JOURNAL ENTRY THE

HOW UTAH TEENS ARE LEARNING ABOUT CAREERS IN ACCOUNTING

VOL 3 · SUMMER 2023

THE UTAH ASSOCIATION OF CERTIFIED PUBLIC ACCOUNTANTS

THE JOURNAL ENTRY | SUMMER 2023 2 Ask about our entrance exam waiver. Currently accepting applications. Apply now! 3 DELIVERY OPTIONS: WITH Face-to-face Live Broadcast Interactive Online Chris Tibbitts 2021 Utah State MBA Graduate UtahStateMBA.com It’s Worth It!

Managing Editor Amy Spencer as@uacpa.org

2023 – 2024

UACPA Executive Board

President: Dustin Wood, CPA

President-Elect: Jason Tomlinson, CPA

Vice President: Dan Frei, CPA

Treasurer: Mark Anderson, CPA

Secretary: Shalaun Howell, CPA

Member-at-Large: Annette Andersen, CPA

Member-at-Large: Marci Butterfield, CPA

Emerging Professionals: Ariane Gibson, CPA

Immediate Past President: Ray Langhaim, CPA

AICPA Council: Stacy Weight, CPA

CEO: Susan Speirs, CPA

UACPA Staff

CEO: Susan Speirs, CPA

CPE Director: April Deneault

Communications & Marketing Director: Amy Spencer

Financial Director: Tom Horn, CPA

Cover Image of Loisanne Kattelman with Money Camp alumni Isabella Romero and Preston West by Chris Wood, robertwoodphotography.com

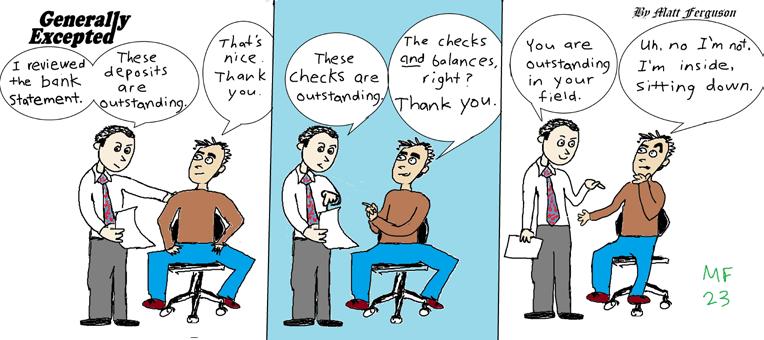

THE JOURNAL ENTRY | SUMMER 2023 3 CONTENTS SUMMER 2023 President’s Message 4 CEO's Message 5 Cover + Articles Opportunities Exposed at Money Camp 6 Dare Mighty Things at Cash Camp 12 By the Numbers: Utah’s Students & Universities 14 Managing Your Cyber Risk 16 The SECURE 2.0 ACT and Qualified Charitable Distributions 18 Membership New Members and Student Affiliates 22 Members in the News 23 Photos: Leadership Council & D.C. Visits 25 Meet the Board 26 UACPA Staff Chat 27 Board Brief 27 Comic: Generally Excepted 28 Meet a Member: Michael Michelsen, CPA 29 CPE 2023 Virtual Courses 30 UACPA Mission 34 100% Firms 34 Utah Association of Certified Public Accountants 15 W. South Temple, Suite 1625 Salt Lake City, UT 84101 801-466-8022 mail@uacpa.org www.uacpa.org

Statement of Policy

Journal Entry is published four times a year by the Utah Association of

Public

(UACPA). The opinions, views and articles expressed in this magazine are

of the authors and not

magazine

not be

an

by the UACPA or

committees or editorial

of

or

contained herein. Copyright © 2023 Utah Association of Certified Public Accountants

UACPA

The

Certified

Accountants

those

necessarily those of the UACPA. This

should

deemed

endorsement

its

staff

any views, opinions

positions

As I considered my message for this quarter — pipeline considerations and discussions are still prevalent — I’ve settled in on urging those within the profession to flip the script on negative narratives and be advocates for change. The AICPA has launched an image initiative and campaign, but it is going to take all of us collectively to affect meaningful change.

Many years ago, I used to watch the nightly news with my family to be aware of what was going on in our community, state, nation, and the world. As I grew up, I made a conscious decision to stop doing that, not because I didn’t want to be informed, but primarily due to the overwhelmingly negative headlines and stories. It may be that such stories bring viewers and attention, but they don’t motivate or inspire. As I review online news sources from time to time and see accounting-related headlines, they typically seem to carry a negative tone and connotation. Many of those headlines recently have related to significant layoffs of team members at large accounting firms, artificial intelligence (AI) replacing accountants, and fines for missteps by accounting firms.

We don’t have the ability amongst ourselves to eliminate all negative narratives, but we can take steps to offset

PRESIDENT’S MESSAGE DUSTIN WOOD, CPA

and overcome them. We must not allow the perpetuation of stereotypes and misconceptions that those of us within the profession know not to be true. These are often believed by those who don’t know any better and aren’t told differently.

At the recent AICPA Spring Council Conference in Washington, D.C., the president of CalCPAs shared that they have coined the phrase “Coolest Profession Around (CPA).” While I believe that to be the case, I don’t think we do enough collectively in public to express that.

You often hear that two constants in life are death and taxes. Personally, I am not a tax practitioner, but I think it relates to the profession as a whole. And no offense to any morticians in the audience, but I find it a whole lot easier to help others understand what we do, and the benefits it provides, than any other reliable employment opportunities.

As we interact with students in college, high school, or other students, and with those around us in general, let’s be passionate about what we do and focus on the positive, inspiring, and motivating aspects of why it is meaningful to us and those around us. If you have especially impactful narratives and stories, please share those with us, and let’s find a way to then share those with others to generate more understanding and excitement related to the profession. We are fortunate enough to be a part of the “Coolest Profession Around,” and I hope we’ll each do our part to make that known. n

THE JOURNAL ENTRY | SUMMER 2023 4

CEO’S MESSAGE SUSAN SPEIRS, CPA

Over the last year, the UACPA has been focusing on pipeline issues as they relate to a decrease in accounting majors. Across the nation, we’re seeing a 17% decline in the number of students majoring in accounting. COVID-19 introduced workplace shifts that contributed to a mass exodus of accountants. Recently, the Wall Street Journal reported that more than 300,000 U.S. accountants and auditors have left their jobs over the last two years. The challenge as to why there is a shortage of accounting majors is multifaceted.

While it is true that we have challenges in the salary, culture, and image of the profession, it is interesting to note that many students in secondary schools see AI and robotic processing as a challenge that will make the profession obsolete. Many students who are interested in accounting have analytic minds, as do those who are interested in finance and information systems. As we visit our high schools, the question often comes up as to when the computer is going to replace the need for accountants. As an organization, we continue to become increasingly involved at the high school level so that students can learn about accounting. One of the struggles we navigate is that fewer and fewer high schools teach accounting in the state of Utah. Below are a few ways we strategize getting accounting in front of our high schools:

• STEM — As noted in our last Journal Entry, STEM is a huge factor when it comes to high school students deciding on a major. We’re working with all our universities in the state to obtain STEM recognition for their accounting programs. We continue to work with agencies directly tied to the governor’s office as questions arise regarding our profession and the needed talent. As of publication date, two of eight universities have received the designation.

• FBLA (Future Business Leaders of America) and DECA (Distributive Education Clubs of America)

— We’ve had the opportunity to judge various DECA competitions and participate in FBLA activities. Perhaps there are opportunities for our chapters to become more engaged. We’ve been able to offer volunteers to our school districts through outreach.

• Academy of Finance — We’ve had the opportunity with the Granite School District to work with their Finance Academy in a competition to help students become more aware of our profession. We look forward to additional opportunities next year.

• Student mentoring — As we’ve been able to get our foot into the door with schools around the state, counselors are reaching out to see if students can meet up with CPAs. We’ve had some cool outreach. In April we were able to connect students that have an interest in healthcare accounting as well as theater accounting. We are hoping that our Mentoring Committee will see more opportunities to assist.

