Gets Into

Gets Into

Voter turnout in Proviso lowest in at least 16 years as Trump’s vote share increased while Harris’s support plummeted

By MICHAEL ROMAIN Editor

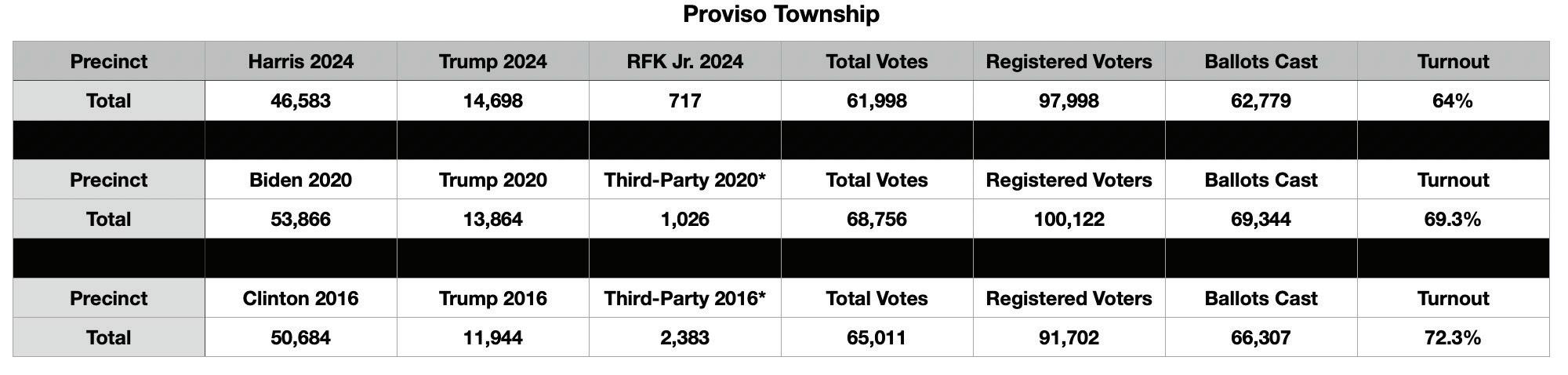

On Nov. 20, the Cook County Clerk’s office released township- and precinct-level results for the Nov. 5 Presidential Election. The unofficial results—which include all precinct totals, early voting, and mail ballots cast—show that, despite sky-high turnout nationally, voter turnout in the suburbs was at its lowest in at least 20 years.

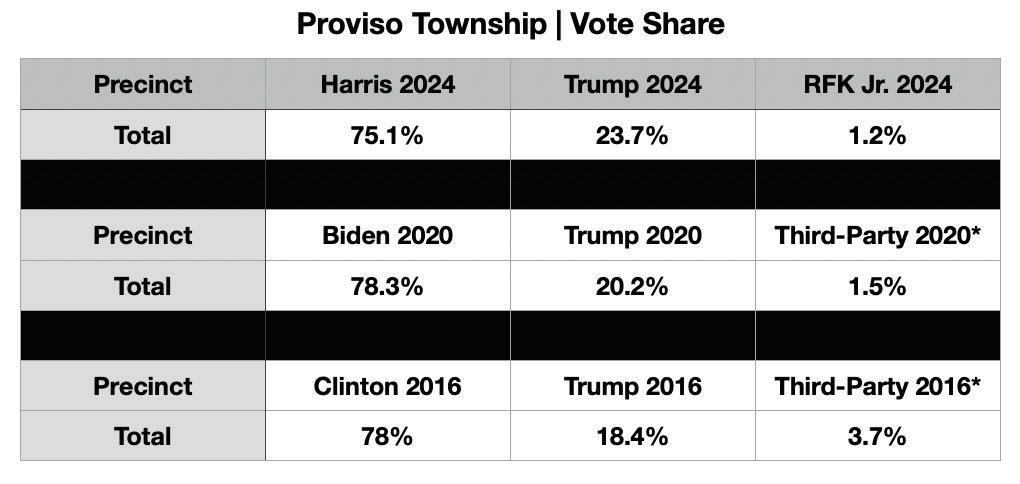

The results also show that support in Proviso Township for the Democratic presidential nominee, Vice President Kamala Harris, plummeted compared to the 2016 and 2020 election cycles. The Republican nominee, former president Donald Trump, experienced slight increases in his vote share over 2016 and 2020.

According to the clerk’s unofficial results, turnout in Proviso Township was 64%. That’s Proviso’s lowest presidential election turnout rate in at least 20 years and slightly lower than the 66.5% turnout rate across the Cook County suburbs. From 2008 to 2020, voter turnout for

Ongoing investigation has identified more than 275 cases of wrongdoing since 2022

By AMALIA HUOT-MARCHAND Capitol News Illinois

A state watchdog has identified at least $7.2 million in fraudulent claims and more than 275 instances of misconduct by state employees accused of bilking a federal program

designed to help businesses during the COVID-19 pandemic.

Since 2022, the Office of the Executive Inspector General has been investigating allegations that state employees fraudulently claimed Paycheck Protection Program loans for small businesses they didn’t disclose or entirely fabricated. State workers may engage in secondary employment, but only if it’s disclosed and permission is granted.

