Maywood native authors book on trauma

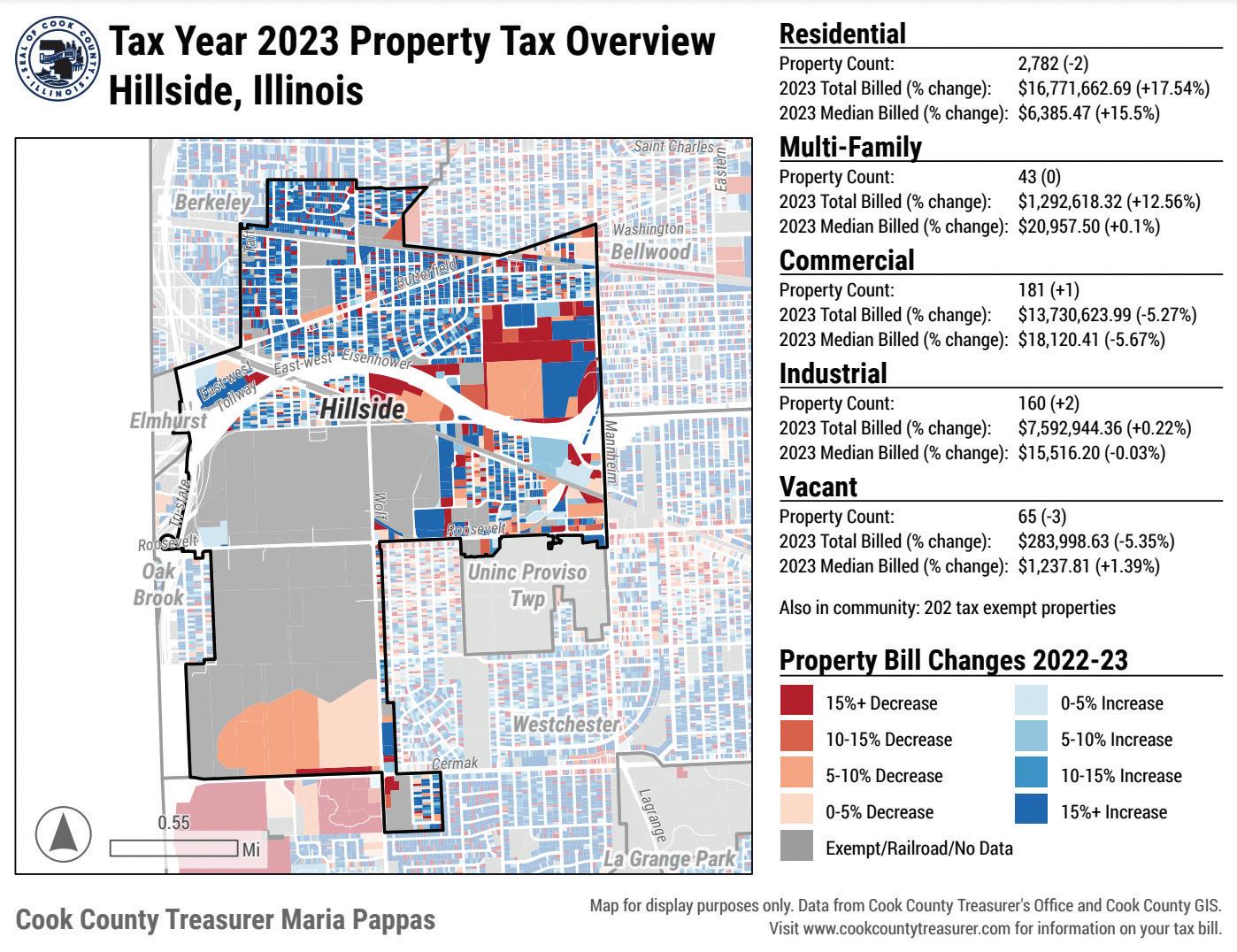

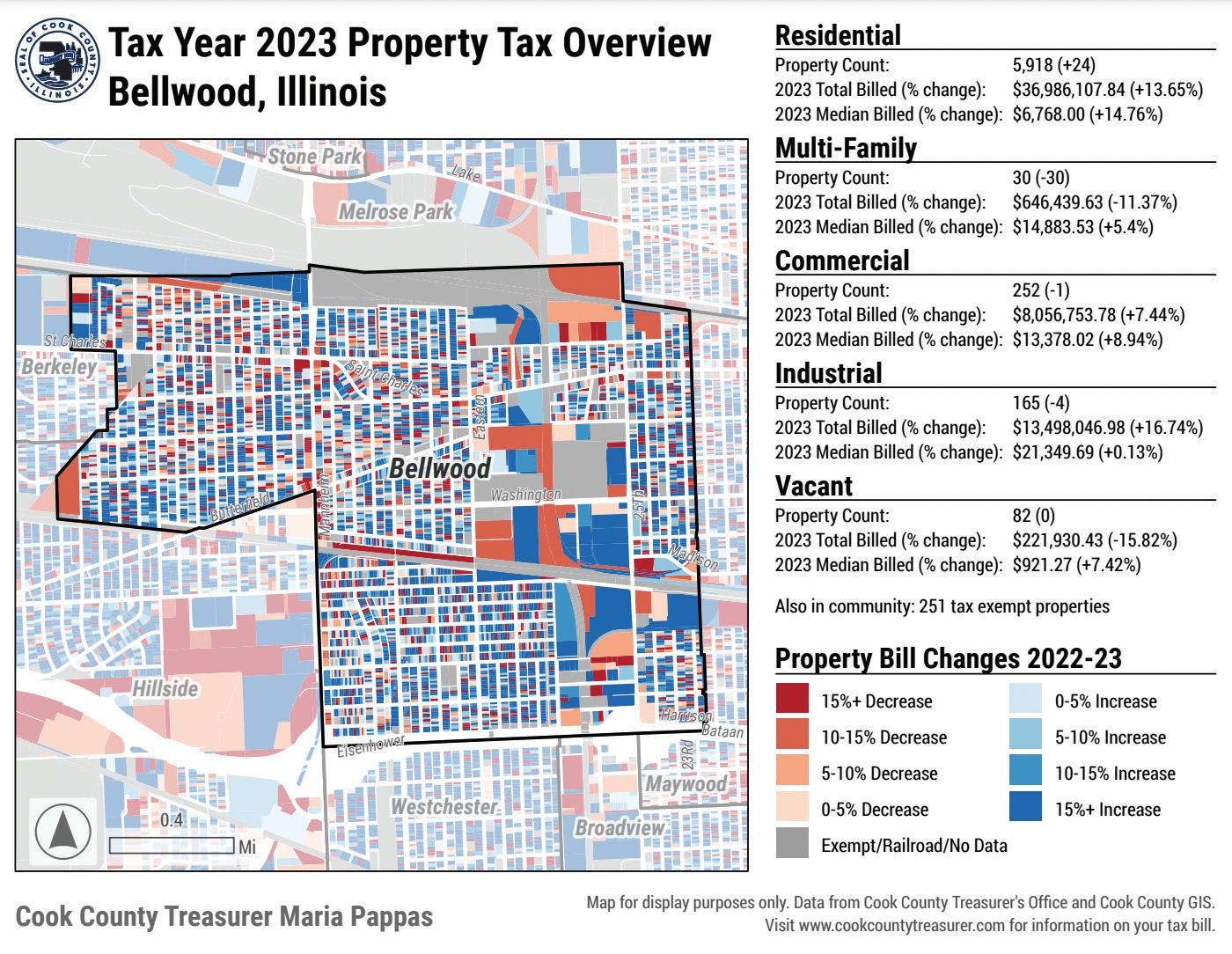

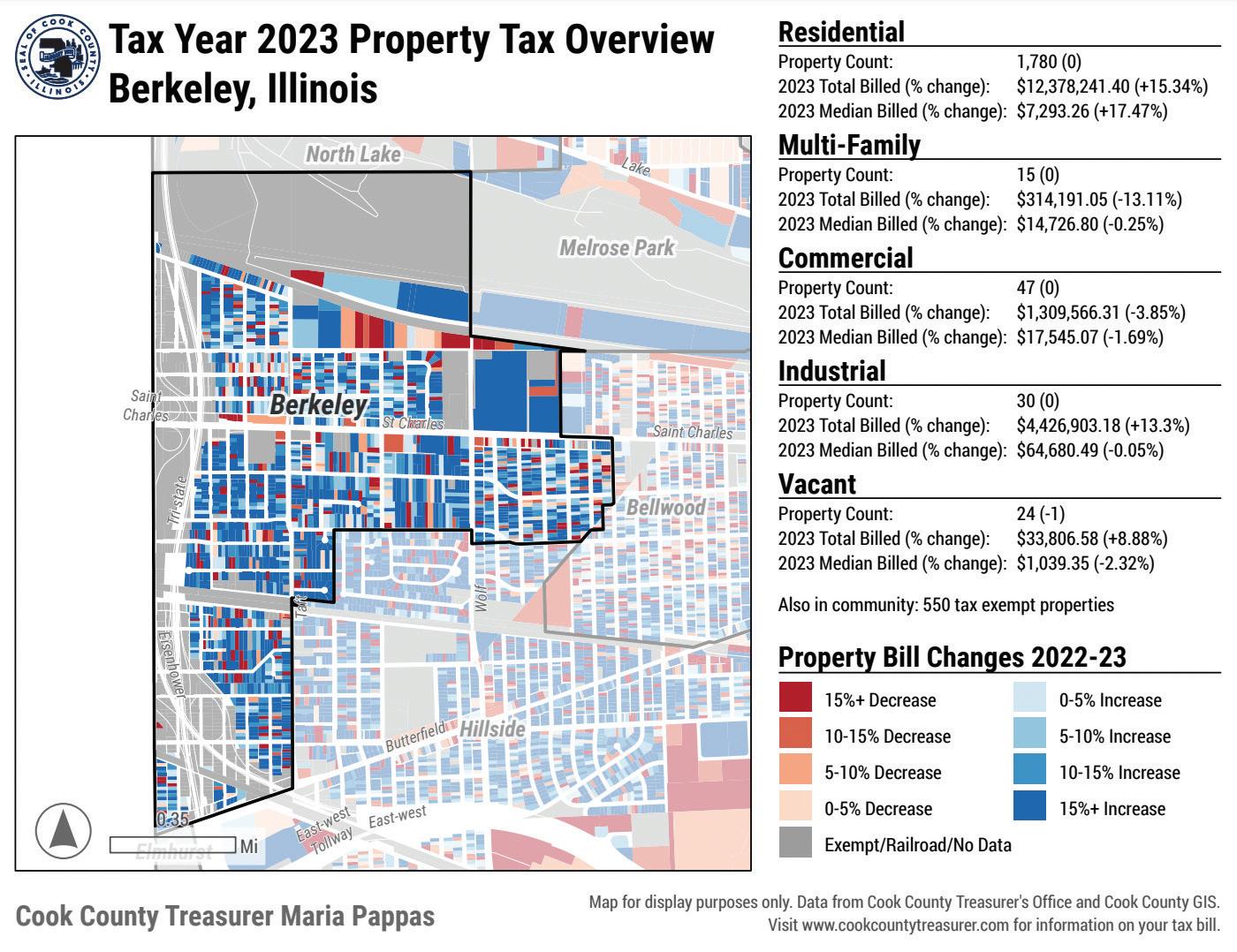

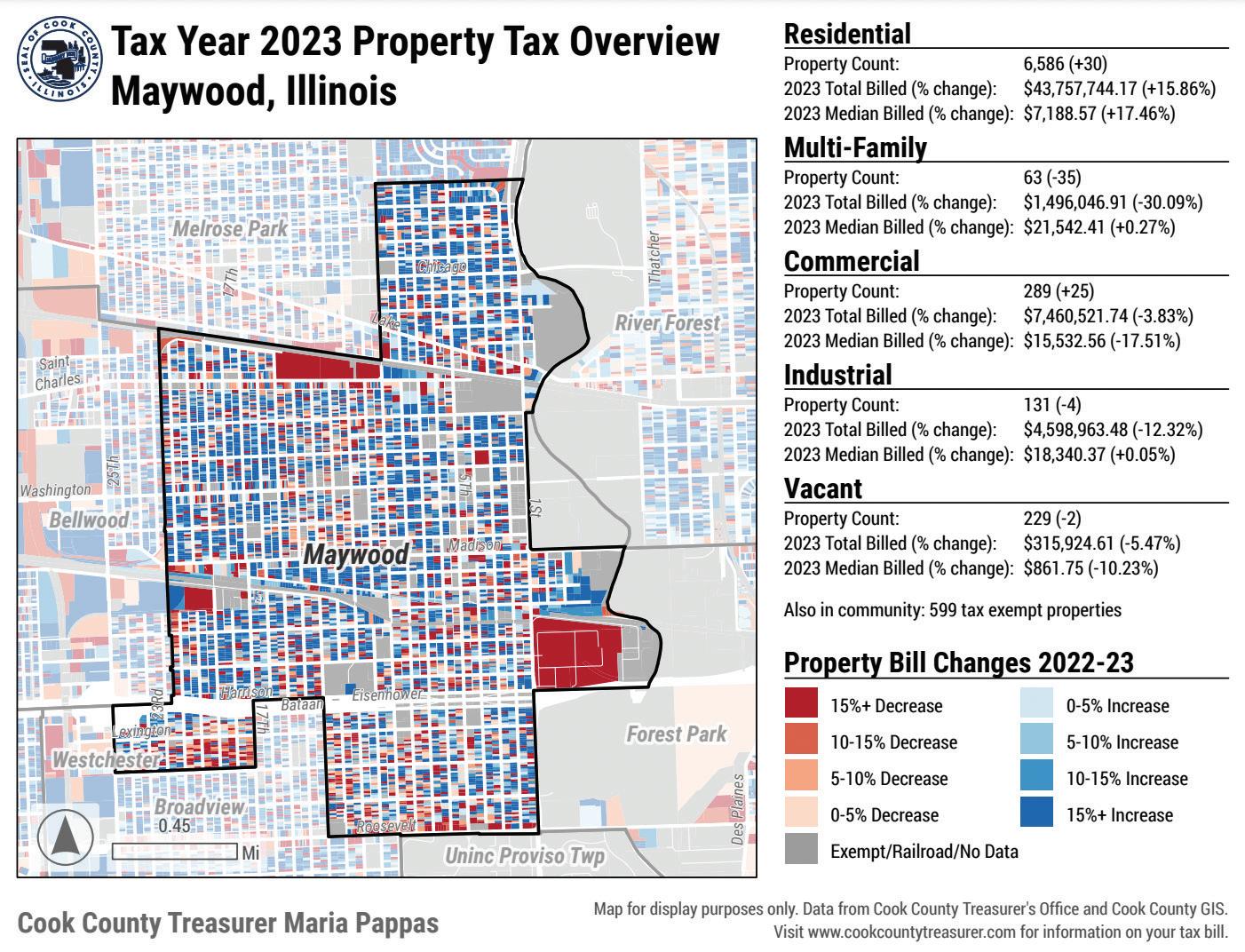

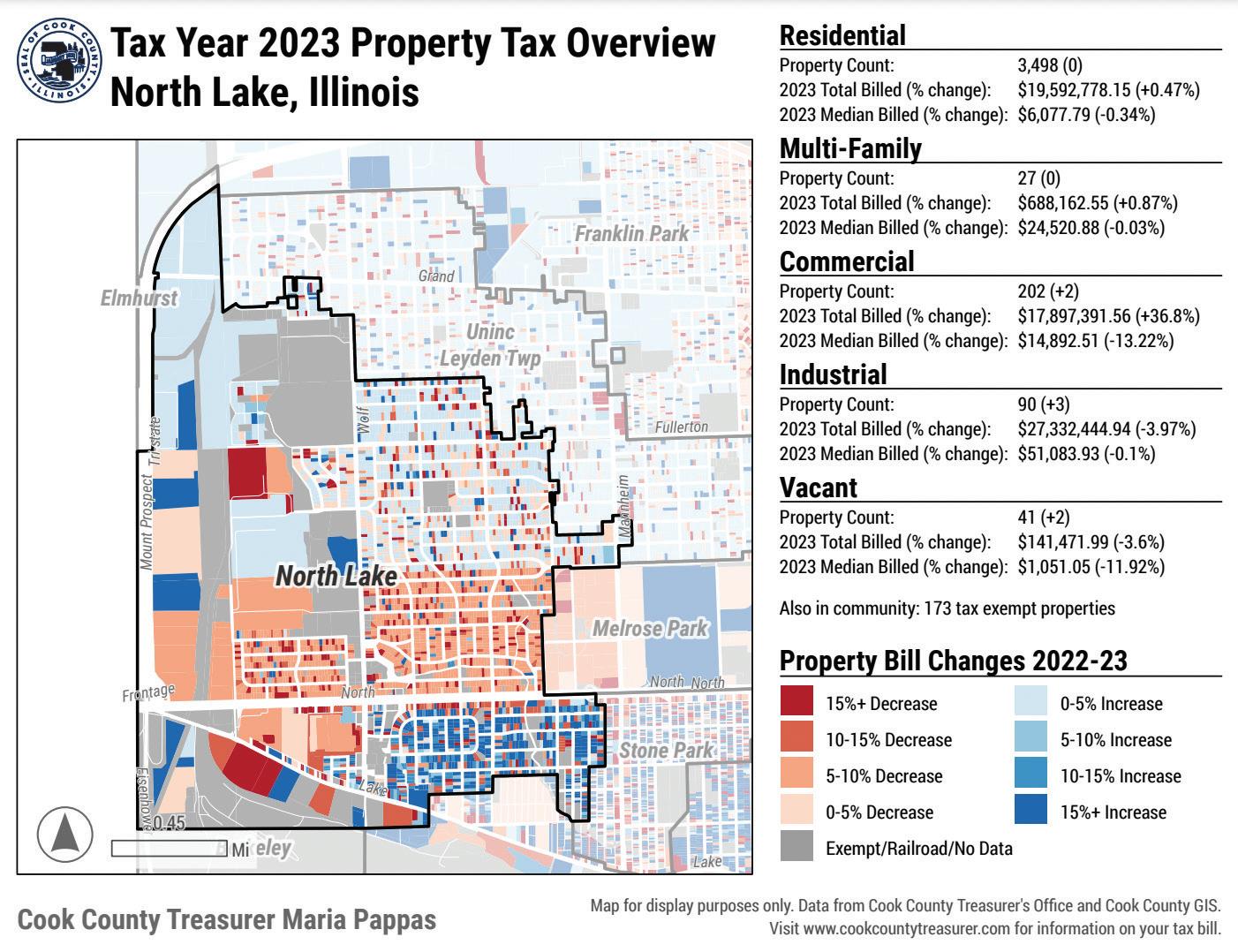

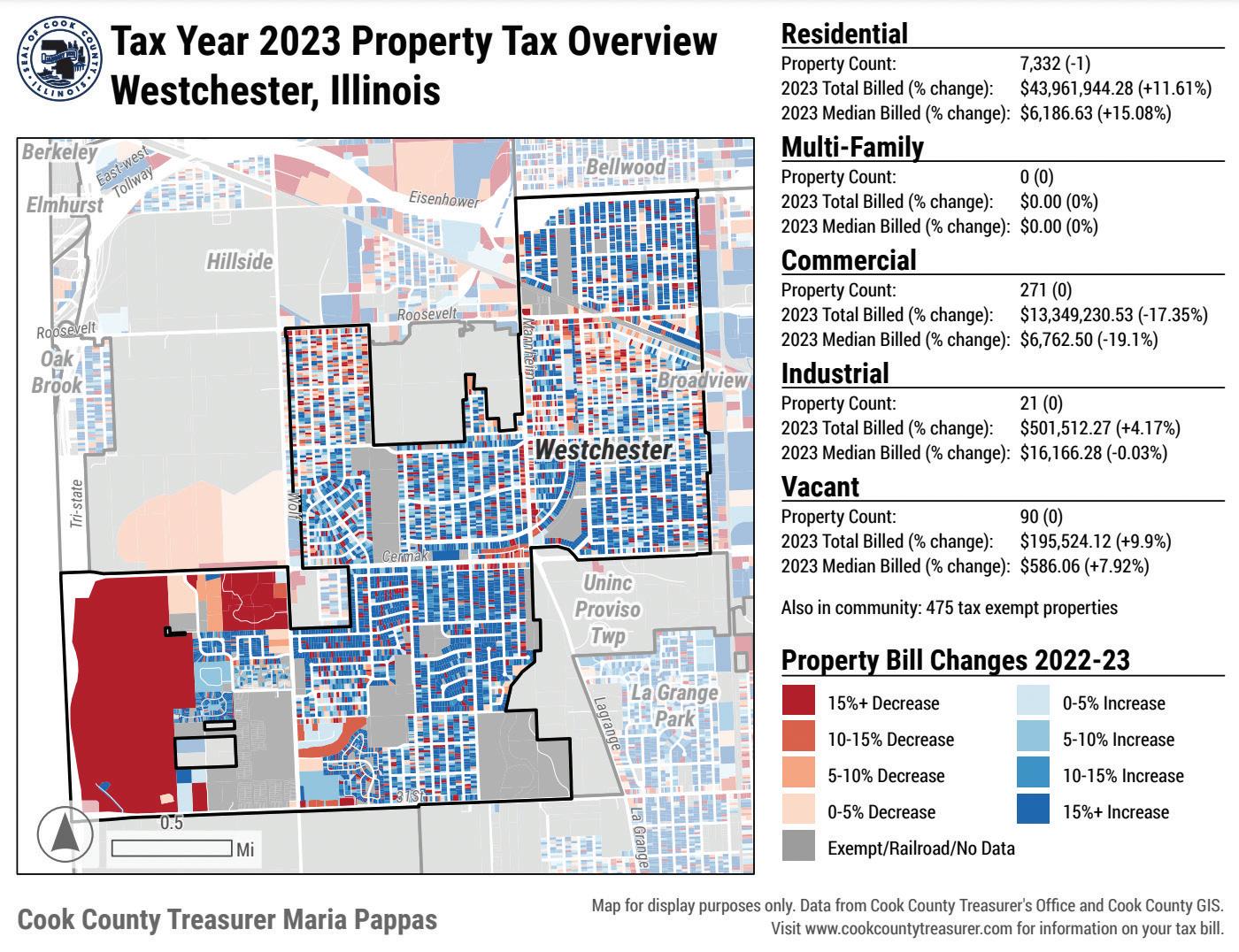

2 See your suburb’s detailed property tax overview Page 9

Maywood native authors book on trauma

2 See your suburb’s detailed property tax overview Page 9

Cook County Commissioner Tara Stamps’‘Shop Talk’ series designed to give men mental health support and resources for confronting trauma

By MICHAEL ROMAIN Editor

According to a 2022 report by Communities United (CU), a Chicago community organization, 66% of young men of color in Chicago who were surveyed reported that they were facing challenges with mental health.