We know that the challenges we’re facing now did not pop up overnight. We also know that as they are multifaceted and changing constantly, they will not be resolved overnight. As you peruse the Journal Entry, think of ways you would be willing to help the cause.n

THE JOURNAL ENTRY | SUMMER 2023 5

FEATURE

INTRODUCING CAREERS IN ACCOUNTING

MONEY CAMP IS BACK AT WEBER STATE FOR A THIRD YEAR

BY LOISANNE KATTELMAN, CPA

Thissummer, about 35 high school students from all over Utah will gather at Weber State University’s (WSU) Ogden campus to spend the week exploring careers in accounting. These teens are part of the UACPA Money Camp, hosted by WSU.

HISTORY

Several years ago, the Utah CPA Foundation sent a survey to UACPA members asking for input on ways to support and promote the CPA profession. In response to the feedback, the foundation committed to support high school outreach programs to address the pipeline issue. Money Camp is the result of a collaboration between the UACPA and Weber State University, with support from numerous accounting firms.

It has been exciting to see Money Camp grow and improve each year. The first camp was originally scheduled for the summer of 2020 but, due to Covid-related restrictions, had to be postponed until 2021. That year, 10 high school students participated in a three-day camp with no overnight stays. In 2022, the number of campers increased to 26 and the camp was extended to four full days with overnight stays in the dorms. To accommodate increased demand for the program, the 2023 camp expanded to 35 students.

GOAL OF THE CAMP

The schedule for the camp includes fun workshops and activities, service opportunities, leadership courses, and presentations from accounting professionals. (See the 2023 camp agenda on page 10). One student who attended the 2022 camp said, “I loved it all! The perfect mix of education and fun!”

At the camp, the kids have a one-of-a-kind experience. They live, eat, learn and play on campus, take classes from college professors, meet industry experts, play games, go on field trips, challenge their skills, and much more. When they go home at the end of the camp, they leave with solid connections with professors, professionals, and other likeminded students; expanded knowledge of the accounting profession; and enthusiasm for the prospect of a grand future in the accounting profession.

The goal of the camp is to educate and also recruit Utah’s youth to the accounting profession. This is accomplished by introducing the field in a fun, interactive way. The students work in groups to solve various problems and experiment with money.

THE JOURNAL ENTRY | SUMMER 2023 7

MONEY CAMP ALUMNI

Students who have previously attended Money Camp are returning as ambassadors to lead first-time attendees. The students pictured alongside Loisanne are

Isabella Romero graduated from the Northern Utah Academy of Math Engineering and Science (NUAMES) this spring and attended the UACPA Money Camp as a junior. The opportunity to attend Money Camp has had a meaningful impact on her and has influenced her career goals. This year Isabella will be assisting in running the camp and is looking forward to a great experience.

Preston West is a graduate of Weber High School. He runs an e-commerce business, is the Goddard School of Business and Economics student ambassador, and is majoring in accounting at Weber State University.

SUPPORT FROM THE PROFESSION

Money Camp is funded by the Utah CPA Foundation and generous donations from the following accounting firms: CBIZ, Deloitte, EY, Haynie & Company, Squire, Tanner, UMB and WSRP. Because students do not have to pay for camp, this opportunity is available regardless of their financial situation.

The firms also encourage their employees to donate their time and expertise as volunteers. Last year, 20+ professionals participated in Money Camp.

INITIAL RESULT AND LOOKING FORWARD

Money Camp is an effective way to show high school students the many different (and exciting!) career paths a degree in accounting offers them. The camp is already delivering positive results. Preston West attended the initial 2021 Money Camp and is currently majoring in accounting at Weber State University. He and Isabella Romero, a 2022 camper, are coming back as camp leaders to help with the upcoming 2023 Money Camp.

“We are anticipating an excellent camp this summer,” said Accounting Department Chair James Hansen, “and look forward to many more in collaboration with the UACPA. Our association with this excellent organization has and will continue to benefit Utah students in countless ways.” n

HOW STUDENTS CAN APPLY

To attend the camp, students ages 15–18 must submit an application, which includes an essay describing their interest in accounting or money-related professions.This year, WSU received 50 applications to the camp, so while not all can attend, those that will be camping in 2023 have high levels of interest in the accounting field.

Loisanne Kattelman, CPA, joined the faculty of Weber State University in 1998 and teaches financial and managerial accounting courses in the Goddard School of Business. She serves on the Utah CPA Foundation board of trustees and is a UACPA Leadership Council member.

THE JOURNAL ENTRY | SUMMER 2023 9

“Before, I didn’t find interest [in accounting], but now I’m interested in the program!”

— 2022 camp participant

A DAY IN THE LIFE OF MONEY CAMP

The 2023 schedule provides plenty of learning experiences and activities during the three-day, immersive on-campus experience.

DAY 1

Shark Tank competition — Students will be divided into teams to come up with a business idea that will make money and entice the “shark” investors. Each team has two mentors, a WSU faculty member and a CBIZ professional, who will support and guide the campers.

DAY 2

Accounting professionals will share their expertise in several interactive presentations — tax investigation & enforcement (IRS), sShort-sellers & financial fraud (WSU) and professional & personal development (Tanner LLC).

Students will also participate in a Mousetrap game (WSU) that highlights the importance of cost benefit analysis and continual improvement.

DAY 3

The students will head to the golf course where they will network with accounting professionals who will teach them the basics of the game. In the afternoon, they will learn about different career options (panel discussion) and do a Lego activity focused on communication (Squire & Company).

DAY 4

Students will participate in a team building activity and service project (UMB). Students have loved working together to compile pantry packs to donate to those in need.

THE JOURNAL ENTRY | SUMMER 2023 10

THE JOURNAL ENTRY | SUMMER 2023 11

DARE MIGHTY THINGS AT CASH CAMP

MINORITY STUDENTS LEARN ABOUT OPPORTUNITIES AT UTAH STATE UNIVERSITY

BY JAYSON TALAKAI, PH.D.

BY JAYSON TALAKAI, PH.D.

The Quigley Ambassadors, an accounting student organization at Utah State University (USU), held their inaugural Dare Mighty Things Cash Camp on October 8, 2022. This event was held to recruit high school students from underrepresented minority groups (e.g., African American, Native American, Latin American, and Pacific Islanders) into the accounting program. Approximately 35 students and parents attended the all-day event. The purpose of this event was to, first, help these students visualize themselves on a college campus, and second, help them see the opportunities and knowledge an

accounting degree could mean for them and their family.

The day started off at Maverik Stadium, where students toured the locker room, the athletics hall of fame, and were even able to go onto the football field. Afterwards they went to the USU challenge course to do some leadership activities. During lunch, students heard from recent graduates Elijah Toa (Samoan), Jaslyn Stevens (Samoan), Ana Patino (Latina), Tony Valdez (Latino), and Kenrik Lopez (Filipino), who talked about their backgrounds and professional experiences since graduating from USU’s

THE JOURNAL ENTRY | SUMMER 2023 12

accounting program. Their stories were inspiring and impactful. They were followed by Chad Simon (associate dean), who gave a very motivational speech where he had the students text themselves a message. The first line read “I can…” and the second line read “I can’t …..yet.” He told them that they may not be able to do certain things now, such as pass challenging college courses, but that’s okay because they are still in high school. However, if they put in work and stick with it, they will be able to eventually. As the majority of the students who attended were of Pacific Islander descent and came from the West Valley City area, I was the concluding speaker and shared the challenges of growing up in West Valley City. I was among the first Tongans to get a Ph.D. in accounting.

Students then participated in a hands-on cost accounting activity where groups of 4 to 5 students built gingerbread houses. They tracked all of the materials that were used and assigned other expenses to the cost of building the houses. Then accounting faculty and the Quigley Ambassadors placed bids on how much they would pay for each house. Students learned the difference between revenue and profit, various strategies to maximize profit and the importance of understanding the cost of overhead. The final events of the day included guidance on how to pay for college, a tour of campus and attendance

at the Utah State vs. Air Force football game.

