Virginia has placed in CNBC’s top 5 states for eight years running. Major investments in education, infrastructure, business friendliness, quality of life, technology and innovation, and access to capital solidified Virginia’s No. 4 spot. Virginia moved into the top 10 for the quality of life and technology and innovation categories, landed No. 2 for infrastructure and finished as the No. 1 state for education.

Virginia’s premier talent base and world-class port, rail, road, and air transportation ecosystem make the Commonwealth an unbeatable business partner. In addition, the Virginia Business Ready Sites Program (VBRSP) has awarded more than $165 million in grants from 2024-25 to accelerate construction and deepen the inventory of shovel-ready sites for employers.

Virginia’s long history of sound economic policy and prudent financial management has earned the Commonwealth an AAA credit rating since 1938 — longer than any other state in the country.

Fiscal consistency has helped maintain a stable tax environment for companies and residents alike, with a corporate income tax rate that has remained unchanged at 6.0% since 1972, compared to the higher national average of 6.75%. This commitment to stability has translated into financial predictability for the companies that choose to operate in Virginia.

When Nestlé USA, a subsidiary of Nestlé S.A., began searching for the site of its new U.S. corporate headquarters, the world’s leading nutrition, health, and wellness company’s decision was ultimately driven by location. After an arduous selection process that spanned 20 cities, in February 2017, Nestlé USA announced it would invest $39.8 million to establish its U.S. headquarters in Arlington County, Virginia, creating 748 new jobs.

A move from its Glendale, Calif., office to the Eastern Seaboard would bring the household brand closer to its world headquarters in Vevey, Switzerland, and to its consumer base — 80% of the company’s products are sold east of the Mississippi River. As a company dedicated to building a healthier future for consumers, Nestlé USA’s strategic headquarters location will facilitate important conversations about using the best ingredients for U.S. food and beverage products.

Northern Virginia’s robust and diverse workforce was also a critical factor in the company’s decision. Arlington County is consistently recognized as one of the most educated areas in the nation, with over 70% of its residents equipped with a bachelor’s degree. Arlington’s millennial population is also one of the country’s fastest-growing, and new graduates from the Commonwealth’s acclaimed colleges and universities flock to the Northern Virginia region annually, ensuring a sustainable pipeline of talent. Arlington also offers a quality of life and assets strong enough to attract team members from California.

In addition to providing the right setting for Nestlé USA to thrive, the Commonwealth delivers sustainable, best-in-class cost affordability, with stable operating costs, and a 6% corporate income tax — one of the lowest in the nation — which hasn’t increased since 1972.

Nestlé USA’s decision to locate its U.S. corporate headquarters in the Commonwealth is the strongest testament to Virginia’s competitiveness in the global arena. As we work to diversify our economy and reduce our reliance on federal dollars, Nestlé USA represents the forward momentum of Virginia’s economy.

Nestlé USA was awarded a grant from the Commonwealth’s Development Opportunity Fund (COF) and the Virginia Economic Development Incentive Grant (VEDIG), and received funding from the Virginia Jobs Investment Program (VJIP). Arlington County offered performance grants and infrastructure updates, as well as relocation assistance for Nestlé USA employees from California.

When we thought about relocating our headquarters, it was really about finding the right location that gave us access to the right talent and the right kind of infrastructure we needed to succeed for the next 100 years and that turned out to be Virginia. What we found in Northern Virginia is the talent we need to win, and it’s exceeded our expectations.

STEVE PRESLEY CEO, Zone North America, Nestlé

The Commonwealth’s Development Opportunity Fund (COF) is designed as a “deal closing” fund used at the Governor’s discretion to secure a company location or expansion in Virginia.

Administered by the Virginia Economic Development Partnership (VEDP), the COF serves as a final resource in the face of serious competition from other states or countries. The COF is a negotiated amount determined by the Secretary of Commerce and Trade, based on the recommendation of VEDP, and subject to the approval of the Governor. A COF is awarded to the Virginia locality (county, city, town, or applicable political subdivision) for the benefit of the company, with the expectation that the grant will result in a favorable decision for the Commonwealth

Grants are made at a locality’s request for a project under the following conditions:

■ $5 million capital investment and 50 new jobs at the prevailing average wage, or $100 million capital investment and 25 new jobs at the prevailing average wage

― Thresholds reduced to $2.5 million capital investment and 25 new jobs at 85% of the prevailing average wage in Single-Distressed Communities

Thresholds reduced to $1.5 million capital investment and 15 new jobs at 85% of the prevailing average wage in Double-Distressed Communities

■ The locality participates with a matching dollar-for-dollar (cash or in-kind) financial commitment

■ Review of financial documents and/or other information from company

■ Public announcement of the project is coordinated by VEDP and the Governor’s Office

■ A performance agreement is executed between the locality and the company outlining promised job creation, capital investment, and wages

■ Annual updates from the company reporting the status of the capital investment and job creation outlined in the performance agreement

The Major Eligible Employer Grant Program (MEE) is a discretionary performance incentive designed to encourage significant capital investment and job creation, by Virginia manufacturers and other basic employers, to grow in Virginia rather than another state or country. The program targets major employers that make a capital investment of at least $100 million and create at least 1,000 new jobs (a minimum of 400 jobs, if the average pay is at least twice the locality’s prevailing average wage).

The Virginia Economic Development Incentive Grant Program (VEDIG) is a discretionary performance incentive designed to assist and encourage companies to invest and create new employment opportunities by locating significant headquarters, administrative, or service sector operations in Virginia. Selected companies must meet the following eligibility requirements.

A company locating in a Metropolitan Statistical Area (MSA) with a population of 300,000 or more in the most recent decennial census must:

■ Create 400 new full-time jobs with average salaries at least 1.5 times the local prevailing average wage; or create 300 new full-time jobs with average salaries at least twice the local prevailing average wage

■ Make a capital investment of at least $5 million or $6,500 per job, whichever is greater

A company locating elsewhere in Virginia must:

■ Create 200 new full-time jobs with average salaries at least 1.5 times the local prevailing average wage

■ Make a capital investment of at least $6,500 per job

(Left) Appian, headquartered in Fairfax County and a recipient of the Commonwealth’s Development Opportunity Fund (COF), provides a low-code automation platform for some of the world’s largest organizations. (Top Left) Booz Allen Hamilton employs thousands of Virginians and received the Major Eligible Employer Grant Program (MEE), among other incentives. (Top Right) Hilton, a leading global hospitality company, headquartered in Fairfax County, received support from the Virginia Economic Development Incentive Grant Program (VEDIG).

The Virginia Investment Performance Grant (VIP) is a discretionary performance incentive designed to encourage continued capital investment by Virginia companies, resulting in added capacity, modernization, increased productivity, or the creation, development, and utilization of advanced technology. The program targets existing manufacturers or research and development services supporting manufacturing. There must be an active and realistic competition between Virginia and another state or country for attracting the project, and matching local financial participation is expected. Grants are made under the following conditions:

■ The project must result in capital investment of at least $25 million

■ The company must be a manufacturer or research and development service that supports manufacturing

■ The company applying must have a legal presence within the Commonwealth for at least three years prior to making the announcement of the project

■ Although no minimum new job creation is required for a VIP grant, the investment must not result in any net reduction in employment from the date of completion of the capital investment through one year from the date of completion

Any grant award determination that includes new job creation will require that the jobs included in the grant award pay an average wage, excluding fringe benefits, that is no less that the prevailing average wage of the locality being considered for non-distressed localities and for double distressed localities, jobs must pay at least 85% of the prevailing average annual wage in the locality, excluding fringe benefits.

