Used Car News

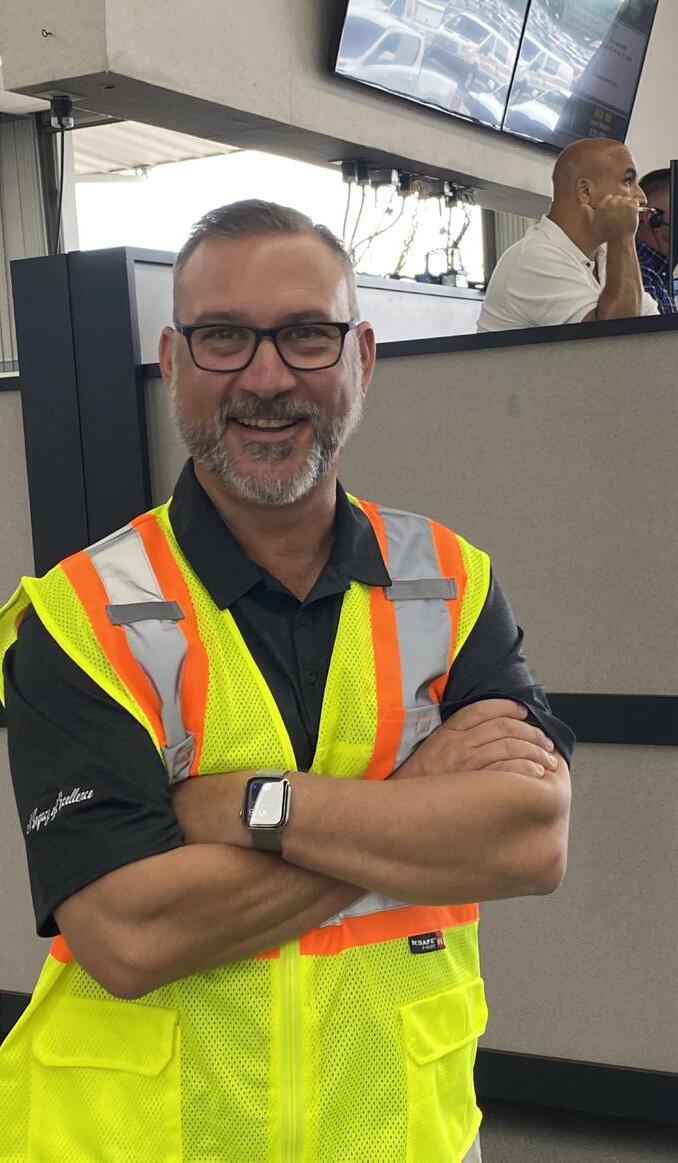

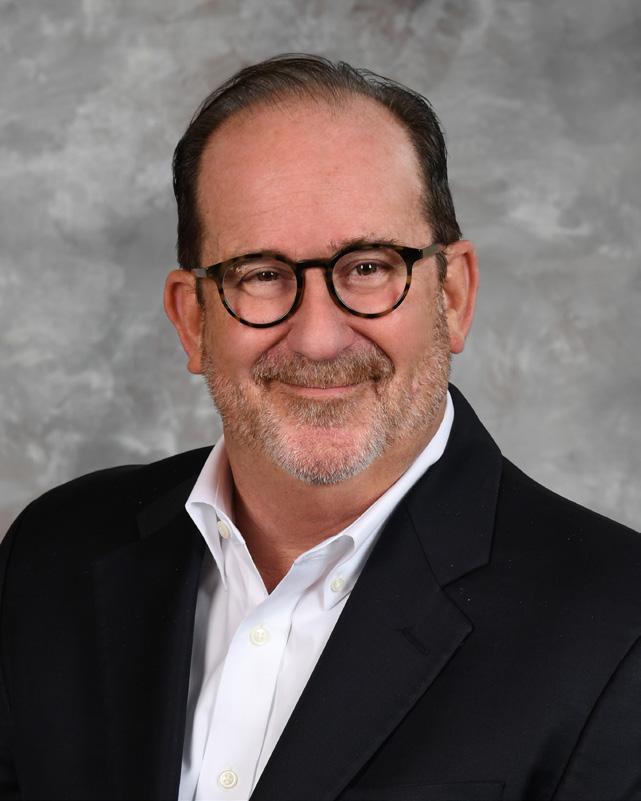

Eric Autenrieth, CEO of the Stanley-Autenrieth Auction Group, is the new president of the National Auto Auction Association. He will be installed at this month’s NAAA Convention & Expo in Chicago. He is the son of auction pioneers Henry and Patty Stanley. He is owner of Indiana Auto Auction and the general manager of Carolina Auto Auction. He is also a past president of the ServNet Auction group.

Used Car News: Tell us about your background.

Autenrieth: I grew up in Columbus, Ohio. Dad (Henry Stanley) bought Capital City Auto Auction in 1969. He was working the circuit and saw that the auction had changed hands a couple of times.

He asked the owner if he was interested in selling and (the owner) said, ‘No kid, I’m not interested in selling.’ The next week he came in and the owner said, ‘Hey kid, were you serious about buying the auction?’ (Stanley) said, ‘I could be.’ Due diligence must not have been too long because I think within about 30 days they came to an agreement and dad bought Capital City Auto Auction for $6,000. He renamed it Ohio Auto Auction. Both Ohio Auto Auction and the Columbus Fair Auto Auction were on the Ohio State Fairgrounds at the same time.

Dad got an old, wore-out pickup truck and three employees and got to run the sale through the cattle barn of the fairgrounds. The auction had to shut down three weeks

out of the year for the fair.