The Dare Mighty Things Cash Camp seems to have struck a chord with the local communities. The feedback has been extremely positive, and I have since met with various minority groups around Cache Valley who have all asked when we were going to hold the Dare Mighty Things Cash Camp in the future so they can participate. In particular, a father reached out to Cash Camp because his son was failing all of his classes. The father expressed concerns about the choices his son was making and was hoping for advice on how to help his son. I invited the son to participate in the Cash Camp. The son was very engaged in the day’s activities and even spoke to a representative from KPMG at the conclusion of the panel discussion. The father also reached out a few days after the event and mentioned how his wife and son couldn’t stop talking about Cash Camp. He also mentioned the positive change he has seen in his son’s behavior towards school and education in general.

Similarly, when the information session concluded, one of the fathers approached Dr. Chris Skousen with tears in his eyes. The father runs a landscaping business and the activities — especially the gingerbread house — helped him see the role that accounting plays in business and overall decision making. He excitedly mentioned that he has a daughter currently serving an LDS mission but would bring her to campus once she returns to meet with some accounting faculty. He hopes that she will enroll in accounting at Utah State University when she starts school.

Special thanks to KPMG, PwC and the UACPA for helping make this event possible. n

Jayson Talakai is among the first Tongans to earn a Ph.D. in accounting. He completed his degree from Texas Tech University in August 2016. Dr. Talakai earned his B.S. in Accounting from Brigham Young UniversityHawaii in 2009. Prior to obtaining his Ph.D., he worked as a staff accountant at the University of Utah. Dr. Talakai and his wife have six children, four girls and two boys.

THE JOURNAL ENTRY | SUMMER 2023 13

The following numbers come from UNIVSTATS for the 2022 - 2023 school year.

BY THE NUMBERS

UTAH’S STUDENTS & UNIVERSITIES

408,979

$8,686

AVERAGE TUITION & FEES FOR IN-STATE UNDERGRADS

COLLEGES AND UNIVERSITIES ARE ACTIVE IN UTAH (17 PUBLIC AND 46 PRIVATE)

63

AVERAGE PERCENTAGE OF ACCEPTANCE RATE FOR UTAH COLLEGES AND UNIVERSITIES

86

66,321

NUMBER OF COLLEGE APPLICANTS

NUMBER OF STUDENTS ATTENDING UTAH COLLEGES AND UNIVERSITIES IN 2022 – 2023

$15,707

AVERAGE TUITION & FEES FOR OUT-OF-STATE UNDERGRADS

THE JOURNAL ENTRY | SUMMER 2023 14

61% Business owners who said they were unaware of the Employee Retention Tax Credit (ERTC) in a recent Paychex survey.

The ERTC could prove a key funding source and create savings that could be invested as your clients’ businesses work toward becoming fully operational.

What your clients should know:

• ERTC is a refundable credit that can be claimed on qualified wages paid to employees.

• The tax credit has been extended and can be claimed through Dec. 31, 2021.

• Businesses that took a Paycheck Protection Program loan now can claim the ERTC, including retroactively.

• Paychex clients who have claimed the ERTC have, on average, saved tens of thousands of dollars

Paychex offers the resources and tools to help you enhance your consultations with clients. payx.me/uacpa-ertc | payx.me/uacpa-spotify-podcast | payx.me/uacpa-apple-podcast

Paychex is proud to be an endorsed provider for the UACPA. Discover how Paychex can help 877-534-4198

Deserve © 2021 Paychex, Inc. All Rights Reserved. | 0 6/21/21

Help Your Clients Get the Credit They

REVIEW YOUR CYBER RISK

HOW TO ASSESS YOUR FIRM’S CYBERSECURITY COMPLIANCE STATUS IN 12 EASY STEPS

BY JAMES HARRISON

As the world navigates the digital transformation, the accounting industry has found itself in the crosshairs of cybercriminals. Firms sit on a treasure trove of sensitive data, making them prime targets for cyberattacks. Not surprisingly, there has been a surge in cyberattacks targeting accounting firms in recent years.

Protecting clients’ sensitive information should be a top priority for CPA firms and financial professionals. Is your firm or business doing enough to prevent a breach? Do you meet minimum regulatory requirements and the commonly accepted cybersecurity standards for safeguarding customer information?

WHAT ARE CYBERSECURITY REGULATIONS AND STANDARDS?

While customers are expecting their information to be protected, governments are requiring it. Under various federal and state laws, as well as industry standards, firms and businesses of all types and sizes must meet minimum data security and privacy requirements to protect against the exposure or theft of customer and employee data.

Well-known federal cybersecurity regulations for financial companies include GLBA, SEC/FINRA and FFIEC. Utah, along with all other states, has enacted data security and privacy laws such as the Utah Cybersecurity Affirmative Defense Act (2021) and the Utah Consumer Privacy Act (2023). These laws require, among other things, that businesses “establish, implement, and maintain reasonable administrative, technical, and physical data security practices.”

And within the accounting industry itself, the AICPA’s System and Organization Controls (SOC) cybersecurity standard details the recommended information security controls for both general business and accounting firms, including assessment and reporting on the maturity of the organization’s information security program.

WHERE TO START IN ASSESSING YOUR CYBER RISKS AND COMPLIANCE

Conducting a comprehensive cybersecurity risk and compliance assessment is not only a best practice, but also a common requirement in all government and industry cybersecurity standards. Good assessments help you identify potential threats and vulnerabilities while evaluating the current level of compliance with regulatory requirements, client expectations and industry best practices.

Cyber risk assessments should be completed at least annually, or in response to security incidents, upon changes in geographic market, regulatory environment, or substantial change to operations.

Use this short checklist to get a quick indication of how well your organization is doing at a high level in these 12 critical areas of cyber risk management and compliance.

1. Information Security Plan. Do you have a written cybersecurity plan detailing all your organization’s current data security and privacy policies, and is it reviewed and updated at least annually?

2. Risk and Compliance Assessments. Do you conduct regular cyber risk and compliance assessments to identify

THE JOURNAL ENTRY | SUMMER 2023 16

new security threats and any required updates to your information security plan?

3. Network and Device Security. Do you have an IT security plan, including network and endpoint protection, external network vulnerability scans, data access controls, email security, encryption, data disposal, and other mandatory compliance requirements?

4. Security Awareness Training. Do you have an employee cybersecurity training program, and are all personnel regularly trained and tested?

5. Remote Workforce Security. Do you have a home office cybersecurity and technical support plan in place for employees authorized to work remotely?

6. Vendor Risk Management. Do you have information security agreements in place and do you periodically evaluate your company’s third-party service providers’ cybersecurity practices?

7. Business Continuity. Have you established policies and procedures for the continued protection and availability of sensitive data during adverse or disruptive events such as a ransomware attack or a natural disaster?

8. Privacy Rights Management. Have you established data privacy policies and procedures that comply with applicable consumer privacy rights laws such as GDPR, CCPA and other state laws?

9. Breach Response. Do you have a formalized data breach incident response plan, and is it tested periodically?

10. Audit Readiness. Do you have the necessary compliance reports and response processes in place to quickly respond to cybersecurity audits and questionnaires?

11. Cybersecurity Certification. Has your company’s cybersecurity plan been reviewed by an independent third party? Does your organization have any cybersecurity compliance certifications?

12. Cyber Insurance. Do you have adequate cyber liability insurance and is your business compliant with the policy’s cyber risk management requirements?

Keep in mind that this short assessment is the proverbial “tip of the iceberg” when it comes to standardized risk and compliance assessments, but it’s a good starting point to get

a quick feel for how your firm or business is doing today.

If you answered “No” or “Not Sure” to two or more questions in this short checklist, it’s time to step up your game!

Free offer to UACPA members

As a UACPA member, you have exclusive access to a complimentary InfoSafe® Risk and Compliance Assessmentd report and consultation for your business. To learn more and register for free, contact us at (801) 724-6211 or by going to www.invisus.com/uacpa.

TAKE ACTION TO SAFEGUARD YOUR BUSINESS

In light of the escalating risks of data breaches for CPA firms, financial professionals, and businesses in general, you may need to take the lead and ratchet up your organization’s cyber risk management efforts. If you haven’t had an outside risk and compliance assessment done recently, make the commitment to get that done right away.

A Word of Caution

Don’t make this too complicated. For small and mid-sized firms, completing your cyber risk assessment shouldn’t take more than an hour or two, and it shouldn’t break your budget. While it’s critical that you have a solid cybersecurity compliance plan, it shouldn’t be so complicated that you don’t take action.