■ Matching local financial participation of at least 50% is expected

■ Review of financial documents and/or other information from company

■ Public announcement of the project is coordinated by VEDP and the Governor’s Office

■ A performance agreement is executed between VEDP and the company outlining promised capital investment, job creation, and wage metrics

Canon Virginia, Inc., has utilized VEDP’s Virginia Investment Performance Grant, which targets existing Virginia manufacturing companies and research and development services that support manufacturing.

(Above) Red Sun Farms received support from the Governor’s Agriculture and Forestry Industries Development Fund to establish its first U.S. high-technology greenhouse production operation in Pulaski County.

The Governor’s Agriculture and Forestry Industries Development Fund (AFID), administered by the Virginia Department of Agriculture and Consumer Services (VDACS), is a discretionary incentive designed to grow Virginia’s agriculture and forestry industries through strategic grants made to businesses that add value to Virginia-grown agriculture and forestry products. AFID grants are awarded to localities at the discretion of the Governor with the expectation that the grant will be critical to the success of a project and will result in the creation of new jobs and investment.

Grants are made to a political subdivision for a project under the following conditions:

■ The business beneficiary is creating new capital investment and jobs in Virginia

■ The business beneficiary is a facility that produces “value-added agricultural or forestry products”

■ At least 30% of the agriculture or forestry products to which the facility is adding value are grown in Virginia

■ The grant may not exceed $500,000 unless the project is determined to have statewide or regional importance

■ The political subdivision applying for the grant provides a matching financial commitment

■ A performance agreement is executed between the applicant and the business beneficiary outlining the agreed upon job creation, capital investment, and purchase of Virginia-grown agriculture or forestry product

■ Public announcement of the project is coordinated with the Governor’s Office

Grants may be used for a variety of purposes, including public and private utility extension or capacity development on and off site; high-speed or broadband internet access extension or capacity development; road, rail, or other transportation access costs beyond the funding capability of existing programs; site acquisition; grading, drainage, paving, and any other activity required to prepare a site for construction; construction or build-out of buildings; or training.

The Port of Virginia administers four grant programs that are collectively designed to attract port users and stimulate economic growth to and through the Commonwealth of Virginia. These grant programs were established by the Virginia General Assembly in 2023 and replaced the tax incentive programs that had historically been available to port users. All four programs are subject to a mandatory pre-application process. Companies who are selected during the pre-application process will receive notification of pre-approval before being directed to submit a general grant application.

The Port of Virginia Economic and Infrastructure Development Grant (EID Grant), administered by the Virginia Port Authority, is designed to incentivize companies to locate new maritime-related employment centers or expand existing centers to encourage growth of The Port of Virginia.

A business entity that meets all the criteria listed below may be eligible for a cash grant from the Port of Virginia Economic and Infrastructure Development Grant:

■ Locates or expands a facility within the Commonwealth

■ Creates at least 25 new, permanent full-time positions at a facility within Virginia from commencement of the project through the first full year of operation or during the year when the expansion occurs

■ Is involved in maritime commerce, or exports or imports manufactured goods through The Port of Virginia

■ Is engaged in one or more of the following: distribution, freight forwarding, freight handling, goods processing, manufacturing, warehousing, crossdocking, transloading, or wholesaling of goods exported and imported through The Port of Virginia; ship building and ship repair; dredging; marine construction; or offshore energy exploration an extraction

■ Pays a minimum entry-level wage rate per hour of at least 1.2 times the federal minimum wage or the Virginia minimum wage, whichever is higher

An eligible qualified company must pre-apply to the Virginia Port Authority in the year preceding the general application period. The applicant will be notified of pre-approval or renunciation status. If pre-approved the company will be directed to complete the general application process. This program is discretionary and grant awards are subject to annual funding allocations. A Memorandum of Understanding is required.

The International Trade Facility Grant Program has been established to provide grant funding to eligible international trade facilities that increase qualified trade activities at port facilities located in the Commonwealth of Virginia. Grant funding is applied based on the capital investment made by the applicant to facilitate the qualified trade activities or an increase in employment at an international trade facility. In addition, the port cargo volume growth at these facilities must increase by a minimum of five percent (5%) in a single calendar year over its base year port cargo volume and requires the facility pay a minimum entry-level wage rate to all full-time positions.

The amount of the grant program is equal to $3,500 per new qualified full- time employee that results from increased qualified trade activities by the applicant or 2% of the amount of capital investment made by the applicant to facilitate the increased eligible trade activities. Applicants can elect to claim either grant award but cannot claim both awards for the same activities that occur in the same calendar year. An eligible company must pre-apply to the Virginia Port Authority between September 1 and October 31 of the year preceding the general application date and receive notification of pre-approval before submitting a general grant application.

The company must be an international trade facility. For purposes of this grant award, an “international trade facility” is defined as a company that:

■ Is engaged in port-related activities.

■ Uses operated marine port facilities located in Virginia.

■ Transports at least 5% more cargo through maritime port facilities in the Commonwealth during the taxable year than was transported by the company through such facilities during the preceding calendar year.

■ Pays a minimum entry-level wage rate per hour of at least 1.2 times the federal minimum wage or the Virginia minimum wage, as required by the Virginia Minimum Wage Act, whichever is higher.

■ For purposes of this grant award, the term “international trade facility” refers to the company itself, rather than the facility where port-related activities are being conducted by the company.

The Virginia Barge and Rail Usage Grant Program is available to eligible international trade facilities that transport containers by barge or rail, rather than by trucks or other motor vehicles on Virginia’s highways. Eligibility requires a facility to increase its barge and rail cargo volume by a minimum of five percent (5%) year over year. Cargo qualifying for this grant award must result from a diversion of shipments from Virginia’s highways. The amount of the grant is $25 per 20-foot equivalent unit (TEU), or 16 tons of non-containerized cargo, or one unit of roll-on/roll-off cargo moved by barge or rail.

An eligible international trade facility must pre-apply to the Virginia Port Authority between September 1 and October 31 of the year preceding the general application data and receive notification of pre-approval before submitting a general grant application. The program has an a FY26 spending cap of $500,000..

To qualify for this grant, companies must be an “international trade facility”, as defined as:

■ A company that is doing business in Virginia

■ Engaged in port-related activities including, but not limited to, warehousing, distribution, freight forwarding and handling, and goods processing

■ Has sole discretion and authority to choose the method used to move cargo originating or terminating in Virginia

■ Using maritime port facilities located in Virginia

■ Using barges and rail systems to move cargo containers through port facilities in Virginia rather than trucks or other motor vehicles on Virginia’s

Beginning January 1, 2025, a grant award from the Virginia Port Volume Increase Grant program could benefit manufacturing, distribution, agriculture, and mineral and gas companies that utilize Virginia’s port facilities. A company that increases its usage by a minimum of 5% in a single calendar year over its base year of port cargo volume can become eligible for a grant award of up to the $250,000 maximum in a calendar year.

An eligible company must pre-apply to the Virginia Port Authority between September 1 and October 31 of the year preceding the general application date and receive notification of pre-approval before submitting a general grant application.

