2008 global financial crisis or to a global, generational disaster such as the Covid-19 pandemic.

In each of those cases, travel was significantly impacted, sometimes for longer periods, sometimes for shorter, but always rebounded. As the industry navigates its way through this unique period of volatility, it is encouraging to see that, despite obvious and persistent challenges, the industry is showing its resilience.

“Despite prevailing political and economic uncertainties, U.S. leisure travelers are demonstrating a notable surge in optimism. Confidence in the future of the nation and the world has climbed significantly compared to levels recorded in 2023 and 2024.”

- MMGY’s Portrait of American Travelers, Summer 2025 Edition

Denver’s travel industry has made great strides in the last several years. Domestic travel volume is at near-record levels, as is spending. Attendance and economic impact from groups at the Colorado Convention Center are expected to reach an all-time high in 2025. The Denver product continues to improve, best exemplified in the renovated 16th Street. And the industry is valued as a key contributor to the local economy.

At the same time, as always, there are headwinds. The national economy, while continuing to show signs of strength, is also showing softness due to volatility in prices, with stubborn and persistent inflation, leading to inconsistent consumer confidence. Business travel and hotel occupancy have still not recovered to 2019 levels, and there is downward pressure on Average Daily Rate (ADR). National policy towards immigration, coupled with the ever-changing plan for implementing tariffs on most countries around the world, has led to a sense of unease in visiting the U.S. particularly for countries like Canada, which is seeing double-digit decreases in inbound visitation. The competitiveness of the U.S. as an international travel destination is also threatened due to the 80% reduction in the budget for Brand USA, the national promotional agency for the U.S. Lastly, closer to home, downtown Denver continues to experience the challenges of remote work, even as it celebrates the reopening of 16th Street. And while great strides have been made in downtown crime and safety issues, much work is left to be done.

More recently, the shutdown of the Federal government adds a significant amount of new uncertainty to the mix. While everyone hopes for a fast resolution, a shutdown that continues into 2026 will have sizable impacts on all of Visit Denver’s markets.

In broad economic terms, the U.S. is in a period of simultaneous strength and softness. On July 30, it was announced that the U.S. economy grew in the second quarter at an annual rate of 3.0%, a turnaround from the first quarter, when it grew at just 0.5%. But both of those numbers are qualified, with news reports suggesting that first quarter’s sluggish growth could be partially attributed to businesses stockpiling foreign goods in advance of tariffs, while second quarter’s strong numbers partially attributed to the drop in imports during that period (NPR).

On September 5, the federal government announced that U.S. employers added just 22,000 jobs in August, less than economists expected. Earlier reports also significantly revised down the data on hiring from May and June by a combined 258,000 jobs, suggesting the labor market was weaker than initially reported.

In the University of Michigan’s September benchmark Survey of Consumers, U.S. consumer sentiment fell after earlier month-over-month improvements, leading to continued concerns about the overall economic outlook.

Demand for travel, particularly the domestic market, has been very hard to pin down in the last few months as consumers balance their interest in traveling with broader concerns about the direction of the U.S. economy. The U.S. Travel Association shows a generally stable market for travel right now:

“August extended the momentum from July, with strong domestic air travel and a record-breaking Labor Day weekend. Even as broader economic concerns weighed on consumer sentiment, stable travel prices helped ensure many Americans still carried out their summer travel plans.

• Passenger volumes hit new highs: August traffic rose 1.0% year-over-year, reaching a record 80.3 million passengers. While the 3 million daily passenger threshold wasn’t exceeded, five separate days came close (2.9+ million).

• Labor Day capped the season: Holiday weekend traffic set a new record, with 10.3 million passengers, up 3.3% from last year.

Travel prices held steady: U.S. Travel’s Travel Price Index was only 0.4% higher than August 2024. Lower gas prices (down 6% YOY) played a major role. As a whole these patterns show that Americans still prioritize travel even as they weigh economic concerns. Over a longer horizon, the remarkable post-COVID air travel recovery appears to be flattening—a reminder of the importance of continued infrastructure investments to improve the travel experience.

U.S. Travel Association, in their Fall 2026 Forecast, predicts that in 2026, higher income domestic households will continue to drive growth, with both business and international travel showing strong potential in the longer term.

Visit Denver will continue to monitor these trends through the final submission of this report on Nov. 15, 2025.

Artificial intelligence continues to reshape how visitors and meeting planners discover, research and engage with destinations, including Denver. Increasingly, AIpowered platforms such as ChatGPT and Google Gemini’s conversational search tools deliver immediate, personalized information, guiding our audiences in their inspiration, planning and decision-making processes. As Visit Denver looks ahead, this shift presents both challenges and opportunities for maintaining Denver’s visibility and effectively connecting with the diverse audiences we serve.

To remain influential and relevant, Visit Denver is strategically adapting our approach to content and digital experiences. We are focused on producing clear, authoritative information that directly answers the questions our audiences ask across various platforms and digital channels. Beyond the VisitDenver.com website, new efforts will ensure that Denver’s brand and messaging remain consistent, accessible and highly visible within these AI-driven conversations.

Recognizing these evolving audience expectations, Visit Denver continues to strengthen its overall digital presence, positioning Denver as an accessible and engaging destination within this conversational landscape. By proactively embracing the opportunities presented by AI, Visit Denver is committed to deepening audience engagement, driving meaningful interactions and ultimately inspiring more visitors and planners to choose Denver.

Travel to Denver in 2024, the most recent full year of data, saw a continuation of the strong visitation patterns of 2023. However, after three years (2021–2023) of aggressive, postpandemic, double digit growth, visitation in 2024 was slightly softer than 2023’s record breaking year with both overnight leisure visitation and spending by overnight visitors down 1% versus 2023. So, while this report had previously said that “there is no new normal,” the fact remains that all the markets that Visit Denver oversees have seen stabilization and a measure of predictability.

According to Longwoods International, the U.S. saw overnight travel increase 1.9% in 2024, from 2.17 billion trips in 2023 to 2.21 billion trips last year. For day travel, the U.S. saw a 2.6% increase, from 2.42 billion trips in 2023 to 2.48 billion trips in 2024.

Despite this softness, Denver did experience several notable wins in 2024:

▷ Even when faced with multiple obstacles, travelers are still coming to Denver. In total, 2024 overnight visitor volume estimates experienced a very mild softening, and total expenditure estimates held at the same level as 2023.

▷ In 2024, Denver saw a 7% increase in Marketable visitor trips, which is the segment that is most likely to respond to promotional messages and that spends the most per day on their trip.

▷ Denver also saw significantly less in-state overnight trips versus 2023, when in-state overnight trips had reached a record peak of 29% of total trips. Denver’s in-state overnight trips accounted for only 24% of total trips in 2024.

▷ Additionally, of the total nights away for an overnight trip, the percentage of time spent in Denver was 70% in 2024, up significantly +8% YOY and on par with the record high in 2019 (69%).

▷ In 2024, Denver also saw overnight visitor average household income jump from $74,400 in 2023 to $83,900.

▷ Lastly, Denver saw satisfaction amongst overnight travelers significantly increase by +5% YOY for those who were very satisfied with their overall trip at 67% or twothirds of overnight visitors.

The picture with international visitation remains murkier, with a combination of factors contributing to slow growth in this segment after several years of post-pandemic rebound. A strong U.S. dollar, which makes travel here more expensive, paired with federal government policies, visa fees and rhetoric are contributing to diminished interest in the U.S. as a travel destination from key overnight markets, particularly Canada.

International visits to Denver are expected to decline by 11% (to 493,200) in 2025, as forecasted and adjusted by Tourism Economics. International travel spending in Denver is forecasted to decline by 8% in 2025, to $442.7 million in 2025. These declines are part of Tourism Economics adjustment due to the current administration actions and impact.