Keep in mind, you don’t have to go it alone. Guidance, assistance, and oversight from outside experts is available to help take the bulk of this work off your plate.

The UACPA has partnered with INVISUS, a Utah-based cybersecurity company specializing in cyber risk management and compliance for professional services companies, including accounting and CPA firms, to help you learn about and take action to reduce risks and stay compliant. n

James Harrison is the founder and CEO of INVISUS, an industry pioneer in cybersecurity and identity theft protection since 2001. As chief strategist and product visionary, he leads the development of the company’s innovative security solutions and is a featured author, speaker and trainer.

THE JOURNAL ENTRY | SUMMER 2023 17

CHANGES FOR CHARITIES

THE SECURE 2.0 ACT AND QUALIFIED CHARITABLE DISTRIBUTIONS TO SPLIT-INTEREST ENTITIES

BY SHELDON R. SMITH, CPA

Tax law allows for qualified charitable distributions (QCDs), which are nontaxable transfers from a traditional IRA to a qualifying charity. Those who use QCDs can get the tax benefit of a charitable contribution without itemizing and without having the IRA distribution included in AGI, which can have many other benefits. This benefit became more

important with the increase in the standard deduction from the Tax Cuts and Jobs Act of 2017 (TCJA), meaning fewer taxpayers are itemizing.

A QCD must be a transfer directly from an IRA to the charity. The IRA account holder must be at least 70½ at the time of the transfer. Most entities that qualify for charitable de-

THE JOURNAL ENTRY | SUMMER 2023 18

duction status will qualify for a QCD. The annual maximum amount for a QCD is $100,000 per taxpayer (indexed starting in 2024). Any amount transferred as a QCD counts toward the annual required minimum distribution (RMD) for taxpayers old enough to have RMDs.

The SECURE 2.0 Act of 2022 included provisions that relate to QCDs, one of which allows a one-time QCD to certain split-interest entities. However, the implications of this new provision make it unlikely that charities will encourage it and unlikely that many seniors will use it.

SPLIT-INTEREST ENTITIES

The new tax provision allowing a QCD to a split-interest entity only applies to certain entities: a charitable remainder annuity trust (CRAT), a charitable remainder unitrust (CRUT), or a charitable gift annuity (CGA). In general, these types of charitable gifts operate by having an individual create a trust or transfer assets to a charity with the provision that the trust or charity will provide income from the assets to a beneficiary for a period of time, perhaps the remaining life of the donor (the lead beneficiary), with the charity (the remainder beneficiary) claiming the remainder interest at the end of the life of the agreement.

A CRAT is one where the donor transfers assets into an irrevocable trust from which fixed annuity payments are made at least annually to one or more beneficiaries. The life of the trust can be for a fixed term in years (not to exceed 20) or for the life or lives of the individual or individuals named as beneficiaries. The fixed annuity payment must be between 5% and 50% of the initial fair market value of the assets contributed to the trust.

When the life of the trust ends, the remainder interest is transferred to a charity. The value of the remainder interest must be at least 10 percent of the initial fair market value of assets contributed, with this percentage being verified with actuarial calculations at the time the trust is created.

Trust distributions to the non-charitable beneficiary(ies) are taxed as ordinary income to the extent the trust has ordinary income to distribute. Similarly, if trust ordinary income is all distributed, payments can be taxed, in order, as capital gain, other income, or a non-taxable return of corpus, depending on the nature of the payment to the beneficiary(ies).

A CRUT is like a CRAT except that the payments to the lead

beneficiaries are a fixed percentage (between 5% and 50%) of the fair market value of the assets, valued annually. Thus, whereas a CRAT has fixed dollar payments to lead beneficiaries, a CRUT has variable payments.

A CGA involves the transfer of assets to a charity. In turn, the charity promises to make fixed annuity payments for life on at least an annual basis to one or two beneficiaries. The annuity amount is calculated such that the value of the contributed assets is larger than the actuarial value of the annuity, providing a remainder interest for the charity.

IRC section 72 allows an exclusion from income for annuity payments received, up to the value invested in the annuity. In addition, if appreciated assets are contributed, the capital gain can be recognized by the donor over the life of the annuity.

Because each of these split-interest entities leaves a remainder interest to a charity, a charitable contribution deduction is allowed for a portion of the amount of the donation. The deduction allowed is based on an IRS formula. However, a taxpayer’s AGI can further limit the charitable contribution deduction.

QCDs TO SPLIT-INTEREST ENTITIES

IRC section 408(d)(8) details the requirements for a QCD. The SECURE 2.0 Act amended this section by adding a new possibility for a QCD. On a one-time basis, a taxpayer can now make a QCD to one of the split-interest entities described above. Each must be funded exclusively by QCDs. In addition, in the case of a CGA, fixed annuity payments of 5% or greater must commence within one year of the date of the funding. The maximum amount for this new QCD is $50,000. The lead beneficiary(ies) can only be the IRA account holder, a spouse, or both; in addition, the income interest cannot be assignable.

Other special rules also apply to this type of QCD. For either of the trust options, the payments to the non-charitable beneficiary(ies) will be treated as ordinary income and cannot qualify as capital gains or tax-free income. QCDs used for a charitable gift annuity are not treated as investments in the contract, so none of the annuity payments received from a charitable gift funded by a QCD can be excludable and will all be treated as ordinary income.

THE JOURNAL ENTRY | SUMMER 2023 19

ADVANTAGES AND DISADVANTAGES

Perhaps the most important benefit from this new law is the tax advantage to the donor. If the new QCD is used to contribute to a split-interest entity, although there is no tax deduction available for the calculated remainder interest to the charity, there is no tax liability for the amount withdrawn from the IRA. In this case, the donor gets a tax advantage for the entire amount of the IRA distribution rather than just for the partial amount of the remainder interest, and the taxpayer does not need to itemize to get this advantage. In addition, the amount withdrawn from the IRA can still count toward the annual RMD for that year but never becomes part of AGI.

However, that tax advantage comes with multiple possible disadvantages.

1. The trust or CGA payments to the non-charitable beneficiary(ies) will be defined as ordinary income; there will be no potential tax advantage for any of the life income (excludable or capital gain treatment).

2. A split-interest entity in this case can only come from QCDs. For any individual, this would mean the maximum amount would be $50,000 (indexed). While charities might be willing to set up a CGA for this amount, the costs of setting up and administering a trust may necessitate larger asset transfers to make a trust worthwhile.

3. If both spouses have IRAs and transfer $50,000 each through a QCD to the same split-interest entity, it is possible the total contribution could be $100,000 (indexed). This amount may still be too small to be worthwhile to trust companies.

4. If spouses desire to make QCDs to the same split-interest entity, this would either need to be done by both spouses simultaneously or they would have to be done through a CRUT. Because CRATs and CGAs make payments based on the initial fair value, they cannot accept additional contributions after the initial amount.

5. One or both parents creating a split-interest entity through a QCD cannot designate a child a beneficiary, as they can with split-interest entities

created in other ways. In addition, there cannot be more than two lead beneficiaries of a trust funded through a QCD, as there can be with a trust created in another way. CGAs are already limited to not more than two lead beneficiaries; for a CGA created through a QCD, they can only be the IRA owner, a spouse, or both.

6. A split-interest entity may not provide much life income based on the dollar limitation of the QCD and the limit of a one-time-only transfer. Annual income of 5% of $50,000 would only be $2,500. If this small amount of income is not really needed, it might be better to just make a QCD directly to the charity rather than to a split-interest entity. That way the charity would get the full benefit of the QCD amount rather than just the remainder interest.

7. A $50,000 QCD to a split-interest entity may not be very helpful to those who want to make exceptionally large charitable gifts with a significant amount of lifetime income.

The potential increased tax advantage of a QCD to a split-interest entity makes this new tax provision sound quite helpful, both to charities and to those with IRAs who desire to support charities. However, taken together, the disadvantages may make it difficult for charities and trust companies to focus a lot of effort in this area. In addition, the dollar limit for this QCD and the one-time limitation may not be adequate to motivate many qualified seniors to take advantage of this opportunity. n

This article is based on a longer article that was published in Tax Notes Federal (https://taxnotes.co/3J8Wwb3) and Tax Notes State (https://taxnotes.co/3X3vCa5) on June 12, 2023.

