Verdo’s Annual Report 2023

06

About Verdo energy group

Energy for the future

22

36

Verdo’s business areas

20

30

Update on historical cases

Climate and environment (E) Energy consumption and composition

61

2 Annual report 2023

Verdo in numbers 2023

3 Annual report 2023 Contents 85 106 Financial statements Management commentary Management introduction 4 About Verdo energy group 6 Social contract 8 Our foundation 10 Value of the social contract – from the local community’s perspective ......................................................... 11 A democratic way of doing business ......................................... 14 Board members in profile......................................................... 16 From the Board of Representatives 18 Verdo in numbers 2023 20 Energy for the future 22 Strategic focus areas 26 Verdo Group companies and structure 29 Update on historical cases 30 The financial statements for 2022 and 2023 must be viewed together to see both sides of the energy crisis 32 Financial highlights 35 Business areas in the Verdo Group 36 Energi & Forsyning ............................................................................. 37 Trading .................................................................................................... 44 Energy ..................................................................................................... 46 Teknik ....................................................................................................... 48 Elsalg ....................................................................................................... 50 Verdo as a responsible social player ...................... 52 Business model 53 Verdo’s ESG results 2023 56 Climate and environment (E) ................................... 60 Social sustainability (S) ............................................ 77 Governance (G) .......................................................... 94 ESG table ...................................................................... 98 Financial statements Management’s statement 107 Accounting policies 108 Income statement for 2023 115 Balance sheet on 31 December 2023 116 Statement of changes in equity for 2023 119 Cash flow statement for 2023 121 Notes 122 The independent auditor’s report 132 Social sustainability (S) Employee training

We have laid the foundation for the future energy supply, and this work will continue at full speed in 2024, with more detailed analyses and several concrete initiatives that will bring the transition much closer to home.”

Course set for Energy of the Future

Some years bring greater changes than others. Most people well remember the energy crisis of 2022 and the tremors it sent through society. 2023 seemed tame – almost boring –by comparison, and is unlikely to be remembered.

However, this is far from true at Verdo, where 2023 ended up being a landmark year and one that marked the start of a new era. This is because of the extensive work on Energy of the Future, which will define the energy supply in Randers and Herning for future generations.

After several years of intense analysis, the backdrop was set for ensuring a green energy supply for consumers at competitive prices in the coming decades. This will be firmly anchored in local energy sources, with security of supply levels that, despite rising external pressures, are at least as high as today.

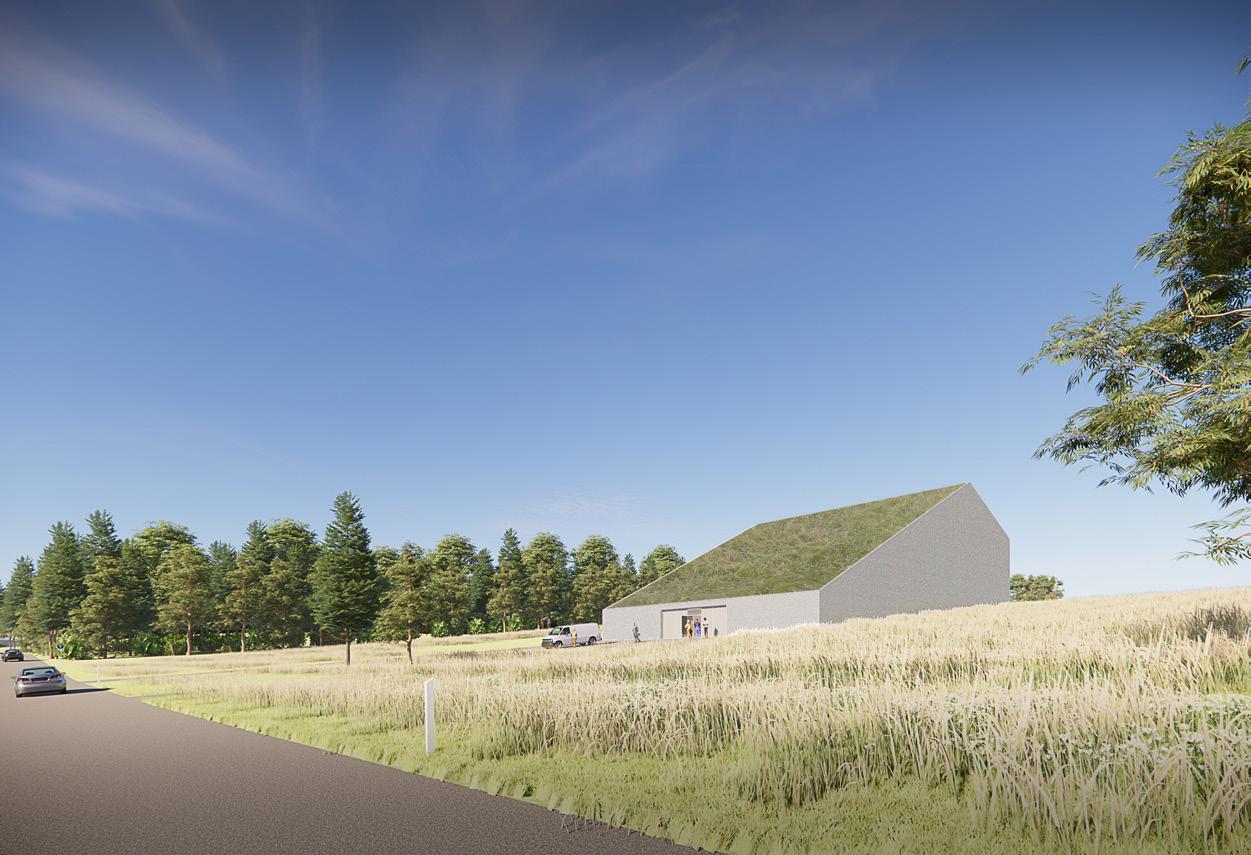

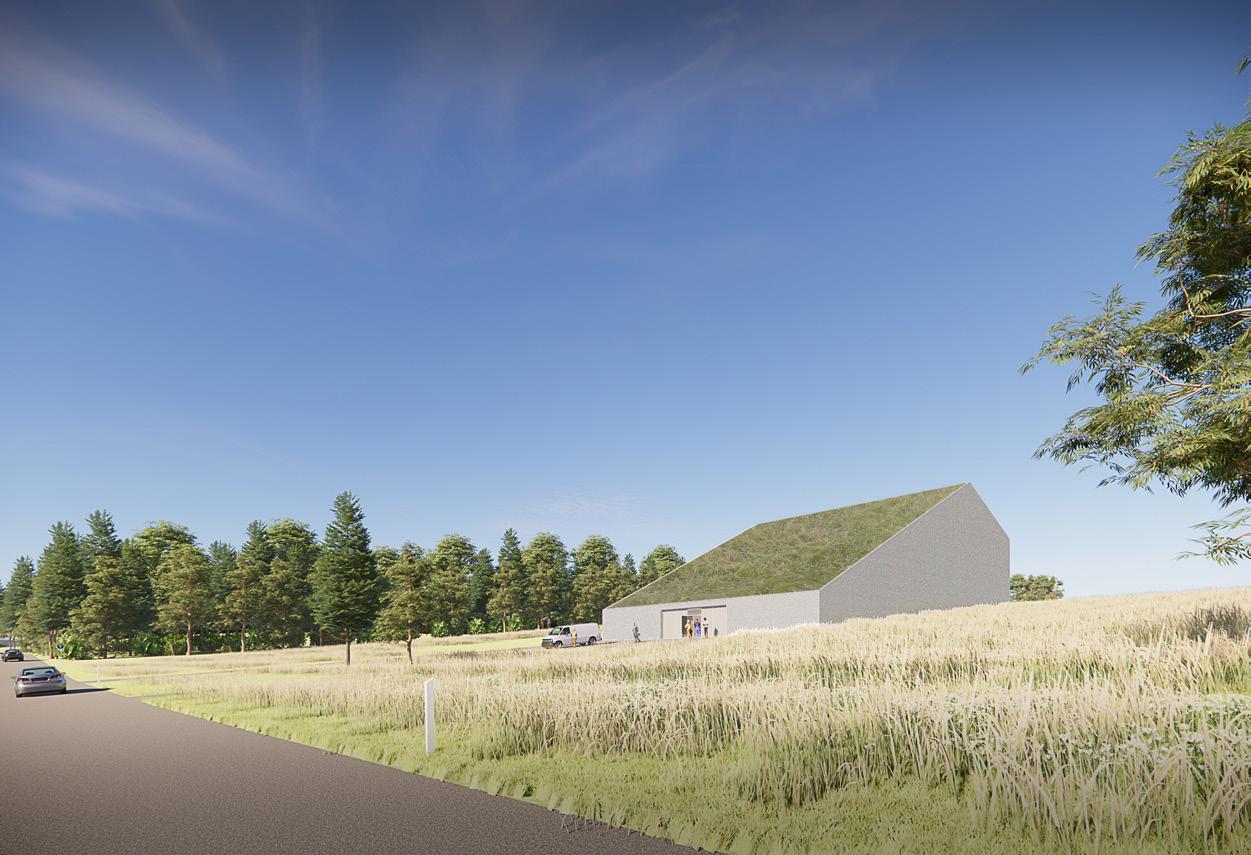

Energy of the Future really got underway when Verdo decided to establish a heat storage facility on Bronzevej in south Randers. This is the first concrete investment in the future energy supply, and one of the elements that will pave the way for increasing the share of renewable energy from solar and wind in the heating supply.

