Visit us online For daily news visit us at wbj.pl FEBRUARY - MARCH 2024 ~ No. 1 (83) MODERN MOKOTÓW: TRANSFORMING WARSAW'S CITYSCAPE WITH SUSTAINABLE URBAN LIVING POLAND: EUROPE'S FUTURE INVESTING, ESG, REAL ESTATE, TALENT: THE PILLARS OF PROGRESS WARSAW YEARS BUILDING SUCCESS Neo Świat Founders Rajmund Węgrzynek & Paweł Brodzik Discuss Entrepreneurship, Values, and Navigating Poland's Real Estate Market in a Transformative Year

INTERVIEW

EXCLUSIVE

50

46

60

59

8 In Review News

12 Opinion

Elections in Poland spark changes in political scene by Sergiusz Prokurat

16 Exclusive Interview

Neo Świat Founders Rajmund Węgrzynek & Paweł Brodzik by Morten Lindholm

23 Poland: Europe's Future

35 Lokale Immobilia

News

CEE & SEE Summit in London

46 Feature

Tourism on the rise in Poland by Sean Reynaud

Interview: Sonam Parashar by Beata Socha

55 Tech News

59

64 Events

2 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

/MAR

FEB

Life + Style Spring is in the bag

23

MIPIM 2024 Visit Warsaw AT STAND R8.D1 Our Partners at MIPIM 2024: GROW WITH WARSAW Smart People. Smart Technology. Smart City. um.warszawa.pl

CHARTING POLAND'S ASCENDANCY

During my 25-year tenure in Poland, I've witnessed the country's remarkable growth in all facets of life. I've had the privilege to interact with ambitious, talented, and hardworking Poles. This journey has exposed me to promising business prospects, remarkable financial development, and an improvement in living conditions for urban communities across Poland. These experiences have left an indelible impression on me, one that continues to inspire me today.

This personal journey, supplemented by compelling data and facts, highlighting Poland's impressive growth over the last 30 years, has served as the driving force behind our celebration of the 30th anniversary of the Warsaw Business Journal under the theme 'Poland: Europe's Future.' We firmly believe that Poland will be the catalyst for Europe's growth and influence.

With nearly 40 million inhabitants, Poland ranks as the fifth most populous European Union country. As of 2023, it also stands as the fifth-largest economy on the continent and maintains a growth rate outpacing many of its European counterparts. We, along with many esteemed experts, share the belief that we are entering a new era. Post-pandemic recovery, economic resurgence, peace in Europe, and significant advancements in technology collectively

mark the beginning of a decade marked by financial growth, increased internal trade, and investment opportunities, and an overall enhancement in the environment, social welfare, and governance.

Poland is uniquely positioned to lead this 'golden decade' due to its skilled and diligent workforce, a robust educational system, a strategic location at the heart of Europe, and abundant investment prospects with attractive returns.

Our mission is to serve as a bridge, connecting international investors from around the world with the stories, insights, and individuals responsible for Poland's success. 'Poland: Europe's Future' is a platform that ensures access to business and economic news in English, through online content, print publications, events, newsletters, and personal interactions.

We invite you to join us in our vision and become a partner in this endeavor. Your participation will not only contribute to your business's growth but also foster your personal development. Let's unite our efforts for Poland's bright future.

MORTEN LINDHOLM

4 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL PORTRAIT BY PIOTR NAREWSKI PUBLISHER'S NOTE

C M Y CM MY CY CMY K

ON THE COVER

Rajmund Węgrzynek Managing Director, Neo-Świat

For more than 25 years I have been active in the construction industry in the broadest sense - and especially in its specific segment, the interior sector. My first experience in the construction industry was in London. In the late 1980s, I moved to Australia, where I started my own construction/interior company. After returning to Warsaw, in 2000, together with Paweł Brodzik, we founded Neo-Świat.

Paweł Brodzik Managing Director, Neo-Świat

Associated with fit-out industry since 1997. After completing his MBA in Australia, brought the improvement-based business model to Poland.Co-founded Neo-Świat in 2001. Regards mutual trust and transparency as key business values. At Neo-Świat responsible for strategic planning, continuous improvement and teamwork.

Interview starts on pages 16

CONTRIBUTOR

Svetlana Bagheri (Fedosova)

Svetlana founded Entralon Club in 2022. She has been working with leading real estate personas in Europe since 2016. She has established the GRI Club Chapter in CEE and delivered high-quality events for members of the Club. In 2022 Svetlana successfully led CEE Quality Awards to its comeback and now decided to focus on delivering top-content events for CEE Real Estate leaders. In the time of crisis and recession at war at the doorstep, CEE Real Estate leaders have the urge to get together and discuss what really is going on in the market. Entralon Club provides such a platform. Svetlana is a passionate advocate for gender equality, work & life balance. She coaches young female entrepreneurs in her free time and enjoys seeing people around grow and prosper. Read about ther last event on page 38

Morten Lindholm

Editor-in-Chief/Publisher mlindholm@valkea.com

Kevin Demaria

Art Director kdemaria@valkea.com

Contributors

Sergiusz Prokurat

Sean Reynaud Beata Socha

Sales Izabela Kaysiewicz ikaysiewicz@valkea.com

Agnieszka Mańkowska amankowska@valkea.com

Katarzyna Pomierna kpomierna@valkea.com

Print & Distribution

Krzysztof Wiliński dystrybucja@valkea.com

Event Director, Valkea Events Magda Gajewska mgajewska@valkea.com

Contact:

phone:

fax:

e-mail: wbj@wbj.pl

WBJ.pl

For

6 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

75 00

+48 22 257

+48 22 257 75 99

enquiries,subscriptions-related please email us at wbj@wbj.pl

@wbjpl All photographs used in this issue are courtesy of partners and companies unless specified otherwise. Copyright © 2024 by Valkea Media SA All rights reserved. This publication or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher. Published by ul. Jerzego Ficowskiego 15 Valkea Media S.A.01-747 Warszawa Tomasz Opiela, CEO NIP: 525-21-77-350 www.valkea.com To subscribe through RUCH SA: www.prenumerata.ruch.com.pl, prenumerata@ruch.com.pl, 801 800 803

WarsawBusinessJournal

BUSINESS FAMILIES

FESTIVAL OWNERSHIP OBLIGES!

Development in business, harmony in the family!

The Business Families Festival is a selection of paid and free stationary and online meetings for business families.

Each meeting has a separate agenda, different speakers and participants. You can sign up for one or more meetings: the full selection of meetings can be found at www.FestiwalRodzinBiznesowych.pl

REVIEW

LEASING BOOSTED THE ECONOMY BY OVER PLN 100 BILLION IN 2023

As much as PLN 102.5 billion in financing for investment was provided by leasing companies last year, setting yet another record. Approximately half of this amount is accounted for by passenger cars and small vans. There is no need to wait for months for cars now that production has begun. Equipment and machinery investments by small businesses increased after the October elections.

The record PLN 102.5 billion of financing provided means an increase of 16.3 percent compared to the previous year, which is significantly higher than inflation. Leasing companies emphasize the change in the economic situation in the last quarter of last year when they provided nearly PLN 30 billion of new financing, and the y/y dynamics was 19.1 percent.

8 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

IN

SHUTTERSTOCK

DOMESTIC Poland's hard coal sector sees stable sales amid fluctuating production

According to the Industrial Development Agency (ARP), Poland's hard coal sales remained steady at 4.2 million tons in December 2023, compared to 4.18 million tons the previous month and 4.03 million tons in December 2022. However, net production dipped to 4 million tons from 4.64 million tons in November and 4.41 million tons in December 2022. Hard coal stocks decreased to 4.2 million tons from 4.33 million tons in November and rose significantly from 2.17 million tons a year earlier. Employment in the sector slightly declined to 76.1 thousand people from 76.16 thousand in November and 77.47 thousand in December 2022.

ECONOMY Shortages, production downtime and the specter of price increases in Europe and Poland

Analysts point to raising concerns about Eurozone inflation and economic growth. The Red Sea route, crucial for European trade, is under continued Houthi attacks targeting Israeli-bound ships, affecting global vessels. Longer shipping routes increase freight costs and production delays. Companies like Tesla and Volvo halt production due to supply chain disruptions.

Marek Tarczyński, president of the Polish Chamber of Forwarding and Logistics, warns of strong dependence on Asian goods, predicting supply shortages and price hikes, impacting European

and Polish inflation rates. The OECD has lowered its Eurozone growth forecast by 0.3 percentage points to 0.6% due to the situation.

