National Centre of Excellence in Research in Financial Technologies

ICT solutions that are secure, compliant and trustworthy are a core component of the financial, asset management and insurance sectors. They’re also within the fabric of the work we do. Our research within the FinTech domain surrounds cybersecurity, blockchain, artificial intelligence, machine learning, law, finance alongside many other areas, as we help to develop the financial services and products of tomorrow.

3

We are your FinTech experts

Financial services is the key sector within the Luxembourg economy, and has been progressively undergoing a digital transformation. Over the last few years, FinTech has revolutionised the industry, forcing an interlacing of traditional business approaches with innovative, cutting-edge technologies. With its vibrant ecosystem of financial institutions, research and development centres and companies specialising in advanced technologies have propelled Luxembourg’s reputation as an emerging FinTech hub.

SnT and FDEF from the University of Luxembourg play an active role in supporting the FinTech sector through research, technology transfer and education. Throughout the years, we have worked closely with banks, insurance companies, FinTechs and the financial regulator to bring innovative solutions to financial services. Luxembourg

Where innovation meets finance

• Rich and supportive business environment, the perfect gateway to the EU for international FinTechs.

• Tech friendly regulatory environment helps FinTech projects to flourish.

• Home to many FinTech activities: DLT T echnologies, InsurTech, RegTech, mobile payments, security and more.

• The largest investment fund centre in Europe and the second largest in the world after the US.

National Centre of Excellence in Research in Financial Technologies

The digital transformation is poised to have a substantial impact on Luxembourg’s most important industry – finance. For the financial industry to keep pace as new technologies change, not only consumer expectations but also regulatory demands, the sector needs more structured scientific support.

Vision

Strengthen Luxembourg’s position as an innovative financial hub by attracting talent and providing world-class research and education.

The National Centre of Excellence in Research in Financial Technologies (NCER-FT ) is an interdisciplinary centre that looks deeply into the financial industry’s technological challenges and opportunities. It provides much-needed thought leadership, scientific insights, and practical training. Led by researchers from the University of Luxembourg’s Interdisciplinary Centre for Security, Reliability and Trust (SnT), the Department of Law (DoL), and the Department of Finance (DoF), the NCER-FT implements a uniquely interdisciplinary research approach, combining expertise from technology, finance, and law. This interdisciplinary research

approach is not only essential for developing practical, sustainable solutions to the challenges of digitalisation in finance, but is also unique in the world.

The NCER-FT fosters a culture of cross-pollination between top researchers and Luxembourg’s financial services industry. Research conducted at the centre follows SnT’s rich tradition of collaborative research, wherein industry partners and university researchers work together on bi- or multi-lateral research projects.

5

4

In the framework of the FNR ’s INITIATE funding instrument, we conducted a feasibility study for the NCER-FT . During this study, we identified key research topics that are relevant for addressing industry needs, and will benefit most from our consortium’s relevant areas of expertise. These topics are:

Potential research projects

New frontiers for digital and automated finance

RegTech and compliance by design

While many aspects of the NCER are already in place within the consortium members, one element that should be strongly fostered through the NCER is transdisciplinary work between SnT and FDEF Therefore, we defined a portfolio of initial projects with the following objectives:

Financial inclusion Trust and security

• As a priority, initiate interdisciplinary work between scientists at SnT, DoF and DoL

• Launch research activities that are necessary but will not attract partner co-funding

• Quickly start activities targeting the acquisition of partners

• Increase the national and international visibility of the NCER

• Develop research infrastructures (datalake, demos, etc.)

The pages 8 – 21 detail potential research projects planned to launch quickly in the ramp-up phase. The pages 24 – 28 will detail five demos of past projects with partners.

7

RUMOFA: Runtime Monitoring of Fund Activities

FinSAT: Automated Investment Advice using AI on Satellite Data

Prof.

Contact: hayder.al-hraishawi@uni.lu

Project Description

- Monitoring fund activities with respect to financial regulations and fund documents (e g , prospectuses) is essential to protect fund investors and ensure well-functioning asset management markets

- This project aims at developing an automated, scalable, and accurate approach for monitoring fund activities by introducing established software engineering techniques in the financial and legal domain

Motivation

Financial service providers will improve their businesses by developing novel investment strategies using satellite data.

Feature engineering and multi-feature analysis will empower AI algorithms to make automated investment advice

Various learning algorithms will ensure that the AI system adapts to new data and improves investment decisions over time.