Here in Denver, the travel product itself continues to evolve. There has been significant progress in crime and safety issues, particularly downtown and citywide, though much work remains. The initial projects covered under the Denver Downtown Development Authority and Vibrant Denver bonds have the potential to dramatically improve Denver’s infrastructure. Certain sectors of the industry, such as restaurants, have had both high points (e.g. the continuation of the Michelin program, with a record 32 local restaurants recognized, including Wolf’s Tailor earning recognition as Colorado’s first two-star restaurant in 2025, and several James Beard Foundation award nominations) yet continue to struggle with high food and labor prices along with red tape and workforce challenges. Hotels, which enjoyed high rates during the peak of the inflationary period, have not yet seen their occupancy return to 2019 levels, primarily due to softness in the transient market and increased supply. These and other trends will be explored more fully below in the Denver 2025 Product Update section.

There are other widespread trends impacting Visit Denver, most prominently the rise of Generative Artificial Intelligence (AI) chatbots in a variety of forms. While not a threat to travel in general, these tools are fundamentally disrupting the way consumers search for travel, which is a direct threat to the VisitDenver.com website, but also an enormous opportunity to inspire future trips by feeding the AI engines the “right” information.

In response to these opportunities and challenges, Visit Denver continues to develop and execute comprehensive sales and marketing strategies that take advantage of the continued strong demand for travel, and also continues to focus on local product development, issue management and stakeholder engagement to continually ensure that the industry can maintain its well-deserved status as a key economic driver for the city.

Innumerable reasons exist for Visit Denver to continue to lean in: Travel remains a highly competitive global business, with domestic visitors indicating increased demand for international trips, and domestic destinations also putting out savvy marketing messages. The recovery in the meetings market brings with it new demand dynamics that have upended decades of booking patterns. While inbound international demand remains a priority, that market has been upended by domestic issues and has yet to reach their 2019 travel levels.

Despite these headwinds, and with an engaged City administration in place, Visit Denver’s outlook for 2026 is strong. The organization retains a commitment to work through all challenges, known and unknown, with the same diligence and professionalism that has marked its stewardship of Denver’s travel industry for 116 years.

Visit Denver has many ways to measure the impact of the travel industry on the city, but none are so eagerly anticipated as the Annual Visitor Profile from Longwoods International. Longwoods surveys domestic visitors 12 months a year and produces for its clients an annual report on visitation, spending, visitor demographics and more. Their methodology is the industry standard for this kind of study, with a high degree of confidence and a low margin of error. Longwoods has been researching the Denver visitor market since 1994.

In 2024, the latest figures available, Denver welcomed 37.1 million visitors, on par with the previous record set in 2023. These visitors also spent nearly as much money in Denver as they ever have, generating $10.3 billion in tourism revenue, also on par with 2023.

Overnight visitors totaled 19.8 million, generating $8.7 billion in spending, on par with 2023’s record-breaking year. Overnight leisure visitors remained steady with 17.4 million visitors, consistent with 2023.

The 2024 study shows that travel trends, both in terms of visitor numbers and spending, are returning to levels more in line with 2019. When compared to other destinations, Denver enjoyed comparably higher growth suggesting that it benefits from its unique position offering visitors both sought-after urban experiences and easy access to outdoor activities.

The study confirmed that Denver is a year-round destination with overnight visitation spread evenly throughout the year, with a modest surge in the warmer months. Denver saw 22% of visitors in Q1, 26% in Q2, 28% in Q3 and 23% in Q4.

The data further showed how crucial Denver International Airport, and its air service, is for continued strong Denver tourism trends. In 2024, nearly 40% of overnight Denver visitors arrived by plane, in comparison to the national average of 24%. The airport as well as Visit Denver’s partners at the Colorado Tourism Office are key to Denver’s position as both a destination and a gateway to the rest of the state with overnight Denver visitors spending an average of 2.7 nights, or 70% of their trip, and the remainder being in other parts of the Centennial State.

Longwoods International also conducted Return on Investment (ROI) research for Visit Denver’s largest advertising campaign of the year, the 2024 summer advertising campaign. The study revealed strong ROI numbers, showing that the campaign generated 3 million incremental trips, $1.3 billion in incremental visitor spending and $143 million in state and local taxes, including more than $106 million for Denver. Measured against spending, the campaign produced a near-record ROI of $217 in visitor spending and $24 in taxes for every $1 in advertising investment.

Key numbers for 2024 include:

Denver welcomed 37.1 million total visitors in 2024, including 19.8 million overnight visitors and 17.3 million day visitors.

Overnight leisure visitors totaled 17.4 million in 2024, including a record 8.7 million “marketable” visitors which is a 14% increase over 2023.

▷ Denver visitors spent $10.3 billion in 2024, including $8.7 billion from overnight visitors and an additional $1.7 billion in spending from day visitors.

▷ Expenditures by overnight visitors averaged $437 per person per trip with year-over-year increases in each tracked category:

○ Transportation spending within the destination reached nearly $3 billion

○ Lodging spending hit almost $2.5 billion

○ Restaurant Food and Beverage spend reached nearly $1.5 billon

○ Retail Purchases totaled just over $1 billion, with 57% of visitors shopping at locally owned businesses compared to 48% nationally

○ Recreation, Sightseeing and Entertainment totaled $735 million

▷ The top four states sending vacationers to Denver in 2024, apart from Colorado itself, were:

○ California

○ Texas

○ Arizona

○ Florida

▷ The top five cities from outside of Colorado sending leisure visitors to Denver in 2024 were:

○ Los Angeles

○ Phoenix

○ New York City

○ Dallas-Ft. Worth

○ Chicago

Note: All are Visit Denver advertising markets

The following section documents the current state of Denver’s tourism product. It is always important to document the strengths and weaknesses of the city’s infrastructure, since it is an area over which Visit Denver has little control.

In 2024, Visit Denver created a new Denver Tourism Roadmap, a long-term destination strategic plan that guides the organization’s approach to product development. The Visit Denver leadership team and Board, along with input from more than 1,000 stakeholders, created this new plan, building on the lessons of the previous 2016 version as well as the learnings from the COVID era.

Visit Denver worked on the Roadmap with NextFactor, the leading industry consulting firm for destination master plans and the same organization that helped build the original plan in 2016.

The new 2024 Denver Tourism Roadmap, like its predecessor, has gone through a rigorous series of inputs and strategic planning sessions, including:

▷ Visit Denver board input on initiatives for the new report.

▷ NextFactor’s DestinationNext community input survey that was completed by more than 250 stakeholders.

▷ 12 sector-specific focus groups across leisure and hospitality sectors attended by nearly 120 participants discussed ranking of areas of focus and discussion and big ideas.

▷ Input from 17 members of Visit Denver’s Convention & Tourism Advisory Board, who offered a unique outside perspective of the city’s hospitality industry.

▷ 21 one-on-one, in-depth interviews with stakeholders and elected officials including members of Denver City Council and Mayor Mike Johnston.

▷ Resident sentiment survey that polled nearly 620 people citywide, including representative samples within each City Council district, ages, ethnicities and income groups.

In December 2024, the Visit Denver board ratified the Roadmap and the seven areas of focus for the

The TID was formed in 2017 with the help of the Colorado Hotel & Lodging Association (CHLA), to make sure that Denver had the marketing funds available to grow the tourism and convention business well into the future. As part of its formation, the TID also dedicates funds annually to the City for the expansion of the Colorado Convention Center (CCC), and the remaining funds then flow to Visit Denver for sales and marketing efforts. Past efforts using the TID tax revenue include programs such as the annual Mile High Holidays campaign and the operations of the Mile High Tree to drive business in the off-season.

In 2025, the TID remained committed to key strategic areas and its mission of increasing overnight demand by convention and meeting visitors as well as leisure visitors to Denver, especially in the low- and off-peak seasons like major holidays and weekends. Specific programs include funding a holiday season marketing campaign highlighting the Mile High Tree and the new Mile High Drone Shows, client concessions to attract meetings and conventions in future years and regional leisure marketing.

The TID continues to serve a significant role in helping Denver remain competitive when attracting conventions. While competing cities offer convention center discounts and financial incentives to book citywide business, the TID program has helped attract critical business with a robust economic impact. Additionally, there has been increased competition from mega-hotels (facilities so large that the entire meeting can be held in one hotel, eliminating the need for a convention center), competing for convention center business. Since the TID’s creation, Visit Denver has booked 103 groups with a $1.8 billion economic impact and $144 million in tax dollars. In 2025 to date, Visit Denver has booked 15 groups through TID incentives, worth $328.9 million in future economic impact which will result in nearly $26.4 million in tax dollars for our city.