Employees from 13 different state agencies are involved in the fraud and have illegally taken these federal public funds, according to the OEIG, which is charged with investigating allegations of misconduct within state

government. As of April, more than 60% of those implicated to date worked for the Illinois Department of Human Services, which operates mental health hospitals and developmental centers across the state. The Paycheck Protection Program was an initiative established by the federal CARES Act in 2020. The Small Business Administration oversaw the implementation of the PPP to provide forgivable loans to cover payroll costs or other expenses for small businesses struggling during the COVID-19 pandemic. By October 2022, the program gave out $786 billion in loans and forgave 93% of them,

Publisher/CEO Michael Romain

Chief Operations Officer Kamil Brady

Creative Designer Shanel Romain

John Wilk Communications, LLC

3013 S. Wolf Rd. #278

Westchester, IL 60154

PHONE: (708) 359-9148

VFPress.news

TWITTER: @VILLAGE_FREE

FACEBOOK: @MAYWOODNEWS

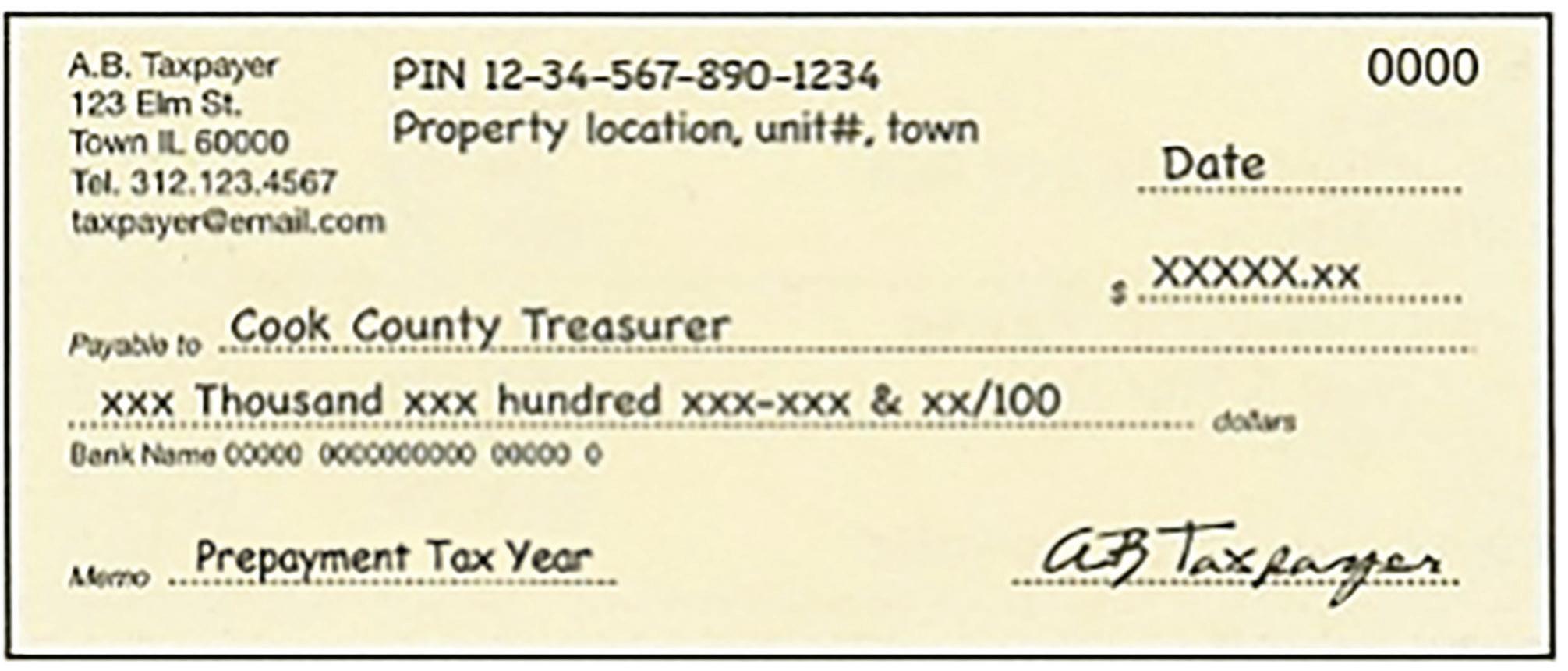

If you’re a Cook County homeowner who spends winters in Florida, Arizona or other climate warmer than Chicago you don’t have to worry about rushing back to town to pay your taxes by the traditional early March due date.

My office lets “snowbirds” and anyone else prepay taxes due the following year before the end of the current calendar year. Taxpayers can register and receive a tax bill in the mail in early December. The deadline to prepay taxes every year is Dec. 31.

to Cook County Treasurer, P.O. Box 805436, Chicago IL 606804155

■ At any Chase Bank location in Illinois

■ In person at the Treasurer’s Office in Room 112 of the County Building, 118 N. Clark St., Chicago

The Village Free Press is published digitally and in print by John Wilk Communications LLC. The print edition is distributed across Proviso Township at no charge each week. © 2024 John Wilk Communication LLC

To obtain a printed copy of a prepayment bill, send a written request by early December that includes your mailing address and 14-digit Property Index Number (PIN). Requests by mail should be sent to:

Cook County Treasurer

Attention: Prepayments 118 N. Clark St., Room 112 Chicago, IL 60602

There are four ways to pay early:

■ Online at cookcountytreasurer.com from your bank account or a credit card

■ By mail using an original early payment tax bill or a pdf of a tax bill downloaded from cookcountytreasurer.com and mailed

If you prepay your taxes by check, you must write your PIN near the amount due. You can find your PIN at the top of your most recent tax bill or look it up using your address at cookcountytreasurer.com.

The First Installment is an estimated bill equal to 55% of the prior year’s total tax. The due date is usually the first business day in March.

Second Installment tax bills vary. It’s impossible to estimate what the Second Installment bill will be, which is why you can only prepay First Installment bills. My office can accept prepayments for First Installment taxes only if the prior year’s taxes have been paid in full. If you have a mortgage and your property taxes are paid from an escrow account, contact your lender prior to attempting to pay early to avoid making a double payment. If your early payment is received by Dec. 31, the First Installment tax bill that will be mailed in late January will reflect that payment.

from page 1

according to the SBA.