In 1978 they built a new facility (which, today, is Manheim Ohio). I started there cutting grass, probably when I was 10 or 11. I started working the snack shop on sale day. Then I worked my way up and learned how to drive so that I got to drive cars and wash cars. It was something different every day. They put me with the good drivers. But there are stories. One guy told me, ‘This is Drive, this is Park and this is Race.’ One good driver taught me that it is easier to back in a car to park than to pull it straight in and I think that’s true. I back cars in all the time now.

I also learned how to drive a manual transmission at that time.

Eventually, my parents sold the auction and moved to Florida to get involved in other things then I went

off to college. I went to a really small school in Southeastern Ohio called University of Rio Grande. It’s the home of Bob Evans Farms. It’s also the home of Bevo Francis, the first basketball player to score 100 points in a game.

I went there for a year, transferred to Ohio State for two quarters but it was just way too big for me. So, I went back to Rio and finished studying communications/public relations there.

I worked as a recruiter at the school after I graduated. Then I moved to Columbus, working different jobs. I was a recruiter for Prudential Insurance. Then I got into retail leasing in Columbus. It was all by phone. They would market to teachers’ credit unions and physicians. They would call us and we would track down the specific car, get what the lease rate was for them and deliver the car. Never got to meet a customer in person and

Continued on page 3

I had to wear a tie every day. I did that a couple of years but I wasn’t really happy with the future there.

Meanwhile, two years into retirement Dad was going crazy. He was bored to death. So, he bought Carolina Auto Auction in 1990 to start all over.

In 1997, my dad offered me an entry-level outside sales position at the auction. I never wanted to get into the family business. Growing up, it was always work at the dinner table and talking about work while I was in the backseat of the car. I always joked that I was at every board meeting.

Once I got there, though, I realized this was great. In outside sales, I was on the road four days a week, always calling dealers, then at the office on sale day. It was about meeting people, communicating our story that Carolina Auto Auction is the place to be.

Before I got there, right after they bought it, they got to a point where if they didn’t become profitable, they were going to close the doors and move back to Ohio. But they turned a profit that next month and it just continued.

We started off with three lanes on 15 acres of gravel. Today, we’re 90 acres, eight lanes, with a reconditioning facility, 14-bay mechanic/14bay condition report writing facility. Anyway, after doing dealer sales for a couple of years – my territory was all of Georgia. We didn’t have much of an in-op sale at the time, so we looked at getting into the salvage business. I worked that area for two years when you had to line the cars up. I was in charge of sales and lining the cars up. We didn’t have a forklift back then, so it was a tow truck. We’d probably run 50 every other week. Did that for a couple of years and then our sales manager position came open. I went over to sales and marketing and oversaw four outside sales reps and four inside sales reps. Did that for a couple of years.

Then our national sales position came open and I had some relationships from the salvage part of it, where we’d call some national accounts to get salvage business.

Eventually we started looking for other locations. We purchased 51% of Charleston Auto Auction. It wasn’t very successful but Keith Lelux came on and bought the minority piece of it. It started taking off and doing well. Dad and Keith started talking about buying some

additional locations. One of the sales they looked at was the Indiana Auto Auction. They never got anything done over a year on that, but I think there was a difference in philosophy in what they wanted to do. Keith’s experience was to buy something that doesn’t really have all the facilities but is full of cars. Then put the chain together and flip it. Dad was for something that was broke that you could fix, build and hold on to. They never got to buy anything.

With my windshield time on the road, I thought it would be nice to have more than one location. So, we put a plan together to buy Indiana Auto Auction. In took about nine months of negotiation and then we bought the auction in 2007. Once we bought that, my wife, Lisa, and I moved our family up there and ran Indiana Auto Auction. We were there for nine years. When I first got there my head was spinning, because I first got there in 2007 then 2008, 2009 and 2010 (the great recession) came. So, you’re looking out at the sale lot, knowing you have to sell 300 cars to break even and there’s only 150 there. You think, ‘My, what did we get into here?’ But once we got into 2011, things started to take off a little bit. There were two sales in town, us and a Manheim sale. Manheim’s truck sale was its strength and it moved to Indianapolis, which helped us for a bit. But once they sold the property to the original owner (Fort Wayne Auto & Truck Auction) who had a lot of

connections there and it picked up steam. From 2014 to 2016, it was really a battle.

In 2016, Lisa and I moved back to Carolina. The timing was right. Two months after we got back, Dad was diagnosed with cancer. That was the end of his working days.

In 2019, we had the opportunity to buy out Fort Wayne Auto & Truck Auction. They sold the property to Copart but we bought the business. Indiana Auto Auction has taken off since then, even through COVID. Carolina is also in a good spot. The management team is pretty deep.

UCN: So, your parents always seemed to be involved in NAAA. When did your involvement begin?

Autenrieth: While I was in Indiana, I went through the Midwest Chapter seats. I became president of that chapter in 2013, I think. Once I got back to Carolina, I went through the Southern Chapter seats. I was president in 2021.

It wasn’t something that my parents expected of me. It was the camaraderie of all the auctions. When you build a relationship with an auction owner or manager, it’s pretty cool to be able to sit down and talk shop. What goes on at your place? What works? What doesn’t work? You really get that at the convention. My first convention had to be around 2000. It was when my dad became president. That was in Washington D.C.

The next convention, 2001 in San Francisco, was the convention I got married at. We didn’t want a big wedding. We thought since my parents were there and we could get her parents there I would (be perfect). We got married in Sausalito, right across the bay. It took a few years for mom (Patty) to forgive us because she wanted a big wedding.

But once we got to Indiana, I attended just about every convention at that point. Then I started to hit things like the Conference of Automotive Remarketing, the International Automotive Remarketing Alliance and other conferences, getting involved in different areas.