2025 could turn out to be a landmark year for the future of Denver due to the combination of two sets of projects: the Denver Downtown Development Authority (DDA) and the 2025 Vibrant Denver Bond Package.

The DDA, which was initially formed to help finance the reconstruction of Denver Union Station, was recently expanded into the greater downtown Denver area, using Tax Increment Financing to inject as much as $550 million in public funds over the next decade into future private projects that align with the City’s goals, particularly projects that spur new development and adaptive reuse, those tied to economic opportunity, parks and public spaces, arts, culture and activation and connectivity and mobility.

On July 30, the DDA board announced the first $100 million in projects:

Business Support

▷

$2.7 million investment in new downtown retail space for Green Spaces Market

▷ $400,000 to renovate space for the Denver Immersive Repertory Theater

▷

$640,000 to expand and relocate Milk Tea People move to a larger and more visible location along 16th Street

▷ $750,000 to expand Sundae Artisan Ice Cream’s flagship store on Glenarm

Two office-to-residential conversions that will bring 236 new units of housing in the downtown core – including units that will be affordable to working Denverites making between 30 - 80% Area Median Income

▷ $23 million for the DDA to purchase the two parking lots on both sides of Glenarm Place at the Denver Pavilions block on 15th Street, offering significant mixed use private redevelopment opportunities between 15th and 16th Street.

▷ $5 million to improve and activate Skyline Park, making improvements in accessibility, lighting, safety features and activation areas like the performance stage and concessions building

▷ $7 million to help support a reimagined McNichols Building including a ground floor restaurant and outdoor patio/dining area and arts marketplace to further activate Civic Center Park as a destination to visitors to downtown.

▷ $30 million to activate Civic Center Park, working to make the park more accessible and a true neighborhood asset by investing in new infrastructure, lighting, garden walkways and tree canopy.

In addition to the DDA, Mayor Mike Johnston has proposed a series of projects valued at $950 million that, if approved by voters in November, would invest in the city’s future by repairing and improving the vital infrastructure and community spaces that residents and visitors rely on daily—like roads, bridges, parks, playgrounds, recreation centers and libraries— without raising taxes. Projects of particular interest to Visit Denver include:

▷ Improvements to top central Denver cultural facilities such as the Denver Art Museum, Helen Bonfils Theatre Complex, Boettcher Concert Hall, Denver Botanic Gardens, Denver Zoo and others

▷ Upgrades to Red Rocks Amphitheatre

▷ Lighting improvements on the Cherry Creek Trail

▷ Buildout of the new Park Hill Park

▷ And many others

Located almost exactly 1,000 miles from both Chicago and San Francisco, Denver is the most isolated city in North America, 600 miles from the closest city of comparable size and surrounded by minimally populated areas of prairie to the north, east and south and mountains to the west.

Denver’s success in the 21st century, both in the leisure and meetings markets, relies heavily on its accessibility, and primarily on the strength of Denver International Airport (DEN) to provide convenient air service, and ground transportation from the airport to a compact, walkable downtown. DEN is Colorado’s largest economic engine, bringing in $47.2 billion in economic impact in Colorado last year.

DEN continues to outperform nearly every airport in the country, based on the strength of its domestic network, and growing international service. In terms of passenger counts, DEN is the fourth busiest in the country and eleventh busiest in the world (Source: DEN, August 2025 Air Service Profile). In 2024, DEN had 82.3 million passengers, surpassing the previous record set in 2023 by 5.8%. Year-to-date in 2025, passenger traffic is 39.5 million, a 1.2% decline versus 2024 (through August).

DEN currently serves 198 domestic and 35 international destinations with nonstop service. The airport recently welcomed new international nonstop routes to Mexico City, Mexico and United, Punta Cana, Dominican Republic on United and has extended the operation of the Airbus A380 between Denver and Munich, Germany on Lufthansa. Recent new domestic routes include Columbia, MO on United, San Diego, CA on Alaska Airlines as well as Page, AZ and Taos, NM on Contour.

In addition, DEN completed a 39-gate expansion in 2022, increasing overall capacity at the airport by 30%. The new gates, on all three concourses, allow DEN’s airlines the opportunity to grow and for DEN to accommodate new airlines, including international carriers.

DEN is also planning for future growth. Vision 100, the airport’s strategic plan, will enable it to prepare for and reach 100 million annual passengers. The strategic plan will serve as a blueprint to align decision-making and enable accountability so DEN can thoughtfully prepare to serve 100 million passengers in the next eight to 10 years. DEN’s strategic plan is centered on the four pillars of Vision 100 and under each pillar are strategic objectives:

▷ Powering their people

▷ Growing their infrastructure

▷ Maintaining what they have

▷ Expanding global connections

The Regional Transportation District (RTD) & 16th Street

The Regional Transportation District (RTD) is the regional agency operating public transit services in eight out of the 12 counties in the Denver metro area. It operates over a 2,345-square-mile area, serving 3.09 million people.

RTD is governed by a 15-member, publicly elected Board of Directors. Directors are elected to a four-year term and represent a specific district of about 200,000 constituents.

RTD currently runs 85 local, 12 regional, 10 limited and five SkyRide bus routes plus some special services. It also includes six light rail lines and an additional four commuter rail lines with 84 stations and 114.1 miles.

In 2024, the system had a ridership of 65,230,065, or about 248,970 per weekday. Through May, total ridership is slightly down YOY at 26,042,000.

In 2025, RTD has continued with significant infrastructure improvements that, while disruptive in the short-term, should ultimately help the system serve its riders’ needs better for decades to come. Key projects include:

▷ After nearly 30 years, RTD is investing in its oldest rail infrastructure to ensure the long-term integrity of the network. Light rail service began in Denver on Oct. 7, 1994, with 5.3 miles of track connecting 30th Avenue and Downing Street to Interstate 25 and Broadway. Much of today’s downtown track infrastructure, commonly referred to as the Downtown Loop, has been in place since the line was first constructed. This section of track has expanded over the years to now serve 10 rail stations on the D, H and L lines, with street-level trains operating adjacent to pedestrians and vehicular traffic.

▷ The near-term work will occur in four phases, with the first phase completed in August 2024, focusing on track at five key intersections in the Downtown Loop. Phases two through four of the approximately $152 million, fulldepth reconstruction project will occur throughout 2025 and 2026.

▷ Built in 1982, the 40-year-old 16th Street is nearing the completion of a major restoration. The project has reconfigured the street’s layout to create wider sidewalks, a new amenity zone and center-running 16th Street Free Ride shuttle service. Reconstruction is complete between Market and Stout streets and California Street and Tremont Place, with full completion planned for fall of 2025.

▷ After years of studying East Colfax Avenue and gathering significant community input, RTD and the City and County of Denver advanced a center-running bus rapid transit (BRT) service from Broadway to Yosemite with a dedicated transit lane in each direction. The project includes new and enhanced transit stations, service amenities, improved pedestrian and bike connections and placemaking opportunities. West of Civic Center Station to Denver Union Station, BRT will operate in the side-running transit lanes along 15th and 17th Streets. East of Yosemite to I-225, BRT will be side-running in mixed flow traffic with potential enhanced stations that will be coordinated with the City of Aurora.

▷ Upon completion in 2027, the project will reduce transit travel time by 15 to 30 minutes, provide more affordable and reliable access to over 250,000 jobs and community services along the corridor, enhance comfort and safety and create exciting streetscape, placemaking and economic development opportunities.

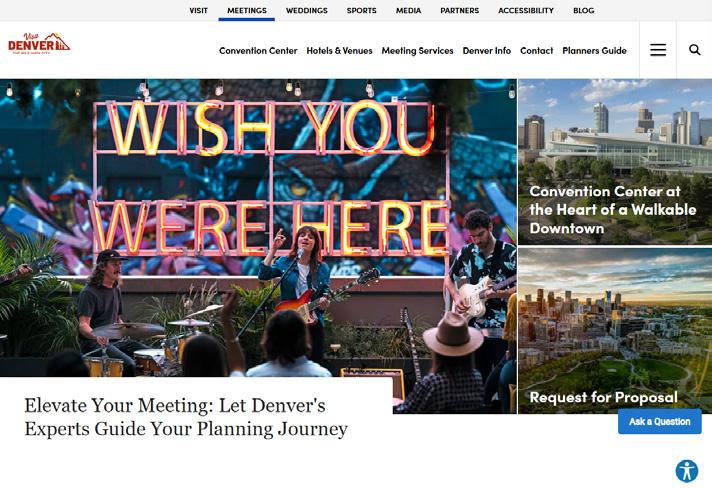

In partnership with the Colorado Convention Center team of ASM Global and Sodexo Live, Visit Denver continues to drive bookings for 2026 and beyond.

