National Health Expenditure UpdateDME Outlook

The latest release of National Health Expenditure (NHE) data provides valuable insights into the future of the Durable Medical Equipment (DME) industry. With healthcare spending continuing to rise and the population aging rapidly, DME is well-positioned to play a central role in the evolving care landscape, which is validated through national health expenditure data analyzed by VGM Industry Insights.

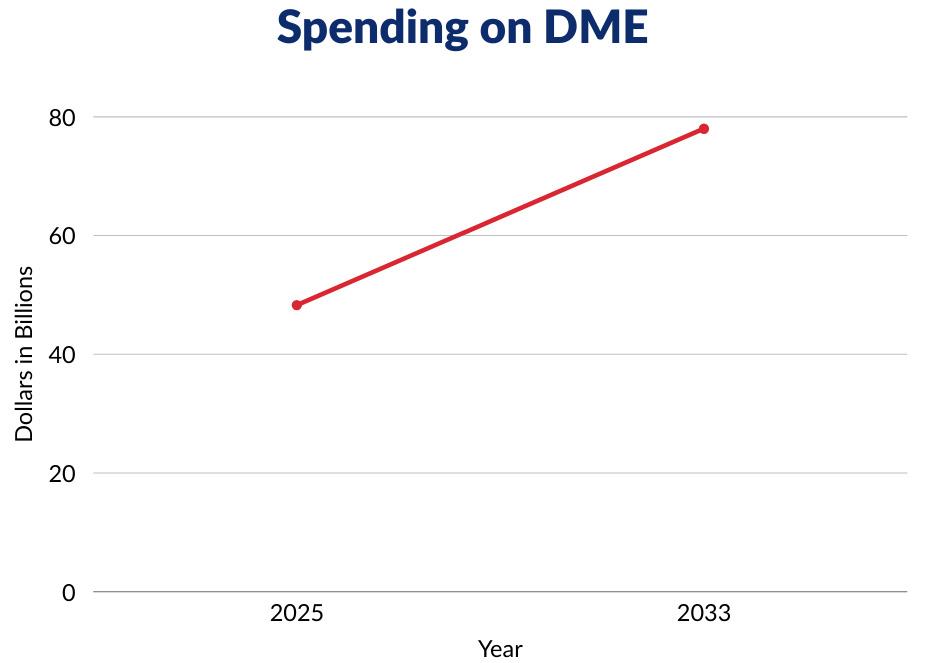

According to the 2025 projections, spending on DME is expected to grow significantly—from $48.4 billion in 2025 to more than $78 billion by 2033. This represents a compound annual growth rate (CAGR) of approximately 6%, signaling a strong and steady expansion of the market.

While DME currently accounts for 2.55% of total health expenditures in 2024, that share is projected to increase slightly to 2.60% by 2030. When looking at Medicare specific spend, DME accounted for 3.30% of total spend in 2024, and will grow to over 3.60% by 2033. Though modest, this growth is meaningful when viewed alongside broader shifts in care delivery. For example, home health services, which complement DME well, are expected to grow from 7.77% to 9.16% of total health spending over the same period. In contrast, hospital spending is projected to decline from 81.39% to 79.25%, reflecting a broader shift toward decentralized, homebased care.

The growth of the DME industry is being fueled by a combination of price increases and rising demand, though demand is clearly the dominant force. While price growth has been relatively modest—driven by inflation, supply chain pressures, and limited pricing flexibility—demand is surging due to structural changes in the healthcare system.

67% of the projected growth in the DME industry through 2033 will be attributable to new demand

An aging population, the increasing prevalence of chronic conditions, and the expansion of home-based care models are all contributing to this demand. In fact, analysis of the latest price index data shows that 67% of the projected growth in the DME industry through 2033 will be attributable to new demand rather than price inflation. This is a strong indicator of the industry’s long-term health and relevance. 67 %

Understanding the payer mix is essential for DME industry stakeholders navigating today’s reimbursement environment. In 2025, DME spending is expected to be evenly split between private insurance (40%) and Medicare (40%), with Medicaid accounting for the remaining 20%. However, by 2033, Medicare’s share is projected to rise to 48%, reflecting both demographic trends and policy shifts.

Within Medicare, the shift toward Medicare Advantage (MA) is particularly noteworthy. In 2010, only 25% of Medicare beneficiaries were enrolled in MA plans. By 2034, that number is expected to climb to 64%, with Traditional Medicare falling to just 36%. In 2025 alone, 23% of DME spending will come from MA plans, compared to 17% from Traditional Medicare. It is worth noting that by 2033, the 23% spent today by MA plans is projected to reach over 30%.

The rise of Medicare Advantage presents both challenges and opportunities for DME suppliers. On one hand, MA plans often introduce administrative complexities, such as prior authorization requirements, narrow provider networks, and downward pressure on reimbursement rates. These factors can create friction for suppliers and limit patient access to the necessary equipment.

On the other hand, MA also opens the door to value-based partnerships and innovative care models. As these plans continue to emphasize home-based care and aging in place, DMEs have an opportunity to demonstrate their value by supporting better outcomes and lower costs. Leveraging outcomes data and aligning with MA plan goals will be key to success in this space.

The Durable Medical Equipment industry is on a clear path of demand-driven growth, supported by demographic trends and a shift in care delivery models. As the market continues to expand rapidly, shifts in site-of-care and the evolving payer landscape are compelling DME providers to align more strategically with health systems and payers more than ever before. For this reason, larger volumes of DME are shifting to a smaller number of providers. In this dynamic environment, it is important for industry stakeholders to stay informed and agile as these trends continue to reshape the industry.

In conclusion, here are three action steps for industry stakeholders to take:

1. Understand the evolving payer landscape across the healthcare continuum, highlighting shifts in site of care that compliment opportunities for the DME industry.

2. Align with the priorities of Medicare Advantage plans as their presence is only going to continue growing.

3. Invest in data driven value propositions to articulate the immense value the DME industry has.

VGM Industry Insights provides data-driven analysis and trends within the Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) sector. Our focus areas include market trends, innovation, and strategic decision-making, helping stakeholders stay informed and competitive. We are committed to a forward-thinking approach, continuously monitoring industry developments to drive progress and innovation.

ALAN MORRIS SVP of Strategy

TYLER COULANDER Market Strategy Manager