2023 also marked another record year for the conversion of households and businesses from fossil fuels to district heating. This is especially the case in Randers, where the potential is greatest and where citizens are strongly supporting this part of the green transition. Gas conversion is the area where Verdo currently contributes most to reducing carbon emissions, and we are conscious of our responsibility to expand the supply area where possible, so that as many households and businesses as possible can phase out oil and gas.

However, in terms of earnings, we cannot in any way be satisfied with 2023. The year was dominated by highly volatile prices and demand scenarios. The collapse in Q4 2022, in particular, was keenly felt throughout 2023. Significant drops in electricity prices impaired conditions for Verdo Produktion A/S, while the collapse in wood pellet prices impaired conditions for Verdo Trading A/S. A change in behaviour towards lower electricity consumption was also part of the mix.

While Verdo Teknik A/S made progress, it was not enough to secure the necessary earnings. Verdo Energy Systems A/S has seen impressive growth, but has only just created the foundation for future earnings now.

The financial results give occasion to review all parts of the business and adjust operations where necessary, adapting to the reality we are now facing.

We expect 2024 to be another difficult year characterised by high levels of unpredictability, supply chain uncertainties, global crises and wars, and a general economic downturn.

However, this does not change our course. We have laid the foundation for the future energy supply, and we will continue to move ahead at full speed in 2024, undertakingmore detailed analyses and several concrete initiatives that will bring the transition much closer to home. It is a complex process involving major investment decisions. Verdo will therefore have a special focus in the coming period on ensuring that we have the competencies needed to take the next steps into the future. It is a job we look forward to.

In conclusion, we would like to thank our employees, partners and everyone else who contributed during 2023 to the development of Verdo and of the communities we are an integral part of.

We look forward to keeping up the good teamwork.

We hope you enjoy reading the report.

Torben Høeg Bonde Jakob Flyvbjerg Christensen Chairman of the Board CEO

Torben Høeg Bonde Jakob Flyvbjerg Christensen Chairman of the Board CEO

5 Annual report 2023

About Verdo energy group

Verdo is a purpose-driven company with over 150 years of history. We work to promote our cooperative owners’ common interest in heating, water and electricity, and towards increased democratisation, by ensuring the broadest possible consumer influence in our supply areas in Randers, Herning and Kongerslev.

We are a locally anchored energy group, responsible for supplying electricity, water and/or heating to a large number of private homes and businesses in central Jutland. In addition to our regulated utilities business, the Verdo Group consists of a number of commercial business areas.

We are a forward-looking organisation, made up of almost 600 talented people, which aims to create energy for the future in responsible ways that contribute to addressing climate and environment challenges. Verdo also makes energy and infrastructure more accessible, thus helping to maintain living standards and ensure well-being in the areas where we are active.

We are the specialists who build the district heating network, and produce and transmit the heat in people’s radiators.

Who supply coal to industry, and thereby to present and future technologies, and for energy production, where coal remains an indispensable part of global security of supply.

Who upgrade street lighting to more climate-friendly LED solutions and help reduce energy consumption and climate footprint.

Who develop intelligent traffic lights that read and optimise traffic flows, helping to improve traffic safety and reduce carbon emissions.

Who make it easier for private households and businesses alike to drive in a more eco-friendly manner through our charging stations.

Who produce and sell green power based on environmentally certified and renewable energy sources such as solar, wind and biomass.

And who help companies and other utilities produce energy responsibly by providing high-tech waste and biomass plants and heat pumps, which actively displace fossil fuels and support the energy transition.

We thus make a key difference in a variety of ways. At home. Locally. Nationally. Globally. We are part of the global community, more than ever before, while also being part of and actively supporting the local community. We take joint responsibility as we develop and use energy-efficient solutions for the benefit of our climate and planet – today and for future generations. We are conscientious and ambitious, and take new steps every day – together.

Facts:

As of 31 December 2023 Verdo had 590 employees –126 in Energi & Forsyning, 155 in Energy, 144 in Teknik, 39 in Trading, 109 in Holding and 17 in Elsalg.

The majority of employees work at our Danish sites in Randers, Herning, Aarhus, Aalborg, Hillerød and Næstved. We also have sites in Norway, Poland and the USA.

6 Annual report 2023

7 Annual report 2023

Social contract

Verdo’s social contract defines our efforts in relation to the climate and environment, and social, financial and leadership sustainability, and the way we do business. It is based on mutual interest and dependence between companies and society, such that we create change together – for the benefit of all.

It is vital for companies that there is a functional society and a strong infrastructure that creates security and opportunities and supports society economically and socially. Conversely, the outside world has an interest in successful and competitive companies that can support the economy.At Verdo, the social contract helps to cement our responsibility towards our customers, the local community, our partners and each other as employees.

We have no shareholders or owners who are entitled to a share of any profits, so instead we reinvest part of the profits over time in developing our business, which also benefits society. As part of our social contract, we also distribute funds to promote business and urban development, and to innovation projects related to the transition to sustainable critical infrastructure. Finally, we support the development of local communities, financially and otherwise, through sponsorships and other local activities that help make a real difference.

In 2023, we supported:

• Randers FC

• Randers Q

• Randers HK

• Randers Cimbria

• Harbour Challenge Randers

• Værket (Randers)

Randers Teater

Randers Regnskov

Randers Festuge

Oust Mølle Rock (Randers)

Underværket (Randers) ice rink

Idrætscenter Korshøj (Harridslev)

• Hornbæk Sportsforening (Randers)

• Munkholmhallen (Stevnstrup)

• Romalt Aktivitetshal (Randers)

• Herning Blue Fox

• HC Midtjylland (Herning)

• Herning Forenede Håndboldklubber (HFH)

• FC Midtjylland

• Viborg FF

Aalborg Pirates

AGF

Medaljefonden

Award ceremony at Tradium

Christmas aid (Randers and Herning)

Byens Bedste Randers

• Danmarks Indsamling

8 Annual report 2023| Social contract

Our social contract

Customers – making life simpler and more secure

• We make an effort to understand and deliver on our customers’ needs, making it easy to be a customer with us.

We deliver secure utility services at competitive prices.

• We act with decency and seek to earn the trust of our customers.

Society – local development

• We give back and contribute to the development of our local communities.

We create an attractive foundation for a rich and growing business community.

We develop and share knowledge and support projects that advance the green transition.

Employees – a community that promotes growth

• We equip employees for the future labour market through individual development and the opportunity to have great responsibility.

• We create the framework for a committed community and dedicated employees, where we dynamically work towards ambitious common goals.

We create an attractive workplace with a strong sense of purpose.

Partners – long-term relationships

• We are transparent and flexible in the way we work with our partners.

• We set set high standards in relation to competitiveness, deliveries and working conditions.

We work towards close relationships and longterm benefits.

9 Annual report 2023

Our foundation

Our mission

Verdo’s mission is to operate and develop sustainable critical infrastructure for the benefit of customers and future society, based on heating, water, electricity and technical infrastructure.

This is the basis for a business that seeks to serve both customers and society.

We look for new possibilities, and seek to use digital and innovative solutions to make life simpler for our customers, while guaranteeing high security of supply and competitive prices.

We invest for the long term and based on careful consideration, focusing on the climate, environment and resource economy, with respect for present and future generations.

Our vision

Verdo’s vision is to be one green step ahead – together.

We seek to realise this vision by actively contributing to the green transition and leading the way in developing the future energy supply.

We cannot do this on our own. We believe we will be most successful when working closely together with the rest of society – as we develop new solutions with our customers, and infrastructure and urban areas with local partners, as we work with government authorities, and as we together build an inclusive corporate culture.