The completion of the Colorado Convention Center expansion in late 2023 marked a transformative milestone in Denver’s meetings and conventions landscape. Now fully operational, the expansion has already proven its value. Since opening, it has enabled Visit Denver to secure 28 new citywide conventions that would not have been possible without the additional space. These bookings are projected to bring more than 176,000 attendees and generate over $430 million in economic impact, further reinforcing Denver’s position as a top-tier convention destination.

At the end of Q1 2025, 1,554 rooms were under construction in the Denver Metro area. Upon completion, the new additions will increase Denver’s room inventory by 2.7%. The largest property underway is the 241-room Virgin Hotel. This luxury property is expected to be completed in 2026 and will be part of Denver’s new Fox Park initiative. The hotel is being built on the former Denver Post printing plant and will anchor the Fox Park development in Globeville, a large project with offices, residences, parks and arts space. While the Virgin Hotel at Fox Park is a welcome addition to Denver’s hospitality scene, it is a limited service/boutique property with modest meeting space.

Travelers choose destinations in part due to the strength of a city’s culinary offerings. Similarly, they may avoid destinations they don’t feel can provide them with the fresh, creative and adventurous dining options they crave. This makes developing and promoting the city’s food and beverage scene a highstakes endeavor.

Denver’s restaurant industry is at an inflection point as 2026 approaches. This sector has always been a key pillar in the

city’s reputation as a sophisticated urban destination. That reputation received a significant boost in the last couple years with the addition of the Colorado Michelin Guide in 2023 and the awarding of Outstanding Restaurateur to Denver’s Id Est Hospitality Group in June 2024 by the James Beard Foundation.

Restaurants are still finding themselves in a state of uncertainty due to factors such as economic uncertainty. Add to these the continued rise in food costs, as well as high labor costs.

Inflation continues to stress the local restaurant industry. Prices continue to rise for food service and hospitality providers in ways that are unsustainable, including taxes and regulatory fees, credit card fees, insurance and the cost of goods.

There have been innumerable stories related to how high prices are causing people to re-think their dining out decisions, leading to a decline in incidences of dining out (though spending is up in part due to higher prices; source: eMarketer, 2024) and putting additional pressure on restaurants. The loss of notable Denver restaurants such as Fruition, Noisette and Farm & Market among others has been felt across the city and has only heightened existing reservations surrounding the precarious nature of the restaurant industry. Ongoing major construction projects such as the Colfax BRT and the revitalization of 16th Street have also been major contributors to restaurant closures as well as diminished foot traffic leading to establishments. However, these issues are not a standalone problem in Denver as other major U.S. cities are facing the repercussions of the political unrest and economic decline nationwide.

This is a sector that has always had its share of ups and downs and, ultimately, there is cause for optimism. The third successful year of the Michelin program was announced in late 2025 and consumers continue to place high value on such ratings, with nearly a quarter of travelers saying Michelin ratings are important to their destination decision, particularly among younger more diverse travelers (Future Partners, 2024).

Additionally, Visit Denver continues to have a role in shaping the future of this industry, with the Boredom is Fired workforce campaign and new Restaurant Liaison position that will be evaluating ways for the City and the industry to work closely together.

The latest Colorado Business Committee for the Arts Economic Activity Study reported $2.6 billion in total economic activity in 2022 (the latest figures available), a 14% increase over 2019.

According to Denver Center for the Performing Arts (DCPA), in their 2023/2024 Community Report (the latest figures available), their programs had the following impact and results:

▷ More than $190 million total economic impact

▷ More than 748,000 tickets distributed across nearly4,000 performances of 53 different productions

▷ More than 908,000 total guest interactions

Additionally, according to Denver Arts & Venues, the City has infused art into the resident and visitor experience through their programs, including:

▷ More than 1,000 hosted cultural events

▷ 2.7 million attendees

▷ 350 artists and organizations receiving funding

▷ More than 80 active public art projects

All of this speaks to a city that values culture as one of its defining principles, a quality that is highly visible to visitors who seek to enrich their lives through culture on their visit.

Some other significant cultural developments in the city include:

▷ In June, Denver PrideFest celebrated its 51st anniversary with a weekend-long festival that saw hundreds of thousands of attendees in Denver’s Civic Center Park.

▷ Denver’s other major cultural festivals had strong performances including March Powwow, Cinco De Mayo, Juneteenth, Colorado Dragon Boat Festival, Cherry Creeks Arts Festival and Colorado Black Arts Festival. The city’s robust festival calendar offers locals and visitors alike multiple opportunities throughout the year to connect with the city’s diverse communities and artists.

▷ In 2025, the Denver Art Museum celebrates 100 years of showcasing their indigenous art collection.

▷ Record-breaking participation in Visit Denver’s own 2025 Denver Arts Week, with more than 630 events and more than 230 participating organizations.

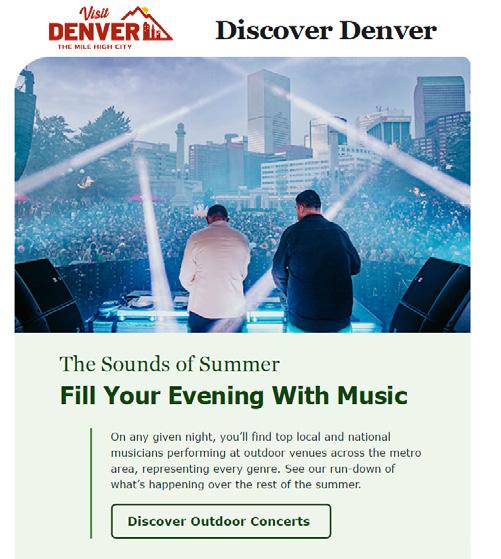

Denver’s strong events calendar continues to emerge as a competitive advantage. A combination of large annual festivals, cultural exhibitions and a substantial, year-round music calendar – including more than 200 at Red Rocks alone – combine to make the city’s events calendar a “must check” for visitors of all kinds.

The Denver Sports Commission, an affiliate of Visit Denver, had a busy year in 2025 working to pursue new sports events for Denver, while preparing for first-time sporting events coming to the city.

Denver welcomed the Denver Summit FC of the National Women’s Soccer League in 2025 with their inaugural season officially beginning in 2026.

▷ NCAA March Madness Men’s Basketball Championship Rounds 1 and 2, March 20–22

▷ USA Open Volleyball Championship, May 23–28

▷ U.S. Women’s National Soccer Team vs. Republic of Ireland on June 26

▷ Pacific Nations Cup Rugby Semifinals on Sept. 14

Denver’s Office of Climate Action, Sustainability and Resiliency has led the way in decreasing the city’s greenhouse gas emissions and prioritizing a sustainable future for the city. Likewise, Visit Denver collaborates with its venues, hotels and other partners to ensure that sustainable options are offered that allow both the community and natural environment to thrive. Below are a few of Visit Denver’s sustainability efforts as well as those from its biggest partners:

▷ Visit Denver Environmental and Sustainability Industry Recognitions:

○ Denver was the first destination to achieve Platinum level certification under the Event Industry Council’s Sustainable Event Standards in 2023 and renewed our certification in Feb. 2025. The EIC Sustainable Event Standards are specific standards for environmental and social responsibility within the events industry. Created by the EIC Sustainability Committee in partnership with industry professionals and leading sustainability practitioners, the requirements provide event planners and suppliers with prescriptive actions for producing and delivering sustainable events.

○ In 2025, Visit Denver maintained a Silver Level member status of the Colorado Green Business Network (CGBN). This is a voluntary program that encourages, supports and rewards organizations that make the move toward the goal of true, operational sustainability.

