NAF Association Leads in Tech, Compliance

By Jeffrey Bellant

Ian Anderson, group president of Nowlake/Westlake Holdings, serves on the board of the National Automotive Finance (NAF) Association, which had its annual convention in June.

It’s an interesting time for the auto finance industry as trends look both similar and different from years past.

Even experienced leaders in auto finance, like Anderson, recognize the benefit that an organization like the NAF Association brings to the industry.

Anderson has been in the auto finance space since 1997, after getting his economics degree from the University of California, Irvine. But even with that experience, there is a lot to learn from fellow association members.

“I just think it’s a great place where people in the auto finance industry can meet, talk about industry trends and figure out creative solutions for industry-specific problems,” he said.

Having people from different groups and companies provides a strong collective mind to tackle different initiatives and opportunities in the industry, Anderson added.

He pointed to the NAF Association’s compliance certification program that was developed through then-executive director Jack Tracey (who died in 2021), Tom Hudson and attorneys from Hudson Cook, along with leaders like Anderson at NAF Association.

The Consumer Credit Compliance Certification can help consumer finance companies and other stakeholders in the industry tackle the increasingly difficult challenge

of complying with federal and state regulatory requirements.

The Certification Program provides the compliance professional with a solid working knowledge of the federal laws and regulations that govern con-

plicable law or regulation and a knowledge test. The coursework is rigorous. There are 42-45 hours of classroom work, and it will take 30 minutes to an hour to complete each of the 42 online sessions.

After successfully completing the

sumer credit, together with a representative overview of state consumer credit law.

The program consists of four modules – all modules are presented in a self-paced online format.

Each module includes multiple sessions; each provides a thorough outline and description of the ap -

program, the graduate will be recognized as a Certified Consumer Credit Compliance Professional. Then the newly crowned compliance professional must complete continuing education every two years to maintain certification.

The continuing education will provide updates on statutory and

regulatory requirements and discuss any recent developments.

Anderson said Westlake adapted that certification program throughout the company and made it an annual requirement of its own leadership.

NAF Association also helps members learn from the perspective of other lenders, along with learning about new technologies and making relationships.

On the tech side, Anderson said his company met with Lightico vendors at the association. The company provides digital solutions for digital ID verification, forms, zerosignatures, etc.

It’s quick and convenient when the lender has to ask for stipulations or if there is going to be an extension, the firm can email the document, the customer opens it, e-signs it and – boom! – it’s done, Anderson said.

“That’s really sped up our funding

Continued on page 4

RushDated Material C M Y CM MY CY CMY K CAA-IAA

1 8/12/23 3:27 PM

UCN FRONT Aug2023.pdf

IN THIS ISSUE: • ARA News • Odometer Fraud

Black Book U S E D C A R N E W S Used Car News 8/21/2023

•

Ian Anderson

ARE YOUR DEAL JACKETS AUDITED?

IF NOT, YOU ARE AT RISK OF CRITICAL ERRORS AND COMPLIANCE FINES

WITH OUR PROVEN EXPERTISE, METICULOUS PROCESS, AND CUTTING-EDGE TOOLS, YOU CAN CONFIDENTLY SAY, "YES, MY DEAL JACKETS ARE AUDITED—WITH COMPLYNET."

AUDITING SERVICES IDENTIFY:

INCONSISTENCIES

DISCLOSURES

UNINTENTIONAL RISKS

SCAN TO LEARN MORE ABOUT OUR SALES, FINANCE & ADVERTISING SOLUTION COMPLYNET COM

Sales, Finance and Advertising News

Recovery News Long Takes ARA Helm

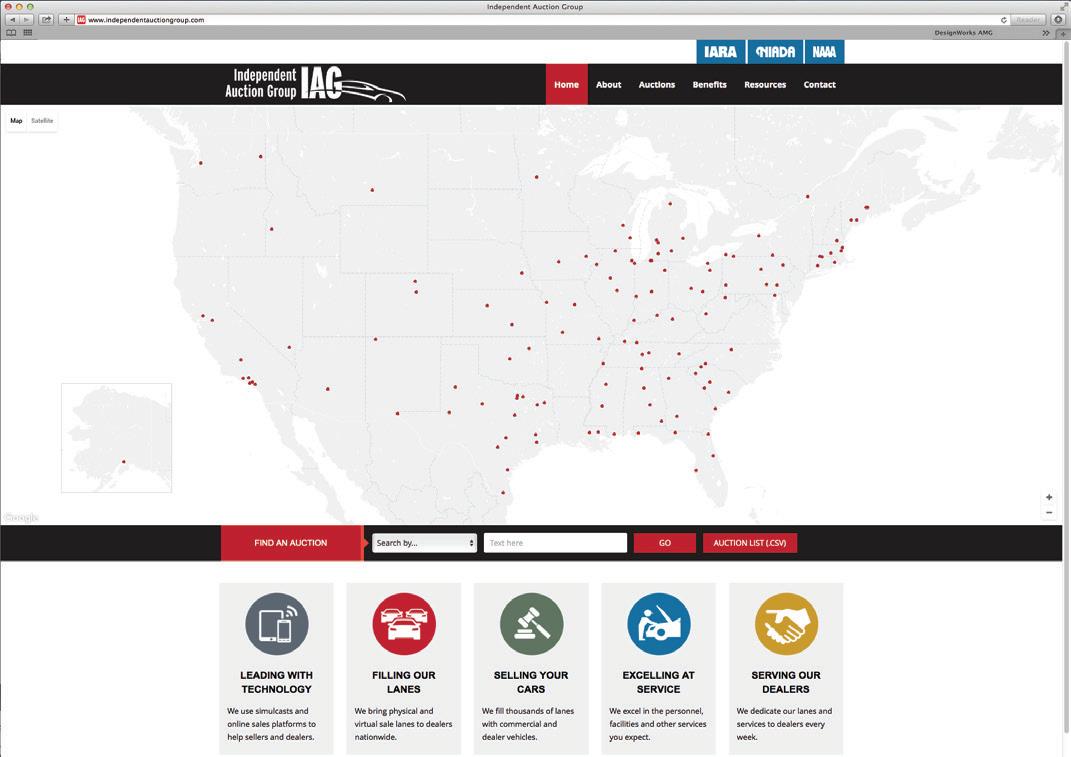

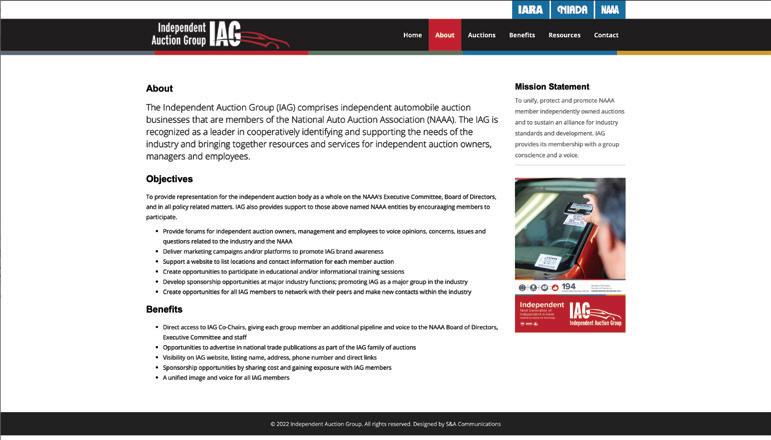

American Recovery Association (ARA), the world’s largest association of recovery and remarketing professionals, has hired Tony Long as its new executive director. Long officially started with the association on Aug. 13, just in time for the North American Repossessors Summit (NARS) 2024 initial planning meeting.