Our values

These values are our foundation: Together Responsible

• Ambitious

They reflect our approach to running a responsible business. As does our aim of being an active and responsible local player that helps drive and spearhead the green transition, and our aim of doing so through mutually committed partnerships – both internal and external.

This means that:

We have a strong team spirit, and work together with our customers, employees, partners and local associations to create solutions for future society.

We take responsibility for more than our own results, and strive to make a clear difference in the green transition.

We are ambitious as we take the lead in ensuring continued development through dynamism, professionalism and dedication.

10 Annual report 2023

| Our foundation

Value of the social contract – from the local community’s perspective

As a company, we have a responsibility towards the environment and climate, to be socially responsible and to practise good governance, and we cannot do all this alone.

Based on our social contract, we therefore recognise the need to enter into strong strategic partnerships. Good partners are key to our success.

We are mutually dependent

By Søren Degn-Pedersen, Head of Secretariat and Sustainability, Randers Municipality

The Randers City Council has adopted a climate plan that strives towards climate neutrality by 2050. The municipality, of course, looks at our emissions as an organisation, but if we are to seriously reduce carbon emissions for the entire municipality we must involve all the players, and Verdo is a key one.

The sustainability committee identified three focus areas in 2023 – afforestation, energy and education – and without Verdo as a partner, we will not achieve our goals.

The afforestation element is about absorbing CO2 and protecting biodiversity. This is relevant because Verdo supplies Randers with drinking water, and afforestation is effective in protecting groundwater resources. If we are successful in this, we can kill several birds with one stone. So I hope we will see the first groundwater protection projects during 2024-25.

With its heating supply and energy production, Verdo plays a key role in the municipality’s strategic energy planning. How do we plan the major energy balances locally so that we get 100% green energy in Randers Municipality?

The municipality acts in the authority role, and Verdo is responsible for implementation. We are thus dependent on each other in order to achieve our goal of 100% green energy in 2050.

When the city council next updates our climate plan, we expect more focus on promoting green behaviour among citizens. Verdo’s direct contact with thousands of utility customers puts the company in a unique position. It will be great if Verdo can also see the possibilities and wants to work with us.

Common to all our partnerships – regardless of size, economic scope and strategic anchoring – is the potential to build long-term relationships that promote mutual growth. This demands that we are transparent and flexible in our collaboration, and also set the bar high regarding competitiveness, deliveries and working conditions. Only by being ambitious together on these parameters can we deliver solutions that make a real difference.

Our direct collaboration is one of the reasons we were able to make the comprehensive climate cooperation agreement between Verdo and Randers Municipality.”

It is clear that Verdo plays a positive role in the major tasks that lie ahead. The numerous households that have switched to district heating in recent years is a good example of the results that have already been achieved. Joint events for entrepreneurs are another good example.

Our direct collaboration is one of the reasons we were able to make the comprehensive climate cooperation agreement between Verdo and Randers Municipality. The agreement is a good joint foundation for achieving results, so I believe that we can achieve even greater results together in the coming years. Randers needs that.

11 Annual report 2023

Value of the social contract |

Verdo can help make consumers aware of their contribution. What they can be a part of and how this helps achieve the national goals.”

Verdo’s local roots build bridges to the major changes taking place globally

By Thea Lyng Thomsen, CEO of Bæredygtig Herning.

As a partner in the work, it is great to see that Verdo has chosen to actively play a greater role in the Herning area.

It is clearly evident that Verdo as a company rests on a consumer-owned foundation – with the strengths and challenges that entails. This is reflected in Verdo’s proactive and positive approach to the transition of the energy and heating supply, by both taking the lead and involving others.

I see local anchorage as central in addressing our challenges with the transition to green energy. This is where

we find the answers to how we can make the transition in a fair way that local citizens can accept. However, this demands a willingness and interest in working continuously with openness in the local area.

As a consumer-owned company, Verdo has a unique role to play through its close connection to consumers. Verdo can help make consumers aware of their contribution. What they can be a part of and how this helps achieve the national goals. Verdo can thereby bridge the gap between major geopolitical movements in the world and the local level, where consumers ask themselves: “Can I get affordable energy? And what energy am I willing to pay for?”

Verdo’s role as a facilitator in the green transition is also important in relation to ensuring that we use our land efficiently. Meeting all the challenges we are currently facing will require more than four times the land we have available in Denmark. We must therefore be good at finding initiatives that will allow us to do several things in the same space.

I have no doubt that we will benefit from the efforts that are currently being set in motion as we begin to reap the results in the coming years.

12 Annual report 2023| Our foundation

13 Annual report 2023

A democratic way of doing business

Not present above

Peter Nowack, board member

Top, from left: Keld Christensen, board member, Peter Kjærsgaard, board member.

Second row: Niels Rasmussen, board member, Martin Rubæk, employee representative.

Third row: Pia Maach-Møller, board member, Finn Stengel Petersen, board member, Bo Svoldgaard, board member. Fourth row: Jakob Flyvbjerg Christensen, CEO of Verdo, Torben Høeg Bonde, Chairman, Dines Velling Johansen, employee representative. Bottom row: Lars van Hulst Pedersen, employee representative, Jan Guldmann, board member, Finn Skaarup Andersen, Deputy Chairman.

Jes Grønning Hansen, employee representative

Peter Nowack, board member

Top, from left: Keld Christensen, board member, Peter Kjærsgaard, board member.

Second row: Niels Rasmussen, board member, Martin Rubæk, employee representative.

Third row: Pia Maach-Møller, board member, Finn Stengel Petersen, board member, Bo Svoldgaard, board member. Fourth row: Jakob Flyvbjerg Christensen, CEO of Verdo, Torben Høeg Bonde, Chairman, Dines Velling Johansen, employee representative. Bottom row: Lars van Hulst Pedersen, employee representative, Jan Guldmann, board member, Finn Skaarup Andersen, Deputy Chairman.

Jes Grønning Hansen, employee representative

Verdo is owned by our cooperative members. This means that we can focus on our customers and on meeting the long-term goals defined by our cooperative members as Verdo’s purpose.

Our role is not to deliver short-term profits to external owners, but through long-term investments, to fulfil our social responsibility, help drive the green transition and deliver the best solutions to customers – who are also our co-owners.

As a cooperative-owned company, we have an obligation and an interest in involving the members of our Board of Representatives in developing the organisation. We

Verdo’s ownership

Verdo a.m.b.a. is owned by the cooperative owners. These are the Group’s heating consumers in Randers and Herning, water consumers in Randers and the consumers connected to the electricity grid in Kongerslev. As a cooperative, Verdo works to advance the cooperative owners’ common interests by purchasing heat, water and electricity. All cooperative members can exercise influence by voting in elections to the Board of Representatives, based on the ‘one meter – one vote’ principle. Elections to the Board of Representatives are held every four years.

do this in part through our two annual meetings of the Board of Representatives, supplemented by one to two annual dialogue meetings focusing on selected themes. Regular information is also provided about developments at Verdo, so that members are best equipped to fulfil their responsibilities on the Board of Representatives and to be good ambassadors for Verdo and for the green transition in the local community.

We asked two of our board members and two members of the Board of Representatives what it means to them to be part of a cooperative and thus have direct influence on Verdo’s role in and contribution to the green transition, now and in the future.

Board of Representatives Supervisory Board

The Board of Representatives is Verdo’s supreme governing authority. The maximum number of members of the Board of Representatives is 85 – elected in the three supply areas: Randers (56 members), Herning (28 members) and Kongerslev (one member). The number of seats per supply area is based on the proportion of meters. On 31 December 2023, the Board of Representatives had 69 members.

Verdo’s Supervisory Board is elected by and from among the Board of Representatives. The Supervisory Board is responsible for the general management of the company and approves the company and Group strategy. The Supervisory Board also approves the Group’s budgets and financial statements. The board has 10 members – three from the Herning voting area and seven from the Randers/Kongerslev voting area. In addition, there are four employee representatives.

Executive Board

Verdo’s Executive Board is responsible for daily operations and consists of one or more executive officers elected by the Supervisory Board. On 31 December 2023, Verdo’s Executive Board consisted of CEO Jakob Flyvbjerg Christensen and CFO Kenneth R. H. Jeppesen.

15 Annual report 2023 >

Board members in profile

As a representative of a cooperative, I am very conscious of our social obligations. It is vital that all citizens have equal access to essential resources such as water and heating.”

Dialogue with the Board of Representatives helps to effectively adapt strategies and initiatives

By Niels Rasmussen, consultant and former factory manager, and a member of Verdo’s Supervisory Board since 2010

Verdo’s strategy and actions are deeply rooted in a commitment to social responsibility. We have entered into a social contract, and with that in hand, we strive to be one step ahead in the green transition, not just internally but also in the communities where we are present and engaged. It also means that we try to raise awareness and improve knowledge of the green transition through partnerships and dialogue – in the local communities and on a more general level.