▷ Hotel Sustainability Reports: Every two years, Visit Denver surveys the downtown hotels on their sustainability practices, including waste management, energy conservation, air quality and more. The survey provides meeting planners and visitors with comparable information regarding the sustainable practices of Denver hotels. This survey was updated in 2024.

▷ Green Vendor Directory: Visit Denver provides a onestop resource to showcase vendors’ sustainability practices. The Green Vendor Directory allows visitors to sort businesses by certification type and practice. Visit Denver is proud to support and promote partners and their sustainable efforts.

▷ Colorado Convention Center’s commitment to sustainability:

○ CCC’s certifications include LEED Existing Building – Operations and Maintenance Level GOLD and ISO Standard 14001 – Environmental Management System. The CCC is pursuing LEED Gold certification for the new ballroom and rooftop terrace since completion.

○ The CCC’s Waste Management Program, Energy and Water Conservation efforts, Air Quality policies and sustainable catering support the CCC’s commitment to making all events held at the convention center sustainable.

▷ Denver International Airport’s dedication to energy efficiency and the environment:

○ The airport holds a strong commitment to sustainability. Programs like the Environmental Management System, wastewater reduction, airport solar program, single-stream recycling and a partnership with the CBGN support the airport’s goals to reduce its impact on the environment. In addition, the RTD A Line offers a “green” way to travel to and from the airport.

Visit Denver prioritizes the core values of diversity, equity and inclusion (DEI) in all of its operations and sales/marketing efforts. The DEI Board Committee, which was formed in June 2020, provides ongoing input for focus areas of internal policies/practices, community affiliations and support, social impact/work force development efforts and marketing efforts and programs.

With the engagement of Darrell Hammond, Sr., of Higher Ground Consulting, several DEI educational training courses for staff were conducted throughout 2024. All staff members participated in Outward Mindset workshops to gain more skills for interacting with clients, stakeholders and co-workers. In addition, staff recruitment efforts have increased the diversity among Visit Denver employees.

Based on opportunity areas identified by the 2021 DEI Perception Survey, staff-led Impact Teams researched and developed proposals for enhancing internal policies and practices, with the goal of enhancing DEI efforts. Visit Denver’s Board and leadership team have consistently embraced and guided this ongoing journey to enhance the organization’s DEI efforts.

The focus on DEI will remain as a constant thread, in 2025 and beyond, woven into the fabric of all things Visit Denver. There will be a focus on additional training and opportunities to keep an “outward mindset” top of mind through action and conversations, as well as continued work with the Board Committee and the DEI focus areas. This includes the organization’s official Commitment to Diversity, Equity and Inclusion:

The Mile High City welcomes everyone! We are committed to making the core values of diversity, equity and inclusion a way of life for our organization, our partners in the hospitality industry and our visitors.

At Visit Denver, we believe that travel makes the world a smaller and more connected place. It brings people together and fosters interaction among diverse cultures. It builds understanding, appreciation, empathy and respect for one another. This philosophy is essential to who we are as a community and why Denver is one of the top destinations in the country to live and to visit.

Denver celebrates its rich cultural heritage across our vibrant neighborhoods with attractions, restaurants, festivals and events throughout the year. Go to Diverse Denver, where you will find Visit Denver’s Accessibility Guide, Land Acknowledgment to support Indigenous people and more.

▷ Travel demand is strong nationally, despite fluctuating concerns about the economy. Longwoods International’s most recent American Travel Sentiment Survey shows that 94% of Americans have travel plans in the next six months, a figure that has remained stable in the last 12 months. Future Partners’ most recent State of the American Traveler (July 2025) shows increases related to confidence respondents’ personal financial situation and in travel spending.

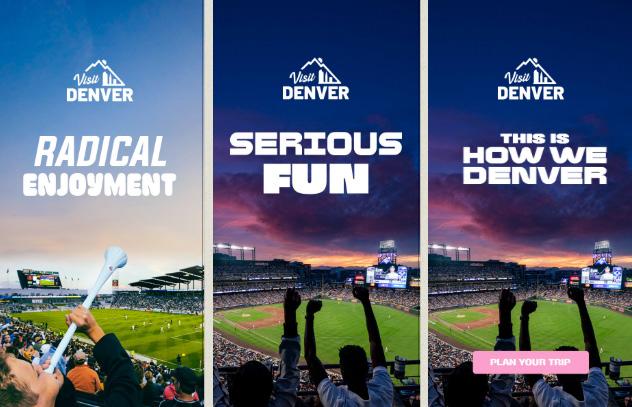

▷ The Denver brand, which received a major refresh in 2023, along with a new logo in 2025, provides Visit Denver with a strong platform from which to market the city, both from tourism and convention standpoints, positioning Denver as “uplifting by nature,” an outdoor city full of urban exploration and sophistication.

▷ Denver has a mild year-round climate, 300 days of sunshine and easy access to outdoor activities, both in the city and the nearby Rocky Mountains. This has been an important part of the brand in attracting visitors in the post-pandemic era with people who are seeking outdoor and less-populated areas to visit.

▷ Denver has a compact, walkable and vibrant downtown that is easily accessible and includes a wide array of amenities that are attractive to residents and visitors alike, including many options for entertainment, arts and culture, sports, dining, nightlife, retail and outdoor activities.

▷ The reopening of 16th Street, paired with Mayor Johnston’s new Downtown Safety Plan, has improved perceptions of downtown, though there is still much work to do.

▷ Smart use of marketing funds in annual regional and national tourism promotional campaigns, including advertising, public relations, social media and search marketing, will keep Denver top-of-mind for the growing domestic leisure travel market. This includes expanded national advertising in the first and fourth quarters, which are historically soft times for visitation from these segments.

▷ The Colorado Tourism Office is a strong partner of Visit Denver, providing additional domestic and international marketing support, which in turn drives additional visitation for Denver.

▷ A new 10-year Denver Tourism Roadmap, developed in 2024 and ratified by the Visit Denver board in December, will help guide the development of Denver’s tourism product for future years and help this organization focus on the top priorities. The plan, which contains seven high-level categories and dozens of individual initiatives, received input from more than 1,000 people including board members, industry representatives and Denver residents.

▷ The Tourism Improvement District (TID), launched in 2017, continues to generate funds to help maintain the nowcompleted Colorado Convention Center (CCC) expansion, attract meeting business and fund marketing initiatives.

▷ Per CoStar, at the end of Q1 2025, 1,554 rooms were under construction in the Denver Metro area. Upon completion, the new additions will increase Denver’s room inventory by 2.7%. The largest property underway in the central business district is the 241-room Virgin Hotel. Unfortunately for the last decade and a half, there has been very little development of hotels with sufficient meeting space which would allow Denver to benefit from the improved meeting demand.

▷ Denver is a central location for meetings, just 340 miles from the exact center of the Continental United States.

▷ Denver’s status as a regional capital gives the city a leg up in many areas, including dining, retail, arts and culture and sports, as well as with business, medicine, technology and financial services.

▷ Denver’s long-term prospects in the conventions market remain strong. Meeting lead volume continues to exceed 2019.

▷ The expansion of the Colorado Convention Center has greatly increased Denver’s competitiveness in the meetings sector, as shown by the performance to-date. Since opening, Visit Denver has secured 28 new citywide conventions that would not have been possible without the additional space. These bookings are projected to bring more than 176,000 attendees and generate over $430 million in economic impact.

▷ Denver International Airport (DEN) remains a central component of Denver’s success in both the leisure and meeting sectors. DEN is currently ranked as the fourth busiest airport in U.S. and the eleventh busiest in the world (latest figures available), due in large part to its strong domestic network and growing international connections.

▷ In 2024 international passenger traffic at Denver International Airport (DEN) grew by 15% year over year. In 2025, DEN added nonstop flights from Rome, Italy (United), Regina, Canada (United), Mexico City (United) and Monterrey (Volaris), Guadalajara and Monterrey (Aeromexico). These are expected to increase lift, but numbers will be available in 2026.

▷ The recently completed 39-gate expansion has also greatly enhanced DEN’s competitiveness and made the city more attractive, particularly to meeting planners.

