Think you know what community association life is all about?

Think again. Residents must obey the rules, directors must follow the law, and managers must keep it all running smoothly. Take It to the Board explores the reality of life in a condominium, cooperative or homeowners’ association, what’s really involved in serving on its board, and how to maintain that ever-so-delicate balance of being legally compliant and community spirited. Leading community association attorney Donna DiMaggio Berger acknowledges the balancing act without losing her sense of humor as she talks with a variety of association leaders, experts, and vendors about the challenges and benefits of the community association lifestyle.

If you’ve got a question, Take It To The Board with Donna DiMaggio Berger – We Speak Condo & HOA!

Every community association will experience a significant property damage claim at some point during its lifespan. In addition to windstorms, fires and floods there are the everyday water leaks with which volunteer boards and managers must contend. While it is reasonable to believe that after years of dutifully paying your insurance premiums your damage claims will be paid quickly and in full, the reality is often quite different.

Episodes are available for subscription on iTunes, Amazon Music, Spotify, or listen through any podcast streaming app.

Navigating the complexities of community association governance is increasingly challenging due to evolving laws, heightened personal liability for board members, and onerous regulation including the personal information required of volunteer board members under the controversial Corporate Transparency Act. In this episode of Take It To The Board, host Donna DiMaggio-Berger and producer Claude Jennings Jr. address a host of listener questions and shed light on the most pressing issues board members face today.

Time-strapped volunteer board members and managers are at a significant disadvantage while trying to shepherd an insurance claim on their own. And the insurance company’s adjuster is not there to help you maximize your claim-in fact, it is the opposite. The insurance company’s adjuster is there to minimize or even deny your claim if possible. Our team intimately knows your business and will fight hard to maximize your insurance payout.

Meeting Minutes—Guidelines for HOAs and Condominiums

Developing a Strong Board of Directors

Unlocking Financial Success: Budgeting Tips for Board Members

FCAP'S Service Provider Directory

Board Member or Bully?

Embarking on Your HOA Journey: Five Tips for New Board Members

Journal

FCAP Community CAM Matters—Betsy Barbieux

Readers' Choice Awards

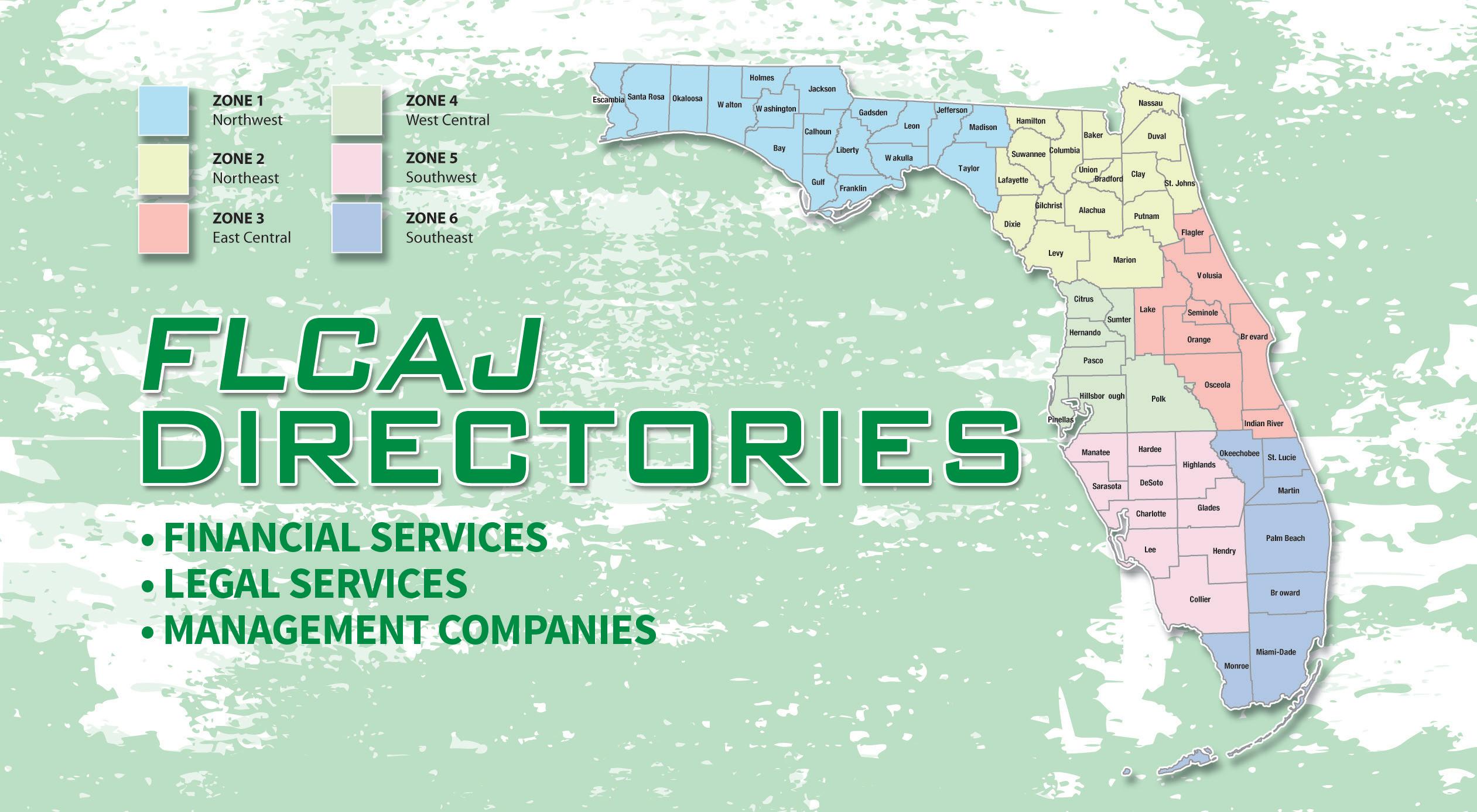

Financial, Legal and Management Directory

Products and Services Directory

Display Advertisers’ Index

Rembaum's Association Roundup 2024 Legislative Clarifications for Board Members And Managers

Crucial Tips for Filing Your Hurricane Damage Claim

Term Limits to First Impact Longstanding Condominium Directors in 2026

Subrogation Lawsuit Survives

The September issue offers several articles for those volunteering their time to serve as board of directors in their community associations. On page 6 Ashley Dietz Gray with Campbell Property Management shares guidelines for recording meeting minutes. She notes that meeting minutes should be a summary of the board’s actions, with proper recording of motion voted on and how each board member voted.

Max Glassburg is with Yardi Systems, and on page 8 he provides 10 recommendations that if adopted will help community managers (CAMs) to develop a strong board of directors. Board members should take pride in their work for the community, and CAMs should encourage the right people to join the board for the right reasons and keep board members motivated by showing them how the HOA benefits from their service.

Turn to page 14 to read the budgeting tips provided by Castle Group. Among other tips they recommend a thorough understanding of an association’s contractual obligations and the establishment of a quality control process that ensures all the figures and formulas are correct.

On page 42 Tara Tallaksen with Vesta Property Services shares the following five tips for serving on the board with confidence and effectiveness: immerse yourself in community knowledge, build strong relationships with fellow board members, educate yourself on HOA rules and regulations, attend training and seek mentorship, and communicate transparently with homeowners.

On page 44 Jeffrey Rembaum with Kaye Bender Rembaum summarizes the 2024 legislative clarifications for board members and managers. He addresses the recent legislative changes to certification requirements, certificate retention, and continuing education requirements for HOA and condominium association board members. He also highlights the new HOA and condominium association hurricane protection requirements as well as provides clarification of HOA website posting requirements.

Turn to page 56 to read the article from Laura Manning-Hudson with Siegfried Rivera that reminds associations that term limits of eight consecutive years for service by board members will kick in starting 2026. She provides a history of the term limits legislation.

Finally, on page 66 Betsy Barbieux addresses the many challenges board members face. She covers financial management, rules enforcement, board member recruitment, effective communication, disaster preparedness, social media strategies, and the role of professional management.

