Annual Impact Report

The Chincoteague pony is a breed of feral horse that lives on Assateague Island in Accomack County. Each July, the ponies swim to Chincoteague Island in an event made famous by Marguerite Henry’s novel, Misty of Chincoteague. The event will celebrate its 100th anniversary in 2025.

Ivy Creek Park, Lynchburg

Leadership Message

ONE YEAR INTO THE IMPLEMENTATION of the Innovative Framework for Economic Growth, VEDP is responding to new challenges and opportunities while positioning the whole of Virginia for economic growth.

The Commonwealth leads the pack in developing best-in-class workforce solutions including the Virginia Talent Accelerator Program, which once again earned the top spot in the Business Facilities Customized Workforce Training rankings for 2024. Virginia also continues to make major strides in project-ready site availability as companies jockey for a limited supply of sites across the country, with improved infrastructure and site funding helping to drive the Commonwealth back to the top spot in CNBC’s America’s Top States for Business rankings for 2024.

Virginia is now working to solidify and extend these advantages. With strong support from Governor Glenn Youngkin and the General Assembly, VEDP recently deployed $125 million in matching grants through the Virginia Business Ready Sites Program and secured an additional $75 million focused on megasite development — all strategically focused on building a competitive inventory of project-ready sites for new and expanding businesses while generating a healthy return on investment for the state General Fund. What was already emerging as one of the most advanced site development programs in the country got a further boost in April with the passage of the Virginia Business Ready Expedited Permitting Program, aimed at streamlining permitting timelines for selected economic development sites and projects.

Project wins are following these kinds of investments in VEDP’s capabilities and Virginia’s business climate. Major announcements in FY24 include Amazon’s 1,100-job operations facility in Virginia Beach, Wells Fargo’s 1,100-job expansion in Roanoke County, CoStar’s decision to relocate its headquarters to Arlington County, Framatome’s 515-job expansion in Lynchburg, Northrop Grumman Corporation’s 300-job facility in Waynesboro, and Topsoe’s $400 million facility in Chesterfield County.

Our involvement with companies that choose the Commonwealth doesn’t end when a project gets announced. VEDP’s International Trade division helps both new and experienced exporters enter new overseas markets and expand their international sales, helping to secure more than 13,000 trade-supported jobs for Virginia in FY24. In May, the International Trade team received the “E Star” Award from the U.S. Department of Commerce, the highest honor U.S. exporters and export service providers can receive from the federal government, for the second time.

This report details these accomplishments and other notable VEDP activities in FY24, made possible by the great work and support of our local, regional, and state partners, including Governor Glenn Youngkin, Secretary of Commerce and Trade Caren Merrick, the Virginia General Assembly, members and staff of the Major Employment and Investment (MEI) Project Approval Commission, The Port of Virginia, the Virginia Chamber of Commerce, the Virginia Economic Developers Association, county and city government leaders, and countless other partners across the Commonwealth.

Thank you for your support for VEDP and for economic development in Virginia. Together, we are positioning the Commonwealth for a bright economic future.

WILLIAM H. HAYTER Board Chair FY24

JASON EL KOUBI President and CEO

Who We Are

The Virginia Economic Development Partnership (VEDP) is the state economic development authority for the Commonwealth of Virginia. Created in 1995, VEDP collaborates with local, regional, and state partners to encourage the expansion and diversification of Virginia’s economy. VEDP works to accomplish these objectives through a variety of activities, including marketing and lead generation; business retention, expansion, and attraction; trade development; business intelligence; competitive benchmarking; site development; performance-based incentives; and talent solutions.

Working closely with multiple departments within VEDP, the organization has adopted the following purpose and values to guide efforts to expand and diversify the Virginia economy.

PURPOSE VALUES

Enriching lives, communities, and the Commonwealth through economic development excellence

One VEDP

Working together as a collaborative, supportive team

Distinctive Insight

Cultivating deep expertise and diverse perspectives

Authentic Partnerships

Building strong partnerships based on integrity, authenticity, and respect

Growth Mindset

Embracing continuous improvement with humility and boldness

Results Focus

Competing with the grit to win and the curiosity to learn from our results

TRANSFORMATIONAL GOALS

Working closely with partners, VEDP has adopted five transformational goals for Virginia and VEDP for FY25–29 that reflect stakeholder input, incorporate elements of the innovative framework, and represent the central focus of its work:

1. Robust State Growth

Position Virginia to achieve a growth rate among that of the top 10 states in the U.S.

2. Every Region Wins

Ensure that every region participates in the growth of the Commonwealth

3. Best State Business Climate

Cultivate a leading business climate and sector-specific ecosystems

4. Top State for Talent

Establish Virginia as a top state for talent retention, attraction, development, and alignment

5. Most Innovative, Collaborative, and Effective State EDO

Solidify VEDP’s position as one of America’s top state EDOs through an innovative strategy, collaborative approach, and effective outcomes

Sandy River Outdoor Adventures, Prince Edward County

VEDP Divisions

BUSINESS INVESTMENT

Collaborates with partners to implement lead generation and project management strategies

KNOWLEDGE WORK

Focuses on sector expertise, lead generation, and ecosystem-building activities in the business services, financial services, software, cybersecurity, and aerospace and defense industries

MANUFACTURING

Focuses on sector expertise, lead generation, and ecosystem-building activities in the advanced materials, food and beverage manufacturing, and biopharmaceuticals industries

LOGISTICS

Focuses on sector expertise, lead generation, and ecosystem-building activities in the logistics sector

STRATEGIC PROJECTS AND LEAD GENERATION

Focuses on high-profile engagements and targeted lead generation, both domestically and internationally, and identifies and converts high-potential leads and prospects into project opportunities

ECONOMIC COMPETITIVENESS

Develops strategies to improve the foundations for state, regional, and local economic growth

INTERNATIONAL TRADE

Provides export development programs, services, and grants to help Virginia companies grow their international sales

REAL ESTATE SOLUTIONS

Collaborates with partners to develop a portfolio of Virginia properties that meet the needs of companies

RESEARCH

Conducts in-depth analysis and creates tailored client materials that convey Virginia’s competitive advantages

VIRGINIA TALENT ACCELERATOR PROGRAM

Provides customized recruitment and training solutions that give Virginia a competitive edge in securing business investment projects

REGIONAL TALENT SOLUTIONS AND BUSINESS OUTREACH (RTSBO)

Connects Virginia companies with workforce solutions and collaborates with partners to strengthen relationships with existing businesses

EXTERNAL AFFAIRS

Oversees the budget, legislative, and policy development process; encourages collaboration and coordination among partners

HUMAN RESOURCES

Seeks to hire, retain, and develop the best and the brightest to accomplish VEDP’s mission and goals

VIRGINIA OFFICE OF EDUCATION ECONOMICS (VOEE)

Leverages data to guide educational and workforce policy and practice on the availability, quality, and supply of talent in Virginia

MARKETING AND COMMUNICATIONS

Markets the Commonwealth to raise awareness of Virginia’s advantages for business and to cultivate new leads

INCENTIVES

Reviews, vets, tracks, and coordinates VEDP’s performance-based incentive programs, along with incentive structuring for major projects

FISCAL AND SUPPORT SERVICES

Provides a financial framework for VEDP to accomplish its mission through accounting, budgeting, and procurement

INFORMATION TECHNOLOGY

Supports VEDP’s technology platforms, including a variety of custom tech solutions

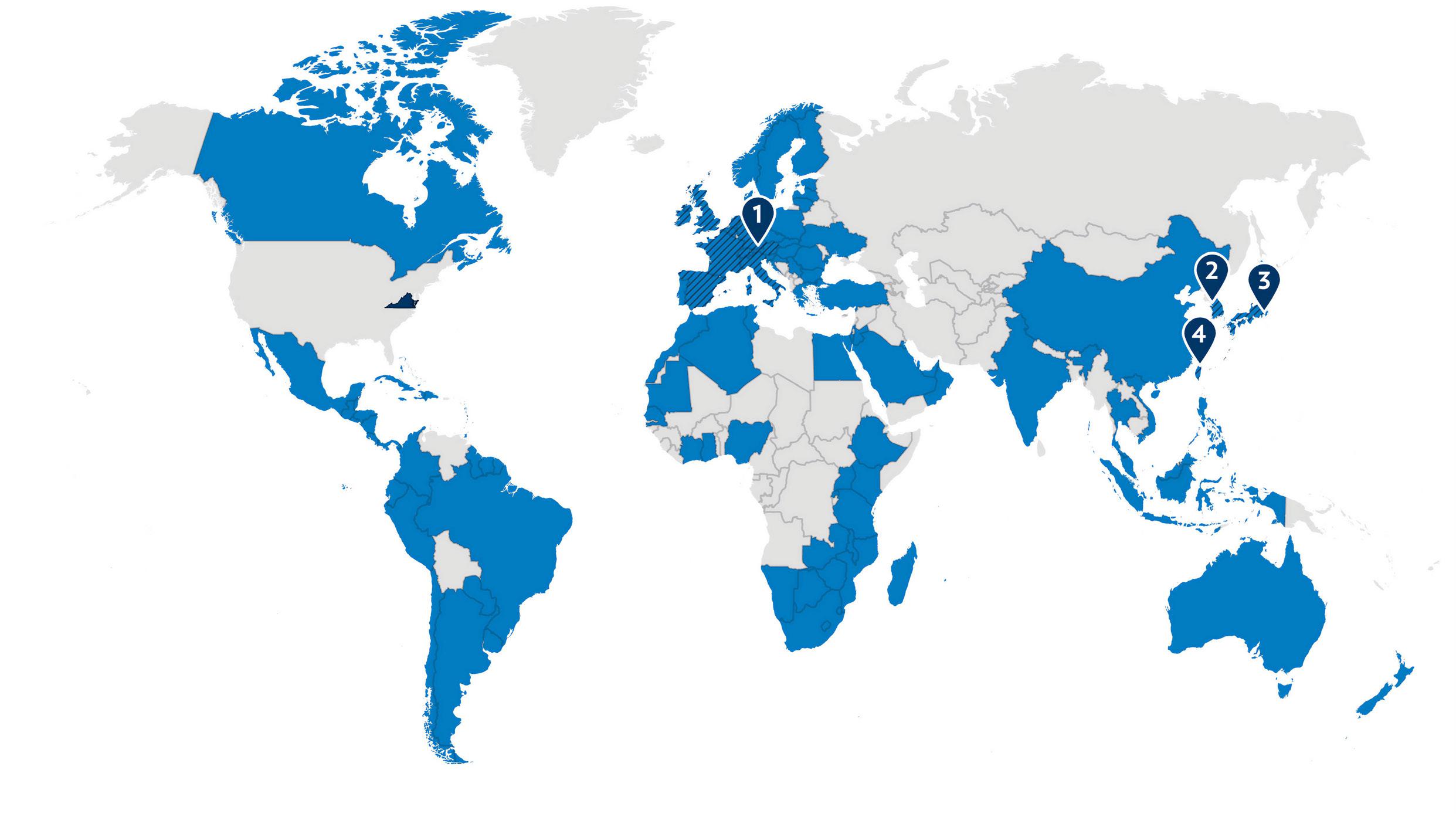

VEDP Global Network

FOREIGN DIRECT INVESTMENT OFFICES

VEDP’s international business investment offices implement lead generation strategies to identify and convert high-potential foreign direct investment leads and prospects into project opportunities for Virginia.

