Former Westchester Trustee, Acting Mayor Says He’s Ready To Rest

Nick Steker, who has been in public service since 2002, left the village board earlier this year

BY MICHAEL ROMAIN Editor

Nick Steker knows a thing or two about Westchester politics. Steker, 47, started his public life in his mid-twenties when he was appointed to the Zoning Board of Appeals. He served there for three years. He also served four years on the Westchester Public Library board and the Police and Fire Commission before being elected a trustee in 2009. He was acting village president from 2022 to 2024. Steker, a longtime Franklin Park firefighter, said he decided against running for another term as trustee to spend more time with his wife, Kathryn, a teacher, and their two daughters, Tegan,8, and Adelyn, 7. He sat down with me a few weeks back to share his thoughts on his many years in public service. The following are excerpts from that conversation.

On

his

proudest moments on the village board

One of my proudest experiences is all the infrastructure work we did. That was a long time coming and helped our property values. The work was important for the long-term sustainability of the community. That was huge. People’s alleys got paved. We made major water system improvements. It was also a difficult decision to put money into

vfpress.news

Public Transit Agencies Begin Planning For ‘Doomsday’ Funding Scenario

Worst impacts avoidable if state lawmakers offer

By ANDREW ADAMS Capitol News Illinois

CHICAGO — Transit agency officials in Chicagoland met last week and formally began the process of planning for next year’s budget, including drawing up plans for major service cuts and potential layoffs.

It’s the latest chapter in an ongoing fight between public transit officials and state lawmakers over funding. Public transportation agencies’ federal COVID-19 relief funds are set to run out in 2026. Despite the funding, ridership on buses and trains still hasn’t

reached prepandemic levels.

Now, transit agencies running buses and trains in northern Illinois are facing a $771 million annual combined budget gap, and lawmakers did not pass funding reform legislation by a critical May 31 deadline.

While House Speaker Emanuel “Chris” Welch told Capitol News Illinois earlier this month that lawmakers “have time” to handle the situation, transit officials told a very different story at two meetings this week.

“We have told everyone they needed to act by May 31st or else,” Regional Transportation Authority board member Tom Kotarac

said at a board meeting Thursday. “We are in the ‘or else’ phase.”

Officials at the RTA laid out a plan Thursday to handle the monetary uncertainty: create two budgets. In one scenario, budget planners assume the gap is filled, and agencies can move forward with the rough plan approved late last year.

“But we cannot operate on assumptions and pledges of good faith and promises. We just can’t, legally,” RTA government affairs director Rob Nash said.

CAPITOL NEWS ILLINOIS PHOTO BY ANDREW ADAMS

The board of the Chicago Transit Authority meets June 12 at the agency’s downtown Chicago headquarters.

Publisher/CEO

Michael Romain

Chief Operations Officer Kamil Brady

Creative Designer Shanel Romain

HOW TO REACH US

John Wilk Communications, LLC

3013 S. Wolf Rd. #278

Westchester, IL 60154

PHONE: (708) 359-9148

VFPress.news

TWITTER: @VILLAGE_FREE

FACEBOOK: @MAYWOODNEWS

Understanding Cook County Property Taxes: A Guide for Homeowners

Navigating the complexities of the property tax system in Cook County can be daunting for homeowners. I hope that this column makes it less intimidating by breaking down a complex process into simple concepts.

determine their revenue requirements and submit revenue requests to the Cook County Clerk’s Office. Those requests are called tax levies.

Cook County Clerk Calculates Tax Rates

The Assessment Process

The Village Free Press is published digitally and in print by John Wilk Communications LLC. The print edition is distributed across Proviso Township at no charge each week. © 2025 John Wilk Communication LLC

Property taxes in Cook County are based on the assessed value of a home, business or land. The Cook County Assessor’s Office determines this value through an assessment process, which occurs every three years. The goal of the assessment process is to ensure that property values reflect current market conditions.

The Appeals Process

MARIA PAPPAS

Cook County Treasurer

If a homeowner believes a property’s assessment is too high, he or she has the right to appeal. Appeals can begin with the Assessor’s Office and proceed to the Cook County Board of Review, or property owners can appeal directly to the Board of Review. A successful appeal can lower a property’s assessed value and ultimately the tax bill for the property owner.