Objective

Objectives

Automated Metadata Extraction

AI-based extraction of metadata and structured requirements from financial regulations and fund documents

Automated Monitoring and Verification

Automated monitoring and verification of financial transaction records against the requirements extracted from the above

Methods

Interpretation of financial regulations and fund documents related to the financial transaction records to be analyzed

Leveraging Natural Language Processing (NLP) and Machine Learning (ML) for metadata and requirement extraction

Application of Runtime Verification (RV) techniques to the financial transaction records with the help of log parsing approaches

To develop AI-based financial solutions that incorporate data analytic outcomes to predict future market returns with interpretable decision logic that can support asset management strategies.

Data and Analysis

• Using the SnT Satellite Traffic Emulator and its temporal data models

• Collecting traditional data from socioeconomic databases

• Exploiting the Spire Data Lake including vessel and flight tracking.

AI-based Fin. Solutions

• Finding signals that create abnormal investment returns and building a realistic showcase.

• Extracting maritime transport information from satellite data to be translated into indicators in the finance domain.

Impact and Beneficiaries

• Solutions relevant to any local asset manager

• Open up new use cases for satellite data in investment strategies.

• Potential collaboration with the Satellite and FinTech companies in Luxembourg.

- Fostering the application of (semi-)automated compliance (and supervision) technologies in the field of asset management

- Next-generation real-time regulatory compliance and its economic and legal implications

- Regulators (e.g., CSSF)

- Public actors (e.g., IOSCO)

- Private institutions (e.g., banks)

• Employing of AI and Learning techniques to extract value from massive unstructured datasets to make predictions about their relative profitability.

9

Prof. Symeon Chatzinotas, Dr. Eva Lagunas, Dr. Hayder Al-Hraishawi, Dr. Wallace Martins (SnT-SigCom)

Michael Halling (Dept. of Finance)

Risk Management Drive Efficiency Uncover Opportunity

New frontiers for digital and automated finance 8

D. Bianculli (SnT), M. Halling (FDEF), S. Abualhaija (SnT), D Shin (SnT), N. Sannier (SnT) University of Luxembourg

Impact Potential Partners

A1. Financial Metadata Extraction A2. Representation of Fund-related Requirements A3. Monitoring and Verification of Financial Transactions Fund Documents Financial Regulations Financial Metadata Structured Requirements Financial Transaction Records Monitoring and Verification Results Fund NAV % Fund Document govern Financial Regulations Investors Share subscribe Financial Transaction Records Initial subscription? YES RUMOFA Apply sales charge percentage of 3% FDEF SnT SnT SnT FDEF New frontiers for digital and automated finance

IDOML: A platform for the Integration, Development and Operations of Machine Learning systems

D@A – Digital market for tokenized data

Zsófia Kräussl(DoF) Denitsa Stefanova (DoF), Radu State (SnT) University of Luxembourg

Hurdles in adopting Machine Learning

Restrictions in innovationbudgets

Lackof in-houseknowledge

Aversions to technology risks

andothers

The ultimate objective of this project is to lead the whole financial industry inits adoption of ML technologies

Project Objective

IDOML, a softwareplatformthat supports research and development activities at the intersection of ML andfinance.

Automates ML developmentprocess

Basedonestablishedtechnologies

Offthe shelf,opensource,flexible,extensible

Enables the explorationof ML research

Tailored tothe financialindustry

Output: Tooled Automations

Research that IDOML will enable

Why don’t you sell your own data?

Is there a business case?

Robust to new and unexpected conditions

Techniques to make Financials ML models: Compliant to regulation requirements

Open to traceability in their decision making

Monitored throughout their lifecycle

IDOML will serve as an off-the-shelf solution for in-utero data science labs that is affordable, practical, and supportive of the NCER research.

• Dataprotectionrulespushindividuals to comprehend implications ofsharing own data

• Turningdata into asset puts the implications of datatrade in thehandsofdataowners

What is your data worth?

Trusted data trade by market design

• Wrongincentivesboostopportunism

• Carefully designed pricing mechanism minimize risk and control trading behavior

Data as tokenized asset

• Raw, tangible, structural

• Blockchain Technology is our toolset to tokenize

• Privacy and security are digitally feasible concepts

• Market mechanisms are coded ex-ante

Trading data for propercredit risk assessment?

