THE PRACTITIONER’S COMPANION

FIRST HOME-BUYERS REPORT

THE PRACTITIONER’S COMPANION

FIRST HOME-BUYERS REPORT

WHITE RIBBON DAY

SPECIAL COMMUNITY FOCUS

The promises we make WHY CONVEYANCERS NEED TO CARE

By ANDREW BROWN

Almost one-in-five “forever chemicals” have yet to be assessed by the federal government’s industrial chemical regulator.

A parliamentary inquiry into the use of per and polyfluoroalkyl substances - known as PFAS – has begun as calls grow for more transparency from the companies that use them.

The Australian Industrial Chemicals Introduction Scheme told the inquiry 423 of the 522 PFAS chemicals in its inventory, or 81 per cent, had been assessed.

However, scheme executive director Graeme Barden said assessments had not been carried out on the other 99 chemicals.

“If two chemicals were equally concerning from a toxicity perspective, and one is in use in Australia and one is not, we’ll focus on the one that is,” he said. “Those mechanisms they’re ongoing, and indeed, we have some PFAS chemicals that are going through that prioritisation process at the moment.”

The scheme does not have a specific deadline for when all of the chemicals in its inventory, which includes non-PFAS substances, would be assessed, but Mr Barden said it was hoped to be completed by the end of the decade.

Thousands of PFAS chemicals have been created, with uses ranging from firefighting foam to non-stick cookware.

Australian Conveyancer highlighted the dangers in a special report earlier this year entitled ‘What on Earth is Under Us?’ which highlighted there are 260,000 potential toxic hotspots around Australia.

Lotsearch founder Howard Waldren, who spent a decade creating maps of polluted sites, said: “This inquiry shows why it is so important to ensure all areas of due diligence are covered. It’s not just PFAS that’s potentially deadly.

“As we highlighted in the “What on Earth Is Under Us?” special report, Australia is peppered with more than 250,000 potentially deadly sites.”

Concerns over potential health risks from exposure to PFAS chemicals, such as cancer, continue to be raised.

inquiry. “In terms of difficulty in ceasing their use ... different PFAS are used in different contexts for a wide range of different products that are sold in Australia.

“It’s important to acknowledge that they’re prevalent in the environment at the moment.”

CSIRO executive director Peter Mayfield said it was not as simple as replacing PFAS chemicals with other substances.

“There has been a move away and that’s going to continue, the idea is substitution and removal,” he said.

“The real challenge area is don’t put something in its place that’s worse. I think we need to make sure of that.”

There is limited evidence of human disease or other clinically significant harm resulting from PFAS exposure.

Division head at the federal environment department Kate Lynch said PFAS chemicals were used in a wide range of areas.

“PFAS use through the economy is pretty broadly spread at the moment,” she told the

UNSW Sydney professor Denis O’Carroll said the use of PFAS in the environment was pervasive.

He told the inquiry that companies which produce the chemicals should be more transparent about what is included in the substances.

“There’s more PFAS out there that potentially we should be concerned about,” he said.

“It would be useful ... to the scientific community if (companies) were compelled to provide information collaboratively with us.

“It really would help us get a sense of the environmental burden and the human health burden of PFAS out there.”

By ANDREW BROWN

Money launderers will soon have a harder time funnelling dirty cash through Australia as part of a federal government crack down.

A Senate inquiry has recommended parliament pass laws that would impose further regulations on professions such as lawyers and accountants to prevent the businesses being used as a front for money laundering or financing terrorism.

A report into the laws, which was handed down on Wednesday, said the changes would help bring Australia more into line with international standards.

The measures would be a significant reform and protect industries from serious crimes, Labor Senator Nita Green said.

“It will reduce complexity and close regulatory gaps in the current regime to ensure that Australia has an effective system to deter, detect and disrupt illegal flows of money internationally and protect Australian businesses from exploitation by criminals,” she said.

The global financial watchdog in 2015 found Australia had failed to comply with a number of standards. The watchdog had singled out that Australia had failed to extend anti-money laundering laws to at-risk industries.

The coalition said it had significant concerns with the money laundering law overhaul because to the cost.

The laws would mean a regulatory cost burden of almost $14 billion over the coming decade, Senator Paul Scarr said.

“The coalition does not believe that this bill can be passed in its current form due to the $13.9 billion cost for small and family businesses, which will ultimately be passed onto consumers,” he said in the Senate report.

“During the Albanese government’s cost-of-living crisis, this is something Australians can ill-afford.”

The opposition had urged the government lower the financial burden for businesses to comply with the updated regulations.

Greens senator David Shoebridge also called for exemptions for barristers who are briefed through solicitors. “This would avoid unnecessary and costly duplication, provide clarity and reduce confusion,” he said.

The Senate report made eight recommendations for the money laundering laws, which included bringing forward the date for when enforcement of some of the offences can begin.

3

From walking into her first settlement room as a spiky-haired 21-year-old to being elected to the AIC board and running a couple of conveyancing businesses in between, Angie Nguyen has seen it all.

Q&A starts of Page 4

Statistics showing the level of domestic violence in Australia are truly shocking. That one woman was killed every 11 days during 2022-23 is shameful. The fact that the true picture of family violence remains unclear because of the issue of under-reporting is even more appalling.

Page 8

As the housing crisis continues to dominate the headlines, dive into our 12-page guide to getting a foothold on the housing ladder.

