2025 Movers and Shakers

Jeff Baker is owner of Car City Supercenter in Grand Rapids, Mich. This summer, NIADA President Don Griffin tapped Baker to chair the revived BHPH Commission, which will work to enhance education and advocacy for this sector of the auto industry. Baker hopes to work closely with NIADA’s Legislative Committee to advocate for BHPH.

Manheim named Mike Browning, a 20-year Cox Au-tomotive veteran and former president of the National Auto Auction Association (NAAA), as associate vice president of Industry Operations. In this new role, Browning will serve as a strategic liaison between Manheim and its independent auction partners.

Pierre Pons received the NAAA Hall of Fame Award this year, adding to his long list of accomplishments. The founder of TPC Management has worked with more than 150 auctions through the years. He also served as CEO of ServNet Auctions. His biggest legacy might be his role as founder/CEO of Auction Academy, a continuing education program for auto auction professionals.

Coup of the Year – Electric Vehicle Sales

With the expiration of the federal tax credits for electric vehicles at the end of September, it isn’t surprising that EVs sold in record numbers through Q3 – over 4030,000 in the quarter alone. Consumers rushed to take advantage of the credit so the sales boost was somewhat bought rather than earned.

October sales fell nearly 50%, but that doesn’t mean EVs are going away. Manufacturers are still invested in the technology and eventually we might get those 500,000 chargers that we paid for. Still, over the next couple of years, the industry will learn the true market of EVs as off-lease units and other used

electric vehicles hit the wholesale lanes and the used market in larger numbers.

This pause gives automakers a chance to…um…reboot their EV strategy.

Manufacturers are still committed to EVs, while hybrids seem to be the more attractive middle ground right

Flop of the Year – Tariff Predictions

The initial shock of “Liberation Day” gave way to market response and over the year, tariffs don’t seem to have been the disaster nor the boon each side expected. Auto auctions which rely on the

flow of Canadian imports saw big dip in those volumes.

Of course, the Trump Administration has tweaked and renegotiated tariffs so much, the implementation hasn’t looked like everyone expect-

ed either. The economy has avoided recession, inflation is relatively flat and companies have made an effort to not pass costs down to con-sumers. But consumer confidence has fallen and the continued changes in

now. Improvements in EV technology and having more time to assess consumers’ preferences could help EVs build market share, without the tax credits.

As Cox Automotive’s Director of Industry Insights Stephanie Valdez Streaty stated, “The training wheels are coming off.”

tariff negotiations has disrupted the clarity the market craves. At press time, U.S. Supreme Court is hearing arguments about how the tariffs were implemented in the first place, so stay tuned.

Chase Cup Award Winners 2024 – 2025

PERFORMANCE WINNERS

Central Region: ADESA Kansas City

Midwest Region: Manheim Milwaukee

Northeast Region: ADESA Boston

Southeast Region: Manheim Nashville

Western Region: ADESA Golden Gate

OPERATION SERVICE AWARD WINNER

Manheim Orlando

MANUFACTURER AWARD

Jaguar: Manheim Atlanta

Land Rover: Manheim Milwaukee

Maserati: Manheim Pennsylvania

Subaru: ADESA Golden Gate

REPOSSESSION AWARD

Manheim Nashville

OVERALL WINNER

ADESA Boston

Year in Review

12/15/2025

Industry Saw Tariffs, Deregulation and Disruption in 2025

By Jeffrey Bellant

Disruption could be the word of the year for the used car industry in 2025.

From the return of the disruptorin-chief President Donald Trump

renegotiated.

Tariffs were never really implemented in the way experts predicted and as of today, their long-term effects are still anyone’s guess.

suit by a coalition of 10 at-torneys general “against the federal government challenging the unprecedented and unlawful use of the Congressional Review Act (CRA).”

Those legal wranglings are ongoing.

States kept busy as well.

Civic Hybrid, the Ford Maverick and the Volkswagen ID Buzz taking home the trophies.

General Motors CEO Mary Barra sat down for a wide-ranging interview in Detroit before the Automotive Press Association, discussing a restructuring of its business in China and the ending of funding for its Cruise robotaxi development work.

She also reiterated her belief that “EVs are better” and stressed the expansion charging networks and affordability.

The announcement of tariffs on China and later the “Liberation Day” announcement of widespread tariffs began a year-long push and pull where tariffs were announced, paused, implemented, reduced or

At press time, the United States Supreme Court was hearing arguments about the lefirst place.