Our approach to the future is based in part on careful consideration of alternative energy sources that can benefit our company, our customers and society at large. Verdo will be making major investments in the development of the future infrastructure, and only by creating a high level of information and openness can we effectively reduce the local resistance that we may encounter to essential green projects such as wind and solar farms.

Our focus on advancing the movement towards more responsible solutions also involves an active effort to overcome the barriers – such as the price cap on excess heat – that impede the green transition. This process requires cooperation and understanding from all sectors, as well as from policy makers.

As a representative of a cooperative, I am very conscious of our social obligations. It is vital that all citizens have

equal access to essential resources such as water and heating.” Through new digital services, we work hard every day to ensure that our customers can benefit from the most efficient solutions, while helping to minimise the environmental footprint and keep prices down for consumers.

As a board member, I believe that Verdo’s efforts to promote open and honest communication with the Board of Representatives are important. We have expanded our communication platforms to include regular dialogue meetings in addition to the two annual meetings of the Board of Representatives. The purpose of these meetings is to create a more informal space for dialogue and the exchange of knowledge and experiences. I believe that the dialogue meetings allow us to achieve a greater understanding between the Board of Directors and the Board of Representatives, and ensure that the views of the Board of Representatives can be taken into account in our strategy. They also help prepare the members of the Board of Representatives for their role as ambassadors for Verdo’s green transition agenda in their respective communities.

16 Annual report 2023 | Board members in profile

Verdo is a cooperative owned by consumers in Herning and Randers, and that is where our focus must be. But if we can contribute at national or even international level with profitable solutions, of course we should do that as a secondary aim.”

Verdo is all of us, and the better things go for Verdo, the more it can give back to us

By Peter Kjærsgaard, car dealer and member of Verdo’s Supervisory Board since 2020

As a board member, I would like to highlight Verdo’s significant contribution to the green transition over the years. Our biomass-fired CHP plant has significantly reduced carbon emissions since 2009. This has ensured green heating at competitive prices for district heating customers, and we have long been involved in sustainable projects such as purchasing and planting forests and replacing street lights with LEDs.

We are facing major challenges globally, but we are doing what we can at Verdo by expanding our district heating network and keeping prices at a reasonable level, while preparing to close the CHP plant in Randers in 2036. Our Energy of the Future project is exploring all possibilities and new technologies, to ensure we have robust and reliable energy solutions with a continued high security of supply.

The work of developing the decentralised plants of the future comes with many new opportunities, but also demands great flexibility – far greater than before. Not only from us at Verdo, but also from our energy consumers, both private and commercial. This development may create a greater need for investments in the homes of energy consumers, which not everyone may be able to do. We should make an effort at Verdo to ensure that consumers can meet these investment needs – for the benefit of consumers, Verdo and society.

It is all very complex, but we are underway, and we are going to succeed.

Verdo is a cooperative owned by consumers in Herning, Randers and Kongerslev, and that is where our focus must be. But if we can contribute at national or even international level with profitable solutions, of course we should do that as a secondary aim. For example, we own Verdo Energy Systems – a commercial company which specialises in energy plants, heat pumps, boiler systems and boiler servicing. They are proof that Verdo’s competencies can be developed into a business area outside the local area.

Our Board of Representatives is one of our most important stakeholders, in that they are Verdo’s decision-making body. If we can encourage each representative to become engaged in the green transition in their network on behalf of Verdo and promote ideas and the flexibility that will be required of all of us, I believe that the Board of Representatives can make a difference. Our role on the Supervisory Board is to prepare everyone for this task and to listen to the input from the representatives. The starting point must be that we all want the best for Verdo.

17 Annual report 2023

Board members in profile |

From the Board of Representatives

Verdo can serve as a beacon for other companies and society by demonstrating how to integrate green principles into all aspects of its operations and business model.”

Verdo has a unique chance to be a key player in the green transition

By Nikolaj Rosenkilde Kølbæk, senior assistant and member of Verdo’s Board of Representatives since 2022

Verdo has a unique chance to be a key player in the green transition – as an active partner in society and as a company that gives centre stage to sustainability. As a local player, Verdo can play a vital role in accelerating the transition to renewable energy sources – by investing in and developing green infrastructure solutions and by informing and engaging the local community in sustainable initiatives.

Verdo can serve as a beacon for other companies and society by demonstrating how to integrate green principles into all aspects of its operations and business model.

Being a member of the Board of Representatives gives me a unique opportunity to directly influence and contribute to the green transition on a local level. As a consumer representative, I can participate in decision-making processes and contribute ideas and perspectives that advance Verdo’s sustainable initiatives and investments. It also gives me a platform to be a voice for our local community and ensure that its interests and needs are heard and met in Verdo’s strategies and projects.

Conversely, by being an integral part of the local community, Verdo can build trust and support for sustainable projects and ensure that local needs and priorities are taken into account. Verdo’s local presence can also help create job opportunities and economic growth through green investments and initiatives.

Verdo’s broadly-based Board of Representatives has the potential to play a vital role in the green transition by serving as a platform for dialogue, collaboration and knowledge sharing. By engaging and involving a diverse Board of Representatives, Verdo can strengthen its legitimacy and anchoring in the local community, and ensure that decisions and actions reflect different perspectives and needs. The active role of the Board of Representatives should possibly be increased through more regular dialogue meetings and topic-based working groups.

Verdo’s most important task in 2024 will be to continue to drive the green transition forward with determination. This means maintaining and increasing investments in renewable energy and energy efficiency, and intensifying efforts to engage and mobilise the local community in sustainable initiatives. Verdo should also focus on strengthening its partnerships and collaboration with other players in the energy sector, and work towards a more integrated and sustainable future for both the company and society as a whole.

18 Annual report 2023| From the Board of Representatives

In order to contribute effectively to developing the sustainable energy sources of the future, Verdo needs to constantly keep abreast of the many new technologies and opportunities that arise along the way.”

Verdo’s aim of being one green step ahead demands the courage to invest and innovate

By Birgit Meyer Balle, radiographer and member of Verdo’s Board of Representatives since 2022

Verdo’s aim of being one green step ahead demands the courage to invest and innovate, which will involve costs. Verdo’s Energy of the Future initiative marks an important step in this direction. It is vital that we communicate our efforts more clearly and more often, not only to the Board of Representatives, but also to the wider public, to ensure awareness and support for the project.

In order to contribute effectively to developing the sustainable energy sources of the future, Verdo needs to constantly keep abreast of the many new technologies and opportunities that arise along the way. While, of course, respecting the financial and resource framework. This includes active participation in relevant research projects that match Verdo’s core values.

Local anchorage is essential in order to promote the green transition at a local level. For example, by launching initiatives such as campaigns with tips for saving water, electricity and heating and thinking ‘greener’, Verdo could motivate individual action and responsibility – ideally with a humorous approach, to make the quite serious messages easier to digest.

Regarding Verdo’s Board of Representatives, our role should be expanded beyond the usual meetings. Active involvement through alternative channels such as

questionnaires can provide valuable insights and ideas, as the Board of Representatives consists of many different individuals, each with their own background and experience. This would not only enrich the work of the Supervisory Board, but also strengthen the link between Verdo and its stakeholders.

Verdo should continue to focus on the green agenda in 2024, while thinking even more creatively and ambitiously. One concrete way to do this would be to establish large public forests, rather than smaller tree-planting projects, as we do today. These would not only significantly improve our carbon footprint, but also serve as educational resources for the local community. The forests could be geographically widespread, so they are not only centred around Randers. Let’s think community and let’s think bigger.

19 Annual report 2023

From the Board of Representatives |

Verdo in numbers 2023

newly connected district heating customers –private and commercial 21 738 trainees and apprentices (9 trainees and 12 apprentices)

employees in total 590

in revenue

is the proportion of the underrepresented gender at Verdo’s executive level

1,388,440 tonnes DKK -17.9 million

(biomass and carbon products) handled in the Trading division in after-tax profit DKK 4 billion 76,000 21 %

private homes and businesses in Randers and Herning receive district heating from Verdo

10 %

is the proportion of the underrepresented gender on Verdo’s Supervisory Board

9

25 % employees in senior jobs

is the proportion of women on the Board of Representatives

400

18,005

trees planted by Verdo

546

district heating conversions in Randers and Herning days of training completed at Verdo Academy reports made to Verdo’s whistleblower scheme

members on Verdo’s Board of Representatives 69

0

net electricity generation from biomass 115,552,864 kWh

Energy for the future

The biggest challenge to the transition is the large number of interdependent processes that need to take place simultaneously. Three perspectives are presented below on the initiatives and changes that companies and consumers should expect in the coming years if the green transition is to succeed.

