PUT RISK IN YOUR FUTURE.

MAJOR IN RISK MANAGEMENT AND INSURANCE

WE ARE EDUCATING THE NEXT GENERATION OF RISK PROFESSIONALS. JOIN US AND PUT RISK IN YOUR FUTURE!

”

- Randy Dumm, PhD Director of The Baldwin Group School of Risk Management and Insurance

“

A DISCOVERY GUIDE

Contact: Professor Dumm rdumm@usf.edu (941) 359-4245 LinkedIn: The Baldwin Group School of Risk Management and Insurance WE ARE HERE TO HELP. When you are ready to put risk in your future and create your “RMI advantage,” please reach out to The Baldwin Group School of Risk Management and Insurance: usf.to/rmi

TO RISK-RELATED CAREER PATHS Risk Management and Insurance 4-6 Accounting 7 Business Analytics and Information Systems 7 Finance 8 Global Business 8 Information Assurance and Cybersecurity Management 9 Management 9 Marketing 10 Supply Chain Management 10 PROGRAMS OF STUDY

DISCOVER THE RMI ADVANTAGE.

Stand out from the crowd with a degree in Risk Management and Insurance (RMI) from the University of South Florida. Pursuing a major in RMI provides you with the risk-centric skills necessary for a successful career as a risk professional. Minoring in RMI also adds a valuable risk dimension to your current field of study.

• Gain a competitive edge in your career with a degree in RMI.

• Get equipped with a unique skill set that opens accelerated opportunities for RMI majors and expands career possibilities for RMI minors.

• Engage with experienced faculty and risk professionals who are committed to your success.

• Find the career path where opportunities are robust with high demand for qualified individuals and unrivaled compensation.

• And enjoy what you do! As a risk professional, you are a problem solver. You help to address risk faced by individuals and businesses. You play a critical role in protecting people, businesses and communities.

4

If you choose RMI as your major or minor at USF, here is an overview of the courses that the school offers:

Principles of Insurance

Principles of Risk Management

Enterprise Risk Management

Risk and Insurance Data

Analytics

Property and Casualty

Insurance Products

Insurer Operations

Life and Health Insurance

Products

Retirement Planning and Employee Benefits

Natural Disasters and Community Recovery

MAJOR IN RISK MANAGEMENT AND INSURANCE

GAMMA IOTA SIGMA

Join Gamma lota Sigma, a fast-rising student-led organization focused on your development and growth as an emerging risk professional.

Gamma Iota Sigma, the Delta Beta chapter at USF, is a professional student organization dedicated to promoting and sustaining student interest in careers in insurance, risk management and actuarial science through teamwork, integrity, excellence, diversity and service.