▷ The A Line train from DEN to Denver Union Station, which launched in April 2016, provides an efficient option for transportation between the airport and downtown for both meeting planners and leisure travelers, and addressed one of the main complaints from meeting planners.

▷ Denver continues to maintain its position as a top city for “green” meetings and has won many awards and recognition for sustainability, including the first-ever destination to achieve platinum status under the Event Industry Council’s Sustainable Event Standards and Silver Member status with the Colorado Green Business Network.

▷ Denver has a highly regarded medical and bio-science campus at Anschutz Medical Campus, which enhances the city’s reputation as a center for medical meetings and serves as a pool from which Visit Denver can recruit ambassadors to assist in the sales process, as well as provide experts and speakers for related groups.

▷ Denver City Council’s 2016 approval of regulations and a taxing mechanism for short-term rental properties (e.g. Airbnb and VRBO) opened the door for partnerships with these providers and generated additional Lodger’s Tax.

▷ Denver has a growing reputation for its arts and cultural scene with world-class museums, performance venues such as the Denver Performing Arts Complex, blockbuster exhibitions, annual cultural events like the Denver Film Festival and the new Denver Jazz Fest. In addition, there are hundreds of arts and cultural organizations bringing creativity to the city and its neighborhoods, thanks in large part to the unique Scientific & Cultural Facilities District (SCFD) funding that was renewed in 2016 for 10 more years. Innovations like art installations in alleyways and non-traditional, immersive programming by Denver Center for the Performing Arts’ Off-Center programming also represent new ways to appeal to visitors.

▷ Denver Arts Week’s record-breaking participation in 2025, with more than 700 events and more than 250 participating cultural organizations, is proof of Denver’s cultural strength.

▷ Sundance Film Festival’s selection of Boulder and Colorado as the home for this iconic festival for the next decade will further bolster the region’s cultural reputation.

▷ The city’s many tourism, sports, entertainment and cultural-related organizations have been very successful in the last several years in attracting high-demand events, exhibitions and festivals, bolstering the city’s already robust events calendar. Visit Denver’s continued involvement in attracting these events will be an ongoing asset.

▷ Denver celebrates its rich ethnic diversity, including its Black heritage, Hispanic/Latino population, Indigenous communities and its engaged LGBTQ+ community, as well as an expanded focus on people with disabilities, through a wide variety of events, attractions and restaurants.

▷ Visit Denver’s board committee on Diversity, Equity and Inclusion continues to evaluate Visit Denver’s practices, from staffing to marketing, in an ongoing effort to ensure the city’s wide diversity is always represented. A consultant hired in 2021 continues to drive this process.

▷ Visit Denver’s website allows the Bureau to effectively reach visitors across devices and with timely, engaging content. An expanded social media effort, including enhanced social media advertising and increased use of video, is also crucial in communicating with visitors.

▷ Visitors to Denver now have two attraction pass options offering discounted admissions to top attractions. The Denver CityPASS launched in 2018, offers tickets to three, four or five of the eight participating attractions, and the Mile High Culture Pass is a three-day pass providing admission to nine of Denver’s top cultural attractions. The Mile High Culture Pass was relaunched in 2022, and both are selling well.

▷ Denver has a robust culinary reputation that was strengthened in 2023 with the announcement of the Michelin Guide and in 2024 with a national James Beard Foundation award for the Id Est Hospitality Group, operator of two of Denver’s one-star Michelin restaurants. Michelin is the global standard of restaurant reviews, and the launch of Denver’s program has immediately elevated the reputation of the city’s dining scene with domestic visitors, meeting planners and international travelers. The program has a three-year contract term with an option for two additional years.

▷ Denver is known as the country’s leading craft brewing city with more than 130 breweries metro-wide. Additionally, the city is becoming increasingly known for its burgeoning craft distilling culture and innovative wineries.

▷ The Denver metro area has extensive parks and open spaces, nearly 80 golf courses and more than 850 miles of bike paths, underscoring the city’s outdoor brand.

▷ Denver has seven professional sports teams and modern facilities.

▷ The Denver Summit FC, the newest team in the National Women’s Soccer League, will begin playing in Denver in 2026 and will move into their own stadium in 2028 (estimated). Their addition to the market will strengthen Denver’s reputation as a sports fan’s paradise.

▷ The strength of the Denver Sports Commission in identifying, securing and servicing high-value, highimpact sporting events, both professional and amateur, puts Denver in a good position to grow its sporting event footprint.

▷ Red Rocks Park & Amphitheatre hosted a full calendar of concerts, films and fitness events in 2025, with more than 200 total events, extending its season into November and reinforcing the city’s reputation for live music, culture and fitness.

▷ Live music in Denver continues to achieve national recognition with the continued success of the Mission Ballroom in RiNo, the impressive (and largely free) concert calendar at Levitt Pavilion, as well as other smaller venues, especially outdoor ones like Number 38. The success of Denver-based bands OneRepublic, the Lumineers, Nathaniel Rateliff & the Night Sweats and others also aid in this effort.

▷ Denver has a rich Western heritage that is associated with the Rocky Mountain West and anchored by one of the world’s most prestigious livestock shows, the National Western Stock Show & Rodeo. In 2015, voters approved funds for the development of a new National Western Center that is intended to be a year-round destination that will engage local visitors and promote out-of-state tourism in collaboration with partners such as Western Stock Show Association, Colorado State University System, the Denver Museum of Nature & Science and History Colorado.

▷ Denver has a variety of authentic, lively and growing neighborhoods filled with unique restaurants, shops, cultural/historical attractions and parks. Shopping at local merchants is particularly important to international visitors.

▷ Denver’s outdoor brand is supported by the continued development and activation at Civic Center Park, including concerts, events and the Civic Center EATS food truck roundup in the summer.

▷ The Amtrak Winter Park Express ski train offers seasonal, weekend rail service from Denver Union Station to Winter Park Resort, creating an option for skiers to stay at least one night in Denver. The service will return for the 2025/2026 season with expanded frequency and reduced fare prices, delivering a win for visitors and locals alike.

▷ The introduction of the Rocky Mountaineer luxury train from Denver to Moab, Utah adds another high-demand, rail-based option for visitors to experience the West by train. The service will expand in 2026 with the addition of a Denver-to-Salt Lake City product under the new brand name, Canyon Spirit.

▷ Denver offers a wide variety of pre- and post-convention vacation opportunities, as well as leisure day trips in the nearby Rocky Mountains.

▷ Denver has a growing inventory of innovative tours, such as culinary, brewery and walking tours, as well as new virtual options, which increases Denver’s appeal to leisure travelers, both domestically and internationally.

▷ Mayor Johnston has shown himself to be a major supporter of tourism in the first year of his administration, attending many Visit Denver events and press conferences.

▷ Denver is one of the most geographically isolated major cities in America, with a relatively small population within a 600-mile radius, thus generating less drive traffic for tourism and conventions.

▷ Denver is overly dependent on air traffic, with 40% of visitors arriving by air (according to 2024 data from Longwoods), significantly higher than the national average of 24%. This makes the city particularly vulnerable during this period with high gas prices that may cause people to travel closer to home.

▷ There is a misconception that Denver is cold, snowy and has unpredictable weather.

▷ Denver is not as well-known as some major U.S. cities with more long-standing tourism brands.

▷ Denver currently has less recognition for offering unique regional cuisine or specialty cooking than other cities, though the addition of the Michelin Guide has helped alleviate this to a large degree.

▷ The average number of weekday office workers downtown is still only around 65% of pre-pandemic numbers according to July 2025 data from the Downtown Denver Partnership, which impacts the viability of supporting local businesses and the overall vitality of downtown. This number does reflect a 5% increase over June.

▷ Year-to-date, the average number of total daily users in downtown is approximately 216,785, which is slightly higher than the same period in 2024 (215,255). This figure represents 86% of the 2019 total daily visits downtown.

▷ Though much progress has been made, visitors and meeting planners continue to share safety concerns on 16th Street and in surrounding areas, noting multiple closed businesses and boarded-up storefronts, aggressive panhandling and people experiencing homelessness. That said, meeting planners have given Denver better marks on safety concerns in surveys this year.

