For Defined Contribution Plan Sponsors

AWARDS PSCA Signature

Excellence in Retirement Plan Education

PSCA honored the winners of its annual Signature Award competition at the 2025 National Conference.

ALSO

PRIVATE MARKET INVESTMENTS

VESTING SCHEDULES AND EMPLOYEE RETENTION

MANAGING AN NQDC PLAN

18

PSCA Signature Awards: Excellence in Retirement Plan Education

PSCA honored the winners of its annual Signature Award competition at the 2025 National Conference.

by Hattie Greenan

Are Private Market Investments Right for Retirement Plans?

Rumored regulatory and political support to allow greater private market investment access—including retirement plans—thrust the issue back into the spotlight. What’s new, positive, and/or problematic?

by John Sullivan

Upcoming Webcasts: Coffee Chat with Will August 29, 2025

Roundtable: Roth Catch-Up Provision September 10, 2025

Insights is Published by

PSCA MEMBER

BENEFITS

AND RESOURCES

Conferences and Training

National and regional conferences designed for defined contribution plan administrators and sponsors.

Our must-attend events provide education from industry leaders and peer networking.

Signature Awards

Peer and industry recognition for employee communication and education.

Recognizing outstanding defined contribution programs implemented by plan sponsors, administrators, and service providers.

Research and Benchmarking

PSCA surveys: Most comprehensive and unbiased source of plan benchmarking data in the industry.

Annual surveys of profit sharing, 401(k), 403(b), and NQDC plans, as well as HSAs, created by and for members. Current trend and other surveys available throughout the year. Free to members that participate. Surveys currently available include:

• 6 7th Annual Survey of Profit Sharing and 401(k) Plans

• 2024 403(b) Plan Survey

• 2024 NQDC Plan Survey

• 2024 HSA Survey

Executive Report

A monthly electronic legislative newsletter. Providing concise, current information on Washington’s most recent events and developments.

Media Outreach

PSCA works to ensure fair coverage of the DC system in the media.

PSCA continually speaks to reporters to provide and promote accurate, concise, and balanced coverage DC plans and responds to negative press with editorials and letters to the editors. PSCA is also active on social media — follow us on twitter at @psca401k and on LinkedIn.

Washington Representation

Your direct connection to Washington DC events and developments affecting DC plans.

PSCA works in Washington to advocate in the best interests of our members and bring you the latest developments that will impact your plan. PSCA is a founding board member of the Save Our Savings Coalition that is currently working in Washington to preserve plan limits amongst tax reform.

Quarterly Magazine, Insights

An award-winning and essential 401(k) and profit sharing plan resource.

Featuring nationally-respected columnists, case studies, the latest research, and more. Providing practical and constructive solutions for sponsors.

Professional Growth — Join a Committee! For plan sponsors, administrators, and service providers.

Many opportunities for PSCA members to serve on committees, speak at regional and national conferences, and write articles for Defined Contribution Insights.

PSCA Mission Statement

The Plan Sponsor Council of America (PSCA) is a broadly based association of diverse businesses which believe that profit sharing, 401(k), and related savings and incentive programs strengthen the free-enterprise system, empower and motivate the workforce, improve domestic and international competitiveness, and provide a vital source of retirement income.

PSCA Competition Law Statement

The Plan Sponsor Council of America (PSCA) is committed to fostering a best practices environment for profit sharing, 401(k), and other employer-sponsored defined contribution retirement programs. PSCA adheres to all applicable laws which regulate its activities. These laws include the anti-trust/competition laws which the United States has adopted to preserve the free enterprise system, promote competition, and protect the public from monopolistic and other restrictive trade practices.

Editor, Director of Research & Communications Hattie Greenan hgreenan@usaretirement.org

Advertising Sales Thomas Connolly TConnolly@usaretirement.org

PSCA STAFF

Executive Director Will Hansen whansen@usaretirement.org

Senior Manager, PSCA Membership & Operations LaToya Millet lmillet@usaretirement.org

PSCA Leadership Council

OFFICERS

President Brandon Diersch, Global Financial Benefits Manager, Microsoft

Immediate Past President Diane Garwood, Horizon Bank

Directors

Joyce Anderson, GE; David Blier, United Health Group; Ann Brisk, HSA Bank; Dena Brockhouse, Kent Corporation; Chris Dall, PNC; Yvette George, Henrico County Government; Scott Greenman, The Principia; Teresa Hassara, Principal Financial Group; Sheri Melvin, Union of Concerned Scientists; Michelle McGovern, American College of Surgeons; Tom Moore, Thryv; Rose Murtaugh, International Motors LLC; Cynthia Oberland, Precision Medicine Group; Maria Quintiguia, Public Employee Retirement System of Idaho; Alexandra Richardson, Mercer; Laura Stamps, Financial Finesse; Malika Terry, NCR Atleos; Tracy Tillery, GM

Insights is published by the Plan Sponsor Council of America, 4401 N. Fairfax Drive, Suite 600, Arlington, VA 22203. Subscriptions are part of PSCA membership. Opinions expressed are those of the authors. Nothing may be reprinted without the publisher’s permission. Information contained in Defined Contribution Insights is for general education purposes only and should not be relied upon as legal advice. Contact your legal advisor for advice specific to your plan. Copyright ©2025 by the Plan Sponsor Council of America.

by Hattie Greenan

Peer Reviewed Participation

Using current plan participants to spread the word about your plan through employee testimonials or business resource groups may help boost plan engagement.

IF I AM LOOKING TO PURCHASE A NEW VACUUM, HIRE A HANDYMAN, OR TRY A NEW RESTAURANT, chances are good I am looking up options online and reading reviews. If a product or company has no reviews, I am pretty likely to skip it in favor for something that is tried and true.

In a culture of Amazon reviews, social media trends, and neighborhood apps, we know that peer influence helps change or promote certain behaviors. So it is not surprising that we are seeing an increase in the use of plan ambassadors, financial wellness champions, and co-worker testimonials to help promote retirement plan participation. In facing the challenge of educating employees about benefits, saving for retirement, and overall financial literacy some organizations are looking at current plan participants to help spread the word. Several of this year’s signature award winners, highlighted in the cover story, used this approach with great results. Leveraging business resource group or affinity groups is a great way to execute this approach as employees may be more open and trusting of information received from peers.

In this issue’s Perspectives article, plan sponsors weigh in on education challenges and success. Some organizations have a lot of resources and provide all the programs to employees while others mostly provide communications from providers – both indicate that engaging employees with the material is a challenge, whether they offer programs with all the bells and whistles or not.

In this issue’s article from our education and communication committee, Jennifer Benford Seibert discusses her WATER concept for promoting total rewards that she presented at the National Conference. Employees often think of their base pay as their total compensation from their employer, but the cost of benefits can add upwards of thirty percent to their total pay in value. Ensuring that employees know the total value of everything provided by the organization can help increase their engagement, but also help them appreciate and take advantage of the benefits you work so hard to cultivate.

Breaking through the email clutter and the increasing amount of content that people consume daily to help them understand and take advantage of their benefits is an ongoing challenge – and likely always will be due to the nature of the task – plan sponsors are and will continue to meet that challenge in small and big creative ways.

Hattie Greenan is the Director of Research and Communications for PSCA. .

WELCOME

NEW & RECENTLY CREDENTIALED MEMBERS!

CORPORATE MEMBER

Primark Benefits

San Mateo, CA

Industry: TPA

Contact: Gregg Rubenstein

CERTIFIED PLAN SPONSOR PROFESSIONALS

Deneen Aceto

Youth Villages

Cristina Aguilar

Total Package HR

Stacy Aldrich

The Aagard Group, LLC

Brian Allen

Dynamic Systems Inc.

Marlene Andrews

Western National Parks Association

Raelene Ashbaugh

Wilson & Company, Inc.