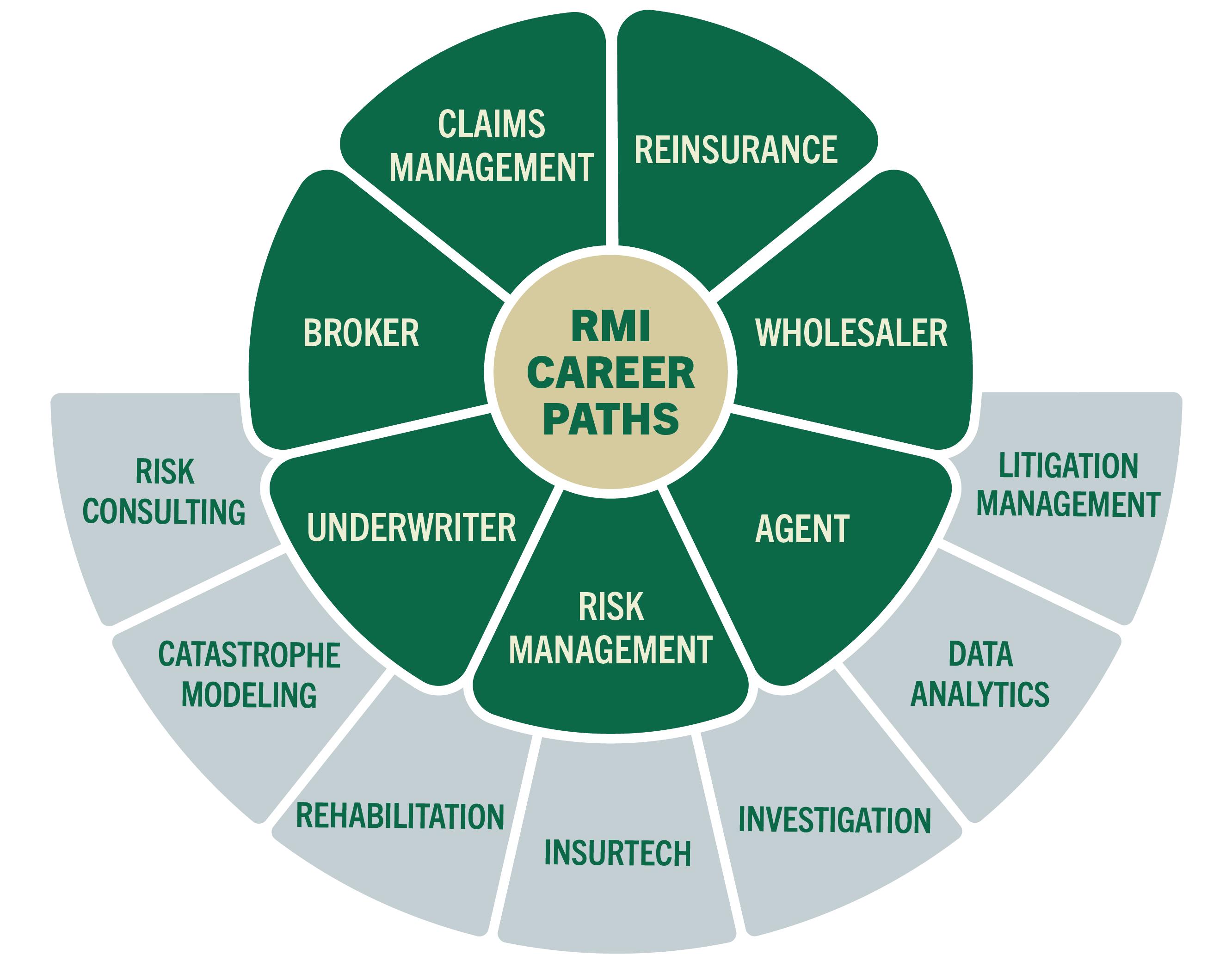

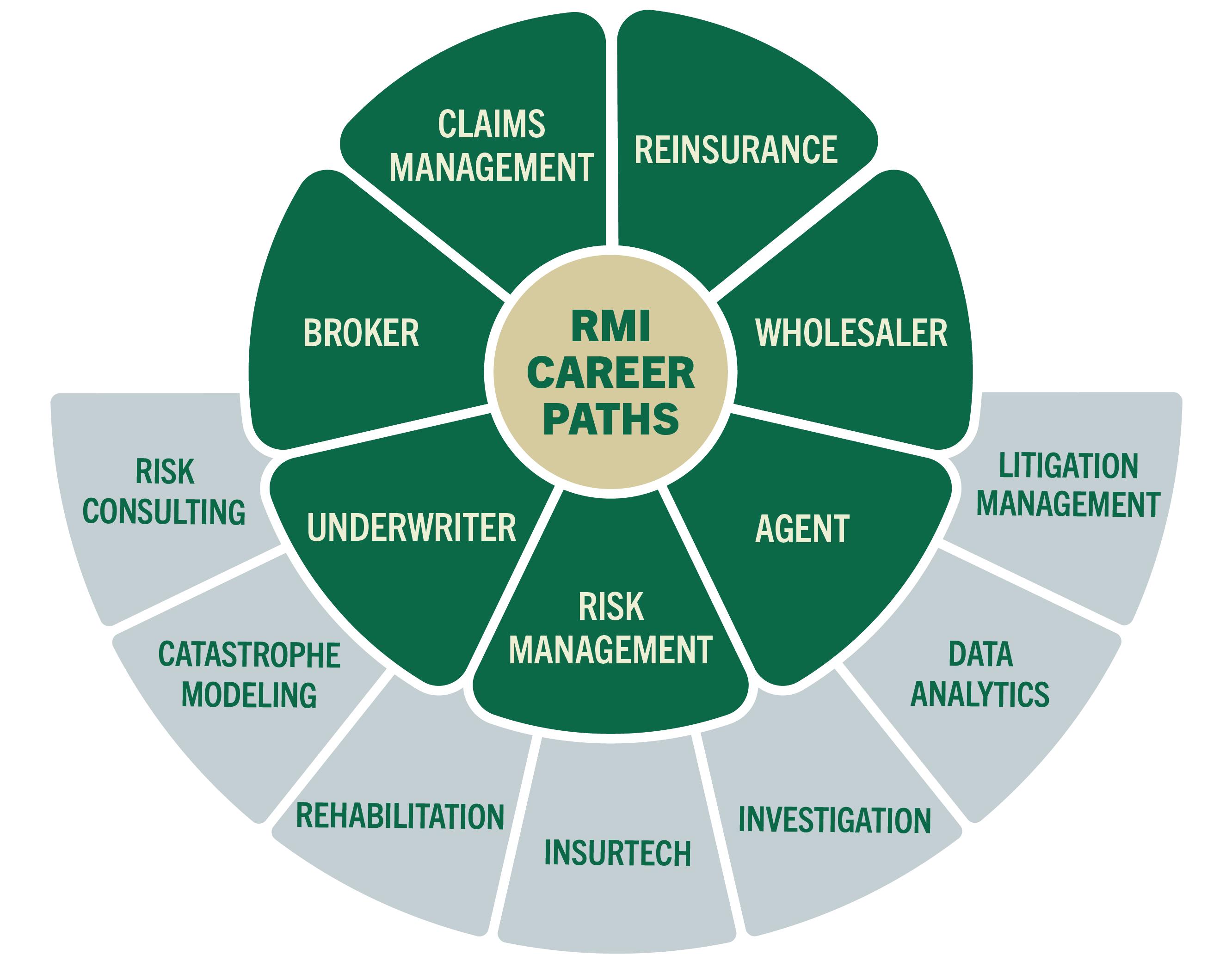

CAREER PATHS WITH AN RMI DEGREE

If you major or minor in RMI at USF, there are a variety of career paths to choose from, including core career pathways and specialized careers.