FLCAJ says, “Thanks for your service, board members.”

Editor

Publishers Richard Johns Dana Johns

Editor Michael Hamline

Art Director Nick Walker

Graphic Designer Jennifer Godwin

Advertising Sales

Phone: (800) 425-1314

Email: info@fcapgroup.com

Circulation/Accounting Tammy Hanner Phone: (800) 443-3433 Fax: (501) 280-9233

Editorial Phone: (800) 443-3433 Fax: (501) 280-9233

FCAP Coordinator Dana Johns Phone: (800) 443-3433

Email: djohns@fcapgroup.com

Florida Community Association Journal is published monthly by True Source Publishing LLC 1000 Nix Road Little Rock, AR 72211-3235

Email: info@fcapgroup.com Website: FCAPgroup.com

Copyrighted by Florida Community Association Journal. Reproductions of any part of this publication without written permission of the publisher are prohibited.

Subscription Rates

$24 for one year, $48 for three years. Back issues are $5 each plus postage. Group rates for 3 or more people are available at $12 per person.

The publisher and editor(s) of this magazine do not accept responsibility for the content of any advertisement, including statements made by advertisers herein, or for the opinions expressed by authors of by-lined articles. The publisher and editor(s) also reserve the right to reject any ad or article for objectionable content in verbiage or images. The intent of this publication is to provide general information only and is not intended to provide specific advice or recommendations. Appropriate legal, financial, or engineering advice or other expert assistance should always be sought from professionals.

Postage paid at Little Rock, AR and additional offices (permit #1085).

Postmaster Send address changes to: Florida Community Association Journal 1000 Nix Road Little Rock, AR 72211-3235 or email info@fcapgroup.com

Ansbacher Law, with board certified partners, 11 attorneys and over 30 professionals, is available to serve your community throughout Florida.

• Full service law firm for your Condominium or Homeowners Association.

• Florida’s leading construction defect team - Full contingency available, no fees or costs unless you win.

• Collections handled on deferred and contingency fee arrangement.

BY ASHLEY DIETZ GRAY

common question for new board members is, how much detail should I include in the minutes?

The short answer—less is more! Why? And what does this really mean?

One of the most common complaints about association boards is a “lack of transparency.” Owners sometimes think that board members are overly secretive and don’t share enough information with owners. When new board members join, their first instinct may be to include as much information in the minutes as possible so that there is complete “transparency,” and owners can know exactly what

transpired at the board meeting, even if they did not attend.

This sounds like a noble goal. Unfortunately, it is very risky to do this and can expose the association to potential lawsuits.

For example, let’s say someone comments on the following:

“There are uneven areas on the sidewalk due to tree roots, which could present a trip hazard.”

This is relevant and something that should be dealt with, but it does not need to be in the minutes unless there was a motion that was voted upon related to the topic. It should become an action item for the property manager to address but does not need to be in the minutes. If someone were to trip on the sidewalk two years later, the minutes could imply that there was a dangerous situation in the neighborhood that the board neglected to address.

Similar issues may arise around topics like pool safety, speeding, poor lighting, and much more.

The minutes should simply be a summary of the actions taken by the board at the meeting.

1. Accurate writing of the motion that was voted on.

2. How each board member voted on each motion.

One other thing to NOT include is whatever follows the following statement from a board member or owner: “I want the minutes to reflect . . . ,” unless what they say is related to 1 and 2 above.

For a more detailed, legal explanation on this topic, visit tinyurl.com/5bb73ux8.

Following is an example of how we recommend the minutes be written:

Ashley Dietz Gray has been handling the marketing at Campbell Property Management since 2013. She is a native Floridian who shines at building relationships and getting things done with a positive attitude. Ashley graduated summa cum laude from Florida Atlantic University with her bachelor’s in communications. She has always believed “knowledge is power” and has made it Campbell’s mission to offer free education through in-person events, webinars, and their blog, Florida Association News (FAN), to board members and property managers of condominiums and HOAs throughout Florida. Ashley has worked hard to spread the word about FAN, which currently has over 19,000 subscribers. To check out FAN and access all of Campbell’s past and upcoming webinars, visit ReadFAN.org. For more information, call 954-427-8770, email contact@CampbellPropertyManagement.com, or visit www.campbellpropertymanagement.com

Del Boca Vista Condominium Association, Inc.

123 Happy Lane, Boca Raton, FL 33441

Board of Directors Meeting

Thursday, October 17th, 2019, 7:00 p.m.

Del Boca Vista Recreation Room Minutes

Call to Order:

Bob Jones, President, called the meeting to order at 7:00 p.m.

Quorum:

A quorum of the board was present with Bob Jones, Linda Simpson, and Susan Gonzalez in person and Bill Turner via speakerphone. Amy Smith was not present. The manager, Robin James, was also present.

Minutes Approval:

Susan Gonzalez made a motion to approve the minutes from the September 19, 2019, board meeting. This was seconded by Linda Simpson and approved unanimously.

Reports:

Reports were read by the treasurer, the manager, and the following committees: finance, social, and landscape.

New Business:

1. Approval to secure loan from Acme Bank for building restoration project. Bob Jones made a motion to approve the association securing a $2,930,000 loan for the building restoration project from Acme Bank at a rate of 4.25%—interest only for the first year and then repayment of principal and interest over the next seven years, secured by an assessment levied specifically for this project. This was seconded by Susan Gonzalez, and the motion was approved unanimously.

2. The landscape bids received from Better Landscaping, Ocean Landscapers, and Green Lawns were discussed at length. Bob Jones made a motion to approve the landscape maintenance bid from Green Lawns, and this was seconded by Linda Simpson. Bob, Linda, and Susan voted yes, and Bill voted no. The motion passed 3–1.

Open Discussion:

The floor was opened to owners present and questions and concerns were addressed.

Adjournment:

With no further business to discuss, the meeting was adjourned at 7:45 p.m.

Respectfully submitted by Robin James, Property Manager n

BY MAX GLASSBURG

Homeowners’ associations (HOAs) can’t function properly without a strong board of directors. But if you see a risk of HOA board member burnout or are looking to increase participation, you’ll need to do more than follow a few legal statutes to help your community thrive. Right now many HOAs are struggling to fill board seats. This puts each association at risk of falling under government control. If a quorum can’t be established, the state will appoint a receiver to administer the bylaws. This also subjects the HOA to numerous fees.

Let’s talk about the ways HOA community managers can

work

tors

of

Pride can be contagious. While this is true for everyone, it’s especially true for leadership. The officers (president, vice president, secretary, and treasurer) are the beating heart of the HOA board.

Do your board officers’ roles motivate them to excel? Do they speak positively to other residents about their work? Officers need to set the tone for everyone else. Granted, pride alone won’t drive membership, but it’s necessary to make anything else work.

GLASSBURG, SENIOR MARKETING WRITER, YARDI BREEZE

Max Glassburg is a senior marketing writer at Yardi. He is usually found writing for Yardi Breeze and especially enjoys connecting with clients and sharing their successes with the real estate community. For more information, visit yardibreeze.com or call 800-866-1144.

HOA board member burnout is difficult to manage alone, and Yardi has a long history helping HOA leadership manage their communities. Yardi Breeze Premier is an all-in-one software that puts you in charge of your entire portfolio. This means HOA managers can easily customize correspondences and communicate rules to residents. Breeze Premier also keeps a record of all communications and violations, so you have all the evidence you need to enforce fees and penalties.

Make sure you train all board members on communication tools built into the property management software you use. This will make it easier for the board to stay connected with homeowners.

You can even send resident newsletters and email updates through the software to let the community know what the HOA is doing to support them.

If you’re finding a lack of interest in your HOA board, it may be that the association’s homeowners don’t “see themselves” in the board’s decisions. Encourage interest by reaching out and discovering what the community wants. While board meetings are an important part of any association, some residents might need more incentive to join.

There are probably specialty committees that can be created to tap into the interests of individual residents: gardening, welcoming, social, etc. Association membership thrives when residents see their interests and skill sets being used to improve life for everyone in the community.