Jessica Ashe

Kellan Restaurant Management

Roni Austin

Hardwood Products

Julia Austin

Baird

Korinn Bajmoczi

Corteva Agriscience

Amanda Baker

LKQ Corporation

Janet baloochestani

AlpHa Measurement Solutions

Stacy Barber

Bell Partners Inc

Billie Barnett

Peoples Exchange Bank

Rapa Barsel

Trusted Doctors LLC

Valerie Beauduy

Cambio Communities

Mary Ann Beil

Memphis Zoological Society

Mari Jean Bellander

St Peter’s Health

Julie Berger Dewpoint LLC

Kimberly Blanc Disability Rights CA

Marisol Blancas

Hunter Industries

Angela Bohne Ionbond, LL

David Boilard

Ebara Technologies, Inc.

Jeannine Boisvert

High Point Treatment Center

Sharon Boston

Transamerica Retirement

Kimberly Boyer

Lomont Molding LLC

Michael Boyle

Mainstream Engineering Corporation

Kelli Bracho

Heartland Food Products Group LLC

Megan Bradbury

TradePending, LLC

Stephanie Brady

HJ Baker

Heather Brady

BE&K Building Group

Eden Braun GMH Associates, Inc.

Melanie Browning

Southern Legacy of Life

Ann Bruner

Burlington Capital LLC

Jennifer Butler

PV Fluid Products, Inc.

Annette Calhoun

Seven Counties Services

Melissa Candida

UNIBANK

Stephanie Capps SourceAmerica

Priscilla Caracter

PNP Pediatrics LLC

Olivia Carson PTC

Mila Castello

ADC Therapeutics Inc

Sarah Cecil

Southern Highlands Community Mental Health Center

Adrienne Charles AVMA Life Trust

Marcy Clark Prevea

David Clark

Arcus Biosciences

Tara Clontz

UNARCO Material Handling, LLC

Ed Colby

Dibble

Theresa Conley

Ferguson Enterprises

Theresa Conley

Ferguson Enterprises

Michaella Cooke

Gentiva

Tonya Coy

Cayuga Health System

Keydotta Crawford Cayuga Health System

Charles Crespo

Milrose Consultants LLC

Samantha Dailey

The Suter Company

Shantel Dashiell

OneDigital

Corey Davis

Wellstar Health System

Dirk de Freitas

SBA Communications Corporation

Jennifer DeBrincat Easterseals MORC

Todd DeCourcy

Thomas Road Baptist Church

Marisela DelaCruz

Post Investment Group

Shaughn Dermody-Cadieux

Accu-Time Systems, Inc.

Darlene DeRosa Houghtaling

Team Penske

Jennie Dillon

Central Bank

Bianca Duna

Smalley Steel Ring

NEW & RECENTLY CREDENTIALED MEMBERS! WELCOME

CERTIFIED PLAN SPONSOR PROFESSIONALS

Roberta Dyer

CNH

Joshua Dykes

INVO PEO

Erin Elder

Nesnah Ventures

Cathy Emerson

Encore Electric Inc

Laci Enslin

FPT Corporation

Carrie Eudy

Westrock Coffee

Alexis Fettig

Other

Lynda Finley

Endurance Lift Holdings, LLC

Mark Fiore

JA USA

Haley Fletcher

Engineered Floors, LLC

Tamara Follett

Upper Lakes Foods

Gayla Fowler

RedCastle Resources

Kathleen Franklin

Lacerta

Jessica Friendshuh

Schreiber Foods

Kayla Frye

Ward Transport & Logistics Corp

Cathleen Fucci

Osteoid, Inc.

Margaret Fuss

Medallion Dental Laboratory

INC

Marcy Gallea

Wenger Corporation

Tim Genovese

Glen Raven, Inc.

Ross Giffin

Orange County’s Credit Union

Alexis Giltner

Pride Transport, Inc.

Lisa Gladysz

Accu-Time Systems, Inc.

Kelly Glassner

Blancco Technology

Karen Goldbeck

Nesnah Ventures LLC

Damarie Gonzalez

UniTek Global Services

Sandra Gonzalez Stratus

Seida Gonzalez

Studio Movie Grill

Jamie Gordon

Hubbell Realty Company

Kymberlee Gore

Rotork Controls Inc

Mary Gould

Custom Control Manufacturer of Kansas, Inc.

John Greene

Greylock Federal Credit Union

Linda Hackleman

Trellis Company

Melissa Hackley

Hagie Manufacturing Company

David Haislip

Blackwood of DC Holdings. Inc.

Shana Harmon

Coushatta Casino Resort

Whitney Harris

RAM Aviation, Space & Defense

Angela Hartley

Tom Barrow Company

Tiffany Hausner

Allpoints Services LLC

Amy Heldt

Whitfield & Eddy

Michelle Henry APV

Alejandro Herrera Rivas

FirstService Residential

Susan Hever PPHP

Vicki Hogan

Cleveland University - Kansas City

Emily Hoke

Larkspur HR Consulting LLC

Richard Holcomb

Memorial Healthcare System

Eric Holland

Tindall Corporation

Katrina Hopping

CAMPUS USA Credit Union

Melissa Huber

Chapman Automotive

Laura Hutzler

Nesnah Ventures

Uyen Huynh

Scarlet Pearl Casino Resort

Michelle Hytry HR Renovations

Justin Ingerham Trestlewood Pediatrics

Christine Jenkins

Warren County Water District

Fallon Jernigan

South Plan Community Action Association, Inc.

Kim Jessup Flix, Inc.

Shelby John Enderwitz Central Bank

Melissa Johnson Carter BloodCare

JoLen Jolly Diamond Bank

Sarah Jones

Pardes Jewish Day School

Kaylee Jordan Quad

Shanyce Joseph Aquent LLC

Mailyn Juhlin Kolbenschmidt Pistons USA, LLC

Suzanne Kanter

People Results

Reagan Karlowicz Rotork

Stephanie Keen G&A partners

Laurie Kelly America’s Credit Unions

Shawn Kennel

Kirby Foods Inc.

Ashley Kennison

Norton Healthcare

Jesse Kim

Alcoa Corporation

Kim King

Blueprint Studios

Matthew King

Unarce Material Handling LLC

Dana Kittendorf

The Benjamin School

Christine Knight Acelero, Inc

Andrea Kokott

Steinhafels, Inc.

Rock Kuchenmeister

K/E Electric Supply Corp.

Arriel Kudela

Zurn Elkay

Kathryn Lang

Johnson & Quin

Anna Langdon

LivePerson, INC

Marie Lara

ITC Manufacturing

WELCOME

NEW & RECENTLY CREDENTIALED MEMBERS!

CERTIFIED PLAN SPONSOR PROFESSIONALS

Rachel Lathy Third Coast

Sarah Laurent

Schreiber Foods, Inc.

Katrina Lawson

Gray Construction

Bonnie Lee

Minghua México California, Inc.

Marika Lemmons Connections Health Solutions

Kathryn Leppert

Members First Credit Union

Mary Ann Lewis

Cosco Shipping Lines (North America), Inc.

Richard Lewis

Coca Cola Bottlers Sales and Services

Marley Lilley

Rosedale

Lauri Lipka

Barr Brands International

Candice Lock

ICD Holdings LLC

Denise Logue

Axos Bank

Moira Long

Mann Eye Institute

Ashley Low

MGP Ingredients

Erin Lowden

Danone

Heidi Lybarger

Nine 30 Consulting, Inc.

Philippe Ma

Liberty University

Lynnell Machernis

Statek Corporation

Jane Mansfield

FirstBank

Alycia Marandola

Westerly Community Credit Union

Kalyn Marshall Camillo Companies

Sammie Marth Alsay Incorporated

Rachel Mastriano Canusa Hershman

Stephanie Mauceri Engage PEO

Sherry Mazorra

Palm Beach County Sheriff’s Office

LaShawn McArthur Emser Tile LLC

Cassie McBee

Gwinnett County Government

Elizabeth McCabe

Smalley Steel Ring Co.

Evelyn McCarthy BankProv

Elizabeth McCredden Ovation Holdings, Inc.

