JOURNAL ENTRY THE

THE UTAH ASSOCIATION OF CERTIFIED PUBLIC ACCOUNTANTS

TURNING STAFF INTO STORYTELLERS

Utah Association of Certified Public Accountants

15 W. South Temple, Suite 1625

Salt Lake City, UT 84101

801-466-8022

mail@uacpa.org www.uacpa.org

Managing Editor

Amy Spencer as@uacpa.org

2025 – 2026

UACPA Executive Board

President: Dan Frei, CPA

President-Elect: Amy Anholt, CPA

Vice President: Rusty Hansen, CPA

Treasurer: David Peaden, CPA

Secretary: Dan Greer, CPA

Member-at-Large: Clinton Armstrong, CPA

Member-at-Large: Noah Meyers, CPA

Emerging Professionals: Melanie Spencer, CPA

Immediate Past President: Jason Tomlinson, CPA

AICPA Council: Stacy Weight, CPA

CEO: Susan Speirs, CPA

UACPA Staff

CEO: Susan Speirs, CPA

CPE Director: April Deneault

Communications & Marketing Director: Amy Spencer

Cover photo with Squire employees Kayla Smith, Andy Nelson, and Kendall Christensen by Chris Wood // robertwoodphoto.com

UACPA Statement of Policy

The Journal Entry is published four times a year by the Utah Association of Certified Public Accountants (UACPA). The opinions, views and articles expressed in this magazine are those of the authors and not necessarily those of the UACPA. This magazine should not be deemed an endorsement by the UACPA or its committees or editorial staff of any views, opinions or positions contained herein. Copyright © 2025 Utah Association of Certified Public Accountants

Thisyear, the UACPA’s image initiative focuses on ways to improve our image and highlights how every member can contribute. In the last issue of The Journal Entry, we showcased the vibrant lives of our board members, illustrating that CPAs are interesting, capable, and fun. Our board members are just a glimpse of the many engaging CPAs across Utah. This quarter, we continue that narrative by sharing compelling stories from a local CPA firm. These efforts are crucial for all members as we tell a more engaging and accurate story about the CPA profession and elevate its standing.

Our next step is a targeted branding initiative. The UACPA has partnered with Jed Morley of Backstory to lead our CPA visibility campaign. A core objective is to transform public perception of CPAs from “number crunchers” to indispensable “strategic advisors.” This shift offers immense benefits: attracting top talent, fostering career growth, and significantly increasing our perceived value among clients and businesses. I hope you’ll embrace this initiative, understanding that a rising tide lifts all boats when we collectively amplify our impact.

We have started gathering crucial feedback through a comprehensive survey sent to business leaders across the intermountain region and UACPA members. Numerous focus groups will also be conducted. You can help by getting involved. Understanding our current perception is fundamental to shaping our desired future image and crafting a plan to bridge that gap.

The role of a strategic or trusted advisor is multifaceted. At the AICPA Spring Council in Washington D.C., I saw firsthand how this perception initiative resonates nationally. AICPA President Mark Koziel, in his presentation “Rise to the Future Together,” laid out a compelling vision for this critical role. He defined a trusted advisor as someone who, among other things, offers clients an integrated approach to problemsolving and strategy, delivers services with impeccable timing, and acts as a key advisor in change management and transformation. His insights underscored the concrete ways we can embrace this unified future..

It truly is an exciting time to be a CPA! I’m inspired by the profound value CPAs nationwide and in Utah provide, enabling businesses and individuals to thrive. To remain at the forefront, we must continue evolving into trusted and strategic advisors by adopting new approaches that deliver even greater value. I hope this vital image campaign will resonate as we collectively forge our path toward being recognized as the strategic advisors we are. n

Can you believe that we’re halfway through the year?

We’ve made it through the legislative season; now we begin the summer season of continued implementation of our strategic plan. Below are some details:

For the past three years, our leadership council and executive board have had serious discussions about how licensure requirements are impacting many of our professions and the trend, nationally, to tear down licensure models from a legislative standpoint. The UACPA has been highly active in designing language that states can use allowing us to maintain the integrity of our CPA license, maintain mobility and ensure the public is protected. On Mar. 25, Gov. Cox signed SB15 S1, which does the following:

• Removes the hours requirement for a CPA to become licensed — many states across the nation, Utah included, are creating three-year bachelor’s degree programs which creates a challenge with the current 150-hour model.

• Broadens the pathway to applicants for CPA licensure, requiring they have a bachelor’s degree, master’s degree, or the equivalent with a concentration in accounting and business.

• Allows for automatic mobility from state to state –simply stated, CPA = CPA.

• Authorizes DOPL to make citations and assess fines to licensees engaging in unlawful conduct relating to CPAs.

• Makes technical and conforming changes to statute.

As of June 30, 17 jurisdictions have signed legislation that will essentially do the same in their state, with nine states seeking change this year. We will continue to see other jurisdictions run and pass legislation over the next few years.

While we know that broadening pathways is only one part of the pipeline challenge for CPAs, we still have many challenges to overcome.

Over the next year, we will be working with Jed Morley and his team at Backstory Branding to help us develop strategy for all of us to shift the negative connotations of our profession into something that we can better communicate to our peers, public and most of all those who may be considering a career in accounting. The first step of this process is to gain an understanding of what people and businesses think of our profession. Jed and his team have created a survey that has been released throughout the western region. You should have received an email from survey@onpointe-insights.com. The link will be individual to you; if you did not receive it, please check your spam or junk. Your input is integral to the research that is being conducted on your behalf as we move our profession forward in a much brighter light. n

Accounting is at a turning point. And the issue goes deeper than numbers.

For years, the profession has been shaped by a narrow story. It is the story of late nights, tax season stress, and endless spreadsheets. While that version may hold some truth, it does not reflect the whole picture. Unfortunately, it has become the one that people pay attention to.

Fewer students are choosing accounting. Fewer young professionals are entering the field. The pipeline is shrinking, and the consequences are real. But we believe part of the problem is not just the work itself — it is how we talk about the work.

We believe it is time to tell a different story.

At Squire, we have taken that challenge to heart.