I feel like it’s kind of a duty. You’re not obligated, but you really are obligated. We’re stewards of the association, of our little piece of the industry and we’re supposed to help push it forward. I think (outgoing NAAA President) Garrison Hudkins says, ‘Leave it better than you found it.’ I think that’s what we should do.

UCN: Leadership at NAAA is always passing the baton, but what do you want to put your heart into this term?

Autenrieth: My goal is to facilitate and set up a conduit to train the next generation, to grow the next generation of leaders within our association. I came up through the chapters, so I got to meet people on a regional level and to know them.

Continued on page 13

Production:

Subscribers:

Experian’s State of the Automotive Finance Market Report: Q2 2023 revealed some interesting trends and a surprise or two.

“The biggest thing that changed in independent financing was a pretty big reduction in bank financing with independent dealers,” said Melinda Zabritski, Experian’s senior director of automotive financial solutions. “Several years ago, it was quite a bit higher.”

In the new Q2 report, bank loans for independents have dipped to 13.29% of used loans. In 2021, the share of bank loans in the used-car space was over 32%.

Zabritski said there has been an increase in finance companies’ share of used loans, over 28%, and buyhere, pay-here loans make up nearly 40% of all used loans. Credit union financing made up just under 19% of used vehicle loans.

“I think this is just another cycle,” Zabritski said. “We saw the same thing after the recession when share came back very quickly. There was a lot of growth on the books. Then you saw lenders kind of pull back a little bit and rebalance their portfolios. Then they came back to the market.”

The only bank that Zabritski can think of that didn’t come back to auto was Citi.

The report also showed subprime used loans continue on record lows.

Subprime makes up less than 20% of used car loans this quarter, compared to nearly 23% two years ago.

Deep subprime has dipped to 2.5% from 5.5% pre-pandemic.

“I don’t think it’s due to lack of lenders,” she said. “Finance companies haven’t gone anywhere. I think

it’s that consumers in the subprime space just haven’t returned to the market.”

Zabritski said it may take used vehicle values coming down more before that trend changes.

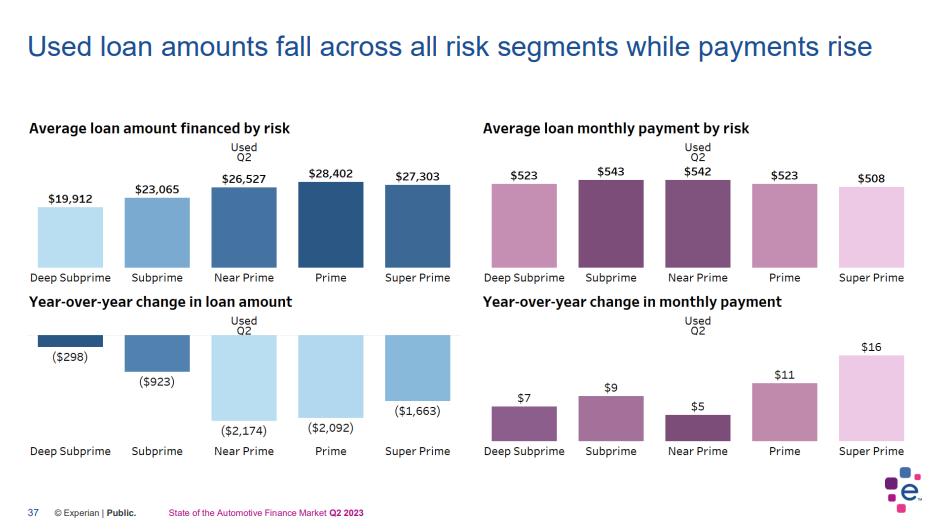

The Experian report also shows that consumers in general are financing used vehicles at decreasing rates.

Zabritski said more new vehicles and incentives in the marketplace may be one reason for this trend. Plus, we are in a tighter used car market, she said.

The Experian report also shows that while average loan rates are up – 11.38% – used values are dropping and the amount financed is down.

“However, that hasn’t caused the payment to go down,” Zabritski said.

One item piqued her curiosity involved the average used loan term for deep subprime going back to Q2 of 2008.

“Deep subprime average term then was 52 months,” she said. “Now it’s approaching 63 months. A lot of growth in those terms.”

The average term for all used loans back then was 59 months and now we’re at 67 months.

The Experian report also points out a trend in delinquencies in all open auto loans.

The delinquency chart shows that 2.28% of all loans are 30-days delinquent and 0.82% are 60-days delinquent. It also shows that 2.29% of loan balances are 30-days delinquent while nearly 1% of total auto loans balances are 60-days delinquent.

These delinquencies have risen past pre-pandemic levels.

Zabritski reminds people that there are a lot of factors involved,

such as more government programs coming to an end.

“Also, over the past couple of years we’ve had some pretty significant increases in monthly payments,” Zabritski said. “As you know, most delinquency does tend to occur in the first 16 or 18 months of the loan. So, I think we’re just naturally in that cycle.

“(Lenders) have been originating fewer subprime loans, but they have been originating at significant higher monthly payments.”

Zabritski said the market is seeing an increase in repossessions, though this report doesn’t cover that.

“What’s been interesting from a lender standpoint is that yes, repos are up, but the charge-offs are down quite a bit.”

She said this speaks to the higher values at the auctions.

The report also had trends on leasing.

While leasing decreased significantly beginning in 2020, data shows leasing experienced a slight uptick to 21.29%, from 19.92% last year.

The Tesla Model 3 made a surprise appearance on the list of top 10 leased models, coming in at No. 7.

