[Type here]

Housing Statement

Lewisham Shopping Centre and adjacent land, Lewisham, London

OCTOBER 2024

Q200858

Table

Table

Table

[Type here]

Housing Statement

Lewisham Shopping Centre and adjacent land, Lewisham, London

OCTOBER 2024

Q200858

Table

Table

Table

Improved Affordability for Everyone

Social Rent Housing

Up to 2,230 new homes, adding substantially to local housing supply and helping reduce housing costs in the area, which have been driven up by a shortage of supply.

Homes for households on the Council’s

Housing Waiting List, with rents starting at £188 per week and sizes ranging from one to three beds.

Housing Keyworkers

Intermediate homes to rent, affordable to keyworkers including emergency services employees providing local community services, and also those starting careers in fields such as nursing, teaching and care.

Delivering and Releasing Family Housing

Directly delivering new family homes as well as providing purpose-built student and single person housing to relieve pressure on conversion of existing family homes to HMOs and shared accommodation.

On-site, professional management of rental homes, improving standards for renters and investing in long-term maintenance of homes.

Market and affordable homes for those with a range of accessibility needs, including wheelchair users.

High quality homes located in the heart of the town centre, expected to be home to up to 4,355 residents. This will have a positive impact on the long-term vitality and viability of Lewisham town centre through increased footfall and activity.

Delivery of a mix of uses (retail, leisure, F&B and a music venue) will support the transformation of Lewisham into a high performing and vibrant hub. The gross annual spending by new residents and employees accommodated by the Development would total over £30 million

Introduction

1.1 Landsec Lewisham Limited (‘the Applicant’) has worked closely with the London Borough of Lewisham (‘the council’ or ‘LBL’) along with local stakeholders to optimise the proposals for housing within the Lewisham Shopping Centre development. Following this work, up to 1,719 homes are proposed, of which 20% of homes (measured by floorspace) are affordable homes meeting local needs. Additional specialist homes will also be provided for students and single people wanting an alternative to house shares / HMOs.

1.2 This Housing Statement sets out the approach to housing and affordable homes, including the provision of social rent and intermediate tenures in relation to the Hybrid Application. Also included are details of the types and tenures of market homes which, together with commercial space, create the value to enable delivery of the site. The applicant is committed to the delivery of affordable homes and ensuring that the substantial economic and housing delivery benefits of the development proposals for Lewisham are optimised.

1.3 The Applicant has a track record of unlocking some of the most technically complex town centre regeneration sites at the heart of communities across London and England. Its vision in Lewisham is to renew the town centre through a contemporary mixed-use development that is entirely compatible with the unique historical nature of the Site, taking inspiration from local businesses and community. The end goal is to reconnect the site with the local community and transform its future as an important and resilient town centre where people want to live, work and spend time for years to come.

1.4 In addition to delivering new homes the Lewisham Shopping Centre development will deliver new open space and a new leisure offer to support the town centre, including bringing back a new Model Market and creating a new cultural venue and community space. It will revitalise the retail environment, tying together the high street, market, station and open space with new convenient and attractive links.

1.5 Delivery of this mixed-use development will bring with it a wide range of public benefits as each phase comes forward and brings new residents, workers and visitors to the area. This is a significant opportunity for the London Borough of Lewisham, the Lewisham community, as well as London more widely.

1.6 The Hybrid Application proposes up to 2,230 homes across the scheme, comprising 366 in detail and 1,864 in outline. An illustrative masterplan has been designed for the Outline Components, complementary to the Detailed Components and in line with the Parameter Plans, Design Code and the Development Specification. A summary of the key considerations and benefits in relation to housing delivery is set out below:

▪ Housing Delivery: up to 1,719 homes (C3 Use) are proposed, equating to more than two years of supply as identified in the Local Plan Purpose built student (PBSA) and co-

living will compliment these, meaning the total is equivalent to 2,230 homes (adopting GLA ratios to convert PBSA / co-living to a conventional housing equivalent) The proposed development therefore has the opportunity to make a significant contribution towards meeting the Council’s housing targets over the remainder of the plan period.

▪ Affordable Housing: 20% affordable homes will be delivered. The site could therefore deliver a year’s worth of the Council’s annual affordable housing target, making a substantial contribution in meeting the local need for affordable housing. The affordable homes will include a mix of tenures:

▪ Social Rent homes will provide for households registered on Lewisham’s Housing Waiting List;

▪ Intermediate Rent homes, aligned to incomes of local key workers, will ease the pressure on those who cannot afford market rents but are unlikely to be allocated social rent, supporting recruitment and retention in local service providers. Options for affordable home ownership may also be offered where local demand and affordability exists;

▪ Affordability: the affordable homes, spanning a range of tenures, will be accessible to those on the council’s housing waiting list. This will include many key worker households who are vital to the growth and success of Lewisham and the wider city – thus supporting the economy and local public services by contributing to recruitment and retention of staff.

▪ Housing Types: the proposed scheme will seek flexibility to provide Build to Sell or Build to Rent (BtR), Purpose-built Student Accommodation (PBSA) and Co-living to meet a range of identified housing needs and will support the creation of a mixed, balanced and inclusive community. The proposals will deliver a number of benefits including:

▪ BtR: high quality, professionally managed homes offering both flexibility and security of tenure for residents, responding to a well-evidenced need for BtR in Lewisham and across London and helping to relieve pressure on the Private Rented Sector (PRS);

▪ PBSA: 661 purpose-built student bed spaces – provided in a well-suited location which will help to meet the backlog of need as student numbers continue to increase, releasing conventional housing back into the market for families. The PBSA homes will in turn enable the growth of local institutions such as Goldsmiths University and the University of Greenwich.

▪ Co-Living: 445 lower cost, high quality homes for the increasing number of single person households in the area that prefer a sociable living model.

▪ In combination, the above tenures will significantly boost local housing supply and, as evidenced by GLA data noted within this report, make local housing more affordable for all households.

▪ Economy: the Local Plan indicates that growing the relatively small borough economy is a priority and essential to the creation of a sustainable community. The borough’s aspirations will be centred around delivery of the reinstated shopping centre which will contribute to the growth and development of the local economy

▪ Unit Mix: the development proposes a mix of house sizes appropriate for the site location and nature of the proposals, ranging from single person homes to larger family

homes. The proposed mix is aligned to population projections and will make an important contribution to meeting currently unmet needs for a range of housing types.

1.7 Overall the proposals will meet a wide range of local and regional policy priorities as set out within this statement. The proposals will support the Government’s aim to kickstart economic growth and swiftly progress towards the delivery of substantial numbers of new homes. The housing and economic benefits of the Application, together with the fact that the Applicant is a long-term asset holder, with a proven track record in successful delivery of large-scale masterplans, mean that the housing proposals should be given substantial positive and material weight in the planning decision making process.

2.1 This Housing Statement has been prepared in support of the hybrid planning application submitted to the London Borough of Lewisham (‘the Council or ‘LBL’) on behalf of the Applicant for the proposed mixed-use development at Lewisham Shopping Centre and the adjacent land

2.2 The hybrid application seeks permission for up to, 2,230 homes of which 20% will be affordable homes. A viability review mechanism will be secured, offering the potential for an increased proportion of affordable homes as delivery of the scheme progresses.

2.3 This statement has been prepared to summarise the affordable housing proposals, demonstrating that the amount, type and mix of affordable housing is appropriate for the Application Site and the development proposals. The statement is structured as follows:

▪ Section 3: Application Overview

▪ Section 4: LBL Policy Context

▪ Section 5: LBL Local Housing Context

▪ Section 6: LBL Housing Proposals

▪ Section 7: Conclusions

2.4 This document should be read in conjunction with a number of other planning Application documents including but not limited to the Planning Statement (prepared by Quod), Design & Access Statement (prepared by SEW, Mae and Archio) and the Financial Viability Assessment (prepared by Quod).