Illinois Department of Revenue Creates EAV

Illinois then gets involved when the Department of Revenue applies a number called the State Equalization Factor, commonly called the multiplier. That number is applied so assessments across the state are standardized. The Equalized Assessed Value or EAV ensures that all 102 Illinois counties similarly determine property tax values, so no county is over or under-taxed.

Taxing Districts Set Their Funding Requests

After assessments are finalized, local taxing districts, such as school boards, park districts and municipalities must

The Cook County Clerk next calculates tax rates by dividing the requested levy amounts by the total assessed value of all properties in the taxing district. These rates are then applied to individual properties to determine the amount of property tax owed.

Treasurer’s Office Sends Bills

Once assessments and tax rates are set, property tax bills are sent by my office. The 1.8 million bills are mailed in two installments: the first is due in March and is always 55% of the previous year’s total tax, while the second installment is typically due in August and reflects any changes from exemptions or appeals. Homeowners should carefully review the bills to ensure all exemptions or reductions have been applied.

Resources for Homeowners

The Cook County Treasurer’s website offers a wealth of resources to assist homeowners. Go to CookCountyTreasurer.com to access your property tax information, check for available refunds and learn about possible missed exemptions. Additionally, the Treasurer’s Office provides tools to help manage payments effectively.

The property tax system in Cook County may seem complex, but understanding its components and the offices involved can help homeowners ensure they’re paying their fair share and are taking advantage of available savings. Utilizing the resources provided by my office can be a step toward financial well-being.

TRANSIT

Funding problems

from page 1

The RTA board formally asked the agencies it oversees — the Chicago Transit Authority, Metra commuter rail and Pace Suburban Bus — to prepare a budget that assumes no new funding from Springfield before the end of the year. This means a roughly 20% reduction from what the agency expected.

Multiple RTA officials called it the “doomsday” scenario. RTA Chief Financial Officer Kevin Bueso said it would require “catastrophic” cuts. CTA acting President Nora Leerhsen told the CTA board on Wednesday that it was “severe and sobering for all of us and hard to stomach.”

Under both plans, the RTA would institute fare increases in 2026 and administrative “efficiencies” to reduce costs in 2025. The RTA also plans to create an ad hoc task force to plan cuts and manage the year’s unusual budget process.

The austerity measures are not just a piece of political theater. The RTA, under state law, must tell service boards the amount of revenue that will be available to them by Sept. 15 each year and the boards must submit individual budgets based on that revenue. The oversight agency releases preliminary funding amounts for transit planners to use months earlier in July.

Leerhsen said the CTA will continue to operate with its current 2025 service plan, but that over the summer and into the fall, the agency will hold public hearings to “more specifically consider” the consequences of the fiscal cliff.

The September deadline is three weeks before the General Assembly’s fall session begins — the earliest that lawmakers are scheduled to meet.

But even if lawmakers meet in October and pass funding reform, officials said that missing their spring deadline has already guaranteed harmful effects.

“I don’t want to give anyone false hope that there is still any way to avoid some of these negative impacts,” RTA Executive Director Leanne Redden said. “The negative impacts are here, and now we’re going to have to all work together to mitigate the worst of those impacts for as long as possible while the legislature continues to do their work.”

Even if lawmakers pass a new funding mechanism, because of the time it takes to implement new policies, that money might not become available to transit agencies until next summer, either due to far off effective dates on any new laws or the delays of implementing new policies.

Delays in funding would, according to Nash, impose “costs, financial and otherwise, to the system and to riders.”

“We are likely to face a challenge in the first part of 2026 no matter what the General Assembly does at this point,” Nash said during

the Thursday RTA board meeting.

What’s next in Springfield

Over the past year, several proposals have been pitched in Springfield to address problems in Chicagoland transit agencies.

Two major proposals came from a coalition of environmentalists and labor unions. On Thursday, representatives of the Illinois Clean Jobs Coalition and Labor Alliance for Public Transportation, two groups that have occasionally disagreed on how to address transit agencies’ woes, released a joint statement.

The groups said the RTA’s Thursday meeting “unveiled the disastrous consequences of Springfield’s inaction” and called for lawmakers to meet this summer to address the problem.

“We cannot wait any longer — the General Assembly needs to avert further disaster and address the transit fiscal cliff with reforms and dedicated revenue, while working with existing agencies to ensure that we are investing in the future of our transit systems. The time to act is now,” the groups said.