Trusteddata governancefor supplychainfinance? ©medium.com

Inter-disciplinary effort toward both financially & technologically feasible digital markets

Data as perceived signal

• Unstructured, sentiment-based

• Meaningful for trading action

• Correlated information signals influence data perception

• Different perception might ead to different valuation

Data market

• Ex-ante mechanism design requires understanding the fundamentals of an asset

• Market design is captured by Finance research

• Market mechanism is captured by CIS research

11

dataA dataA signalA signalB ©j-mel - stock.adobe.com

New frontiers for digital and automated finance 10

Adriano Franci Thibault Simonetto, Dr. Renaud Rwemalika, Dr. Maxime Cordy SnT University of Luxembourg

Trust and security New frontiers for digital and automated finance

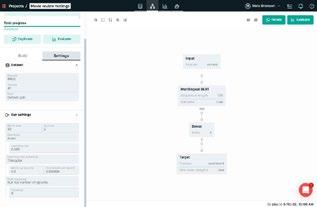

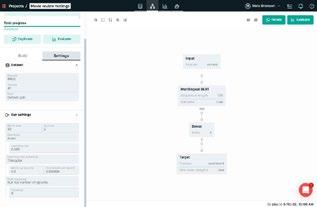

Enabling non-expert Data Fusion, Machine Learning and Analysis through no-code tools for the FinTech domain

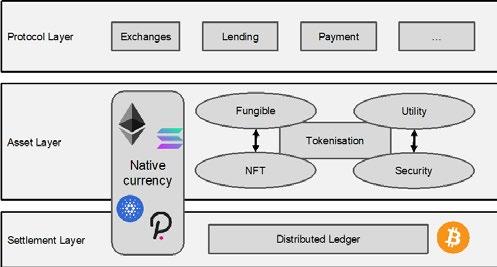

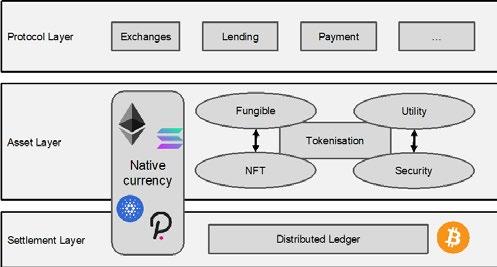

CryptoReg: Regulating Crypto-assets

Prof. Dr. Dirk Zetzsche, ADA Chair in Financial Law (financial inclusion), FDEF/DL Prof Dr Silvia Alegrezza, FDEF/DL Prof. Dr. Gilber Fridgen, PayPal Chair, SnT

Democratising Data analytics, Classification and Prediction

Current state-of-the-art in low/no-code machine learning

Description

Crypto-asset as technical innovation challenges for law and regulation

Law and regulation of crypto-assets preconditionfor pricing, custody institutionalinvestments, listing

EU law on crypto-assetsat infancy vagueness, uncertainty

Decentralized finance as technical frameworkfor legalanalysis

Issues

• ML-expertise still needed

• No data fusion support

• Domain knowledge not reflected

Project Objectives

• No-code tools to perform data fusion and model exploration

• Supporting anonymisation at the source

• Synthetic data generation based on data origin.

• Test the tool feasibility with Finance professionals.

• Validate output performance with ML experts.

Problem-specific data collection and modelling for financial decision-making.

Interdisciplinary cooperation

• Domain expertise from DoF

• Scientific ML expertise at SnT.

• Integrating FDEF students for experiments.

Research activities for NCER

• Embracing open source

• Integral for NCER Fintech data-lake

• Secure access to anonymised data.