“ARA’s selection of Tony Long is the result of a nationwide search conducted by an incredible search committee with the assistance of a national recruiting firm based in Dallas,” said Vaughn Clemmons, ARA president. “While the competition was fierce, we are extremely pleased with the results and eagerly anticipate Tony’s leadership and wealth of experience to help take ARA to the next level.”

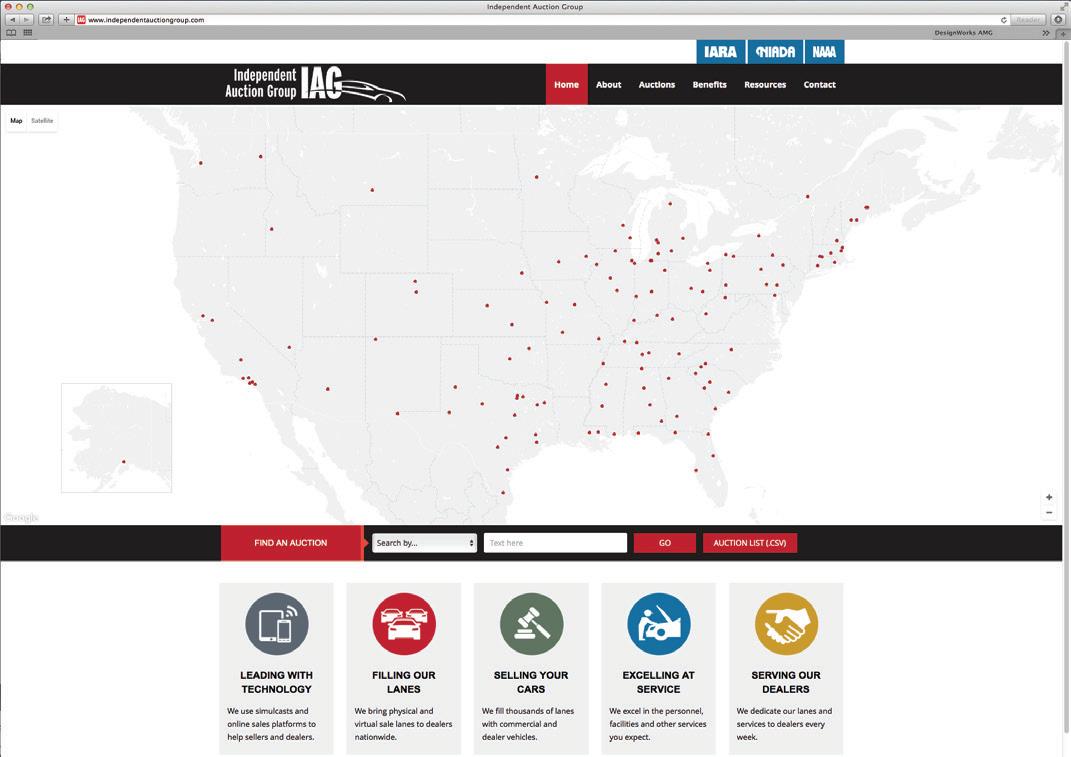

As a veteran of the auto auction industry, Long spent nearly twenty years of his early career managing commercial accounts and becoming the general manager of his family’s wholesale auto auction.

After a successful four-year period of establishing dealer partnerships for a major subprime lender, Long became the executive director of the International Automotive Remarketers Alliance (IARA). During a near decade-long tenure, that association experienced record growth in membership, conference attendance, and capital assets. Long is also the former president of both the Southern Auto Auction Association and the National Auto Auction Association.

He was the first president of the Warren Young Scholastic Founda-

tion and was named a WYSF Fellow by the NAAA.

The National Independent Automobile Dealers Association also named him to its prestigious Ring of Honor, the organization’s highest recognition presented to a non-dealer industry member.

“I am honored to join the dynamic team at ARA,” said Tony Long. “I look forward to building upon ARA’s years of exceptional leadership and its remarkable legacy – leading the association forward in growth, strategic partnerships, and more offerings for its members.”

Originally chartered in 1965, and located in Dallas, ARA is a membership organization of more than 260 repossession businesses with more than 500 locations to more than 27,000 national and international cities.

Recovery Group Proposes New Surcharge, Standards

By Eric L. Johnson

One of the largest recovery associations in the country recently proposed implementation of a COVID-19 surcharge and a new set of post-pandemic policies and also issued a white paper setting forth uniform standards for operating in this changed environment.

The American Recovery Association is advising that all recovery agencies, forwarders, and creditors immediately implement a “Post Recovery Safety Surcharge,” a specific fee charged by the recovery agency to the creditor. This fee will be used to partly offset some of the additional costs to provide safety equipment and security measures relating to the repossession and post-repossession and redemption process.

The ARA explained that the COVID-19 guidance from the Centers for Disease Control and Prevention to keep all parties safe and wear personal protective equipment comes with increased costs for recovery agencies. The purchase of PPE is an added layer of expense that was not prevalent before the pandemic and was not factored into the agencies’ operating costs.

In addition, the ARA explained that operating in a COVID-19 environment means an added level of compliance, possible litigation for COVID-19-related issues, increased liabilities, and higher workers’ com-

pensation rates. The ARA posited that there are coronavirus risks due to unknown exposures that the industry will be required to handle when engaging in collateral recovery. These potential exposures to the virus increase liability to recovery agencies and result in higher costs. In addition, the ARA theorized that employees may seek to file workers’ compensation claims due to the exposure they incurred. Finally, consumers may claim that they contracted COVID-19 as a result of their cars being repossessed and/or their property being mishandled by the recovery agent.

The ARA proposes that the surcharge be implemented through an addendum to the recovery agency’s repos-session agreement with the creditor. The draft addendum prepared by the ARA does not designate a specific amount for the surcharge; I assume it will be up to each recovery agency and creditor to negotiate the appropriate amount.

