Ride-Sharing Programs Create New Class

By Ted Craig

What is an Uber car?

That’s a question the industry will have to answer as ride-sharing services grow in popularity.

A car driven by somebody contracting through a company like Uber or Lyft combines both the most and least sought after vehicles in the market.

It’s a one-owner private car with the miles of a fleet vehicle.

“It’s part of the gray zone Uber operates in,” said Tim Fleming, manager of residual and industry forecasting for Kelley Blue Book.

Uber drivers use their own cars.

They are not employed by the company, but rather the company connects them with people looking for rides.

However, Uber launched a lease program last year to provide vehicles for these drivers. It also works with several creditors to arrange vehicle financing, including subprime financing.

Other than these vehicles, it’s hard to tell for sure if a car was used for hire other than guessing by the high miles put on in a short amount of time.

“It’s going to be hard to separate these from any other highly driven vehicle,” Fleming said.

Jonathan Banks, executive automotive analyst for the NADA Used Car Guide, said these vehicles offer a great opportunity for used-car dealers, especially buy-here, payhere operators.

Uber already benefits new-car dealers.

Some claim they make more than 10 percent of their sales in some months to Uber drivers. There is very little data about how many new car sales these service are driving overall.

“It’s increasing new-car business and that’s fantastic,” Banks said.

There are some potential downsides to buying former Uber ve-

hicles. One is that in addition to high miles, the cars might have hard miles as the drivers used them in stop-and-go trafc.

Another is passenger behavior, especially the risk of late-night riders becoming ill.

This would make the cars more like taxis than either traditionally driven cars or even rental cars.

Banks said he only expects the number of ride-share vehicles to grow in years to come unless regulators put the brakes on the services.

General Motors Co. believes the future is bright for such services. It recently made a bid to increase its share of Lyft.

A man earns a little extra money using his car to transport others. But industry experts say it remains unclear what happens when that car re-enters the wholesale market.

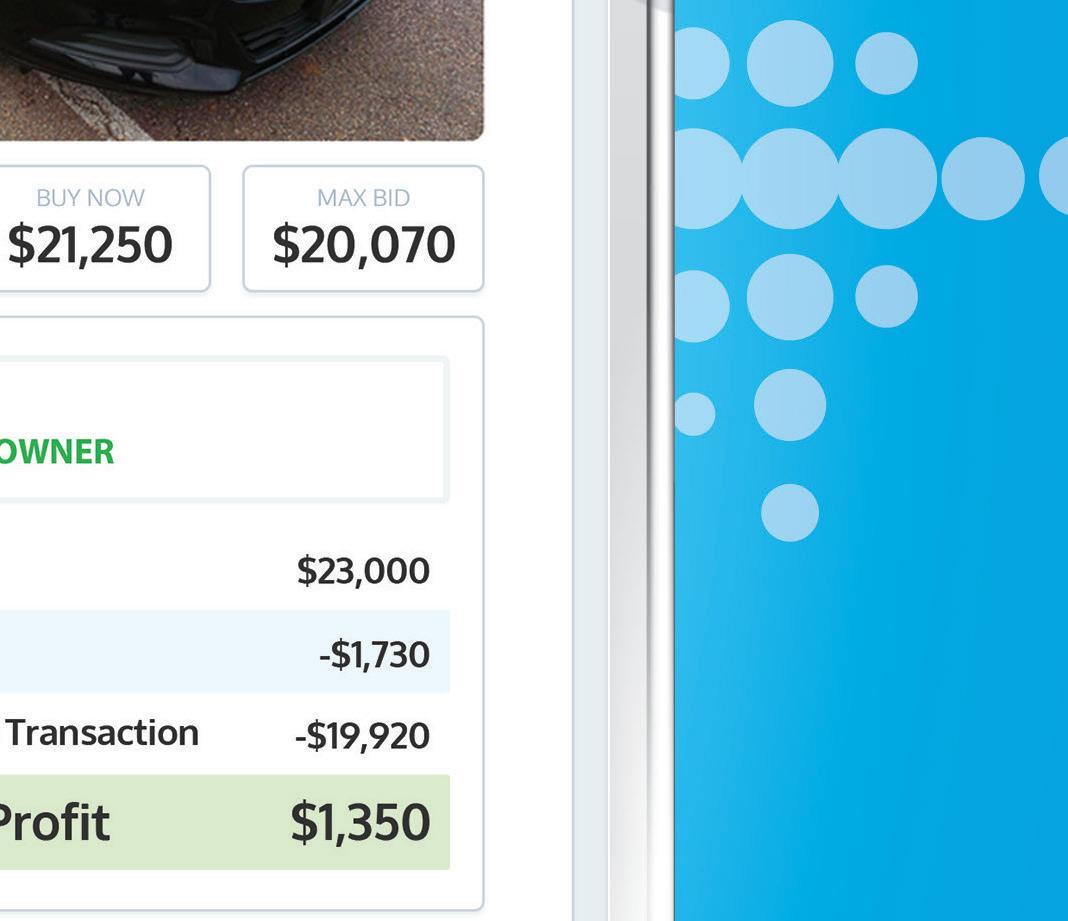

Imagine auction day without the long hours and lost sleep. You hit the lanes or get online already knowing which cars you want to buy and what you need to pay. Making decisions is easy. Making money is automatic. How is sourcing suddenly so simple?

The simple answer is Stockwave. Using your existing buying preferences and profitability goals, it finds cars at auctions across the country, ranks them according to your gross profit target and pulls them into a single smart stream. You only see the good buys. You never miss your opportunity. It’s a sourcing solution so simple, you only have to do one thing: Just turn it on

Flooding Brings Back Memories of Pain, Hope

By Ted Craig

For residents of Louisiana, including those who work in the used-car business, flooding is an unfortunately regular part of life.

