Conveyancer.

INDUSTRY CHECK-UP

✓ View from the frontline

✓ Growth and green shoots

✓ The home loan rates effect

✓ View from the frontline

✓ Growth and green shoots

✓ The home loan rates effect

BY LEWIS PANTHER

Tackling the housing crisis could keep inflation higher for longer, judging by remarks made by Michele Bullock and her RBA colleagues at the latest parliamentary economics committee hearing.

The Reserve Bank governor conceded that inflation will not return to its 2 to 3 per cent target band until the end of 2025. That means a cut to the 4.35 cash rate is off the cards for 2024, despite numerous market commentators pricing in a cut for November or December.

With residential housing costs a “big part of the inflation basket”, it raises questions about the federal government’s plans to build 1.2 million houses over the next five years.

Inflation in household construction rose at an annual rate of 5.1 per cent according to most recent measures and was slowing inflation’s progress back towards its 2 to 3 per cent target band, Bullock warned.

“Construction costs have continued to rise more in Australia,” she said during a House of Representatives hearing where she admitted “uncertainties around residential construction” were a worry.

“What we observed coming out of the pandemic was supply chain issues and strong demand to build houses,” Bullock said.

“That resulted in a large increase in costs in the construction industry – a shortage of people as well.”

While shortages that drove costs up by 20-25 per cent immediately after COVID have subsided over the past year, building costs are still up by that 5.1 per cent figure, she explained.

SPECIAL REPORT from page 8

Expanding on problems facing those involved in building high-density housing projects like social housing, Bullock noted that there was a conflicting demand for skilled tradies from commercial non-residential developers.

“What we hear from our liaison with construction companies, and particularly residential higher density, is that competition with non-residential construction and also infrastructure is meaning that it’s difficult to get staff and trades,” Bullock said.

Difficulty in finding staff had drawn out the time it was taking to finish home building as housing completions lagged new starts, she said. Those that do get finished are unaffordable, she added.

Competition for skilled tradies will clearly have an impact on wage demands too.

RBA Chief economist and assistant governor Dr Sarah Hunter’s remarks at the hearing also show why there is ongoing friction between the need to build more to tackle the housing crisis, and trying to tame inflation.

“Building costs – rental and new builds –are big parts of the inflation basket,” she said, admitting the RBA was concerned the housing shortage could become entrenched.

“It’s very challenging in the sector at the moment,” Hunter added, noting that ongoing supply side issues had led to a sharp decline in building, especially for small scale builders.

“It’s unlikely to resolve itself in the near term.”

While Bullock conceded that the fact rates would not fall in the near term was not news Australians wanted to hear, she maintained bringing inflation down was necessary.

“The alternative of higher inflation for longer is much worse,” she said. “We know that it hurts people with mortgages and debts, businesses with debts more.

“High inflation hurts everyone.”

“The alternative of higher inflation for longer is much worse … We know that it hurts people with mortgages and debts, businesses with debts more … High inflation hurts everyone.

Confusion, nervousness and uncertainty can reign supreme when seismic change comes at a rapid pace. It is true for most businesses – a reality for the conveyancing profession.

These are extraordinary times for the conveying industry: technology is making it faster, stronger but it is also weighing it down with greater responsibilities around data security and compliance.

While pressure to perform has always been there, practitioners are feeling it more than ever.

This is a noble profession but it is also a vital one. Property transactions do not occur without it.

The Australian Conveyancing Magazine was established in September 2023 to help the industry navigate its way through the complexities of its fast-evolving landscape.

Operators with their heads down and focused on serving their customers need an advocate, an extra set of eyes and ears to help them stay on top.

One year on this month, The Australian Conveyancer would like to think it has played

STAYING CONNECTED

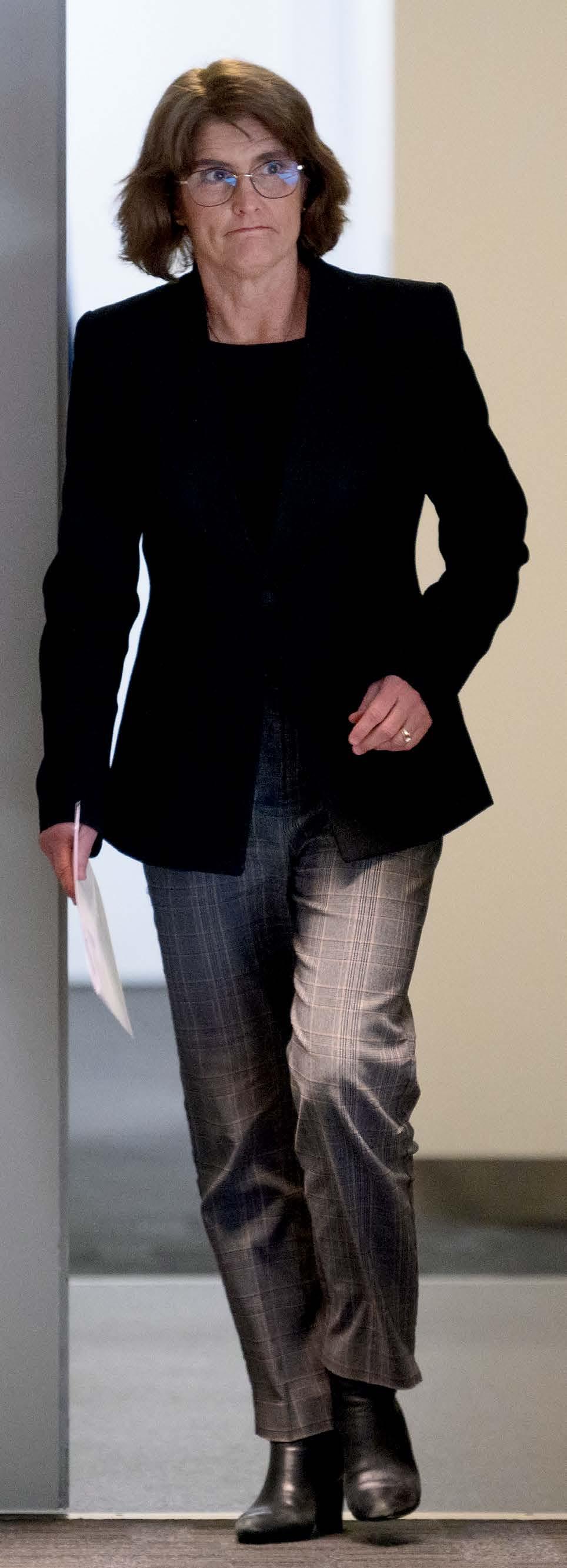

AIC Victoria vice-president Linda Cameron is widely respected for her knowledge and her capacity to keep moving with the times, and for giving back to the industry she has devoted many years to.