Don’t make things more difficult than they have to be. For instance, some states have laws that allow residents to air dry their laundry regardless of HOA regulations. In these states, the board can’t create a rule restricting this behavior just because they don’t like the way laundry looks blowing in the wind.

Furthermore, the Fair Housing Act sets lines you cannot cross even when something is bothering you or another community member. The FHA is a powerful tool that helps you wield authority for your residents, not against them. When in doubt, stick to it blindly. After all, you can’t enforce a rule that’s illegal in the first place!

Rule of thumb: Even if a regulation isn’t illegal, if it’s not stated clearly in the association bylaws, it can’t be enforced.

Disagreements can be productive. HOA boards generally pass regulations when they reach consensus, but that doesn’t mean every single board member will agree with every single aspect of every idea. Formal consensus proceedings should allow the board to hear and discuss all concerns. It’s important for board members to understand that while they do have a voice, the needs of the community outweigh the needs of the board.

If one or two board members are consistently voting down meaningful changes for nitpicky reasons, the legitimacy and effectiveness of the entire board can be compromised. That’s exactly why every concern needs to be

heard and thoroughly discussed. A lot more will get done, and consensus will be reached more often, if all members feel like their input matters.

Every HOA board member should be there for the right reasons. If anyone expresses interest in joining, have some talking points (consider a printout and/or emailed document).

Cover a few major points to ward off anyone who may be joining for the wrong (aka self-motivated) reasons. Encourage those with their hearts in the right place.

A resident may be a good candidate for the board if they possess the following:

• Put the community’s needs before their own interests

• Do the work and follow through with commitments

• Develop their leadership skills

• Learn the bylaws and apply them fairly across the community

• Discuss issues rather than make demands

• Are already active volunteers in the community

• Enjoy finding creative solutions that accommodate everyone’s input

• Are not too busy with other activities that they cannot keep up

It’s not always easy to find enthusiastic volunteers. HOA board membership is unpaid volunteer work that asks people with families and full-time jobs to go the extra mile. But once you find the right people, the results are wonderful.

Members of the board of administration may use email as a means of communication but may not cast a vote on an association matter via email. A meeting of the board of directors of an association occurs whenever a quorum of the board gathers to conduct association business.

Communicate professional expectations among board members. Keep summaries of each meeting, and ask the board to ratify the results at future meetings. If you do a good job of coordinating discussions, assisting the board on policy matters, and resolving issues during meetings, there will be less incentive for board members to privately discuss business outside of board meetings. There’s simply less risk of turmoil and HOA board member burnout when everyone respects the rules.

When residents go on social media to express frustrations or personal feelings, be sure to acknowledge them. You can even go as far as to thank them for their input, but do not engage with a negative conversation.

For more ideas, check out our article on the dos and don’ts of social media. It’s important to address all comments, good or bad, but the most important thing is to protect the HOA’s reputation and credibility.

HOA board member volunteers don’t grow on trees. It’s important to keep them motivated by showing them how the HOA board benefits their community. Here are a few quick thoughts on attracting board members:

Be honest about their responsibilities. The worst thing you can do is misrepresent the level of commitment to a new member.

Welcome the new. You’re not there to control; you’re there to facilitate. Encourage new ideas, new committees, new directions, etc.

Set them up for success. Provide the legal documents HOA members need up front. Be sure they’re aware of any individual liabilities, ways to manage time, and anything else that will help them thrive. n

BY CASTLE GROUP

As we approach another budget season, Florida community associations gear up for what is often a rigorous financial planning exercise. However, with the right preparation and strategic approach, this season can transform from a daunting task into a well-executed financial plan for the upcoming year. Let’s explore essential tips and tricks to ensure a smooth and successful budget process for your association.

A critical first step in budget preparation is thoroughly understanding your contractual obligations. Begin by conducting a

detailed audit of all existing service contracts. Ensure all contracts are well-documented, highlighting key terms, expiration dates, and escalation clauses. Engage in proactive discussions with vendors to anticipate cost increases and negotiate terms, which allows for more accurate budget projections.

Insurance has become a significant line item in community association budgets. Insurance costs have been consistently rising, and securing policies has become increasingly challenging, particularly for communities with deferred maintenance or delayed 40-year certifications. Collaborating closely with your insurance agent to gain a comprehensive understanding of your policies and projected cost increments is essential.

Castle Group is the premier choice for property management; we specialize in serving the finest residential communities. With 2,700-plus dedicated team members, we are the preferred service provider for 500-plus associations. Our philosophy stays the same no matter where we are—putting the resident first. At Castle, we call it Royal Service®.

Our focus is to provide our clients with a powerful combination of incredible people, streamlined systems, and advanced technology to deliver the best service to our communities. Since no two properties are identical, we’ve created a menu of services that allows our customers to tailor a solution that fits their needs.

To learn more about how Castle Group can serve your community, request a proposal at www.castlegroup.com/request-a-proposal.

Early engagement with your insurance provider will help you effectively anticipate changes and integrate them into your budget.

Reserves are critical to your association’s financial health, and recent legislative changes have tightened the regulations around them. It’s imperative, especially for condominiums and cooperatives, to ensure that your budget aligns with these new requirements, particularly concerning structural integrity reserves. Budgeting accurately for reserve funding is crucial to ensure compliance and maintain your association’s financial health.

The budgeting process is a collective effort, often involving

property managers, board treasurers, and finance committees. After investing significant time and effort into creating the budget, the last thing any association wants is an error due to a simple oversight, such as a formula mistake or an outdated hardcoded number. To avoid costly errors, establish a robust quality control process. Double check all figures and formulas and verify that any manual entries are correct. A single miscalculation can have a ripple effect, so it’s essential to review the budget meticulously before presenting it for final approval.

Timely communication with your community is vital. Delays in delivering statements or coupons can lead to frustration and late payments at the beginning of the new year. To avoid

these issues, it is best to initiate budget preparations early, ideally after the June financials are available. Completing an early budget meeting allows for the timely distribution of statements/coupons. Since only a

CURRENT COMMUNITY

ASSOCIATION CLIENTS

$300M+ RECOVERED IN CONSTRUCTION DISPUTES SINCE 2018

COMMUNITY ASSOCIATION LAW SERVICES:

Covenant enforcement

Covenant amendments

Contract review/negotiation

Collection of assessments

Meeting package preparation

Attendance at meetings

OF SERVICE

Legal counsel on all day-to-day operational decisions

Review and negotiation of loan/line of credit documents

General litigation

And more!

TURNOVER & CONSTRUCTION DEFECT SERVICES:

Turnover meetings

Review of turnover documents

Assisting in the selection and hiring of turnover auditors, engineers and other consultants

Chapter 558 inspections and procedures

Negotiating repair protocols

All aspects of state/federal litigation for construction warranty claims, from settlement negotiations through trial

7 board certified attorneys in condominium & planned development law

5 board certified attorneys in construction law

Recognized by Chambers & Partners, Super Lawyers, Best Lawyers

*Information for results/recognitions referenced can be provided upon request

handful of companies produce these documents, providing data well in advance ensures efficient production and delivery.

In addition to the essential steps outlined, also consider these factors for a comprehensive budget:

1. Utility Trends— Monitor utility consumption and rate changes.

2. Legal Expenses— Legal fees can be unpredictable. Review past expenses and consult with your legal counsel to estimate potential costs for the upcoming year.

3. Community Projects— Plan for any significant community projects or enhancements. Gather bids early and include a contingency fund for unforeseen expenses.

4. Delinquency Rates— Analyze past delinquency rates to forecast potential shortfalls in collections. This will help maintain financial stability even when faced with revenue inconsistencies.

In summary, budget season doesn’t need to be a source of stress for Florida community associations. Your association can craft a robust budget by thoroughly reviewing contracts, diligently managing insurance, adhering to reserve fund regulations, enforcing quality control, and adhering to a strategic timeline. This proactive and systematic approach lays the groundwork for a financially secure and thriving community, allowing you to approach budget season confidently and clearly. n

Every community association will experience a significant property damage claim at some point during its lifespan. In addition to windstorms, fires and floods there are the everyday water leaks with which volunteer boards and managers must contend. While it is reasonable to believe that after years of dutifully paying your insurance premiums your damage claims will be paid quickly and in full, the reality is often quite different.