Increased electrification and close interaction with the electricity sector led Verdo to expand the scope in 2023 from Future Heating to Energy of the Future.”

We have moved from a focus on Future Heating to a broader focus on Energy of the Future

By Jesper Møller Larsen, Director of Energi & Forsyning at Verdo

Verdo’s largest climate contribution at present is to displace natural gas. This area has grown considerably in recent years, and we now have more than 10 employees engaged primarily in planning new expansions to the district heating network. The aim is to give as many households and businesses as possible the opportunity to move away from fossil fuels as quickly as possible. This work will continue until the last oil and gas boilers in Randers and Herning have been replaced.

Phasing out these small oil and gas boilers also helps improve the local environment by reducing pollution. District heating from Verdo is now based almost exclusively

Oil and gas conversions achieved by Verdo in Randers in 2023

on certified biomass which complies with the legislation in this area.

Verdo has the capacity to continue doing conversions from gas to district heating at the same fast pace as it is now. However, the pace could be affected by outside factors, including insufficient funds in the government’s district heating pool or shortages of essential components due to global supply chain problems.

Potential oil and gas conversions in Randers 2023-2025

Note: The figures for potential oil and gas conversions in Randers were extracted from the BBR register during the 2020-2023 period when

22 Annual report 2023

| Energy for the future

various

planning the

conversion projects.

Over Hornbæk Neder Hornbæk Romalt Stevnstrup Harridslev Assentoft Total Gas 647 376 220 739 387 1139 3508 Oil 38 59 14 36 30 99 276 Total 685 435 234 775 417 1238 3784

Randers Herning Households converted to district heating 366 34 Commercial floor space converted to district heating 66,000 m2 4,000 m2

Fremtidens Energi – Mulige teknologier

Heat sources

Varmekilder

Vind og sol

HPs and electric boilers

VP og elkedler

CHP plants?

KV-anlæg?

Biogas, syngas, brint, biomasse?

Biogas, syngas, hydrogen, biomass?

In parallel with the conversions, Verdo is engaged in a long-term strategic transition of the entire energy supply in Randers and Herning. The transition will contribute to a more energy-efficient, competitive and secure energy supply, based more extensively on local renewable energy sources such as solar and wind, and utilising surplus and waste heat.

Industri, Fjernkøling, PtX, Geotermi, Vand, Spildevand, Luft

Industry, district cooling, PtX, geothermal, water, wastewater, air

Increased electrification and close interaction with the electricity sector led Verdo to expand the scope in 2023 from Future Heating to Energy of the Future. The focus is on optimising the interplay between the production and consumption of electricity and heat. The work involves a wide range of elements such as agreements on establishing local energy sources, energy-efficient production, excess heat, improving utilising existing buildings, interaction with cooling, greater storage capacity, lower temperatures in district heating network and digitalisation.

The transition also involves reducing the use of biomass. The scope of this reduction will depend on the analyses Verdo is currently working on. Preliminary results suggest that biomass will continue to be needed to a minor extent as a tool for achieving the best interplay between the many different energy sources in the future energy system.

A decision was made in 2023 to take the first concrete step towards the future energy supply with the establishment of a heat storage facility on Bronzevej in south Randers.

Randers / Herning-Ikast-Sunds

Wind and solar Randers/Herning-Ikast-Sunds

Storage

Lager

Ab værk: 675 / 800 GWh

Spidslast: 200 / 230 MW

Reserve boilers

Reservekedler

El, naturgas, biogas, syngas, brint, biomasse?

Electricity, natural gas, biogas, syngas, hydrogen, biomass?

Ikoner lånt fra gram-fjernvarme.dk

Throughout the process, it is crucial that Verdo has the necessary capacity to cover the current energy demand at all times. Due to rising numbers of district heating customers, capacity must be regularly increased. The transition must also be competitive and not lead to unacceptable price increases for individual consumers.

This is a process involving large investments and many stakeholders. The process has a time limit, as the CHP plant at the Port of Randers is to be phased out in 2036. The contract with the CHP plant in Herning also expires in 2034.

These will be major, visible changes in the local community. There is therefore a need for local anchoring, with acceptance and understanding of the positive effects of the changes among citizens.

The transition to the energy of the future will be a complex process. We therefore have a strong focus on attracting the competencies needed to manage the task.

There are large interdependencies between the various initiatives and thus a high risk that bottlenecks may arise along the way, for example in connection with processing by the regulatory authorities. Unstable global supply chains constitute another possible delay factor.

Inflation and rising prices could also, in the worst case, become a barrier to achieving the desired goals. Icons from gram-fjernvarme.dk

23 Annual report 2023 Fremtidens Varme 03-04-2024

Energy for the future |

The biggest challenge in the transition is that everything has to happen at the same time

By Henrik Lund, Professor of Energy Planning at the Department of Sustainability and Planning, Aalborg University

The utility sector is important for the green transition, as this is where much of the fossil fuel combustion takes place.

The biggest challenge in the transition is that everything has to happen at the same time. There is also a need for coordination with large numbers of stakeholders.

With consumers, who need to save energy and use more energy-efficient solutions, and with production, which needs to be made more energy-efficient. And also with distribution, which is being developed for low-temperature district heating to enable the use of energy-efficient production and consumption, and when it comes to integration with electricity.

Coordination is crucial to being able to phase out the use of fossil fuels in the energy sector.

In relation to biomass, we need to look at Denmark as a whole, to ensure resources are best utilised overall.”

In relation to biomass, we need to look at Denmark as a whole, to ensure resources are best utilised overall. We should not phase out biomass, but develop it, and in this respect biomass will be better used as carbon in other sectors.

District heating is a major strength in the Danish energy system. As an energy company, Verdo has good opportunities to contribute to the green transition, with long-term strategies that include dialogue with all parties involved.

24 Annual report 2023| Energy for the future

A historical focus on energy efficiency, a move to renewable energy and a transition with local acceptance at its centre have driven the Danish transition.”

Elusive sector coupling has to become a reality

By Torsten Hasforth, Chief Economist, CONCITO’s analysis team

The Danish utility sector has been at the forefront of the green transition for many years. There has been a significant transition in Danish electricity, heating and water supply. It has been the flag bearer when we have prided ourselves on our role as a pioneer country in the green transition.

A historical focus on energy efficiency, a move to renewable energy and a transition with local acceptance at its centre have driven the Danish transition. This is praiseworthy, and the result of a lot of hard work. But more hard work will be needed in the coming years if the utility sector is to continue to do well. A utility sector that must continue to advance the green transition in a way that makes it clear to consumers that the sector is part of the solution.

But the future solutions are not simple. Increasing decentralisation of the utility sector will require greater

flexibility and resource awareness. Green investments are also far from complete in the sector. Biomass is only a stepping stone towards much more extensive electrification. Storage will also have to become much more widespread. The elusive sector coupling has to become a reality. Customers’ energy consumption must begin to actively interact with the system they are a part of. Their consumption must be responsive, whether consciously or unconsciously. Much work lies ahead for the Danish utility sector.

25 Annual report 2023 Energy for the future |

Strategic focus areas

Verdo’s must-win battles ensured focus and momentum in 2023

Verdo’s three new strategic focus areas – also called mustwin battles – were launched in 2022. Since then, they have been a focal point in the business and were the foundation for several key efforts in the Group in 2023.

HR Director Margrete Larsen, Sustainability Manager Line Risgaard Mortensen and IT Manager Lars Bødskov offer some perspectives from all three areas below.

Verdo’s three must-win battles:

• Must-win battle #1: Competencies and the future workplace

Must-win battle #2: Stronger sustainable development

Must-win battle #3: Digitalisation and data

Physical setting is a clear competition parameter

With must-win battle #1, ‘Competencies and the future workplace’, Verdo aims to ensure that we continue to attract, develop and retain the right competencies in an attractive working environment.

HR Director Margrete Larsen believes it is the combination of all our efforts – small and large – that make Verdo an

attractive and sought-after workplace. Many steps were taken in 2023, and Margrete Larsen particularly highlights the rethinking of our work setting.

“The physical setting is a clear competition parameter. We therefore put a lot of resources into reorganising the existing setting and upgrading the canteen at the head office in Randers, and into designing our future premises in Aalborg to match the way we work today and will work in the future," says Margrete Larsen.

She also notes the establishment of a trainee programme for traders, a new mentoring scheme, and mapping competencies for key employees as important initiatives last year.