Additionally, the ARA recommends that every recovery agency adopt a new set of post-pandemic policies and procedures addressing its operations in a COVID-19 environment, including:

• Wearing of PPE (gloves, masks, gowns, etc.);

• Social distancing of employees and consumers while in the agency’s facilities (including breaks and mealtimes);

• Following strict CDC guidelines for dealing with the public and their property;

• Following a 72-hour “do not access” policy where the recovery agency would not access any repossessed or recovery vehicle to itemize and remove personal property for a period of no less than 72 hours after the time of repossession (although this might upset the timing on a recovery agent’s duty to remove and itemize personal property left in a vehicle within a shorter state-mandated time period after recovery of the collateral); and

• Disinfecting equipment, shared vehicles, and consumer service areas.

Finally, the ARA outlined some of the proposed policies in its summary white paper “Setting Uniform Standards for Operating in a Changed Environment,” which is available on its website. The white paper compares the employment wages, equipment pricing, fuel costs, technology fees, compliance fees, and secured vehicle storage costs in 2000 versus 2020 and makes the case for change within the industry and ways in which all parties can help build a viable and sustainable business model that provides a network of quality recovery professionals. If the dollar figures in the white paper are accurate, one can easily see how much more it costs to operate a recovery agency now than it did 20 years ago;

in this post-Consumer Financial Protection Bureau/post-COVID-19 world, that’s a lifetime ago.

The white paper also provides for uniform operating standards and terminology by outlining an agreedupon consensus among recovery industry personnel and for-warding clients on 18 different issues concerning the re-possession industry. Some of the more challenging issues to implement include:

• Personal property inventory and storage (storage and removal of property “must now be compensated”);

• Reverse indemnification (“New contract language must be provided that specifies liability resides with the appropriately responsible parties.”); and

• Compliance education requirements (“Professional recovery agencies should choose which compliance program they offer and should not be mandated by the lender or forwarder. If a lender or forwarding company requires an additional compliance pro-gram, all additional compliance expenses become the financial responsibility of the requiring party.”).

The ARA indicated that it is confident that if agencies, forwarders, and creditors work together, they can develop a more sustainable model for the recovery industry.

3

© CounselorLibrary.com 2020, all rights reserved. Based on an article from Spot Delivery. Single print publication rights only to Used Car News.

8/21/2023

Tony Long

Used Car News

Continued from page 1 while keeping us compliant in servicing,” he said.

It’s a huge benefit for customers in getting through the documentation process quickly, while making sure everything is compliant.

“It’s a great tool we’ve used throughout the years to speed up our operation and improve our customer service levels,” he said.

The association’s events also draw great speakers. Getting insights from speakers like Amy Martin, of S&P Global, for example, gives a global perspective to the market, which is unique, Anderson said.

Association members also work together to battle headwinds that come from the legislative and regulatory environments, he said.

Today’s market offers some parallels to 2006-2008, he said, although the financial system is more intact in today’s market, he said.

“You did have rising rates back in’05 and’06 and some hint of inflation, as well,” Anderson said. “But obviously there was a collapse of the banking system, so that was com-

pletely different.

“What’s interesting right now, I would say, is you’ve had a rapid rise in delinquency, especially on the non-prime side of the auto asset.

“Because of the stimulus and the shortage of cars, people bought vehicles at a much higher value in 2021-2022. So, with the value dropping out from where it was and expenses increasing from where they were – from credit card bills to food to gas, you name it – it has had an ef-

Put the power of Chase Auto to work for you

fect on delinquencies.”

Anderson added this is not just happening on the auto side, but on the credit card and unsecured debt side as well.

Westlake, however, is a full-spectrum lender, he said, with an average FICO of about 645 and 656 in California, after starting out in the non-prime subprime space.

Anderson joined Westlake in 2005 as director of risk management when the average FICO was about 530. In 2007, he advanced to senior vice president of production, business strategy and analytics.

Westlake has migrated from a lender that serviced an average 530 FICO with a max term of 48 months to a 72-month term with rates as low as 4.99.

As Group President, Anderson contributed to the growth of Westlake’s portfolio from $400 million in 2008 to over $9.5 billion in 2019.

Anderson said he’s currently seeing a reduction in the recovery rates at auction.

“Part of this is attributed to the loan-to-value rates,” he said. “But last year, we were recovering about 54% of the balance at that time. Right now, we’re recovering about 36% of the balance, which is in line with expectations, though it’s come down a little faster than we’d like.”

In the second half of 2022 into 2023, Westlake has pulled back on its LTVs, so as those losses come through, the recovery rates on those loans probably will come up as a percentage of the balance, Anderson said.

Anderson said that a focus on tech remains critical.

“Showcasing more companies that have leading technology, I think, is a real key,” he said. “I always feel the auto finance industry is kind of behind the times a little bit when it comes to technology.

“So, I’m hoping that it continues to be a focus as much as it has been in the past years.”

Charles M. Thomas Founder (1947-2002) Lynda R. Thomas, Publisher Emeritus Colleen Fitzgerald, Publisher

Editorial: Jeffrey Bellant, Managing Editor Ed Fitzgerald, Staff Writer

Advertising: Shannon Colby, Account Manager Tony Moorby Columnist:

Circulation: subs@usedcarnews.com

Production: Tom Savage, Production Manager Cee Lippens, Web Master Used Car News is published every third week.

Subscribers: We print advertisements as sent to us by auctions and other advertisers. It is not possible to verify the correctness of listed vehicles in auction ads. Most lists are partial and all lists are subject to last minute changes by auto auctions, so before travelling a long distance for a particular auto auction event, contact the auction by telephone for a fax of vehicles in the sale.

Used Car News assumes no guarantees or liabilities concerning the accuracy of any advertisements. All Rights Reserved. Reproduction in any form is prohibited without the written consent of the publisher.

OUR ADVERTISING APPROVAL POLICY Payments from first time advertisers must accompany the insertion order. Distribution is guaranteed by the USPS. The advertising reservation deadline is 12:00 noon Thursday, 11 days prior to the issue cover date. Ad materials are due by 5 pm Friday, 10 days prior to issue cover date. For advertising specifications please email colleen@usedcarnews.com.

