UCN Used Car News

LAS VEGAS – Training, education and certification for the remarketing industry took center stage during the Conference of Automotive Remarketing last month at Caesars Palace.

Penny Wanna, president of Auction Academy and vice president of administration for TPC Management, moderated the panel discussing these topics. Wanna also serves on several education committees and a compliance committee.

Wanna called the session a “back to basics” look at opportunities for education and training available to the industry through Auction Academy, the International Automotive Remarketers Alliance’s (IARA) Certified Remarketers Program and its Audit and Compliance Training (ACT).

IARA’s CAR certification is one of the more comprehensive educational programs in the industry. Participants have to go through a rigorous program with 20 modules

covering everything from remarketing channels, reconditioning, repossessions and branding, to benchmarking, arbitrage, the title process and legal issues.

Panelists discussed their journey to CAR certifications. It provides “universal and fundamental instruction and best practices, industry regulations and guidelines to better position yourself when working with other people in the industry,” Wanna said.

Keely Smith, who works in compliance for AutoIMS, said CAR certification broadened her view.

“It gave me a greater appreciation for all of our partners, consignors, and auctions – what they go through to remarket a car,” she said.

Mere Rangel, general manager of Big Valley Auto Auction, became CAR certified before entering Auction Academy and it helped him speak the same language with people in the industry. Jim Jackson of Holman Remarketing Solutions said his boss called him to take part in CAR and he became certified in

2010 and later received lifetime certification.

Once he got involved in the modules and the testing, it “really opened” his eyes to the wider remarketing business.

Jackson said he is the biggest advocate of the program and Holman has 18 workers who are CAR certified, including six with lifetime certifications.

“It is required in our company that all of our remarketers become certified – either we hire them as certified or they become certified upon employment,” Jackson said

Members of the Auction Academy also become CAR certified.

Tommy Rogers, general manager of Bel Air Auto Auction, became CAR certified seven years ago to set an example.

CAR graduates have to re-certify every three years and on the third certification, the student achieves lifetime certification, Wanna said.

“We have 18 lifetime certified honorees,” she said.

Continued on page 4

By Jeffrey Bellant

By Jeffrey Bellant

LAS VEGAS – The topic of EVs raised more questions than answers during a panel discussion at the recent Conference of Automotive Remarketing.

The panel was moderated by Tom Stewart of Auction Management Solutions and sponsored by the International Automotive Remarketers Alliance.

Panelists Michele Pierog of ParkMyFleet; Jeremy Louisos of Preowned Auto Logistics; John Mathiowetz of IAA; and Doug Turner of Byrider are all part of IARA’s Industry Advancement Committee, which covers various EV issues.

Stewart kicked off the discussion by asking the tough question: what is the primary concern of consignors when it comes to EVs?

Mathiowetz suggested the answer keeps evolving.

“I think the more we learn, the more questions we have,” he said.

He said a couple of years ago he and IARA Board Chairman Paul Seger interviewed more than 30 consignors and the questions centered on batteries, charging, infrastructure, etc.

“This is still really new to the industry,” Mathiowetz said. “At this point, 2% to 3% of vehicles at auction – if you include hybrid.

“It’s something we’re still not prepared for.”

From a consignor standpoint, the question is how do they put them into their fleets, how do they depreciate that asset, etc.

“But just solely from a remarketing perspective, what we need to be concerned about as auctions is how can you make sure you have the infrastructure to supply the charging,” Mathiowetz said. “If it’s a damaged battery, what do you do then? How

As a remarketer, Turner said he is not seeing any EVs in his portfolio. But he is seeing them come to auctions.

“I really think the important thing, not only from a consignor’s perspective but from an auction perspective, is how can you tell the story and the history of that car?” Turner said.

Continued on page 8

Continued from page 1

Another program offered through IARA is ACT (Audit & Compliance Training).

Smith said the idea of ACT goes back over a decade to the formation of the Consumer Financial Protection Bureau and the pressure of regulators requiring more compliance.

Auction owners eventually came to IARA Executive Director Tony Long asking if IARA could come up with a tool to help train auctions on compliance, Smith said.

“It took us a while, honestly, because there are a whole lot of components to it,” Smith said.

