Buying Centers Boost Profits for Independents

By Jeffrey Bellant

Acquiring inventory remains a key to an independent dealer’s success because – as the saying goes – you make your money when you buy the car.

Dealers have always sought out various sources of vehicles, from auctions and wholesalers to franchise dealers and private sellers.

Buying off the street has become a key source of inventory for two successful Midwest dealers – Chris Haus and Otto Hahne.

Chris Haus, owner of Haus Auto Sales in Canfield, Ohio is a thirdgeneration dealer and 2018 Ohio Quality Dealer of the Year.

“I’ve been working the dealership my whole life,” he said. “I’m 36 and I started when I was 13.”

Otto Hahne, 2019 National Quality Dealer of the Year, owns City of Cars in Troy, Mich. and has his son, Evan running a buying center just down the road from the dealership.

Both dealers advertise they buy cars and both use leads from Kelley Blue Book Buying Center, where customers looking to sell cars get an offer online and a push to participating dealers in their area.

Haus started using KBB right before COVID.

“We didn’t think it was going to be as lucrative as it was,” he said. “But as soon as COVID hit, cars started going through the roof so people started selling their cars.”

Haus realized that he had to do something different with his marketing.

“So we took some of our inventory spend and decided to advertise that we buy cars,” he said.

He bought “We Buy Cars” billboards all over town.

“We kind of became the place to go to make sure you were getting enough if you were trading in at a new car store,” Haus said. “During COVID, I bet we were buying 600 to 700 cars off the street. Now we’re down to about 400.”

COVID changed how City of Cars does business as well.

Otto’s son, Evan, is general man-

ager of the City of Cars Buying Center, which is coming up on its third year.

Prior to COVID, City of Cars made many of its acquisitions from Canadian auctions and dealers, with Evan trekking across to the Great White North three times a week.

“We knew we needed to do more, because post-COVID a lot of Cana-

dian stuff slowed down for us,” Evan said. “Both because we couldn’t go over there and the currency fluctuation. Plus the leases were drying up, so we needed to get more inventory.”

They decided to use the tools available – both KBB and a similar program from CarGurus.

Continued on page 6

Two-Day Auction and Wednesday Evening Party & Concert

JULY 16th & 17th

Used Car News

By Jeffrey Bellant

BIRMINGHAM, Mich. – Tesla

dominated the Cars.com AmericanMade Index (AMI), with four models sitting atop the list of 99 vehicles.

Patrick Masterson, AMI lead researcher, and David Greene, principal industry analyst, unveiled the results of the 20th year of the report at an event held this month by the Automotive Press Association.

The Tesla Model 3 topped the list, followed by the Tesla Model Y, the Tesla Model S and Tesla Model X. The Jeep Gladiator closed out the top five vehicles.

Only two other vehicles from American automakers made the top 20; the Jeep Wrangler at No. 13 and the Chevrolet Colorado at No. 19.

“For those of you who have been following the American-Made Index in recent years, this won’t come as a huge surprise,” Masterson said.

“Tesla has had a prominent presence on the Index, especially at the top for the last few years.

“But the Model 3 is a little bit of a surprise to me, actually.”

Last year it was No. 4. The primary change was the domestic parts content percentage in the Model 3 – on the whole – was much higher this year. The overall percentage was 75%.

“The Jeep Gladiator made a huge leap,” Masterson said. “The Kia EV6 (at No. 6) brand new this year. It was really low last year.”

Masterson pointed out that Honda had the Ridgeline, Odyssey, Passport, Pilot, and Accord all making the top 15.

The Ridgeline and Passport are regulars on the list, Masterson said.

The vehicle that made the biggest jump this year was the Toyota Corolla Cross Hybrid which went from No. 66 in 2024 to No. 18 this year.

The biggest drop on the list was Toyota RAV4 Hybrid which fell to No. 99 this year compared to No. 65 last year.

Nine vehicles were new to the 2025 list. The Kia EV6 and the Kia EV9 made the list after their assembly locations moved from South Korea to West Point, Ga.

The Hyundai Ioniq 5 final assembly also moved from South Korea to Georgia – the Hyundai Motor Group Metaplant America in Ellabell, Ga.

Other new vehicles on the list made it because they reached the minimum threshold of 2,000 vehicles. Those included the BMW X5

50e, the BMW X6, the Ford Ranger and the Mercedes-Benz GLE450e. Also making the list were the re-introduced Honda Civic Hybrid, and the all-new Mazda CX-50 Hybrid.