The top “two outlets that young men of color identified that they use to cope and destress are video games and talking with friends,” researchers found.

First District Cook County Commissioner Tara Stamps, whose district covers most of Proviso Township, hopes that she can provide another critical outlet to men of all ages who need to cope with trauma and work toward mental wellness — the barbershop.

“About six weeks ago, I was inspired watching my own sons and what they’re going through, and being a teacher, I saw for many, many years how our boys are in the middle of a mental health crisis born of pain, anger, neglect, and abandonment,” Stamps said during an inter-

Bills due Aug. 1 up by thousands as Cook County Treasurer Maria Pappas urges taxpayers to ‘read your tax bill’ to see where the money goes See SHOP TALK on page 4

BY MICHAEL ROMAIN Opinion & Analysis

“Many homeowners are going to be shocked and angry when they get their bills,” said Cook County Treasurer Maria

Pappas — whose office is responsible for sending out the bills and collecting taxes — in a statement on June 27. She was right.

Days later, dozens of taxpayers went to Facebook to complain about their rising bills. A few users posted in the group “I Love Maywood!!!” that their property tax bills had increased by upwards of $3,000. Last month, Pappas’ office released the

Publisher/CEO

Michael Romain

Chief Operations Officer Kamil Brady

Creative Designer Shanel Romain

John Wilk Communications, LLC

3013 S. Wolf Rd. #278

Westchester, IL 60154

PHONE: (708) 359-9148

VFPress.news

TWITTER: @VILLAGE_FREE

FACEBOOK: @MAYWOODNEWS

The Village Free Press is published digitally and in print by John Wilk Communications LLC. The print edition is distributed across Proviso Township at no charge each week. © 2024 John Wilk Communication LLC

The Maywood native pens a new book about finding mental wellness after her husband’s death

By MICHAEL ROMAIN Editor

In a recent interview, Maywood native Lola D. Smith said she’s always wanted to write a book. Originally, she thought she’d write a memoir. That plan changed when her husband, Joseph E. Smith, died at 41 in 2018.

Smith’s new book, “Mending Masculine Hearts: Navigating Trauma, Love, and Relationships,” details her late husband’s mental health issue, her experience navigating other life challenges, and her road to healing. Smith, who lives in Villa Park, released the book in June for Men’s Health Month. She’s hosting a book launch event on Sunday, July 14, from 4 to 6 p.m., at White Smoke & Ash, 2301 Plainfield Rd. in Crest Hill.

Can you talk a bit more about your husband’s mental health challenges?

I had been preparing to leave him for three years, but he didn’t know that until maybe about eight months before his passing. That was a trigger, and that’s when I started seeing things go downhill. I was still trying to take care of him, but he didn’t want help. When I would try to get him to seek a doctor, he was afraid, thinking that the doctors were going to hurt him. It was a horrific experience I didn’t see coming. I realized that in that three-year span, I thought I was leaving my husband, but God was preparing me for what would eventually happen.

How long were you all together?

We were together for over 20 years. Throughout our relationship, I would tell him your pride will kill you. He wouldn’t deal with his emotional trauma and baggage. He harbored those things, and in the end, I saw them play out in his mental. He lost his mind in the blink of an eye.

How did your husband die?

They said it was pneumonia, but I think that the trauma had stirred up so many things within his body in the form of dis-

eases. He had an enlarged heart and thyroid disease [among other health issues] when he passed.

What do you want the impact of your book to be?

I hope this book will be a source of power and strength for anyone seeking healing, love, and encouragement to confront their unspoken pain. I hope people of all cultures read this book, but I particularly want people in the Black community to use it to reclaim the abundant and genuine love and joy that rightfully belongs to us. I want it to empower our people.

For more information on Lola Smith and her book, visit instagram.com/loveoflostarts_. You can purchase the book on Amazon at a.co/d/4Xv92eb. PROVIDED Lola D. Smith

MARIA PAPPAS COOK COUNT Y TREASURER

from page 1

view on June 16.

“Anger either implodes or it explodes,” she said. “Right now, among our Black boys and men, it’s doing both. They are killing each other and themselves. We need interventions in real time.”

Earlier this year, Stamps partnered with barbershops across her district to launch Shop Talk (Shop stands for sharing hope and overcoming pressure). The first several events have been on Sundays and featured free haircuts, food and drinks, and resources and services—from massages to manicures.

“I told the barbers, if they open their shop on a Sunday and give free haircuts, I’ll bring in everything else,” Stamps said. The objective, she explained, is to get men, young and old, talking to each other about their trauma and trusting each other enough to seek help.

“My hope is that they leave that moment with a mentor or walk away with a clinician,” she said.

Stamps said her initiative has since expanded to include spaces beyond barbershops and every Sunday in the year. On June 16, Stamps held a special Father’s Day edition of Shop Talk hosted in Demiurge Clothing Co. 116 Chicago Ave. in Oak Park.

Jimmie Wallace, Demiurge’s owner, sits on a 15-person advisory committee that’s formed around Stamp’s initiative.

“The experience has been great,” Wallace said on June 15. “It’s been great seeing the unity and solidarity, Black and Brown men coming together to confront this trauma that plagues our community, starting with our youth. They’re dealing with a rise in teen suicides, peer pressure — all those things. We hope when they leave these, someone grabs one of those kids to mentor them.”

Cook County Commissioner Tara Stamps, right, and Paris Marlow Sr., a staffer who works in her office, on June 16.

Stanley Que, a mental health substance abuse counselor and professional photographer, opened up about his experience surviving childhood trauma at the June 16 Shop Talk event. He spent much of his youth cycling in and out of group homes and correctional facilities as he seethed with anger stemming from a childhood beating by his father for reportedly not turning in a homework assignment.

His teacher later told his parents she had simply overlooked it, but the damage was done. His father had whooped him for two hours. When he went to the school the next day, school officials reported the abuse to the police.

“That’s how I was taken out of my home,” he said. “A lot of children are taken out of their homes because of abuse or neglect. The first place they put me was in a correctional facility.”

Stanley said his healing began when he met therapists, doctors, lawyers, and other professional men in the neighborhood.

“They were good people, and I started being in circles like this one,” he said. “That’s where my journey of healing began because I was getting good information. One of the greatest things we can get in life is good information.”

Paris Marlow Sr., a staffer with Commissioner Stamps’ office, said the effect of the Shop Talk events “has been tremendous,” adding that the initiative reflects the commissioner’s keen focus on mental health issues, particularly those affecting the Black community.

Stamps said she’s looking to partner with local barber colleges and instructors to train barbers to ask certain questions that may flag a mental health intervention. Her office is also seeking barbers in the Chicago area who might want to open their doors to host future Shop Talks.

“My objective is that by this time next year, we’re introducing this at the county nationally as an intervention around mental health supports,” Stamps said.

For more information on the Shop Talks initiative, email or call Khadija Warfield at khadija.warfield@cookcounty-il.gov or (312) 603-4566.

Commissioner Stamps will host the next Shop Talk for young men ages 12 to 16 on Sunday, July 14, 4 to 6:30 p.m., at Kutten Up Barber Shop, 5457 W. Chicago Ave. in Chicago. To register, visit https://rb.gy/jp6tew.

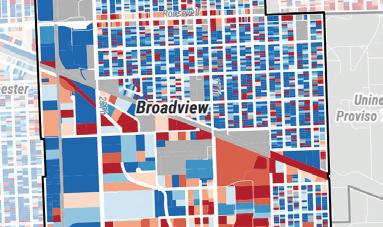

A chart showing the median property taxes billed in 2022 and 2023.