In 2024, the National Pipeline Advisory Group (NPAG) issued a call to action, urging firms and leaders across the country to help reshape how people see the profession. Our CEO, Jonyce Bullock, responded by signing the Pipeline Pledge. As part of that pledge, she committed to taking real steps to promote the profession and support the next generation of accountants.

One of those steps was choosing storytelling as our firmwide theme for 2025.

We are making it our mission to tell the stories that often go untold. Stories about our people. Stories about growth and connection. Stories that show the real purpose and heart behind what we do.

This is not a one-time project. It is something we are working to build into our culture. Whether it is a client conversation, an internal event, or a quiet moment of reflection, we are trying to make space for stories to be seen and heard. The more we share them, the more we understand each other — and the more meaningful our work becomes.

Stories create connection. They help us build trust, make sense of the world, and see each other more clearly. When we take the time to understand someone’s background or share part of our own, we form relationships that change the way we work together.

Imagine meeting with a new client. On paper, they trust you because of your credentials. But when you slow down, ask questions, and find a point of connection, something shifts. You move from being a service provider to being

(l-r) Andy Nelson, Kayla Smith and Kendall Christensen // Chris Wood, robertwoodphoto.com

a trusted advisor. That shift changes the quality of the relationship. It also changes the quality of the work.

These moments happen all the time. A teammate stepping in without being asked. A client becoming a friend. A small encouragement that helps someone feel seen. These stories may be quiet, but they matter. They are the reason accounting, at its best, is about more than accuracy or deadlines. It is about people.

In January, we gathered for a firmwide retreat focused entirely on storytelling and the importance of storytelling in the accounting profession.

Throughout the retreat, employees across the firm shared personal experiences, many of them deeply honest and moving. It reminded us that behind every spreadsheet and every deadline, there is a story. And when we take time to share those stories, we begin to understand one another in new ways.

As part of the retreat, each employee was also invited to sign NPAG’s Pipeline Pledge. The pledge is a shared

commitment to help grow and strengthen the future of our profession. For us, that commitment starts with changing the way we talk about what it means to be an accountant. The more fully we tell the story of who we are and why we do what we do, the more we can inspire others to join us.

To carry that message forward, we gave every team member two simple tools: a workbook and a Kindle. The workbook from Stiry, “This Is My Story,” is designed to help people discover their stories. The Kindle was an invitation to step into other people’s stories to explore new ideas, see new perspectives, and deepen understanding.

In a note we shared with the firm, we invited each employee to:

• Explore worlds beyond their own and step into someone else’s shoes.

• Find inspiration in stories that challenge, uplift, and teach.

• Bring curiosity and courage into our everyday lives.

That retreat marked the beginning of something more

than a theme. It marked the beginning of a culture that is learning to listen more closely, speak more openly, and tell stories that bring us together.

Following the retreat, we continued the theme with a firmwide talent show to allow employees an opportunity to share pieces of themselves that don’t always show up in the day-to-day. Colleagues showcased everything from floral arrangements to piano solos to rebuilt cars. We saw paintings, poems, and personal passions that rarely come up in team meetings or emails. Every performance told a story not always through words, but through expression, effort, and creativity. It reminded us that storytelling takes many forms, and that behind every title is a person with a rich, complex story worth sharing.

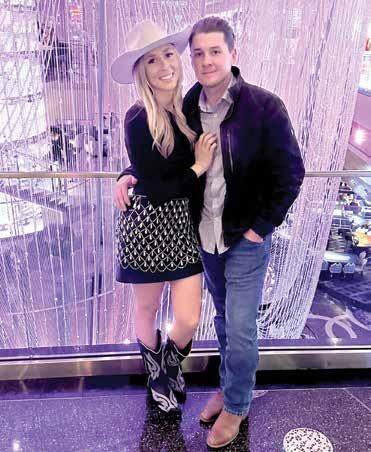

Advisory Associate Kendall Christensen closed the evening with a high-energy ballroom dance routine performed with his wife. He also shared the story behind it:

“Dance has always been a big part of my life. My parents met dancing, and I started competing from a very young age. I eventually made it onto the BYU Ballroom Touring Team, where I met my wife. We toured together for three years across three continents, ten countries, nine states winning six national titles and a world championship in England.

“We all have stories of success that aren’t always visible in our professional lives. Dancing brought me joy, discipline, and perspective. And I believe that how we spend our time outside of work shapes who we are in it. Sharing our talents helps us see each other more clearly. I just happened to be able to show mine on stage.”

Kendall’s story was a clear example of how sharing even a small part of ourselves can shift how we see each other. When we take the time to learn about one another, we create space for deeper understanding, trust, and connection.

In February, we introduced “This Is My Story,” a workbook designed to prompt reflection and meaningful dialogue. While the books had already been shared with employees earlier in the year, February marked the beginning of a more intentional effort to use them across the firm. Each month, employees are encouraged to complete a new section of the workbook. It has become a simple but meaningful way to keep storytelling present in our conversations, our team dynamics, and our culture.

In March, we launched a new internal newsletter feature called Squire Stories, where team members are spotlighted and invited to share a piece of their backstory. Andy Nelson reflected on the value of storytelling in leadership:

“I love managing through storytelling. Drawing on our experiences to help others is both fulfilling and effective. It shows people that they don’t have to have it all figured out to move forward. It gives them permission to be vulnerable and create their own story.

“When someone comes to me and says they related to something I shared, it validates those experiences and creates a sense of community I didn’t expect.”

In April, we offered store credit to employees for the Squire Swag Store. It was a small gesture, but also a way to make it easier for people to talk about where they work. A simple shirt or water bottle can be a natural conversation starter and a chance to share a little of what makes Squire, and accounting as a profession, different.

We are now bringing that spirit outside our firm by sharing this article with you. We see it as both a milestone and an invitation. A way to open the conversation to others in the profession who are also looking for a better way to connect.

We plan to bring storytelling to life at our summer retreat. With PowerPoint parties, scavenger hunts, and thoughtful group sessions, we are creating experiences that will give every person something to share. These are not just team activities. They are moments of meaning, moments that build culture, and moments that remind us we are more than the work we do.

We have already seen the impact storytelling has had on our people. Storytelling has opened conversations, strengthened our culture, and has brought our values of personal connection, proactive ownership, and thoughtful innovation to life in tangible ways.