1 2 1 The tradename Subaru Motors Finance (SMF) and the Subaru logo are owned by Subaru of America, Inc. (Subaru) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase. 2 The tradename Maserati Capital USA and the Maserati logo are owned by Maserati North America, Inc. (Maserati) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase. 3 The tradename Aston Martin Financial Services and the Aston Martin logo are owned by Aston Martin Lagonda of North America Inc. (Aston Martin) or ts affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase. 4 The tradenames Jaguar Financial Group and Land Rover Group and their respective logos are owned by Jaguar Land Rover North America, LLC (JLR) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase. Neither JPMorgan Chase Bank, N.A. nor any of its affiliates are affiliated with ADESA, Inc. or Manheim, Inc. Each auction is solely responsible for their website content, sales events, promotions, fulfillment and operation of the auction. Dealer communication only; not intended for retail purchaser. ©2021 JPMorgan Chase Bank, N.A. Member FDIC 21-014 (2021) Your customers want to choose from quality vehicles, so you need a national industry leader who can deliver. That’s Chase. We offer: • A broad range of vehicles — from economy to luxury — upstream and through auctions nationwide • Convenient online and in-lane vehicle availability with on-site Chase remarketers Choose Chase owned vehicles at ADESA.com and Manheim.com Your

clear choice for quality

4 4 3

CR R O O S S W D PAGE 14

Volume 29 | No.7 Join the Conversation! Visit Used Car News online at www.usedcarnews.com or scan this QR code with your smartphone to be taken directly to the website. 4 Published By General Media LLC USED CAR NEWS (ISSN 1555-7413) is published at : Used Car News P.O. Box 80800 St. Clair Shores, MI 48080 Phone: 586-772-5200 or 800-794-0760 Fax: 586-772-9400 www.usedcarnews.com

U S E D C A R N E W S 8/21/2023

Compliance News

8/21/2023

Odometer Fraud Forces Dealers to Remain Diligent

By Jeffrey Bellant

Odometer fraud remains a problem for the auto industry, whether a dealer is a victim or a perpetrator of the crime.

This month, Ohio Attorney General Dave Yost announced he is spearheading legal action against a Columbus used-car dealership, Uncle B Auto, and its owner, Bethrand Ekeanyanwu, following allegations of odometer-tampering and deceptive practices.

Yost is seeking restitution for affected consumers who bought vehicles from Uncle B. Additionally, the lawsuit requests the imposition of civil penalties and seeks to prohibit Ekeanyanwu from acquiring or maintaining auto dealer or salesperson licenses.

Kirsten Von Busch, Experian’s director of product marketing for automotive and Ron Montoya, Edmund’s senior consumer advice editor and content strategy, recently discussed the issue of odometer fraud.

“The National Highway and Traffic Safety Administration estimates it could affect 450,00 vehicles each year and potentially cost customers over $1 billion,” Montoya said.

Today’s electronics makes it even easier to roll back mileage than it was with the old-style non-digital type.

“It is easier because you just have

to plug into the vehicle and use some special software to alter it,” Montoya added.

Not only is it easier, but NHTSA reports that digital odometer fraud is even more difficult to detect.

Von Busch said dealers need to focus on the data to avoid becoming a victim of odometer fraud.

“There’s a number of different data points you can review,” she said. “There’s the title brand, if that’s been reported, along with auction announcements.

“You can also use modeling, where you’re evaluating based on a vehicle’s history.”

For example, looking at a data point such as a service record to see what the mileage was at that moment.

“Where it’s really concerning from a dealer’s perspective is making sure that a vehicle they are taking in to inventory or retailing, is at a price point that is reflective of the vehicle’s actual history,” Von Busch said.

A fraudulent odometer reading can hurt either a buyer or seller.

“So, the big thing is that the value of the vehicle is being hidden,” Montoya said. “Then it’s potentially worth a lot less than it might have been when paid for initially. So, you’re going to lose money on that.

“Then you’ll probably have to do more maintenance since it’s actually a (higher-mileage vehicle). Also, if a customer has taken out a loan on the

car, that may change the terms of the loans since it is not worth the initial amount paid.”

Montoya said dealers must catch any fraud earlier.

“If they do end up selling a vehicle which has been flagged as having inconsistent mileage, then that’s when these companies (lenders) are going to take a closer look at it,” he said.

Von Busch said AutoCheck or another vehicle history report can help spot discrepancies, allowing dealers to check for mistakes, which do happen, such as a set of numbers being transposed during a service visit. With a vehicle history report, that mistake can be discovered quickly.

Vehicle history reports, however, have their own blind spot – they can only reveal what has been reported.

“So, in addition to a vehicle history report, we would always recommend having a vehicle inspected by a licensed mechanic, before making any decisions,” Von Busch.

Auto auctions offer inspections that can help in this area.

Von Busch said any auction announcement activity would also be on an AutoCheck or other vehicle history report.

For dealers, it’s simple.

“Just make sure you do your due diligence on a car before you purchase it,” Montoya said.

“I wouldn’t assume that the (seller or auction) have done all of their

homework on the car and it’s up to the buyer to do the research beforehand.”

Montoya also recommended checking the history report for mileage increments for each service visit or annual registration of a car for discrepancies.

“Also, you want to check to see if it’s a branded title and whether there has been any flood damage,” Montoya said.

With the inventory shortage that the industry is experiencing right now, the potential for fraud only rises, he added.

“Since the inflation of vehicle prices has gotten higher, there’s more money on the table for people to take,” Montoya said.

A lawsuit filed in June against FedEx alleges the “largest odometer fraud scheme in United States automotive history.”

The lawsuit said that FedEx “systematically and surreptitiously replaced odometers on thousands of used diesel fleet delivery vehicles.”

The result was that new odometers showed zero miles on vehicles that had allegedly been driven thousands of miles.

The class action lawsuit, filed in the U.S. District Court of New Jersey, alleges “Defendants continue to use the vehicles, but then later sell the vehicles at a premium, without disclosing that the mileage listed on the odometers is inaccurate.”

5

Credit News

Industry Receives Good News on Credit Accessibility

Access to auto credit improved again in July, according to the Dealertrack Credit Availability Index for all types of auto loans. Following tightening across all channels and all lender types in the spring, July marked a second month of continuous improvement of credit access across all channels and lender types, except captives which had a slight decrease. However, credit access remains tighter than a year ago and, for many channels, tighter than before the pandemic. The All-Loans Index increased 0.2% to 97.4 in July, which was the highest reading since March and reflected that auto credit was easier to get than in April, May, and June. With the increase in July, access was tighter by 5.2% year over year, and compared to February 2020, access was tighter by 1.8%.

Movement in credit availability factors was mixed in July. While yield spreads narrowed, approval

rates increased, improving consumer credit access. However, average terms lengthened, the subprime share declined, down payments declined, and the negative equity share declined, and those moves hurt credit access for consumers.

The average yield spread on auto loans in July narrowed by 6 basis points (BPs), so rates consumers saw on auto loans were more attractive in July relative to bond yields. The average auto loan rate increased by 13 BPs in July compared to June, while the 5-year U.S. Treasury increased by 19 BPs, resulting in a narrower average observed yield spread.

The approval rate increased by 74 BPs in July but was down 1 percentage point year over year. The subprime share declined to 10.4% from 10.5% in July and was down 1.1 percentage points year over year.

The share of loans with greater than 72-month terms decreased 0.4 percentage points and was down 1.3

percentage points year over year. All channels saw improving credit availability in July. Used loans saw the most loosening. On a year-overyear basis, all channels were tighter, with certified pre-owned (CPO)

loans having seen the most tightening.