3.1 This section of the statement provides an overview of the Application Site and the development proposals.

The Application Site

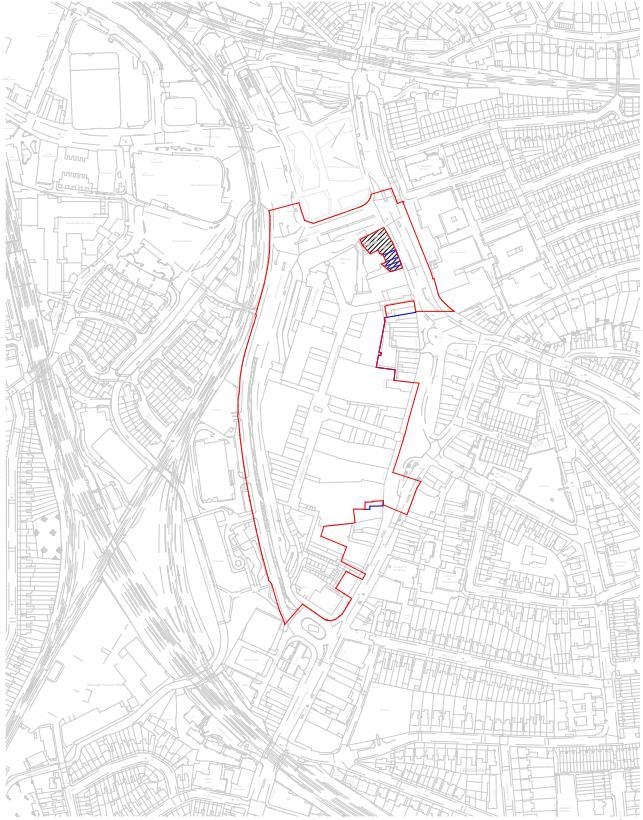

3.2 The Site is bound to the west and south by Molesworth St (A21), the east by Lewisham High St and the north by Rennell Street (A20). West of Molesworth St is the railway line and Ravensbourne River as well as a mix of green space, residential and commercial buildings. The London Underground DLR and Lewisham railway line are located, respectively, approximately 170m and 240m north of the Site. Northeast of the Site is a Police Station, east of Lewisham High St which is then followed by shops and commercial premises running south beyond the southern tip of the Site.

3.3 The Site currently comprises the Shopping Centre, which includes a range of retail units, a multi-storey car park, the 18-storey vacant former office building - Lewisham House, the vacant leisure box and Riverdale Hall, as well as commercial properties on the High Street.

3.4 The Shopping Centre was built in 1977.

3.5 The application site boundary is shown in Figure 3-1

Figure 3-1: Hybrid Planning Application Boundary

3.6 The Site benefits from the highest Public Transport Accessibility Level (PTAL) rating, i.e. 6b (excellent). The closest London DLR station is Lewisham, approximately 170m north of the Site, and the nearest National Rail station is Lewisham, located approximately 240m north of the Site

3.7 The Site does not lie within a conservation area, but there are a number of statutorily listed buildings within 500m of the Site - the grade II listed clock tower is located at the northern end of Lewisham High Street. Several locally listed buildings are located on the Site.

3.8 The Site is located within the Lewisham and Catford/Rushey Green Archaeological Priority Area (APA) designated by LBL for potential to contain remains of medieval settlement that grew up beside the Ravensbourne River, often used for powering mills.

3.9 A Hybrid Planning Application is being submitted for the Proposed Development, with Detailed Planning Permission sought for Phase 1a (Plots N1, N2 and surrounding spaces), as well as shopping centre interface and highway access works; and Outline Planning Permission sought for the remainder of the scheme.

3.10 The Outline part of the Planning Application is supported and informed by an Indicative Scheme, Parameter Plans, a Development Specification and Framework and a Design Code.

3.11 The Applicant seeks hybrid planning permission for the following development:

“Hybrid planning application for the comprehensive, phased redevelopment of land at Lewisham Shopping Centre and adjacent land, comprising:

Full planning application (within Phase 1a) comprising the demolition of existing buildings, structures and associated works to provide a mixed-use development including the erection of a Co-Living building (Sui Generis) up to 23 storeys in height (Plot N1), and a residential building (Class C3) up to 13 storeys in height (Plot N2), associated residential ancillary spaces as well as town centre uses (Class E (a, b, c, d, e, f, g (i, ii)); and Sui Generis) together with public open space, public realm, amenity space and landscaping, car and cycle parking, highway works and the formation of new pedestrian and vehicle accesses, existing shopping centre interface works (the ‘Phase 1a Finish Works’), service deck modifications, servicing arrangements, site preparation works, supporting infrastructure works and other associated works.

Outline planning application (all matters reserved) for a comprehensive, phased redevelopment, comprising demolition of existing buildings, structures and associated works to provide a mixed-use development including:

▪ The following uses:

▪ Living Uses, comprising residential (Class C3) and student accommodation (Sui Generis);

▪ Town Centre Uses (Class E (a, b, c, d, e, f, g (i, ii)) and Sui Generis);

▪ Community and Cultural uses (Class F1; F2; and Sui Generis);

▪ Public open space, public realm, amenity space and landscaping works;

▪ Car and cycle parking;

▪ Highway works;

▪ Formation of new pedestrian and vehicular accesses, permanent and temporary vehicular access ramps, service deck, servicing arrangements and means of access and circulation within the site;

▪ Site preparation works;

▪ Supporting infrastructure works;

▪ Associated interim works;

▪ Meanwhile and interim uses and

▪ Other associated works.”

3.12 The application seeks permission for 366 new homes within the detailed area and up to 2,230 homes in total across the detailed and outline area. Details of floorspace for the detailed and outline permissions (maximum parameters) are set out in Table 3.1 below.

Table 3-1: Detailed and Outline Area Floorspace

Use

4.1 This section of the statement sets out the national and local policy and guidance which has informed the proposed approach to housing delivery.

National Policy

National Planning Policy Framework (2023)

4.2 The National Planning Policy Framework (NPPF) 2023 sets out the Government’s planning policies for England and how these are expected to be applied. The NPPF contains national policy on a range of topic areas including decision-taking, viability, affordable housing, design, open space, heritage, and the economy. The “presumption in favour of sustainable development” is a central tenet of the NPPF.

4.3 Chapter 11 makes clear that planning policies and decisions should promote an effective use of land in meeting the need for homes and other uses, while safeguarding and improving the environment and ensuring safe and healthy living conditions, making as much use as possible of previously developed or brownfield land.

4.4 Chapter 6 (Building a Strong, Competitive Economy) emphasises the need to create conditions for economic growth and productivity; planning authorities should address potential barriers to growth and investment, such as inadequate infrastructure and housing, and poor environments. Similarly, Chapter 7 (Ensuring the Vitality of Town Centres) highlights the role town centres play at the heart of communities, recognising the importance of residential development in ensuring the vitality of urban centres.

4.5 Plans and decision-taking should ensure delivery of a wide choice of high-quality homes for a range of needs for today and in the future (paragraph 8(b)). An aim of the NPPF is to reduce reliance on scheme-specific viability evidence, however it is recognised that there will be circumstances where this is necessary, and that the decision maker should have regard to the circumstances in the case (paragraph 58).

4.6 The NPPF defines affordable housing as “housing for sale or rent, for those whose needs are not met by the market (including housing that provides a subsidised route to home ownership and/or is for essential local workers)” and complies with the relevant definitions:

▪ Affordable housing for rent: housing let by a registered provider (with the exception of BtR) at rents set in accordance with Government policy or is at least 20% below market rents and includes provision to remain affordable for future eligible households.

▪ Affordable routes to home ownership: housing for sale available to those who cannot achieve home ownership through the market, one such route being Shared Ownership.

4.7 The NPPF sets out an expectation that 10% of homes should be delivered for affordable home ownership, unless this would exceed the level of affordable housing required in the area or significantly reduce the identified housing needs of specific groups (paragraph 66).