While no proposal received close to the support it needed this spring, one bill made it through the Senate in the final hours of lawmakers’ legislative session.

That bill would have instituted several reforms that had been broadly agreed on, although not unanimous. Certain provisions laying out the balance of power on various boards were opposed by local governments. Its funding mechanism, however, ignited quick controversy. The provision that sparked the greatest opposition would have instituted a $1.50 tax on package deliveries except on orders of groceries and medicine.

That provision drew near-immediate opposition from businesses and interest groups with influential networks of lobbyists. The major tech lobbying group TechNet, along with Uber, Instacart, DoorDash, Chicagoland Chamber of Commerce and several retail industry groups, registered their opposition.

That bill was not considered in the House, and no bill with a similar funding mechanism was proposed in that chamber.

Paula Worthington, an economist and senior lecturer at the University of Chicago, told Capitol News Illinois that imposing a new tax like the delivery fee would be difficult.

“That is a heavy lift, procedurally, legally,” Worthington said. “You can’t just wave a magic wand.”

Worthington pointed to other states’ systems of transit funding that typically include “some elements of shared burden.” Other states have implemented a “commuter transportation mobility” tax on certain businesses, taxes on road users, or expanding taxes on ride sharing companies. Worthington said Illinois could consider those or other taxes during discussions over the summer to identify a solution.

“But those discussions now need to be out in the public,” Worthington said.