Kayla Smith, an advisory associate and avid reader, quickly embraced the spirit of the initiative. She began sharing personal reflections on LinkedIn that sparked thoughtful dialogue across the firm and beyond. Her story is one of many, but it captures what this movement is all about:

“I love the [storytelling] theme because I’m a major reader. Stories have brought so much joy to my life. A particular book that inspired me years ago is The Midnight Library, in which the narrator has the opportunity to explore different lives she could have lived. She finds her dream life but chooses not to stay because she didn’t earn it.

“This concept helped me really fall in love with my life. It’s not perfect, but it’s MY life and I earned it. Sharing my story is really a reflection on how I got to where I am personally and professionally. It’s to show others that life is line upon line and no experience goes to

waste in our story.”

That is the power of storytelling. It builds bridges. It brings teams closer together. It helps people show up more fully — for their clients, for their colleagues, and for themselves.

We want to change the way people see accountants. We want to celebrate more wins, make more meaningful connections, and help shape a profession that feels as human as it is technical. Because storytelling is not just about “once upon a time.” It is about trust. It is about context. And it is about choosing to connect — one conversation at a time.

We are not asking anyone to write a book. We are simply encouraging everyone to be curious, to be open, and to share what matters.

Because telling our stories might be the very thing that keeps the profession thriving.

So, what story will you tell? n

Courtney Higbee (left) is the strategic operations and communications manager at Squire, where she leads internal communications and manages strategic projects in support of executive leadership. Her work centers on creating clarity, alignment, and connection across the firm. She believes in the power of storytelling to shape culture, spark engagement, and bring strategic initiatives to life - an approach she weaves into everything from firmwide updates to leadership messaging.

Courtney earned her bachelor’s degree in business management from Brigham Young University in 2019, followed by an MBA from Western Governors University in 2022.

Outside of work, Courtney enjoys spending time with her family, tackling home improvement projects, and doing her best to keep her garden alive (though the garden often has other plans).

Pyper Foote (right) joined Squire in 2024 as the communications and project coordinator after earning her degree in linguistics from Brigham Young University. In her role, she supports internal messaging and firmwide communications, with a strong focus on clarity, consistency, and strategic alignment.

Pyper has developed a passion in planning and executing internal events and projects, contributing meaningfully to firm culture and employee engagement. She is passionate about fostering communication and connection, and believes in the power of shared experiences to deepen understanding and strengthen relationships across the organization.

A Boise, Idaho, native, she enjoys being outdoors and watching movies with family and friends, and spends her free time singing, dancing, and staying active.

GEN ZS AND MILLENNIALS

48 PERCENTAGE OF GEN ZS (AND 46% OF MILLENNIALS) SAY THEY DO NOT FEEL FINANCIALLY SECURE

These numbers come from Deloitte Global’s 2025 Gen Z and Millennial Survey where responses come from 23,482 individuals across 44 countries.

74

70

PERCENTAGE OF GEN ZS AND MILLENNIALS WHO WILL MAKE UP THE WORKFORCE BY 2030

PERCENTAGE OF GEN ZS WHO DEVELOP SKILLS AT LEAST WEEKLY FOR CAREER ADVANCEMENT

92

PERCENTAGE OF MILLENNIALS (89% OF GEN ZS) SAY A SENSE OF PURPOSE IS CRITICAL TO JOB SATISFACTION & WELL BEING

86

PERCENTAGE OF GEN ZS WHO RATE SOFT SKILLS AS SOMEWHAT OR HIGHLY NECESSARY

6

PERCENTAGE OF GEN ZS WHO SAY THEIR PRIMARY CAREER GOAL IS TO REACH A LEADERSHIP POSITION

BY TINA M. CANNON, UTAH STATE AUDITOR

AsUtah’s independently elected State Auditor, I have a front-row seat to the powerful role transparency and accountability play in shaping the relationship between government entities and the taxpayers they serve. These principles are not just lofty ideals — they are essential standards that improve governance and strengthen our state and our communities. At their core, transparency and accountability portray the actual picture of what government is doing and why.

What do transparency and accountability look like in practice? And why should they matter to every citizen and public official?

Transparency starts with access to information. Government records, documents and information — ranging from reports, audits, contracts, and statistical data on performance and outcomes — must be publicly available. When information is hidden or only selectively disclosed, it limits the public’s ability to understand how decisions are made, how money is spent and what results are achieved.

But access alone isn’t enough. Information should be practical, not just theoretical. Information must be organized, searchable, and presented in clear, understandable terms. That’s why my office maintains Transparent.Utah.Gov, a growing hub with more than 30 dashboards that allow citizens to explore government data, view infographics and search for information anytime at their convenience. These dashboards provide insight into revenues, expenditures, and outcomes

which help taxpayers understand how government operates and how it performs.

Transparency and accountability empower citizens to engage in the governing process. For some, this means utilizing their access to information to engage in meaningful dialog with policy makers and with each other.

Citizens can have a seat at the table to contribute — not just observe — when prepared with the same information and data used to set policies. When governments create platforms that encourage public input and genuinely consider that input in policymaking, it legitimizes decisions and strengthens our republic.

The cornerstone of financial transparency is clear and comprehensive financial reporting. Where does the money come from? How is it spent? Do those expenditures align with public priorities and lead to good governance? Accurate financial reporting tells the whole story.

Clear, comprehensive reporting on revenues and expenditures must always be timely, easy to understand, and available to all. Citizens deserve to know the sources of funds because, most often, it’s the very taxes they have paid. Expenditures need to demonstrate not just how much is being spent, but what value they are receiving in return.

These financial stories can also reveal trends, highlight inefficiencies, or signal red flags. Transparency enhances oversight — whether by the Office of the Utah State Auditor or an engaged citizen — making it more effective and impactful.

Whether it’s audit findings, statutory compliance issues, or budget updates, information must be disclosed promptly to inform public debate, decision-making and create meaningful accountability. When the public and media can engage with current data, it increases pressure on decision-makers to act responsibly — and gives them the opportunity to hold government accountable.

Transparency must be paired with oversight to create true accountability. Independent audits, statutory compliance reviews, and published findings are essential to assess whether public funds are being used properly, and statutes are being followed.

