PROVIDING STABILITY, FOSTERING COMMUNITY

As we reflect on 2024, a year marked by transformation, I am filled with pride and optimism for the future of our organization. This year, we embraced a bold new identity as the Texas Housing Conservancy, a name that reflects our expanded mission to preserve housing affordability not just in Austin, but across the state of Texas. Our commitment to Austin remains unwavering, as evidenced by our acquisition of two properties in North Austin near the Domain an area where many hardworking Texans struggle to find affordable homes. At the same time, we celebrated a major milestone with the acquisition of 2929 Wycliff, our first property in the Dallas market, signaling our readiness to scale our impact statewide

Our progress this year has been powered by a passionate and resilient team We welcomed Caro Fenno as Director of Programs and Marketing whose energy and dedication has already made a meaningful difference We were honored to receive the ULI Global Award for Excellence, a testament to the innovation and integrity of our work Through strong partnerships we brought financial wellness webinars, free fresh grocery giveaways, and community-building events to our over 4,000 residents, and our largest-ever Back to School Series provided supplies to more than 400 children. In these uncertain times, our team has proven that we are not only capable of weathering the storm we are built to thrive through it, together.

Monica Medina CEO & President

In 2024, Texas’ multifamily housing market continued to evolve rapidly, revealing both headwinds and new opportunities for forward-thinking, mission-driven investors. For the Texas Housing Conservancy Fund committed to preserving and expanding workforce housing in dynamic markets like Austin and across the state this was a year of strategic growth, meaningful milestones, and strengthened resolve.

We’re especially proud to have reached a major milestone with the acquisition of 2929 Wycliff, our first property in Dallas. This expansion marks the beginning of a more geographically diverse, statewide portfolio that enhances long-term resilience and allows us to serve more communities. By extending our reach, we are mitigating market-specific risk while advancing our mission to deliver stable, high-quality housing to Texas’ working families Austin remained one of the most active multifamily development markets in the country According to Cushman & Wakefield, nearly 50,000 new rental units were delivered across 2023 and 2024, with 31,305 units added in 2024 alone a 103% increase in total inventory Demand remained strong, with 29,515 units absorbed, driven by continued in-migration and job growth, particularly in the tech, healthcare, and education sectors

However, the pace of new deliveries contributed to rising vacancy rates. Overall market vacancy reached 15.1%, while stabilized assets ended the year at 8.2%. These supply pressures pushed rents down 4.6% year-over-year, with Class C properties our Fund’s historical focus experiencing some of the sharpest declines. Against this backdrop, the Texas Housing Conservancy Fund delivered a total return of –4.82% in 2024. While this lagged the NCREIF NFI-ODCE benchmark return of –1.43%, it outperformed the broader Austin multifamily market, where asset values fell between 8% and 12%, according to industry analysts including CBRE and Northmarq. Our more modest decline reflects the relative resilience of income-restricted, mission-aligned properties that benefit from stabilized rent rolls and long-term affordability protections.

Encouragingly, our long-term performance remains strong Since inception, the Fund has delivered a 513% annualized return and a 337% total return, underscoring the value of our disciplined investment approach and long-term commitment to affordability and community stability We believe the current softening presents one of the most attractive acquisition environments in recent memory With construction financing constrained and fewer active buyers in the market, our capital can go further positioning us to acquire high-quality assets at belowreplacement cost Our investment thesis has always focused on downside protection and durable yield, and this phase of the market cycle plays directly to our strengths.

Looking ahead, market fundamentals are expected to improve. Bloomberg forecasts a 60% drop in new construction starts in Austin in 2025, helping ease supply pressure. While 18,883 units are expected to deliver, demand is projected to reach 24,172 units, potentially restoring market occupancy to 94.7% by year-end. Rent growth is projected to resume in early 2026 as the pipeline rebalances and absorption outpaces deliveries Our strategic expansion across Texas is a key pillar of our long-term vision A broader footprint not only enhances diversification but also allows us to meet the rising need for workforce housing among households earning less than 80% of the area median income an increasingly underserved demographic

While 2024 brought market adjustments, it also marked a year of significant progress We navigated near-term challenges, expanded our reach, and continued to protect affordability for thousands of working families With development slowing, occupancy improving, and demand remaining resilient, we believe the stage is set for recovery in 2025 and renewed growth in 2026.