Page 4

a part in informing an industry in need of independent analysis and thought-provoking discussion.

In the 11 editions before this one, The Australian Conveyancer has pulled the covers back on technological game changers, cyber criminals, the future of housing, long-term threats to land values, and money laundering. It has also shown humanity through coverage of our greatest innovators and thought leaders, and has spoken of the open secret of professional burnout. We are proud of how far we have come and the ground we have covered.

We are also please to advise that this is just the beginning. We’ll continue to probe the big issues.

And as of mid-August, The Australian Conveyancer has become a daily news website. The special reports and the stories of people continue in a magazine format. We hope you like it.

The website is free to access and you can subscribe to receive news alerts: www.australianconveyancer.com.au

THE ANNUAL HEALTH CHECK

The Australian Conveyancer canvasses the leaders and advocates in each state to take a snapshot of where the industry is at.

From Page 8

THE M&A PLAY

We talk with three key conveyancing industry leaders about their plans and activities around business expansion. How does this impact the industry at large?

Page 22

With AIC Victoria vice-president

LINDA CAMERON

In recent decades, Linda Cameron, Victorian vice-president of the Australian Institute of Conveyancers, has witnessed significant shifts in how conveyancers do their job.

Once upon a time, things rarely changed - a far cry from today when the profession has moved online and things are constantly in flux, meaning conveyancers must continually update their skills to remain top of their game.

As well as her advocacy role, Linda is principal of Cameron Conveyancing, and has been a solo operator since 1980.

After a brief shift in career direction, she returned to conveyancing with ease, armed with the smarts on how to market herself, a deep network of industry contacts and vast professional expertise.

These days, Cameron is deeply passionate about the education of younger conveyancers coming up the ranks. She is enthusiastic about supporting her younger colleagues, and ensuring the integrity of the profession is maintained.

Australian Conveyancer sat down with Cameron to learn more about the highly respected leader and her vast experience, and why she believes, in these times of constant change, AIC membership should be compulsory for conveyancers.

AUSTRALIAN CONVEYANCER: What daily challenges do you face in your practice?

LINDA CAMERON: It’s challenging liaising with new conveyancers coming into the industry who may not understand the process, and the legality and serious impact a bad decision can have.

Some people experience challenges with ethical considerations and understanding the proper way to manage a workload upon completing their diploma.

For an extreme example, some will tick the box “That I hold the paper title” to settle electronically. In fact, they do not. They’ve forgotten to get the paper title from their client, or their client has lost it.

But you can’t use a shortcut and be deceptive. If that happened to me, I’d just say to everybody that we can’t settle, and I’d jump in my car and go get the title. If it was truly lost, I’d apply for an urgent substitute.

I decided to join AIC Victoria, because I’d love to be able to help in some way.

Another challenge that’s come about with the rise of electronic conveyancing is the banking industry not checking their client names against BSB and account numbers which can lead to fraud.

AC: What about when it comes to technology advances and the impact on workflow?

LC: The biggest change definitely are the wonderful online settlements. I just think they are absolutely fantastic.

I work from home and everything is online, so I’ve got plenty of time to see my grandkids and monitor the level of work I’ve got. The good part about the tech advances is we’re constantly educated now. PEXA and the ELNO assist us, and the AIC offers a lot of learning.

I don’t have many technology challenges. I have an excellent IT man but I stick to my comfort zone, which is knowing how to operate a file. Because I’ve been in the industry for so long, the challenge is how to do new things. I’m a very curious person and I’ll make sure I add to my knowledge.

“I’m a bit of a realist - you’ve got to work with changes and not just complain about them,”

Linda Cameron

CONTINUED FROM PAGE 5

AC: How do you ensure your practice is as profitable as it needs to be?

LC: COVID was extremely profitable but with every interest rate hike, things quietened down.

I was extremely quiet for a couple of months this year, so I wasn’t that profitable, but thanked god for the rest.

But for a younger conveyancer with a mortgage and other financial commitments, you’ve really got to keep on the ball to be profitable.

In my early years, I’d do projections and when things weren’t looking good, I’d market myself, knocking on doors and ringing contacts to bring the work in, but again, I really don’t have to do that now.

Having a decent website has been fantastic, though, it’s one of the best thing I ever did.

AC: How do you manage work-life balance?

LC: I often work seven days a week because the work is there. Although I work very hard, I really look after my energy levels.

But it’s not as if I work nine to five. If I’ve only got one settlement this afternoon and have signed off on it, I can take my laptop and go to see my grandkids.

So, I work my life around work. There are, of course, some times I can’t.

A lot of people may wake up at 3am and stare at the ceiling. Well, I don’t. I get up, make a cup of tea, go to the computer and work on contracts. Then it’s 6am and there’s no point going back to bed.

Work ethic is so important. You can’t let people down and you have to understand what’s achievable and what’s not. It comes back to client communication.

If there’s a very serious problem, I’ll face the email down on the desk until I’m in the right frame of mind. I’ll wait for the next day and make sure I’ve had a relaxing bath, listened to lovely meditation music and taken a deep breath – then I’ll deal with it. You’ve got to deal with problems, otherwise they’re sitting on your shoulder continually.

Even if you’ve stuffed up chronically, most times clients will understand and thank you for being honest.

AC: How do you cope with industry changes, and increasing obligations around data security and legal compliance?

LC: There’s a lot more compliance but it’s fine by me. It means I spend more time on a file, but you need to be up to date. You just make sure you put the right things into place, so you comply.

I’m a bit of a realist – you’ve got to work with changes and not just complain about them.

Every now and again, something comes that’s frustrating, but I don’t sweat the small stuff.

As far as security breaches, if it happens on one of my files, it certainly affects me. Years ago, it wasn’t a requirement to ask for a client’s ID. Twenty years later, we must ensure our clients undertake their identity verification and ensure we’ve got all of the right pieces of paperwork. It doesn’t really bother me that much because I make the time.

Now, a lot of conveyancers out there have got so much work and are so rushed. I empathise for with them, because that’s when you make mistakes.

I became a member of AIC later on, because previously I relied on my industry contacts and solicitors for assistance, but my reasoning was wrong.

As I got older and many colleagues retired, I didn’t have as many people to refer to, so I joined the AIC. From that moment, the education and assistance has been absolutely fantastic. I really wish AIC VIC membership was compulsory for conveyancers.

AC: What do you think about the industry practice of larger conveyancing practices acquiring smaller ones?

LC: We’ve still got a lot of small operators out there, but it’s the way of the world.

If smaller practices are being bought up by the bigger firms, taking a client’s best interests at heart and doing a good job, it’s still creating employment.

It’s all about quality of work and it depends on how the bigger companies are going to handle the files.

I know one particular company that was bought by a bigger one and the clients were scrambling trying to find out from a previous secretary how they could get her to do the work because the firm was not answering calls. That’s a typical example of no service.