ECONOMY

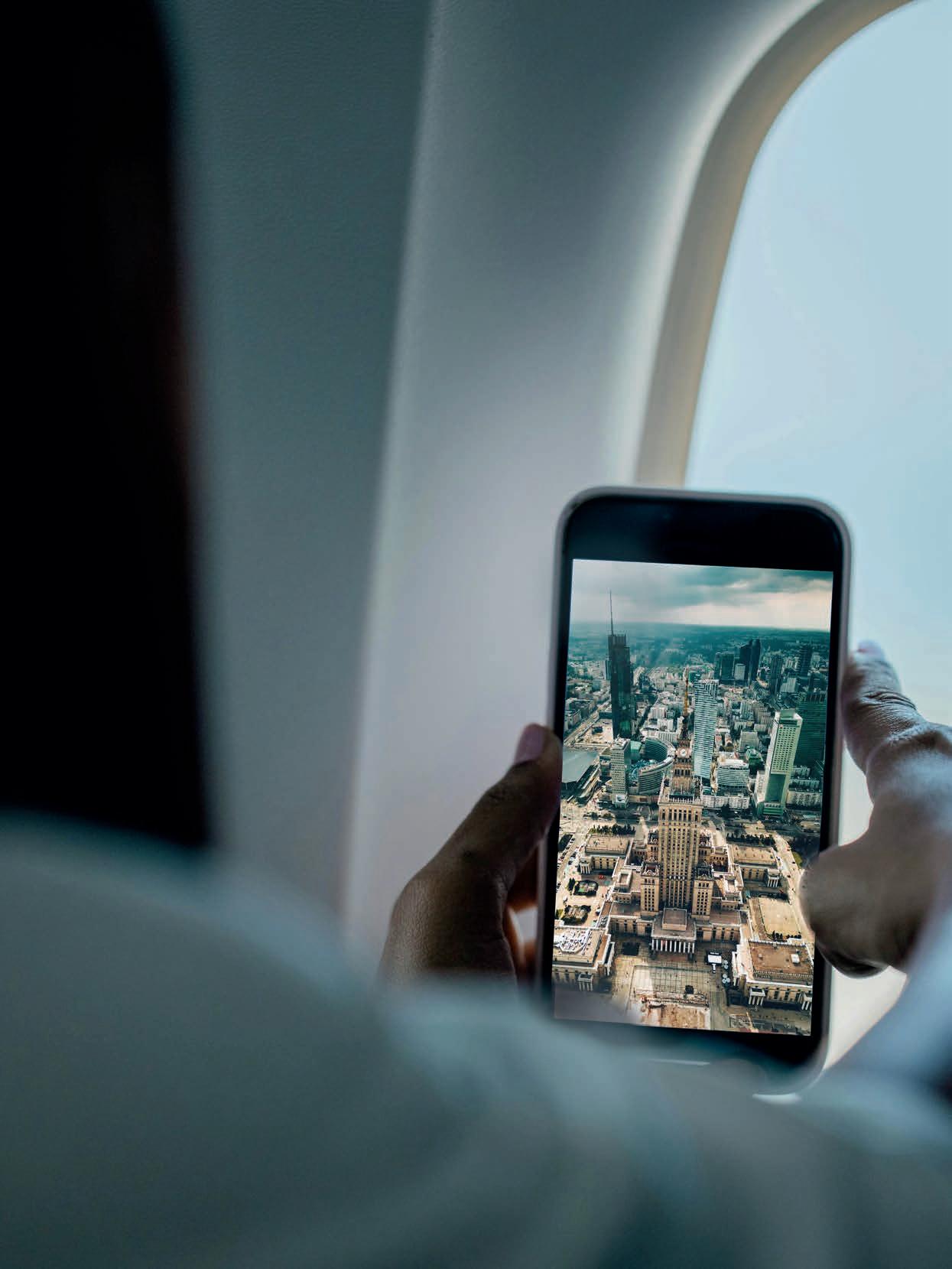

Poland becomes hub for international travel

Poland stands out in Central and Eastern Europe as the only country where air traffic has significantly rebounded compared to the pre-pandemic year of 2019, despite challenges faced by larger aviation markets like Germany, France, and Italy. The country's regional airports play a crucial role in this recovery, contributing to a 4.5% increase in passenger traffic compared to 2019. The use of regional airports has facilitated the growth of low-cost airlines in Poland, leading to a more diversified

and evenly distributed air traffic. Meanwhile, Germany struggles with a mature aviation market, impacting long-haul flights, while Scandinavian countries face challenges due to flight shaming and restrictions on air corridors, affecting their aviation businesses.

INTERNATIONAL EY: international political pressures on supply chains expected in 2024

Rising global tensions in 2024 mean businesses must prioritize reducing supply chain risk. Sourcing key materials and diversifying chains are crucial due to geopolitical instability, according to the latest EY-Parthenon report: “2024 Geostrategic Outlook.”

Public support for R&D in clean tech is expected to boom, offering opportunities for companies partnering with governments. Sustainable development will become an even bigger focus for businesses, driven by investor demand and lower capital costs.

This year provides a chance to re-evaluate supply chains, prioritizing resilience and minimizing risk.

INTERNATIONAL NATO Meets spending goals, Poland leads defense investment

While former US President Donald Trump's warnings of NATO protection conditions reverberate, ten European allies met the 2% GDP defense spending target in 2023. Secretary General Jens Stoltenberg anticipates 18 NATO countries meeting the threshold this year, despite concerns. Excluding the US, NATO's collective defense expenditure has surged, driven by geopolitical tensions. Notably, Poland leads with nearly 4% of GDP allocated for military purposes. Plans include doubling troop size and tank acquisitions, showcasing a robust modernization drive, as affirmed by Deputy Prime Minister

10 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL News

IN REVIEW THIS PAGE SPREAD SHUTTERSTOCK (3)

STRONG YEAR AHEAD

26.7% more passenger cars produced y/y in 2023 (KPMG and PZPM)

4.1% y/y in 2023

Increase in turnover for retail and service networks operating in shopping centers (Retail Institute)

25% y\y revenue growth for PwC Polska to a record high of $53.1 billion, up by 5.6% (PwC)

0.6%

Sales inch up y/y in December (Eurostat)

8% warehouse vacancy rate (JLL)

1,927

Largest network of fuel stations–Orlen (Polish Organization of Petroleum Industry and Trade - POPiHN)

80% Number of Poles that choose OOH delivery points

(DPD Poland and European Geopost's "e-Shopper Barometer 2023")

Difficulties

21% of Poles lack any savings ("Savings Barometer 2023" study)

Core economic figures

25k

Number of energy consumers that changed providers in 2023 (Energy Regulatory Office (URE))

50% average natural gas price drop in 2023 (URE)

22.2% increase in shoplifting misdemeanors in Poland (Polish Police Headquarters)

PLN 2.77 bln

Investment by Tauron in power grids in 2023 (ISBnews)

WBJ.PL 11 News in Numbers IN REVIEW

>>>

Władysław Kosiniak-Kamysz. Investment in domestic arms manufacturing underscores Poland's commitment to bolstering defense capabilities.

INVESTING

Poland on the radar for an investment of €53 billion

Innovation and technology, sustainability, and social responsibility have long invaded our daily lives. However, the project of the company MMgo Investment Group Scr. takes a step toward the future by investing in technological development, innovation, and Artificial Intelligence in the textile and footwear sectors.

Poland, Portugal, France, Spain, Italy, and the United Kingdom are the countries on the radar of this ambitious investment, which aims to produce luxury brands, benefiting companies in the textile and footwear sector that have quality production potential. In recent years, companies in the textile and footwear industry have been going through a serious economic crisis, given their positioning in medium-low segments.

It is undeniable that with a total investment of €53 billion (of which €30 billion will be for infrastructure that boosts business tourism through hotels, services, logistics, and real estate) this project would allow the Polish industry to reposition itself in the international market, by boosting high-quality production and supporting exports for luxury fashion brands.

Moreover, this project, to be established in Poland, will be the largest private investment ever brought to the country, and will represent 6 percent of the national GDP.

BUSINESS

More than half of Polish CEOs see need for transformation to remain profitable long-term

The 27th global CEO Survey by PwC reveals that 55% of Polish CEOs

(compared to 45% globally) doubt their current business trajectory will ensure profitability over the next decade, signaling necessary transformations. Despite increased optimism regarding global economic growth compared to the previous year, many CEOs express concerns about long-term profitability. Technology emerges as the primary factor driving long-term value creation.

While global CEOs focus on technological advancements, Polish CEOs emphasize the impact of governmental regulations and shifting customer preferences. Additionally, CEOs recognize their role in responsible AI utiliza-

tion, foreseeing significant changes in their companies' operations. Concerns include workforce upskilling, cybersecurity risks, misinformation, legal liability, reputation risks, and biases.

The survey sampled 4,702 CEOs globally, including 31 in Poland and 111 in Central and Eastern Europe, with data weighted proportionally to ensure representativeness.

BUSINESS

Court overturns 2021 decision against Eurocash by UOKIK for PLN 76 million

DOMESTIC Poles divided on lifting Sunday trade ban

Poles are deeply divided on Sunday trading, with nearly equal support and opposition. 46% of Poles support resuming trade on Sundays, while 44% are opposed. Only 10% have not made up their minds. Support for the lift on trading ban has dropped slightly, especially among those with lower income or in smaller towns. Young, urban, educated Poles with higher income opt for stores remaining open on all Sundays.The government hasn't acted despite promises, potentially due to declining support. Opponents cite worker rights and different shopping habits in smaller locations. While a majority still wants some change, falling support might make the government wait until other issues are addressed.

12 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

IN REVIEW News SHUTTERSTOCK

The Court of Competition and Consumer Protection (SOKiK) overturned entirely the decision of the Office of Competition and Consumer Protection (UOKiK) from November 30, 2021, which imposed a fine of PLN 76.02 million on Eurocash for allegedly using unfair trading practices. Eurocash welcomed the decision, stating it aligns with the company's position. The verdict is not final, and Eurocash did not create reserves due to the UOKiK's decision. In 2021, UOKiK found that Eurocash imposed unjustified fees on suppliers of agricultural and food products to reduce their compensation.