The latest disaster to strike the state came when more than 20 inches of rain fell on southern Louisiana over the course of a few days in early August.

This area was not considered a high risk for flooding, so many residents, including dealers, opted against carrying extra flood insurance.

Four feet of water covered dealer James DuPont’s lot in Baton Rouge. When it finally receded, a thin layer of dust covered all the cars and his paperwork was waterlogged.

Floodwaters reached the “Open” sign on DuPont’s rented ofce, and the 24-year-old fears his business, Louisiana Direct Buy, is now closed for good. He had a dozen or so vehicles on the property, including his personal car, and they all appear to be total losses.

“I don’t have flood insurance so everything is gone,” he said. “I’ll try to salvage what I can. I don’t know if I’m going to be able to open back up or not.”

Auction executive Mike Browning, a Louisiana native, said many dealers are finding themselves in the same situation, as even those with insurance struggle to cover the costs.

“You will see numerous small used-car lots that will never re-open,” Browning said.

Browning, the president of the National Auto Auction Association, speaks from the experience of somebody who grew up in the state, actually in the area that wound up underwater, and who has worked in the car business there for most of his life.

Browning held several jobs at dealerships before joining Manheim New Orleans.

He became the auction’s general manager on June 1, 2005. On Aug. 29, Hurricane Katrina struck the city.

The eye of the storm passed right over the auc-

tion. There was no flooding, but the wind caused tremendous damage, blowing of the barn door and destroying all the lights in the arena. Browning showed up the next day to assess the damage and found dealer Buddy Naquin working with Ronnie Brey, an auction employee, sweeping up glass with

push brooms.

The auction was closed for more than a month. During that time, parent company Cox Enterprises kept paying all the auction staf and provided whatever was needed, even cash at one point.

“Without Cox, it would have been unbearable,” Browning said.

Manheim also provided two lanes to Auto Auction of New Orleans to use until that facility could recover. However, it was too damaged and never did reopen. Browning said the situation around Baton Rouge is diferent and the auctions are already up and running.

Continued on page 6

Photo by The Associated Press

WASHED AWAY : Flood waters sweep away a car in Baton Rouge, La. This summer’s flooding have residents remembering the events of Hurricane Katrina in 2005.

NEWS BRIEFS

Floor Planner Reaches Milestone

Westlake Flooring Services announces it has hit the milestone of 100,000 vehicles floored.

The 100,000 floored vehicle milestone comes less than 4 years after Westlake Flooring Services was founded. Since November 2012, Westlake Flooring has grown to a division of over 100 employees with approximately 1,000 active dealerships.

CarMax Opens New Store

CarMax Inc. celebrated the grand opening of its eighth store in Tennessee.

The new store is located at 449 Pinnacle Parkway and has an inventory of more than 140 used cars.

In celebration of the Bristol store opening, CarMax donated $2,500 to the Southwest Virginia 4-H Educational Center in Abingdon, Va. This donation will help support the center’s mission of providing hands-on, experiential learning programs at a low cost to area youths.

The CarMax Foundation also provided a $5,000 grant to the Second Harvest Food Bank in Maryville, Tenn., to help fund the Food for Kids Backpack Program. This program works with local schools to provide

healthy, easily prepared food to some of the most vulnerable children in the community.

Bristol CarMax associates recommended that both nonprofits receive the donations.

CarMax is currently hiring more than 40 employees for the company’s new store in Daytona, Fla.

The store, scheduled to open in October, is located at 800 N. Tomoka Farms Road. It is CarMax’s 17th store in Florida.

CarMax is also currently hiring more than 40 associates for the company’s third store in the Bay Area of California.

The store, scheduled to open in November, will be located at 2783 Corby Avenue in Santa Rosa and will stock more than 300 used vehicles.

The Santa Rosa launch continues CarMax’s expansion into the Bay Area and a third store, in Fremont, is also scheduled to open this November.

CarMax opened its first store in the Bay Area in Pleasanton on May 18.

Firm Tops $400 Million in Claims

GWC Warranty has successfully topped $400 million in claims paid to date.

GWC Warranty’s $400 million in claims paid, combined with sistercompany EasyCare’s $3.1 billion, brings the APCO Holdings, Inc., claims paid total to more than $3.5 billion. Since 2015, GWC has been designated a Bronze Level National Corporate Partner of the NIADA.

Finance Outlook Remains Stable

Subprime 60-plus-day delinquencies rose 13 percent month-overmonth in July to 4.59 percent. This rate was still below the record peak 5.16 percent level recorded in early 2016. Subprime ABS annualized net losses hit 7.39 percent in July.

Prime delinquencies moved higher month-over-month to 0.4 percent in July. Prime ANL were at 0.48 percent last month. Prime auto ABS continues to produce solid asset performance in 2016.

Ratings performance remains solid in 2016, with Fitch issuing 47 upgrades through mid-August versus 41 during the same period in 2015.

Fitch’s prime sector outlook for the remainder of 2016 is stable for asset performance even with losses expected to rise, and positive for the ratings outlook.

The outlooks are both stable for

the subprime sector.

Auction Adds Accounts

DAA Seattle’s growing national account lineup now includes American Honda Finance Corp., Ally Auto Remarketing and GSA. The auction’s inaugural GSA public auction took place earlier this summer; AHFC made its debut in the lanes and online on July 15; and Ally’s initial sale was held Aug. 5.

These accounts join ARI, Enterprise Holdings, PAR North America, Element, ROA and others as DAA Seattle’s featured national accounts.

The increase in volume has warranted an expansion of DAA Seattle’s lot. The auction broke ground on eight additional acres adjoining its current facility, which will increase its paved and secured consignment parking capacity to include 1,300 more units. The project will be completed in September.