Sheldon R. Smith is a professor of accounting at the Woodbury School of Business at Utah Valley University in Orem, Utah. He graduated from BYU with a B.S. degree in accounting and a joint MAcc/MBA. He completed a Ph.D. degree in accounting at Michigan State University.

THE JOURNAL ENTRY | SUMMER 2023 20

2023 GOLF TOURNAMENT

THURSDAY, AUG. 17 | OLD MILL GOLF COURSE

GRAND PRIZE DELTA GIFT CARD

The UACPA’s annual golf tournament supports the CPAs of the future through the Utah CPA Foundation. This fundraising event includes a lunch buffet, exclusive giveaways and prizes.

Old Mill Golf Course provides spectacular panoramic views of the Wasatch Valley. It is conveniently located off I-215, a short drive from all major areas of the valley.

Date: Thursday, Aug. 17

Time: 8:00 a.m. shotgun start

Location: Old Mill Golf Course, 6080 Wasatch Blvd., Salt Lake City

Fees: $500 per foursome; $150 per individual

7:00 a.m. – Registration Opens

8:00 a.m. – Shotgun Start

12:30 p.m. – Lunch Buffet & Awards

TO REGISTER OR SPONSOR, VISIT UACPA.ORG/GOLF

MEMBERSHIP

NEW MEMBERS

Congratulations to the following individuals who were approved for membership in the UACPA as of May 31, 2023.

Joan D. Burk

Utah Transit Authority

Michael Fisher

Grant Thornton LLP

Ian Keyes

Cayden Law

Tanner LLC

Jeff Niebergall

Jones Simkins LLC

Deon B. Taylor

Tom Wheelwright

WealthAbility

Student Affiliates

Brigham Young University

Thomas Hall

Caroline Cochran

Brooklyn Angle

Lauren Mackin

Abigail Braithwaite

Henri Hammari

Rachel Hall

Brian Ray

Joseph Richards

Caleb Judd

Jared Robins

Michael Stubbs

Bryce Burley

Elizabeth Bowers

Taina Carvalho

Abigail Lisonbee

Jacob Hendershot

Elise Snow

Nicole Humpherys

Alvin Torrico

Utah Tech University

Sage Dutson

Treyson Jones

Sierra Demers

Alexis Saldivar

Dylan Bourgoin

Nicholas Hardy

AudriLyn Morley

Thomas McFarlane

Dane Stewart

Erin Callahan

William Farris

Ben Blake

Brandon Reynolds

Whitney Brown

Alex Searle

Connor Smith

Joshua Wallentine

Derek Johnson

Utah Valley University

Ashley Olsen

Oakley Olson

Sage Stoker

Irene Pole

Natalie Edwards

Morgan Marcom

Zoram Quintana

Kiersten Hancock

Utah State University

Michael Moore

Mark Godfrey

Julie Andrews

Rebecca Adhikari

Allison Hansen

University of Utah

Zaid Saffarini

Ailama Fesola’i

Eduardo Flores

Weber State University

Alysa Smith

Susanah Kunzler

Jaren Smith

Jaxon Wortley

Salt Lake Community College

Jonathan Lishenko

Jessica Hicks

Emily Ayres

Southern Utah University

Katelyn Church

Allison Smith

Katherine Niederehe

Richard Hrabchak

Andrew Blanco

IN MEMORIAM

Thaes Webb, Jr.

March 15, 1933 – April 25, 2023

Member since 1964

Lynn Eldon Janes

May 5, 1938 – April 12, 2023

Member since 1963

Larry George Simpson

July 8, 1954 – April 22, 2023

Member since 1981

Rex K. Griffiths

April 14, 1941 – Feb. 17, 2020

Member since 1971

THE JOURNAL ENTRY | SUMMER 2023 22

MEMBERS IN THE NEWS

Do you or your firm have news to share? Send the details to Amy Spencer, as@uacpa.org.

Joanna Johnston, CPA, has joined Frazier & Deeter as tax principal at their Las Vegas office. Joanna has nearly two decades of experience and specializes in nonprofit organizations, high-net-worth individuals, and passthrough entities. Joanna has previously chaired the UACPA’s Nonprofit Committee and has been recognized by Utah Business Magazine with “30 Women to Watch.”

Tanner LLC has named Crystal Bush CFO of the company. With 11 years of accounting experience, Crystal has worked in Tanner’s assurance departmennt for the past seven years. She has a master’s in accounting from Weber State University.

Eide Bailly has promoted Sam Lake, CPA, to audit partner. He specializes in providing audit and assurance services to clients in a varety of industries. Sam has worked for Eide Bailly for 10 years. He received his Master of Accounting from the University of Utah.

CLA (CliftonLarsonAllen LLP) has promoted Tommy Jensen, CPA, (top) to managing principal and Rich Haubrich, CPA to principal. Tommy began his career at PwC and was previously an assurance partner at BDO. He received his Master of Accounting from the University of Utah. Rich provides tax planning compliance and consulting to privately held businesses and their owners. He also received his master of accounting from the University of Utah. CLA is the eighth largest accounting firm in the U.S. and one of the largest professional services firms in the Salt Lake City area.

Haynie & Company has earned the 2023 Top Workplaces Culture Excellence Recognition from Energage, a research company that surveys employees. Top workplace awards are based solely on employee feedback. Areas of consideration for the award include innovation, worklife balance, compensation and benefits, leadership, and purpose and values.

THE JOURNAL ENTRY | SUMMER 2023 23 MEMBERSHIP

Listen to Conversations with UACPA Members on the Money Making Sense Podcast . Find it wherever you listen to podcasts.

DISCOVER COLLABORATION AND DISCUSSION ON UACPA CONNECT

• Send messages to other UACPA members

• Ask questions and learn from other CPAs

• Collaborate and share ideas with like-minded professionals

• Find discussions or create a new one

1. Log into Connect

Get to UACPA Connect from our website at uacpa.org and select it from the dropdown menu at “My UACPA” or directly at connect.uacpa.org.

2. Find groups and start or participate in discussions

• Go to My Group Pages > My Groups to see any committees or groups you are currently a member of.

• Use Find Group to Join to find and join in group discussions.

• Visit any group page to read updates, reply, or Post a New Discussion.

3. Set your profile and notification settings

• Click on My Account > My Profile in the gray navigation bar on the left side of the page.

• From here you can upload a photo, add bio information, and select your notification settings.

THE JOURNAL ENTRY | SUMMER 2023 24

UACPA CONNECT WILL HELP YOU

Get Started!

LEADERSHIP COUNCIL

Leadership Council met on June 16 to hear from the AICPA, NASBA and AAA about reducing barriers to licensure. Leadership Council is made up of committees, councils, past presidents, educators, Leadership Academy alumni and students.

U.S. CAPITOL VISITS

THE JOURNAL ENTRY | SUMMER 2023 25 PHOTOS

UACPA board members and PAC committee made visits to Utah’s policy makers in Washington D.C. during Spring Council.

WHAT ARE YOU DOING TO MAKE THIS SUMMER MEMORABLE?

Dustin Wood, CPA

“I always have tickets to a handful of shows at any given point in time. It is good to be past the COVID restrictions as that really took away a big part of what I enjoy doing.”

Stacy Weight, CPA

“This summer will be exceptionally memorable for me, as I am spending quality time with my oldest two children, who I will be moving out at the end of summer so they can begin their college experience!”

Annette Andersen, CPA

“I am 100% a summer person! I love making memories with my family; dinners, hiking and biking, and working together on worthwhile projects. Our vacations are in Utah this year: Moab, Bryce, Zion, Alton, and other wonderful spots. We are excited to be extras in TC Christensen’s new movie based on my relative.”

Ray Langhaim, CPA

“This summer is my 35 year anniversary, so a big celebration, but trying to spend as much time with grandkids as possible Utah is beautiful in the summer, and I hope to get some good hikes in too.”

Mark Anderson, CPA

“This will be the first summer as true empty nesters. I want to enjoy that and spend time with our family especially the arrival of our newest granddaughter.”

Jason Tomlinson, CPA

“It looks to be a normal, busy summer with my teenagers going in several directions. However, we have several family camps and backpacking trips planned to get away from the ‘busy.’”