BUSINESS

Only 20% of Polish enterprises are ready for National e-Invoice System (KSeF)

Only 20% of Polish businesses are prepared to implement the National eInvoice System (KSeF), with 32% having taken no action regarding the impending reform due to technological barriers and high costs. Larger companies, employing over 250 workers, show the most readiness, with 49% already taking steps toward KSeF implementation. In contrast, micro-enterprises, with

up to 9 employees, exhibit the least readiness, with nearly half having taken no action. Challenges include adapting procedures and tools for invoicing, conducting employee training, and additional costs. Uncertainty regarding process adaptation is justified, affecting all organizations, whether they have implemented e-invoicing tools or not. Flexible tools enabling process adjustments without extra costs are crucial for compliance.

FINANCE

Ministry of Finance: PLN 126.7 Billion to be transferred to domestic market

The Ministry of Finance disclosed that as of January 31, 2024, PLN 126.7 billion will be transferred from the budget to the domestic market by year-end. February 2024 will witness no fund flows from Treasury securities redemption or interest payments. The outstanding debt in 2024 amounts to PLN 135.7 billion, covering wholesale bonds, retail bonds, and foreign market bonds/loans. By January's end, budget accounts held PLN 138.6 billion, ensuring liquidity for borrowing. Bond sales in January

Quote of the month

2024 totaled PLN 33 billion, marking an increase from the previous year. The consolidation of liquidity management amassed PLN 93.3 billion by January's close, with domestic market debt reaching PLN 862.3 billion by December 2023. The average maturity of domestic debt stands at 4.12 years.

BUSINESS

QNA Technology Completes pilot production line for quantum dots materials

QNA Technology completed the construction process of the first experimental version of the Quantum Dot Synthesis Pilot Line, as announced by the company. The next steps include testing the entire system technologically, reproducing the synthesis process on the pilot line, and adjusting it to meet the technical conditions specific to the pilot line. The company aims to strengthen its industry reputation by meeting customer demands for quantum dot materials. Future plans involve optimizing processes, increasing synthesis efficiency, automation, and reducing production costs.

“This new branch of the economy is a huge opportunity for Polish companies involved in the production and supply chain for onshore and offshore wind. Domestic entrepreneurs have the potential to offer the main construction elements, i.e. wind towers, turbine elements, marine transformer stations. However, urgent support and decisive investment actions are needed. A conscious industrial strategy of the state is necessary, which will give priorities in the development of factories, projects, industry education and obtaining financing. ”

Piotr Czopek, director of regulation at PWEA

WBJ.PL 13 IN REVIEW Quote News

ELECTIONS IN POLAND SPARK CHANGES IN POLITICAL SCENE

As the local elections approach, Poland’s economic landscape stands at a critical juncture. The nation’s economic narrative was about to change, after the 2023 elections, however it does not look that simple. With the 2024 local elections nearing, Poland's economy teeters between recovery and uncertainty. Will prudent policies sustain a soft landing?

BY SERGIUSZ PROKURAT

the Polish proverb “Od Sasa do Lasa” is used to convey that two or more people, or views, differ significantly from each other and are contradictory. In other words, it highlights situations where a wide range of opposing views or contradictions coexist side-by-side. The saying has its roots in the 17th century political conflict between the followers of the Wettin (Saxon) dynasty (“Sas”) and the supporters of king Stanisław Leszczyński (“Las”). Interestingly, the original meaning of this saying likely comes from a pair of horses pulling a cart— one running slowly to the left (“sasa”) and the other heading toward the forest (“las”), signifying two completely different directions. It’s a nice exemplification of today’s Poland. After nearly a decade in power Poland’s dominant party, Law and Justice Party (PiS), was ousted in the 2023 parliamentary elections. A new multi-party coalition government, led by Prime Minister Donald Tusk, vows to do things differently. The new government aims to shift towards a more EU-friendly direction, reform judicial independence, and uphold the rule of law. However, challenges include overcoming PiS's institutional influence, restructuring state-owned companies, and demonstrating progress to the electorate.

SOCIAL VS LIBERAL

Poland is visibly divided into two philosophies that reflects the attitude of Poles. On one side is Social

14 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

SHUTTERSTOCK OPINION

Poland, at times leaning towards socialism, which prioritizes social cohesion, welfare programs, and communal support. They are less amicable towards the EU and the global community. On the other hand, Liberal Poland champions individual freedoms, free-market principles, and minimal government interference. Liberals advocate for entrepreneurship and economic vitality. These contrasting visions offer divergent paths for Poland, impacting its economic, social, and political landscape. While the liberals emerged victorious in the last election, their mandate remains fragile, contingent on forthcoming outcomes. The ongoing debate profoundly influences the country's future trajectory, particularly with another election on the horizon.

ELECTIONS COMING

The 2024 local government elections, are scheduled to take place in April. These elections were initially planned for the autumn of 2023, following the five-year term of local government bodies. However, to avoid overlapping with parliamentary elections held in October 2023, the Polish authorities changed the schedule. Voters will select mayors, city councillors, district councillors, and representatives for municipal, county, and regional councils. At the local level, candidates and parties are wrestling with strategies to tackle regional economic challenges, promote industrial growth, attract foreign investment, and effectively oversee infrastructure development, all amid the challenges of early 2024. “Third-Way,” Civic Coalition and “Left” were the three separate electoral committees that came together to form a government in 2023 and secure a parliamentary majority. Now they have split and will fight for voters. If PiS

experiences a loss, as indicated by polls, it could potentially face significant challenges and internal turmoil within the party.

In 2023, the Polish economy displayed resilience, although GDP growth reached a modest 0.2%, slightly under initial forecasts. While the 2024 outlook appears more optimistic after the shortterm inflation surge of 2023 abates, projections anticipate inflation rates of 4-6% in 2024 and a milder 3-4% in 2025. Despite this, Poles continue to receive state subsidies on electricity and gas. Removing price freezes and zero VAT on food could prove unpopular. Even cautious politicians, including those of liberal leanings, would approach such measures delicately.

IT'S NEITHER GOOD NOR BAD

Indeed, Poland faces numerous challenges. As of 2021, the public finance deficit in Poland stood at a mere 1.9% of GDP. However, by the end of 2023, it surged to as high as 5.6% of GDP. Consequently, this spring, Brussels will initiate the excessive deficit procedure against Poland. Additionally, the government has planned for a significant deficit for 2024, amounting to 5.1% of GDP. Another challenge arises from the necessity to borrow record-high amounts from financial markets, potentially leading to a depreciation of Polish debt or even a fiscal crisis. It’s worth noting that Poland currently has one of the highest deficits in the EU, and financial transparency has worsened since the outbreak of war. Several new off-budget funds have emerged, where the government allocates its expenses, eluding parliamentary control.

The underperformance of the German economy, potentially leading to a crisis in Europe, combined with a strong Polish zloty (PLN) and increased price competition from Asian manufacturers, may impact Poland’s foreign trade balance. A huge river of funds, committed by the European Commission as a post-pandemic aid package, is expected to boost investment in Poland. However, it will also strengthen the Polish zloty (PLN) even more. In the meantime, Poland relies heavily on coal for energy, which poses both environmental and economic challenges. The nation requires a transition towards more sustainable energy sources. Investments in modern energy infrastructure, including nuclear or renewable energy, alongside enhancing energy efficiency, are crucial for ensuring stability and security in energy supply. The current government remains undecided on whether to continue significant investments, such as the construction of a new airport in Baranów and the state-owned development of Izera’s EV factory in Jaworzno. Moreover, the ongoing conflict on the eastern border exacerbates concerns regarding stability. “Od Sasa do Lasa” encapsulates the ongoing power struggles, wars and the twists of fate in Polish history.

WBJ.PL 15

FIT TO BE!

Morten Lindholm, Editor-in-Chief, met with Neo Świat founders Rajmund & Paweł in downtown Warsaw, 15 months after they unveiled Neo Świat. Their discussion delved into topics such as values, the Polish real estate market, entrepreneurship, the importance of quality, and prospects for the future.

WBJ.PL 17

“The significance of relationships, both internal and external, cannot be overstated when facing the challenges of company growth. I want to emphasize the recruitment of talented individuals in a competitive market, which has been facilitated by maintaining a personal connection and open dialogue with team members. Our success stems from a people-centric approaches.

WBJ: Good to see you again Paweł & Rajmund. Let me kick off our talks by asking how you are doing and how has business been the past year?

What a year it has been. A transformative year. Initially focused on regaining momentum, we diligently reached out to our market contacts, updating them on the new circumstances. As spring turned into summer in 2023, we began to observe a notable change in momentum and purpose, sensing a positive evolution in our business endeavors.

A key for success was cultivating a familial atmosphere within our tight-knit team. Plus, Rajmund and the business development team deserve immense recognition for their contributions, diligently securing projects and expanding our network.

Of course, we didn't expect any handouts. It's been hard work, but work we take pride in. We never turn down an opportunity to submit an offer for a client. Over the past year, we've likely sent out 2-3 offers a day. We do this with a clear purpose, believing that our efforts have ramifications for both the recipient and, ultimately, bring benefits and respect to us.

Recognizing the growth from 35-40 employees a year ago to 100 is a significant achievement. It's based on business growth, connected with relations both with clients but also internally. With our values, we've been able to attract the best fitters in the market, including those who have returned to work for us due to the family culture. Our team comprises architects, project managers, cost control personnel, business development managers, and the individuals responsible for the actual fit-outs who are

100 strong, on top of the previously mentioned number.