Time-strapped volunteer board members and managers are at a significant disadvantage while trying to shepherd an insurance claim on their own. And the insurance company’s adjuster is not there to help you maximize your claim-in fact, it is the opposite. The insurance company’s adjuster is there to minimize or even deny your claim if possible. Our team intimately knows your business and will fight hard to maximize your insurance payout.

Recent laws have shortened the timeframe during which you must act to protect your rights if you have construction defects.

If your community is experiencing water intrusion such as leaks through roofs, windows or sliding glass doors, excessive stucco cracks, or ponding water, you have limited time to legally pursue the potentially responsible parties. This process is initiated with what is commonly known as the “558 Notice” or “Notice of Claim.” This entails compiling a list of defects and sending it to the potentially responsible parties, giving them an opportunity to inspect and offer a solution. A proposed solution may be a monetary offer or a complete or partial offer to repair. If the proposed solution is inadequate, you may then proceed with a formal lawsuit.

Diana Sada Shareholder Attorney

This often involves retaining licensed engineers or architects to perform various inspections to assess the existence and extent of any suspected defects. It also involves conducting a careful and strategic analysis of potential claims that may be brought on your behalf. To set the Association up for highest chance of success, this process is best navigated with the representation of construction defect counsel from the earliest stage possible.*

*This article is for educational purposes only and is not intended to provide legal advice. Each case requires careful analysis. If you need legal advice, please seek legal counsel.

5523 W. Cypress Street, Suite 102

Tampa, Florida 33607

866-403-1588 www.RealManage.com Serving Orlando and Tampa Communities.

Towers Property Management 1320 N. Semoran Blvd., Suite 100 Orlando, FL 32807

407-730-9872 www.towerspropertymgmt.com

PAVEMENT PRESERVATION

Holbrook Asphalt Co. 1545 E. Commerce Drive

St. George, UT 84790 321-430-2232

mark@holbrookasphalt.com www.holbrookasphalt.com

PIPE ASSESSMENT

SageWater 1319 Powhatan Street Alexandria, VA 22314 888-584-9990 www.sagewater.com

PIPELINING

Mike Douglass Trenchless Technologies 517 Paul Morris Drive, Suite A Englewood, FL 34223 877-426-8660 mikedouglassplumbing.com

Pipeliner Pros 3401 N Miami Avenue, Suite 230 Miami, FL 33127 888-454-PROS (7767) info@pipelinerpros.com pipelinerpros.com

PUBLIC INSURANCE ADJUSTERS

Strategic Claim Consultants 18711 N Dale Mabry Highway Lutz, FL 33548 strategicclaimconsultants.com

Community Association Program 2801 Gateway Drive Pompano Beach, FL 33069 954-290-7576/800-878-7806 www.adt.com/communityassociations

Pecora Corporation

800-523-6688

freemana@pecora.com www.pecora.com/coatings

Kings III Emergency Communications 751 Canyon Drive #100 Coppell, TX 75019 800-354-6473

kthomas@kingsiii.com www.kingsiii.com

Breezeline 3 Batterymarch Park, Suite 205 Quincy, MA 02169 888-674-4892

breezeline.com/communities

Southern Chute: 954-475-9191; toll free 866-475-9191; fax 954475-9476; www.southernchute.com.

OWNERS REPRESENTATIVES

SOCOTEC

305-985-3772

socotec.us Run Your Association's Restoration Project Like a Pro

Jay, RS, PRA 561.488.3012 800.298.0683 • jrfrazerent@aol.com www.JRFrazer.com

Ramco Protective 401 Center Pointe Circle, Suite 1527 Altamonte Springs, FL 32701 407-622-7609

sam.negri@ramcoprotective.com www.ramcoprotective.com

Hinterland Group: 561-6403503; hinterlandgroup.com

BY

The audacity of some people who take positions on their HOA board and profess that they have the best interest of the community at hand yet also use that same position to harass some and seek favor from others never ceases to amaze me. As a contractor for the last 25 years, I have seen it many times; and each time it happens, I am shocked and saddened by the individual doing the bullying, the person receiving their wrath, and even more saddened when I learn why!

The most recent confrontation with a board member happened right before I was getting ready to host a “What to Expect” meeting for the residents of the community where we were getting ready to apply our surface

treatment, PDC asphalt rejuvenator, to their roadways. The current board was very proactive and made the meeting mandatory. That in itself caused a lot of commotion, but I wasn’t complaining as knowledge is power; and the more residents that attended, the more confident I became in the project being a total success. After all, when it comes to surface treatments, the results will only be as good as the residents let them be!

I had met with this property MANY times before, and I do not mean that in a bad way! I mean that the board was very active in their research, interviewed me along with other companies, and truly did their due diligence in researching what they wanted, why they wanted it, and when they wanted it! I wanted this project

Asphalt Restoration Technology Systems Inc. (AR Tech) is led by Connie Lorenz, also known as the “Asphaltchick,” and provides education and consultation services on proper asphalt maintenance. As a multi-year recipient of the Florida Readers’ Choice Award and Pulse of the City Awards and one of the Top 50 Asphalt Contractors in the country four years and running through Pavement Maintenance and Reconstruction Magazine, we are the team to turn to! We provide a no-cost, detailed evaluation, property specific, with our proposals and offer board presentations to explain the different options available for pavement maintenance today. For more information on Asphalt Restoration Technology Systems, call 800-254-4732 or visit www.asphaltnews.com.

more than anything because of the board and their efforts.

Arriving at the meeting, I discovered that the board had replaced an area of pavement that I had proposed for repair. At first, I was thrilled as the community was pristine up to this area, and with it being the focal point, of course I was supportive! However, I wasn’t supportive about the end result and how bad the paving project looked. Based on my experience, and I have A LOT of experience, I could tell that the contractor was working with the wrong equipment and maybe even the wrong trucks as well; temperatures were probably not even taken into consideration nor compaction rates and densities.

Go Green with Commercial Saline Systems! Save money, make your own Chlorine, enjoy a mineral pool!

Commercial Grade Saline Systems pay their own way giving owners years of guaranteed water quality and chemical savings.

Call us today for your FREE on-site evaluation!

• Water Management Programs for over 8,000 municipal & condo pools since 1983.

• Experts in chemistry controls, treatment, heating, heat retention, Ozone, UV & Saline.

• Master Distributor & Factory Service Center for over 10,000 parts & accessories.

• Leaders in Proven Green Technologies saving electricity, gas, water, and chemicals.

• Low cost monthly water quality programs starting at $69 a month.

800-940-1557 • www.CESWaterQuality.com

• Building Re-Certification

• Milestone Inspections

• Structural Integrity Reserve Study (SIRS)

• Concrete Restoration

• Roofing Consultant

• Forensic Engineering

(954) 399-2075 • www.simplerengineer.com

It was clear that it was none of the work of the local contractors whom I had provided. Before the board president and vice president could even ask my opinion, I blurted out “What did you do? Hire someone from the local do-ityourself store?” I instantly saw the looks on their faces and knew I had hit the mark!

Two of the board members were very gracious and explained what happened, and I almost felt vindicated as many others had approached them as well and asked what had happened. They told me, “Even people who knew nothing about asphalt knew that it didn’t look right,” and were anticipating my visit and opinion.

I don’t think they understood my frustration as I couldn’t understand why the community was going with the “Mercedes” of surface treatments yet hired the local outof-state contractor to do the most important work. I started asking questions, got the story straight, and found out that they had nothing to do with it. A former board member on the roadway committee was responsible for the decision, and worse, here he was walking in the door!

They asked me if I would talk to the committee member and let him know my concerns about the work after the “What to Expect” meeting. After all, it had already been corrected once, and they were still very unhappy with the work and rightfully so. They wanted it “right,” and the committee member wasn’t “hearing” them.