VILLAGE FREE PRESS

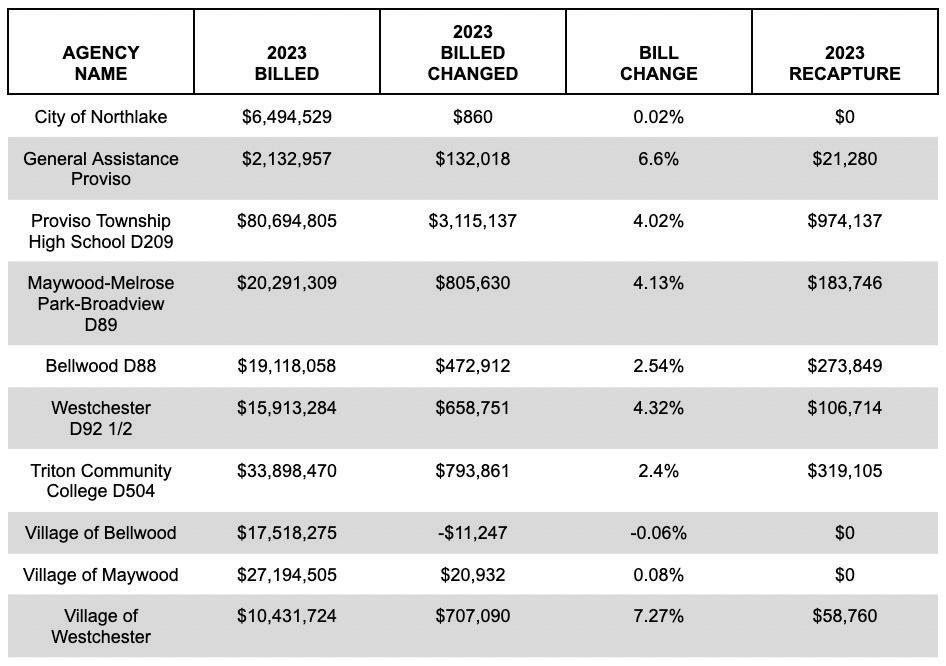

A representative sample of taxing agencies that shows the change in taxes billed in 2022 and 2023, along with the amount of recapture each agency received.

A chart showing the total tax change in the nine Village Free Press suburbs. Data is from the Cook County Treasurer’s Tax Year 2023 Bill Analysis report.

from page 1

Tax Year 2023 Bill Analysis report, which examined nearly 2 million bills mailed to property owners on July 2 and due on Aug. 1. Pappas said the most significant increases were in 15 south suburbs, where taxes soared 30% or more.

As those Facebook comments show, taxes in the west suburbs soared, too. The median residential tax bill increased in all nine Village Free Press (VFP) suburbs, ranging from 7% in Stone Park to 24% in Northlake.

And those increases aren’t insignificant amounts. In Northlake, the median residential tax bill jumped from $5,376 in 2022 to $6,183 in 2023 — a $1,198 difference.

The Pappas report shows that not all homeowners saw increases in their tax bills. In Maywood, the VFP suburb with the lowest percentage of residential property own-

ers experiencing an increase, tax bills went up for 64% of residential property owners – meaning tax bills went down for roughly a third of homeowners. In Berkeley, 82% of residential property owners experienced tax increases, the highest percentage in the nine VFP suburbs.

Village Free Press suburbs’ median commercial taxes were more mixed. The Westchester 2023 median commercial tax bill decreased by 20%, from $9,099 to $7,205, while the Bellwood 2023 median commercial tax bill increased by 20%, from $12,318 to $14,812.

On June 27, Cook County Assessor Fritz Kaegi’s office released new data showing the effect of commercial property tax appeals with the Cook County Board of Review (BoR). When commercial and residential property owners get their assessments, they can appeal to the BoR within 30 days of receiving their assessment notice. Kaegi has long criticized the BoR for routinely lowering commercial property tax assessments after owners appeal. When commercial property assessments are lowered, residential property owners likely pay a bigger share of total taxes.

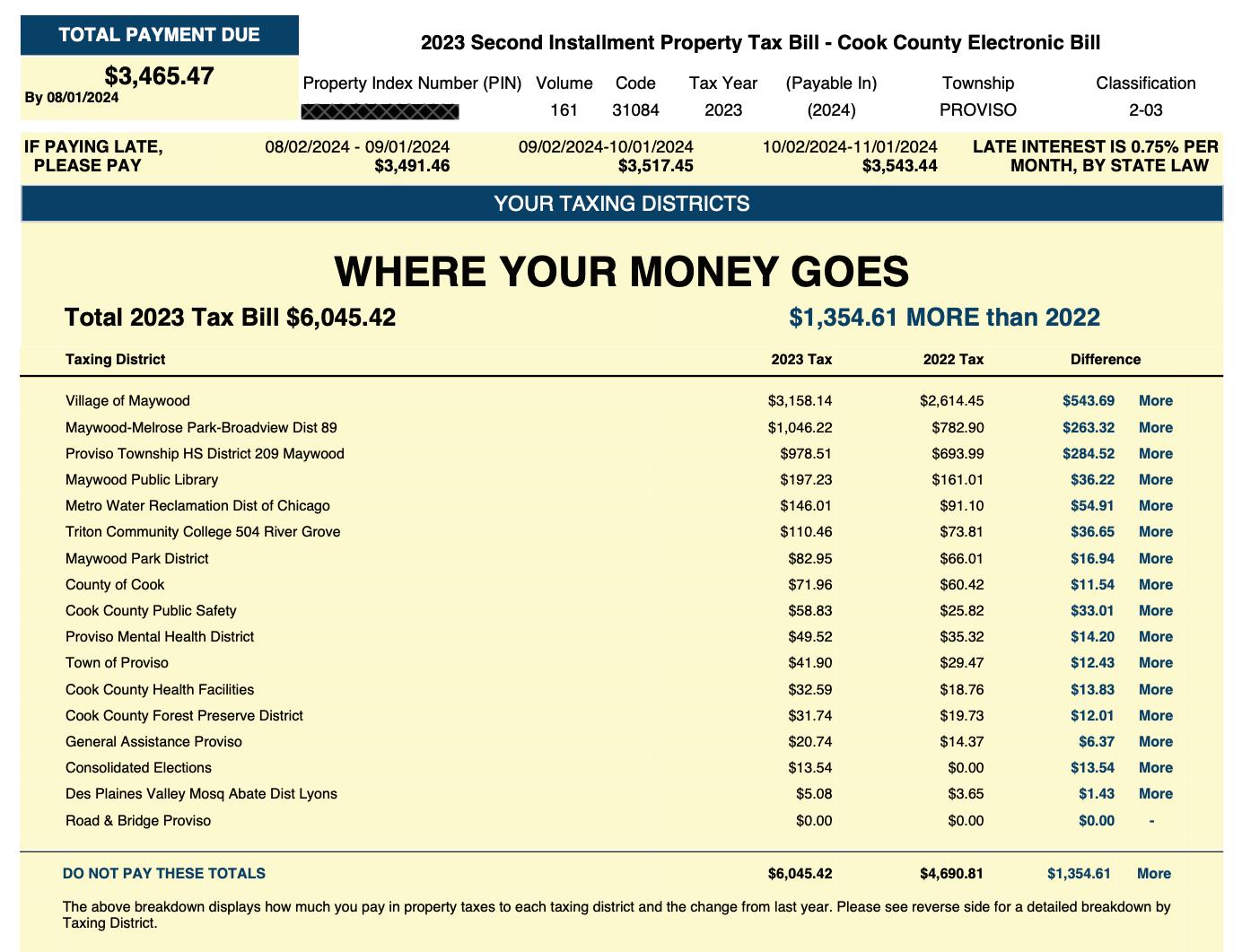

An example of the new property tax bills that include the “Where Your Money Goes” feature allowing taxpayers to see which agencies their money funds.