April McIntyre

Mario Sinacola

NaShanta McQuay

Unity Healthcare, LLC

Traci Merrell

Thomas Road Baptist Church

Seth Mertz

Liberty University

Anna Metnick FoodCorps

Whitney Mitchell Fulwell Entertainment

Gina Montesonti

Junior Achievement USA

Phillip Morris

Thomas Road Baptist Church

Rebecca Morrow

HigherVisibility

Sharon Moses Wellstar Health System

Tambre Moten

Cy-Fair Fire Department

Sarah Nash

Catalina Marketing Corporation

Nichole Neuendorff

Citizens State Bank

Katie Newton

Prime Capital Financial

Steve Nguyen

Precision Drilling

Gregory Norum

Shimizu North America LLC

Kimberly Noyes

Littleton Coin Company

Jessica Olbricht

Biodesix Inc

Melissa Olsen

ReSource Pro

Joseph Ortiz

Walton Isaacson, LLC

Daniel Ortiz Moreno

Boot Barn

Alexis Palise

Dewpoint LLC

Jacqueline Pardo

Wurth Group of North America Inc.

Robin Parker

San Diego County Office of Education/Fringe Benefits Consortium

Tina Pauluzzi

Glen Raven, Inc

Matia Person

Sanford Health

Angela Peterson

Southern Highlands Cmhc Inc

Michelle Pleet

Renaissance Learning, Inc.

Elizabeth Pollock

The Emmes Company LLC

Jacqueline Portillo

University of Southern Califronia

Jessica Powell

Gray Construction

LeNorris Price

Wellstar Health System

Lori Pryor

Genesis Connected

David Pulford

DART

Rachael Pullman Versaterm

Kathryn Purcell

A2 Global Electronics and Solutions

Jennifer Pysczynski

GoDaddy

Marilyn Quinones

Coca-Cola Bottlers’ Sales & Services Company

Jordan Raver

Mesh Systems

Hannah Rego

Cardinal Glass Industries, Inc.

Terese Reilly

Reynolds Consumer Products

Jonah Resch

Mapletree US Management LLC

Ceri Richards

Altria

Melissa Riggs Hoosier Energy

Sara Riorden

Alter Trading Corporation

Ericka Robinson

ISTH

Sarah Rogers

Easy Step Enterprises, LLC

Marissa Rosado

Johns Hopkins

Anissa Rose

Jesuit Volunteer Corps

NEW & RECENTLY CREDENTIALED MEMBERS! WELCOME

CERTIFIED PLAN SPONSOR PROFESSIONALS

Robin Sabbarese

Commonwealth Rolled Products, Inc.

Eric Salyers

Wound Pros Management Group, Inc.

Dale Santos Cooke School and Institute

Tammie Sauber

University of Kansas Health System

Mary Scarbrough

True Environmental Holdings LLC

Jill Schmidt

Southern Farm Bureau Casualty Insurance Company

Tracy Schnieders Enclos Corp

Lissa Scott

Allied Universal

Leslie Serrano Provident Bank

Antwoine Shepard

FSG, Inc.

Lisa Sheppard

Cayuga Medical Center

Claribel Simancas

Dragados

Nancy Simmons

Triumph Inc.

Timothy Sirkoi Redfin Corporation

George Smith

Benetrends Financial

Meagan Smith

Coushatta Casino Resort

Morgan Smith

Wind Creek Hospitality

Hillary Snyder

Riverstone Communities

Kelly Soto

Arkansas Methodist Medical Center

Ciria Soto South32 Hermosa Inc

Sara Speaks

Commonwealth Rolled Products, Inc.

Michael St Clair Texas Mutual Insurance Company

Dawn Stackpoole Riverstone Communities LLC

Sydney Stanfill

North Range Behavioral Health

Karla Stewart

Caramoor Center for Music & the Arts, Inc.

Ashley Stidham Insperity

Tammie Strohl

Summit Pathology

Brett Struthers

Pride Transport Inc.

Lacey Sturgis

Propio

Cheryl Swidrak

Ono Pharma USA, Inc.

Kimberly Taormina

Las Vegas Review-Journal, Inc.

Kimberly Taormina

Las Vegas Review-Journal, Inc.

Amie Tatosian

SFM Mutual Insurance Company

Mark Taylor Everi

Sherryl Terry Trusted Doctors, LLC

Carl Thompson

Colonnas Shipyard, Inc.

Jennifer Thompson

Kovach Enclosure Systems

Julia Thompson

Invio Automation, Inc.

Bhagyalakshmi Thottingal

The Emmes Company LLC

Angela Toomey

Morris & Garritano Insurance

Ellen Trastelis

Pace Communications

Casey Tucker

Todd & Associates, Inc.

Janet Turner

Willow Bridge Property Company

Jeanette Uchida

Charles Schwab

Jim Uhlarik

Conference of Consulting Actuaries

Christine Van De Mark Fair-Rite Products Corp.

Christine Van De Mark Fair-Rite Products Corp.

Michael Van Epps

Barr Brands

John Vander Leeuw

MMA Securities

Mason Vaughn

Kellan Restaurant Management

Deborah Vetter

Macon-Bibb County Transit Authority

Mayra Villalobos CV3 Financial Services, LLC

Amber von Hone

The American Radio Relay League

Laura Vowinkle Paysafe

ThuTrang Samantha Vu NCMEC

Stacy Waller

RBS Holdings LLC dba RBS Opco LLC

Shea Walls

First Mid Bank and Trust

Sapphire Wang HR Options

Whitney Wangness Center for Primary Care

Bradley Wanstall DAI

Daria Warner

McNees Wallace & Nurick, LLC

Nancy Wasko

Mitchell Plastics

Andre Watkins GameStop, Inc

Taryn Watson

Tekmetric

Holly Weaver

Steak ‘n Shake

John Weber

Yale

Alysa Weidinger

Absher Construction

Lisa Weiss

KC Engineering and Land Surveying, PC

Sarah Welsh

Canyon Ranch

Teresa Williams USOSM

Carrie Wilson

Purdue Federal Credit Union

Jessica Wise

Cavco Industries, Inc.

Rob Wisniewski

GoDaddy

Caleb Wood

Alamo Drafthouse Cinemas

Evern Yildirim

Amcor

Edlin Zavala

Desert Orthopedic Center

Natalie Ziegenhagen

Storck USA LP

Valerie Ziemer

The Hartz Group, Inc.

by Diane Garwood

A New Chapter for Me and PSCA

As I finish out my term as president, I am excited about the progress we have made, and what the future holds.

GREETINGS!

It is it with mixed emotions that I write my final President’s letter to you. Serving as your President as been a truly rewarding experience. I’ve met so many wonderful people. And I’ve been so lucky to be involved in the advancement of PSCA with tools and resources for all plan sponsors. I look forward to staying involved in many of them.

The new website platform is one of the enhancements. Being a part of the American Retirement Association has allowed PSCA access to so much more from a technology standpoint and the work ARA has done to improve the customer experience has been phenomenal. The project is not complete so stay tuned for more tools in the coming year. If you haven’t spent any time on the new platform, I encourage you to do so and test out all the new capabilities.

The Retirement Income Certificate is a great learning tool. I’ve started the process and hope to finish soon, but I’ve already learned so much. It’s so helpful when talking to your Administrative Committees about the possibility of adding any type of lifetime income product to your plans. If you’ve

taken it and received your certificate, congratulations! If you haven’t, consider carving out some time to get this done. You’ll be glad you did.

I think I’m most excited about the new partnership between PSCA and Knowa. I hope you all had an opportunity to see a demonstration of this new platform when you were at the national conference in May. I’m looking forward to getting this in place at my organization so that all the history and information currently residing in my head can be put in a place where others can use it as a resource. Plus, I think the committee meeting area will be of great use to us.

Speaking of the National Conference – what a great job the Conference Planning Committee did bringing this all together this year. Great speakers, great networking, and great weather. I hope those of you that were there had a great experience, and those of you that couldn’t attend – consider joining us next

year in St. Louis! I look forward to seeing new faces and reconnecting with those that have been there before. Make sure you take the opportunity to provide feedback on topics you’re interested in learning more about when given the chance. This is what makes the sessions meaningful. Best wishes to all of you in the coming year!

Diane Garwood is the Vice President of Human Resources for Horizon Bank.

Automatic enrollment and its challenges for plan sponsors

Automatic enrollment in 401(k)s and other defined contribution retirement plans is designed to help workers save money for retirement and better prepare them for the future. But certain factors have caused the initiative to face challenges.