TRADE REPRESENTATION

VEDP’s network of international research consultants covers more than 120 countries around the world. These experts provide in-country market research for Virginia exporters, specific to the needs and opportunities for each company.

Our Partners

VEDP conducts its work in collaboration with hundreds of economic development partners. Core VEDP partners include the Governor and the Administration, the Virginia General Assembly, other state agencies, 17 regional economic development organizations, and more than 100 local economic development partners, utilities, railroads, and trade associations.

STATE COUNCIL OF HIGHER EDUCATION FOR VIRGINIA

VIRG I NIA

Regional Economic Development Organizations

A Strong Year for Business Development in the Commonwealth

In collaboration with local, regional, and state partners, VEDP had a successful FY24 in the first year of implementation of its new Innovative Framework for Economic Growth.

$8.2B

Capital Investment in VEDP-Assisted Project Announcements

VEDP-Assisted Project Announcements 76

8,210

Direct Jobs

Colonial Beach

BUSINESS INVESTMENT:

PARTNER AND CLIENT SATISFACTION

VEDP implements partner and client surveys to assist in evaluating project management effectiveness. The program received high approval in FY24.

Overall average response that VEDP effectively manages economic development projects:

99.8%

Strongly Agree/Agree

INTERNATIONAL TRADE STATS

Virginia’s central location and commitment to expanding its global network make the Commonwealth the key partner for businesses, exporters, and service providers worldwide.

504

Companies participated in VEDP International Trade programs and services in FY24*

*the most companies VEDP International Trade has ever served in a year

$1.5B

Total international sales attributed to VEDP International Trade programs in FY24

13,123

Jobs supported by VEDP’s trade programs in FY24

Virginia’s International Trade Team

Recognized With Nation’s Top Export Award for Second Time

New Point Comfort Lighthouse, Mathews County

INTERNATIONAL TRADE CLIENT SATISFACTION

VEDP’s International Trade division achieved exceptionally high scores for the quality of its programs and services in FY24.

99%

Companies that were “extremely likely” or “likely” to recommend VEDP’s export assistance programs to other Virginia companies

99%

Companies that rated the quality of VEDP International Trade’s export assistance as “excellent” or “above average”

99%

Companies that were “extremely likely” or “likely” to use VEDP International Trade for export assistance in the future

99%

Companies that say VEDP International Trade services helped them work toward achieving their strategic international goals

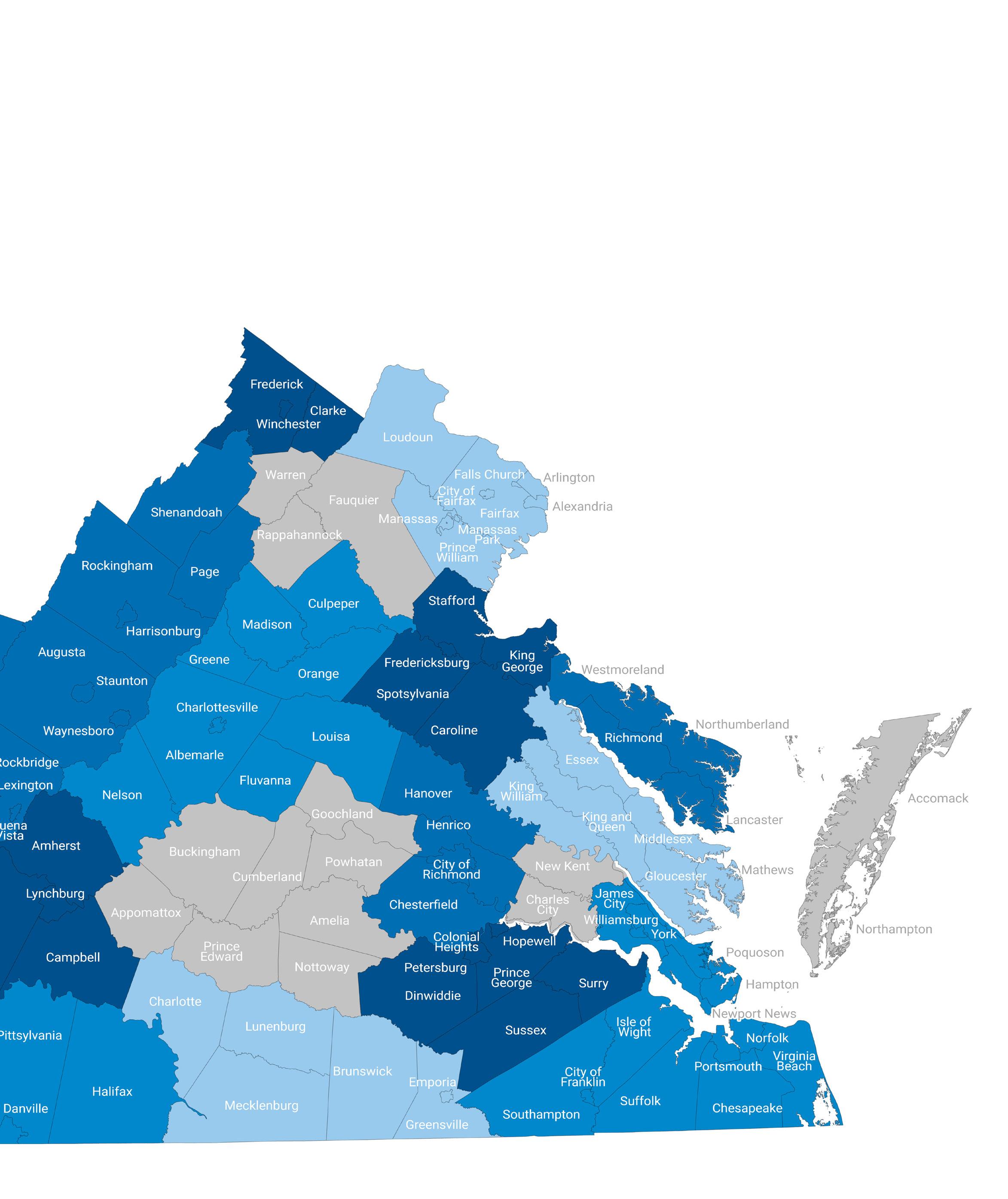

Existing Business Outreach

VEDP’s Regional Talent Solutions and Business Outreach (RTSBO) team meets with Virginia businesses in collaboration with our local and regional economic development partners to foster relationships with companies that drive Virginia’s economy and highlight existing business needs, particularly around talent. These efforts uncover challenges that might cause businesses to consider relocating, identify potential growth opportunities, and cultivate supplier ecosystems domestically and internationally. Here’s how Virginia’s innovative approach to economic development has driven greater outreach and service delivery to the Commonwealth’s companies.

502

Existing business outreach visits (20% increase from FY23)

570

Consultative services delivered, including 323 connections with partner organizations

69%

Businesses visited had an optimistic business outlook

Virginia Diodes, Inc.,

VIRGINIA JOBS INVESTMENT PROGRAM

The Virginia Jobs Investment Program (VJIP), Virginia’s most frequently used recruitment and training incentive, is a discretionary incentive that provides funding and services to qualifying companies to support new job creation or upskilling in conjunction with new or expanding operations. The cash grant and accompanying services are intended to offset a company’s recruitment and training costs.

249

Client projects supported by the VJIP incentive

71

Localities that had a VJIP-supported project 85%

VEDP-assisted project wins supported by the VJIP incentive

$35.76

Average hourly wage for VJIP projects 4,434

Jobs supported by VJIP projects

$822M

Capital investment for VJIP projects 98%

FY24 VJIP Client Satisfaction Survey respondents “strongly agree” or “agree” that VJIP contributed to their growth and success

Virginia Beach

FEATURES

I’ve never seen [anything] like the Virginia Talent Accelerator Program, and I’ve been to many places around the world to look at facilities…It’s phenomenal.