Ariane Gibson, CPA

“I have two fun summer trips this year: the Redwood National Park and France to attend a destination wedding. The rest of the summer will be filled with the rush of fiscal year end closing (June 30) with any free moments spent with my family and in my garden.”

Shalaun Howell, CPA

“This summer I am relandscaping my yard with two goals in mind: (1) finally admitting that Utah is a desert, and, (2) creating the level of maintenance I want to handle when I am 65.”

Marci Butterfield, CPA

“My husband and I are going to be taking some road trips to bucket list destinations. We are also going to be doing a lot with family such as trips to the cabin and grilling on the patio. I am also doing a lot of gardening!”

Dan Frei, CPA

“My daughter graduated from high school this past month. I told her if she took six years of Spanish during jr. high and high school, my wife and I would take her to a Spanish speaking country for her graduation present. She did her part, so we are taking her to Costa Rica in July.”

THE JOURNAL ENTRY | SUMMER 2023 26

BOARD

QUESTION

WHAT ARE YOU DOING TO MAKE THIS SUMMER MEMORABLE?

Amy Spencer

“Earlier this year, I reserved several campsites in cooler places so that I have somewhere to go when I need to get out of the hot city. I am looking forward to camping near lakes where I can enjoy stand-up paddleboarding.”

April Deneault

“I have my girls trip to Moab with my mom and sisters in June and then some family camping trips planned throughout the summer. ”

Tom Horn, CPA

“Moving into a new home and booking a trip to France!”

BOARD BRIEF

THE LATEST ACTIVITIES WITH THE BOARD

• Highlights were given from the March AICPA Regional Council meeting update. Topics included consideration of potential threats to mobility as states are looking at changing licensure requirements.

• Pipeline challenges continue to dominate the profession as many baby boomers retire and we continue to see a decreasing trend in students majoring in accounting across the nation. Utah is holding steady; there is still cause for concern, however.

Susan Speirs, CPA

“My husband and I get to go on a longawaited adventure in Alaska later this summer. On the docket is glacier gazing, hiking with the bears, sightseeing through Glacier Bay National Park and, of course, some salmon fishing.”

• Legislation has been dropped in the state of Minnesota that would provide a pathway to licensure at 120 hours with a requirement of additional work experience. Discussion about 120 v. 150 covered whether the education requirement is a threat to the profession or whether the lack of attractiveness is in “front and center.” The AICPA has drafted a Pipeline Acceleration Plan that addresses Education and Experience, Learn and Earn Program that would be developed within the AICPA. Concern has been expressed whether the program would be substantially equivalent as per the Uniform Accountancy Act and whether they should even be creating a program.

• Leadership Council was held June 16 at Little America. The topic was 120 v. 150. Representatives from the AICPA, NASBA and AAA were invited to participate in the conversation.

THE JOURNAL ENTRY | SUMMER 2023 27

STAFF CHAT

CYBER RISK SERIES

Managing cyber risks and staying compliant with data security requirements has not only become an essential business practice, but a matter of survival. Unfortunately, most businesses, CPA firms, and financial professionals are not doing enough to mitigate the financial and reputational damages associated with data breaches and cyber-attacks.

INVISUS CEO James Harrison leads this series where you can earn one hour of CPE. Plus it’s free to members.

Aug. 10

Understanding Cybersecurity Regulations & Standards

Oct. 12

Effective Cyber Risk Management Made Simple

Nov. 9

Leveraging Cybersecurity to Build Customer Loyalty

uacpa.org/cyber-series

THE JOURNAL ENTRY | SUMMER 2023 28

MEET A MEMBER MICHAEL MICHELSEN, CPA

What do you like about volunteering with the UACPA? I have enjoyed meeting and getting to know people I would not have met otherwise. With the foundation, it has been gratifying to see many of the things our association members do to give back to their communities. I especially loved hearing about the financial literacy task force when they were teaching classes at the prison. More recently, it is exciting to see the activities planned at local universities that are part of the association’s pipeline outreach.

What would surprise people to know about you? I learned to play the violin beginning in elementary school and played through junior high. I also took piano lessons for several years. I am currently teaching myself to play the ukulele.

What is your favorite book? There are too many good ones to choose. I was an avid reader of science fiction, and it is still my favorite genre. I recently reread the Dune series by Frank Herbert.

Michael

Michelsen was born in Glendale, California, and later moved to Cottonwood Heights in Utah. After graduating from Brighton High School, he attended Brigham Young University where he earned his bachelor’s and master’s degrees. He soon began working for Hansen, Barnett & Maxwell and became a partner in 2009. He remained with the firm after it merged into Eide Bailly LLP in September 2013. Michael volunteers with the UACPA’s State & Local Government Committee and is the board chair for the Utah CPA Foundation. Michael and his wife, Nancy, married in 1996 and have four adult children. He says, “we are looking forward to having an empty nest and to future grandchildren.”

What led you to become an accountant? My father was a CPA. He worked as the controller for a medical device manufacturing company, and I had the opportunity to help in the accounting department doing data entry when the accounting system was upgraded. I saw closely what accountants do, and chose accounting as my major. During my accounting program, visiting CPAs presented about their careers. I was impressed by a CFO who was reading a medical textbook. He explained that as CFO, he needed to fully understand the business to fulfill his position. I realized that accountants need to know more than just accounting. I was attracted by the necessity to continue learning as standards change and saw a career that provided an opportunity for lifelong learning.

What do you like to do outside of work? For a long time, we chased our children to their activities. We have attended music and dance recitals, soccer and baseball games, musical theater, and robotics tournaments. Now that our youngest has graduated from high school, we are planning to travel more, starting with London and Paris this summer. As a family of Disney fans, we spend too much time at Disneyland or Disney World. Future travel plans include additional cities in Europe, more cruising to sunny destinations, and hopefully a visit to each MLB stadium. When I was four, my father took me to my first Dodger game, and I have been a fan ever since.

What are your goals both personally and professionally?

Professionally, I hope to contribute to Eide Bailly reaching its revenue goal of $1 billion by 2030. Personally, we plan to travel more and hope to spoil any future grandchildren.

What advice do you live by? “Free advice is worth what you pay for it.” My father-in-law also used to say, “I’m going to give you some advice, and you can do whatever you want with it.” When people give advice, they mean well; however, the same thing does not work for everyone. These quotes also help me be careful about the unsolicited advice I give others. I will usually preface my advice with one of the two idioms. n

THE JOURNAL ENTRY | SUMMER 2023 29

UACPA Virtual Courses

*Early-bird pricing available for classes when registering at least two weeks in advance. (Excludes 4-hour courses and core training courses). AICPA members receive an additional $30 off the price of each 8-hour course (excluding 4-hour courses and core training courses) where the AICPA is listed as the vendor. Use promo code AICPA8 for 8-hour courses.