Quickly, PPP loans led to “unprecedented fraud levels,” according to the SBA inspector general. Applicants self-certified their small business status and income. The OEIG is investigating only public employees who received more than approximately $20,000 from the program. To receive a $20,000 loan, businesses investigated by the OEIG typically declared $100,000 or more of net profit or gross income on the loan application.

The OEIG could not comment on whether this investigation was close to the end. Due to the sheer size of this fraud, investigations involve many different agencies. In May 2023, the Illinois legislature passed House Bill 3304, which allows criminal prosecutions for COVID-19 related fraud to start up to five years after authorities discover the fraud.

Rep. Fred Crespo, D-Hoffman Estates, who filed the bill, said most of the routine checks such as cross-referencing data on the loan forms with other agency databases were suspended

for this program. A large issue was also the lack of personnel. According to Crespo, between April 2020 and April 2022, the fraud hotline of the SBA received millions of calls, of which a large number went unanswered.

“The vulnerabilities that led to the issues with PPP fraud weren’t really attributable to things at the state level. I would say that the issues had far more to do with the unaccountable nature of the program itself,” said State Rep. Mike Kelly, D-Chicago, who co-sponsored the bill.

IDHS employees have been heavily involved in the fraud. Since 2022, at least 43 employees have been discharged and 53 resigned before further action by management. In most cases on the OEIG website, the employees either lied about being self-employed or provided false information about their income.

Records show Deborah Reynolds-Jones was a human services caseworker who had been working for the IDHS since 2016. ReynoldsJones told OEIG investigators that her barber recommended a company that could help her apply for the loan. She sent the company her personal information, including her Social Security number. The company filled out the form and simply asked her to sign. The information was inaccurate. Reynolds-Jones paid the company $3,000 for their service after she fraudulently received a $20,000 PPP loan.

In another case, Shanythia Anderson admitted to the OEIG that she allowed a third party to apply for a PPP loan on her behalf and that the information provided was inaccurate. She began working as a mental health technician at IDHS in 2020. Anderson met a woman on Facebook, and she sent her personal records. In exchange for this service, the woman was to receive half of her loan, $10,000. Anderson worked at the Ludeman Development Center in Forest Park, where at least 36 other employees were accused of wrongdoing.

“It happens that in one particular location when you find out there are 37 people that have done this, they’ve obviously been talking to one another at work,” Gov. JB Pritzker said in a news conference last year. “Maybe somebody committed this kind of fraud and then tried to convince somebody else.”

IDHS declined to comment on why so many of its employees were implicated. IDHS is the largest public agency in Illinois, which could be one explanation. Crespo said that his best guess was that public employees had early access to the loan forms, so it was easier for them to understand how to file them, fraudulently or not.

“While the vast majority of IDHS’ roughly 14,000 State employees are hard-working people of strong character who work tirelessly to help the most vulnerable, it is deeply concerning

any time an employee takes advantage of public programs,” IDHS said in a statement. Other state agencies where the OEIG found multiple cases of PPP fraud included the Department of Corrections (31 cases), the Department of Children and Family Services (27), Pace (10) and the Department of Healthcare and Family Services (8).

The OEIG, through the Executive Ethics Commission, publishes reports of wrongdoings only if there is proof of employee misconduct. It can refer cases to the Attorney General if the fraud is significant enough. The Attorney General, specifically the Public Integrity Bureau, then conducts its own investigation in order to prosecute involved public employees. Many cases mentioned third parties who applied for the PPP loan on behalf of an individual. The DOJ has gone after some of these third parties in Illinois, but it’s unclear that these are the same third parties that helped public employees.

There are severe consequences for PPP fraud. Knowingly declaring false statements to a financial institution can result in up to 30 years in prison or a fine of up to $1 million. Wire fraud, the use of the Internet or electronic communication to carry out fraud, is a federal crime that can be punishable by up to 20 years in prison.

Dr. Lee specializes in treating a wide array of spinal disorders and conditions.

A fellowship-trained surgeon and awardwinning researcher, he’s here to help you achieve the best outcome and improve your quality of life.

• Adult and pediatric scoliosis and spinal deformity

• Age-related degenerative arthritis

• Spinal stenosis

• Disc herniation

• Revision spinal surgeries

Schedule an appointment in Westchester or Chicago.

patterns

from page 1

presidential elections in Proviso ranged from 69.3% in 2020 to 73.7% in 2008. The clerk’s online election data doesn’t clearly show township turnout rates for elections after 2008.

The story in Proviso Township mirrors what happened in other places where the election wasn’t contested.

“Turnout dropped from 2020 in noncompetitive states such as Illinois, which recorded more than 500,000 fewer votes than in the last presidential election, and Ohio, which reported more than 300,000 less,” the Associated Press reported.

Proviso precincts in Northlake, Maywood, and Melrose Park experienced the lowest voter turnout in the township (some Melrose Park and Northlake precincts are in Leyden Township).

Northlake’s Proviso voter turnout was 50%, up from 47.8% in 2020 but down from 59.2% in 2016. Maywood’s voter turnout was 53.6%, around 6% lower than 2020 and 13% lower than 2016. In Melrose Park’s Proviso precincts, voter turnout averaged 56.7%, down from 61.8% in 2020 and 67.7% in 2016. In one Proviso precinct in Melrose Park, turnout was as low as 41.9%.

Westchester had the highest voter turnout among the nine suburbs covered by Village Free Press, but the village’s 71.6% turnout rate was still around 3% lower than in 2020 and 2016.