We now have 8 project teams operating across Poland, with teams in Tri-city, Wroclaw, Krakow, and of course Warsaw. This expansion signifies our increased scale, providing us with more stability and flexibility to approach each project optimally for our partners on a local level.

What would you highlight as key lessons learned during the past year?

The significance of relationships, both internal and external, cannot be overstated when facing the challenges of company growth. I want to emphasize the recruitment of talented individuals in a competitive market, which has been facilitated by maintaining a personal connection and open dialogue with team members. Our success stems from a people-centric approaches.

We came from corporate structures, which has equipped us with valuable skills. That experience provided us with improved tools for processes such as contract pricing, procurement, project management, and goalsetting. We've been able to leverage this expe-

18 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

EXCLUSIVE

ABOUT NEO SWIAT

Neo Swiat's core business focused on the fit-out of commercial, residential, and office spaces, encompassing design, arrangement, cabling, and infrastructure management. With their dedicated team of experienced specialists, they ensured the reliable implementation of projects down to the smallest detail, offering a guarantee of quality throughout.

rience in our new operations, making it easier for partners to understand our objectives.

I would like to express our heartfelt gratitude to our open-minded customers for the opportunities and trust they have bestowed upon us. Through ongoing conversations with our partners, we aim to provide assistance and offer solutions, enabling them to plan ahead effectively. Our accomplishment of completing over 60,000 square meters of fit-outs in 2023 is significant, and it underscores the importance of strong relationships in our endeavors.

How have you navigated the difficult real estate market?

Obviously the office market bottomed out. All the data corroborates this, showing low investment levels and a lack of new projects.

I think we should acknowledge that things will never return to how they were. Our society has been altered, first by COVID and now by the devastating war east of the border. These events have changed behaviors and habits, affecting various patterns in the urban landscape, such as where and how people live, commute to the office, and seek entertain-

ment and services in office districts. Additionally, generational differences play a role, with younger individuals adopting a more balanced approach to work and life. All of these factors deeply influence the future of real estate.

For us, it signifies that we've expanded our services beyond the office market. Our expertise now spans multiple sectors: residential properties continue to thrive in Poland, Private Rental Sector (PRS) has seen recent success, logistics remains strong, and there's a significant demand in the high-end residential segment where virtually anything we build is sold. Let's not overlook hospitality either. This year, we're concluding several massive hotel projects, delivering hundreds of rooms.

We've expanded our offerings to include what we term 'Design & Build', where we not only provide excellent design but also ensure proper functionality and efficient execution, all within the specified time and budget. This may also involve fulfilling individual orders for furniture or decorating the designated space. When executed correctly, this approach is the most effective way for investors to save both time and money. It eliminates the friction between partners during various stages of the project.

The conversation transitions to the “design and build” concept in real estate. The expert underscores the advantages of integrating design and construction phases, stressing the importance of trust and transparent communication between clients and contractors. They outline the hurdles present in the Polish market and draw comparisons to practices in Western Europe.

Which sectors will be most important for you in the coming year?

As previously discussed, we observe macro trends impacting the real estate market, including a potential shift from homeownership to renting in Poland. The PRS market is nascent in Poland but holds significant potential, with projections of up to a million units for such projects. These ventures are particularly compelling for us as fit-out specialists because the standardized nature of these projects allows for efficient and streamlined processes, making it convenient to work on multiple apartments within the same scheme.

The same goes for the hospitality sector, it presents significant opportunities. As mentioned, we are currently involved in several major projects, with more details to be shared upon completion. The market potential in the region is substantial, prompting us to consider business expansion in the Central and Eastern European (CEE) region. Many hotel owners and operators operate across borders, presenting opportunities for us to extend our services. For instance, hotel markets in Budapest, Prague, and Vienna boast around 40,000 rooms per city, significantly larger than Poland's. Additionally, listening to our clients reveals their primary concern: a shortage of skilled contractors in the fitting area. Coupled with the increasing interest in travel, this sector remains a focal point for us, and we maintain close relationships to stay informed.

ESG is a new market. What are your observations about ESG and its impact?

There is no doubt that ESG will influence the real estate market. While our company may be relatively small in scale, we gauge our ESG success by our ability to assist clients in reducing carbon footprints and conserving energy.

We already have projects underway in Wroclaw where we are

WBJ.PL 19

Essentially, at the end of the day, we're moving towards processes like standardization, prefabrication, pre-manufacturing, and robotics—anything that reduces the reliance on human labor in the construction process.

revitalizing buildings, altering their functions. While we don't alter the building's structure extensively, through redesigning and incorporating technology, we inadvertently promote ESG principles. By introducing technological advancements to the building, we inherently contribute to creating an outcome that better serves the environment and the society overall.

Other areas ripe for both business development and ESG impact are within the industrial sector. Many old factories, warehouses, and production facilities were built at a time when technology, social impact, and workplace conditions were different concerns, and energy efficiency wasn't a priority. However, times are changing, and there is significant potential for development in these areas. A fit-out company can play a crucial role in optimizing costs and effects for these locations and companies, considering the evolving landscape of technology and environmental responsibility.

So we now possess the expertise , and have employees that can support the clients in making the appropriate decisions, in terms of implementing ESG.

How are you preparing to meet the anticipated rise in market demand and competition as conditions improve?

We are in a good spot. However, there are indeed challenges facing the construction and real estate development sectors in Poland. Despite the current slowdown, issues such as the scarcity of skilled labor, aging demographics, and the imperative for innovation are already apparent.

This is a significant discussion, and let's approach it systematically. Remember when Poland joined the EU, and over two million Poles migrated to the UK and Germany for employment? Now, Poland finds itself in a similar predicament, needing more labor. This presents a challenge for the government and requires legislative attention. I believe we require around half a million workers in Poland, and it's crucial to address this before it's too late and demand exceeds supply. Otherwise, we risk construction costs escalating significantly.

We still have skilled labor, and they can continue to educate the younger generations. However, my concern lies in the fact that these youngsters may not necessarily come from Poland, as their focus seems to be on higher education and technology.

Essentially, at the end of the day, we're moving towards processes like standardization, prefabrication, pre-manufacturing, and robotics—anything that reduces the reliance on human labor in the construction process.

It's crucial for us to voice our concerns and acknowledge our responsibility to the market. We want to emphasize that in the construction industry, skilled workers are essential; financial plans alone won't suffice. The time to act and implement proactive measures to tackle challenges and capitalize on opportunities is now.

KEY TAKEAWAYS

1. Our business underwent a revolutionary shift with the power of relationships. Leaving a corporate giant and venturing on our own was daunting, but the market's response exceeded our expectations, thanks to the support from contacts and friends spanning over two decades.

2. The transformation in 2023 was achieved by assembling a stellar team of professionals committed to delivering high-quality work. Rooted in fundamental values of care, trust, and purposeful action, it's not rocket science but a recipe for success.

3. With 23 years in the business, transitioning from entrepreneurs to a corporate setting and back, our goal extends beyond acquiring more jobs. We aim to elevate standards, utilize our experience to support employee development, offer clients faster and cost-effective solutions, and share market insights for sustainable development.

4. Fitting over 2 million sqm of real estate space taught us valuable lessons. A one-size-fits-all approach doesn't work; acting local and respecting individual differences is crucial.

5. While the market might not fully grasp it now, in five years, the cost of finishing offices, apartments, or hotels could surpass Western Europe due to high demand and a shortage of skilled resources.

20 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

“

WBJ.PL 21

Get a Polish business news briefing in English delivered to your inbox each weekday before 9:00

Scan code & Sign up now for a no-obligation 2-week trial.

POLAND EUROPE’S FUTURE

POLAND HAS SHOWN REMARKABLE RESILIENCE AMIDST HEADWINDS AND MULTIPLE CHALLENGES. WE HIGHLIGHT THE AREAS THAT SHOW THE BIGGEST POTENTIAL AND ATTRACT THE MOST INTEREST: TECHNOLOGIES, GREEN ENERGY AS WELL AS POLAND'S DRIVEN AND SKILLED WORKFORCE.

WBJ.PL 23

Investing in Poland | Technology & Innovation | ESG & Energy | Real Estate/gastronomy | Workplace