Factor 1: Job turnover

Nearly 40% of individuals quit their jobs within a year of being hired. Many of these people leave behind retirement accounts — which some may not even realize they have. By requiring employees to opt out of 401(k)s and 403(b)s instead of allowing them to opt in, employers are enrolling thousands of employees who may have no intention of growing their retirement savings in their employer’s plan. The effects of this are as follows:

• Plan sponsors must deal with a growing number of ex-employees’ small-balance accounts in their retirement plans.

• Because administrative fees for retirement plans are typically based on the amount of assets in a retirement plan or how many participants are in the plan, retirement plans with transitory participants’ small-balance accounts often generate higher administrative fees.

• Most employers continue being fiduciarily responsible for small-balance accounts left behind by ex-employees, which increases liability risks.

Factor 2: A nonexistent or ineffective cash-out policy

With a sizeable number of ex-employees’ small-balance accounts in retirement plans, mandatory cash-out policies take on more meaning. A retirement plan’s cash-out policy allows plan fiduciaries to force out ex-employees’ small-balance accounts. Since January 1, 2024, the upper limit for mandatory cash-outs is $7,000 and applies to 401(k)s, 403(b)s, 457(b)s, and 401(a)s. But if a plan sponsor has no cash-out policy or its cash-out policy is less than the maximum limit, small-balance accounts of ex-employees can accumulate in retirement plans.

Factor 3: Missing persons and uncashed distribution checks

When individuals resign or are terminated from their jobs, rarely do they keep in touch with their former employers. So if a plan sponsor cashes out ex-employees’ small-balance retirement accounts of $1,000 or less via checks, some or many of those distribution checks may go uncashed because of non-responsive or missing plan participants. This is because employers do not have up-to-date contact information for ex-employees. Uncashed checks are considered plan assets until they are cashed, so they constitute a fiduciary risk for plan sponsors.

What can plan sponsors do?

There are two things plan sponsors can do to mitigate these factors. First, they can change their retirement plans’ mandatory cash-out limit to $7,000 or less and implement an automatic rollover IRA program. This will allow plan sponsors to roll over ex-employees’ retirement savings into safe harbor IRAs if those individuals don’t specify what they want to do with their money.

And second, instead of cashing out retirement account balances under $1,000 by mailing checks directly to ex-employees, plan sponsors can roll over small-balance accounts of $1,000 or less into safe harbor IRAs — just as they do for balances between $1,000 and $7,000. This will minimize uncashed checks and keep ex-employees’ money in the retirement system until those individuals are located and contacted. In addition, it can help decrease plan maintenance, plan fees, and fiduciary liability.

by Will Hanson

Plan Sponsors Weigh In on Future Retirement Policy

Attendees at PSCA’s National Conferfence in May voted on what policy changes they would like to see, or not see, in future legislation.

DURING THE WASHINGTON UPDATE SESSION AT THE 2025 PSCA NATIONAL CONFERENCE, I posed five critical polling questions to attendees about potential policy proposals that could shape the next major retirement legislation. The responses from nearly 400 plan sponsors provide invaluable insights into how plan sponsors view the regulatory landscape and what approaches you believe will best serve American workers.

AUTO-ENROLLMENT: MANDATE WITH PRAGMATISM

The question of mandatory auto-enrollment has been a cornerstone of recent policy discussions, and your responses reveal a sophisticated understanding of both the benefits and implementation challenges. While 67 percent of the audience supported federal auto-enrollment requirements for all retirement plans, the slight preference for a three-year phased transition (34.4 percent) over immediate implementation (32.6 percent) demonstrates a slightly practical approach to this possible change.

This measured support reflects your dual perspective as both advocates for participant outcomes and professionals who understand operational realities. You recognize auto-enrollment’s proven ability to increase participation rates, but you also know that successful implementation requires adequate time for system changes, employee communications, and administrative adjustments—particularly for existing plans that weren’t designed with auto-enrollment in mind.

WHILE AUTO-ENROLLMENT HAS BEEN PROVEN TO BE EFFECTIVE IN INCREASING RETIREMENT SAVINGS, WE SHOULD KEEP IN MIND THAT A MANDATE ON A SINGULAR PLAN DESIGN DOESN’T ALWAYS FIT ALL PLANS DEPENDING ON THE EMPLOYEE POPULATION.

The remaining third of attendees who did not support auto-enrollment were split between favoring tax incentives to adding auto-enrollment (nine percent) and simply against this type of mandate (24 percent). I agree this is a tricky potential policy proposal. While auto-enrollment has been proven to be effective in increasing retirement savings, we should keep in mind that a mandate on a singular plan design doesn’t always fit all plans depending on the employee population.

PRIVATE MARKET INVESTMENTS: SEEKING CLARITY

The debate over private market investments in retirement plans revealed our membership’s most divided opinion, with responses split almost evenly. While 42 percent are in favor of private market investments in DC plans so long as there is additional DOL guidance, nearly 33 percent believe private market investments are too complex for DC plans.

The 33 percent who view private markets as too complex or risky for most DC plans represent a significant contingent concerned about participant protection. This division likely reflects varying organizational sizes, participant sophistication levels, and plan complexity— all factors that influence how fiduciaries view emerging investment options. My primary takeaway from this polling question is that industry needs to increase education to plan sponsors on private market products.

LEGISLATIVE INVESTMENT

RESTRICTIONS: TRUST PROFESSIONAL JUDGMENT

Perhaps the strongest consensus emerged around proposals that would restrict asset classes within DC plans, with 67.6 percent opposing government specification of allowable investments. Your overwhelming preference for ERISA’s existing fiduciary framework (49.8 percent) combined with concerns about stifling innovation (17.8 percent believe this proposal would stifle innovation) sends a clear message to policymakers: trust

experienced professionals to make prudent investment decisions within established guidelines.

This response reflects confidence in your own expertise and the current regulatory structure’s flexibility. Rather than seeking additional restrictions, you’re advocating for maintaining the discretion that allows you to adapt investment lineups to your participants’ specific needs and evolving market opportunities.

FINANCIAL EDUCATION: FOUNDATIONAL INVESTMENT

The strongest support across all Washington Update polls came for mandatory financial education in high schools, with 72.8 percent favoring federal requirements. The preference for dedicated curriculum (51.8 percent) over integration into existing courses (21 percent) shows you believe financial literacy deserves focused attention rather than being relegated to a subset of other subjects.

This overwhelming support reflects your frontline experience with the consequences of financial illiteracy. You’ve seen how limited basic financial knowledge affects participation rates, contribution levels, and investment decisions. Your advocacy for federal education standards represents a long-term strategy for improving retirement readiness that goes beyond plan design features.

AUTO-PORTABILITY: REDUCING LEAKAGE THROUGH AUTOMATION

Support for mandatory auto-portability features garnered 63 percent approval, with strong preference for full automation (47.5 percent agree it should automatically occur with each job change) over targeted approaches focused on small accounts (15.5 percent agree but only for account balances below $15,000). This preference for comprehensive solutions over piecemeal fixes aligns with your systematic approach to addressing retirement security challenges.

The significant support for auto-portability reflects your understanding of how job mobility affects retirement savings accumulation. You’ve witnessed the long-term impact of small account cash-outs and recognize that seamless portability could significantly improve retirement outcomes across all income levels. With that said, a strong third of participants believe that the market should focus on autoportability solutions with limited government involvement.

SETTING THE STAGE FOR FUTURE DISCUSSIONS

These polling results provide valuable insights into how experienced practitioners view potential policy directions, though it’s important to note that none of these proposals have been formally introduced and the next major retirement legislation is likely several years away. The purpose of these polling questions was to gauge member perspectives and set the stage for future policy discussions.

The responses reveal the complexity of retirement policy and the nuanced views of plan sponsors who would ultimately implement any changes. Whether it’s the split opinions on private market investments, the preference for phased implementation of auto-enrollment, or the strong preference for maintaining fiduciary discretion, these insights help us understand the practical considerations that should inform future policy development.

As policy discussions evolve in the coming years, PSCA will continue to gather member input and ensure that the practitioner perspective is part of the conversation. These polling results represent an important baseline for understanding where our membership stands on key issues that may shape the retirement landscape down the road.