Page 14

COPYRIGHT

© Copyright 2023 triSearch Services Pty Ltd. triSearch and its licensors are the sole and exclusive owners of all rights, title and interest (including intellectual property rights) of this publication including all data, information, images, commentary and content (content). All rights reserved.

with ANGIE NGUYEN

Convey Property Settlements

From getting to grips with property law in an accountancy firm to working as an e-conveyancing specialist in the South Australian Office of the Registrar-General and as practitioner services manager at Sympli, Angie Nguyen has seen it all. Having launched Convey Property Settlements – her second conveyancing business – just over a year ago and recently being elected to the board of AICSA, Nguyen has an unrivaled perspective of the conveyancing landscape and how the future is shaping up for the sector, which she is sharing with Australian Conveyancer.

AUSTRALIAN CONVEYANCER: Why did you decide to become a conveyancer?

ANGIE NGUYEN: When I left school, I worked for an accountancy firm helping with property management. Then, at 21, I was working as a property manager for Ray White, where I was exposed to conveyancing, collating the contracts and sending them over to the conveyancers. At that time the agents weren’t really inspiring me to sell So instead of going down the sales path, I went down the conveyancing path.

I ended up working as an operations manager at Espreon Property Services before I set up my own conveyancing business, Angie Boscolo Conveyancing, in 2008.

AC: You were approached in 2015 to be the state operations manager in South Australia for GlobalX Information? What did you learn from that experience?

AN: I learnt how to build and manage a business from the ground up, which required a very different skill set to being a conveyancer settling properties.

Bruce Walker was a great manager; he was there when I needed to bounce ideas off someone.

It was at this time electronic conveyancing was coming to the forefront and I was able to participate on behalf of GlobalX in early working groups, and to sign up some of the first practitioners to PEXA, the days before PEXA direct specialists.

AC: What was it like working at the Registrar-General of South Australia as an electronic conveyancing e-specialist?

AN: It was an opportunity to represent conveyancers to give them a voice in the Office of the Registrar-General in government.

While South Australian conveyancers were fortunate to have had a great working relationship with the Land Titles Office [LTO], it was evident there was a knowledge gap between what happened in the settlement room and when dealings were lodged for registration.

It was an opportunity to work on committees such as the Australian Registrars Working Group which supported ARNECC [the Australian Registrars’ National Electronic Conveyancing Council] and be involved as a state representative, providing me with a broad view of the industry nationally and electronic conveyancing.

AC: What kind of insights did you gain working for the Registrar-General?

AN: They were a great team, some of the best I’ve worked with. I have always had a love for the law of property and the Torrens system.

People such as Ian Gant and Jenny Cottnam were walking encyclopedias for all things land titling.

What was really clear to me was the importance of government and industry collaboration, and the need for greater understanding of how legislative requirements, particularly in electronic conveyancing, translated to practitioners practically.

It was a great experience, having had the opportunity to work with Jenny Cottnam, who up until recently was the Registrar-General in South Australia.

I think it worked really well because Jenny was interested in how conveyancing operated beyond the LTO; we shared industry insights and practical knowledge, always with the view of supporting the industry and end consumer and the protection of the register.

I learnt quite a lot from her from a regulatory perspective, and the machinery of government and how it operates. It’s easy for us practitioners to sit here and say a piece of legislation needs to be changed, but actually doing something like that is an 18-month to two-year project. So it was great to have that kind of balance.

AC: Your career took another turn when you joined the Sympli start-up in 2019 as a manager in practitioner services. What did you take away from that experience?

AN: As a firm believer in competition and the need for a second ELNO [electronic lodgment network operator], joining Sympli gave me the opportunity to work across many areas of the business, [including] product workflow design, stakeholder engagement and advocating with government regulators to enable the offering to come to market.

Conveyancers are my people, and a highlight of the role was being able to bring the voice of the conveyancer to Sympli and engage with AICs at a state and national level. We need competition in e-conveyancing. There are too many roadblocks that remain.

AC: You relaunched as a sole trader a year ago with Convey Property Settlements. Do you feel good being back on the tools?

“It’s the people at the end of the transaction . . . I love being a small part of their journey. It’s as exciting for them as it is for me!”

Angie Nguyen

CONTINUED FROM PAGE 5

AN: Yes, I do. In some respects, I was a bit apprehensive. I wondered if I still had the ability because a lot had changed. Luckily, I had never closed my conveyancing business. I kept my credentials and license running, and my trust account open, and so, fundamentally, it was all just sitting there humming along waiting for that right time to focus on me and my clients.

In the end it was an easy decision. I was also grateful for the encouragement and support from my conveyancing colleagues to jump back in.

AC: How different is the conveyancing world now in comparison to when you were first in the game?

AN: Very different. Obviously e-commerce, e-settlements, have shaken all that up for us. I think it is harder now because I feel we have lost that common community. I spent 25 years in the settlement room, five days a week, settling properties in person. The hard part now is we don’t get to interact with our fellow conveyancers in the way we once did, and it can be a very solo, lonely game, particularly for sole practitioners like myself. And, I’ve got to say, I think we are all getting a bit chubbier, sitting in our offices, not going anywhere!

AC: So how do you counteract the loneliness or disconnection?

AN: It’s really important to get out from behind the desk and continue to connect with other conveyancers and industry partners, or just networking and meeting new people. I have made a conscious effort to stay connected and have drunk a lot of coffee in the last 12 months.

So it’s about keeping in touch, attending best practice groups. Getting out and walking my dog every morning is really important to clear my mind.

AC: What tactics are you using to build your new business?

AN: I think a lot of other practitioners really stick to traditional referral partners as their main source of leads. And I think that’s a bit of a saturated market. I’m looking at areas that are not as common. For me it’s also about having diversity in the matters I work on and the partnerships with professionals who have the same approach to supporting the “whole” client.

AC: How important is social media for conveyancers?

AN: I think it is very important. Print media is obsolete and people are looking for their information and making connections in a different way, and that’s digitally and through social media.