Trump effectively shut down the Consumer Financial Protection Bureau in early 2025 and later cut its funding. Acting director Russell Vogt reportedly expects the bureau will run out of funding in 2026.

In April, Trump also issued an executive order to eliminate the use of disparate impact liability and to “deprioritize enforcement of all statutes and regulations” as they involve such impact, including the Equal Credit Opportunity Act (ECOA).

But this didn’t mean federal officials didn’t stop going after wrongdoers.

The Justice Department on Sept.

29 announced that New City Funding, a New York-based auto finance company, will pay over $120,000 to resolve allegations that it violated the Servicemembers Civil Relief Act (SCRA) by illegally repossessing vehicles owned by military servicemembers.

In September, the Equal Employment Opportunity Commission announced a settlement of a $1.8 million fine and significant nonmonetary relief to settle a federal age discrimination lawsuit against Enterprise Leasing Company of Florida, LLC, which operates National, Enterprise and Alamo car rental services in Florida.

Trump on June 12 signed Congressional resolutions blocking several California rules vehicle emissions standards that would have banned the sale of gas-powered vehicles.

On the same day, California Attorney General Rob Bonta filed a law-

the Office of the Attorney General (OAG) found that Nicolas failed to file annual sales tax returns for his car dealership business for all but two years from 2013 to 2023.

Nicolas and his company pleaded guilty to felony charges in November 2024 and yesterday judgments were en-tered against them requiring them to pay back the full amount of the stolen sales tax.

Nicolas was also sentenced yesterday to five years of probation.

Pennsylvania Attorney General Dave Sunday announced a settlement on Aug. 18 with The Rosado Group, regarding the northeastern Pennsylvania-based vehicle sales Continued on page 4

Year in Review

Continued from page 4

group’s deceptive sales tactics and credit practices.

The New York Independent Automobile Dealers Association (NYIADA) on May 21 announced to its mem-bers a significant victory for independent automobile dealers across the state.

After months of sustained advocacy, the New York State Department of Motor Vehicles (NY DMV) has announced, via its VERIFY Tip # 128, a pause in the enforcement of Regulation 78.25(b), a policy that would have severely disrupted core business prac-tices for independent dealers.

Originally announced on Jan. 22, 2025, through VERIFY Tip #122, Regulation 78.25(b) requires dealers to maintain physical proof of ownership for all vehicles in their inventory at their registered place of business.

Enforcement was scheduled to begin on June 1, 2025, effectively ending a long-standing industry stand-ard that allowed floor plan

lenders to retain original ve-hicle titles.

In other news, the Independent Auction Group cele-brated a revamping of its website, creating committees, adding resources for members.

In April the BHPH United Summitt held its fourth annual conference, but with a new twist.

It partnered with Ignite Consulting’s “Compliance Unleashed Conference, a united conference to make it easier for dealers wanting to benefit from both shows without two trips.

Also this year, Cars.com announced its annual American-Made Index and Tesla models took the top four spots.

In the spring, the industry saw The Auction Academy’s Class 8 graduate and its next class start. Reynolds & Reynolds’ Terrence J. O’Loughlin, director of compliance for Reynolds Document Services, was inducted into the F&I Hall of Fame and a career of service to law and compliance.

In May, Manheim Detroit hosted

a media tour of the entire auction, from the sales lanes to the paint shop, de-tail shop and recon areas. Media were also presented with a market update from Manheim industry experts.

In June, Minnesota dealer Don Griffin became presi-dent of the NIADA, which put on a well-attended convention in Las Vegas after a few lean years.

A packed agenda for retail and buy-here, pay-here dealers included its annual scholarship awards with Northwood University and its annual charity auto auction raising over $25,000.

Georgia’s Jack Carter won the 2025 National Quality Dealer of the Year and Amy Bennett, executive director of the Georgia Independent Automobile Dealers Association, was named the AEC Executive Director of the Year.

If September, Manheim Seattle General Manager Eddie Lafferty took the reins of the National Auto Auction as its newest president during its annual convention in Kansas City, Mo.

The association also honored others during the event.

Bob McConkey, president and CEO of McConkey Auction Group, introduced two new winners of the NAAA Industry Pioneer award, Mike Broe and Henry Stanley.

Akron and Value Auto Auction Owner Chad Bailey presented TPC Management Founder and CEO Pierre Pons with the NAAA Hall of Fame award (see page 1).