Will Hansen is the Executive Director for Plan Sponsor Council of America.

by Hattie Greenan

2025 Industry Award Winners

Announced

PSCA recognized three Individuals for contributions to the retirement industry at its annual national conference in May.

PSCA BESTOWS THREE AWARDS TO RETIREMENT INDUSTRY PROFESSIONALS EACH YEAR AT ITS NATIONAL CONFERENCE: a lifetime achievement award, advisor of the year, and CPSP of the year. PSCA’s Lifetime Achievement Award was created in 2015 and recognizes individuals who have had a positive, lasting impact on the defined contribution retirement system throughout their careers. The Advisor of the year and CPSP of the year were created last year to recognize individuals currently excelling in their own corner of the retirement industry. Previous winners and nominating criteria can be found here. Winners of all awards are nominated by PSCA members and voted on by the PSCA leadership committee.

LIFETIME ACHIEVEMENT

This year, PSCA recognized Nevin Adams, semi-retired, with the Lifetime Achievement award for contributions over his more

than thirty years in the industry. Nevin Adams served as the chief content officer for the American Retirement Association for nearly a decade. Prior to his time at ARA, he was the Employee Benefits Research Institute’s director of education and external relations, co-director of EBRI’s Center for Research on Retirement Income and director of the American Savings Education Council. Prior to his role at the American Savings Education

Council, he spent a dozen years as global editor-in-chief of PLANSPONSOR magazine and PLANSPONSOR.com, as well as PLANADVISER and PLANSPONSOR Europe magazines. He was the originator, creator, writer, and publisher of PLANSPONSOR. com’s NewsDash. He began his retirement services career at Northern Trust in Chicago, where he later served in a variety of management roles, culminating in the development of a proprietary recordkeeping platform, and at Wachovia Bank, leading their defined contribution/ recordkeeping businesses.

Nevin Adams is widely known in the industry as a prolific writer on all things retirement related and respected for his ability to succinctly break down complicated retirement industry information and provide the details and impact to plan sponsors and advisors alike in a highly digestible and witty manner. In his remarks announcing Adams as this year’s award recipient, Hansen noted, “Whether the topic was legislation, litigation, plan design, participant behavior, whether he was writing, speaking, moderating, mentoring, or, yes, even

tweeting. I’ll even add to that podcasting, and he did it all with deep respect for the plan sponsor audience and an unwavering belief in the power of education to improve outcomes. His voice has guided this industry; his passion has pushed it forward. He didn’t just leave a mark; he helped define what excellence looks like.”

Even in his “retirement” Nevin continues to the steady voice of the reason in the retirement industry though his ongoing writing, analysis, and podcasting.

ADVISOR OF THE YEAR

Lisa Buffington works with retirement plan sponsors to maximize retirement plan efficiencies and outcomes so that their employees can achieve their goals for retirement. In her role as vice president, Lisa works with both for-profit and non-profit organizations. She works

directly with finance, human resources, and benefits groups to assist with all aspects of their retirement plan strategy. Lisa is a member of MMA New England’s Investment Committee and MMA’s National Financial Wellbeing Steering Committee. She has been acknowledged as one of PLANADVISER’s Top Financial Advisors for 2023, 2024, and 2025. Lisa has been named as National Association of Plan Advisors (NAPA’s) Top Women Advisors for 2018 through 2024. She participates on NAPA’s Leadership Council and was the 401(k) Summit Steering Committee Co-Chair for 2022 and 2023. She is also a member of the industry’s national Retirement Advisor Council (RAC) as a Board

Member and co-chairs the RAC’s financial literacy committee.

Lisa has a strong passion for women’s professional development, financial literacy education, and urban city K-12 educational reform. She has served as the past president of the Women in Pensions Network’s national group (WIPN) and worked directly with the team responsible for launching WIPN’s non-profit organization. Her dedication to non-profits does not end there as she also serves as board chair for a start-up non-profit charter management organization, Capital Preparatory Schools, and is actively involved in Junior Achievement.

CPSP MEMBER OF THE YEAR

Anthony Davlin is a dedicated Controller at Enviromatic Corporation with extensive expertise in accounting and financial management. He has successfully spearheaded a significant 401(k) plan change, leveraging his passion for financial literacy to educate employees and enhance their retirement readiness. By actively participating in local Roundtables, Anthony has fostered collaborative discussions that promote best practices and innovation within the industry. His commitment to empowering others through knowledge and strategic financial planning sets him apart as a leader in the field. With a keen eye for detail and a collaborative spirit, Anthony continually strives to drive positive change and support organizational growth.

by Hattie Greenan

PSCA Signature

AWARDS

Excellence in Retirement Plan Education

PSCA honored the winners of its annual Signature Award competition at the 2025 National Conference.

PSCA ANNOUNCED THE WINNERS OF ITS ANNUAL SIGNATURE AWARDS COMPETITION AT ITS NATIONAL CONFERENCE ON MAY 1st IN LAS VEGAS. PSCA’s Signature Awards competition recognizes education programs that embrace creative and innovative solutions to plan education, with direct and measurable results that help secure financial security for employees. The awards program is the longest-running, most distinguished retirement plan education and communication recognition programs of its kind.

Educating employees about their retirement plan options and encouraging them to save for retirement is an ongoing challenge for employers. This year’s Signature Award winners exemplify what it takes to cut through the clutter to drive great results for employees.

A panel of business leaders evaluated and selected the winners of the 2025 Signature Awards in four key categories. The 2025 Signature Award Winners are:

Emphasizing Diversity and Inclusion

• 1st Place – Fidelity National Financial with Principal Financial Group

• 2nd Place – Quad with Principal Financial Group

• 3rd Place – Humana with Financial Finesse

Financial Wellness

• 1st Place – The University of Texas at Dallas with Lincoln Financial Group

• 2nd Place – CNO Financial with Financial Finesse

• 3rd Place – Empower

Provider Innovation

• 1st Place – Nestlé USA, Inc. with Voya Financial

• 2nd Place – Medical College of Wisconsin with Transamerica

• 3rd Place – Darden Restaurants, Inc. with Principal Financial

Innovation in Promoting Participation

• 1st Place – Medical College of Wisconsin with Transamerica

• 2nd Place – Bread Financial with T. Rowe Price

• 3rd Place – Lumen Technologies Inc. with Principal Financial Group

Emphasizing Diversity and Inclusion

This category showcases retirement plan communications that have a diversity, equity, and inclusion focus by using more inclusive language, imagery, and other creative methods to reach minority groups. Entries in this category include print or digital communications relating to any diversity topic or non-majority employee group aimed at retirement and financial wellness such as increasing participation among minorities, women, or other populations.

Fidelity National Financial with Principal Financial Group

Fidelity National Financial (FNF) is a provider of title insurance and settlement services to the real estate and mortgage industries and has more than 18,000 employees across 250 locations.

At Fidelity National Financial, women outnumber men 2.5 to 1. Although both males and females are participating in the retirement plan at 93 percent, savings rates and engagement for women consistently lag men. FNF wanted to create a campaign targeting female employees to help bridge the gap in savings rates and wellness scores between its male and female employees. The goals of the program were to increase the average deferral rate for women, increase the number of female participants with secure account access, increase the retirement wellness score for women, and increase their use of the retirement wellness planner.

The “smartHER” (smarter) campaign was created to take the intimidation out of saving and empowering women to believe they are “smartHER” than they give themselves credit for.

This program targeted eligible women in the Fidelity National Financial 401(k) plan (excluding highly compensated employees) and consisted of an email series, live webinars held across six different time zones on multiple days, and a direct mail component. The key message across all platforms is that women generally live longer than men and therefore need to save more to make their income last longer in retirement. The campaign aimed to empower women to save more and “save smartHER.”

Overall, this campaign resulted in significant improvement for women at Fidelity National Financial with their average deferral rate increasing from 6.5 to 7.21 percent. The use of two-factor authentication increased by nearly five percent (78 percent to 83 percent) among women and now surpasses the rate for men. The use of the Retirement Wellness Planner (RWP) increased by 19 percent for women with those linking outside assets in the tool increasing by 58 percent. Additionally, women with a Retirement Wellness Score

(RWS) of 70+ increased by 14 percent – a RWS of 70 or above indicates a high level of retirement readiness

The judges selected this campaign because of the creative and targeted use of the tagline “save smartHER” with great results, increasing the retirement savings of female employees.