“I’ve never seen that before,” Zabritski said. “When you look at this, the vehicles that are in the top 10 are high-volume vehicles.

“The Model 3 is not a high volume vehicle, but it’s in the top 10 for leasing. And I ran this list several times.”

Zabritski said the Tesla stands out because the list of top leased models rarely changes.

“It’s almost always the Ford F-150, Honda CRV, Rogue, Equinox, or Civic,” she said.

But another chart in the report also drew Zabritski’s attention. It shows the average monthly payment

comparing the loan payment vs. the lease payment.

In the case of the Tesla Model 3, the average monthly payment of the lease is $741 – higher than the average loan payment for the same car, which was $679.

“But there’s a lot of options that can be turned on with the Tesla, so we don’t know if the leased vehicle was just naturally more expensive, with more features, bells and whistles. I just don’t know.

“But it’s rare that I’ve ever seen a lease payment higher than a loan payment.”

Amid rising interest rates, consumers are continuing to opt for shorter term loans. Used vehicle loans with 1- to 48-month terms made up 11.31% in Q2 2023 compared to 10.06% the previous year. As a result of shorter-term loans, the average monthly payment of new and used vehicles increased. The average monthly payment for a used vehicle saw a slight uptick from $519 last year to $528 this quarter.

Another trend is that captives regained the lion’s share of total vehicle financing, outpacing banks and credit unions. Experian’s report showed captives made up 29.05% of the total vehicle financing market in the U.S., up from 22.15% the previous year. They were followed by banks (24.84%), credit unions (22.49%), finance companies (13%) and BHPH/others (10.52%).

“It’s a return of the captives,” said Zabritski. “The banks’ share has been steadily dropping over the past couple of quarters. Some banks have left auto lending or severely de-emphasized auto lending. That total financing does include leasing and, of course, that’s all captive driven.”

9/18/2023

Manheim’s Craig Amelung, who becomes National Auto Auction Association President-elect during this month’s convention in Chicago, is general manager of Manheim’s MidAtlantic Market Center and serves as president of the Virginia Independent Automobile Dealers Association (VIADA). He is a 30-year veteran of the automotive industry.

Used Car News: How has it been as a Manheim veteran working with Eric Autenrieth, NAAA’s incoming president?

Amelung: I think it’s been easy. It’s been an easy relationship to build, in all fairness. Coming into this role –a leadership role in the association – one of the things that was really important to me was acknowledging the fact that I work for Manheim. But, at the same time, building relationships with independents over the course of my career has been

important to me. I sat in the Independent Auction Committee at the convention last year. You can’t lead an association and only represent a certain fraction of the membership. Eric and I have talked about it in doing a couple of these interviews before. We play off each other well and bring a different perspective to the business. I think my first convention was in Toronto in the mid-1990s. In 2012, I started getting involved in committees with the Standards Committee and, eventually, in the Legislative Committee. After starting in committees, I got a little more involved in some other things. At the time, my role was a corporate role at Manheim. But as the years went on, I felt I really wanted to do this (get involved in NAAA leadership).

As I started getting into the 2000s, your career gets a little more stable, you know a little bit more. For me, it was about giving back. When I look

at what this industry has provided for my family, I’ve been fortunate. I’ve worked for some great people and I’ve been part of some great teams. The auction industry has provided for me. I’ve been blessed. So, for me, asking to be a part of this,

and working to be a part of this is about giving back.

I tell people all the time, if you get out of bed and you’re not looking to learn something that day, you might as well stay in bed.

9/18/2023

As the Florida Independent Automobile Dealers Association preps for its annual convention Oct. 29-31 in Orlando, it has a new leader at the helm who looks like the perfect fit.

Chuck Bonanno has been a friend of independent dealers and a resident of Florida for decades.

Since this spring, he represents his home state dealers as executive director of the Florida IADA. Bonanno lives in Sarasota, Fla., where FIADA is now headquartered.

Bonanno has more than 30 years of experience in the independent dealer industry, including serving as the vice president of dealer development for NIADA from 2016 to 2021. He’s served as a trainer, moderator and 20 Group consultant for independent dealers and spent years on the dealer conference circuit training and helping independents.

The move came after a transition period for FIADA.

Longtime executive director Lisette Mariner resigned at the end of 2021, after 10 years at the helm. Ejola Cook, an attorney and FIADA board member, took over on an interim basis in 2022 to help keep the association afloat.

Meanwhile, after Bonanno’s time at NIADA, he had a short stint with Buckeye Dealership Consulting, then became available and was thrilled to join the FIADA team.

As a supporter and longtime FIADA member, he expressed his excitement at the time of his hiring.

“I am a staunch believer in the association and it is my goal to increase membership participation, leverage our vendor relationships, improve our educational offerings, advocate for dealers in Tallahassee and our staff pledges to provide excellent customer service to our

dealer members,” Bonanno said in a press release at the time.

Bonanno admits the group has a lot of work to do.

“The association has been in decline from many years and that was exacerbated by COVID and then the executive director leaving and not having (a permanent person) in place for over a year,” he said. “So, we’ve got nowhere to go but up.”

Bonanno reflected back to when he first got into the buy-here, payhere business decades ago.

“At the time, I knew nothing about BHPH. I knew nothing about car dealerships. But I knew from the very beginning that the association is a must for all,” Bonanno said.

Often, non-members will only call the association when they are in trouble and they need help fixing something.

“The association can do so much for dealers, whether it’s networking

Chuck Bonanno

Chuck Bonanno

with other dealers, all the benefits, programs, services and providers in the vendor world or lobbying the state capital,” Bonanno said.