Accountability means continuous improvement. An independent review of government functions ensures statutes are followed. Reviews and audits aren’t just about catching errors, they’re about identifying opportunities for improvements, making course corrections, and ensuring that resources are directed where they’re needed most. They also deter misconduct by making it clear that oversight is real and that consequences exist for misuse or negligence.

When government is transparent and accountable, public trust grows. People are more likely to support institutions that are open, honest, and responsive. Transparency exposes both problems and progress, and it helps restore confidence in how government operates — whether on the side of taxation, spending or operations.

Transparency and accountability invite more citizens to take part in civic life. When people feel informed and respected, they’re more likely to vote, attend meetings, share ideas, and even run for office themselves. This participation strengthens our republic and builds a more engaged and informed society.

What’s more, transparency and accountability lead to improved decision-making. When public officials know their actions will be visible, they tend to be more careful, more ethical, and more data driven. The result: smarter policies, more efficient use of public funds, and decisions that better serve the public interest.

Transparency and accountability are the foundation of governance in a democratic republic. They ensure that power is exercised responsibly, resources are used wisely, and that the government remains answerable to the people.

As Utah’s State Auditor, I’ve seen firsthand the impact that transparency and accountability can have. I remain committed to advancing these principles across all levels of government and expanding tools like Transparent.Utah.Gov to make government more accessible, responsive, and trustworthy.

I invite you to participate. Together, through transparency and accountability, we can make government better for all. n

Tina M. Cannon serves as Utah’s 26th State Auditor. She is a graduate of Utah State University’s School of Accountancy at the Jon M. Huntsman School of Business. She holds the historic distinction of being the first woman elected Utah State Auditor and the first independently elected Republican woman to any statewide office in Utah.

In 2025, a new CEO of the American Institute of CPAs and Association of International Certified Professional Accountants took the reins from long-time leader Barry Melancon, CPA, CGMA.

Mark Koziel, CPA, CGMA, has hit the ground running to get acclimated to his new position. This isn’t his first experience with this global Association — prior, he had worked with the AICPA for 15 years in multiple capacities before accepting a role as president and CEO of Allinial Global, where he worked from 2020 to 2024 until being selected as Barry’s successor.

So our members can get to know him a little better, Mark shares what he’s most looking forward to as he moves the Association and CPA profession into the future.

From the start, I have absolutely loved the CPA profession. I actively promote and encourage others to consider a career in this great profession. I’ve been fortunate to encounter and accomplish many things, gaining experience in public accounting, corporate finance, politics and public affairs.

For the past five years, I served as CEO of an international association of firms with $6 billion in revenues. When I left the Association in 2020, I didn’t expect to become its CEO, but my international experience made me a strong candidate. Since WWII, there have only been five CEOs of this esteemed organization.

It is an honor and privilege to serve. I do not take the role lightly, and I am committed to advancing the profession to serve the public interest and meet market demands.

1. Additional Pathway to CPA Licensure

First and foremost, advancing discussions already in the market to create an additional pathway to licensure. Creating flexibility for those wrestling with the time and cost of education is critical. This conversation has been going on far too long. It was clear that state societies, state boards of accountancy and members in firms and businesses wanted to see this happen. Even before I started, the team was working on ways to support that. Education is important, as is experience and examination. We will continue to explore how competencies fit into the ongoing health of our profession while maintaining what the public expects of us. I worry about mobility but have said we need to help our members navigate it and solve for it as quickly as we can. Meanwhile, there is much more outside of licensure that needs to be done to shore up accounting talent, including continuing to examine firm business models.

2. Reconnecting with Members & Listening

We started an email address, AskMark@aicpacima.com, and have thus far received just shy of 500 responses — and I’ve responded to all of them. It’s important that we listen and react to members’ needs. For state societies and the AICPA, we have the challenge of keeping the profession self-regulated and having challenging standards to make sure we set the bar high. But we are also here to serve our members, and I’d like to lean into that a little more. I’ve said for years, our members seem to remember more what we do TO them, not for them. I’d like to do more for members. One thing we’re discussing is more focused communities. More on that in the short-term.

3. Reconnecting with Team Members

I plan to check in regularly to make sure we stay

focused on our strategic direction to help our members. It’s a great team, and I’ve missed being part of a larger organization. I’ve been working hard in these early days to reconnect and look for ways to make their jobs easier, so they serve our members better.

I regularly receive requests to comment on the Washington, D.C., landscape for our U.S. members, as well as for our professionals worldwide and other accountancy bodies seeking guidance on their readings.

The political landscape is certainly interesting and, dare I say, challenging? During my initial days, the team has been focused on securing meetings with key figures in Washington and globally. It’s a challenging task because the names keep changing and the topics we need to discuss seem to shift by the hour. Working to keep up with the current uncertainty has certainly been at the forefront. Our Washington team has done a great job with it, but I worry greatly that our members might not get the support they need from the IRS based on the current landscape. Keeping up with

regulatory changes has been the greatest challenge and will hopefully settle in the second half of the year.

As I mentioned before, the CPA profession is the greatest profession in the world! I’m excited to see it continue and will do my best to help shape the future. There are many opportunities to advance this greatness. We need to focus on increasing the pipeline, building on the work of the National Pipeline Advisory Group and collaborating with states. Practice changes and helping firms grow through additional services are crucial. ESG and sustainability remain important, but there’s much more. Artificial intelligence will reduce mundane tasks, allowing us to focus on complex, client-facing work. Expanded services like client advisory services (CAS) enable us to be trusted advisers. New audit tools will add value by providing insights beyond standard reports. We can help Main Street small businesses simplify reporting and oversight. Creating future-ready finance professionals with the Finance Leadership Program is essential. The list goes on, and there’s no shortage of opportunities. That’s what keeps me excited about the future. n

JOB TITLE: President & CEO, American Institute of CPAs, and CEO, Association of International Certified Professional Accountants

ORGANIZATION SIZE: AICPA & CIMA, together as the Association of International Certified Professional Accountants (the Association), advance the global accounting and finance profession through our work on behalf of approximately 600,000 AICPA and CIMA members, candidates, and registrants in 188 countries and territories.

PREVIOUS POSITIONS: Most recently, I was president and CEO of Allinial Global, an association of independent accounting and advisory firms with 268 member firms worldwide. I started there in 2020 after 14 years with the Association (previously the AICPA), where I served in a number of roles, including executive vice president of firm services.