“The whole point of (the index) is to see the economic impact of these vehicles,” Masterson said. “It’s a way to show shoppers how close does the money stay to where you live in the country.”

The site of the final assembly is

vital to make the list. If the car isn’t finished in the U.S. the car doesn’t qualify for the list, Masterson said.

Vehicles built and bought in the U.S. for the 2025 model year were weighted on five key factors on a 100-point scale: percentage of U.S. and Canadian parts; location of final assembly; country of origin for available engines; U.S. manufacturing workforce; and country of origin for available transmissions.

The list showed that international

automakers make up 67% of vehicles on the list. It’s been rising slowly since 2020.

“That’s one of the reasons we do this Index because not everyone’s aware that what the badge is on the hood, doesn’t necessarily correlate to where it’s made,” Masterson said. “This is good way to illustrate that.”

The share of domestic automakers has been pretty consistent, generally between 32% and 35%, Masterson

8

News Briefs

Buckeye Dealership Consulting Rebrands

Buckeye Risk Services is the new name of Buckeye Dealership Consulting. The new name signals the company’s evolution from a consulting firm to a full-spectrum organization specializing in risk assessment coupled with customized solutions.

The rebrand unifies Buckeye’s expanding portfolio of services, internal teams, and acquired entities under a single identity.

It follows the company’s 2023 acquisition of Berkshire Risk Services.

The firm is a longtime partner and respected provider of insurance tracking and Collateral Protection Insurance (CPI) solutions for Buy Here-Pay Here (BHPH) dealers and other automotive, trucking and equipment financiers.

“This new name better reflects who we are and where we’re headed,” said Rob Fox, CEO of Buckeye Risk Services. “We’ve outgrown the consulting label. Today, we’re helping clients across automotive, fleet,

and financial markets account for risk, grow revenue, and build longterm wealth.”

Buckeye’s transformation has been underway for several years.

In 2020, it acquired Truck Master Warranty, expanding its offerings into commercial vehicle service contracts tailored for independent truck dealerships and fleet operators—a niche often underserved by national providers.

The company later acquired SAS (Specialty Administrative Services), a third-party administrator with experience in claims management, compliance, and warranty processing.

These moves enabled Buckeye to integrate key F&I and reinsurance operations vertically, enhancing both service delivery and profitability for clients.

“These strategic acquisitions strengthened our ability to support clients with turnkey F&I programs and customizable reinsurance models,” Fox added.

“It’s about meeting our customers

where they are and guiding them forward, with the legal, operational, and financial support to scale effectively.”

Founded as a reinsurance consultancy for independent automobile dealers, Buckeye now supports both franchise and independent dealers, subprime lenders, and fleet-focused businesses.

Senior leadership and key staffing additions over the past 18 months have further accelerated the company’s growth. Its team includes insurance professionals, attorneys, and CPAs focused on helping clients maximize compliance, profitability, and long-term growth.

Despite broadening its reach, Fox said Buckeye remains deeply committed to the BHPH segment.

“That market built us,' he said. “It’s still our golden goose. Everything we develop—from CPI to warranty products to digital tools— is designed with BHPH in mind, even as it unlocks opportunities across other verticals.”

Buckeye Risk Services is also investing in infrastructure, automation, and digital transformation to improve client service and scalability.

The company is positioning itself for additional expansion through potential acquisitions and strategic partnerships in the coming year.

“While the name has changed, our mission hasn’t,” said Fox.

“We’re here to help our clients win—with better tools, better support, and a brand that reflects the strength of everything we’ve built.”

State News

6/23/2025

Association Lobbies Against New Taxes, Fees for Auto Sales

By Jeffrey Bellant

Oregon lawmakers at press time were considering legislation that would raise taxes on new and used vehicle sales, along with raising additional fees and taxes.

The Oregon Vehicle Dealer Association (OVDA) is urging its members to contact lawmakers to express opposition to the legislation.

The proposed package is titled the Oregon Transportation Reinvestment Package (TRIP), filed as House Bill 2025.

It increases the Dealer Certification fee from $1,100 to $2,044, according to the OVDA.

It doubles the current Dealer Privilege Tax of .005%. It is a tax for “the privilege of selling vehicles in Oregon.”

It creates two new separate vehicle sales taxes: 2% for new vehicle sales, 1% for used vehicle sales.