There’s the odd rogue conveyancing company that’s going out buying smaller ones, cutting corners and not looking out for clients’ best interests. It’s dreadful and shouldn’t be allowed.

AC: What do you see as risks to industry profitability?

LC: It’s a risk to profitability if you’re taking on too many clients for a cut price.

Conveyancing is a specialised area, and you can’t just say, ‘I’m going to do the course, be a conveyancer, go out, cut the price and really minimise everything that must be done.’ That’s going to have a long-term effect.

Profitability is very difficult. AIC VIC is always trying to persuade members and non-members to understand our value and charge accordingly.

People starting out need help to understand how to run a business and that’s where their ongoing education really needs to be looked at.

AC: What impact does the current property market and interest rate uncertainty have on the industry?

LC: I’m generally not a government basher, it’s a hard job. But keeping interest rates so low for so long was going to increase housing prices, there’s no argument there and many could see this happening.

As interest rates kept going down, you could see the size of the land reducing and increasing the value of the property. If there was an increase in the first-home owner’s grant, land prices would go up that much. It’s one of the saddest things because young kids can’t afford to buy a home in the suburbs.

Then the Reserve Bank comes along saying they need to increase interest rates because things have changed. That was just so unfair, there should have been more responsibility.

In Victoria, I’m getting a lot of vendors selling their investment properties because they’re being charged much higher land tax because of the government’s COVID clawback. Their council rates and owners’ corporation fees have increased. The industry for owners’ corporation managers is not properly regulated, leading to inexperienced individuals managing high rises and making costly mistakes.

AC: How do compliance obligations affect the industry?

LC: If you want to be in an industry, you have to comply. At the end of the day, as long as you tick your boxes, the job’s done. These days we have to do more for the ATO and State Revenue Office.

It comes back to having that further education. Without it, you’re not going to comply, because you don’t know.

That’s why we want our regulatory body to make further education mandatory, so compliance can be met.

AC: What do you think of using AI within the workflow?

LC: It’s early days but it’s fantastic. However, it’s really got to be used properly, like everything else.

While some may embrace AI and overlook important factors, those with experience and expertise will be better positioned to identify any inconsistencies. You need people with knowledge to control it.

AIC Victoria vicepresident Linda Cameron: Facing up to change and challenges, and helping young conveyancers rising through the ranks.

STORIES BY LEIGH REINHOLD

With nearly a million conveyancing transactions signed off this past year, Australia’s agents are in agreement – they are stretched to the limit by heavy workloads and by time-consuming and ever-growing compliance burdens.

And AIC National President Michelle Hendry says the industry is in for more shaking up in the coming five years with a Deloitte report identifying two “critical uncertainties” for the future of the Australian conveyancing industry. Australian Conveyancer magazine speaks to industry leaders countrywide for our State of the Nation special report taking a look at how the sector is faring in 2024 and how it is shaping up for the future.

More than half a million of Australia’s 11 million dwellings were sold last financial year. And that bumper workload – along with at least 20 per cent of time spent on each file being compliance-related – is making for long days in the office for the country’s conveyancers, settlement agents and property lawyers.

“I think conveyancers are feeling stressed and time poor and it’s a national issue,” AIC national president Michelle Hendry tells Australian Conveyancer magazine.

“Conveyancers very much underestimate how important our role is and, as a result, we probably lean towards doing more high value work at lower price points, rather than getting the fee that we should be getting paid.

“Our role is extremely important and it’s only expanding. The work that we’re required to do and the compliance we are required to do for each file is a lot. Now we’ve got anti money laundering (AML) requirements which are about to come out, which means more compliance requirements. That just continues to expand for us and we’re not increasing our fees accordingly for all this additional work.

“The real estate industry is a major part of the Australian economy, and the conveyancing profession is a fundamental contributor. The role of a conveyancer for a consumer is more important now than ever with the rapidly changing market and the ever-changing regulation and compliance.”

Hendry believes the role of conveyancers and settlement agents is going to further reshape over the next five years.

“The role of the conveyancer will likely start changing more rapidly as a result of innovative technology, automation and consumer behaviour as well as generational change, and a conveyancer must adapt,” says Hendry. “But it is how a conveyancer adapts to change that is vital to our profession.”

In The Future of the Australian Conveyancing Industry 2025 and 2030 report from Deloitte in 2018, >>

Adelaide-based AIC national president Michelle Hendry says there is pressure to perform and remain profitable.

“Our role is extremely important and it’s only expanding.”

Michelle Hendry

9

two “critical uncertainties” for the conveyancing industry were identified:

1. will conveyancing be digitally enabled or digitally led?

2. the visibility of conveyancing as a distinct or embedded service.

“If conveyancers provide a personal service deriving benefit from digitisation, automation and integration of new technologies, we will have a digitally enabled profession and be a distinct standalone service,” Hendry says. “Adversely, if a digitally led service is provided reducing human input, the profession will be at risk of becoming an embedded service – vertically integrating with an electronic lodgement network operator, financial institution or other element of the property transaction.

“In our view, this will not only have a huge impact on the profession but ultimately the consumer, restricting choice and deteriorating the consumer’s ability to seek the right advice for what can be their most significant investment in their life.”

Hendry reports another problem facing the industry nationwide is when business referral partners assume they can dictate a conveyancer’s fees to them.

“Real estate agents and buyers’ agents, some mortgage brokers, try to negotiate our fees for their clients

with us,” she says, “which is kind of hard to swallow when their fees are a certain percentage of the price and they are not doing the legal work that we’re doing.”

Being squeezed on price and time means conveyancers nationwide are finding it difficult to grow their SMEs.

“It’s the chicken and the egg, isn’t it?” says Hendry. “We’re small businesses that don’t get paid appropriately for our work which makes it difficult for us to grow and to employ the resources to help us grow and it’s because of all that compliance.”

Hendry says while the states may have their differences in the way they carry out day-to-day conveyancing, fundamentally there are a lot of similarities.

“Even though each state will say, no they’re not similar, they’re all different, they all stem from the Real Property Act and the Torrens Title in SA, so there are a lot of similarities but there are certainly nuances,” she says.

“Probably the biggest difference is the scope of work in each state. I think WA is quite limited, SA has a relatively good scope of work but NSW and Victoria can give legal advice whereas the other states can’t. Which is stupid. Take SA for an example – we’re an exception under the Legal Practitioners Act but we can’t give legal advice.

“It’s pretty hard for Tasmania and the Northern Territory right now who are not on PEXA. But I do have views about PEXA. PEXA is a private entity that we are mandated to use and they get $137 a transaction from each party - the vendor and the purchaser.