At the NAAA, some big news was announced with thecreation iof a new spring remarketing conference.

he Automotive Remarketing Alliance (ARA) and the National Auto Auction Association (NAAA) are proud to announce their first-ever joint presentation of the Spring Remarketing Exchange, taking place March 2–4, 2026, at the Renaissance Dallas Addison Hotel in Addison, Texas.

For the first time, this event will bring together both consignors and auctions for three days of collaboration, innovation, and elevated networking.

Designed to foster progressive dialogue across the automotive remarketing landscape, the Spring Remarketing Exchange will feature networking opportunities, expert panels, and keynote addresses.

In years past, ARA collaborated with Bobit Business Media to deliver the spring CAR Conference, however, after the 2025 event, both organizations mutually agreed to wind down their collaboration.

Editorial:

Advertising

Production:

Vehicle Reliability News

Used Vehicle Prices Dip, Retention Values Remain Strong

By Jeffrey Bellant

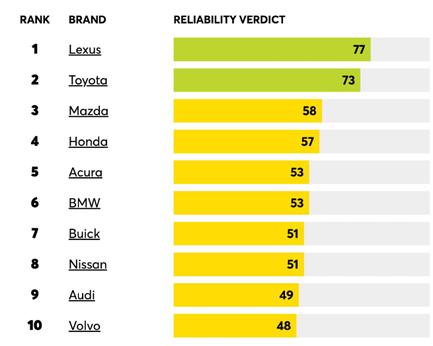

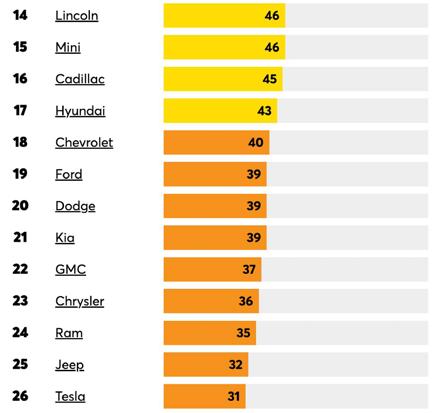

Lexus, Toyota and Mazda were the top 3 brands for average reliability among 5-10-year-old models, accord-ing to Consumer Reports rankings released this month during a webinar with the Automotive Press Association.

Honda and Acura round out the top 5. Jeep and Tesla were at the bottom.

On the new car side, Toyota topped the Consumer Reports 2026 Most Reliable New Car Brands, while Sub-aru came in at No. 2, followed by Lexus, Honda and BMW to round out the top 5.

CR also offered its 2026 Brand Report Card Rank-ings which lists the brands that make the best vehicles overall. Subaru topped that list followed by BMW, Por-sche, Honda and Toyota to round out the top 5.

The results of CR’s annual rankings were presented by Jake Fisher, senior director, CR Auto Test Center and Steven Elek, program leader, auto data analytics.

“The most reliable new car brand – no surprise – Toyota is the most reliable new car brand again.,” Elek said. “The reason being is that the redesigned Camry last year has improved in reliability in its second year. The Tundra has overcome its growing pains from its re-design a couple of years ago…and the Tacoma is now well above average, which it wasn’t before.”

Conservative redesigns have helped Subaru to main-tain its 2nd place position, Elek said.

Tesla is in the top 10 this year, as the Model Y and Model 3 updates have overcome past problems with build quality from the past.

The only model that Tesal has which is below aver-age in reliability is the Cyber Truck, which is a brand new, build from the ground up model.

“Our biggest drop for this year was from Mazda, (at No. 14)” Elek said.

Mazda used completely groundup redesigns of the CX-90 and the CX-70, which dragged down Mazda’s ranking.

Jeep, with the exception of the Compass, has models that are all below or well-below average reliability.

“Coming in last place this year

is the Rivian,” Elek said. “Rivian continues to have reliability issues. The kinks are not being worked out.”

But Rivian was also an oddity in this year’s report as owners criticize it for reliability issues but still liked the brand.

“They tell us in owner satisfaction, it’s the top brand,” Elek said. “The love their Rivians.”

Fisher said the message from Rivian owners is that yes, they had problems, but they would buy it again.

After Rivian, BMW, Subaru. Tesla and Ford rounded out the top 5 in owner satisfaction.