Credit availability was mixed in July across all lender types. Captives tightened, while auto-focused finance companies loosened the most.

6

a oabc TM ONE VENDOR ONE ECOSYSTEM CRM + LOS DMS + LMS Built-In Accounting Collections Live Support Payment Portal Desking + Scoring eForms + Digital Vault Reporting + Analytics Security + Compliance Prompt Customizations Schedule a demo today: 800.526.5832 | dealpack.com 8/21/2023

Chart Courtesy of Cox Automotive EXTRA CREDIT: Dealertrack’s Credit Availability Index (above) shows how credit availability ticked up in July, marking the second month of continuous improvement in credit access across all channels and lender types.

ADESA Boston

September 1, 15, 29

508-626-7000

ADESA Charlotte

September 7, 21

704-587-7653

ADESA Chicago

September 8, 15

847-551-2151

ADESA Cincinnati/Dayton

September 19

937-746-4000

ADESA Golden Gate

September 19

209-839-8000

ADESA Indianapolis

September 5, 19

317-838-8000

ADESA Kansas City

September 5, 19

816-525-1100

ADESA Lexington

September 28

859-263-5163

ADESA New Jersey

September 7, 21

908-725-2200

ADESA Salt Lake

September 12

801-322-1234

ADESA Tulsa

September 8

918-437-9044

ADESA Washington DC

September 13

703-996-1100

Columbus Fair AA

September 20, 27

614-497-2000

Manheim Atlanta

September 6, 7, 20, 21 404-762-9211

Manheim Dallas

September 12, 13, 27

877-860-1651

Manheim Denver

September 13

800-822-1177

Manheim Detroit

September 7, 21 734-654-7100

Manheim Fredericksburg

September 14, 28 540-368-3400

Manheim Milwaukee

September 13, 27

262-835-4436

Manheim Minneapolis

September 6

763-425-7653

Manheim Nashville

September 26, 27

615-773-3800

Manheim Nevada

September 22

702-730-1400

Manheim New Jersey

September 13, 27

609-298-3400

Manheim New Orleans September 13, 27 985-643- 2061

Manheim Seattle September 20

206-762-1600

Manheim Southern California

September 7, 21

909-822-2261

Manheim Tampa

September 7, 21

800-622-7292

Manheim Texas Hobby

September 7, 21

713-649-8233

Southern AA

September 13

860-292-7500

Manheim Atlanta

September 6

404-762-9211

Manheim Dallas

September 12

877-860651

Manheim Milwaukee

September 13

262-835-4436

Manheim Nashville

September 27

615-773-3800

Manheim Nevada

September 22

702-730-1400

Manheim New Jersey

September 13

609-298-3400

Manheim Orlando

September 12

800-822-2886

Manheim Palm Beach

September 27

561-790-1200

Manheim Pennsylvania

September 7, 21

800-822-2886

Manheim Riverside

September 14, 28

951-689-6000

Manheim Seattle

September 20

206-762-1600

Manheim Atlanta

September 6

404-762-9211

Manheim Dallas

September 12

877-860-1651

Manheim Milwaukee

September 13

262-835-4436

Manheim Nashville

September 27

615-773-3800

Manheim Palm Beach

September 27

561-790-1200

Manheim Pennsylvania

September 7, 21

800-833-2886

Manheim Riverside

September 14, 28

951-689-6000

Manheim Seattle

September 20

206-762-1600

ADESA Boston

September 1, 29

508-626-7000

ADESA Charlotte September 21

704-587-7653

ADESA Salt Lake

September 12

801-322-1234

Columbus Fair AA

September 20

614-497-2000

Manheim Dallas September 27

877-860-1651

Manheim Denver

September 13

800-822-1177

Manheim Fredericksburg

September 14

540-368-3400

Manheim New Jersey

September 27

609-298-3400

Manheim Orlando

September 5

800-337-8491

Manheim Pennsylvania

September 8, 22

800-833-2886

Manheim Pittsburgh

September 13

724-452-5555

Manheim Seattle

September 20

206-762-1600

Manheim Southern California

September 7, 21

909-822-2261

Southern AA

September 13

860-292-7500

Manheim Atlanta

September 20

404-762-9211

* The tradename Jaguar Financial Group and the Jaguar logo are owned by Jaguar Land Rover North America, LLC (JLR) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase.

* The tradename Land Rover Financial Group and the Land Rover logo are owned by Jaguar Land Rover North America, LLC (JLR) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase.

* The tradename Subaru Motors Finance (SMF) and the Subaru logo are owned by Subaru of America, Inc. (Subaru) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase).Auto finance accounts are owned by Chase.

* The tradename Maserati Capital USA and the Maserati logo are owned by Maserati North America, Inc. (Maserati) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase.

* The tradename Aston Martin Financial Services and the Aston Martin logo are owned by Aston Martin Lagonda of North America Inc. (Aston Martin) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase.

Neither JPMorgan Chase Bank, N.A. nor any of its affiliates are affiliated with ADESA, Inc. or Manheim, Inc. Each auction is solely responsible for their website content, sales events, promotions, fulfillment and operation of the auction.

©2023 JPMorgan Chase Bank, N.A. Member FDIC 9/23

SEPTEMBER 2023

an auction near you to stock your inventory of pre-owned vehicles

Chase on ADESA.com and OVE.com for bank-sourced vehicles. Contact auctions directly for current sale information.

Find

Choose

5, 12, 19,

September 27, 28

September 1, 7, 8, 15, 21, 22, 29

Manheim Orlando September

26 800-822-2886 Manheim Palm Beach

561-790-1200 Manheim Pennsylvania

800-822-2886 Manheim Phoenix September 14, 28

623-907-7000 Manheim Pittsburgh September 13 724-452-5555

Manheim Riverside September 12, 14, 26, 28 951-689-6000

Retail Markets

MONTANA

Chad Randash, owner, Randash Auto Center, Billings and Bozeman, Mont

“We’ve been in business since September ’07.

“What we found during COVID was that people wanted to do more online so we adjusted, like a lot of dealers did. We had already been buying online.

“We have a flooring plan with our local bank, with the inventory at about $600,000 and a line for $800,000. We’ve crept up to about $700,000. The transporters are starting to loosen up, so we can get them faster. I probably have $1.4 million between both stores.

“We sell about 30 a month each store. We’re trying to get that to 33 and every year we try to beat it by two, so next year it will be 35.

“Forty percent of what we sell are SUVs, 5% trucks and

the rest are cars. We could sell more trucks but the warranty and reconditioning costs are through the roof.

“I like the GSA auctions so we kind of stick with the models they offer -- primarily domestics, Impalas, Caravans, but also Hyundais.

“We are strictly buy-here, pay-here. I equate those guys (dealers who try BHPH) to someone who goes to Vegas and is going to play a little blackjack for fun. You’re going to lose because you don’t know what you’re doing. If you get a little more knowledge, then it’s a lot more fun to play the game, whether it’s craps or BHPH.