Before appeals with the BoR, Kaegi’s office said residential property in the south and west suburbs comprised 68% of total assessed value, while non-residential comprised 32%. Following appeals, the residential share of total assessed value rose to 71%.

“This was mainly because of appeals granted to non-residential properties: In total, the assessed value of non-residential property decreased $950 million, or just over 18%, during the BoR appeals stage,” Kaegi’s office explained.

Kaegi’s data shows that appeals to the BoR reduced the assessed value of all residential property in Proviso Township from $1.183 billion to $1.17 billion, a 1% decrease. Appeals to the BoR also reduced the assessed value of non-residential property in the township from $661 million to $558 million, a 16% decrease — a difference of $103 million.

Non-residential property assessments within individual municipalities were also lowered after BoR appeals.

For instance, appeals to the BoR had virtually no impact on the assessed value of all residential property in Bellwood. However, appeals to the BoR by non-residential property owners cut the total assessment of all non-residential property in Bellwood by 12%, or $6.6 million, with the total non-residential assessment going from $56 million to $49 million.

The BoR has countered Kaegi’s criticism by explaining that “unlike the Assessor’s office, our job is to look at each individual appeal that comes before us on a case-by-case basis. We do not systematically grant appeals to one kind of property

owner over another, and the data backs that up.”

BoR officials also point out that “an assessment reduction granted by the BOR may result in a tax bill lower than it otherwise would be without the reduction. However, many factors other than your level of assessment, including exemptions, local tax levies [and] tax rates, determine the amount of your tax bill.”

A property’s value is another major factor that determines property taxes. According to the Illinois Department of Revenue, a property’s assessment “can increase because your neighborhood is improving, the sales prices of homes in your area are increasing, and inflation.

“The value that the assessor assigns to your property is the amount that the assessor determines your property would sell for in today’s market. Market values vary from one neighborhood to another [...] Assessors use market data when they determine property values.”

The department adds that, contrary to what some may believe, most normal home maintenance doesn’t raise a property’s assessment.

“If your assessment increases because you added an improvement to your property, you can apply for a homestead improvement exemption,” the department explains. “This exemption is limited to the fair cash value that was added to the homestead property by any new improvement, up to an annual maximum of $75,000. The exemption continues for

four years from the date the improvement is completed and occupied.”

Treasurer Pappas said another factor that affects property taxes is what’s called recapture.

“Recapture is a 2021 provision in the Illinois tax code that allows school districts and many local governments to recover money refunded to property owners who successfully appealed their taxes the previous year,” Pappas’ office explains. “Recapture led to an additional $136.3 million being tacked onto bills this year. That’s $51.9 million less than was added to property owners’ bills this year.”

In the Proviso Township area, school districts recaptured the most property taxes by far. For instance, Proviso Township High School District 209 recaptured nearly $1 million, while Triton College recaptured around $319,000.

It’s important to note that most property taxes go toward education and municipal services. The share of taxes that go to municipalities and school districts depends on various factors, including where they live.

One significant factor is the size of a municipality’s total non-residential tax base. Broadview, Hillside, Melrose Park, and Northlake have larger commercial tax bases than residential tax bases. This doesn’t automatically translate into lower property taxes, but it may correlate with a lower share of those bills going to municipal services rather than schools.

For instance, an analysis of one residential property in Melrose Park with a $772 property tax bill shows that $428, or more than half, goes to School Districts 89 and 209, while just $176 goes toward the village.

A residential property owner in Melrose Park who lives within a Tax Increment Financing (TIF) district owes $3,777 in 2023 property taxes, of which $564 goes to the TIF district, $564 to the village, $711 to District 89 and $665 to District 209.

A residential property owner in Bellwood owes $7,082 in 2023 property taxes, of which $2,679 goes to the village, $2,041 to District 88, and $1,094 to District 209.

Another residential property owner in Maywood owes $6,045 in 2023 property taxes, of which $3,158 goes to the village, $1,046 to District 89, and $979 to District 209.

In light of the property tax increases, Treasurer Pappas urges property owners to pay close attention to their bills. This year’s bills have a new feature, “Where Your Money Goes,” which allows taxpayers to see which taxing bodies are getting their dollars.

“Bills show the amount of taxes owed for 2023 and how much the bill changed compared to 2022,” Pappas added. “A typical bill displays about a dozen different taxing districts and shows how much you pay to each taxing body.”

Pappas said she added the new feature “so you can call the people who raised your taxes to tell them how you feel. This makes it easier than ever to compare tax bills from one year to the next. Your tax bill tells you which units of government are getting your money and how much each receives.”

You can read the Tax Year 2023 Bill Analysis report, look up your tax bill (or anyone else’s as long as you have the property pin number), pay your taxes and explore all kinds of tax-related data at cookcountytreasurer.com.

To access the Data Dashboards created by the Cook County Assessor’s Office to allow viewers to review assessments at each stage of the assessment process, visit cookcountyassessor.com/dashboard.

The above visualizations are screenshots from the website of Cook County Treasurer Maria Pappas. To see more data on property taxes, visit cookcountytreasurer.com.

PUBLIC NOTICES

PUBLIC NOTICE

Notice is hereby given, pursuant to “An Act in relation to the use of an Assumed Business Name in the conduct or transaction of Business in the State,” as amended, that a certification was registered by the undersigned with the County Clerk of Cook County. Registration Number: G24000232 on June 24, 2024 Under the Assumed Business Name of LUXE SALON STUDIOS with the business located at: 2100 W. ROOSEVELT UNIT A, BROADVIEW, IL 60155. The true and real full name(s) and residence address of the owner(s)/partner(s) is: KALEEMA WILLIAMS 3124 MONROE ST. BELLWOOD, IL 60104.

Published in Village Free Press July 3, 10, 17, 2024

PUBLIC NOTICE

PUBLIC NOTICE OF COURT

DATE FOR REQUEST FOR NAME CHANGE

STATE OF ILLINOIS, CIRCUIT COURT COOK COUNTY.

Request of ERNEST LILTRELL BLIZZARD 20244003827.

There will be a court date on my Request to change my name from: ERNEST LILTRELL BLIZZARD to the new name of: ION ONAREI

The court date will be held: On August 27, 2024 at 11:00 a.m. at 1500 Maybrook Drive Maywood, Illinois 60153, Cook County in Courtroom # 0112

Published in Village Free Press July 3, 10, 17, 2024

PUBLIC NOTICE

NOTICE OF PUBLIC HEARING BEFORE THE VILLAGE OF BROADVIEW

ZONING BOARD OF APPEALS

Notice is hereby given that the Village of Broadview Zoning Board of Appeals meeting on Tuesday, July 16, 2024, at 7:00 P.M. in the Village Hall Chambers, 2350 S. 25th Avenue, Broadview, IL 60155 will hold a Public Hearing regarding the Variance Application submitted. Seeking variances from Title 10 Chapter 9 Section 10-9-9 B.2 Maximum number of wall signs per establishment and Title 10 Chapter 9 Section 10-9-15 E Maximum height of flagpole

The applicant is seeking to erect 5 wall signs on the proposed Chickfil-A where only 2 are allowed. The applicant is seeking a variance to allow a 50’ flag pole that will display the American Flag. The restaurant is proposed for 3300 Broadview Village Square. The property is an outparcel to Broadview Village Square Shopping Center and fronts on 17th and Cermak. The proposed sign package includes one freestanding monument sign, tenant panels on an existing multi-tenant sign, five wall signs, drive thru menu

boards, and a flag pole.

The real estate affected by said applications is described as follows: Parcel Number(s): Part of 15-22-411019; 15-22-411-020; 15-22-411-022

All interested person desiring to present their views on the above application, will be given an opportunity to be heard at the abovementioned time and place.