Published By General Media LLC USED CAR NEWS (ISSN 1555-7413) is published at 24114 Harper, St. Clair Shores, MI 48080 Phone: 586-772-5200 or 800-794-0760 Fax: 586-772-9400 www.usedcarnews.com

Charles M. Thomas - Founder (1947-2002)

Lynda R. Thomas, Publisher Colleen Fitzgerald, General Manager

Editorial: Ted Craig, Managing Editor Jeffrey Bellant, Staff Writer

Contributing Writers: Ed Fitzgerald, Jenny King, Sheila McGrath

Advertising: Shannon Colby, Account Manager Marie Hingst, Account Manager

Used Car News is published the first and third Monday of each month.

Subscribers: We print advertisements as sent to us by auctions and other advertisers. It is not possible to verify the correctness of listed vehicles in auction ads. Most lists are partial and all lists are subject to last minute changes by auto auctions, so before travelling a long distance for a particular auto auction event, contact the auction by telephone for a fax of vehicles in the sale. Used Car News assumes no guarantees or liabilities concerning the accuracy of any advertisements. All Rights Reserved.

Columnist: Tony Moorby

Circulation: Helen Thomas

Production: Josie Godlewski, Media Manager Cee Lippens, Web Master

Reproduction in any form is prohibited without the written consent of the publisher. OUR ADVERTISING APPROVAL POLICY Payments from frst time advertisers must accompany the insertion order. Distribution is guaranteed by the USPS. Te advertising reservation deadline is 12:00 noon Tursday, 11 days prior to the issue cover date. Ad materials are due by 5 pm Friday, 10 days prior to issue cover date. For advertising specifcations please email colleen@usedcarnews.com.

Vol. 22 • No. 11

Finance Sources Must Provide Communication

The relationships auto finance providers develop with dealerships are critical to dealer satisfaction and to remaining competitive in the market, especially as the new-vehicle sales market tightens, according to the J.D. Power 2016 U.S. Dealer Financing Satisfaction Study.

A combination of slowing newvehicle sales and an uncertain usedcar market is contributing to an already contested auto-lending environment.

Technology has eliminated disparity of speed in financing, leaving lenders to diferentiate themselves by the relationship they are able to form with the dealership.

“Speed has been king and the area lenders have traditionally focused on, but as the market gets tougher, lenders need to center their attention on their relationships with dealers, or they are going to lose business,” said Jim Houston, senior director of the automotive finance practice at J.D. Power.

“Lenders need to move beyond a transactional relationship with dealers to a richer consultative partnership. Lenders with a dealercentric culture across their organization – not just in various pockets of the business – are the ones that are most likely to excel.”

Houston said lenders must under-

stand their dealers’ businesses and goals, which helps establish them in the eyes of dealers as their business partner and problem solver.

That starts with communication with the dealer.

The study finds that fewer than half of dealers receive consistent sales rep calls or visits, both of which can boost overall satisfaction by as much as 68 points and 75 points, respectively, on a 1,000-point scale.

But it’s more than just the frequency of the contact.

It’s the nature of those touch points that adds value to the relationship.

“Dealers value a lender that can help them handle the tough issues and solve those ‘outside-the-box’ situations,” Houston said. “This is where having the right people focused on their dealers and helping them execute their strategic plan is essential.”

Mercedes-Benz Financial Services ranks highest among lenders in all three categories: prime retail credit (961), retail leasing (982), and floor planning (986).

Following in the retail rankings are BMW Financial Services (959); Alphera Financial Services (941); Lincoln Automotive Financial Services (936); and Infiniti Financial Services (930).

Following in the leasing rankings are BMW Financial Services (958); Ford Credit (913); Volvo Car Financial Services (912); and Subaru Motors Finance (911).

Following in the floor planning rankings are BMW Financial Services (975); Huntington National Bank (969); Hyundai Motor Finance (945); and Kia Motors Finance (945).

Satisfaction is measured across three factors in the prime and

non-prime retail credit segments: finance provider oferings; application and approval process; and sales representative relationship.

The 2016 U.S. Dealer Financing Satisfaction Study captures more than 20,000 finance provider evaluations across the four segments. These evaluations were provided by 3,100 new -vehicle dealerships in the U.S.

(For a list of the top retail performers, turn to page 19.)

Congratulations West Michigan Auto Auction Midwest Region's 2016 Auction of the Year!

We are extremely thankful for the recognition the Midwest Zone has awarded us. Our mission, "The Auction with the servant’s heart" is the reason we are deeply committed to serving our employees, customers, and community in any way possible.

"Santander Consumer USA would like to congratulate WMAA for being recognized as the Midwest Auction of the Year. This is a remarketable achievement and we are honored to have them as one of our business partners. Carl and his staf exceed expectations with their service, reliablilty, and attention to servicing the Santander Account" - Brent Huisman

"Congratulations to Carl and the WMAA team. We are proud to be a business partner to the auction for over 10 years!" - Paul Seger

"West Michigan is well deserving of this award! Congrats to Carl and all of his folks at WMAA!” - Bill Cieslak

“Congrats on a job well done to Carl and the entire team....good stuf!” - Randy Meyer

“Very exciting and deserving news! Congrats to the WMAA staf on their compassion to those in need” - Tim Meta

"The WMAA staf is one of the best to work with. Congrats to a great team for all they do to serve our account and their community!” - Jef Beekley

“Capital One team congratulates WMAA and is very proud of

Louisiana

- from 3

That is why the NAAA is waiting to see what is really needed before providing material support.

“Most of them don’t know what they need from us yet,” Browning said.

Jacob Warren, assistant general manager of Louisiana’s 1st Choice Auto Auction of Hammond, La., said his staf members are helping to rebuild their community.

til 10 p.m. gutting houses and come back to work the next morning,” he said.

