Home Oxygen Market Outlook

Industry Insights

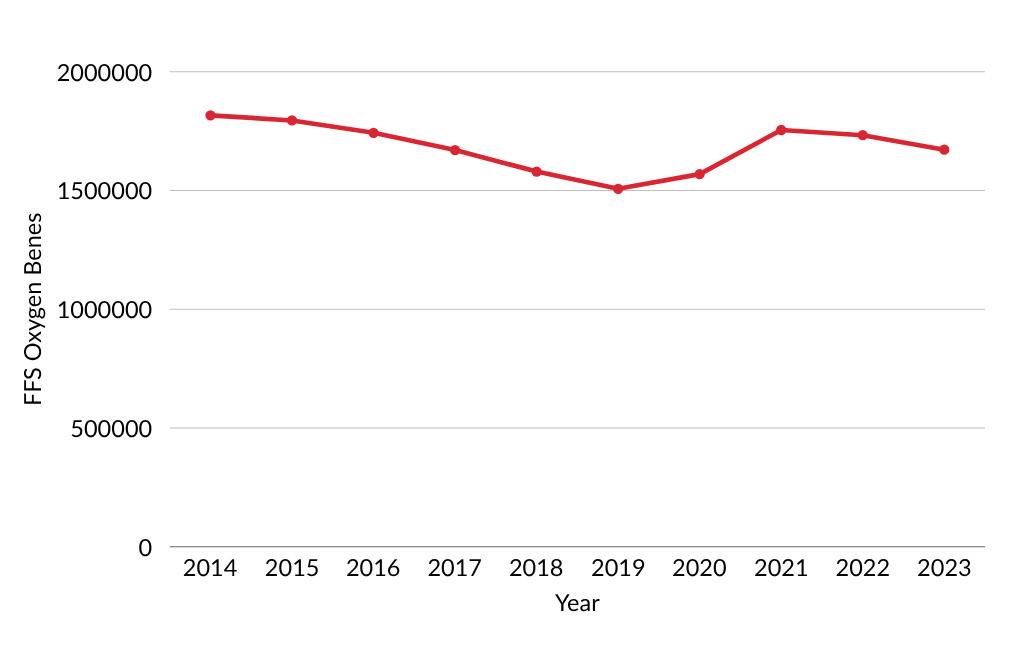

The home oxygen therapy market is undergoing a notable shift. From 2014 to 2023, the percentage of fee-for-service (FFS) Medicare beneficiaries utilizing oxygen has fallen from 3.44% to 2.51%. Adjusted for the shift of beneficiaries from traditional Medicare to Medicare Advantage, this holds true as well. This is a notable dynamic considering the number of Medicare eligible patients continues growing daily.

While Medicare enrollment has surged from 53 million to 66 million between 2014 and 2023,—reflecting a rapidly aging population—the number of beneficiaries using oxygen therapy has declined from 1.8 million to 1.6 million. This inverse trend suggests that despite more older adults entering Medicare, fewer are receiving oxygen treatment.

PORTABLE OXYGEN CONCENTRATORS (POC

s) are rapidly gaining traction. Since 2014, the number of Medicare beneficiaries utilizing portable oxygen concentrators has continued increasing. In 2014, the percentage of total oxygen beneficiaries that were utilizing portable oxygen concentrators was 7%. By 2023, this had reached 26%, articulating that a higher percentage of the overall oxygen market is being attributed to the growing segment of POCs.

• Changing Patient Preferences: Today’s seniors are more active and travel-oriented. POCs— lightweight, battery-powered, and approved for air travel—align with these lifestyle goals far better than stationary or tank-based systems.

• Policy and Coverage Evolution: Medicare’s 2025 guidelines now support POC coverage for mobile patients, provided the device is sourced from an accredited supplier. This marks a shift from the program’s historical preference for stationary systems.

• Technology Advancements: Modern POCs are smaller, quieter, and more efficient, making them more appealing for daily use.

• Supplier Incentives: POCs offer lower long-term servicing costs compared to liquid oxygen systems, making them a more sustainable option for suppliers.

Meanwhile, the overall decline in oxygen therapy usage is influenced by broader health trends. Smoking rates in the U.S. have dropped significantly— from 23% in 2000 to 11.5% in 2022—reducing the prevalence of chronic obstructive pulmonary disease (COPD), a major driver of long-term oxygen therapy. Additionally, Medicare has tightened qualification criteria, requiring more rigorous documentation and testing.

This shift toward portable solutions also reflects a broader movement in healthcare: the transition from institutional care to home-based models. POCs support this evolution by offering flexibility, ease of use, and compatibility with remote monitoring technologies.

STRATEGIC IMPLICATIONS

11.5 %

The rise of portable oxygen concentrators presents a timely opportunity for stakeholders to:

• Align product strategies with patient mobility and independence.

• Invest in innovation that enhances usability and efficiency.

• Support the growing demand for home-based care solutions.

SUMMARY

In short, while fewer Medicare beneficiaries may be using oxygen overall, those who do are increasingly choosing portable, patient-centered solutions that reflect the future of care delivery. As the population continues to age, a growing number of beneficiaries will continue increasing the utilization of portable oxygen concentrators.

VGM Industry Insights provides data-driven analysis and trends within the durable medical equipment, prosthetics, orthotics, and supplies (DMEPOS) sector. Our focus areas include market trends, innovation, and strategic decision-making, helping stakeholders stay informed and competitive. We are committed to a forward-thinking approach, continuously monitoring industry developments to drive progress and innovation.

ALAN MORRIS SVP of Strategy

TYLER COULANDER Market Strategy Manager