“We use Ituran GPS, I’m a big fan. We use Passtime too, but I have a great relationship with Ituran. The deck got shuffled during COVID and having a starter interrupt is a lifesaver for me. I can’t see doing this business

without it.

“The average down payment we get is around $875. We’re just a touch over two years (term length) and we hope to start bringing that down. I’ve got one car on my lot for $10,995 the rest are $14,000-16,000.

“The cost of parts has gone up so we’re sitting at about $2,700 in average recon per vehicle. We’ve got 17 techs between the two stores. You’ve got to get creative to keep these guys. A $20 an hour guy is now $30 an hour.

“I still do billboard advertising. Google and Facebook, of course. And for years I’ve been a local radio guy. But you’ve got to dominate every hour that you’re on.

“I think the biggest challenge is this bull run we’ve been in. Some guys have taken their eye off what they loved about this business.

“The last car I sold was a

2019 Hyundai Elantra. It had 85,000 miles and I sold it for $21,995.”

TENNESSEE

John Somich, owner, The Car Store, Piney Flats, Tenn.

“I’ve been in business for a little more than 30 years. We’ve had as many as four locations and now we’re operating two. During COVID we consolidated down to one, due to vehicle availability.

“We’re typically buy-here, pay-here. We keep about 150 vehicles in inventory between the two stores, with about 100 ready to sell. The reconditioning times are longer now, but when they’re ready the cars sell quickly. I spend $800-$1,000 on average recon. Our vehicle turn is much better. We learned how to do more with less.

“Our sales are probably 50-

50 with imports and domestics. We sell a lot of Toyotas.

“We still go to auctions inperson. Normally we go the day before the auction so we can still lay our hands on the inventory.

“We haven’t found a good substitute for seeing the car before we buy it.

“When you’re buy-here, pay-here, it’s not about closing the deal on the front end. It’s about that last payment.

“Our advertising budget is really small. We rely on word of mouth and referrals. We don’t spend more than $1,000 a month.

“A new dealer should join his association and go to a convention. I didn’t go for the first 20 years and that was the most monumental strategic failure in my career.

“The last car I sold was a 2013 F-150 with 120,000 miles.”

8

SAVANNAH AMERiCA’S AUTO AUCTiON: SAVANNAH 1712 DEAN FOREST RD, SAVANNAH, GA 31408 WWW.AMERiCASAA.COM | (912) 965-9901 AMERiCA’S AUTO AUCTiON: CHARLESTON 651 PRECAST LANE, MONCKS CORNER, SC 29461 WWW.AMERiCASAA.COM | (843) 719-1900 WEDNESDAY, SALE STARTS 9:30AM SEPT. 13TH CHARLESTON $5,000 GiVEAWAY tickets toss sale sale cars cash caring cars cash & caring FRiDAY, SEPTEMBER 15TH EARLY BiRD SALE STARTS 9:30AM ALL LANES START AT 10AM $5,000 CASH & PRiZE GiVEAWAYS 8/21/2023 Compiled

by Ed Fitzgerald

Wholesale Markets

MONTANA

Jake Gertsch, sales manager, Auto Auction of Montana, Billings, Mont.

“We’ve been in business over 20 years, since 2002.

“About 450 to 500 is about what we’ve been running. To be honest, I didn’t look at this year compared to last year, but overall, it’s been pretty good. (Percentagesold) has been good, though I’m sure numbers are down in general just because of a lack of 2- to 3-year-old vehicles, which is what we sell a lot of. But it’s been a decent year overall, I would say.

“Percentages (sold) have been right about 60-65% the last few weeks.

“We’re not getting as many dealers in the lanes as we used to. But we’re selling at least 50% online, or better. We get probably 50-60 live bodies in lanes and probably 100+ online. It’s because

once you leave Billings, there’s not another town with more than 5,000 people for about 140 miles.

“Retail dealers, overall, have said that business has been decent, considering it’s summer and we’ve been through a couple of unprecedented years.

“I would guess our average price has been $38,000 to $42,000. Trucks and SUVs have to make up 80% of our volume.

“We have a GSA sale once a month. Last month we had 55 vehicles. Those numbers have ticked up a bit. It’s typically the third Wednesday of the month.

“Our fleet numbers and rental returns have definitely ticked up in comparison to the last three years, so that’s been good.

“We also sell a lot of Canadian imports. At least 50% of what we sell are Canadian

imports. That inventory has kept us alive, to be honest.

“I think we’re going to see the normal fall trend where things tick up. The latemodel stuff fell off a bit in July and I think that stuff will bounce back. September and October are going to be good months, I think.”

WASHINGTON

Collin McConkey, general manager, DAA Northwest, Spokane, Wash.

“In Spokane, we celebrated our 30th anniversary last November, so we’re closing the door on 31.

“We have eight physical lanes. Things have been in a little bit of a flux. For a long time, our sales percentages were pretty high, like the rest of the country. We’d get 1,300 cars, and 75% fresh consignment because we’d be selling so much of that product. Lately, it’s dipped a

Simple Payment Processing

little bit.

“We had our big push for our annual Rock & Roll sale, obviously. Since then, we’re down into a 50% conversion rate, but we’re running about 1,500 cars.

“Part of that volume is because we have really good wholesalers. It’s not so much predicated on what the retail market is doing.

“On average, we’ll get about 650 total bidders and 150 of those are in the lane.

“On the retail side, it feels very sporadic – different week to week.

“The used cars have been tougher, for sure, because of interest rates. On retail, everyone is pivoting to the $20,000 to $40,000 range. We had so many trucks and SUVs that were between $65,000 and $85,000. That’s really where we’ve seen the biggest change in retail appetite, mainly due to interest

rates.

“Dealers are getting used to smaller margins and focusing on a little bit of a cheaper used product.

“Through Q1, the average price across the block was still pretty strong, holding onto that $29,000 mark. Through Q2, when we saw all these book values drop, we dropped to around $22,000 or $25,000. PreCOVID, we were probably around $21,000.

“In Spokane, we do two RV sales a month. We do a bigger one that’s a mix of fleet RVs and dealer RVs.

“Then the second sale of the month is just the bank or fleet RV sale. We’re looking at increased repossessions in those, because if you’re going to look to cut out a payment, that will be one of the first things to go compared to a car that you need to get to work.”