NPPF Consultation

4.8 Revisions to the National Planning Policy Framework were recently consulted on between 30 July 2024 until 24 September 2024. The consultation sought views on the newly appointed Labour government’s proposed approach to revising the National Planning Policy Framework, aiming to deliver a substantial uplift in housing delivery and economic growth

4.9 The broad principles of the changes and amendments to the revised NPPF which, if adopted, will have implications for the proposed development are highlighted below.

4.10 Angela Rayner’s statement as Deputy Leader and Secretary of State for Housing, Communities and Local Government brings necessary urgency to housing delivery setting out a moral obligation to deliver economic growth by approving more housing and commercial development, now; and highlights the social and economic impacts1 arising from our national housing shortage. Fundamentally she makes it clear that the Government will intervene where there is persistent failure to deliver new homes.

4.11 The overall narrative is that there is a Government led presumption in favour of sustainable development which is supported by the technical changes proposed within the Framework. Cumulatively the Government seeks to provide a significant boost to housing delivery.

4.12 The Framework seeks to draw together housing need and delivery of that need, the overall aim to meet an area’s identified housing need2, rather than just publish it. It restates the requirement to demonstrate a 5 year housing supply3; and elevates the substantial weight applied to the value of using suitable brownfield land within settlements for homes because these proposals “should be regarded as acceptable in principle4” .

4.13 The Government proposes to delete the “get outs” introduced by the previous Government which advised that housing numbers are advisory starting points5; local authorities do not need to plan density uplifts where they would be out of character6; and that local need should be met ‘as far as possible.’7

4.14 The Government’s annual target of 300,000 homes per annum, has increased to at least 370,000 homes per annum, specifically recognising that London has fallen well behind meeting its housing needs:-

More important than setting a deeply ambitious but credible target is of course meeting it. The Government is clear that recent delivery in London has fallen well short of what is needed, and that is why we are committed to working in partnership with the Mayor of London and the GLA to turn this around - including by optimising density and through Green Belt review8

1 “150,000 children are in temporary accommodation, nearly 1.3 million households on social housing waiting lists; and rents are up 8.6% in the last year; and homelessness is at record levels”

2 NPPF (2024) para 61

3 NPPF (2024) para 76

4 NPPF (2024) 122(c).

5 NPPF (2023) para 60

6 NPPF (2023) para 130

7 NPPF (2023) para 60

8 MHCLG Blog 5th August 2024 (Our Plan to Get Britain Building Again

4.15 The Government proposes to delete the 35% urban uplift of housing need9 in the nation’s 20 most populous urban centres, of which London is one. However, even allowing for this, the new proposed standard method for Lewisham (2,470 homes per annum), requires more housing than the current London Plan requirement of 1,667 homes per annum, an increase of 803 homes every year.

4.16 With this change Footnote 28 has been deleted (“In doing so, strategic policies should promote an effective use of land and optimise site densities in accordance with section 11. This is to ensure that homes are built in the right places, to prioritise brownfield and other under-utilised urban sites, to utilise existing infrastructure, and to allow people to live near the services they rely on, making travel patterns more sustainable.”) This has been replaced by the clear objective to prioritise brownfield land with new paragraph 122(c), a more potent policy.

4.17 The consultation text reiterates the Ministerial Statement that new housing contributes to economic growth and “maximising delivery in urban areas” will also make the most of our transport hubs, support the objectives of brownfield-first and gently densifying urban areas, including building upwards where appropriate.

4.18 The consultation also included revisions to guidance on First Homes, proposing:

“removing the requirement to deliver at least 10% of the total number of homes on major sites as affordable home ownership, as set out in paragraph 66 of the current NPPF. We also propose removing the requirement that a minimum of 25% of affordable housing units secured through developer contributions should be First Homes” .

4.19 The PPG provides guidance on First Homes, a type of discounted market sale housing, which meet the NPPF definition of affordable housing and: a) are discounted by a minimum of 30% against market value; b) are sold to a household meeting the criteria; c) will have a restriction registered on the title at first sale to ensure the discount (and other restrictions) are passed on at re-sale; and d) the discounted price can be no higher than £420,000 in London. Government expects that First Homes should account for at least 25% of all affordable housing delivered through planning obligations (PPG: First Homes).

4.20 The PPG also makes clear the need to assess the requirements of different groups and plan accordingly for different types of housing in addition to general housing including, but not limited to affordable housing, housing for older people and housing for those who wish to rent privately (BtR).

4.21 The PPG states as part of the plan making process, local planning authorities should use a local housing need assessment to take into account the need for a range of housing types and tenures in their boroughs. The assessment will enable an evidence-based planning judgement to be made about the need for BtR homes, and how they can meet the housing needs of different demographic and social groups.

9 NPPF (2024) para 62

4.22 The PPG states that affordable housing on BtR schemes should be provided by default in the form of affordable private rent, a class of affordable housing specifically designed for BtR National affordable housing policy also requires a minimum rent discount of 20% for affordable private rent homes relative to local market rents.

4.23 The document goes on to state authorities will need to consider the extent to which the identified needs of specific groups can be addressed in the area, taking into account:

▪ the overall level of need identified using the standard method (and whether the evidence suggests that a higher level of need ought to be considered);

▪ the extent to which the overall housing need can be translated into a housing requirement figure for the plan period; and

▪ the anticipated deliverability of different forms of provision, having regard to viability.

4.24 Tenure data from the Office for National Statistics can be used to understand the future need for private rented sector housing. However, this will be based on past trends. The level of changes in rents, (known as “market signals”), may reflect the demand in the area for private rented sector housing. Evidence can also be sourced from the English Housing Survey, Office for National Statistics Private Rental Index, the Valuation Office Agency, HomeLet Rental Index and other commercial sources.

4.25 In regard to PBSA the PPG states authorities need to plan for sufficient student accommodation whether it consists of communal halls of residence or self-contained dwellings, and whether or not it is on campus. Encouraging more dedicated student accommodation may provide low-cost housing that takes pressure off the private rented sector and increases the overall housing stock. Strategic policy-making authorities are encouraged to consider options which would support both the needs of the student population as well as local residents before imposing caps or restrictions on students living outside university-provided accommodation. Local Planning Authorities will also need to engage with universities and other higher educational establishments to ensure they understand their student accommodation requirements in their area.

Policy

The London Plan

4.26 The London Plan 2021 provides the overarching strategic planning framework for London. Increasing the supply of housing is central to the London Plan; Policy H1 sets a 10-year target for net housing completions of 16,670 for London Borough of Lewisham.

4.27 Policy directs Boroughs to ensure housing targets are met by optimising the potential for housing delivery on all suitable and available brownfield sites through their development plans and decisions, in particular via the following sources of capacity:

▪ Sites with existing or planned public transport access levels (PTALs) 3-6 or which are located within 800m distance of a station or town centre boundary

▪ Mixed-use redevelopment of car parks and low-density retail parks and supermarkets

▪ Housing intensification on other appropriate low-density sites in commercial, leisure and infrastructure use

▪ The redevelopment of surplus utilities and public sector owned sites

▪ Small sites (see Policy H2 Small sites)

▪ Industrial sites that have been identified through the processes set out in Policy E4

4.28 Policy H4 sets a strategic target for 50% of all new homes delivered across London to be genuinely affordable. Developments are expected to maximise the delivery of affordable housing and make the most efficient use of available resources to contribute towards the strategic target.

4.29 Policy H6 prescribes the tenure mix of affordable housing, requiring:

▪ At least 30% low-cost rent (Social Rent or London Affordable Rent)

▪ At least 30% intermediate (including London Living Rent and Shared Ownership); and

▪ The remaining 40% to be determined by the borough as low cost rented homes or intermediate homes based on identified local need.

4.30 Policy H11 sets out the requirements for BtR. Guidance recommends boroughs should take a positive approach to the BtR sector to enable it to better contribute to the delivery of new homes. It highlights how BtR developments can make a positive contribution to increasing housing supply and are beneficial in a number of ways. They can:

▪ attract investment into London’s housing market that otherwise would not exist;

▪ accelerate delivery on individual sites as they are less prone to ‘absorption constraints’ on build-out rates;

▪ deliver more readily across the housing market cycle as they are less impacted by house price downturns;

▪ provide a more consistent and at-scale demand for off-site manufacture;

▪ offer longer-term tenancies and more certainty over long-term availability;

▪ ensure a commitment to, and investment in, place-making through single ownership; and

▪ provide better management standards and better-quality homes than much of the mainstream private rented sector.