The whole Transportation Reinvestment Act increases taxes and fees by more than a billion dollars a year, OVDA has stated.

Darrell W. Fuller, OVDA’s veteran lobbyist, testified before the Joint Committee on Transportation Reinvestment on June 10.

He informed the committee that OVDA is “Oregon’s largest association representing all DMV certified motor vehicle dealers, with approximately 500 dues paying members. Our members include franchised and independent dealers, boat and trailer dealers, RV dealers, powersports dealers and motorcycle dealers.”

Fuller’s written comments stated the trade group opposes the dealer privilege and use taxes.

“Moreover, OVDA objects to the proceeds from the privilege and use tax increases being exclusively diverted to encourage use of rail ser-

vice in Oregon. This is akin to taxing beef to encourage people to eat more chicken. It lacks a sense of fairness,” his comments read.

Fuller added that OVDA opposes nearly doubling the certification fee to sell vehicles in Oregon.

“The certification fee has not changed in many years, and an increase is due,” he stated.

“However, this fee is too steep with no on-ramp. With this dramatic increase, we suggest DMV be required to allow dealers to pay their certification fee in payments, much like property taxes.

“When DMV Business Regulation fines an uncertified dealer, the uncertified dealer is allowed to make payment arrangements to extinguish the penalty over time. But a dealer is not offered this opportunity to be certified. This lacks common sense.

“Please don’t force dealers to

move from a certified business to an uncertified business just to stay in business.”

Fuller stated OVDA’s opposition to the proposed sales taxes on vehicles. He also noted the bill is silent on whether the sales taxes are applied before, or after, the value of a traded in vehicle is calculated into the price of the vehicle.

He urged lawmakers that any “future drafts of the bill clearly state whether the tax applies to the cost of the vehicle before or after the value of a traded in vehicle is considered. OVDA believes the tax should apply to the price of the vehicle after it is reduced by the value of a traded in vehicle.”

OVDA has sent notices to its members urging them to reach out to their lawmakers to comment.

Oregon’s legislative session will end no later than June 29 this year.

Vehicles priced to sell

Used Car News

Buying

– Continued from page 1

Also, they had an opportunity to acquire a building just a block from the dealership, near an auto mall.

The separate building has “WE BUY CARS” displayed across the office windows which draws attention.

“If anything, it’s really helped us with the foot traffic, with people just driving by,” Evan said. “A good amount of the cars we buy are just customers who saw our sign while driving by.”

Evan and Otto said when they first opened the new building, they were acquiring 10 to 15 a month.

“I think last month we did close to 50,” Evan said. “If it’s a walk in (we close) almost 50% of the time.”

Most of the leads that don’t close is because City of Cars is being picky: bad title, higher mileage, etc.

“We’re getting a lot of organic (acquisitions) too,” Haus said. “We’re buying 30 to 40 a month.”

Haus also pays sales reps to buy cars, as well as to sell them.

Evan’s staff includes two buyers and a third employee who takes the photos and does other work.

Evan said customers also like that it’s just a buying center and they are not being pushed into buying a car.

Despite that, some acquisitions do lead to future sales, just as the buyers chat with the sellers.

“‘Oh, you’re looking for a Bronco? That’s so crazy, I just took one in three days ago,’ they will say. “If you want to see it, our retail spot is right down the road.”

Buying cars off the street makes good business sense.

“Your margins are just better,” Haus said.

Also, it draws new customers.

“Keep in mind, if I’m buying 70 cars a month, I’m probably going through a couple of hundred people,” Haus said, “and if I’m selling 40 cars a month, I’m probably going through a couple of hundred people.

“That means I’ve doubled the foot traffic coming into my dealership.

“So people have come in here that would have never come in here before.”

Since Haus has a fixed ops business, people coming in notice that he has a service shop.

“I figure, any traffic is good traf -

fic,” Haus said.

It’s the same with City of Cars.

“To be an independent in this space has given us a great advantage,” Otto said. “Our acquisition cost is much cheaper with this business model and we get to see the cars, test the cars and drive the cars much better than we can at auction, which I really like.”

Evan has a cement pad out in front of the center to park a new acquisition and take photos in front of the building for a consistent background.

Photos are uploaded and the vehicle goes to the dealership for sale.

Now, 60% of Evan’s acquisitions are from private sellers.

Haus and Evan have also learned more about the acquisition process.