For more information on the above applications, please contact the Village of Broadview Building Department (708-345-8174) or Expedite The Diehl LLC (614-8288215) tracey@expeditethediehl.com Applicant: Chick-fil-A Agent for Applicant: Expedite The Diehl LLC 614-828-8215

Published in Village Free Press July 10, 2024

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION WELLS FARGO BANK, N.A.

Plaintiff, -v.-

FRANCES J. LEE A/K/A FRANCES LEE, LATHROP TOWER CONDOMINIUM ASSOCIATION

Defendants

24 CH 18 314 LATHROP AVENUE UNIT 404 FOREST PARK, IL 60130

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on April 15, 2024, an agent for The Judicial Sales Corporation, will at 10:30 AM on August 13, 2024, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 314 LATHROP AVENUE UNIT 404, FOREST PARK, IL 60130

Property Index No. 15-12-429-058-1028

The real estate is improved with a condominium.

The judgment amount was $75,647.47. Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of

Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale.

The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4).

If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW.

You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

For information, contact The sales clerk, LOGS Legal Group LLP Plaintiff’s Attorneys, 2121 WAUKEGAN RD., SUITE 301, Bannockburn, IL, 60015 (847) 291-1717 For information call between the hours of 1pm - 3pm.. Please refer to file number 23-100379. THE JUDICIAL SALES CORPORATION One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales. LOGS Legal Group LLP 2121 WAUKEGAN RD., SUITE 301 Bannockburn IL, 60015 847-291-1717

E-Mail: ILNotices@logs.com

Attorney File No. 23-100379

Attorney Code. 42168

Case Number: 24 CH 18 TJSC#: 44-1045

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose.

Case # 24 CH 18 I3247463

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION US BANK TRUST NATIONAL ASSOCIATION AS TRUSTEE OF LB-IGLOO SERIES IV TRUST; Plaintiff, vs.

UNKNOWN HEIRS AND LEGATEES OF MONIQUE CAMERON

JEROME CAMERON JR.; CHICAGO TITLE LAND TRUST COMPANY AS SUCCESSOR TRUSTEE UNDER THE PROVISIONS OF A TRUST AGREEMENT DATED THE 26TH DAY OF NOVEMBER 1994, KNOWN AS TRUST NUMBER 9768; UNKNOWN BENEFICIARIES OF CHICAGO TITLE TRUST COMPANY AS SUCCESSOR TRUSTEE

UNDER THE PROVISIONS OF A TRUST AGREEMENT DATED THE 26TH DAY OF NOVEMBER 1994, KNOWN AS TRUST NUMBER 9768; AMIR MOHABBAT, AS SPECIAL REPRESENTATIVE FOR MONIQUE CAMERON, DECEASED; UNKNOWN OWNERS AND NONRECORD CLAIMANTS; Defendants, 22 CH 11912 NOTICE OF SALE PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above entitled cause Intercounty Judicial Sales Corporation will on Monday, August 12, 2024 at the hour of 11 a.m. in their office at 120 West Madison Street, Suite 718A, Chicago, Illinois, sell at public auction to the highest bidder for cash, as set forth below, the following described mortgaged real estate: P.I.N. 15-10-403-019. Commonly known as 245 South 14th Avenue, Maywood, IL 60153. The mortgaged real estate is improved with a single family residence. If the subject mortgaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: 10% down by certified funds, balance, by certified funds, within 24 hours. No refunds. The property will NOT be open for inspection

For information call Ms. Mary E. Spitz at Plaintiff’s Attorney, Sottile & Barile, LLC, 7530 LUCERNE DRIVE, MIDDLEBURG HEIGHTS, OHIO 44130. (440) 572-1511. ILF2203049

INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3247427

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS

COUNTY DEPARTMENTCHANCERY DIVISION PHH MORTGAGE CORPORATION

Plaintiff, -v.-

DEBBY MCCLINTON A/K/A DEBBY C. MCCLINTON, UNITED STATES OF AMERICA - DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT, OCWEN LOAN SERVICING, LLC

Defendants

2020 CH 03113 549 48TH AVE BELLWOOD, IL 60104

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on June 13, 2023, an agent for The Judicial Sales Corporation, will at 10:30 AM on August 9, 2024, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 549 48TH AVE, BELLWOOD, IL 60104

Property Index No. 15-08-409-073-0000

The real estate is improved with a single family residence.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale.

Where a sale of real estate is made to satisfy a lien prior to that of the United States, the United States shall have one year from the date of sale within which to redeem, except that with respect to a lien arising under the internal revenue laws the period shall be 120 days or the period allowable for redemption under State law, whichever is longer, and in any case in which, under the provisions of section 505 of the Housing Act of 1950, as amended (12 U.S.C. 1701k), and subsection (d) of section 3720 of title 38 of the United States Code, the right to redeem does not arise, there shall be no right of redemption. The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4).

If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS

MORTGAGE FORECLOSURE LAW.

You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff’s Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 794-9876 THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales.

CODILIS & ASSOCIATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100 BURR RIDGE IL, 60527

630-794-5300

E-Mail: pleadings@il.cslegal.com

Attorney File No. 14-20-01819

Attorney ARDC No. 00468002

Attorney Code. 21762

Case Number: 2020 CH 03113

TJSC#: 44-1593

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose.

Case # 2020 CH 03113 I3247773

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT - CHANCERY

DIVISION

ROCKET MORTGAGE, LLC F/K/A

QUICKEN LOANS, LLC F/K/A QUICKEN LOANS INC. Plaintiff, -v.-

LANCE WESBY, SANDRA FINCH, CITY OF CHICAGO, UNKNOWN OWNERS AND NONRECORD CLAIMANTS

Defendants 2023 CH 07541 1032 EASTERN AVE

BELLWOOD, IL 60104

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on May 30, 2024, an agent for The Judicial Sales Corporation, will at 10:30 AM on July 29, 2024, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 1032 EASTERN AVE, BELLWOOD, IL 60104 Property Index No. 15-16-120-048-0000 The real estate is improved with a residence.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within

twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court. Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale.

The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4). If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 151701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW. You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales. For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff’s Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 794-9876 THE JUDICIAL SALES CORPORATION One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales. CODILIS & ASSOCIATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100 BURR RIDGE IL, 60527 630-794-5300

E-Mail: pleadings@il.cslegal.com

Attorney File No. 14-23-05331

Attorney ARDC No. 00468002

Attorney Code. 21762

Case Number: 2023 CH 07541 TJSC#: 44-1626

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose. Case # 2023 CH 07541 I3247101

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION LOANDEPOT.COM, LLC; Plaintiff, vs. ESAU AYALA; THE SECRETARY OF HOUSING AND URBAN DEVELOPMENT; HELEN CANOLA ARIAS; DONTE PARKER, JR.; UNKNOWN OWNERS AND NONRECORD CLAIMANTS; Defendants, 23 CH 8824 NOTICE OF SALE PUBLIC NOTICE IS HEREBY

GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above entitled cause Intercounty Judicial Sales Corporation will on Monday, August 5, 2024 at the hour of 11 a.m. in their office at 120 West Madison Street, Suite 718A, Chicago, Illinois, sell at public auction to the highest bidder for cash, as set forth below, the following described mortgaged real estate: P.I.N. 15-08-213-022-0000. Commonly known as 124 46th Avenue, Bellwood, IL 60104. The mortgaged real estate is improved with a single family residence. If the subject mortgaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: 10% down by certified funds, balance, by certified funds, within 24 hours. No refunds. The property will NOT be open for inspection.