I have made lots of connections through LinkedIn when people have reached out to me, saying they like my presence and the educational content that I’m putting out.

AC: What is it about conveyancing that keeps you interested in the work?

AN: Ultimately, it’s my clients. It’s the people at the end of the transaction.

I just settled one this afternoon and my clients are very excited because they are going to build a house, and I still really get a kick out of it.

I love being a small part of their journey. It’s as exciting for me as it is for them!

AC: What is the biggest challenge conveyancing professionals face in 2024 and beyond?

AN: There are a few. I think the big one is cybersecurity, which is paramount. I say to my clients that I am cautiously paranoid. We have to be really conscious and the scammers are getting better every day.

Being a professional services business, undervaluing ourselves continues to be a challenge. The lack of recognition for the knowledge and expertise we bring to our clients and partners, as well as the risk we take on is an industry and nationwide concern.

Sadly it’s not a new story but one that we need to work together to change.

AC: You’ve had a lot of support from the conveyancing community over the years.

AN: I get quite emotional about it but I walked into the settlement room when I was a 21-year-old kid and I’m about to turn 50.

A lot of the people have seen me start as a youngster with short, black spiky hair, who didn’t really know what she was doing; to my registration as a conveyancer; to becoming the operational state lead of Espreon and GlobalX.

They have watched me get married, have children, take my children to settlements. In fact, I almost went

into labour in the settlement room. So it has been a long journey and I see the industry and many people within it as my family.

AC: So you are all about giving back to your community now?

AN: I want to support the industry and give back to the people who have shaped me throughout my career as a conveyancer and as a person.

And that’s why I like to pay back now where I can. We need to help new entrants into the profession, whether it’s through the AICSA Conveyancer Ready Program to give them that practical knowledge, or for them to complete internships as we once did, chasing the title or spending hours in the settlement room.

We need to find new ways to help new conveyancers if we, as an industry, want to thrive.

AC: You’re a new AICSA board member. How do you intend to use this position to benefit members?

AN: The timing is right for me to move into a position where my experience and knowledge from previous roles can be used to support my fellow conveyancers.

I have always identified strongly with the conveyancing community, and I think we need to continue to advocate.

So it’s primarily the reason I wanted to be on the AICSA board, to continue to advocate for the profession, to make sure we remain valued and supported. And that we are heard by the government at a state and federal level.

Conveyancers ultimately look after the consumer; we are the gatekeepers for the data that comes into the various land title offices around the country; we have to keep pushing for industry improvements.

AC: What do you think you’ll bring to the AICSA?

AN: I bring diversity in my experience from working in both the private sector and government, as well as residential conveyancing through to representing financial institutions, and more recently representing an ELNO.

I have had many different roles throughout my near 30-year career, and each of these roles has given me a different perspective of how the industry operates.

AC: How do you think the different rules – from state to state – can be harmonised for more efficiency? If they can.

AN: We have definitely tried to work across states and that was where we were heading when COAG started the ball rolling on electronic conveyancing. But the problem is, we have a federated structure and until we have one national Real Property Act, you just can’t do it.

You ask any ELNO trying to build a platform to accommodate every jurisdictional nuance, and they will tell you it’s no small challenge. What I do think would be great is one national discharge authority. We live in hope.

Violence against women is one of the biggest human rights issues we have in Australia.

By MELISSA IARIA

The scale of men’s violence against women in Australia is “significant”, according to White Ribbon Australia program manager Dean Cooper.

During 2022-23, one woman was killed every 11 days by an intimate partner, according to the Australian Institute of Health and Welfare.

“Men’s violence against women is one of the biggest human rights issues we have in this country, and around the world,” Dean says.

“You will never get a real, true and accurate picture of domestic violence and rates, because it’s such a complex issue with under-reporting, difficulty in detecting coercive control and prosecuting more subtle acts of violence and control.”

The public conversation around domestic violence has increased in recent years, and as a community, we are understanding it better, Dean says.

Workplaces now play a significant role in preventing violence through policies, education and training, and schools also include respectful relationship programs in their curriculums.

But whether that’s translating to reductions in violence is yet to be proven, Dean says.

“We’re still quite early in our infancy of policy and legislative changes,” he says.

“Only just this year, coercive control and more subtle, insidious forms of abuse are now legislated and can be prosecuted. So, until legislation catches up with women’s experience, we won’t really get at the forefront of seeing a reduction in violence occurring.”

Workplaces can play a vital role in tackling violence against women through not only health and safety rules and training addressing discrimination, harassment,

“People experiencing domestic and family violence often rely on their workplaces to be a safe place to escape violence and really be just a crucial source of social and economic support.”

Dean Cooper

bullying and abuse but also being a place of refuge for employees.

“People experiencing domestic and family violence often rely on their workplaces to be a safe place to escape violence and really be just a crucial source of social and economic support,” Dean says.

In Australia, 62% of women who have experienced or are experiencing domestic and family violence are in the paid workforce, according to the Champions of Change Coalition.

Nearly one in five reported that domestic violence followed them into the workplace, for example, with abusive calls, emails, or their partner physically coming to work.

Dean says workplaces offer unique opportunities for employees to be attuned to changes in someone’s presentation, performance or attendance, isolation from work events, overworking or underworking, and big changes in stress and fatigue.

“Really workplaces should be capitalising on those

• 1 woman was killed every 11 days in 2022-23 by an intimate partner (AIHW, 2023)

• In 2021-22, 1 in 6 women had experienced physical or sexual violence by a current or previous cohabiting partner (AIHW, 2022)

• In 2021-22, 1 in 4 women had experienced emotional abuse by a current or previous cohabiting partner (AIHW, 2022)

• 13 women per day are hospitalised for DFV-related injuries (AIWH, 2020)

moments to start to have conversations and notice changes in people’s behaviours and provide support,” he says.