To be eligible for the Port Volume Increase Grant Program, a company must:

■ Be an agricultural entity, manufacturing-related entity, or mineral and gas entity

■ Use port facilities in Virginia

■ Increase its port cargo volume at these facilities by a minimum of 5% in a single calendar year over its base-year port cargo volume

■ Own the cargo at the time that port facilities are used

A number of targeted incentive programs exist in designated regions of the Commonwealth and within individual localities to attract businesses and assist in their growth. These programs can be statutory or discretionary and may offer additional financing options in some areas of Virginia.

Virginia’s cities, counties, and towns have the ability to establish, by ordinance, one or more defense production and support services zones to attract growth in national defense-related businesses.

Qualified Businesses include:

■ Service providers that support national defense, including, but not limited to, logistics and technical support

■ Designers, developers, or producers of materials, components, or equipment required to meet the needs of national defense

■ Companies deemed ancillary to or in support of the aforementioned categories

Establishment of a defense production zone allows localities to create special incentives and certain regulatory flexibility for qualified businesses locating or expanding operations within a zone.

Virginia’s cities, counties, and towns have the ability to establish, by ordinance, one or more green development zones. Establishment of a green development zone allows localities to create special incentives and certain regulatory flexibility for qualified businesses locating or expanding operations within a zone.

Virginia cities, counties, and towns have the ability to establish by ordinance, one or more technology zones to attract growth in targeted industries.

Qualified businesses locating or expanding operations in a zone may receive local permit and user fee waivers, local tax incentives, special zoning treatment or exemptions from ordinances. Once a local technology zone has been established, incentives may be provided for up to ten years.

Each locality designs and administers its own program. Benefits from the Technology Zone are offered by the administering locality.

The Virginia Enterprise Zone (VEZ) Program, administered by the Virginia Department of Housing and Community Development (DHCD), assists with business development and expansion in targeted areas throughout the state called Enterprise Zones. Virginia’s Enterprise Zone Program offers two state incentives to qualified businesses and zone investors located in a Virginia Enterprise Zone. In addition to state incentives, each zone community offers additional local incentives to qualified businesses. In order to access Enterprise Zone incentives, companies must submit applications and all required attachments to DHCD by April 1st of each year.

Qualified businesses in an Enterprise Zone are eligible for cash grants for permanent net, new jobs created over a four-job threshold that meet certain wage and benefit requirements. Qualified businesses receive up to $800 annually per grant eligible position filled by an employee earning 175% of the Virginia minimum wage who was offered health benefits. Qualified businesses receive up to $500 annually per grant eligible position filled by an employee earning at least 150% (125% in High Unemployment Areas or SWaM certified businesses) of the Virginia minimum wage, who was offered health benefits.

Qualified zone investors (entities and individuals) making a qualified investment in industrial, commercial, or mixed-use real property located within an Enterprise Zone are eligible for a cash grant. For companies investing less than $5 million, the maximum grant is equal to 20% of the excess above the minimum required investment, up to a maximum of $100,000. For companies investing between $5 million and $20 million, the maximum grant is equal to 20% of the excess above the minimum required investment, up to a maximum of $200,000. For companies investing more than $20 million, the maximum grant is equal to 20% of the excess of the above the minimum required investment, up to a maximum of $300,000. Total grant awards may not exceed the maximums specified above within any fiveyear period for a specific building or facility. Investment in rehabilitation/expansion projects must exceed $100,000 in qualified real property investments, while investments in new construction must exceed $500,000. Investments in machinery and tools and business personal property are not considered qualified real property investments.

Foreign Trade Zones (FTZs) allow businesses to defer paying U.S. Customs duties on imported goods held within the zones until the goods enter the United States for domestic consumption. No duties are paid if goods are re-exported. Companies also receive the benefit of not having to pay duties on broken or scrapped product. Businesses are allowed to store goods within foreign trade zones for an unlimited period of time. They are also allowed to manufacture products within zones and pay duties at the duty rate of either the foreign parts used or on the finished product, whichever is most advantageous to the company. Virginia offers six general-purpose FTZs, designated by the U.S. Department of Commerce. Each of Virginia’s six FTZs are designated under the Alternative Site Framework (ASF) option, which allows greater flexibility when adding new zone operations as well as expedited FTZ Board applications. Any property within the ASF-designated area of a particular FTZ can obtain status as a usage-driven FTZ site. All zones provide space for storage, distribution, and light assembly operations.

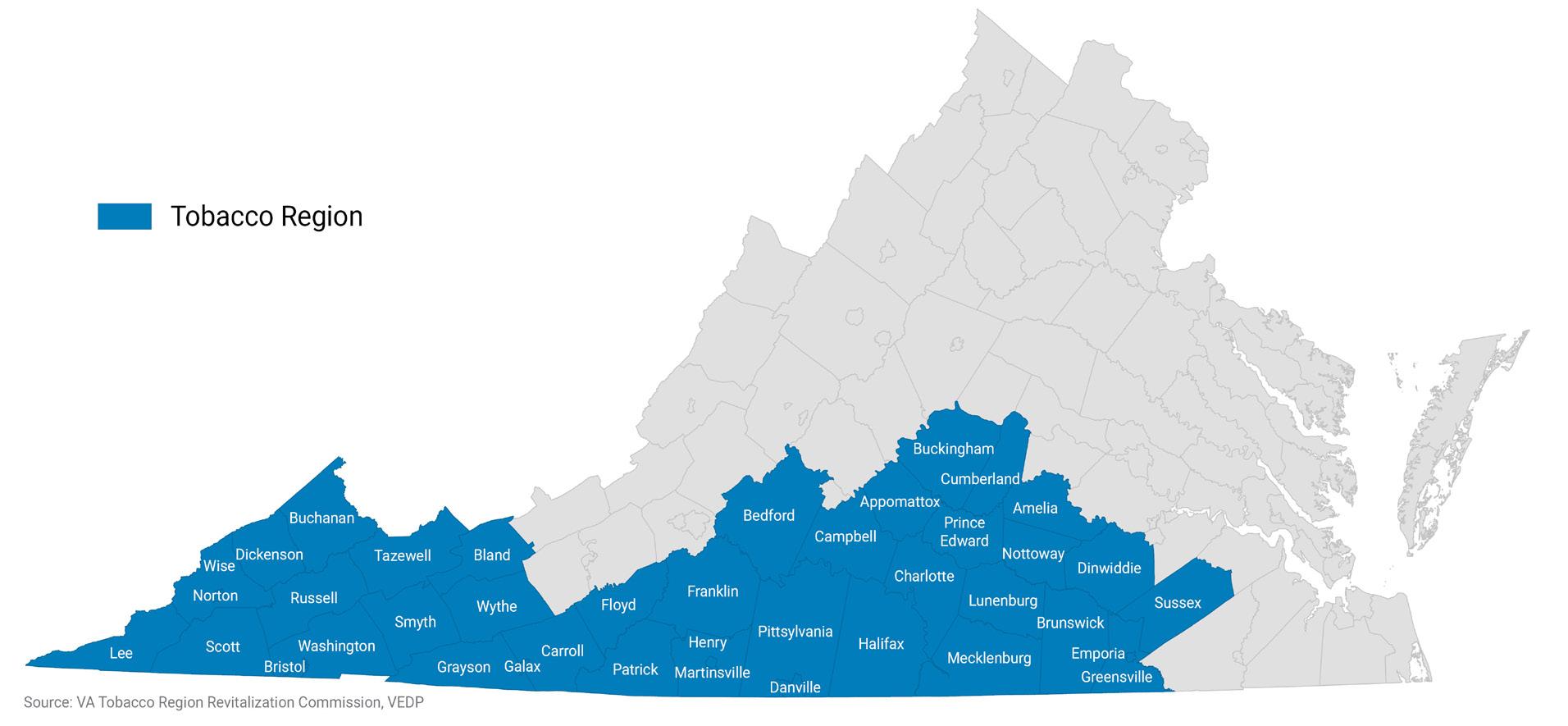

The Tobacco Region Opportunity Fund (TROF), administered by the Virginia Tobacco Region Revitalization Commission, provides performance-based monetary grants and loans to localities in Virginia’s tobacco-producing regions (34 counties and six cities in southern and southwestern Virginia). These grants and loans assist in the creation of new jobs and investments, whether through new business attraction or existing business expansion and are awarded at the Commission’s discretion.