CARSTEN RASMUSSEN Chief Operations Officer, The LEGO Group

The LEGO Group rendering, Chesterfield County

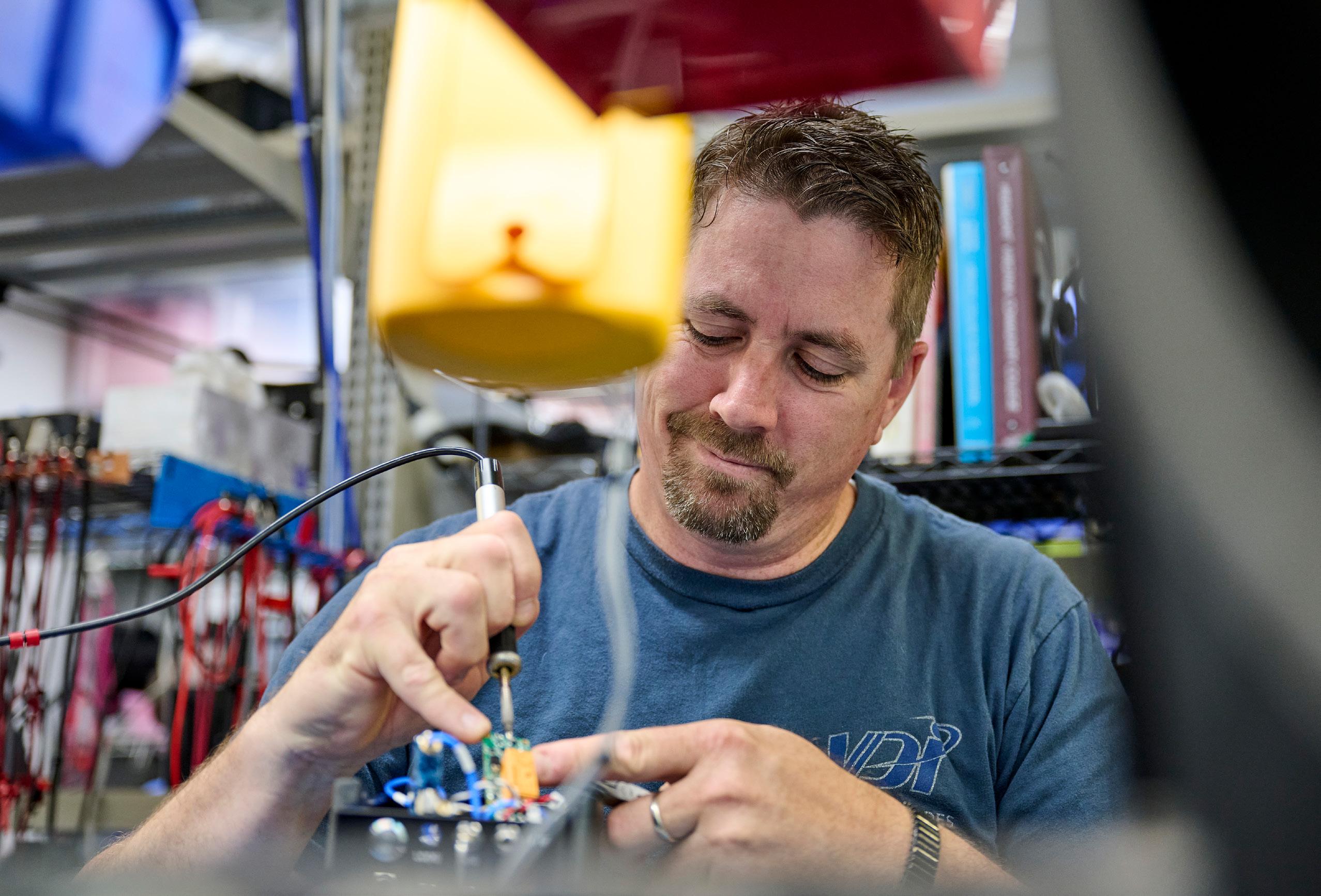

Talent Accelerator

Inside the Virginia Talent Accelerator Program’s Bespoke Workforce Solutions

WHEN THE LEGO GROUP was considering an East Coast location for their return to manufacturing in the United States, Virginia offered a nearly shovel-ready site in a well-established industrial park in the fast-growing Richmond metro area. But what helped seal the deal was the opportunity to work with the Virginia Talent Accelerator Program, ranked as the No. 1 Customized Workforce Training program by Business Facilities for two years in a row.

The Talent Accelerator team began developing sophisticated recruitment tools for the LEGO Group weeks before the project was announced to help the company leverage the publicity to build its future talent pool. The response was undeniable — thousands of candidates applied within 36 hours, and the pool continues to grow each day as the company continues to hire for the facility in advance of the planned opening in 2027.

The program is a differentiator for Virginia in a competitive national economic development environment and has produced tremendous return on investment, helping secure more than 13,000 jobs since its launch in early 2020. In addition to the LEGO Group, companies as diverse as Haleon (formerly GSK), Rocket Lab, and Tyson Foods have benefited from the program’s world-class training and recruitment solutions, which are fully customized to a company’s unique operations, equipment, standards, and culture. The program’s work, delivered in collaboration with the Virginia Community College System, is delivered by a talented in-house team of video producers, instructional designers, and 3D animators who develop highly customized visual media to expedite recruitment and accelerate new hire learning.

Every Talent Accelerator project begins with an analysis of company processes, job roles, tasks, culture, and existing recruitment and training processes. The process starts with data-driven recruiting campaigns featuring robust advertising and a range of services aimed at generating large pools of qualified candidates for positions at all levels of a company.

Once employees are in place, companies benefit from Talent Accelerator training services that include hands-on training, simulations, broadcastquality videos, illustrated work instructions, instructor-led classroom sessions, animations, and e-learning modules. The Virginia Talent Accelerator Program operates like a military Special Forces unit, a team of talent acquisition and instructional design experts that Virginia deploys across the Commonwealth.

The Talent Accelerator team is hired fresh from the private sector, with deep experience across a wide swath of industries. The technical training they provide is supplemented by modules in organizational development, operational excellence, and leadership. They deliver fully customized proprietary solutions that expedite recruiting and shorten the new hire learning curve.

In addition to delivering fully customized workforce solutions, the Talent Accelerator team provides clients with direct access to the talent generated by Virginia’s world-class universities and community colleges. All program services are provided at no cost to qualified new and expanding companies as an incentive for job creation. All company-specific materials developed during the course of the project become property of the client, and all proprietary information is protected by a nondisclosure agreement.

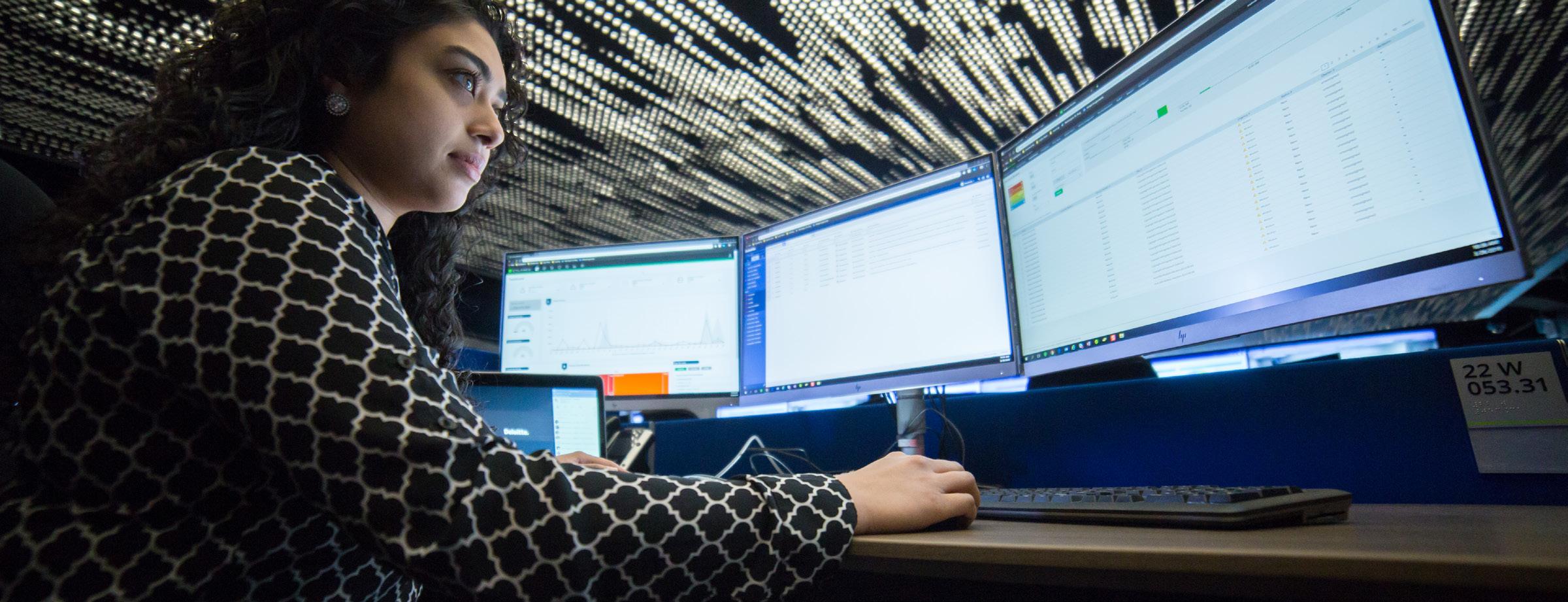

International Trade

Virginia’s International Trade Team Recognized With Nation’s Top Export Award for Second Time

VEDP’S INTERNATIONAL TRADE PROGRAMS provide direct support to Virginia companies committed to increasing their international export sales as a corporate growth strategy. These services help companies identify potential new markets, develop market entry strategies, and locate possible distributors and representatives for products or services — all at little to no cost to the company.

The team recently received the “E Star” Award from the U.S. Department of Commerce, the highest honor U.S. exporters and export service providers can receive from the federal government, for the second time. U.S. Deputy Under Secretary of Commerce for International Trade Diane Farrell presented the 2024 President’s “E Star” Award to VEDP President and CEO Jason El Koubi and Assistant Vice President of International Trade Lindsey Bertozzi in May.

The “E Star” Award, the nation’s top export honor, is presented to companies and organizations that have made significant contributions over the past four years to expand U.S. business in international markets. VEDP’s International Trade team previously won the “E Star” Award in 2007, and the International Trade team’s recognition in 2024 is a milestone achievement.

“Helping businesses develop the tools to generate sales beyond the U.S. is a catalyst for increased job growth across every region of Virginia,” El Koubi said. “The International Trade team’s work in this area is a key example of how Virginia is leading the way as a top state for business.”

The client companies who participated in VEDP-assisted programs in 2023 reported $1.5 billion in export revenue, which the “E” Awards Committee recognized as a significant contributor to export growth in the United States.

The mission of the International Trade team at VEDP, led by Senior Vice President and Chief Administrative Officer Stephanie Agee, is to increase the number of Virginia companies selling overseas and their volume of international business. VEDP helps both new and experienced exporters enter new international markets.

“It’s a true honor to receive the ‘E Star’ Award, the highest award given to an export promotion organization, and we are thankful to the Department of Commerce for recognizing the contributions of VEDP International Trade to export expansion in both Virginia and the United States,” Agee said. “Providing valuable, actionable resources to assist Virginia companies in growing their international sales is incredibly important to us and we are proud to do this work in support of economic growth throughout the Commonwealth.”

U.S. Deputy Under Secretary of Commerce for International Trade Diane Farrell (left) presented the 2024 President’s “E Star” Award to VEDP Assistant Vice President of International Trade Lindsey Bertozzi (center) and President and CEO Jason El Koubi in May 2024.

VEDP has demonstrated a sustained commitment to export expansion through development of new and innovative education programs to assist Virginia exporters and through the organization’s measurable growth of client companies in 2023.

GINA RAIMONDO

U.S. Secretary of Commerce

Virginia Secretary of Commerce and Trade Caren Merrick (center) joined officials from the Virginia and Taiwan governments to celebrate the opening of VEDP’s Taiwan office.

Foreign Direct Investment

VEDP Bolsters FDI Attraction Efforts With Opening of Taiwan Office

VEDP’S ONGOING EFFORTS to secure foreign direct investment (FDI) in Virginia reached a major milestone in September 2023 with the opening of the Virginia-Taiwan Trade office in Taipei City, aimed at strengthening business relationships between Virginia and foreign companies, including mutual trade and investment initiatives. The Taiwan office is VEDP’s fourth foreign office, in addition to offices in Europe (Germany), Japan, and South Korea.

Taiwan is the fourth fastest-growing source of FDI in the United States, while the U.S. is Taiwan’s second-largest trading partner. Specific to Virginia, Taiwan is the Commonwealth’s ninth-largest export market and 10th-largest import source market. In 2022, Virginia exported $730 million in products to Taiwan while importing $1 billion in goods.