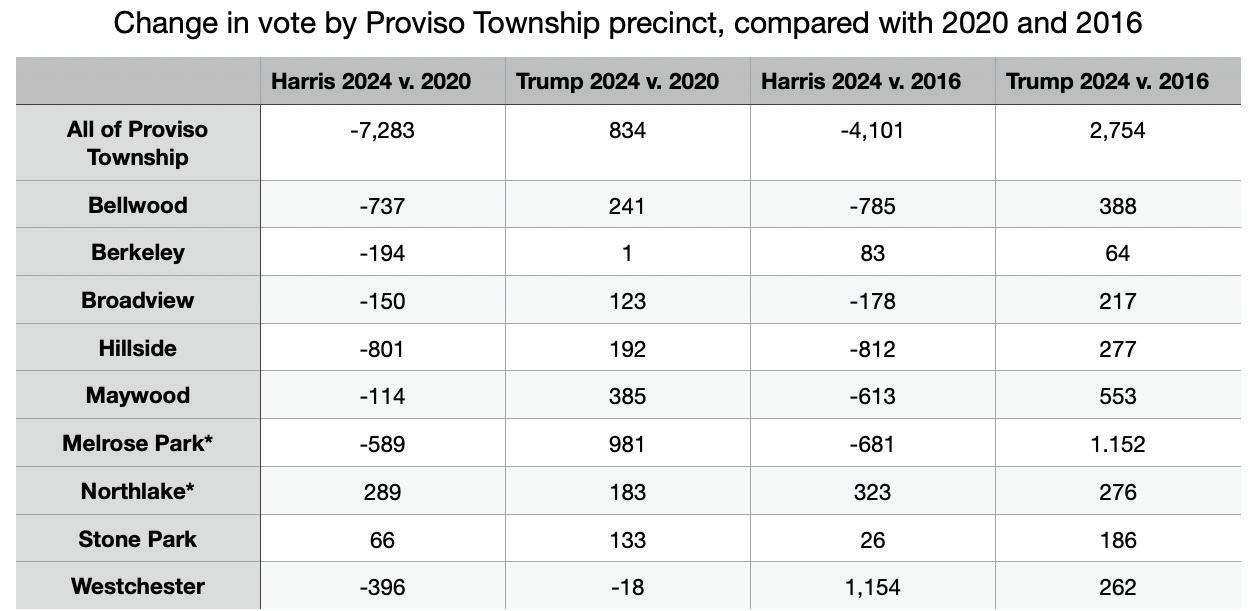

In Proviso, support for Vice President Harris was lower than for President Joe Biden in 2020 and Hillary Clinton in 2016. Harrison won Proviso 75.1% to Trump’s 23.7%, three points lower than the 78% garnered by Biden and Clinton. That translates into 7,283 fewer votes in Proviso than Biden and 4,101 fewer votes than Clinton.

Meanwhile, Trump’s vote share in Proviso increased by 3.5% over his 2020 performance and 5.3% over his 2016 performance. The biggest shifts toward Trump in Proviso were in Maywood and Melrose Park, suburbs with heavily Black and Hispanic populations.

A chart showing the change in votes in Proviso Township precincts in the nine Village Free Press suburbs. Note that not all Melrose Park and Northlake voting precincts are in Proviso Township, so those totals don’t reflect all of those suburbs’ votes.

In Melrose Park’s Proviso precincts, Trump gained 981 voters in 2024 over his 2020 level while Harris lost 589 voters. Trump even won two Proviso precincts in Melrose Park that went overwhelmingly for Biden in 2020 and Clinton in 2016. In Maywood, Trump gained 385 voters while Harris lost 114.

The pattern is consistent with election analysis showing support for Trump up nationally among some Blacks and Hispanics. An NBC analysis of census data showed a rightward shift of Black voters in the South and counties with large Black populations. The analysis also found that areas with “high concentrations of high school graduates saw some of the steepest Democratic declines.” And an Edison Research exit poll showed Trump’s support among Hispanic voters up 14% from 2020, Reuters reported.

Proviso Township’s voting shifts also reflected what’s happening in urban areas like New York City.

“Donald J. Trump won 30 percent of the

votes cast in New York City this month,” the New York Times reported. “It was a sevenpoint jump from his performance in 2020, and a higher share of the vote than any Republican nominee has won in the city since George H.W. Bush in 1988. But his improved vote share was driven more by the votes Democrats lost than by the votes he gained.”

Statewide, Harris is ahead of Trump 54.8% to 43.8%. Biden won Illinois by around 17% in 2020. Clinton won the state by around 16% in 2016.

The Associated Press reported that more than 153 million ballots were cast in the U.S. during the Nov. 5 Presidential Election, “with hundreds of thousands more still being tallied in slowercounting states such as California. When those ballots are fully tabulated, the number of votes will come even closer to the 158 million in the 2020 presidential contest, which was the highest turnout election since women were given the right to vote more than a century ago.”

Trump, who won 312 Electoral Votes to Harris’s 224, leads in the popular vote by around 2.5 million votes. The Cook County clerk must certify election results before Nov. 26. The state must certify Illinois election results by Dec. 6.

DATE 11/27/24

REVENUE SUMMARY:

PROPERTY TAXES - GENERAL FUND

$3,516,506.77 - PROPERTY TAXES - FIRE PROTECTION $641,249.75 - PROPERTY TAXESSTREET & BRIDGE $207,903.28 - PROPERTY TAXES - LIABILITY INS $512,681.61 - PROPERTY TAXES - FIRE PENSION

$1,992,113.48 - PROPERTY TAXES - POLICE PENSION $1,596,738.01 - PROPERTY TAXES - AUDITING

$65,422.61 - PROPERTY TAXES - POLICE PRTCTN

$641,249.77 - SALES TAXES

$5,185,894.58 - UTILITY TAXELECTRIC $515,100.27 - UTILITY TAX - GAS $201,442.12 - UTILITY TAX - TELEPHONE $156,638.35ALARM SYSTEM FEES - ADT $25.00 - CABLE SERVICES $81,032.91 - VIDEO GAMING TAX $195,882.43 - AUTO RENTAL TAX $267.58 - USE TAX

