BB

$AY 4EST $RIVE 4HE INDUSTRY S MOST TRUSTED VALUES ON YOUR PHONE

September 19, 2016

www.usedcarnews.com

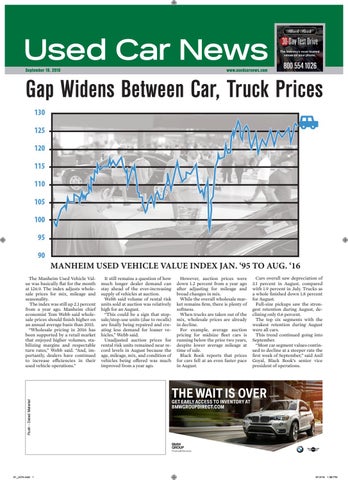

Gap Widens Between Car, Truck Prices

MANHEIM USED VEHICLE VALUE INDEX JAN. ‘95 TO AUG. ‘16

Rush - Dated Material

The Manheim Used Vehicle Value was basically flat for the month at 126.9. The index adjusts wholesale prices for mix, mileage and seasonality. The index was still up 2.1 percent from a year ago. Manheim chief economist Tom Webb said wholesale prices should finish higher on an annual average basis than 2015. “Wholesale pricing in 2016 has been supported by a retail market that enjoyed higher volumes, stabilizing margins and respectable turn rates,� Webb said. “And, importantly, dealers have continued to increase efficiencies in their used vehicle operations.�

It still remains a question of how much longer dealer demand can stay ahead of the ever-increasing supply of vehicles at auction. Webb said volume of rental risk units sold at auction was relatively high for an August. “This could be a sign that stopsale/stop-use units (due to recalls) are finally being repaired and creating less demand for loaner vehicles,� Webb said. Unadjusted auction prices for rental risk units remained near record levels in August because the age, mileage, mix, and condition of vehicles being offered was much improved from a year ago.

However, auction prices were down 1.2 percent from a year ago after adjusting for mileage and broad changes in mix. While the overall wholesale market remains firm, there is plenty of softness. When trucks are taken out of the mix, wholesale prices are already in decline. For example, average auction pricing for midsize fleet cars is running below the prior two years, despite lower average mileage at time of sale. Black Book reports that prices for cars fell at an even faster pace in August.

Cars overall saw depreciation of 3.1 percent in August, compared with 1.9 percent in July. Trucks as a whole finished down 1.8 percent for August. Full-size pickups saw the strongest retention during August, declining only 0.6 percent. The top six segments with the weakest retention during August were all cars. This trend continued going into September. “Most car segment values continued to decline at a steeper rate the first week of September,� said Anil Goyal, Black Book’s senior vice president of operations.

THE WAIT IS OVER BMW

GET EARLY ACCESS TO INVENTORY AT BMWGROUPDIRECT.COM

56951_BMW Group Direct Media Plan_UCN_Front Page Strip_THE WAIT IS OVER_4.65in x 2.25in.indd 1 01_UCN.indd 1

9/9/16 2:12 PM 9/12/16 1:38 PM