▷ Downtown Denver lacks major retail on or near 16th Street, a trend that was further exacerbated by COVIDera closures and the reconstruction project. To combat this, the City and Downtown Denver Partnership have embarked on a major effort to attract and incentivize new retailers.

▷ Denver has fewer nonstop international flights compared to many other large U.S. cities, though that number has increased substantially in recent years. Recently however, Air France has reduced capacity on their Paris to Denver flights, though flight frequency has not changed. Turkish Airlines has also dropped plans to add more flights between Istanbul and Denver. Note: Denver is not the only city that these airlines are reducing service to.

▷ Traffic congestion issues exist on I-70 to and from the mountains, especially on weekends.

▷ There is limited public transportation to many of the city’s top neighborhoods, attractions and shopping centers.

▷ There are negative perceptions of Denver’s elevation, including that it can adversely impact a visitor’s stay.

▷ Construction on I-70 and at DEN is greatly increasing traffic congestion from the airport to downtown and creating longer wait times to check in.

Strengths, Weaknesses, Opportunities & Threats

▷ The expanded Colorado Convention Center, which opened in December 2023, allows Denver’s convention and exhibition facilities to stay competitive for years to come. The TID will also provide additional marketing funds, further ensuring the city’s competitiveness in leisure and meetings markets.

▷ The upcoming of signature industry events such as the 2028 Meeting Planners International’s World Education Congress and the 2029 U.S. Travel Association’s IPW will create tremendous business opportunities for Denver far into the future.

▷ The 16th Street project will be fully completed in 2025. The new street will be a focal point for visitors and residents alike, with wider sidewalks, more and larger outdoor patios, an expanded tree canopy and a more consistent bus configuration.

▷ The initial $100 million investments proposed under the expanded Downtown Development Authority (DDA) will bring transformative projects to downtown. The DDA could bring as much as $550 million in new investment to the area over 10 years.

▷ Mayor Johnston’s proposed $950 million Vibrant Denver bonds could enhance city infrastructure and amenities for years to come,

▷ A proposed new headquarters hotel near the CCC, though far off, could dramatically increase the city’s capacity to host large conventions.

▷ The Downtown Denver Partnership’s funding plans to help businesses on 16th Street could contribute to the revitalization of the street.

▷ The renovation at DEN of the Great Hall, ticketing and security areas will improve safety, make the airport more efficient and elevate the passenger experience when complete.

▷ Visit Denver will continue to work with DEN to maintain existing air service and pursue additional nonstop flights to tap un-served and under-served destinations in target markets including Europe, Asia, Oceania and South America. DEN added nonstop flights from Rome, Italy (United), Regina, Canada (United), Mexico City (United) and Monterrey (Volaris), Guadalajara and Monterrey (Aeromexico). These are expected to increase lift, but numbers will be available in 2026.

▷ On-going marketing initiatives, particularly the expanded Winter Campaign that targets Colorado resort intenders, are poised to take advantage of the consistent interest in Denver’s urban appeal.

▷ Visit Denver’s already strong track record in promoting the city’s inclusive communities to diverse audiences will be strengthened in 2026 with the continued operation of the Diversity, Equity and Inclusion Committee and expanded content for multiple diverse markets on the VisitDenver. com website.

▷ Temporary exhibitions at Denver’s cultural attractions have continued throughout the pandemic and provide time-specific marketing opportunities while also enhancing Denver’s reputation as a city that embraces arts and culture. Exhibitions like History is Painted by the Victors and Pissarro’s Impressionism at Denver Art Museum; Angkor: The Lost Empire of Cambodia and Jurassic Oceans: Monsters of the Deep at Denver Museum of Nature & Science; and many others at Denver’s museums will continue to highlight the arts and culture scene into 2026.

▷ The potential hosting of large sporting events like a proposed Indy Car race, 2030 FIFA Women’s World Cup and Rugby World Cup (Men’s in 2031; Women’s in 2033) present opportunities for new business and to raise the city’s international profile.

▷ Visit Denver’s Denver365 events calendar is a key resource and promotional platform for visitors and locals alike, and emerging competitive advantage as events become more important in promotional strategies.

▷ Brand USA’s website content and cooperative advertising and marketing programs offer ways to reach travel trade and consumers in international markets in a cost-effective way.

▷ U.S. Travel Association’s continued advocacy around visas and improvements to the entry process for international travelers improves perceptions of the U.S. as a travel destination, which continues despite other headwinds confronting this segment.

▷ Strong leadership at the City’s Office of Special Events helps ensure that large events are handled smoothly with more streamlined processes.

▷ The Michelin program has given Visit Denver an expanded platform to market its culinary scene to domestic and international visitors, as well as meeting planners and attendees.

▷ The Downtown Denver Partnership’s retail strategy for 16th Street could provide a big boost to the area’s shopping amenities.

▷ Denver’s overall mild climate could be an asset in coming years when compared to other parts of the West.

▷ Denver and Colorado’s central role in vital water issues in the U.S., and particularly the West, could create opportunities for hosting new conferences and businesses related to this critical topic.

▷ Visit Denver’s new workforce promotion efforts could help attract more workers to an industry that still struggles with reputation and still has hiring challenges.

▷ Visit Denver’s new outreach efforts to local realtors and other influencers to provide information on Denver’s vibrant events calendar could help continue to improve the reputation of central Denver across the metro area.

▷ The advent of Generative Artificial Intelligence engines presents a generational opportunity for Visit Denver to create new content that is referenced by these new tools that enhance existing web search efforts and continue to offer valuable resources to potential visitors.

▷ The short- and medium-term prospects of a recession/ economic downturn could negatively impact tourism both domestically and internationally. The impact on the industry is not known, but the prospect alone is enough to be cautious.

▷ The City of Denver is dealing with a $250 million budget shortfall through the end of the next fiscal year, leading to an estimated 12% budget cut, furloughs and layoffs.

▷ Brand USA’s budget was recently cut from $100 million to just $20 million, which will impact the country’s ability to remain competitive in international markets, as are the impacts of the current Federal shutdown.

▷ The entire hospitality industry is struggling to fill open positions. New headwinds make it difficult to find qualified workers include competitiveness with other industries, reputational issues with the leisure and hospitality sector, health and safety concerns, childcare challenges and affordable housing.

▷ University-level leisure and hospitality programs are experiencing lower enrollment across the country, which could lead to future challenges in filling key industry workforce roles.

▷ Work-from-home policies have led to a slower-thanexpected return of the downtown Denver workforce, which has contributed to the shutting of many downtown businesses that serve this market, including food service and retail. Visit Denver is part of several initiatives with the City, local businesses and related agencies like Downtown Denver Partnership to try and address these issues on multiple fronts.

▷ Denver’s restaurant industry seems particularly at risk right now due to a combination of high wages, rents and food costs paired with more caution on the part of consumers and a diminished number of downtown workers. Visit Denver, along with DEDO, has hired a restaurant industry consultant to better understand these issues and make recommendations to the City.

▷ The 1,500-room Gaylord Rockies in Aurora is a top source of lost business for Denver over the long term. The Gaylord Rockies has submitted plans to the city of Aurora that call for adding 450 rooms and a 47,000-square-foot indoor addition to its water park. The expansion would increase the hotel’s capacity from 1,501 rooms to 1,950 rooms.

▷ Several major convention centers across the U.S. have recently, or are currently undergoing significant expansions or renovations, including the George R. Brown Convention Center in Houston, the Kentucky Exposition Center in Louisville, the Los Angeles Convention Center and the Las Vegas Convention Center. The Orange County Convention Center will begin a $560 million expansion in 2026, and the Austin Convention Center is set to nearly double in size by 2029, while the Kay Bailey Hutchison Convention Center in Dallas is undergoing a massive, $3.7 billion renovation and expansion project, also by 2029.

▷ Across the country, many cities, led by their Destination Marketing Organizations, are adding Tourism Improvement Districts to bring in new funds that can increase their competitiveness and act as a war chest to incentivize meetings and events to their markets.

▷ New hotel supply coming online in the metro area will slow the pace of recovery, especially in the meeting and convention sector.

▷ Perceptions of the impacts of construction and traffic congestion, by both locals and visitors, could negatively impact the city’s appeal.