Enabling Growth for Luxembourg

Partnership projects

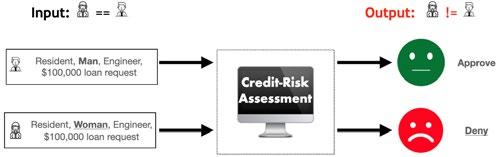

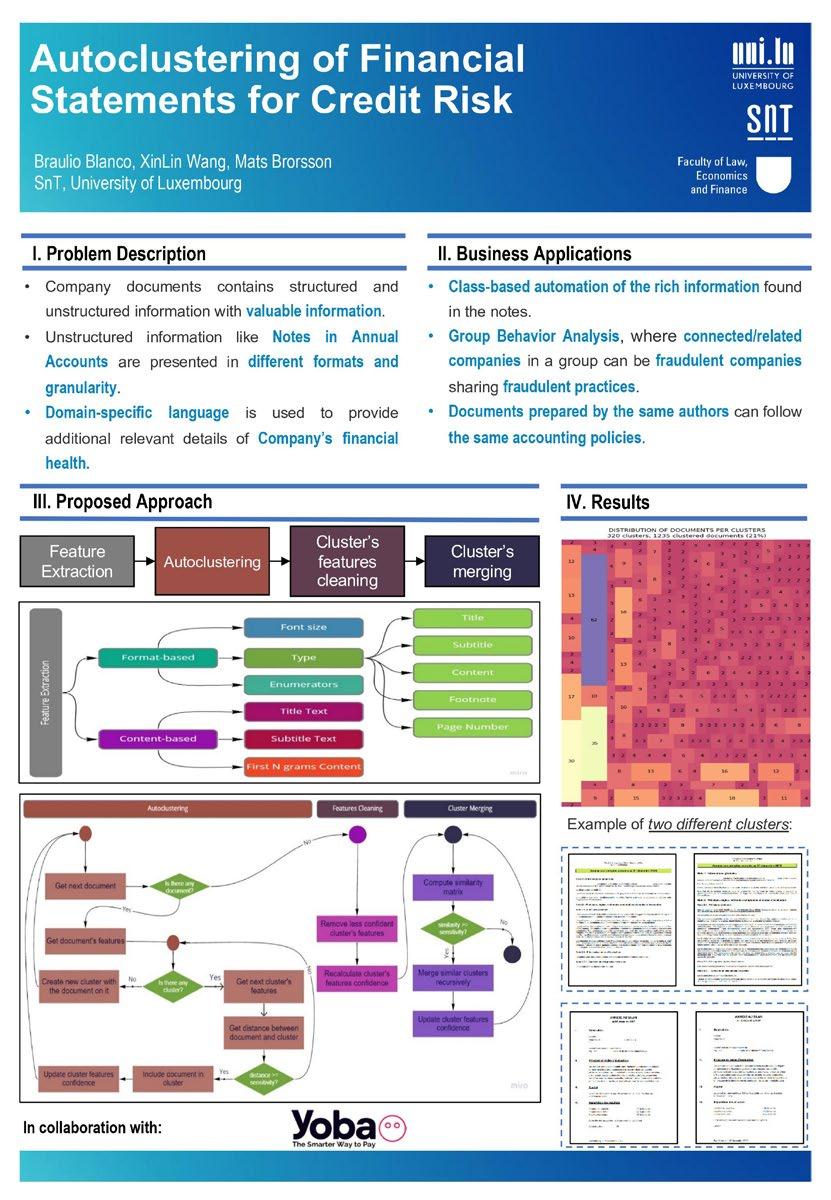

• SnT Partnership with Yoba SA.

• Use of LBR data.

• Use of alternative data (e.g. social media).

Ensuring Legal Certainty

Sound Technical Foundation

• Alternative crypto platforms

• Crypto- nnovation: NFTs, DeFi, DAOs

• Technicalapproachesto legal problems selective privacy through zero-knowledge-proofs

Balancing risks and opportunities

Financial law and Regulation

• Investment and custody by investmentfunddepositaries

• Listing, trading, lendingat stock exchanges

• Transfer amongindividuals

• Private law, insolvency

Proportionate Regulation

AML/CTF/ KYC

Openness to Innovation

• Anti-Money laundering

• Counter terrorist financing

• Know yourcustomers

• Reformed W ire Transfer Regulation

• Tracing crypto-asset flows

Partners: Luxembourg Parliament, CSSF, ALFI, ABBL, law firms, accountants, exchanges, service providers, entrepreneurs

13

Trust and security New frontiers for digital and automated finance 12

Mats Brorsson, SnT, Zsofia Kräussl, DoF University of Luxembourg

Trust and security New frontiers for digital and automated finance

FinTech for Renewable Energy Markets (FinER)

Prof. Gilbert Fridgen, SnT, University of Luxembourg

Prof. Nils Löhndorf, Depmt of Econ. & Mgmt, FDEF, University of Luxembourg

Description

Digitalization of energy systems and markets is a key enabler for reaching the EU's climate goals. Renewable power purchase agreements (PPAs) are an increasingly popular instrument to finance renewable energy projects. However, there are no financial instruments to hedge the captured price of renewable PPAs, which limits their use in financing investments in renewables. This project investigates the feasibility of “renewable power futures” as financial derivatives for renewable PPAs. A particular focus will be the feasibility of using smart contracts to encode PPA properties and ensure proof-of-origin.

The goal: Develop renewable power futuresas smart contractsand investigate theirapplication for hedging the pricerisk of renewable PPAs

Renewable Power Futures

• Encode renewable power futures as smart contracts with dynamic load profiles.

• Contrasts rigid contracts with static load profiles.

• Encode PPA characteristics n a standard manner, allowing for standard pricing formulae.

• Attach proof-of-generation to smart contract as immutable proof-of-origin.

• Non-fungible tokens (NFTs) and distributed ledgers as possibletechnologies.

RegCheck: Program analysis for regulatory compliance assessment of FinTech Software

J. Klein (SnT), S. Tosza (FDEF), T. Bissyandé (SnT), D. Bianculli (SnT), S. Abualhaija (SnT) University of Luxembourg

Project Description

RegCheck aims at developing a tool that facilitates compliance checking of software systems against data protection regulations (e g , GDPR)

Project Output

Outlook

• Early cooperation with Luxembourgish energy companies (Encevo, Enovos)

• Mid-term collaboration with tech startups (Nexxtlab, DataThings)

• Long-term goal: integrate FinER into ecosystem of investments in renewable energies (Green Exchange LGX, Alma Solar).