“Now I pick and choose a little bit more,” he said. “Honestly, sometimes I would just pay to have the car, but it doesn’t pay to do that all the time.”

The other thing he learned is to do a more thorough inspection.

Evan said the biggest battle they have is with buyers like Carvana.

“Their market adjustment is so crazy sometimes,” he said.

But once Evan or his buyers get a customer in the center, even that can be overcome and they can close the deal most of the time.

Also, City of Cars Buying Center can get an acquisition done in 15 minutes and they write their own checks, which is a major attraction for sellers.

“That’s huge for customers,” Otto said. “We get compliments all the time because other dealers will say, ‘We can’t give you a check right now, can you come back?’” Evan is being extra careful.

“If it’s 100,000 miles, then we really put eyes on the car. If it’s 150,000 then it would have to be really exceptional.”

City of Cars is active in the community and supports Detroit Dog Rescue.

Both Haus and Otto Hahne have another thing in common, they both are training the next generation of used car guys.

“My son is 11 and he’s done all of our commercials since he was 5,” Haus said.

Hahne has his grandson, Brooks, 9, helping wherever he can.

Used Car News

American-Made – Continued from page 3

said.

“The most significant presence on the list is General Motors –15% of the index,” Masterson said. “Toyota is typically close behind. Honda also has a significant presence on the list and Ford, too.”

The least American-made vehicles included the Ford Maverick and Bronco Sport and Mustang Mach-E made in Mexico.

The GMC Sierra 1500 is split between the U.S. and Mexico and the Chevrolet is split between the U.S., Mexico and Canada.

Regionally, the South has seen a 17% increase in vehicles assembled there, though the Midwest still has a strong presence, with plants in Kansas City and Sterling Heights, Mich.

The Buick Encore Gx and the Buick Envista are assembled in South Korea.

The West made the list simply

because of Tesla, Masterson said.

The report shows that Alabama has the most vehicles assembled on the list by state, with Michigan also near the top.

Cars.com analyzed 173,000 cars in the site’s inventory and through approximately 450 in-person dealer visits.

Greene kicked off the event discussing the issue of tariffs, saying that they aren’t something new.

“Prior to 2025, there were tariffs,” he said. “They still existed. There was already a 2.5% tax on autos and the ‘chicken tax,’ everybody knows, was a 25% tax on (imported) pickups. There were tariffs on steel and aluminum already.

“And for China there was 25% tariff on all autos and a 100% tariff on EVs.”

The new tariffs added this year included some that closed loop -

holes or fixed things.

The new tariff that affects autos is the 50% tariff on aluminum, which was the first increase on tariffs. There has been some relief with new ways that some parts and materials get exempted.

Greene pointed out that with 60% of new vehicles priced below $50,000 and 58% of them being imports, they are the most vulnerable to price increases.

Vehicles under $30,000 are at the most at risk of being affected by price, according to Cars.com.

“Certainly the lowest priced inventory is the most vulnerable to tariffs because that’s going to push that price up for shoppers that are most sensitive to price,” Greene said.

Cars.com’s report showed that of the new car prices by country of final assembly, the U.S. has the highest average price at $53,000.

6/23/2025

Mexican-built vehicles are the least expensive at $42,000, though prices have gone up another $300 since the report was written, Greene said.

One key figure when it comes to tariffs that affect the auto industry is 5.4 million – the number of Americans who work in the auto industry. That incudes over 1.3 million who work at new-and used-car dealerships, 387,000 wholesalers and other areas.

A cars.com survey included in the report showed 52% of car shoppers are buying earlier to avoid tariff increases.

The survey showed 51% of consumers said they would be more likely to buy an American-made vehicle because of the tariffs.

It also revealed that 55% of inmarket car shoppers said they would be willing to pay more for a vehicle if it creates more U.S. jobs.

Let Auto Assign do the heavy lifting, automatically routing vehicles to the best-fit auctions based on your custom rules. Faster decisions. Better results.

Retail Markets

6/23/2025

OHIO

George Shehadeh, owner, West 40 Auto Sales, Cambridge, Ohio.

“We have over 24 years of dedicated service at this same location.

“We shortened our hours after COVID. We found out ‘you know what, quit trying to work yourself to death and the customers will come when you are available.’ Even before COVID we were doing more stuff online, but even more so afterwards. Most of our customers are dealing with us online before they come in in-person.

“We like to keep 55-60 cars in inventory but we seem to be only able to do 45-50. Our goal is to sell 30 every month, sometimes we beat it, sometimes we don’t.