$318,067.61 - STATE INCOME TAX

$1,364,370.72 - REPLACEMENT TAX

$1,622,162.03 - LIQUOR LICENSES

$46,600.00 - BUSINESS LICENSES

$110,807.29 - VEHICLE LICENSES

$77,002.85 - DOGS AND CATS TAGS

$1,350.00 - PARKING LOT REV $5,604.70 - CONTRACTORS REGISTRATION

$53,100.00 - BUILDING PERMITS

$656,185.53 - ELECTRICAL PERMITS

$50,082.00 - PLUMBING PERMITS

$92,125.50 - OCCUPANCY INSPECTIONS

$72,380.84 - BLDG - TRANSFER FEES

$19,175.00 - ZONING FEES $2,200.00 - HEALTH INSPECTIONS $11,525.00TRAFFIC FINES $124,600.74PD ADJUDICATION $550.00 - POLICE DEPT COMPLIANCE VIOLATION $270.00

- LDING DEPT CODE VIOLATIONS

$53,750.00 - INFRASTRUCTURE

LOCATION AND FEES $32,000.00 - GARAGE SALES PERMIT FEE $380.00HOSPITAL MEDICAL BILLINGS $4,750.00

- LOYOLA-HOSP MEDICAL

$463,165.50 - HINES-HOSP MEDICAL

$77,164.98 - FIRE SUPPRESSION SERVICES $26,402.50 - LOYOLA-FIRE SUPPRESSION $166,975.00HINES-FIRE SUPPRESSION $154,462.50MADDEN-FIRE SUPPRESSION $37,650.00 - AMBULANCE CHARGES $1,931,620.90INTEREST INCOME

$437,671.12 - INTEREST INCOME-AUXILARY PUB WKS $22,062.30 - REIMBURSEMENT OF VILLAGE EXPENSE

$259,141.76 - GRANT FUNDS REC’DILLINOIS $341,150.00 - GRANT FUNDS REC’D - FEDERAL $17,091.36 - GRANT FUNDS REC’D - OTHER $250.00 - POLICE MISC. REVENUE

$138,084.97 - POLICE OVERTIME REIMBURSEMENT $5.00 - OPERATING TRANSFERS IN $2,351,553.54CR - OPERATING TRANSFERS OUT $976,675.00CROSSING GUARD (LINDOP) $16,000.00

- ALARM SYS REBATES $15,035.00 - VACANT BUILDING REG $4,000.00 - TOWING AND STORAGE $57,210.00FIRE DEPT MISC REVENUES $8,060.75 - MISCELLANEOUS $115,901.75 - RUBBISH BILLINGS $660,340.20 - PENALTIES

$73,024.39 - MOTOR FUEL TAX (STATE) $350,920.89 - NEW DEBT ISSUANCE - BONDS $2,225,000.00 - WATER TOWER RENTERS $1,800.00 - WATER SALES $4,422,423.68SEWERAGE CHARGES $376,783.49 - WATER METER SALES $17,012.50 - ADMIN FEE - SHUT OFF LIST $530.00 - MISCELLANEOUS $800.00 - TOTAL REVENUES: $31,272,050.33.

EXPENDITURE SUMMARY: 1-800MD, LLC $3,906.00 - 911 TECH, INC. $2,782.00 - AA RENTAL CENTER

$2,734.60 - ACTIVE INTERNET TECHNOLOG

$5,443.00 - ADMIN. CONSULTING SPECIAL $28,000.00 - AERO REMOVAL SERVICE $4,475.00 - AIR ONE EQUIPMENT, INC. $21,834.46 - A LAMP CONCRETE CONTRACTO $121,905.00AL PIEMONTE FORD SALES, I $2,601.00 - ALPHA PRIME COMMUNICATION

$3,126.00 - AL WARREN OIL CO. INC. $92,016.99 - AMAZON CAPITAL SERVICES, $6,586.57 - AMERICAN TRADE MARK, CO. $2,810.00 - APPLE CHEVROLET OF TINLEY $68,370.53 -

ARTISTIC ENGRAVING $4,298.50 - AT&T

$129,698.79 - AT&T CWO $21,291.41AXON ENTERPRISE, INC. $6,761.16BARCO PRODUCTS CO.

$12,881.96 - BARRY SLATER, INC.

$17,250.00 - BELLWOOD ELECTRIC MOTORS, $7,600.00 - B&F CONSTRUCTION CODE SER $211,373.18 - BIG BLUE BOXES $4,130.00 - BIG TENT EVENTS, INC. $8,739.14 - BLUE CROSS BLUE SHIELD OF $1,708,310.69 - BOUND TREE MEDICAL, LLC

$5,751.35BROADVIEW FIRE PENSION

$43,889.40 - BRISTOL HOSE & FITTING, I $4,710.30 - BROADVIEW HARDWARE, INC.

$6,338.50 - BROADVIEW POLICEPENSION $30,136.96 - BROADVIEW PUBLIC LIBRARY $212,279.01 - BROADVIEWWESTCHESTER JOI $4,014,114.54 - BUDDY BEAR CAR WASH/GAS P

$3,238.00 - BUILDERS PAVING, LLC

$1,122,051.70 - CARGILL, INC. $43,805.07 - CASE LOTS, INC. $6,860.70 - CDS OFFICE TECHNOLOGIES

$26,168.40 - CHRISTOFANO EQUIPMENT CO, $6,824.09 - CINTAS $9,617.49 - CIORBA GROUP $67,431.50 - CITY WIDE FACILITY SOLUTI

$8,140.76 - COMED $58,712.65 - COMCAST BUSINESS $50,543.99 - COMCAST $25,023.71 - CONTRACTORS EQUIPMENT REN

$2,745.00 - COOK COUNTY GOVERNMENT $25,000.00 - COLLEGE OF DUPAGE $18,784.00 - COOK COUNTY DEPT. OF PUBL $4,900.00 - COPS & FIRE PERSONNEL TES $13,978.68CORPORTATE CLASS, INC. $16,950.00 - TECHNOLOGY MNGMT REVOLVIN

$14,934.84 - COMMERCIAL TIRE SERVICE $10,090.22 - GROOT, INC.