VEDP’s international offices support company executives with the site selection process in the United States, confidentially and free of charge, and ensure that Virginia is on the list of states being considered for new operations in the United States. The new office, along with the existing offices in Europe, Japan, and Korea, will offer

services to assist Taiwanese companies with opportunities in Virginia and bring investment and jobs to the Commonwealth. Virginia is already realizing benefits from having a physical footprint in Taiwan — multiple media requests from within the country show an increased interest in Virginia’s economy on the international stage.

“Taiwan and Virginia share a commitment to innovation, collaboration, and leadership, and the new office will showcase the Commonwealth’s advantages to prospective investors and businesses and expand markets for Virginia products,” said Virginia Secretary of Commerce and Trade Caren Merrick.

Foreign direct investment is a foundational component of the U.S. economy, bringing highquality, skilled jobs to the country. Nationally, jobs at foreign-owned companies pay 7% more than the economy-wide average. More than 1,000 foreignowned companies operate in Virginia, employing more than 200,000 people. VEDP’s Taiwan office helps the Commonwealth’s concerted, government-wide effort to maximize foreign investment and create jobs in Virginia.

FY24 in Brief

VEDP continues to see bipartisan support from administration partners and the General Assembly for its economic development efforts, including historic investments in the Innovative Framework for Economic Growth, the Virginia Business Ready Sites Program, and the Virginia Office of Education Economics (VOEE). Explore the following ways VEDP is continuing to utilize these investments to make Virginia more competitive.

VEDP SECTOR TEAM LEADERS HELP DRIVE SHIFT IN FOCUS

As part of the Innovative Framework for Economic Growth, VEDP created three new sector teams within the organization to prioritize lead generation and ecosystem-building in the sectors with the most predicted growth in the coming years. These sectors include knowledge work, manufacturing, and logistics. Three new vice presidents at VEDP are leading the charge of revolutionizing economic development in the Commonwealth.

TED SNIFFIN

Vice President, Knowledge Work

SNEHA ATWAL

Vice President, Manufacturing

Vice President of Knowledge Work Ted Sniffin leads a team that focuses on sector expertise, lead generation, and ecosystem-building activities in the business services, financial services, software and cybersecurity, and aerospace and defense industries. Prior to joining VEDP, Sniffin served as Managing Director of Global Business Development at Amazon Web Services, where he led global business development for the Worldwide Public Sector business.

Vice President of Manufacturing Sneha Atwal provides primary staff leadership for developing and implementing strategies to promote employment growth within the advanced materials, food processing and manufacturing, and biopharmaceuticals industries in Virginia. Prior to joining VEDP, Atwal served as Global Head of Regulatory Strategy & Emerging Issues with Celanese, a global chemical manufacturer.

ERIC JEHU

Vice President, Logistics

Vice President of Logistics Eric Jehu provides primary staff leadership for developing and implementing strategies to promote employment growth within the logistics industry in Virginia. Before joining VEDP, Jehu served as Vice President of Business Development for Ardent Global Logistics, and served in multiple roles over 17 years at Expeditors International, a top 10 global third-party logistics (3PL) company.

Anthem GO Outside Festival, Roanoke

FY24 in Brief Continued

SOLVING THE EDUCATION AND EMPLOYMENT EQUATION

In FY24, the Virginia Office of Education Economics (VOEE) launched five dashboards specifically tracking education and workforce alignment in the Commonwealth. From identifying which jobs are in the highest demand to curating job postings for new graduates, these dashboards are a powerful resource for higher education institutions across the region. These new tools help VOEE fulfill its mission of providing a unified, consistent source of information and analysis on linkages between education and employment outcomes. The new dashboards include Education and Workforce Alignment, Virginia 2024 High Demand Occupations, Job Posting Analytics Explorer, Virginia Post-Secondary Completion, and Virginia College and Career Outcomes Explorer. Find out more at voee.org

AI’S EMERGING OPPORTUNITY FOR VIRGINIA

As part of Virginia’s proactive efforts related to AI, VEDP produced a report in accordance with an executive order with insights from leading AI researchers, economists, and private-sector companies on Virginia’s competitive position with respect to generative AI, workforce implications, and recommendations on how Virginia can capture economic growth driven by rapidly evolving Gen AI technology.

The research indicated that Virginia is in a strong position to capture growth from AI, but proactive policies should be pursued to prepare the workforce and position the Commonwealth as a leader in Gen AI innovation. Several of Virginia’s target industries will see rapid growth due to AI, including software and cybersecurity, data centers, and technology consulting firms. Virginia ranks third in total AI job postings, ahead of all Southeastern peer states, and has advanced two spots since the original report was published. While insights continue to evolve, the latest analysis indicates that AI tool integration will lead to productivity gains for many occupations.

Commonwealth Crossing Business Centre, Henry County

HISTORIC FUNDING FOR SITE DEVELOPMENT

The Virginia Business Ready Sites Program (VBRSP), which awarded $90 million in development grants in 2023 and is awarding $126 million in 2024, certifies sites in advance by partnering with localities, utilities, and state agencies to assemble permits and approvals to make way for a smooth construction process. Site readiness has been the deciding factor for numerous major recent Virginia wins and was a primary reason Virginia was named America’s Top State for Business by CNBC in 2024. Building on the VBRSP’s success, VEDP worked with the General Assembly and the Governor’s administration to establish the new Virginia Business Ready Expedited Permitting Program to establish the permitting process for transformational economic development projects in Virginia.

Deloitte, Arlington County

New River Community College

Germanna Community College

Impact in Virginia

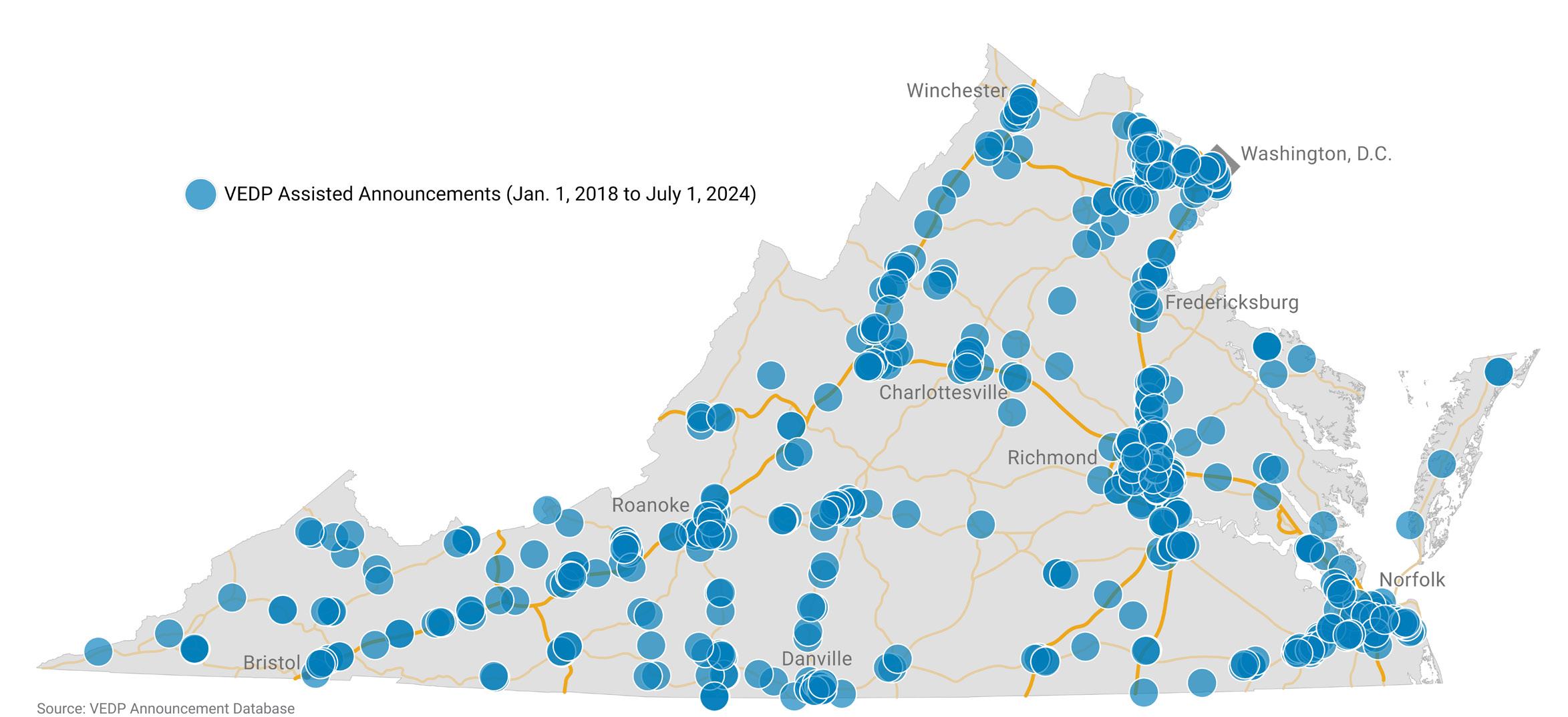

VEDP-assisted projects have added more than 100,000 new direct jobs and $100 billion in capital expenditure in Virginia since the beginning of 2018. Working in collaboration with state, regional, and local economic development partners, VEDP’s economic development activities provide jobs for Virginians and promote economic growth in the Commonwealth.