Continued on page 38

Continued from page 36

When the committee member walked in, I was going to pull him aside and get a little more information. However, the board members I was talking with took it upon themselves to introduce the matter in a more aggressive matter, like right between the eyes by saying, “Connie, why don’t you tell _____ what you think of the paving job?” I saw the headlights, I heard the horn, but I didn’t know the bus was coming at me!

When I asked him about the work, who the contractor was, what type of warranty was given, if he had the certificate of insurance, and if he had paid

them yet, the man got a little upset with me. Now, as a female in a male-dominated field, I know what buttons to push and how not to insult men, but his response was a little bit more aggressive to the point I almost cancelled the contract and walked away. He said that my turn was coming up with my team, and before I made a quick judgment against this contractor, let’s just see how good my crew does. In my mind I thought to myself that my crew could do it better backwards, blindfolded, and without equipment!

The committee member was livid with me; and understanding there were hurt feelings , I told the board that there was a way to fix it, but I needed more details before I would put my equipment on it. I continued to be disrespected by the committee member, and it became apparent that he did not like me or at least did not like what I was saying. I informed the board that I wouldn’t touch the area until the full year warranty had expired and hopefully that would not be too late!

I knew that the asphalt was installed cold and without the proper trucking based on those that watched it being installed. I knew that they didn’t have the right roller size to compact the asphalt, and even if they did, it was probably too cold to compact it by the time they did

Continued on page 40

Continued from page 38

put the roller on it. I also knew that they used an abundance of chemicals that are used to clean equipment in my industry, but not on the asphalt that had just been installed. The shiny areas they saw were where the binders were being weakened by the contractor’s cleaning agents.

There is nothing worse, as a contractor, than seeing a board battle one of their own.

Sometimes we have board members that demand to be right out of pride rather than acknowledging they might have made a mistake, letting the community come together and “fix” the situation.

The board president sent me an email late at night on a Friday, which apologized on

behalf of the residents/committee members/former board members. She stated that he has been a problem in the past after not being re-elected to the board, and he was known to give the current board— where both the president and vice president positions were filled by women—a hard time, criticizing them at every meeting! How sad for them!

Therefore, please know that when you run for the board or you volunteer for a committee, it is an unpaid, unappreciated position that involves a lot of work. Sometimes you get what you want, and other times you have to side with the majority as two percent of the community takes care of 100 percent of the problems while the other 98 percent complain about it. Board members and committees are the most valued part of a community, and its members should recognize that they are there for the betterment of a community, not for bullying to get their own way!

The project has been completed and the PDC application went well! I warned my team about the aggressiveness of the one resident and forgot to focus on another problem resident that revealed himself at the meeting…. who was he, you might ask? Well, he was the luckiest resident in the community, who had full access both days as we split his driveway between the two shoot days, and he thought this meant he could bring in a landscaper to install pavers in his yard. He allowed the contractor into the community and damaged the pavement near his unit at the entrance! Sigh! That story will be for another time! n

are you in compliance?

Most 3+ story residential condos require milestone inspections by the end of 2024

Osborn has conducted 230+ Condo Projects

• Corrosion Control Plans

• Structural Assessments

• Milestone Inspections

• Repair Designs

inspections@osborn-eng.com

321.784.5811

www.osborn-eng.com

BY TARA TALLAKSEN

Joining a homeowners’ association (HOA) board is a commendable commitment to community leadership. As a new board member, navigating the responsibilities and expectations can seem overwhelming at first. Fear not! Here are five invaluable tips to help you embark on your HOA journey with confidence and effectiveness.

Take the time to familiarize yourself with the community’s history, bylaws, and ongoing projects. Engage with existing board members to understand the current state of affairs and any pressing issues. A thorough understanding of the community’s dynamics will empower you to make informed decisions and contribute meaningfully from the outset.

Collaboration is key in HOA leadership. Establish open lines of communication with your fellow board members to foster a culture of teamwork. Regularly attend board meetings, participate in discussions, and actively listen to the perspectives of others. Building strong relationships within the board ensures a

cohesive and harmonious decision-making process.

A solid grasp of HOA rules and regulations is essential for effective governance. Familiarize yourself with the community bylaws, covenants, and any relevant state or local laws governing HOAs. This knowledge will not only guide your decision-making but also enable you to communicate effectively with homeowners and address their concerns within the bounds of the established guidelines.

Take advantage of any training programs or resources offered by your HOA or other relevant organizations. Seeking mentorship from experienced board members can provide valuable insights into the intricacies of community leadership. Learning from those who have navigated similar paths can help you avoid common pitfalls and enhance your effectiveness as a board member.

Tara Tallaksen is the marketing and sales assistant of Vesta Property Services. She started working for Vesta in amenities as a lifeguard supervisor for about a year before transitioning into her corporate office position. Tara graduated from the University of Florida with her bachelor’s degree. She enjoys exercising and is a certified personal trainer. She plans on continuing her career in marketing and is always willing to learn more about the field. Vesta’s great career opportunities, team support, and diverse trainings can help Tara achieve her professional and personal goals. To learn more about Vesta Property Services and our services, please visit www.VestaPropertyServices.com or call 904-355–1831. We look forward to hearing from you!

Transparency builds trust. From the moment you step into your role, communicate openly and transparently with homeowners. Keep them informed about board decisions, upcoming projects, and any changes that may impact the community. Establishing a culture of transparency fosters a positive relationship between the board and homeowners, contributing to a cohesive and well-informed community.

Embarking on your journey as an HOA board member is a rewarding endeavor that requires dedication, collaboration, and a commitment to continuous learning. By immersing yourself in community knowledge, building strong relationships, educating yourself on regulations, seeking mentorship, and communicating transparently, you set the foundation for effective leadership and contribute to the wellbeing of the community. Embrace the opportunity to make a positive impact, and enjoy the journey of serving your community as an essential part of its leadership. n

BY JEFFREY A. REMBAUM, ESQ.

The purpose of this article is to address the following:

• Homeowners’ and condominium association board member certification requirements, certificate retention and continuing education requirements (all of which are quite different);

• Condominium association and homeowners’ association hurricane protection requirements;

• Clarify homeowners’ association website posting requirements and remind homeowners’ association board members of mandates from the 2024 legislation.

CONDOMINIUM ASSOCIATION BOARD MEMBER

CERTIFICATION REQUIREMENTS, CERTIFICATE RETENTION AND CONTINUING EDUCATION REQUIREMENTS

• Each newly elected or appointed board member must submit to the secretary of the association the: (i) written certification AND (ii) educational certificate within 1 year before being elected or appointed or 90 days after the date of election or appointment.

• Specifically, for the (i) written certification, all residential

Attorney Jeffrey Rembaum has considerable experience representing countless community associations that include condominium, homeowner, commercial, and cooperative associations throughout Florida. He is a board-certified specialist in condominium and planned development law and is a Florida Supreme Court circuit civil mediator. Every year since 2012 Mr. Rembaum has been inducted into the Florida Super Lawyers. He was twice awarded as a member of Florida Trend’s Legal Elite. Kaye Bender Rembaum P.L. is devoted to the representation of community and commercial associations throughout Florida with offices in Palm Beach, Broward, Hillsborough, and Orange Counties (and Miami-Dade by appointment). For more information, visit kbrlegal.com

condominium board members must certify, in writing to the secretary of the association, that he or she has read the association’s declaration of condominium, articles of incorporation, bylaws, and current written policies; that he or she will work to uphold such documents and policies to the best of his or her ability; and that he or she will faithfully discharge his or her fiduciary responsibility to the association’s members.

• For the (ii) educational certificate, condominium association board members must complete an educational curriculum that has been approved by the DBPR that is at least four hours long with certain mandated subjects.

• A director of an association of a residential condominium who was elected or appointed before July 1, 2024, must comply with both written certification AND educational certificate requirements by June 30, 2025.

• To reiterate, a director of an association of a residential condominium who was elected or appointed after July 1, 2024, must comply with both the written certification AND educational certificate requirement within 90 days after being elected or appointed to the board.

• The written certification and/or educational certificate is valid for seven years after the date of issuance and does not have to be resubmitted as long as the director serves on the board without interruption during the seven-year period.