Powerfully

Empower your dealership to seamlessly process customer payments with FrazerPay. FrazerPay, the new payments solution designed exclusively for independent used car dealers by the most trusted DMS in the industry. www.Frazer.com | Phone: 888-963-5369 Credit card, debit card, and ACH processing Secure payment terminals and hand-keyed entry Online payments Recurring payments for Buy Here, Pay Here customers

10 8/21/2023

Compiled by Jeffrey Bellant

National Auto Auction Association NAAA World Remarketing Convention 2023 Keynote Speaker Laughter & Learning Howl at the Moon Entertainment www.naaa.com SEPT TUE Hilton Chicago Hotel 26 SEPT WED 27 SEPT THUR 28

Actual Wholesale and Projected Residual

Wholesale Numbers my seg_type make_model_name 2022-08-01 2023-02-01 2023-08-01 2024-08-01 2025-08-01 2018 Car Toyota Camry 20025 15350 15675 12750 10600 2018 Car Honda Accord 20675 16300 16725 13675 11400 2018 Car Honda Civic 18750 15075 15175 11850 9475 2018 Car Toyota Corolla 16875 13300 13300 10825 8850 2018 Car Nissan Altima 14950 11250 11225 9225 7700 2018 Car Chevrolet Malibu 16325 12125 12400 9350 7200 2018 Car Hyundai Elantra 14850 11225 10775 8400 6525 2018 Car Nissan Sentra 14925 10375 10025 7850 6250 2018 Car Hyundai Sonata 16175 11825 11525 9325 7575 2018 Car Ford Mustang 19950 16175 18775 14500 11325 2018 Truck Ford F150 31500 25800 26800 22225 18775 2018 Truck Chevrolet Silverado 1500 33700 27775 30000 25500 21600 2018 Truck Honda CR-V 24000 19450 19850 16300 13650 2018 Truck Toyota RAV4 21300 17475 17050 14650 12775 2018 Truck Jeep Grand Cherokee 25175 19750 18125 13600 10550 2018 Truck Toyota Tacoma 31000 26900 28425 24850 21700 2018 Truck Jeep Wrangler 32375 25200 26625 23200 20400 2018 Truck Ford Escape 17075 12200 12950 10750 8975 2018 Truck Nissan Rogue 19125 13400 14150 10975 8700 2018 Truck GMC Sierra 1500 32900 28100 28500 24050 20375 2019 Car Toyota Camry 22600 17400 17750 14450 12000 2019 Car Honda Accord 23250 18625 19025 15525 12900 2019 Car Honda Civic 20100 16475 16425 12975 10550 2019 Car Toyota Corolla 19300 15575 15625 12650 10250 2019 Car Nissan Altima 19750 14400 15450 12500 10200 2019 Car Chevrolet Malibu 19200 14125 15025 11425 8850 2019 Car Hyundai Elantra 17200 13200 12950 10125 7875 2019 Car Nissan Sentra 17900 13850 14050 10725 8275 2019 Car Hyundai Sonata 19525 14750 14800 11775 9400 2019 Car Ford Mustang 22750 18050 21600 16650 12950 2019 Truck Ford F150 36400 31100 31100 25650 21700 2019 Truck Chevrolet Silverado 1500 36000 29250 32700 28075 24025 2019 Truck Honda CR-V 26550 21200 22100 18300 15425 2019 Truck Toyota RAV4 26325 21425 22175 18825 16200 2019 Truck Jeep Grand Cherokee 27875 22650 21675 16750 13100 2019 Truck Toyota Tacoma 33450 28325 30025 26350 23100 2019 Truck Jeep Wrangler 38250 31600 32150 27925 24525 2019 Truck Ford Escape 20200 15200 16225 13475 11200 2019 Truck Nissan Rogue 21500 15675 17900 13825 10800 2019 Truck GMC Sierra 1500 37900 31700 32700 27750 23600 2020 Car Toyota Camry 24225 19100 19750 16275 13700 2020 Car Honda Accord 25400 20375 21000 17200 14325 2020 Car Honda Civic 22450 18050 18400 14775 12100 2020 Car Toyota Corolla 21900 17400 17900 14675 12050 2020 Car Nissan Altima 22575 16475 17775 14400 11750 2020 Car Chevrolet Malibu 21825 16025 17900 13675 10600 2020 Car Hyundai Elantra 19275 15325 15275 12175 9600 2020 Car Nissan Sentra 20275 16125 17125 13400 10600 2020 Car Hyundai Sonata 21800 16700 17550 14075 11350 2020 Car Ford Mustang 24875 19975 23675 18700 14925 2020 Truck Ford F150 40300 34500 34000 28575 24525 2020 Truck Chevrolet Silverado 1500 40900 35250 36000 31175 26900 2020 Truck Honda CR-V 28825 23225 24200 20175 17225 2020 Truck Toyota RAV4 28725 23075 23675 20400 17775 2020 Truck Jeep Grand Cherokee 31900 25550 24100 18850 14975 2020 Truck Toyota Tacoma 36825 30275 32275 28350 24850 2020 Truck Jeep Wrangler 42375 34350 35200 30500 26725 2020 Truck Ford Escape 23875 17650 19150 16150 13650 2020 Truck Nissan Rogue 23850 17500 19900 15875 12775 2020 Truck GMC Sierra 1500 39500 33700 34500 29625 25500 2021 Car Toyota Camry 26875 21050 22200 18250 15300 2021 Car Honda Accord 27475 22300 23150 19425 16575 2021 Car Honda Civic 24925 19675 20175 16375 13575 2021 Car Toyota Corolla 23100 18750 19400 16100 13375 2021 Car Nissan Altima 24075 17650 19225 15900 13225 2021 Car Chevrolet Malibu 23100 17500 19750 15425 12200 2021 Car Hyundai Elantra 21725 16475 16975 13850 11200 2021 Car Nissan Sentra 21775 17825 19250 15200 12075 2021 Car Hyundai Sonata 23625 18250 19425 15725 12775 2021 Car Ford Mustang 28675 22750 26350 21325 17450 2021 Truck Ford F150 46500 40000 40500 33900 29075 2021 Truck Chevrolet Silverado 1500 42800 37150 38500 34025 29975 2021 Truck Honda CR-V 30875 25350 26350 22275 19150 2021 Truck Toyota RAV4 31475 24550 25600 22325 19700 2021 Truck Jeep Grand Cherokee 34400 28000 26750 21125 17175 2021 Truck Toyota Tacoma 38400 32375 33775 29750 26175 2021 Truck Jeep Wrangler 45750 38625 38875 33400 29000 2021 Truck Ford Escape 26225 20025 21500 18325 15600 2021 Truck Nissan Rogue 30600 22750 23900 19000 15275 2021 Truck GMC Sierra 1500 41100 37200 37500 32725 28600 U S E D C A R N E W S 8/21/2023

Values Source: Black Book

Tony Moorby Disconnected Jottings From

Boxes, boxes and more boxes! I feel like that fellow, Kilroy, peering over the top of a wall. Some are still full, some empty and awaiting their compression to go to the recycling center.

Let me explain; we’ve moved. We sold our house just south of Nashville, from the once-bucolic Franklin, Tennessee to South Carolina, on a small lake between Charleston and Savannah, Georgia.