Expected Impact

• Contributing to "Compliance by Design"

Compliance checking of software systems against regulations

• Bringing together software concerns and regulatory compliance concerns (multi-disciplinary)

• Providing tool support to be integrated in the NCER date lake: compliance checking of apps and services developed as part of the infrastructure

Define user_view(){ Cookie cookies[]=request.getCookies(); String []selected_options = request.getParameterValues(“radio-consent”); if consent_notice is selected, then user_consent = TRUE AND show withdraw_consent_button; send_notification(user_name);}

Potential Partners

• The CSSF

• One or more Big Four companies (EY, Deloitte, KPMG, PwC)

• Software development companies

15

Privacy Regulation (e.g., GDPR) Software Artifacts (e.g., source code) Consent Viewpoint Case Laws

Compliance Checking Rules Objective . Extraction of privacy-related requirements from GDPR and translation of these requirements into rules Objective . Analysis of software artifacts from a regulatorycompliance viewpoint Lawyer Software Engineer If user gives consent: Allow user to withdraw consent

Artificial Intelligence Machine Learning Natural Language Processing Methods Code Search Code Tagging Methods Static Analysis Methods 1 2 3 New frontiers for digital and automated finance 14

Objective

Annual growth rate of PPAs in Europe since 2018 Proof-of-Generation as Smart Contract 17.45 GW* Amazon* Top purchaser of PPAs Installed renewable capacity via PPAs during covid-19 pandemic (2020-21) 42%* Renewable

Futures

Power

Proof of Concept

Market Prototype with Partner Company

Monte Carlo Simulation Model

Financial inclusion New frontiers

and

*Source: European PPA Market Outlook 2022, Pexapark

for digital

automated finance RegTech and compliance by design

ICCOFIDO: Incremental Compliance Checking of Financial Documents

AFRICA: Automated Financial Regulations Change Impact Analysis

L. Briand (SnT), D. Zetzsche (FDEF), S Abualhaija (SnT), M Bodellini (FDEF), D. Bianculli (SnT) University of Luxembourg

Project Description

Project Description

Financial regulations oblige funds to produce and amend various documents, which fall under regulatory supervision.

ICCOFIDO aims to accelerate compliance checking of financial documents by developing a tool for making the process incremental:

After a new document version is produced, ICCOFIDO will enable to perform the minimal set of compliance checks required by the changes

Project Objectives and Methods

Devising a tool-supported approach for:

O1. Automated identification of document metadata changes

Identifying which key data or information has changed in the document and needs to be reverified

O2. Impact analysis of metadata changes on compliance rules

Determining the subset of rules, the evaluation of which is affected by the changes in the document

O3. Incremental compliance verification

Checking only the meaningful set of compliance rules over the changes

Expected Impact

Nowadays, compliance checking of financial documents is a time-consuming, resource intensive and static activity

Instead of performing compliance checking over an entire document, ICCOFIDO would allow:

- Checking selected sets of rules on an incomplete draft document

- Checking only the revised portions of a document

Potential Partners

- Regulators who are responsible for validating the submitted documents

- Management companies during document authoring and in-house compliance checking activities prior to (re)submission

AFRICA aims at detecting the change in financial regulations and analyzing in a (semi-)automated manner the impact of this change on FinTech-related software, directly affecting the compliance of a financial institutions

Project Objectives

Objective 1. (Semi-)automated detection and analysis of financial regulations changes over time.

Objective 2. (Semi-)automated impact analysis of regulations changes on fintechrelated software artifacts, consequently recommendation of adaptation to remain compliant.

Impact

Developing a foundational framework for change impact analysis re financial regulation

Preparing a model for informing financial institutions on future regulatory change

Technically assessing the impact on regulation on an institution's core business

Potential Partners

Public sector (e.g., CSSF, ECB and EMSA)

Private sector, including traditional banks, investment banks, management companies, and FinTech companies