▷ Despite some gains, there are continued safety issues on and near 16th Street that create an ongoing possibility for negative press, as well as the potential for lost business as more high-profile incidents become public.

▷ Once frequently cited by U.S. News as a top place to live (No. 14 last year in 2021 and No. 40 in 2024), Denver did not make the list of the top 250 places to live in the most recent report.

▷ Increased competition exists from a variety of traditional web, mobile and social media sources within both the leisure and meetings outlets.

▷ Online booking options enable meeting delegates to easily find lower rates and book outside the block, and new options like short-term rentals further erode hotel room blocks.

▷ Ongoing competition from third-party travel and meeting planning websites challenges the relevance of DMOs.

▷ There is always potential for new local, statewide or national legislation or ballot initiatives that could have a negative impact on tourism.

▷ Denver residents’ frustration with growth and traffic could be transferred to anti-tourism feelings, leading to a reduction in local and state tourism marketing dollars.

▷ Visit Denver’s success is tied to measurements that may not truly reflect business. Convention room blocks are decreasing due to delegates booking outside the block, so attendee counts and room nights booked are frequently lower than actual numbers. New measurements may be needed to accurately provide a picture of tourism business in the 21st century.

▷ Climate changes in general, and worsening fire conditions across the west in particular, could make wildfires and wildfire-related poor air quality conditions a more frequent issue for Denver and the state.

Denver’s appeal rests on a strong brand foundation that combines outdoor adventure and urban amenities. This section will explore how the current brand positioning was developed, and how it will be deployed in 2025 and beyond.

Visit Denver regularly conducts brand awareness research to gauge the current perceptions of the Denver brand in key regional and target markets.

The 2023 research was conducted by Denver-based BrandJuice, the same firm that conducted earlier studies in 2005 and 2013 from which the previous brand positioning was derived, providing continuity for the development of Denver’s brand.

The research showed a significant expansion of positive brand attributes, as well as some unexpected findings, which has provided the basis for Visit Denver’s campaigns for 2024 and beyond.

Travel continues to be a sought-after activity, and the reasons for taking trips shifted dramatically as people looked to meet up with loved ones much more frequently post-pandemic. Rather than escape or adventure as primary motivators, travel is now defined by the idea of reconnecting and doing so in new places. Campaigns to be implemented in 2026 will take advantage of this trend and make Denver generally more welcoming and inclusive.

A strong correlation exists between Denver and the Rocky Mountains in the minds of many respondents, often referred to as “Denver’s Duality.” The single most important icon for Denver is the Rocky Mountains; the city and its mountain backdrop are inextricably linked.

Denver’s urban qualities were put into a new perspective, with particular emphasis on the previous use of the phrase, “urban adventures,” which was somewhat off-putting and not believable, particularly among long-haul audiences and residents of larger cities like New York and Los Angeles.

Denver’s welcoming and open-minded spirit was reinforced as a key brand differentiator.

Denver’s western history was highlighted and also brought into modern times with qualities of entrepreneurship and collaboration.

Uplifting by Nature

Denver is a vibrant outdoor city at the base of the Rocky Mountains with natural energy that heightens every moment.

Known for crisp mountain air, sunshine and expansive blue skies, it’s a destination of discovery that thrives in the beauty of every season — offering an escape that uplifts and invigorates travelers with every visit.

1 2 3 4 5 6 7 8

Vibrant, contemporary atmosphere with an open-minded community that embraces visitors

300+ days of sunshine to enjoy panoramic natural beauty and the allure of every season

Exciting array of attractions and activities for visitors of all ages (arts, culture, shopping)

Creative, contemporary dining scene (including fine dining, “foodie” hangouts, craft breweries, cocktail lounges and urban wineries)

Walkable, safe environment that encourages exploration and discovery of eclectic neighborhoods

Outdoor activities and adventures, both in the city and the nearby mountain playground

Welcoming city for family-friendly fun, providing a variety of opportunities for education and play

Dynamic destination for all types of events and entertainment in one-of-a-kind venues

▷ Travelers who have been to Denver agree that there is a combination of factors that make the city great, but they struggle to articulate one singular selling point.

▷ Defining clear differentiation from this kaleidoscope of elements can ensure Denver’s appeal as a standout destination is more immediately recognized and understood.

▷ Denver is “the best of both worlds,” offering the amenities of the city with the outdoor setting of a mountain town.

▷ While the idea of an “Outdoor City” resonates, more can be done to define what it means to get outdoors within city limits.

▷ Denver’s 300 days of sun are a surprise to travelers who often associate the city with winter.

▷ To sway winter-weary travelers, the brand should explore interesting ways to position the city as a year-round destination.

▷ The rising cost of living and proximity to expensive resorts has created a perception that Denver is an expensive destination, but visitors don’t find this to be true.

▷ In terms of cost, the brand must show the value it offers to help attract new visitors.

▷ Travelers, at best, believe the phrase “urban adventure” makes sense paired with “Outdoor City,” but, at worst, they don’t believe it is a true or desirable description of Denver compared to other cities.

▷ Removing “Urban Adventure” from the strategy is the first step to repositioning Denver as a destination.

▷ To deliver on travelers’ desires to experience new places and different cultures in a unique way, the brand should consider leaning into the spirit of Denver’s wild west roots to create an authentic sense of local culture within the city.

▷ Former Denver visitors believe that the city has something for everyone, while those unfamiliar think of it as an adultonly destination.

▷ To deliver on Denver being a destination for groups of all ages, the brand pillars and messaging should reference more family-friendly attractions.

▷ Red Rocks and seven professional sports teams make Denver an event destination for both regional and national travelers to get away for a long weekend.

▷ The brand should further leverage the appeal of Denver’s events to attract travelers from across markets and spur repeat visits.

Attracting tourists to visit Denver for their vacation — whether as a stand-alone Denver trip or as part of a larger Colorado visit — requires a combination of tactics. Regardless of whether the visitor is from a long-haul target market (e.g., Chicago, New York or Los Angeles), a regional market (e.g., Kansas City, Cheyenne or Albuquerque) or international markets, the decision to come to Denver begins with the city’s brand appeal.

Visitors may make their final decision to come to Denver based on a variety of factors, including short-term exhibitions, special events or the use of Denver as a base for day trips, but the choice to spend time in the city depends first and

• Geographic focus: Colorado (excluding Denver metro) and regional markets

• Main goal: appeal to travelers’ specific interests they can find in Denver, including outdoor adventure, live music, dining and more

• Timing: February–October

• Geographic focus: Colorado (including Denver metro) and regional markets

• Main goal: retail, based on availability of events, exhibitions and performances related to winter holidays including the Mile High Tree and the Mile High Drone Show

• Timing: October–December

foremost on the emotional appeal created by exposure to Denver’s brand.

As the brand research study confirmed, Denver’s appeal as an active, vibrant outdoor city drives interest to visit and likely precedes investigation of specific things to do.

The year-round popularity of the city, combined with an evergrowing list of festivals, events, exhibitions and performances throughout the year, allows marketing campaigns to promote the city 12 months a year. All campaigns have the same goal: to bring more visitors to Denver. Specific tactics and markets change with the individual campaign. Here is a summary of 2025 national and regional campaigns, which are discussed in more detail in the Tourism section of this report:

• Geographic focus: large target markets (NYC, Chicago, LA, Dallas and Houston) with smaller test markets (Austin, Orlando, Detroit, Phoenix and others), national overlay

• Main goal: create inspiration through interestbased branding; encourage further research

• Timing: April–August

• Geographic focus: National; audience is behavioral, as well as geographic, focusing on interest in outdoor activities and winter vacation intenders

• Main goal: encourage Colorado winter vacationers to stay overnight in Denver before heading into the mountains

• Timing: January–March, October–December

Denver is consistently regarded as a top-tier convention city, offering the essential attributes meeting planners seek: state-of-the-art facilities, a strong hotel package, convenient accessibility, affordability, exceptional service, and a reputation for safety.

To build on this foundation, the sales team can consistently emphasize these strengths while also highlighting Denver’s broader destination appeal. Research shows that “destination appeal” and the ability to attract attendees are among the most important factors for meeting professionals when selecting a city.