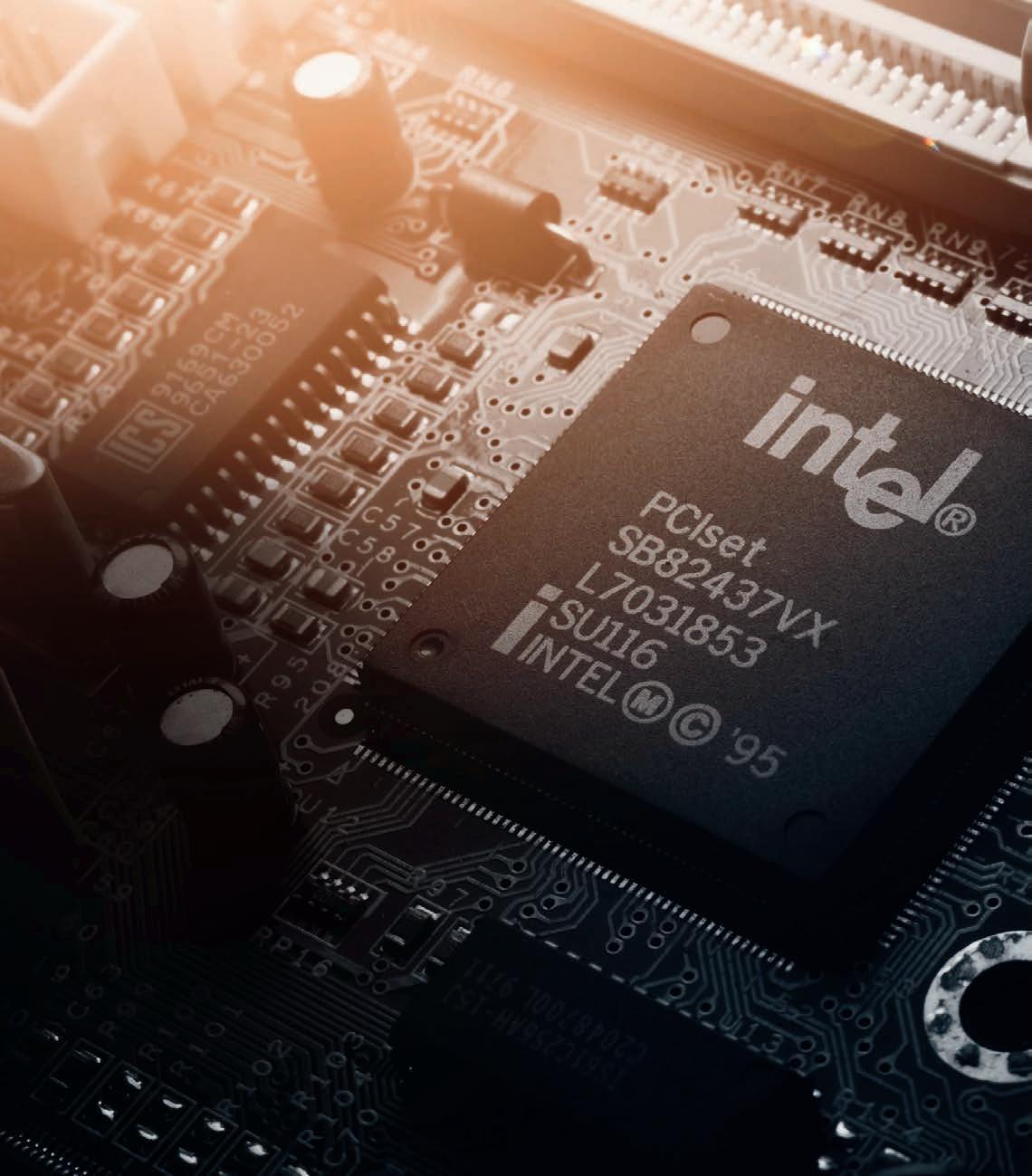

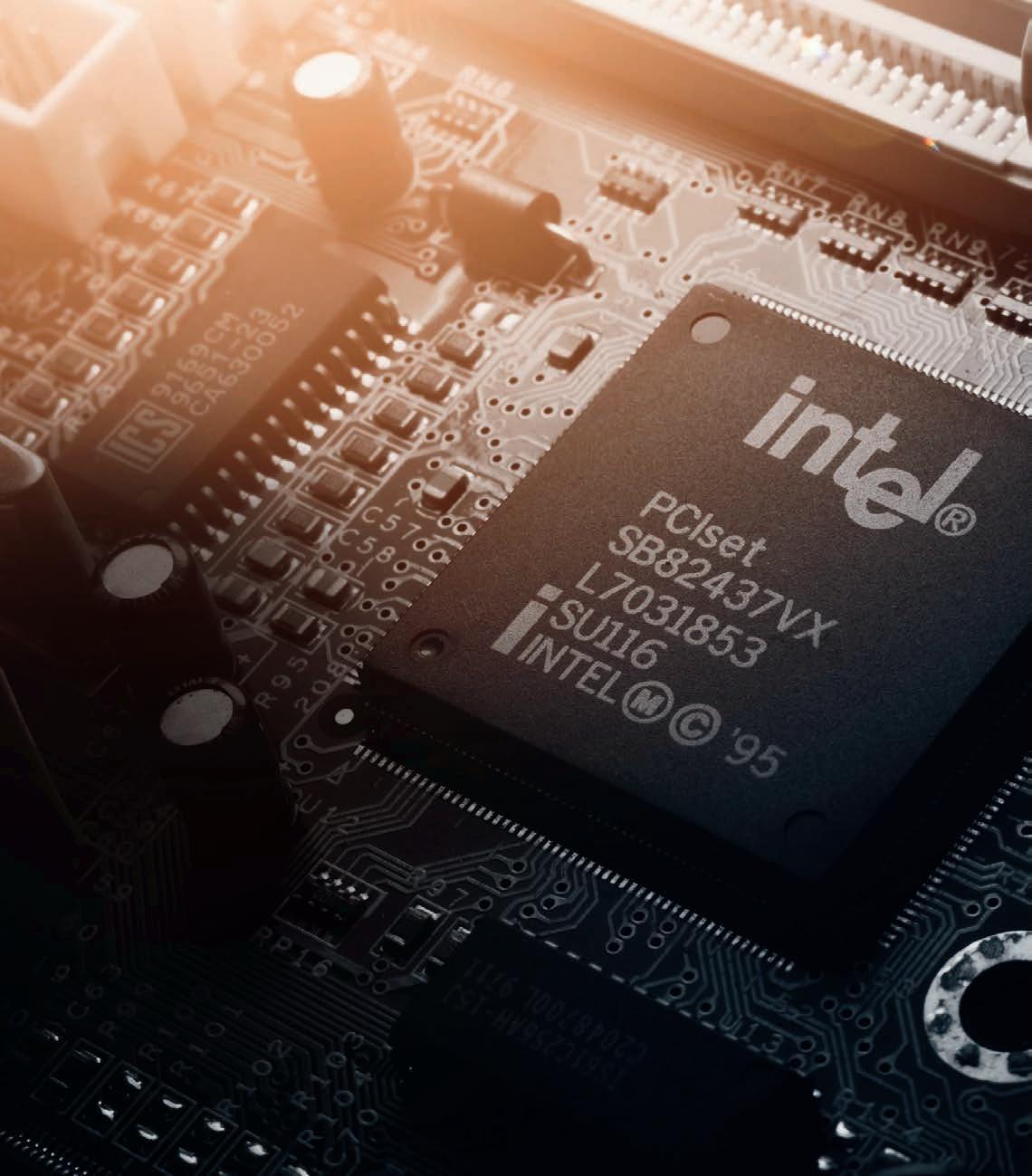

5.1 TRILLION USD IN IT EXPENDITURES

The development of new technologies remains a driving force behind global economic investments for yet another year. Forecasted by Gartner, global IT spending in 2024 is expected to reach 5.1 trillion USD, marking an 8% increase from the previous year. Enterprises predominantly invest in automating and streamlining business processes, cloud solutions, and cybersecurity.

The development of new technologies remains a driving force behind global economic investments for yet another year. Forecasted by Gartner, global IT spending in 2024 is expected to reach 5.1 trillion USD, marking an 8% increase from the previous year. Enterprises predominantly invest in automating and streamlining business processes, cloud solutions, and cybersecurity.

Polish business representatives acknowledge the necessity of investing in new technologies. As per the recent KPMG report titled "Modern CFO in a Transforming Company: New Strategies and Challenges," 35% of surveyed companies intend to boost IT expenditure by more than 10%, while

an additional 10% aim for incremental increases. Only one in every five firms plans to curtail such investments in 2024.

"This highlights how crucial IT departments have become. They have long ceased to be mere providers and operators of software and hardware. Modern IT actively contributes to business operations; it's a partner. It has transitioned from being a cost center to a revenue-generating service provider," emphasizes Piotr Szypułka, Director of IT Infrastructure Maintenance at Polcom.

Automation as a Priority

According to the Polcom and Intel study, 88% view new tech as beneficial, with 71% targeting automation for innovation. Cloud

computing aids cost-effective operations and predictive planning. Advanced algorithms allow precise production forecasting and optimization, aided by beacon data for machinery maintenance planning.

Digital Transformation in Financial Management

Digital transformation is also revolutionizing enterprise financial management. According to KPMG's research, 76% of companies find the financial planning process too time-consuming. Only 16% of CFOs claim this process has been automated, while 43% of enterprises are currently working on improving planning efficiency. 55% of respondents in the Polcom and Intel survey plan to migrate critical applications and systems to the cloud.

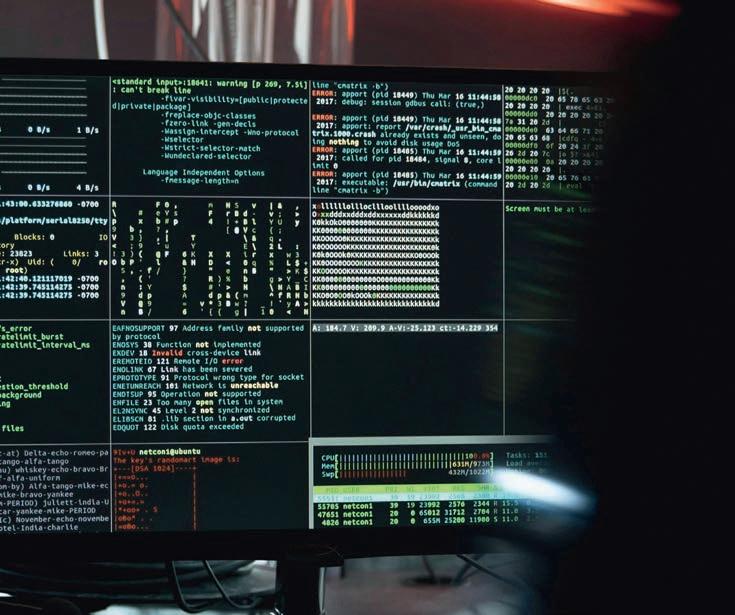

Priority on Cybersecurity

Analysts anticipate significant growth in cybersecurity investments. "One of the reasons is the new EU directives such as NIS2, DORA, and CER. They impose precise requirements regarding security levels, incident reporting, and introduce severe penalties for non-compliance," explains Stanisław Borkowski, Director of Security and Quality at Polcom.