For information call Mr. John Kienzle at Plaintiff’s Attorney, Marinosci Law Group, PC, 2215 Enterprise Drive, Westchester, IL 60154. (312) 9408580. 23-03583 ADC INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3247022

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION US BANK NATIONAL ASSOCIATION NOT IN ITS INDIVIDUAL CAPACITY BUT SOLELY IN ITS CAPACITY AS INDENTURE TRUSTEE OF CIM TRUST 2021-NR1; Plaintiff, vs. TONNIE YOUNG; WILLIE HAYES; STATE OF ILLINOIS Defendants, 19 CH 9367 NOTICE OF SALE PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above entitled cause Intercounty Judicial Sales Corporation will on Monday, August 5, 2024 at the hour of 11 a.m. in their office at 120 West Madison Street, Suite 718A, Chicago, Illinois, sell at public auction to the highest bidder for cash, as set forth below, the following described mortgaged real estate: P.I.N. 15-09-112-030-0000, 15-09112-029-0000, 15-09-112-028-0000. Commonly known as 306 Bohland Avenue, Bellwood, IL 60104. The mortgaged real estate is improved with a single family residence. If the subject mortgaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: 10% down by certified funds, balance, by certified funds, within 24 hours. No refunds. The

property will NOT be open for inspection.

For information call Sales Department at Plaintiff’s Attorney, Manley Deas Kochalski, LLC, One East Wacker Drive, Chicago, Illinois 60601. (614) 220-5611. 18-016158 F2 INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3247016

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION FEDERAL HOME LOAN MORTGAGE CORPORATION, AS TRUSTEE FOR THE BENEFIT OF THE FREDDIE MAC SEASONED LOANS STRUCTURED TRANSACTION TRUST, SERIES 2019-2

Plaintiff, vs. SHEILA K. COLLINS-JOHNSON AS GUARDIAN FOR CANUTE G. COLLINS A/K/A CANUTE GEORGE COLLINSSR Defendants, 23 CH 6288 NOTICE OF SALE PUBLIC NOTICE IS HEREBY

GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above entitled cause Intercounty Judicial Sales Corporation will on Monday, August 5, 2024 at the hour of 11 a.m. in their office at 120 West Madison Street, Suite 718A, Chicago, Illinois, sell at public auction to the highest bidder for cash, as set forth below, the following described mortgaged real estate: P.I.N. 15-22-110-085-0000.

Commonly known as 2320 S. 22ND AVE., BROADVIEW, IL 60155. The mortgaged real estate is improved with a single family residence. If the subject mortgaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: 10% down by certified funds, balance, by certified funds, within 24 hours. No refunds. The property will NOT be open for inspection.

For information call Mr. Ira T. Nevel at Plaintiff’s Attorney, Law Offices of Ira T. Nevel, 175 North Franklin Street, Chicago, Illinois 60606. (312) 3571125. 23-01771 INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3247013

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION CITIGROUP MORTGAGE LOAN TRUST INC. ASSET BACKED PASS-THROUGH CERTIFICATES SERIES 2007-AMC2; US BANK NATIONAL ASSOCIATION AS TRUSTEE; Plaintiff, vs. MICHAEL REED; CITY OF CHICAGO; Defendants, 20 CH 3433

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above entitled cause Intercounty Judicial Sales Corporation will on Tuesday, July 30, 2024 at the hour of 11 a.m. in their office at 120 West Madison Street, Suite 718A, Chicago, Illinois, sell at public auction to the highest bidder for cash, as set forth below, the following described mortgaged real estate: P.I.N. 15-16-200-075-0000. Commonly known as 3101 Monroe

Street, Bellwood, IL 60104. The mortgaged real estate is improved with a single family residence. If the subject mortgaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: 10% down by certified funds, balance, by certified funds, within 24 hours. No refunds. The property will NOT be open for inspection. For information call Sales Department at Plaintiff’s Attorney, Manley Deas Kochalski, LLC, One East Wacker Drive, Chicago, Illinois 60601. (614) 220-5611. 20-003431 F2 INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3246568

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION

U.S. BANK TRUST NATIONAL ASSOCIATION, NOT IN ITS INDIVIDUAL CAPACITY BUT SOLELY AS OWNER TRUSTEE FOR VRMTG ASSET TRUST

Plaintiff,

-v.-

BENJAMIN MCGEE, MARVA MCGEE

A/K/A MARVA D MCGEE, UNITED STATES OF AMERICA, UNKNOWN OWNERS AND NON-RECORD CLAIMANTS

Defendants

2023 CH 00549

2918 WILCOX AVENUE

BELLWOOD, IL 60104

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on May 1, 2024, an agent for The Judicial Sales Corporation, will at 10:30 AM on August 2, 2024, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 2918 WILCOX AVENUE, BELLWOOD, IL 60104

Property Index No. 15-16-206-0550000

The real estate is improved with a single family residence.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale. Where a sale of real estate is made to satisfy a lien prior to that of the United States, the United States shall have one year from the date of sale within which to redeem, except that with respect to a lien arising under the internal revenue laws the period shall be 120 days or the period allowable for redemption under State law, whichever is longer, and in any case in which, under the provisions of section 505 of the Housing Act of 1950, as amended (12 U.S.C. 1701k), and subsection (d) of section 3720 of title 38 of the United States Code, the right to redeem does not arise, there shall be no right of redemption.

The property will NOT be open for

inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information. If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4). If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS

MORTGAGE FORECLOSURE LAW. You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

MCCALLA RAYMER LEIBERT

PIERCE, LLC Plaintiff’s Attorneys, One North Dearborn Street, Suite 1200, Chicago, IL, 60602. Tel No. (312) 346-9088. THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales.

MCCALLA RAYMER LEIBERT PIERCE, LLC

One North Dearborn Street, Suite 1200 Chicago IL, 60602 312-346-9088

E-Mail: pleadings@mccalla.com Attorney File No. 22-13437il_864723

Attorney Code. 61256

Case Number: 2023 CH 00549 TJSC#: 44-1239

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose.

Case # 2023 CH 00549 I3246832

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION U.S. BANK NATIONAL ASSOCIATION, AS TRUSTEE, SUCCESSOR IN INTEREST TO BANK OF AMERICA NATIONAL ASSOCIATION, AS TRUSTEE, SUCCESSOR BY MERGER TO LASALLE BANK NATIONAL ASSOCIATION, AS TRUSTEE FOR STRUCTURED ASSET INVESTMENT LOAN TRUST MORTGAGE PASSTHROUGH CERTIFICATES, SERIES 2004-6 Plaintiff, -v.KOFI OKYERE A/K/A KOFI A. OKYERE, UNITED STATES OF AMERICA

Defendants

2018 CH 08427 10530 CAMELOT WESTCHESTER, IL 60154

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY

GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on October 11, 2018, an agent for The Judicial Sales Corporation, will at 10:30 AM on July 29, 2024, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 10530 CAMELOT, WESTCHESTER, IL 60154

Property Index No. 15-20-203-0210000

The real estate is improved with a single family residence. Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale.

Where a sale of real estate is made to satisfy a lien prior to that of the United States, the United States shall have one year from the date of sale within which to redeem, except that with respect to a lien arising under the internal revenue laws the period shall be 120 days or the period allowable for redemption under State law, whichever is longer, and in any case in which, under the provisions of section 505 of the Housing Act of 1950, as amended (12 U.S.C. 1701k), and subsection (d) of section 3720 of title 38 of the United States Code, the right to redeem does not arise, there shall be no right of redemption.

The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4). If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure

sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW. You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales. For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff’s Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 7949876 THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales. CODILIS & ASSOCIATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100 BURR RIDGE IL, 60527 630-794-5300

E-Mail: pleadings@il.cslegal.com

Attorney File No. 14-18-06643

Attorney ARDC No. 00468002

Attorney Code. 21762 Case Number: 2018 CH 08427 TJSC#: 44-1622

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose. Case # 2018 CH 08427 I3246973