Continued on page 12

The Consumer Financial Protection Bureau recently issued this summer’s Supervisory Highlights in connection with examinations completed between July 1, 2022, and March 31, 2023. The Supervisory Highlights publications are a way for the CFPB to convey periodically to the general public its findings of violations of federal consumer financial laws and regulations from otherwise confidential, private examinations of supervised institutions without naming names of specific companies.

This latest issue of Supervisory Highlights is a regular cornucopia of information; there’s something for everyone to digest. Here are a few of the most significant compliance issues identified by examiners as applicable to those in the business of au-to sales and/or finance.

CFPB examiners found that supervised institutions engaged in the deceptive marketing of auto “loans” when they used advertisements that pictured vehicles that were significantly larger, more expensive, and newer than the vehicles to which the advertised “loan” offers would apply. (The CFPB refers to “loans,” but because the CFPB tends to conflate a loan with a retail installment sale contract, I’ve included the term “loan” in quotes.) Examiners found that the representations made in these ads were likely to mislead consumers, as the “net impression” to consumers was that the ads applied to a subset of vehicles to which they did not actually apply. Examiners concluded that it was reasonable for consumers to believe that the advertised terms applied to a class of vehicles similar to the cars that were pictured in the ads. These representations were material to consumers, as information about the central characteristics of a product or service—such as costs, benefits, and/ or restrictions on the use or availability—are presumed to be material. The examiners claimed that the promotional offers advertised were significantly more restricted than a consumer may have realized. If you’re going to advertise vehicles to be financed, make sure the vehicles you advertise are representative of the types of vehicles you actually finance.

Among the tasty morsels in the most recent Supervisory Highlights is a change in CFPB policy around the issue of “powerbooking”—where a dealer fraudulently represents to a financing source that a vehicle subject to financing has options or enhancements that it does not actually have. This practice may artificially inflate the value of the vehicle, which may make it easier for a dealer to find funding for the contract from a financing source.

The CFPB found that certain auto servicers engaged in unfair or abusive acts or practices by charging and collecting interest on amounts owed on vehicle RISCs that were based on those fraudulent representations by dealers. The CFPB claimed that when the auto servicers identified these discrepancies (in other words, determined that the dealer was powerbooking), the servicers reduced the amounts they paid dealers by the amount of the missing options. However, the servicers did not reduce the amount that consumers owed on the RISCs and continued to charge interest tied to the financing of those nonexistent options. Also, after a vehicle was repossessed, servicers compared the options on the repossessed vehicle with the information provided by the dealer. Where the options were not actually included, the servicer obtained a refund from the dealer that was applied to the consumer’s deficiency balance but did not refund to the consumer the finance charges (interest) that accrued on the financed cost of the non-existent options.

This new expectation by the CFPB could have a major impact on auto finance companies and banks that purchase RISCs. When you learn that a dealer has engaged in powerbooking, how many of you are refunding your consumers the interest that was charged on the non-existent options? And if you are refunding interest tied to the financing of those illusory options, are your calculations correct? Further, if you’re a dealer and you sell RISCs you originated to a financing source, you can likely expect increased scrutiny from your financing source as a result of this recent change in CFPB policy. Now more than ever, a dealer should be prepared to prove that the vehicle financed by the RISC has all the options and enhancements that the dealer represents it has to financing sources.

CFPB examiners claimed that auto servicers engaged in unfair acts or practices by suspending recurring automated clearing house payments before a consumer’s final payment without sufficiently notifying the consumer that the final payment must be made manually. The written electronic funds transfer authorizations signed by consumers contained a small-print disclosure that servicers would not automatically withdraw their final payment. The CFPB claimed that when servicers cancelled the final withdrawal and did not debit the final payment, consumers missed payments and were charged late fees. If you have an ACH payment agreement with your customers, be sure that you don’t cancel or suspend their final payment without giving them adequate notice as to how they can make that payment.

The CFPB claimed that some vehicle financing contracts contained cross-collateralization clauses that allowed servicers to effectively use the collateral vehicle to secure unrelated unsecured debts that consumers may owe to the company, such as credit card debt. Examiners found that after servicers repossessed vehicles, they accelerated the amounts due on the vehicle finance contracts and also accelerated any other amounts the consumers owed to the company under different and unrelated credit agreements. When consumers called to recover their vehicles, the servicers required consumers to pay the full amount owed on all accelerated debts, not just the vehicle debt.

Examiners found that servicers engaged in unfair and abusive acts or practices by engaging in the blanket practice of cross-collateralizing contracts and requiring consumers to pay other debts to redeem their repossessed vehicles. While servicers occasionally allowed consumers to pay lesser amounts, they did so only if consumers objected or argued about the debt, and consumers were not meaningfully made aware that arguing about the crosscollateralization could result in lesser payment amounts to redeem their vehicles. Even if a consumer objected, servicer representatives still allegedly used the cross-collateralization provision as a coercive collection tactic.

The CFPB also claimed that this practice took unreasonable advantage of a lack of understanding of consumers of the material risks, costs, or conditions of their financing agreements. The CFPB claimed that accelerating all debts owed by defaulting consumers resulted in a significant monetary advantage to servicers while imposing a corresponding degree of economic harm on consumers. The CFPB claimed that these practices also inflicted significant emotional and psychological distress on consumers. If your contracts have cross-collateralization provisions, you should check your policies and procedures to ensure that you’re not requiring consumers to pay other debts to redeem their repossessed vehicles.