• Condominium association board members elected or appointed before July 1, 2024, have until June 30, 2025, to meet the new education curriculum requirement consisting of 1 hour of continuing education per year.

• The condominium association must retain a director’s written certification and/or educational certificate for inspection by the members for seven years after a director’s election or the duration of the director’s uninterrupted tenure, whichever is longer.

• Any director who fails to timely comply with the foregoing written certification and educational certificate requirements is suspended from service on the board until he or she complies.

• Homeowners’ association board members elected or appointed to the board on or after July 1, 2024, must take a board certification course within 90-days after being elected or appointed to the board (no minimum time required, typically around two hours).

• Continuing Education: In addition to the (i) written certification and (ii) educational certificate discussed above, one year after submission of the most recent written certification and educational certificate, and annually thereafter, a board member of an association of a residential condominium must submit to the secretary of the association a certificate of having satisfactorily completed at least one hour of continuing education administered by the division, or a division-approved condominium education provider, relating to any recent changes to this chapter and the related administrative rules during the past year.

• In addition, homeowners’ association board members must complete the education specific to newly elected or appointed directors at least every four years.

• The DBPR approved educational curriculum specific to newly elected or appointed directors must include training relating to financial literacy and transparency, recordkeeping, levying of fines, and notice and meeting requirements.

• In addition to the education course specific to newly elected or appointed board members, Homeowners’ association board members with fewer than 2,500 parcels in the association must take four-hours of continuing education annually and if 2,500 parcels or more in the association, then eight-hours of continuing education annually.

• The homeowners’ association must retain each director’s written certification or educational certificate for inspection by the members for five years after the director’s election.

• The ability of a recently elected or appointed homeowners’ association board member to simply submit a written certificate certifying that they read the association’s declaration of covenants, articles of incorporation, bylaws, and current written rules and policies; that he, or she, will work to uphold such documents and policies to the best of his or her ability; and that he, or she, will faithfully discharge his or her fiduciary duties to the association, is no longer an option to meet certification requirements as it has been removed from Section 720.3033, Florida Statutes.

• Chapter 718 F.S.: Condominium Association Hurricane Protection Specifications. Each board of a residential condominium or mixed used condominium must adopt hurricane protection specifications for each building within the condominium operated by the association which may include color, style, and other factors deemed relevant by the board (please note that this provision used to apply to hurricane shutters but now applies to all hurricane protection).

• Chapter 720 F.S.: Homeowners’ Association Hurricane Protection Specifications. The board or any architectural, construction improvement, or other similar committee of an association must adopt hurricane protection specifications for each structure or other improvement on a parcel governed by the association. The specifications may include the color and style of hurricane protection products and any other factor deemed relevant by the board. All specifications adopted by the board must comply with the applicable building code.

HOA New Website: By January 1, 2025, an association with 100 or more parcels shall post several documents within its Official Records on its website or make available such documents through an application that can be downloaded on a mobile device

HOA New Website Posting Requirement for Members’ Meetings Notice of any scheduled meeting of the members and the agenda for the meeting, as required by Section 720.306, Florida Statutes, at least 14 days before such meeting. The notice must be posted in plain view on the homepage of the website or app, or on a separate subpage of the website or app labeled “Notices” which is conspicuously visible and linked from the homepage. The association shall also post on its website or app, any document to be considered and voted on by the members during the meeting, or any document listed on the meeting agenda, at least seven days before the meeting at which such document or information within the document will be considered

HOA New Website Posting Requirement for Board Meetings— Notice of any board meeting, the agenda, and any other document required for such meeting must be posted on the website or app no later than the date required for such notice.

REMEMBER, EVERY HOMEOWNERS’ ASSOCIATION BOARD MUST DO THE FOLLOWING:

• Adopt hurricane protection standards/rules as discussed above.

• Provide copies of the rules and covenants to every association member before October 1, 2024, or post same on the association’s website and send notice to each member at their address used for official notices as to where they can locate them.

• Adopt rules and regulations governing official record retention. n

BY KEN SHRIBERG

s another hurricane season sweeps across Florida, condominium associations (COAs), homeowners’ associations (HOAs), and their residents brace for potential storms. With predictions for a particularly intense season, preparation is paramount. From understanding your insurance policy to knowing the critical steps to take before and after a hurricane, being prepared can make a significant difference in handling damage claims as a board navigates their fiduciary duties.

This article provides key considerations from an insurance adjusting perspective to help navigate the complexities of hurricane damage claims effectively as well as damages caused by flood, fire, water pipe leaks, wind, hail, and other weather occurrences.

Before a storm hits, ensure you have a complete and easily accessible paper and digital copy of your association’s insurance policy. This includes the declaration pages, main policy jacket, and all endorsements and exclusions sections. It’s advisable to have a certified copy. Reach out to your commercial insurance agent for help in obtaining this. When a hurricane occurs, you’ll need to know exactly what your coverages are. Having this documentation handy saves time and stress during a crisis.

Conduct a thorough review of your policy with your insurance agent. Understanding your coverage details, potential

Ken Shriberg is affiliated with Becker’s Association Adjusting, a licensed and insured public adjusting firm exclusively and specifically experienced in serving community associations throughout Florida. They assist with claims from all weather-related events, including hurricanes, storms, water damage, fire, theft and vandalism, and mold and roof leaks. Association Adjusting provides pre-loss policy review consultations, on-site damage analysis and documentation, loss estimate valuation, negotiation, and claim settlement with insurance companies. Ken has been a licensed public insurance adjuster specializing in association loss claims since 2006 and is a longtime member of the Florida Association of Public Insurance Adjusters (FAPIA), including as a retired board director. Ken also has 40 years of experience in multiunit commercial property restoration/reconstruction projects. For more information visit www.associationadjusting.com.

exclusions, and the time-sensitive steps to take in the event of a weather-related loss is crucial. As a second set of eyes with a professional perspective, consultation from an association specialist licensed public adjusting firm can provide additional insights into potential gaps in your coverage and suggest necessary changes to your policy

Continued on page 52

January 1, 2025 marks the deadline to be in compliance with Florida law regarding Milestone Inspections and Structural Integrity Reserve Studies,

Wi th over 25 year s of ex perience wi th reser ve studies and insurance apprais al, we ser vice condominium associations , homeowner associations , businesses , clubs , and organizations . Let a team of ex per ts and quali t y

With over 25 years of experience with reserve studies and insurance appraisal, we service condominium associations, homeowner associations, businesses, clubs, and organizations. Let a team of experts and quality customer service provide you with solutions and strategies you are looking for.

customer ser vice provide you wi th solutions and strategies you are looking for.

• Structural Integrity Reserve Studies (SIRS)

• S truc tural Integri t y Reser ve S tudies (SIR S)

• Traditional Reserve Studies

• Tradi tional Reser ve S tudies

• Insurance Appraisals (Replacement Cost Valuations)

• Insuranc e Appraisals (Replac ement Cost Valuations)

• Milestone Inspections

• Milestone Inspe c tions

• Florida-based and Family owned

• Florida-base d and Family owne d

Please contact us to discuss how we can be of service to your association! The Reser ve S tud y, Milestone Ins pe ct ion & Insurance A pprais al E x per t!

Go to our website to download your FREE copy of Anastasia’s new book!

Go to our websi te to download your FREE copy of A nastasia’s new book!

Please cont act us to discuss how we can be of ser vice to your association!

“By failing to prepare, you are preparing to fail.” — Benjamin Franklin

“By failing to prepare, you are preparing to fail.” — Benjamin Franklin

Continued from page 49

before a weather event occurs. These initial consultations are free of charge and can be done virtually.

Based on the policy review, consider making changes if necessary. This might involve increasing coverage limits, adding endorsements for specific risks, obtaining discounts and credit, or clarifying any ambiguous terms. Making these adjustments ahead of time ensures that you are adequately covered and can assist in preventing complications during the claims process.

Both condominium and homeowner associations have pre- and post-loss hurricane fiduciary duties, such as making good faith efforts to prepare and keep the property protected, to preserve and protect official records prior to the hurricane and to recover official records which are lost or destroyed, and to recover all insurance monies owed to the association. Because damage is not always apparent to the visible eye, trained experts should be consulted.