“Sometimes when we’ve listened to women’s experiences, they just wanted someone to notice what was going on - that they’re in this world where they’re gaslit and denied and told it’s their fault. To have someone provide that counter-narrative, to say, ‘Hey, what I’m seeing here isn’t okay, and are you okay’?

“Obviously, that can be really confronting, and those conversations can be difficult. And I really think that’s where the workplace responsibility comes in – to have conveyancers absolutely trained to recognise those signs, to generally and respectfully have those conversations and provide those opportunities.

“You never know when that opportunity might be that moment for someone to leave a relationship or to make that phone call to a support service.”

Dean says it is a “low-cost” approach if the question is framed in the right way.

“We have a big fear of getting it wrong. But I really think the consequence of not having these conversations is greater than getting it wrong or extending an offer of support to someone,” he says.

“We lose nothing by continually showing up and saying, I see you. I’m here for you, and at a time when you’re ready, I’ll be available and educated and equipped to have that conversation.”

While we don’t all have the privilege of changing legislation, Dean says everyone can contribute to solutions by calling out disrespect and advocating for their workplaces to provide education and training.

“Not all disrespect leads to violence, but all violence starts with disrespect,” he says.

“When we are hearing jokes that put women down, that sexualise women, whether it be rape jokes or we are seeing things in advertisement and media, we can actually provide a counter-narrative to say, ‘Hey, I don’t agree with that’.

“Because in our silence, we all are incorrectly assuming we are okay with this culture that we’re perpetuating.

Caption caption

• In Australia, 62% of women who have experienced violence or are currently experiencing DFV are in the paid workforce (ANROWS, 2016)

“Boys just won’t be boys. They’ll be whatever we role model and teach them to be, and that’s where our focus needs to be.”

By MELISSA IARIA

Estranged couples, terrified clients, abusive behaviour and a client meeting in a carport: conveyancers are no stranger to handling property transactions where domestic violence is involved.

Victorian conveyancer Marie Keane recalls the time a transaction meeting had to take place in a client’s carport rather than home, because of family violence fears.

“We were appointed by the court to do the conveyancing, and were acting for both the former husband and the wife,” says Keane, an Australian Institute of Conveyancers Victoria regional committee member.

“She was terrified he was going to be at my office if she came here, because he was also my client, so I agreed to meet her at her house. But she wouldn’t let me in because she thought he could follow.

“We did the signing of the documents in the carport.”

A family violence support agency had also arranged for the woman to hand over items to her former partner, “but of course there was no way she was going to go there”.

“For some reason, I ended up going and handing over the items, which is well outside the scope of our job, just because she was so traumatised,” Keane says.

When dealing with estranged couples with a history of family violence, it’s essential for conveyancers to ensure their matters are kept separate and private, she adds.

“We’ll put notes on our system to be aware it is a domestic violence situation, where you have to send separate letters,” she says.

“If they’re staying in the marital home, they obviously know where they live, but sometimes they don’t, as they’re living elsewhere in fear.

“We cannot share any confidential information about where that person could be living and it’s our responsibility to take that very seriously.”

Controlling behaviour can continue to be a factor during transactions, in which one party refuses to sign

documents in a bid to maintain control or they insist their name be listed first in the documents, Keane says.

At other times, she has referred clients to family violence support services.

“Some people are embarrassed, some are ashamed,” she says. “For somebody like me who has never had to be personally confronted with family violence, it’s very eyeopening and sad.”

AIC Victoria president Shakila Maclean agrees there is room for greater awareness of family violence in the conveyancing sector.

“If you’re alerted to it, it might inform how you handle interaction between the parties,” she says.

“There might be a situation where someone does not want him or her to know where they’re moving to, and that might be where, as a conveyancer, you’ve got to handle the privacy carefully.

“It’s one of those things you can’t have too much awareness or education on.”

Australia’s shameful rate: one woman a week.