In the other survey, “Which Brands Make the Best Vehicles?” overall, which is an average of all the vehi-cles they’ve tested, not just reliability, but safety, roads test, etc.

Subaru continues to be strong because it uses similar platforms across all of its product lineup, Fisher said.

Another survey, which just focuses on the road test, BMW takes the top spot, followed by Subaru, Audi Hyundai and Porsche to round out the top 5.

Jeep scored at the bottom, with Dodge and Land Rover just above it.

CR’s study showed reliability varies by powertrain.

This year’s rankings showed hybrids have fewer problems than internal combustion engines (ICE)., Elek said.

Plug-in Electric Vehicles (PHEV) and Electric Vehi-cles (EVs) have about 80% more problems than ICE.

However, CR states that it does not mean a hybrid counterpart of a gas model is always more reliable, Elek said.

“A lot of time what we see is that it’s the reliable brands that have been making hybrids for a long time,” he said.

“Toyota has made them for a while and Hyundai, Kai have made them for a while.”

So the general trend is the longer a technology has been available, the more time manufacturers have to work out the kinks, Elek said.

‘They get more reliable,” he said.

EV problems including battery issues, charging is-sues, build quality and climate system.

Problems with powertrains make sense since these are newer, while ICE vehicles have had de -

cades to im-prove their technology.

This year’s analysis comes from a data set of 380,000 vehicles over 25 model years, an 80,000 increase from 2024, This included 92,000 models from 2025 and 68,000 from 2024.

“We actually have the most (number) of vehicles that we’ve had for a very long time,” Fisher said.

The survey of CR members looked at reliability and owner satisfaction along with mainte

nance and repair costs.

The surveys include what CR calls “verbatims” where the members doing the surveys explain often in detail what is really happening with the vehicles when there are problems.

The new car predicted reliability is based on model history. The analysis considered up to latest 3 years of data of current design.

If a model was new or redesigned, or there was limited data, it looked at similar models and brand history.

In Memoriam

Auction Industry Remembers Leaders Who Passed in 2025

As we come to the end of the year, the industry remembers some notable people who passed away in 2025.

Edward Piatnik

Earlier this year, NAAA announced that Edward (Eddie) Piatnik died on June 18, 2025. He had a long and successful career in the auto auction industry, most recently serving as general manager of Manheim San Antonio before his retirement. Piatnik began his career working in sales at what was then Imperial Auto Auction in Lakeland, Fla. He then served as sales manager at Manheim Denver before moving to Texas to work at Manheim San Antonio.

NAAA stated, “Piatnik was known for his outgoing character and life of the party attitude. Once you met him, he was a friend for life.”

Chuck Stepter

Chuck Stepter, 79, of Orlando, Fla.,

died on May 11, 2025. Stepter was a longtime supporter of NAAA and served as NAAA General Counsel.

The announcement, released by NAAA, stated Stepter was an NAAA Warren Young, Sr. Scholastic Foundation Fellow and a member of the NAAA Honor Society. He helped guide the association through many foundational years, including the creation of the NAAA Foundation and NAAA Services Corporation.

Stepter was born in Dallas, Texas on August 29, 1945. He served his country with honor in the United States Army doing two tours of duty in Vietnam from 1968-1969. Stepter was an accomplished attorney and practiced law with Fishback Dominick Attorneys for 40 years. He won awards for his work as a guardian ad litem while helping children in need of legal representation. He also served as the attorney for Manheim Auto Auctions and the ABC Liquor

Company. Stepter would often volunteer at soup kitchens to help those less fortunate complete required paperwork. In recognition of his giv-

ing spirit and all that he did to support the industry, NAAA is making a donation to the NAAA Foundation in Stepter’s memory.

Retail Markets

12/15/2025

SOUTH DAKOTA

Troy Gregorie, owner, Quality Motors, Vermillion, S.D.

“We’ve been in business 36 years. All in the same location. I was 20 years old when I started, it wasn’t even legal to have a beer after work.

“As far as going to auctions in person and online, I do a little bit of both.

“We keep 90-100 vehicles in inventory and we sell 2530 a month. SUVs are No. 1 for us. Then trucks and then cars -- we just sell so few cars anymore.

“For reconditioning it’s probably $1,200-$1,500 a vehicle. We have our own shop; it’d be a battle without our own. We started our shop 30 years ago because we couldn’t find anyone who could handle their customers and ours, too. We have two full-time mechanics.