Browning said while his heart goes out to those afected by the floods, he knows they will persevere.

“If there’s a group of people who can bounce back from this, it’s the people in southeast Louisiana,” Browning said.

“We’ve also got staf members who – as soon as they’ve gotten of at 5 p.m. – have left and worked un-

(Staf writer Jefrey Bellant and The Associated Press contributed to this article.)

AUCTIONS GIVE MONEY, TIME, EVEN THEMSELVES AUCTIONS OF THE YEAR

By Jeffrey Bellant

The National Auto Auction Association recently honored four regional auctions for their charitable work in recognition of National Auto Auction Week.

West Michigan Auto Auction, Kansas City Independent Auto Auction, Louisiana’s 1st Choice Auto Auction and ADESA Winnipeg are the regional winners.

They will go on to vie for NAAA’s National Auction of the Year award, which will be announced Nov. 17.

Each regional chapter award winner received $5,000, to be donated to the charity or charities of its choice.

The auction that earns the national honor will receive an additional $20,000 to be donated to the charity or charities of its choice, and be featured on the cover of the 2017 NAAA Member Directory.

Frank Hackett, NAAA’s chief executive ofcer, credited NAAA President Mike Browning with suggesting the award.

“They all do a lot of this work, but you just don’t hear about it,” Hackett said.

“So this has been a nice way to do it.”

Hackett said about six auctions from each chapter were submitted for consideration, with about 25 or 26 total.

A group of community leaders in Frederick, Md., will select the overall winner, Hackett said.

Louisiana’s 1st Choice Auto Auction of Hammond, La., earned the Southern Chapter award.

Jacob Warren, assistant general manager of the auction, said “elated’ was the initial reaction of the auction.

“It’s something to strive

for,” Warren said. “We do a lot for local charities and even some national ones. So it’s great to be recognized.”

Warren said the auction management and staf believe strongly in giving back to the community it does business in.

“It’s a ‘reap what you sow’ kind of thing,” he said. “We want to impact as many lives as we can.”

He said that a couple of staf members were already thinking about which charities to support with the proceeds from the award.

“It’s definitely an exciting time around here,” Warren said.

“There’s a lot of pride in being named one of the top four.”

In many cases, the charitable eforts of these auctions went above and beyond the standard fundraising events.

For example, West Michigan Auto Auction helped give a quadruple amputee war veteran his dream car, while one of its employees donated a kidney to a local dealer.

Carl Miskotten, general manager, was thrilled with the award.

“I’m so thankful for my crew,” he said.

“We’ve got a great bunch of people.”

Miskotten said the desire to do this comes from the employees and “a servant’s heart.”

It started with the reconditioning department financially helping a woman who had lost a child and has just

evolved from that.

In another case, a female employee found out one of the dealers needed a kidney and responded, “Well, I have two kidneys, I wonder if mine would be a match,” Miskotten said.

It was a match and the dealer received the kidney.

Other eforts include raising $42,000 for the family of a Michigan auction worker who died in a car accident and each year holding a memorial ride for his family’s continued support.

One efort that drew attention from news organizations was the auction partnering with a dealer to give a Dodge SRT8 to Brendan Marrocco, a quadruple amputee war veteran, who said the vehicle was his dream car.

Continued on page 10

Auctions - from page 8

In the Western region, KCI in Missouri took the top honor.

“KCI Auto Auction is a business that serves as a testament to what it means to have a dedication to excellence,” said Russ Smith, Western Chapter president, who is the general manager of Dealers Auto Auction of Idaho.

“Their community service eforts are widely recognized as having farreaching efects in the community and beyond.”

Doug Doll, the auction’s owner/ general manager, was grateful for the award.

“It was a great reward for all the work employees have put in for our charitable arm of the auction – KCI Cares.”

The staf came to Doll about four years ago with the idea and a committee of managers and employees put together the program.

In addition to the local school district, the group picked three charities to help.

The three community organizations – Camp Quality USA, Court Appoint Special Advocates for Children and Shefeld Place – nominated the auction.

“KCI Auto Auction’s involvement has included a remarkable level of support with a combined total giv-

ing of $441,136 to the three organizations over the past four years,” their joint nominating letter stated.

Camp Quality is a summer camp experience and year-round support program for children with cancer and their families.

Court Appoint Special Advocates for Children advocates for abused and neglected children.

Shefeld Place is a treatment and supportive housing program for homeless women and their children.

ADESA Winnipeg, located in Winnipeg, Manitoba, Canada, earned the Eastern Region honor.

NAAA Eastern Chapter President Charles Nichols said the award for ADESA Winnipeg is truly an honor, as it comes by way of a vote from the auction’s peers.

“ADESA Winnipeg displayed the kind of dedication and support to the community and its employees that make us proud to be members of this industry and this outstanding association,” said Nichols, president of the BSCAmerica Auction Group.

In 2011 for instance, ADESA Winnipeg’s 24th Annual Golden Gavel Golf Classic and Charity Auction raised $250,000 for Variety, the Children’s Charity of Manitoba, the most money raised in a single day.

Dealer Event Aids Charity

By Jeffrey Bellant

Automobile dealers in Boise, Idaho, used an annual boxing event at CenturyLink Arena to raise money for local charities.

“This year, we raised nearly $53,000,” said Sandy Beach, a Nampa, Idaho, car dealer. “This was just a bunch of car dealers giving back to the community.”

The event featured several matches with boxers sponsored by dealerships; a charity auto auction and even an appearance from former heavyweight champ James “Buster” Douglas, Beach said. There were also a couple of bouts between dealers’ employees.

The fundraiser started 17 years ago as a promotion highlighted by “grudge matches” between dealership and auction employees.