IARA attorney Jim Demetry and his team created the program.

Smith said it’s less intimidating than CAR because it’s not as many modules and a shorter time commitment of about 60-90 minutes.

“We try to divide it up in the areas where we saw regulators looking for different oversight,” she said. “That’s not just IT security; how you handle your clients’ data and if you’re a good steward of that data. It’s also about your employees’ behavior, how you train your employ-

ees to behave and handle that information.”

Also, it discusses human resources practices like background checks, Smith said.

How important is compliance?

Jackson said Holman Remarketing Solutions recently had its entire U.S. department – 44 people – complete ACT certification, both at management and employee levels.

“It gives clients reassurance that everybody, from remarketers to the title folks, has been trained in this and will continue to train,” Jackson said.

Wanna said because regulations and compliance changes so quickly, the ACT certification is an annual requirement.

“We feel it’s very important because, as laws change, we need to keep up,” Rangel said. “We’ve got to make sure we’re in compliance.”

Rogers said it wasn’t long ago when conferences like CAR had agendas full of compliance issues.

“Our employees who are handling your cars, your information and your customers are ACT certified,”

he said.

Wanna said IARA member firms can use ACT training as a part of their onboarding process, so they “don’t have to recreate the wheel.”

NAAA’s “Privacy Pam” training goes hand-in-hand with ACT, Rogers said.

“It’s to make us aware of the things our consignors expect from us and what we need to be doing to protect data and the cyber security that goes into our day-to-day operations at our facilities,” Rogers said.

NAAA has also had its regular Safe T. Sam safety training for years and NAAA is working on supplemental videos to be more department specific, Rogers said.

A third video program is “Coach Caution,” to help auctioneers identify and avoid potential risks in their jobs.

Speaking of training, the CAR conference officially opened registration for the Auction Academy’s Class Group 8.

Class 7 will graduate in September in conjunction with the NAAA Convention & Expo in Chicago.

The program, consisting of eight sessions, launches in Nashville this August. Auction Academy was developed by TPC Management Company at the urging of a number of industry leaders who saw the need for formal training for the rising generation of auction industry leadership.

Its two-year training and development experience is structured like an executive MBA program. With faculty drawn from expert practitioners around the country, Auction Academy’s course of study is designed to enhance essential skill sets, promote best practices and yield better auction performance. The curriculum includes site visits, field trips and work with industry experts in all areas of auction operations. In between sessions, there are virtual classroom sessions.

Smith said AutoIMS has been a sponsor of the academy.

“We’re just such huge believers in it,” she said. “The curriculum is just excellent.”

Wanna said the goal is to have the program touch on every aspect of the industry, exposing students to the whole business of auctions.

Instructors who participate become lifetime resources to students, Wanna said.

The relationships formed is one of the best parts of the program, Rangel added.

A lifetime benefit to academy graduates includes the ability to attend future classes that might appeal to you at any time, Rogers said.

Charles M. Thomas Founder (1947-2002)

Lynda R. Thomas, Publisher Emeritus Colleen Fitzgerald, Publisher

Editorial: Jeffrey Bellant, Managing Editor Ed Fitzgerald, Staff Writer

Advertising: Shannon Colby, Account Manager Tony Moorby Columnist:

Circulation: subs@usedcarnews.com

Production: Tom Savage, Production Manager Cee Lippens, Web Master Used Car News is published every third week.

Subscribers: We print advertisements as sent to us by auctions and other advertisers. It is not possible to verify the correctness of listed vehicles in auction ads. Most lists are partial and all lists are subject to last minute changes by auto auctions, so before travelling a long distance for a particular auto auction event, contact the auction by telephone for a fax of vehicles in the sale.

Used Car News assumes no guarantees or liabilities concerning the accuracy of any advertisements. All Rights Reserved. Reproduction in any form is prohibited without the written consent of the publisher.

OUR ADVERTISING APPROVAL POLICY Payments from first time advertisers must accompany the insertion order. Distribution is guaranteed by the USPS. The advertising reservation deadline is 12:00 noon Thursday, 11 days prior to the issue cover date. Ad materials are due by 5 pm Friday, 10 days prior to issue cover date. For advertising specifications please email colleen@usedcarnews.com.