“Since day one we’ve gone

after the low-mileage cars and now with the market adjusting it’s been a little easier—a little—to find those cars. During COVID it was brutal. We like to have people come back in a trade every three or four years. I can’t sell a car with 150,000 miles and expect it to last four years.

“Funny you should ask about down payments. I had a friend come down from Minneapolis, an F&I guy, and he said he’d never seen anything like this. People will come in to get a car and we say: we’ve got financing too. “No, just get the checkbook ma, we’ll write a check.” We probably finance only 35-40 percent of our deals.

“My dad knows someone with a GM store which he turned it over to his son. He told my dad that his son was going to turn him in to the police for child abuse. Any-

one who gets their kid into the car business should be arrested for child abuse.

“Right now, the market is as tough as I’ve ever seen it as far as sales. When I started in ’89, I had a floor plan for 150, 200 grand and I could fill the lot with that amount. Now, you can buy a couple Suburbans.

“The last car we sold was a 2024 Chevy 2500HD with 21,000 miles and we sold it for $55,000.”

TENNESSEE

Tim Duff, owner, Earl Duff Pre-Owned Sales, Harriman, Tenn.

“I’ve been in business here, just outside of Knoxville, since 1989. I also bought a Subaru franchise in 2020 about 10 miles east of here. I kept that store for two-anda-half years and someone made me an offer I couldn’t refuse.

“We’re smaller than we used to be. We keep 20-25 vehicles in inventory. These days we only sell 10-15 a month.

“Interests rates fell in 2025 so it became easier to do business. Car prices tapered off some. We’re looking for that trend to continue and I do think 2026 will be a better year.

“We shop at auctions mostly online. Our average re-con cost is $600. We have our own shop.

“We like to keep cars that are just six or seven years old. The trick is that it’s not just the age but the miles. But if the car has 100,000 miles on it, we will consider that too.

“It’s going to sound weird to say this but our customer base is, since we don’t do BHPH, really strong credit.

There are people who put money down just because

Compiled by Ed Fitzgerald

that’s what they want to do. But very rarely do we have a customer where the lender is requiring a certain amount of down payment. I can’t tell you the average is 10 percent or 15 percent, because our customers just aren’t made up of that demographic.

“COVID definitely changed the way we do business. We learned to be more online focused.

“My tip to someone just starting out in this business would be: Be super capitalized.

Expenses these days, just the software required to be compliant with government regulations, payroll expenses and everything else – it’s a very expensive proposition to start a business these days.

“The last car we sold was a 2021 Nissan Rogue, mileage was in the 50s, and we sold it for $24,000.”

Tuesday DEC 9 DEC friday 19

Wholesale Markets

12/15/2025

MONTANA

Jake Gertsch, sales manager, Auto Auction of Montana, Billings, Mt.

“We’ve been in business 23 years. Volumes have still been hanging around 450 to 500. Sales percentages, all the way up until November we were probably in the 6065% range. In the past few weeks it’s dropped back into the 50s.

“Overall the year has been good. It seems like mid-November started to slack off a bit and we just had our first sale in December and you can tell the December market is here for sure.

“Weather can play a factor for sure, but we do a ton of business online so that helps in that regard. But when we do get a big storm it slows things down operationally, getting CRs (condition reports) done, getting transport in and out, stuff like

that. But we didn’t see a flake of snow until Thanksgiving, so we did pretty good.

“Right now, I’m pretty heavy on fleet stuff so that fleet lane has about 160 or 180 cars a week. I wouldn’t say repos are anything like they were in 2008-2009, but they are up from what they’ve been.

“I think dealers are the same (as us), dealers have had a good year overall. It got a little bit sluggish at the end of November but overall, I think the year has been good. It’s obvious finances are tight among people so everybody is shopping for that price-range vehicle. Anything $30,000-and-under that they can retail is what they’re looking for. Higher dollar stuff has slacked off a bit.

Manufacturers aren’t building a lot of the cheaper models anymore. Our aver-

age car price years ago was $16,000 and I think right now it’s $26,000 or $27,000. So, we’ll sell $1,000 cars, but we’ll also sell $80,000 cars.

“Tariffs, of course, affected us right away because we sell a lot of Canadian imports through our auction and probably 40% of our inventory. Granted tariffs did not affect all of those cars, but maybe 20% for what we were doing. But it’s out of my control anyway.

“I’m always optimistic, but you have to be.”