The TROF program is intended to support the goal of the Commission to revitalize and diversify the economies of tobacco-dependent regions and communities.

Region

Source: VA Tobacco Region Revitalization Commission, VEDP

Tobacco Region

Amelia Appomattox

Bedford Bland

Bristol Brunswick

Buchanan

Buckingham

Campbell

Carroll

Charlotte

Cumberland

Danville

Dickenson

Dinwiddie

Emporia

Floyd

Franklin

Galax

Grayson

Greensville

Halifax

Henry

Lee

Lunenburg

Martinsville

Mecklenburg

Norton

Nottoway

Patrick

Pittsylvania

Prince Edward

Russell

Scott

Smyth

Sussex

Tazewell

Washington

Wise

Wythe

The Tobacco Region Incentive for Agribusiness Development (TRIAD) program, administered by the Virginia Tobacco Region Revitalization Commission, is a tool for local governments in the Tobacco Region to attract new or expanding agriculture- and forestry-based businesses to their communities.

To qualify:

■ Applications are made by political subdivisions of the Commonwealth within the Tobacco Region

■ Benefiting businesses must add value to agriculture or forestry products from which they source at least 20% from Tobacco Region producers or otherwise bring substantial benefits to the region’s farmers and forestland owners

■ TRIAD grants are generally paid on a performance basis and require a dollar-for-dollar match from the applicant locality (at least 10%) and other incentive payments from public and certain non-profit sources

■ Grant award based on return-on-investment analysis to the Commonwealth (driven by new jobs and investment), impact on the region’s farmers and forestland owners (driven by company purchases), and factors that raise the quality and impact of the project

Localities and companies interested in this program should contact Tobacco Commission staff to introduce the project, discuss whether or not it is a fit for the program, and describe the source of the applicant’s required matching funds.

The Virginia Coalfield Economic Development Authority (VCEDA) provides low-interest loans to qualified new or expanding businesses through its financing program. The loans may be used for real estate purchases, construction or expansion of buildings, and the purchase of machinery and equipment. These loans are designed to enhance the economic base of Southwest Virginia’s e-Region, which comprises the seven counties and one city of southwestern Virginia: Buchanan, Dickenson, Lee, Russell, Scott, Tazewell, and Wise counties and the City of Norton. VCEDA also provides grants on a limited basis for workforce development and training, start-up seed capital, and for projects that do not generate a sufficient revenue stream to repay a loan.

Goodyear Tire & Rubber Company, the world’s largest aircraft tire and medium radial truck tire manufacturing plant, received support from the Tobacco Region Opportunity Fund (TROF) when expanding in Southern Virginia’s City of Danville.

We love the Martinsville workforce, as they are hard workers who are committed to producing high quality products while emphasizing people, safety, and excellent customer service. This will be our fourth expansion at the Martinsville facility, and we are excited to continue creating quality jobs in the state of Virginia.

KARL SCHLEDWITZ Chairman and CEO, Monogram Foods Solutions

Memphis-based Monogram Foods Solutions purchased a plant in Henry County for its food processing operation in 2009, just five years after the company was founded. After ramping up quickly, the company announced an expansion just a year later. Upon landing additional customer business in 2014, Monogram needed to select one of its existing facilities to add capacity rapidly. The Henry County operation offered a proven track record of success and a workforce committed to Monogram Foods Solutions.

Working within the constraints of a tight turnaround, Monogram aimed to expand at one of its existing facilities. The food processor had been pleased with the growth opportunities and quality of the workforce and training programs in Henry County, and thus considered the Commonwealth to be a strong contender for the competitive project. Virginia worked with the Martinsville-Henry County Economic Development Corporation to craft a robust proposal for the company’s review and offered solutions in the permitting process to keep the project on target and on schedule.

In December 2014, less than two months after receiving the proposal, Monogram Food Solutions announced it would invest $36 million to expand its Henry County operation in the Patriot Centre Industrial Park, creating 200 new jobs.

Given its successful partnership with the Commonwealth and Henry County on earlier expansions, Monogram again chose to grow the operation in 2015 with a $7.2 million investment to purchase and upfit a neighboring building in the industrial park to be used as a distribution warehouse. The project created 101 new jobs.

In 2018, Monogram Food Solutions issued yet another vote of confidence in the Commonwealth. The company committed to investing an additional $30 million in the Henry County facility to accommodate new and expanding contracts, thereby creating 300 new jobs. This was Monogram’s fifth expansion in less than a decade, bringing total job creation to over 870 and total capital investment to more than $80 million since 2009.

Monogram Foods Solutions was awarded a grant from the Commonwealth’s Development Opportunity Fund (COF), a performance-based grant from the Virginia Investment Performance Program (VIP), several grants from the Tobacco Region Opportunity Fund (TROF), as well as a direct loan from the Virginia Small Business Financing Authority. The company was eligible for the Enterprise Zone Program, the Major Business Facility Job Tax Credit, sales and use tax exemptions on manufacturing equipment, and funding and services to support employee training activities through the Virginia Jobs Investment Program (VJIP).

The Rail Industrial Access (RIA) Program, administered by the Virginia Department of Rail and Public Transportation (DRPT), provides funds to construct railroad tracks to new or substantially expanded industrial and commercial projects having a positive impact on economic development in Virginia. Funds may be used to construct, reconstruct, or improve part or all of the necessary tracks and related facilities on public or private property. Funds may not be used for right-of-way acquisition or adjustment of utilities.

The Virginia Department of Transportation (VDOT) administers the Transportation Partnership Opportunity Fund (TPOF), which may be used to address transportation aspects of economic development opportunities. TPOF monies are awarded at the discretion of the Governor in the form of grants, revolving loans, or other financial assistance to an agency or political subdivision of the Commonwealth for activities associated with eligible transportation projects.

VDOT administers a program that assists localities in providing adequate road access to new and expanding manufacturing and processing companies, research and development facilities, distribution centers, regional service centers, corporate headquarters, and other basic employers with at least 51% of the company’s revenue generated from outside the Commonwealth. The program may be used to:

■ Improve existing secondary highway system roads and city streets to accommodate the anticipated additional and/or type of traffic generated by an eligible economic development site

■ Construct a new road from a publicly maintained road to the new eligible establishment’s primary entrance when no road exists

(Right) An associate receives items into a sortable tote at the Amazon Fulfillment Center in Chesterfield, which received support from the Economic Development Access (EDA) Program, as well as various Virginia incentives.

text at bottom >>>

Virginia’s corporate income tax is 6% and no unitary tax is levied on Virginia companies’ worldwide profits. Corporations generally apportion their multistate income by using a three-factor formula that consists of a property factor, a payroll factor, and a double-weighted sales factor.