By MELISSA IARIA

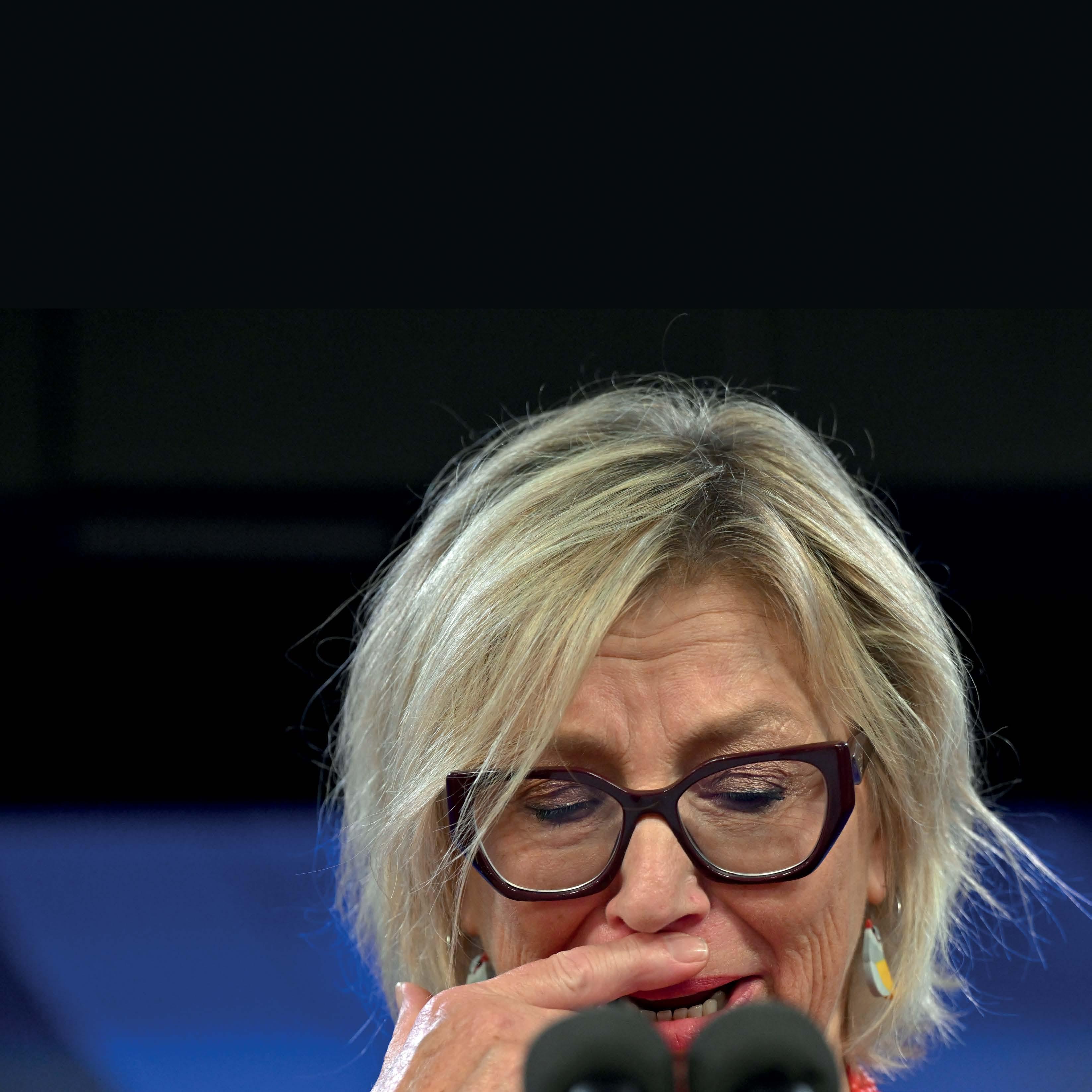

Rosie Batty became a powerful advocate for domestic violence victims after her 11-year-old son, Luke, was murdered by his father at a sports ground in 2014.

Rising above her personal tragedy, she put family violence on the national agenda and reinforced the understanding that it can happen to anyone.

Today, family violence is acknowledged as a huge societal problem affecting women across cultures and social standing. Yet, despite enormous work to raise public awareness of the issue, the statistics of violence against women in Australia are still “incredibly overwhelming and horrifying” Batty says.

“We still have one woman a week being murdered,” she says. “You would apparently think nothing has changed, and nothing is improving if you were basing it on those statistics, which makes it difficult to remain positive in the face of so much frustration.”

A decade on, there have been some changes to the way the public perceives domestic violence, she says, including greater understanding of it being a gendered issue.

“The evidence is really clear that 90 per cent of those who choose violence are men,” Batty says. “As uncomfortable as that conversation still is, it is more accepted and understood.”

The victim-blaming narrative has also been challenged.

“A decade ago, we more readily fell into victim-blaming language and put the onus of responsibility on the woman’s shoulders for the safety of herself and the children,” Batty says. “We now know the area of highest risk and time of significant harm is often around the point of leaving, leading up to the leaving and that timeframe around that.

“Rather than asking the question, ‘Why doesn’t she just leave?’ we should be asking the question, ‘Why is the perpetrator – predominantly that would be a man – choosing to be violent?’”

Batty is hopeful family violence is now recognised as taking many forms, particularly financial abuse, which is one of the most significant barriers preventing a woman from leaving a violent situation if she can’t find or afford accommodation.

“There is evidence to suggest a lot of women are controlled financially, and it’s very difficult to understand what options may be available to them,” she says.

“They weigh up the relationship they’re in and potentially decide it may be better for them to stay in this type of

relationship rather than risk the other alternative being worse.

“Certainly, the fastest growing area of homelessness is indeed women over 50. And most families, including their children, who are experiencing homelessness, are recognised to have family violence as a major cause of that situation.”

Even in Victoria, where Batty believes the government has been the most progressive and made the most significant improvements in systemic change, families continue having to endure unsafe situations.

“We still have over 200 families every night unable to be placed safely into a refuge and having to be put up into a motel, which is unsafe,” she says.

“And often, the victims may return because it’s too overwhelming and unsafe to stay separated and leave.”

Workplaces and major employers have recognised they are an important part of the solution, creating gender-equal workplaces and policies, safe working environments, and support for family violence victims who may be staff members.

But societal change is a long, slow journey where everyone plays a part.

Batty says this includes educating ourselves to recognise family violence where it occurs, calling out inappropriate behaviour, and reaching out to police and family violence services like 1800RESPECT to learn how we can support victims.

Some people may also not recognise their relationship is harmful or abusive, and it is important they know they won’t be blamed or judged if they reach out.

“A lot of people may not want to go to the police for varying reasons,” Batty says. “They … may need to be able to speak to somebody in confidence and in safety, to recognise what their options may be, and do that in a safe and supported way.”

More advocacy work is needed to tackle the issue, along with government investment for “chronically” underfunded crisis organisations.

And while systemic responses are improving, they reflect societal attitudes, Batty says.

“There is a spectrum of violence, and violence begins with disrespect,” she says.

“And so, what is really important is the recognition of gender equality, and the importance of a gender-equal world and a gender-equal society where violence towards women is less likely to occur.”