It originated at Idaho Auto Auction, which was later purchased by the Brasher family, and has since been acquired by ADESA.

The money from the event is distributed to several local charities, including Camp Hodia, a non-profit organization that provides camps and programs for children up to age 18 who sufer from Type 1 diabetes.

The efort also supports Shop with a Cop, a program that gives un-

derprivileged children a chance to obtain school supplies, holiday gifts and other necessities by pairing a child with a Boise police ofcer on a shopping excursion.

Funds were also raised for The Burnout Fund designed to provide assistance to families whose homes have been destroyed by fire.

Other groups supported include the Juvenile Diabetes Research Foundation and the Idaho Food Bank.

Douglas, the first man to beat Mike Tyson, attended the event and spent time with the dealers.

“Buster Douglas was great,” Beach said. “He’s the nicest guy. He posed for pictures with everybody.”

The highlight of the event was “The Last Man Standing” fundraiser.

Dealers were asked to stand up if they would donate $10. The donations get progressively higher; the dealer who continues to contribute remains standing.

The top bidder becomes the “last man standing.”

Beach earned the honor by donating $15,000.

“I’ve been the last man standing five times,” he said. “It’s my privilege to reinvest my money in the youth of our area.”

Dealer Pays for Misleading Ads

Three Dallas area auto dealers, collectively known as Southwest Kia, have agreed to pay an $85,000 civil penalty to settle Federal Trade Commission charges that they violated an FTC administrative order barring them from deceptively advertising the cost of buying or leasing a car.

According to the FTC, New World Auto Imports Inc., New World Auto Imports of Rockwall Inc. and Hampton Two Auto Corporation concealed sale and lease terms that added significant costs or limited

who could qualify for vehicles at advertised prices, in violation of a 2014 order.

In a TV ad, for example, the dealers ofered two cars for “under $200 per month,” but in fine print that appeared for two seconds, disclosed that the ofer applied only to leases, not sales, and required a $1,999 payment at lease signing. One dealer mailed ads claiming a new car could be purchased for $179 per month, but in print too small to read without magnification, disclosed that Continued on page 13

BMWGroupDirect.com, a new online platform offering quick access to BMW Group vehicles. This site is the only one that gives you 24/7 access to BMW and MINI vehicle inventory and daily national sales before the inventory is offered to the wholesale buying community. Access BMWGroupDirect.com from any device, making it more convenient to buy from anywhere. Don’t wait for the lanes.

FTC - Continued 13

$1,999 would be due up front, along with tax, title and license fees, and that $8,271 would be due at the end of a 38-month financing term.

The FTC’s complaint also cited a TV ad targeted at people with major credit problems, such as repossessions or foreclosures.

The ad touted vehicles for $250

dealers advertised credit and lease terms without clearly and conspicuously disclosing information required by federal law, and failed to keep records required by the 2014 order.

In addition to the $85,000 civil penalty, the proposed order prohibits the dealers, in any ad for buying, financing or leasing vehicles, from misrepresenting the cost of purchase with financing, the cost of leasing, or any other material fact about price, sale, financing or

When you’re searching for a wide variety of the right vehicles for your customers, look to a nationwide industry

Look to Chase.

Chase is your source for: A broad range of vehicle makes and models — from economy to luxury — upstream and through preferred auctions nationwide.

Convenient online and in-lane vehicle availability with on-site Chase remarketers.

Put Chase to work for you. Visit ADESA.com and Manheim.com.

Your Source. Chase.

PEOPLE IN THE NEWS

Cox Names President For Media Group

Cox Automotive announced that Brian Geitner has been named president of the company’s Media Solutions Group.

Geitner will oversee the company’s Autotrader, Kelley Blue Book and Dealer.com business divisions and brands, leading the integration of Cox Automotive’s platforms.

Geitner succeeds Jared Rowe, who is departing the company for a new opportunity outside of the automotive industry.

Since 2015, Geitner was president of Financial Solutions Group at Cox Automotive responsible for the advancement of NextGear Capital.

Geitner joined Cox Automotive in 2012 as chief executive ofcer of Dealer Service Corp.

ADESA Appoints Auction Managers

ADESA, announced changes to its auction management teams at ADESA Orlando, ADESA Los Angeles and ADESA Colorado Springs.

Theo Jelks, previously general manager of ADESA Los Angeles,

Geitner began his new role on Aug. 15, reporting directly to Mark O’Neil, chief operating ofcer of Cox Automotive.

will lead ADESA Orlando as general manager.

Jef Brinkley, previously assistant general manager at ADESA Indianapolis, will serve as assistant general manager.

Jelks joined ADESA in 2001 as executive sales director and was named general manager at ADESA Tampa in December 2005.

He transferred to ADESA Los Angeles as general manager in 2009 and was named

general manager at ADESA Las Vegas in 2011. He returned to ADESA Los Angeles as general manager in 2014.

Brinkley has more than 30 years of experience in the auction industry, having started at Indianapolis Auto Auction in 1985 as operations manager.

He was general manager at ADESA Southern Indiana for two years and has been at ADESA Indianapolis for 16 years.

At ADESA Los Angeles, Vic Yancone, previously assistant general manager of operations, has been promoted to general manager.

Cheryl Toler, previously assistant general manager, has been promoted to auction manager.

Jesse Estrada, previously general sales manager, has been promoted to assistant gen-

eral manager of sales and administration.

Jef Hyde, previously operations director, has been promoted to assistant general manager of operations.

Yancone has over 25 years of auction and remarketing experience, including 13 years as senior vice president for BSCAmerica.

He joined ADESA Los Angeles in 2008 as operations director and later was promoted to assistant general manager of operations.

Toler began her career in the auction industry in 1988 with ADT Automotive.