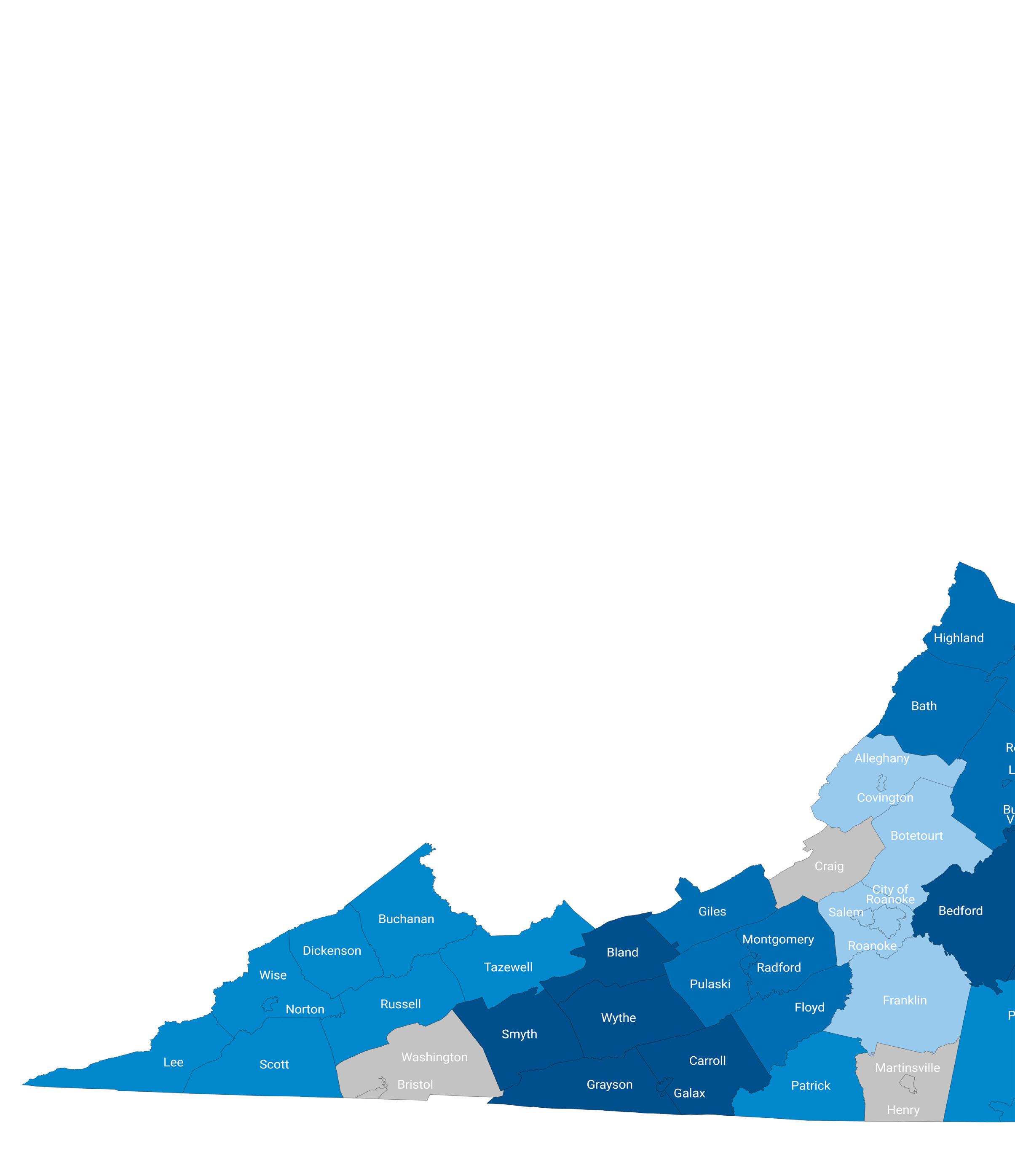

VEDP-Assisted Announcements (Jan. 1, 2018 to July 1, 2024)

620+ Project Wins ~103,000 New Direct Jobs

$103B+ in CapEx 67% Expansions*

*Percentage of projects that are expansion projects

Mack Trucks, Roanoke County

CASE STUDIES

Wells Fargo

Jobs: 1,100 New Jobs

CapEx: $87M

In brief: The expansion is Virginia’s largest ever non-manufacturing project west of the Blue Ridge Mountains.

Banking on Virginia: Wells Fargo Expansion to Create 1,100 New Jobs in the Roanoke Region

VIRGINIA’S BANKING BOOST

WELLS FARGO & COMPANY is a leading financial services company that has approximately $1.9 trillion in assets, proudly serves one in three U.S. households and more than 10% of small businesses in the United States, and is a leading middle-market banking provider in the United States.

Wells Fargo provides a diversified set of banking, investment, and mortgage products and services, as well as consumer and commercial finance, through four reportable operating segments: consumer banking and lending, commercial banking, corporate and investment banking, and wealth and investment management. Wells Fargo ranked No. 47 on Fortune’s 2023 rankings of America’s largest corporations.

In 2023, the team at Wells Fargo realized exponential growth was on the horizon and began seeking the right location to enhance and expand its customer service experience. Wells Fargo first established its customer support operation in Roanoke County in 2008 and had firsthand knowledge of the region’s strong pool of talent that could support an expansion of this magnitude.

THE VIRGINIA SOLUTION INVESTING IN A PRODUCTIVE COMMUNITY

The Roanoke Region of Virginia is the largest metropolitan area in western Virginia. The workforce ranges beyond the boundaries of the region, comprising a total labor pool of more than 300,000 people. There are 25 colleges and universities and more than 100,000 undergraduate and graduate students within a 60-minute radius of the region, ensuring a stable long-term workforce pipeline. With a cost of living below the national average, a diverse arts and cultural community, and nationally recognized outdoor recreation, the Roanoke Region easily attracts and retains talent. The Virginia Employment Commission estimates that employment in the region will increase through 2028, which means an increase in skilled job seekers and businesses seeking workers.

A deep bench of talent ensures that businesses like Wells Fargo will find a ready workforce for growing Virginia operations. The company was already one of the largest private employers in Roanoke County, and was confident that its successful operation could become an even larger hub.

Nuclear Energy Powerhouse Doubles Down on Virginia: Framatome Expands in Lynchburg

FOR MORE THAN 60 YEARS, Framatome, Inc., an international leader in nuclear energy, has called Virginia home. The company, once part of Babcock & Wilcox (B&W), first became one of the Lynchburg Region’s leading employers in 1956 when it opened a plant to manufacture nuclear fuel elements, cores, and other reactor parts. It was the first privately financed nuclear facility built in the United States.

France-based Framatome ANP and B&W became partners in the commercial nuclear fuel business in 1987, followed in 1989 by another partnership providing technical services to the nuclear power industry. Framatome ANP acquired total interest in these joint ventures in 1993.

During the company’s decades-long tenure in Lynchburg, Framatome has time and again chosen Virginia as the location to expand its business. In 2018, Framatome announced the relocation of its North American headquarters from Charlotte, N.C., to the City of Lynchburg. When demand surged for servicing existing nuclear power plants and developing solutions for advanced and small modular reactors, Framatome turned to its reliable, long-term business partner, Virginia, for expansion, announcing plans to expand its Lynchburg facilities in 2023 to meet increasing demand.

THE VIRGINIA SOLUTION INNOVATION AT HOME

Framatome is known for its innovative solutions and high-value technology. Framatome and Virginia have that in common, as innovation is at the heart of how Virginia does business. Ranked No. 1 for education by CNBC, Virginia’s stellar universities and school systems provide a best-in-class talent pipeline to ensure companies find a ready workforce eager to fulfill new roles.

In addition, the Virginia Talent Accelerator Program, ranked the No. 1 Customized Workforce Training program in the U.S. in 2023 and 2024 by Business Facilities, develops innovative recruitment and training solutions that accelerate a new facility’s startup. Every solution is fully customized to each client’s unique talent needs, processes, and culture, and offered at no cost to expanding companies like Framatome.

The Virginia community that has made Framatome successful in the U.S. for more than six decades was a major factor in Framatome’s decision to expand in the region. Virginia is America’s Top State for Business according to CNBC because of the partnerships like the one between the City of Lynchburg and Framatome. Whether it be through periods of economic growth or financial uncertainty, the Lynchburg Region has continued to provide a strong workforce pipeline for Framatome to thrive.

EXPONENTIAL GROWTH

The nuclear sector has grown exponentially over the past five years, representing nearly 40,000 jobs in the U.S. in 2023. Virginia has strong growth in all key subsectors that supply materials and products to the nuclear industry. In all identified critical subsectors, Virginia is growing even faster than the nation overall. In some of these sectors, Virginia’s growth outpaces the national average by a large margin. For example, in the inorganic chemicals manufacturing industry, Virginia’s job growth is nearly 60 points ahead of the industry’s growth across the United States.

In December 2023, Framatome announced plans to invest $49.4 million to expand, modernize, and enhance its facilities in the City of Lynchburg to meet increased demand. Virginia successfully competed with North Carolina and Pennsylvania for the project, which is creating 515 new jobs.

Framatome

Jobs: 515 New Jobs CapEx: $49.4M

In brief: Framatome first came to Virginia through an acquisition in 1989 and moved its U.S. headquarters from North Carolina to Lynchburg in 2018. The company announced a $49.4 million expansion in 2023.

Press Glass

Jobs: 335 New Jobs

CapEx: $155.2M

In brief: Press Glass’s expansion at Commonwealth Crossing marks the largest single capital investment by a business in Henry County history.

Virginia: The Clear Choice for Press Glass

PRIMED FOR EXPANSION

POLAND-BASED PRESS GLASS, INC., the largest independent glass fabricator in Europe, first announced its Virginia location in 2018. That investment to build a manufacturing facility in Henry County created 212 new jobs for local citizens. By 2023, the company was ready to expand its U.S. operation to meet the increasing demand for its state-of-the-art glass products.

Press Glass’s handiwork can be admired all over the world. From Oslo’s Barcode to the skyscrapers of New York, Press Glass has made a name for itself as a leading glass manufacturer for industrial projects worldwide. Headquartered in Konopiska, Poland, Press Glass was founded in 1991 and has 15 factories in Europe and the United States. As the largest independent flat glass processing operation in Europe, the company processes glass for fabricators of windows and doors, facades, and interior glass constructions.

After nearly five years at its manufacturing location in Henry County, Press Glass knew it was preparing for a major expansion. The company needed space for an additional 360,000-sq.-ft. building to bolster its U.S. presence, access to a premier talent base, and an advantageous location with robust infrastructure to manufacture glass for the commercial construction industry. Virginia delivered.

THE VIRGINIA SOLUTION CUTTING-EDGE TALENT

Southern Virginia is a region built on manufacturing that delivers strategic access to markets, a skilled talent pool, and innovative, targeted workforce training. Business in Henry County thrives on a community built on a strong work ethic, which was a major factor in the decision for Press Glass. The company had spent years contributing to the region’s thriving manufacturing sector, and seized the opportunity to solidify that relationship. Southern Virginia is located along the Virginia-North Carolina line at the foothills of the Blue Ridge Mountains. An excellent highway system coupled with easy access to interstates make the region extremely well-suited to reach Mid-Atlantic markets and international shipping facilities. The region offers a direct route to the The Port of Virginia’s Hampton Roads facilities, and from there, the Atlantic Ocean.

One in every five people employed in Martinsville-Henry County work in manufacturing. This powerhouse pipeline for talent delivered experienced employees for Press Glass in 2018, and helped win the project for Virginia in 2023.

Our clients have trusted us and recognized the high quality of Press Glass products, so the expansion of the factory in Ridgeway is a natural step to increase the availability of our offerings and strengthen our position in the American market. Administration of Governor Glenn Youngkin | Martinsville-Henry County Economic Development Corporation Henry County | Virginia Department of Housing and Community Development

MACIEJ MIGALSKI President, Press Glass, Inc.

Northrop Grumman Bets on Virginia’s Workforce: Waynesboro Facility Provides High-End Tech Jobs

NORTHROP GRUMMAN CORPORATION, a global aerospace and defense technology company, announced plans to invest more than $200 million to build a new advanced electronics manufacturing and testing facility in the City of Waynesboro. This expansion will create more than 300 new high-end technology jobs and commerce opportunities to support the region over the next few years as the state-of-the-art facility is fully established.