17

on the activities and supervision of institutions for occupational retirement provision Directive (EU)2016/2341 Financial regulations Identification of regulatory changes Software artifacts Change impact analysis Detection and classification of regulatory changes Taxonomy for regulatory change Automatically generated patterns Recommendations towards compliance Use case Directive 2011/61/EU Throughout these regulatory changes: Articles 4, 9, 15, 17, 32, 33 and 61 as well as annex IV have been amended, articles 30a, 32a, 43a and 69a have been introduced, and article 62 was repealed on markets in financial instruments Directive 2014/65/EU Directive 2013/14/EU on over-reliance on credit ratings with regard to cross-border distribution of collective investment undertakings and Directive (EU) 2019/2034 on the prudential supervision of investment firms. Directive (EU)2019/1160 laying down general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation Regulation (EU)2017/2402 was amended by 2013 2014 2016 2017 2019 FDEF SnT FDEF SnT RegTech and compliance by design 16 Document v1 Document V2 Compliance checking over the identified rules Identify the changes Compliance Rules Identify the subset of rules to reevaluate O1 O2 O3 Artificial Intelligence Software Engineering Law and Regulatory Compliance Compliance Report Incremental Compliance Checking Rules to Reevaluate Change Impact Analysis Compliance Rules Metadata Change Analysis Fund Document Metada Extraction Document Metadata Modified Metadata

Prof. Domenico Bianculli (SnT), Prof. Stanislaw Tosza (FDEF), Dr. Nicolas Sannier (SnT) University of Luxembourg

RegTech and compliance by design

AFS: Auto Fund Set-up

Prof. Dr. Dirk Zetzsche, ADA Chair in Financial Law (inclusive finance), FDEF/DL

Prof. Dr. Yves Le Traon, SnT

Vision: a fully automated fund –set-up Establishment

15,000 undertakings for collective investments holding EUR 6 trillion in assets, providinga third of Luxembourg’S GDP, wait for automatisation

The undregistration process as well as the adjustment of the fund’sconstituting documents to legislative changes is a major cost for Luxembourg’s investment funds.

AFS to provide cost-efficient automatedsolutions for the Luxembourg fundindustry.

Prototype as envisionedoutput.

Makinguse of the PotentialofRegulatoryTechnologies (RegTech)

Digitalization as CompetitiveAdvantage

To automatefundregistration,includinglegalcomplianceandchange-impactpropagation

Leveraging well-establishedtechnologiesforbusinessprocessautomation (BPM, rule-basedtechniques)

Addingthe keyadvancedtech ingredients (AI,NLP, Model-Driven Engineering) Being adaptive to frequentchanges in the legislation andlargeconfigurationspace(SoftwareProductLine)

Law and Regulation

• Law as a cost factor to he Luxembourg fundindustry

• Manyadjustmentsto law and regulation followsimple patterns (boilerplate)

• AFS to provideautomated solution for moststandard adjustmentsto law and regulation

Technology

Goal: Automatingthe process

How?

• Rule-basedapproaches and model-driventechniques

• SPL for controllingthe configuration space and consistencychecking

• Advanced AI-enabled solutions, includingNLP

•

Integrated System

• Law firms

• Regulators

• Management Companies

• Depositaries

• Accountants

• Advisors

• Frequentupdates

ROBOCOMP: Robotic Process Automation in Anti-Money Laundering (AML) Compliance

Stanislaw Tosza, DL, FDEF Djamila Aouada, CVI², SnT Raphael Frank, SEDAN / 360Lab, SnT

Compliance-by-design in AML

Overall objective: Develop machine learning tools for Anti-Money Laundering (AML). The innovation of the project relies in the interdisciplinary interaction between legal and technical experts to achieve an AML framework which is compliant by design.

Need for this research:

AML policy imposes compliance obligations on financial institutions:

• due diligence regarding the identity of the customer

• reporting obligations

OLD approach: “tick-the-box” job static, predictable CURRENT approach design your own risk management process

flexible, less predictable

BUT: heavier burden on financial institutions

REACTION: automatization of the due diligence process

PROS: cost limitation, increased effectiveness, elimination of monotonous work, employees can focus on high value tasks

CONS: Risk of sanctions; risk of over-enforcement; deprivation of business opportunities; bank as a judge

Analysing beneficial ownership

SEDAN / 360Lab SnT

Develop a methodology that:

• collects open access data from European business and beneficial owners registers,

• analyses complex relationships between them to identify anomalies and fraudulent constructs

136

Analysing transactions

CVI, SnT

Design an AI tool to:

• conduct ongoing monitoring of the business relationship including scrutiny of transactions

Analysing the legal challenges

DL, FDEF

Understand and examine:

• How is automation already used for AML compliance in Luxembourg?

• How can compliance by design respond to legal challenges in fulfilling AML obligations?

Addressing legal challenges through technology

Partners CSSF; ABBL, ALFI; management companies depositaries law firms; service providers.