By Sam McKeith

It’s official – it got even tougher for first-home buyers to enter the Australian property market. House prices logged a 0.3 per cent rise nationwide in October, according to property consultancy CoreLogic data, marking a staggering 21 months of growth since February 2023.

As a result, Australia’s combined capital city median house price now stands at $1,004,385, while the median unit price in Australia’s capital cities is $570,627.

With property prices continuing to surge, experts say that first-home buyers need every edge they can get to crack the market. That includes looking at state and federal incentives.

Real Estate Institute

Real Estate Institute of NSW chief executive Tim McKibbin recommends first-home buyers in Australia’s priciest realty market, Sydney, to check out the state’s First Home Buyer Assistance scheme.

The NSW government initiative, launched in July 2023, gives a full exemption from stamp duty on new or existing homes up to $800,000, while those over $800,000 and less than $1 million may qualify for a lesser concession.

It also applies to vacant land, offering an exemption on land valued up to $350,000 and a concessional rate on blocks over $350,000 and less than $450,000.

McKibbin calls the incentive the “standout” measure for first-home buyers in the state.

“Obviously, if you don’t have to come up with some tens of thousands of dollars in stamp duty it’s welcomed particularly for first-home buyers,” he says.

However, the program has some flaws, according to the chief of the property industry body.

“I’ve always found it a bit entertaining, because the median house price in Sydney is over $1 million so you’re saying to yourself ‘by the time I go to buy the property it’s not worth very much to me,’” McKibbin explains.

“People like to call the stamp duty (initiative) an incentive but I’m not sure you’d get me over the line on that one because it’s actually the removing of a disincentive, what they’re doing is removing a tax which is artificially put on the price.”

In NSW, there’s also the state’s Shared Equity Home Buyer Helper. Launched in January 2023, it sees the NSW government pay up to 40 per cent of the purchase price of an eligible property, retaining it as equity until the first-home buyer sells the property.

A big upside of the scheme – open to key workers like nurses, police officers and teachers, as well as those impacted by domestic violence – is that payments aren’t required on the government’s equity stake in the property. It’s aimed at boosting home ownership for those unlikely to be approved for a mortgage due to their life circumstances.

For McKibbin, the jury is out on the program. He says, “I’m going to keep an open mind, but to me, it is a bit odd that you would be buying a property with the government.”

“All of these things are just addressing symptoms of the problem,” he elaborates. “The only thing that will solve the problem is more property.”

“We see the government being able to put more money in the hands of first-home buyers, and that means that when they go to buy the property, they’re able to offer more.

“That simply drives the price up, it doesn’t put people into homes. They do everything except tackle the problem.”

Under the NSW government’s pledge to the National Housing Accord, struck with the federal government in 2022, the state must deliver 377,000 new homes statewide by 2029, all part of an effort to ease the intense supply-side strain on property prices.

NSW is under the most pressure to grapple with fast-rising property prices, especially in Sydney, where the median dwelling value hit $1,193,240 in October, according to CoreLogic.

The First Home Owner Grant (FHOG) is designed to assist eligible first-time home buyers with purchasing or constructing a new home. One-time payments vary by state, with recent updates, such as Queensland’s increase to $30,000, reflecting local housing market conditions. To qualify for the FHOG, applicants must be at least 18 years old, permanent residents or citizens of Australia, and planning to live in the property for at least six months – and must not

1 ACT 2 NSW 3 NT 4 QLD 5 SA 6 TAS 7 VIC/WA

No longer offers the FHOG but provides stamp duty concessions.

Offers $10,000 for eligible first-time buyers on homes up to $750,000.

have previously claimed the grant or owned a home. The grant only applies to new builds or substantially renovated properties to ensure it supports genuine first-home buyers entering the owner-occupied market rather than investors or those purchasing pre-owned homes. Additional benefits are available to first-time buyers, including the First Home Super Saver (FHSS) Scheme, the Home Guarantee Scheme, and various stamp duty concessions.

Provides a $50,000 HomeGrown Territory Grant that is uncapped on off-plan purchases. A $10,000 grant is also available to first-time buyers to established properties.

Offers $30,000 as of November 20, 2023 on a property valued up to $750,000.

Grants up to $15,000 for new home purchases starting June 2024, which is uncapped.

Provides $30,000 on new builds up to $600,000

Each offer $10,000 for new builds up to $750,000

7 $10,000

3 $50,000

4 $30,000

5 $15,000

2 $10,000

7 $10,000 NSW

HOW MANY HOME BUYERS ARE GETTING THE GRANT?

More than 18,700 buyers have used the First Home Buyers Assistance scheme VIC Stamp duty concessions to 36,318 buyers last financial year QLD

Over last 8 years, the first homeowner grant has supported 69,000 buyers

WA More than 3000 access the First Home Owners Grant per year TAS Tas gov says hundreds have used the state’s stamp duty concession scheme this calendar year SA More than 3000 per year

6 $30,000

1 $000

In McKibbin’s view, while incentives are welcome, first-home buyers would be most helped by a state government with a real commitment to rein in local councils.

He says councils take too long to green-light developments, slowing down property supply.

“We don’t need the government’s political best endeavours, what we need is what’s required, by that we mean some political courage,” McKibbin says.

“The councils, the consent authorities around the state, it’s disgraceful. It regularly takes longer for the council to say yes to a development than it takes to actually do the building. There is something fundamentally wrong with that.”

The state’s peak body for local government, Local Government NSW, recently defended the performance of councils and their role in solving the housing crisis, following similar criticism regarding development application approval rates.

LG NSW says a slowdown in the construction sector has resulted in a fall in the number of applications being submitted and the number of commencements statewide.