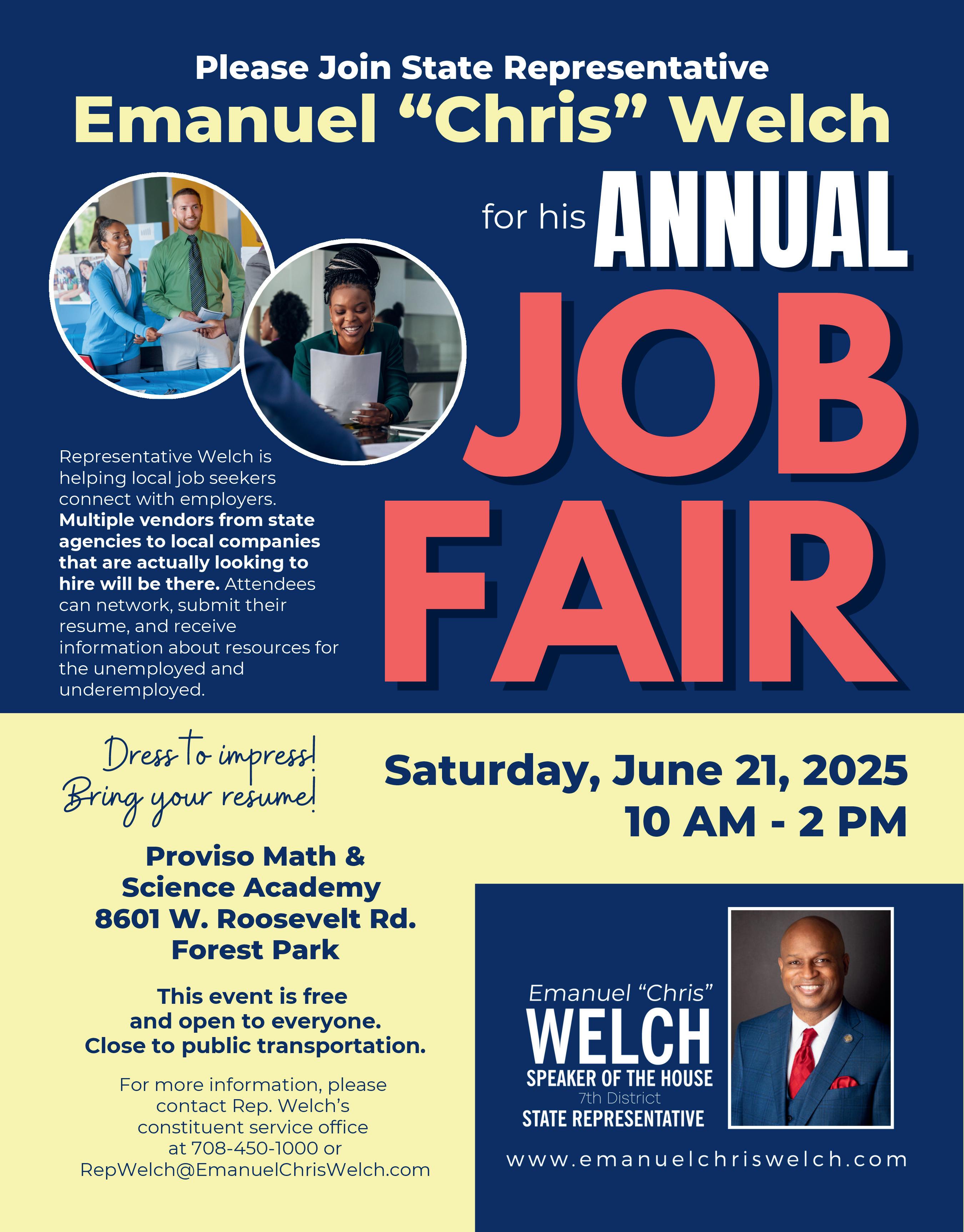

Speaker of the House and 7th District State Representative

Emanuel “Chris” Welch

Invites you to the 13th annual FREE

HEALTH FAIR

Free food, drinks & entertainment

SATURDAY, JULY 26, 2025

10 AM - 2 PM

proviso west high school | 4701 harrison st. in hillside

school & sport physicals will be available

Free school supply kids with essential items for the year

(First 200 families, one kit per family)

Get a head start on the new school year with a variety of local service providers offering important health and wellness resources for children and families.

Brookfield Zoo Ambassador Animals, Music, Free Raffle Prizes, Band Performances & Much More!

Erskine Reeves Barber Academy will be giving free haircuts! Special thanks to Amazon for their continued support. Special performance from Maywood Fine Arts Youth Band.

with his two daughters, Tegan, 8, and Adelyn, 7.

NICK STEKER

Taking a break

from page 1

that kind of infrastructure work. You want everybody to like you and don’t want be the guy telling people that it’s going to cost more money, but you’re also elected o make difficult decisions

On his support for Village President Greg Hribel

There is nobody with more institutional knowledge of the village than Greg. In government, we’re all replaceable, but he’s been such a crutch for this community, unbeknownst to all the residents. If we were to lose him, we’d lose so much.

… if we werw eto lose him we’d lose so much. … he is transitioning into … instead of being everybody’s go to guy … now being thrown into the front of everything and having to be the spokesman and articulating all these things … you’re in a lot more confrontations with people … “Id get letters like this person wants you dead and you shouldnt call them … i litterally called very single person back and .. .they just wanted someone to listen [~7:00] … next thing you know people are sending me cakes .. they just wanted someone to listen to them …

On the acting village manager and trustee positions, and not seeking reelection.

I thought it might be nice to finish knowing

that this would be my last term. At the end of the day, being an elected official is a huge commitment, and I’m a doer. In the village manager form of government, the village president doesn’t have as much power as some people think, but you’re held accountable for everything that goes wrong. You have equal input as a trustee. You have to be at all these meetings, taking in all the complaints and emails and Facebook posts.

As acting president, I’d get threatening letters and phone calls. When people called, I called them back. Most of the time, people just want someone to listen to them. Next thing you know, they’re sending me cakes. They just wanted someone to listen.

I am 100% content being “the guy behind the guy.” You can be more influential as a trustee or trusted voice of reason. At the end of the day, though, I’m just like everybody else. I like privacy for me and my family. I have no problem making myself vulnerable, but at that level, it really takes a toll on your family and I got too much at stake there. Right now, everything affects them. It’s not fair to them to get what’s left of me. They’re only little for so long.

On future political ambitions.

I’ve kicked around the idea of maybe something at the county level or later on when I’m retired. I’ve got three more years left at the firehouse. We’ll see once the girls are on their own and doing their own things.

MICHAEL ROMAIN

Nick Steker

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION

Citibank, N.A., not in its individual capacity but solely as Owner Trustee for New Residential Mortgage Loan Trust 2018-1 Plaintiff

vs. James W. Williams Jr.; Unknown Owners and Nonrecord Claimants; Unknown Heirs and Legatees of Beulah M. Williams; Stanley Evans as Successor Independent Administrator with the Will annexed of the Estate of Beulah M. Williams, Deceased Defendant 22 CH 196 CALENDAR 64 NOTICE OF SALE

PUBLIC NOTICE is hereby given that pursuant to a Judgment of Foreclosure entered in the above entitled cause Intercounty Judicial Sales Corporation will on July 22, 2025, at the hour 11:00 a.m., Intercounty’s office, 120 West Madison Street, Suite 718A, Chicago, IL 60602, sell to the highest bidder for cash, the following described mortgaged real estate: P.I.N. 15-15-202-014-0000.