$50,716.26 - DAVEY RESOURCE GROUP $18,000.00 - DAVIS BANCORP, INC. $4,037.00 - DAVID ORMSBY, INC.

Village of Broadview ANNUAL TREASURER’S REPORT PERIOD ENDING 04/24

ALYSSA,NEELY, JALEN,CHAVEZ, FABIOLA,MOORE, JAMEL,STAPLETON, AARON,DAVID, JARRELL,ORR, ARIELLE,STEPHENS, BROOKLYN,SHAVERS, DESHAUN,WILLIAMS, ZAIDA,WASHINGTON, BENNIE,ESPINOSA, GABRIELA,GRIMM, SCOTT,STEGALL, ARMONZO,HUMPHREY, MARCUS,LOVE, BREENA,WILLIS, SHED,CONFORTI, DANIEL,DANIEL, TAYLOR,KYLES, TIMOTHY,SANTUCCI, ANTONIO,HALL, CLIFTON, ABRAHAM, JUDY,MILLER, JUDY,SENIOR, ANDREA,ARMOUR, SHEILA,CHAOMALAVE, PATRICIA,SHELBY, JARRY,VAZQUEZ, AMADOR,HERRON, EVA,PICARDI, CHARLES,SHED, JOYCE,TORRES, MARK,HENDERSON, JAMES,NEAL, IVORYANA,ALFARO-PENA, LESLIE,ROMAN, LITZY,KLAMER, KENNETH,JENKINS, DWAYNE, CIELOCHA, CHRISTOPHER,MCGRIER, KEVIN,BARBER, WESLEY,WESTBROOK, TOMMY,STARLING-BITOY, LAVETTE,MILLER, ASHLEY,MITCHELLSANDERs-SHANTAY

,WEBB, CHARLES,RUCKER, JERMAINE,CALVILLO, CARMEN,HICKS, TREVOR,PORTILLO, JENNIFER,ORTEGA, JONATHAN - Between $25,000 and $49,999STRAUGHTER, DERRICK,JOHNSON, DENNIS,URIBE-HERNANDEZ, LUIS,MOBLEY, LASHAE,MURPHY, KRISTINE,SIERRA, TIFFANY,COOK, CATHY,SIERRA, SOBEIDA ,BRYANT, DEREK - Between $50,000 and $74,999 - NAUGLE, DAVID,BUCHANAN, YARA,BUSTOS, EDUARDO,AMES, JASON,HUDSON, SANDRA,DELK, TIARA, DIEGO, ANGELICA,HANNAH, AARON,THOMPSON, KATRINA,ALBRITTON JR, RAYMOND,SCALISE, DAVID,GENER, GILMAR,RADASZEWSKI, LINDY,BUSH, SPANISH ,PAOLONI, MELISSA,SCHNEEBERGER, ZACHARY - $75,000 and $99,999 - PAJEWSKI, MARK,WADE, DEMETRIUS,SANTUCCI, JENNIFER,JONES, LETISA,GLENN , JEFFREY,AKYOL, KAMURAN,GREVE, JAKE,DALTORIO, GIANNI,LEE, RYAN,WALKER, EDCAR,NEWTON, JAKE,BOKUS, COLE,TOLEDO, JOSE,REYES, FRANCISCO,

GARCIA, JUAN - Between $100,000 and $125,000 - GONIA, TRACY,AMES, MATTHEW,TRINER, CORY,KOSMOWSKI, PATRICIA,LANZIROTTI, DUNCAN,LATELLE , ROBERT,UPSHAW, DAVID,MARBACH, JOSEPH,SCAFIDI, MARTIN,ARMSTRONG, JOHN,FABISZAK, RYAN,McMAHON, NEIL,MCILVENNY, SEAN,COHEN, DAVID,SANTOS , JOSE,STEVENS, ALEC,SMITH, PIERRE,NAPOLI, VINCENT,HOOD, THOMAS,SCHAER, STEVEN,ANAYA, GUILLERMO,SCHAER, CHARLES - Over $125,000 - MARTIN, MATTHEW,JOHNSON, BRANDY,AKIM, MICHAEL,YURKOVICH, DAVID,SCHODTLER, NICHOLAS,CHAPP, MATTHEW,McGIVNEY, PATRICK,WILLIAMS, SHELTON,BRICHTA, ZACHARY,GALVAN, GUSTAVO,GRZYMKOWSKA, BEATA,MILLS, THOMAS,CARLSON, MICHAEL,FLORENTINO, IAN,MATHEW, TONY

Published in Village Free Press November 27, 2024

$39,000.00 - DEARBORN LIFE INSURANCE, $18,091.03 - DEL GALDO LAW GROUP, LLC $167,895.12 - DONALD BERO

$3,204.00 - DOOR SYSTEMS

$49,093.63 - ECO CLEAN MAINTENANCE, IN $20,032.00 - EDWIN HANCOCK ENGINEERING $490,607.47 - ELECTRICAL RESOURCE MGMT.

$13,200.00 - ELEVATED SAFETY

$4,140.16 - EMPLOYEE RESOURCE SYSTEMS $2,526.30 - EQUIPMENT MANAGEMENT, CO. $30,353.00 - ESO SOLUTIONS, INC. $6,240.81 - FACTORY MOTOR PARTS $3,488.67 - FEDERAL RENT A FENCE $2,510.76 - FIRST FENCE $4,370.00 - FIRE SERVICE, INC.