Research firm Cybersecurity Ventures estimates cybercriminal activity losses at 8 trillion USD in 2023 and a staggering 410 trillion USD by 2025. This substantial increase is partly attributed to the proliferation of cybercrime-as-a-service and the utilization of artificial intelligence for cyberattacks.

"It's not an exaggeration to say that there's an arms race between organizations and cybercriminals. Each side continuously tries to outsmart the other. Conventional intelligent antivirus software or regular backup creation are no longer sufficient," emphasized Piotr Szypułka.

External partners are crucial for cybersecurity; yet not all companies can afford inhouse teams.

24 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

Technology & Innovation | Poland. Europe’s Future

POWERING POLAND'S GREEN SHIFT

As Poland strives towards a zero-emission future, the spotlight intensifies on

indispensable

the

role of energy storage in stabilizing renewable energy sources. Despite early-stage development, Poland's strides in this sector hold promise for grid resilience, consumer security, and reduced reliance on external factors.

Without energy storage, energy transformation will not be possible

The importance of energy storage as a fundamental component for a successful green transformation has been widely acknowledged. It plays a vital role in stabilizing the energy system sourced from wind and photovoltaic farms. The development of this sector is essential for achieving a zero-emission future, ensuring consumer security, and reducing dependence on external factors such as imported fuels, inflation, and armed conflicts. Although Poland's progress in storage development is at an early stage, its potential impact is significant.

Renewable energy sources require storage

The previous year marked notable advancements in renewable energy, with a remarkable 23.7% of Poland's electricity stemming from renewable sources in 2023. Yet, the growing enthusiasm for renewables, coupled with favorable weather conditions, frequently results in surplus electricity generation. This strains the power grid and leads to rejections of renewable installations' grid connections. Enhancing the grid's flexibility is crucial for improvement. Electric energy storage helps stabilize the situation by

absorbing surplus energy during peak production and releasing it when required.

Multiple solutions

The Ministry of Climate and Environment has undertaken various actions to support energy storage technology development, including educational and financial support for investments. We are currently awaiting the government's decision on launching the My Electricity 6.0 program, the new edition of which was announced the day after the new Council of Ministers was sworn in.

Micro-prosumer setups also have the potential to significantly expedite energy transformation. As the quantity of renewable sources linked to the local distribution grid grows, it presents a challenge to its optimal operation. Frequently, voltage levels surpass acceptable thresholds, leading to a failure to reap the benefits of the generated energy.

By observing the constant increase in power from renewable energy sources, it becomes clear that devising novel techniques to stabilize power grid operations is imperative. Supporting renewable sources with energy storage enables stable and predictable energy management in the power system.

Euros Energy is a Polish heat pump engineering firm.

Aneta Gałka, PR Director, US Energy

WBJ.PL 25 ESG & Energy | Poland. Europe’s Future

COMING SOON TO A CITY NEAR YOU

On a dark, windy, and somewhat rainy Saturday afternoon, we met Karol Szafraniec and Bartek Serdakowski-Goldstein at their newly opened Popolare restaurant in the Wola district of Warsaw and talked about seeking explosive growth across Poland. .

Inspire: "With the headwinds of higherconstruction costs and increasing labor, rent, and utility costs, and the never-ending challenge of finding competent staff, why in the heck would you embark on such an aggressive growth strategy at this time?"

Karol: We believe that if we are not growing, we are dying. It’s that easy. We believe that with growth, our teams will be better, and our costs will be lower.

Bartek: We are growing to improve our margins. We have secured a lease for 500m2 in the Fuzja project developed by Echo in Lodz. We plan to open an Italian restaurant under the name Sartoria this summer. We have also secured a lease for a 400m2 restaurant in Globalworth’s Renoma project in Wroclaw. We will open another Italian restaurant here, under the name Zucca. Having Dinette next door and knowing that Globalworth’s Pawel Konarski is supporting the project from an F&B standpoint gave us comfort to sign this

lease. Our restaurant will open in the summer of 2024, meaning that we will be quite busy this year.

Inspire: We heard rumors that you guys are much more hungry than that. Can you share with us your other plans across Poland?

Karol: We also have an LOI signed for a 400m2 space in Katowice on a site that would open in 2025, but we can’t yet reveal more details than that. We are aggressively looking for sites in Gdansk, and we would entertain potential sites in Poznan, but we hear about how tough the Poznan market is for restaurants. But we really like the Stara Rzeznia developed by Vastint and hope to find space in it for one of our restaurants.

Inspire: Based on our research, approximately 7 out of 10 new restaurants these days are in the Italian cuisine segment. Yes, Poles love Italian, but this is an extremely competitive cuisine seg-

26 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

Estate/gastronomy | Poland. Europe’s Future

Real

Michał Kaczmarczyk, Head Chef, Poplare

Michał Szulc, Pizzaiolo, Popolare

Inspire, a Warsaw-based consulting company helmed by John Gabrovic, an American expat with extensive experience in F&B and Leisure, is collaborating with WBJ to provide a series of insightful interviews on the state of the gastronomy, leisure, and real estate sectors in Poland.

ment. Why did you pick Italian cuisine for growth?

Karol: We make what we love and serve it with love. We personally want to change how Italian restaurants are perceived. We pay great attention to details, aiming to showcase interior designs that echo the essence of post-war Italian venues. Gone are the days of restaurants resembling trattorias and playing Italo disco. Expect beautiful design and contemporary Italian groove or funk music.

Inspire: Why open Popolare, an Italian restaurant only 350 meters away from your successful Bocca Italian restaurant in Fabryka Norblin? Didn’t you fear cannibalization?

Karol: Why don’t you turn around and look

“I think financial success in our industry is based on one single ingredient: if you offer authentic cuisine with a focus on your guests’ dining experience, the numbers will take care of themselves.

Inspire: Let’s talk about your real estate strategy. Do you prefer mixed-use or high street locations? What criteria do you use to pick your future locations?

- Karol Szafraniec

at our restaurant? When we started our conversation, there were only two tables occupied. Now the restaurant is full with a line out the door. Sorry for not being focused on your questions, but I see that we may be short one server because we did not anticipate such strong business so quickly after opening.

Bartek: Why Popolare? Well, it kind of just happened. We had a great chef to work with, we found this location that was available at good terms, and we thought, “Why not!?” The target consumer in Popolare is different than in Bocca. Fabryka Norblina attracts a great crowd – mainly business people and wealthy Poles and ex-pats. Our average checkin Noblin is high, and we sell a lot of alcohol. Popolare is more like the neighborhood Italian restaurant – a bit smaller, less alcohol –people come here primarily for the food.

Bartek: That’s a good question. We have been in the market long enough to also have made a mistake or two – believing landlords who overpromised and under-delivered. We learned that we need to be very careful with where we sign leases. It’s all about the quality of the project, the reputation of the landlord, and rental terms. For us, the project is paramount. If we are to engage in it, it must be exceptional. People crave authenticity and uniqueness. Just look at Norblin and its success.

Inspire: What do you guys see as the bigger trends facing the restaurant industry in Poland?

Bartek: Generally, we see rents falling for restaurants and terms are getting better because we restaurateurs are finally getting credit for what we bring to retail and mixed-use projects, and it is about time. We bring the community to real estate projects.

Karol: Our generation treated dining out as truly a luxury, maybe dining out one or two times a month. Today’s young people view dining out or hanging out in a café as part of everyday life. People today truly want a real, authentic, and community-based dining experience not a food court. We think we offer that.

WBJ.PL 27

PUBLIC-PRIVATE PARTNERSHIPS: POWERING MODERN WARSAW'S GROWTH

28 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL Investing in Poland | Poland. Europe’s Future

Grzegorz Kaczorowski

Director of the Economic Development Department at the City of Warsaw

Grzegorz Kaczorowski is a seasoned professional in economic development and project management. With a law degree from the University of Gdańsk, he has been deeply involved in Public-Private Partnership (PPP) initiatives since 2009. Specializing in coordinating and executing PPP and Concession-based investments, particularly in multifunctional urban development, Kaczorowski is a prolific author with publications in specialized press focusing on PPP challenges. He brings extensive managerial expertise and serves as a seasoned trainer in project management and business law, notably within the realm of large-scale investment projects.

Public-private partnerships are proving to be an excellent tool here, enabling projects that both enrich the city and provide quality living space for its residents “

The WBJ sits down with Director Grzegorz Kaczorowski to delve into the dynamic landscape of public-private partnerships (PPPs), driving infrastructure development and community enrichment in Poland's vibrant capital city.

What is a public-private partnership?

A public-private partnership (PPP) is one of the ways of addressing public needs through cross-sector collaboration. It is part of the public procurement system, where projects are carried out jointly by private and public sector entities on a contractual basis. These partnerships set forth task allocation and risk sharing between the involved parties. Unlike traditional public procurement, public-private partnerships allow for a more comprehensive and long-term implementation of selected projects.

