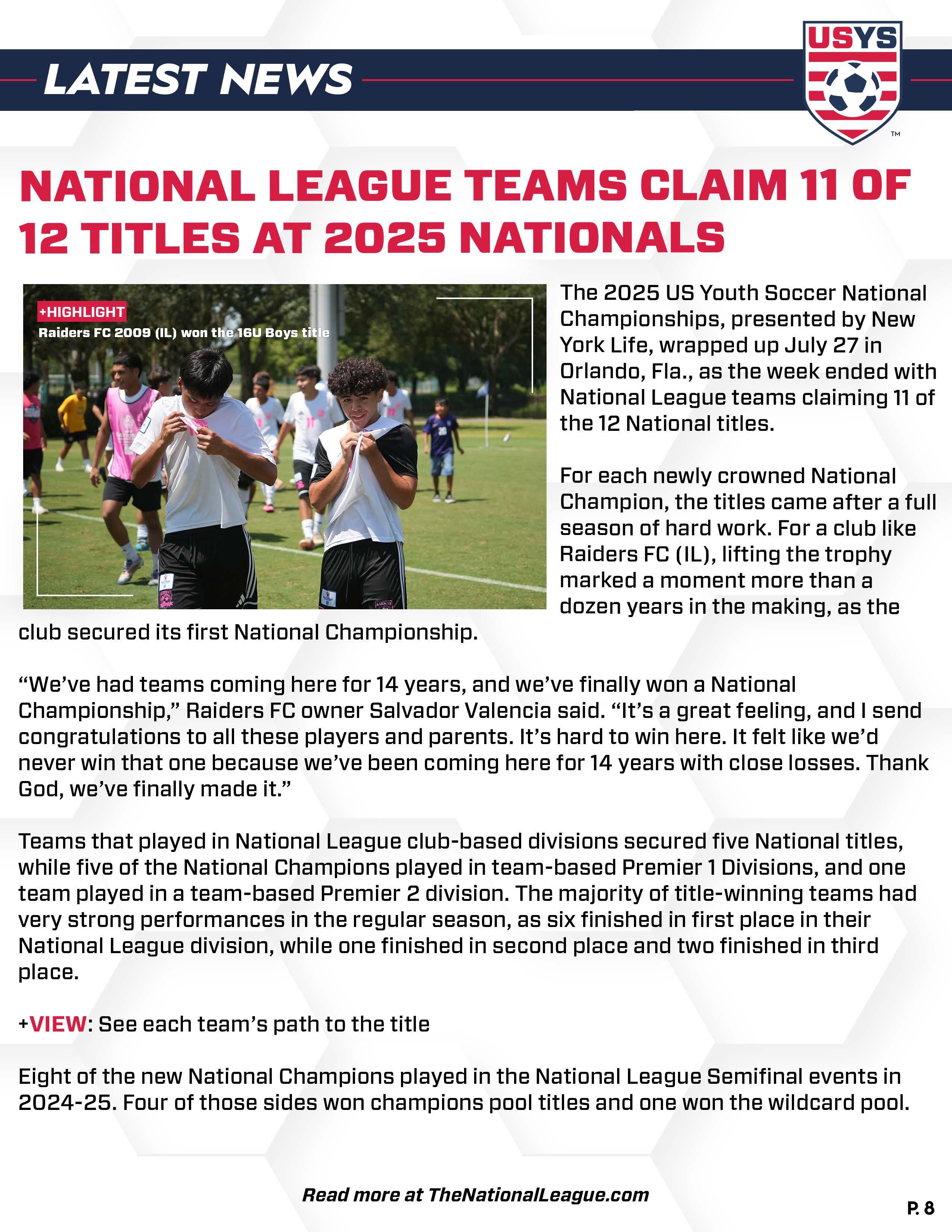

GRILLAandUSYouthSoccer

andhealthychoicesmadethem anobviouschoiceasahydrationpartnertoworkwithour

andhealthychoicesmadethem anobviouschoiceasahydrationpartnertoworkwithour

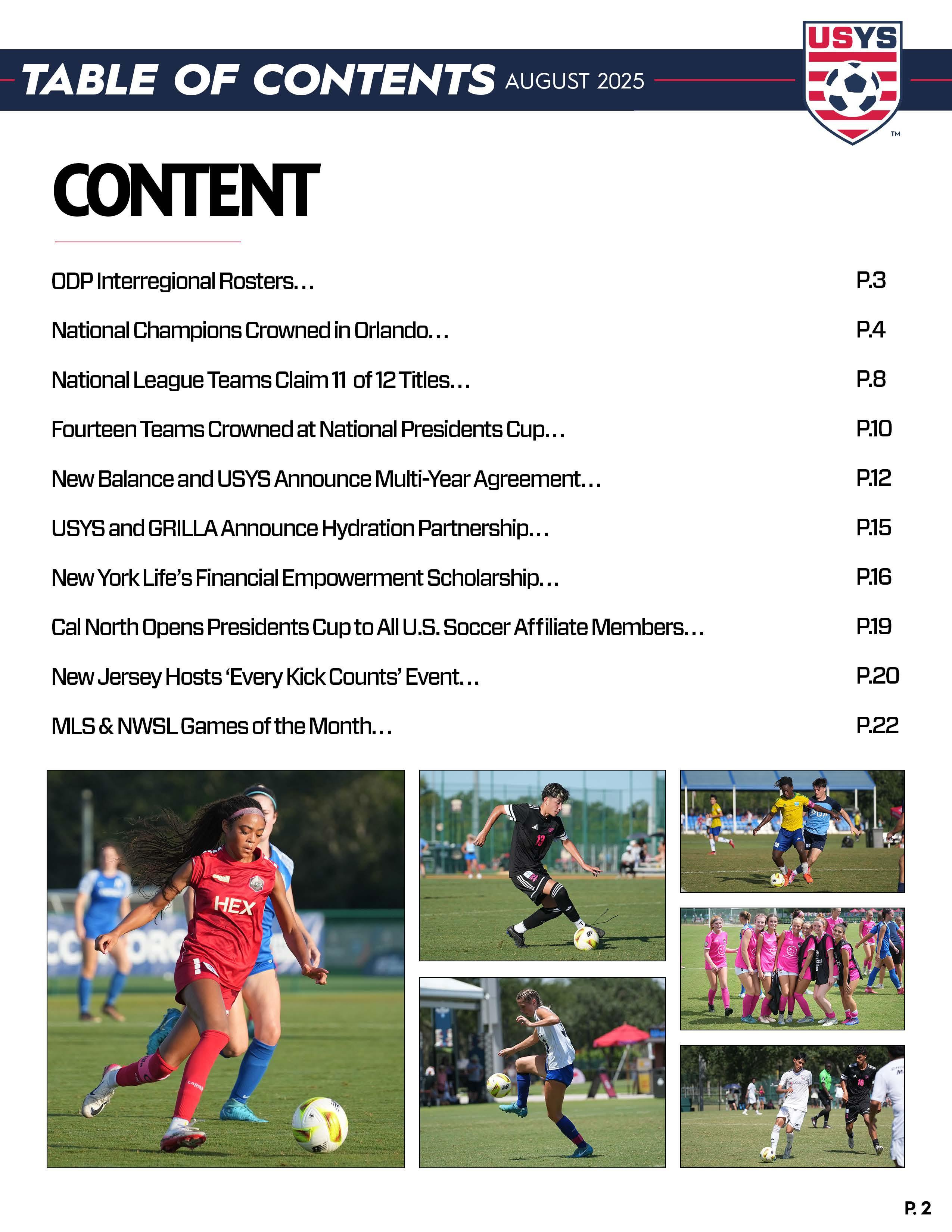

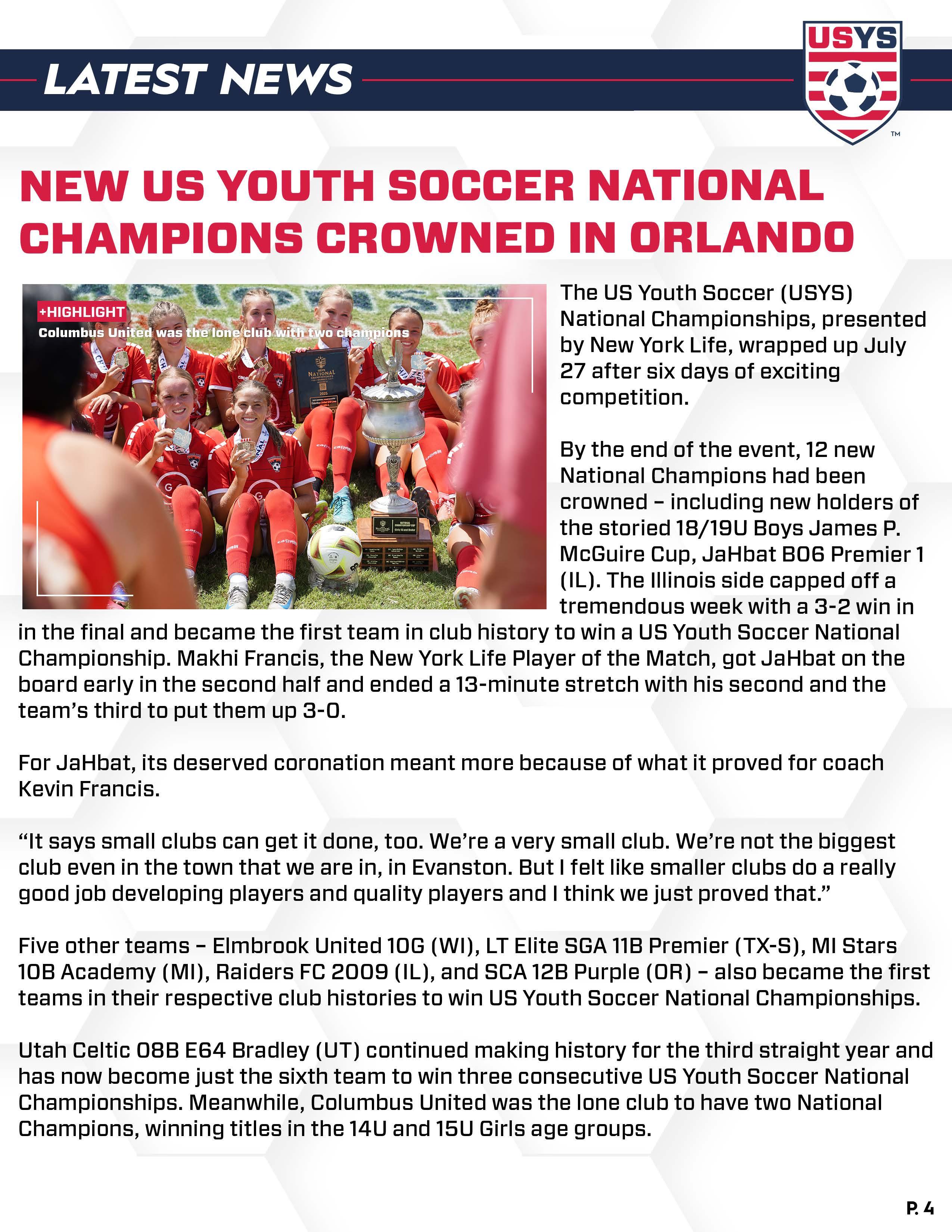

You’ve probably got a lot going on right now.

There’s the time and money you’re putting into your children’s youth sports activities. There’s saving for their college education, which gets more expensive with each passing year. You might also have aging parents who need caregiving support. And of course, there’s your own financial goals, including saving for retirement.

It’s no wonder that the parents in this situation—caring for both their children and their parents, while also trying to contribute to their own financial future— are sometimes dubbed the “Sandwich Generation.” So if you’re feeling sandwiched yourself, what are some strategies that can help you manage all of these priorities?

A recent New York Life survey found the average parent spends around $900 per season on a child’s primary sport, and that 21% of parents spend over $5,000