4.31 Policy H15 sets a requirement for 3,500 PBSA bed spaces to be provided annually over the Plan period. The strategic need for PBSA is not broken down into borough-level targets as the location of PBSA need will vary over the Plan period. The policy requires that:

A. Boroughs should seek to ensure that local and strategic need for purpose-built student accommodation is addressed, provided that:

1) at the neighbourhood level, the development contributes to a mixed and inclusive neighbourhood

2) the use of the accommodation is secured for students

3) the majority of the bedrooms in the development including all of the affordable student accommodation bedrooms are secured through a nomination agreement for occupation by students of one or more higher education provider

4) the maximum level of accommodation is secured as affordable student accommodation as defined through the London Plan and associated guidance:

a) to follow the Fast Track Route, at least 35 per cent of the accommodation must be secured as affordable student accommodation or 50 per cent where the development is on public land or industrial land appropriate for residential uses in accordance with Policy E7 Industrial intensification, co-location and substitution

b) where the requirements of 4a above are not met, applications must follow the Viability Tested Route set out in Policy H5 Threshold approach to applications, Part E

c) the affordable student accommodation bedrooms should be allocated by the higher education provider(s) that operates the accommodation, or has the nomination right to it, to students it considers most in need of the accommodation.

5) the accommodation provides adequate functional living space and layout.

B. Boroughs, student accommodation providers and higher education providers are encouraged to develop student accommodation in locations well connected to local services by walking, cycling and public transport, as part of mixed-use schemes

4.32 Policy H16 applies to large scale purpose built shared living housing. The policy requires schemes including such housing to meet the following attributes:

A. Large-scale purpose-built shared living development must meet the following criteria:

1) it is of good quality and design

2) it contributes towards mixed and inclusive neighbourhoods

3) it is located in an area well-connected to local services and employment by walking, cycling and public transport, and its design does not contribute to car dependency

4) it is under single management

5) its units are all for rent with minimum tenancy lengths of no less than three months

6) communal facilities and services are provided that are sufficient to meet the requirements of the intended number of residents and offer at least:

a) convenient access to a communal kitchen

b) outside communal amenity space (roof terrace and/or garden)

c) internal communal amenity space (dining rooms, lounges)

d) laundry and drying facilities

e) a concierge

f) bedding and linen changing and/or room cleaning services.

7) the private units provide adequate functional living space and layout, and are not selfcontained homes or capable of being used as self-contained homes

8) a management plan is provided with the application

9) it delivers a cash in lieu contribution towards conventional C3 affordable housing. Boroughs should seek this contribution for the provision of new C3 off-site affordable housing as either an: a) upfront cash in lieu payment to the local authority, or b) in perpetuity annual payment to the local authority

10)In both cases developments are expected to provide a contribution that is equivalent to 35 per cent of the units, or 50 per cent where the development is on public sector land or industrial land appropriate for residential uses in accordance with Policy E7 Industrial intensification, co-location and substitution, to be provided at a discount of 50 per cent of the market rent. All large-scale purpose-built shared living schemes will be subject to the Viability Tested Route set out in Policy H5 Threshold approach to applications, however, developments which provide a contribution equal to 35 per cent of the units at a discount of 50 per cent of the market rent will not be subject to a LateStage Viability Review

GLA, First Homes Practice Note, July 2021

4.33 Paragraph 4.19 summarises the PPG’s guidance on First Homes. The GLA issued a note on First Homes where it sets out the London Plan tenure requirements for affordable housing delivery. The note confirms that, based on evidence specific to the London location, First Homes will not be prioritised above London Affordable Rent, Social Rent, London Living Rent and London Shared Ownership. The note states:

“First Homes is a DMS product that falls within the category of intermediate housing where it meets national and Mayoral affordability and eligibility criteria. London Plan policy does not preclude the delivery of DMS homes as part of the intermediate affordable housing component, however it does not contain a specific requirement for First Homes or DMS products and does not allow for the prioritisation of First Homes above the tenures set out in Policy H6. ”

Local Policy

Lewisham Core Strategy (2011)

4.34 The Lewisham Core Strategy was adopted in June 2011 Core Strategy Policy 1 confirms the Council sets a borough-wide target of at least 50% affordable housing, of which 70% should be social or affordable rent and 30% should be a range of intermediate housing.

4.35 The provision of family housing (3+ bedrooms) will be expected as part of any new development with 10 or more dwellings. For affordable housing, the Council will seek a mix of 42% as family dwellings (3+ bedrooms).

4.36 The Applicant has engaged with the council on the preparation of the new local plan over several years. Examination of the plan by an independent planning inspector was recently completed and it is anticipated the plan will be adopted in the near future.

4.37 Once adopted, the Lewisham Local Plan will replace the currently adopted documents as follows: Core Strategy (2011), Site Allocations (2013), Development Management (2014) and Lewisham Town Centre (2014) local plans. The new Local Plan will establish a future vision for Lewisham, along with the planning and investment framework for its delivery over a 20year period (2020 to 2040). Key policies relevant to the scheme are noted below.

4.38 Part H states: “Development proposals for Build to Rent housing will be assessed in accordance with London Plan policy H11 (Build to Rent). They must demonstrate that all such provision qualifies as Build to Rent by meeting the criteria set out in London Plan. Where the criteria are not met proposals will not be considered as Build to Rent and will be assessed against other relevant Local Plan policies”

4.39 Part A states: “The strategic target is for 50 per cent of all new homes delivered in Lewisham to be genuinely affordable. The Council will seek the maximum amount of genuinely affordable housing to be delivered on new housing developments”

4.40 In accordance with Part E, of Policy HO3 the Applicant will secure the proportion of affordable homes on a habitable room basis.

“Development proposals for new housing, including mixed-use developments, with site capacity to accommodate 10 or more dwelling units must deliver the maximum amount of genuinely affordable housing, taking into account:

a. Their contribution to the Borough’s strategic affordable housing target, based on habitable rooms, subject to viability;

b. The need for provision of a mix of secure housing tenures, with the affordable component sought to be provided on the basis of a tenure split of 70 per cent genuinely affordable (social rent or London Affordable Rent) and 30 per cent intermediate (London Living Rent or shared ownership)”

4.41 Part H states: “To maximise affordable housing delivery and address economic uncertainties that may arise over the lifetime of a development proposal the use of ‘review mechanisms’ will be required, where appropriate, and implemented in line with the Mayor’s Affordable Housing and Viability SPG.”

4.42 As highlighted above, Applicant has engaged with the local plan development process and submitted representations at each stage, most recently at examination. Whilst support for much of the plan was confirmed, concern was noted that viability testing of the plan excluded abnormal costs which are significant forthe scheme. As indicated within representations made, if these abnormal costs where included in the testing the viable level of affordable homes would have been c.10-15%.

5.1 The Lewisham Local Plan sets out a housing requirement (as required under the then London Plan) of 975 new dwellings per annum to be provided in Lewisham between 2007 to 2026. The housing trajectory under the London Plan steps up the delivery against this requirement over time, with 1,105 dwellings per annum 2011/12 to 2015/16, 1,385 per annum 2016/17 to 2020/2021, and 1,667 per annum from 2021/22 to 2028/29. The emerging local plan maintains the existing targets, but uplifts these during the initial 5 year period to account for backlog need (i.e. past under-delivery of homes).

5.2 Delivery over this period to date is set out in Table 5-1 below, as evidenced in the latest Residential Completions recorded by the Greater London Authority (GLA).

Table 5-1: Lewisham Housing Delivery

Source: Greater London Authority, 2024

5.3 The overall housing delivery over the 12-year period set out in Table 5.1 (above) has been considerably below the target requirement, falling short by 3,455 homes. This figure substantially under-represents the true scale of the shortfall as the London Plan target was itself c.25% less than the needs identified by the London Plan Strategic Housing Market Assessment (the adjustment being informed by capacity). Accounting for this, delivery in Lewisham over the last 12 years will be close to 4,500 homes less than that needed.