THE JOURNAL ENTRY | SUMMER 2023 30

Register online at uacpa.org/cpe. July 7/10/23 8 Postmortem Estate Planning Arthur Werner Werner-Rocca Seminars, Ltd. $250 $300 7/13/23 4 Current Issues in Accounting and Auditing: An Annual Update Robert Wells Surgent McCoy $164 $189 7/18/23 4 Employer’s Handbook: Health Care, Retirement, and Fringe Benefit Tax Issues Arthur Auerbach Surgent McCoy $164 $189 7/20/23 8 Estate Planning — Beyond the Basics Arthur Werner Werner-Rocca Seminars, Ltd. $250 $300 7/21/23 2 Depreciation Rules for Bonus and Section 179 Expensing Don Cochran Surgent McCoy $95 $110 7/25/23 8 Social Security and Medicare: Planning for Your Clients Arthur Auerbach Surgent McCoy $260 $310 August 8/3/23 8 Financial Reporting Update for Tax Practitioners Robert Wells Surgent McCoy $260 $310 8/8/23 8 Fringe Benefit Planning for 2023 and Beyond Arthur Werner Werner-Rocca Seminars, Ltd. $250 $300 8/8/23 2 Work-Life Balance: Maximizing Productivity and Understanding Related Tax Issues Arthur Pulis Surgent McCoy $95 $110 8/9/23 8 Annual Accounting and Auditing Update Ken Levine Surgent McCoy $260 $310 8/10/23 2 Combating Internal Fraud Karl Egnatoff Taynes LLC $95 $110 8/11/23 2 Defining Where and Why Internal Controls are Needed Karl Egnatoff Taynes LLC $95 $110 8/14/23 2 Reducing a Business Owner Client’s Exposure to Social Security and SelfEmployment Taxes Dennis Riley Surgent McCoy $95 $110 8/15/23 8 K2’s Excel Pivot Tables for Accountants Brian Tankersley K2 Enterprises $250 $300 8/16/23 4 Finance Business Partnering: Successful Business Models and Strategic Choices Lance Radziej AICPA $164 $189 8/17/23 4 Critical Issues That CPAs in Industry Will Need to Face This Year Jason Carney Surgent McCoy $164 $189 8/21/23 2 Current and Upcoming FASB Issues Kurt Oestricher AICPA $95 $110 8/22/23 4 Gaining a Competitive Advantage: Critical Skills for CFOs and Controllers Jay Giannantonio Surgent McCoy $164 $189 8/25/23 8 Breaking Down the New Auditor’s Reporting Suite of Standards for NonERISA Engagements Leah Donti AICPA $260* $310 8/28/23 8 Audits of ERISA Plans, With a Focus on 401(k) Plans Randy Dummer AICPA $260* $310 8/29/23 8 Employee Benefit and Retirement Planning: Pension and Deferred Compensation Tools Arthur Werner Werner-Rocca Seminars, Ltd. $250 $300 8/30/23 2 Employee Stock Options: What Financial Professionals Should Know When Advising Their Clients Arthur Auerbach Surgent McCoy $95 $110 DATE CPE COURSE TITLE INSTRUCTOR VENDOR MEMBER FEE* NONMEMBER FEE

CPECourseSchedule

THE JOURNAL ENTRY | SUMMER 2023 31 september 9/7/23 8 Audits of 401(k) Plans: New Developments and Critical Issues Martha Lindley Surgent McCoy $260 $310 9/7/23 8 Creative Strategies for Buying, Selling, or Gifting a Business Arthur Werner Werner-Rocca Seminars, Ltd. $189 $164 9/11/23 4 IRS Tax Examinations and Hot Issues Michael Reilly Surgent McCoy $164 $189 9/11/23 8 CFO - Big Picture Mega-Trends and Risks Bob Mims The Knowledge Institute $260 $310 9/12/23 4 Finance Business Partnering: Communicating and Influencing for Optimum Engagement Rebeka Mazzone AICPA $164 $189 9/13/23 4 Controller/CFO Update: Hot Topics Facing Today’s Financial Professional Art Pulis Surgent McCoy $164 $189 9/14/23 2 Internal Control Changes for Telecommuting Workers Karl Egnatoff Taymes LLC $95 $110 9/14/23 2 Top Business Tax Planning Strategies Charles Borek Surgent McCoy $95 $110 9/15/23 2 Bankruptcy Basics: Understanding the Reorganization and Liquidation Process in These Uncertain Economic Times Jason Carney Surgent McCoy $95 $110 9/15/23 2 Keeping Organization Assets Safe Karl Egnatoff Taymes LLC $95 $110 9/20/23 8 A Practical Guide to Trusts Arthur Werner Werner-Rocca Seminars, Ltd. $250 $300 9/20/23 4 Small-Business Accounting, Audit, and Attest Update Hunter Cook Surgent McCoy $164 $189 9/21/23 8 Advanced Taxation LLCs & Partnerships Deborah Phillips AICPA $250* $310 9/25/23 4 The Most Critical Challenges in Governmental Accounting Today Philip Marciano Surgent McCoy $164 $189 9/27/23 4 Conducting a Remote Audit Daryl Krause AICPA $164 $189 9/28/23 8 Estate Planning for 2023 and Beyond Arthur Werner Werner-Rocca Seminars, Ltd. $250 $300 OctOber 10/4/23 4 Operations Level Internal Control Karl Egnatoff Taymes LLC $164 $189 10/10/23 8 CFO - Planning for the Long Term Anita Layton The Knowledge Institute $260 $310 10/11/23 8 Current Developments and Best Practices for Today’s CFOs and Controllers Art Pulis Surgent McCoy $260 $310 10/12/23 8 Advanced Audits of 401 (k) Plans: Best Practices and Current Developments Robert Bedwell Surgent McCoy $260 $310 10/17/23 8 Advanced Tax Planning for S Corporations Brian Greenstein AICPA $260 $310 10/17/23 4 Annual FASB Update and Review Hunter Cook Surgent McCoy $164* $189 10/17/23 8 CFO - Preparing for Change Brian Maturi The Knowledge Institute $260 $310 10/18/23 8 Performing Single Audits Under the Uniform Guidance for Federal Awards Martha Lindley Surgent McCoy $260 $310 10/19/23 8 The Best S Corporation, Limited Liability, and Partnership Update Course Michael Reilly Surgent McCoy $260 $310 10/19/23 4 K2’s An Accountant’s Guide to Blockchain and Cryptocurrency Steve Yoss K2 Enterprises $164 $189 10/19/23 4 K2’s Case Studies in Fraud and Technology Controls Steve Yoss K2 Enterprises $164 $189 10/20/23 4 Federal Tax Update Individuals with Greg & George Gregory White Cutting Edge Tax Strategies $175 $200 10/20/23 4 2023 Federal Tax Update Business with Greg & George Gregory White Cutting Edge Tax Strategies $175 $200 10/24/23 8 A Practitioner’s Guide to IRAs and Qualified Retirement Plans Arthur Werner Werner-Rocca Seminars, Ltd. $250 $300 DATE CPE COURSE TITLE INSTRUCTOR VENDOR MEMBER FEE* NONMEMBER FEE

*Early-bird pricing available for classes when registering at least two weeks in advance. (Excludes 4-hour courses and core training courses). AICPA members receive an additional $30 off the price of each 8-hour course (excluding 4-hour courses and core training courses) where the AICPA is listed as the vendor. Use promo code AICPA8 for 8-hour courses.

THE JOURNAL ENTRY | SUMMER 2023 32

OctOber cOntinued 10/24/23 4 Finance Business Partnering: Techniques for Effective and Impactful Communications Lance Radziej AICPA $164 $189 10/24/23 4 A Financial Statement Disclosures: A Guide fo rSmall and MediumSized Businesses Hunter Cook Surgent McCoy $164 $189 10/25/23 4 How Fraud Can Affect Smaller Organizations Karl Egnatoff Taymes LLC $164 $189 10/25/23 3 PreparingSchedules K-2 and K-3: Critical Update for Reporting ForeignRelated Tax Information for Partnerhships and S Corporations Dennis Riley Surgent McCoy $115 $130 10/26/23 2 Current Audit Environment and ASB Activity Michael Brand AICPA $95 $110 10/27/23 4 Choice and Formation of Entity Charles Borek AICPA $164 $189 10/30/23 4 Tax Research I David Peters AICPA $164 $189 10/30/23 4 Tax Research II David Peters AICPA $164 $189 10/31/23 4 Reviewing Individual Tax Returns: What Are You Missing? David Peters AICPA $164 $189 10/31/23 4 Reviewing Partnership Tax Returns: What Are You Missing? David Peters AICPA $164 $189 10/31/23 4 Guide to Payroll Taxes and 1099 Issues Arthur Auerbach Surgent McCoy $164 $189 nOVember 11/1/23 4 Introduction to Forensic Accounting Robert Wells Surgent McCoy $164 $189 11/2/23 8 Form 990: Best Practices for Accurate Preparation Robert Lyons AICPA $260* $310 11/6/23 4 Enterprise Risk Management Concepts and Strategy for Small and Medium-Sized Compnies Ronald Kral Surgent McCoy $164 $189 11/6/23 4 Protecting Digital Data - More Important Now Than Ever Before Karl Egnatoff Taymes LLC $164 $189 11/7/23 2 Contract Accounting and Lease Accounting and Their Impact on Construction Contractors Eugene Ristaino AICPA $164 $189 11/7/23 4 Federal Tax Update Individuals with Greg & George Gregory White Cutting Edge Tax Strategies $175 $200 11/7/23 4 Federal Tax Update Business with Greg & George Gregory White Cutting Edge Tax Strategies $175 $200 11/8/23 4 Social Security and Medicare: Maximizing Retirement Benefits Andrew Blum AICPA $164 $189 11/8/23 8 Surgent’s Comprehensive Guide to Tax Depreciation, Expensing, and Property Transactions Dennis Riley Surgent McCoy $260 $310 11/9/23 4 Limited Liability Companies: Losses, Liquidations, Terminations, Continuations, and Sales Arthur Auerbach Surgent McCoy $164 $189 11/10/23 8 CFO - Skills for 2023 and Beyond Bob Mims The Knowledge Institute $260 $310 11/10/23 8 Federal Tax Update - Individual & Business Current Developments J Patrick Garverick The Tax U $325 $375 11/13/23 8 Advanced Partnership Taxation with Greg & George Gregory White Cutting Edge Tax Strategies $325 $375 11/14/23 8 S Corporations - Planning and Tax Strategies Greogry White Cutting Edge Tax Strategies $325 $375 11/15/23 8 Evaluating Fraud Risk in a Financial Statement Audit Ken Levine Surgent McCoy $164 $189 11/16/23 2 Maximize Social Security Benefits Gregory White Cutting Edge Tax Strategies $95 $110 11/16/23 2 Becoming a Tax Ninja: Loss Limitations - Basis, At-risk, Passive Activity and 461 (I) Gregory White Cutting Edge Tax Strategies $95 $110 DATE CPE COURSE TITLE INSTRUCTOR VENDOR MEMBER FEE* NONMEMBER FEE