This latest Supervisory Highlights edition includes, for the first time, findings from the CFPB’s Supervision information technology program, which evaluates information technology controls at supervised institutions that may impact compliance with federal consumer financial law or implicate risk to consumers. The CFPB assesses the effectiveness of information technology controls in detecting and preventing data breaches and cyberattacks. Examiners found that institutions engaged in unfair acts or practices by failing to implement adequate information technology security controls that could have prevented or mitigated cyberattacks. More specifically, the institutions’ password management policies for certain online accounts were weak, the institutions failed to establish adequate controls in connection with log-in attempts, and they did not adequately implement multi-factor authentication or a reasonable equivalent for consumer accounts. You should review whether you use multi-factor authentication, or a reasonable equivalent, have good password management practices, and have adequate controls for failed log-in attempts to prevent/ mitigate unauthorized access to your consumer accounts.

(This article has been edited from a longer article in Spot Delivery)

Eric L. Johnson is a partner in the Oklahoma office of Hudson Cook, LLP. © CounselorLibrary.com 2020, all rights reserved. Based on an article from Spot Delivery. Single print publication rights only to Used Car News.”

He said it seems the internet and social media have gotten in the way of what the mission is.

“You see people going online, getting answers from strangers they don’t know from other states,” he said. “It’s not a good mix.”

Bonanno plans on attending NIADA’s National Policy Conference in Washington D.C. later this month where there will be a meeting of state executives.

“We’ve got to really interject our value to the dealers,” Bonanno said. “I’m not sure everyone sees it. We’ve had a generational shift and we’ve got to communicate our value to them and provide them with the education they need.

“That’s always been a challenge. I’ve been at this 20 years trying to educate dealers. Now, it’s easy to help the dealers who want to be educated. How do you get them to recognize how valuable this can be

to them should they need it – and it’s at a very low price?”

The association has to fill a need, whether it’s compliance, networking or operational education.

“That’s my 2024 marching orders; to put a real operational educational program in place for dealers so they can get beyond just the stuff about the DMV, the Department of Revenue, etc.,” Bonanno said.

He loves the work of industry attorneys and compliance experts, but sometimes “they just scare dealers.”

The dealer’s state association will focus on the dealers, laws and regulations in that individual state.

“I just want to make sure we can become a source for dealers to at least know the right things to do,” Bonanno said. “If you don’t do the right things, it’s because you made a choice, not because you’re ignorant of the rules.”

Again, a lot of these dealers are

self-made and risk takers who just hustle, he said.

“A lot of decisions they make are based on what they consider to be common sense. But I have a lawyer in the family, my daughter, who just constantly reminds me, ‘Dad, it’s not common sense. It’s what the law says.’”

Which brings Bonanno to this year’s convention, called “Driven” and being held at Hilton Orlando Bonnet Creek.

“The ‘Driven’ is kind of that ‘Good to Great’ thing,” he said. “Do you want more? Here is how to get it.

“We want it to be dealer-driven.

So, we’ve got a lot more presentations that are going to be led by dealers, wither it’s a dealer panel or a dealer presentation.

“That’s why I have Tracy Myers (of Frank Myers Auto Maxx in North Carolina) as a keynote speaker. I want a dealer who’s been in re-

tail and BHPH through good times and bad times.”

It’s a critical and scary time where some big dealers have shut their doors, he said. The problem usually comes down to the same things.

“It’s almost always cash flow and capital,” he said.

But bringing dealer presenters and dealer panels to the convention will give attendees a chance to hear stories from real dealers about how they have navigated through difficult times and what techniques, tools and strategies can help.

Bonanno wants his presenters to focus on the issues that will resonate with attendees six months down the line. Topics include everything from maximizing F&I gross and collections to underwriting trends, staffing and digital retailing.

The conference will also have an exhibit hall to offer technology and tools to help dealers.

I feel like we can do better. A lot of times we know people when they attend a conference. But we don’t know their abilities. We don’t know what their interests are or their abilities might be if they were on a committee or as a chapter or NAAA president. It’s about trying to get to know the right people before they get to those positions.

I’d like to try and create some type of an annual leadership weekend. Not just for the sales people or the general managers that are going to the NAAA Convention or the CAR conference or IARA. This could be for the (staffers) below them that an auction could send them for training to learn about NAAA and leadership.

UCN: What do you think about the state of the industry?

Autenrieth: As an industry, data shows we’re 5% up over the same period last year (as of July). I think

dealers always need to buy cars or sell cars, so that makes us very viable. We also have lots of tools in our tool belt, whether that’s in-lane, whether that’s selling cars on their lots, whether that’s simulcast or selling on a digital-only platform. We’re able to do all of that. We also have a place to park the car, a place to recon the car and mechanics to fix the car. We can do it all. It sets us apart. With COVID, we became a little more efficient and profitable because we were selling 80% of the cars. We just didn’t have enough of them to start with. Now the cycle seems to come back.

UCN: What’s the future look like?

Autenrieth: We’ve always been brick and mortar and driving through the lanes. COVID introduced us more into the digital piece,

whether it’s safety or the constraints of hiring. Some locations don’t drive (cars through the lanes) now, some do. Some preferred not to drive through COVID, some did. Some said digital-only is the wave of the future. But now you’re seeing some digital players buy brick-and-mortar

auctions.

NAAA auctions have all the tools to our disposal and we’re, hopefully, able to – as (MAG CEO) Bob McConkey would say – meet the dealer where the dealer is and do the business the way dealers want it done.

The Indiana Independent Auto Dealers Association (IIADA) held its first convention in over a decade, celebrating the distinguished achievements and milestones of its members and industry leaders. In the spotlight were several prominent names who have showcased excellence, resilience, and innovation in the auto dealer industry.

Kesler Schaefer Auto Auction received a special honor on their 80th Anniversary as the first ever recipient of the IIADA Distinguished Member Award. Having established themselves as a stalwart in the auto industry for the better part of a century, the recognition is a testament to their unwavering commitment to quality and service.