PENNSYLVANIA

Clint Weaver, general manager, America’s Auto Auction – Harrisburg, Mechanicsburg, Pa.

“We’ve been in business 44 years. We have six lanes, but we kind of recycle them and turn them into a double block during the day.

“Actually, volumes have

been off a little bit. We’re still running 1,100 to 1,200 cars a week. But dealer consignment is down a little bit. They’re retailing a different type of car today. As far as the new-car stores, a lot of them are opening up those bargain type lots. So it’s off a little bit but not a ton.

“Our volumes are about 60% dealer consignment and 40% fleet/lease. We work with pretty much all of the national accounts, a majority of them.

“Our average sale price is probably about $7,500 to $8,000. Today (Dec. 4) we were at $7,900. It’s about the same as this time last year, but it might fluctuate $500 or $600 a week.

“Today, we had about 450 bidders in the lanes at our sale and probably had another 250 online. It was cold here and we actually got some snow on (Dec.2) be-

Compiled by Jeffrey Bellant

fore the sale. I was expecting (attendance) was going to a little lighter, but I think with the holiday last week (Thanksgiving fell on our sale day) and people not doing a ton of business, they were anxious to get back in the lanes.

“What I’m hearing from dealers is that retail in this area slowed down a little bit. A lot of our new-car stores that normally buy heavy are buying half of what they used to at the moment because retail is where it is.

“I think everybody is just trying to get through the end of the year and see what next year brings.

“I think independents are thinking the same thing.

“Luckily here at Harrisburg, we have a good staff and a majority of them have been with us for a long time.

“We’re looking forward to next year.”

Let Auto Assign do the heavy lifting, automatically routing vehicles to the best-fit auctions based on your custom rules. Faster decisions. Better results.