Commonly known as 1016 S. 14th Ave., Maywood, IL 60153. The real estate is: single family residence. If the subject mortgaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: At sale, the bidder must have 10% down by certified funds, balance within 24 hours, by certified funds. No refunds. The property will NOT be open for inspection. Prospective bidders are admonished to check the court file to verify all information. For information call Sales Department at Plaintiff’s Attorney, Codilis & Associates, P.C., 15W030 North Frontage Road. Suite 100, Burr Ridge, IL 60527. (630) 794-5300. 14-20-03882

INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3268039

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION

U.S. BANK TRUST NATIONAL ASSOCIATION, NOT IN ITS INDIVIDUAL CAPACITY BUT SOLELY AS OWNER TRUSTEE FOR RCF2 ACQUISITION TRUST Plaintiff vs. UNKNOWN HEIRS AND LEGATEES OF DARIUS FLORES; CARISA J.

BOYES; KYAHRA FELICIANO; D.F., A MINOR; A.F., A MINOR; LUIS SOTO AS INDEPENDENT ADMINISTRATOR OF THE ESTATE OF DARIUS FLORES FELICIANO; LUIS SOTO AS GUARDIAN OF D.F. A MINOR, LUIS SOTO AS GUARDIAN OF A.F. A MINOR; UNKNOWN OWNERS.AND NONRECORD CLAIMANTS

Defendant 24 CH 468 CALENDAR 60 NOTICE OF SALE

PUBLIC NOTICE is hereby given that pursuant to a Judgment of Foreclosure entered in the above entitled cause Intercounty Judicial Sales Corporation will on July 28, 2025, at the hour 11:00 a.m., Intercounty’s office, 120 West Madison Street, Suite 718A, Chicago, IL 60602, sell to the highest bidder for cash, the following described mortgaged real estate: P.I.N. 15-07-215-046-0000. Commonly known as 1529 N. Hillside Avenue, Berkeley, IL 60163. The real estate is: single family residence. If the subject mortgaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: At sale, the bidder must have 10% down by certified funds, balance within 24 hours, by certified funds. No refunds. The property will NOT be open for inspection. Prospective bidders are admonished to check the court file to verify all information. For information call Sales Department at Plaintiff’s Attorney, Diaz Anselmo & Associates P.A., 1771 West Diehl Road, Suite 120, Naperville, IL 60563. (630) 453-6960. 1446-185708 INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3268382

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION MIDFIRST BANK, Plaintiff,

-v.-

ROBERTA ALLEN A/K/A ROBERTA LEEDORA ALLEN A/K/A ROBERTA L ALLEN; SECRETARY OF HOUSING AND URBAN DEVELOPMENT; Defendants. 22 CH 03678

1925 South 8th Avenue, Maywood, IL 60153

NOTICE OF SALE PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on 9/17/2024, an agent of Auction. com, LLC will conduct the auction in

person at 12:00 PM on July 2, 2025 located at 100 N LaSalle St., Suite 1400, Chicago, IL 60602, and will sell at public sale to the highest bidder, as set forth below, the following described real estate.

Commonly known as 1925 South 8th Avenue, Maywood, IL 60153

Property Index No. 15-14-309-0100000

The real estate is improved with a Single Family Residence. The judgment amount was $323,567.17

Sale Terms: 20% down of the highest bid by certified funds at the close of the sale payable to Auction.com, LLC, No third party checks will be accepted. All registered bidders need to provide a photo ID in order to bid. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. (relief fee not required)

The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a certificate of sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale.

The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property, prospective bidders are admonished to check the court file to verify all information. If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by the Condominium property Act, 765 ILCS 605/9 (g) (l) and (g)(4). If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by the Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701 (C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW.

For information, contact Plaintiffs attorney: McCalla Raymer Leibert Pierce, LLC (312) 346-9088 please refer to file number 22-09700IL. Auction.com, LLC 100 N LaSalle St., Suite 1400 Chicago, IL 60602 - 872225-4985 You can also visit www. auction.com.