ALMA MATER: Bachelor of Science in accounting from Canisius University (Buffalo, NY) in 1991.

FAMILY: Wife, Maryann, and son, Ben

PETS: Dog, Ozzie

HOBBIES: In my down time, I enjoy the beautiful mountains of North Carolina (home); spending time with my wife, Maryann, and my family; and boating, golfing and smoking—both a fine cigar (with a glass of wine) and BBQ.

Get to know Mark a little better by seeing what an “average” day can look like for him as he settles into his new leadership role.

“As the CEO of a global organization, I’ve already found myself with a very full travel schedule. In this job, there is rarely a day that’s the same. As of day 42 as CEO, I’ve visited three of our offices, including London for CIMA Council, Durham, NC, and New York City for staff meetand-greets and other meetings. Today, I am in NYC.”

5 A.M.: Wake up and get the day started. Typically, I first catch up on overnight emails, then check the day’s headlines (global, then profession). Next will be any social media to catch up on and respond to.

5:45 A.M.: Head to the office. Today I’m in NYC, so it’s a quick walk from where I typically stay.

6 A.M.: Grab my cup of coffee and get to work answering the highest-priority emails from what I reviewed in the morning.

7:30 A.M.: Today is an unusually late start for my first meeting — a briefing from our team in North Asia. I’ve been checking in with each region as I get up to speed on their top priorities, how we can help them in their roles, and discovering their greatest areas of growth. I usually schedule these meetings in the time zone most suitable for the region and, today, they selected this later time.

8:30 A.M.: Town Hall final run-through before we go live later today. The AICPA Town Halls were created by Erik Asgeirsson, president and CEO of CPA.com, and me in 2020 during the pandemic to help members stay informed of critical issues. Back then, the big topic was the Paycheck Protection Program (PPP). Now it’s the Washington, D.C., landscape and tax. We started with about 400 attendees back in April of 2020. That quickly grew to about 1,000 attendees when I left in August 2020. Now there are over 10,000 attendees per session. The popularity and audience growth are just amazing. This run-through is to make sure we all have our topics set and, more importantly, includes a time check so we stay on time.

9 A.M.: I’m double-booked, so I quickly stop into a breakfast celebration for my executive assistant, Donna Wolf, who is retiring at the end of the month. I then join a Zoom meeting with the Audit & Finance Committee to discuss audit-related matters, final Association financial statements, internal audit reviews and what will be presented at the April live board meeting. This call runs much of my morning, to approximately 11:20 a.m.

11:30 A.M.: Immediately following the Audit & Finance meeting, I hustle to the other side of our office to the studio to record a congratulatory video message for the president-elect of a state CPA society who will be named president at an upcoming annual meeting. I was invited to attend live but unfortunately had a conflict, so they asked if I could record a video. It is someone I know well, and I am more than happy to do so.

NOON: Following the recording, I make my way to an informal luncheon with the office staff. I share a quick introduction about my thoughts on the future of our organization and the profession. I thank the team “live” for all the things they do for our members, and we share some pizza, wings and cake (with my picture on it!). It’s been a really great experience getting to meet all the people who have largely been thumbnail video boxes on my computer screen.

1:30 P.M.: After the announcement of my return to the Association, we had several requests for interviews from the media that cover our profession. This was the first week in which my schedule was able to accommodate some of these requests, so today I’m speaking with Courtney Vien, senior reporter at CFO Brew.

2 P.M.: Quick check-in with my assistant to see if she needs me for anything or if there are any pressing matters to discuss.

2:30 P.M.: The AICPA Town Hall starts in 30 minutes, so I head back to the studio to get set up for sound and prepare for the show. At this time, all presenters are on video in a green room waiting for the start and nailing down final instructions.

3 P.M.: Erik Asgeirsson kicks off the Town Hall. I’m up

first to discuss feedback I’ve received from members both on the road and through the AskMark@aicpacima.com inbox. At a prior Town Hall and in several articles after, we’ve asked members to reach out to me directly to provide feedback on the profession. I present the results to the audience and am followed by our D.C. team with an update on BOI, the IRS, DOGE and other D.C. topics. The last session focuses on Quality Management and new requirements about to be introduced in audit. To finish, we open it up to questions from the audience. On this day, there are 11,400 participants.

4 P.M.: I return to my office to join another Zoom meeting with the Association’s firm services team to discuss the agenda and topics for the Major Firms Group meeting in July.

5 P.M.: Time to catch up on emails and any calls I need to make before leaving the office for the day.

6:30 P.M.: I take a walk around NYC, clear my head and figure out where I want to grab a quick dinner.

8 P.M.: I head to the Carnegie Club, where I have a scheduled cigar call with an IT confidante that I check in with regularly. We usually talk once per week, and he helps me sort out any IT challenges I may be dealing with.

9:30 P.M.: I grab a glass of red wine and do a final review of text messages, emails and social media. I choose a Zinfandel from Grgich Hills Estate in Napa.

10 P.M.: Call my wife, Maryann, to check in on her day, fill her in on mine and discuss our schedules for the next few days and weekend.

10:45 P.M.: Final check of current events and profession news headlines.

11 P.M.: Lights out. n

12 – 13

Next Level is for professionals who are ready to move from capable to exceptional. Through dynamic workshops, real-world case studies, and powerful peer connections, you’ll sharpen the skills that matter. Whether you’re leading teams or driving change, this program equips you with the tools to lead with purpose and confidence.

This UACPA retreat is an extension of Leadership Academy and open to everyone. Connect with a community of ambitious professionals who are ready to lead boldly and shape the future of the profession.

Learn more at uacpa.org/nextlevel

Tell us about your new job or what’s been happening at your firm. Send your news to Amy Spencer, as@uacpa.org

Cory Nielson (left) has been announced as the audit group director in the Salt Lake office of ORBA (Ostrow Reisin Berk & Abrams, Ltd). Cory was previously an audit partner at Eide Bailly LLP. He is involved in multiple business networking organizations, serves as a board member and financial consultant for his local country club and acts as a city government financial consultant. Cory graduated from Weber State University with a Bachelor of Science in Accounting and a Master of Professional Accounting.