Outside of NSW, the major federal incentive for firsthome buyers is the Home Guarantee Scheme – an initiative administered by Housing Australia, a public entity set up in 2018 to deliver social and affordable housing, and assist first-home buyers.

A stream in the program – the First Home Guarantee – helps eligible first-home buyers across the country get into the market with a deposit as low as 5 per cent. It has helped more than 100,000 people into a home since May 2022, the federal government says.

The catch, though, is that places are very limited, with just 35,000 spots available nationwide in financial year 2024-25. There are also property price caps, which come in at under $1 million across the country. NSW has the highest cap at $900,000.

Steven Tropoulos, managing director of Highfield Private, a Sydney-based financial services firm specialising in property strategy, is a fan of the federal program, in the context that “first-time home-ownership remains challenging for many Australians”.

“At a federal level, the First Home Guarantee is invaluable, allowing eligible buyers to purchase a property with as little as a 5 per cent deposit, bypassing lender’s mortgage insurance,” Tropoulos says.

He also points to the federal government’s First Home Super Saver Scheme, which he says “enables potential buyers to make voluntary contributions to their superannuation fund, helping them save for a deposit faster due to tax benefits”.

The scheme allows first-home hunters to make personal voluntary contributions into their super fund to help save for a first home. These contributions are taxed at 15 per cent, usually less than a participant’s marginal income tax rate. Assessable amounts also get a 30 per cent tax offset.

Otherwise, Tropoulos notes that “Victoria and Queensland offer stamp duty exemptions for properties below specific thresholds”.

“State-level initiatives vary, but many states provide stamp duty concessions or exemptions,” he adds.

In Victoria, on shared equity, the state government will pay up to 25 per cent of the purchase price in exchange for an equivalent share in the property if a buyer has a 5 per cent deposit. Meanwhile, stamp duty has been abolished for first-home buyers purchasing houses under $600,000.

In Queensland, the most-hyped assistance is the firsthome owner grant, which gives eligible buyers $15,000 or $30,000 towards buying or building a new home in the state.

Western Australia, South Australia and Tasmania also offer state-based assistance, mostly in the form of one-off grants to first-home buyers.

“To maximise these opportunities, I advise first-time buyers to thoroughly assess their eligibility for both federal and state incentives,” Tropoulos says. “Setting realistic goals and obtaining pre-approval can also be advantageous, ensuring they are financially prepared when the right property becomes available.”

Even so, Kaleido Loans, a Sydney mortgage broking company with expertise in getting first-home buyers into the market, says government help is often failing to meet its aims.

Kaleido’s founder, Jason He, says while most federal and state level initiatives cut the deposit barrier for firsthome buyers “what we are seeing on the ground is that borrowing capacity is holding back a lot of first-home buyers even when they only need a 5 per cent deposit and in most cases, don’t have to pay any stamp duty”.

“Many first-home buyers we are talking to are struggling to get the borrowing capacity for the loan that they need,” He explains.

For this reason, the founder says many of his clients are taking an alternate, more long-term, approach to purchasing a dwelling to occupy.

“Many of our first-home buyer clients who realise they can’t purchase their ideal property due to the borrowing capacity issue are looking to purchase an investment property instead,” he says.

“This allows them to borrow more and access different property markets interstate where the purchase price is lower compared to buying an owner-occupied property.

“By doing this, they’re at least not missing out on getting onto the housing ladder, and they will have an asset that is appreciating in value and generating an income.”

Ultimately, the goal is to sell this property and then “purchase their dream home with a combination of a higher income as they progress in their careers”.

Prominent Melbourne real estate agent Dion Besser of Besser + Co, says there are some other positive signals for first-home buyers in the state.

“In Victoria, new taxes are pushing some Baby Boomer investors out of the market, especially in the apartment sector. That’s creating more options and lowering prices for first-time buyers, with plenty of entrylevel properties on offer right now,” he says.

“With apartment prices levelling out and possible rate cuts on the horizon, now might be a great time to get into the market. If you’ve got everything lined up, you’ll be ready to move quickly when the right place comes along”.

On this front, he urges first-home buyers to get their “support crew” lined up as a priority. For newbies to property, he urges a conveyancer for “the legal stuff”, a building inspector to check the property, a mortgage broker for finance and a financial advisor “to help you plan your budget, pay down debt, and build stability”.

Still, Kaleido Loan’s He concedes the battle for many first-home buyers remains uphill, making the “bank of mum and dad” a popular option for those with access.

“The bank of mum of dad can do two things. Firstly, parents can use their property to guarantee to support their kids, but this doesn’t resolve the borrowing capacity issue mentioned earlier,” He says.

“Secondly, parents can provide cash to increase the kid’s deposit so they don’t have to borrow as much.”

Moxin Reza, founder of Investor Partner Group, a firm that assists clients to build scalable and sustainable property portfolios, adds some left-field ideas for firsthome buyers.

In addition to “basic” methods like making the most of first-home grants, Reza says creating a “money pool with family to enter into the market” can be a strategy that works.

This can involve the “’granny at the back’ approach where you buy a house with granny and live in the main house or granny flat and rent the other half,” he says.

Alternately, there’s the “co-living route where you live in a portion of the house and rent other rooms”.

Reza’s tips fit with latest data from Proptrack, the Victoria-based analytics company, which identifies that first-home buyers are thinking more outside the box on property, including on location.

For instance, Proptrack’s analysis shows that, in Queensland, the Brisbane fringe suburb of Greenbank now ranks highly with first-home buyers. The median house price in Greenbank is $837,000, far cheaper than Brisbane’s inner areas.