Margrete Larsen reports that many more new initiatives will be launched in 2024, for example in relation to diversity and compliance with the new Danish act on registration of working hours, which comes into effect on 1 July. The HR director also predicts that there will be greater focus on strengthening existing initiatives.

“After seeing a large influx of new employees over the past several years, especially in Verdo Energy System and Verdo Varme, 2024 will be a year of consolidation, where we focus on creating a robust organisation.”

Materiality is material at Verdo

An accelerated green transition places even greater demands on companies – today and in the future. That is why we have made ‘Stronger sustainable development’ a strategic focus area at Verdo.

One of the elements in must-win battle #2 has been to define our materialities. This will help us to focus our efforts where they have the greatest effect. At the same time, Verdo has to comply with the requirements in the EU’s Corporate Sustainability Reporting Directive (CSRD) on double materiality reporting, which will enter into force for the 2025 financial year.

We therefore performed our first double materiality assessment in 2023. The purpose was to test the method and process, and create a data foundation that we can continue to

26 Annual report 2023

Margrete Larsen, HR Director at Verdo

| Strategic focus areas

work with. Group Management’s three new selected metrics were ‘Waste generated from operations’, ‘Business travel’ and ‘Employee commuting in own vehicle’. The results of the analysis are presented in the ESG part of this report.

Sustainability Manager Line Risgaard Mortensen is pleased that Verdo has started on this work.

“The process has shown us how involved the work with double materiality is. Great complexity is associated with both identifying the relevant factors and obtaining data, which is very time and resource-intensive,” says Line Risgaard Mortensen. However, she is convinced that it is worth the effort.

“We have emerged stronger from the process and now take a more systematic approach to working with data and materiality. As a result, we are ready to include more metrics in 2024, thereby getting an even more complete picture of Verdo’s total environmental impact,” she says.

A solid digital foundation was built in 2023

‘Digitalisation and data’ is Verdo’s must-win battle #3, as strategically we want to accelerate Verdo’s digital transformation. This means that we must become a data-driven organisation by 2025 that creates more digital customer experiences.

However, this requires a digital foundation, and building this has been a strong focus of Verdo’s strategic IT priorities and initiatives in 2023. We have established a common data platform that we use to collect, organise, store and process our data. We have gone live with D365 in several of our

divisions, and we are working on a new billing system, which we expect to be ready in early 2025.

Verdo’s core business is critical infrastructure. IT security is therefore a cornerstone of our digital foundation. We had a targeted focus on improving IT security in 2023. We have added more competencies in this area and launched initiatives to ensure we are better equipped to withstand cyber threats and attacks.

“Verdo is covered by the NIS2 directive, which enters into force on 17 October 2024, and this has further accelerated our work with IT security. We are closely following Danish implementation of the directive and are already well on our way to meeting the requirements. We are thus on a completely different level than before,” says IT Manager Lars Bødskov.

In addition to our focus on IT security, Verdo has been working with AI. We have created our own Verdo GPT platform – a language model we control ourselves. This means that we can ask it both personal and businesssensitive questions, as the model is not trained on this data and therefore does not share it with the outside world. The next step is to build dedicated and specific AI models on top of our own Verdo GPT, so these can be used for specific purposes such as customer service, HR support, IT support, help with answering emails and help with bidding on tenders.

27 Annual report 2023

Lars Bødskov, IT Manager at Verdo

Line Risgaard Mortensen, Head of Sustainability at Verdo

Strategic focus areas |

Verdo Group companies and structure

Verdo a.m.b.a.

Verdo Holding A/S

Energi & Forsyning

Verdo Varme A/S

Verdo Herning A/S

Verdo Varme Herning A/S

Verdo Produktion A/S

Verdo Vand A/S

EL-NET Kongerslev A/S

Verdo Forsyningsservice A/S

Verdo

A/S Carbon Partners AS

Energy Systems A/S

Verdo Energy Systems sp. z.o.o.

Verdo Teknik A/S

Go Green A/S Teknik

Note: Verdo Innovation A/S and Verdo Energy Systems GL ApS were liquidated in March 2024 and are therefore not shown in the overview.

Trading Carbon Partners Inc.

Energy

Trading

Verdo

Verdo

Elsalg

Update on historical cases

In its role as a utility company, Verdo receives a number of enquiries each year from the various authorities and regulators overseeing electricity, water and heating utilities. This is a natural part of daily operations for the Group’s supply activities and of the general oversight that all companies in the energy sector are subject to. At Verdo, we also see it as a way of ensuring that the Group’s prices for electricity, water and heating comply with the legislation and frameworks that utilities are subject to.

The historical cases concerning which Verdo was in dialogue with the Danish Utility Regulator for a number of years are cases that go beyond these general enquiries. There have been no new enquiries in 2023, but we remain engaged in constructive and open dialogue with the authorities concerning the ongoing cases, which we wish to see concluded as soon as possible*.

In 2023, Verdo continued to repay amounts that had previously been overcharged, and we expect to have completed repayments for resolved cases in 2025, ahead of the time frame set by the Danish Utility Regulator. We are still waiting for the Danish Utility Regulator to process a few outstanding historical cases*. However, most of the cases have been closed.

* Please see note 1 of the financial statements for further information on ongoing cases.

The following cases were decided during 2023:

Tax collected in price demonstration

In March 2023, the Danish Utility Regulator reported its decision in the cases concerning tax collected in the price demonstration. The case was an offshoot of the previous cases concerning unapproved return on investment in Verdo Varme A/S and Verdo Produktion A/S. They assess whether the tax on the approved return is a necessary cost and can thus be included in the price demonstration.

In its decision, the Danish Utility Regulator found that tax on the unapproved return is not a necessary cost, and that the tax included in the price demonstration in the 2012-2017 period for Verdo Varme A/S, and 2010-2017 for Verdo Produktion A/S, cannot be included in the price demonstration. It was thus decided that Verdo Varme A/S must repay DKK 56 million to consumers, while Verdo Produktion A/S must repay DKK 9 million to consumers. A provision for these repayments was recognised in the consolidated financial statements for 2022. They therefore did not affect earnings in 2023. We expect to complete these repayments in 2024.

30 Annual report 2023 | Update on historical cases

Equity Solvency ratio

31 Annual report 2023 408,803 907,293 235,120 130,123 901,791 29.6% -17,900 -23.8% -68.2% -0.6%

Revenue EBITDA

2.7 percentage points

year All amounts are stated in DKK ‘000 and before discontinuing operations. Financial highlights have been calculated after adjustment for special items. No special items are recognised in the Group’s financial statements for 2023. 3,971,435 2023 2023 2023 2023 2023 5,423,823 2022 2022 2022 2022 2022 5,488,854 Adjusted 473,834 300,151 Adjusted Adjusted 32.3%

Net profit/loss from continuing operations for the

Results for 2023 must be viewed against backdrop of 2022 to see both sides of the energy crisis

By Kenneth R. H. Jeppesen, CFO of Verdo

A review of the year just passed

While 2022 saw a series of extreme events that led to the energy crisis and increases in energy and raw material prices, 2023 was a very different year. While prices rose steadily up to Q4 2022, they have been falling ever since. And where inflation was soaring in 2022, it cooled off during 2023. But in many ways the two years should be viewed together, to see both sides of the energy crisis in play.

The fact that electricity prices continued to fall during 2023 has had a particularly large impact on Verdo. This had a negative impact on Verdo Go Green A/S and Verdo Produktion A/S – both revenue and profit. The falling prices for fuel and raw materials also impacted Verdo Trading A/S, which began 2023 with stocks of commodities that were bought at high prices in 2022, but had to be sold in 2023 after significant price drops. This impacted both revenue and profit.

Earnings

Verdo’s earnings are, of course, influenced by the world around us. Declining energy and raw material prices led to a significant decrease in revenue, to DKK 4 billion, while operating profit (EBITDA) was DKK 130 million. Both are significantly lower than the record year of 2022, and also significantly below budget.

Earnings after tax for the year were DKK -17.9 million. This result, which reflects the fact that virtually every division had a difficult year in 2023, is not satisfactory.

General drop in energy prices affected all divisions

Falling prices for fuels and other energy sources made their mark across the Group’s divisions last year. They were particularly felt in Verdo Go Green A/S, the Group’s electricity trading company, and in the Trading division. Despite positive earnings overall for the Trading division, these were significantly lower than expected due to weak demand and lower prices for wood pellets. The price drop hit Verdo Trading A/S hard, as stocks had been purchased to service the company’s many customers at a time when the price and demand for wood pellets were both high. Both fell again during 2023, and some products had to be sold at a loss.