“There is a bit of a false impression out there that PEXA has created so many efficiencies and that it’s e-conveyancing, when in actual fact it is e-settlement. All it is is the settlement platform. There’s still a lot of work that needs to be done prior to the settlement platform.

“So it’s coming down to the value of what we do is very important. Someone buying a home is their most important and biggest financial investment in their life.

“People are spending an average of between $500,000 and $800,000, probably higher, on their homes and yet they are squabbling with us over a few hundred extra dollars.

“It is a bug bear of mine - and it’s a national sentiment as well - that we have to bring up our value. It’s not going to remove the stress as much but I think it will have an impact.”

More than 500,000 of Australia’s 11 million dwellings were sold last year. Twenty per cent of the workload for conveyancers is compliance-related.

AICSA president Matthew Kelly

• 622 licensed conveyancers and 130 conveyancing businesses.

• AICSA has 708 active members

• 80% female participation

NSW

AICNSW CEO Chris Tyler

• 1800 conveyancers working in 550 businesses across the state

• Foreign resident surcharge purchaser duty has increased professional indemnity insurance by 59%

AIC VIC President Shakila Maclean

• 2000 licensed conveyancers working across 700 conveyancing firms

TASMANIA

AIC President Emmi Balmer

• 15 licensed conveyancers

• Seeing a housing boom, with 2277 sales recorded in the last quarter

AIC WA branch CEO Brook Durling

• 697 licensed settlement agents work in 350 businesses statewide.

• 280 are members of AIC WA.

• Completed 90,354 transactions in the past financial year.

QLS Law Society CEO Matt Dunn

• 15,000 solicitors in 2500 law practices.

AIC NT president Sue Carmody

• 38 members

• Noticed a small trend whereby

Jared Zak, whose Dott & Crossitt was acquired by LocalAgentFinder, acknowledges the pressures on sole traders have resulted in a market environment which is conducive for takeovers. Trade is up 20-30% yearon-year

D&T – which operates a franchise network of more than 40 licensed conveyancers and solicitors in nine offices – is in the market to buy more businesses. Sees more growth potential in WA where there is more yield.

Nick Gould – MD of Colwell Conveyancing Group – is keen to grow but wants his team of nine to stay focused on Queensland.

AML compliance burden, vendor disclosure, and new Property Law Act will bring some of the biggest challenges to the industry in decades.

Victoria-based Skilled Conveyancing CEO Trent Taylor - who took over the family firm 18 months ago and has already acquired one business - intends to keep the merger momentum with further takeovers in NSW, Victoria and Queensland.

New government legislation and the extra work that brings has had a significant impact on real estate lawyers in Queensland over several years. And the rollout of more compliance obligations is expected to continue over the coming years.

BY LEIGH REINHOLD QUEENSLAND

The Queensland market has come off the “super highs” of the COVID years but is still “quite buoyant”, according to Queensland Law Society chief executive Matt Dunn.

“Data from the titles office shows the creation of new lots remains strong in Queensland, which is likely a reflection of the demand created from domestic activity and inter-state migration,” he tells Australian Conveyancer magazine.

in other states, Dunn says the legislative compliance obligations attached to property transactions in Queensland are designed to assist Commonwealth and State governments.

“Law practices in Queensland are also self-assessors for Queensland duties payments and this adds to the work required in transactions,” he says.

OPPOSITE: The Gold Coast – challenges in Queensland in the next five years will come from increased compliance obligations.

BELOW: Queensland Law Society chief executive Matt Dunn.

Operating differently from the rest of the country, all of the Sunshine State’s conveyancing transactions are handled by the state’s 15,000 solicitors, working in more than 2500 law practices.

Dunn says the switch in Queensland to e-conveyancing for most transactions has made life easier for the state’s legal practitioners to settle quickly and efficiently.

“Queensland also has an active professional indemnity insurer who publishes material that assists with transactional compliance,” he says.

However, echoing the complaints of conveyancers

“All firms are looking to ways to make their services more effective, but with the constant run of legislative change in the process of Queensland conveyancing over the past five years it has been difficult to effectively move to an easily scalable approach.”

Dunn says two new measures will “reshape” the conveyancing market in the state: a new form of abbreviated cost disclosure; and a new Property Law Act which brings with it the new vendor disclosure regime and has yet to commence.

Dunn says the past year has posed some challenges as Queensland comes out of its COVID highs and returns to a more normal level of activity in the market.

“This has been coupled with the mandate to e-conveyancing and additional compliance obligations around CGT and other government requirements,” he says. “The biggest challenges in the next five years are dealing with compliance issues, both the introduction of the new vendor disclosure regime and the looming antimoney laundering and counter-terrorism financing (AML/ CTF) regime.

“The vendor disclosure regime has the potential to be positive in its impact in making buyers more aware of what they are purchasing and making contracts move more reliably to settlement.

“The AML/CTF regime will be an enormous challenge for industry and has the potential to be highly costly and largely ineffective. I feel this may be the biggest issue we are discussing in five years.”

“All

firms are looking for ways to make their services more effective, but with constant legislative change it has been difficult to effectively move to an easily scalable approach.”

Matt Dunn

ANNUAL CHECK-UP

A mixture of limited supply, higher build costs and greater compliance burden for the close-knit NT conveyancing community has been compounded by a small influx of interstate carpetbaggers looking to get into the Top End market.

ABOVE: AIC NT president Sue Carmody.

BELOW: Darwin, hub of the Top End: Supply and build cost are front of mind.

BY LEIGH REINHOLD NORTHERN TERRITORY

As the housing market cools in the Northern Territory, a whole raft of issues are affecting the Top End’s conveyancers, according to the president of AIC NT Sue Carmody.

The low supply of housing compared to demand, land tenure and planning arrangements, flatlining incomes, high interest rates and housing prices, along with high crime rates and antisocial behaviour, are all impacting her 36 members.

“Affordability in the NT has declined,” says Carmody. “Construction of a house in the NT is expensive with high builders rates and charges for construction. Freight is also a large factor.”

With 38 conveyancers operating in the Northern Territory, Carmody says they form a “small village” of practitioners who are “focused, task motivated and always looking out for the best interest of their clients”.

“We all know each other and respect each other,” she reports. “There is a unity among the members which makes working in the industry a little more easier.”

Carmody says compliance with new legislation from both Federal and Local Government is causing considerable stress to a number of the AIC NT members, who are made responsible for that legislation rather than it being up to the federal or local government to uphold.

In the Northern Territory each conveyancing matter also has additional regulatory requirements beyond that of Verification of Identity (VOI), ATO, capital gains tax, withholding clearance, and FIRB which include swimming pool/spa fencing compliance, smoke alarm compliance and electrical outlet compliance.

“These matters would best be completed by the vendor or the selling agent prior to going to market,” says Carmody. “Unfortunately, these matters are often not attended to prior to the buyer signing the contract of sale resulting in the buyer’s conveyancer having to attend to these issues.”

