PREPARED EXCLUSIVELY FOR:

Melody --

The following is a Current Value Assessment of your home based on current market conditions, comparable homes in Lake Hills Reserve, what I believe your home could sell for if my marketing strategy were implemented, and a little info about me and my team.

The next page is your Tax Record followed by the comparables I used in this analysis to come up with my assessment followed by what the Top 4 real estate websites have your home estimated at.

949-294-2506

No two homes are identical, which is why choosing a sales price or offer price for a home can be challenging. That's where the Comparative Market Analysis, or CMA, is most useful.

The CMA is a side-by-side comparison of homes for sale and homes that have recently sold in the same neighborhood and price range. This information is further sorted by data such as type of home, number of bedrooms, number of baths, lot size, neighborhood, property condition and features, and many other factors. The purpose is to show estimated market value, based on what other buyers and sellers have determined through past sales, pending sales and homes recently put on the market.

CMAs are generated by using property information from your real estate agent's Multiple Listing Service (MLS). The MLS is available to licensed members only, including brokers, salespeople, and appraisers, who pay dues to gain access to the service's public and proprietary data, including tax roll information, sold transactions, and listings input by all cooperating MLS members. Listing agents generate CMAs for their sellers, and buyer's agents create them for their buyers so both sides know what current market conditions are for the homes they're interested in comparing.

The CMA is a here-and-now snapshot of the market, based on the most recent data available, but it can instantly be rendered obsolete by a new listing, or a change of status in a home with the same criteria. Why? The market is constantly changing — new listings, pending sales, closed sales, price reductions, and expired listings. CMAs can vary widely, depending on the knowledge and skill of the person creating the CMA as well as the number and type of data fields that are chosen.

CMAs can vary widely, depending on the knowledge and expertise of the person inputting the search parameters. They also may vary between identical homes in that one property may simply offer better “curb appeal” or is in better condition that the other. Lastly, buyer and seller motivation can’t be quantified. It is typically impossible to say why a seller agreed to take less for their home or why a buyer paid more for another home. Family problems, corporate relocations and other reasons all play a role. What you can learn from the CMA is how long a home took to sell. If it was quick, the seller was highly motivated. If it didn’t, it was probably overpriced.

Is a CMA the same as an Appraisal?

No. Although the CMA is used to help determine current market value, it does not establish the seller's home value. A bank appraisal, on the other hand, is a professional determination of a home's value. The appraisal is completed by a licensed Appraiser, using guidelines established by the Federal Housing Finance Agency, which regulates federal housing loan guarantors such as FHA, VA and housing loan purchasers Fannie Mae and Freddie Mac. An appraisal is a comprehensive look at a home's location, condition, and eligibility for federal guarantees. For example, a home that doesn't meet safety requirements such as handrails on steps will not be eligible for FHA or VA loans until the handrail is installed or repaired. Appraisers use the same data in their market research to find comparable homes as real estate agents. While they are also members of the MLS, they also have additional guidelines from the bank to follow that minimize risk to the bank. They will take into consideration — and can adjust values to reflect — the speed of the market and whether prices are rising or falling. When the appraisal is finished, the bank makes the decision to fund the loan, or it may require the seller to fix certain items and show proof that the repairs have been made before letting the loan proceed. If the loan doesn't meet lending guidelines, the bank will decline the loan.

And is my home worth what the Internet says?

In short — maybe? Many homeowners like to visit sites like Zillow, REDFIN, etc., to see what their home is worth. What they fail to understand is that most of those sites have an 8% - 12% margin of error which means a home worth $400,000 could be worth anywhere between $360,000 and $440,000 and that’s if we only use a 10% margin of error. That is quite the large window!

Estimating a home’s market value is far from an exact science. These sites contract with major title companies to obtain county tax roll data which they combine with data obtained from the MLS, push it through their algorithm and bingo! You have your “Zestimate”!!

On February 29, 2016, then Zillow CEO Spencer Rascoff sold a Seattle home for $1.05 million, 40 percent less than the Zestimate of $1.75 million shown on its property page a day later.