LAS VEGAS – Economists and data experts discussed the challenges of the post-pandemic market during the recent Conference of Automotive Remarketing last month.

Jonathan Smoke, chief economist, Cox Automotive, kicked off the discussion on a macro level with the recent bank failures.

In studying the credit indices Cox produces every month – which show if it’s easier or harder for a consumer to get an auto loan – credit started to tighten last year, Smoke said.

“To start this year, we were actually seeing a little bit of a loosening of the tightening that had happened last year,” he said.

Consumers were seeing slightly better rates and approvals were up. Cox was seeing more subprime buyers as tax season started, Smoke said.

However, looking at the first half of March, Cox data shows credit is tightening in every channel, with the exception of independent used, he said.

“What changed the most? Interest rates,” Smoke said.

Also, lenders brought back the lengthening of terms, which typically helps mitigate price increases and rates, leading to one conclusion.

“Availability of credit, combined with affordability, are going to be significant issues weighing on the industry for several years,” Smoke said.

Interest rates continue to rise, making auto rates go up dramatically – more than 1¾ points in the first two and a half months of 2023.

“We are right at 14% as the average used loan rate,” Smoke said. “If you add that to prices, you really get an affordability problem.”

Tom Kontos, chief economist of ADESA Auctions, said market trends have changed.

“Our industry always used to have both a floor and a ceiling to prices,” he said. “The ceiling was always rep-resented by what new-car prices were doing.”

Once used car prices got so high, the trade-off isn’t worth it to consumers, causing a decline in demand in used cars and a softening of prices.

But today’s supply is having an effect on these trends.

“We’re in what I would call a ‘perfect drought,’” Kontos said. “The offlease units are in short supply and will remain so for at least a couple of years. Repos, though they are starting to rise, they are still only a shade of what they used to be in terms of total volumes at auctions.”

Additionally, dealer consignment is also tight because dealers are holding on to the trades they take and are trying to retail out of them. Lastly, even commercial and rental fleets remain in tight supply, Kontos said.

Generally speaking, used-car prices and new-car prices typically rise at the same rate although used cars did rise at a faster rate during the 2008-2009 recession.

The chip shortage caused the ceiling to rise on used-car prices, while 2022 saw a correction – as more normalizing of those prices – though still higher than normal, Kontos said.

In January, an uptick in sales pretax season resulted from dealers clearing out the vehicles they had bought at higher prices in 2022, he said.

Continued on page 6

“As prices were softening, they were being aggressive in pushing those vehicles through retail channels, getting them sold,” Kontos said. “So, when they started out in 2023, they were in a lean position, inventory-wise, and needed to build that inventory back up so they would have good quantities to sell during the spring tax season.”

Kontos believes prices will likely taper a little sooner in the spring market, even as early as April.

Alex Yurchenko, senior vice president and chief data science officer for Black Book, focused on used prices.

Yurchenko said after a lack of normal seasonality in the market last year, there was a hope it would return in 2023.

“I think it’s still an open question, but if you look at the first three months, we’re in a different world,” he said.

“Weekly prices in the wholesale market are rising over 0.5 % with some segments 1% a week. Even in a normal spring market, we’ve never seen that.”

Yurchenko believes used-car prices will still stay at elevated levels for two reasons.

“One is because of (lack of) inventory,” he said. The second is new-car sales, where incentives are still very low and the availability of new vehicles is still limited.”

Yurchenko forecasts somewhere around 18% depreciation rate, a little higher than historic numbers, but still more normal than it has been.

However, we’re still starting from a very high number, he said.

John Coles, ACV Auctions’ senior director of data science and analytics, looked at the microeconomic side.

During the first portion of 2022, ACV Auctions saw increased demand and delivery compared to the same time as last year.

“(That trend) highlights the need for affordability in the midst of credit tightening,” Coles said.

The residuals of 3- to 5-year-old vehicles – because of OEMs struggling with supply – will continue to hold through this year.

Used retail affordability is a critical factor for dealers and consumers.

Smoke added that 10% of the newand used-market was lost because of affordability and those numbers won’t improve until interest rates stop rising and vehicles depreciate more normally again.