“We specialize in buy-here pay-here financing. We are passionate about helping customers who have faced

credit challenges in the past.

“Everyone who comes in wants a truck but they can’t all buy a truck. So, what happens is that a lot of the people who say they want a truck end up buying an SUV. We probably sell 60 percent SUVs, 20 percent trucks and 20 percent cars. On trucks we sell a lot of Chevys and Fords, and the SUVs and cars are a lot of imports.

“I go to auctions in person, I like that better. Most of our cars are under $20,000. Those kinds of cars, I like to ‘see.’

“Our average down payment is about $1,500.

“Our average reconditioning is about $400-500 and it’s definitely going up. I have a mechanic and a detail guy but we still have to send some stuff out.

“Car miles are going up. We used to try to keep it under 100,000, now we try to

keep it under 150,000. The average age is probably 7-8 years old.

“Most of our advertising is online, we still do a little bit of radio, but very little print.

“The last car I sold was a ’16 Impala with 140,000 miles. We sold it for $12,995.”

SOUTH DAKOTA

Derrick Sinner, general manager, Sinner Auto, Waubay, S.D.

“We’ve been in business since 1967, my grandfather started it as a salvage yard, selling used car parts. My dad bought him out in 1990. I’ve been involved since I graduated in 2001, of course I’ve really been involved my whole life. The salvage yard started in Webster, S.D., and they moved to Waubay in the ‘70s.

“The auctions moved more online, so I do more of that now than before COVID.

It’s more convenient. I can watch the auction for an hour or two and do other things, and not be gone all day.

“We’re a smaller lot, so we usually have about a dozen cars for sale, we’ve got about 16-17 now. We sell about three or four a month, but we do a lot of body repair.

“We probably put $500 to $1,000 in reconditioning.

“The majority of our sales are SUVs, maybe 70 percent. Trucks and cars would be the rest. Sometimes we will sell motorcycles and fourwheelers too.

“Our customers’ downpayment is 10% that seem to be the average with the banks we deal with.

“Our advertising is strictly online. Sometimes we do a paper ad when we’re sponsoring some community event or a school function. We host the car show for the

Compiled by Ed Fitzgerald

Waubay fest every July.

“Most of our cars are over 100,000 miles. Our customers aren’t buying near-new, so they don’t mind a few more miles for a few less dollars. We do a lot of special orders too.

“Our state association works hard on the various legislation. It’s good to bounce ideas off other dealers. One dealer might be looking to sell a vehicle you need, it just gives you more resources and contacts.

“Our goal is for the customer to be so delighted with their vehicle purchase that they’ll come see us when they need their next car and will happily recommend us to friends and family. Customer referrals are the ultimate compliment.

“Last car I sold was a 2014 Ram one-ton dually. It had 152,000 miles and we sold it for $29,500.”

Wholesale Markets

6/23/2025

WASHINGTON

Collin McConkey, general manager, DAA Northwest, Spokane, Wash.

“DAA Northwest opened in 1992, so this is our 32nd year.