Like Tasmania, the Northern Territory is yet to adopt PEXA. “There is no e-conveyancing (PEXA or Simpli Electronic Settlements) in the Northern Territory, thus we are being left behind,” she says.

Carmody has noticed a recent trend in the territory of interstate lawyers moving to the territory and setting up conveyancing practices.

“With the current state of the economy, more and more businesses are being forced to expand their markets to ensure survival,” she says. “And they are moving into new geographical areas with new potential clients, so growth will assist in their profitability.”

WA’s 697 licensed settlement agents - in 350 businesses - completed 90,354 transactions in the past financial year as the state sees a housing growth spurt.

Risks from cyber, fraud and government compliance are adding to their workload.

BY LEIGH REINHOLD WESTERN AUSTRALIA

The newly appointed chief executive of the AIC WA branch, Brook Durling, says the “crazy hot” property market in Western Australia in 2024 is keeping the state’s settlement agents very busy with many experiencing difficulty in finding enough employees to carry the load.

This past financial year its 697 licensed settlement agents – working in around 350 businesses statewide – have completed 90,354 transactions (figures: EAS2).

“There appears to be a lack of available staff to support businesses in this industry,” Durling tells Australian Conveyancer magazine.

He believes a possible solution to the understaffing issue could lie in AI carrying some of the settlement agent’s burden in the future.

“AI could make things interesting,” he says. “It remains to be seen but I am leaning in to the AI ‘revolution’ as I believe there are use cases where it will provide benefit to business. I am actively exploring this space currently.

“It’s early days with some members adopting the technology albeit in limited capacity – that is, ChatGPT for content creation, document checking, etc.”

Durling says other factors affecting his 280 members are the “increasing obligations being stacked on settlement agents by government departments, for example, ATO requirements”.

“Also, the fraud and scam landscape is growing in sophistication and success – when it is successful they grow in number and intensity.”

The AIC WA is actively instructing its members how to deal with cyber scammers.

“I have just launched a new fraud/scam awareness

training tool for all my members and their office staff,” says Durling, who has also recently onboarded a new sponsor partner in the cybersecurity support space.

Durling says it is important to be prepared for the challenges ahead which he identifies as: “Technology change, AI, fraud and scam and the housing market cycle downturn – if it happens!”

But he also sees great opportunities ahead for Western Australia’s settlement agents.

“They will be able to re-imagine the role of a settlement agent in the property value chain as consumer expectations in this space change and evolve,” he says.

ABOVE: AIC WA branch chief executive Brook Durling.

TOP: Heart of the West, Perth: the industry needs more support - AIC.

Adelaide: It’s a busy time for conveyancers statewide.

BY LEIGH REINHOLD SOUTH AUSTRALIA

As the property market booms in South Australia, the state’s conveyancers are stretched to capacity with predictions there won’t be enough practitioners to carry the added load of extra housing in the future.

“An additional 300,000 homes need to be built in the next 30 years to deal with the demands of home owners and we need conveyancers to assist with this demand,” says AICSA president Matthew Kelly, referencing a report by demographer Simon Keustermuser at the 2023 State Conference.

“Basically there will be ample work and growth in conveyancing, but not enough conveyancers to assist with the growth.”

South Australia currently has 622 licensed conveyancers and 130 conveyancing businesses with approximately 80 per cent female participation, mostly aged 30-60. Many are sole traders or in small partnerships. While the large conveyancing firms are likely to be generational family businesses.

“Conveyancing for many participants in South Australia is seen as a lifestyle business,” says Kelly. “Referrals are hotly contested. The more successful conveyancers are those that can actively market their personal brand, provide personalised service and still produce quality outcomes for the registry.”

While the demand for new conveyancers in South

Australia is strong, Kelly says there is pressure from experienced conveyancers that education pathways need to be improved and developed. “We are currently working with the minister and CBS for pathways for new and emerging conveyancers through mandatory traineeships,” he says. “This is due to the rise in the concern experienced conveyancers have with new conveyancers not understanding the practical side of the job.

“Our members also have fears of unanticipated vertical integration by ELNOs – we are working with the Registrar-General on steps to assist in addressing these concerns.”

Kelly says the mandating of electronic settlements was the biggest challenge in the last five years facing AICSA’s 708 active members, which has included the retraining of staff and rewriting of office procedures.

He says the most significant improvement in conveyancing in South Australia in the past decade has been the introduction of PEXA along with advancements in searching technology and significant improvements with practice management software.

However, Kelly says the added incidental and adjacent reporting requirements are placing extra burdens on the profession.

“This should transfer into increased fees,” he says, “but, because the industry participants here are fractured and price sensitive, the average conveyancer is working more, with greater risk, and often for less money.”

Busy conveyancers on the Apple Isle have been handling a housing bonanza at the same time as added compliance and upskilling to deal with e-conveyancing.

BY LEIGH REINHOLD TASMANIA

Tasmania is experiencing a post-COVID property bonanza with buyers from the mainland returning to the Apple Isle in droves and keeping the state’s conveyancers very busy, according to the president of AIC (TAS) Emmi Balmer.

“The market has picked up, especially with first home buyers and mainland buyers,” says Balmer, who saw 2277 sales recorded in the state in the last quarter. “Although there is still the issue of affordability.”

Balmer says Tassie’s 15 licensed conveyancers are a close-knit bunch, who often work together to pull off some of the southern state’s trickier transactions.

“Given we are a smaller state, having a great working relationship with your colleagues definitely helps with the tricky files,” says Balmer.

“I would describe the typical Tasmanian conveyancer as extremely committed to what they do, and the service they provide to their clients, and passionate about the advancement of the industry.”

And Tassie does have some catching up to do with its northern neighbours, as it has not yet implemented PEXA and, in the coming years, the state’s conveyancers will need to learn how to transact in an electronic space – something the AIC (TAS) is anticipating will be a game changer.

“It will free up a lot of time for settlements and ensure that settlements take place smoothly without the worry of documents or funds being incorrect and settlements falling over on the morning or, even worse, at the actual settlement location,” says Balmer.

“As we transition into the e-conveyancing space, the AIC TAS division has been focused on education for our members as well as transparency about what the

government is doing in the background.”

Meanwhile, Balmer says the biggest challenges affecting her members in recent times has been adapting to include the state’s new compliance requirements.

“The Land Titles Office has implemented the Recorder’s Directions which incorporate compliance examinations on right to deal, client authorisation and verification of identity (VOI) so we have been adapting to that.

“Compliance challenges seem to be the biggest challenge to our members and finding the time to answer to the examinations is substantially affecting Tassie’s conveyancers. It is taking staff away from working on their files.”