When electricity prices dropped in early 2023, many Verdo Go Green A/S customers switched from products with fixed quarterly prices to ones with variable hourly rates. This meant that the company had to sell electricity at the lower variable price instead of at the much higher prices realised when the company hedged its electricity purchases. However, the situation stabilised from the start of Q2. Verdo Go Green A/S performed satisfactorily from then on.

Verdo Produktion A/S was not significantly impacted by the fall in electricity prices early in the year. Since Q1 usually has the largest volume of electricity generation, it is also the quarter with the greatest earnings. Despite lower-thanexpected earnings from electricity production in Q4, our CHP plant in Randers thus posted satisfactory results for the year.

With many orders in the pipeline, Verdo Energy Systems A/S was expected to see a high level of revenue in 2023. Revenue met expectations, at more than double the 2022 level. However, the company experienced challenges in first having to find qualified labour to fill positions, and then integrate the many new employees into the organisation. In addition, several projects were delayed. The company therefore only achieved a modest operating profit (EBITDA), but profitability is expected to improve in 2024 based on revenue expectedly on par with 2023.

Despite higher revenue in 2023 than in the previous year, Verdo Teknik A/S did not manage to achieve satisfactory earnings. The company has faced challenges in relation to order inflow and efficiency, in part because the municipalities still do not have much money for street lighting and traffic light projects.

The balance sheet total is down, largely due to a decrease in capital tied up in stocks and receivables, i.e. working capital. Given that equity is virtually unchanged, this means that the Group’s solvency ratio has risen to 32.3% and is now very close to our long-term goal of 35%.

32 Annual report 2023 | Results for 2023 must be viewed against the backdrop of 2022 to see both sides of the energy crisis

The fact that electricity prices continued to fall during 2023 has had a particularly large impact on Verdo.”

Commercial and regulated business

Operating profit (EBITDA) in Energi & Forsyning – i.e. in the Group’s regulated areas – came to DKK 217 million, while the commercial areas – Trading, Energy, Teknik and Elsalg –posted a loss of DKK -43 million overall. Verdo Holding A/S and parent company, Verdo a.m.b.a., ended the year with an operating loss of DKK -44 million.

The solvency ratio for the regulated companies is 29.81, while it is 52.53 for the commercial companies (which are subject to competition), when including Verdo Holding.

No new heating cases

There were no new cases or enquiries from the utility authorities in 2023, and no decision been made regarding return on investment before 2010 in Verdo Produktion A/S. However, discussions are still ongoing with the Danish Utility Regulator regarding the ‘output model’ for Verdo Produktion A/S.

We are pleased that the other authorities found no basis for proceeding with the accusations brought against the Verdo Group years ago by a number of citizens in Randers. This also brings an end to this matter, as the State Prosecutor’s decision is final and cannot be appealed.

Uncertainty regarding recognition

Return on invested capital in the 2000-2009 period

In 2021, while the Group’s production company was investigating similar matters relating to the 2000-2009 period, indications were found that Verdo Produktion A/S had recognised a return on invested capital of up to DKK 69 million during the period. It has not been possible to identify a direct legal basis for recognising this return, and discussions have been initiated with the Danish Utility Regulator concerning the matter.

Discussions continued during 2023, but it is still not possible to know when they will be concluded. Verdo Produktion A/S is therefore still recognising a provision corresponding to the entire return identified.

Interest on loans with external mortgage credit institutions

The Group received questions from the Danish Utility Regulator in 2022 regarding the inclusion of interest in price demonstrations in the Group’s production company. The discussions concern interest on loans taken out by Verdo Produktion A/S with external credit institutions, as a result of a change in practice in the calculation of interest in the price demonstration in 2018.

The Verdo Group deems that the change in the practice of Verdo Produktion A/S is correct, and that the interest can be seen as a necessary cost and thus included on a pro rata basis according to the share of heat production. Our discussions with the Danish Utility Regulator in 2023 have not made it possible at this stage to assess the potential accounting implications, or when the discussions are expected to be concluded. The recognition has therefore still not been made.

Output model

The Danish Utility Regulator contacted Verdo Produktion A/S in 2021 about the sector’s usual method for allocating costs between electricity production and heat production –also called the ‘output model’.

Verdo Produktion A/S is in dialogue with the Danish Utility Regulator about the use of the model. The discussions in 2023 have not made it possible at this stage to assess the potential financial consequences of this enquiry.

33 Annual report 2023 Results for 2023 must be viewed against the backdrop of 2022 to see both sides of the energy crisis |

>

Expectations for 2024

Signs are that we will continue to see greater uncertainty in the coming years than we have been used to in the past. The energy crisis may be over, but we are seeing much greater volatility in energy markets than before. The same applies to interest rates, where it appears that the expected interest rate cuts will be postponed. We are also seeing greater volatility than before in the interest rate markets.

Despite this year’s financial results, Verdo is in a strong position to meet these challenges. Liquidity is strong based on a cash flow of DKK 79 million from the Group’s primary operations. Cash flow will increase in the coming years when the repayments to heating customers are expected to be completed. Financial gearing (earnings to interest-

bearing debt ratio) is 2.4, which is very satisfactory and well within our target of being below 5. As mentioned above, the solvency ratio is rising.

The energy markets have been relatively calm since the end of the financial year, although with a slight downward trend. As mentioned earlier, this has a negative impact on the Verdo Group. We expect earnings to be around zero in 2024, but this depends greatly on what happens to electricity prices.

Overall, the earnings for the year are not satisfactory, but our key figures remain strong, and with good cash flow generation, Verdo is well-positioned to continue the ‘StepTogether’ strategy in the coming years.

34 Annual report 2023

| Results for 2023 must be viewed against the backdrop of 2022 to see both sides of the energy crisis

Calculation of ratios Ratios have been calculated based on CFA Society Denmark’s recommendations, and definitions are stated in the accounting policies.

35 Annual report 2023 FINANCIAL

2023 DKK ‘000 2022 DKK ‘000 2021 DKK ‘000 2020 DKK ‘000 2019 DKK ‘000 EARNINGS Annual revenue 3,971,435 5,489,652 2,971,906 2,347,640 3,106,900 Revenue 3,971,435 5,424,621 2,909,931 2,437,610 2,615,643 EBITDA 130,122 408,803 151,309 83,254 98,643 Operating profit -12,551 271,977 19,873 -376,858 -270,799 Net financials -23,649 -21,557 -35,683 -27,724 -19,698 Profit/loss from continuing operations before tax -36,200 250,420 -15,810 -404,582 -290,497 Net profit/loss for the year -17,900 238,156 158,917 -407,565 -267,772 BALANCE SHEET Total assets 2,790,892 3,065,700 3,207,660 2,837,911 3,301,382 Investments in property, plant and equipment 157,505 153,671 142,991 193,431 144,931 Equity 901,791 907,293 822,171 571,941 970,432 LIQUIDITY Net cash flow from: Operations 44,583 308,322 -119,955 227,666 -85,486 Investments -166,056 196,554 -118,847 -196,252 217,869 Financing/repayments -32,083 -36,599 -48,277 -44,004 -32,467 Net change in cash and cash equivalents -153,556 468,277 -287,079 -12,590 99,916 RATIOS Gross margin 17.2% 16.2% 20.0% 20.6% 4.8% Gross margin, adjusted 17.2% 16.0% 19.6% 17.5% 4.8% EBITDA margin 3.3% 7.5% 5.2% 3.4% 3.8% EBITDA margin, adjusted 3.3% 8.6% 7.4% 1.7% 3.8% Financial gearing 2.4 0.5 4.6 5.0 4.5 Financial gearing, adjusted 2.4 0.4 3.2 - 4.5 Return on equity -2.0% 27.5% 22.8% -52.8% -23.8% Return on equity, adjusted -2.0% 34.7% 13.6% -16.7% -23.8% Solvency ratio 32.3% 29.6% 25.6% 20.2% 29.4%

HIGHLIGHTS

Financial highlights |

Business areas in the Verdo Group

36 Annual report 2023

Energi & Forsyning

The Energi & Forsyning division is made up of Verdo Varme A/S, Verdo Varme Herning A/S, Verdo Produktion A/S, Verdo Vand A/S, Verdo Forsyningsservice A/S and EL-NET Kongerslev A/S.

Energi & Forsyning supplies clean drinking water to around 13,000 households in Randers, and district heating based on certified biomass to around 38,000 households in Herning and 38,000 households in Randers. The division also connects around 870 households in Kongerslev to the electricity grid.