5.4 Looking forward, GLA data presented in Figure 5.1 shows that the number of homes that have started on site is below the housing target for five out ten years over the last ten-year period, reflective of the ongoing challenging economic environment.

Starts

0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000

Source: Greater London Authority, 2024

5.5 The delivery of housing across London more widely has consistently fallen short of targets, achieving an average of 83% since 2011/12 and having not met the requirement since 2016/17. The shortfall over this time period amounts to c.91,000 homes. A significant change in delivery of homes across the city is essential in order to deliver the homes that Londoners need.

Table 5-2: London Housing Delivery

Source: Greater London Authority, 2024

Affordable Housing Delivery

5.6 The 2021/22 SHMA update evidenced the current gross unmet need of 24,056 affordable homes, requiring 2,406 per annum over the next 10 years to achieve the number of homes required to meet the current affordable housing need and 2,064 homes to meet the projected affordable housing need.

5.7 As set out in paragraph 5.1, the London Plan has set a target of 1,667 homes to be delivered per annum. Lewisham currently has a policy target of 50% of all homes to be affordable, meaning 834 affordable homes are required per annum (significantly below the current and projected housing need).

5.8 Figure 5-2 shows that delivery has consistently failed to meet the affordable housing target in Lewisham, failing to meet the target since 2012/13, achieving 39% of the requirement between 2011 to 2024

Figure 5-2: Affordable Housing Delivery

Requirement

Source: Greater London Authority, 2024

5.9 Whilst the annual affordable housing target has increased over the course of the plan period, there has been a downward trend (with the exception of year 2018/19) in affordable housing delivery resulting in a greater cumulative shortfall each year, with the cumulative shortfall to date being 5,354 affordable homes.

5.10 Furthermore, as set out in paragraph 5.6 the SHMA identified 24,056 affordable dwellings (2,406 affordable homes per annum) are required to meet the affordable housing need. The annual forecast set out in the SHMA is considerably higher than the affordable housing target from 2016 onwards, as set out by the London Plan. The affordable housing completions data presented in Figure 5-2 concludes Lewisham has been unable to deliver the required affordable homes (with the exception of year 2012/13) set out in SHMA.

5.11 Over the period 2011-24 there were 13,996 completions, of which 24% were affordable. Of these affordable completions where the tenure was known, 72% were for low-cost rent and 28% were intermediate products (including Shared Ownership, Discounted Market Sale, Rent to Buy, Shared Equity and Intermediate Rent).

5.12 The emerging Local Plan, sets out 50 per cent of all new homes delivered in Lewisham to be genuinely affordable. For individual sites, the Council will seek the maximum amount of genuinely affordable housing to be delivered on new housing developments. Development proposals involving new housing will only be supported where the site capacity has been optimised and delivery of affordable housing maximised.

5.13 The affordable housing requirement will apply to all forms of conventional housing in the C3 Use Class, unsecured student accommodation and, where appropriate, specialist and supported accommodation.

5.14 The need for provision of a mix of secure housing tenures, with the affordable component sought to be provided on the basis of a tenure split of 70 per cent genuinely affordable (social rent or London Affordable Rent) and 30 per cent intermediate (London Living Rent or shared ownership). The preferred housing size mix for affordable housing, as set out in Table 5-3.

Table 5-3: Target Unit Mix for Affordable Housing

Existing Housing Stock

Tenure

5.15 As illustrated in Figure 5-3, London has a lower proportion of home ownership (45%) compared to the national average (61%). Ownership in the borough (42%) is the most dominant tenue followed by social rented (29%), complemented by a relatively high proportion of private rented homes (27%). The proportion of intermediate homes is very small across all areas, accounting for 2% of households.

5.16 Between the 2011 and 2021 censuses, the majority of growth in London and Lewisham was concentrated in the private rented sector (PRS), over this period households privately renting in the borough increased by 3% (c.5,100 households) followed by 1% growth in shared ownership homes. The proportion of households in owner occupation remained the same, while social rented households reduced by 2%. The large proportion of PRS housing correlates to Lewisham’s young age profile: Census data reveals that 16–34-year-olds make up almost half (41%) of all households who are privately renting.

Source: Census, 2021

5.17 The growth of the PRS is likely due to a combination of pull factors (changing lifestyles that favour renting) and push factors (lack of social housing, worsening affordability and/or availability of market sale housing, and insufficient supply of intermediate housing). Following the easing of the Covid-19 restrictions, there was an unprecedented scale of pent-up demand for rented homes in London which has continued to increase since the 2021 Census10 .

5.18 At the same time, the supply of non-purpose-built rental housing is falling as many shared private rental homes have been removed from the market due to changes in taxation and rising mortgage costs. Recent analysis by CBRE11 estimated on a net basis, approximately 273,500 rental properties were sold between 2016 and 2021 across the UK. And since the start of 2022, when the Bank of England began increasing the base rate, it is estimated that a further 126,500 rental properties have been sold (to July 2023). This is supported by research by the GLA, which found that number of private rental properties available to rent in London has fallen substantially since mid-2020 and is significantly lower than before the pandemic12 .

5.19 Where there is rapid growth in demand for PRS housing that outstrips dwindling supply, the result is considerable increases in rental values, overcrowding and increased prevalence of poor-quality accommodation. The growth in rents between early 2021 and late 2022 puts increasing pressure on private renters in London, contributing considerably to the cost-of-living crisis as renters attempted to adjust to higher housing costs (see further detail on rental affordability at paragraph 5.34).

5.20 In addition to more general long-term affordability pressures, the pandemic and the Cost of Living crisis have worsened affordability and increased the risk of eviction for renters, due to reasons including higher living costs and lack of job security resulting in increased rent arrears.

10 GLA Housing Research Note 9: Understanding recent rental trends in London’s private rented market

11 Why are landlords leaving the rental market? CBRE, July 2023

12 GLA Housing Research Note 9: Understanding recent rental trends in London’s private rented market

In late 2022, 40% of London’s renters reported being likely to struggle to meet rent payments in the next six months (YouGov 2022).

5.21 Table 5-4 shows how the housing stock in Lewisham is occupied. Census data shows there are high levels of overcrowding in the PRS – 4,857 households who are privately renting are classed as overcrowded across Lewisham (15% of the PRS). Overcrowding is likely to have increased further since 2021 particularly in the PRS as a result of affordability constraints, increased migration and the proliferation of HMOs.

Table 5-4: Lewisham Occupancy Rating (Bedroom) by Tenure (Census 2021)

5.22 Prevalence of poor-quality accommodation in the PRS is high, and the sector is also faced with amateur/absentee landlords, poor management/maintenance and unsecure leases. The English Housing Survey (2023) has consistently found that the PRS has the highest proportion of inadequate housing and 21% of private rented homes failed to meet the Decent Homes Standard in 2022-23.

5.23 The Council reports in the Local Plan that the supply of family housing has steadily declined as smaller terraced homes in the borough have been converted into multiple flats to meet the demand for smaller rental dwellings. According to Census data, there are c. 2,200 HMOs in the borough, of which 371 are occupied by households who do not have enough bedrooms.

5.24 Conversely, the data also indicates that the borough’s housing stock could be used more efficiently: c.18,000 owner occupied homes have at least two spare bedrooms, as do c.2,500 Social Rented homes. Delivery of unit mixes that meet identified market needs can facilitate ‘rightsizing’ and the most efficient use of the existing stock, helping to reduce the overall unmet housing need.

5.25 London’s housing stock is generally made up of smaller homes, as opposed to the national picture where larger homes are more common. Within Lewisham, the housing stock generally comprises smaller properties (one and two bed) and less family housing (three beds and over), which is typical for local authorities in central locations closer to the city.