The prestigious Joe Krier 2023 Quality Dealer of the Year Award was given to GMG Motors and their president, Melanie Goldman. The announcement was made by Joe’s

son, Drew Krier. The award, named after former IIADA President Joe Krier, stands as an example of what the Indiana auto dealer community represents – dedication, integrity, and an unparalleled customer experience.

IIADA also honored Kinetic Advantage with the Vendor of the Year award, with Lori Kahre representing the company. IIADA praised the company’s “outstanding contributions and commitment to excellence (that) has set it apart in the industry, fostering a strengthened relationship between vendors and dealers. Additionally, Kahre played an integral role in the planning and execution of the 2023 IIADA Events as the Chair of the IIADA Vendor Advisory Council.

The event saw attendance from state leaders including Secretary of State Diego Morales and Attorney General Todd Rokita.

Another highlight was the recognition of State Sen. Andy Zay, who previously served as IIADA board president. Zay was honored for his exemplary service to the IIADA. The association announced that

Vice President Travis Baldwin of Best Deal Auto Sales will take the reins as the new president of IIADA.

The convention marked the beginning of a new chapter for the IIADA.

FLORIDA

Borys Klementowski, salesman, Auto 4 You, Sarasota, Fla.

“My dad opened this business in 2012. I started working for him when I was about 16 or 17. After I graduated high school, I started working for him full time.

“Every kind of shift in the environment causes change, whether it’s technology or COVID. We’re now doing more credit applications and approvals over the phone than we ever were.

“After COVID our inventory was 10 cars, two months ago it was 20 cars and now we’re up to 32 cars. I’d say we sell 15 vehicles a month.

“I believe I only have one truck. I have a lot of cars, but they don’t seem to be selling as much as the SUVs.

“About 95 percent of our business is buy-here, payhere. We use GPS systems

and some people don’t do the oil changes. People don’t realize that we are not yet in the era of electric cars where you can just go until the battery runs out. If an internal combustion engine is not lubricated properly, it will just lock up.

“I think if we over-recondition, the customers will see the value and keep the car longer. I’d say we have $1,500 in each vehicle, just in parts. Our average car probably has 165,000 miles and those vehicles need some tender loving care. We have one detailer and two mechanics and everything is done in house.

“Before when (the government) was giving away money you could get $2,000$4,000 for a down payment. Now I’m dealing with more $500-$1,500 down payments. Our terms are 32-36 months.

“Anyone starting out in this business needs to treat people right. Many of our young customers don’t know about debt or credit. When they finally get enough money to buy a car, they are putting all of their trust into you that the car will run. We offer a warranty and I think that’s one of the reasons people come to us.

“The last vehicle I sold was a 2002 Jeep Cherokee with 154,375 miles. We sold it for $6,900 and the gentleman put $500 down with biweekly payments of $200 a month.”

Jon Davachi, owner, The Leader Dealer, Goodlettsville, Tenn.

“I started in this business pretty much as soon as I could. I went to my dad’s lot after school and I remember my first sale. I hopped

in the car with the customer, he drove it around, and he looked at me and said, ‘OK, I want it.’ I remember that moment of magic, and it’s one I’m chasing forever.

“COVID was the best of times and the worst of times. It really rattled the wholesale market. I had my driest month in sales ever, and I had my largest month of volume sales in recent history. I did find myself attending the auctions less and I started buying more online.

“I have 20-25 vehicles ready to sell at any given time; and accumulatively 5560. I sell about 15 a month.

“Pickups have been commanding top money. I try to keep a variety but I definitely see a trend toward practical and affordable transportation -- and compact SUVs.

“Buy-here, pay-here is all I do. That’s why I’m in the business. I like building the

relationship and helping the customer stay within a small margin of error in life. I keep a direct line of communication with them in case there are any hurdles or hiccups. I want that buyer to buy their next 20 cars from me and send their friends and family.

“I used to have two sales lots and a recon shop and I’d spend all day in re-con, shipping them off to the sales guys who’d then have all the fun. I was making a bunch of money but I was more miserable than ever. I had to go through some growth and development to realize there’s no happiness in trying to take over the whole world.

“I spend $1,300-1,400 average in reconditioning.

“The last car I sold was a 2017 Toyota Corolla with 40,000 miles. I sold it for $14,900.”

“I switched to premium used tires from Champtires and have drastically increased my margin. Champtires has a huge inventory and a three-step inspection process. Free shipping is included.

Plus, there’s a program for auto businesses to take 10% off every order.”Compiled by Ed Fitzgerald

9/18/2023

Nathan Simonson, general manager, America’s Auto Auction – Baton Rouge, La.

“I’m general manager at both America’s Auto Auction – Baton Rouge and America’s Auto Auction – Pensacola.

“There’s a lot of growth here in Baton Rouge. We run four lanes. We’re running about 350 to 400 every week. A year-and-a-half ago they were running about 100. So, we’ve really grown a lot.

“The repos are up and we’ve gained a lot of new business this year with our national accounts. We also brought on two new sales people who have been in the industry for a long time. So, that’s really helped our dealer growth for new-car trades.

“We just had a huge sale featuring Credit Acceptance

Corp. and Ally Financial. We ran 350 on Sept. 7 and sold 75%.

“We have about 100 to 120 people in the lanes and about 150 online. We use Pipeline for our online sales.

“Retail dealers have been buying up stuff.

“Our average price is between $8,000 and $9,000 across the block.

“We start our sale with an in-op sale on video. We’ll run about 50 to 60 in-ops in our sale. While we’ll do the sale on video, we line up the in-ops near the video sale, as close as we can, so dealers can see them.