Virginia provides special apportionment formulas for certain motor carriers, financial corporations, construction corporations, railway companies, manufacturing companies, retail companies, and enterprise data centers. Of these, only the method that applies to manufacturing companies is optional. Manufacturing companies may elect to use single sales factor apportionment to determine their Virginia taxable income.

Virginia does not tax property at the state level; real estate and tangible personal property are taxed at the local level. Moreover, Virginia differs from most states in that its counties and cities are separate taxing entities.

A company pays either county or city taxes, depending on its location. If the company is located within the corporate limits of a town, it pays town taxes as well as county taxes. In addition, Virginia localities do not have separate school district taxes.

Virginia does not tax intangible property, which includes:

Manufacturers’ inventory; manufacturers’ furniture and fixtures; certified pollution control facilities and equipment; and solar energy equipment, facilities, and devices that collect, generate, transfer, or store thermal or electric energy; Pollution Control Equipment is exempt under § 58.1-3660

Localities have the option to fully or partially exempt the following property from taxation: Certified recycling equipment; rehabilitated commercial/industrial real estate for up to 15 years; manufacturers’ generating and co-generating equipment; certified solar energy devices; and environmental restoration sites (eligible real estate in the Virginia Voluntary Remediation Program)

Localities may elect to tax the following tangible personal and real property at reduced rates: Research and development tangible personal property; equipment used for biotechnology research, development, and production; semiconductor manufacturing machinery and tools; computer hardware and peripherals; aircraft; clean-fuel vehicles; tangible personal property used in

the provision of certain internet services; tangible personal property owned by qualifying businesses in their first two taxable years; and energy-efficient buildings

Virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing agricultural products for market, medicine and drugs sold to a veterinarian, or property used to produce agricultural products for market in an indoor, closed, controlled environment commercial agricultural facility.

Some important exemptions include:

■ Commercial feeds

■ Seeds

■ Livestock

■ Agricultural chemicals

■ Farm machinery

■ Property used directly in producing agricultural products for market in an indoor, closed, controlledenvironment commercial agricultural facility.

Virginia’s combined state and local sales and use tax ranges between 5.3% and 7.0% depending upon the locality. A seller is subject to a sales tax imposed on gross receipts derived from retail sales or leases of tangible personal property, unless the retail sales or leases are specifically exempt by law. When a seller does not collect the sales tax from the purchaser, the purchaser is required to pay a use tax on the purchase, unless the use of the property is exempt.

Some important exemptions include:

■ Manufacturers’ purchases used directly in production, including machinery, tools, spare parts, industrial fuels, and raw materials

■ Items purchased for resale by distributors

■ Certified pollution control equipment and facilities

■ Custom computer software

■ Utilities delivered through lines, pipes, or mains

■ Purchases used directly and exclusively in research and development in the experimental or laboratory sense

■ Most film, video, and audio production-related purchases

■ Machinery, tools, and equipment of a public service corporation used to generate energy derived from sunlight or wind

■ Charges for internet access and sales of software via the internet

■ Purchases used directly and exclusively in activities performed in cooperation with the Virginia Commercial Space Flight Authority

■ Semiconductor clean rooms or equipment and other tangible personal property used primarily in the integrated process of designing, developing, manufacturing, or testing a semiconductor product

■ Machinery, tools, equipment, and materials used by a licensed brewer in the production of beer and materials such as labels and boxes for use in packaging and shipment for sale

Virginia offers a data center retail sales and use tax exemption (DCRSUT Exemption) on qualifying computer equipment or enabling software purchased or leased for use in certain data centers in the Commonwealth meeting minimum investment and job creation requirements as outlined on VEDP.org The DCRSUT exemption is available beginning July 1, 2010, through June 30, 2035, unless the company meets the investment and job creation provisions required for an extension of the DCRSUT.

Statutory Minimum General Eligibility Thresholds:

■ $150 million new capital investment

■ 50 new jobs located at the data center in the applicable locality and associated with the operation or maintenance of the data center

■ Each new job must be paid at least 150% of the prevailing annual average wage in the locality where the data center is located, excluding fringe benefits

Statutory Minimum Eligibility Thresholds for Distressed Localities:

■ Locality with annual unemployment and poverty rates that were greater than the state average

■ $70 million capital investment

■ 10 new jobs associated with the operation or maintenance of the data center in the locality

■ Each new job must be paid at least 150% of the prevailing annual average wage in the locality where the data center is located, excluding fringe benefits

Extension of the DCRSUT Exemption beyond 2035 requires a data center operator to enter into a MOU with the VEDP on or after January 1, 2023.

Eligibility Thresholds for Extension of the Tax Exemption to 2040:

■ $35 billion new capital investment in data centers in localities identified in a memorandum of understanding

■ 1,000 direct new jobs located at data centers identified in the MOU

■ At least 100 of the new jobs must be paid at least 150% of the prevailing annual average wage in the locality where the data center is located, excluding fringe benefits

Eligibility Thresholds for Extension of the Tax Exemption to 2050:

■ $100 billion new capital investment in data centers in localities identified in a memorandum of understanding

■ 2,500 direct new jobs located at data centers identified in the MOU

■ At least 100 of the new jobs must be paid at least 150% of the prevailing annual average wage in the locality where the data center is located, excluding fringe benefits

The Hershey Company’s expansion in Augusta County qualified the leading North American chocolate producer and global snacks company to receive Sales and Use Tax Exemptions on manufacturing equipment.

To meet the ever-growing demands of serving substantial amounts of traffic, Meta, formally known as Facebook, needed to invest in a new data center to increase capacity while also keeping its energy footprint low. After zeroing in on the East Coast, Facebook set out to find the location of its eighth U.S. data center.

Home to nearly 700 data centers, Virginia boasts one of the largest data center markets in the world, thanks to the Commonwealth’s access to a robust fiber and power network that matches or exceeds virtually every domestic market and most major financial centers around the globe. With approximately 70% of the world’s internet traffic passing through Virginia, the Commonwealth’s sophisticated IT infrastructure is second to none.

Henrico County, located in Greater Richmond, offered a shovel-ready site and fast-track permitting. White Oak Technology Park, a master-planned, high-tech manufacturing center conveniently located at the intersection of I-295 and I-64, is optimally designed to meet the scale and digital speed requirements for data centers. White Oak houses the QTS Richmond Network Access Point (NAP) and DE-CIX Richmond, offering access to subsea cables MAREA, BRUSA, SAEx1, and Dunant and providing a gateway to the largest interconnection ecosystem in North America. The park is served by Dominion Energy via two 230 KVA transmission lines, has significant water and sewer capacity, and offers connectivity through multiple fiber providers.

While Henrico County clearly met the critical elements of Meta’s search, the environmentally conscious company also prioritized being able to source clean and 100% renewable energy for its newest data center. Dominion Energy and Meta worked together to create a renewable energy tariff called Schedule RF. The tariff allows Meta and other large energy users to meet their needs through the addition of renewable energy sources. As a secondary economic benefit, the renewable energy projects served under this tariff must be completed in Virginia.

Facebook is eligible for the Data Center Retail Sales and Use Tax Exemption (DCRSUT Exemption) on qualifying computer equipment or enabling software purchased or leased for use in certain data centers in the Commonwealth meeting minimum investment and job creation requirements.