Why move from a place where everyone wants to move to? Precisely that reason. You’ve heard me before, moaning and groaning about Nashville’s inability to keep pace with the massive influx of people. Trendy is no longer tantalizing as Metro Nashville enjoys all the new revenue sources without spending the necessary funds to support the new population. If they do,

the money comes excruciatingly slowly; a recent road improvement project, a mere 3 miles of road expansion, took 5 years! It seemed that no one was ever there wielding a pickaxe or shovel. If someone did show up, he’d hide in the air-conditioned cab of some yellow and expensive monster machine.

Nashville was once friendly, expansive and accommodating. Now it’s meanspirited, pushy and shovey and selfish. I could write three more essays on the differences that forty years have made. Don’t misunderstand; our little cul de sac on a small development next to a golf course was terrific, with neighbors everyone could wish for but once outside, the pressure was there.

Terry found a beautiful house whilst on a trip with her sister and a deal was

done lickety split. When we moved to the last house, I swore it would be the last time – the rigors of packing and unpacking were horrifying! Famous last words!

I thought we had all we needed then. The further accumulation of stuff managed to secrete itself in every nook and cranny of available space. We eased our consumer consciences with promises of sharing the no-longer needed belongings with family who mostly no longer needed them either. The Goodwill store had about a threeweek windfall where we became known on a first name basis.

Professional movers are magicians! Executing the Tetris maneuvers of stacking a lifetime of belongings into a space that’s a tenth the size of your house is amazing to watch.

Standing in an empty house with that slopedshouldered sense of “What have we done?” echoing around the once-comfy spaces is soon overcome with the anticipation of all that’s new and exciting again.

I didn’t realize we had so many books! It took a separate foray for me, my son-inlaw, two Land Rovers and a trailer to ferry the volumes from one place to the other. I won’t live long enough to cook all the recipes from 258 cookbooks but access to each of them is something I revere and can’t let go. It’s the same with paintings – some acquired over a lifetime and many daubed by myself, have all made the trip except for those in a 10’ x10’ storage locker gathering the dust of time and forgotten efforts.

So all this was stuffed into

enough cardboard boxes to give me pangs of guilt about deforesting the Amazonian lungs of the Earth. I only hope that the promise of recycling is kept by the local authority and the cardboard will enjoy a new life somewhere new and exciting –just like us!

B RON CO DO LL AR S E A H RCA EA R O NI SS AN DRA G STE R Z I ROD T E E SI GN AL IN TA N V E I C DO W T AL FA RO ME O A OBO L U L R RED VI NTA GE VEY RON E N RT E OD E SE DAN S T UNDRA S DO T UP T E HUD SO N BEN TL EY U G L B RO LE X BL EN DS CORO LL A 123 4 567 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 123 4 567 8 91011 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 Solution to the 7/31/2023 puzzle Solution to this puzzle in the 9/18/2023 issue. Call 1.800.794.0760 for a FREE subscription. Play Online at UsedCarNews.com By Myles Mellor Across 1 Ford SUV 4 Greenbacks 9 Elvis’ record label 11 Corn section 12 Altima makers 14 Car designed for very short races 15 Part of an axle 17 Left turn indicator, for example 18 Popular 19 Light brown 22 Stock index 23 ___ ___ Tonale Ti E 25 Classified ad abbreviation 26 Stop light 28 Classic 30 A beautiful Bugatti 32 Highway abbreviation, abbr. 33 “To a…” poem 35 4 door cars 40 Toyota SUVs 42 Town on a map, for example 43 Raise 44 Makers of the classic car- the Phantom 46 Luxury car brand 50 High quality watch 51 Mixes 52 Civic competitor Down 1 Goes with Mercedes 2 Desert springs area 3 Midsize car from Dodge 4 Old Dodge compact 5 Famous 6 ___ Vegas 7 Skill 8 Kia SUV 10 Data storer, abbr. 13 ___- negotiable 16 German auto pioneer Gottlieb 19 Like a coupe, 2 words 20 Engine parts 21 Chevy model 24 Enjoyment 27 Hesitation sound 29 Landers of advice columns 31 Secrecy pledge, for short 34 Compass point 36 College email ending 37 Viper maker 38 Cadillac model 39 Source of solar power 41 Dodge SUV 44 Part of a wheel 45 Dated 46 UK TV 47 Laughter on the internet, abbr. 48 Addition 49 Senate vote in favor 14

• 50-year veteran of the industry • President from 1997–2000 of ADT Automotive • Served as ADESA’s executive vice president of sales and marketing • Moorby & Associates 2006–present • NAAA Hall of Famer • IARA Circle of Excellence To see past columns from Tony Moorby, visit www.usedcarnews.com/ columnists/tony-moorby

8/21/2023

Tony Moorby

SIMPLIFYING THE BUYING EXPERIENCE

OPTIMIZING IN-LANE AND DIGITAL EXPERIENCE

SERVNET auctions offer advanced technology solutions, providing a best-in-class experience for inventory management, remote repping, online buying, and customer service.

OPERATIONAL EXCELLENCE

Confidently secure vehicles with the comfort of knowing SERVNET auctions operate with the highest level of standards and integrity in the industry.

PERSONALIZED SERVICE

Each SERVNET auction is independently owned and operated. No matter which location you buy or sell with, each SERVNET auction offers the same exceptional support and assistance.

NATIONAL NETWORK GREATER ROCKFORD AA graa.net NORTH BAY AA nbauto.com GREENVILLE AA greenvillencautoauction.com SAN ANTONIO AA sanantonioautoauction.com INDIANA AA indianaautoauction.net STATE LINE AA statelineauto.com MID-STATE AA msaanym.com TALLAHASSEE AA bscamerica.com MISSOURI AA missouriautoauction.com VALUE AA valueautoauction.com AKRON AUTO AUCTION akronautoauction.com BEL AIR AUTO AUCTION bscamerica.com CAROLINA AA carolinaautoauction.com CORPUS CHRISTI AA corpuschristiautoauction.com AA OF NEW ENGLAND aane.com DAA OF IDAHO daaofidaho.com DAA NORTHWEST magauctions.com DAA SEATTLE magauctions.com GREAT LAKES AUTO AUCTION GREAT LAKES AA greatlakesaa.com AVDAA LOS ANGELES avdaauction.com AKRON AUTO AUCTION VALUE AUTO AUCTION AA OF NEW ENGLAND STATE LINE AA BEL AIR AUTO AUCTION GREENVILLE AA CAROLINA AA MISSOURI AA GREATER ROCKFORD AA MID STATE AA INDIANA AA GREAT LAKES AA SAN ANTONIO AA CORPUS CHRISTI AA AVDAA LOS ANGELES NORTH BAY AA DAA SEATTLE DAA NORTHWEST DAA OF IDAHO TALLAHASSEE AA SERVNETAUCTIONS.COM