ABOVE: AIC TAS president Emmi Balmer. TOP: Hobart – a housing ‘bonanza’ on the Apple Isle.

Conveyancers must compete with firms offering unrealistic bottom-of-the-barrel pricing, plus increased financial burdens and compliance responsibility. A lack of mandated CPD requirements means inconsistent educational standards.

BY LEIGH REINHOLD VICTORIA

Unfair competition, increased financial burdens and insurance hikes are affecting Victorian conveyancers and the way they do business in 2024, according to industry leader Shakila Maclean.

“Many Victorian conveyancers are having to compete with firms offering unrealistic bottom-of-the-barrel pricing,” Maclean, president of AIC VIC, tells Australian Conveyancer magazine.

The industry head says it is a “troubling trend” where many practitioners are not adequately valuing their work.

“This, in turn, results in risks to clients and increasing insurance claims against firms,” says Maclean, whose focus at AIC VIC is to equip the organisation’s 600-plus members with the “knowledge, resources and network they need so they can grow with clarity and confidence”.

With the number of new dwellings needed to ensure housing for the state’s growing population, Maclean is confident Victoria has enough conveyancers to take on the extra work required to service the growth.

“The state has a robust network of conveyancers who are prepared to manage the additional workload efficiently,” says Maclean.

OPPOSITE: The heart of Melbourne – Victorian conveyancers locked in a price battle.

BELOW: AIC VIC president Shakila Maclean.

“By pricing their services too low, these practitioners not only jeopardise their own business sustainability but also contribute to a broader problem that undermines the perceived value of conveyancing services,” she says.

With 2000 licensed conveyancers in Victoria and over 700 conveyancing businesses statewide, Maclean says “mixed standards” exist across the industry due to a “lack of mandatory CPD (continuing professional development)”.

“Moreover, the profession is adapting to meet future needs, with ongoing efforts to train and support new conveyancers. This proactive approach ensures that Victoria can effectively support the housing growth and maintain a smooth property transaction process.”

The majority of licensed conveyancers in Victoria operate their own business, either as a sole practitioner or within a small team, and Maclean says they have experienced several changes, innovations, and regulations in recent years which have both facilitated and challenged them.

Digital innovations like electronic settlement platforms and digital contract management systems have streamlined many aspects of conveyancing.

At the same time, increased compliance requirements including new regulations and heightened scrutiny around anti- money laundering (AML) and consumer protection have added layers of complexity to the conveyancing process.

“Overall, while technological advancements and regulatory changes have made many aspects of conveyancing easier, the profession continues to navigate challenges related to compliance and cost,” says Maclean.

“By pricing services too low, practitioners contribute to a problem that undermines the perceived value of conveyancing services.”

Conveyancers do arguably the most work and carry the most risk but get paid the least – even less than property stylists who get a multiple of what the conveyancer earns.

BY LEIGH REINHOLD NEW SOUTH WALES

Conveyancers in NSW need to be properly remunerated for the vital role they play in property negotiations, says industry leader Chris Tyler.

“In a typical property transaction, conveyancers do arguably the most work, carry the most risk and get paid the least,” says Tyler, chief executive of AIC NSW.

“Even the property stylist would get a multiple of what the conveyancer earns. Conveyancers in NSW need to be paid for what their service is worth.”

“They are also concerned about banks not meeting PEXA transfer guidelines. And constant change in the industry.”

Tyler believes conveyancers in NSW have been unfair victims of the Revenue NSW foreign resident surcharge purchaser duty. “This poorly introduced revenue raising measure has directly resulted in an increase in professional indemnity insurance premiums to our members of 59 per cent”.

Meanwhile Tyler is critical of NSW Fair Trading as an inadequate regulator of licensed conveyancers and says there is also a lack of consideration given to conveyancers when reforms are being introduced.

OPPOSITE: Sydney, where conveyancers carry the workload and the risk.

BELOW: AIC NSW chief executive Chris Tyler.

With some factors making life easier for conveyancers in NSW – like practice management software, improved internet access enabling remote work, and the introduction of PEXA – Tyler says other elements are adversely impacting the 1800 conveyancers working in 550 businesses across the state.

“The main concern is they feel they are unpaid tax collectors for the government and Revenue NSW,” says Tyler.

And he expects tranche 2 of the AML/CTF (antimoney laundering and counterterrorism financing) legislation – to be introduced next year – will put more work on to conveyancers.

The burden of compliance is also affecting conveyancers’ time and earning capacity, says Tyler.

“They must undertake Revenue NSW audits and NSWLRS subscriber audits – to ensure the work they do for these agencies is correct,” he says. “And time completing the compliance activity is not reimbursed.”

Tyler says NSW is currently experiencing a shortage of experienced licensed conveyancers and the industry could do with some new recruits. He also reports seeing a small rise in mergers and acquisitions with small conveyancing businesses being sold to legal practices.

With indications the strong property market in NSW is softening in the second half of 2024, Tyler doesn’t expect the slowdown to impact on conveyancers in the short term.

“As most are small businesses, they can easily react to slowing business activity and use the time for updating processes and procedures, business development, etc,” he says.

“Conveyancers feel they are unpaid tax collectors for the government and Revenue NSW.”

Dott & Crossitt managing director Jared Zak.

Three major players in the conveyancing sector tell Australian Conveyancer why mergers and acquisitions is on the mind of businesses and sole traders who are dealing with a perfect storm of pressures. The latest Special Report finds out why consolidation and economies of scale are top of mind for many firms fighting for a fair share of the property transaction pie as they tackle ever-increasing legislative burdens.

BY SAM McKEITH

The conveyancing sector looks poised for consolidation as fast-growing industry players go on the hunt for merger and acquisition (M&A) targets across the country.

Several high-profile conveyancers said they were on the lookout for M&A opportunities amid a spate of deal activity in Australia’s legal sector, including the high-profile merger of Gadens with Canberra-based Trinity Law and Thomson Geer’s takeover of Perthbased Tottle Partners.

Jared Zak, managing director of Sydney-headquartered Dott & Crossitt, says he is mulling M&A after a period of strong growth at the firm, with trade up 20-30 per cent year-on-year.

“We’re definitely keen to acquire some more businesses and bring them under the banner,” Zak tells Australian Conveyancer magazine.

across nine offices nationwide. It is the biggest operator in NSW by transaction volume, according to the MD.

Zak says Dott & Crossitt’s position as a market leader has been assisted by recent push into Victoria and Western Australia where the firm is seeing “a fair bit of growth”.

The west coast in particular is a “booming market at the moment”, the MD says. “It’s a function of the housing market. I think maybe there’s still a fair bit of yield there in terms of those houses, whereas if you read the headlines, house prices don’t have too much further to go upwards in the eastern states.

“It’s hard to be out on your own as the sole practitioner – that’s what I’m hearing on the ground.”