Quad with Principal Financial Group

Quad is a marketing solutions company with eight different brands under their umbrella and a total of 8,500 employees across 224 locations. Quad’s campaign aimed to increase engagement with their Hispanic workers – 87 percent of whom work in shiftbased roles within the printing operation with limited access to computers during work hours.

Compared with the plan averages, Hispanic participants lag in savings rates and average account balances. The average Hispanic participant is 43 years old, deferring 7.46 percent and has an average account balance of $41,000. That’s compared to overall plan averages of 47 years old, deferring 8.13 percent with an average account balance of $133,000. The goal of the campaign was to increase engagement and savings behaviors for Hispanic participants as well as participants working in production roles (there is significant overlap between these two audiences). The goals were to increase the percentage of participants with secure access (two factor authentication), increase app utilization (making a fully Spanish version available), and increasing overall savings rates.

Quad decided on a drip campaign with multiple touchpoints to increase engagement. The campaign had several bilingual

elements and deployed both email and direct mail postcards to nudge participants to establish two-factor authentication in their retirement accounts, then access to the Principal app, and then increase their savings rates. The campaign leveraged humor about everyday items that you may go to exceptional lengths to protect (such as lunch in a shared office refrigerator), to motivate participants to secure their retirement savings accounts. Quad corporate also leveraged Human Resource Business Partners (HBRPs) across all locations, arming them with details of the campaign ahead of time to gain buy-in and enlist their teamwork in promoting the campaign.

The results for this multi-pronged approach were impressive and exceeded stated goals with two-factor authentication use increasing from 35 percent to 49 percent, 20 percent of targeted employees used the Principal® app (up from 2 percent), and the average savings rate for Hispanic participants increased from 7.46 to 9.40 percent.

The judges liked that the campaign was simple and effective with great results, along with the use of humor and engaging the HBRPs to help with buy in.

Humana with Financial Finesse

Humana is a Louisville, Kentucky based health insurance company with 65,000 employees across 1,115 locations. Humana has been offering a financial wellness program for a few years and did a needs analysis to evaluate their program and make changes if necessary. Through one-on-one interviews, they discovered a need for more tailored materials to specific groups of employees. They leveraged their Network Resource Groups (NRGs) as distribution channels and created culturally relevant content that addressed specific financial challenges. The NRGs are cultural connection hubs, open to all associates, to promote inclusivity and belonging. These include groups for veterans, Native American and Indigenous people, Asian and Pacific Islander employees, LGBTQ+ employees, employees with a disability, African American/Black employees, female employees, a mutigenerational group, and a group for caregivers.

The goals of their program were to provide culturally relevant financial resources and coaching tailored to the diverse needs of employees, tackle financial stressors and disparities specific to various employee groups, and break down barriers to financial wellness, creating equal opportunities for all employees.

They met with each NRG to assess their financial wellbeing knowledge, understand its relevance to their NRG, and explain goals and expectations. Based on these conversations, they either used pre-existing content or created new material. In some groups, focusing on personal stories around financial wellbeing proved more effective than discussing financial concepts alone. They tailored the marketing and registration approaches for each group, then held the events (webinars), analyzed the outcomes, and used those insights to guide the next steps in supporting both the NRGs and the wider Humana community. They are currently holding interactive panels across groups that spark dialogue and foster inclusivity within the organization. By continuously adapting based on employee feedback, they built a financial wellness initiative that was responsive to their diverse workforce and impactful in creating change.

Twelve webcast sessions were held across the different NRGs, with more than 1,200 total attendees and 700 unique attendees. Of the 700 unique attendees, 65 percent reengaged in some way with financial wellness services. The judges liked that the campaign targeted a wide range of cultural groups and that it was creative and inclusive.

Financial wellness programs work to address employees’ total financial circumstances, rather than focusing solely on retirement. These programs can help employees with cash management, debt reduction strategies, saving for college, home buying and other financial life events that people face throughout their careers. Campaigns can include those that cover a single financial need, or multiple needs.

The University of Texas at Dallas with Lincoln Financial Group Financial Wellness

The University of Texas at Dallas (UT Dallas) is a public university with more than 31,000 students across seven schools and has 7,800 employees. Employees of UT Dallas can choose from multiple service providers under the University of Texas System Retirement Program and determine which one will best suit their needs.

UT Dallas conducted an employee climate survey in 2022 and received feedback that employees would like HR to host seminars, training, and provide tools for them to learn more about benefits, specifically retirement and savings. UT Dallas implemented a program to provide these resources during their annual benefits enrollment in July 2023 and 2024 with the goals of educating employees on financial wellness topics, increasing participation in the retirement plan, and increasing participation in the overall wellness program and other benefit offerings.

One of their biggest challenges was delivering the campaign to a hybrid and diverse workforce consisting of staff (executive and administrative support), support personnel (facilities and police), faculty, graduate student employees (research and teaching Assistants), and other student and hourly employees.

UT Dallas developed a multi-channel approach which included a benefits flash initiative that highlighted key benefits each month during their HR Forum, posted that topic on a landing page, pushed it out on an HR Campus Connection Teams Channel, and included it in the monthly employee newsletter. They also enhanced the HR-Benefits Website and Employee Wellness section focus on financial education/promotion. They provided a Total Rewards Statement that helps employees understand the value of their benefits in addition to their salary.

Onsite and virtual financial wellness events were held, campus “Wellness Days” included financial wellness, and financial wellness events were hosted by vendors. There was an annual benefits fair that included an automatic enrollment communication strategy and the benefits resource center housed online vendor booths throughout the year.

These multichannel, ongoing approaches achieved great results with increased participation, increased deferral rates, and more Roth contributions. The benefits flash website had nearly 5,000 page views in 2024, up from 2,000 the year before. There was also an increase in employees visiting the benefits resource center, the retirement section of the website, the HR forum and financial wellness websites, as well as an increase in enrollment in other non-retirement benefits across the board. Eighty-five percent of attendees to the benefits fair rated the fair as excellent and employees loved the theme of “Peace, Love, and Benefits” as well as the content.

Judges were impressed with the breath of the program, meeting employees where they are on so many different levels, and liked that they got feedback from staff letting them know specifically what they wanted and then targeting the campaign around that.

CNO Financial Group with Financial Finesse

CNO Financial Group provides life and health insurance, annuities, financial services, and workforce benefits through multiple brands, including Bankers Life, Colonial Penn, Optavise, and Washington National, and has 3,400 employees across six locations.

In January 2024, CNO transitioned financial wellness providers and while employees were accustomed to having financial coaching available, the existing services were under-utilized. Along with changing vendors, they transitioned to a new, comprehensive well-being and rewards platform. Their goal with this program was to successfully communicate all of the changes and increase employees’ engagement with financial wellness tools and programs.

To announce the change in vendors and to engage associates, they created a multi-channel marketing campaign communicating that the financial wellness program had been expanded to offer much more than before. Their new program included a Digital Financial Wellness Hub (accessible via single sign-on) with Virtual Financial Coach Aimee, a live coaching helpline and chat feature with unbiased Certified Financial Planner™ professionals, and monthly subscription webcasts on various financial topics.

CNO leveraged Business Resource Groups (BRG) and Health Champions to help spread the word about the program by holding sessions for them prior to campaign launch. They then launched the campaign with an email series, designed to introduce associates to Financial Finesse and drive immediate action. The first email provided a concise, visually engaging overview of the program, complete with direct links to key resources. CNO incorporated Financial Finesse branding on the company intranet and highvisibility banners on their “myBenefits+” homepage. They then provided a $100 incentive for completing the Financial Wellness

Score assessment and up to $500 to an employee’s HSA for ongoing engagement with financial coaching sessions. For those that did not engage in the first round, they launched a reengagement campaign with targeted emails. The email series included subject lines “Discover the secret weapon of every financially well person,” “How to transform your financial future in 5 mins,” “The average American has a score of 5.2.,” and “Action: Complete Your Financial Finesse Assessment - Don’t Miss Out On a Free $100.”