Northrop Grumman broke ground on the 63-acre Waynesboro site in February. Construction of the 314,000-sq.-ft. plant is expected to be completed by 2025, and production is forecasted to start in 2026. Located a couple of hours from Northrop Grumman’s Fairfax County headquarters, the new Waynesboro facility adds to the company’s growing presence in the Commonwealth.

UNTAPPED TALENT

Northrop Grumman has had a presence in Virginia for more than 30 years. The company employs approximately 6,800 Virginians across the Commonwealth, with corporate headquarters in Falls Church, an office in Fairfax County, and manufacturing facilities in Loudoun County and Charlottesville. Expanding into the Shenandoah Valley and Waynesboro provides Northrop Grumman an opportunity to reach untapped talent for its new ventures.

Virginia’s talent pool will help Northrop Grumman solve some of the biggest challenges in global security and advance human discovery. The company’s implementation of digital solutions across its business is transforming how it designs,

tests, and manufactures the next generation of systems, and will drive improved performance and productivity across the company.

Among its catalogue of innovations, Northrop Grumman led the design, build, total system integration, and preparation of the observatory for launch of the James Webb Space Telescope. The engineering marvel is the world’s most powerful space telescope in human history. The company is currently developing the world’s first sixth-generation aircraft, the B-21 Raider, equipped with the most advanced capabilities in survivability, advanced networking, and rapid upgradeability.

Northrop Grumman’s engineering, manufacturing, and office facilities put Virginia’s best-in-class talent to work problem-solving for national security and space exploration. From intelligence analysis to satellite design to supply chain and communications, Northrop Grumman is driven by a shared purpose to solve customers’ toughest problems.

Northrop Grumman

Jobs: 300 New Jobs

CapEx: $200M

In brief: Northrop Grumman moved its headquarters from California to the Virginia city of Falls Church in 2011. The company’s Virginia facilities also include manufacturing facilities in Charlottesville and Loudoun County, multiple Northern Virginia offices, and aerospace facilities on Wallops Island on the Eastern Shore.

The new facility will increase capacity to manufacture and test advanced electronics and mission solutions to meet our customers’ growing needs. We are pleased to expand our technology presence in the Commonwealth.

KATHY WARDEN Chair, Chief Executive Officer, and President, Northrop Grumman Corporation

PARTNERS

Administration of Governor Glenn Youngkin | City of Waynesboro

Shenandoah Valley Partnership | Virginia Community College System

Location, Location, Location: CoStar Moves Global Headquarters to Virginia

FOUNDED IN 1987, CoStar Group, Inc., is a leading global provider of online real estate marketplaces, information, and analytics in the property markets. The company is on a mission to digitize the world’s real estate, empowering all people to discover properties, insights, and connections that improve their businesses and lives. CoStar has grown to over 6,200 employees in 14 countries and is included in the S&P 500 Index, one of the premier benchmarks of the U.S. equities market, and in the NASDAQ 100, one of the world’s preeminent large-cap indexes.

CoStar established its headquarters for research and data analytics in the City of Richmond in 2016 and now employs more than 1,000 team members, representing one of the top 25 largest employers in the city. In 2021, CoStar announced plans to build a corporate campus in Richmond, creating an additional 2,000 new jobs. The campus consists of approximately 750,000 square feet of office and retail space with a 26-story, LEED-certified office building and a six-story, multipurpose building to be used as a central location for employee amenities.

THE ‘PERFECT HOME’ IN VIRGINIA

Since establishing its headquarters for research and data analytics in 2016, and announcing a corporate campus in 2021, CoStar has experienced tremendous success. The company has developed strong partnerships with the

City of Richmond, the Commonwealth, and Virginia’s higher education institutions. When the time came to relocate the company’s global headquarters, these partnerships, combined with Virginia’s robust talent pipeline and toprated quality of life, fostered an ideal business environment for CoStar to continue its growth in the Commonwealth.

In February, 2024, CoStar announced plans to invest $20 million to relocate its global headquarters from Washington, D.C. to Arlington County. The company purchased a 560,000-sq.-ft. office building in Rosslyn known as Central Place Tower, and will occupy 150,000 square feet of commercial office space. The move to the new headquarters includes 500 relocated jobs and 150 new jobs to the Commonwealth.

“The financially strategic acquisition of this building will provide the perfect home for the employees at our current headquarters,” said CoStar Group Founder and Chief Executive Officer Andy Florance.

The ability to create an inclusive, welcoming hub not just for CoStar, but also for the community, was a key tenet in the company’s growth plan. CoStar’s decision to expand its presence in Virginia is a testament to the Commonwealth’s leadership in innovation and exceptional business climate. Administration of Governor Glenn Youngkin | Arlington County

CoStar Group

Jobs: 650 New Jobs CapEx: $20M

In brief: The CoStar Group’s headquarters move from Washington, D.C. to Arlington County is the company’s second major Virginia announcement in the last five years after a 2,000-job announcement in Richmond in 2021.

Progress Report

This section offers an update on the progress made by the Virginia Economic Development Partnership Authority (VEDP) in FY24 relative to VEDP’s Strategic, Operational, and Marketing Plans. These plans were previously submitted in accordance with the Code and other requirements. Due to the confidentiality of these plans and their exclusion from mandatory disclosure provisions (Code of Virginia § 2.2-3705.7.33), this progress report references specific elements of the plans without revealing information that is protected by the Code for competitive purposes.

STRATEGIC PLAN (FY21–FY25)

The Strategic Plan for Economic Development of the Commonwealth of Virginia adopted by the VEDP Board in FY21 was a five-year plan (FY21–FY25) for which implementation began in January 2021. The FY21–FY25 Strategic Plan includes five transformational goals with metrics to measure progress toward achieving those goals. Virginia has made major strides in accomplishing these goals since they were established in the original 2017 Strategic Plan:

1. Robust state growth

Virginia has experienced accelerated job growth, becoming the 16th-fastest-growing state in 2024, an improvement from its 28th-place ranking in 2017; Virginia has secured over 620 VEDP-assisted project wins since 2018, bringing over 100,000 jobs and $103B in capital expenditures to the state

2. Every region wins 17 of 18 marketing regions have seen net-positive job growth since 2017

3. Best state for business

For a record sixth time, Virginia obtained the No. 1 spot in CNBC’s America’s Top States for Business rankings and has an average position of sixth across key business climate rankings

4. Top state economic development organization (EDO)

In 2023, VEDP was recognized by Development Counsellors International (DCI) as one of the leading EDOs in the nation

5. Super collaborator

VEDP has strengthened collaboration with hundreds of state, regional, and local economic development partners, regularly achieving a partner satisfaction rate of over 80%

KEY HIGHLIGHTS OF STRATEGIC PLAN IMPLEMENTATION FOR FY24:

With the support of the Administration, the General Assembly, and hundreds of partners, much progress has been made in implementing many of the initiatives detailed in the Strategic Plan. The following are just a few examples of initiative progress and accomplishments across the plan’s three strategic focus areas (not comprehensive):

Enhancing Virginia’s economic competitiveness:

■ Virginia reclaimed the No. 1 ranking in CNBC’s America’s Top States for Business rankings in 2024, up from the No. 2 spot in 2023.

■ With new state funding, VEDP awarded over $125M in Virginia Business Ready Sites Program (VBRSP) grants to over 20 site development projects across the Commonwealth, representing the largest investment grant round to date.

■ With continued state support, the Virginia Talent Accelerator Program solidified its status as the national leader for customized talent solutions, ranking No. 1 in the U.S. for Customized Workforce Training in the annual Business Facilities State Rankings Report for the second consecutive year.

■ With new state funding, VEDP identified new megasites and conducted analysis to estimate state and local ROI for new site development through the Virginia Business Ready Sites Acquisition Program.

■ With VEDP support, the General Assembly passed legislation to establish the Virginia Business Ready Expedited Permitting Program to streamline permitting timelines for select economic development projects. The Governor signed this legislation in April 2024.

■ VEDP collaborated with partners and companies on over 15 federal grant applications in FY24, generating over $300M in project-specific federal grants and tax incentives for companies locating in Virginia and more than $3.5M in grant funding for partner organizations.

Enhancing VEDP’s capabilities:

■ With support from the Administration and the General Assembly, VEDP began implementation of the Innovative Framework for Economic Growth, establishing three dedicated sector teams to drive growth in the Knowledge Work, Manufacturing, and Logistics sectors.

■ Development Counsellors International’s 2023 “Winning Strategies in Economic Development Marketing” report recognized VEDP as a best-in-class economic development organization (top five in the nation).

■ VEDP established the Regional Talent Solutions and Business Outreach division in FY23 to engage key businesses across the Commonwealth and address their talent and growth needs; in its first year, the division made 415 visits to companies across all of Virginia’s regions.

■ VEDP’s International Trade team received the 2024 President’s “E Star” Award from the U.S. Department of Commerce, the nation’s highest honor for exporters and those who provide export services.

■ With new state funding and support from the Administration, VEDP opened a Taiwan trade office focused on foreign direct investment and export assistance.

Cultivating target industry growth clusters:

■ Working in collaboration with state, regional, and local partners, VEDP-assisted projects resulted in over 8,200 announced jobs and $8.2B in capital investment in FY24.

■ Wells Fargo invested $87M to modernize and expand its customer support center in Roanoke County, creating 1,100 new jobs. This announcement marks Virginia’s largest-ever non-manufacturing project west of the Blue Ridge Mountains.

■ Amazon announced plans to build 1,100-job state-of-the-art operations facilities in the City of Virginia Beach.

■ CoStar Group relocated its 650-job corporate headquarters from Washington, D.C. to Arlington County.

STRATEGIC PLAN UPDATE (FY25–FY29)

In FY24, VEDP updated its Strategic Plan and transformational goals in accordance with the Code of Virginia (§ 2.2-205 and § 2.2-2237.1), which requires a biennial update. The FY25–FY29 Strategic Plan includes the following five transformational goals, with implementation beginning in FY25:

1. Robust state growth: Position Virginia to achieve a growth rate among that of the top 10 states in the U.S.

2. Every region wins: Ensure that every region participates in the growth of the Commonwealth

3. CNBC’s America’s Top States for Business: Cultivate a leading business climate and sector-specific ecosystems

4. Top state for talent: Establish Virginia as a top state for talent retention, attraction, development, and alignment

5. Most innovative, collaborative, and effective state EDO: Solidify VEDP’s position as one of America’s top state economic development organizations through an innovative strategy, collaborative approach, and effective outcomes

The Virginia Economic Development Partnership’s team of dedicated and knowledgeable professionals is committed to Virginia’s economic success and connects industry-leading businesses to the resources they need to make relocations and expansions successful. From site selection, customized research, cost analysis, and coordination with public and private partners to discretionary incentives and workforce solutions VEDP’s services are tailored to companies’ unique requirements.