THE JOURNAL ENTRY | SUMMER 2023 33 nOVember cOntinued 11/17/23 8 Estate Planning - Business Issues Arthur Werner Werner-Rocca Seminars, Ltd. $250 $300 11/17/23 8 Introduction to Business Acquisitions Bruce Nelson AICPA $260* $310 11/20/23 8 International Taxation Adan Islam AICPA $260* $310 11/20/23 4 Guide and Update to Compilations, Reviews, and Preparations Robert Wells Surgent McCoy $164 $189 11/21/23 4 Preparation and Compilation Engagements Under the SSARS Robert Wells Surgent McCoy $164 $189 11/21/23 8 The Complete Guide to Estate Administrations Arthur Werner Werner - Rocca Seminars, Ltd. $250 $300 11/30/23 4 Common Deficiencies in SSARS Engagement Melissa Galasso Galasso Learning Solutions $164 $189 december 12/1/23 8 Hottest Tax Topics for 2022 William Murphy AICPA $260* $310 12/4/23 2 Annual Update for Defined Contribution Plans Joann Cross Surgent McCoy $95 $110 12/4/23 2 Lease Accounting: The Impact of Changing Standards on Both Lessors and Lessees Joann Cross Surgent McCoy $95 $110 12/5/23 2 Government GAAP Update Melisa Galasso Galasso Learning Solutions $95 $110 12/5/23 8 Financial and Estate Planning Techniques of Charitable Arthur Werner Werener-Rocca Seminars, Ltd. $250 $300 12/6/23 4 Government and Nonprofit Frauds and Controls to Stop Them Diane Edelstein Surgent McCoy $164 $189 12/6/23 8 The Best Estate and Financial Planning Topics of 2023 Arthur Werner Werner-Rocca Seminars, Ltd. $250 $300 12/7/23 8 Advanced Income Tax Accounting Robert Bedwell AICPA $260* $310 12/7/23 4 Applying the Yellow Book to a Financial Statement Audit Diane Edelstein Surgent McCoy $164 $189 12/11-12/23 16 S Corporations: Hot Issues of 2023 Robert Jamison Robert W Jamison CPA $450 $500 12/11/23 8 CFO - Staying Ahead in a Dynamic Economy Robert Berry The Knowledge Institute $260 $310 12/11/23 8 Federal Tax Update - Individuals (Form 1040) J Patrick Garverick The Tax U $325 $375 12/12/23 8 Federal Tax Update - C & S Corporations, Partnerships & LLCs (Forms 1120, 1120S & 1065) J Patrick Gaverick The Tax U $325 $375 12/13/23 8 Project Management for Finance Professionals Art Pulis Surgent McCoy $260 $310 12/14/23 4 Federal Tax Update Individual with Greg & George Gregory White Cutting Edge Tax Strategies $175 $200 12/14/23 4 Federal Tax Update Business with Greg & George Gregory White Cutting Edge Tax Strategies $175 $200 12/14/23 2 Lessons Learned from Successful Companies Samuel Monastra Surgent McCoy $95 $110 12/15/23 8 Annual Update and Practice Issues for preparation, Compilation, and Review Engagements Joann Cross AICPA $260* $310 12/15/23 8 CFO - Today’s Staff Retention and Accounting Steve Bousson The Knowledge Institute $260 $310 12/19/23 2 Working Paper Documentation Charles Borek AICPA $95 $110 12/19/23 4 Section 199A: Schedule K-I Reporting by Relevant Pass-Through Entities Arthur Auerbach Surgent McCoy $164 $189 12/20/23 4 IRS Disputes Arthur Auerbach AICPA $164 $189 12/20/23 8 S Corporations: Advanced Workshop Robert Jamison Robert W Jamison CPA $260 $310 12/21/23 2 Starting Small Business: What Every Trusted Advisor and Entrepreneur Needs to Know Arthur Pulis Surgent McCoy $95 $110 DATE CPE COURSE TITLE INSTRUCTOR VENDOR MEMBER FEE* NONMEMBER FEE

UACPA MISSION MISSION

The UACPA leadership supports and challenges members through advocacy, professional education, leadership development, networking, and community service to help them succeed in a competitive and changing world.

VISION

At the UACPA, our vision is to be a world-class professional association essential to our members.

We unite a vibrant community of CPAs to enhance the success of our members and champion the values of the profession; integrity, competency, and objectivity.

VALUES Advocacy

The UACPA represents the profession at the Legislature and other regulatory bodies and promotes the value of the CPA to employers, the business community, and the public at large.

Leadership & Service

The UACPA provides leadership and service within the profession, within the UACPA, and within the community.

Professional Development

The UACPA supports and encourages continuing education and leadership development.

Professional Community

The UACPA reinforces peer accountability to encourage members to maintain integrity and high ethical standards. It provides member-tomember networking opportunities and networking opportunities with other professions. It values belonging to a distinguished organization and believes that we serve as the primary resource and point of contact for Utah CPAs.

Diverse Population Outreach

The UACPA believes in reaching out to under-represented populations, those returning to the profession or choosing it as a second career, and other professions.

CONGRATULATIONS

100% FIRMS

Congratulations to the firms and businesses currently participating in the UACPA’s 100% membership program. This demonstrates their commitment to the profession, to the association’s high ethical standards and lifelong learning.

• Adams & Petersen, CPAs

• FORVIS

• CBIZ MHM, LLC

• Cook Martin Poulson, P.C.

• Davis & Bott, Certified Public Accountants, L.C.

• Eide Bailly

• Haynie & Company

• HBME

• HintonBurdick

• Jones Simkins LLC

• Savage Esplin & Radmall, PC

• Squire & Company, PC

• Tanner LLC

• WSRP

Firms with 10 or more full-time CPAs are eligible to be a part of the 100% membership program. Call our membership team to sign up, 801.466.8022.

THE JOURNAL ENTRY | SUMMER 2023 34

Nonprofit Org. U.S. Postage PAID Salt Lake City, UT Permit No. 1996 UTAH ASSOCIATION OF CPAS 15 W. SOUTH TEMPLE, STE 1625 SALT LAKE CITY, UT 84101 Get started with CPACharge today cpacharge.com/uacpa AL: $3,000.00 *** PAY CPA

increase in cash flow with online payments

of consumers prefer to pay electronically

of bills sent online are paid in 24 hours CPACharge is a registered agent of Synovus Bank, Columbus, GA., and Fifth Third Bank, N.A., Cincinnati, OH. AffiniPay customers experienced 22% increase on average in revenue per firm using online billing solutions

22%

65%

62%

– Cantor Forensic Accounting, PLLC

Trusted by accounting and tax professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments

. + Member

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles

BY JAYSON TALAKAI, PH.D.

BY JAYSON TALAKAI, PH.D.