Larson & Company celebrated 50 years on May 1, 2025. Dennis Larson started the firm with just one employee in 1975. Today, the firm has three offices and more than 110 employees. Dennis established the firm as the go-to for specialized audit services for insurance companies in Utah. Because of the firm’s success, Larson & Company was able to expand into other niches. Now a full-service accounting and business advisory firm, Larson & Company has been recognized as a top firm in Utah and the Western region specializing in assurance services for insurance entities, government organizations, and not-for-profit organizations, tax planning and preparation, small business consulting and accounting services.

Armanino expands into Utah with the addition of Cooper Savas LLC. Cooper Savas was founded in 2011 and has 35 seasoned professionals who serve clients across a broad range of industries. “Since our founding we’ve prided ourselves on our ability to deliver a hands-on, thoughtful approach to clients, and we know that Armanino maintains that shared culture and commitment, making this a great opportunity for our firm,” said Phil Cooper, partner and founder of Cooper Savas.

Gabe Utley, CPA, MBA, (top) and Brad Matheson, recently raised $1.5 million to launch Integrated Healing Centers, a mental health treatment facility in St. George. “We’ve received overwhelmingly positive feedback on our pro forma and pitch deck, with several bankers, venture capital firms, and angel investor groups calling it the best they’ve seen. It’s been a great reminder of the value a CPA can bring to the table,” Gabe says. Gabe and Brad earned their MBAs through BYU’s Executive MBA program. The two were close childhood friends who reconnected and are channeling their shared passion in this new venture.

In April, Forbes shared their America’s Best-In-State CPAs List. Forbes editorial staff complied a list of the profession’s finest, which was culled from a collection of candidates sourced through independent nominations and recognitions from numerous associations of CPAs. The UACPA is proud to see so many members on this list. Tyler Alleman (Partner, Jones Simkins), Clinton Armstrong (Owner, Armstrong CPAs & Advisors), Amanda Barrett-Bough (Partner, Squire), Jonyce Bullock (CEO, Squire), Katina Curtis (Partner, Grant Thornton), Greg Denning (Managing Partner, Larson & Company), Mark Erickson (Managing Partner, Tanner), Todd Hafen (Shareholder, Hafen, Buckner, Everett & Graff), Ken Jeppesen (Partner, Eide Bailly), MK Mortensen (Principal, Grant Thornton), Mariah Nielsen (Partner, Forvis Mazars), David Peaden (Assurance Partner, Eide Bailly), David Peterson (Managing Partner, Haynie), Steve Racker (Emeritus Partner, WSRP Advisory), Daniel Rinehart (Managing Partner, WSRP Advisory), Bob Thomas (Managing Partner, Jones Simkins).

Congratulations to the following individuals who were approved for membership in the UACPA as of May 31, 2025.

Candice Arnold

Vanessa Coburn

Ben Murray

Kali Rhodes

Ryan Trader CBIZ & CBIZ CPAs

Stephen Larson CFGI

Joseph B. Bradshaw CLA (CliftonLarsonAllen LLP)

Christopher Gonzales CSA Partners

Susahah Kunzler

Davis & Bott, CPAs, L.C.

Jarrett G. Bradshaw

Emylee Jensen

Eide Bailly, LLP

Brooke N. Linton

Ensign College

Phillip Di Giordano FORVIS

Jamie H. Morris

Intermountain Healthcare

Trevyn Jensen

Jones Simkins LLC

Ivan Madunic

Julia Taylor

Erika Whitmore

KPMG LLP

Emily Pearson

Southern Utah University

Camille Christiansen

Jennifer Littleford

Daniel Merkley

Andrew Osborn

Alexi Shumacher

Moss Adams LLP

Jayson Holt

Spencer H. Knaras

Joshua Shelley

Squire & Company, PC

Emily Fowles

Skyler Higginson

Kameron Mortezazadeh

Joseph T. Wheat

Luke H. Yorgason

Tanner LLC

David Adams

Jason Allen

Holly Bishop

Shawn Evans

Gregg Hastings

Morgan Hirschi

Muhammad Khan

Leslie A. Larsen

Bertha Lui

Seth Oveson

Hadley Scott

Sam Steffensen

Taylor Whitman

Julie Wrigley

Utah Office of the State

Auditor

Abel Chavez

Lance Rodrigues

Kayla Torgersen

Brigham Young University

Amanda Yancey

Gabriella Puertas

Josh Wilson

William Barton

Abril Oguey

Lincoln Cosby

Michael Ebert

RaidenGould

Fernando Bello

Thomas Cassler

Jim Christensen

Dakota Hollingshead

RebeKerst J. Meibos

Aidan Greenwade

Alexander R. Curtis II

Ziyi Likah Ricks

Bonneville High School

Boston Blair

Ensign College

Janet G. Bouet Ndoudi

Aboli A. Ebissan

Dina R. Florian

William E. Day

Grover J. Vasquez

Utah Tech University

Logan Gonzales

Brayden Bunnell

Alivia Cluff

Zachary Billings

Collin Carroll

Lacee Durrant

Hailey Wilkins

Ethan Rees

Geneva Raber

Payton Wilcox

Jaden Robinson

Tristan Johnson

Sarah Lanter

Carter Johnston

Alastrina Belt

Connor Forest

Falon Richards

Southern Utah University

Bransyn Christiansen

Gavin Jones

Joseph Morgan

Tanner Midgley

Tazia Johnson

Annalee MacArthur

Jerika Torgerson

University of Utah

Samuel Cuello

Brandon Soto

Jonathan Chan

Daniel Call

Ethan Sherman

Dhristi Patel

Josiah Johnson

Mariana Yukari

Jaxon Backus

Yen-Jung Su

Juliet Nava

Noah J. Nash

Tohri Honarvar

Tue Tran

Kelvin Chae

Alexander Smith

Caite Gosselin

Sheldon Kopf

Ryan W. Doidge

Kami L. Teeasyatoh

Hanna L. Weakley

Adira M. Moore

Madison Fairbanks

Jacob Winters

Jennifer Allred

Utah Valley University

Jonas Christianson

Rachel Campbell

Bronson Whitmore

Pone Linthalath

Kara Burnham

Eric Ellis

Jesika Woodall

Eugene Takita

Devin Morrow

Bailey Martin

Boston Cordero

Zane Price

Jessica Fenrick

Makenzie Walker

Jacob Cozzens

Zachary Jarvis

Russell Baugh

Andre Chapman

Simon Hohneke

Anna Ames

Gracie Douglas

Nicholas Hunter

Alec J. Barron

Kara R. Burnham

Boston M. Cordero

Kyle Hotvedt

Utah State University

Logan Johnson

Jonah Anderson

Westminster University

Kris Ortega

Baylee White

Weber State University

Taylor Sampson

Hayden T. Hall Jr.