She joined ADESA Los Angeles in 2002 as factory manager for Toyota. She was promoted to commercial account manager in 2008 and to assistant general manager in 2009.

She transferred to ADESA Las Vegas to

assist with its opening and then returned to ADESA Los Angeles as assistant general manager.

Estrada began his career with ADESA in 2001 as an outside sales representative for dealer consignment.

In 2005, he was promoted to dealer consignment sales manager. In 2014, Estrada was named general sales manager.

Steve Swanson has been named general manager at ADESA Colorado Springs.

Cindy Kuhn, previously general manager at ADESA Colorado Springs, has accepted a position as regional online manager for the company.

Swanson had been general manager at ADESA Austin since 2007. He was previously president at AutoVIN, a subsidiary of ADESA.

Brian Geitner

Theo Jelks

RETAIL MARKETS

OHIO

David Adkins, dealer principal, Wilmington Auto Sales, Wilmington, Ohio:

“We’ve been in business 40 years as of this year. My dad started it. We have one location.

“We have 45 vehicles on the lot. We’re down in inventory. We were carrying 60 at this time last year. We’re trying to get that number up. It’s been a difficult time trying to find the right inventory mix.

“We were at 45 sold per month, but we’re down to about 35 to 40 per month. August killed us. We were at about half of what we were last year. I’ve been talking to other dealers and their floor trafc is down also.

“I get my inventory mainly from auctions.

“We’re strictly regular retail.

“The average retail price is up – it’s about $12,000. We’re buying some newer, higher-dollar stuf. That $10,000-and-under stuf is

hard to come by.

“Our average model year is about 2010. Our average mileage is probably in the 70,000- to 80,000-mile range.

“We try to keep about a 50-50 mix between cars and trucks/SUVs.

“It doesn’t matter whether it’s domestic or import, I’ll buy it.

“We’re averaging about $1,500 in reconditioning. We over-recondition our cars. We do that in-house.

“We have a full service facility. It’s been busy. We have 10 service bays; two detailers and we’ve got four techs. We have an 18,000 square foot facility.

“We mainly do Internet advertising. We use TrueCar.com, AutoTrader.com, Cars.com, CarGuru, etc.

“We’ve been strictly Internet for quite a few years. We might do some local print for oil changes, but I don’t consider that a big part of advertising.

BelAir_UCNsep5.pdf 1 8/25/16 3:05 PM

“Believe it or not, hybrids are doing really well for us.

The Toyota Prius has been really strong for us. I usually try to keep four or five of those in stock. We also service those. It’s a simple, straightforward car. We usually don’t have any troubles with hybrid systems other than batteries and we can repair those also.

“We just sold a 2013 Toyota Prius V. It sold for $15,800. It had around 60,000 miles.”

PENNSYLVANIA

Robert Straub, owner, 1st Choice Auto LLC, Fairview, Pa.:

“We’ve been in business 18 months. Previously, I was the Credit Acceptance market-area manager for six years. I had originally spent 30 years as a finance manager and then got into the banking end with Citigroup.

“We’ve got about 18 to 20 on the lot. That’s the same as this time last year.

“I get my cars mostly from auctions.

“We averaged 12 cars a

month our first year.

“Our average price is in the $6,500 to $8,000 range.

“We focus on the subprime. We utilize the Credit Acceptance program.

“I believe our average model year now is 2008 and average mileage is right around 130,000.

“We carry about 90 percent cars and SUVs. Trucks are probably less than 10 percent. That’s a little because of price point and it’s tough to get the subprime market to advance money on trucks.

“(Inventory) is evenly mixed between domestic and imports.

“Reconditioning costs –with inspections and safety checks included – is probably in the $725 to $750. Probably 80 percent of that is mechanical service work.

“We do not have a service department on site, so everything we do is farmed out. Getting dependable, quality work is my biggest struggle.

“I’m using three or four

Compiled by Jeffrey Bellant

diferent garages at any given time.

“We do a few of the local penny savers, but most of the advertising we do is Facebook-driven.

“It seems like the fouror five-year old car with 80,000 to 90,000 miles is extremely strong. The higher-mileage cars (are not as strong). So while I used to be OK with a car that had 110,000 to 115,000 miles on it, I’m now looking at a car with 90,000 miles. The margin of that higher mileage car has seemed to tighten up.

“I don’t think miles bother the customers as much, but I don’t see the advances in financing. The 80,000- or 90,000-mile car is advancing way more money than the 110,000-mile car.

“That’s afecting us a little bit. But being small allows us to change course quicker than the bigger guys.

“I recently sold a 2010 Dodge Journey. I had 91,000 miles. It sold for $10,995.”

WHOLESALE MARKETS

MASSACHESETTS

Jim Lamb, president, Lynnway Auto Auction, North Billerica, Mass.:

“I’ve been a car auctioneer for 40 years. The auction itself has been around since 1997.

“We just completed a major remodeling of our facility early this summer. It includes a brand new ofce complex and detail shop.

“We have eight lanes. I would say our volume is about 2,100 cars.

“We’re probably up 300 cars per week. I attribute that to a lot of hard work –being fair, being honest.

“The majority of our customers are new-car dealer stores. We’re probably hitting, easily, 73 percent conversion. I don’t know how it is compared to last year. The thing is we have sellers. We have some of the biggest dealers in Massachusetts that run here. They want to sell cars.

“We probably have 1,300 dealers coming to the sale. With 2,100 cars, you have to

have a lot of buyers.

“Our bidders are coming from all over the country. With the Internet, bidders are from everywhere.

“You’re never going to hear anything negative from me. The dealers are all working hard and making things happen. They’re buying cars.

“We also have a lot of crazy cars, some high-end cars.