Figure 5-4: Unit Type

Source: Census, 2021

5.26 According to the latest AMR, 3 bed properties accounted for 12% of completions over the period 2022/23, indicating a high market demand for smaller properties.

Table 5-5: Completions between 2017 – 2022 (London Borough of Lewisham, 2024)

5.27 The population of London grew by 7.7% to 8,799,723 between 2011 and 2021 (Census 2021), an increase of nearly 625,782 people over 10 years. The population of England grew by 6.6% over the same period. In respect of growth in Lewisham since the 2011 Census, the population grew by 8.9% (24,669 persons).

5.28 London has a younger population than England as a whole, the largest age cohort being age 30-39 which account for 18% of the city’s population, as illustrated in Figure 5-5. In terms of Lewisham, the data demonstrates the borough reflects regional trends but having a considerably younger population compared to national trends, with the cohort of 20–39-yearolds making up more than a third (35%) of Lewisham’s populace

Figure 5-5: Population Age

Source: Census, 2021

5.29 According to ONS data, the population of Lewisham is projected to increase by c.27,600 (8%) individuals from 316,326 to 343,437 between 2024 and 2043

Figure 5-6: Projected Population Change

Projected Population Change

Source: Census, 2021

5.30 Over the next 20 years, the vast majority of the projected net population growth will be driven by people aged 50 and above. The size of the borough’s older population is expected to grow by at least 32% between 2024 and 2043, by which point there will be c.114,000 people aged 50 and above living in the borough.

5.31 There is also some minor growth expected in younger adult households aged 20-34. Meanwhile, the total population growth hides the decrease in working age households aged 35 to 44, which is greater in relative terms than the regional trend.

5.32 A loss of working age households is typically caused by improved economic opportunities elsewhere or challenges with current living arrangements. However, in London, it is unlikely that a move would be due to better employment opportunities elsewhere. Instead, a lack of suitable housing including affordable housing is a likely cause of a net outmigration of younger households. This is especially the case for young families where there are constraints on affordability and availability of appropriate housing stock.

5.33 As presented in Figure 5-7 overleaf, between 2018 and 2043 one person households and other childless households are expected to see the greatest increase, driven by the growing number of both young and older households.

5.34 It is forecast that by 2043 the number of single person households in Lewisham will increase by a further c.15,300 households (an increase of 35%). It is also anticipated that there will be a significant rise in the number of co-habiting adults (with no dependent children), equating to an additional c.13,900 households – an increase of 32%. A significant proportion of future need is therefore anticipated to be for 1 and 2 bed properties to accommodate the growing number of smaller households.

One person households

Households with two dependent children

Other households with two or more adults

Source: ONS, 2018

Affordability

Households with one dependent child

Households with three or more dependent children

5.35 Housing affordability is a growing concern nationwide, regionally and in the borough. ONS data based on the median and lower quartiles of both house prices and earnings recorded an affordability ratio of 11 65 (up from 8.18 in 2011) in Lewisham, this is considerably higher (indicating housing is less affordable) in comparison to the regional ratio of 12.66 and the nationwide ratio of 8.18.

5.36 High house prices relative to earnings mean that many first-time buyers and key workers cannot afford to buy a property on the open market in a mile radius of the site. The household income required for market sale housing ranges from c.£77,000 for a studio property to c.£210,000 for a 3 bed (income required is calculated as housing costs being 28% of income).

5.37 The income requirement set out in Table 5.5 implies the affordability to rent a studio and 1 bed is higher than the purchase price, this could be driven by the increasing demand for smaller units in the borough which is reflected in the data on growth in single person households. The affordability for market rent homes is better than for market sale when factoring in larger homes (2 bed+)

Table 5-6: Market Affordability within 1 mile radius of the site (Property Data, September 2024)

*Market rents and Market Sale are based on local area (within 1 mile radius of the Lewisham Shopping Centre Site) asking prices and therefore reflect a range of typologies / quality standards within each unit type

5.38 As explored earlier within this section, as demand has outstripped a dwindling supply of PRS homes, rents have increased dramatically. Since the end of the Covid-19 lockdowns rents have increased rapidly in London, with annual increases peaking at 21.1% in Inner London in Q2 2022. In London, the average advertised rent in Q4 2019 was £2,119 compared with Q4 2022 was £2,480 per month, an increase of 17% over a three year period

5.39 Since Q3 2020 when the data for Inner/Outer London began, Inner London rents have risen from £2,288 to £3,010 (an increase of 31.5%), whilst in Outer London they have risen from £1,731 to £2,089 (an increase of 20%).

5.40 The graph below demonstrates the worsening affordability in the PRS, where rents have increased by 9% in the last 5 years to 2022/23, thus constraining further the ability of households in PRS to save for a deposit and access home ownership.

Source: VOA, 2024

5.41 Research by the GLA13 found that boosting the supply of market housing helps to relieve affordability pressures locally: “building new market-rate homes makes other housing more affordable. It does so by creating chains of vacancies and moves that can reach across an entire housing market area. These moving chains improve the availability and affordability of housing throughout the range of prices and rents, including for low-income households.” According to MHCLG’s estimate, a 1% increase in the housing stock leads to a 2% fall in house prices (if other factors remain constant). Delivery of new homes in Lewisham would not only contribute to the availability of additional homes but indirectly contribute to the easing of upward pressure on affordability in the wider market.

Housing Register

5.42 This sections sets out the use of temporary accommodation and the growth in the number of households on the council’s housing waiting lists.

5.43 The number of households living in temporary accommodation is 2,739, this is mainly due to a lack of move on accommodation from temporary accommodation especially suitable properties in the private rented sector. The number of households on the housing register has continued to rise, exceeding 11,000.

5.44 In order to reduce the pressure within temporary accommodation sector, the Council has benefitted from revisions to the New Homes Bonus Grant an increase of £1.88m from 2023/24to 2024/25,. This is beneficial because it will alleviate the number of households on the list, however, the supply of homes and demand for housing in the borough will limit the council’s ability to reallocate households.

13 GLA Housing Research Note 10: The affordability impacts of new housing supply: A summary of recent research (August 2023)

5.45 The Local Government Association indicate that a severe shortage of social housing means councils are being forced to pay to house people in private temporary accommodation, including hotels and B&Bs while households wait for a permanent home. Dwindling supply is further compounded by the rising cost of living and frozen Local Housing Allowance (LHA) rates which are driving increases in homelessness and reducing councils’ ability to source suitable accommodation.

5.46 Detailed below are the accommodation types at the time of application for those who are owed a relief duty in Lewisham. The data in Table 5-6 implies 16% of assessments are from households who were previously living in PRS, a contributing factor to households becoming homeless as a result of rising rents / an undersupply of market rent homes

Table 5-7: Initial assessments of statutory homelessness duties owed Lewisham, Financial Year 2023-2024 (April 23 – Mar 24)

Accommodation at time of application for those owed a relief duty:

*No fixed abode was reported to have been overused by some authorities who are aware that living with friends or family was a more appropriate field selection

**Includes other, unknown, caravan / houseboat, student accommodation, looked after children placement, tied accommodation, Armed Forces accommodation.

5.47 Providing stable, appropriate, and affordable housing is important for the retention and recruitment of staff and has often been highlighted as a particular challenge for key workers. Key workers span a number of sectors providing essential services; this includes police officers, teachers, doctors, nurses, midwives, paramedics, social workers, care workers, other frontline health, educational and social care staff but also wider private sector employees supporting the local community.

5.48 Despite working full time and supporting the economic prosperity ofthe city, young professional and key worker salaries may not enable them to buy or rent a market product of suitable quality close to where they work and spend time enjoying the leisure and culture that London has to offer.

5.49 There is c.50,500 individuals working within a range of key worker and enterprise professions in Lewisham. Figure 5-9 below provides an indication of the breakdown of the borough’s key worker population by profession and individual incomes, which range from £19,601 to £50,717. Household incomes will often be greater than individual incomes due to couples with dual earners or one full / one part time earner.