To learn more about VEDP’s expertise and resources, visit vedp.org

Virginia Economic Development Partnership

Audited Basic Financial Statements

Fiscal Year 2024

INTRODUCTORY SECTION

VIRGINIA

ECONOMIC DEVELOPMENT PARTNERSHIP

Richmond, Virginia

APPOINTED OFFICIALS

As of June 30, 2024

Board of Directors

Bill Hayter, Chair

The Honorable Caren Merrick, Ex-Officio, Vice Chair

Nancy Howell Agee

Carrie Hileman Chenery

Mimi Coles

Richard “Rick” O. Harrell, III

John Hewa

Pace Lochte

Marianne Radcliff

Nick Rush

Will Sessoms

Steven David Stone

The Honorable Stephen Cummings, Ex-Officio

April Kees, Ex-Officio

Anne Oman, Ex-Officio

Stephen Edwards, Ex-Officio

President and Chief Executive Officer

Jason R. El Koubi

FINANCIAL SECTION

VIRGINIA ECONOMIC DEVELOPMENT PARTNERSHIP

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

AS OF JUNE 30, 2024

The Virginia Economic Development Partnership (the Partnership) management offers the readers of the Partnership’s financial statements this narrative overview and analysis of its financial activities for the fiscal year ended June 30, 2024. We encourage the reader to consider this information presented here in conjunction with the financial statements and accompanying notes.

Overview of the Financial Statements

Government-Wide Financial Statements

The government-wide financial statements are designed to provide readers with a broad overview of the Partnership in a manner similar to a private sector business.

The Statement of Net Position presents information on all of the Partnership’s assets and liabilities, with the difference between the two reported as net position Over time, increases or decreases in net position may serve as a useful indicator of whether the financial position of the Partnership is improving or deteriorating.

The Statement of Activities presents information showing how the Partnership’s net position changed during the most recent fiscal year. All changes in net position are reported as soon as the underlying event giving rise to the change occurs, regardless of the timing of the related cash flows. Thus, revenues and expenses are reported in this statement for some items that will only result in cash flows in future fiscal periods. For example, expenses that are accrued for the net pension liability in the current period are expected to be paid with future funding appropriations from the Commonwealth of Virginia (COV).

Fund Financial Statements

A fund is a grouping of related accounts that is used to maintain control over resources that have been segregated for specific activities or objectives. The Partnership, like other political subdivisions of the COV, uses fund accounting to ensure and demonstrate compliance with finance-related legal requirements. The financial activities of the Partnership are reported in governmental funds.

Governmental Funds: Governmental funds are used to account for essentially the same functions reported as governmental activities in the government-wide financial statements. However, unlike the government-wide financial statements, governmental fund financial statements focus on near-term inflows and outflows of spendable resources, as well as on balances of spendable resources available at the end of the fiscal year. Such information may be useful in evaluating the Partnership’s near-term financing requirements.

Reconciliations between Government-Wide and Fund Financial Statements

There are two reconciliations between the government-wide and the fund financial statements. The first is found on the Balance Sheet and explains the difference between the fund balance on the Balance Sheet and net position on the Statement of Net Position. The second is found on the Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances of Governmental Funds to the Statement of Activities, which reconciles the difference between the net change in fund balances on the fund-based statement and the change in net position on the government-wide based statement. Both statements describe in sufficient detail the amounts and the reasons for those differences.

Government-Wide Financial Analysis

As noted earlier, net position may serve over time as a useful indicator of an organization’s financial position At the close of the fiscal year ended June 30, 2024, the Partnership had a net position of ($2,228,882) compared to a net position of $5,739,075 as of June 30, 2023 Following is an analysis of the changes in the net position of the Partnership.

Net Position

Total assets decreased this fiscal year by $9,218,224 when compared to last year due to a decrease of $7,798,010 in Current and other assets and a decrease of $1,420,214 in Capital assets, net of depreciation and amortization. The decrease in Current and other assets consists of a decrease in the Current asset, cash of $6,429,874 due to payments made related to the Virginia Business Ready Sites grant program (VBRSP) that were funded with General Fund appropriations from the COV in prior years and the continued expansion of the Lead Generation Sector Teams division, along with a decrease of $1,634,700 in the Current asset, prepaid expenses, due to the timing of various promotional activities. These decreases were offset by an increase of $131,434 in the Restricted net other postemployment asset recorded in compliance with GASB 75, Accounting and Financial Reporting for Postemployment Benefits Other Than Pension (GASB 75), related to the Partnership’s participation in the Virginia Retirement System Disability Insurance Program, an increase of $130,921 in Operating grants receivable due to the timing of reimbursement payments in connection with Federal grants, and an increase in other current assets of $4,209.

The decrease of $1,420,214 in Capital assets, net of depreciation and amortization, is due primarily to the amortization of lease and subscription-based information technology arrangement (SBITA) assets recorded in compliance with GASB Statement No. 87, Leases (GASB 87) and GASB Statement No. 96, Subscription-Based Information Technology Arrangements (GASB 96) that require the value of leases and SBITAs with non-cancellable terms in excess of twelve months be recorded on the statement of net position as right to use intangible assets, as well as normal depreciation expense on leasehold improvements, furniture, and equipment. These decreases were offset by capital asset acquisitions at the Partnership’s James Center headquarters location, including the capitalization of individual assets below the Partnership’s capitalization threshold in accordance with GASB Implementation Guide 2021-1.

Deferred outflows of resources increased by $1,556,671 This increase is due primarily to differences between expected and actual experience, and an increase in the Partnership’s FY2024 employer contributions subsequent to the measurement date related to the Partnership’s participation in the Virginia Retirement System pension and other postemployment benefit plans, recorded in compliance with GASB Statement No. 68, Accounting and Financial Reporting for Pensions (GASB 68) and GASB 75.

Total liabilities increased by $1,843,703 due to an increase in Current and other liabilities of $644,369. This increase is due primarily to an increase of $533,921 in Accounts payable related to the timing of payment transactions at the end of the fiscal year, as well as a net increase of $110,448 in other current liabilities. Non-current liabilities increased $1,199,334 due primarily to an increase of $2,665,686 related to the Partnership’s Net pension liability, offset by a decrease of $1,777,667 in Long-term lease and SBITA liability related to amortization of assets recorded in compliance with GASB 87 and GASB 96, along with a net increase of $311,315 in other non-current liabilities.

Deferred inflows of resources decreased by $1,537,299. This decrease is due mainly to differences between expected and actual experience, and differences between projected and actual earnings on plan investments related to the Partnership’s participation in the Virginia Retirement System pension and other postemployment benefit plans, recorded in compliance with GASB 68 and GASB 75.

Net investment in capital assets consists primarily of right to use intangible lease and SBITA assets, leasehold improvements, furniture, computers, and technology equipment used to deliver program services to clients, net of long-term lease and SBITA liability The Partnership considers technology a vital asset in its efforts to market Virginia and will continue to invest in technology to ensure that its equipment and software are updated to take advantage of the latest data handling capabilities and processing speeds.

Restricted Net position represents the portion of fund balance related to the Restricted net other postemployment asset recorded in compliance with GASB 75 due to the Partnership’s participation in the Virginia Retirement System Disability Insurance Program. The remaining Net position balance of

($4,692,135) is classified as unrestricted. The Partnership has recorded $19,043,679 of net pension liability and net other postemployment benefits liabilities that are expected to be paid with future appropriations from the COV. The Partnership’s Current and other assets exceed its Current and other liabilities by $8,110,484. Changes in Net Position

(Decrease) in net

(8,339,301) 1,991,128 (10,330,429) Beginning net position, as restated (Note 1)

3,747,947 2,362,472 Ending net position ($2,228,882) $ 5,739,075 ($7,967,957)

Net position for the Partnership decreased by $7,967,957 during the current fiscal year The total revenues increase of $676,415 is due primarily to a $417,651 increase in federal Operating grants revenue related to the International Trade State Trade Expansion Program (STEP) grant and the Virginia Office of Education Economics (VOEE) Workforce Data Quality Initiative (WDQI) grant.

Total expenses for the Partnership increased by $11,006,844 This increase is due primarily to expansion of the Lead Generation Sector Teams division, continued expansion of the Talent Solutions – Talent Accelerator Program and the International Trade division, as well as increased Pass-Through Payments

for the VBRSP. These increases were offset by a reduction in Administration related to an economic development strategy and roadmap project that was completed in FY2023.

Governmental Funds Analysis

The Partnership records all its financial activities in the General Fund, with the exception of International Trade and VOEE federal and other grant programs that are recorded in the Special Revenue Fund. The fund balance of the General Fund of the Partnership decreased by $8,382,703 in FY2024 primarily due to the decrease in Cash and Prepaid expenses, offset by an increase in current liabilities, primarily in Accounts payable, resulting in a fund balance of $10,576,284 as of June 30, 2024 $787,907 of the fund balance consists of Prepaid expenses and Lease deposits and is nonspendable, with the remaining balance of $9,788,377 unassigned. The Special Revenue fund records revenues and expenditures related to federal and other grant programs and has a fund balance of $52,477 as of June 30, 2024 Activity for the Special Revenue fund increased from $1,342,305 in FY2023 to $1,520,788 in FY2024 due to the timing of payments for the VOEE Virginia Skills Initiative grant, the VOEE WDQI grant, and the International Trade STEP grant.

General and Special Revenue Fund Budgetary Highlights

The Statement of Revenues, Expenditures, and Changes in Fund Balance, Budget and Actual-Cash Basis is presented to provide information on the budget as originally prepared and the final budget on which the Partnership operated for the fiscal year. Also, the final budget is compared to the cash basis actual results by revenue source and expenditure activity. The Partnership’s budget, as originally prepared, included total revenues of approximately $53.5 million. The final budget was increased by $.2 million for additional interest income on the Partnership’s cash deposits, offset by a reduction in federal Operating grants revenue.

Actual expenditures were below the final budget by approximately $10.1 million for the fiscal year. This underspending was primarily in the Talent Solutions – Talent Accelerator Program and International Trade.

FY2025 Outlook

The Partnership received additional FY2025 COV funding related to the expansion of VOEE ($1.25 million), Lead Generation Sector Teams ($1.0 million), cyber security initiatives ($.2 million), and the VEDP office in Taiwan ($.3 million). The Partnership will continue to seek funding for other important initiatives critical to its success during the FY2026 budget cycle.

Notes to the Financial Statements

The notes provide additional information that is essential to a full understanding of the data provided in the government-wide and fund financial statements. The notes describe the nature of the Partnership’s reporting entity and the relationship to the COV as a whole, the basis on which the financial statements were prepared, and the methods used for presentation. Further, the notes provide explanations of specific accounts with significant balances.

Requests for Information

This financial report is designed to provide a general overview of the Partnership’s finances for all those with an interest. Questions concerning any of the information provided in this report or requests for additional financial information should be addressed to the President and Chief Executive Officer, Virginia Economic Development Partnership, P.O. Box 798, Richmond, Virginia, 23218-0798.