The campaign also included weekly “Quick Tips” emails, providing actionable, easy-to-digest financial guidance: “Boost Your Savings: Small Changes, Big Results,” “Smart Ways to Show Financial Love This Valentine’s Day,” and “Maximizing Your Tax Refund: Strategies for 2025.

In addition to the email campaigns, CNO held an in-person benefits fair where associates interacted directly with financial coaches, received printed resource guides, and gained a firsthand look at their new financial wellness tools. CNO also integrated Financial Finesse’s monthly webcasts into their corporate calendar and actively promoted key sessions to employees.

CNO’s program received a great engagement rate – 57 percent of its workforce engaged during the initial launch period. In 2024 there were 6,318 engagements with the Digital Financial Wellness Hub with 1,992 unique users, and 712 attendees joined monthly webcasts. Employees also reported a thirty percent improvement in financial stress levels.

Empower

Empower is a financial services company with more than 10,000 employees in three locations. Though Empower is in the financial industry, they still find it a challenge to remind employees that they can benefit and improve their retirement outcomes by engaging with ongoing financial education. The goals of Empower’s campaign were to improve employees’ overall financial wellness by encouraging them to save to the maximum match rate, aggregate their accounts, attend employee education sessions, and review the Comprehensive Services Brochure (CSB).

To accomplish these goals, they distributed a “Save More” email to all associates in March 2024 prior to the annual NCAA Basketball tournament. This March Madness theme made saving fun and competitive with the tag line “Shoot your shot and start saving today.”

Empower followed that up with custom virtual education sessions in April 2024 that were also recorded as brainsharks for future reference. These virtual sessions covered how to access personalized, high-quality advice at no additional cost. The sessions provided a special focus on My Total RetirementTM(MTR), online advice, and various comprehensive benefits of the plan. Empower Business Resource Groups assisted in promoting the sessions. Registration links were posted on the associate intranet as well as included in Human Resource emails promoting April as Financial Literacy Month.

In April 2024, they provided associates with the digital CSB. This CSB shows that the 401(k) plan is more than just a retirement account—it’s a comprehensive wellness tool. The brochure highlights how digital tools like the Empower Personal Dashboard for account aggregation and personalized support can make financial wellness more achievable. The CSB was promoted on the associate intranet as well in separate emails from HR.

In May 2024, Empower distributed the “Meet the Match” email to employees deferring below six percent of pay. The Triple Crown theme brought energy and excitement into what can sometimes feel like a dry topic. By associating retirement savings with the thrill of a race, employees were more likely to feel motivated.

The campaign saw an overall engagement rate of 35 percent with eight percent of associates increasing their contributions, and four percent meeting the match. The judges liked the I liked the tie-in to March Madness, and Triple Crown meeting employees where they are.

Provider Innovation

This category highlights service providers that bring pioneering ideas, services, or solutions to the retirement planning industry. This award typically acknowledges innovation in technology, investment strategies, or administrative services within retirement plans that is effectively communicated to educate plan sponsors and/or participates to increase outcomes. Examples include complete education campaigns with a unique or innovative approach or targeted campaigns addressing a specific problem with a unique solution.

Nestlé USA, Inc. with Voya Financial

Nestlé is a food products and retail company with multiple brands in the pet care, coffee, premium bottled water, consumer health, and infant nutrition industries. In the U.S. Nestlé has more than 30,000 employees across 28 states and 128 locations and a very diverse workforce with all ages, multiple nationalities, varying educational backgrounds, union and non-union workers, hourly and salaried employees, as well as office and manufacturing workers.

Nestlé conducted an employee survey and learned that many employees were unaware of the employer contribution that is made to all employees’ retirement accounts whether they actively participate or not. Nestle wanted to highlight this generous benefit

and encourage employees to also voluntarily contribute to the plan and receive additional employer matching contributions. A second call to action was to update beneficiary forms. One of the primary challenges of this campaign was capturing the attention of employees who had never accessed their retirement accounts or participated in the retirement plan.

Nestlé’s employer contribution announcement campaign included an email to more than 18,000 employees once the contribution was made to their accounts, prompting them to log into and view their updated balances. Following the email notification, Nestlé sent a custom mailer specifically tailored to each employee using a clear plastic envelop to capture attention. This mailer provided detailed information on how their contribution was calculated based on their employment details and included a QR code that took them to their accounts.

The email announcement achieved an open rate of 45.9 percent, with six percent of recipients logging into their accounts directly from the email. Five percent of recipients scanned the QR in the mailer. The campaign resulted in a twelve percent increase in account access over the same time period the year before and a 34 percent increase in mobile app usage. Additionally, close to 1,000 employees who were not actively participating in the plan prior to the mailer began making salary deferrals. The judges liked the use of the personalized QR code and clear envelope to gain attention and make it easy to take action.

Medical College of Wisconsin with Transamerica

See the first place Promoting Participation write up for details on this campaign that won multiple awards this year.

Darden Restaurants, Inc. with Principal Financial

Darden operates 2,100 restaurants including several well-known brands across North America including Olive Garden, LongHorn Steakhouse, Yard House, Ruth’s Chris Steak House, Cheddar’s Scratch Kitchen, The Capital Grille, Seasons 52, Eddie V’s, and Bahama Breeze. Together, their more than 190,000 team members serve more than 420 million guests annually.

In 2024, Darden created a program to target their more than 10,000 salaried employees to encourage them to take full advantage of the company match, and to increase overall deferral rates. Their biggest challenge in implementing a program was that 93 percent of the targeted employees worked in one of the 2,100 restaurant locations across the U.S. These team members included restaurant managers in training, general managers, restaurant managing partners, and directors of operations. Because of the nature of the restaurant industry, it is difficult to keep team members engaged with all of the benefits available to them. To address this challenge, they developed a multi-channel approach in an effort to capture the attention of team members in different locations and roles.

The campaign included a poster detailing the matching contributions that was sent to all 2,100 Darden restaurants and branded to the specific restaurant. Posters were available in English and Spanish, with QR codes linking to the Principal® app and Principal® Real Start onboarding experience for easy, quick enrollment and account access and placed in high traffic areas. They then developed a custom presentation: “Your financial future: Best practices for success,” which a Principal retirement specialist delivered at Darden corporate headquarters that was both live and recorded. The presentation covered best practices for financial success, with specific segments for women, LGBTQ employees, Hispanics, and people of color. The main call to action of this presentation was to have participants visit the Retirement Wellness Planner within their account at Principal.com.

The final approach was the use of two short videos produced by Principal that explained key savings concepts, including deferral rates and the company match, and about the importance of having a beneficiary for your retirement savings. These videos were promoted on the benefits portal via a web tile.

Through this multi-channel approach, Darden saw great success in increasing engagement with the plan overall and helping this group with long term financial knowledge and success. The number of employees with an account value increased by seven percent, from 9,076 to 9,719. This was considered extremely successful considering the difficulty in engaging restaurant industry team members, especially without the use of automatic enrollment. Additionally, the average deferral amount increased from 5.8 percent to 6.5 percent and the percentage of participants contributing 10 percent or more rose from 16.3 percent (1,038) to 17.4 percent (1,184). The percentage of employees maximizing the match increased, as did those with a positive Retirement Wellness Score of 70+. The savings videos saw a monthly average of nearly 1,000 views.

The judges liked the amount of personalization the communications had about an individual’s current account status as well as targeted messaging to local GMs to enhance the message to employees.

Innovation in Promoting Participation

The Innovation in Promoting Retirement Plan Participation award celebrates creative and effective strategies implemented by plan sponsors or financial service providers to encourage and increase participation in retirement plans. Recipients of this award often showcase innovative methods, educational initiatives, or engagement programs that successfully boost the number of employees enrolling in and contributing to retirement plans.

Medical College of Wisconsin with Transamerica

The Medical College of Wisconsin (MCW) healthcare system is Wisconsin’s eighth-largest private employer and third-largest private medical school in the nation and has more than 7,000 employees across multiple locations. MCW allows participants to save to the maximum allowed by the IRS ($70,000 in 2025).