19

Amount of money laundered globally in 1 year

Compliance-by-design

60 % Increase in compliance cost after the financial crisis Number of banks in Luxembourg 25% global GDP Legal Compliance Framework Data Analytics and Machine Learning Transaction Monitoring Relationship between Beneficial Owners EU Business registers Financial Transactions Interdisciplinary interaction between legal and technological aspects Trust and security RegTech and compliance by design 18

Insert picture

(one time)

Amendments to Legislation (frequent)

(Re-)Filing of Constituting Documents of the Fund

Trust and security RegTech and compliance by design

Legal Lake

A Legal Analysis of Data Lakes and how to govern them

Investment and Sustainability

Data

enables enables

Regulatory Framework AML/CTF Regulatory Compliance

Financial Regulation, Risk Management, Outsourcing, Liability (Prof Zetzsche)

Data Lake

Intellectual Property in Data and Data Processing (Prof Stierle)

Data Protection and Consumer Rights (Prof Poillot)

Administrative Supervision and Criminal Law Enforcement (Prof Allegrezza)

FinInclusion: Assessing Financial Inclusion in Digital Financial Services (DFS)

Prof. Yves Le Traon, Dr. Mike Papadakis, SerVal, SnT Prof. Dirk Andreas Zetzsche, ADA Chair in Financial Law (inclusive finance), FDEF/DL Prof. Michael Halling, Chair in Sustainable Finance, FDEF/DF

Financial Inclusion (FI) aimsat providing(digital) financial services to individuals and institutions at fairterms

FIadvocated by regulators and policy makers (World Bank,UnitedNations, European Central Bank (ECB), EU, G20).

Alliance for FinancialInclusion (AFI) (ie. network of Central Banks of developingcountries) to increase access/usage of qualityfinancial services forunderserved and most vulnerablepopulations

Project Objectives

• Formalizing FI properties into testable and measurable software (fairness) properties.

• Empirically identifying and evaluating the causes of FI violations.

• Developing techniques that assess and validate the FI properties of FinTech software.

1)Improving the quality of DFS.

2)Ensuring compliance with FI regulations.

Challenge: Assessing and Validating FI properties of DFS:

Solution: Develop Automated Digital Testing Methods

3)Supporting clients, institutions and regulators.

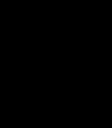

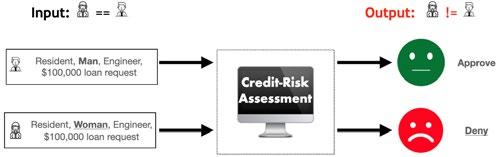

The focus ofFinInclusion is on developing digital tests for fairness properties of DFS for specific sub-segments ofcustomers (e.g., women,elderly, SMEs)

Example of Financial Exclusion:

Data Lake

Data Governance (Prof. Lenzini)

A formalization of FI as a testable and measurable software fairness properties.

Prototypical implementation of testing methods in detecting FI violations (e.g., financial exclusion) in DFS.

A methodology and empirical assessment of FI in digital financial services.

Partners: FIs (e.g. BGL, Spuerkeess), Regulators (e.g., AFI) and FinTech firms (e.g. PayPal).

21

Financial inclusion 20

Data “prosuming” Trust and security RegTech and compliance by design

Demos of past projects

23

A Chatbot in Banking Using LuxemBERT

A Chatbot in Banking

Goal:

• A new online Luxembourgish Chatbot to support BGL’s customers

• The chatbot is modular and support various components, listed below

LuxemBERT:

• A new Luxembourgish language model, developed by the TruX and BGL Teams

• Helps the chatbot to “understand” Luxembourgish (machines cannot attribute meaning to words)

• Represents words and sentences as lists of numbers meaningful for computers

• Leverages German databases (Luxembourgish is a low-resource language)

Why do chatbots matter in banking ?

• Enable customers to be more autonomous

• Improve customers overall experience

• Avoid repetitive work for BGL employees

Intent Detection

Intents are the possible actions our chatbot is able to complete:

• Check_balance

• Transfer_money

• Pay_off_credit_card

• Search_transactions

• Check_earnings

• Check_recipients

• Open_account

• Order_credit_card

• Change_card_limit

• Schedule_appointment

• Apply_for_loan

Banking Glossary

12 million sentences

To train LuxemBERT + It leverages German corpora

5/6 tasks 4 new datasets

LuxemBERT beats previous models for 5 over 6 tested tasks

Interactive

To help the community to further improve Lux. models

Designed to help BGL’s customers with the banking vocabulary:

• Overdraft

• Standing order

• Direct debit

• Can also inform about BGL’s products:

• Account ‘‘Essential’’

• Account for students

• Account for officials

•

In collaboration with:

Try to be user friendly

Show to the user

• The chatbot’s confidence in the language understanding

• If the chatbot is lost during the conversation

• If the chatbot is not properly used

Detect bullying tentative

25 24

C. Lothritz B. Lebichot, T. F. Bissyandé, J. Klein , SnT, University of Luxembourg

C. Lefebvre, A. Boystov A. Goujon, BGL BNP Paribas

The chatbot components and LuxemBERT

Robust Financial Machine Learning

Simonetto, S. Dyrmishi S. Ghamizi, M. Cordy, Y. Le Traon SnT, University of Luxembourg

A. Boytsov, C. Lefebvre, A. Goujon, BGL BNP Paribas

Financial machine learning systems

can be fooled!