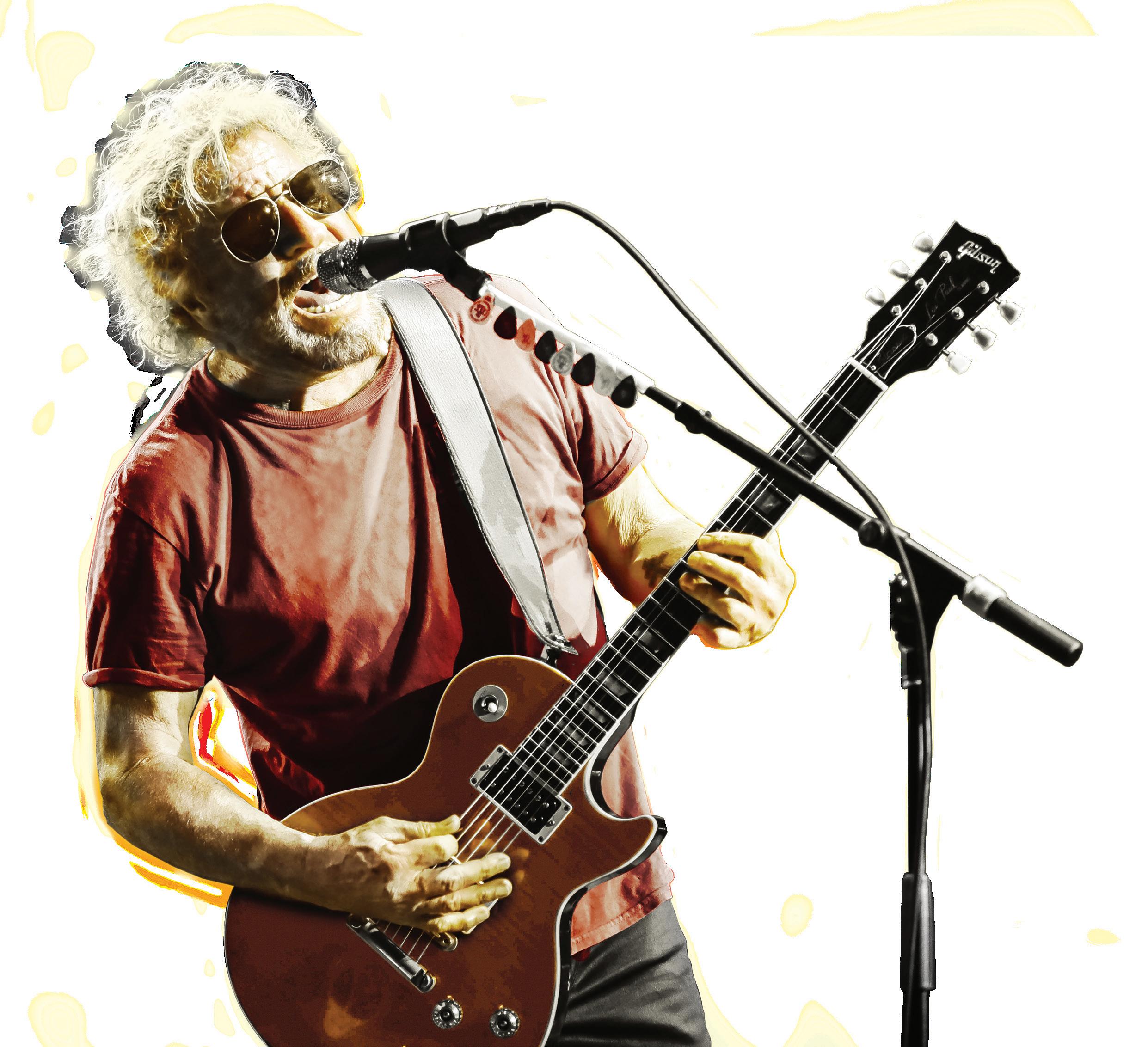

“We have our annual Rock and Roll sale coming up July 16-17. This year, we’ve having Sammy Hagar and his backing band – Sammy and Friends. Hagar also was the (performer) at DAA Northwest’s 2022 Rock and Roll sale.

“For the Rock and Roll sale, we’re expecting, probably, 3,300 vehicles. It’s a two-day event, starting on a Wednesday and running through Thursday. Wednesday we’ll run about 1,000 vehicles and Thursday, we’ll run another 2,300.

“On an average Thursday sale we run about 1,200 vehicles. I’d say that’s pretty flat with this time last year.

The market is a little better than last year, but the volume is more flat.

“Our conversion rates are about 60% over the past six weeks. Is that typical? What’s typical anymore, right?

“Around this time, it starts to cool off as summer starts to come. We’re getting back to those more seasonal adjustments. Those went away, kind of, from 2020 through 2023.

“So, it’s starting to cool off a touch. I think we had the tariff scare in February and March which kind of fueled a more aggressive used-car market.

“The prices are still relatively stable. Our conversion is pretty stable. I would have expected that number to fall off a little bit by now.

“On average, we probably have about 160 dealers in the lane and another 500 to 550

online. So our average attendance is just overt 700.

“Yeah, it’s changed from the past, it has flipped.

“During COVID, Washington state was more closed down than other states, so we were really aggressive with our online sales. We bolstered up our condition reports and inspections process. We really tried to make it so if people couldn’t get here, their experience was still first class.

“But with that, dealers really got trained to be able (to bid online). It used to be we’d have 400 to 500 guys here in the lanes, so the numbers flipped.

“But the number of cars that sell online compared to in-lane is still half and half.

“Now, some of our better buying partners are out in places as far away as Anchorage, Alaska or Denver, Colo. To be able to have that

trust is something we’re very proud of.