What encourages investors to participate in PPP projects and what criteria are taken into account when selecting a partner?

Primarily, the allure lies in implementing projects that are commercially beneficial and ensure long-term profitability. The key benefit often revolves around the public component, along with the gradual distribution of profits over time. This aligns with companies seeking stable and enduring investment opportunities. However, participation in PPPs requires partners to have experience, financial capacity and the ability to deliver complex projects, which may constitute an initial barrier. In the process of selecting a partner, public institutions will often require experience and set reasonable criteria for the selection of participants in the proceedings, thus paying attention above all to economic potential and previous experience in implementing similar investments. This limits the number of participants to the most competent actors, and is usually done by setting conditions and pre-selection criteria.

When evaluating applicants for a PPP project, experience is considered along-

WBJ.PL 29

Visualizations of Hala Gwardii

side the quantity and caliber of references, as well as the alignment of past projects with the subject of the procedure. In the pre-qualification process, we assess the companies' achievements in the relevant field. At a later stage, once the tender is selected, the scope of responsibilities (which in the case of extensive projects includes both design and execution, as well as financing and subsequent maintenance of the facility), as well as elements like the project implementation concept, including architectural urban design, functional and quality solutions, etc., also become important.

What makes Warsaw an attractive city for PPP projects?

Firstly, Poland's capital city is one of the country's main economic and business centers, which means it has huge investment potential. Secondly, Warsaw has a stable and predictable business environment, which is crucial for long-term PPP investments. The city's credibility as a project partner is confirmed by its high ratings, ensuring investors of transparent and efficient procedures, as well as support from the city administration. It is also worth emphasizing that Warsaw, as the largest metropolis in Poland, has a dynamically developing infrastructure and a growing demand for public services. Cooperation under PPP enables the implementation of key projects, such as the development of sports, educational or cultural infrastructure, often without burdening the city budget with full investment costs. This makes PPPs an attractive formula for both the public sector and the private investor.

So why do so few companies still choose to participate in PPP proceedings?

One of the main concerns of potential partners is that of the long waiting period for a return on investment. It often exceeds the standard 3-5 years typical in business. Additionally, financing issues pose a challenge, especially for smaller entities. Medium-sized companies may find it difficult to obtain long-term bank financing and are also concerned about the high cost of collateral. These factors mean that larger companies, with a more stable financial position, are in a better position to carry out such projects, while smaller entities approach them with apprehension.

Cooperation with a reliable public entity, such as the City of Warsaw, as part of the PPP can certainly increase the credibility of the project in the eyes of banks. Indeed, this implies a sound basis for the project and may work in the company's favor when assessing financial risks by banks. However, the final assessment depends on the individual policies of the financial institutions and the details of the loan agreement.

And what makes up the negotiation/dialogue process with potential partners?

In the context of implementing projects under the public-private partnership (PPP) model, a key aspect is defining and communicating our, i.e. the city's, needs. This approach allows us full control and flexibility in shaping the project through the competitive dialogue, including the possibility of adjusting the degree of public sector participation, modifying the objectives and

The allure lies in implementing projects that are commercially beneficial and ensure long-term profitability “

scope of the project. One of the key aspects at the initial stage is to consider the concept proposed by the potential private partner, which should respond to the needs we have identified. The PPP model enables the realization of investments both on the basis of ready-made construction projects and the initiation of enterprises aimed at revitalizing degraded areas or developing undeveloped land, the so-called greenfield. The remuneration of the private partner is also an element subject to negotiation and although we do have preliminary assumptions regarding costs before the partner selection procedure, the financial parameters of the project may change during the negotiations. This is a natural part of the process, allowing the terms and conditions of cooperation to be adapted to current market conditions and the expectations of both parties.

What projects are currently being implemented in Warsaw under PPP?

One of the key projects is the construction of a four-story car park at Powstańców Warszawy Square, under a concession agreement with Immo Park, concluded in March 2020. The facility, providing 420 parking spaces, is being financed solely by the concessionaire and is expected to open early next year. The value of the concession is approximately PLN 86 million and, after the concession period, the facility will become the property of the city.

Another major project is the Targowa Creativity Centre, managed by the Polish Chamber of Commerce under a PPP agreement signed in 2019. The project functions as an urban business incubator, offering support

30 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

Investing in Poland | Poland.

This page Różyckiego Bazaar, opposite page, left underground car park at Plac Powstańców Warszawy, Polonia Stadium

Europe’s Future

for start-ups and creative businesses, as well as opening up to the needs of the local community. The centre operator follows a substantive program, including proprietary business services, incubation and acceleration program, which promotes the development of new business initiatives.

Also worth mentioning is the innovative concession contract for the construction and maintenance of more than 1,500 bus shelters, already signed in 2014 for a period of 106 months. This project was one of the first such large PPP projects in Poland. It assumed that the investment costs, estimated at around PLN 100 million, were covered by the concessionaire. In return, the concessionaire obtained the right to exploit the advertising space on the bus shelters. Significantly, therefore, in connection with this project, the city not only did not incur any costs, but also shared in the profits from the sale of advertising space.

And what PPP projects does the city still have in the pipeline?

Among the upcoming projects, the most noteworthy is the planned renovation and development of Hala Gwardii, where we are already finalising the procedure with the existing operator as the bidder. This project assumes that the city does not bear the costs associated with the renovation of this historic space, while the private partner will be responsible for the entire investment, reaping the profits from the operation. The scope of work includes not only the renovation of Hala Gwardii, but also the reorganisation of the road system around the Hall, the devel-

opment of Wielopole Square and the construction of an underground car park. An important element in this case will be the preservation of the character of the facility and the reopening of the underground parts of the Hall to users and customers.

The second project, where we are already completing the procedure, is the construction of modern, energy-efficient kindergartens to replace the existing StolbudCiechanów-type buildings. The private partner will take care of the demolition, design and construction of the new facilities, as well as their maintenance for 20 years. The partner's remuneration will be a fee for accessibility borne by Warsaw, and kindergartens will remain under the care of the city in terms of recruitment and educational program.

A third important project at a similar stage concerns the modernisation of the Polonia Centre complex at Konwiktorska Street 6, including the construction of a multi-purpose sports hall and Sports Support Centre. Here, the private partner will be responsible for financing, construction and maintenance of the new infrastructure. The investment also provides for the modernisation of the stadium, including the renovation of the stands and supporting infrastructure.

A number of other projects are in the pipeline, including in the revitalisation area. These include the reconstruction of the Emilia furniture pavilion in a new location, the revitalisation of the Praga North area, including the city-owned part of Różyckiego Bazaar, the development of the Praski Park area, as well as the revitalisation and development of the Bema Fort area.

What market trends are influencing the selection of facilities and the concept of their development under PPPs?

Examples of initiatives such as the Targowa Creativity Centre, Hala Gwardii or Bema Fort, which is still in the preliminary concept phase, show that in the face of growing social needs, our city is moving towards creating spaces that are friendly and attractive for both residents and visitors. This is linked to our observations of consumer trends and residents' expectations of quality of life and the way they use urban space. Understanding these needs goes beyond the traditional list of administrative tasks and includes our aspirations to create a place where people want to live, work and spend time. Being residents of Warsaw ourselves, we, too, experience the benefits of such an approach. The basis of this process is the aim to increase the quality of life and offer such a cultural, entertainment and lifestyle offer that will distinguish Warsaw from other European metropolises.

Realising this vision requires bold decisions and investments that translate into long-term value for the entire community. An example of such an approach is the resignation from the sale of a valuable plot of land in the city centre in favour of creating a market hall that will give the city a unique character and meet the expectations of residents in terms of quality of life. We are therefore moving away from focusing solely on the commercial use of urban space to creating places that live and grow along with the needs of the community. Public-private partnerships are proving to be an excellent tool here, enabling projects that both enrich the city and provide quality living space for its residents.

WBJ.PL 31

NAVIGATING THE FUTURE WORKFORCE

Deloitte's latest Human Capital Trends report unveils critical challenges and opportunities in sustainable HR management, evolving productivity metrics, and fostering employee imagination, shaping the path forward for organizational success.

Unlocking Success: Insights from Deloitte's 2024 Human Capital Trends Report

According to Deloitte's 2024 Human Capital Trends report, organizations practicing sustainable human resource management nearly double their chances of reaching desired business objectives. However, less than one-fifth of leaders report using effective methods to gauge employee effectiveness amidst evolving work patterns. Another challenge is the lack of employee imagination regarding technological advancements. The twelfth Deloitte survey involved 14,000 HR leaders and management members from 95 countries, including Poland. This study uncovered trends in sustainable HR management, the development of new productivity metrics, and the need to stimulate employee imagination. Businesses addressing these issues are poised to significantly increase their likelihood of success.

32 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL

Workplace | Poland. Europe’s Future

Sustainable human resource management

Amidst dynamic societal and business shifts, employee/employer relationships are straining. Over half of respondents fear work stress's detrimental impact on mental health and nearly 30 percent worry about job losses due to technology. Moreover, only 43 percent feel their current situation surpasses their initial employment status, attributing improvements to employer actions. John Guziak, leader of Deloitte's Human Capital team in Poland, underscores the importance of prioritizing people over physical assets for business success. He emphasizes that interpersonal connections drive organizational value, urging a shift towards prioritizing employee well-being.