In October 2017, Meta announced plans to establish a 970,000-square-foot data center in the White Oak Technology Park in Henrico County. The company committed to investing $750 million in the project, as well as hundreds of millions of additional dollars in the construction of multiple solar facilities to service Meta’s Henrico Data Center with 100 percent renewable energy.

Site work began in February 2018, thanks to Henrico County’s fast permitting approval program and the development-ready site at White Oak Technology Park. In September 2018, Meta announced an additional investment of $750 million to construct three new 500,000-square-foot buildings. The first phase of the Henrico Data Center campus officially went online in August 2020 and is being delivered in multiple phases, with an anticipated completion date of late 2023.

The $1 billion campus is estimated to be at least four football fields long, a total of 2.5 million square feet across more than 350 acres, and cooled using outside air. At full operational capacity, Meta will employ at least 200 Virginians in positions that include technical operations, electricians, air-conditioning and heating specialists, culinary, cleaning, logistics, security, and more.

Meta has worked closely with Dominion Energy and other partners to bring over 500MW of new renewable energy to the Virginia grid, and the Henrico campus is supported by 100 percent new solar energy sourced from the Commonwealth. In 2021, Meta announced that the Henrico Data Center was awarded LEED Gold certification, a program that focuses on energy modeling rather than actual energy consumption. Meta’s Henrico operations were at least 80% more water efficient than the average data center, 100% solar powered, and recycled over 50,000 tons (82%) of its construction waste in 2021.

Virginia offers Meta the full package: infrastructure with room to grow, access to renewable energy, and a talented pool of employees to keep the Henrico Data Center online for years to come.

Virginia has been a home to the internet since the tech industry’s earliest days. And thanks to Henrico County’s robust infrastructure and attractive business climate for data center development, we could not be more thrilled to locate our next data center here. When considering new data center locations, we not only look for clean and renewable energy solutions, but great partnerships within the local community, a strong pool of local talent, excellent access to fiber, and a robust electric grid. Henrico County and the Commonwealth of Virginia has it all.

The Virginia Jobs Investment Program (VJIP) is a vital part of the Commonwealth of Virginia’s economic development efforts. VJIP is a performance-based discretionary incentive that provides funding and assistance to companies creating new jobs or experiencing technological change. VJIP funding helps to offset recruitment and training costs for new or expanding companies and companies retraining their employees. Funding for each net new full-time job created or full-time employee retrained is determined by an assessment of the company’s recruiting and training activities, as well as the project’s expected benefit to the Commonwealth, and is subject to approval by the Secretary of Commerce and Trade. Funding is reimbursable 90 days after a new employee is hired (for new jobs programs) or after the retaining activity is complete (for retraining programs). In addition to direct funding, Business Managers offer human resource consultative support at no charge, including facilitating relationships with other workforce and education partners and programs.

Only full-time jobs with benefits, which pay a minimum entry-level wage rate per hour of at least 120% of the Federal Minimum Wage or the Virginia Minimum Wage, whichever is higher, are eligible for funding.

The New Jobs Program targets expansions of existing companies or new facility locations that involve competition with other states or countries. This program supports companies that have more than 250 employees company wide. Qualifying companies must create a minimum of 25 net, new, full-time jobs and make a new capital investment of at least $1 million.

The Small Business New Jobs Program supports expanding or newly locating Virginia companies that have 250 employees or fewer company-wide. Qualifying companies must create at least five net new full-time jobs within 12 months from the date of the first hire and make a new capital investment of at least $100,000 associated with the location or expansion.

The Retraining Program supports existing Virginia companies that are undergoing integration of new technology into their production process, a change of product line in keeping with marketplace demands, or substantial change to their service delivery process that would require assimilation of new skills and

technological capabilities by their existing labor force. The program targets expansions of existing companies that involve competition with other states or countries. Qualifying companies must make a new capital investment of at least $1 million directly associated with the retraining efforts and need to retrain at least 25 full-time positions.

The Small Business Retraining Program supports companies that have 250 employees or less company-wide. Qualifying companies must make a new capital investment of at least $100,000 directly associated with the retraining efforts and need to retrain at least five full-time positions.

The Virginia Talent Accelerator develops and delivers recruitment and training services fully customized to a client’s unique jobs, processes, procedures, and culture. All services are provided at no charge to eligible projects as an incentive for job creation.

The program is comprised of an expert in-house team of talent acquisition, instructional design, video production, graphic design, and organizational development professionals, all hired from the private sector with deep experience in their fields.

Customized training services include:

■ Hands-on training

■ Simulations

■ E-learning modules

■ 3D Illustrations and animations

■ Broadcast-quality videos

■ Instructor-led classroom sessions

Customized recruitment services include:

■ Video Production

■ Ad Design & Placement

■ Job Board Posts

■ Customized Website Design

■ Applicant Tracking & Screening

■ Pre-Hire Assessments Simulations

In addition to recruiting and customized training services, the Virginia Talent Accelerator Program offers a robust suite of organizational development and operational excellence training and consulting services. These services help companies establish a collaborative culture and optimize individual performance.

All manufacturing projects are delivered in collaboration with regional workforce agencies and the nearest Virginia Community College to ensure companies have direct access to their talent pipelines. The Talent Accelerator’s goal is to accelerate the start-up of new and expanding facilities by expediting recruiting and shortening the new-hire learning curve.

(Right) Civica Rx worked with the Virginia Talent Accelerator Program team to develop a recruitment campaign that helped the company identify and attract specialized talent to meet its staffing needs.

Business Facilities, 2025

TOP STATE — WORKFORCE

Area Development, 2024 #2

Virginia doesn’t just offer training; they bring an entire recruitment and training infrastructure... They helped us recruit workers, trained them in-house with customized materials, and even developed video and 3D animations for our unique processes. It’s like having your own dedicated workforce development agency.

KRIS WEIDLING Chief Human Resources Officer, Civica Rx

Virginia offers a state tax credit to employers who establish Registered Apprenticeships. Registered Apprenticeship consultants are positioned throughout the Commonwealth to provide support and technical expertise to employers in creating Registered Apprenticeship Programs. Additional resources which offset training costs for the Related Technical Instruction component of Registered Apprenticeship Programs are available in partnership with many of Virginia’s Community Colleges.

Through Virginia’s community colleges and higher education centers, employers can benefit from shortterm training of employees provided by FastForward, a program that aligns the state’s workforce development investments to support the growth of Virginia’s industry

sectors. FastForward develops industry-endorsed, competency-based workforce training programs for in-demand jobs.

Virginia’s G3 program offers tuition-free community college to low- and middle-income students who pursue jobs in high-demand fields. G3, which stands for “Get Skilled, Get a Job, Get Ahead,” provides financial support to cover tuition, fees, and books for eligible students at Virginia’s two-year public institutions. The G3 program, which brings new workers into key industries including information technology, is one of the first in the nation to provide qualifying students at the lowest income levels with wraparound financial assistance to help with expenses such as food, transportation, and child care as they pursue higher education and vocational training.

The Virginia Innovation PArtnership Corporation (VIPC) drives innovation and economic growth in Virginia by focusing on supporting entrepreneurship and startups, expanding regional innovation ecosystems and industry sectors, and advancing research and technology. As part of its mission, VIPC attracts and helps catalyze private investment in earlystage startups, awards research and commercialization grants to universities and entrepreneurs, and provides resources and funding to support entrepreneurial ecosystems, innovation networks, and public-private partnerships across local, state, and federal levels.