2021

ADESA Boston January 2, 16, 30

508-626-7000

ADESA Charlotte January 8, 22, 30

704-587-7653

ADESA Chicago January 2, 30

847-551-2151

ADESA Cincinnati/Dayton January 6

937-746-4000

ADESA Golden Gate January 6, 20

209-839-8000

ADESA Indianapolis January 6, 20

317-838-8000

ADESA Kansas City January 6, 20

816-525-1100

ADESA Lexington January 15

859-263-5163

ADESA New Jersey January 8, 22

908-725-2200

ADESA Salt Lake January 6, 27

801-322-1234

ADESA Tulsa January 9

918-437-9044

Columbus Fair January 7, 14 614-497-2000

Manheim Atlanta January 22

404-762-9211

Manheim Dallas January 14, 27

877-860-1651

Manheim Milwaukee January 14, 28 262-835-4436

Manheim Atlanta January 8, 21, 22

404-762-9211

Manheim Baltimore Washington January 27

410-796-8899

Manheim Dallas January 14, 27, 28

877-860-1651

Manheim Denver January 7, 28

800-822-1177

Manheim Detroit

January 22

734-654-7100

Manheim Fredericksburg January 29

540-368-3400

Manheim Milwaukee January 14, 28

262-835-4436

Manheim Minneapolis January 21

763-425-7653

Manheim Nashville January 13, 14

615-773-3800

Manheim Nevada January 9

702-730-1400

Manheim New England January 6

508-823-6600

Manheim New Jersey January 14, 28

609-298-3400

Manheim Nashville January 14

615-773-3800

Manheim Nevada January 9 702-730-1400

Manheim Palm Beach January 14 561-790-1200

Manheim New Orleans

January 14, 28

985-643-2061

Manheim Orlando January 6, 13, 20, 27

800-822-2886

Manheim Palm Beach

January 14, 15

561-790-1200

Manheim Pennsylvania

January 2, 8, 9, 16, 22, 23, 30

800-822-2886

Manheim Phoenix

January 15, 29

623-907-7000

Manheim Pittsburgh January 28

724-452-5555

Manheim Riverside January 13, 15, 27, 29

951-689-6000

Manheim Seattle January 7

206-762-1600

Manheim Southern California January 8, 22 909-822-2261

Manheim Tampa January 8, 22

800-622-7292

Manheim Texas Hobby January 8, 22 713-649-8233

Manheim Atlanta January 22

404-762-9211

Columbus Fair January 14

614-497-2000

Manheim Dallas January 14, 27

877-860-1651

Manheim Milwaukee January 14, 28

262-835-4436

Manheim Nashville January 14

615-773-3800

Manheim Nevada January 9

702-730-1400

Manheim Orlando January 6, 20

800-822-2886

Manheim Palm Beach January 14 561-790-1200

Manheim Pennsylvania January 8, 22

800-822-2886

Manheim Phoenix January 15, 29

623-907-7000

Manheim Riverside January 15, 29

951-689-6000

Manheim Seattle January 7 206-762-1600

ADESA

January 2, 16,

508-626-7000

ADESA Charlotte January 8, 22

704-587-7653

ADESA Golden Gate January 6 209-839-8000

ADESA Salt Lake January 6, 27

801-322-1234

Columbus Fair January 7

614-497-2000

Manheim Dallas January 28 877-860-1651

Manheim Pennsylvania January 8, 22

800-822-2886

Manheim Riverside January 15, 29

951-689-6000

Manheim Seattle January 7 206-762-1600

Manheim Fredericksburg January 29 540-368-3400

Manheim Milwaukee January 14 262-835-4436

Manheim New England January 6 508-823-6600

Manheim New Jersey January 14, 28 609-298-3400

Manheim Orlando January 6, 20 800-822-2886

Manheim Atlanta January 21

404-762-9211

Manheim Dallas January 14, 27 877-860-1651

Manheim Milwaukee January 14, 28 262-835-4436

Manheim Pennsylvania January 9, 23

800-822-2886

Manheim Pittsburgh January 28

724-452-5555

Manheim Seattle January 7 206-762-1600

Manheim Southern California January 8, 22 909-822-2261

Manheim Palm Beach

January 14

561-790-1200

Manheim Pennsylvania January 8, 22

800-822-2886

Manheim Riverside January 15, 29

951-689-6000

Tony Moorby Disconnected Jottings

I recently read in this magazine that U.S. Sen. Ted Cruz (R-Texas), Chairman of the Senate Committee on Commerce, Science and Transportation, will convene a full committee hearing to discover ‘The Views of the American Auto Industry on the Upcoming Surface Transportation Reauthorization.’

An initial premise to be discussed in the January meeting, will be that (previous) government mandates to regulate radical technologies for the manufacture of new vehicles, that address global warming, have driven up the cost of vehicles for American consumers.

The Big Three bosses have been invited to comment on how prices have doubled in the last decade, driven up by onerous, costly regulations. So under the auspices of President Trump’s cost re-

duction endeavors, they will try and find ways to make cars more affordable, taking costs from the production processes. This at a time when consumers are paying close attention to prices.

I’m not privy to the complete attendee list but I’d bet that it stops at the manufacturers and does not include members from the rest of the industry that make all this work.

It’s important, in an industry as complex as ours, to get a ‘360 view’ of the pricing structures that support new-vehicle sales and prices. Data would support that new-vehicle prices have doubled in ten years but that figure does not stand alone; there are so many variables that influence prices, that ultimately, the cost-to-trade is the only number a consumer has to face.

Convenient political

By Myles Mellor

points can be made from data that looks as though it supports the premise of a stand-alone proposition and I feel this is more about the ‘look’ of the committee’s undertakings than an in-depth attempt to understand the machinations of our business or our customers.

Let’s suppose, as a result of the committee’s findings, expensive production cost mandates go away and the price of new vehicles (whether EVs or not) go down. Whither the used car market? What happens to leases – open or closed end – and someone has to pay the piper for deficiencies in lease-end values? Floorplanning companies might feel a financial draft on inventory values’ diminishment. I’m hard-pressed to imagine a consumer preferring to pay more for a used car with all the government-

mandated gubbins, next to one without.

I realize that products come to market over time; I’m just concerned that those in authority should have all the facts. Assumptions are dangerous.

At the NADA Convention many years ago, I was staying at Caesar’s Palace, as were the top brass from General Motors including Roger Smith. I shared the elevator ride with him and four of his “suits”. He was blaming and berating “those car auctions” for the lack of value of shortterm lease returns; cars being brought back to market by the daily rental companies, some as young as 3 months and some which hadn’t turned a wheel in rental service! Cadillacs that looked like Buicks that looked like Pontiacs all built on the same bodies. Looked

good when thousands were registered and GM’s sales numbers appeared great. Smith was an accountant by discipline – he missed the mark in marketing! The elevator ride was too short to acquaint him with the facts. The meeting will probably be heralded as a success, if not we won’t hear about it.