Supply was hampered by the pan-

demic, with 8 million to 10 million fewer new cars manufactured during the three years of the pandemic that we would have expected.

There is another factor.

“We actually had a higher scrappage rate at the beginning of the pandemic, which made the situation even worse,” Smoke said.

The industry shouldn’t underestimate the market’s ability to meet customers’ needs, Kontos said.

“The other thing I would add is the creativity of dealers and finance companies to work with rates,” he said. “They’re competitive. So, the Fed does what it does, but our industry does respond with some rate subvention and support to keep payments a bit more affordable.”

Kontos doesn’t deny that rates will go up, but dealers and lenders don’t sit still.

Yurchenko was asked about the challenge of determining residual values in such an unpredictable market.

“I’ll start with affordability, because it’s a concern at every level,” he said.

Yurchenko also touched on what Kontos said, that the supply of 1- to 2-year-old vehicles is down everywhere from rental units to fleet units, so there are fewer choices “at every level.”

Then the shift of new-car vehicles to larger SUVs and pricier units also hurts affordability, Yurchenko said. He said the days of retention rates lower than 50% won’t be returning for up to seven years because of supply.

Smoke returned to the bailout of one of the richest banks in the country, which led to credit tightening for the average Americans trying to get loans in the midst of what the Fed is doing.

Kontos, however, said the Fed chairman has a tough job because inflation is inherent in the economy above just the interest rate increases.

(“Some of this) is being driven by everything we’re trying to do in this society in moving away from fossil fuels to renewables,” Kontos said, “and moving away from internal combustion engines to EVs.

“All of this is taking big R&D dollars and, in the meantime, we have some supply hiccups that result from this, too.”

The reason is the investment into these emerging technologies “doesn’t happen instantaneously.”

Kontos said this means there’s only so much the Fed can do.

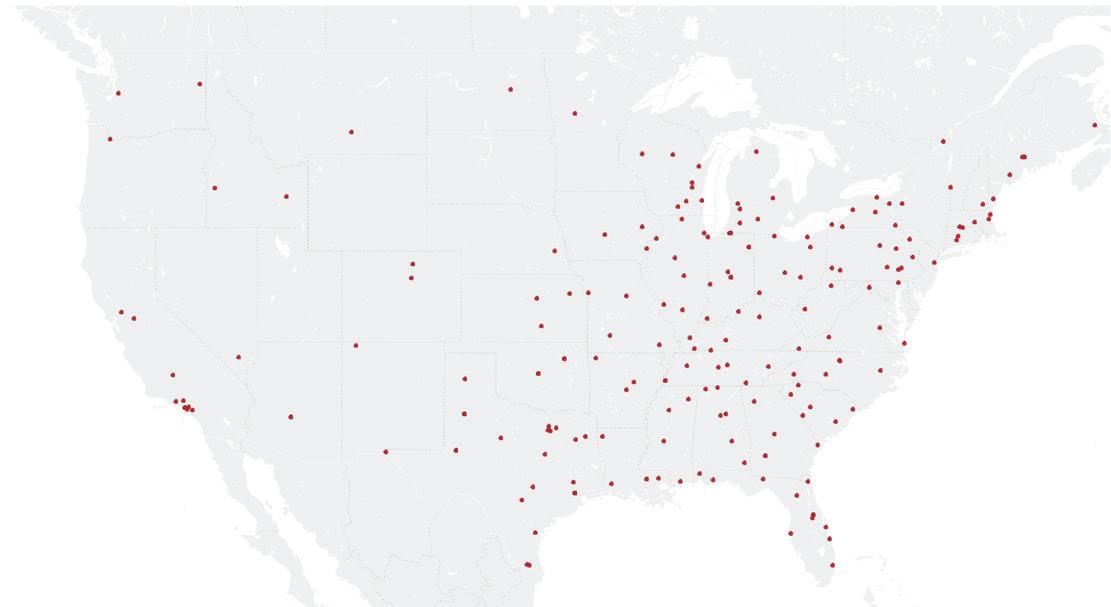

ADESA Boston May 12, 19, 26

508-626-7000

ADESA Charlotte

May 4, 18

704-587-7653

ADESA Chicago

May 26

847-551-2151

ADESA Cincinnati/Dayton May 2, 30 937-746-4000

Neither JPMorgan Chase Bank, N.A. nor any of its affiliates are affiliated with ADESA, Inc. or Manheim, Inc. Each auction is solely responsible for their website content, sales events, promotions, fulfillment and operation of the auction.