$91,725.76 - FIVE ALARM FIREWORKS, CO. $8,500.00 - FLOCK GROUP, INC. $28,038.01 - FOX VALLEY FIRE & SAFETY $3,823.60 - GALENA CHRYSLER $85,358.00 - GINO’S HEATING & PLUMBING $481,724.66GRASSO GRAPHICS, INC. $5,451.39AIRGAS USA, LLC $5,409.52 - HOME DEPOT USA, INC. $44,571.00CORE & MAIN LP $37,098.36 - HEALTH ENDEAVORS, SC $2,500.00 - HERITAGE BROADVIEW, LLC $101,647.91 - H&H ELECTRIC COMPANY $22,382.09 - HOME DEPOT CREDIT SERVICE

$5,103.94 - HOME DEPOT CREDIT SERVICE $17,979.78 - ILLINOIS COUNTIES RISK MN $721,287.50 - IL SECTION AMER. WATER WO $3,375.00 - IMAGETREND $4,182.50 - IWORQ SYSTEMS, INC.

$3,500.00 - JAMES HOWARD $3,204.00CLAUDIA HUMMEL $3,204.00 - JAMES Q BRENNWALD $3,150.00 - LINCOLN NATIONAL LIFE INS $72,072.89JJ EFFECT, INC. $7,375.00 - JOHN WILK COMMUNICATIONS, $4,291.00 - JOHN R RODGERS $3,204.00 - JOSEPH L. PONSETTO $23,010.00 - JX TRUCK CENTER-ELMHURST $9,145.45KATRINA THOMPSON

$3,075.85 - KEITH CALDWELL $6,650.00K-FIVE HODGKINS, LLC $6,400.00 - KONICA MINOLTA PREMIER FI $15,252.00KONICA MINOLTA BUSINESS $7,957.70 - LANDMARK SIGN GROUP $25,696.96 - LEADS ONLINE, LLC $3,081.00 - LEAHY WOLF CO, INC. $4,406.05 - LECHNER SERVICES $3,776.74 - LEXIPOL, LLC

$9,672.15 - LOCIS $8,198.00 - LOYOLA EMS $2,623.20 - MABAS DIV 20 $7,000.00 - MASTERS IRRIGATION

CO. $15,245.71 - MECA TREE SERVICE, INC. $2,500.00 - MERCURY SYSTEMS CORP. $23,078.96 - MID AMERICAN WATER $50,645.25 - MIDWEST911, INC. $44,724.35 - MIDWEST FENCE CORP. $15,606.00 - MIDWEST MECHANICAL $7,240.95 - MIDWEST PAVING EQUIPMENT, $42,665.00 - MICHAEL J. KASPER $2,964.00 - MONTANA & WELCH, LLC $41,650.49 - MULDER’S COLLISION CENTER $6,972.08 - MURPHY’S TRANS & COMPLETE $8,857.57 - NAFISCO, INC. $22,695.40 - NATIONAL HOSE TESTING SPE $4,983.00 - NORTH EAST MULTI-REGIONAL $4,330.00 - NICOR GAS $17,886.22 - NORTHERN ILLINOIS POLICE $3,380.00 - NORCOMM PUBLIC SAFETY COM $6,411.00 - NORTHWESTERN UNIVERSITY $4,500.00 - O’REILLY AUTOMOTIVE,INC. $9,393.17 - ORLANDO LAWN SERVICE $7,150.00 - OTTOSEN DINOLFO HASENBALG $15,151.00 - PACE SYSTEMS, INC. $3,360.00 – PAMPERED PRINCESS SPA $30,000.00 - PARAMEDIC BILLING SERVICE $59,537.02 - PATINO’S MUSIC, LLC $3,015.00 - PAYLOCITY $16,788.19 – PETROLEUM TECHNOLOGIES EQ $14,648.70 - PITNEY BOWES PURCHASE POW $9,390.34 - PIPE VIEW LLC $2,920.00 - PIPE VIEW, LLC $2,555.00 - PITNEY BOWES GLOBAL FIN. $3,573.60 - POLICE LAW INSTITUTE $4,640.00 - PRECISE DIGITAL PRINTING,$3,155.00 - PRINTING ARTS $7,110.02 - PUBLIC SAFETY DIRECT, INC $5,039.83 - RAY O’HERRON CO., INC. $29,674.63 - REGIONAL RUCK EQUIPMENT, $9,735.00 – RESTORE CONSTRUCTION, INC $6,325.00 - RJN GROUP, NC. $18,900.00 - VILLAGE OF ROMEOVILLE FIR $6,975.00 - RUSH TRUCK CENTER,CHICAGO $13,426.66 - RUSSO’S POWER EQUIPMENT,$19,708.83 -SAM’S CLUB DIRECT $5,206.22 - AT&T LONG DISTANCE $20,489.06 – SBC WASTESOLUTIONS $483,752.04 - SCHAAF EQUIPMENT CO., INC $4,501.71 - SECURITAS TECHNOLOGY CORP $10,271.16SERVICE SANITATION, INC. $2,830.00 - SERVPRO OF LAGRANGE PK/N. $11,863.24 - SEVEN GENERATIONS AHEAD $58,569.00 - SHERWIN-WILLIAMS CO. $8,079.05 – SITEONE LANDSCAPE SUPPLY $13,598.84 - SOUTH CENTRAL CAPITAL GRO $6,875.00 - SPECIALTY MAT SERVICE $6,905.11 - STAPLES $10,413.85 -STERICYCLE, INC. $9,285.18 - STP TRANSPORT $16,565.00 - STROB CORPORATION $20,000.00 - TARGETSOLUTIONS LEARNING, $3,357.40 - TERMINAL SUPPLY CO. $13,945.04 - TESKA ASSOCIATES, INC. $10,257.50 - THE ABOVE AVERAGE SCHOOL $4,200.00THE FIRE OFFICER TRUST $3,000.00 - THIRD MILLENNIUM $22,018.39 - TIERPOINT, LLC $38,643.21 - TNT TOWING & RECOVERY, IN $9,600.00 - TOTAL PARKING SOLUTION, I $7,776.45 - TRANE US, INC. $63,940.50 - TRENCHDRAIN SUPPLY

$4,358.00 - TRIPLE CROWN PRODUCTS

$4,915.85 - TRIGGI CONSTRUCTION, INC. $554,606.00 - UNIFIRST $6,422.95US POSTMASTER $10,974.00 - UTILITY SERVICE CO., INC. $97,086.00 - VALOR SYSTEMS, INC.