“We run about an average of 80 to 100 Credit Acceptance vehicles every week now. We just won our territory – all of Louisiana – for Credit Acceptance.

“They ran 148 units on Sept. 7 and sold 146.

“This year, we got a lot

more growth from Holman on the lease side. We also have vehicles from LeasePlan. Plus, we have Credit Acceptance plus Ally Financial and we have Consumer Portfolio Services.

“The thing we’ve tried to do here in Baton Rouge since I took over here is just to try and create consistency every week.”

Kim Joyce, general manager, Greensboro Auto Auction, Greensboro, N.C.

“I took over as GM in October of last year. But I’ve been in the auction business in and around North Carolina for 37 years. I was one of the first 10 employees here in Greensboro so I’m pretty familiar with it. We have 16 lanes in our standard building and right now we’re utilizing 10 of those because of

the effects of COVID and the change in the fleet business. But we’re slowly working our way back into running 16 lanes.

“We run an average of anywhere from 1,100 to 1,300 cars a week. It seems like the buying market has been pretty steady. We’ve been pretty steady with that number.

“We have an average sales percentage anywhere from 57% to 63%, but that fluctuates.

“We’ll sell about 60% of (our volume) in-lane and 40% of our sales are internet sales. In 2019, it was probably 5%.

“On the retail side, I think everybody’s pretty optimistic at this point. The interest rates have a lot of the used-car dealers hesitant. But sales have been better. Our guys here are fairly optimistic because you’ve got to

Compiled by Jeffrey Bellanthave them to sell them.

“I would say the average price across the block would be in the $24,000 to $25,000 range. We’re pretty heavy into trucks and SUVs.

“We usually do a classic car sale about three times a year, usually in late February, July and November.

“We run about 700 cars each sale. We’ll usually run around 80% to 82%.

“We do quite a bit with rental companies. We have some nice size rental companies that are moving vehicles with us. We also do Ford and Stellantis sales but they are relatively low at this time.

“We have seen an uptick in repos. I think we’ll continue to see them come in. Our body shop business is doing well.

“We’re working hard on our dealer business, trying to improve our dealer sales and help the dealer group.”

ADESA Boston October 13, 27

508-626-7000

ADESA Charlotte October 5, 19

704-587-7653

ADESA Chicago

847-551-2151

ADESA Cincinnati/Dayton

ADESA

Chase.

Neither JPMorgan Chase Bank, N.A. nor any of its affiliates are affiliated with ADESA, Inc. or Manheim, Inc. Each auction is solely responsible for their website content, sales events, promotions, fulfillment and operation of the auction.

©2023 JPMorgan Chase Bank, N.A. Member FDIC 10/23

The National Auto Auction Association was formed seventy-five years ago. So was I. We’ve seen many changes over the years – the post-war boom of the fifties brought a prosperity that many had never dreamed of, especially after the ravages of World War Two. The infrastructure of wartime industries became more formal during that time, providing the basis for ready growth to people demanding better things.

The simultaneous spread of the automobile industry and the population both gave birth to the suburbs – there was no longer a necessity to live within walking distance of home and work.

Harry S. Truman presided over 147 million people earning an average 40 cents an hour to buy a house that was about $6,300, a gallon of milk was 3x more expensive than gas which was 29 cents.

A more formal used car industry came about, more out of necessity than whim, to

support new vehicle distribution. And used car values were tracked and tabulated in various guidebooks, some regional and a couple of national ones observed regional preferences, reflecting population and weather differences.

That’s how Cox Communications got into the auto auction business. They bought five smallish auctions in the flourishing Eastern market to protect a data stream of weekly used car values, viably and actually established, which they could then publish as a known market.

The auto auctions’ first association was originally called the National Auto Auction Protection Association because it represented an industry that was largely unknown, even to regulators, and ignorance breeds rules that invariably reflect wrongly on the business they’re trying to regulate. A legislative background provided the framework back

then, as local owners of auctions marketed their businesses through brochures reflecting their performance on sale days – these were known as Market Reports. Of course, better prices attracted more cars, more cars attracted more dealers and so on. The motivation to “enhance” performance was considerable and so the growth of clocking became a thing – a surefire way of increasing a car’s value by lowering the mileage showing on the odometer. I’ve written several essays on that subject before.

Today’s national association is a much more rounded utility, providing all kinds of access to valuable assets, shared evenly for the benefit of its members. Not the least of which is training. National training takes the guesswork out of local interpretation, especially when representing national companies’ products across so many markets.

Tom Adams Sr. brought one of the most valuable by-prod-

ucts to the industry, bringing believable underwriting to the value of transactions in the form of insurance for checks and titles issued to enable sales and purchases on a sound, national basis. His son, Tom continued to bring value-added products and services to the betterment of the members. Their company, Auction Insurance Agency, through various subsidiaries, finds all sorts of ways to underwrite the declared condition and histories of the cars and trucks bought and sold through today’s auctions.

Unlike me, the auction industry has not only kept pace with the digital environment we find today but has formulated new and, dare I say, better ways to enable transactions here and across the globe. Other industry titans like Willis Johnson fulfilled visions of global access through technology, starting from the seat of a fork lift truck.

Success stories abound

• 50-year veteran of the industry

• President from 1997–2000 of ADT Automotive

• Served as ADESA’s executive vice president of sales and marketing

• Moorby & Associates

2006–present

• NAAA Hall of Famer

• IARA Circle of Excellence

To see past columns from Tony Moorby, visit www.usedcarnews.com/ columnists/tony-moorby

throughout our business as confidence grows not only in the established methods of distribution but, with the underpinning of our national association, we continue to grow from strength to strength. We help grow others’ businesses by growing our own capabilities. I look back with pride at having been involved.

Myles Mellor