©2023 JPMorgan Chase Bank, N.A. Member FDIC 5/23

The challenge is how to make the buyer comfortable in making a good decision to purchase that car, he said.

Pierog said people want an EV to be like an ICE (Internal Combustion Engine) car, but they are two different things.

This will force an auction and remarketer to be two different things –an EV and an ICE remarketer at the same time, she said.

Pierog called it “uncharted territory.”

Stewart asked if any specific segments of EVs are growing faster than another.

Mathiowetz, who serves on the consignor group of the EV committee, said it’s all growing at a “snail’s pace.”

For everyone else, it’s unpredictable.

Stewart asked Louisos, the logistics member of the panel, how dif-

ferent it is to transport an electric vehicle from a regular car.

Having drivers transport cars that could catch fire is a major concern, Louisos said, even though ICE vehicles have fuel tanks that could also catch fire and transporters have been able to deal with them.

But there’s another concern.

“The most common type of transportation damage is undercarriage damage,” Louisos said, “and the undercarriage of this vehicle is the battery; I don’t know what that’s going to do with the integrity of the battery.”

The next issue involves the financial impact of transporting EVs.

“Weight’s the big one,” Louisos said. “It’s sort of the first one that comes to mind.”

If a truck has a full capacity of 80,000 pounds – and every vehicle is double the weight, what’s that going to do to a truck’s capacity?

Mathiowetz added that qualified techs will be a big problem.

“There’s no secret that there’s already a technician shortage,” he said. “So now you compound that with a completely new vehicle type.”

Pierog added another wrinkle to the discussion.

“If that car shows up at the auction and it’s a Tesla,” she said, it could be “connected to the previous owner on their app. If you can, then you charge it, but it’s going to charge the credit card of the previous owner.

“If you disconnect that vehicle from the previous owner, you may not be able to charge that car.”

Turner said the first part of the EV life cycle should not be a big problem from a repair perspective when it comes to off-lease, off-rental or out of fleet. Those vehicles will go to auction and it’s unlikely the necessary pre-sale repairs will be a big challenge.

“My biggest concern is when it comes to life cycle 2, life cycle 3 and life cycle 4 after it’s been bought by a dealer, sold by a dealer and brought back to auction,” Turner said. “There are going to be a lot more mechanical repairs needed on those vehicles.”

Stewart questioned when a significant volume of EVs will be coming to the wholesale market.

Pierog said it’s hard to predict.

“Two years ago, fleets thought they were going to have 100 EVs in their fleet. Now they have five,” Pierog said. “It didn’t pan out the way they expected.”

Stewart asked about how much charge to have on a battery in a wholesale/remarketing situation.

Pierog suggests the industry come up with some sort of benchmark, maybe 40%.

“It could depend on the battery size, it could depend on the vehicle.”

• Local Point of Service in YOUR market

• Bulk Purchase Program

• Payment Stream Advances (6-15 months)

• Aged Pay Share Program that gives you Capital and Cash Flow!

• Floorplan for select BHPH Dealers

• Servicing for all types of Auto Receivables

Randy Luster, owner, Hazlehurst Auto Sales, Hazlehurst, Miss.

“We opened in 2012 and have always been at the same location.

“COVID caused changes, but now we’re going back to the way we used to do things.

“Obviously, the biggest thing that changed was our costs.

“Our average ACV (actual cash value) right now is double what it was three years ago.

“It absolutely affected getting employees and we had to pay them more to keep them.

“Our average inventory, not counting tax season, is 25-30 vehicles. I like to take tax season out of it because those are future numbers, so we average 15 sales a month. In February and March we

usually sell 60.

“Probably 60-70 percent of our sales are SUVs, 30 percent cars. We don’t sell a lot of pickup trucks because we’re buy-here, pay-here. I can buy two cars for what I pay for one truck.