MCW requires faculty and staff aged 21 or older to make mandatory employee contributions of six percent of pay to the 403(b) plan after two years of service. MCW adds a mandatory employer contribution of eight percent, pushing the total contribution to 14 percent of a participant’s salary which falls within the generally accepted 10 to 15 percent annual contribution rate recommended by many financial professionals. Beyond the 14 percent mandatory contributions, participants may also make voluntary contributions. Faculty and staff are immediately eligible to make voluntary contributions when they join MCW.

The MCW employee population is diverse, ranging from highly educated doctors, nurses and researchers to administrative and support staff. Many employees work long, irregular hours making engaging with traditional financial and retirement education programs a challenge. MCW created a financial wellness campaign they called “Healthy Retirement – It’s in the Bag!”, using an everyday medical bag and its contents as symbols for financial and retirement planning. The campaign consisted of several emails, text messages, a flyer, LCD screens, a newsletter article, and a web banner, ensuring broad visibility. Using the medical bag as a metaphor for retirement planning was a great way to tie into the organization’s culture and delivering it as one simple quick action item at time worked well to motivate and engage employes that don’t have a lot of time.

The campaign tied the idea of account security to Personal Protection Equipment (PPE) such as gloves and masks, tied a stethoscope and the sound of beating hearts to beneficiary designations, shears to voluntary contributions (small intentional actions can “cut down” the time it takes to retire comfortably), and

DESIGNATE BENEFICIARY

NEED HELP?

Plan, hover over the My Plan tab on the Account Overview page, and select Beneficiaries from the dropdown menu.

It’s in the bag! Schedule an appointment with a Transamerica retirement planning consultant (RPC) to get help setting up your online account or to discuss any �nancial goals you’re working toward There’s no additional cost for this service

SCHEDULE APPOINTMENT

retirement planning as the “treatment” for pain points. These efforts allowed employees to relate financial concepts to everyday items in their work lives. Account logins, beneficiary updates, and financial consultations increased significantly following the campaign. A third of employees opened emails, with an eight percent action rate. There was also a 56 percent increase in total site visits with a 35 percent increase in new visitors to the site. Twenty percent of participants who visited the website created an online account, and 26 percent designated a beneficiary. Additionally, nearly half of the target audience increased their voluntary contributions (42 percent).

DOWNLOAD THE TRANSAMERICA RETIREMENT APP

Periodically check the pulse of your retirement account You can make contribution changes investment changes and manage your bene�ciaries anytime, anywhere Available in the App Store and Android Marketplace

The MCW Healthy Retirement – It’s in the Bag! campaign was an innovative, out-of-the-box approach that made financial planning relatable, intuitive, fun, and engaging. By leveraging the everyday tools of healthcare professionals, the campaign drove real behavior change. The judges liked the theme of the campaign and the creative use of imagery to make it relatable as well as the use of clear and easy actionable messaging with good results.

and

If

The

of

Bread Financial with T. Rowe Price

Bread Financial® is a tech-forward financial services company with 5,800 active plan participants and 5,500 terminated vested employes across 10 office locations and a large work from home population.

Historically, Bread Financial’s 401(k) Plan participation has hovered around 70 percent of eligible U.S. associates—and while they felt it was a reasonable level of participation, they recognized that nearly a third of their employees were not saving for retirement, and half of employees noted financial stress.

To address these concerns, Bread Financial overhauled their retirement plan by increasing employer contributions, including the addition of a three percent nonelective contribution, eliminating the six-month service requirement, moving the plan underneath their exiting internal well-being program, and replaced an existing advice provider that employees paid for with free access to financial advice and wellness offerings.

Though the plan design changes went into effect in 2023, the first free money deposit (equivalent to three percent of 2023 eligible annual pay) was deposited into accounts in March 2024. Bread Financial built a campaign around this timing with pre-deposit communications (email and home mailer) letting employees know it was coming, a post-deposit announcement encouraging employees to log in and see their balances, as well as to increase contributions to the match level and designate beneficiaries, then a third set of communications providing information on financial wellness and advice resources.

A challenge with this campaign was that the addition of the three percent contribution to all employees meant that the 30 percent of the workforce that was not previously participating now had to access and set up their accounts and needed basic retirement plan education.

The free money communications were championed by the Chief Financial Officer and the Chief People & Culture Officer and teasers were placed on homepage banners on the company intranet. One month after the deposit, associates received a home mailer that linked via QR code to a digital resource guide filled with various educational tools. Eight 30-minute live webinar options were offered throughout April to educate associates on basic 401(k) plan info and setting up their account.

The campaign was effective with 1,000 new accounts created – the participation rate rose from 74.5 percent to 80.7 percent by year-end. The average deferral rate also increased – moving

from 9.7 percent to 10.4 percent. Retirement confidence also increased while financial stress decreased. The judges liked the puns tied to the company name and the clear call to action that got great results.

Sent by client

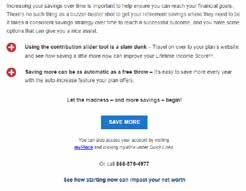

Lumen Technologies Inc. with Principal Financial Group Financial Fitness Week email

Subject: It’s Financial Fitness Week at Lumen

Lumen Technologies, Inc. is a global technology firm with 28,000 employees in the US across 1,235 locations. Lumen created a campaign in 2024 to target the 1,500 eligible employees not currenting participating in the plan. They also aimed to drive awareness of the 401(k) resources available to employees through Principal and motivate them to actively engage in retirement planning and improve their financial well-being. The average age of the targeted group was 48 years old with an average length of service of 15 years and there was concern that if they haven’t ever saved for retirement, they would not start without targeted help.

In connection with National 401(k) Day on September 6th, and Lumen’s Financial Fitness Week the following week, Principal deployed a series of three emails (a total of six versions for Union and Non-Union employees). They customized the emails to include first name personalization in the subject line and email body, animated GIFs, and variable employer match content for NonUnion employees (included specific match details), and for Union employees. The emails included these calls to action:

• Start saving in the 401(k) plan

• Watch the Well-Connected program video

• Schedule a 1-on-1 meeting with a Principal retirement professional

• Use the Impact on Paycheck Calculator tool on principal.com

The emails included a link to the customized video that encouraged employees to use the Retirement Wellness Planner on principal.com and to name their 401(k) plan beneficiary. Lumen incentivized their employees to complete these activities with $25 in Rally Rewards. To kick off financial fitness week, Principal hosted a live webinar titled, “Invest in Yourself: Building Wealth with the Lumen 401(k) Plan.” The webinar, which promoted participating in the plan, was also recorded and made available for those who couldn’t attend.

To re-enforce the campaign messaging internally, Lumen deployed two emails to the targeted audience, following the series of emails from Principal – one about financial fitness week and one to encourage employee to start saving. Lumen also sent four text messages to the targeted audience to encourage them to start saving (two texts), sign up for one-on-one meetings with a principal rep, and to attend the webinar.

Two hundred of the targeted employees began saving in the plan – 14 percent – with an average savings rate of 7.2 percent. The overall plan participation rate increased by one percent.

by John Sullivan

RIGHT FOR RETIREMENT PLANS?

Rumored regulatory and political support to allow greater private market investment access—including retirement plans—thrust the issue back into the spotlight. What’s new, positive, and/or problematic?

Rapid and recent developments in the retirement plan space surprised many in an industry known for moving at a slow (some would say glacial) pace.

A renewed push for private market investments (equity, debt, credit, etc.) in retirement plans is underway after years of debate about the role they would or could play in retirement savings. It’s driven partly by President Trump’s reported consideration of an executive order to expand investor access to these asset classes, among others.

Once part of a larger argument about the appropriateness of offering alternative investments in retirement plans overall, the administration’s rumored actions turned a spotlight on the private investment subset. If you’ve heard the term more frequently recently, you’re not alone.

“Alternative is such a vague catch-all that I think it could mean anything,” Jason Kephart, Director of Multi-Asset Ratings for Global Manager Research at Morningstar, said. “In the 1990s, people considered publicly traded REITs an alternative investment. Emerging markets used to be alternative. I think it’s one of these things where what ‘alternative’ means constantly changes. I think ‘private markets’ helps better define what we’re talking about. It’s probably better to be more specific than less, particularly when discussing people’s retirement accounts.”

OneDigital Chief Investment Officer Michael Esselman agreed, adding that the vernacular has changed.