Attorney File No. 22-09700IL Case Number: 22 CH 03678 NOTE: PURSUANT TO THE FAIR

DEBT COLLECTION PRACTICES ACT, YOU ARE ADVISED THAT PLAINTIFF’S ATTORNEY IS DEEMED TO BE A DEBT COLLECTOR ATTEMPTING TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. I3267520

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS

COUNTY DEPARTMENTCHANCERY DIVISION

TRUIST BANK, SUCCESSOR BY MERGER TO SUNTRUST BANK Plaintiff, -v.-

MARISSA

A CONSENTINO, DANIEL J TUREK

Defendants 22 CH 00628

3013 KENSINGTON AVENUE WESTCHESTER, IL 60154

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on August 21, 2024, an agent for The Judicial Sales Corporation, will at 10:30 AM on July 18, 2025, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at public in-person sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 3013 KENSINGTON AVENUE, WESTCHESTER, IL 60154

Property Index No. 15-29-417-0430000

The real estate is improved with a single family residence.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale.

The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a

mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4). If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW.

You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

MCCALLA RAYMER LEIBERT PIERCE, LLC Plaintiff’s Attorneys,

One North Dearborn Street, Suite 1200, Chicago, IL, 60602. Tel No. (312) 346-9088.

THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales.

MCCALLA RAYMER LEIBERT PIERCE, LLC

One North Dearborn Street, Suite 1200 Chicago IL, 60602 312-346-9088

E-Mail: pleadings@mccalla.com

Attorney File No. 22-08657IL_763150 Attorney Code. 61256

Case Number: 22 CH 00628 TJSC#: 45-1373

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose.

Case # 22 CH 00628 I3267720

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION WILMINGTON SAVINGS FUND SOCIETY, FSB, AS TRUSTEE OF QUERCUS MORTGAGE INVESTMENT TRUST; Plaintiff vs. ALAN GRAVES; SUSAN RABELO A/K/A SUSAN GRAVES; UNKNOWN

OWNERS AND NON-RECORD CLAIMANTS; Defendant 22 CH 7306

CALENDAR 56

NOTICE OF SALE

PUBLIC NOTICE is hereby given that pursuant to a Judgment of Foreclosure entered in the above entitled cause Intercounty Judicial Sales Corporation will on July 8, 2025, at the hour 11:00 a.m., Intercounty’s office, 120 West Madison Street, Suite 718A, Chicago, IL 60602, sell to the highest bidder for cash, the following described mortgaged real estate: P.I.N. 15-16-201-052-0000.

Commonly known as 3016 Madison St., Bellwood, IL 60104. The real estate is: single family residence. If the subject mortgaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: At sale, the bidder must have 10% down by certified funds, balance within 24 hours, by certified funds. No refunds. The property will NOT be open for inspection. Prospective bidders are admonished to check the court file to verify all information. For information call Sales Department at Plaintiff’s Attorney, Lender Legal PLLC, 1800 Pembrook Drive, Suite 250, Orlando, Florida 32810. 407730-4644. LLS10857-IL INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3267175

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION

Federal Home Loan Mortgage Corporation, as trustee for Freddie Mac Seasoned Credit Risk Transfer Trust, Series 2017-3, as owner of the Related Mortgage Loan Plaintiff vs. Unknown Beneficiaries of Henry Ison, Jr. Living Trust; Village of Bellwood; Wells Fargo Bank, National Association as s/i/i to Wells Fargo Bank Minnesota, National Association, as Trustee for Soundview Home Equity Loan Trust 2001-1; Lucinda Hughes, as Trustee of the Lucinda Hughes Living Trust, u/a dated April 5, 2018; Unknown Beneficiaries of Lucinda Hughes Living Trust, u/a dated April 5,2018; Unknown Successor Trustee of Henry Ison, Jr. Living Trust; Unknown Successor Tustee of Lucinda Hughes Living Trust, u/a dated April 5, 2018; Henry Ison, Jr, Living Trust; Lucinda Hughes Living Trust, u/a dated April