“Everyone wants a truck until you get one on the lot. You put four or five trucks out and since you’ve got to get so much down on them, no one buys them.

“I go to auctions in person because as a BHPH I can get burned online. Most of the cars I buy I try to check out ahead of the sale.

“You know, most dealers don’t want to give out what their favorite auctions are, but I like Dealers Auto Auction in Jackson, Miss. I frequent the Atlanta and Dallas markets.

“Our average down payment for last year was $2,200. We try to keep ev-

erything under four years.

“If there’s something to do to a car, I do it. Most of our reconditioning costs are on repossessions

“I’m not really looking for an average age of a car, it’s really just about price. I’ve got to buy something that I can get a decent down payment on.

“My average vehicle is probably 10 years old.

“One of the biggest things that helped me is that I operated on the skinny for 10 years, just trying to build it.

“I’ve got friends who sell a couple cars, make some money on ‘em and then spend it, instead of reinvesting it. If you do that, you can run yourself out of cash real quick.

“The last car I sold was a 2009 Hyundai Sonata with 119,000 miles. I sold it for $9,995.”

Garrett Smith, co-owner, Smitty’s Auto Sales, Greenfield, Ohio

“My grandfather started our business in 1947. Now I co-own it with my dad.

“The size of our inventory fluctuates. The number we have on the lot, being a small-town dealer with not that big of a parking facility, the most we’ve ever had is 45-50 cars.

“Right now, we’ve got about 30. We probably sell four to seven a month.

“The price of gas is going up. Gas prices are kind of like Forrest Gump and a box of chocolates: you never know what you’re going to get. Cars are like that, too. People just want something to get them from point A to point B.

“We go regularly to the auctions, if possible. But that takes away from us being at the shop. We try to go Tues-

Compiled by Ed Fitzgeralddays through Thursdays. Or we’ll go online to find a certain car that someone is looking for.

“I don’t do any buy-here, pay-here. In some cases, if they’re local, and they’re just starting out, we’ll try to help.

“But sometimes someone who likes a $40,000 car has only $200 to put down. There’s only so much you can do. We’re starting to see a trend where people will buy late-model, high-mileage cars.

“I always want to help people get something better than what they used to have.

“My dad always said we’re not a new-car dealership and we’re not here to make a lot of money. But this is our business and our passion.

“The last car I sold was a 2018 4WD, very clean, Jeep Cherokee, with only 54,000 miles. We sold it for $19,245.”

David Aahl, vice president, North Bay Auto Auction, Fairfield, Calif.

“We’re in the Bay Area, on the north end of San Francisco Bay. We’ve been in business for 29 years.

“We recently won ‘Auction of the Year’ from Merchants Fleet for the third year in a row. To us, it’s a huge deal and we’re really proud of it.

“Currently we’re running four lanes every Thursday.

“We’re running about 450 a week. I would say inventory is starting to come back to the sale.

“Before COVID we were running two lanes and 600 or 650. But our sales percentages are way better than they used to be. It’s like 70s across the board – dealer cars, bank cars, everything.

“Our mix is probably 60/40. That’s 40% dealer cars and 60% that are pre-

dominantly repossessions, with some lease returns, too.

“We’re seeing a couple of hundred guys in-lane and a couple of hundred bidders.

“We’re well over $10,000 on average price per car (sold). I would say pre-COVID it was $6,500ish. We’ve got a lot more lease returns in the lanes and those are about a $40,000 average.

“The commercial business has been one of the segments that’s grown the most. We call it ‘white metal’ because it’s mostly cargo trucks, pickup trucks, multiperson vans – anything for commercial use.

“We run those vehicles every week, plus we run GSA sales at least once a month, most of the time twice a month. That’s mostly that same plain jane governmentstyle stuff.

“The GSA is a steady flow. Maybe last month we sold

150 vehicles.

“Looking ahead, we have to remember there wasn’t a lot of cars built for a 2 ½ year period. I used to specialize in 2- to 3-year-old cars and now they don’t exist. That’s going to play out for years to come.”

“I’m optimistic that the market is going to continue to be hot.”

John Vance, president, Bloomsburg Auto Auction, Bloomsburg, Pa.