£60,000

Other Health Professionals, £50,717

£50,000

£40,000

£30,000

£20,000

£10,000

£-

Protective Service Occupations, £46,096

Administrative Occupations: Office Managers and Supervisors, £38,991

Welfare Professionals, £43,211

Health Associate Professionals, £31,605

Elementary Construction Occupations, £28,041

Welfare and Housing Associate Professionals, £30,469

Hairdressers and Related Services, £19,061

Customer Service Occupations, £28,286

Teaching and Childcare Support Occupations, £22,825

Nursing and Midwifery Professionals, £44,739

Teaching and other Educational Professionals, £47,143

Road Transport Drivers, £37,207

Secretarial and Related Occupations, £34,121

Elementary Security Occupations, £29,632

Caring Personal Services, £28,065

Elementary Cleaning Occupations, £23,826

Number of Jobs

Sales Assistants and Retail Cashiers, £23,238

5.50 As part of the process of developing the proposals, the Applicant has engaged with Lewisham Hospital in order to establish keyworker housing requirements in the borough. Feedback on common hurdles keyworkers/keyworker organisations experience when looking for suitable housing included:

▪ Locating housing for new and existing staff, with extensive time required and real challenges finding suitable homes;

▪ Affordability, quality and availability of housing is a major issue and impacts negatively on recruitment and retention of staff;

▪ Challenges housing more junior staff with lower salaries. Accommodation affordable to this group can be hard to find and often of lower quality. Shared accommodation can be a good option for younger staff, but is also difficult to find;

▪ Experienced staff, considering starting a family, also face challenges in affordability. This leads to a loss of mid-level staff;

▪ Often staff have to live great distances from their place of work, requiring a commute and added stress

5.51 The UK higher education sector continues to grow, driven by increases in the proportion of applicants accepted, the strong international appeal of the sector, and the ongoing attraction of postgraduate study. Lewisham is home to a number of university and higher education institutions, namely, Goldsmiths University and University of Greenwich. Student retention is a significant trend across London, by having two universities in the borough, this enables the borough to attract a new talent to enable the borough to grow.

5.52 Between 2019/20 and 2021/22, London saw an increase in student numbers of 38,000. The last two years alone have seen international students in the city grow by 27,495. Between 2014/15 and 2020/21, the number of students at Goldsmith University increased by 1,185 (14.5%) from 8,165 to 9,350 and the number of students at University of Greenwich increased by 7,365 (34.5%) from 21,295 to 28,660.

5.53 The London SHMA 2016 compares the current provision with the gross projected need and arrives at a net need for approximately 88,500 additional PBSA bedspaces between 2016 and 2041, or 3,500 when annualised over the 25-year period.

5.54 Despite the continued growth in demand for university education (and accommodation), Cushman & Wakefield report that the London market remains structurally undersupplied, and the pace of new delivery continues to slow. There are 718,805 PBSA beds in the UK for the 2023/24 academic year, an increase of just 8,760 on 2022/23, continuing the recent decline in new beds entering the market. In 2022/23 only 330 beds opened in London14

5.55 The market is also seeing an acceleration in older university or first-generation private sector schemes being closed for refurbishment. The balance between supply and demand in student markets is measured by the student to bed ratio (the number of students competing for each available bed offered by universities or private providers – a high student to bed ratio generally indicates a lack of supply). London currently has the second highest ratio at 3.6:115, meaning students are unable to access purpose-built accommodation and, combined with wider economic factors, this has contributed to unprecedented levels of rental growth for student bedspaces: rents in London increased by 11.1% from 2022/23 to 2023/24.

14 UK Student Accommodation Report 2023 (Cushman & Wakefield)

15 UK cities need much higher rates of student housing delivery, Savills, 8th April 2024 (https://www.savills.co.uk/blog/article/358493/commercial-property/uk-cities-need-much-higher-rates-ofstudent-housing-delivery.aspx)

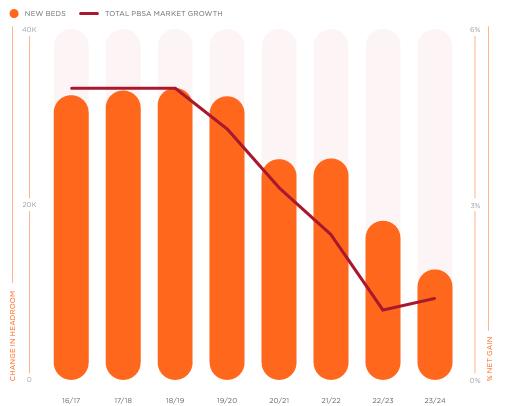

5-10: Student Accommodation Bedspace Delivery (2016/27 - 2023/24)

5.56 The Updated Lewisham SHMA highlights the 2021 council tax data reported a total of 1,013 dwellings were wholly occupied by students. A considerable amount of the student population in Lewisham is housed in the private rented sector. Whilst pressure on the private rented sector from students has been mitigated by the delivery of new PBSA, the sector will still continue to be subject to demand from students who are unable to afford PBSA16

5.57 The Council reports whilst both Goldsmiths University and the University of Greenwich cater for student housing needs by providing a variety of on-campus accommodation, it is evident that over recent years there has also been an increase in the delivery of off-campus PBSA.

5.58 However, even with the growing number of PBSA units, there is still a shortfall of purpose-built supply to accommodate the growing numbers of students. This means that pressure on conventional housing to accommodate students has continued to increase. The Council is of the view that there is a growing need to increase the capacity of student accommodation in the area in order to ensure that there is a suitable choice of available purpose-built accommodation.

5.59 The table below shows that across London there are almost 134,000 full-time students living in non-purpose built privately rented accommodation (a significant proportion of which are likely to be HMOs). The breakdown for Goldsmiths and the University of Greenwich is also included to provide an indication of how students are occupying housing more locally and give an indication of the scale of need17. Table 5-7 shows that there are over 12,000 full-time

16 Strategic Housing Market Assessment 2021/22 Update (London Borough of Lewisham)

17 It is acknowledged that the student population of Goldsmith and Greenwich will be dispersed beyond Lewisham, but conversely there will be students attending universities outside of the borough who are occupying conventional housing within the borough.

students at both universities who are renting non-purpose built housing. There is a clear and pressing need to deliver student bed spaces to meet the significant backlog of unmet need as student numbers continue to increase.

Table 5-8: Student Living Arrangement Breakdown (HESA)

5.60 This section focusses on single person households and Co-Living. Co-Living is a product that has emerged in recent years, particularly in London, to help tackle the housing crisis by offering a new rental product to sit alongside existing products, in turn increasing the housing offer to existing and prospective residents.

5.61 Co-Living represents an expanding trend in modern managed rental housing, particularly for single renters. This segment, historically poorly served by traditional rental markets, now finds a viable and attractive option though Co-Living.

5.62 The principal appeal of Co-Living for residents lies in its all-inclusive price, professional management and greater flexibility in tenancy durations. It is emerging as an ideal solution for those who do not want to live alone but require greater privacy and an upgrade from Houses in Multiple Occupation (HMOs).

5.63 Co-Living buildings are thoughtfully designed to balance private and communal spaces. This creates an ethos of sleeping in your bedroom, but living in the building.

5.64 Residents have access to their own private studios, which are then complemented by a variety of shared amenities. These often encompass co-working spaces, fitness centres, screening rooms, expansive cooking and dining facilities, along with lounge areas for relaxation and social interaction. Many Co-Living operators curate events and activities fostering a sense of community within the building

5.65 The shared access to significant internal and external amenity means that Co-Living is a completely different model for residential living (i.e. the entire building is designed to be the living environment of the residents).

5.66 Co-Living schemes are typically professionally managed to ensure that resident experience is high as possible.

5.67 The National Planning Practice Guidance (PPG) confirms that all households whose needs are not met by the market can be considered to be in housing need (Paragraph Ref: ID: 2a018-20190220). This includes both households who live in over-crowded or otherwise unsuitable housing (Paragraph ID: 2a-020-20190220).

5.68 The London Plan SHMA (2017) confirms all London households who live in private shared housing (which has not been specifically designed for sharers) lack facilities (i.e. house shares) and should be considered to be in housing need (SHMA 2017, Table 10).