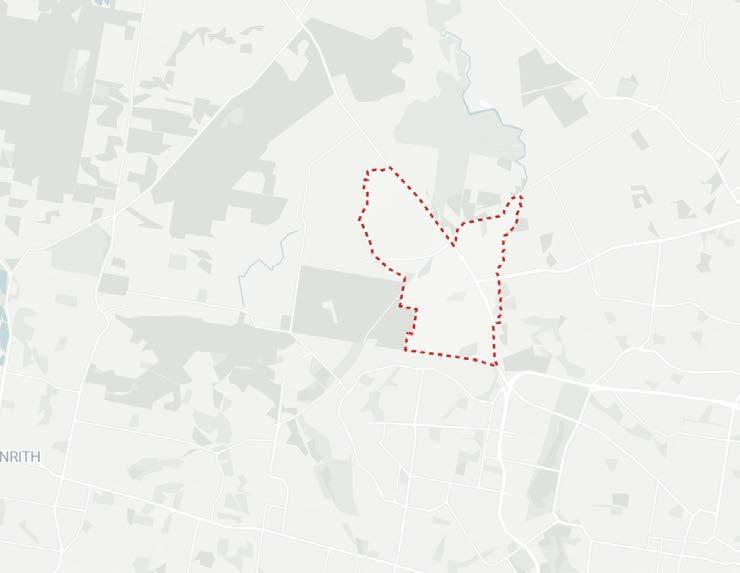

Across the border, Sydney house hunters are looking even further away from their CBD to Marsden Park, situated 50 kilometres north-west of the city’s central business district.

In Marsden Park, the median house price is $985,000, which is relatively affordable for first-home buyers in Sydney. According to Domain, the city’s median house price recently reached a record $1.65 million.

Further south, Proptrack points to the Melbourne suburb of Tarneit, about 30 kilometres west of the CBD, as a standout for first-home buyers. Here, the median house price is $650,000, far below the over $1 million average for a two-bedder in the inner suburbs.

Marsden Park

The western suburbs continue to dominate the growth in home-buying as families are pushed out of super expensive Sydney.

Perennial favourite Marsden Park is at the very top of the list of property purchases, followed by Ravensdale and Leppington Camden and Campbelltown also continued the “moving out” momentum, showing there is no slowing in the demand to find more affordable housing away from the harbour city’s inner residential suburbs.

Residents

As our special report from June highlighted, Sydneysiders have been heading west in droves since the area was designated as a priority development area as part of the NSW government infrastructure plan.

Marsden has seen the growth in the number of dwellings climb from just 2900 in 2017 to more than 4500 in the last census – and is expected to grow to close to 13,000 by 2046. Further afield Bateau Bay, on the Central Coast, remained in the top 10, underscoring its appeal among lifestyle-driven property buyers.

How many first-home buyers entered the market in October 2024, compared to same time last year.

Percentage of all properties sales recorded by triSearch.

Tarneit continues to yo-yo up and down the leaderboard, once again taking top spot for Victorian property purchases. It’s easy to see why. Located 25 kilometres from the CBD, its mixture of affordability, open spaces and relatively easy commute, make Tarneit a top pick for purchasers who want to be away from the bustle – and the cost – of downtown Melbourne.

Werribee holds its position in second place, with Melbourne City moving up to third.

Gippsland’s biggest city Traralgon sits at fourth on the table, showing a solid demand in regional markets as priced-out buyers move further afield. Other areas seeing notable activity include Clyde North and Berwick, reflecting sustained growth in Melbourne’s outer suburbs.

Morayfield leapfrogs Surfers Paradise to take top spot as Queensland’s hottest suburb for property purchases in October 2024.

It’s easy to see why the fast-growing suburb that is ideally positioned between Brisbane and the Sunshine Coast is a firm favourite. The region has plenty to offer buyers, from affordability, family-friendly amenities, a strong

sense of community, and scenic surroundings.

Property agents have been pointing out that there has been strong demand across the Moreton Bay region, even in usually quiet times of the year.

Southport also continues to attract buyers, ranking sixth, with demand extending to both Redbank Plains and Kirwan.

Legendary jazz musician Miles Davis once remarked that time isn’t the main thing but the only thing. He was not referring to the busy life of a conveyancer, yet the sentiment rings true. For conveyancing firms, time management is crucial. Juggling tasks can feel overwhelming, but these strategies can help reduce stress, optimise time, boost productivity and achieve success.

Blocking out time in your schedule for specific tasks helps you organise your day visually. A diary, planner or calendar is the best way to do this. Digital tools like practice management software, online calendars, and email notification reminders can also help. Timeblocking helps sharpen your focus on one task at a time, encourages you to stay organised and may help improve the quality of your work.

Choosing the wrong priorities can waste time and energy on things that aren’t productive.

Create a basic daily and weekly to-do list focusing on what you want to achieve, and review your plans and priorities regularly so you’re spending appropriate time on each task.

Also, note how long each task takes to help you improve the efficiency of your day.

With the Eisenhower Matrix, you can prioritise tasks based on what you’ll do first, tasks you’ll schedule for later, what you’ll delegate, and what you’ll delete.

A priority list can help you strategise what tasks can be done together.

For example, by ordering your conveyancing searches early, you can complete tasks such as entering leads or inputting new clients’ data for other matters while waiting for their return.

Practice management software (PMS) can save you time.

The award-winning PMS, triConvey, has built-in tasks and workflows that can be customised based on your firm’s needs.

Tasks can be prioritised to be visible by the due date, helping you and your staff stay on top of tasks and deadlines.

Your daily email also outlines your upcoming tasks for the day, and triConvey’s built-in workflows ensure you complete all required steps of a task.

These necessary tools help you to stay organised and work smarter, not harder.