CORECAREERS SPECIALIZEDCAREERS

USE THIS GUIDE TO CONNECT YOUR CURRENT MAJOR TO AN RMI CAREER.

Numerous educational pathways can pave the way to a promising career in risk management and insurance. USF’s Muma College of Business offers an array of programs that play a crucial role in the thriving insurance and risk job market. If you choose to pursue these programs of study, this guide can help you find specific roles within the risk and insurance job sector that might pique your interest. Earning an RMI degree can provide immediate access to the roles listed in the guide. An RMI minor can support your major and expand your career opportunities by providing the framework for managing risk more broadly. Even without an RMI major or minor, there are still potential career opportunities within your area of study.

6

ACCOUNTING

Your background provides you with a strong foundation of financial knowledge and analytical skills that can be beneficial in this field. Your accounting knowledge will provide you with the necessary skills to analyze financial data, identify control weaknesses and make recommendations for improvement — all important skills to have as a risk professional. You will be valuable in evaluating financial risks, managing insurance policies and analyzing the financial implications of risk management decisions. Your interpretation of financial regulations and ensuring financial compliance will be very useful.

BUSINESS ANALYTICS AND INFORMATION SYSTEMS

Your background will be valuable in analyzing and interpreting data related to insurance claims, underwriting and market trends. Your area of expertise will make you well-equipped to excel in this field by helping with data analysis, statistical modeling and interpretation, risk assessment, predictive analytics, automation, AI and technology and information systems. You will be essential in identifying potential vulnerabilities and developing risk mitigation strategies specific to the insurance industry.

7

FINANCE

Your background will be valuable in understanding the financial aspects of insurance policies and assisting clients in making informed decisions.

Your strong analytical and risk assessment skills and modeling techniques will be essential to data interpretation, assessing and analyzing various risks to make informed decisions about insurance coverage, risk mitigation strategies and pricing. You will be able to effectively manage portfolio investment risks effectively.

GLOBAL BUSINESS

Your background provides a well-rounded foundation that includes knowledge of international markets, cultural awareness, regulatory understanding and skills in risk analysis and management — all of which are highly relevant to a successful career in RMI, particularly in a global context. Your understanding of global markets is valuable in RMI as it allows professionals to assess and mitigate risks associated with global economic trends, currency fluctuations and geopolitical events.

8

INFORMATION ASSURANCE AND CYBERSECURITY MANAGEMENT

Your background equips you with the technical knowledge, analytical skills, and strategic thinking needed for a successful career in RMI, especially in the context of emerging cyber threats.

Your knowledge will help you understand the various threats and vulnerabilities to assess the potential impact on businesses and their assets. It will also help you provide valuable guidance and recommendations to clients on how to improve their security measures, develop incident response plans and implement risk mitigation strategies.

MANAGEMENT

Your background knowledge will help you grasp the complexities of risk management and insurance within the context of an organization’s overall goals and objectives.

Your analytical skills will be valuable when evaluating financial, operational, or legal risks and implementing appropriate risk management strategies. Your ability to think critically, anticipate potential risks and design comprehensive risk management plans will be enhanced by your background in business management.

9

MARKETING

Your background helps you understand customer behavior, market dynamics and preferences. This skill is transferable to risk management, where understanding the needs and concerns of clients is essential. Knowing how to tailor insurance solutions to meet the specific needs of different clients can set you apart. Your creative problem-solving and thinking outside the box is beneficial where assessing and mitigating risks sometimes requires innovative solutions.

Your analytical, creativity and communication skills, along with a broad business perspective, can be useful in understanding the broader economic and market factors that can impact risk and insurance considerations.

SUPPLY CHAIN MANAGEMENT

Your background equips you with a diverse skill set that is highly relevant to the challenges faced in risk management and insurance. It provides a solid foundation for understanding and managing various types of risks, making you an asset in the insurance industry.

Your knowledge in supply chain management is crucial when assessing and mitigating risks in the context of insurance. It allows you to identify potential vulnerabilities and design risk management strategies that are specific to the intricacies of supply chain operations. Your critical thinking and problem-solving skills are valuable in risk management, where you must assess complex situations and develop effective strategies to mitigate potential risks.

10

RISK ADVISORY COUNCIL

USF’s Risk Advisory Council is an engaged group of industry professionals who bring experience, expertise and commitment to our students and program.

#PutRiskInYourFuture 11

#PutRiskInYourFuture 12