5, 2018; Unknown Owners and Non Record Claimants

Defendant 23 CH 1966

CALENDAR 60 NOTICE OF SALE

PUBLIC NOTICE is hereby given that pursuant to a Judgment of Foreclosure entered in the above entitled cause Intercounty Judicial Sales Corporation will on July 7, 2025, at the hour 11:00 a.m., Intercounty’s office, 120 West Madison Street, Suite 718A, Chicago, IL 60602, sell to the highest bidder for cash, the following described mortgaged real estate: P.I.N. 15-10-123-006-0000. Commonly known as 2204 Saint Charles Road, Bellwood, IL 60104. The real estate is: single family residence. If the subject mortgaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: At sale, the bidder must have 10% down by certified funds, balance within 24 hours, by certified funds. No refunds. The property will NOT be open for inspection. Prospective bidders are admonished to check the court file to verify all information. For information call Sales Department at Plaintiff’s Attorney, The Wirbicki Law Group LLC, 33 West Monroe Street, Suite 1540, Chicago, Illinois 60603. (312) 360-9455. W22-0504 INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3267133 IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION DEUTSCHE BANK NATIONAL TRUST COMPANY, AS TRUSTEE FOR THE REGISTERED HOLDER OF EQUIFIRST MORTGAGE LOAN TRUST 2005-1 ASSET-BACKED CERTIFICATES, SERIES 2005-1 Plaintiff, -v.JIMMY LEE JOHNSON SR A/K/A JIMMY L. JOHNSON, CYNTHIA YOW-JOHNSON A/K/A CYNTHIA Y. JOHNSON, THE HUNTINGTON NATIONAL BANK Defendants 2024 CH 08391 1460 SPEECHLEY BLVD. BERKELEY, IL 60163 NOTICE OF SALE PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on March 25, 2025, an agent for The Judicial Sales Corporation, will at 10:30 AM on June 27, 2025, at The Judicial Sales

Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell

at public in-person sale to the highest bidder, as set forth below, the following described real estate:

Commonly known as 1460

SPEECHLEY BLVD., BERKELEY, IL

60163

Property Index No. 15-08-107-064-0000

The real estate is improved with a residence.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale.

The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4).

If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW.

You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff’s Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 794-9876 THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-

SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales.

CODILIS & ASSOCIATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100

BURR RIDGE IL, 60527

630-794-5300

E-Mail: pleadings@il.cslegal.com

Attorney File No. 14-24-05559

Attorney ARDC No. 00468002

Attorney Code. 21762

Case Number: 2024 CH 08391

TJSC#: 45-1194

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose.

Case # 2024 CH 08391 I3267132

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION

PHH MORTGAGE CORPORATION

Plaintiff, -v.-

CHEMAINE HAMPTON, UNITED STATES OF AMERICA - SECRETARY OF HOUSING AND URBAN DEVELOPMENT, UNKNOWN HEIRS AND LEGATEES OF BETTIE W. HAMPTON, UNKNOWN OWNERS

AND NONRECORD CLAIMANTS, JOHN LYDON, AS SPECIAL REPRESENTATIVE FOR BETTIE W. HAMPTON (DECEASED), ALEX HAMPTON JR., MONIQUE HAMPTON

Defendants 2023 CH 03777

942 BELLWOOD AVENUE

BELLWOOD, IL 60104

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY

GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on March 28, 2025, an agent for The Judicial Sales Corporation, will at 10:30 AM on June 30, 2025, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at public in-person sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 942 BELLWOOD AVENUE,BELLWOOD, IL 60104

Property Index No. 15-16-109-0890000

The real estate is improved with a single family residence.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate

and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale. Where a sale of real estate is made to satisfy a lien prior to that of the United States, the United States shall have one year from the date of sale within which to redeem, except that with respect to a lien arising under the internal revenue laws the period shall be 120 days or the period allowable for redemption under State law, whichever is longer, and in any case in which, under the provisions of section 505 of the Housing Act of 1950, as amended (12 U.S.C. 1701k), and subsection (d) of section 3720 of title 38 of the United States Code, the right to redeem does not arise, there shall be no right of redemption.

The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments

and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4). If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW.

You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff’s Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 794-9876 THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236SALE

You can also visit The Judicial Sales

Corporation at www.tjsc.com for a 7 day status report of pending sales. CODILIS & ASSOCIATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100 BURR RIDGE IL, 60527 630-794-5300

E-Mail: pleadings@il.cslegal.com

Attorney File No. 14-23-02310

Attorney ARDC No. 00468002

Attorney Code. 21762 Case Number: 2023 CH 03777 TJSC#: 45-916

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose. Case # 2023 CH 03777 I3267389