As always, our focus remains clear: invest in communities, strengthen families, and create longterm, mission-aligned value across Texas.

Thank you for your continued trust and partnership.

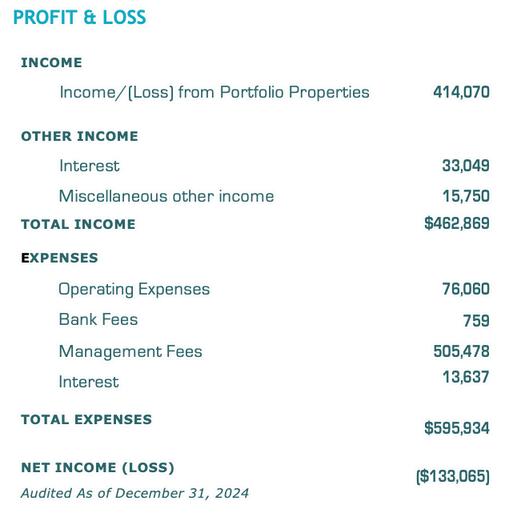

*Note on Income/(Loss) from Portfolio Properties:

The Fund accounts for its real estate investments using the equity or cost method, depending on the level of ownership and influence

Equity Method: For properties where the Fund has significant influence, we recognize our share of net income or loss — including non-cash expenses like depreciation, which totaled approximately $1.8 million in 2024. These non-cash charges can result in a reported accounting loss even when the underlying properties are generating positive cash flow

Cost Method: For properties where the Fund does not have significant influence, income is recognized only when cash distributions are received.

The Income/(Loss) from Portfolio Properties includes: Cash distributions from cost method investments

The Fund’s proportionate share of net income or loss from equity method investments

Excluding depreciation, the Fund would have reported net income for the period.

Twelve100 added 384 units in Austin’s Domain district, giving essential workers access to affordable housing in one of the city’s most dynamic live-workplay environments

Cielo North Domain, a 64-unit property, strengthened TxHC’s presence near The Domain and underscored its commitment to preserving affordability in highopportunity areas

2929 Wycliff brought 284 units to the portfolio and marked TxHC’s bold expansion into Dallas, securing a foothold in the vibrant Oak Lawn neighborhood

In 2024, we reached a defining milestone with the official launch of our new name and an expanded mission to serve communities across the entire state of Texas We marked this moment with a vibrant celebration at our new headquarters, joined by investors, board members, Austin housing leaders, and banking partners

Throughout the year, as we broadened our reach, we remained deeply committed to our core purpose: providing stability, fostering community, and expanding access to homeownership across Texas.

We were honored to receive the prestigious ULI Global Award for Excellence an inspiring recognition of our commitment to innovation and excellence in urban development This award reflects the collective efforts of our team and partners throughout the year

Our CEO and President, Monica Medina, was honored as one of Austin Business Journal’s Power Players of 2024 Her leadership continues to strengthen our mission and expand our impact across Texas

Our Board Chair and Founder, David Steinwedell, received the 2024 ULI Austin People of the Year Influence Award for his leadership and commitment to affordable housing

Board of Directors

A balance of expertise in real estate and affordable housing

Chairman

David Steinwedell Founder TxHC

President

Monica Medina CEO TxHC

Audit Chair

Brian Strickland Former CFO, TxHC

Treasurer

Shar Kassam

Independent Trustee

Secretary

Marianne Dwight

Integrada Business Strategies

Frances Ferguson

Mueller Foundation

Printice Gary

Carleton Residential

Jennifer Wenzel

Teacher Retirement System of Texas

Kirk

Christopher

Greg

Perry