$31,248.00 - VEN SHERROD & ASSOCIATES $3,800.00 - VERIZON WIRELESS

$23,759.72 - VICTORY MEDIA GROUP LTD. $2,759.05 - BAKER TILLY US, LLP $102,290.00 - WEST COOK COUNTY SOLID WA $168,604.17 - WEST CENTRAL MUNICIPAL CO $14,447.80WHOLESALE DIRECT, INC.

$9,910.78 - WILLIAM RADKIEWICZ

$9,731.02 - WOODLAKE OCCUPATION

HEALT $3,986.00 - ZEIGLER FORD NORTH RIVERS $59,195.56 - All other Disbursements Less Than (2500.00)

$170,700.72 - TOTAL VENDORS: $13,958,804.60.

SUMMARY STATEMENT OF COMPENSATION Under $25,000 - OWENS, AMARI,MORENO, KARINA,KRYGOWSKI, SARAH,HILL, ERICA,HOWERY, JAYLEN,RENDON, SAMANTHA,TURNER, SARAE,ALLEN, ROBERT ,LASCHIAZZA, FRANK,NEELY, CAMERON,PHILLIPS, JENAE,EDWARDS,

PUBLIC NOTICE

NOTICE OF PROPOSED REAL ESTATE TAX LEVY PUBLIC HEARING FOR THE VILLAGE OF MAYWOOD FOR YEAR 2024

I. A public hearing to approve a proposed real estate tax levy increase for the Village of Maywood for Tax Levy 2024 will be held on Tuesday, December 10, 2024 at 7:00 p.m. in the Village Council Room located at 125 South 5th Avenue, Maywood, Illinois 60153.

Any person desiring to appear at the public hearing and present testimony to the taxing district may contact the Village Clerk at 40 East Madison Street, Maywood, Illinois 60153, phone number 708-450-6360.

II. The corporate and special purpose real estate taxes extended or abated for 2023 were $24,721,430.00.

The proposed corporate and special purpose real estate taxes to be levied

for 2024 are $26,056,277.00. This represents a 5.4% increase over the previous year.

III. The real estate taxes extended for debt service and public building commission leases for 2023 were $0.00.

The estimated real estate taxes to be levied for debt service and public building commission leases for 2024 are $0.00. This represents a 0.00% decrease / 0.00% increase over the previous year.

IV. The total real estate taxes extended or abated for 2023 were $24,721,430.00.

V. The estimated total real estate taxes to be levied for 2024 are $26,056,277.00. This represents a 5.4% increase over the previous year.

All hearings shall be open to the public. The corporate authorities of the Village of Maywood shall explain the reasons for the proposed increase and shall

permit persons desiring to be heard an opportunity to present testimony at the Tuesday, December 10, 2024 public hearing, within reasonable time limits as the corporate authority determines.

VILLAGE OF MAYWOOD Tori-Love Garron Village Clerk

Published in Village Free Press November 27, 2024

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION

U.S. BANK TRUST NATIONAL ASSOCIATION, NOT IN ITS INDIVIDUAL CAPACITY BUT SOLELY AS OWNER TRUSTEE FOR VRMTG ASSET TRUST

Plaintiff, -v.-

DEBBIE CALDWELL, SUE LOMBARDO A/K/A SUSAN LOMBARDO, SAM LOMBARDO A/K/A SAMUEL LOMBARDO, DEBBIE LOMBARDO A/K/A DEBRA J. LOMBARDO, GIANNA M. LOMBARDO, UNITED STATES OF AMERICA - SECRETARY OF HOUSING AND URBAN DEVELOPMENT, UNKNOWN HEIRS AND LEGATEES OF SAMUEL M. LOMBARDO, UNKNOWN OWNERS AND NONRECORD CLAIMANTS, GERALD NORDGREN, AS SPECIAL REPRESENTATIVE FOR SAMUEL M. LOMBARDO (DECEASED)

Defendants 2024 CH 03656

600 N. IRVING AVENUE HILLSIDE, IL 60162

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on October 29, 2024, an

agent for The Judicial Sales Corporation, will at 10:30 AM on December 16, 2024, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 600 N. IRVING AVENUE, HILLSIDE, IL 60162

Property Index No. 15-07-406-0200000

The real estate is improved with a single family residence.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale. Where a sale of real estate is made to satisfy a lien prior to that of the United States, the United States shall have one year from the date of sale within which to redeem, except that with respect to a lien arising under the internal revenue

laws the period shall be 120 days or the period allowable for redemption under State law, whichever is longer, and in any case in which, under the provisions of section 505 of the Housing Act of 1950, as amended (12 U.S.C. 1701k), and subsection (d) of section 3720 of title 38 of the United States Code, the right to redeem does not arise, there shall be no right of redemption.

The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4).

If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW.

You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order

to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff’s Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 794-9876 THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales. CODILIS & ASSOCIATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100 BURR RIDGE IL, 60527

630-794-5300

E-Mail: pleadings@il.cslegal.com

Attorney File No. 14-24-00624

Attorney ARDC No. 00468002

Attorney Code. 21762 Case Number: 2024 CH 03656 TJSC#: 44-2943

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose.

Case # 2024 CH 03656 I3255309