5.69 The borough has a high proportion of single person households, the number of which is projected to increase significantly by a further +35% by 2043 (ONS 2018). This is illustrated in the 2018 based household projections shown in Figure 5-7 and in Figure 5-11, overleaf.

Source: ONS (2018)

5.70 House prices in Lewisham have increased significantly in the last 10 years. The average price of a home is now c.11 x median and low quartiles household incomes (ONS, 2024). As a result, the number of households who cannot afford to buy their own home but would also not be eligible for social rented housing has increased substantially.

5.71 Due to a lack of intermediate housing (which makes up less than c.2% of all local housing, Census 2021) these households require PRS housing. This is evidenced by the fact the number of households living in the sector has increased by over 5,000 homes in Lewisham since 2011 (Census 2021).

5.72 The majority (56%) of households in the borough are living in the rented sector, ONS data suggests a third (30%) of whom are typically single person households. There is however an extremely low stock / new supply of good quality cost effective purpose-built rental homes that are affordable to individuals. The increase in one person households as presented in Figure

5-11 will place significant pressure on the existing housing stock as a result of the limited supply of housing, to meet the growing demand of one person households

5.73 In any case, the number of house shares is reducing due to recent tax changes and increases in mortgage rates resulting in buy to let landlords exiting the market. This is evidenced by recent analysis from CBRE detailed further below. This model and form of housing is therefore clearly both insufficient in scale and unsuitable for meeting growing needs of sharers.

5.74 The lack of supply means increasing numbers of young single person households are likely to be forced to: i) leave the local area (displacing communities and reducing the local working age population); ii) continue to live with parents, family or friends into later life (including sofa surfing); or iii) live in unsuitable low quality house shares (of which only a very small amount is fully regulated and/or good quality housing purpose built for sharing). A recent survey from Hamptons evidenced significant growth in the number of young adults living with their parents (Hamptons 2023).

5.75 In respect of shared housing, the existing shared rental sector is insufficient in scale, quality and availability to meet growing need of single person households/ sharers. Many shared homes have recently been removed from the market due to changes in taxation and rising mortgage costs. Recent analysis by CBRE estimated on a net basis, approximately 273,500 rental properties were sold between 2016 and 2021. And since the start of 2022, when the Bank of England began increasing the base rate, it is estimated that a further 126,500 rental properties have been sold (to July 2023). At the same time there has been very little new investment into the creation of new shared buy to let properties.

5.76 As highlighted previously in this section, growing demand for a diminishing number of shared buy to let homes is resulting in a range of local issues including reduced quality of housing, reduced security, reduced affordability and ultimately reduced quality of life, as well as the conversion of homes otherwise highly suited to families.

5.77 These local issues are set out in further detail below:

▪ Reduced Quality: The scale of demand and lack of competition from good quality affordable alternatives means a third of London’s rental stock typically fails basic ‘Decent Homes’ standards with many being classed hazardous;

▪ Reduced Affordability: The demand supply mismatch is resulting in upward pressure on private sector rents in the borough (+19% in the 5 years to 2022/23 (VOA & ONS, 2023). This doesn’t take account of the most recent spike in private rents caused by landlords exiting the market.

▪ Reduced Availability: The availability of shared rental housing has reduced considerably in the last 12-18 months due to current undersupply. Letting agents also typically prioritise higher earners. This means some tenants face considerable waits or are unable to find a room to rent in the area.

▪ Increased Overcrowding: The implications of reduced affordability mean the existing private rented sector is overcrowded. As set out in Table 5.3 the levels of overcrowding in Lewisham (15%) exceed the national average of (4%).

▪ Reduced Security: Single persons unable to afford increasing rents are increasingly being evicted and becoming homeless. This will result in increased demand for temporary housing.

▪ Increased Fraud: A chronic shortage of homes to let, rising rents, and a privatised market have created ideal conditions for scammers and rogue agents (The Times, Dec 2023).

5.78 The above issues are expected to be exacerbated by growth in the number of single person households. This is illustrated in the 2018-based household projections shown in Figure 5-12 below which evidences the number of single and shared households are projected to increase by 115,902 to 2043 (ONS 2018). This equates to 100% of all projected household growth in Lewisham to 2043 with growth projections in family households to be very limited. The majority of the growth in childless households is expected to be single person or multi person (sharing) households as opposed to cohabiting couples.

Figure 5-12:

2043

Source: ONS (2018)

Summary

5.79 The key considerations of the local housing context are summarised below:

▪ Rising Housing Costs – an undersupply of market homes to rent is causing housing costs to increase for all households. More homes are needed to improve affordability and living conditions for everyone.

▪ Local Services – keyworkers have particular difficulties finding suitable homes. This is a priority issue for local service providers, as they struggle to attract new staff and retain existing employees who can often find a better balance of salary / housing costs elsewhere.

▪ Population – Lewisham’s population is projected to increase by 27,000 over the next 19 years. The borough has a young population (compared to London more widely), but the number of working age households is declining, whilst the older population is expanding

rapidly. Growth is forecast to be concentrated amongst smaller households (comprising singles and childless couples).

▪ Housing Delivery – the number of housing starts in Lewisham is inconsistent, the borough has not met the annual requirement five times in the last ten years, indicating completions in the short to medium term will fall short of targets. Delivery of housing across London more widely is falling short of targets, achieving an average of 85% since 2011/12 and has consistently declined since 2018/19. The shortfall over this time period amounts to c.72,000 homes. A significant step change in delivery of homes across the city is essential in order to deliver the homes that Londoners need.

▪ Affordable Housing – the Council has achieved c. 39% of its affordable housing requirement over the reported last 13-year period which has resulted in an under supply of 5,354 affordable homes in the borough.

▪ Tenure – the PRS (typically characterised by young professionals and key workers in their 20s and 30s) saw the greatest increase between 2011 and 2021 (+5,000 households), followed by shared ownership (c.500 homes). The PRS is under significant strain, with rents increasing at unprecedented and unsustainable rates, and high levels of over-occupation.

▪ Size – the housing stock in the borough is typically characterised by 2 and 3 bed properties, however the existing stock will not address the demand for smaller one person households based on the projected figures set out in Figure 5-7 of the report

▪ Affordability – the affordability of homes to rent is increasingly out of reach. Households would need an income of c. £77,000 to purchase a studio property and an income of £127,000 to rent a 2-bed home on the open market.

▪ Economy – the borough’s aspirations to maintain the success of the reinstated shopping centre and grow and develop its local economy will require a range of sustainably located, high quality homes to attract and retain a skilled workforce. This will include options for those relocating to start a career and more senior professionals. Set against the context of the Cost of Living crisis, the role that housing provision has to play in Lewisham’s economic success is now more important than ever. The combination of homes and employment space will support the town centre to:

▪ Capture a higher proportion of spend – this is not about competing with online retail sales, but capturing more of what people spend in person, including on experiences and leisure food and beverage (‘F&B’) and the evening economy. There is comparatively little nighttime economy floorspace in Lewisham town centre, with no hotels or theatres, limited F&B and an overprovision of hot food takeaways.

▪ Expand and diversify its catchment to attract more and higher spending visitors to the town centre The Proposed Development includes purpose-built Co-Living and student accommodation as well as traditional homes.

The location (adjacent to Lewisham Station) and the type of units (the inclusion of flats / build to rent) are likely to attract young, mobile households who will spend money in the town centre, particularly if the town centre offer is diversified and improved.

The provision of student accommodation is a further opportunity to support the demand for a wider variety of amenity and leisure uses and help animate the town

centre in the evening. While student income is generally low, student spending is not – and it tends to be a disproportionally local and on a range of amenities. It also helps to forge links between education and employment opportunities.

The Proposed Development includes a range of uses including retail, leisure, community and office / workspace. This will facilitate significant opportunities across a range of uses.

6.1 The development proposals include a diverse mix of types and tenure of homes to meet a range of needs in the local area. This section of the report provides an overview of these proposals.