VIPC is dedicated to establishing Virginia as a hub for groundbreaking advancements business expansion, and the scaling of new technologies. Its funding programs support the entire lifecycle of innovation, fostering a dynamic ecosystem for early-stage development and entrepreneurship.

VIPC’s is dedicated to establishing Virginia as a hub for groundbreaking advancements, business expansion, and the scaling of new technologies. Its funding programs support the entire lifecycle of innovation, fostering a dynamic ecosystem for early-stage development and entrepreneurship.

Virginia-based startups with high potential for achieving rapid growth and generating significant economic returns for Virginia may be eligible to seek pre-seed and seedstage investments through Virgina Venture Partners (VVP), VIPC’s venture capital investment platform. VVP targets companies for which current and future equity investments will serve as a critical enabler of company growth.

VIPC’s Federal Funding Assistance Program (FFAP) supports early-stage technology firms pursuing federal SBIR (Small Business Innovation Research) and/or STTR ( Small Business Technology Transfer) funding. FFAP offers guidance, training, and other valuable resources, including funding assistance for select first time SBIR or STTR Phase I or II applicants, to help companies navigate the application process and become competitive for these grants.

Virginia Invests expands investment and growth opportunities for Virginia-based, innovation-driven startups and entrepreneurial ecosystems. Managed by VIPC’s Virginia Venture Partners (VVP), the programs funds venture capital managers committed to Virginia and aligned with VVP’s seed-stage investment thesis, aiming to attract and catalyze additional capital for Virginia startups.

VIPC fuels innovation in Virginia by advancing cuttingedge research and turning novel ideas into real-world solutions. Through competitive grants, VIPC supports universities in developing technologies at the earliest stages of commercialization and the infrastructure to support these efforts.

Virginia’s vibrant entrepreneurial ecosystem includes accelerators, incubators, technology councils, chambers of commerce, and other Virginia-based organizations

that support entrepreneurs in their earliest stages. VIPC’s Regional Innovation Fund (RIF) provides grants to these organizations, enabling them to continue fostering science-and thechnology-based enterprises.

VIPC’s Strategic Initiatives enhance Virginia’s research and commercialization capabilities in emerging technology sectors while driving industry opportunities for economic development in new, high-potential markets.

The Unmanned Systems Center at VIPC is the nexus for Virginia’s UxS activities, including land, air, sea, space, and advanced air mobility (AAM). VIPC is the key source for UxS information and connections, helping establish Virginia as a national leader in umanned aircraft systems.

The Public Safety Innovation Center (PSIC) at VIPC assists with the development, promotion, and implementation of new and improved technology for use by public safety emergency responders at the local, state, and federal levels.

The Virginia Smart Community Testbed, located in Stafford, is a “living laboratory” launched in partnership with VIPC to develop and deploy practical, proven, and scalable smart technology solutions, accelerating innovation across Virginia and beyond.

Many companies across the U.S. are shifting a significant portion of their workforce to permanent telework. That wave of increased telework also will affect how companies make decisions when evaluating locations for future projects. The Commonwealth of Virginia has adopted new statutory language that enables VEDP to take telework positions, held by Virginia residents, into account when offering performance-based economic development incentives for new, competitive site-selection projects.

VEDP Incentives that may apply:

■ Commonwealth’s Development Opportunity Fund

■ Major Eligible Employer Grant Program

■ Virginia Economic Development Incentive Grants

■ Virginia Investment Performance Grant

■ Virginia Jobs Investment Program

■ Virginia Talent Accelerator Program

■ Data Center Retail Sales & Use Tax Exemption

I’ve not seen that before, and I’ve been to many places around the world… I think it’s phenomenal and the support has been amazing.

CARSTEN RASMUSSEN Chief Operations Officer, The LEGO Group

“Only the Best Is Good Enough” is a LEGO motto used since the 1930s. The successful state had to deliver a comprehensive, best-in-class solution to meet the company’s proven standards of excellence and provide strong synergies with its corporate values. VEDP worked with the General Assembly’s Major Employment Investment (MEI) Commission, Chesterfield County, and the Greater Richmond Partnership to do just that. The Virginia solution

centered around an attractive pad-ready site, a commitment to renewable energy, comprehensive workforce solutions, and a competitive community and state incentive package.

The LEGO Group will receive an MEI custom performance grant of $56 million as well as site development improvements estimated at up to $19 million, as approved by the Virginia General Assembly.

When the LEGO Group was considering an East Coast location for their return to manufacturing in the United States, Virginia offered a nearly shovel-ready site in a well-established industrial park in the growing Richmond metro area.

But what helped seal the deal was the opportunity to work with the Virginia Talent Accelerator Program, ranked as the No. 1 customized workforce training program in the United States by Business Facilities again in 2024.

As soon as the LEGO Group committed to Virginia, the Virginia Talent Accelerator Program started working with the company to develop innovative recruiting tools designed to leverage publicity from the upcoming Governor’s announcement to capture talent. This featured a recruitment website fully customized to the LEGO Group’s Virginia job and lifestyle opportunities. Within 36 hours, the talent pool had grown to over 3,000. Thousands more applied afterwards, establishing a huge pool of highly interested candidates years before most jobs open.

That was just the beginning of the highly customized talent recruitment and training services that the Virginia Talent Accelerator has delivered to support the company. Shortly after the announcement, the Talent Accelerator team traveled to the Lego Group’s flagship plant in Mexico to meet with the leadership team, benchmark best practices, and collaboratively map out all the recruiting and training tasks that the Accelerator team will take off the LEGO Group plate. This is enabling the company team to focus on getting the Virginia operations up and running.

The Accelerator team went back to the Monterrey plant to capture more than a terabyte of video footage of the company’s unique manufacturing processes. This has been refined into concise training modules, specifically designed to accelerate the learning for future new hires in what has become the Talent Accelerator’s signature approach.

To fully prepare new hires and amplify the impact of the customized training media, the Talent Accelerator facilitators are delivering a wide range of training to support the hundreds of new hires working to kit, package, and

■ Pre-Hire Job Preview

■ Manufacturing Process Training

Pre-Pack Systems

Final-Pack Systems

Logistics

Safety

Forklift Operations

■ Lean Fundamentals

■ A3 Thinking & Problem Solving

■ Leadership & Team Building

■ Teamwork

■ Effective Communication

■ Cross-Cultural Awareness

■ Interviewing Skills for Hiring Managers

distribute LEGO Group products while the permanent manufacturing facility is under construction. This training will continue through the hiring of 1,761 employees for the 1.7 million-square-foot facility. The topics include:

All Talent Accelerator services are being provided at no cost to the LEGO Group as an incentive for job creation. All company-specific materials developed during the project become property of the client, and all proprietary information is protected by a non-disclosure agreement.

Throughout the project, the Talent Accelerator team has been working collaboratively with nearby Brightpoint Community College (BCC). BCC provided space for the initial Talent Accelerator training and operates maintenance technology training programs that will supply much of that mechatronics talent that the LEGO Group’s long-term needs. The programs include fast-track certificates that can be applied to earning associates degrees, and most students are eligible to participate tuition-free through Virginia’s innovative G3 Program.

With a number of business units operating throughout the Northeast, ADP saw the opportunity to centralize certain operations in one location as a way to improve efficiency, increase cohesion, and maximize resources. The global provider of cloud-based human capital management solutions wanted an urban space that could accommodate its needs and attract a strong pipeline of talent.