Jared Zak

“The market is pretty ripe for it now, it’s hard to be out on your own as the sole practitioner – that’s what I’m hearing on the ground.

“There are so many headwinds with rent prices going up and wage demands and that kind of thing, so it pays to be part of a bigger organisation.”

Zak says the firm, which itself was acquired by property technology firm LocalAgentFinder earlier this year, used a business model that helped when it came to expansion.

“We bought a couple of businesses recently where we’ve bought the business but [the staff] have stayed on as salaried employees but under a micro business of their own,” Zak says.

Founded in 2014, the firm operates a franchise network of more than 40 licensed conveyancers and solicitors

“The first six months of this year have been crazy, extraordinarily busy, in what is seasonally a very quiet time.”

In Brisbane, Colwell Conveyancing Group is also on the lookout to make acquisitions and is targeting smaller firms in Queensland, according to managing director

Nicholas Gould.

Colwell, which was established in 1972 and has offices in Brisbane, Sunshine Coast and Gold Coast, is in a good position to pursue M&A after a surge in growth in the last 12 months. “We’ve been experiencing significant growth, which is fantastic,” says Gould, who pointed to developing strong business-to-business relations as a key to the firm’s recent success.

Unlike Dott & Crossit, Colwell, which uses a team of nine, wants to stay focused on the Queensland market, which Gould says is part of plans to grow “in a way that’s sustainable”.

“This is a market where we have great relationships with referrers, great relationships with clients and

CONTINUED FROM PAGE 23

we’re really sticking to that piece at the moment,” Gould says.

“We’re not trying to grow too big and too broad and be all things to all people – we’re really focusing on doing one thing, doing it well, and doing it in a market that we know.”

Looking ahead, he says there are looming challenges for the industry that could disrupt some operators, and prompt consolidation.

“I think there are going to be some significant changes in our industry with the roll out of the changes under the new property law act, we’re going to see the implementation of the vendor disclosure scheme, I think that will be interesting for our industry,” the MD says.

“I think those who are utilising technology will be well ahead of the rest to implement those.”

company 18 months ago, says inorganic growth was put high on the agenda after a year spent revamping the firm.

He says it has already made one acquisition – a firm in Ballarat – which means Skilled now has a presence in most of Victoria.

“We bought a great little firm in regional Victoria and took on the principal and their owner and it’s just gone awesomely well,” says Taylor, who uses a team of around 10.

He says ther firm is on the hunt for firms, especially those in NSW, that are looking for a suitor and is currently working on “creating a few models on how I can do that with them”.

BELOW LEFT: Colwell Conveyancing Group managing director Nicholas Gould.

BELOW RIGHT: Skilled Conveyancing chief executive Trent Taylor.

Planned regulatory changes could also have an effect, Gould says, pointing to the introduction of stricter antimoney laundering and counter-terrorism financing rules.

“They will be some of the biggest changes to our industry that we’ve seen in decades,” he says.

In Victoria, Skilled Conveyancing chief executive Trent Taylor says he plans to make one acquisition per year and was on the lookout for targets in Victoria, NSW and Queensland. Taylor, who took over the family-run

“I’m aware of eight or nine different purchases, and what people get for their conveyancing companies is just horrific, so I’m working on a model where people can merge with us and be part of our family,” Taylor says.

One option being explored is to strategically invest in a number of small firms and leave owners with a minority equity stake, he says.

“They’ll leave some equity in and my plan is that in five years’ time that equity that they’ve left in is worth more than when they put it in initially,” Taylor says.

“The whole focus is just to build the business. I want to serve those regional communities, I’m regionally based so I would like to do more of serving the local people.”

Also key, he says, is keeping the “wisdom of the more experienced operators in the industry”.

“Consolidation has been happening across all industries for the last two decades in a serious way, and when larger players outside of this industry decide to infiltrate our industry, the real danger is the personal touch and care is not as valued,” he says.

“[Then] the pricing of our services becomes a race to the bottom as they only chase scale.”

In Taylor’s view, creating awareness about the benefits of “pure conveyancers” among property professionals and mortgage broker industries is critical for long-term industry health. It is important to show that conveyancers can do transactions “better than anyone as it is our full time focus and how we can work as a trilogy with our clients”.

He says conveyancers should be seen as not “just as service providers, but as confident people who charge what they are worth, for the work they do”.