The 2024 legislative session introduced several key changes addressing various aspects of community association governance relating to hurricanes. Florida Statute Chapter 718.113, as amended, calls into question who pays to remove and reinstall hurricane shutters in

condominium associations. It is important that the association confer with counsel and, if necessary, amend the declaration to clearly define the responsibility for the removal and reinstallation costs of hurricane protection before it becomes an issue during a repair or renovation project.

Likewise, Florida Statute, Chapter 720.3035 for HOAs was amended to require HOA boards to adopt specifications for hurricane protections on homes and to prohibit associations from denying applications for hurricane protection by a parcel owner that conforms to specifications adopted by the board.

Communication is vital. After making sure that everyone is safe, provide frequent updates for the shareholders and explain what steps the board is taking.

a Qualified

Right after the weather event, contact a public adjusting firm that is experienced in large-loss association claims handling. If you are acting as a property manager or board member on behalf of your HOA, you have specific fiduciary duties to perform after a loss. These include documenting the damages, evaluating the property, and mitigating damages. It is best to familiarize yourself with all the required duties

and adhere to the required timeframe as failure to do so can result in claim denial.

A qualified public adjusting firm can coordinate all your emergency needs, including scheduling experienced emergency mitigation contractors for you. These emergency service companies include tarping, boarding up, water removal, mold remediation, debris removal, and possibly structural stabilization among other tasks. Having a professional public adjusting firm that specializes in emergency claims handling will help to smoothly guide you through the process from start to finish, ensuring that all necessary steps are taken and documented correctly.

A qualified public adjusting firm will guide you in determining the dollar value and scope of work required to bring the property back to its pre-loss condition. Once you have these details, the information can be used in preparing a base budget, in which you can solicit “apples to apples” bids from at least three qualified contractors.

Remember, you should not execute a contract for final restoration repairs unless you have the necessary funds allocated in reserves, or alternatively have a written agreement for full payment from your insurance company!

Beware of Unlicensed and Uninsured Contractors

In the aftermath of a hurricane, desperation can unfortu-

nately lead to poor decisions, resulting in chaos. Avoid hiring contractors who knock on doors randomly as they may not be properly licensed, insured, and bonded or have adequate workers’ compensation. Initially bringing in a licensed public adjusting firm can help guide your decisions towards selecting qualified contractors who bid the damages in alignment with insurance scope of work so that all contracts are up to those same standards.

For the building reconstruction, especially the larger losses, it is advisable to have a standardized bidding process. This ensures that all bids are uniform and compa -

rable. A standardized process also helps in making informed decisions and prevents disputes over the scope and cost of the work.

Never sign any contract for reconstruction without having it reviewed by your lawyer or legal team first. Signing without legal oversight could lead to losing your rights regarding the reconstruction work and/or payment of same. This also ensures that the terms are fair and that your interests are protected.

Insurers have the right to inspect damaged property to assess the claim. Document by taking photos and do not throw away any damaged items except materials like porous, water-damaged drywall and carpeting (keep a sample) before they have been documented by your public adjusting firm and insurance company. Premature disposal can complicate your claim and potentially reduce the compensation you receive. Make sure this has been communicated to everyone who lives in the building.

Navigating a hurricane or other property loss can be challenging, but being prepared and having the assistance of a qualified public adjusting firm can make a significant difference. Becker’s Hurricane Preparedness and Recovery Guide also helps boards and managers prepare for the approach as well as the aftermath of a storm or other weather disaster. n

BY LAURA MANNING-HUDSON

The Florida legislature’s confusing rollout of board member term limits for condominium association directors created many initial questions about how and when the term limits applied. Some directors still have lingering questions and uncertainties, so hopefully this article will help to resolve those.

Board member term limits were first added to the Florida laws governing condominium associations in 2017 when they were imposed for a maximum of four consecutive two-year terms. However, the legislature gave a reprieve for “termed-out” directors who received votes from more than two-thirds of the voting interests of the association, and also for associations with insufficient numbers of candidates to fill the vacancy.

Confusion reigned. Associations that did not have two-year board terms were unsure as to how the limits were to be applied, and there was uncertainty as to how board service prior to the effective date of the new law would apply against the limits.

As a result, the state’s lawmakers made further changes to the new law the following year in 2018. Those amendments made it clear that a board member may not serve more than eight consecutive years unless a) the director received votes from at least twothirds of all votes cast in the election, or b) there were not enough eligible candidates to fill the vacancies. However, questions remained over when to start calculating the eight-year term limit.

In 2021 additional changes further clarified that only board service occurring on or after July

Laura Manning-Hudson is a shareholder with the Coral Gables-based law firm of Siegfried Rivera who is board certified as an expert in community association law by the Florida Bar. She is the managing shareholder of the firm’s West Palm Beach office and a regular contributor to its Newsroom blog at www.SiegfriedRivera.com/blog. We encourage association directors, members, and property managers to visit the blog and enter their email address to receive future articles. The firm also has an office in Broward County, and its 50 attorneys focus on real estate, community association, construction, and insurance law. www.SiegfriedRivera.com, 561-296-5444, LManning@SiegfriedRivera.com.

1, 2018, would apply to calculating a board member’s term limit. This means that the very first term-limited directors will be those who have served eight consecutive years in mid-2026.

Some condominium association bylaws may already contain term limits, but most do not. What they typically do include is language that incorporates and adopts all changes to Florida’s laws governing condominiums in perpetuity, so they must comply with the term limits law.

For smaller condominium associations that find it challenging to attract and maintain enough qualified candidates to fill their board seats, they should feel reassured by the law’s concessions enabling longstanding directors to continue serving if they get two-thirds of the votes cast or if there are not enough

SOME CONDOMINIUM ASSOCIATION BYLAWS MAY ALREADY CONTAIN TERM LIMITS, BUT MOST DO NOT. WHAT THEY TYPICALLY DO INCLUDE IS LANGUAGE THAT INCORPORATES AND ADOPTS ALL CHANGES TO

FLORIDA’S

LAWS GOVERNING CONDOMINIUMS IN

PERPETUITY,

SO THEY MUST COMPLY WITH THE TERM LIMITS LAW.

candidates. And, long-term directors of homeowners’ association communities need not be concerned since board member term limits were only added to the condominium statutes and not those governing HOAs.

Ultimately these term limits that will first apply to long-term directors in 2026 are not expected to create too many issues and difficulties for the majority of communities. Of course, directors with any questions and concerns will need to consult with highly qualified association legal counsel, but for the most part the clear language of the statute will leave little room for any major doubts and uncertainties. n

BY MICHAEL J. GELFAND, ESQ.

NSURER’S SUBROGATION LAWSUIT AGAINST ASSOCIATION SURVIVES: NO “SUE AND LOSE FIRST” RULE

When an association finds itself embroiled in litigation, settlement is very often the end result. Settlements usually include releases. A recent decision shows the dangers of a Florida community association settling litigation with releases but seemingly not addressing all of the consequences, especially insurance claims.

Specifically, a Florida appellate court recently ruled that a condominium association’s property insurer was able to sue the condominium association for breach of contract when the association allegedly signed releases that barred the insurer’s subrogation rights. The facts in Seneca Specialty Insurance Company v. Jade Beach

Condominium Association, Inc., 49 Fla. L. Weekly D 706 (Fla. 3rd DCA, April 3, 2024), indicate that Seneca issued a liability insurance policy to the association, which required the association to do nothing that would impair the insurer’s subrogation rights.

What is a subrogation right? An example of subrogation that associations have faced is when property is damaged, instead of the property owner suing the other person that caused the damage, the owner’s insurer pays the owner for the repair or replacement. Then in exchange for making that payment, the insurer obtains the right to sue the other person that caused the damage.

Regarding subrogation, the condominium association’s policy provided the following: If the insured has rights to recover all or part of any payment we have made under this coverage part, those rights are transferred to

MICHAEL J. GELFAND, ESQ., SENIOR PARTNER, GELFAND & ARPE, P.A.