Deloitte's proposal for sustainable human resource management outlines how organizations generate value for employees on a human level, fostering better health, skill enhancement, career opportunities, appealing work environments, equality, and a stronger sense of belonging and purpose. This approach enables mutual enhancement of organizational finances and individual output. While more than three-quarters of respondents acknowledge its importance, less than half (46 percent) enact substantial changes, with only 10 percent effectively addressing the issue. There's a perception gap between management and employees, as 89 percent of leaders claim some commitment to sustainable development, contrasted with only 41 percent agreement from employees.

Beyond productivity

Work is reliant on collaboration and the utilization of intricate yet challenging-toassess skills. Consequently, conventional productivity measures like hours worked and task duration are losing efficacy. With these shifts, three-quarters of leaders recognize the necessity for crafting novel performance metrics. Regrettably, this awareness often fails to translate into action, with only 40 percent of respondents observing organizational efforts toward developing new criteria. Many firms still prioritize tracking actions and outputs over actual outcomes.

Seventeen percent of respondents assert that their organizations effectively measure employee-generated value. Meanwhile, access to productivity data has never been greater.

We are witnessing exponential growth in data collection capabilities. This is both an opportunity and a threat – "more" in terms of data does not necessarily mean "better," especially when the quantity exceeds analytical capabilities. Organizations should ask themselves what data they should collect, how to ensure quality and convert it into indicators for better decision-making. Business is gradually moving away from measuring for its own sake and moving towards in-depth analysis of human efficiency in various dimensions – says Zbigniew Łobocki, Senior Manager, Human Capital, Deloitte.

Just over half (53 percent) of respondents indicated that their organization is exploring improved methods to gauge productivity. Deloitte's analysis suggests that transitioning towards human-centric performance metrics requires organizations to: empower employees to voice their perspectives, strive for a balance between business outcomes and human considerations, and implement protocols addressing data privacy concerns. Trust plays a pivotal role in data gathering. While both employees and leaders acknowledge this, employees express less certainty regarding the responsible use of their data. Hence, effective communication regarding data collection purposes and practices, along with empowering employees to make decisions about data collection, is imperative.

Combatting the deficit in imagination

Rapid technological advancements surpass the capacity of many organizations and workers to envision innovative work methods that fully leverage both human capabilities and technology. Almost three-quarters of respondents emphasize the importance of aligning human imagination with technological progress. However, merely nine percent of organizations effectively address this aspect. Collaboration between humans and technology poses a novel challenge for businesses. Pioneering firms foster curiosity and

Unlocking success hinges on sustainable HR management, novel productivity metrics, and stimulating employee imagination

creativity among their employees. Encouraging experimentation with new tools and exploring how emerging technologies can enhance work processes, can expedite business outcomes. This dynamic will propel companies and their workforce towards a future driven by technological innovation, asserts John Guziak.

The rise of generative AI sheds light on the overlooked benefits of human abilities and the risks of neglecting their cultivation. Curiosity and creativity often remain underdeveloped. While employees express concerns about technology replacing them, they also anticipate that generative AI will boost creativity. According to Deloitte's research, 71 percent of executives intend to leverage generative AI to enhance employee capabilities. An illustrative example of leveraging technology to amplify human potential is the establishment of digital playgrounds. These safe environments foster play and exploration, not confined to a single space or virtual platform but rather embodying a mindset where technologies are deliberately selected, empowering employees to experiment, collaborate, and envision multiple potential futures fueled by new technologies. Despite the recognition of digital solutions' importance by 65 percent of respondents, only 41 percent of organizations are actively advancing in this domain. Furthermore, while 76 percent of employees believe it's vital for their organization to assist them in envisioning how their work might evolve in the future, only 43 percent report receiving such support from their employer.

WBJ.PL 33

“

13-14

June 2024

CEE Business Retreat 2024

Cavatina Holding transforms building purpose in WIMA Investment, Łódź

Cavatina Holding has decided to repurpose Building A in the WIMA Widzewska Manufaktura project in Łódź from offices to apartments. The development will combine loft residential spaces with service areas and green public spaces, including a revitalized 9,000 sq m park. The revised concept aims to offer a total of 750 apartments across three buildings, alongside ground-floor service areas such as dining. Apartments ranging from 26 to 77 sq m are already available for sale in Buildings B and C, with Building A set to offer a vibrant living space and patio. Cavatina prioritizes creating a resident-friendly environment while preserving historical heritage, says Daniel Draga, vice-president of Cavatina Holding. Resi Capital manages apartment sales for the project.

WBJ.PL 35 >>> LOKALE IMMOBILIA REAL ESTATE INDUSTRY NEWS (covering) Hospitality, Investment Market,Logistics , Mixed-use, Office, Residential, Retail Find more daily at wbj.pl/real-estate COMMERCIAL

Panattoni launches City Logistics Warsaw Airport IV

Panattoni is embarking on its most significant urban project in Warsaw with City Logistics Warsaw Airport IV near Chopin Airport. The development will encompass two halls, totaling over 45,000 sq m. The initial phase will deliver 10,700 sq m, already leased to a leading logistics operator. Positioned near key transport hubs and expressways S2, S7, S79, and S8, the location facilitates efficient distribution, particularly for last-mile logistics. Sustainable features will enable BREEAM Excellent certification. Michał Samborski, Panattoni's Head of Development, highlights its strategic position and sustainable initiatives.

New residential project, Orzechowa, underway in Warsaw's Włochy district

Construction has commenced on Orzechowa, a new housing development in Warsaw's Włochy district. GH Development, a Belgian developer, aims to deliver 114 apartments and seven commercial spaces to the market by early 2026. SPS Construction serves as the general contractor for the project. Located at ul. Orzechowa 3, the apartments will range from 25 to 82 sq m and feature underground parking. GH Development is also expanding its portfolio, planning over 2.1 thousand apartments in Warsaw and acquiring additional land for future projects.

RESIDENTIAL

Dekpol looks to increase volumes and margins, eyes Warsaw

Dekpol expects their development segment to grow and improve margins in coming years. They see less volatility in material costs and aim for 2024 revenue of PLN 400 million with 500 unit sales. Warsaw expansion includes premium apartments while other cities like Wrocław are targeted for typical housing projects. Their overall 2024 sales target is 650 units across various agreements.

RESIDENTIAL

Poland’s

apartment market sees uptick in January 2024

In January 2024, Poland saw a significant uptick in the sale of new apartments, with a 62% increase compared to the previous year, totaling 4.5 thousand units. Developers responded by introducing 5.3 thousand units to the market, a 42% rise from December. Notably, the inventory reached its highest level in nine months, with 40.7 thousand units available by the end of January. Wrocław, Warsaw, and Łódź accounted for the majority of new listings. The lengthening sales time hints at a better situation for buyers, especially in Łódź and Katowice, compared to more challenging markets like Warsaw, Kraków, and Wrocław, where prices continue to rise.

36 FEBRUARY - MARCH 2024 WARSAW BUSINESS JOURNAL LOKALE IMMOBILIA NEWS

INVESTMENT

PRESS MATERIAL (4)

RESIDENTIAL

INDUSTRIAL AND TRADE

Tricity emerges as a prime investment destination in Poland

Tricity earns a remarkable rating of 8/10 in the Business Environment Assessment Study, with 18% of respondents eyeing it for investments from 2023-2025. Notably, the region sees a diverse influx of investors, ranging from IT to shared services centers and engineering projects.

Businesses acknowledge Tricity's potential, with a 7.4/10 rating for employing specialists and managers. An impressive 75% anticipate increased employment levels, particularly in the industrial and trade sectors.

COMMERCIAL

Primark expands footprint in Poland

Primark unveils plans for its seventh Polish outlet, situated in Zielone Arkady Bydgoszcz shopping center, marking its first presence in northern Poland. The 3.2 thousand square meter store will offer a wide range of clothing, cosmetics, and home furnishings, slated to open between September 2024 and September 2025.

Maciej Podwojski, head of sales CEE at Primark, reveals ambitious expansion goals, aiming for 16 stores across six CEE countries by 2025. Additionally, the chain eyes new locations in Prague, Budapest, and Timisoara, further solidifying its presence in Central and Eastern Europe.

WBJ.PL 37 LOKALE IMMOBILIA NEWS

CEE & SEE SUMMIT IN LONDON

(by Entralon Club, hosted by EBRD, 6-7 Feb)

As the real estate market grapples with uncertainties from 2023, including looming refinancing and post-pandemic shifts, investors eye potential amid inflation spikes and global market divergences. ESG integration, logistics resilience, and office space evolution dominate discussions, while AI's transformative potential and urban regeneration projects offer glimpses of future trends. In the CEE market, investors navigate risks and rewards amidst changing landscapes and investment strategies.

By Svetlana Bagheri (Fedosova)

Keynote: Economic Outlook 2024

With 2023 being notably tough, the outlook for 2024 reflects the challenges of the preceding year and presents increasing difficulties. A looming refinancing cloud adds to uncertainties, while people reconsider how real estate is used post-pandemic. Key considerations include bond market volatility and asset repricing, with an overall moderately positive outlook expected as inflation, though spiked, is projected to decline, potentially opening the door for interest rate cuts by central banks, slated to commence in the first half of 2024.

Global contrasts between investment and occupier markets emerge, with capital values decreasing while rents rise, presenting buying opportunities. However, challenges persist, with rising office vacancy rates and a sharp decline in construction activity. Occupiers prioritize spaces that enhance productivity, brand, and employee well-being, underlining a shift towards collaborative and flexible environments.