Judith Sanchez

Michael C. Blanco

Audrey Jolley

Davie M. Sorrells

Zarai Lee

Hamid ullah y. Khan

Kristen Barber

Josue Esquivel Frias

Philip M. Etter

Jose L. Hernandez

Jeff M. Broadhead

Jonathan Hansen

Eric Vang

Hanna Hansen

Sandra Carr

Chris S. Ohsiek

Welington N. Carvalho

Santiago Clancy

Jatziry German

Wendy Huynh

LDS Business College

Angelo Puga

Salt Lake Community College

Chloe Millington

Fremont High School

Talia Fowers

Providence Hall High School

Baylee Lesh

Skyridge High School

Eliana Harris

Jill Briggs 1973 - 2024 Member since 1998

James Merrill Rushforth

July 16, 1930 – March 22, 2025 Member since 1960

Roger Orville Richins

June 20, 1945 – March 25, 2025 Member since 1974

Daniel Jon Armstrong

July 3, 1952 – April 3, 2025 Member since 1983

Vincent Marinus Tilby April 7, 1936 – March 14, 2025 Member since 1962

“This summer, we’re all about soaking up the good times! Our agenda includes relaxing getaways to Hawaii and Bear Lake. We’ll also be making the most of those long evenings with the kids, enjoying classic night games, and unwinding with cool beverages and delicious BBQs alongside family and friends.”

“Summer always passes in a flash! I plan to spend as much time outside as possible and get that vitamin D before it is gone again!”

“I plan to spend as much time as possible outside (hiking and playing with my kids). My family and I also have some really fun trips planned (Huntington Beach, Yellowstone, Flaming Gorge, and Alaska).”

“This summer, after finishing up a quick summer block of classes, I’ll be presenting at the Global ACFE meeting in Nashville on using AI tools for fraud detection and data analytics. I’m also preparing for fall classes and enjoying time with my family through hikes, swimming, and a California trip.”

“This summer, I’m going to get my hands dirty — literally! I’m planning to build a new garden space in my yard, making it my little green escape. Can’t wait to build, dig, plant, and watch it all come to life!”

“I’m keeping it simple this summer — maybe a camping trip, but mostly enjoying time with family, with evenings sitting around the fire pit in our backyard. I’m also planning to work on a few yard projects to improve the landscaping. I’m looking forward to the slower pace this summer!”

“We were blessed to take a spring trip to London and Paris, so our summer plans are to stay home and manage a construction project at our home, which includes a major addition. Things are progressing and we are cleaning and mopping pretty much every night to mitigate the dust and dirt.”

“Plans for the summer include camping/ spending time with the family. Lots of swimming and fishing — we enjoy the summer and the time to spend outside together.”

“I don’t have any major plans this summer. Most of my summer will be mountain biking with the Wasatch Mtn bike team. I’ll go on a few campouts here and there and hopefully do a little bit of four-wheeling.”

“With youth summer camps, marching band, driver’s ed, summer school programs and family reunions...I plan to spend my summer just as busy with kids’ activities as we are during the school year. But it’s all good times, and I’m looking forward to camping and some relaxing in between.”

“We kicked our summer off with a leisurely vacation to Coronado Island to celebrate our 40th wedding anniversary. Laptops were left home, and the only requirement was to enjoy each other’s company, relax and enjoy the beach. We hope to take some long weekenders throughout the summer to chill and stay ahead of potential burnout.”

“This summer, I plan on spending lots of time in my sister’s pool. I have some camping trips scheduled, and we will be going on an Eastern Caribbean cruise in August.”

“Between lake days and camping trips, I am looking forward to a road trip to California and a trip with my mom and sisters to the San Juan islands in August.”

Whether you’re planning headcount growth or refining your talent acquisition strategy, understanding the cost of hiring a new employee can support more accurate budgeting, improve hiring efficiency, and inform long-term workforce planning.

The cost per hire metric gives employers a clearer picture of what it really takes to bring on new talent. By combining internal and external recruiting expenses, it provides a single, measurable figure that helps assess how efficiently a business is hiring.

The cost per hire formula is relatively simple — but the insights it yields can be game-changing. Hiring costs can vary across industries and job types, but the formula gives employers a steady benchmark to evaluate and compare what they’re spending to fill positions.

Cost per hire (CPH) = (Total Internal Costs + Total External Costs) ÷ Total Number of Hires

A small accounting firm fills 5 new positions over the course of a quarter. It spends $20,000 considering the time and effort spent by internal recruiters, internal interview time, and onboarding activities (internal costs), plus $5,000 on job board ads and background checks (external costs).

Cost per hire = ($20,000 + $5,000) ÷ 5 = $5,000 per hire

The cost of hiring an employee is rarely one-size-fits-all. Highly specialized positions, for example, often require more extensive sourcing efforts, higher advertising budgets, and greater time investments from recruiters and hiring managers.

Location can also play a significant role. In competitive labor markets or remote-unfriendly industries, the cost to hire an employee may increase due to higher compensation expectations, relocation help, or a limited talent pool. Similarly, the choice of recruitment channels — job boards, agencies, internal referrals — can dramatically affect both the cost and quality of candidates.

Companies that invest in efficient hiring processes and strong HR support tend to spend less and move faster when filling roles. .

Reducing the cost to hire an employee doesn’t have to mean cutting corners — it starts with building a smarter, more efficient process. Leveraging AI-supported recruiting tools can save time on sourcing, screening, and initial outreach, allowing HR teams to focus on high-value tasks. Encouraging employee referrals is a cost-effective way to reduce external advertising and find high-quality hires faster.

Streamlining your recruitment workflow — from clearer job descriptions to more structured interviews — may also lower overhead and shorten time-to-hire. Tracking your cost per hire consistently over time helps uncover patterns, identify bottlenecks, and spot opportunities to improve efficiency.