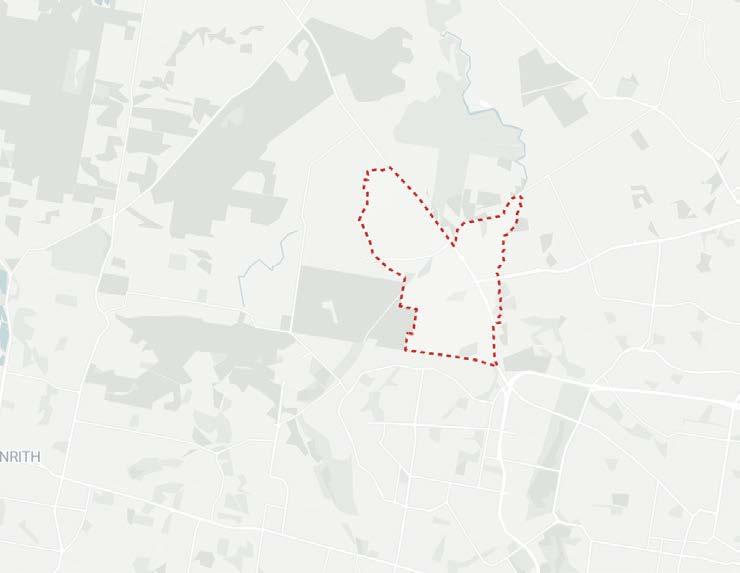

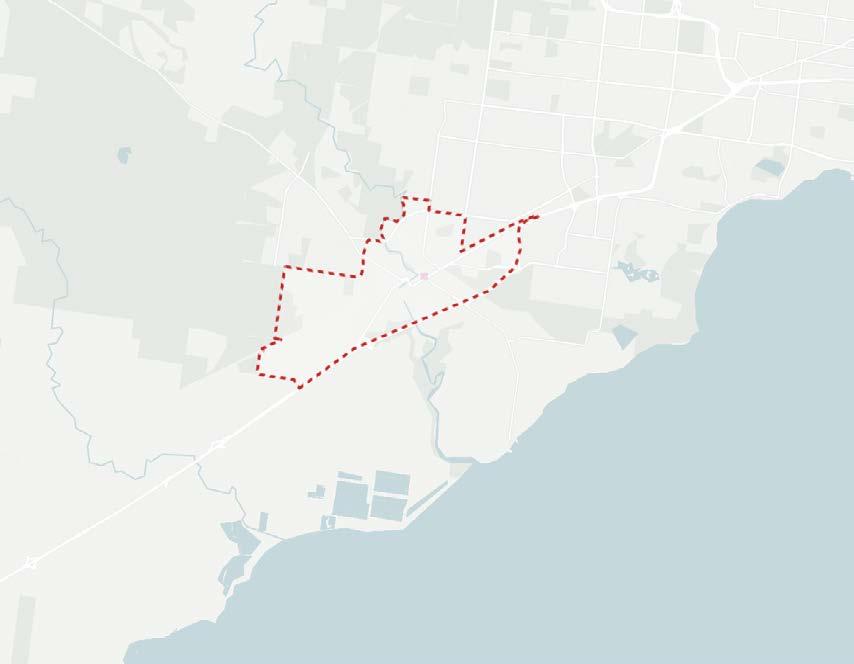

Marsden Park continues to top the NSW buyers’ chart with 200 more sales than its nearest rival during July. A quarter of all sales across the state’s top 20 postcodes belonged to the 2675 location, highlighting its ongoing dominance –standing at the top of the leaderboard for the past three months. It’s remarkable to think it was home to fewer than 3,000 dwellings in 2017. But with 10,000 new homes in the planning pipeline, there is clearly room for significantly more growth, especially as authorities see the population growing from 27,700 in 2024 to 38,393 by 2046. Apart from Maitland and Wyong, the rest of those making up the top 10 are to the north and

south-west of Sydney, where buyers are fleeing to escape after being squeezed out of the market by the city’s sky-high prices. Campbelltown, Campden, and Penrith also keep their place on the sales leaderboard, as a testimony to their value for money and combined marketing budgets of councils and developers.

Sydney’s outer suburbs attract the bargain hunters

near Newcastle, in the Top 10

The NSW suburbs where most property was bought in July 2024.

Which countries invested in the Australia property market for the first time in June 2024.

How many first-home buyers entered the market in July 2024, compared to same time last year.

Percentage of all propert y sales recorded by triSearch.

home owner

-home buyer

The average time a property spends in market before being

compared to the same time last year, including advertising.

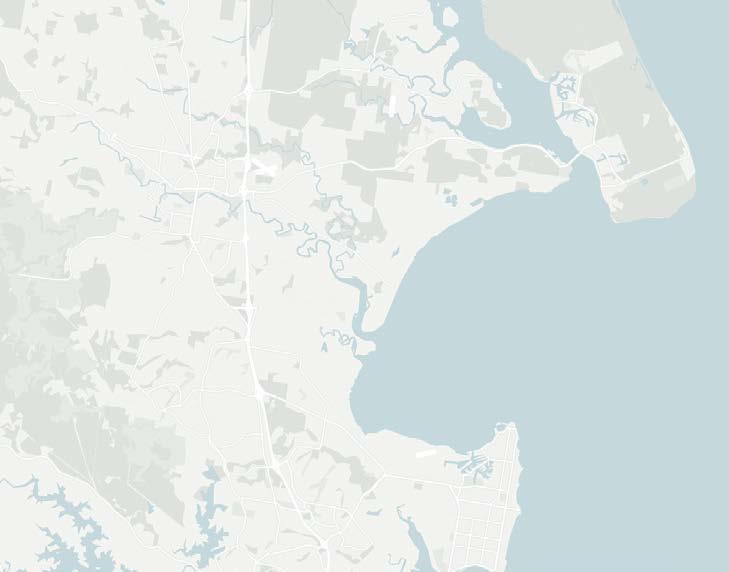

It isn’t that surprising that Werribee has circled back to the top of the hottest suburb table. Sitting 32 kilometres south-west of the Melbourne CBD and part of the Department of Transport and Planning’s priority precincts linked to the Suburban Rail Loop, it is seen as a good place for first-time buyers and investors alike. There is clearly room for more growth in the perfectly placed pocket between the Melbourne business district and Geelong that is often touted as Victoria’s fastest growing suburb. But

with the state government identifying the City Wyndham as a key area for expansion, and plans for 110,403 new homes by 2050 – increasing the housing stock to a total of 210,769 - it will need substantial investment in infrastructure to cope. Elsewhere, Armstrong Creek has fallen off the list entirely after sitting in the second spot in June. Truganina, Sunbury, Resevoir and Hawthorn are all also missing this month. They have been replaced by South Bank, Berwick, Preston and Point Cook. Melbourne City remains strong, month on month.

Booming Morayfield has taken top spot on the hottest suburbs podium for the second month in a row. It is easy to see why the suburb 45 kilometres to the north of Brisbane has been named in one of Australia’s top 100 to watch. First-time buyers looking to get onto the property ladder are flocking to the hotspot that ticks all the boxes –offering value for money, lifestyle and a connected location. Savvy investors also see Morayfield as a prime location between Brisbane to the south and

the Sunshine Coast just 60 kilometres further north. With the population of the region increasing rapidly, rental accommodation is going to remain in high demand, especially in the lead up to the Brisbane 2032 Olympic and Paralympic Games. Gracemere jumps up a few spots to land in second, highlighting its affordability and growth potential. Outside of that, most of the suburbs from last month retained their "hottest suburbs" spots in July.

According to American business author Michael LeBoeuf, a satisfied customer is the best business strategy of all.

When those satisfied customers endorse your service, it helps convince other potential clients to take a leap of faith and decide to do business with you.

Research by UK financial review website

Smart Money People shows eight people in 10 are more likely to trust reviews from other

customers than industry experts, professional reviewers and brands.

Honest customer testimonials are one of the most effective ways to build trust, credibility and new customers, and in the conveyancing world, your business relies heavily on your reputation.

Not only does having a library of testimonials from satisfied clients help organically build a positive reputation for your service – they cost little to nothing if done well.

To build an effective customer testimonials campaign, consider these strategies.

CUSTOMER TESTIMONIALS

You can collect customer testimonials in several ways: email the client after the post-settlement invoice stage, asking for an email testimonial; ask customers to leave a review on your website, social media pages or thirdparty review sites like Yelp or Google Reviews; or phone them to ask for a verbal testimonial you can transcribe and use.

INTO TESTIMONIAL CATEGORIES

After you’ve collected a library of testimonials, it may help to break them into categories such as service, cost, overall, and more. Consider using your website to create a testimonials page. This will help prospects learn more about what to expect from you before inquiring. Also use your social media to promote testimonials, either sporadically or as they occur. Alternatively, you can store up a number of testimonials and create a long-term weekly social campaign.

Showcase your testimonials in a way that’s engaging and effective. For example, photos or videos can help make testimonials more compelling. You can also add specific quotes or feedback on your website’s homepage. Testimonials can also be used in your marketing materials, such as email campaigns, social media posts and ads. In addition, customer testimonials can be included throughout your website, such as on the product description or services offered pages.