annually on youth sports across all their children¹. If you find your sports spending ballooning out of control, consider which expenses are truly necessary and which are luxuries. And as your child gets older, consider prioritizing one or two sports rather than paying for them to play sports in every season.

You know those airline safety routines that tell you to put on your own oxygen mask before helping others? It might go against your instincts as a parent, but it’s a good approach to take with your finances, too. For instance, consider the decision of whether to prioritize contributing to your child’s college fund or to your own retirement. While there’s a range of factors that go into that decision, keep in mind that there are many ways to manage the costs of college, from financial aid to

1 Methodology: This survey was conducted between March 1 – 6, 2025 among a sample of 1036 parents with children aged 7 – 18 who participate in youth sports. The interviews were conducted online. Results from the full survey have a margin of error of plus or minus 3 percentage points.

Whether you’re worried about your parents’ care needs or looking ahead to your own, it’s important to understand what might be needed and how you’ll pay for it. The U.S. Government estimates² that 70% of people turning 65 will eventually need some form of assistance with activities of daily living, and unfortunately Medicare typically does not cover long-term care expenses (outside of limited nursing home stays). It’s important to fit potential long-term care needs into your financial plan, and consider your options for paying for them—whether that’s through insurance solutions or out-of-pocket.

2 “How Much Care Will You Need?,” U.S. Administration for Community Living, February, 2020.

View scholarship details » student loans to private scholarships. By contrast, they don’t give out financial aid and scholarships to retirees who are short on cash. Work with a financial professional to figure out how much you need to save for retirement every month, and treat that as a non-negotiable budget item.

Rising high school seniors and recent high school graduates who take courses on personal finance fundamentals can earn a chance to be awarded up to $20,000 in scholarship money to put toward their education.

Try to take the pressure off yourself to do it all. A bit of planning and prioritization can go a long way in keeping those balls in the air.