BASIC FINANCIAL STATEMENTS

VIRGINIA ECONOMICDEVELOPMENTPARTNERSHIP

STATEMENTOFNETPOSITION

Asof June30,2024 Governmental Activities

Assets

Cashandcashequivalents(Note2)12,077,032 $ Traveladvances941

Operatinggrantsreceivable345,766

Prepaidexpenses771,392

Leasedeposits (Note5)16,515

Restrictednetotherpostemploymentasset (Note13)1,032,859

Capitalassets,netof accumulateddepreciationandamortization(Note6)

Leaseholdimprovements, furniture, andequipment2,791,528

Righttouseintangibleleaseassets13,849,380

RighttouseintangibleSBITA assets206,961

Totalassets31,092,374

Deferredoutflowsof resources(Notes10, 11,12, 13,and14) 8,153,549

Totalassetsanddeferredoutflowsof resources39,245,923

Liabilities

Accountspayable1,959,270

Accruedpayroll505,965

Unearned revenue117,650

Long-termliabilitiesduewithinoneyear Compensatedabsences(Note9)1,292,021

Long-termleaseliability(Note7)2,101,822

Long-termSBITA liability(Note8)106,584

Netotherpostemploymentliability(Note14)50,709

Long-termliabilitiesdueinmorethanoneyear Compensatedabsences(Note9)555,040

Long-termleaseliability(Note7)12,964,554

Long-termSBITA liability(Note8)109,827

Netpensionliability(Note10)15,843,442

Netotherpostemploymentliability(Notes11,12, and14)3,149,528

Totalliabilities38,756,412

Deferredinflowsof resources(Notes10,11, 12,13, and14) 2,718,393

Totalliabilitiesanddeferredinflowsof resources41,474,805

Netposition

Netinvestmentincapitalassets1,565,082 Restrictedfornetotherpostemploymentasset(Note13)898,171 Unrestricted(4,692,135)

Totalnetposition(2,228,882) $

Theaccompanyingnotesareanintegralpartof thefinancialstatements.

ProgramRevenues

Netposition,June30,2024(2,228,882) $

VIRGINIAECONOMICDEVELOPMENTPARTNERSHIP

AsofJune30,2024

Amountsreportedforgovernmentalactivitiesinthe statementofnetpositionaredifferentbecause:

Capitalassetsusedingovernmentalactivities arenotfinancialresourcesand,therefore,are notreportedinthefunds.

Restrictednetotherpostemploymentassetisnot afinancialresourceand,therefore,isnot reportedinthefunds.

Deferredoutflowsanddeferredinflows associatedwithpensionandother postemploymentbenefitrelatedcostsarelongterminnatureand,therefore,notreportedinthe funds.

Noncurrentliabilities(compensatedabsences, long-termleaseliability,netpensionliability andnetotherpostemploymentobligation)are notdueandpayablewithcurrentfinancial resourcesand,therefore,notreportedinthe funds.

Totalnetpositionofgovernmentalactivities(2,228,882) $

Theaccompanyingnotesareanintegralpartofthefinancialstatements.

RECONCILIATIONOFTHESTATEMENTOFREVENUES,EXPENDITURES,AND CHANGESINFUNDBALANCESOFGOVERNMENTALFUNDS TOTHESTATEMENTOFACTIVITIES

FortheFiscalYearEndedJune30,2024

Amountsreportedforgovernmentalactivitiesinthestatementofactivitiesaredifferent because:

Netincrease(decrease)infundbalanceofthegovernmentalfunds(8,382,961) $

Governmentalfundsreportcapitaloutlaysasexpenditures.However,inthe statementofactivitiesthecostofthoseassetsisallocatedovertheirestimated usefullivesandreportedasdepreciationandamortizationexpense.Thisisthe amountbywhichdepreciationandamortizationexpenseexceededcapital outlaysinthecurrentperiod.

Someexpensesreportedinthestatementofactivities(compensatedabsences, long-termleaseliability,long-termSBITAliability,netpensionliabilityand netotherpostemploymentassetandobligation)donotrequiretheuseof currentfinancialresourcesand,therefore,arenotreportedasexpendituresin governmentalfunds.

(1,791,558)

1,835,218

Decreaseinnetpositionofgovernmentalactivities(8,339,301) $

Theaccompanyingnotesareanintegralpartofthefinancialstatements.

VIRGINIAECONOMICDEVELOPMENTPARTNERSHIP STATEMENTOFREVENUES,EXPENDITURES, ANDCHANGESINFUNDBALANCES

BUDGETANDACTUAL-CASHBASIS GENERALANDSPECIALREVENUEFUNDS

FortheFiscalYearEndedJune30,2024 SpecialVarianceswith GeneralRevenueFinalBudgetFund FundPositive OriginalFinalActualActual(Negative)

Revenues RevenueprovidedbytheGeneralFund oftheCommonwealth(Note4)

BudgetedAmounts

Fundbalance,June30,2024(Note3)$ - $ $11,552,755

$ 11,976,813 $ Theaccompanyingnotesareanintegralpartofthefinancialstatements.

NOTES TO FINANCIAL STATEMENTS

NOTES TO FINANCIAL STATEMENTS

AS OF JUNE 30, 2024

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A. Reporting Entity

The Virginia Economic Development Partnership (the Partnership) was established on July 1, 1996, by Chapter 638 of the 1995 Acts of Assembly and operates as an authority in accordance with the provisions of Chapter 22 of Title 2.2 of the Code of Virginia. The Partnership’s major activities are to encourage, stimulate, and support the development and expansion of the economy of the Commonwealth.

The Partnership is a component unit of the Commonwealth of Virginia. A separate report is prepared for the Commonwealth of Virginia, which includes all agencies, boards, commissions, and authorities over which the Commonwealth exercises or has the ability to exercise oversight authority. The Partnership is an integral part of the reporting entity of the Commonwealth of Virginia; accordingly, the Partnership’s financial statements are included in the financial statements of the Commonwealth as a discretely presented component unit.

B. Measurement Focus, Basis of Accounting, and Financial Statement Presentation

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles. The Statement of Net Position and the Statement of Activities are referred to as “government-wide” financial statements and are reported using the economic resources measurement focus and the accrual basis of accounting. Revenues are recorded when earned and expenses are recorded when a liability is incurred, regardless of the timing of related cash flows. Interfund activity and balances between the General Fund and Special Revenue Fund have been eliminated in the government-wide financial statements. The Statement of Activities shows the extent that direct expenses of governmental functions are offset by program revenues. In cases where certain indirect costs have been allocated to the various divisions by headcount, program expenses will include both direct and indirect costs. Program revenues include charges for services and operating grants. Charges for services are comprised primarily of participation fees, sponsorship fees, and shared mission reimbursements Operating grants are grants awarded to the Partnership from the federal government and other sources Net investment in capital assets consists of leasehold improvements, furniture, computers and peripheral technology equipment used to deliver program services to clients, as well as right to use intangible lease assets recorded in accordance with GASB 87, Leases (GASB 87), and right to use intangible subscription assets recorded in accordance with GASB 96, Subscription-Based Information Technology Arrangements (GASB 96) Restricted Net position represents the portion of fund balance related to the Restricted net other postemployment asset recorded in compliance with GASB 75 due to the Partnership’s participation in the Virginia Retirement System Disability Insurance Program. The remaining Net position balance is classified as unrestricted.

The Balance Sheet and the Statement of Revenues, Expenditures, and Changes in Fund Balances are referred to as “governmental fund” financial statements and are reported using the current financial resources measurement focus and the modified accrual basis of accounting Revenues are recognized as soon as they are both measurable and available. Revenues are considered available when they are collectible within the current period or soon enough thereafter to pay liabilities of the current period. For this purpose, the Partnership considers revenues to be available if they are collected within 60 days of the end of the current fiscal period. Expenditures generally are recorded when a liability is incurred, as in accrual accounting. However, debt service payments and expenditures related to compensated absences are only recorded when payment is due. The Partnership reports its activities in governmental funds. The general fund is used for its primary operating fund and accounts for all financial transactions not accounted for in the special revenue funds. The special revenue fund is used to account for grant revenues and related expenditures for operating grants awarded to the Partnership by the federal government and other sources. Both the General Fund and Special Revenue Fund are reported as major governmental funds.

Fund balances for the Partnership’s governmental funds financial statements are classified in accordance with Governmental Accounting Standards Board (GASB) Statement No. 54, “Fund Balance Reporting and Governmental Fund Type Definitions.” Fund balances are classified as restricted, committed or assigned if the related resources reported in governmental funds have either externally or internally imposed restrictions on their usage. Nonspendable fund balances represent assets such as prepaid expenses and lease deposits that are unavailable to be spent on future operations. The unassigned fund balances represents the remainder of the fund balances funds.

C. Operating Grants Receivable

Operating grants receivable represents the amount due from the federal government for grants that are funded based on reimbursement of expenses paid by the Partnership.

D Prepaid Expenses

The Partnership’s prepaid expenses include amounts paid for promotional activities, other services and portions of insurance premiums for which the economic benefits had not been received as of June 30, 2024

E Capital Assets

Capital assets are defined by the Partnership as those assets with an initial cost of more than $5,000 and an estimated useful life in excess of two years. Such assets are recorded at historical cost or estimated historical cost. Donated capital assets are reported at acquisition value, measured at estimated market value at the date of donation. Capital assets are comprised of leasehold improvements, furniture, and equipment. The cost of normal maintenance and repairs that do not add to the value of the asset or materially extend asset lives are not capitalized.

Capital assets are depreciated using the straight-line method over useful lives of five to ten years.

F. Leases

The Partnership adopted GASB 87 on July 1, 2021. Beginning adjustments to record right to use intangible lease assets (lease asset) and lease liabilities had no effect on beginning net position. For new or modified contracts, the Partnership determines whether the contract is a lease. If the lease contains a non-cancellable term in excess of 12 months (including any options to extend or terminate the lease when exercise is reasonably certain), the Partnership records a lease asset and lease liability. The lease liability is measured at the present value of payments expected to be made during the lease term, and then is reduced by the principal portion of lease payments made. Lease payments are apportioned between interest expense and principal based on an amortization schedule. The lease asset is measured as the initial amount of the lease liability, adjusted for lease payments made at or before the lease commencement date, plus certain initial direct costs, then amortized on a straight line basis over a period that is the shorter of the lease term or the useful life of the asset. The Partnership reports lease assets with a present value of $50,000 or greater and an expected useful life of more than one year.

The Partnership is a lessee for non-cancellable leases of certain office space. The Partnership has recorded a lease liability and lease asset on the Statement of Net Position. Leases with an initial, non-cancellable term of 12 months or less are not recorded on the Statement of Net Position and expense is recognized as incurred over the lease term.