“We’re in northeastern Pennsylvania. If you look at a map, we’re about 20 miles west of where I-80 and I-81 cross. We’ll have been in business 10 years this August.

“We have two lanes. We’ve been running about 125 per week. Before the pandemic, we were running about 150 or a little more.

Compiled by Jeffrey Bellant“We get a few repos from banks, but I’d say we’re 99% dealer cars.

“We’ve been selling in the low- to mid-60s (conversion rates).

“So, between in-lanes and online we usually draw between 130 and 140 dealers per week. I’m going to say it’s about 50/50 online to inlane.

“We’re seeing a lot of new faces, a lot of new activity online.

“Everybody in the lanes says that retail business is kind of slow. But everybody seems to be buying.

“Dealers are saying that nobody seems to be trading as much. That’s kind of the weird thing.

“It used to be that 60% to 70% of car deals had a trade. Now it’s more like 30% of (customers) have a trade. Nobody has an answer for me about that.

“I’ve noticed this year for tax season that prices have seemed to be up this year.

“Our average price coming across the block is $6,000. Before COVID it would have been $4,000 or $4,500.

“Going forward, I’m pretty optimistic. When things go (bad) cars still have to move. Whether it’s by repo or to get them off the books, cars end up going to the sale. They’re not just sitting on the lot, collecting dust.

“Also, I’m not jumping on this EV thing, even though I’m driving one. I think we’ve got at least a decade before they even start to become more than 20% of what’s on the road.

“I drive a 2022 Rivian R1T. I bought the car just to flip. I didn’t want to like it, but I’ve had it six months.

“What do I like about it? Zero to 60 mph in three seconds.”

A few articles ago, I wrote about the capture of photos of people applying for drivers’ licenses. Real ID’s were now replacing drivers’ licenses as the only document, apart from a passport, enabling travellers to pass through airport security. I postured, at the time, that Uncle Sam was effectively building a facial recognition database. Some would say it was a good thing, helping law enforcement efforts and so on. Others would protest that civil rights were being trampled on. I noted China’s ability to pinpoint anyone, anywhere and anytime from a street crossing to a border crossing.

I have to admit that I take a middle-road approach, allowing that technology improves everyone’s footprints to go into new territories, but observing that they are traceable. Every day we ex-

ercise those choices, weighing our own sensitivities to scrutiny; it’s a cost/benefits kind of thing. I go to Wikipedia for some information, Google knows I’ve been there, what I researched, how long I tarried and so on. No biggie. Even watching television allows so many entities to draw your profile and reach you in your ‘preferred’ media formats.

Older people still watch television the way they always have, not through streaming channels, albeit with more program choices. The news is usually a focal point for early evenings and older people are normally less well so we are regaled with those interminable adverts for medications whose side effects are worse than that which they are meant to cure!

A database is one thing –two databases, when rubbed

together, especially with today’s Artificial Intelligence, is something different. One plus one isn’t two anymore – patterns and predictions are possible. Introduce more data and information grows exponentially.

Nashville and some of our surrounding counties have just started introducing vehicle license plate readers. An especially useful tool for traffic police, car theft tracking and other offenses involving vehicles. Mind you, with satellite navigation systems almost a standard fitting on today’s cars, we could negate license plates all together in the not-too-distant future.

However, in Great Britain the authorities, under the auspices of The Driver and Vehicle Licence Centre, can see a licence plate through cameras, know the registered owner, whether the

vehicle has been properly insured (a legal requirement there), if the car has had its annual “MOT” test (a test for a vehicle’s mechanical fitness to be driven) and even whether the driver is medically able or allowed to drive. Tolls can be automatically charged, such as the London Access fees – if you drive a diesel they’re more expensive! All this grew from Speed Control Cameras about 30 years ago. Data on vehicle movements could be enormously valuable to many entities from manufacturers to holiday planners, insurance companies to town planners.

A ‘nanny state’ or Big Brother’s existence seems more and more inevitable because it is becoming easier to achieve and for authorities to access our everyday activities. These things tend to start with the thin end of

a long wedge, almost unnoticed at first but by the time it’s in place, it’s too late to take away.

The old adage that ‘if you’ve done nothing wrong, you have nothing to fear…’ is all very well or is it George Orwell?