“I think for a long time, within a given month, you could have a swing of thousands of dollars in book values, right.

“It’s more stable – meaning, nothing’s on fire but nothing’s ice cold either.

“(Our volumes) are 70% and 30% fleet. Of that dealer mix, probably about half of that is from Canadian sellers. So, about 30% to 35% of our volume is Canadian.

“In our market, what we’re seeing is that repossessions are still climbing. I think it was pretty aggressive, almost on a ladder going straight up. I think it’s flattened out a little bit and it’s still trending up.

“We have an in-house remarketing service for credit unions called ‘Auction Direct Remarketing.’ We do the repossession and the

Compiled by Jeffrey Bellant

remarketing side and our repossession program has been breaking records every month, month over month. It’s not as much as it was at the beginning of the year, but it’s still growing.

“Our average price across the block is $23,000. It’s a lot of late-model trucks, a lot of that is Canadian imports. A lot of 2020 and newer trucks.

“Every other week, we have an RV and specialty sale. We always start out with fleet and repo RVs, then it gets other products; sideby-sides, bikes, boats, miscellaneous. It’s usually about 70 units, but we’re looking to grow that segment.

“The used RV market is still pretty popular in our area so we’re really looking to tap into it to serve our dealers. A lot of our independents have moved into that segment.”

Tony Moorby Disconnected Jottings From

I think I may have mentioned in prior scribblings that I started washing cars at the age of eleven, at first for ‘pocket money’ but as my endeavor grew, so did the bounty and I ended up paying a buddy to help with the load. Of course, I paid him less than I got; thus, my introduction to capitalism and management.

That would have been in 1959 but the ferocious and deadly winter of 1963 put paid to that, when my bucket, sponge and leather froze before my eyes, along with my skin and I became a greengrocery delivery boy, just like my twin brother who did the same for the local butcher. It was still cold on a bike!

That was the start of my life with cars (and anything to do with cars) and now, even in retirement, the interest is like dog poop on my

shoes; I can’t get rid of it.

One would think I could make a seemly exit from the business, buy a grey Toyota Corolla and blend in with the local populous with no muss, no fuss. The only camouflage I adopted was having an old Range Rover Classic painted in Desert Digital Camo. I gave it to my son after a while and it now constitutes a type of ‘yard art’.

I’ve always had an affection (or is it affliction) for Land Rovers and have enjoyed all kinds of models from Series IIIs in the UK, Defenders, Discoveries, an LR4 and numerous Range Rovers. I still own a 1997 Range Rover Vitesse in AA Yellow (one of 125), originally my company car, which I purchased when the company was sold. It’s still my everyday errand car and while Terry doesn’t un-

derstand my willingness to continue my charitable donations for its survival, it’s never really let me down. I’ve had to “limp” home on a few occasions and I drive it all the way to Nashville for Kenny, my Rover ‘boffin’ to ensure it carries on puffing and wheezing a while longer. Terry, meanwhile, huffs and puffs about the expense – until her Genesis went in for a service - $2200 later, she doesn’t mention my old banger much anymore.

Whilst I have other cars, I still can’t stop everyday forays into so many websites to see what’s about and what prices are doing. Auction sites still mesmerize me –the online ones like Hemmings, Bring-a-Trailer and Bids and Cars lure me in for a couple of hours a day.

I’m glued to the telly for the Barrett Jackson sales and it’s even better spend-

ing three or four days there to get totally imbued in the buzz and marvel at some of the handywork. Their exhibitions are fabulous and then they attract other auction houses, each with their own specialties – it’s mindboggling.

The Mecums have grown tremendously with their muscle car sales. Their setup and tear-down is like a travelling circus – fascinating.

I love that the efficiency of the wholesale automobile auction industry whiles quietly by without the pomp and circumstance – the numbers are stunning and the infrastructure today is nothing short of a marvel.

No wonder my obsession sticks – it’s in my blood.

WE A R E

R O L L I NG I N T O

V i s i t U s A t

BOO T H # 8 1 1

LEARN HOW COPART IS THE SOURCE FOR BUYING AND SELLING VEHICLES IN ALL CONDITIONS IN ONLINE AUTO AUCTIONS WORLDWIDE.

SALE LIGHTS HELP BUYERS QUICKLY ASSESS

VEHICLE CONDITION AND ARBITRATION ELIGIBILITY, MAKING THE PROCESS MORE TRANSPARENT AND SECURE.