Chris Taylor

Keller Williams Luxury International

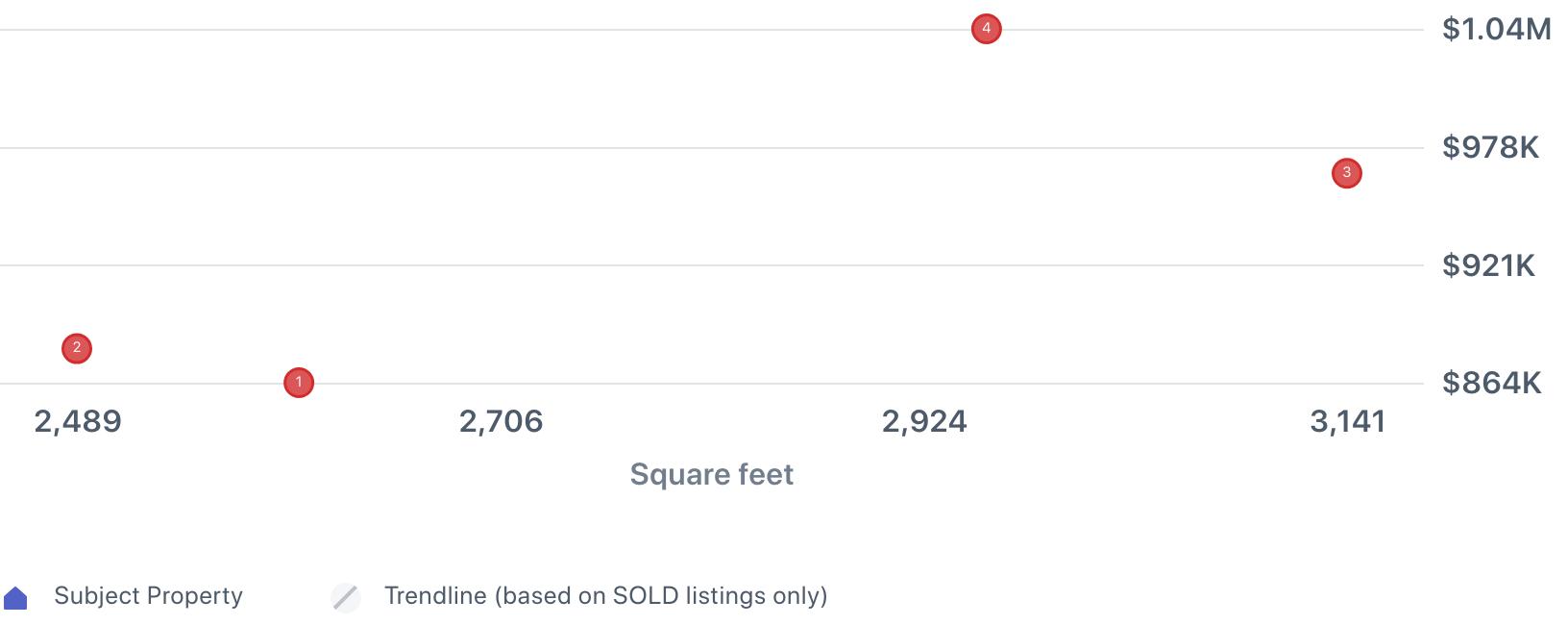

Comparable homes sold for an average of $336 / sq. ft. Many factors such as location, use of space, condition, quality, and amenities determine the market value per square foot, so reviewing each comp carefully is important.

Chris Taylor

Keller Williams Luxury International

SO WHAT DOES THE INTERNET SAY ABOUT YOUR HOME?

$927,342 $921,680 $958,800 $804,728

Not a typo. Just goes to show how messed up these algorithms can get.

Based on a close review of homes comparable to yours in Lake Hills, our current market conditions, a review of the pictures of the home when it sold in 2023, and the implementation of my marketing plan, my Current Value Assessment for your home would be:

$975K - $1.035K

To get a more accurate assessment of property value, a physical inspection would be required.

Tracie Albert

Operations

DRE# 01432850

With a high regard for the overall client experience, Tracie oversees the Operations for Taylor Residential Real Estate. A licensed Real Estate Agent herself since 2004 with experience in Residential, Investment and Luxury Sales as well as Short Sales, REOs and House Flipping, Tracie possesses a comprehensive level of Real Estate-related expertise that is largely unsurpassed. As a key component to Taylor Realty Group’s success, Tracie has access to a variety of tools and resources designed to foster the most rewarding experiences for clients with even the most complex goals at hand in addition to cutting edge marketing techniques and strategies and innovative resources.

Brenda Listana Administration

With over 5 years of experience and having worked for some of the biggest e-commerce companies in the world, Brenda has established herself as a strong Customer Support Representative. She takes great pride in her exceptional computer skills, organization, planning, and administrative abilities and her experience has taught her the importance of attention to detail, resilience, and flexibility. Brenda commits herself fully to any task and embraces the responsibility.

DRE# 02210680

Valerie Alicajic

Marketing Director

Josh Hartman — a Lake Hills Reserve resident — launched his real estate career in 2010. Initially specializing in residential investments, he quickly became an expert in local trends, building strong buyer and seller relationships. With over a decade of experience, Josh helps clients — from first-time buyers to investors — find the right property. When selling, he uses digital and traditional marketing for maximum exposure and top-dollar results. Outside of real estate, Josh enjoys outdoor adventures with his wife and four children. A martial arts enthusiast, he also holds a Ph.D. in Computational Quantum Chemistry and teaches chemistry.

Valerie’s passion for design began at an early age, culminating in earning her Bachelor of Arts degree with an emphasis in graphic design at California State University Long Beach, and most recently, a Multi-Media Certificate in Web Design from Golden West College. Today, Val spearheads our design strategies and executes creative concepts that ensure maximum exposure. By conceptualizing and designing projects from start to finish, she creates a cohesive message portrayed through color, art and photography, all while meeting intense deadlines.

Property Designer

DRE# 01432850

Brooke Fetzer, "The Property Stylist", is a Certified Feng Shui Practitioner with YEARS of experience in the art of Home Staging. With over 1500 homes to her credit, Brooke is detail-oriented and works seamlessly with Sellers to prepare their homes for sale with careful attention paid to the individual marketing needs of each home so they can stand out from the rest online.