2023 was generally characterised by high levels of activity in the division. But the aftermath of the 2022 energy crisis also clearly impacted the year in several ways. In relation to district heating, the effect was positive. We are still seeing many new connections and conversions from gas and oil-fired boilers, even though gas prices have been significantly lower than in the previous year. However, the energy crisis also led to major price increases that impacted a broad range of the division’s activities in 2023 – such as investments in cables and pipes, and welding and excavation contracts. Above all, the energy crisis has resulted in a generally lower price level for electricity. Despite this, Energi & Forsyning posted a profit of DKK 109,473 million.

Last year, we further accelerated our targeted efforts on planning Energy of the Future in Randers and Herning, as the existing power plants in both cities are expected to be

phased out between 2034 and 2036. Based on the many analyses that precede the concrete development work, we can now begin to form a picture of what needs to happen in Randers and Herning in order to ensure efficient, secure, affordable and green district heating supplies in the future.

Verdo’s Supervisory Board has made the first major investment decision towards this end, concerning a 10,000 m3 heat storage tank in Randers. We will be investing in more heat pumps and electric boilers, and we continue to view the possibilities for district cooling positively. We are also looking into the possibility of establishing renewable energy parks.

Verdo Varme A/S

In Randers, 2023 was another good year for the district heating roll-out and saw the connection of a further 498 households and 66,000 m2 of commercial floor space. Of the 498 households, 97 are new homes and 35 are commercial, while 366 are conversions (mainly from natural gas or oil).

• Almost all the surrounding towns have traditionally used natural gas for heating, and so most people are welcoming the opportunity to convert to district heating. The figures for 2023 show that up to 90% of homeowners in the areas that have been connected to district heating have chosen to replace their oil or

37 Annual report 2023 Business areas – Energi & Forsyning |

>

gas boiler with district heating. In Neder Hornbæk and Over Hornbæk in west Randers, 90% and 82% of all households, respectively, have waved goodbye to fossil fuels. In Romalt, south of Randers, 77% of all properties using oil and gas have so far been converted to district heating, and more are on the way.

We are hoping for a similarly high uptake in Stevnstrup and Harridslev. Advance registrations already stand at around 60% of households, and the number is likely to increase as the roll-out gets underway.*

• High security of supply and stable operations are always key goals for Verdo Varme A/S. We therefore rectified a record number of faults in the district heating system in both Randers and Herning in 2023, including alarm faults. This reflects our proactive approach to avoiding possible breakdowns. In addition to benefiting customers, it is also good for the green transition.

• The district heating price in Randers dropped slightly in 2023 compared to 2022. In mid-2023, we reduced the heating price for a ‘standard house’ – the Danish Energy Agency’s definition of a house, 130 m2 in size with annual consumption of 18,100 kWh – from DKK 14,083 to DKK 11,993 per year (incl. subscription, contribution and VAT), a drop of DKK 2,090. From 1 January 2024 we have again reduced the heating price in Randers – from DKK 11,993 to DKK 11,251 per year, a saving of DKK 742.

District heating connections in rolled-out areas – Randers

*The calculations show houses that have a water-based heating system.

We expect to see a large number of district heating connections in Randers in 2024. Verdo’s Board of Directors approved the takeover of a local district heating project from Assentoft Forsyning at the beginning of 2024, under which a total of 1,750 households in Assentoft have the opportunity to connect to district heating. This further reinforces the trend. We will begin to establish the district heating infrastructure in Assentoft in 2024, and expect to be able to connect the first residents in spring 2025.

• Between 2023 and 2025, Verdo will establish a new 10,000 m3 heat storage tank in Randers. Once completed, the tank will be able to store large quantities of heat for district heating, produced using renewable energy from our CHP plant and also from other renewable energy sources in the future. The tank will also enable us to increase our electricity revenue from the CHP plant. The heat storage tank will help reduce the use of oil and gas, so that a larger proportion of the electricity generation in Denmark is based on certified biomass. This is particularly important for security of supply during periods when electricity demand is high, when sunshine and wind are in short supply and electricity prices are high. The new heat storage tank will thus make a significant contribution to the green transition.

38 Annual report 2023

100.00% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% All From NG/Oil All From NG/Oil Neder Hornbæk Over Hornbæk

233 224 466 454 Connected to DH Not connected | Business areas – Energi & Forsyning

Verdo Varme Herning A/S

• Verdo connected a total of 240 new district heating customers in Herning in 2023. Of the 240 new customers, 196 are new homes, 10 are commercial (corresponding to 4,000 m2 of commercial floor space), and 34 are conversions (typically from natural gas or oil). The figures for Herning are much lower than for Randers because there is virtually no natural gas used for heating in Herning, so the potential is more limited.

Verdo lowered heating prices in Herning significantly last year, primarily due to falling oil and gas prices on the global energy market. However, between 1 January and 1 June 2023, the heating price for a ‘standard house’ –the Danish Energy Agency’s definition of a house with annual consumption of 18,100 kWh – was relatively high at DKK 17,959 per year. The relatively high price was due to a three-month overhaul of Herning CHP plant during summer 2023, during which Ørsted carried out planned maintenance. Verdo’s peak and reserve load stations therefore had to be put into operation to ensure enough heating supply for customers. The plant was shut down again for a further two weeks or so during autumn, when Herning CHP plant’s turbine was reconnected. We lowered the heating price on 1 June 2023 to DKK 13,900 per year due to a drop in oil and natural gas prices, and again on 1 January 2024 to DKK 13,315 per year for a standard house. The lower heating price in 2024 is due to the completion of the long overhaul of Herning CHP plant, which means that we have returned to normal operations.

RATIOS: Energi & Forsyning

The table covers:

Verdo Produktion A/S, Verdo Varme A/S, Verdo Herning A/S, Verdo Varme Herning A/S, Verdo Vand A/S, El-NET Kongerslev A/S and Verdo Forsyningsservice A/S.

• We ran a campaign in Herning during the summer offering homeowners in single-family houses and townhouses using heating sources other than district heating the chance to be connected to the district heating network at half price. The aim was to speed up the green transition in Herning Municipality. There were around 350 properties not heated by district heating within the supply area, and 13 of these were converted during the campaign. The relatively low number of conversions was mainly due to the fact that gas prices were low at the time, and the incentive to convert to district heating was not as strong as it had been when gas prices were at their peak.

• Verdo Varme Herning A/S completed the construction of a new heat exchange plant at the regional hospital in Gødstrup in 2023. When the new plant became operational, it was possible to decommission an oil-fired boiler which had previously heated the hospital hotel. The hotel is now heated using green district heating. The heating plant is also necessary in order for Verdo to supply the many upcoming developments south of the new regional hospital.

• In 2023 we also completed the remote meter reading project begun in 2022 in Herning, as a joint collaboration between Verdo and Herning Vand, whereby Verdo leases Herning Vand’s network to transport data from remotely read heating meters.

Around 8,500 district heating meters were replaced in connection with the remote meter reading project, and a further 8,000 were fitted with a new module that will allow data to be sent via Herning Vand’s network in the future. The rest of the district heating meters were already ready to communicate in this manner. Verdo established ten new antenna sites for data collection, and entered into an agreement with Herning Vand to use their existing network. It is now possible to remotely read all Verdo’s 21,700 district heating meters in Herning.

39 Annual report 2023

Business areas – Energi & Forsyning |

2023 2022 Revenue 1,187,602 1,104,021 EBITDA 217,325 294,621 Net profit/loss for the year 109,473 168,392 Investments 128,094 130,114 Equity 654,998 566,568

All figures in DKK ‘000

Vand and Digital Forsyning

Verdo Vand A/S worked throughout 2023 to ensure security of supply and water quality remain high in the Randers area, and a final investment decision was made regarding a new spring site and new waterworks.

• The ‘New waterworks’ project, which will replace the two existing waterworks in Bunkedal and Østrup Skov, required a lot of resources in 2023 and took longer than expected. This added to the cost of the project in terms of both capital investment and consultant fees. We have set ourselves the goal of reducing energy consumption at the waterworks and meeting the consumption that remains using renewable energy. Plans for afforestation near the waterworks have been included as part of efforts to improve groundwater protection.

• The ‘New spring site’ project has also been delayed, as no exploratory drilling has yet been permitted. This has created uncertainty about the time schedule and budget. The new spring site will be established northeast of Randers and will replace Oust Mølle. Afforestation is also planned here. The investments in the new waterworks and new spring site will total more than DKK 60 million. The waterworks is expected to be ready some time in 2026, while the plan is to expand the spring site over a number of years.

• We have intensified discussions with the waterworks that we work with and work for – Dronningborg and Strømmen. This collaboration provides great value for all parties.

Downtime for customers over the year