Last month we sold a Maybach. Another week we sold a Ferarri. So we’re selling all kinds of crazy stuf

“We don’t do any commercial vehicles. We sell all dealer consignment. Everybody was also chasing fleetlease companies and we just focused on what we do with dealers.

“We don’t do any separate powersports or highline sales. Our highline sale is every week. Seriously, we have highline cars every week. We also have powersports mixed in with the regular sale. We always have something. We don’t specifically go after that stuf, it

just comes in.

“Our average price overall is about $10,000. I’m not sure how that compares to what we were running last year, of the top of my head.

“Nothing is struggling. Everything is just status quo. Everything is good.

“We’re really looking for a strong fall season. We’re very aggressive right now. We’re marketing the (heck) out of everything.

“It’s going to be a good season.”

PENNSYLVANIA

Louis Craig, general manager, America’s Auto Auction – Pittsburgh, Washington, Pa.:

“We were bought out in 2008 by America’s Auto Auction. It’s been great. It’s a good company. I’ve been here since 1994.

“We have six lanes and we’re currently running five.

“Volumes have been good, especially in August. Things really picked up. For the year, it’s been a softer year

than 2015 in Pittsburgh, which is probably an anomaly.

“I just looked at some stats and – year-to-date in July – new-car registrations were down 4.5 percent in Pittsburgh. In June and July only, they were down 7.3 percent from last year. Our auction is mostly new-car trades. So for us to be flat with last year is good.

“I would say the tri-state area of Pennsylvania, Ohio and West Virginia is in a bit of a slump. Because of the gas prices all of the Marcellus Shale activity has slowed down.

“Our volume at one recent sale was about 820, which is typical.

“Conversion rates are a little softer than this time last year, but still in the mid-60s – 64 to 65 percent. Typically we’re in the high 60s.

“We’re drawing about 300 dealers in the lanes – it might be a few up or down from that. That’s typical for this time of year.

“Dealers will come from

Compiled by Jeffrey Bellant

everywhere but mostly Pennsylvania, Ohio and West Virginia. Those will be the three biggest places.

“Our cars are 95 percent dealer trades and 5 percent commercial/fleet-lease.

“Online isn’t on fire, but it’s growing. Every month we see modest gains. Right now, our dealers are using it as a tool when they can’t make it to the sale. We’ve been using AWG, but that’s been bought out (by Integrated Auction Solutions).

“We also do a weekly specialty sale. We might have a toy sale or a truck sale.

“We still have the U.S. marshal sale, but it’s been very weak. Right now, we’re basically in the vehicle storage business for them. We’re not having many sales at all. In the past, there was not a set schedule, but you’d still have maybe five sales a year. There wouldn’t be very many cars.

“Our average price in the lanes has gone up and down throughout the year, but overall it’s about $4,800.”

UNI TE D ACCEP TANCE , I NC.

• CA SH f or y our auto notes – Bulk P urchase

• P ay ment Strip P rogram ( 3 to 15 months) Dealer collects.

• Reduce administratv e burden of collecton calls and taking cash.

• Build y our inv entory to sell more.

• We are y our source f or capital and serv icing solutons.

• Quick , simple and consistent f unding process

COMPACT CAR

Jan 2016 $5,090 101,983

Feb 2016 $5,053 102,234

Mar 2016 $5,261 101,367

Apr 2016 $5,343 100,510

May 2016 $5,170 101,761

Jun 2016 $5,079 102,042

Jul 2016 $4,986 102,238

YTD AVG: $5,146 101,719

FULLSIZE CAR

Jan 2016 $3,954 77,291

Feb 2016 $3,580 76,723

Mar 2016 $3,528 70,653

Apr 2016 $3,666 70,426

May 2016 $3,528 71,150

Jun 2016 $3,373 71,291

Jul 2016 $3,629 71,346

YTD AVG: $3,598 72,467

LUXURY CAR

Jan 2016 $11,859 97,412

Feb 2016 $11,336 100,106

Mar 2016 $11,836 98,413

Apr 2016 $13,034 95,553

May 2016 $12,498 97,344

Jun 2016 $12,423 97,329

Jul 2016 $12,501 94,312

YTD AVG: $12,191 97,297

MIDSIZE CAR

Jan 2016 $5,859 109,088

Feb 2016 $5,870 109,764

PICKUP

Jan 2016 $15,926 103,871 Feb 2016 $15,880 104,156

2016 $16,417 102,263 Apr 2015 $16,991 100,413 May 2015 $16,770 102,306 Jun 2016 $16,701

Mar 2016 $6,117 108,931

Apr 2016 $6,371 107,144

May 2016 $6,138 107,948

Jun 2016 $6,062 108,353

Jul 2016 $6,069 106,873

YTD AVG: $6,073 108,342

DISCONNECTED JOTTINGS FROM TONY MOORBY

Language, in all its forms, has long been a fascination for me, English especially so because you can do so much with it. Skillfully used, it can

many others – usually brought by marauding invaders of that small island. It has been constantly changing and evolving with influences from all

Tony Moorby

• 40-year veteran of the industry

• President from 1997–2000 of ADT Automotive

• Served as ADESA’s executive vice president of sales and marketing

• Moorby & Associates 2006–present

• Awarded the Ring of Honor by NIADA

• NAAA Hall of Famer

bring nations through crises as Winston Churchill did through World War II or have people collapsing in laughter from a clever comedian’s delivery. Few other languages can be as playful as with puns or spoonerisms; changing the first letters or syllables of two words or more to change the meaning: “A pack of lies” becomes “A lack of pies”, for instance.

The history of the English language signifies its richness by being derived from so

over the world and, nowadays largely through immigration.