Michael J. Gelfand, Esq., the senior partner of Gelfand & Arpe, P.A., emphasizes a community association law practice, counseling associations and owners how to set legitimate goals and effectively achieve those goals. Gelfand is a dual Florida Bar board-certified lawyer in condominium and planned development law and in real estate law, a certified circuit and county civil court mediator, a homeowners’ association mediator, an arbitrator, and parliamentarian. He is a past chair of the Real Property Division of the Florida Bar’s Real Property, Probate & Trust Law Section, and a Fellow of the American College of Real Estate Lawyers. Contact him at ga@gelfandarpe.com or 561-655-6224.

us. The insured must do nothing after loss to impair them. At our request, the insured will bring “suit” or transfer those rights to us and help us enforce them.

Returning to the facts of this dispute, in 2014 the owners of Jade Beach Condominium Unit 4701 sued the association as well as the owner upstairs, Unit 4904, and others, alleging that water flowing down from Unit 4904’s balcony damaged Unit 4701’s balcony.

The owners of the upstairs Unit 4904 then sued the association, alleging the association breached its duty to maintain the common elements and duty to remedy structural defects. Seneca Specialty Insurance defended the

association and paid out the policy limit of $1 million to settle upstairs Unit 4904’s crossclaim.

Unbeknownst to Seneca, the association filed a separate construction defect lawsuit against the developer, contractor, and others which was then settled. As part of the settlement, the association provided general releases to the defendants in the association’s construction claims. It was those construction claims releases that Seneca asserted prevented Senecca from suing the construction defect defendants for the money Seneca paid to settle with Unit 4904. In 2020 Seneca sued the association for breach of contract alleging the association’s releases to the construction defect defendants barred Seneca’s subrogation rights against those defendants.

The trial court granted the association’s motion to dismiss the complaint, finding that the breach of contract claim was premature because Seneca did not

first sue the construction defect defendants and did not receive a judgment that found its subrogation rights were impaired by the association.

The Florida appellate court disagreed and reversed the trial court’s dismissal. The appellate court reasoned that where an insurer honors a claim under an insurance policy, the insurer becomes subrogated to the insured’s rights. If the insured settles with and releases the at-fault party preventing the insurer from making claims against the at fault party, then the subrogated insurer may have a claim against the insured for breach of contract. The court concluded that an insurer is not required to first sue the parties to whom the insured granted releases. In other words, Florida law does not have a “sue and lose first” law.

This case emphasizes the dangers of settling a case if there are potential subrogation claims. If there is a potential insurance claim, check with the insurers to ensure no right of subrogation will be impacted.

During hurricane season, it is very important to understand what your insurance policies actually cover. If a Florida community association sustains damage to its property before, during, or after a hurricane warning has been issued, will the insurance policy cover the losses? Will the insurer subtract the hurricane deductible?

In two identical decisions, a Florida appellate court recently ruled that a hurricane deductible cannot be applied to a Florida property loss caused by a hailstorm when the hurri-

Get Your Life Flowing To

cane was far away from Florida at the time of the hailstorm. In Florida Farm Bureau General Insurance Company v. Jones, 49 Fla. L. Weekly D 777 (Fla. 5th DCA, April 9, 2024), and Florida Farm Bureau General Insurance Company v. Williams, 49 Fla. L. Weekly D 779 (Fla. 5th DCA, April 9, 2024), the facts show that a hurricane warning was issued for parts of Florida as Hurricane Isaias neared Florida’s eastern coast. The hurricane warning lasted until August 2, 2020.

Two days later, on August 4, 2020, a severe hailstorm damaged the insureds’ homes. At the time of the hailstorm, Hurricane Isaias was located over Vermont, nowhere remotely close to Florida. Nonetheless, when the owners submitted claims for the damage caused by the hailstorm, the insurer paid the claims but subtracted the hurricane deductible, a higher deductible than for “normal”

weather losses. Both owners sued the insurer for breach of contract. The trial court granted summary judgment for the homeowners.

Agreeing with the trial court’s decision in favor of the homeowners, the Florida appellate court noted that the insurance policy defined “hurricane occurrence” as a period that begins “at the time a hurricane watch or warning is issued for any part of Florida” and ends “72 hours following the termination of the last hurricane watch or hurricane warning issued for any part of” the state.

The problem with the language in the policy was that the loss did in fact occur during a “hurricane occurrence” as defined by the policies. This is because the loss occurred less than 72 hours following termination of the hurricane warning for Florida.

“Given this imprecise policy language, the parties are constrained to offer imperfect interpretations of paragraph D.1. Were their competing interpretations both reasonable, we would hold any ambiguity against the insurer,” the Court explained. “However, we need not resort to this ‘tie goes to the insured’ canon because the parties’ interpretations are not both reasonable.” The court agreed with the homeowners’ argument that a hurricane did not cause their loss because the hailstorm was a local weather event with no connection to the hurricane.

As can be seen by these two decisions, it is very important to understand your insurance policies, especially as hurricane season is here! Considerations to inquire of your insurance broker include whether your policy provides for actual or replacement value coverage, whether there is a component age issue, must a “preferred contractor” be hired, and when, how and to whom must notice of a claim be provided. n

Commercial Painting Solutions for Extreme Florida Weather Conditions, General Contracting and Remodeling Expertise

• Commercial and New Construction Painting

• Interior Repaint

• Exterior Repaint

• Waterproofing

• Tenant Build-Outs

•

•

BY BETSY BARBIEUX, CAM, CFCAM, CMCA

iving in a Florida community association offers a sense of order: there are shared amenities and shared expenses for the upkeep and maintenance of the community. But our community associations are also multi-million-dollar corporations. The members of the corporation are all the owners—and membership is mandatory. There is no opt out. The leaders of the corporation are the board of directors elected by the members. The board members choose their officers: president, vice president, secretary, and treasurer. Often the duties of the officers are delegated to a CAM or management company under contract with the corporation.

Serving on the board of directors can be a thankless job full of challenges, not only from the weather, the owners, and aging buildings and grounds but also from the laws and regulations.

Besides the challenge of upholding the association’s governing documents, which include the declaration or proprietary lease, articles of incorporation, bylaws, and rules and regulations, there are now more laws than ever that board members must be aware of and precisely follow. Understanding and navigating the legal abyss requires legal advice. That advice should come from an attorney who specializes in community association law—not a real estate attorney and not an estate planning attorney, but one who is involved in our professional organizations, provides blogs and educational classes, and is familiar with mediation and arbitration proceedings.

Florida’s community associations manage significant financial

Betsy Barbieux, CAM, CFCAM, CMCA, guides managers, board members, and service providers in handling daily operations of their communities while dealing with different communication styles, difficult personalities, and conflict. Effective communication and efficient management are her goals. Since 1999 Betsy has educated thousands of managers, directors, and service providers. She is your trainer for life! Betsy is the author of Boardmanship, a columnist in the Florida Community Association Journal, and a former member of the Regulatory Council for Community Association Managers. Subscribe to CAM MattersTM at www.youtube. com/c/cammatters. For more information, contact Betsy@FloridaCAMSchools.com, call 352-326-8365, or visit www.FloridaCAMSchools.com.

resources used for maintaining common areas, amenities, and infrastructure. Board members must create and adhere to a balanced budget, allocating funds for necessary repairs, capital improvements, and potential emergencies. Rising insurance costs, unforeseen repairs, and resident pushback on assessment increases can make financial management a delicate dance.

Board members often find themselves caught between a rock and a hard place when it comes to resident relations. Enforcing association rules, such as pet restrictions or yard maintenance standards, can lead to disgruntled residents. Conversely,

failing to enforce rules can breed resentment and create a sense of unfairness within the community. Striking a balance between upholding regulations and fostering a sense of community is an ongoing struggle for many boards.

Serving on a board is a timeconsuming and often thankless job. This can make it difficult to recruit qualified volunteers, especially in smaller communities. Additionally, board fatigue and frustration can lead to high volunteer turnover. Associations need to find ways to encourage board service and provide ongoing training and support to retain members. Some think every owner should take a turn. If they did, it might cut down on the grumbling.