Tools like AI-powered applicant tracking systems and automated screening solutions may shorten time-to-hire, improve candidate quality, and reduce manual workloads — leading to faster and more cost-efficient hires.

Don’t have the time or resources to do recruiting as usual? Explore how AI-supported recruiting tools, like Paychex Recruiting Copilot, in partnership with Findem, can elevate your hiring strategy at go.paychex.com/uacpa-ai.

Paychex is proud

McKenna Sanders is the recruiting manager at Tanner LLC. She attended Washington State University studying environmental science and quickly discovered she loved her business course and “100% hated my science classes.” She returned to Utah and earned a bachelor’s and master’s in accounting at the University of Utah. McKenna spent a few years working in tax before discovering her knack for helping aspiring accountants and seasoned professionals.

Tell us about what you do at Tanner. I worked in tax for a total of five years before I dove into my social skills and moved into the recruiting manager role. I now lead the recruiting department and connect with future CPAs as a regular part of my job! I go onto college campuses where I talk with students about the different CPA career paths, recruiting process, and what it is like to work at Tanner.

What would surprise people to know about you? I love the rodeo! My family and I go to the National Finals Rodeo (NFR) every year.

How did you get involved with the UACPA? And what do you like about volunteering? I strive to get involved in as many networking opportunities as possible. I saw on an email that the UACPA was looking for volunteers to join the Emerging Professionals committee and I sent in an email! I love connecting with other CPAs across the state. It is always good to build relationships that strengthen your network.

What do you like about being a CPA?

I love being able to use the knowledge of a CPA in many areas of my life — whether it is my actual career, my personal taxes, family budgeting, starting a business, etc! There are so many aspects of my life where the CPA knowledge is applicable.

What do you like to do outside of work? I love to spend time with my family, which is all over the place! I have family in Arizona, San Diego, LA, and Utah. I take a lot of weekend trips to go around and visit them. I also have two dogs who demand all my attention. You will also catch me in the gym lifting weights multiple times a week.

What are some of your goals both personally and professionally? I want to live to be 100! But not just kickin’ around, I want to be functional and living a full life! I strive to eat a healthy diet and exercise regularly. Professionally, I want to contribute to growing and developing the CPAs of Utah! Whether I help guide them to their career journey at Tanner or to other places. I want to be a helping hand and mentor to students seeking advice and information.

What advice do you live by? “Look good, feel good, do good.” When you have confidence in yourself it shows! By putting in the work to put your mental, physical, and emotional health first it creates a ripple effect in your life that impacts your productivity, marketability, and many more areas! n

UACPA

Leadership Council members gathered at the Grand America Hotel on Friday, June 13, to hear a legislative update, AICPA council update and learn about the CPA visibility campaign with Jed Morley from Backstory.

Utah Practice For Sale: Gross Revenues Shown: Bountiful, UT CPA Tax Practice $1.4M; Bountiful, UT Tax & Accounting Practice $866K

New Listings Coming Soon! For more information, contact 1-800-397-0249 or www.AccountingPracticeSales.com to see listing details and register for free email updates to be notified first of new/upcoming listings.

THINKING OF SELLING YOUR PRACTICE? Accounting Practice Sales is the leading marketer of accounting and tax practices in North America. We have a large pool of buyers, both individuals and firms, looking for practices now. We also have the experience to help you find the right fit for your firm, negotiate the best price and terms and get the deal done. For more information, please visit our website at www.accountingpracticesales.com

Interested in Buying a Practice? See local and nationwide listings at www.AccountingPracticeSales.com and register for free email updates.

To place your classified advertisement in The Journal Entry, contact Amy Spencer, as@uacpa.org.

To view and post job listings, visit uacpa.org/jobs. Create your own post by selecting the yellow button in the upper left corner that says “Add Job Posting.” Posting is free for members and posts are active for 60 days.

Jobs currently posted

• Controller Position

• Free Tax Practice

• CPA-Tax Accountant - All Experience Levels Considered

• Business Administrator - San Juan School District

Invest and expand your expertise with exclusive offers from Wolters Kluwer. Get access to expertly-written content and continuing professional education that meets requirements and works with your busy schedule.

The UACPA leadership supports and challenges members through advocacy, professional education, leadership development, networking, and community service to help them succeed in a competitive and changing world.

At the UACPA, our vision is to be a world-class professional association essential to our members.

We unite a vibrant community of CPAs to enhance the success of our members and champion the values of the profession; integrity, competency, and objectivity.

Advocacy

The UACPA represents the profession at the legislature and other regulatory bodies and promotes the value of the CPA to employers, the business community, and the public at large.

Leadership & Service

The UACPA provides leadership and service within the profession, within the UACPA, and within the community.

Professional Development

The UACPA supports and encourages continuing education and leadership development.

Professional Community

The UACPA reinforces peer accountability to encourage members to maintain integrity and high ethical standards. It provides member-tomember networking opportunities and networking opportunities with other professions. It values belonging to a distinguished organization and believes that we serve as the primary resource and point of contact for Utah CPAs.

Population Outreach

The UACPA believes in reaching out to under-represented populations, those returning to the profession or choosing it as a second career, and other professions.

Congratulations to the firms and businesses currently participating in the UACPA’s 100% membership program. This demonstrates their commitment to the profession, to the association’s high ethical standards and lifelong learning.

• Adams & Petersen, CPAs

• CBIZ & CBIZ CPAs

• CLA (CliftonLarsonAllen LLP)

• CMP

• Davis & Bott, Certified Public Accountants, L.C.

• Eide Bailly

• FORVIS

• Haynie & Company

• HBME

• HintonBurdick

• Jones Simkins LLC

• Moss Adams

• Savage Esplin & Radmall, PC

• Squire

• Tanner LLC

• Teuscher Walpole, LLC

• WSRP

Firms with 10 or more full-time CPAs are eligible to be a part of the 100% membership program. Call our membership team to sign up, 801.466.8022.

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles.

Trusted by accounting and tax professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments – Cantor Forensic Accounting, PLLC

22% increase in cash flow with online payments

65% of consumers prefer to pay electronically

62% of bills sent online are paid in 24 hours