It’s worked the other way too, of course, English having found its way to all corners of the globe (what other language would describe corners of a round object?). Accents are diferent and interesting depending on their derivation – the Australian form coming from the nasal intonations of Londoners who were the first penal settlers, having been sentenced to “… seven years in lands beyond the seas.” In

By Myles Mellor

the ‘60s a fellow named Morison called the Aussie tongue ‘Strine’ (a shortened form of Australian) and came out with a common usage dictionary in Afabeck Lauder (alphabetical order) describing such things as ‘eggnishners’ for air conditioners.

Perhaps one of the most fascinating things about English is how prolific is its slang. It difers not only where you’re from, but some industries have developed their own. Take our car business for instance and while it may be diferent in England to here, both were born to confuse customers or have them avoid listening to descriptions of themselves, their cars or their financial positions.

An English salesperson might say to their manager, “I’ve got a barker outside –might be worth monkey if the punter’s lucky. Wanna come and have a butcher’s hook?” or roughly translated, “I have a trade outside that’s a bit shabby (a dog), it may be worth five hundred pounds if the customer’s lucky. Would you

like to come and have a look?”

Over here we speak of spifs, roaches, be-backs, ups, downs and so on, all for much the same reason. There is also the sense that we’re all in the same club, afrming that feeling of being on the inside.

Speaking of confusing outsiders, perhaps the most daunting twist of language is the use of cockney rhyming slang. Sir John Peel was the first Parliamentarian to introduce a formal police force to England – early policemen were called ‘peelers’. One of the ways they would try and stop crimes or find out who had committed them was to visit the inns and taverns where the thieves, vagabonds and ne’er-do-wells spent their time. The peelers would listen to conversations and nab them on the spot.

To be a true Cockney one has to be born within the sound of the bells of the Church at

St. Mary Le Bow, about a mile radius. These Cockneys came up with a way to avoid being understood. They used two words for one, the second of which rhymed with the word they wanted to say such as Caine and Abel for table. Then they would confuse even more by dropping the word that rhymed so that a Caine meant table!

Try a full sentence; “I’m taking a ball down the frog, going back to the mickey, run up the apples, jump in my uncle and put my loaf on the weeping.” That’s short for, “I’m taking a ball of chalk (walk) down the frog and toad (road), going back to the mickey mouse (house), run up the apples and pears (stairs), jump in my uncle Ned (bed) and put my loaf of bread (head) on the weeping willow (pillow).”

I know of no other language that can be so creative.

Waze or Tomtom for example

Clint Eastwood flm named after a classic Ford, 2 words

Made in the ___ 23. Geek’s department, abbr.

Ducato or Doblo 30. Let the engine turn

Makers of the Aventador

XT5 maker 3. It comes in a can 4. Device used to monitor and change air fow past a moving vehicle 6. Type of truck, 2 words 7. Essentials for all car owners, 2 words

8. Ford T6 ___

11. Where Toyota is based

Politico, abbr. 17. Audi Q7 ____ TDI Plug-in hybrid 19. Direct a fow of fuid 21. Ending for public and column 25. Car that was in an accident and now being resold 27. Genius physicist whose name is now a car brand 28. Nissan sedan

Specially built for a client

German “the”

French for water

PlayStation competitor

The p in mpg

Popular family wheels

Ballpark fg.

Madison’s state

MORE SALES!

AROUND THE BLOCK

CHICAGO ROCKS SPOKANE

DAA Northwest drew 3,600 customers and guests to its 21st annual Rock & Roll Sale featuring the famous rock band Chicago.

Sale results eclipsed even last year’s record-setting numbers, according to Bob McConkey, auction president.

“Thank you to the DAA family of dedicated employees who worked their hearts out to make it happen. And thank you to all of our loyal customers who choose to do business with DAA.”

DAA’s Rock & Roll Sale concert and party followed the auction’s Wednesday morning fleet/ lease sale, and set the tone for the Thursday morning mega sale.

The Cronkites got things rolling on the DAA Stage, opening for Chicago. The Cronkites, who include DAA’s own Greg Mahugh and Pat Simmons, have opened for nearly every featured act DAA has hosted.

Compiled by Jeffrey Bellant

Auction Celebrates 20th Anniversary

Southeastern Auto Auction of Savannah celebrated its 20th anniversary sale on Aug. 17.

The sale ofered a record consignment featuring a variety of vehicles from new-car dealers, independent dealers and institutional accounts. These vehicles were ofered to a huge crowd of dealers both in the auction lanes and online via Simulcast.

Dealers enjoyed a free BBQ lunch and had an opportunity to win some of $25,000 in cash and prizes.

A donation was made to Shriners Hospital for Children, which came from money raised through a 50/50 drawing.

McConkey stated consignment for the two-day sale reached 4,938 vehicles. The auction posted an overall conversion rate of 75 percent with 3,690 sold for a gross sales total of $61.5 million.

In addition, they have opened for KCI Kansas City’s Guitars and Cars concerts and have made appearances at National Auto Auction Association conventions.

“The entire event is a product of an auction team that is simply the best,” McConkey said.

“We could never have predicted the way this event has evolved when we held the first Rock & Roll sale in 1985,” said McConkey.

“It was another record-breaking day for both number of vehicles consigned and sold,” said Bill McCready, auction vice president.

“To achieve this on the 20th anniversary of the auction is a great achievement.”

We invite news items and top-quality photos from our readers to be considered for “Around the Block.” Please include the name of a contact person and a telephone number. Send items and photos to: Jeffrey Bellant. Mail: Used Car News, 24114 Harper Ave., St. Clair Shores, MI 48080. Fax: (586) 772-9400 e-mail: jeff@usedcarnews.com

CHICAGO STYLE: Legendary band Chicago jams at DAA Northwest’s annual Rock & Roll Sale in Spokane, Wash.