Adversarial examples are inputs carefully designed to cause erroneous predictions in machine learning systems Our contribution is to generate realistic adversarial examples and use them to improve the models

Model-Based Specification and Analysis of Requirements in the Financial Domain

A. Veizaga, A. Rizzi, S. Shin, L. Briand, SnT, University of Luxembourg

T. Henin E. Pitskhelauri, S. Rohackova, Deutsche Börse Group, Clearstream Service

B. Cardinael ESCENT

Context

Good requirements must be:

ü Precise

ü Consistent

ü Complete Risks arise when requirements are:

x Vague

x Inconsistent

x Inadequate

Our Solution: Drona

Challenges

Requirements analysis is crucial for the success of an IT project in the financial domain

Production of high-quality requirements and models

Generation of a full deliverable in a single tool

Automated generation of acceptance criteria

Robustness of real-world ML systems

RQ1: How robust are financial ML systems to realistic adversarial examples?

97.5% of the transactions can be altered to trick the system

RQ2: How to make ML systems robust to adversarial examples?

We need dedicated methods to fool real-world systems

1. Modeling support

2. Requirements authoring support

4. Full deliverable generation

5. Gherkin test scenarios generation

21% more robust with no additional training cost Real machine learning systems are vulnerable to realistic adversarial

Effectiveness of our defenses

Ready for industrial applications

Applied on real-world systems at BGL BNP Paribas. We have demonstrated the benefits of our approach on the bank’s ML systems.

Cross domain, no tuning. Our approach can be applied to different domains and use cases without parameter tuning.

Also improve model generalization. Training a model using our generated examples also help it to correctly classify unforeseen patterns.

In collaboration with:

3. Requirements-to-model reconciliation support

Interdisciplinary Approach: Software Engineering, Linguistics, and Artificial Intelligence

1 Modelling Support

Full integration into the Enterprise Architect modeling platform including customized toolboxes, model patterns, and model templates

2 Requirements Authoring Support

RIMAY: A language for writing requirements Improve the quality of requirements

LEVERAGING Detect errors and assist in writing requirements in Rimay

3 Reconciliation Support

• Consistency checking between textual requirements and models

• Proposal of recommendations for model enrichment

4. Deliverable Generation

Capture of all deliverable sections in Enterprise Architect to generate a full deliverable

5 Gherkin Test Scenarios Generation

Automated generation of Acceptance Criteria in the Gherkin language based on the requirements (text and models)

Drona requirements authoring support, deliverables generation and automation of Acceptance Criteria will save significant time on your projects!

27

ACTOR When Transfer_System

a File, Transfer_System

the File to System. SYSTEM RESPONSE CONDITION STRUCTURE (Optional ü System quality ü Return on investment ü Customer satisfaction x Failed projects x Excessive maintenance costs x Loss of credibility and business

receives

forward

Text Test Scenarios (Gherkin) ML Impact on Luxembourg’s Financial Sector

Read only MS Word

26

T.

picture

Insert

Insert picture and/or graph

Noise / Additional transactions Accepted transaction

Refused transaction

0.0% 0.0% 9.9% 97.5% 0.0% 25.0% 50.0% 75.0% 100.0% PGD PGD + SAT C-PGD MoEvA2 Previous approaches Our approaches

examples

To know more Get the paper

Conclusions

The NCER-FT will have a strong, sustainable impact on not only research, but also the economy and society. By supporting the development of Luxembourg’s deep-rooted financial tradition with leading technologies, we will create a more inclusive future for everyone who relies on the markets we will influence – and make Luxembourg a global leader in financial technology innovation.

Our ambitious, collaborative approach to research in financial technologies fosters a dynamic culture of technological innovation in Luxembourg’s strongest industry. We strengthen Luxembourg’s position as an innovative financial hub by attracting talent and providing world-class research and education.

28

30 University of Luxembourg Interdisciplinary Centre for Security, Reliability and Trust 29, Avenue J.F. Kennedy L-1855 Luxembourg 4, rue Alphonse Weicker L-2721 Luxembourg