The City of Norfolk, with its walkable downtown, public transportation offerings, affordable housing, and entertainment options, has attracted millennials in full force. Long known for being home to the world’s largest naval station, Norfolk annually absorbs exiting military into its workforce, while also benefiting from the local higher education system.

In addition to boasting ADP’s target workforce, Norfolk could offer a state-of-the-art office building to accommodate ADP’s needs at a competitive price. Set just steps from the harbor, the nearly 300,000-square-foot facility at 2 Commercial Place has the space and layout ADP officials envisioned for its regional customer service center. The former bank building’s prestige and location in the heart of the city was the right fit.

In March 2016, ADP announced plans to invest $32.25 million to establish a regional customer service center in the City of Norfolk, creating more than 1,800 new jobs. Today, ADP employs more than 2,200 at its Norfolk facility — well over the estimated job creation — and is a marquee company on Norfolk’s corporate roster and an active member of the community.

ADP was awarded a grant from the Commonwealth’s Development Opportunity Fund (COF). The company was eligible for the Use Tax Exemption on manufacturing equipment, in addition to funding and services to support employee training activities through the Virginia Jobs Investment Program (VJIP).

The mission of VEDP’s Division of International Trade is to increase the number of Virginia companies selling overseas and their volume of international business. International Trade annually serves 500 Virginia companies by identifying new international markets, developing market entry strategies, optimizing their supply chains, and locating distributors and representatives for products or services.

International Trade maintains offices across the state and offers a global network of on-call consultants in 120 countries, who provide international market research and set up one-on-one meetings with prospective clients for Virginia exporters. Additionally, the team conducts more than 20 international trade missions and trade shows annually to introduce Virginia products and services to global markets. Virginia businesses interested in increasing international sales benefit from International Trade’s one to two-year long programs to develop and execute export plans to grow international sales. These programs provide training, counseling, and grant funding to offset the cost of exporting, including the award-winning, two-year export accelerator Virginia Leaders in Export Trade (VALET) Program. Other services and grants include:

■ International Market Research

■ Trade Missions and Trade Shows

■ State Trade Expansion Program (STEP) Grant

■ Global Defense Program (GDP)

■ Trade Show Program

■ Supply Chain Optimization Program

■ Virginia Global Business Internship Program

Through the Virginia Leaders in Export Trade (VALET) program, International Trade works with companies to accelerate their international sales into international markets. Since its inception, over 375 companies representing a wide cross-section of industries have been accepted into and graduated from the VALET program.

When Dutch secondary packaging solutions provider BluePrint Automation decided to open a U.S. location in 1987, the company chose a site in Chesterfield County near Richmond, due in part to the regional talent market and multiple nearby ports that could facilitate importing.

After initially offering packaging systems primarily to customers in the U.S., to extend its reach farther south, BluePrint retained local sales agents to gain a foothold in countries such as Mexico and Brazil.

The company, however, wasn’t getting as much traction as it would have liked in some areas, according to Robbie Quinlin, the company’s marketing manager for the Americas. To support its sales efforts in Latin America, BluePrint signed on to participate in VEDP’s two-year Virginia Leaders in Export Trade (VALET) program in 2003.

The business acceleration program, launched in 2002, provides Virginia companies with resources to bolster their international growth — ranging from sales plan development assistance to access to international professional services providers who can offer expertise in areas like transportation or the law.

“There may be someone who’s really knowledgeable about export tax or shipping,” Quinlin said. “You’re able to make those connections with other resources right here in Virginia.”

The VALET program accepts 25 companies a year. Program participants who have completed it report a 78% average increase in international sales. The initiative is one of several VEDP programs to help Virginia businesses enhance their global operations.

The State Trade Expansion Program (STEP) Grant, funded through a Cooperative Agreement with the U.S. Small Business Administration, was established to raise the value of products companies sell in other countries and increase the number of small businesses in the Commonwealth that export items.

The research is extremely important for any company to be able to know how to attack a particular market. That’s the only way you can be successful. [But] it will take anywhere between three to five years to do it yourself.

VEDP’s Trade Show Program provides eligible companies with up to $10,000 in reimbursements to exhibit at product-, service-, or industry-related events that occur outside of the U.S. or have a demonstrated international aspect.

VEDP has also offered more informal assistance to companies, such as connecting BluePrint with a translation services provider who also served as a local point of contact when the manufacturer sponsored a booth at a Sao Paulo trade conference in 2010.

BluePrint Automation, Chesterfield County

The translation capabilities allowed BluePrint to attend the event, Quinlin said, which was a key component of its promotional plan for the region.

“We’re really established in our industry in the U.S.; not so much in Latin America,” he said. “We’re still growing in that market. Going to the trade shows, we’re trying to set ourselves up as a leader. Brand awareness is huge. What the program is providing is immeasurable — it’s allowing us the opportunity to become who we should be there.”

Conquering International Commerce

BluePrint is currently planning to participate in the VALET program again this year. The company has already engaged Fairfax County-based business management consultant Capstone Strategic, Inc. to determine locations to concentrate on.

“They did some preliminary research and gave us a matrix to say, ‘This country’s headed upward; this one, not so much,’” Quinlin said. “We’re a mid-sized company, but if you’re a smaller company trying to penetrate that market, and your resources are even more limited, you don’t want to waste them in a country that’s not ready or able to buy.”

“We’ve been going to these trade shows, promoting BluePrint,” Pino said. “With the assistance of the VALET program, that growth can be further extended. That help allows us to sell more; in the future, expand the factory — it’s a benefit for us, but it’s [also] a benefit for the community in Chesterfield.”

Amthor International received support from the Enterprise Zone Real Property Investment Grant Program, Virginia Jobs Investment Program (VJIP), and the Enterprise Zone Job Creation Grant Program. The company has generated 520 jobs for Virginians.

The Virginia Small Business Financing Authority (VSBFA) is the Commonwealth of Virginia’s business and economic development financing arm.

Aligned within Virginia’s Department of Small Business and Supplier Diversity, the VSBFA offers programs to provide businesses, not-for-profits, and economic development authorities with the financing needed for economic growth and expansion throughout the Commonwealth. To accomplish this goal, the VSBFA offers loans directly to businesses & non-profits, credit enhancements to banks that are lending to businesses & non-profits, as well as bond financings to benefit forprofit businesses, 501 (c) (3) not-for-profit entities, and to support clean energy and P3 transportation projects. VSBFA also helps small businesses seeking to attract equity investments by providing an equity incentive grant program.

VSBFA offers a variety of financing opportunities for small businesses across the Commonwealth, including:

■ Direct Loan Program

■ Microloan Program

■ Childcare Financing Program

Support Bank Loan Programs:

■ Cash Collateral Program

■ Loan Guaranty Program

Other Programs:

■ State Small Business Credit Initiative (SSBCI 2.0)

■ Small Business Investment Grant Fund

■ Bond Program

Throughout the VSBFA’s 30 plus-year history they have helped many Virginia businesses gain the access to the capital they needed to grow and create jobs in the Commonwealth.

Additional information about VSBFA’s programs and eligibility requirements are available at the VSBFA website at sbsd. virginia.gov/virginia-small-businessfinancing-authority

Community Development Block Grant (CDBG) funds are available to eligible cities, counties, and towns to support local community and economic development activities. Funds may be used for off-site development such as public facilities improvements including, but not limited to, construction of access roads, water and sewer line extensions, and installation of fiber network for telecommunications.